Mgmt 383 Chapter 12 Total Rewards and Compensation

- Slides: 57

Mgmt 383 Chapter 12 Total Rewards and Compensation Spring 2009

Why Must Employers Provide Different Types of Compensation? • Attract • Retain • Reward

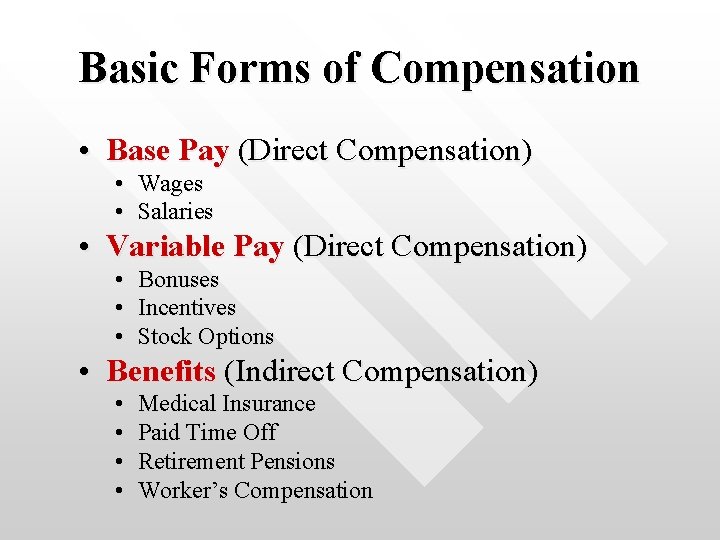

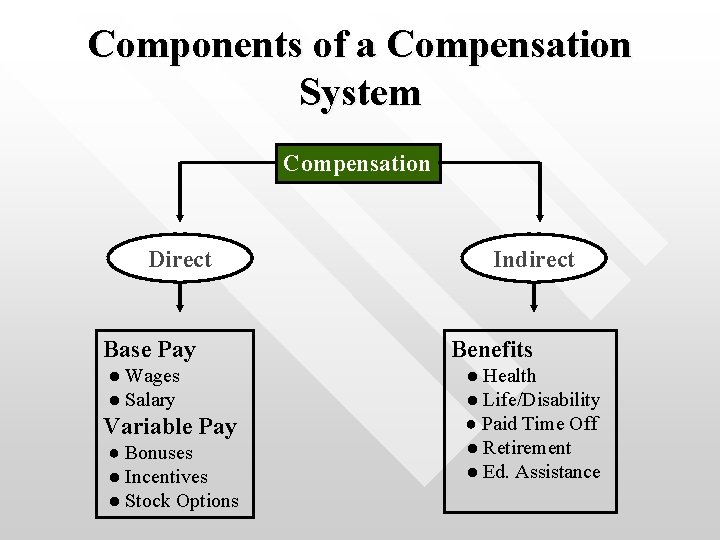

Basic Forms of Compensation • Base Pay (Direct Compensation) • Wages • Salaries • Variable Pay (Direct Compensation) • • • Bonuses Incentives Stock Options • Benefits (Indirect Compensation) • • Medical Insurance Paid Time Off Retirement Pensions Worker’s Compensation

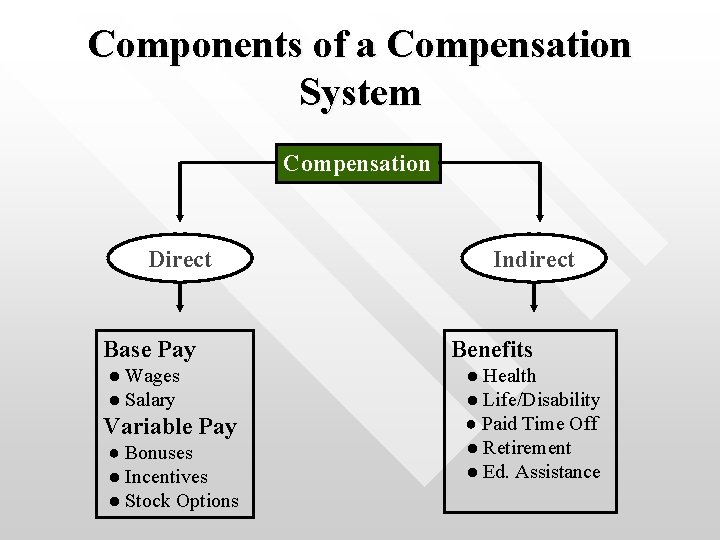

Components of a Compensation System Compensation Direct Base Pay ● Wages ● Salary Variable Pay ● Bonuses ● Incentives ● Stock Options Indirect Benefits ● Health ● Life/Disability ● Paid Time Off ● Retirement ● Ed. Assistance

Base Pay • Base Pay – The basic compensation an employee receives in exchange for work performed. • Wages - time-based (usually hourly) compensation calculated on the basis of the amount of time worked. • Salaries - payments consistent from time period to time period regardless of the actual amount of time worked.

Variable Pay • Variable Pay - compensation linked to individual, team and/or organizational performance. • Piece-rate - productivity-based compensation paid for each unit of product produced or service provided. • • Bonuses Profit-sharing Gain-sharing Commissions

Benefits • Benefits - indirect compensation contingent upon organizational membership. [41% of total payroll costs or 70% of the base pay rate]. • Health Insurance • Life Insurance • Vacations • Pensions • Sick Leave

Matching Compensation with Organizational Needs • New organizations in competitive environments (emphasis on innovation) • Lower base pay • Greater emphasis on variable pay • Established large organizations in stable environments (emphasis on cost containment) • • Structured base pay system Structured benefits programs

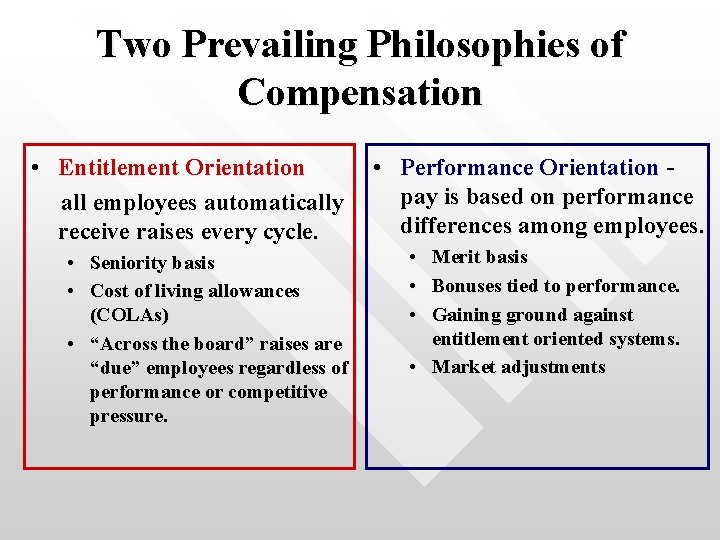

Two Prevailing Philosophies of Compensation • Entitlement Orientation all employees automatically receive raises every cycle. • Seniority basis • Cost of living allowances (COLAs) • “Across the board” raises are “due” employees regardless of performance or competitive pressure. • Performance Orientation pay is based on performance differences among employees. • • • Merit basis Bonuses tied to performance. Gaining ground against entitlement oriented systems. • Market adjustments

Competency-Based Pay • Competency-Based Pay (a. k. a. Task-based or Skill-Based, Knowledge-Based Pay) – rewards employees for the capabilities they demonstrate and acquire. • Employees are paid more in jobs requiring more skills and knowledge than those that do not. • Encourages employees to increase their human capital. • Popular in those trades or professions with certification programs (accounting, HRM, finance, architecture, engineering, etc. ).

