Market Structures Perfect Competition O L I G

- Slides: 37

Market Structures Perfect Competition O L I G O P O L Y Monopolistic Competition Monopoly

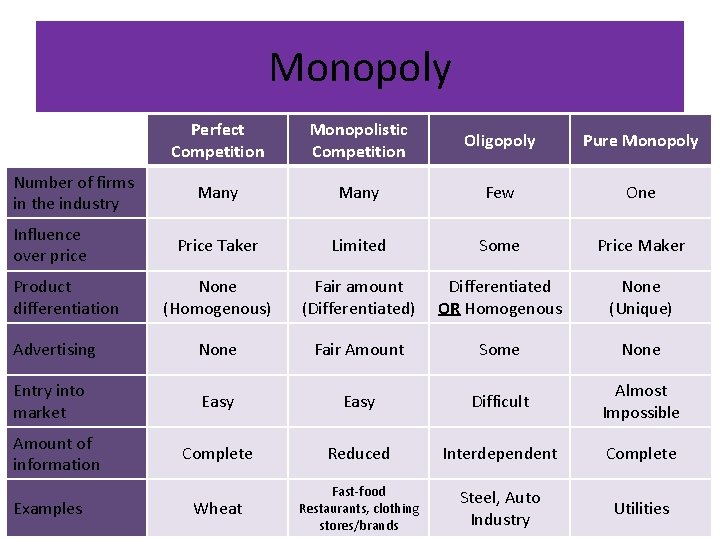

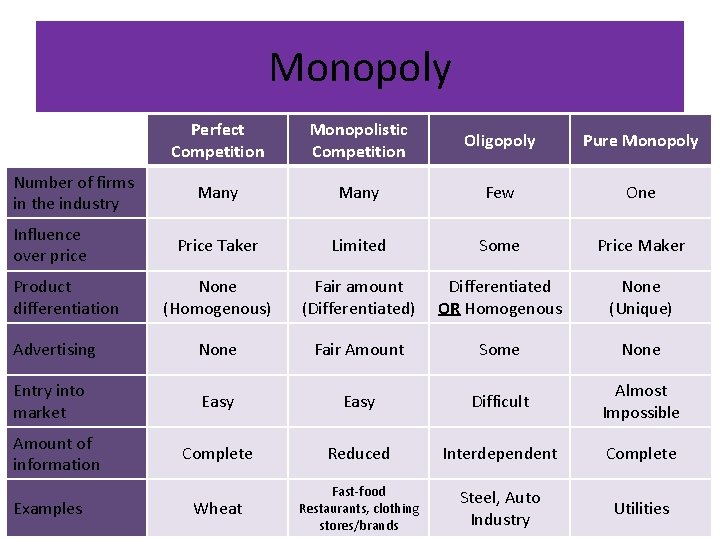

Competition and Market Structures • Market Structure – nature and degree of competition among firms in the same industry • There are four forms of market structure: – Perfect Competition – Monopolistic Competition – Oligopoly – Monopoly Imperfect Competition • Firms fall into one of the four forms based on six characteristic

Characteristics of Market Structures • Number of Firms – from one to thousands • Product Differentiation– either homogenous, (wheat) differentiated, (burgers) or unique (natural gas) • Ease of Entering or Leaving the Industry – easy (starting a restaurant) or difficult (car manufacturing) • Amount of information – complete or restrictive • Influence Over Price– Price Takers or Price Maker • Nonprice Competition – sales strategy focusing on a product’s appearance, quality, or design rather than its price

Perfect Competition • Perfect Competition – market structure with many well-informed and independent buyers and sellers who exchange identical products. Wheat is a good example – There a great many producers – It is a homogeneous product – It is relatively easy to enter or exit the market – Information flows freely and completely among the participants – Farmers are price takers – they can sell no product above the market price, but can sell all they want at the market price

Perfect Competition • Perfectly Competitive firms do not earn Economic Profit (Excess Profits) – total revenue minus total costs – Remember costs are: • • Land Labor Capital Entrepreneurship = = Rent Wages Interest (Normal) Profit • Normal profit is already figured into total costs

Perfect Competition • If Economic Profit existed, then new firms would enter the market, since it is easy – this would increase supply, which lowers price and gets rid of the economic profit • Perfectly Competitive Markets will produce at a level where marginal cost = marginal revenue or (MC) = (MR) • Perfectly Competitive Markets will produce at the lowest possible average cost of production (ATC) – These two things make PC the most efficient market

