MFA 2016 Qualified Allocation Plan and Application Workshop

- Slides: 73

MFA 2016 Qualified Allocation Plan and Application Workshop November 12, 2015 11/12/2015 New Mexico Mortgage Finance Authority 1

Presentation Overview • Tax Credit Program Overview Page 3 • 2016 Qualified Allocation Plan Review 18 • Application Process 54 • What Makes a Successful Application 67 11/12/2015 New Mexico Mortgage Finance Authority 2

TAX CREDIT PROGRAM OVERVIEW 11/12/2015 New Mexico Mortgage Finance Authority 3

Housing Priorities • Increase the supply of decent, affordable rental housing; • Expand housing opportunities and access for individuals with special needs; • Expand the supply of housing and services to assist the homeless; and • Preserve the State’s existing affordable housing stock. 11/12/2015 New Mexico Mortgage Finance Authority 4

Background • LIHTC Program created by Tax Reform Act of 1986 as an incentive for individuals/ corporations to invest in the construction or rehabilitation of low income housing. • The Tax Credit provides a dollar-for-dollar reduction in personal or corporate federal income tax liability for a 10 year period. 11/12/2015 New Mexico Mortgage Finance Authority 5

Internal Revenue Code § 42 • IRC § 42 sets forth the requirements and process for the Tax Credit program. • § 42(m) states the housing credit agency must make Tax Credit allocations pursuant to a Qualified Allocation Plan, which: § Sets forth project selection criteria; § Gives preference to those serving lowest income tenants for the longest period of time; § Provides a procedure for monitoring compliance 11/12/2015 New Mexico Mortgage Finance Authority 6

Background, continued • Credit Ceiling: $2. 35 per capita allocation + any returned or unused credits + any National Pool credits – forward allocations • MFA allocated $6. 267 mm in 2015 • MFA will allocate about $5 mm in 2016 • Tax Credits are the deepest Federal Subsidy that funds up to 70% of total development cost 11/12/2015 New Mexico Mortgage Finance Authority 7

Affordable Use § Minimum set aside: • 20% of units for tenants earning no more than 50% of median income (20/50 election) - Requires that all restricted units be at 50% AMI or below to be eligible for credits OR • 40% of units for tenants earning no more than 60% of median income (40/60 election) • This election is irrevocable. § Use restriction for 30 years required (income and rent limits) 11/12/2015 New Mexico Mortgage Finance Authority 8

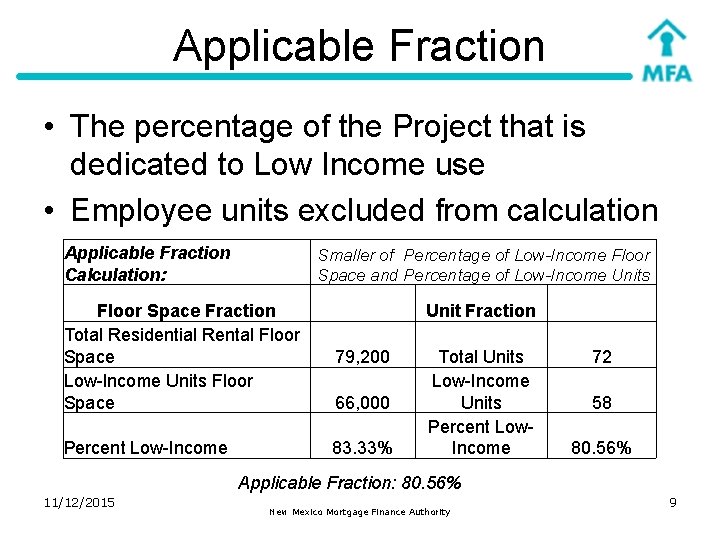

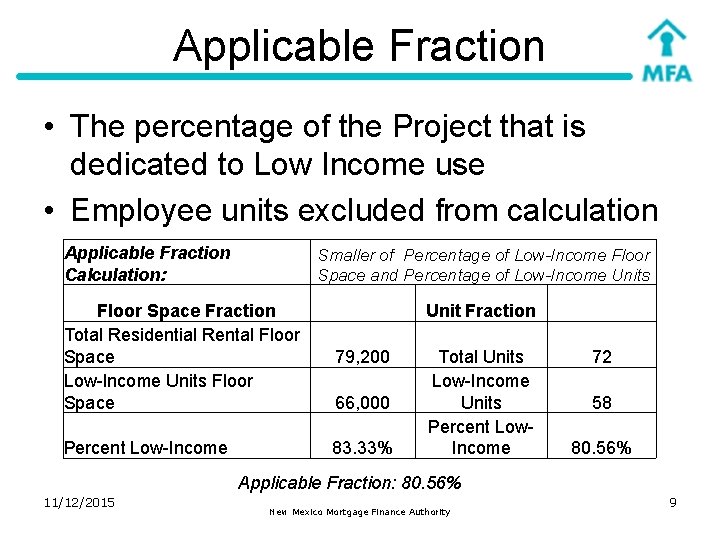

Applicable Fraction • The percentage of the Project that is dedicated to Low Income use • Employee units excluded from calculation Applicable Fraction Calculation: Smaller of Percentage of Low-Income Floor Space and Percentage of Low-Income Units Floor Space Fraction Total Residential Rental Floor Space Low-Income Units Floor Space Unit Fraction 79, 200 Percent Low-Income 83. 33% 66, 000 Total Units Low-Income Units Percent Low. Income 72 58 80. 56% Applicable Fraction: 80. 56% 11/12/2015 New Mexico Mortgage Finance Authority 9

Eligible Basis • The sum of the eligible cost elements that are subject to depreciation. • 70% Eligible Basis (9% Tax Credits) for new construction or rehabilitation costs. • 30% Eligible Basis (4% Tax Credits) for acquisition costs and projects with federal subsidy. • Exclusions- federal grants, land acquisition cost, commercial, etc. • “Basis Boost” – Increases Eligible Basis 30% if project is in a HUD Defined QCT or DDA 11/12/2015 New Mexico Mortgage Finance Authority 10

Basis Boost • Basis Boost – Up to 30% increase to Eligible Basis for new construction and rehabilitation costs only (acquisition costs not eligible) • For Projects in HUD designated QCT or DDA (30%) • MFA designation of need for Financially Feasibility (up to 30%) and: 1. Not Financed with Tax Exempt Bonds; 2. Must score at least 10 points under Projects that Benefit the Environment; and 3. Serve a target population. 11/12/2015 New Mexico Mortgage Finance Authority 11

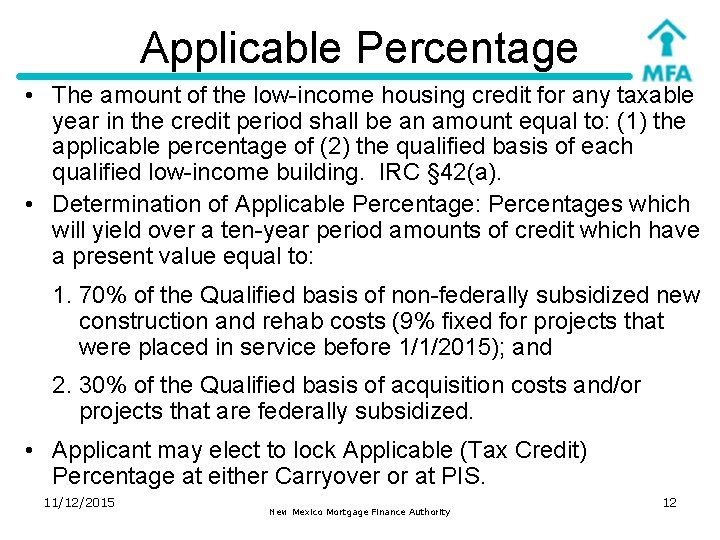

Applicable Percentage • The amount of the low-income housing credit for any taxable year in the credit period shall be an amount equal to: (1) the applicable percentage of (2) the qualified basis of each qualified low-income building. IRC § 42(a). • Determination of Applicable Percentage: Percentages which will yield over a ten-year period amounts of credit which have a present value equal to: 1. 70% of the Qualified basis of non-federally subsidized new construction and rehab costs (9% fixed for projects that were placed in service before 1/1/2015); and 2. 30% of the Qualified basis of acquisition costs and/or projects that are federally subsidized. • Applicant may elect to lock Applicable (Tax Credit) Percentage at either Carryover or at PIS. 11/12/2015 New Mexico Mortgage Finance Authority 12

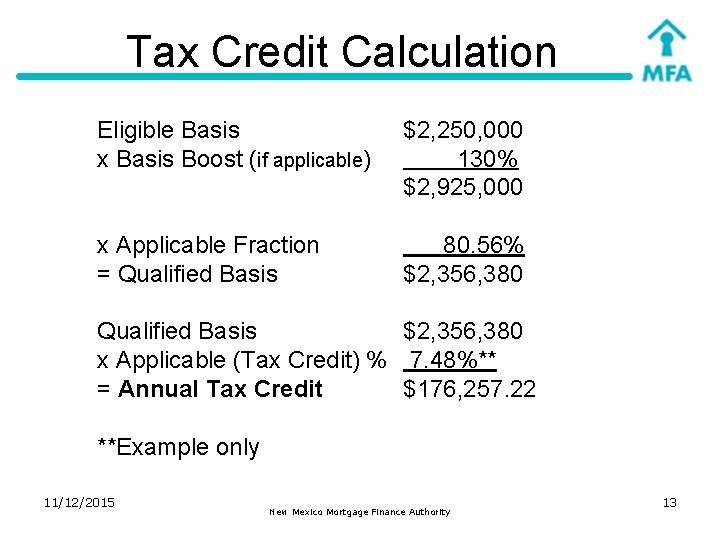

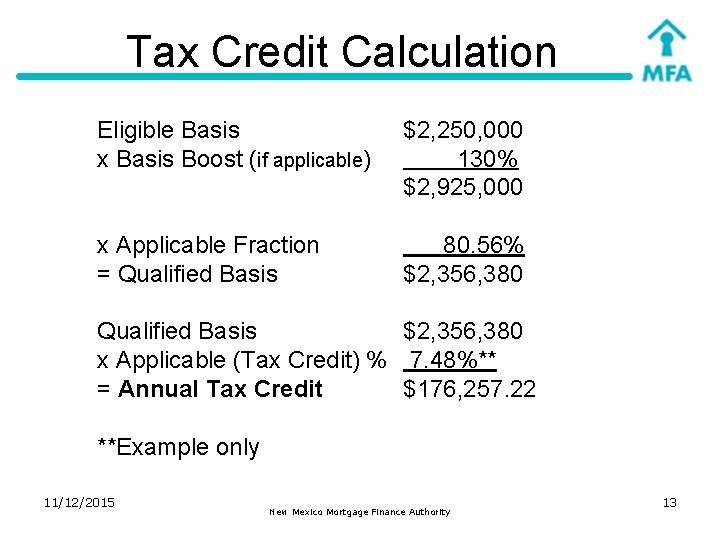

Tax Credit Calculation Eligible Basis x Basis Boost (if applicable) $2, 250, 000 130% $2, 925, 000 x Applicable Fraction = Qualified Basis 80. 56% $2, 356, 380 Qualified Basis $2, 356, 380 x Applicable (Tax Credit) % 7. 48%** = Annual Tax Credit $176, 257. 22 **Example only 11/12/2015 New Mexico Mortgage Finance Authority 13

