MCS AND RELATED DOCUMENTS UPDATES 20212022 1 20212022

- Slides: 10

MCS AND RELATED DOCUMENTS UPDATES 2021/2022 1

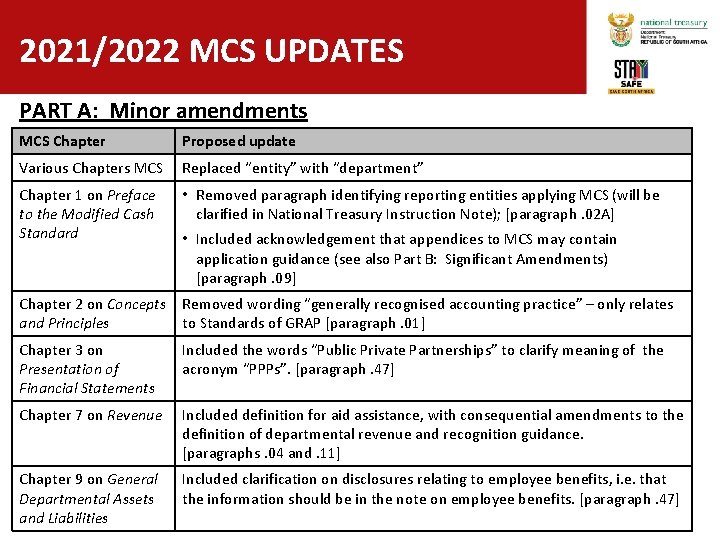

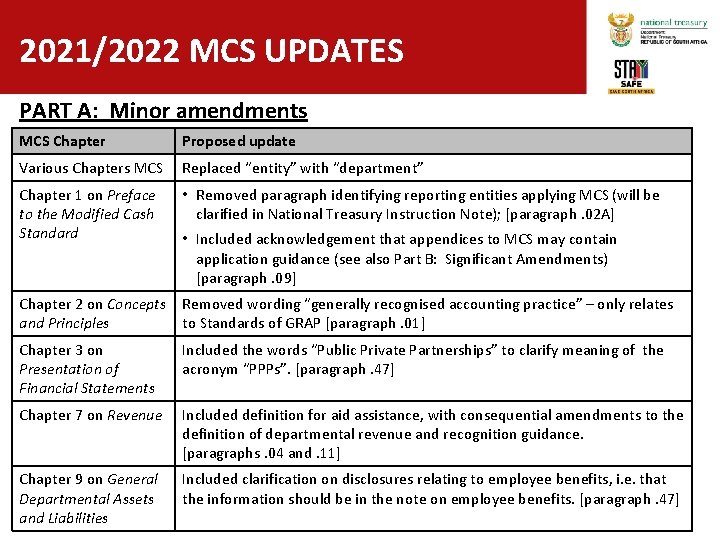

2021/2022 MCS UPDATES PART A: Minor amendments MCS Chapter Proposed update Various Chapters MCS Replaced “entity” with “department” Chapter 1 on Preface to the Modified Cash Standard • Removed paragraph identifying reporting entities applying MCS (will be clarified in National Treasury Instruction Note); [paragraph. 02 A] Chapter 2 on Concepts and Principles Removed wording “generally recognised accounting practice” – only relates to Standards of GRAP [paragraph. 01] Chapter 3 on Presentation of Financial Statements Included the words “Public Private Partnerships” to clarify meaning of the acronym “PPPs”. [paragraph. 47] Chapter 7 on Revenue Included definition for aid assistance, with consequential amendments to the definition of departmental revenue and recognition guidance. [paragraphs. 04 and. 11] Chapter 9 on General Departmental Assets and Liabilities Included clarification on disclosures relating to employee benefits, i. e. that the information should be in the note on employee benefits. [paragraph. 47] • Included acknowledgement that appendices to MCS may contain application guidance (see also Part B: Significant Amendments) [paragraph. 09] 2

