MEDICARE SAVINGS PROGRAMS MSP LOW INCOME SUBSIDY LIS

MEDICARE SAVINGS PROGRAMS (MSP) LOW INCOME SUBSIDY (LIS) Updated January, 2021 GWAAR, Inc.

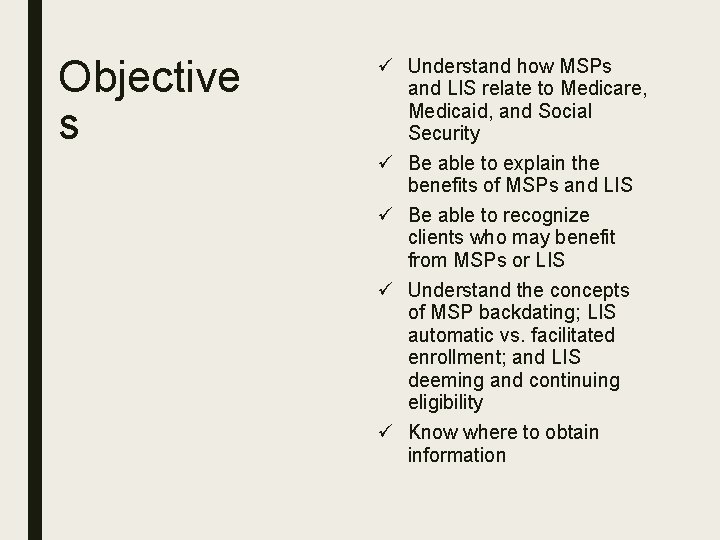

Objective s ü Understand how MSPs and LIS relate to Medicare, Medicaid, and Social Security ü Be able to explain the benefits of MSPs and LIS ü Be able to recognize clients who may benefit from MSPs or LIS ü Understand the concepts of MSP backdating; LIS automatic vs. facilitated enrollment; and LIS deeming and continuing eligibility ü Know where to obtain information

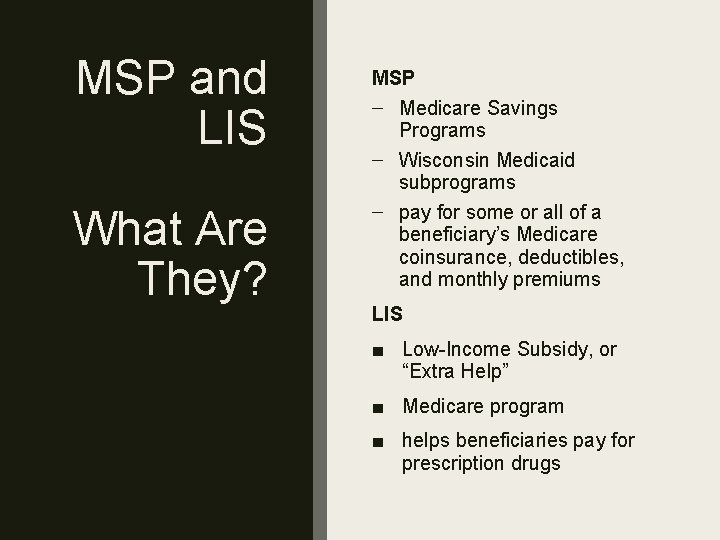

MSP and LIS What Are They? MSP – Medicare Savings Programs – Wisconsin Medicaid subprograms – pay for some or all of a beneficiary’s Medicare coinsurance, deductibles, and monthly premiums LIS ■ Low-Income Subsidy, or “Extra Help” ■ Medicare program ■ helps beneficiaries pay for prescription drugs

MEDICARE SAVINGS PROGRAMS (MSP) QMB SLMB+ QDWI

Medicare Savings Programs ■ QMB (Qualified Medicare Beneficiary) ■ SLMB (Specified Low-Income Medicare Beneficiary) ■ SLMB+ (Specified Low-Income Medicare Beneficiary Plus) ■ QDWI (Qualified Disabled and Working Individual)

What Benefits Do They Provide? ■ QMB: Pays Medicare Part A and B premiums, and all Medicare Parts A & B copays and deductibles ■ SLMB: Pays the Medicare Part B premium ■ SLMB+: Pays the Medicare Part B premium ■ QDWI: Pays the Medicare Part A premium ■ Note: MSPs also automatically provide beneficiaries with the full Low-Income Subsidy (more on this later)

General Eligibility Requirements All MSPs Non-financially eligible for Wisconsin Medicaid or Badger. Care Plus – Elderly (Age 65+), Blind, or Disabled – Resident of Wisconsin; and – U. S. Citizen or a non-citizen who meets certain criteria

General Eligibility Requirements All MSPs – Entitled to receive, or actually receiving Medicare Part A – Receive income at, or below, the income limits – Own assets at, or below, the asset limits

Automatic QMB Eligibility Some Medicaid recipients are automatically eligible for QMB Medicaid + – Persons who are receiving or are eligible to receive Supplemental Security Income (SSI) – Special Status Medicaid (MEH 25)

Fiscal Test Groups The fiscal test group size determines the income and asset limits The fiscal test group is two if a couple is married and living at home The fiscal test group is one if the couple is not living together or if the couple is living in the same nursing home

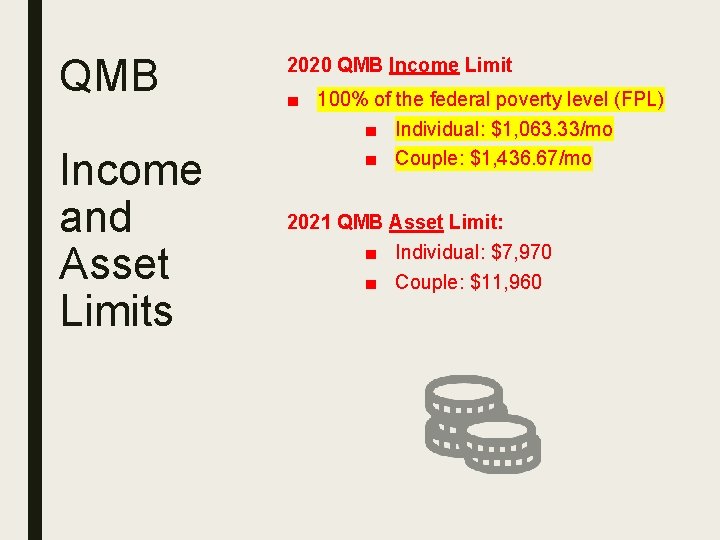

QMB Income and Asset Limits 2020 QMB Income Limit ■ 100% of the federal poverty level (FPL) ■ Individual: $1, 063. 33/mo ■ Couple: $1, 436. 67/mo 2021 QMB Asset Limit: ■ Individual: $7, 970 ■ Couple: $11, 960