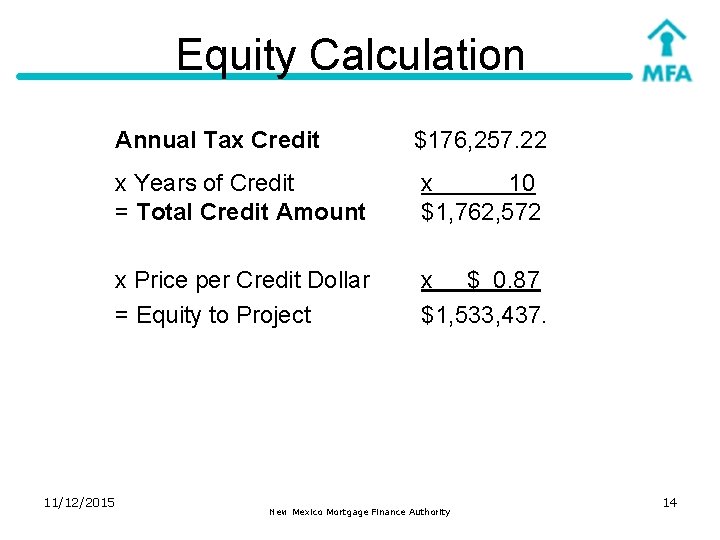

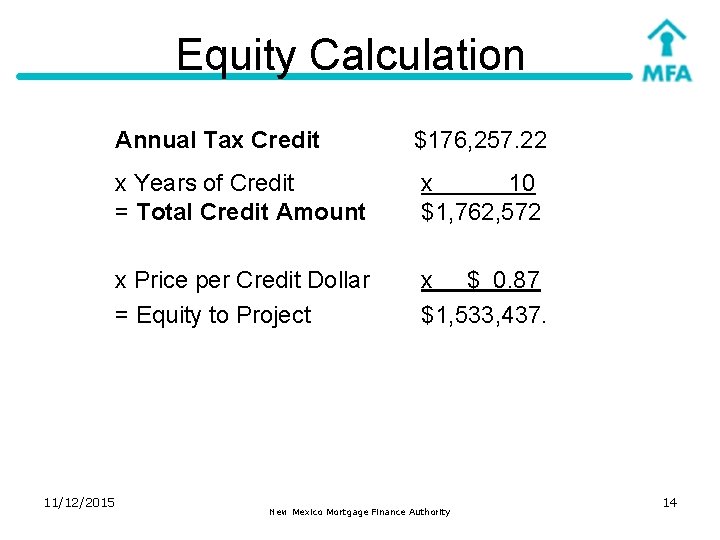

Equity Calculation Annual Tax Credit 11/12/2015 $176, 257. 22 x Years of Credit = Total Credit Amount x 10 $1, 762, 572 x Price per Credit Dollar = Equity to Project x $ 0. 87 $1, 533, 437. New Mexico Mortgage Finance Authority 14

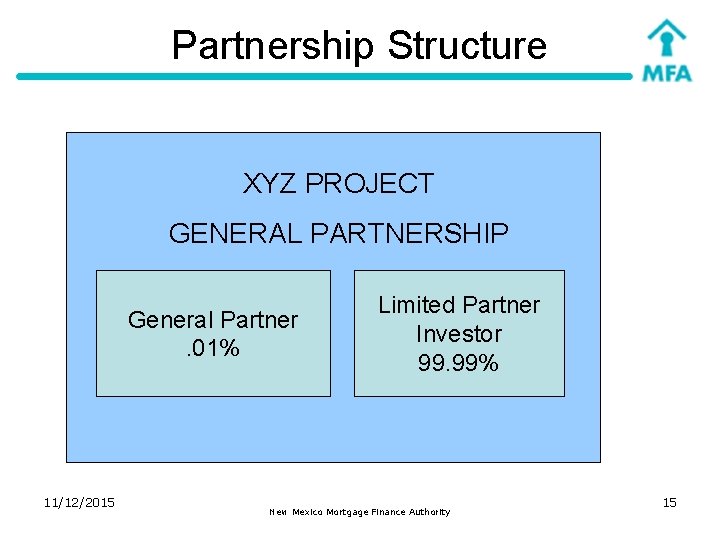

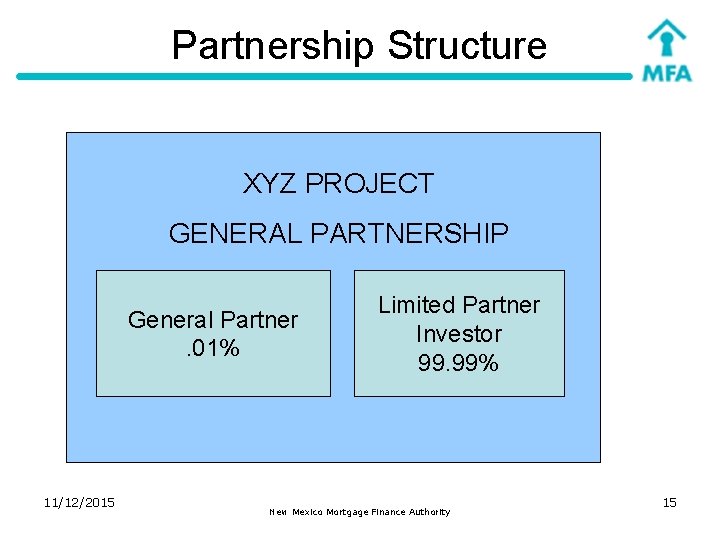

Partnership Structure XYZ PROJECT GENERAL PARTNERSHIP General Partner. 01% 11/12/2015 Limited Partner Investor 99. 99% New Mexico Mortgage Finance Authority 15

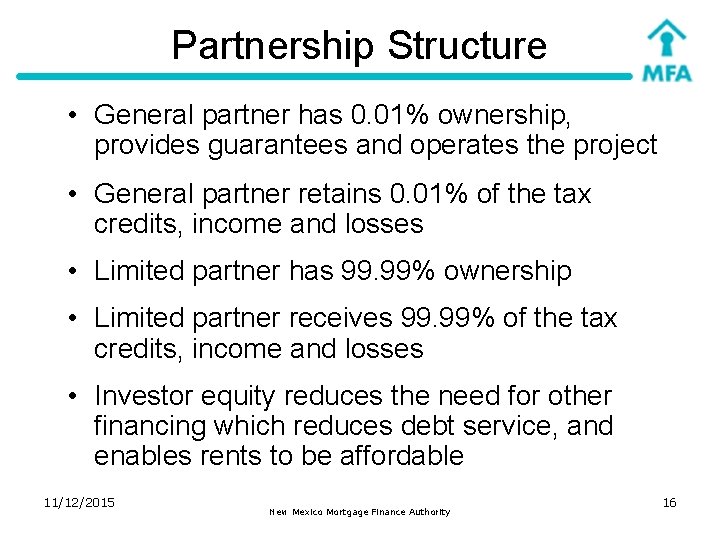

Partnership Structure • General partner has 0. 01% ownership, provides guarantees and operates the project • General partner retains 0. 01% of the tax credits, income and losses • Limited partner has 99. 99% ownership • Limited partner receives 99. 99% of the tax credits, income and losses • Investor equity reduces the need for other financing which reduces debt service, and enables rents to be affordable 11/12/2015 New Mexico Mortgage Finance Authority 16

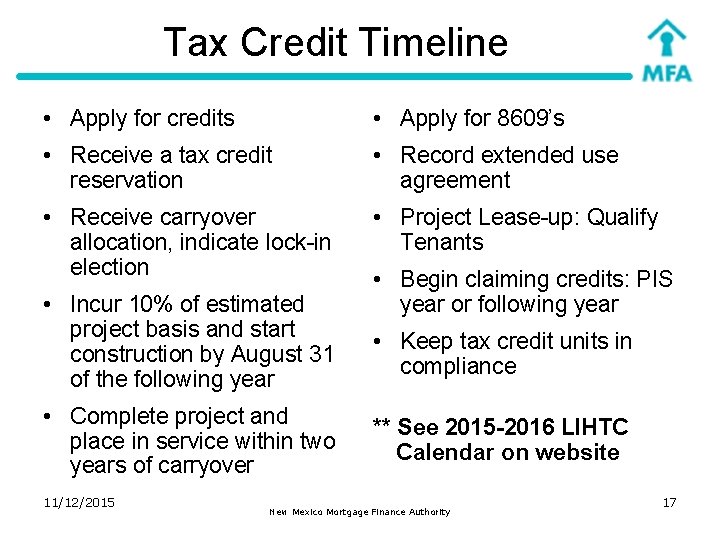

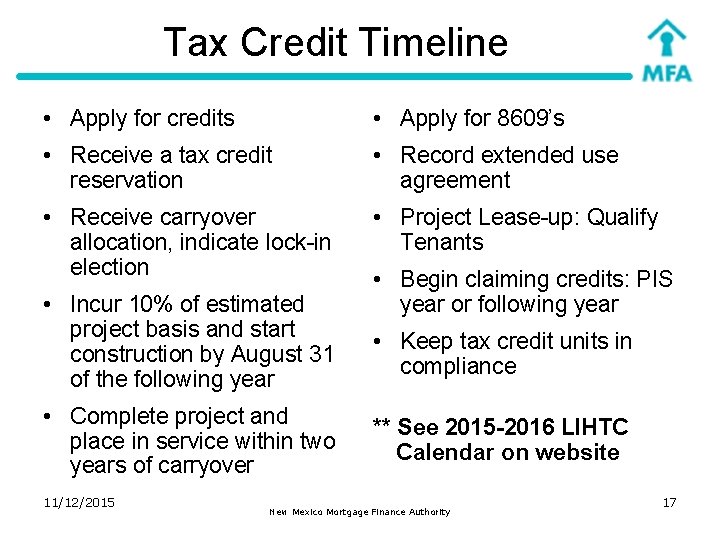

Tax Credit Timeline • Apply for credits • Apply for 8609’s • Receive a tax credit reservation • Record extended use agreement • Receive carryover allocation, indicate lock-in election • Project Lease-up: Qualify Tenants • Incur 10% of estimated project basis and start construction by August 31 of the following year • Complete project and place in service within two years of carryover 11/12/2015 • Begin claiming credits: PIS year or following year • Keep tax credit units in compliance ** See 2015 -2016 LIHTC Calendar on website New Mexico Mortgage Finance Authority 17