Objectives of a Compensation Program • Equity • Legal Compliance • Cost Effectiveness

Perceptions of Pay Fairness • Equity - the perceived fairness of the relationship between a person’s inputs and the outcomes they receive. • Internal Equity (equity within the organization) ensuring that compensation for jobs that are similar in terms of KSA within the organization are compensated the same. • External Equity (equity with other organizations) ensuring that jobs in our company are paid the same as the same jobs (in terms of KSA)in other companies.

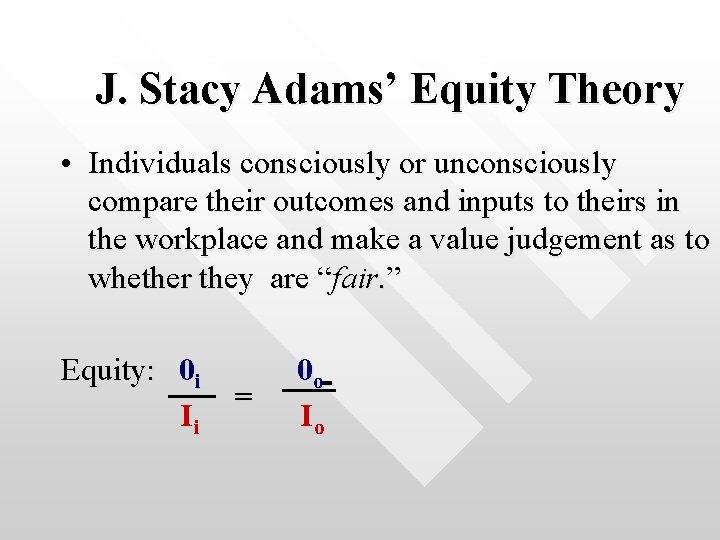

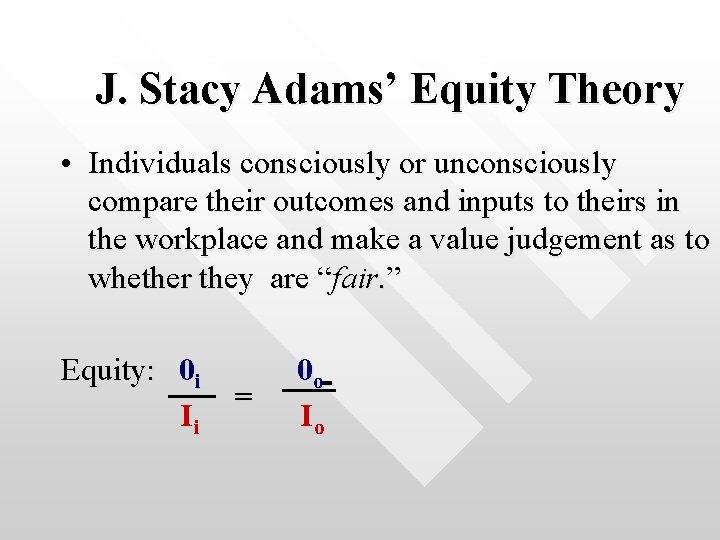

Equity Theory • Individual Equity (J. Stacy Adams) • An individual expects his/her outcomes in any exchange relationship to be proportional to his/her inputs. • Individuals consciously or unconsciously compare their outcomes and inputs to others in the workplace and make a value judgement as to whether they are “fair. ”

J. Stacy Adams’ Equity Theory • Outcomes (On) any and all factors that an individual values or desires. • • • Raises Promotions Status Job assignments Recognition

J. Stacy Adams’ Equity Theory • Inputs (In) any and all factors that an individual believes are relevant to being eligible for a desired outcome. • • • Effort Quality of work Experience Education Seniority Loyalty

J. Stacy Adams’ Equity Theory • Individuals consciously or unconsciously compare their outcomes and inputs to theirs in the workplace and make a value judgement as to whether they are “fair. ” Equity: 0 i Ii = 0 o Io

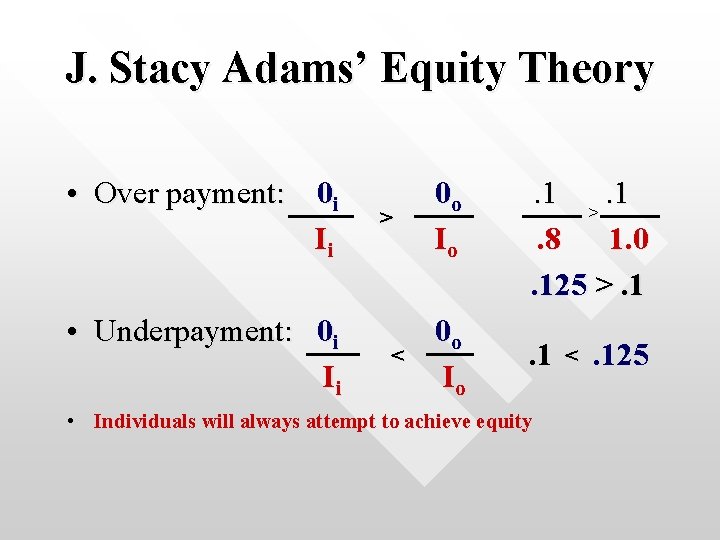

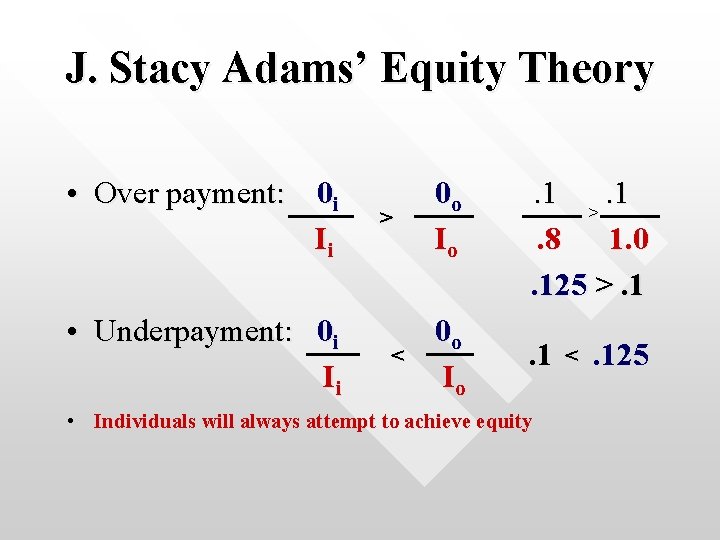

J. Stacy Adams’ Equity Theory • Over payment: 0 i Ii • Underpayment: 0 i Ii > < 0 o Io . 1. 1 >. 8 1. 0. 125 >. 1. 1 • Individuals will always attempt to achieve equity < . 125