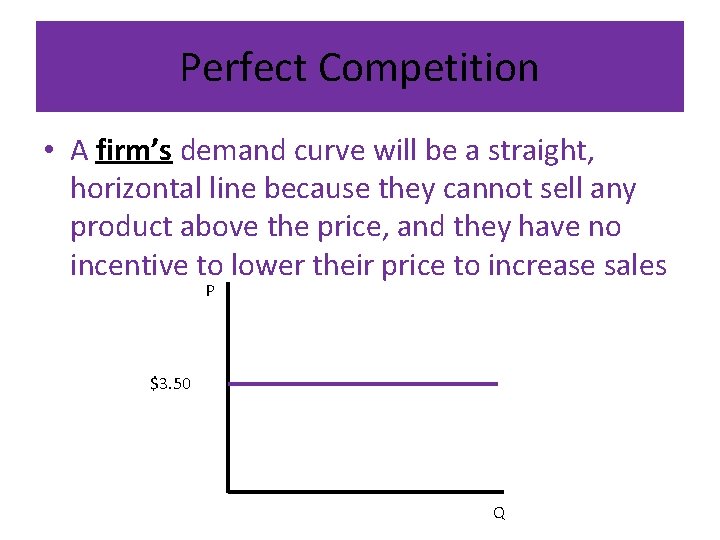

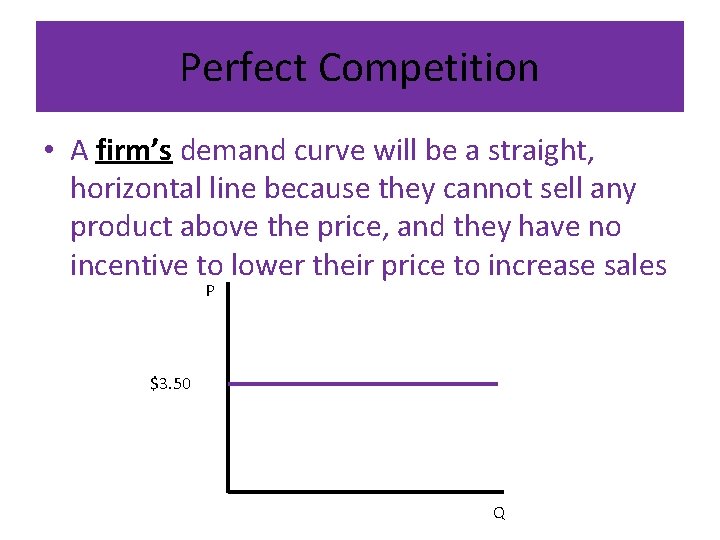

Perfect Competition • A firm’s demand curve will be a straight, horizontal line because they cannot sell any product above the price, and they have no incentive to lower their price to increase sales P $3. 50 Q

Perfect Competition Number of firms in the industry Influence over price Product differentiation Many Price Taker None (Homogenous) Advertising None Entry into market Easy Amount of information Examples Complete Wheat Monopolistic Competition Oligopoly Pure Monopoly

Monopolistic Competition • A market structure that meets all conditions of perfect competition except identical products • The industry is relatively easy to enter or leave and there is some degree of price control • Demand in a monopolistically competitive market is very price elastic because there are so many substitutes

Monopolistic Competition • Examples – any retail stores: jeans, haircuts, restaurants, fast-food places etc. • The products are differentiated, but still close substitutes for each other (The Big Mac vs. The Whopper or Post Raisin Bran vs. Kellogg’s Raisin Bran) • Price control is limited because of the large number of close substitutes • The market is closer to perfect competition than monopoly, but price will be a little higher due to cost of advertising

Monopolistic Competition • The demand curve for a monopolistically competitive firm will be flatter than a market demand curve P because the large number D of substitutes makes it very price elastic Q • Economic profits will be unlikely because of the ease of entry and exit from the industry • The output level will be where MC = MR and price should be very close to equaling ATC

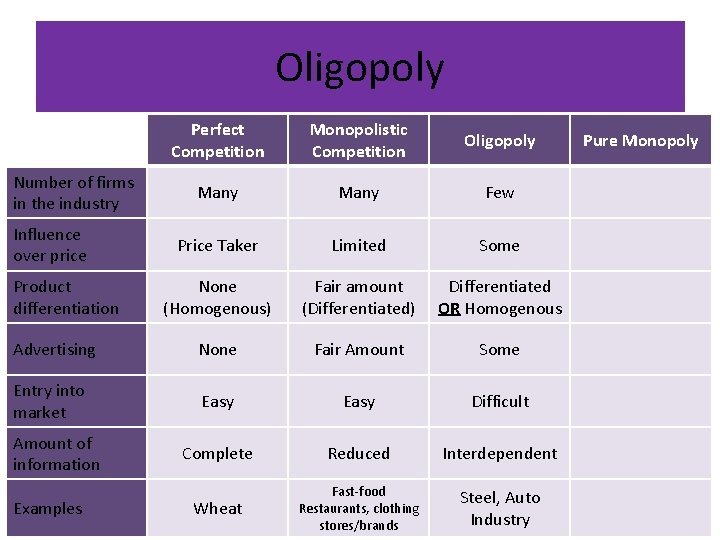

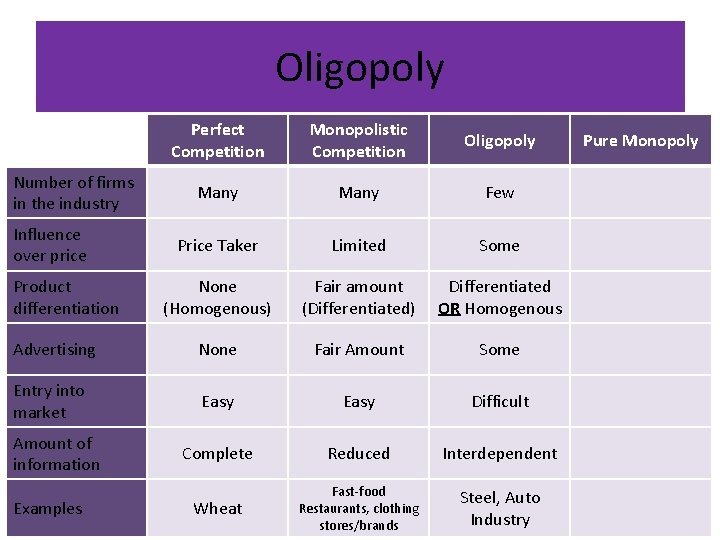

Monopolistic Competition Perfect Competition Monopolistic Competition Many Price Taker Limited None (Homogenous) Fair amount (Differentiated) Advertising None Fair Amount Entry into market Easy Complete Reduced Wheat Fast-food Restaurants, clothing stores/brands Number of firms in the industry Influence over price Product differentiation Amount of information Examples Oligopoly Pure Monopoly

