Middlesbrough Welfare Rights Unit Welfare Reform Malcolm Bateman

Middlesbrough Welfare Rights Unit Welfare Reform Malcolm Bateman

Welfare Reform • From 2013 onwards there a number of changes to the existing welfare benefit system that will impact upon a wide range of individuals, resulting in a decrease in income for many people. • These changes may affect both working age and pension age claimants due to changes in both pension age and the forthcoming introduction of Universal Credit.

State Pension Age • The current State Pension Age is still 65 for men and will also be 65 for women by 2018. After this it will rise to 66 by 2020, 67 by 2036 (possibly 2028), with proposals in place to reach 68 by 2046. • The implications of this are that many older people will be expected to meet the conditions currently in place for working age benefit recipients, as well as the changes in Council Tax Support and the new local Social Fund provision.

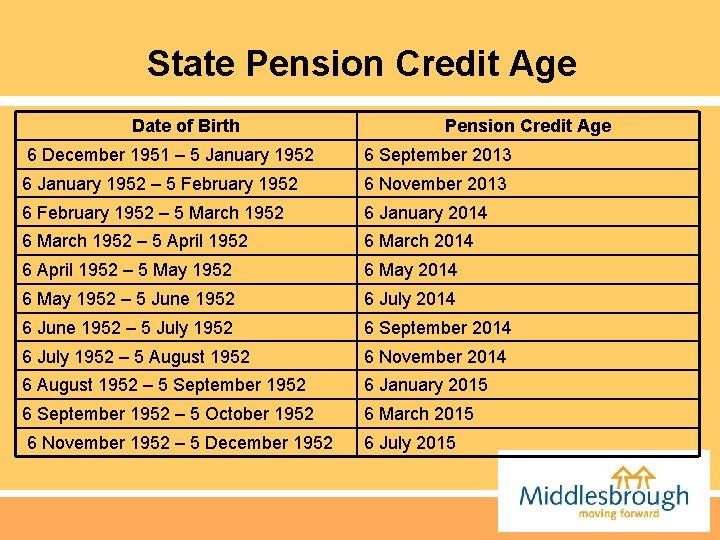

State Pension Credit Age Date of Birth Pension Credit Age 6 December 1951 – 5 January 1952 6 September 2013 6 January 1952 – 5 February 1952 6 November 2013 6 February 1952 – 5 March 1952 6 January 2014 6 March 1952 – 5 April 1952 6 March 2014 6 April 1952 – 5 May 1952 6 May 2014 6 May 1952 – 5 June 1952 6 July 2014 6 June 1952 – 5 July 1952 6 September 2014 6 July 1952 – 5 August 1952 6 November 2014 6 August 1952 – 5 September 1952 6 January 2015 6 September 1952 – 5 October 1952 6 March 2015 6 November 1952 – 5 December 1952 6 July 2015