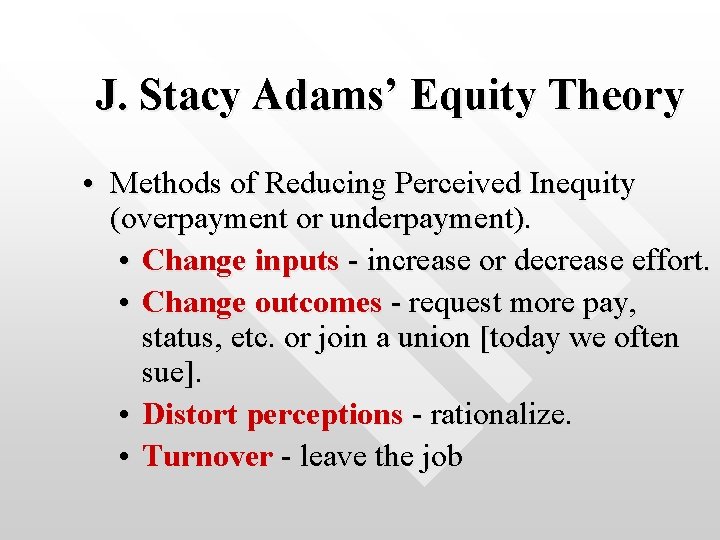

J. Stacy Adams’ Equity Theory • Methods of Reducing Perceived Inequity (overpayment or underpayment). • Change inputs - increase or decrease effort. • Change outcomes - request more pay, status, etc. or join a union [today we often sue]. • Distort perceptions - rationalize. • Turnover - leave the job

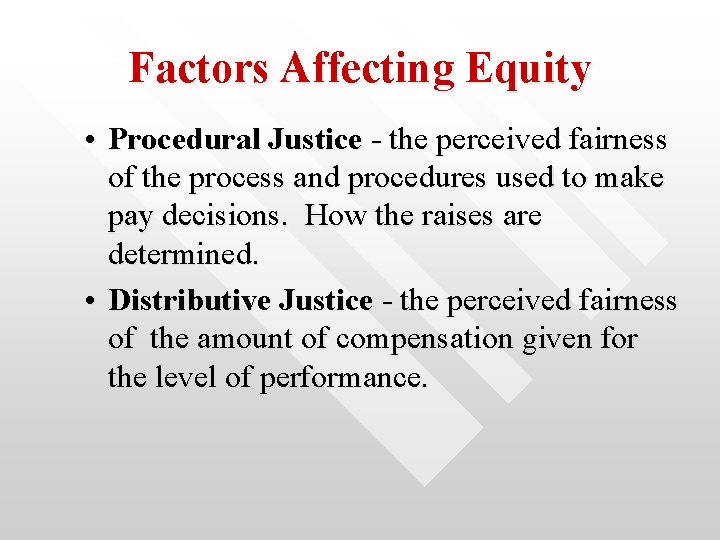

Factors Affecting Equity • Procedural Justice - the perceived fairness of the process and procedures used to make pay decisions. How the raises are determined. • Distributive Justice - the perceived fairness of the amount of compensation given for the level of performance.

Secret v. Open Pay systems • Secret Pay Systems - policies that prohibit discussion of pay between employees. • Subverted by the grapevine. • Employees suspect that the ulterior motive is to hide unfair practices. • Open Pay Systems - employees can gain access to each others pay levels. • • Works best under true merit pay systems. Concerns about employee privacy.

Factors Affecting Equity • External Equity – how the compensation in your organization compares to similar jobs in other organizations

Market Competitiveness and Compensation • Market Positioning • Pay Market - match competitors • Lead the Market - pay more than competitors • Lag the Market - pay less than competitors • Market Pricing - basing wages on the immediate labor market and the industry. • Houston, TX v. NYC • $45, 000 v. $109, 051 • $30, 948 v. $75, 000 Source: Salary Comparison (April 2, 2009) http: //cgi. money. cnn. com/tools/costofliving. html

Market Pricing & Cost of Living • If you move from Jackson, MS to New York (Manhattan) NY: • • • Groceries will cost 66%more. Housing will cost 440%more. Utilities will cost 61% more. Transportation will cost 22% more. Healthcare will cost 32% more.

Fair Labor Standards (1938) • Minimum wage • 3 step increase is scheduled as follows: • $5. 85 – July 24, 2007 • $6. 55 - July 24, 2008 • $7. 25 - July 24, 2009 • Overtime (time & one-half for each our worked in excess of 40 during a 168 consecutive hour work week).

Fair Labor Standards (1938) • Child labor • • • Hazardous jobs > 18. Unlimited hours > 16. 14 to 15, 3 hours limit on school days, 18 hours in school weeks. 8 hours and 40 hours respectively in nonschool weeks. No work between 7 pm & 7 am except June 1 to Labor Day-- 9 pm to 7 am.

Employees under FLSA • Classification of employees: • Hourly (nonexempt) • Salaried-Nonexempt • Salaried-Exempt - Those not protected by the FSLA

Exempt Employees under the FLSA • Exempt Employees • • • Executive Administrative Professional Computer Employees Outside sales