Oligopoly • A form of market structure in which a few large sellers dominate the industry • It is also characterized by difficulty entering or leaving the market due to high equipment costs and brand loyalty • Information about the market will be incomplete – firms are large enough to get price reductions on inputs and trade secrets exist

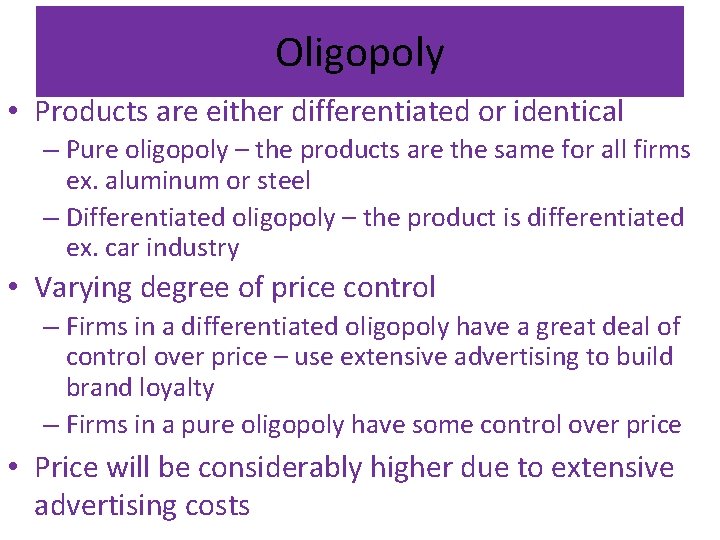

Oligopoly • Products are either differentiated or identical – Pure oligopoly – the products are the same for all firms ex. aluminum or steel – Differentiated oligopoly – the product is differentiated ex. car industry • Varying degree of price control – Firms in a differentiated oligopoly have a great deal of control over price – use extensive advertising to build brand loyalty – Firms in a pure oligopoly have some control over price • Price will be considerably higher due to extensive advertising costs

Oligopoly • Price Control: ØCollusion – agreement, usually illegal, among producers to fix prices, limit output, or divide markets – ex. baseball owners or prisoner’s dilemma ØCartel – a formal organization of firms in the same industry acting together to make decisions ex. OPEC ØPrice Fixing – agreement, usually illegal, by firms to charge the same price for a product

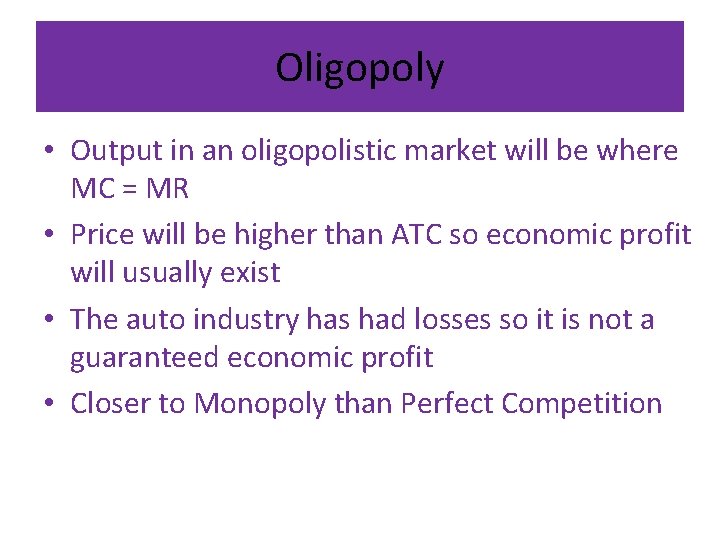

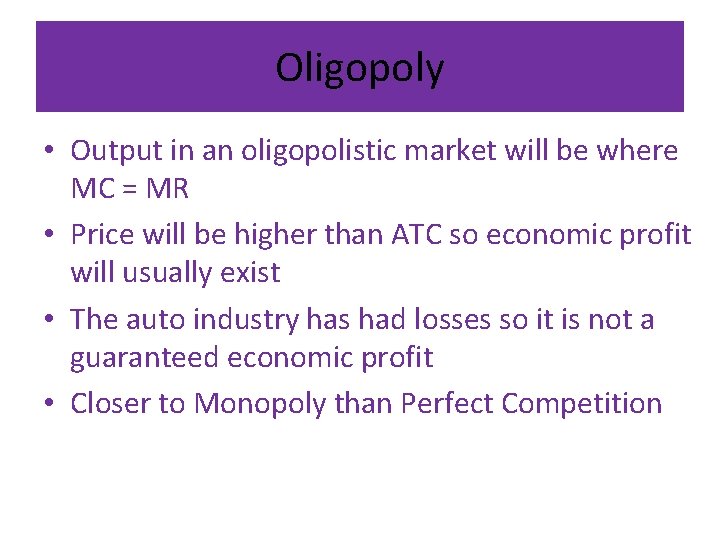

Oligopoly • Output in an oligopolistic market will be where MC = MR • Price will be higher than ATC so economic profit will usually exist • The auto industry has had losses so it is not a guaranteed economic profit • Closer to Monopoly than Perfect Competition

