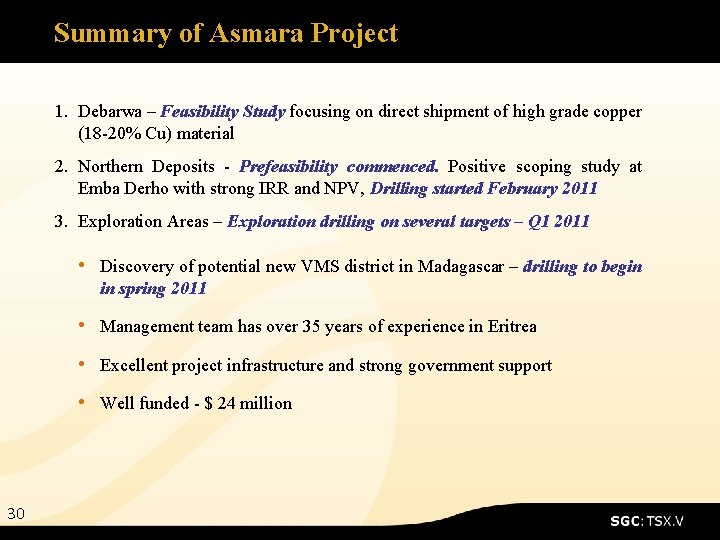

March 2011 Developing Copper Zinc and Gold Deposits

- Slides: 31

March 2011 Developing Copper, Zinc and Gold Deposits at the Asmara Project, Eritrea

Sunridge Gold – Highlights The Asmara Project in Eritrea hosts four deposits. Sunridge has completed independent, TSX 43 -101 approved resource estimates on three deposits, Emba Derho, Adi Nefas and Debarwa. Combined Indicated resources total: • • 1. 28 billion lbs (580, 000 tonnes) copper 2. 5 billion lbs (1, 130, 000 tonnes) zinc 1. 05 million oz gold 31. 8 million oz silver In addition a fourth deposit, the Gupo Gold deposit, contains an Inferred resource of 189, 000 ounces of gold. 2

Sunridge Gold – Highlights • Feasibility Study at Debarwa focusing on fast tracking high grade copper zone to production • Prefeasibility Study underway on three Northern Deposits • Major drill programs with five rigs operating by end of first quarter • Experienced management team • “De-riskification” of region continues • Discovery of potential new VMS district in Madagascar • Well funded – $24 million in treasury 3

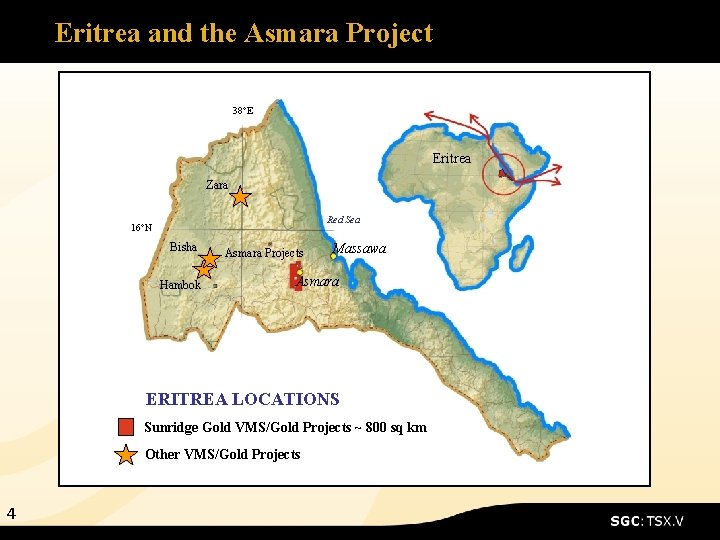

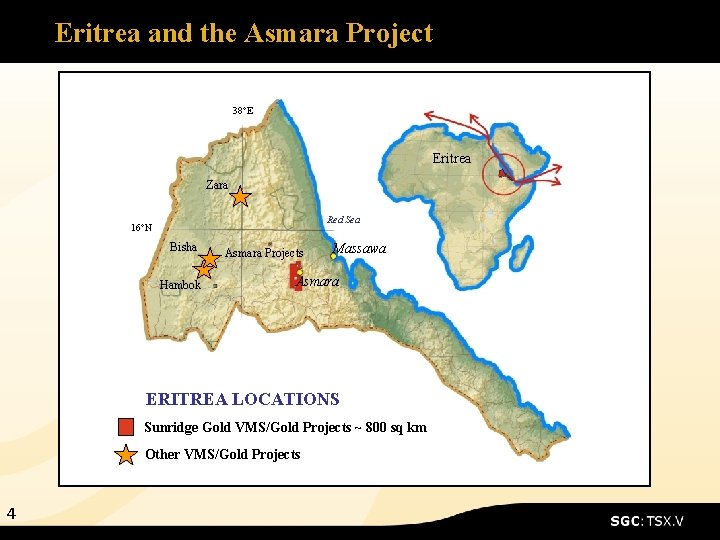

Eritrea and the Asmara Project 38°E Eritrea Zara Red Sea 16°N Bisha Hambok Asmara Projects Massawa Asmara ERITREA LOCATIONS Sunridge Gold VMS/Gold Projects ~ 800 sq km Other VMS/Gold Projects 4

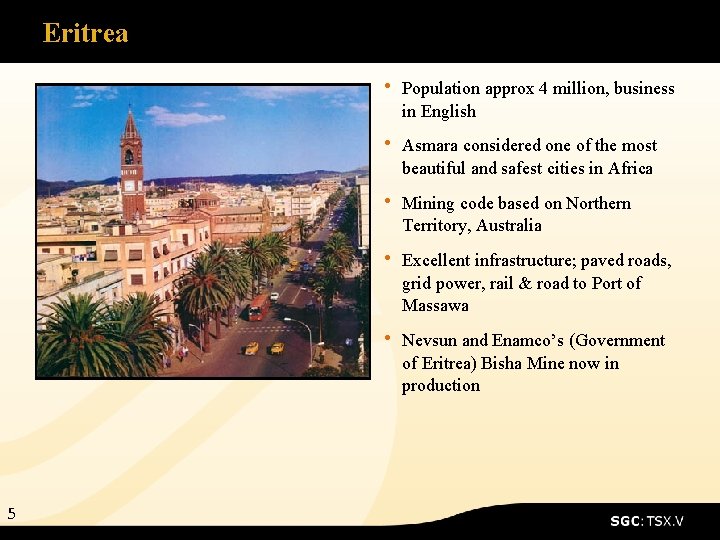

Eritrea • Population approx 4 million, business in English • Asmara considered one of the most beautiful and safest cities in Africa • Mining code based on Northern Territory, Australia • Excellent infrastructure; paved roads, grid power, rail & road to Port of Massawa • Nevsun and Enamco’s (Government of Eritrea) Bisha Mine now in production 5