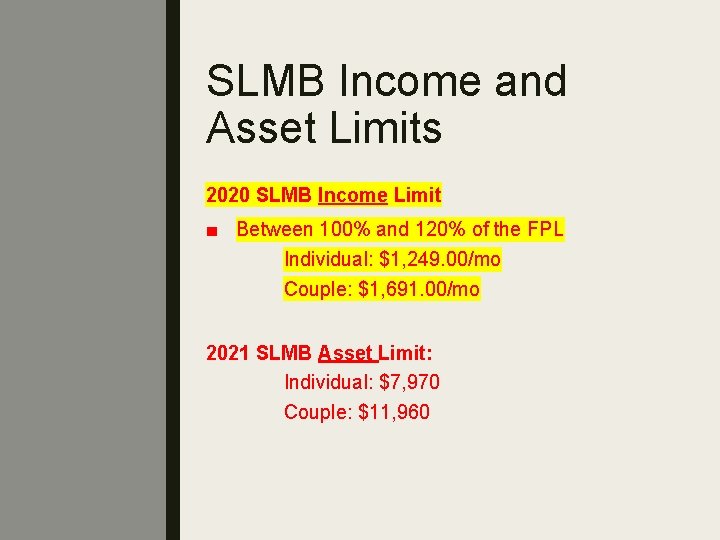

SLMB Income and Asset Limits 2020 SLMB Income Limit ■ Between 100% and 120% of the FPL Individual: $1, 249. 00/mo Couple: $1, 691. 00/mo 2021 SLMB Asset Limit: Individual: $7, 970 Couple: $11, 960

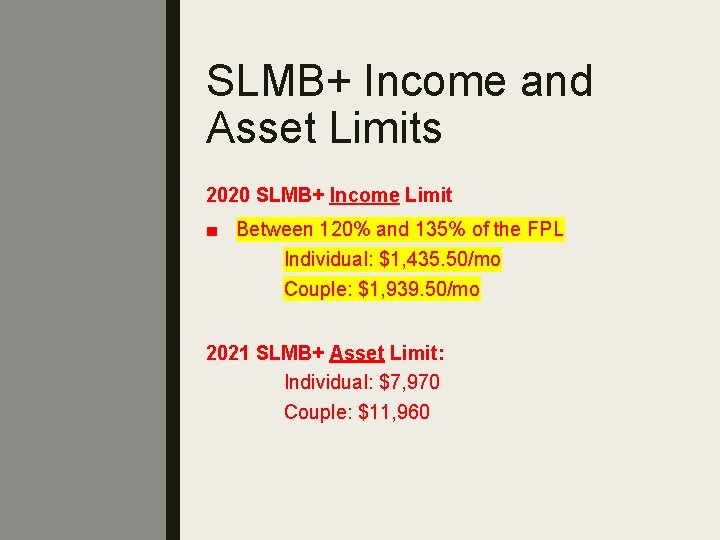

SLMB+ Income and Asset Limits 2020 SLMB+ Income Limit ■ Between 120% and 135% of the FPL Individual: $1, 435. 50/mo Couple: $1, 939. 50/mo 2021 SLMB+ Asset Limit: Individual: $7, 970 Couple: $11, 960

How Is Income Counted? Income calculated the same as SSI 1. Separate earned and unearned income 2. Apply Earned Income Calculation ü Subtract the $65 and ½ earned income deduction from the total earned income ü Add the result to the unearned income 3. Subtract Special Exempt Income 4. Subtract the $20 Disregard

How Are Assets Treated? Similar to SSI Countable assets include: – Money in checking or savings accounts – Stocks – Bonds

Countable assets do not include: – Personal residence – One motor vehicle – Burial plot – Up to $1, 500 in burial expenses if money is put aside – Furniture and household items How Are Assets Treated?

When Do Benefits Begin? (QMB) Applications For initial applications, QMB benefits begin on the first of the month after the month in which the beneficiary is determined eligible Example: Joe applies for QMB on April 16, 2021 and is approved. His QMB benefits will begin May 1, 2021.

When Do Benefits Begin? (QMB) Recertifications QMB benefits begin on the first of the month following the month the review is due Example: Mary’s QMB benefits are up for review in June 2021. Even if the review is approved on July 1, 2021, QMB benefits begin on July 1, 2021 - not August 1, 2021. There is no disruption in benefits.

When Do Benefits Begin? (SLMB, SLMB+ and QDWI) Benefits begin on the first of the month in which all eligibility requirements are met. Example: Joan applies for MSP benefits on May 21, 2021 and is approved for SLMB on May 27, 2021. Her SLMB benefits will begin on May 1, 2021.

Timing of Benefits ■ It will take 2 -3 months for SSA to process the MSP eligibility information. ■ The beneficiary will still need to pay his or her Part B premiums while waiting for SSA to update the beneficiary’s information.

Timing of Benefits After information is processed, the beneficiary will receive 2 -3 months of Part B premiums as a reimbursement for the period spent waiting. Careful! The opposite is also true. If an individual is deemed ineligible, it may take 2 -3 months to process the termination. Once the termination is processed, SSA will deduct 2 -3 months’ worth of Part B premiums at once. This can cause clients serious financial difficulties

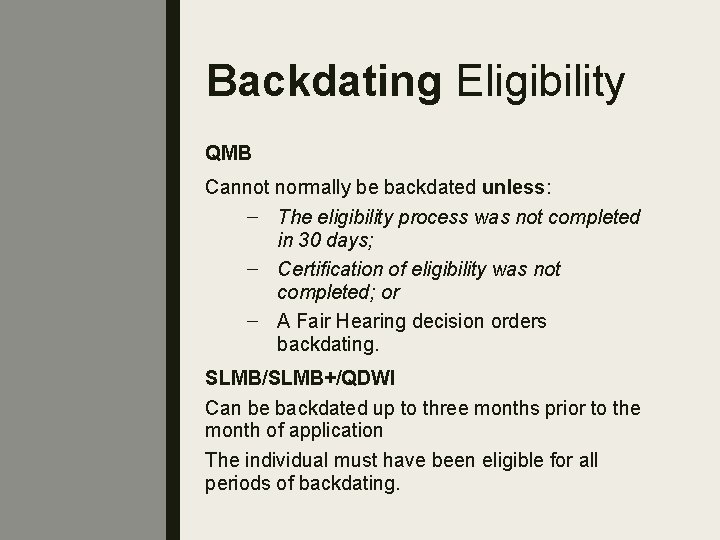

Backdating Eligibility QMB Cannot normally be backdated unless: – The eligibility process was not completed in 30 days; – Certification of eligibility was not completed; or – A Fair Hearing decision orders backdating. SLMB/SLMB+/QDWI Can be backdated up to three months prior to the month of application The individual must have been eligible for all periods of backdating.