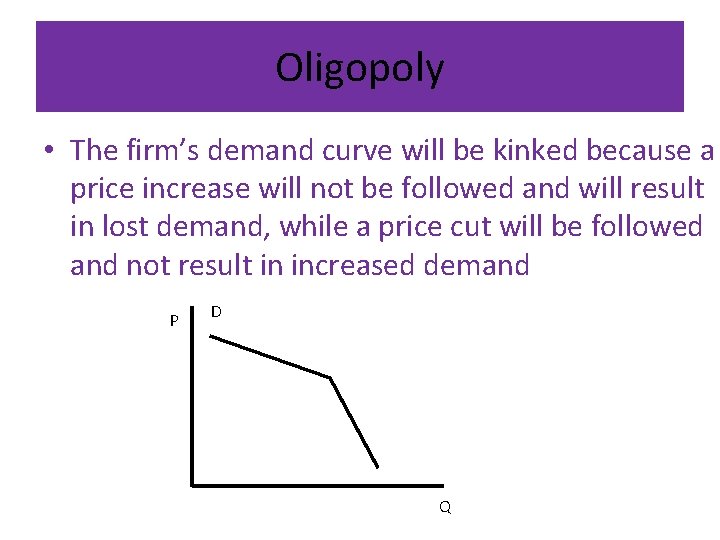

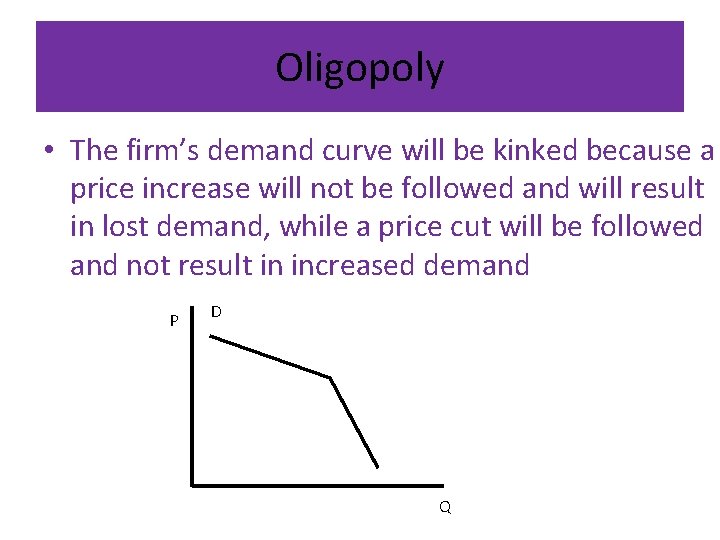

Oligopoly • The firm’s demand curve will be kinked because a price increase will not be followed and will result in lost demand, while a price cut will be followed and not result in increased demand P D Q

Oligopoly Perfect Competition Monopolistic Competition Oligopoly Many Few Price Taker Limited Some None (Homogenous) Fair amount (Differentiated) Differentiated OR Homogenous Advertising None Fair Amount Some Entry into market Easy Difficult Complete Reduced Interdependent Wheat Fast-food Restaurants, clothing stores/brands Steel, Auto Industry Number of firms in the industry Influence over price Product differentiation Amount of information Examples Pure Monopoly

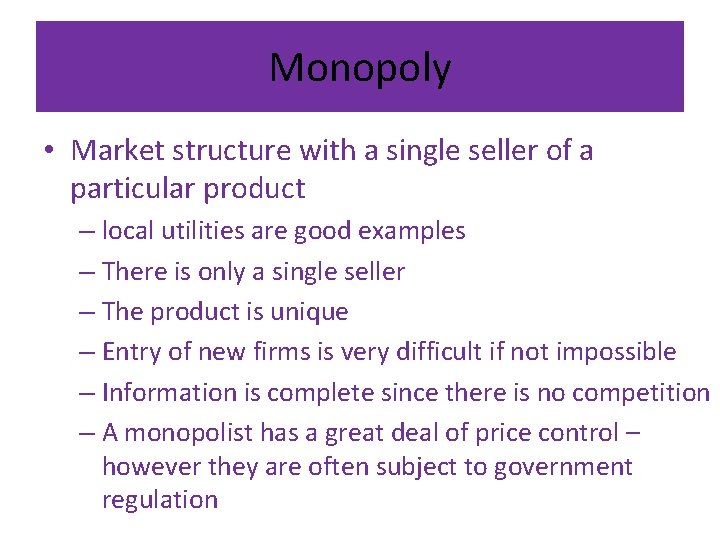

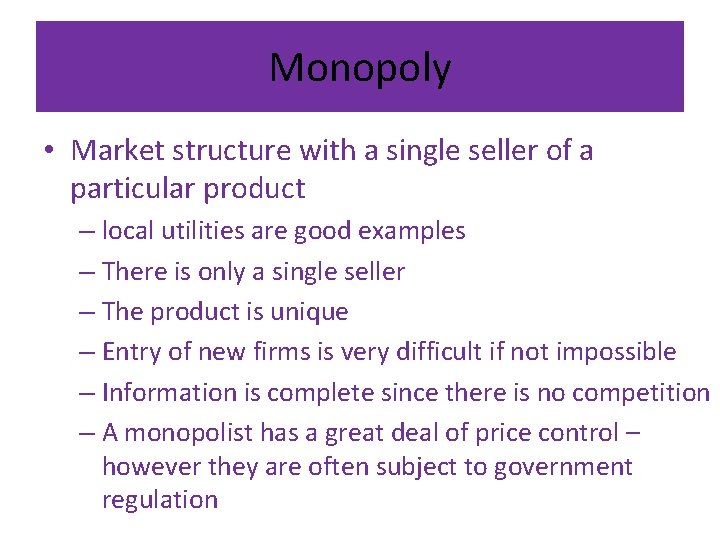

Monopoly • Market structure with a single seller of a particular product – local utilities are good examples – There is only a single seller – The product is unique – Entry of new firms is very difficult if not impossible – Information is complete since there is no competition – A monopolist has a great deal of price control – however they are often subject to government regulation