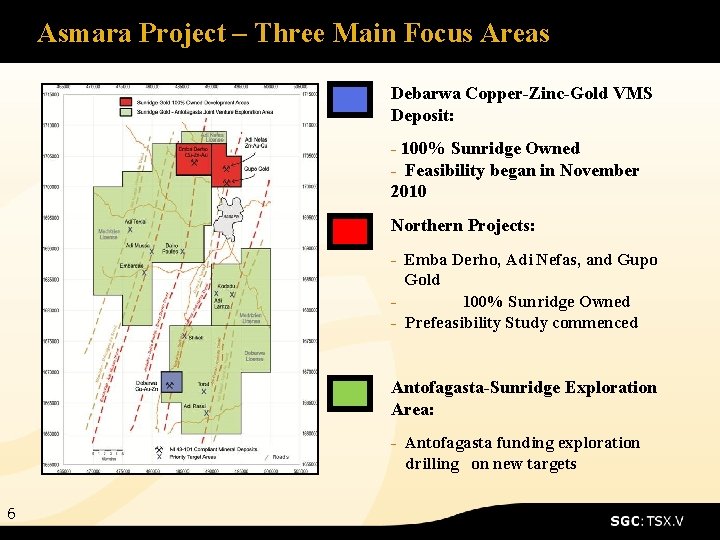

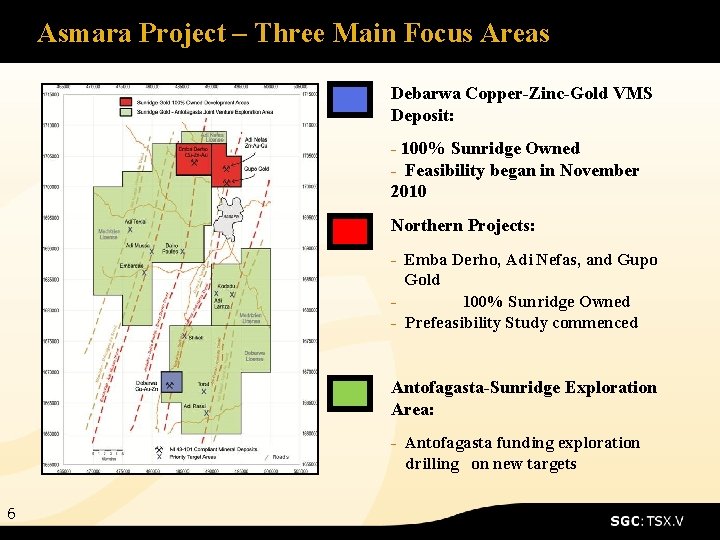

Asmara Project – Three Main Focus Areas Debarwa Copper-Zinc-Gold VMS Deposit: - 100% Sunridge Owned - Feasibility began in November 2010 Northern Projects: - Emba Derho, Adi Nefas, and Gupo Gold - 100% Sunridge Owned - Prefeasibility Study commenced Antofagasta-Sunridge Exploration Area: - Antofagasta funding exploration drilling on new targets 6

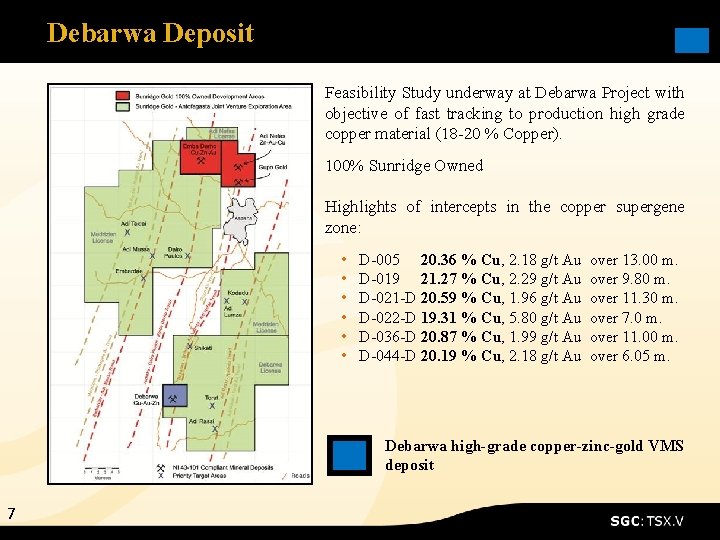

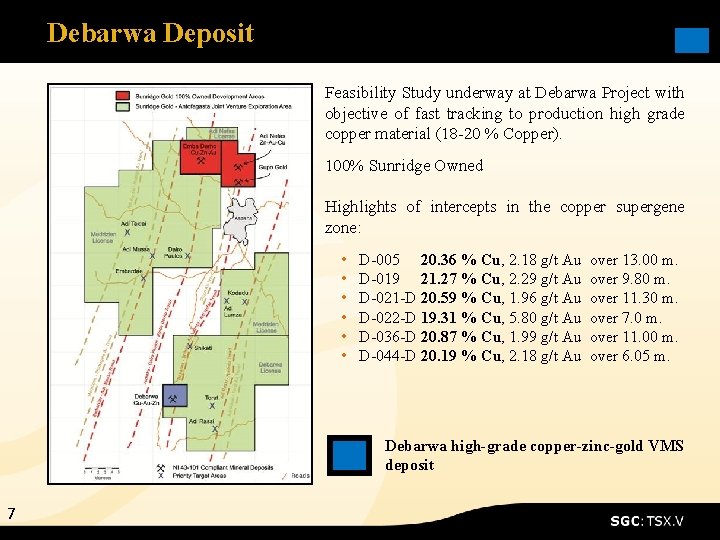

Debarwa Deposit Feasibility Study underway at Debarwa Project with objective of fast tracking to production high grade copper material (18 -20 % Copper). 100% Sunridge Owned Highlights of intercepts in the copper supergene zone: • • • D-005 20. 36 % Cu, 2. 18 g/t Au over 13. 00 m. D-019 21. 27 % Cu, 2. 29 g/t Au over 9. 80 m. D-021 -D 20. 59 % Cu, 1. 96 g/t Au over 11. 30 m. D-022 -D 19. 31 % Cu, 5. 80 g/t Au over 7. 0 m. D-036 -D 20. 87 % Cu, 1. 99 g/t Au over 11. 00 m. D-044 -D 20. 19 % Cu, 2. 18 g/t Au over 6. 05 m. Debarwa high-grade copper-zinc-gold VMS deposit 7