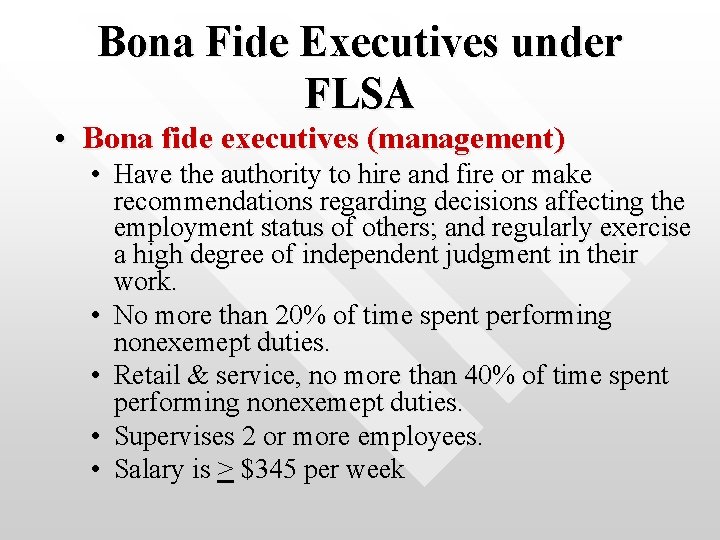

Bona Fide Executives under FLSA • Bona fide executives (management) • Have the authority to hire and fire or make recommendations regarding decisions affecting the employment status of others; and regularly exercise a high degree of independent judgment in their work. • No more than 20% of time spent performing nonexemept duties. • Retail & service, no more than 40% of time spent performing nonexemept duties. • Supervises 2 or more employees. • Salary is > $345 per week

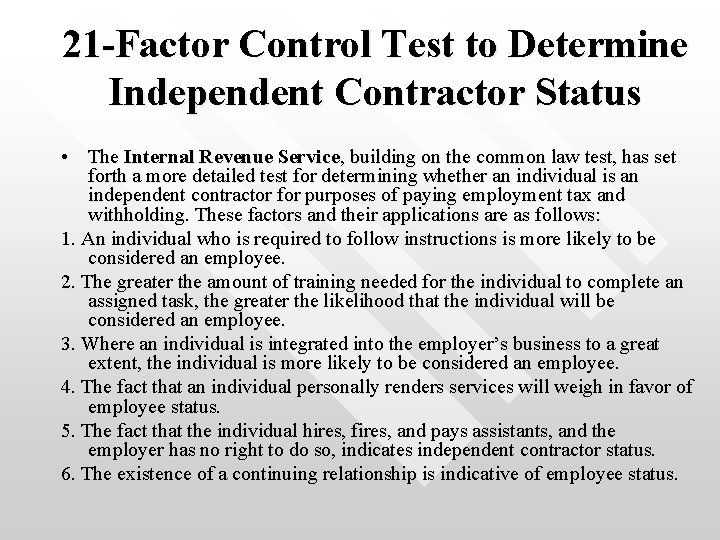

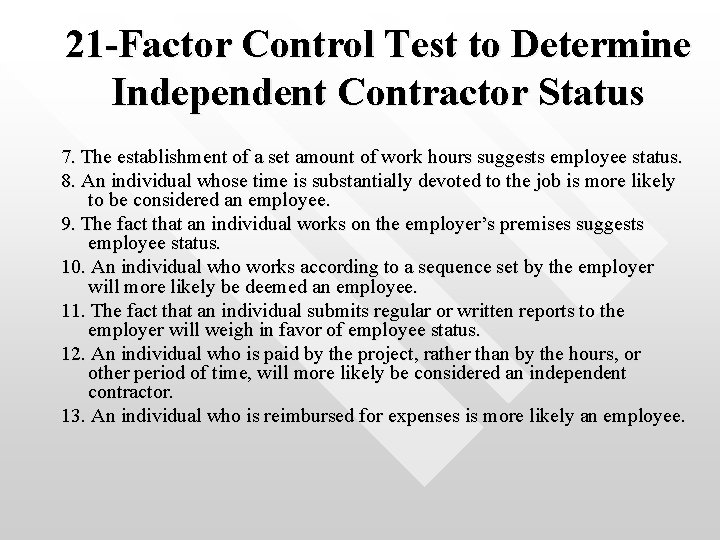

21 -Factor Control Test to Determine Independent Contractor Status • The Internal Revenue Service, building on the common law test, has set forth a more detailed test for determining whether an individual is an independent contractor for purposes of paying employment tax and withholding. These factors and their applications are as follows: 1. An individual who is required to follow instructions is more likely to be considered an employee. 2. The greater the amount of training needed for the individual to complete an assigned task, the greater the likelihood that the individual will be considered an employee. 3. Where an individual is integrated into the employer’s business to a great extent, the individual is more likely to be considered an employee. 4. The fact that an individual personally renders services will weigh in favor of employee status. 5. The fact that the individual hires, fires, and pays assistants, and the employer has no right to do so, indicates independent contractor status. 6. The existence of a continuing relationship is indicative of employee status.

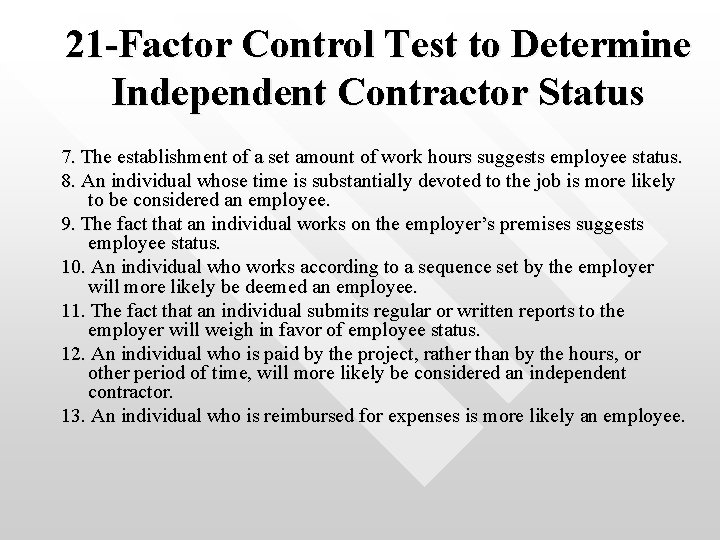

21 -Factor Control Test to Determine Independent Contractor Status 7. The establishment of a set amount of work hours suggests employee status. 8. An individual whose time is substantially devoted to the job is more likely to be considered an employee. 9. The fact that an individual works on the employer’s premises suggests employee status. 10. An individual who works according to a sequence set by the employer will more likely be deemed an employee. 11. The fact that an individual submits regular or written reports to the employer will weigh in favor of employee status. 12. An individual who is paid by the project, rather than by the hours, or other period of time, will more likely be considered an independent contractor. 13. An individual who is reimbursed for expenses is more likely an employee.