Monopoly • Reasons for the difficult entry to the market – Natural monopoly – market structure where average costs of production are lowest when a single firm exists • economies of scale – situation in which the average cost of production falls as a firm gets larger – Geographic monopoly – market structure in which one firm has a monopoly in a geographic area – One firm may control the natural resources to produce the good ALCOA or De Beers – Government monopoly – a monopoly owned and operated by the government – water utilities

Monopoly – Technological monopoly – monopoly based on a firm’s ownership or control of a production method, process, or other scientific advance • Patent – an exclusive right to manufacture, use, or sell any new and useful invention for a specific time period inventions are covered for 20 years • Copyright – the exclusive right of authors or artists to publish, sell, or reproduce their work, for their lifetime plus 70 years • It is difficult to leave because the equipment is usually highly specialized

Monopoly • A monopolists demand curve will be the market demand curve because they are the only firm in the market • Unregulated Monopolists will be able to earn economic (excess) profit • Unregulated Monopolists will charge too high a price and will produce a quantity that is too low so the market is not efficient • Because of this, government usually regulates monopolistic markets

Monopoly Perfect Competition Monopolistic Competition Oligopoly Pure Monopoly Many Few One Price Taker Limited Some Price Maker None (Homogenous) Fair amount (Differentiated) Differentiated OR Homogenous None (Unique) Advertising None Fair Amount Some None Entry into market Easy Difficult Almost Impossible Complete Reduced Interdependent Complete Wheat Fast-food Restaurants, clothing stores/brands Steel, Auto Industry Utilities Number of firms in the industry Influence over price Product differentiation Amount of information Examples

Market Failures • Market failure – condition that causes a competitive market to fail 1. Inadequate Competition – government regulates markets when this happens 2. Inadequate Information – can prevent the efficient allocation of resources 3. Resource Immobility – when resources do not move to markets where returns are the highest 4. Public goods – products that are collectively consumed by everyone 5. Externalities – economic side effect that affects an uninvolved third party

Maintain Competition • Producers reduce competition by collusion or through trusts or monopolies • Consumers reduce competition through boycotts

Externalities • Negative Externality – harmful side effect that affects an uninvolved third party – pollution, airport noised, beet plant stench • Positive Externality – beneficial side effect that affects an uninvolved third party – a restaurant benefits from a business owner building a new factory in town – public education, public transportation, flu vaccinations