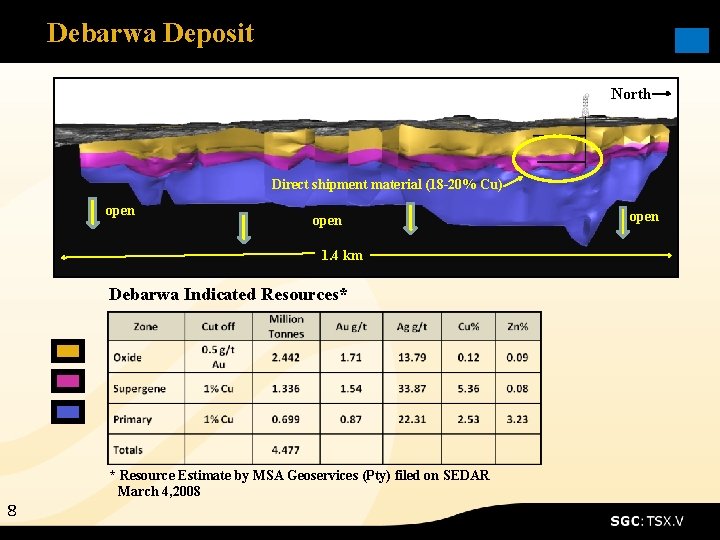

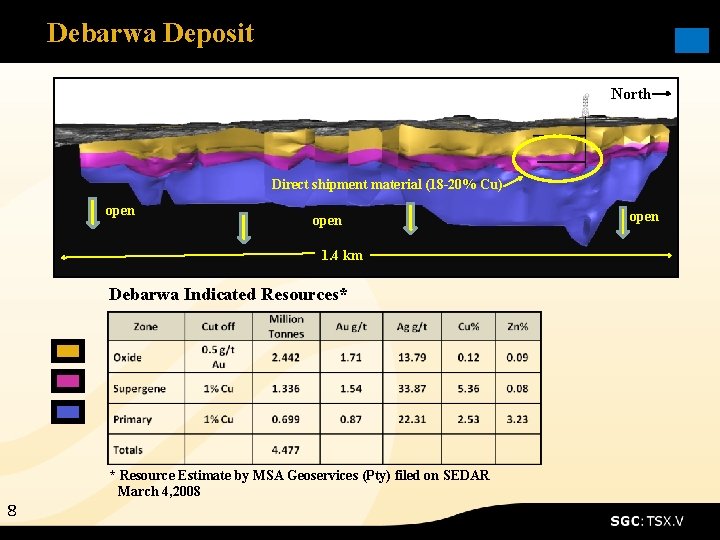

Debarwa Deposit North Direct shipment material (18 -20% Cu) open 1. 4 km Debarwa Indicated Resources* 8 * Resource Estimate by MSA Geoservices (Pty) filed on SEDAR March 4, 2008 open