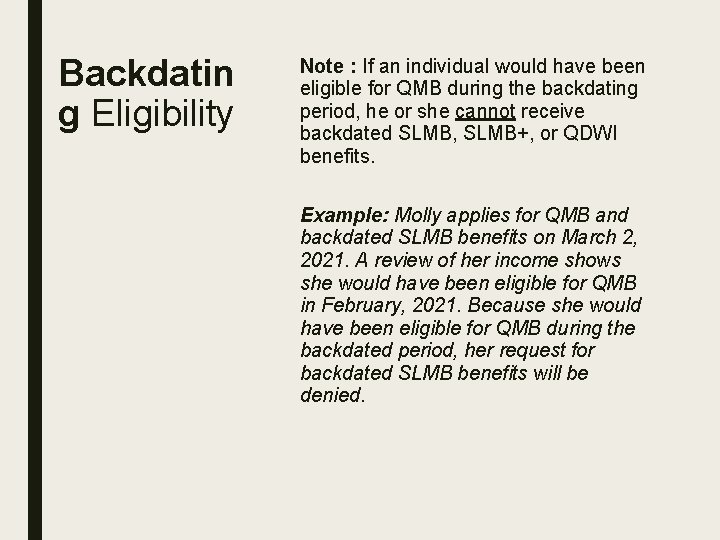

Backdatin g Eligibility Note : If an individual would have been eligible for QMB during the backdating period, he or she cannot receive backdated SLMB, SLMB+, or QDWI benefits. Example: Molly applies for QMB and backdated SLMB benefits on March 2, 2021. A review of her income shows she would have been eligible for QMB in February, 2021. Because she would have been eligible for QMB during the backdated period, her request for backdated SLMB benefits will be denied.

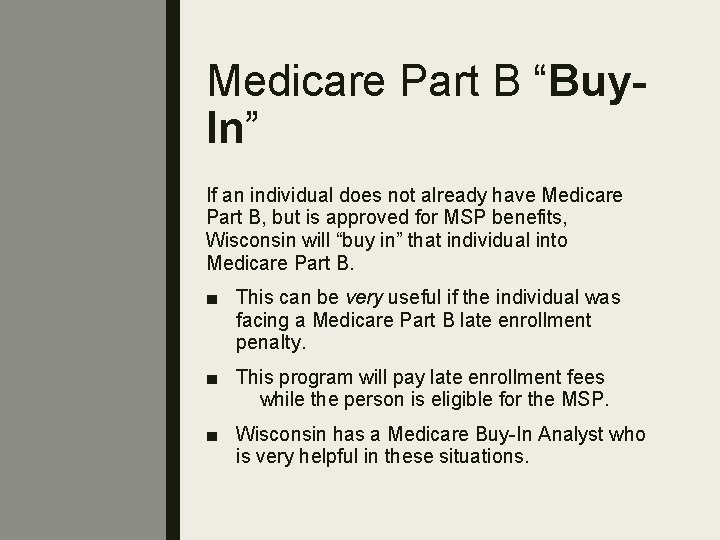

Medicare Part B “Buy. In” If an individual does not already have Medicare Part B, but is approved for MSP benefits, Wisconsin will “buy in” that individual into Medicare Part B. ■ This can be very useful if the individual was facing a Medicare Part B late enrollment penalty. ■ This program will pay late enrollment fees while the person is eligible for the MSP. ■ Wisconsin has a Medicare Buy-In Analyst who is very helpful in these situations.

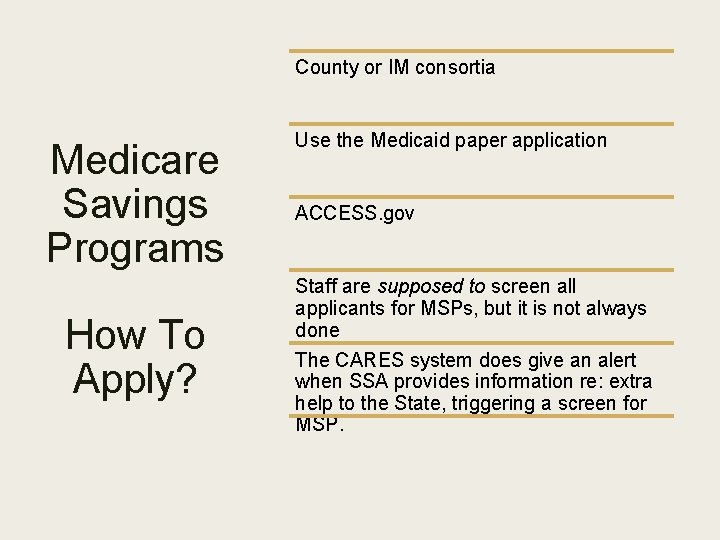

County or IM consortia Medicare Savings Programs How To Apply? Use the Medicaid paper application ACCESS. gov Staff are supposed to screen all applicants for MSPs, but it is not always done The CARES system does give an alert when SSA provides information re: extra help to the State, triggering a screen for MSP.

Treatment Of Extra Help Data Received From SSA ■ The state receives information from Social Security regarding all LIS applications who didn’t opt out. – It is required to treat these individuals as applicants for MSPs. – The state will mail all of these individuals an EBD Medicaid application and asks them to fill it out. ■ Applications are not complete until the state receives the EBD Medicaid applications. ■ Application date is the date that the state received the extra help information from Social Security.

Medicare Savings Programs: Knowledge Check George, 72, a single man who is receiving Medicare comes to your office and explains he is having difficulty paying his bills each month. He explains that he earns $200 per month doing handyman work for a local business and he also receives $920 per month in Social Security Retirement income. He further explains that he owns his own home, does not have a car and has $5, 900 in a checking account at the bank that he uses to pay his bills. Will George be eligible for a Medicare Savings Program? If so, which one?