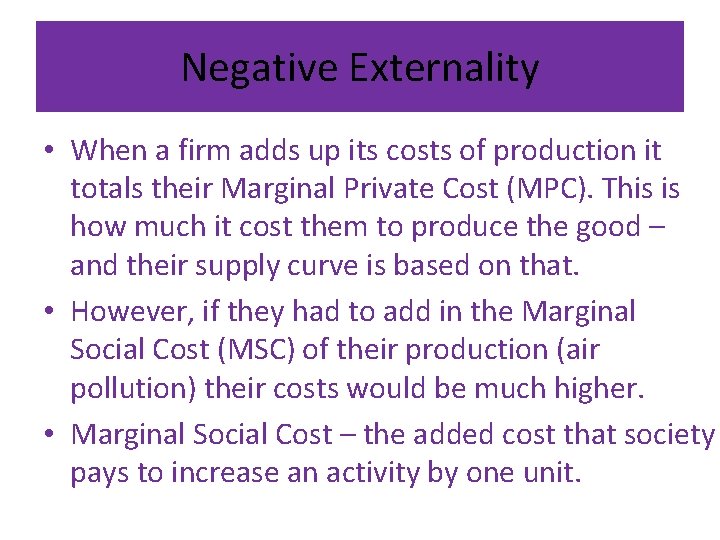

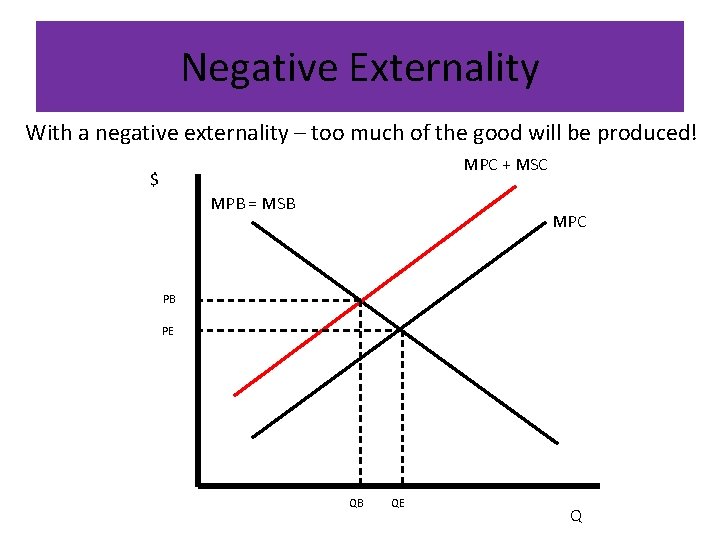

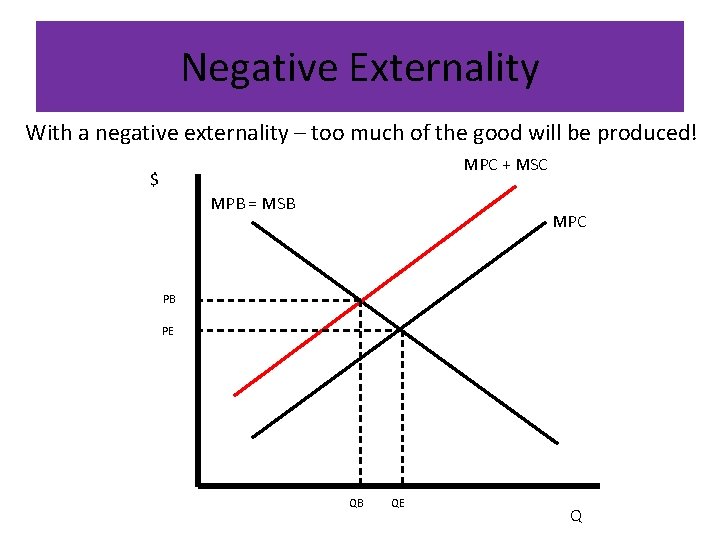

Negative Externality • When a firm adds up its costs of production it totals their Marginal Private Cost (MPC). This is how much it cost them to produce the good – and their supply curve is based on that. • However, if they had to add in the Marginal Social Cost (MSC) of their production (air pollution) their costs would be much higher. • Marginal Social Cost – the added cost that society pays to increase an activity by one unit.

Negative Externality With a negative externality – too much of the good will be produced! MPC + MSC $ MPB = MSB MPC PB PE QB QE Q

Negative Externality • Because some costs are not being counted, the good will be overproduced • To correct a negative externality, like pollution, government has two choices: – Make pollution illegal – firms would have to buy equipment to stop the pollution which would drive up their costs which shifts supply (MPB) to the left causing higher prices – Use a tax to curb pollution – the tax makes a firms costs go up which shifts supply (MPB) to the left causing higher prices

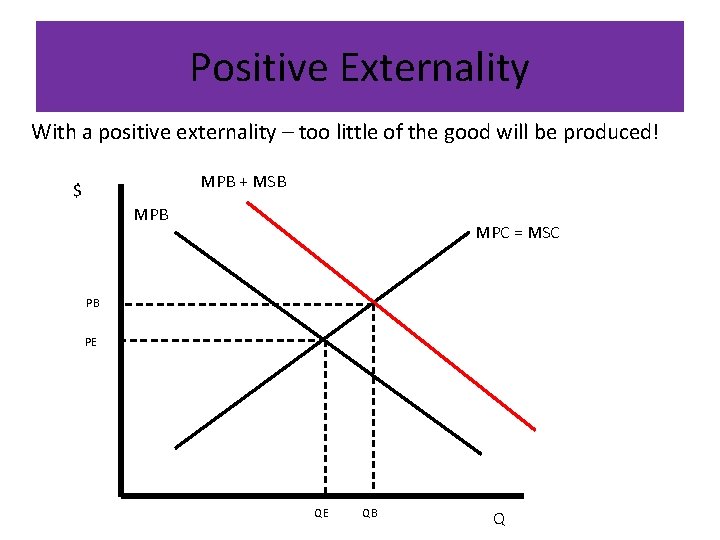

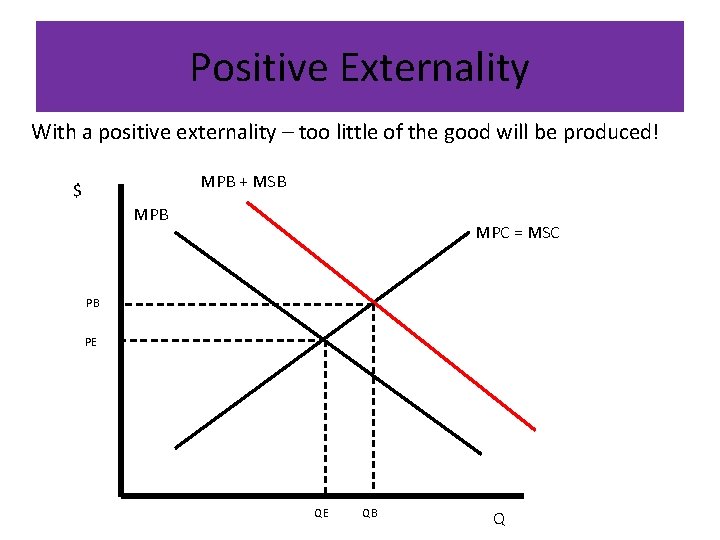

Positive Externality • When an individual adds up their benefit of their activity it totals their Marginal Private Benefit (MPB). This is how much benefit they received– and their demand curve is based on that. • However, if they got to add in the Marginal Social Benefit (MSB) of their activity (riding the bus) the benefit would be much higher. • Marginal Social Benefit – the added benefit that society gets from increasing an activity by one unit.