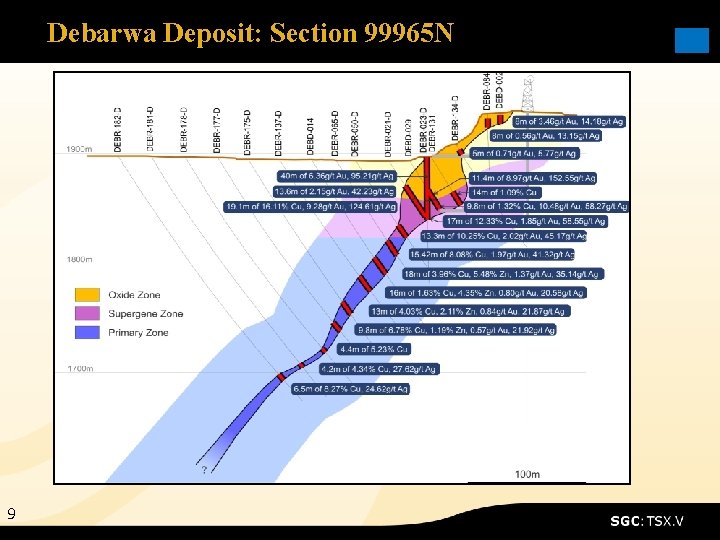

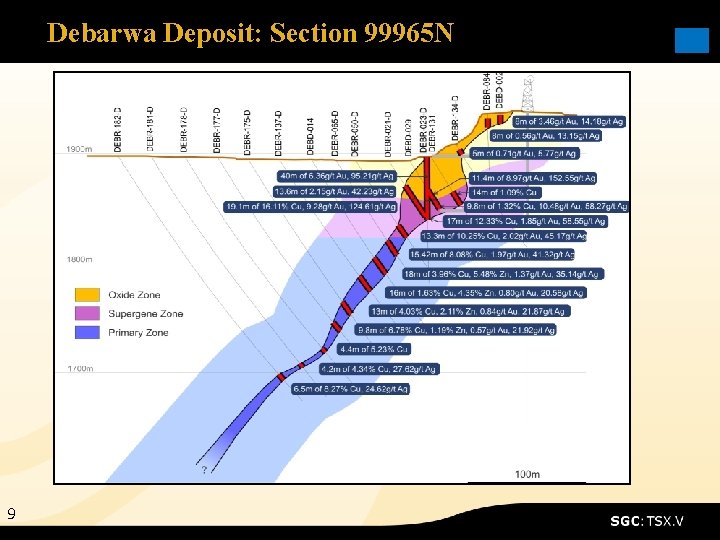

Debarwa Deposit: Section 99965 N 9

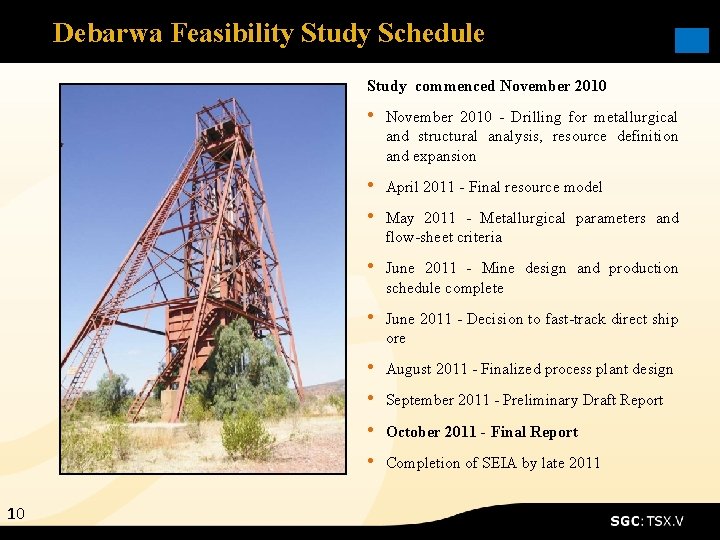

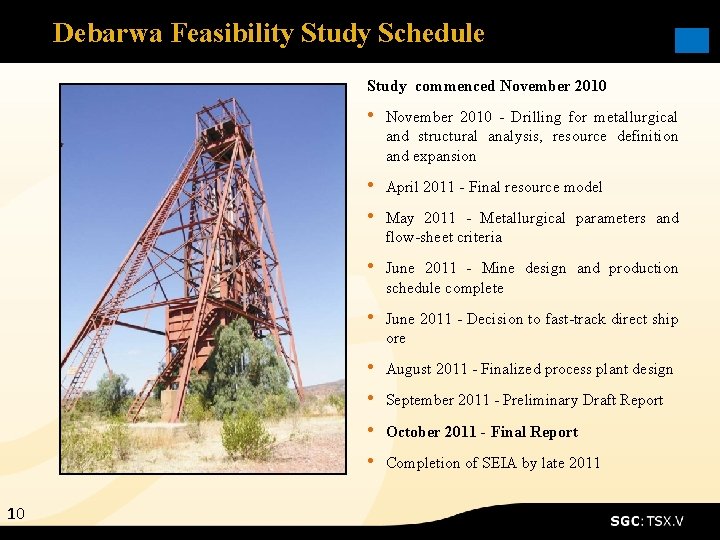

Debarwa Feasibility Study Schedule Study commenced November 2010 • November 2010 - Drilling for metallurgical and structural analysis, resource definition and expansion • April 2011 - Final resource model • May 2011 - Metallurgical parameters and flow-sheet criteria • June 2011 - Mine design and production schedule complete • June 2011 - Decision to fast-track direct ship ore • August 2011 - Finalized process plant design • September 2011 - Preliminary Draft Report • October 2011 - Final Report • Completion of SEIA by late 2011 10

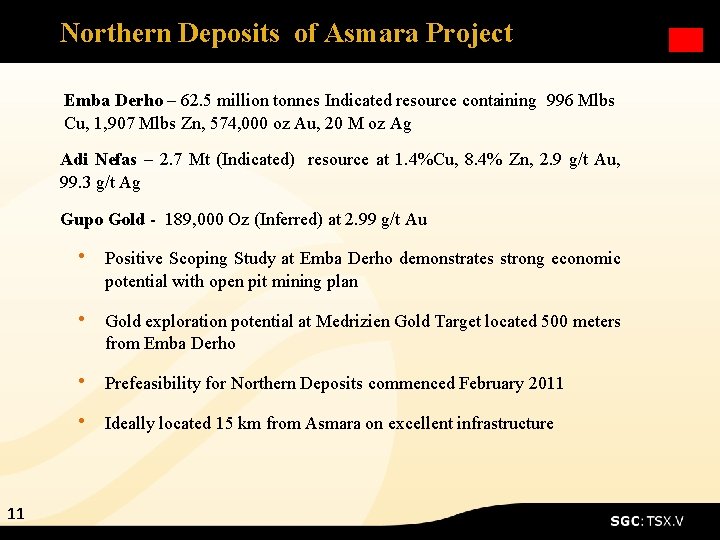

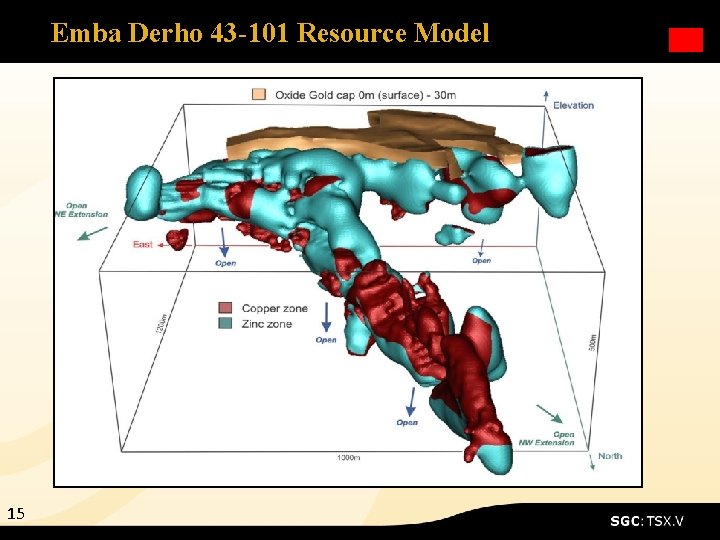

Northern Deposits of Asmara Project Emba Derho – 62. 5 million tonnes Indicated resource containing 996 Mlbs Cu, 1, 907 Mlbs Zn, 574, 000 oz Au, 20 M oz Ag Adi Nefas – 2. 7 Mt (Indicated) resource at 1. 4%Cu, 8. 4% Zn, 2. 9 g/t Au, 99. 3 g/t Ag Gupo Gold - 189, 000 Oz (Inferred) at 2. 99 g/t Au • Positive Scoping Study at Emba Derho demonstrates strong economic potential with open pit mining plan • Gold exploration potential at Medrizien Gold Target located 500 meters from Emba Derho • Prefeasibility for Northern Deposits commenced February 2011 • Ideally located 15 km from Asmara on excellent infrastructure 11