2016 Qualified Allocation Plan Review 11/12/2015 New Mexico Mortgage Finance Authority 18

Qualified Allocation Plan What is it? § The QAP is the State of NM’s plan for allocating its tax credits § It is prepared annually, consistent with IRC § 42(m). Approval Process Where is it? http: //www. housingnm. org/low-income-housingtax-credits-lihtc-allocations 11/12/2015 New Mexico Mortgage Finance Authority 19

Threshold Review All Applications must meet each of the following and include all required materials: • Site Control • Zoning • Minimum Project Score • Applicant Eligibility • Financial Feasibility • Fees 11/12/2015 New Mexico Mortgage Finance Authority 20

Site Control • Fully executed purchase contract or option • Written governmental commitment to transfer property by deed or lease • Recorded deed or long term lease. 11/12/2015 21 New Mexico Mortgage Finance Authority

Site Control, Continued Transfer Commitment must: • Provide an initial term lasting until at least July 31, 2016. • Be binding on seller through initial term • Have names, legal description, and acquisition cost that matches application. **Initial term must not be conditioned upon any extensions requiring seller consent, additional payments or financing approval. 11/12/2015 New Mexico Mortgage Finance Authority 22

Zoning • Evidence that multifamily housing is not prohibited by the existing zoning and dated < 6 months before application deadline. • No pending litigation or unexpired appeal process relating to zoning for project. • Only exemption, a site that is not zoned or which is zoned agricultural. 11/12/2015 New Mexico Mortgage Finance Authority 23

Fees • All fees owed to MFA for all Tax Credit Projects in which Principal(s) participate must be current. • Fees for 2016: Application Fee: $3, 500 Deposit: $8, 500 Processing Fee: ** 8% (9% award) or 5. 5% (4% award) **Applicable if a reservation is received 11/12/2015 New Mexico Mortgage Finance Authority 24

Applicant Eligibility All members of the development team of the proposed Project must be in good standing with MFA and all other state and federal affordable housing agencies. 11/12/2015 New Mexico Mortgage Finance Authority 25

Financial Feasibility • Applications must demonstrate, in MFA’s reasonable judgment, the Project’s financial feasibility. • QAP Section IV. C. 2, Section IV. D, and Section IV. E. summarize MFA’s financial feasibility considerations. • Additional Underwriting Details in the Initial Application Underwriting Supplement 11/12/2015 New Mexico Mortgage Finance Authority 26

Per Unit Costs Limits § Based on average per unit costs of new construction and adaptive re-use projects submitted in the round § Purchase price attributed to land, costs related to commercial space, and reserves will be excluded. § In 2015 the average was $191, 211 and in 2014 it was $196, 682 § Per project maximum Tax Credit award is $1, 150, 000 and any entity (including affiliates) may not receive more than 2 awards. 11/12/2015 New Mexico Mortgage Finance Authority 27

Minimum Project Score • 130 points for competitive round; 80 points for bond projects • Partial points will not be awarded • Applicant self-scores application; MFA scores application • Scoring criteria and information needed to obtain points in QAP and checklist • Deficiency Correction used only to correct incomplete application or meet threshold – not scoring or Allocation Set Aside requirements 11/12/2015 New Mexico Mortgage Finance Authority 28

Scoring Criteria Criterion 1: Nonprofit, New Mexico Housing Authority , or Tribally Designated Housing Entity (0 -10 points) § Requirements in application and checklist must be § § § provided for points Requirement for points different than requirements for set-aside Net worth/net assets must be substantiated by reviewed or audited financial statements Document fee split agreement among parties Entity required to attend training within 6 months prior to application Indicate on checklist if submitting as a qualified nonprofit, NMHA, or TDHE 11/12/2015 New Mexico Mortgage Finance Authority 29

Scoring Criteria Continued Criterion 2: Projects that Benefit the Environment (0 -18 points) • Five options, two scoring tiers: § LEED, Enterprise Green Communities, National Green Building Standard, or Build Green NM – 18 points § MFA Green Criteria – 10 points • Building Performance Standard • Use composite wood only if free of urea formaldehyde 11/12/2015 New Mexico Mortgage Finance Authority 30

Scoring Criteria Continued • Projects that Benefit the Environment, continued § Basic Application Requirements • Narrative description of features • Green professional • Criteria Checklist • Architect or green professional certification 11/12/2015 New Mexico Mortgage Finance Authority 31

Scoring Criteria Continued Criterion 3: Locational Efficiency (0 -2 points) Projects located in proximity and connected to: 1) services 2) public transportation 11/12/2015 New Mexico Mortgage Finance Authority 32

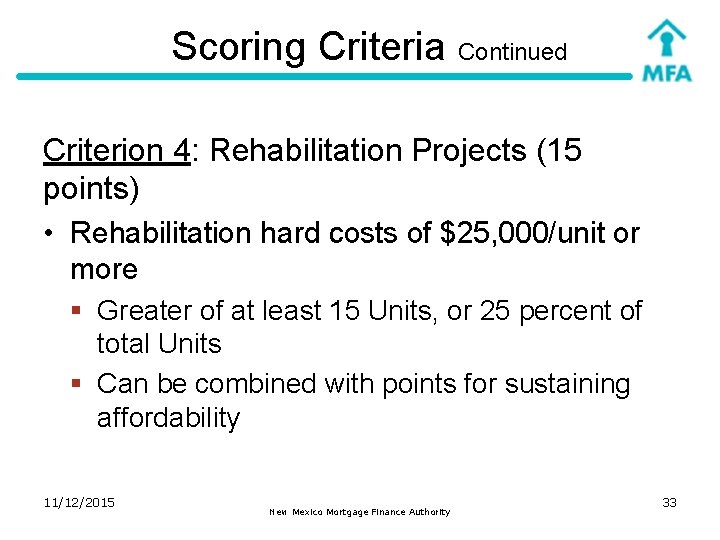

Scoring Criteria Continued Criterion 4: Rehabilitation Projects (15 points) • Rehabilitation hard costs of $25, 000/unit or more § Greater of at least 15 Units, or 25 percent of total Units § Can be combined with points for sustaining affordability 11/12/2015 New Mexico Mortgage Finance Authority 33

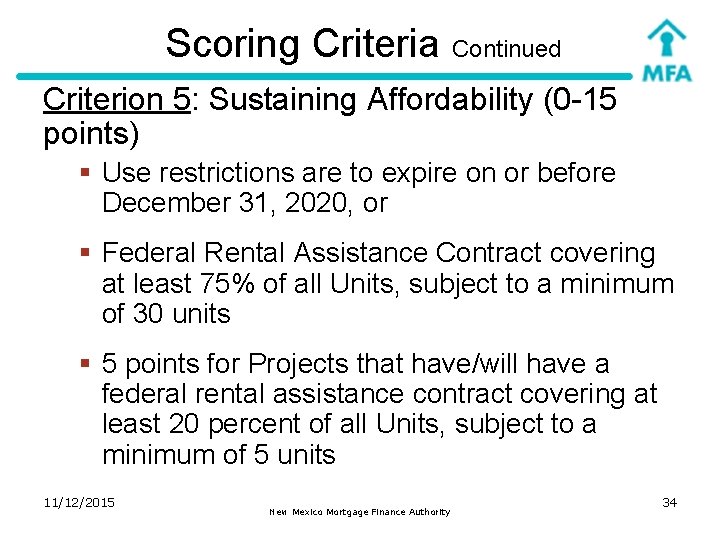

Scoring Criteria Continued Criterion 5: Sustaining Affordability (0 -15 points) § Use restrictions are to expire on or before December 31, 2020, or § Federal Rental Assistance Contract covering at least 75% of all Units, subject to a minimum of 30 units § 5 points for Projects that have/will have a federal rental assistance contract covering at least 20 percent of all Units, subject to a minimum of 5 units 11/12/2015 New Mexico Mortgage Finance Authority 34