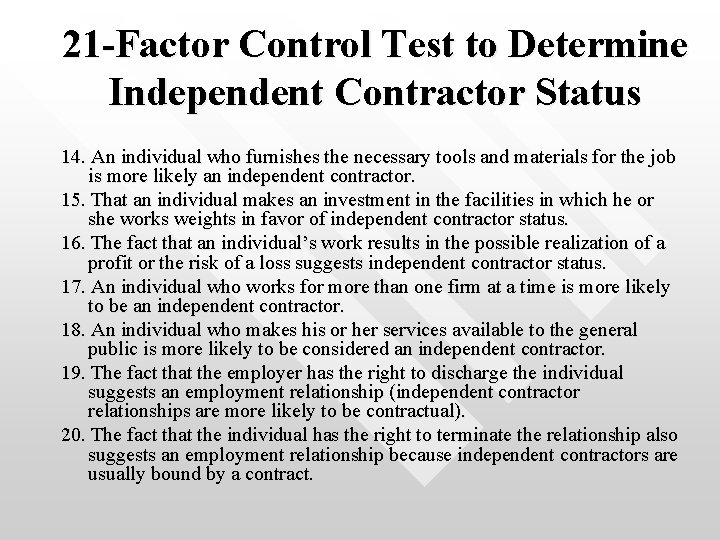

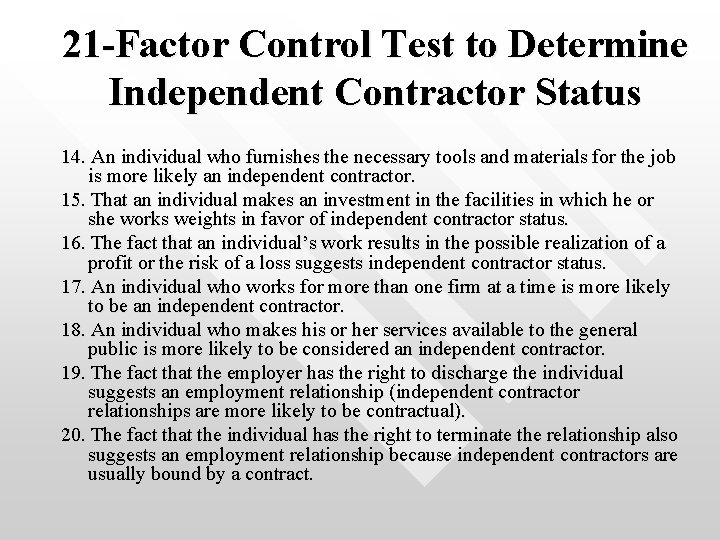

21 -Factor Control Test to Determine Independent Contractor Status 14. An individual who furnishes the necessary tools and materials for the job is more likely an independent contractor. 15. That an individual makes an investment in the facilities in which he or she works weights in favor of independent contractor status. 16. The fact that an individual’s work results in the possible realization of a profit or the risk of a loss suggests independent contractor status. 17. An individual who works for more than one firm at a time is more likely to be an independent contractor. 18. An individual who makes his or her services available to the general public is more likely to be considered an independent contractor. 19. The fact that the employer has the right to discharge the individual suggests an employment relationship (independent contractor relationships are more likely to be contractual). 20. The fact that the individual has the right to terminate the relationship also suggests an employment relationship because independent contractors are usually bound by a contract.

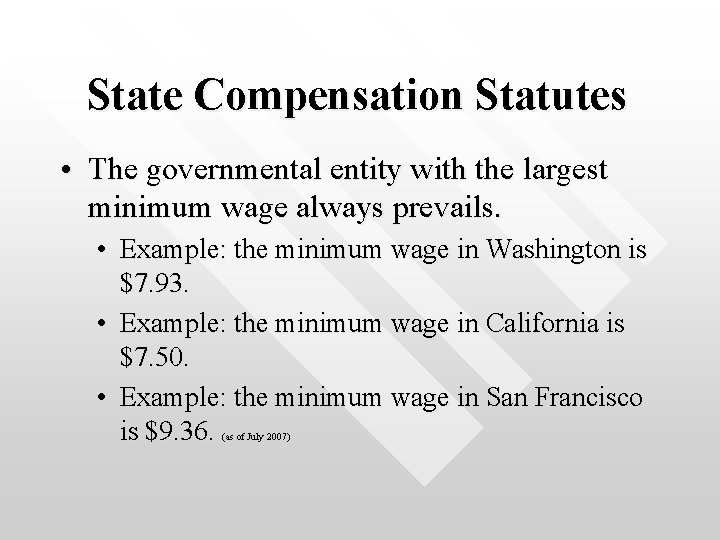

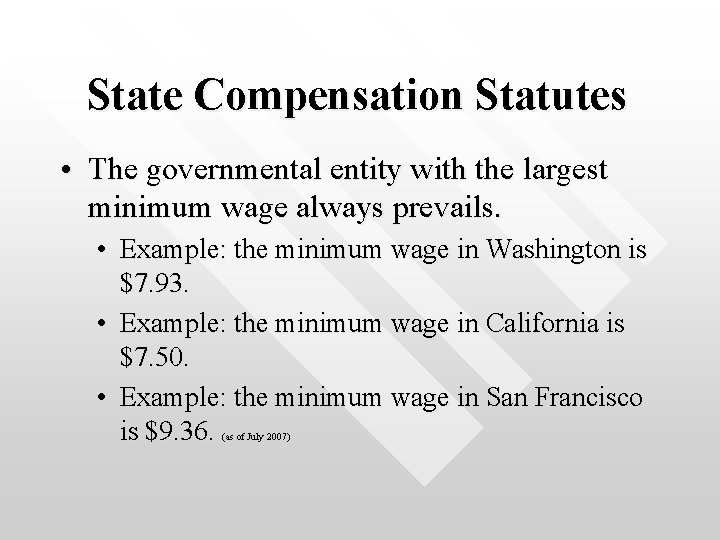

State Compensation Statutes • The governmental entity with the largest minimum wage always prevails. • Example: the minimum wage in Washington is $7. 93. • Example: the minimum wage in California is $7. 50. • Example: the minimum wage in San Francisco is $9. 36. (as of July 2007)