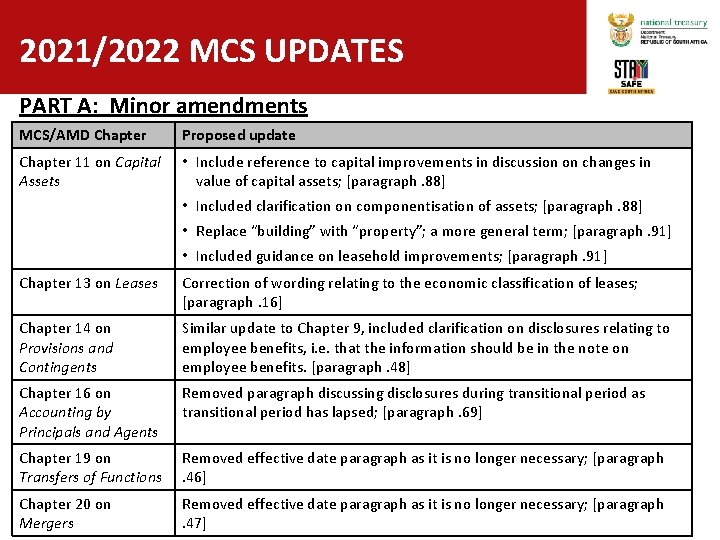

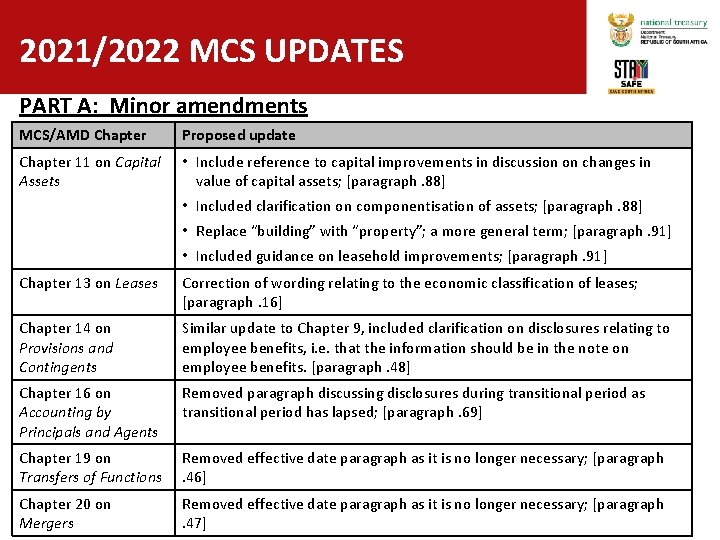

2021/2022 MCS UPDATES PART A: Minor amendments MCS/AMD Chapter Proposed update Chapter 11 on Capital Assets • Include reference to capital improvements in discussion on changes in value of capital assets; [paragraph. 88] • Included clarification on componentisation of assets; [paragraph. 88] • Replace “building” with “property”; a more general term; [paragraph. 91] • Included guidance on leasehold improvements; [paragraph. 91] Chapter 13 on Leases Correction of wording relating to the economic classification of leases; [paragraph. 16] Chapter 14 on Provisions and Contingents Similar update to Chapter 9, included clarification on disclosures relating to employee benefits, i. e. that the information should be in the note on employee benefits. [paragraph. 48] Chapter 16 on Accounting by Principals and Agents Removed paragraph discussing disclosures during transitional period as transitional period has lapsed; [paragraph. 69] Chapter 19 on Transfers of Functions Removed effective date paragraph as it is no longer necessary; [paragraph. 46] Chapter 20 on Mergers Removed effective date paragraph as it is no longer necessary; [paragraph 3. 47]