THE LOW INCOME SUBSIDY (LIS) AKA: “Extra Help”

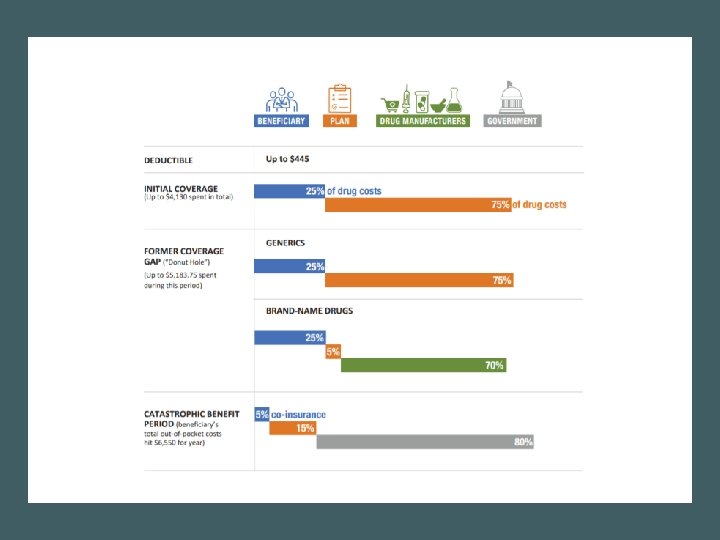

Low Income Subsidy A Medicare program that helps beneficiaries pay for prescription drugs A person with a subsidy has lower Part D costs than a person without a subsidy. The Part D coverage is “subsidized. ”

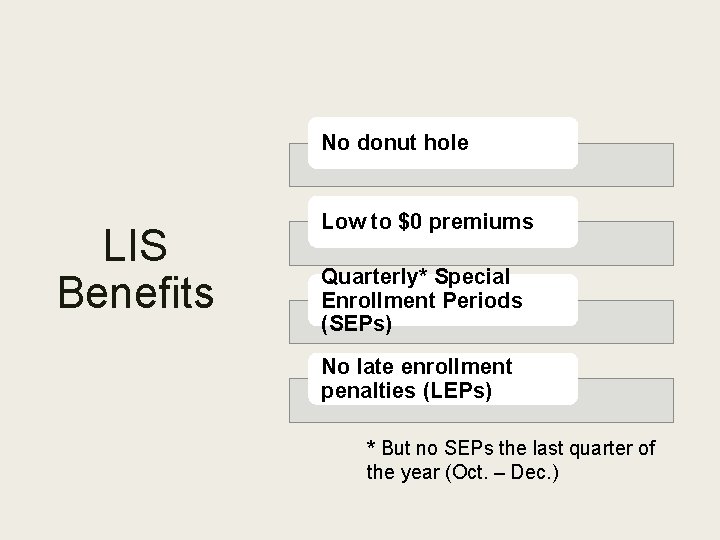

No donut hole LIS Benefits Low to $0 premiums Quarterly* Special Enrollment Periods (SEPs) No late enrollment penalties (LEPs) * But no SEPs the last quarter of the year (Oct. – Dec. )

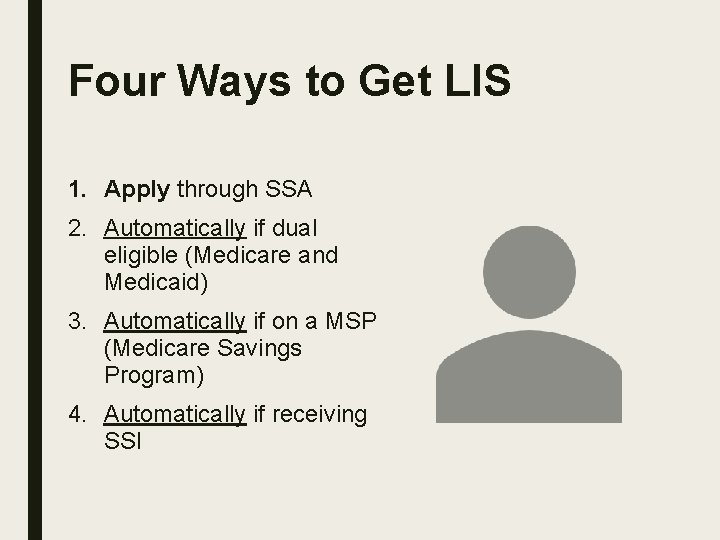

Four Ways to Get LIS 1. Apply through SSA 2. Automatically if dual eligible (Medicare and Medicaid) 3. Automatically if on a MSP (Medicare Savings Program) 4. Automatically if receiving SSI

Two Types of LIS Benefits Full Benefit Partial Benefit

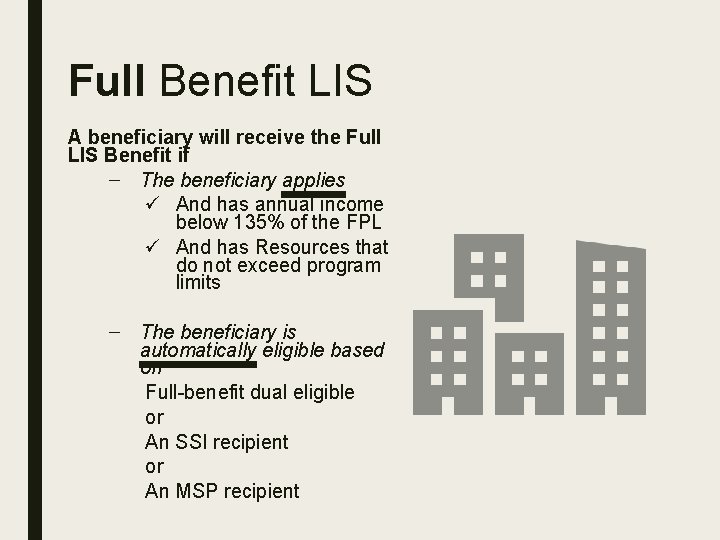

Full Benefit LIS A beneficiary will receive the Full LIS Benefit if – The beneficiary applies ü And has annual income below 135% of the FPL ü And has Resources that do not exceed program limits – The beneficiary is automatically eligible based on Full-benefit dual eligible or An SSI recipient or An MSP recipient

Partial Benefit LIS An individual receives the partial subsidy if he or she applies and: – Has an annual income below 150% of the FPL; and – Resources that do not exceed program limits