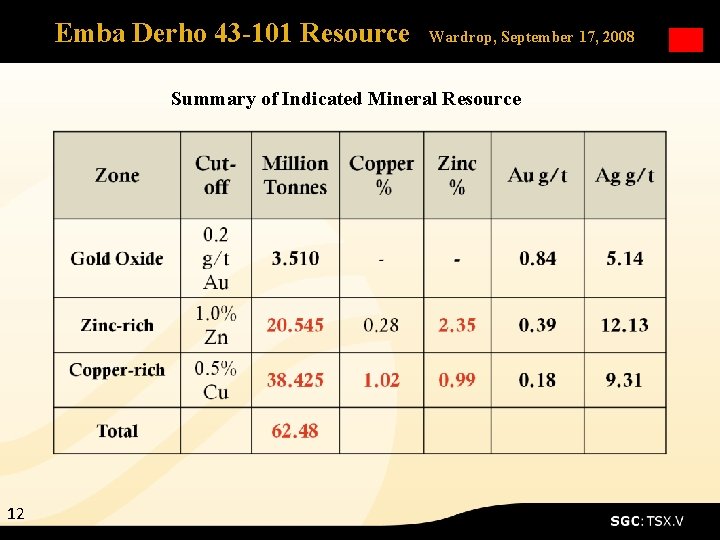

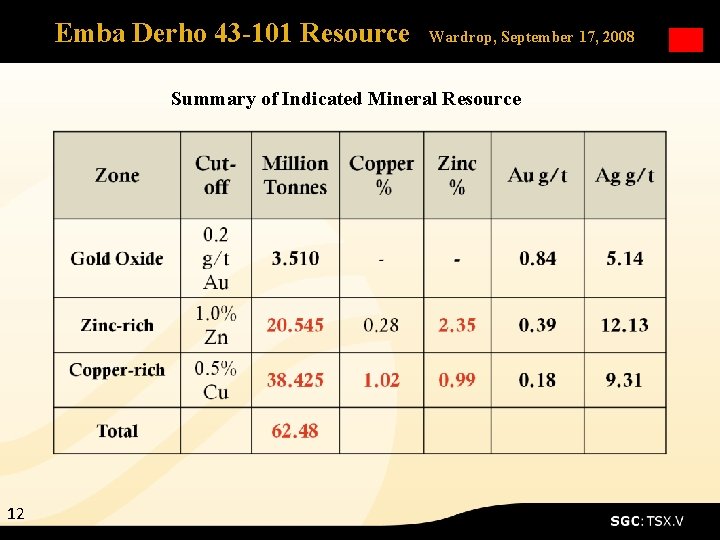

Emba Derho 43 -101 Resource Wardrop, September 17, 2008 Summary of Indicated Mineral Resource 12

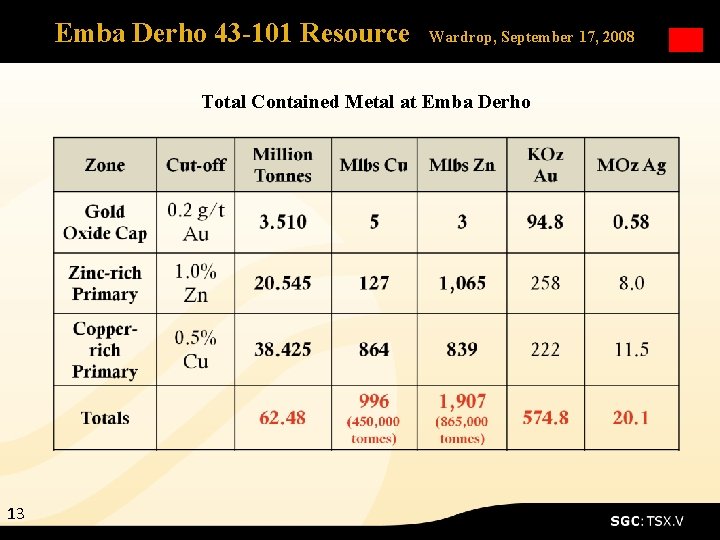

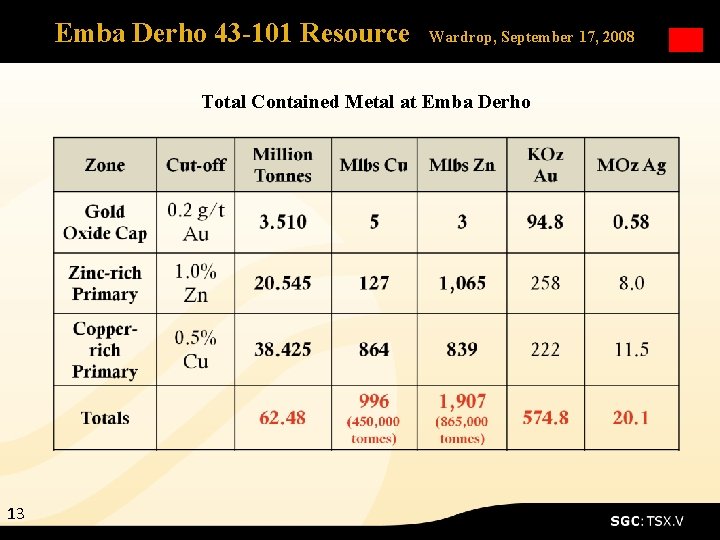

Emba Derho 43 -101 Resource Wardrop, September 17, 2008 Total Contained Metal at Emba Derho 13