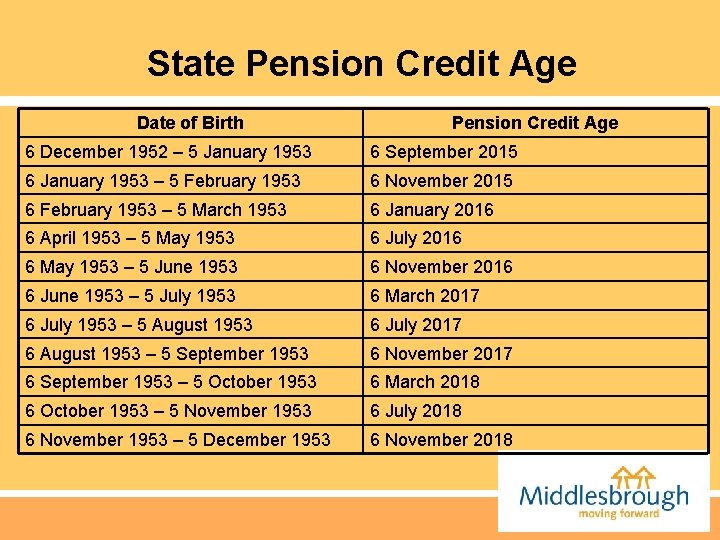

State Pension Credit Age Date of Birth Pension Credit Age 6 December 1952 – 5 January 1953 6 September 2015 6 January 1953 – 5 February 1953 6 November 2015 6 February 1953 – 5 March 1953 6 January 2016 6 April 1953 – 5 May 1953 6 July 2016 6 May 1953 – 5 June 1953 6 November 2016 6 June 1953 – 5 July 1953 6 March 2017 6 July 1953 – 5 August 1953 6 July 2017 6 August 1953 – 5 September 1953 6 November 2017 6 September 1953 – 5 October 1953 6 March 2018 6 October 1953 – 5 November 1953 6 July 2018 6 November 1953 – 5 December 1953 6 November 2018

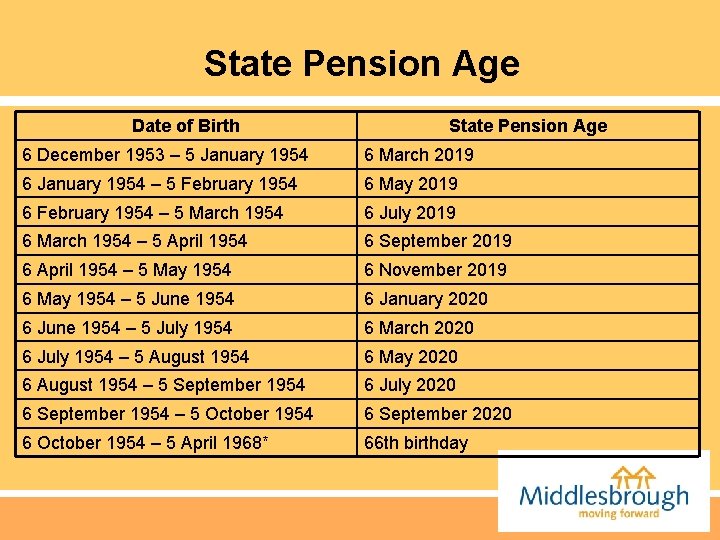

State Pension Age Date of Birth State Pension Age 6 December 1953 – 5 January 1954 6 March 2019 6 January 1954 – 5 February 1954 6 May 2019 6 February 1954 – 5 March 1954 6 July 2019 6 March 1954 – 5 April 1954 6 September 2019 6 April 1954 – 5 May 1954 6 November 2019 6 May 1954 – 5 June 1954 6 January 2020 6 June 1954 – 5 July 1954 6 March 2020 6 July 1954 – 5 August 1954 6 May 2020 6 August 1954 – 5 September 1954 6 July 2020 6 September 1954 – 5 October 1954 6 September 2020 6 October 1954 – 5 April 1968* 66 th birthday