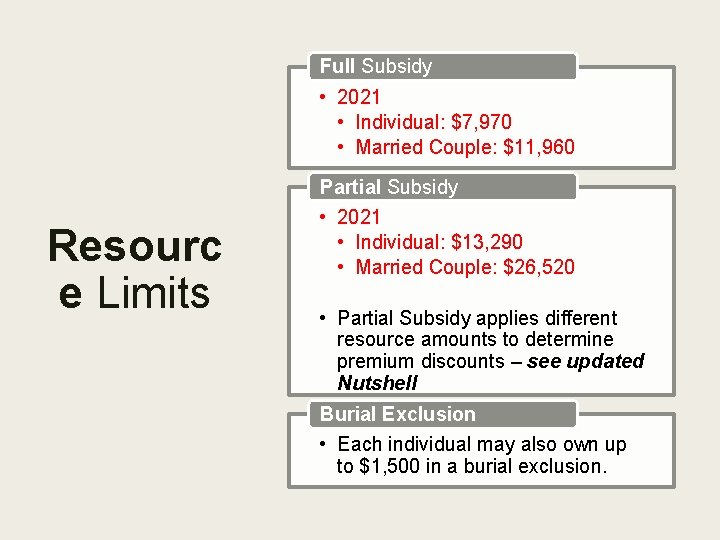

Full Subsidy • 2021 • Individual: $7, 970 • Married Couple: $11, 960 Partial Subsidy Resourc e Limits • 2021 • Individual: $13, 290 • Married Couple: $26, 520 • Partial Subsidy applies different resource amounts to determine premium discounts – see updated Nutshell Burial Exclusion • Each individual may also own up to $1, 500 in a burial exclusion.

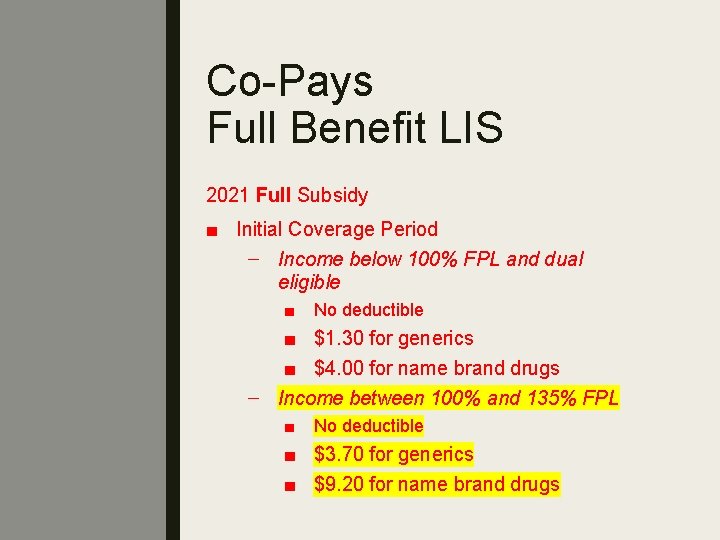

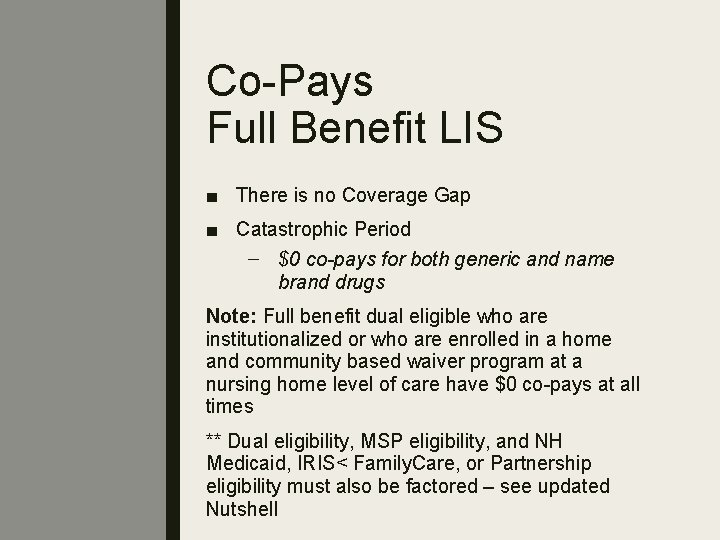

Co-Pays Full Benefit LIS 2021 Full Subsidy ■ Initial Coverage Period – Income below 100% FPL and dual eligible ■ No deductible ■ $1. 30 for generics ■ $4. 00 for name brand drugs – Income between 100% and 135% FPL ■ No deductible ■ $3. 70 for generics ■ $9. 20 for name brand drugs

Co-Pays Full Benefit LIS ■ There is no Coverage Gap ■ Catastrophic Period – $0 co-pays for both generic and name brand drugs Note: Full benefit dual eligible who are institutionalized or who are enrolled in a home and community based waiver program at a nursing home level of care have $0 co-pays at all times ** Dual eligibility, MSP eligibility, and NH Medicaid, IRIS< Family. Care, or Partnership eligibility must also be factored – see updated Nutshell

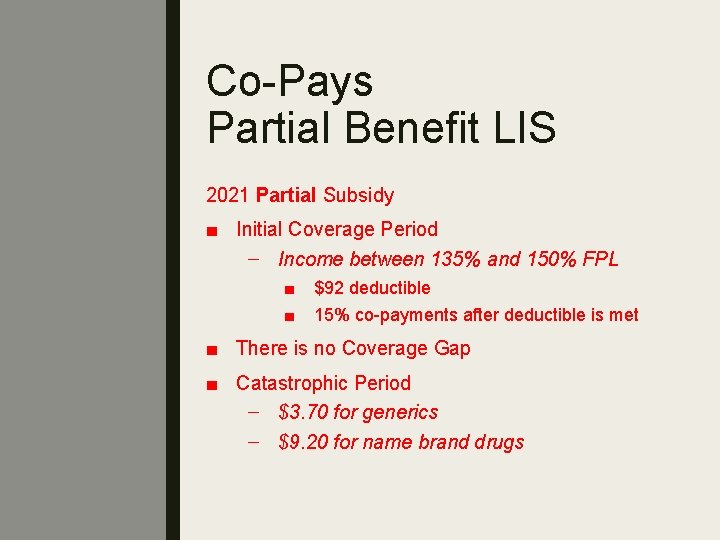

Co-Pays Partial Benefit LIS 2021 Partial Subsidy ■ Initial Coverage Period – Income between 135% and 150% FPL ■ ■ $92 deductible 15% co-payments after deductible is met ■ There is no Coverage Gap ■ Catastrophic Period – $3. 70 for generics – $9. 20 for name brand drugs