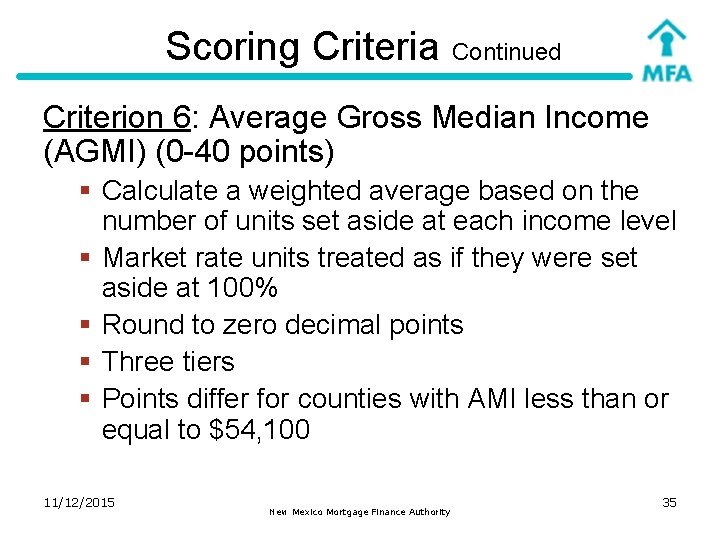

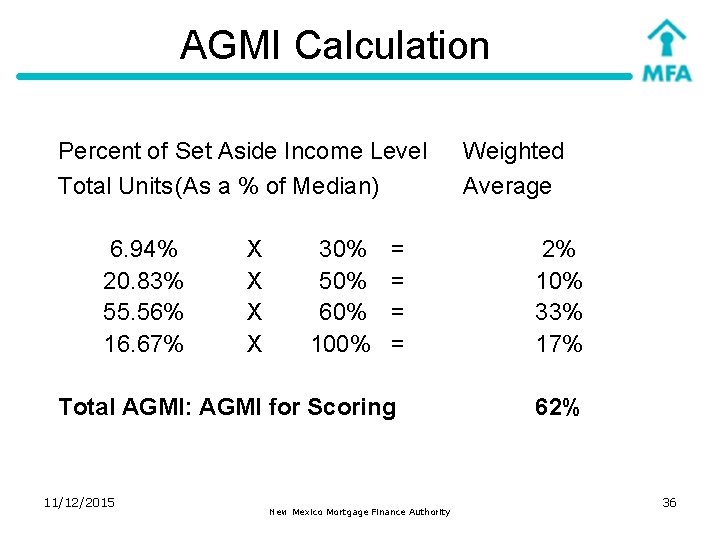

Scoring Criteria Continued Criterion 6: Average Gross Median Income (AGMI) (0 -40 points) § Calculate a weighted average based on the § § number of units set aside at each income level Market rate units treated as if they were set aside at 100% Round to zero decimal points Three tiers Points differ for counties with AMI less than or equal to $54, 100 11/12/2015 New Mexico Mortgage Finance Authority 35

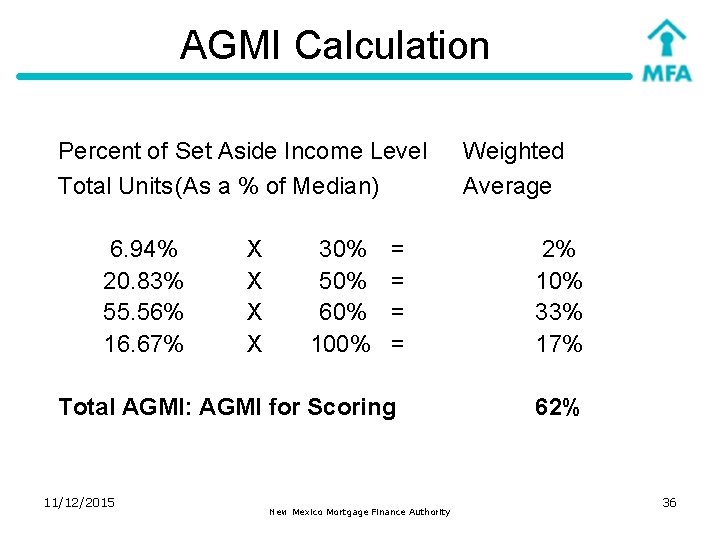

AGMI Calculation Percent of Set Aside Income Level Total Units (As a % of Median) 6. 94% 20. 83% 55. 56% 16. 67% X X 30% 50% 60% 100% = = Total AGMI: AGMI for Scoring 11/12/2015 New Mexico Mortgage Finance Authority Weighted Average 2% 10% 33% 17% 62% 36

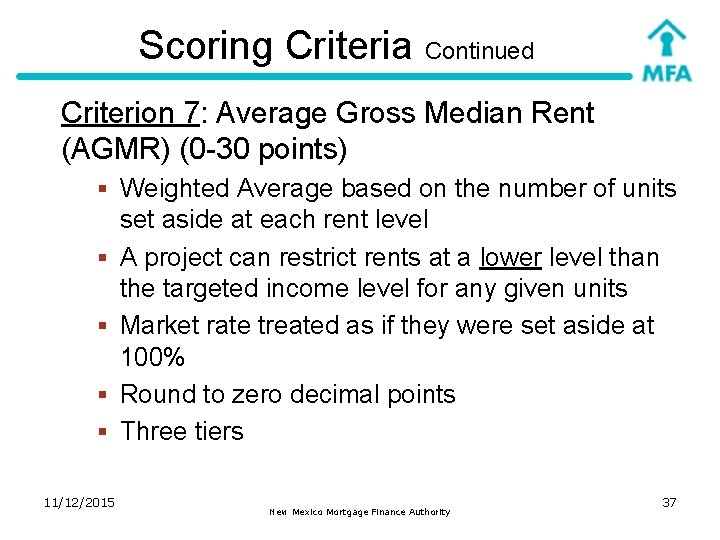

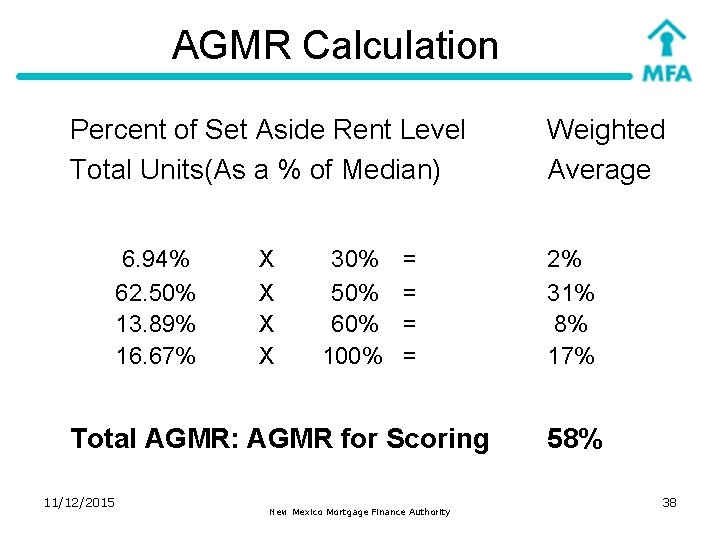

Scoring Criteria Continued Criterion 7: Average Gross Median Rent (AGMR) (0 -30 points) § Weighted Average based on the number of units § § 11/12/2015 set aside at each rent level A project can restrict rents at a lower level than the targeted income level for any given units Market rate treated as if they were set aside at 100% Round to zero decimal points Three tiers New Mexico Mortgage Finance Authority 37

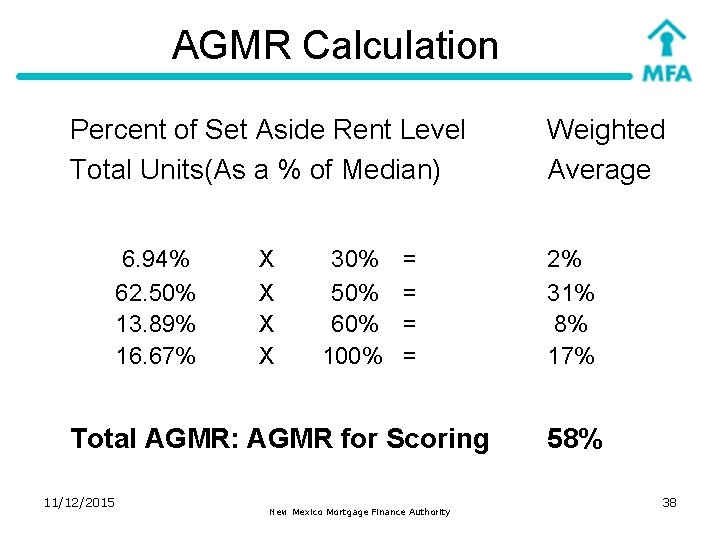

AGMR Calculation Percent of Set Aside Rent Level Total Units(As a % of Median) 6. 94% 62. 50% 13. 89% 16. 67% X X 30% 50% 60% 100% = = Total AGMR: AGMR for Scoring 11/12/2015 New Mexico Mortgage Finance Authority Weighted Average 2% 31% 8% 17% 58% 38

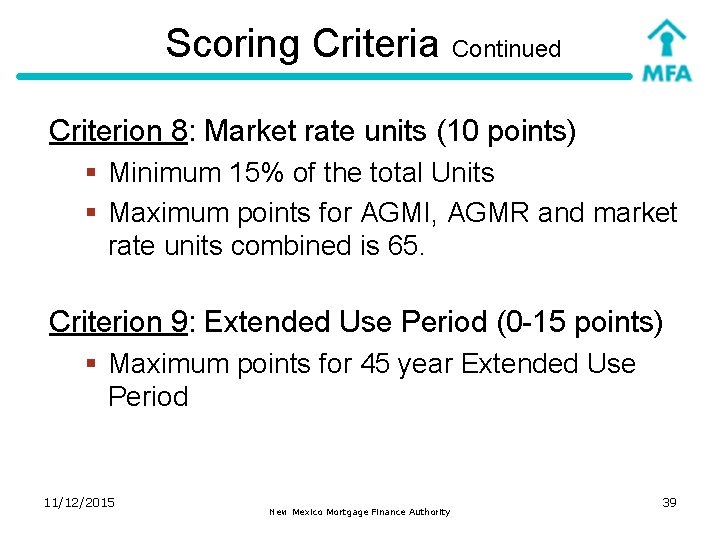

Scoring Criteria Continued Criterion 8: Market rate units (10 points) § Minimum 15% of the total Units § Maximum points for AGMI, AGMR and market rate units combined is 65. Criterion 9: Extended Use Period (0 -15 points) § Maximum points for 45 year Extended Use Period 11/12/2015 New Mexico Mortgage Finance Authority 39