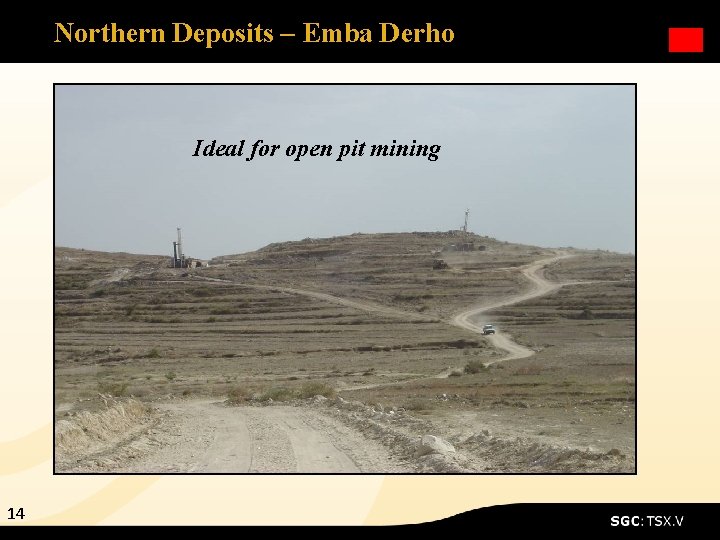

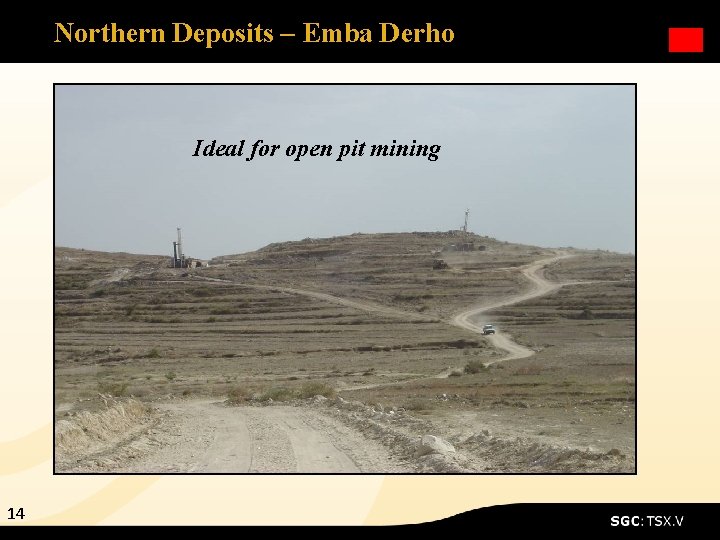

Northern Deposits – Emba Derho Ideal for open pit mining 14

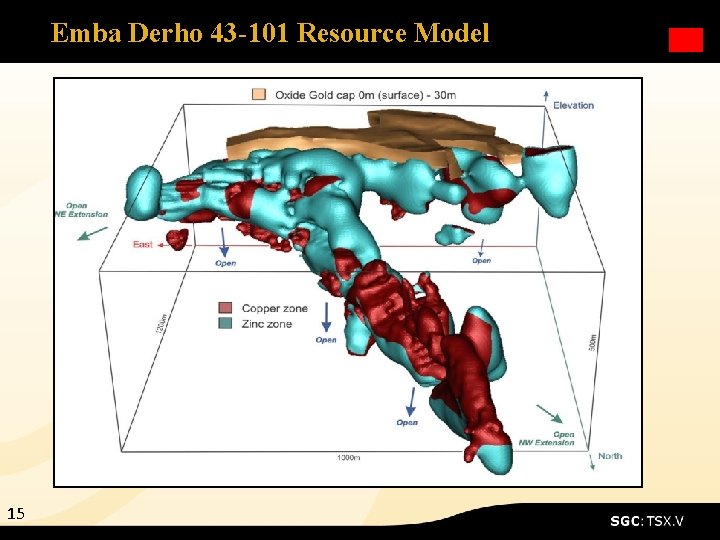

Emba Derho 43 -101 Resource Model 15

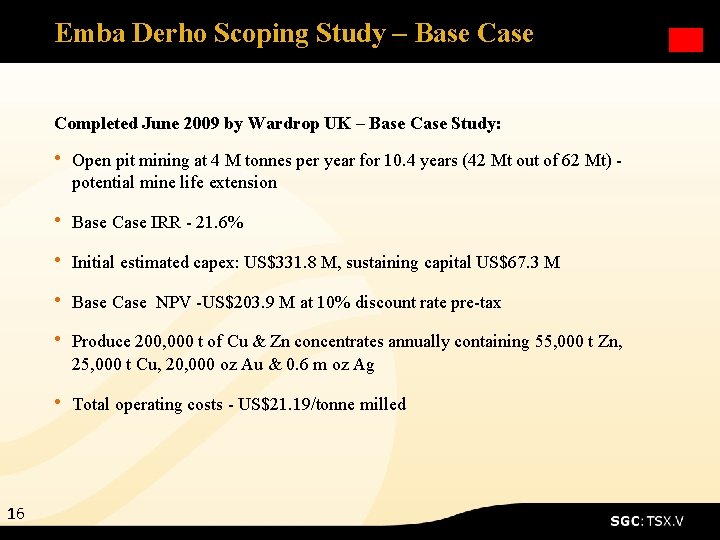

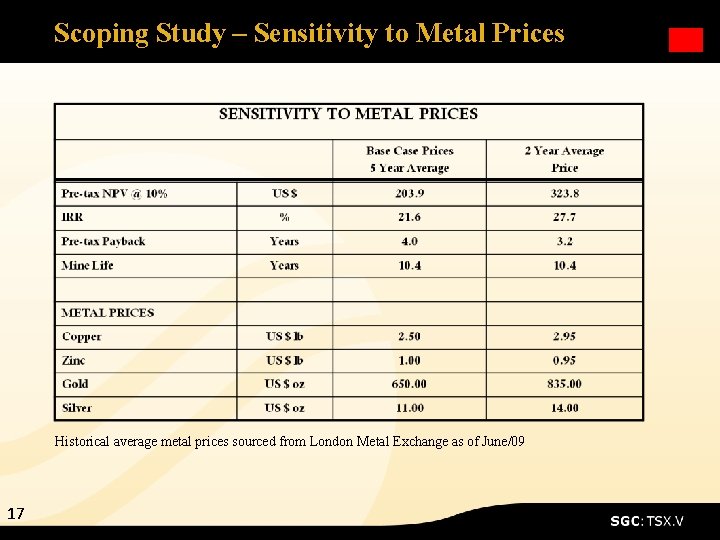

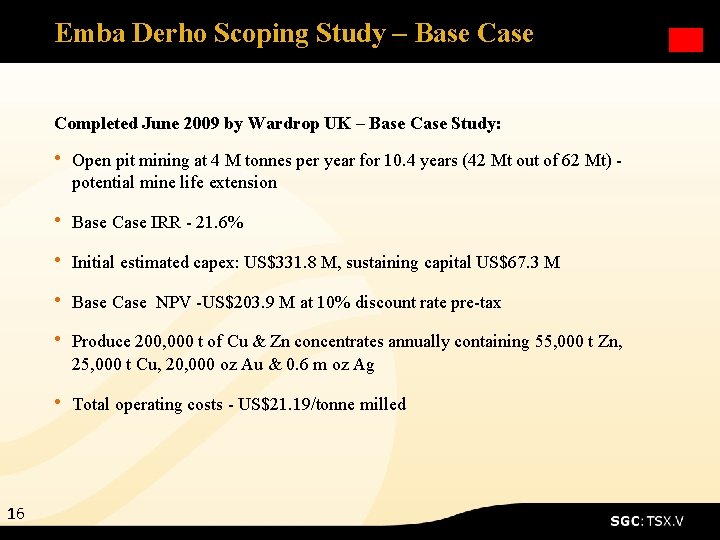

Emba Derho Scoping Study – Base Completed June 2009 by Wardrop UK – Base Case Study: • Open pit mining at 4 M tonnes per year for 10. 4 years (42 Mt out of 62 Mt) - potential mine life extension • Base Case IRR - 21. 6% • Initial estimated capex: US$331. 8 M, sustaining capital US$67. 3 M • Base Case NPV -US$203. 9 M at 10% discount rate pre-tax • Produce 200, 000 t of Cu & Zn concentrates annually containing 55, 000 t Zn, 25, 000 t Cu, 20, 000 oz Au & 0. 6 m oz Ag • Total operating costs - US$21. 19/tonne milled 16