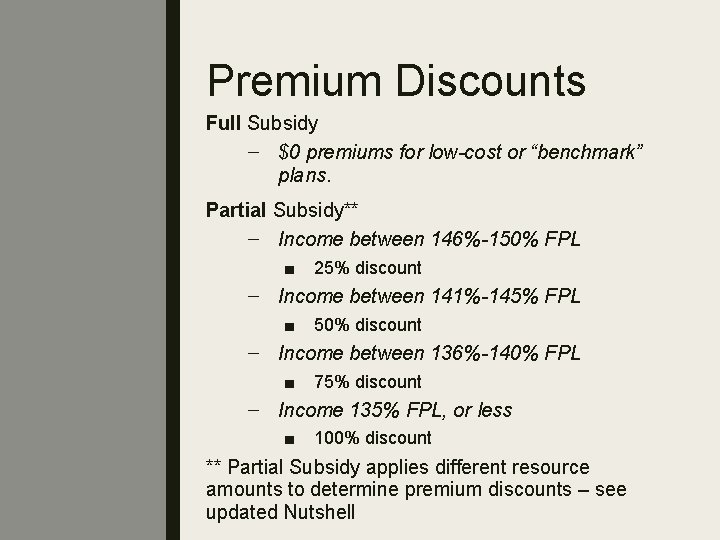

Premium Discounts Full Subsidy – $0 premiums for low-cost or “benchmark” plans. Partial Subsidy** – Income between 146%-150% FPL ■ 25% discount – Income between 141%-145% FPL ■ 50% discount – Income between 136%-140% FPL ■ 75% discount – Income 135% FPL, or less ■ 100% discount ** Partial Subsidy applies different resource amounts to determine premium discounts – see updated Nutshell

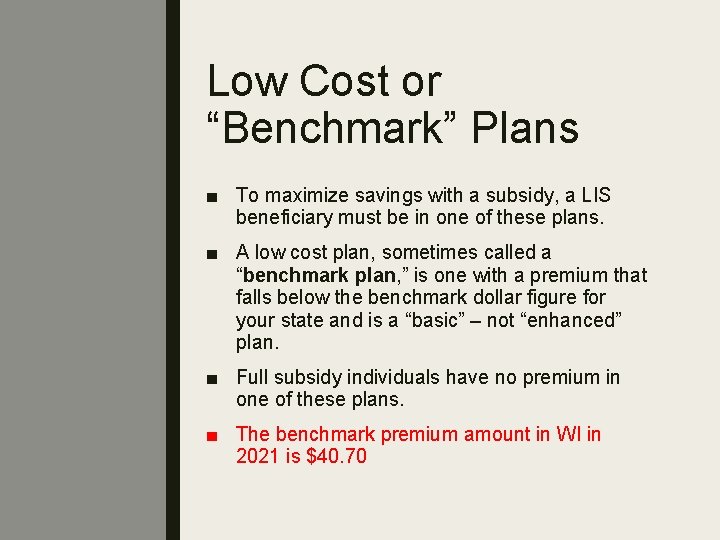

Low Cost or “Benchmark” Plans ■ To maximize savings with a subsidy, a LIS beneficiary must be in one of these plans. ■ A low cost plan, sometimes called a “benchmark plan, ” is one with a premium that falls below the benchmark dollar figure for your state and is a “basic” – not “enhanced” plan. ■ Full subsidy individuals have no premium in one of these plans. ■ The benchmark premium amount in WI in 2021 is $40. 70

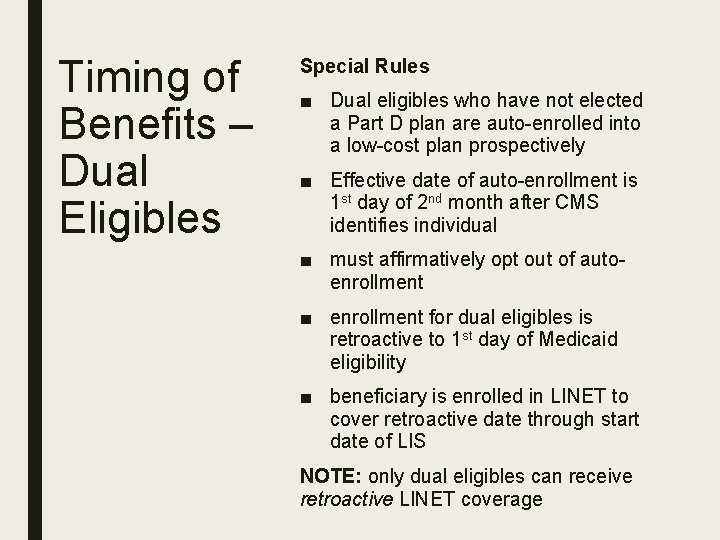

Timing of Benefits – Dual Eligibles Special Rules ■ Dual eligibles who have not elected a Part D plan are auto-enrolled into a low-cost plan prospectively ■ Effective date of auto-enrollment is 1 st day of 2 nd month after CMS identifies individual ■ must affirmatively opt out of autoenrollment ■ enrollment for dual eligibles is retroactive to 1 st day of Medicaid eligibility ■ beneficiary is enrolled in LINET to cover retroactive date through start date of LIS NOTE: only dual eligibles can receive retroactive LINET coverage

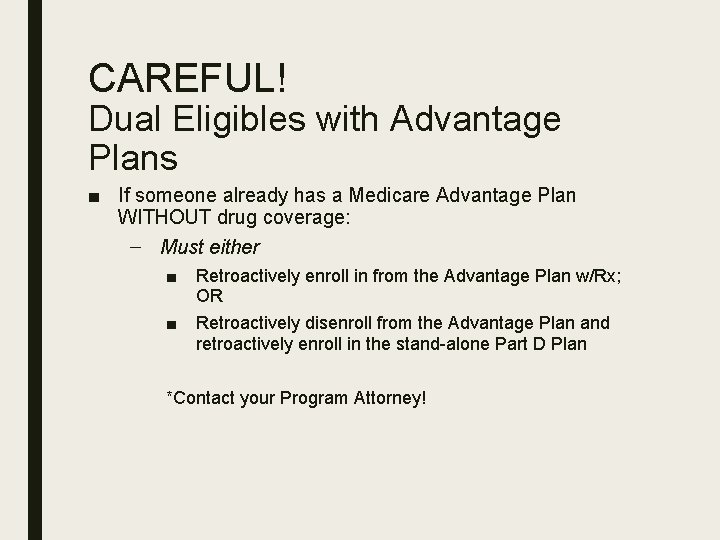

CAREFUL! Dual Eligibles with Advantage Plans ■ If someone already has a Medicare Advantage Plan WITHOUT drug coverage: – Must either ■ Retroactively enroll in from the Advantage Plan w/Rx; OR ■ Retroactively disenroll from the Advantage Plan and retroactively enroll in the stand-alone Part D Plan *Contact your Program Attorney!