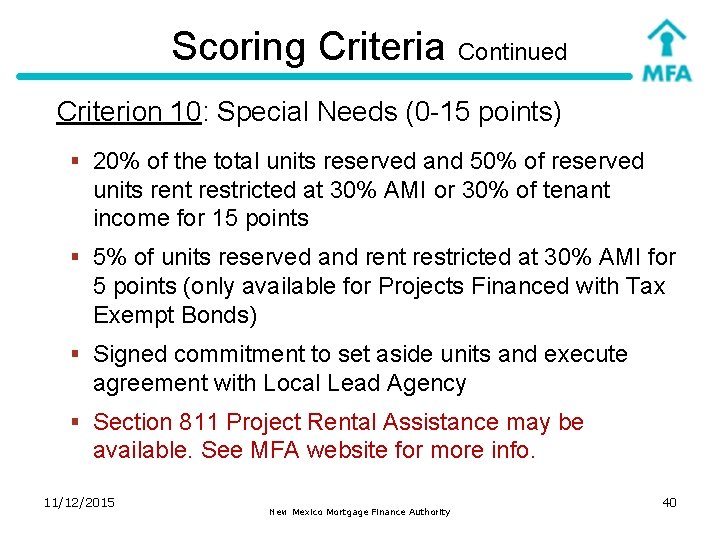

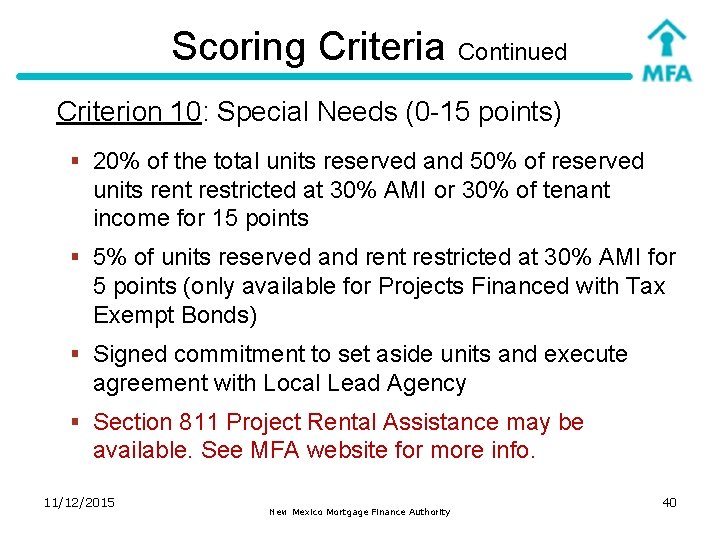

Scoring Criteria Continued Criterion 10: Special Needs (0 -15 points) § 20% of the total units reserved and 50% of reserved units rent restricted at 30% AMI or 30% of tenant income for 15 points § 5% of units reserved and rent restricted at 30% AMI for 5 points (only available for Projects Financed with Tax Exempt Bonds) § Signed commitment to set aside units and execute agreement with Local Lead Agency § Section 811 Project Rental Assistance may be available. See MFA website for more info. 11/12/2015 New Mexico Mortgage Finance Authority 40

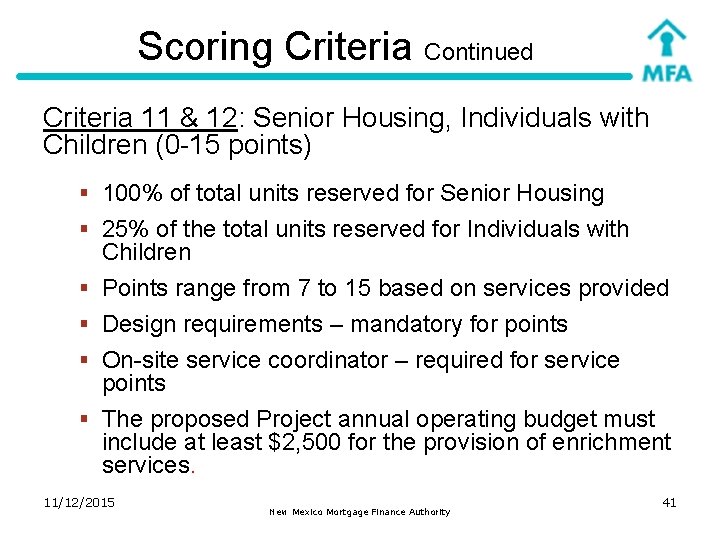

Scoring Criteria Continued Criteria 11 & 12: Senior Housing, Individuals with Children (0 -15 points) § 100% of total units reserved for Senior Housing § 25% of the total units reserved for Individuals with § § Children Points range from 7 to 15 based on services provided Design requirements – mandatory for points On-site service coordinator – required for service points The proposed Project annual operating budget must include at least $2, 500 for the provision of enrichment services. 11/12/2015 New Mexico Mortgage Finance Authority 41

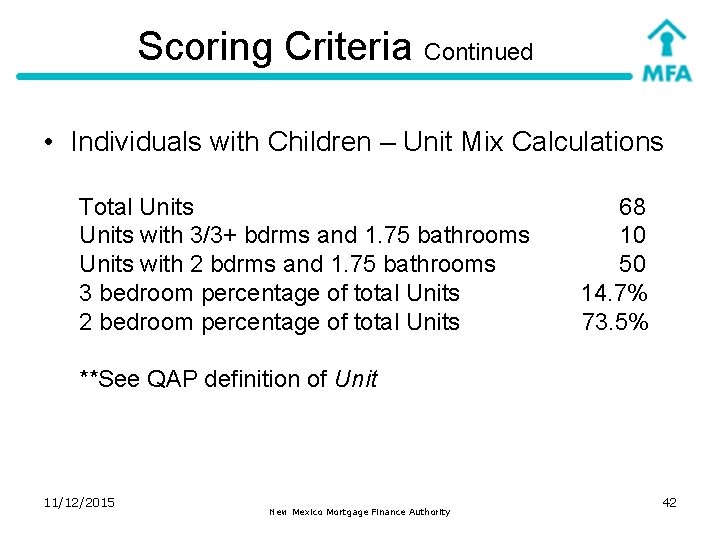

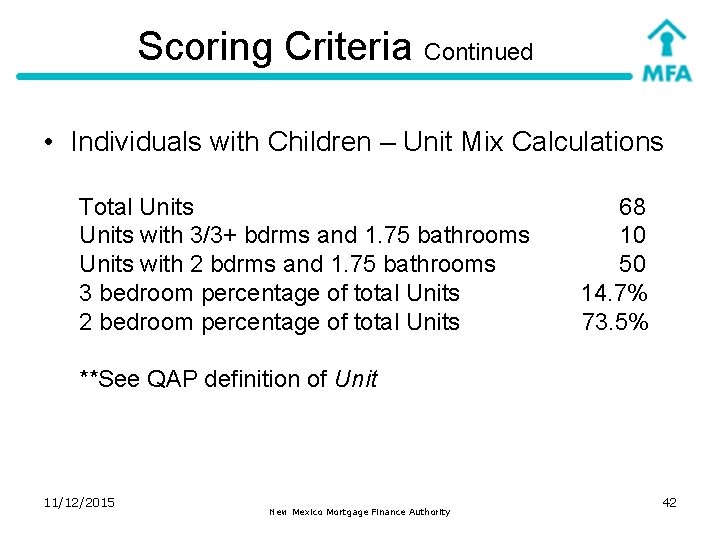

Scoring Criteria Continued • Individuals with Children – Unit Mix Calculations Total Units with 3/3+ bdrms and 1. 75 bathrooms Units with 2 bdrms and 1. 75 bathrooms 3 bedroom percentage of total Units 2 bedroom percentage of total Units 68 10 50 14. 7% 73. 5% **See QAP definition of Unit 11/12/2015 New Mexico Mortgage Finance Authority 42

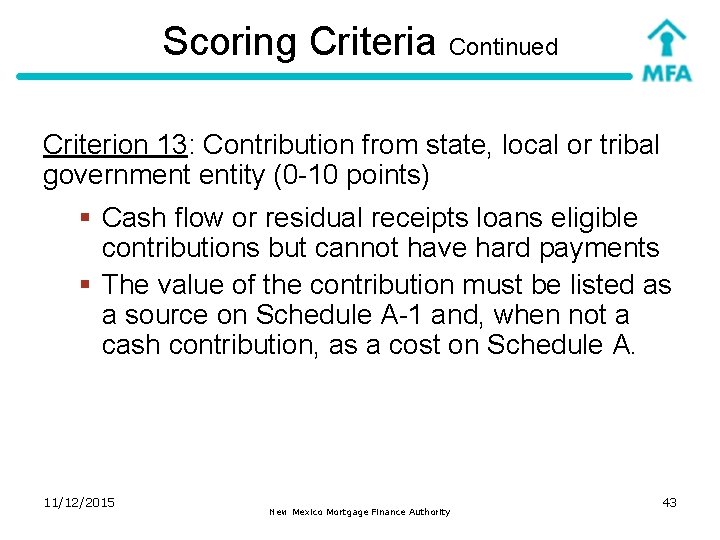

Scoring Criteria Continued Criterion 13: Contribution from state, local or tribal government entity (0 -10 points) § Cash flow or residual receipts loans eligible contributions but cannot have hard payments § The value of the contribution must be listed as a source on Schedule A-1 and, when not a cash contribution, as a cost on Schedule A. 11/12/2015 New Mexico Mortgage Finance Authority 43

Scoring Criteria Continued Criterion 14: Complete Application (5 points) Applications that do not require any deficiency corrections. See Section IV. A. 4 in the QAP: • Original Signatures in blue ink from all General Partners • Don’t forget the CD, DVD or flash drive! • Brown Classification Folder • All Attachments, Current MFA forms • Architectural Submissions must demonstrate compliance 11/12/2015 New Mexico Mortgage Finance Authority 44

Scoring Criteria Continued Criterion 15: Commitment to market units to public housing authority waiting lists (2 points) Criterion 16: QCT/Concerted Community Revitalization Plan (0 -5 points) § Projects that contribute to a Concerted Community Revitalization Plan or are located within ½ mile of a New Mexico designated Main Street are eligible for 3 points. § If the Project meets one of the above criteria and is located in a QCT, it is eligible for 5 points. 11/12/2015 New Mexico Mortgage Finance Authority 45