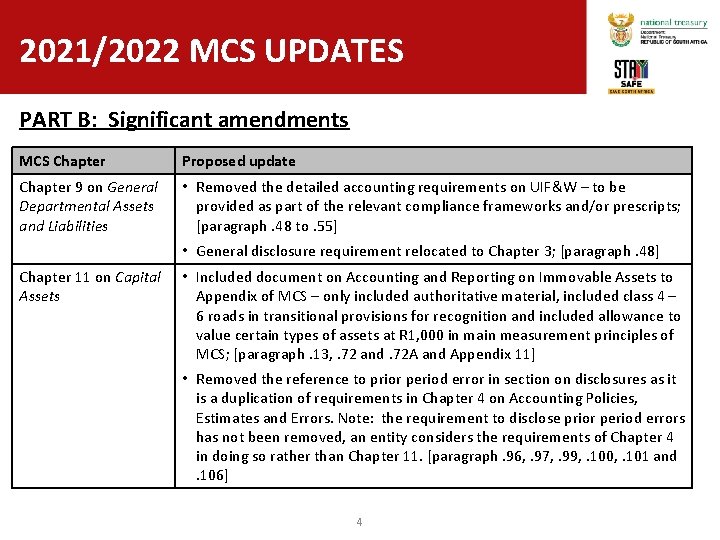

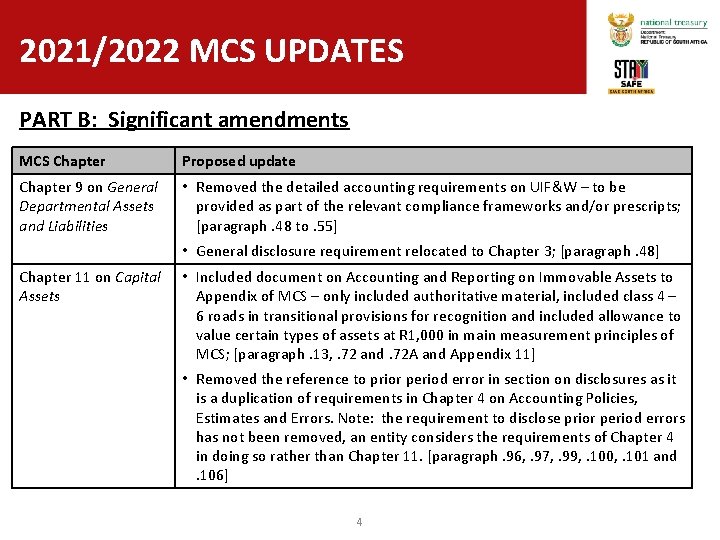

2021/2022 MCS UPDATES PART B: Significant amendments MCS Chapter Proposed update Chapter 9 on General Departmental Assets and Liabilities • Removed the detailed accounting requirements on UIF&W – to be provided as part of the relevant compliance frameworks and/or prescripts; [paragraph. 48 to. 55] • General disclosure requirement relocated to Chapter 3; [paragraph. 48] Chapter 11 on Capital Assets • Included document on Accounting and Reporting on Immovable Assets to Appendix of MCS – only included authoritative material, included class 4 – 6 roads in transitional provisions for recognition and included allowance to value certain types of assets at R 1, 000 in main measurement principles of MCS; [paragraph. 13, . 72 and. 72 A and Appendix 11] • Removed the reference to prior period error in section on disclosures as it is a duplication of requirements in Chapter 4 on Accounting Policies, Estimates and Errors. Note: the requirement to disclose prior period errors has not been removed, an entity considers the requirements of Chapter 4 in doing so rather than Chapter 11. [paragraph. 96, . 97, . 99, . 100, . 101 and. 106] 4