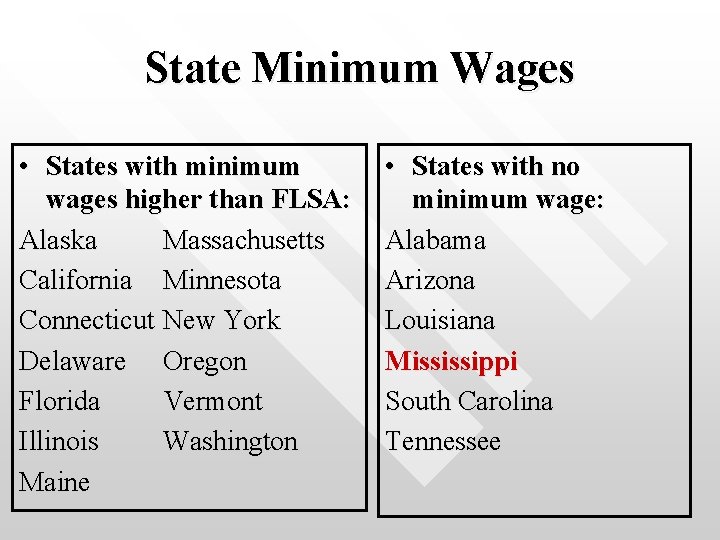

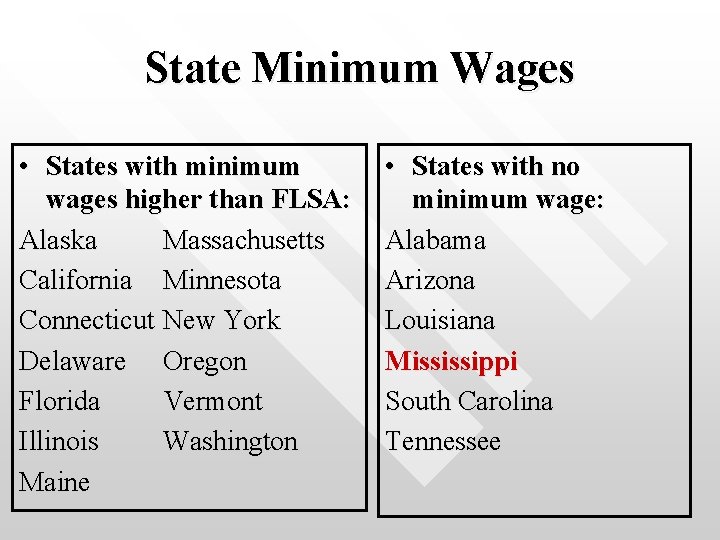

State Minimum Wages • States with minimum wages higher than FLSA: Alaska Massachusetts California Minnesota Connecticut New York Delaware Oregon Florida Vermont Illinois Washington Maine • States with no minimum wage: Alabama Arizona Louisiana Mississippi South Carolina Tennessee

Garnishment Laws • Garnishment – a court action which directs that a portion of an employee’s wages are to be side aside to pay a debt owed by the employee to a creditor.

Davis-Bacon Act (1931) • Federal construction contractors with contracts or subcontracts in excess of $2000. • Enacted to encourage hiring union labor in the Great Depression. • Requires employers to pay the “prevailing wage” for the area (the union wage scale for the area).

Walsh-Healey Act (1936) • Federal supply and service contractors with contracts or subcontracts in excess of $10, 000. • Requires employers to pay the “prevailing wage” for the area (the union wage scale for the area).

Mc. Namara-O’Hara Service Contract Act (1965) • Employers who hold contract or subcontracts to provide services in excess of $2, 500 to the United States government. • Must pay their employees the prevailing wage for the geographic area in which the work is being performed. • Must provide fringe benefits to service employees comparable to the prevailing benefits.

Equal Pay Act (1963) • Equal pay for equal work. • Differentials are permitted for: • • Merit Seniority Quantity of work Quality of work Education Level of responsibility Working conditions

The Equal Pay Myth • The myth: Women in the workplace earn only 74¢ for every $1 made by men. • Fact: Men pursue jobs that are more dangerous and receive higher pay for context. (92% of all job-related deaths involve men). • Fact: Men are more represented in the higher paying professions. • Fact: Women who never had children made 98¢ for every $1 men made. Source: Diana Furchtgott-Roth, et al. (1999). Women's Figures: An Illustrated Guide to the Economic Progress of Women in America.

Developing a Base Pay System • Job Evaluation - the systematic determination of the relative worth of jobs within an organization. • Evaluation criteria of jobs: • Relative importance of one job to other jobs. • Skills required to perform TDR of one job as compared to other jobs. • Difficulty (complexity) of the job compared with other jobs.

Job Evaluation Methods • Ranking Method - jobs are ranked from highest to lowest in importance. • Very subjective. • Awkward with large numbers of jobs. • Classification Method - categories are established to group jobs of similar KSA. • • • U. S. Civil Service GS system, e. g. Very subjective Overly reliant on job titles and descriptions and assumes similarity between agencies and job context.

Job Evaluation Methods • Point Method - jobs are broken into compensable factors [job dimension common across job categories] and weights or points are assigned to the factors. Hay System is the most popular (60%). • Advantages: • Simple enough for managers to understand. • Allows for comparison between jobs • Can be used by people who are not specialists • Disadvantages • Time consuming • Results in job rigidity [highly delineated TDR].

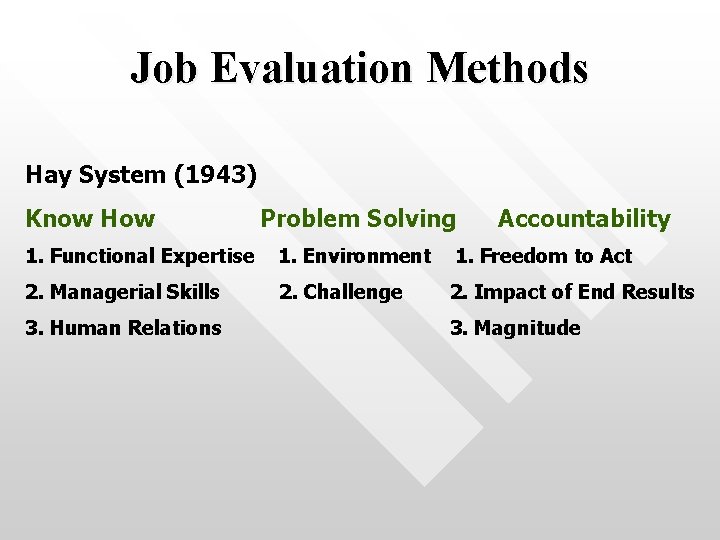

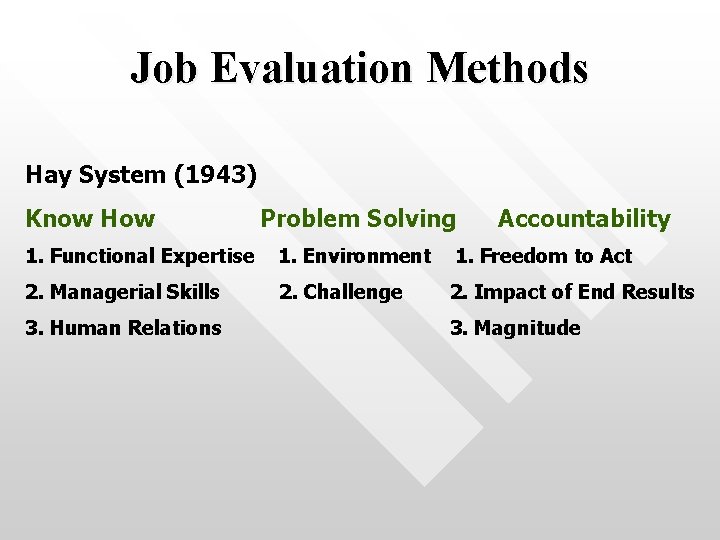

Job Evaluation Methods Hay System (1943) Know How Problem Solving Accountability 1. Functional Expertise 1. Environment 1. Freedom to Act 2. Managerial Skills 2. Challenge 2. Impact of End Results 3. Human Relations 3. Magnitude

Job Evaluation Methods • Factor Comparison Method - sophisticated quantitative combination of both ranking and point methods. • (1) Benchmark jobs are identified (those performed by workers with similar TDR and similar KSA). • (2) Market rates are gathered for benchmark jobs. • (3) Monetary values are assigned to each factor. • (4) All other jobs [with their corresponding factors] are compared to the benchmark jobs.