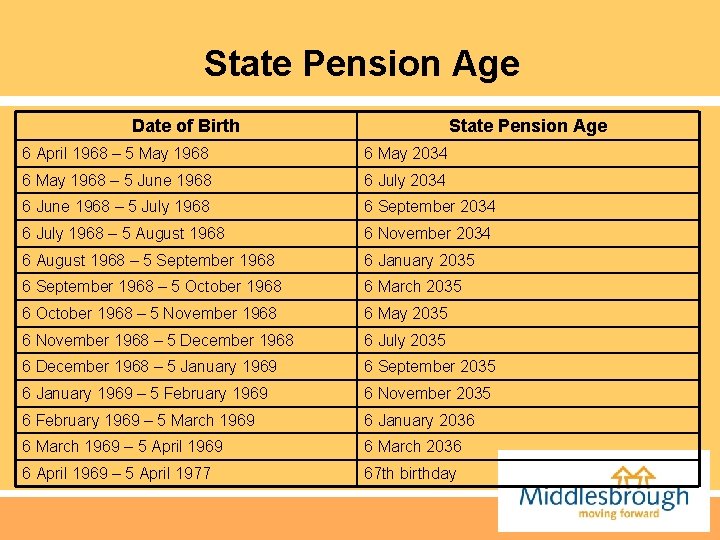

State Pension Age Date of Birth State Pension Age 6 April 1968 – 5 May 1968 6 May 2034 6 May 1968 – 5 June 1968 6 July 2034 6 June 1968 – 5 July 1968 6 September 2034 6 July 1968 – 5 August 1968 6 November 2034 6 August 1968 – 5 September 1968 6 January 2035 6 September 1968 – 5 October 1968 6 March 2035 6 October 1968 – 5 November 1968 6 May 2035 6 November 1968 – 5 December 1968 6 July 2035 6 December 1968 – 5 January 1969 6 September 2035 6 January 1969 – 5 February 1969 6 November 2035 6 February 1969 – 5 March 1969 6 January 2036 6 March 1969 – 5 April 1969 6 March 2036 6 April 1969 – 5 April 1977 67 th birthday

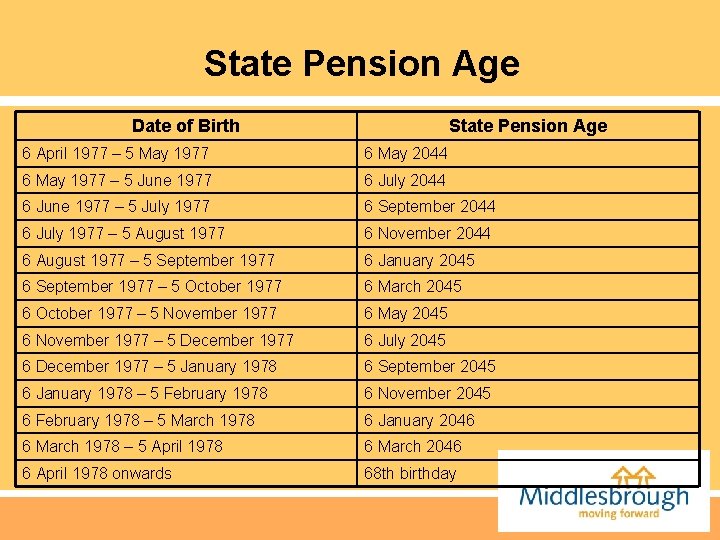

State Pension Age Date of Birth State Pension Age 6 April 1977 – 5 May 1977 6 May 2044 6 May 1977 – 5 June 1977 6 July 2044 6 June 1977 – 5 July 1977 6 September 2044 6 July 1977 – 5 August 1977 6 November 2044 6 August 1977 – 5 September 1977 6 January 2045 6 September 1977 – 5 October 1977 6 March 2045 6 October 1977 – 5 November 1977 6 May 2045 6 November 1977 – 5 December 1977 6 July 2045 6 December 1977 – 5 January 1978 6 September 2045 6 January 1978 – 5 February 1978 6 November 2045 6 February 1978 – 5 March 1978 6 January 2046 6 March 1978 – 5 April 1978 6 March 2046 6 April 1978 onwards 68 th birthday