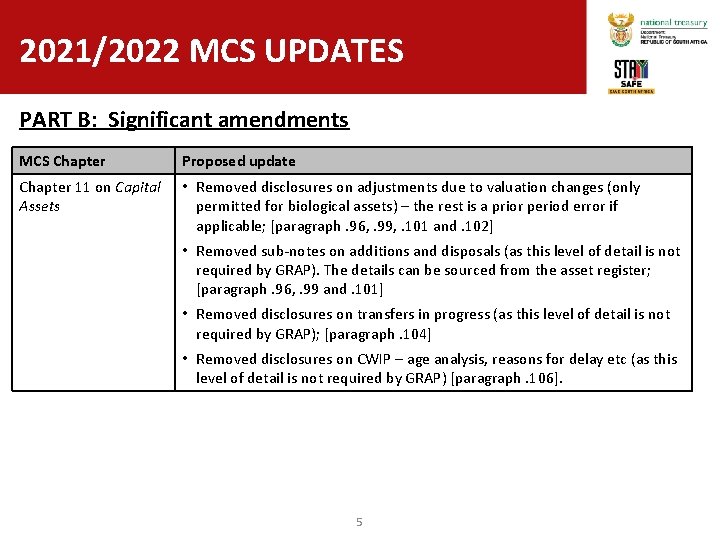

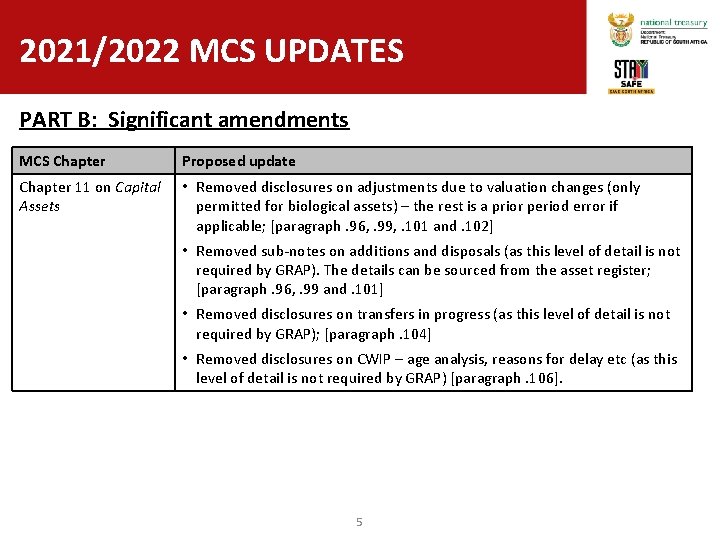

2021/2022 MCS UPDATES PART B: Significant amendments MCS Chapter Proposed update Chapter 11 on Capital Assets • Removed disclosures on adjustments due to valuation changes (only permitted for biological assets) – the rest is a prior period error if applicable; [paragraph. 96, . 99, . 101 and. 102] • Removed sub-notes on additions and disposals (as this level of detail is not required by GRAP). The details can be sourced from the asset register; [paragraph. 96, . 99 and. 101] • Removed disclosures on transfers in progress (as this level of detail is not required by GRAP); [paragraph. 104] • Removed disclosures on CWIP – age analysis, reasons for delay etc (as this level of detail is not required by GRAP) [paragraph. 106]. 5