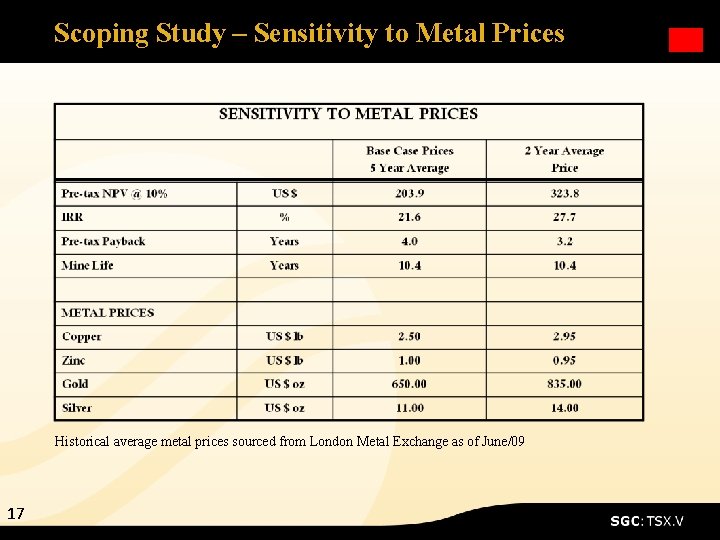

Scoping Study – Sensitivity to Metal Prices Historical average metal prices sourced from London Metal Exchange as of June/09 17

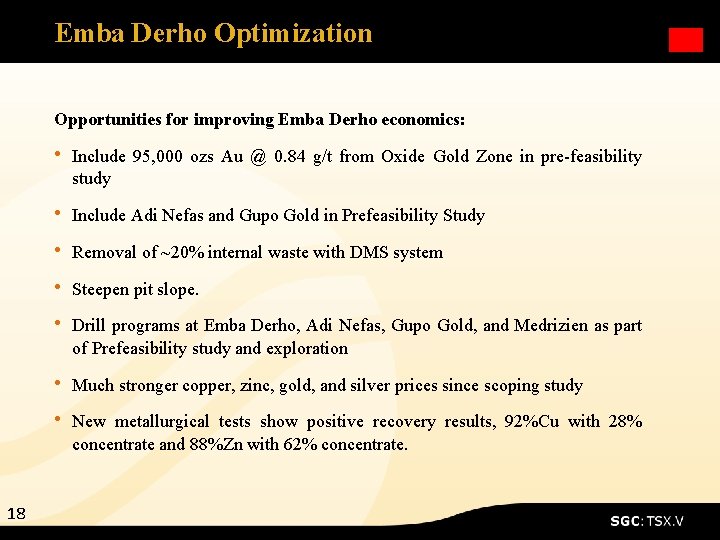

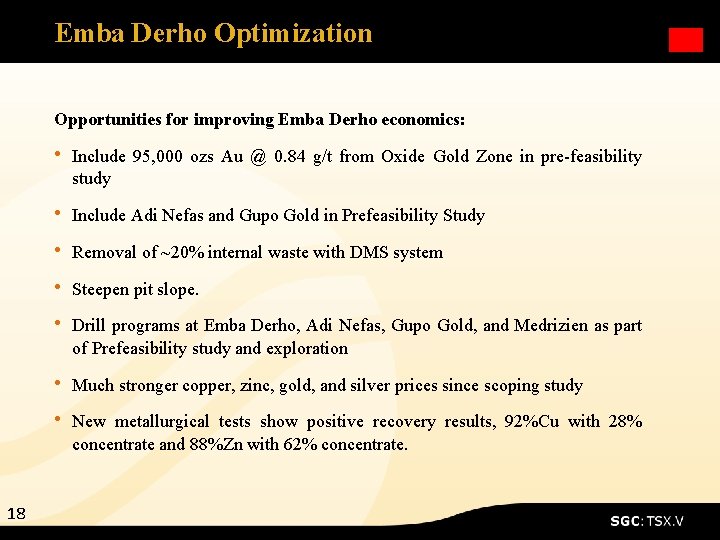

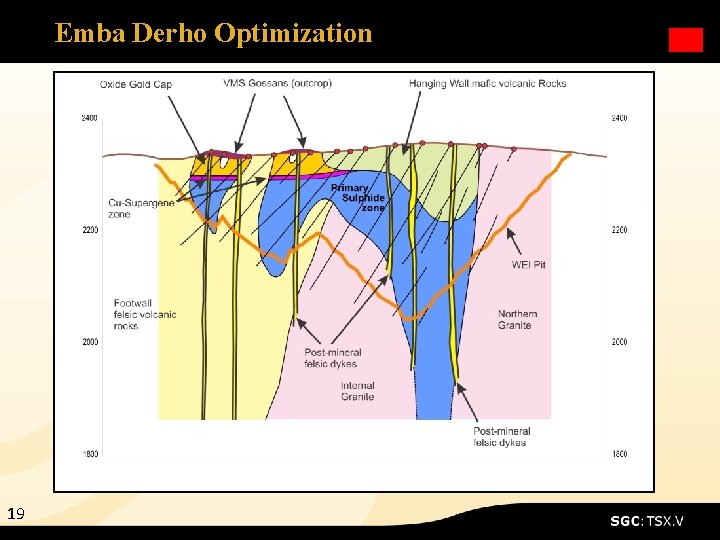

Emba Derho Optimization Opportunities for improving Emba Derho economics: • Include 95, 000 ozs Au @ 0. 84 g/t from Oxide Gold Zone in pre-feasibility study • Include Adi Nefas and Gupo Gold in Prefeasibility Study • Removal of ~20% internal waste with DMS system • Steepen pit slope. • Drill programs at Emba Derho, Adi Nefas, Gupo Gold, and Medrizien as part of Prefeasibility study and exploration • Much stronger copper, zinc, gold, and silver prices since scoping study • New metallurgical tests show positive recovery results, 92%Cu with 28% concentrate and 88%Zn with 62% concentrate. 18