Scoring Criteria Continued Criterion 17: Projects with Units Intended for Eventual Tenant Ownership (5 points) § Cannot be combined with Extended Use Period Points Criterion 18: Financial Literacy Programs (2 points) § The proposed Project annual operating budget must include at least $1, 500 for the provision of the financial literacy classes Criterion 19: Historic Significance (5 points) Criterion 20: Blighted Buildings or Reuse of Brownfield Site (5 points) 11/12/2015 New Mexico Mortgage Finance Authority 46

Scoring Criteria Continued Criterion 21: Projects Located in Areas of Statistically Demonstrated Need (0 -15) • Tier 1 Areas (15 points) § Chaves, Cibola, Curry, Eddy, Lea, Sandoval, Santa Fe and Taos. All Projects on Native American Trust Lands or Native American-owned lands within the tribe’s jurisdictional boundaries. • Tier 2 Areas (10 points) § Bernalillo, Colfax, Grant, Lincoln, Luna, Mc. Kinley, Rio Arriba, San Juan, and Torrance. 11/12/2015 New Mexico Mortgage Finance Authority 47

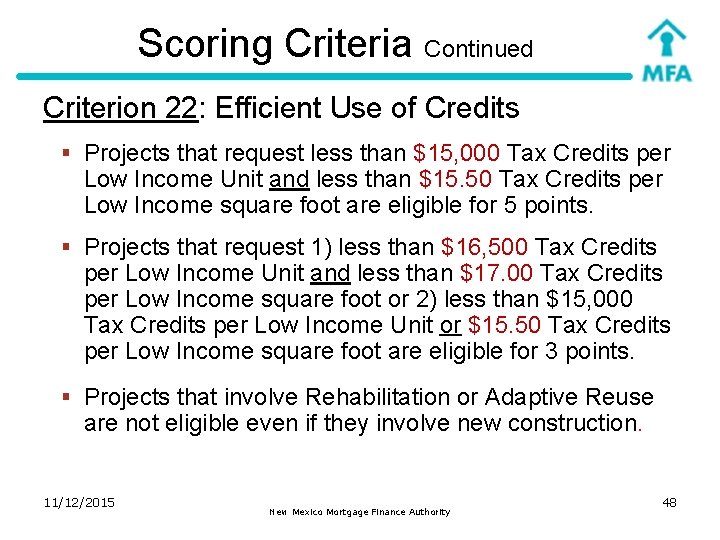

Scoring Criteria Continued Criterion 22: Efficient Use of Credits § Projects that request less than $15, 000 Tax Credits per Low Income Unit and less than $15. 50 Tax Credits per Low Income square foot are eligible for 5 points. § Projects that request 1) less than $16, 500 Tax Credits per Low Income Unit and less than $17. 00 Tax Credits per Low Income square foot or 2) less than $15, 000 Tax Credits per Low Income Unit or $15. 50 Tax Credits per Low Income square foot are eligible for 3 points. § Projects that involve Rehabilitation or Adaptive Reuse are not eligible even if they involve new construction. 11/12/2015 New Mexico Mortgage Finance Authority 48

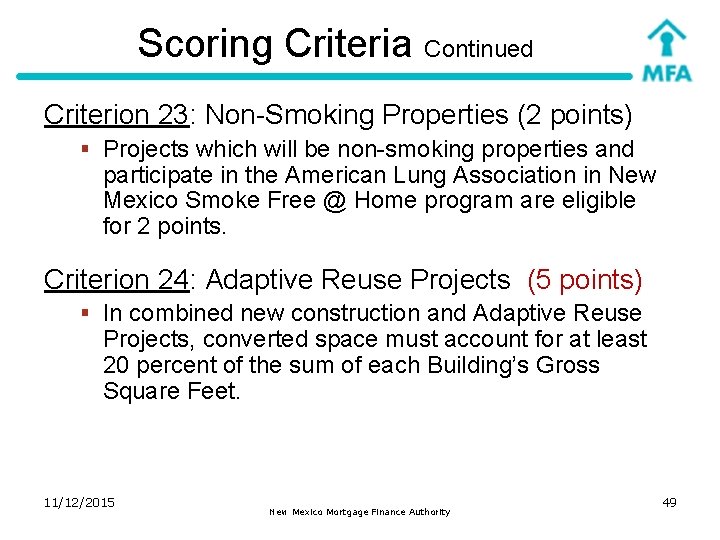

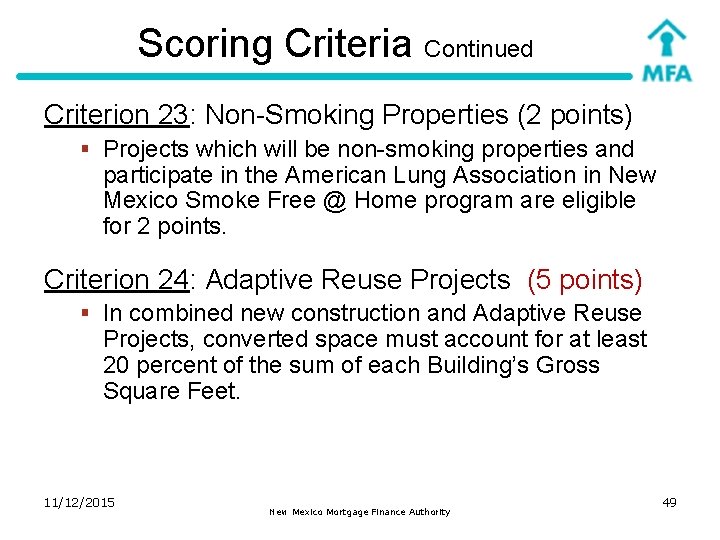

Scoring Criteria Continued Criterion 23: Non-Smoking Properties (2 points) § Projects which will be non-smoking properties and participate in the American Lung Association in New Mexico Smoke Free @ Home program are eligible for 2 points. Criterion 24: Adaptive Reuse Projects (5 points) § In combined new construction and Adaptive Reuse Projects, converted space must account for at least 20 percent of the sum of each Building’s Gross Square Feet. 11/12/2015 New Mexico Mortgage Finance Authority 49

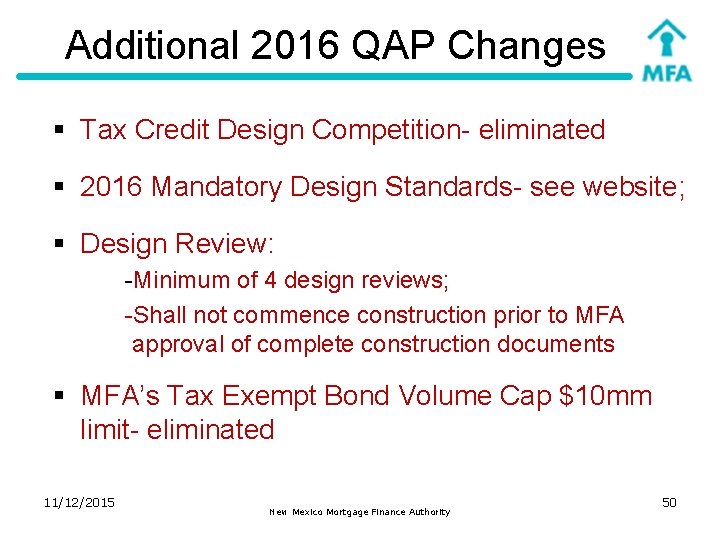

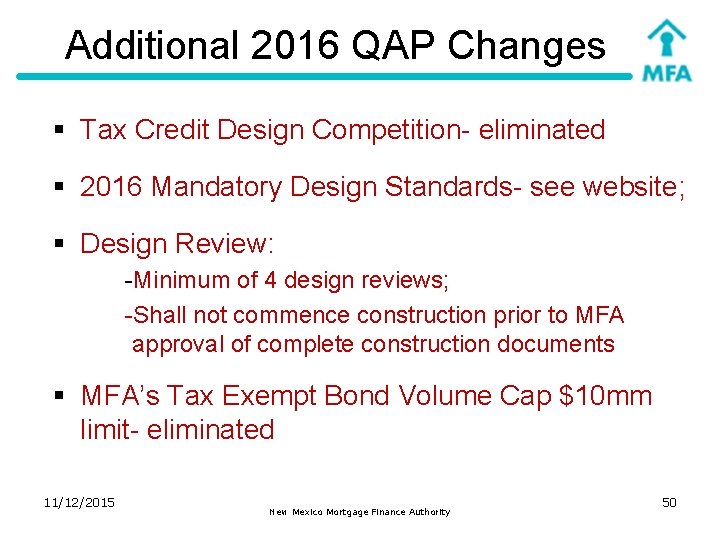

Additional 2016 QAP Changes § Tax Credit Design Competition- eliminated § 2016 Mandatory Design Standards- see website; § Design Review: -Minimum of 4 design reviews; -Shall not commence construction prior to MFA approval of complete construction documents § MFA’s Tax Exempt Bond Volume Cap $10 mm limit- eliminated 11/12/2015 New Mexico Mortgage Finance Authority 50

Other Areas Covered in QAP • Quiet Period- Section IV. A. 5 • Allocation Set Asides- Section III. D. 2 • Affirmative Actions after Reservation- Section IV. G. • Termination of Reservations- Section IV. H • Changes to the Project- Section IV. I. • Tax Credit Monitoring & Compliance- Section X. 11/12/2015 New Mexico Mortgage Finance Authority 51

Dates to Remember… • Applications due February 1, 2016 • Awards: May 2016 • 2017 QAP Public Comment Period: August/September 2016 • Carryover: November 15, 2016 • Final plan submittal: June 30, 2017 • 10% Test: August 31, 2017 **See LIHTC calendar for additional dates 11/12/2015 New Mexico Mortgage Finance Authority 52

Questions? BREAK! 11/12/2015 New Mexico Mortgage Finance Authority 53

APPLICATION PROCESS 11/12/2015 New Mexico Mortgage Finance Authority 54

Application Review • Universal Application § HOME § Risk Share § Other • Indicate § Extended Use Period § Set-Aside Option § Special Needs Reservations 11/12/2015 New Mexico Mortgage Finance Authority 55

Application Review Continued • Utility Allowance § Rent calculation – Schedule B § Attach current documentation § Must be approved allowance • Contact Information – update MFA if this changes after application • Ownership Information § To-be-formed partnerships § Non Profit participants 11/12/2015 New Mexico Mortgage Finance Authority 56

