Materiality Misstatements and Reporting Part III ISA Implementation

- Slides: 9

Materiality, Misstatements and Reporting – Part III ISA Implementation Support Module Prepared by IAASB Staff October 2010

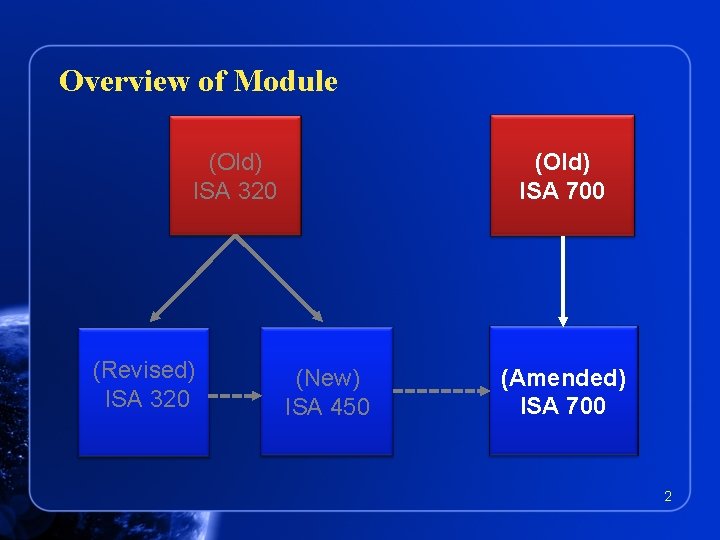

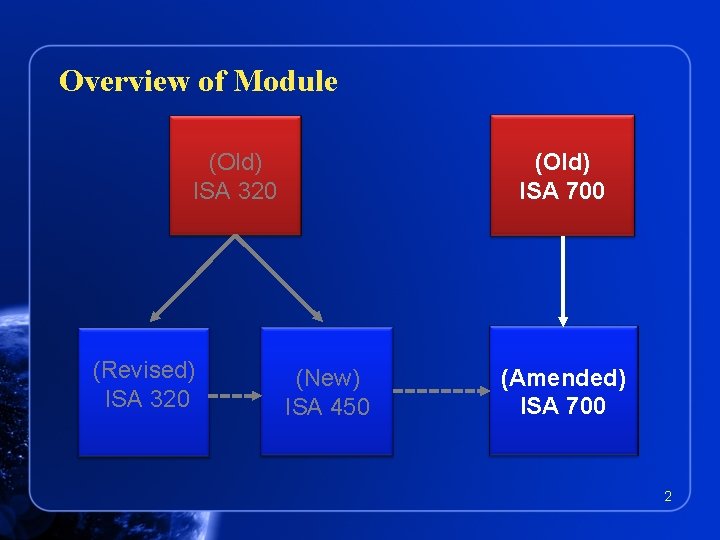

Overview of Module (Old) ISA 320 (Revised) ISA 320 (Old) ISA 700 (New) ISA 450 (Amended) ISA 700 2

Overview of Significant Amendments to ISA 700 • Evaluation of whether the financial statements as a whole are free from material misstatements, and consideration of management bias • Forming more than one opinion when the financial statements are prepared in accordance with two financial reporting frameworks • Description of management’s responsibility for the financial statements in the auditor’s report 3