Positive Externality With a positive externality – too little of the good will be produced! MPB + MSB $ MPB MPC = MSC PB PE QE QB Q

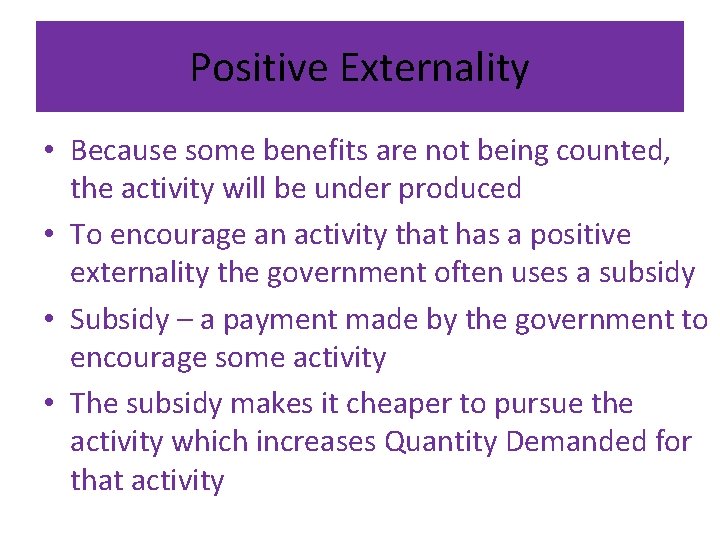

Positive Externality • Because some benefits are not being counted, the activity will be under produced • To encourage an activity that has a positive externality the government often uses a subsidy • Subsidy – a payment made by the government to encourage some activity • The subsidy makes it cheaper to pursue the activity which increases Quantity Demanded for that activity

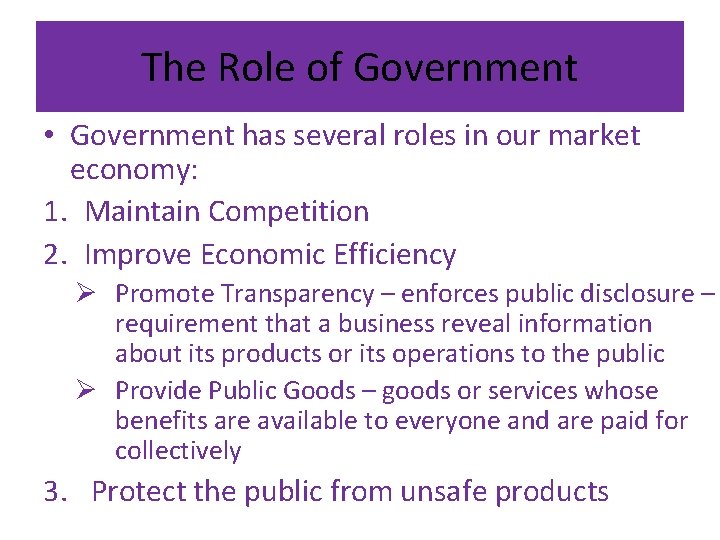

The Role of Government • Government has several roles in our market economy: 1. Maintain Competition 2. Improve Economic Efficiency Ø Promote Transparency – enforces public disclosure – requirement that a business reveal information about its products or its operations to the public Ø Provide Public Goods – goods or services whose benefits are available to everyone and are paid for collectively 3. Protect the public from unsafe products

Maintain Competition • Prohibiting market structures that are not competitive ØTrusts – illegal combination of corporations or companies organized to hinder competition • Anti-Monopoly Legislation 1. Sherman Antitrust Act (1890) – outlawed all contracts “in restraint of trade” to halt the growth of trusts 2. Clayton Antitrust Act (1914) – strengthened the Sherman Act by outlawing price discrimination Ø Price Discrimination – practice of selling the same product at different prices to different buyers

Maintain Competition 3. Federal Trade Commission Act (1914) – established the Federal Trade Commission to regulate unfair methods of competition in interstate commerce Ø Cease and Desist Order – ruling requiring a company to stop an unfair business practice that reduces or limits competition 4. Robinson – Patman Act (1936) – forbade rebates and discounts on the sale of goods to large buyers unless the rebates and discounts were available to all