Application Review Continued • Development Team § Identity of interest § Developer fee amount § Attach resumes • Identification of Local Official • Original Signature(s) in blue ink 11/12/2015 New Mexico Mortgage Finance Authority 57

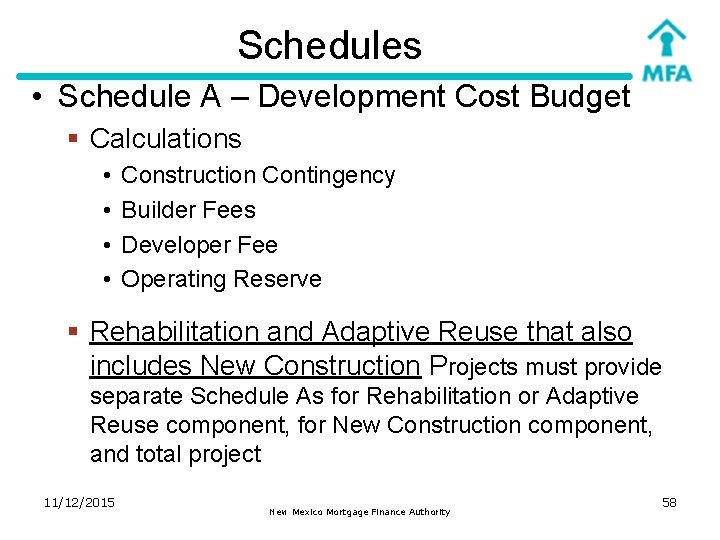

Schedules • Schedule A – Development Cost Budget § Calculations • Construction Contingency • Builder Fees • Developer Fee • Operating Reserve § Rehabilitation and Adaptive Reuse that also includes New Construction Projects must provide separate Schedule As for Rehabilitation or Adaptive Reuse component, for New Construction component, and total project 11/12/2015 New Mexico Mortgage Finance Authority 58

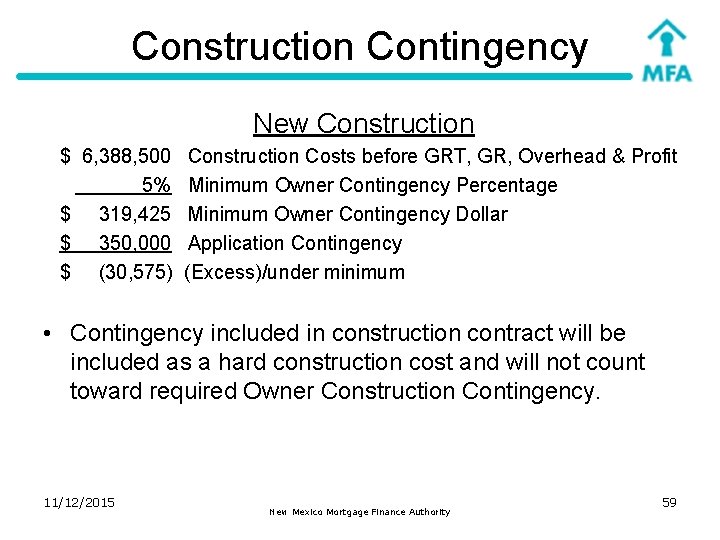

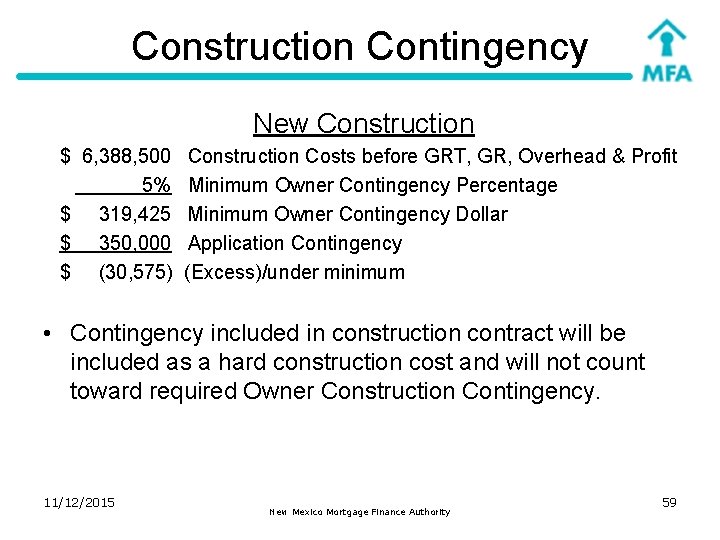

Construction Contingency New Construction $ 6, 388, 500 5% $ 319, 425 $ 350, 000 $ (30, 575) Construction Costs before GRT, GR, Overhead & Profit Minimum Owner Contingency Percentage Minimum Owner Contingency Dollar Application Contingency (Excess)/under minimum • Contingency included in construction contract will be included as a hard construction cost and will not count toward required Owner Construction Contingency. 11/12/2015 New Mexico Mortgage Finance Authority 59

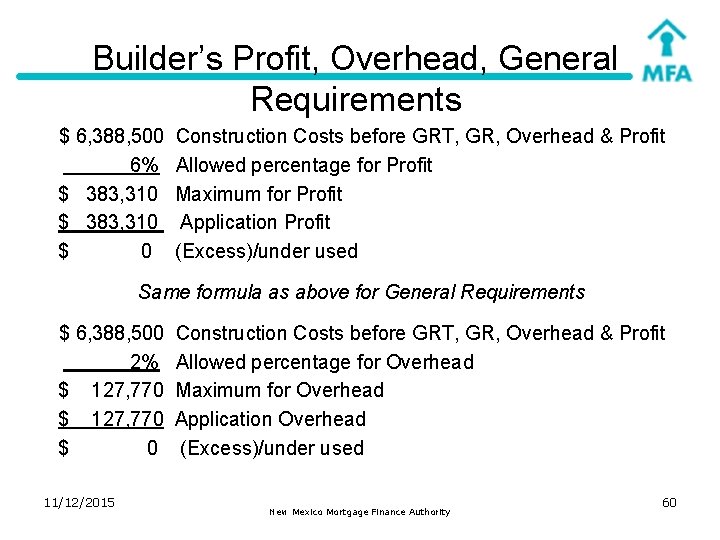

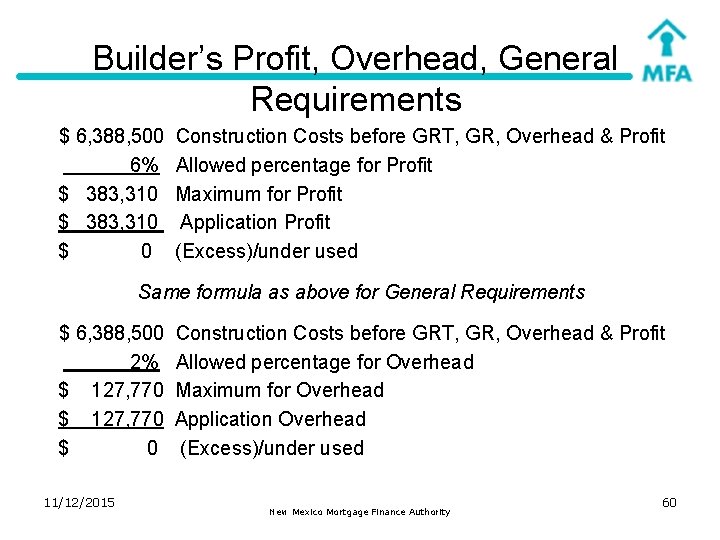

Builder’s Profit, Overhead, General Requirements $ 6, 388, 500 6% $ 383, 310 $ 0 Construction Costs before GRT, GR, Overhead & Profit Allowed percentage for Profit Maximum for Profit Application Profit (Excess)/under used Same formula as above for General Requirements $ 6, 388, 500 2% $ 127, 770 $ 0 11/12/2015 Construction Costs before GRT, GR, Overhead & Profit Allowed percentage for Overhead Maximum for Overhead Application Overhead (Excess)/under used New Mexico Mortgage Finance Authority 60

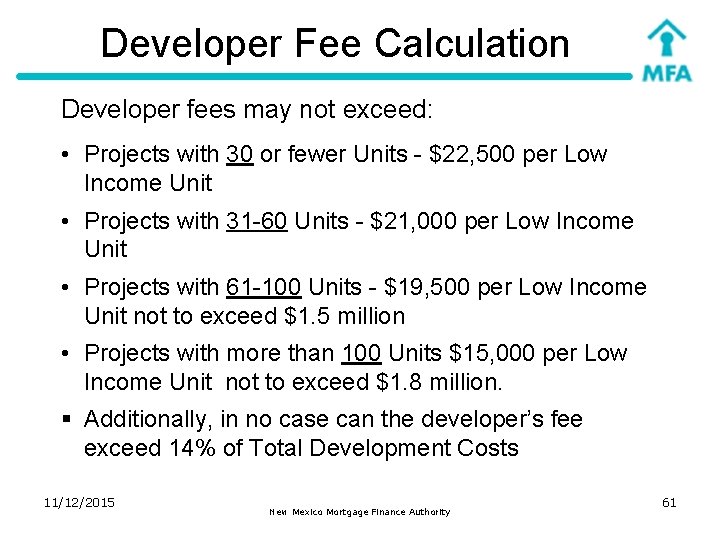

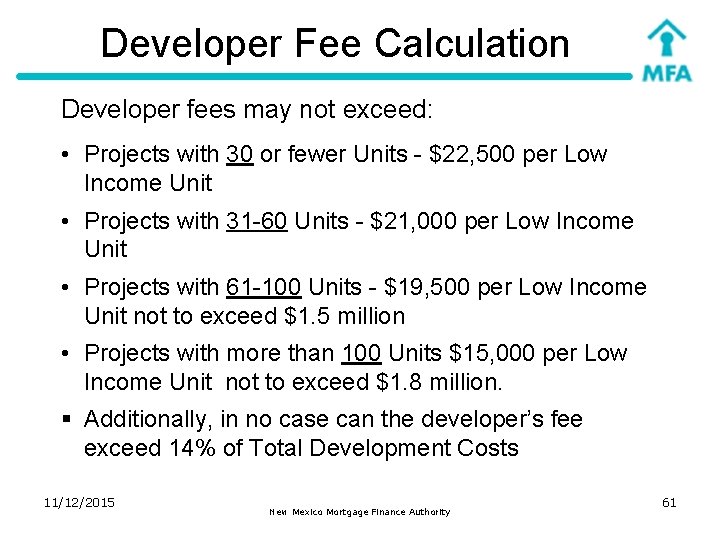

Developer Fee Calculation Developer fees may not exceed: • Projects with 30 or fewer Units - $22, 500 per Low Income Unit • Projects with 31 -60 Units - $21, 000 per Low Income Unit • Projects with 61 -100 Units - $19, 500 per Low Income Unit not to exceed $1. 5 million • Projects with more than 100 Units $15, 000 per Low Income Unit not to exceed $1. 8 million. § Additionally, in no case can the developer’s fee exceed 14% of Total Development Costs 11/12/2015 New Mexico Mortgage Finance Authority 61