Timing of Benefits – Dual Eligibles ■ Example: Lydia, a Medicare recipient, becomes eligible for Medicaid on June 1, 2021 and CMS identifies her as eligible for LIS on July 1, 2021. Her Part D plan effective date is September 1, 2021. As a dual eligible, Lydia can receive LINET coverage from June 1, 2021 through September 1, 2021.

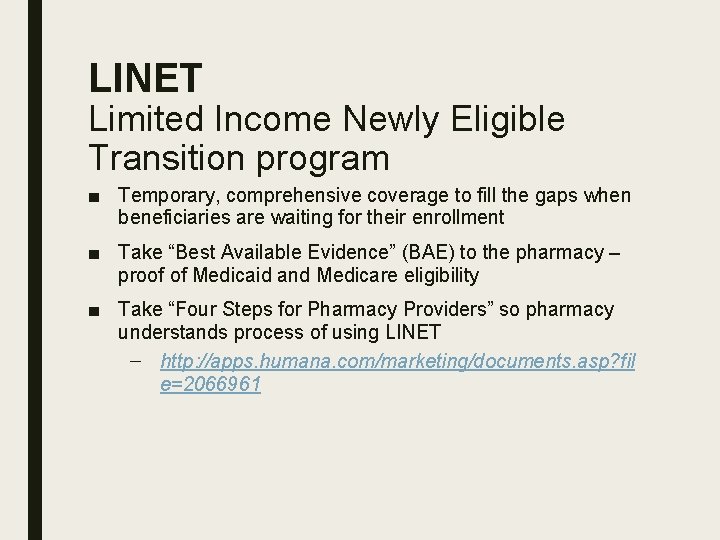

LINET Limited Income Newly Eligible Transition program ■ Temporary, comprehensive coverage to fill the gaps when beneficiaries are waiting for their enrollment ■ Take “Best Available Evidence” (BAE) to the pharmacy – proof of Medicaid and Medicare eligibility ■ Take “Four Steps for Pharmacy Providers” so pharmacy understands process of using LINET – http: //apps. humana. com/marketing/documents. asp? fil e=2066961

CAREFUL! When LINET Won’t Work 1. Client already has a Part D Plan 2. Client opted out of auto-enrollment 3. Has an Advantage plan without drug coverage 4. Has employer or retiree sponsored drug coverage

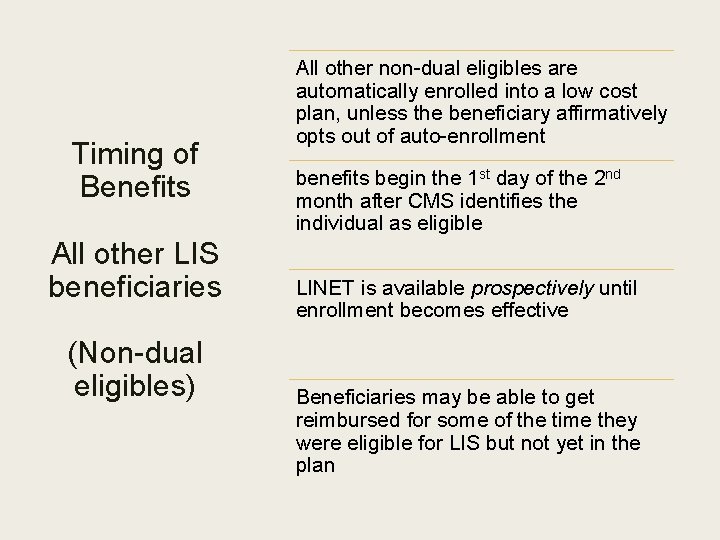

Timing of Benefits All other LIS beneficiaries (Non-dual eligibles) All other non-dual eligibles are automatically enrolled into a low cost plan, unless the beneficiary affirmatively opts out of auto-enrollment benefits begin the 1 st day of the 2 nd month after CMS identifies the individual as eligible LINET is available prospectively until enrollment becomes effective Beneficiaries may be able to get reimbursed for some of the time they were eligible for LIS but not yet in the plan

Timing of Benefits All other LIS beneficiaries (Non-dual eligibles) Example: CMS receives notice that Leonard is eligible for LIS in July, 2021. Leonard’s enrollment into a LIS plan will be effective September 1, 2021. Leonard can get prospective LINET coverage from July-September, 2021.

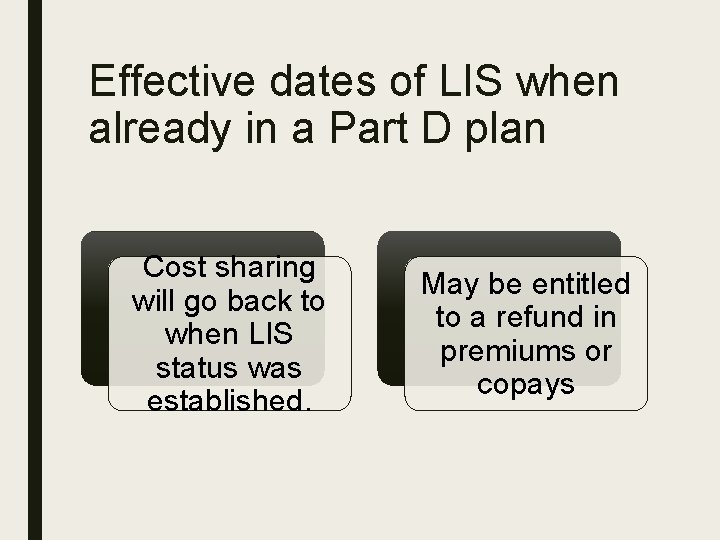

Effective dates of LIS when already in a Part D plan Cost sharing will go back to when LIS status was established. May be entitled to a refund in premiums or copays

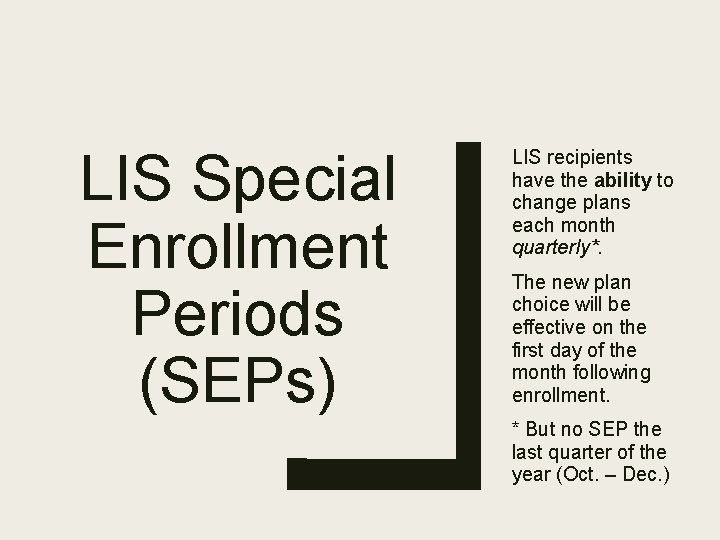

LIS Special Enrollment Periods (SEPs) LIS recipients have the ability to change plans each month quarterly*. The new plan choice will be effective on the first day of the month following enrollment. * But no SEP the last quarter of the year (Oct. – Dec. )