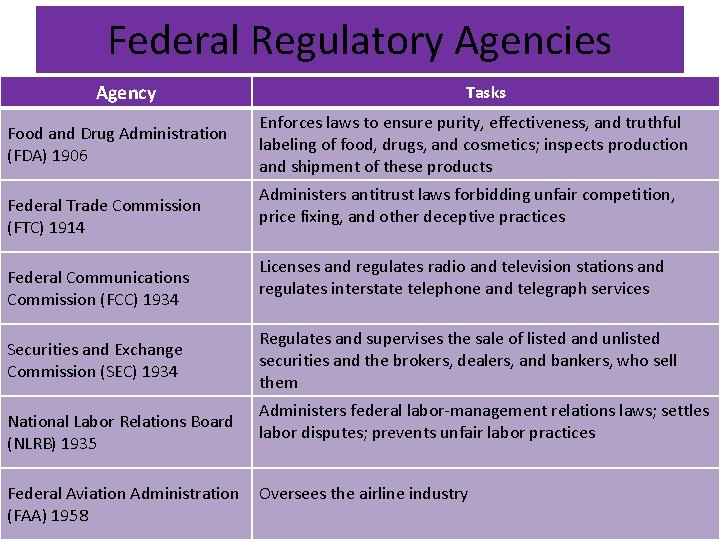

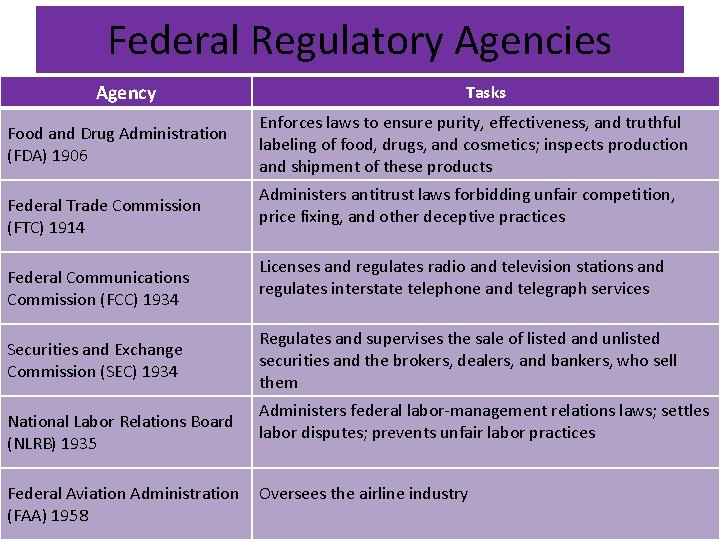

Federal Regulatory Agencies Agency Food and Drug Administration (FDA) 1906 Federal Trade Commission (FTC) 1914 Federal Communications Commission (FCC) 1934 Securities and Exchange Commission (SEC) 1934 National Labor Relations Board (NLRB) 1935 Federal Aviation Administration (FAA) 1958 Tasks Enforces laws to ensure purity, effectiveness, and truthful labeling of food, drugs, and cosmetics; inspects production and shipment of these products Administers antitrust laws forbidding unfair competition, price fixing, and other deceptive practices Licenses and regulates radio and television stations and regulates interstate telephone and telegraph services Regulates and supervises the sale of listed and unlisted securities and the brokers, dealers, and bankers, who sell them Administers federal labor-management relations laws; settles labor disputes; prevents unfair labor practices Oversees the airline industry

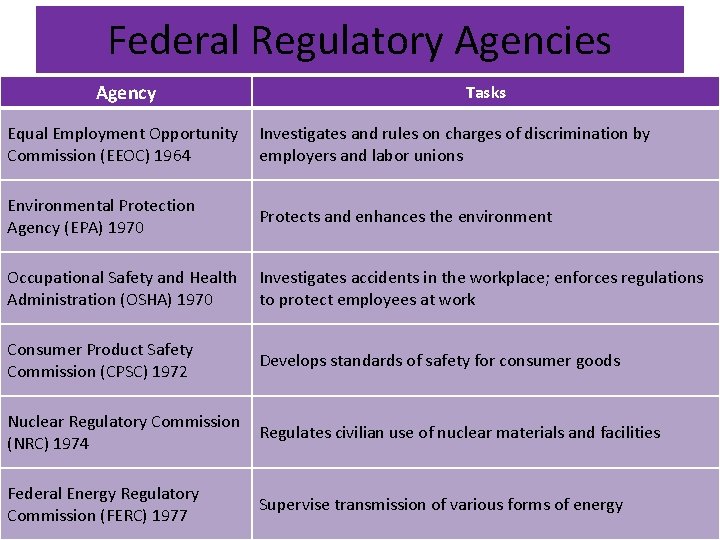

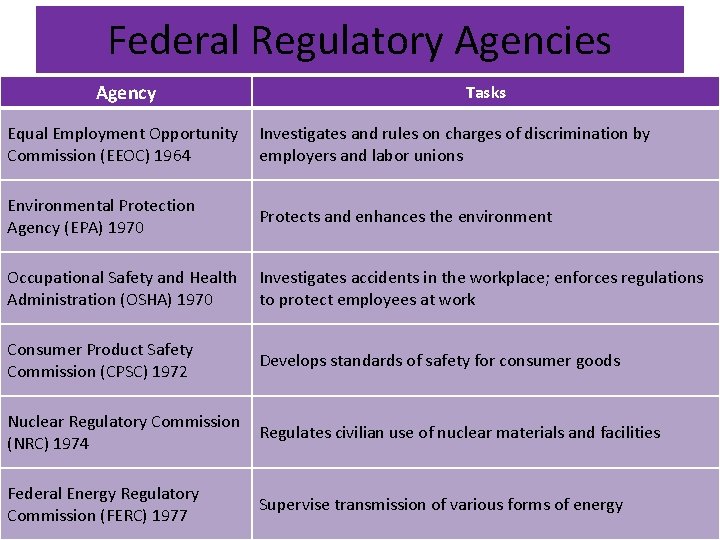

Federal Regulatory Agencies Agency Tasks Equal Employment Opportunity Commission (EEOC) 1964 Investigates and rules on charges of discrimination by employers and labor unions Environmental Protection Agency (EPA) 1970 Protects and enhances the environment Occupational Safety and Health Administration (OSHA) 1970 Investigates accidents in the workplace; enforces regulations to protect employees at work Consumer Product Safety Commission (CPSC) 1972 Develops standards of safety for consumer goods Nuclear Regulatory Commission (NRC) 1974 Regulates civilian use of nuclear materials and facilities Federal Energy Regulatory Commission (FERC) 1977 Supervise transmission of various forms of energy