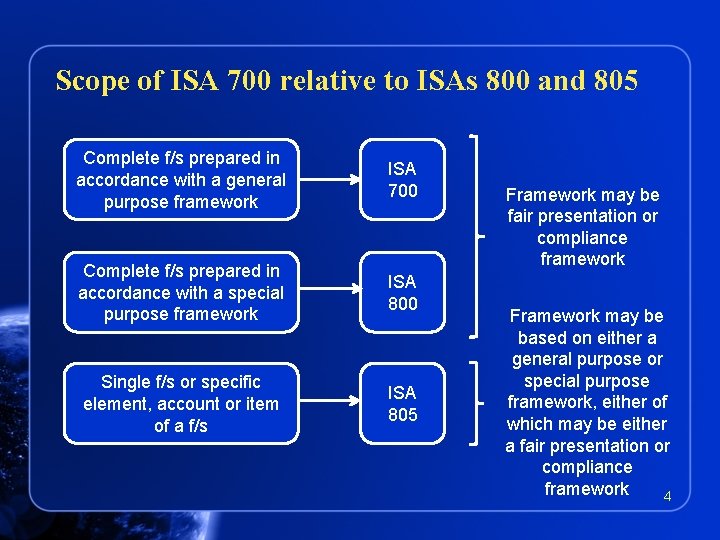

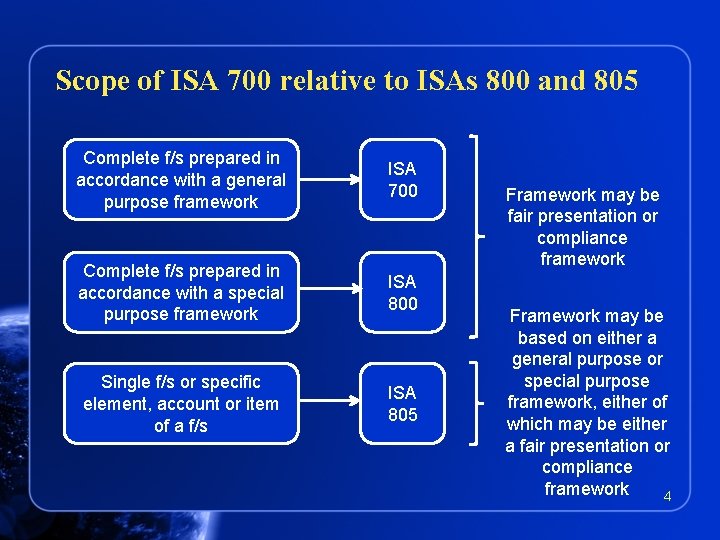

Scope of ISA 700 relative to ISAs 800 and 805 Complete f/s prepared in accordance with a general purpose framework ISA 700 Complete f/s prepared in accordance with a special purpose framework ISA 800 Single f/s or specific element, account or item of a f/s ISA 805 Framework may be fair presentation or compliance framework Framework may be based on either a general purpose or special purpose framework, either of which may be either a fair presentation or compliance framework 4

Evaluation of Financial Statements as a Whole • Under ISA 700, evaluation of whether financial statements as a whole are free from material misstatement now a step to forming the audit opinion • Evaluation takes into account – Conclusion under ISA 450 as to whether uncorrected misstatements are material, individually or in aggregate – Qualitative aspects of entity’s accounting practices, including indicators of possible bias in management judgments 5

Financial Statements Prepared in Accordance with Two Financial Reporting Frameworks • Question of whether more than one opinion may be expressed when management asserts that financial statements comply with two FRFs – E. g. national GAAP and IFRS • Under ISA 700, two opinions may be expressed • If financial statements represent compliance with one framework and disclose extent of compliance with another, express only one opinion – The additional disclosure cannot be differentiated from the rest of the financial statements 6

Description of Management’s Responsibility • Describe management’s responsibility for financial statements in the audit report as it is described in terms of engagement • Use wording in relevant law or regulation to describe management’s responsibility if equivalent in effect to wording in ISA 210 • In any other case, use wording in ISA 210 to describe management’s responsibility in the audit report 7

Note This set of support slides does not amend or override the ISAs, the texts of which alone are authoritative. Reading the slides is not a substitute for reading the ISAs. The slides are not meant to be exhaustive and reference to the ISAs themselves should always be made. In conducting an audit in accordance with ISAs, the auditor is required to comply with all the ISAs that are relevant to the engagement. 8

International Federation of Accountants Copyright © October 2010 by the International Federation of Accountants (IFAC). All rights reserved. Permission is granted to make copies of this work provided that such copies are for use in academic classrooms or for personal use and are not sold or disseminated and provided that each copy bears the following credit line: “Copyright © October 2010 by the International Federation of Accountants (IFAC). All rights reserved. Used with permission of IFAC. Contact permissions@ifac. org for permission to reproduce, store, or transmit this work. ” Otherwise, written permission from IFAC is required to reproduce, store, or transmit, or to make other similar uses of, this work, except as permitted by law. Contact permissions@ifac. org. ISBN: 978 -1 -60815 -078 -6 www. ifac. org