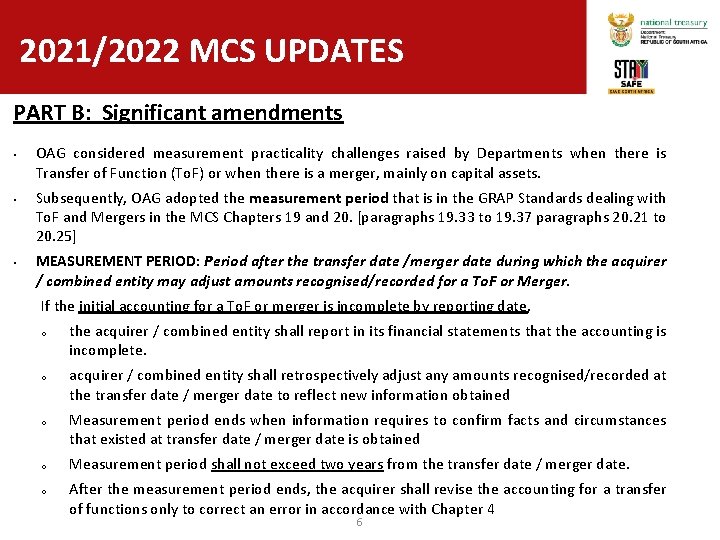

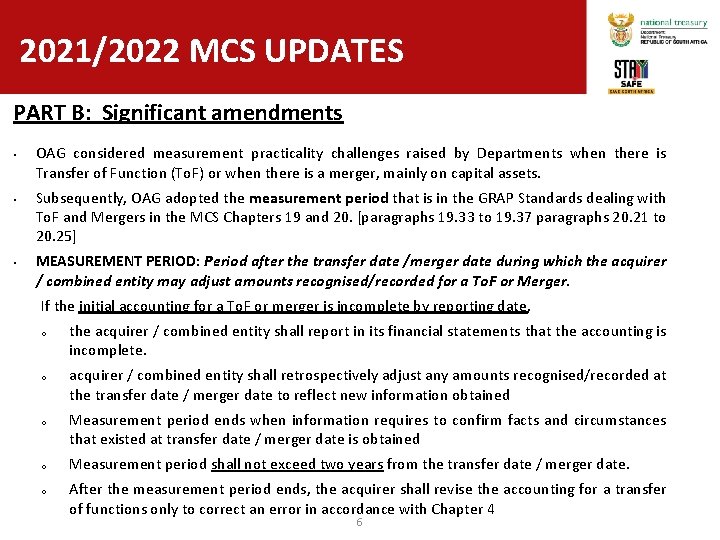

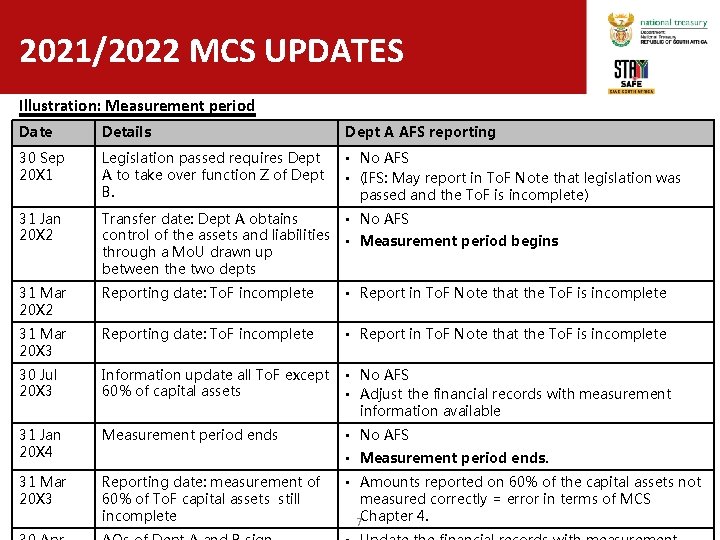

2021/2022 MCS UPDATES PART B: Significant amendments • • • OAG considered measurement practicality challenges raised by Departments when there is Transfer of Function (To. F) or when there is a merger, mainly on capital assets. Subsequently, OAG adopted the measurement period that is in the GRAP Standards dealing with To. F and Mergers in the MCS Chapters 19 and 20. [paragraphs 19. 33 to 19. 37 paragraphs 20. 21 to 20. 25] MEASUREMENT PERIOD: Period after the transfer date /merger date during which the acquirer / combined entity may adjust amounts recognised/recorded for a To. F or Merger. If the initial accounting for a To. F or merger is incomplete by reporting date, o o o the acquirer / combined entity shall report in its financial statements that the accounting is incomplete. acquirer / combined entity shall retrospectively adjust any amounts recognised/recorded at the transfer date / merger date to reflect new information obtained Measurement period ends when information requires to confirm facts and circumstances that existed at transfer date / merger date is obtained Measurement period shall not exceed two years from the transfer date / merger date. After the measurement period ends, the acquirer shall revise the accounting for a transfer of functions only to correct an error in accordance with Chapter 4 6