Job Evaluation Methods • Factor Comparison Method • Disadvantages • • • Expensive and can only be done by trained specialists. Complicated and difficult for some managers to understand. May lead to employee dissatisfaction or worse (litigation, AFSCME v. State of Washington).

Job Evaluation Methods • Computerized Job Evaluation - simply the application of existing job evaluation methods to computer technology.

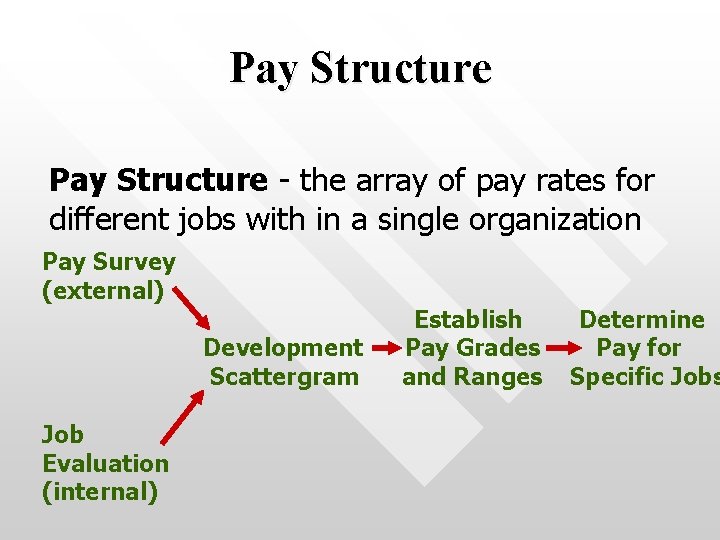

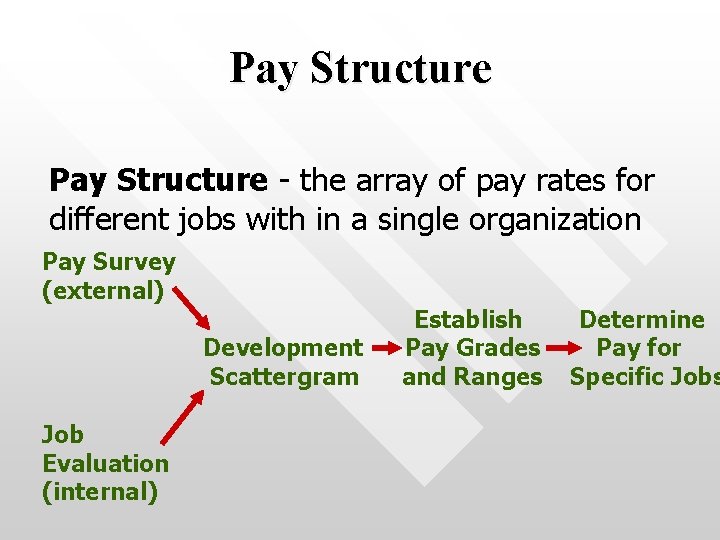

Pay Structure - the array of pay rates for different jobs with in a single organization Pay Survey (external) Development Scattergram Job Evaluation (internal) Establish Pay Grades and Ranges Determine Pay for Specific Jobs

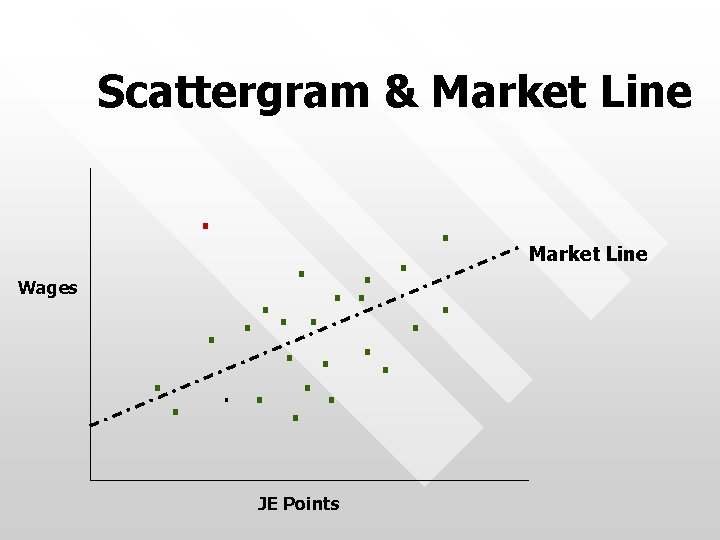

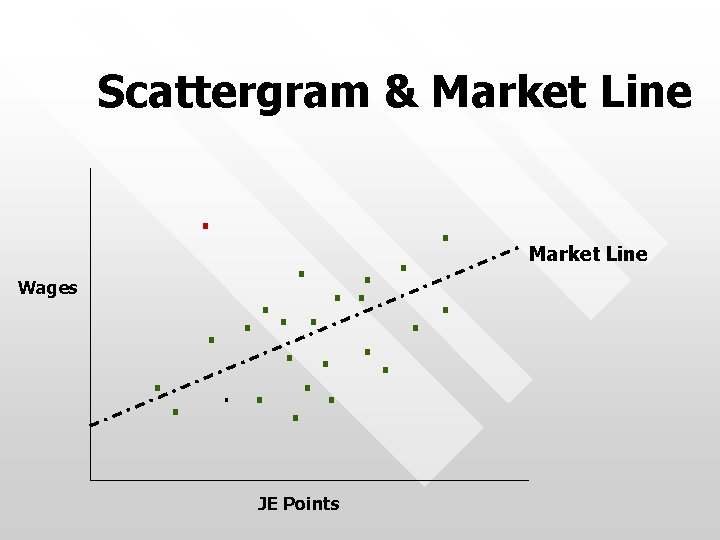

Pay Structure • Pay Survey - collecting compensation data from similar jobs in other organizations. • Develop Wage Curve or Scattergram - using survey data and the internal job evaluation a pay scatter gram is developed. • Market Line – a trend line showing the relationship between job value (resulting from job evaluation) and the pay survey rates.