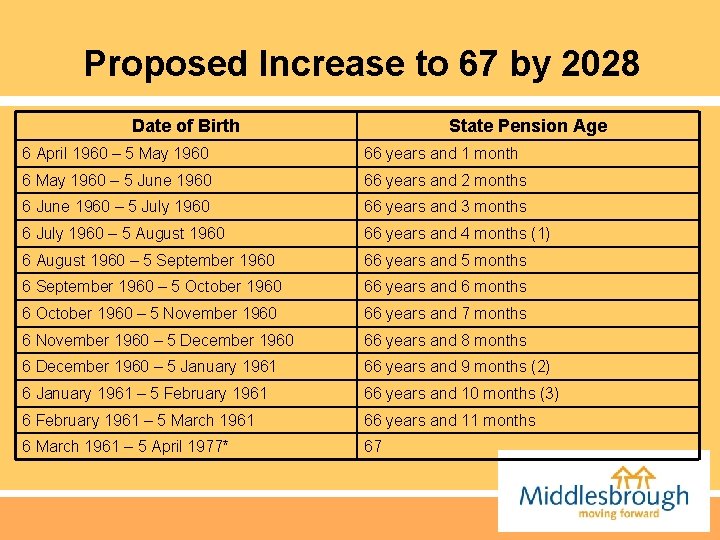

Proposed Increase to 67 by 2028 Date of Birth State Pension Age 6 April 1960 – 5 May 1960 66 years and 1 month 6 May 1960 – 5 June 1960 66 years and 2 months 6 June 1960 – 5 July 1960 66 years and 3 months 6 July 1960 – 5 August 1960 66 years and 4 months (1) 6 August 1960 – 5 September 1960 66 years and 5 months 6 September 1960 – 5 October 1960 66 years and 6 months 6 October 1960 – 5 November 1960 66 years and 7 months 6 November 1960 – 5 December 1960 66 years and 8 months 6 December 1960 – 5 January 1961 66 years and 9 months (2) 6 January 1961 – 5 February 1961 66 years and 10 months (3) 6 February 1961 – 5 March 1961 66 years and 11 months 6 March 1961 – 5 April 1977* 67

Implications • By increasing the age at which Pension Credit/State Retirement Pension can be received it means that persons under this age will be expected to meet the working age requirements in order to receive benefits. • Claimants of working age are expected to either be actively seeking and available for work or be unable to work either due to sickness/disability or because of other roles, ie being a carer or a lone parent of a child under 5.

Implications • Further implications also include the changes to rent support for Social Housing tenants and the new localised Council Tax Support schemes, both of which apply to working age claimants only. • The under-occupation of Social Housing, known as the bedroom tax, came into effect April 2013. It applies to all working age claimants of Social Housing properties.

Social Housing • Social Housing tenants will now have their Housing Benefit reduced if they under-occupy their property based upon the bedrooms the household requires. Anyone under-occupying by one bedroom will see their eligible rent reduced by 14%, with a reduction of 25% for those who under-occupy by two or more rooms. • There are no exemptions from this rule though an extra room may be available for non- resident overnight carers and children who cannot share due to severe behavioural issues can be allocated a room for themslves

Social Housing • Room allocation for a property is based upon; • One room for each person or couple aged 16 or over • One for two children of the same gender under age 16 • One room for two children of any gender under age 10

Other Help • Discretionary Housing Payments are still available with an increased budget. Anybody can apply who has a current Housing Benefit claim which does not meet their rental liability. Awards are usually short term but repeat applications can be made. Priority would normal be given to additional needs such as a disability or needing to be near services, friends or family who assist with caring duties. • Applications can be made through the Local Authority.

Council Tax Support • From April this year Council Tax Benefit has been abolished and replaced with a local Council Tax Support scheme for working age claimants. This scheme is administered by the Local Authority, with each Local Authority able to devise its own scheme. • For Middlesbrough all working age claimants are expected to pay a minimum of 20% of their liability. There may be some additional help for those who are unable to afford this liability through the Local Government Finance Act.

Council Tax Support • At present couples who receive Pension Credit are exempt from the new scheme. However, any pension age couples where one of them receives either income related Employment and Support Allowance, income based Jobseekers Allowance, Income Support or Universal Credit will also be affected by the 20% payment.

Universal Credit • Universal Credit is a new working age benefit which is gradually being rolled out nationally from 2014. It is a single benefit administered by the DWP and will replace income based Jobseekers Allowance, Income Support, income related Employment and Support Allowance, Housing Benefit, Child Tax Credits and Working Tax Credits. • One of the features of Universal Credit is that it will consider the age of the youngest member of a couple when deciding whether Pension Credit or Universal Credit should be claimed, which means that where there is a member of a couple under Pension Credit age they will be affected by the under-occupation, Benefit Cap and Council Tax Support changes

Universal Credit • There a number of concerns around the introduction of Universal Credit including; • Payment method of all entitlement one month in arrears direct to claimant. • An online application and claims maintenance system. • Likelihood of increased conditionality and sanctions.