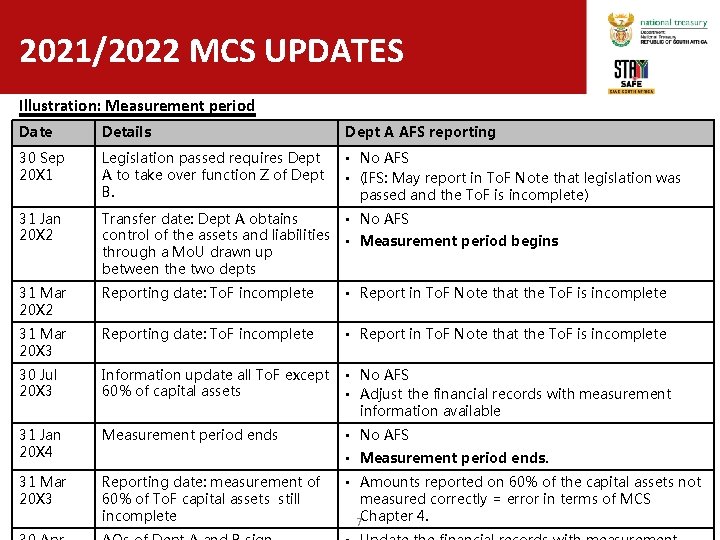

2021/2022 MCS UPDATES Illustration: Measurement period Date Details Dept A AFS reporting 30 Sep 20 X 1 Legislation passed requires Dept A to take over function Z of Dept B. • No AFS • (IFS: May report in To. F Note that legislation was passed and the To. F is incomplete) 31 Jan 20 X 2 Transfer date: Dept A obtains control of the assets and liabilities through a Mo. U drawn up between the two depts • No AFS 31 Mar 20 X 2 Reporting date: To. F incomplete • Report in To. F Note that the To. F is incomplete 31 Mar 20 X 3 Reporting date: To. F incomplete • Report in To. F Note that the To. F is incomplete 30 Jul 20 X 3 Information update all To. F except 60% of capital assets • No AFS • Adjust the financial records with measurement information available 31 Jan 20 X 4 Measurement period ends • No AFS 31 Mar 20 X 3 Reporting date: measurement of 60% of To. F capital assets still incomplete • Measurement period begins • Measurement period ends. • Amounts reported on 60% of the capital assets not measured correctly = error in terms of MCS 7 Chapter 4.