Scattergram & Market Line. Wages . . . JE Points Market Line

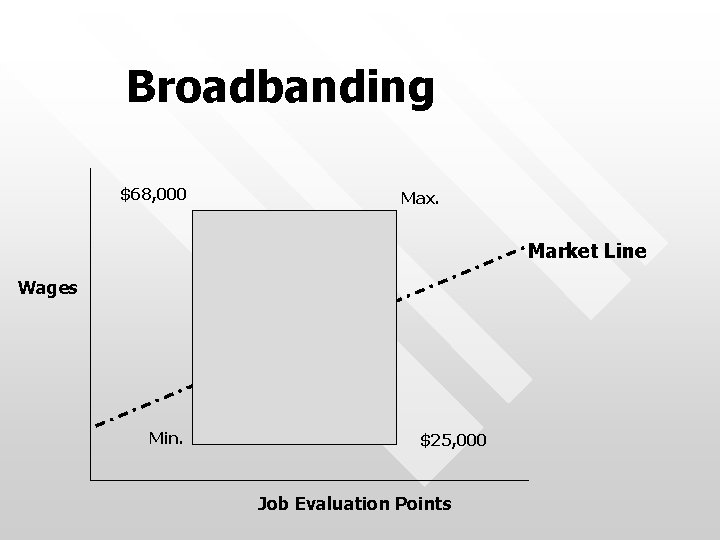

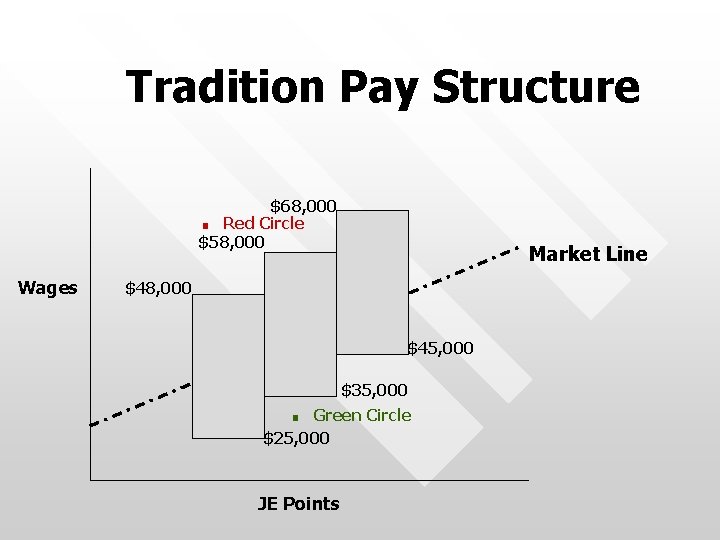

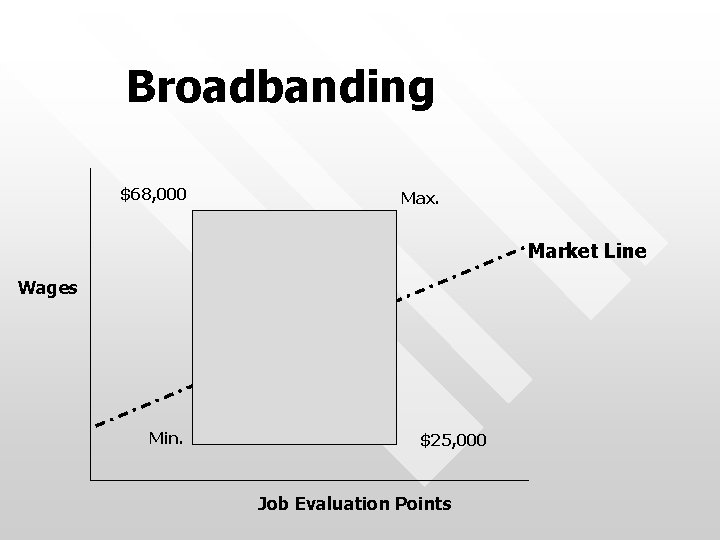

Pay Structure • Using the Wage Curve, pay grades and pay ranges are developed. • Pay Grades - grouping individual jobs having approximately the same worth. • Pay Range - establishing the maximum and minimum range of compensation for each job. • Broadbanding – the practice of using fewer pay grades having broader ranges than a tradition compensation system.

Pay Range • Determines the maximum and minimum each job incumbent may earn. • Differentials within the range are based on seniority/time in grade. • The lower the level the job, the narrower the range and vice versa.

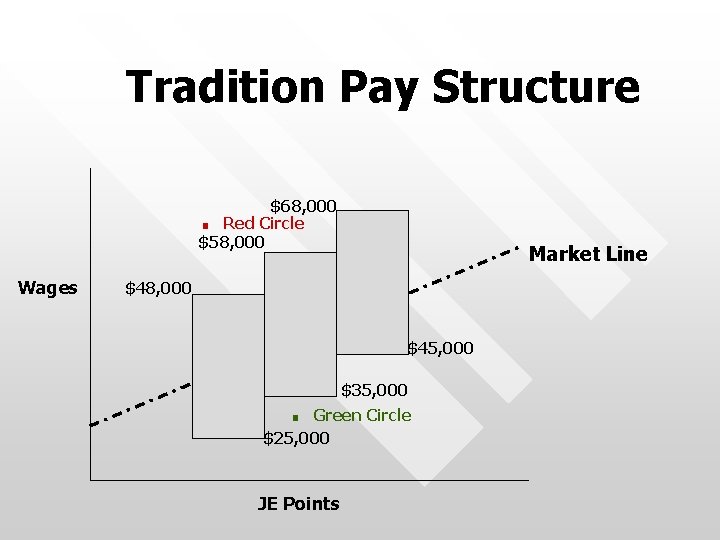

Tradition Pay Structure. $68, 000 Red Circle $58, 000 Wages Market Line $48, 000 $45, 000 . $35, 000 Green Circle $25, 000 JE Points

Broadbanding $68, 000 Max. Market Line Wages Min. $25, 000 Job Evaluation Points

Pay Range • Red-circled employees are those employees whose pay goes beyond the established range for their particular job (usually due to an inordinate amount of longevity). • Green-circled employees are those paid below the established range for their particular job. (usually due to pay compression).

Pay Compression • Pay Compression - pay differences between persons with different levels of experience and performance are small. • Usually occurs when labor market pay levels rise faster than internal pay adjustments. • Example: An employee with 10 years longevity makes $45, 000/yr, a newly hired employee makes $43, 000.

Pay Inversion • Pay Inversion may sometimes occur. New hires make more than veteran (more experienced) employees. • Usually occurs when internal pay adjustments lag behind labor market pay levels. • Example: An employee with 10 years longevity makes $45, 000/yr, a newly hired employee makes $50, 000.

Cost Effectiveness • Cost Effectiveness - ideally, in a competitive environment, increases in productivity should be greater than increases in compensation. Labor Cost = Output Input