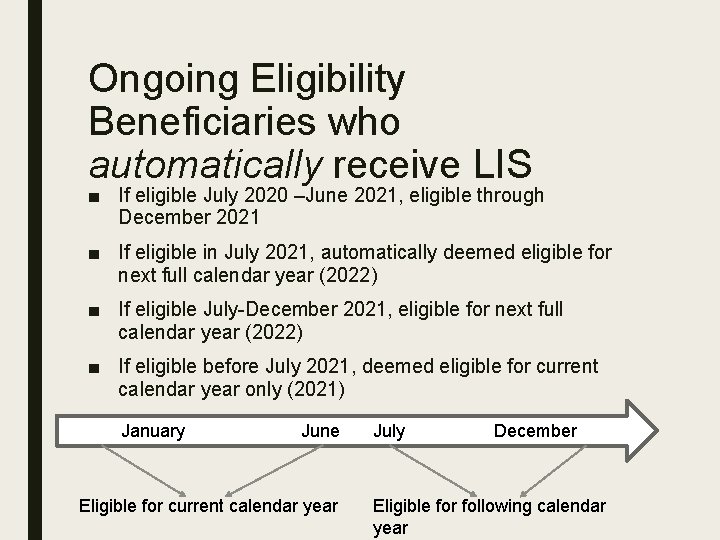

Ongoing Eligibility Beneficiaries who automatically receive LIS ■ If eligible July 2020 –June 2021, eligible through December 2021 ■ If eligible in July 2021, automatically deemed eligible for next full calendar year (2022) ■ If eligible July-December 2021, eligible for next full calendar year (2022) ■ If eligible before July 2021, deemed eligible for current calendar year only (2021) January June Eligible for current calendar year July December Eligible for following calendar year

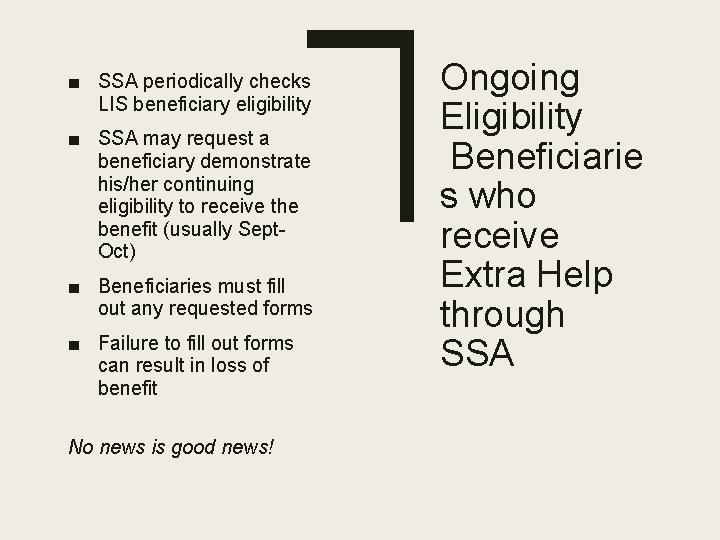

■ SSA periodically checks LIS beneficiary eligibility ■ SSA may request a beneficiary demonstrate his/her continuing eligibility to receive the benefit (usually Sept. Oct) ■ Beneficiaries must fill out any requested forms ■ Failure to fill out forms can result in loss of benefit No news is good news! Ongoing Eligibility Beneficiarie s who receive Extra Help through SSA

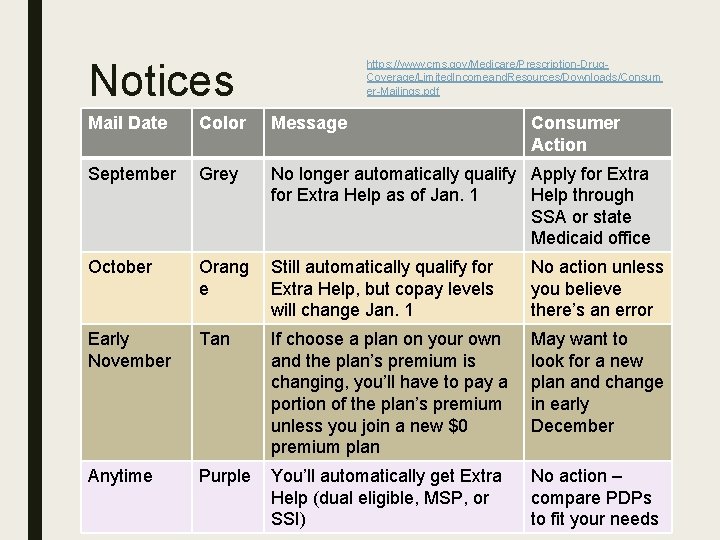

Notices https: //www. cms. gov/Medicare/Prescription-Drug. Coverage/Limited. Incomeand. Resources/Downloads/Consum er-Mailings. pdf Mail Date Color Message Consumer Action September Grey No longer automatically qualify Apply for Extra Help as of Jan. 1 Help through SSA or state Medicaid office October Orang e Still automatically qualify for Extra Help, but copay levels will change Jan. 1 No action unless you believe there’s an error Early November Tan If choose a plan on your own and the plan’s premium is changing, you’ll have to pay a portion of the plan’s premium unless you join a new $0 premium plan May want to look for a new plan and change in early December Anytime Purple You’ll automatically get Extra Help (dual eligible, MSP, or SSI) No action – compare PDPs to fit your needs

Determinin g if a client has LIS ■ 1 -800 -Medicare ■ www. medicare. gov: personalized Planfinder search ■ If they have Medicaid or an MSP, they should have LIS, but it might not be reflected on the Medicare system. Each month, and, hopefully, starting soon, each week, WI sends an upload to Medicare with a list of its Medicaid and MSP recipients with Medicare. ■ Medicaid knows who has extra help from Social Security. ■ It is not a good idea to rely on CARES or the Forward. Health Portal. This can confirm Medicaid eligibility, but only Medicare can tell whether Medicare believes the person has the subsidy.

- Slides: 54