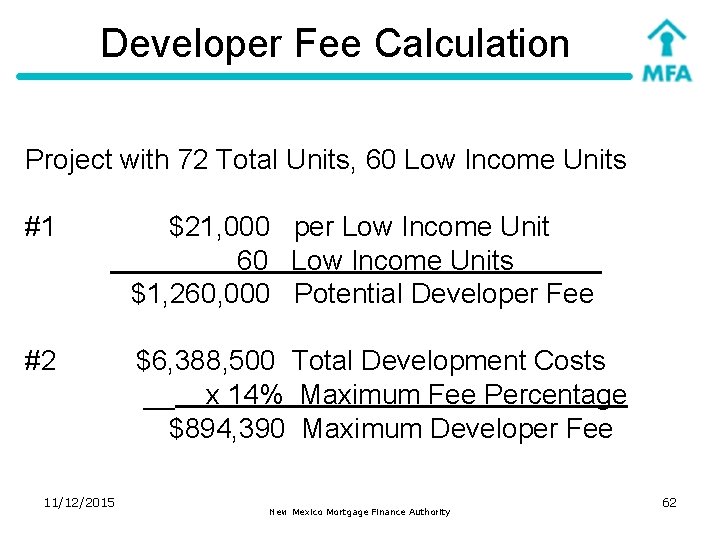

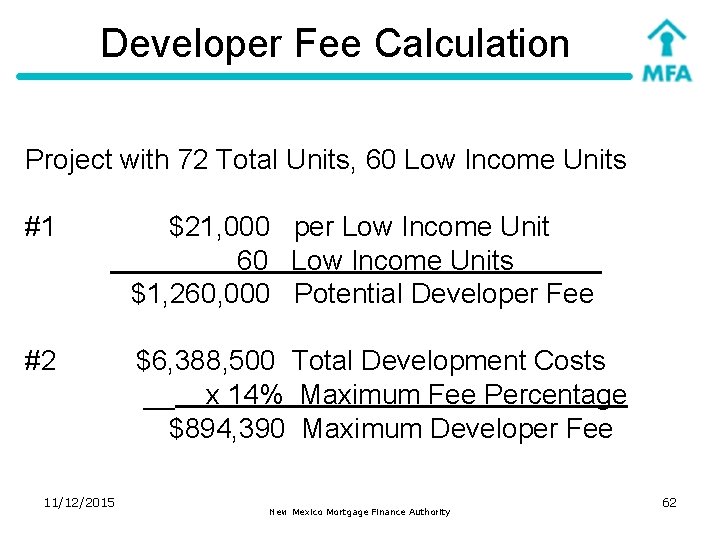

Developer Fee Calculation Project with 72 Total Units, 60 Low Income Units #1 $21, 000 per Low Income Unit 60 Low Income Units $1, 260, 000 Potential Developer Fee #2 $6, 388, 500 Total Development Costs __ x 14% Maximum Fee Percentage $894, 390 Maximum Developer Fee 11/12/2015 New Mexico Mortgage Finance Authority 62

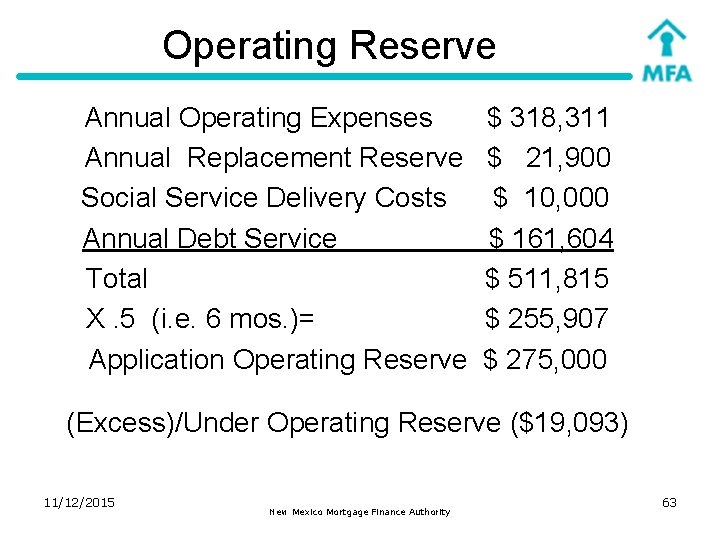

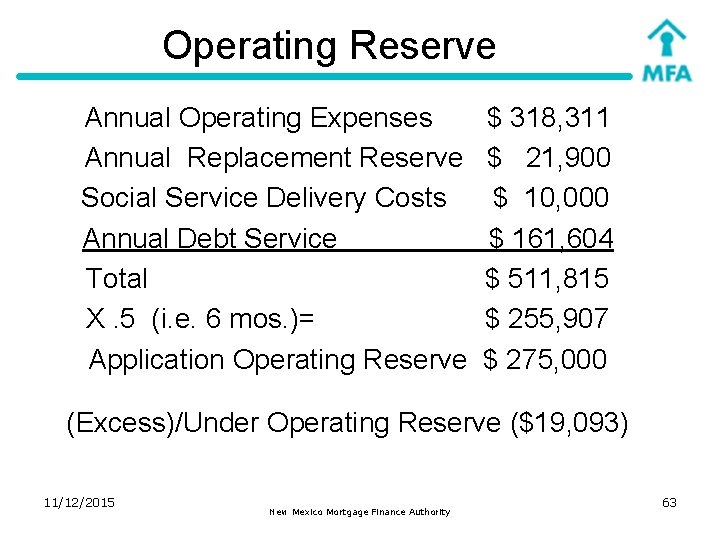

Operating Reserve Annual Operating Expenses Annual Replacement Reserve Social Service Delivery Costs Annual Debt Service Total X. 5 (i. e. 6 mos. )= Application Operating Reserve $ 318, 311 $ 21, 900 $ 10, 000 $ 161, 604 $ 511, 815 $ 255, 907 $ 275, 000 (Excess)/Under Operating Reserve ($19, 093) 11/12/2015 New Mexico Mortgage Finance Authority 63

Schedules Continued • Schedule A-1 – Sources of Funds § Construction and Permanent § Deferred Fee § Sources = Uses • Schedule B – Unit Type & Rent Summary § Distribution of units proportionately § Set-aside rents cannot exceed tax credit limits § Indicate unit net square feet 11/12/2015 New Mexico Mortgage Finance Authority 64

Schedules Continued • Schedule C – Operating Expense Budget § Minimum 7% vacancy § Maximum 6% management fee (calculated on gross income) § Replacement Reserves – we will underwrite to at least MFA minimums • Cash Flow Projection § Income, expense, and reserve escalators at minimum stated in underwriting supplement • Schedule D – Contractor Cost Breakdown § Tie to Schedule A 11/12/2015 New Mexico Mortgage Finance Authority 65

Schedules Continued • Schedule G- Affordable Unit Set Aside Election- irrevocable • Schedule H – Applicant’s Previous Participation § One Schedule H for each General Partner and Developer § Compliance Affidavit from each General Partner and Developer Principal 11/12/2015 New Mexico Mortgage Finance Authority 66

What makes a successful application? 11/12/2015 New Mexico Mortgage Finance Authority 67

2015 Tax Credit Round Of the 16 Applications submitted: • $14, 309, 500 in credits were requested § Ratio of requests to credit ceiling was 2. 63: 1 § This ratio decreased from 3. 38: 1 in 2014 • Average TDC per unit for new construction was $191, 211 § Down from $196, 681 in 2014 § Up from $191, 034 in 2013 § Range of $151, 036 to $247, 254 § Range in 2014 was $125, 823 to $248, 232 • 11/12/2015 Average Project size decreased to 56 units from 60 units in 2014. New Mexico Mortgage Finance Authority 68

2015 & 2014 Tax Credit Round Results Ø Seven awards in 2015, eight in 2014 • All Projects awarded have a sponsor or co-sponsor that is a non-profit, governmental or tribal entity. • All projects committed to LEED Silver, Enterprise Green Communities Criteria, or Build Green NM. • Five of the fifteen Projects scored points for acquisition/rehabilitation or Adaptive Reuse. • Two of the fifteen Projects are mixed income projects. 11/12/2015 New Mexico Mortgage Finance Authority 69

2015 & 2014 Tax Credit Round Results, Continued Ø Seven awards in 2015, eight in 2014 • All of the Projects are providing services to targeted populations: elderly, special needs, or households with children. • All of the Projects are in MFA’s Areas of Statistically Demonstrated Need. • Sizes range from 21 to 85 units. • Award amounts range from $343, 087 to $1, 150, 000. 11/12/2015 New Mexico Mortgage Finance Authority 70

The Most Successful Application. . . Is for the project that you can deliver and successfully operate for the entire extended use period! 11/12/2015 New Mexico Mortgage Finance Authority 71

Questions? 11/12/2015 New Mexico Mortgage Finance Authority 72

For more information: Visit MFA’s website at: www. housingnm. org/developers Contact: Susan H. Biernacki, J. D. Housing Tax Credit Program Manager (505) 767 -2273 sbiernacki@housingnm. org 11/12/2015 New Mexico Mortgage Finance Authority 73