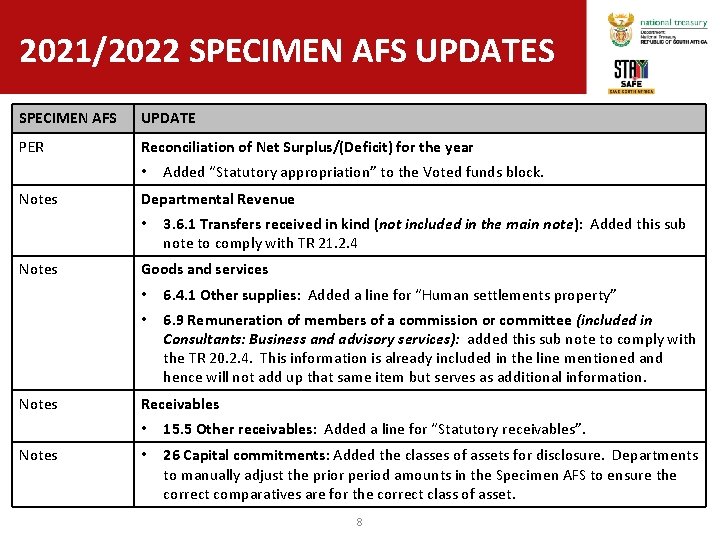

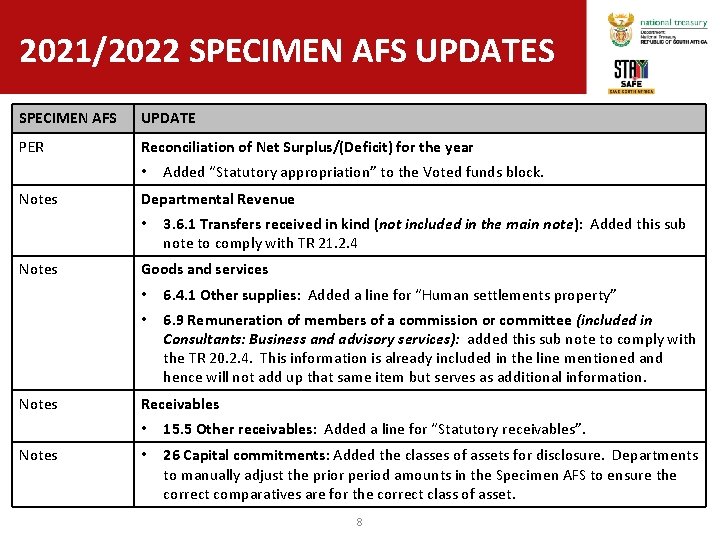

2021/2022 SPECIMEN AFS UPDATES SPECIMEN AFS UPDATE PER Reconciliation of Net Surplus/(Deficit) for the year • Notes Departmental Revenue • Notes Added “Statutory appropriation” to the Voted funds block. 3. 6. 1 Transfers received in kind (not included in the main note): Added this sub note to comply with TR 21. 2. 4 Goods and services • 6. 4. 1 Other supplies: Added a line for “Human settlements property” • 6. 9 Remuneration of members of a commission or committee (included in Consultants: Business and advisory services): added this sub note to comply with the TR 20. 2. 4. This information is already included in the line mentioned and hence will not add up that same item but serves as additional information. Receivables • 15. 5 Other receivables: Added a line for “Statutory receivables”. • 26 Capital commitments: Added the classes of assets for disclosure. Departments to manually adjust the prior period amounts in the Specimen AFS to ensure the correct comparatives are for the correct class of asset. 8