Social Fund • April 2013 saw the replacement of the Discretionary Social Fund (Community Care Grants and Crisis Loans) with a localised Support Scheme. • Each Local Authority has designed and manages its own funds and therefore these are likely to vary between Local Authorities. • In Middlesbrough there are two provisions, a Crisis Support scheme (replacing Crisis Loans) and a Community Care Support scheme (replacing Community Care Grants).

Social Fund • Both schemes are open to residents of Middlesbrough, with the Crisis Support being available to meet costs associated with a crisis or disaster, whilst the Community Care Support scheme is to enable someone to move into the community or remain living in the community. • Both schemes have a limited fund and do not offer any cash payments. Additionally only two Crisis Support awards can normally be made in a financial year.

Social Fund • Applications for a Crisis Award are made by calling 0808 1789278 and applicants should get a decision from the call. • Applications for Community Care Support awards are made using the form which is completed online at; http: //www. middlesbrough. gov. uk/index. aspx? article id=6800

Other Changes • There are other changes which have been introduced in 2013 which affect working age claimants including changes to Disability Living Allowance, Employment and Support Allowance, Tax Credits and A Benefit Cap.

Disability Living Allowance • From April 2013 Disability Living Allowance has been replaced by Personal Independence Payment (PIP) for those who are aged 16 – 64. • New claims will be for PIP from April 8 th 2013. From October 2013 any existing claims which are due for renewal, who report a change in circumstances which affects their entitlement or reach age 16 will also be assessed under the new criteria. Long term awards will be reassessed from October 2015.

Disability Living Allowance • PIP relies upon different assessment criteria and also consists of either a standard or an enhanced award for both the Daily Living (care) and Mobility components. • To receive the benefit a claimant must score 8 points for the standard award or 12 points for the enhanced award following their initial application. • It is expected that the majority or claimants will have to engage in a face to face consultation with a healthcare professional.

Disability Living Allowance • Central government announced that the introduction of PIP is to produce a 20% saving on the current spend on DLA. • The Minister for Disabled People, Esther Mc. Vey stated; By October 2015 we estimate we will have reassessed 560, 000 claimants. Of these 160, 000 will get a reduced award and 170, 000 will get no award. However 230, 000 will get the same support or more support.

Employment and Support Allowance • Employment and Support Allowance (ESA) is now the only benefit that can be claimed to replace earnings for those who are unable to work due to sickness or disability. It is based upon an assessment from which a claimant must score 15 or more points to be able to be classed as unfit for work and receive the benefit. • The changes relate to the assessment criteria and include the use of aids and adaptations (including wheelchairs).

Employment and Support Allowance • Existing claims for Incapacity Benefit, Severe Disablement Allowance and Income Support on the grounds of disability continue to be migrated to ESA. Many claimants are being found fit for work at this stage and are able to appeal the decision. Middlesbrough Welfare Rights Unit has an 80% success rate for all benefit appeals where the client is supported or represented.

Tax Credits • The major change to Tax Credits is in the number of hours a couple must work in order to receive Working Tax Credits. Previously this was 16 hours but has been increased to 24 hours, with one partner working at least 16 hours. This can have a major impact on claimants who currently only work 16 hours with a considerable loss of income.

Benefit Cap • A benefit cap is being rolled out nationally with full implementation by September 2013. The cap applies to working age households who are not in employment. It is set at £ 350 per week for a single person and £ 500 per week for a couple or family. The cap includes the main earnings replacement benefits, Child Tax Credits, Child Benefit and Housing Benefit. There are some exemptions to the cap and claimants should check if they meet any of these criteria. The majority of claimants affected in this area have four or more children. The cap will have a greater impact in areas where rental costs are higher.

Rights • All benefit decisions carry a right of appeal relating to whether the benefit is paid, how it is calculated, the date it is paid from and any overpayments or errors. However, many people are unaware of their rights or where to go for support. Middlesbrough residents are able to access Middlesbrough Welfare Rights Unit for help with any benefit queries, including checking whether they have an entitlement to any benefits. The service is free and can be contacted on 01642 729242.

- Slides: 30