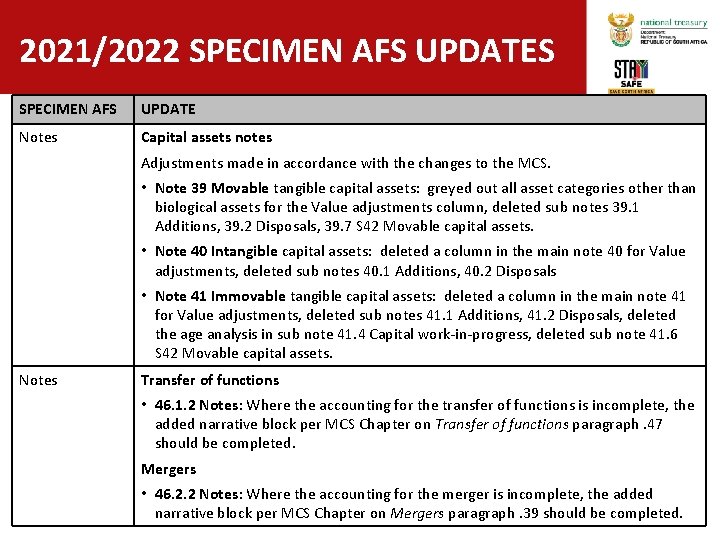

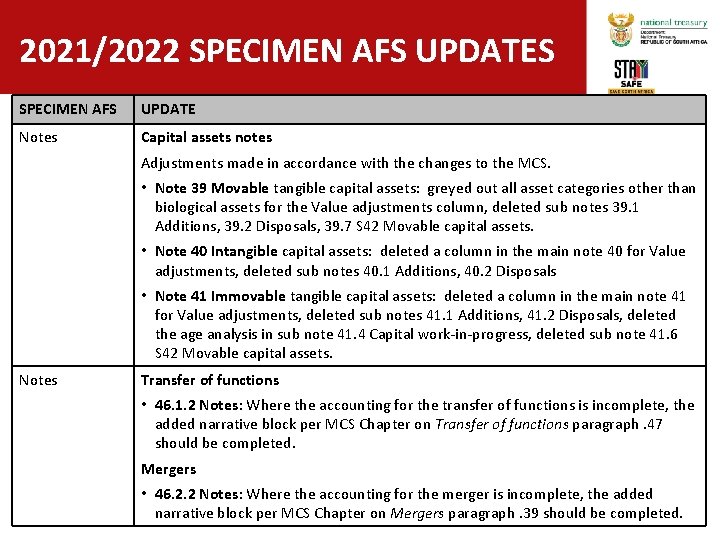

2021/2022 SPECIMEN AFS UPDATES SPECIMEN AFS UPDATE Notes Capital assets notes Adjustments made in accordance with the changes to the MCS. • Note 39 Movable tangible capital assets: greyed out all asset categories other than biological assets for the Value adjustments column, deleted sub notes 39. 1 Additions, 39. 2 Disposals, 39. 7 S 42 Movable capital assets. • Note 40 Intangible capital assets: deleted a column in the main note 40 for Value adjustments, deleted sub notes 40. 1 Additions, 40. 2 Disposals • Note 41 Immovable tangible capital assets: deleted a column in the main note 41 for Value adjustments, deleted sub notes 41. 1 Additions, 41. 2 Disposals, deleted the age analysis in sub note 41. 4 Capital work-in-progress, deleted sub note 41. 6 S 42 Movable capital assets. Notes Transfer of functions • 46. 1. 2 Notes: Where the accounting for the transfer of functions is incomplete, the added narrative block per MCS Chapter on Transfer of functions paragraph. 47 should be completed. Mergers • 46. 2. 2 Notes: Where the accounting for the merger is incomplete, the added narrative block per MCS Chapter on Mergers paragraph. 39 should be completed. 9

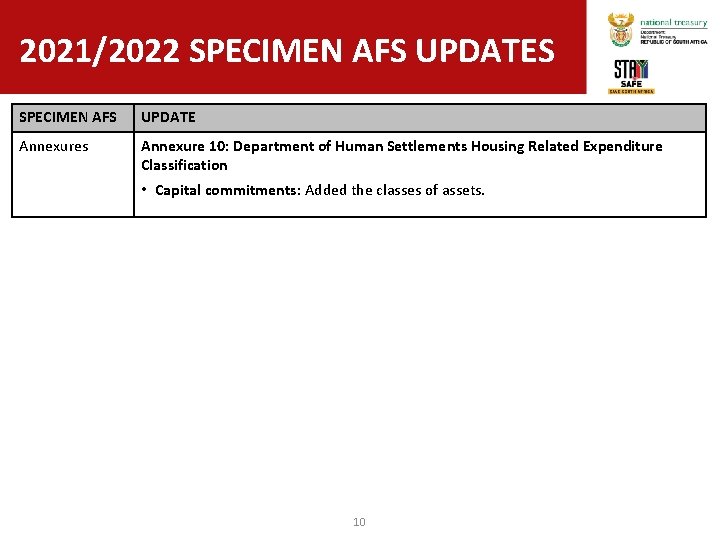

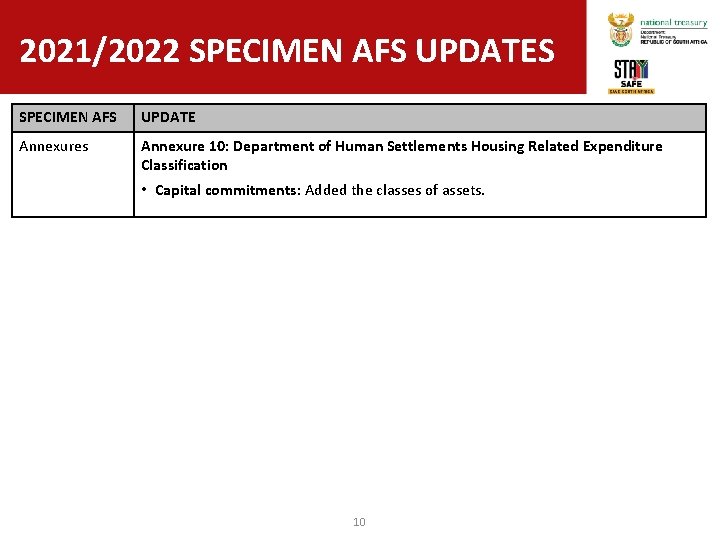

2021/2022 SPECIMEN AFS UPDATES SPECIMEN AFS UPDATE Annexures Annexure 10: Department of Human Settlements Housing Related Expenditure Classification • Capital commitments: Added the classes of assets. 10