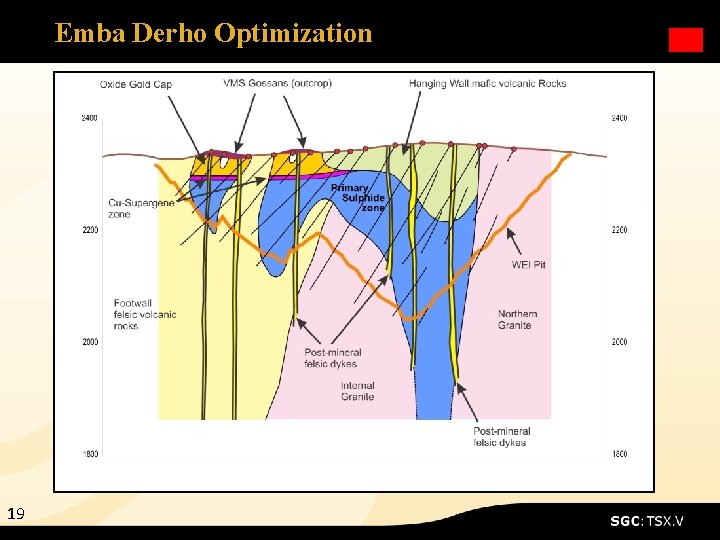

Emba Derho Optimization 19

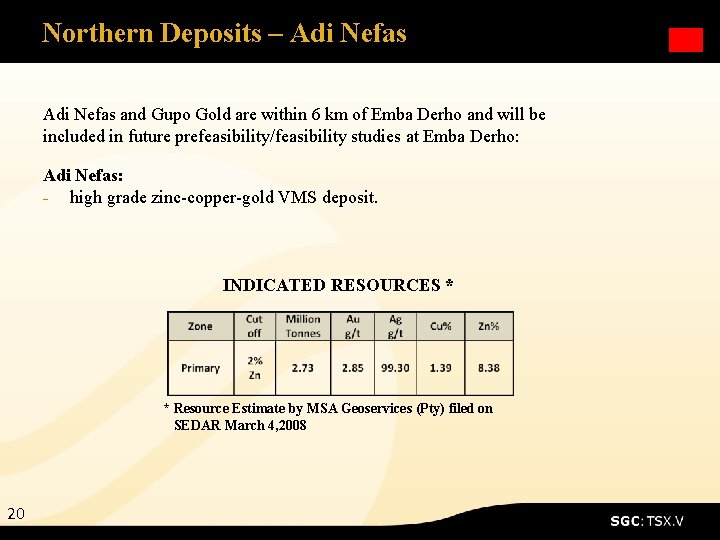

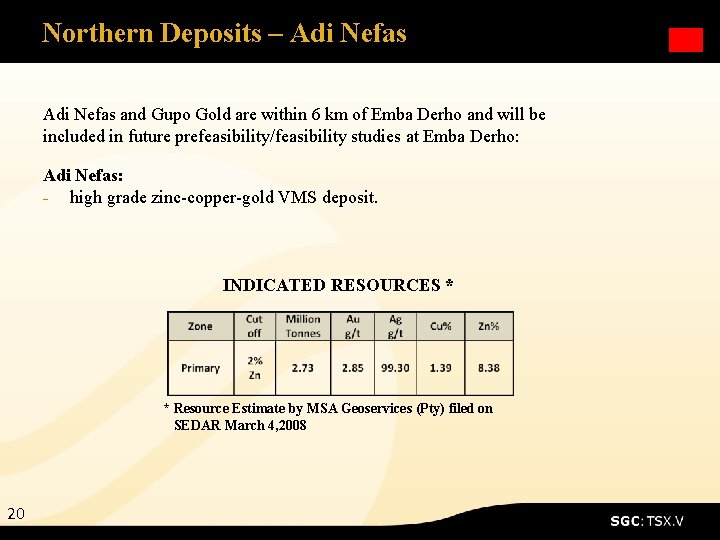

Northern Deposits – Adi Nefas and Gupo Gold are within 6 km of Emba Derho and will be included in future prefeasibility/feasibility studies at Emba Derho: Adi Nefas: - high grade zinc-copper-gold VMS deposit. INDICATED RESOURCES * * Resource Estimate by MSA Geoservices (Pty) filed on SEDAR March 4, 2008 20

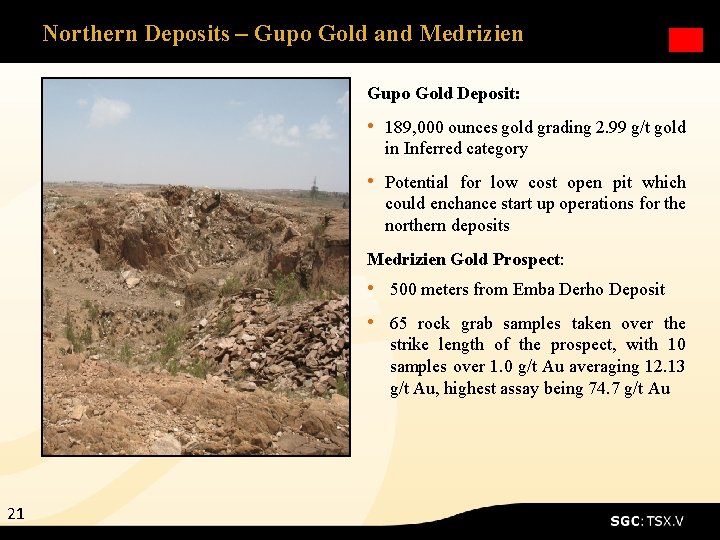

Northern Deposits – Gupo Gold and Medrizien Gupo Gold Deposit: • 189, 000 ounces gold grading 2. 99 g/t gold in Inferred category • Potential for low cost open pit which could enchance start up operations for the northern deposits Medrizien Gold Prospect: • 500 meters from Emba Derho Deposit • 65 rock grab samples taken over the strike length of the prospect, with 10 samples over 1. 0 g/t Au averaging 12. 13 g/t Au, highest assay being 74. 7 g/t Au 21

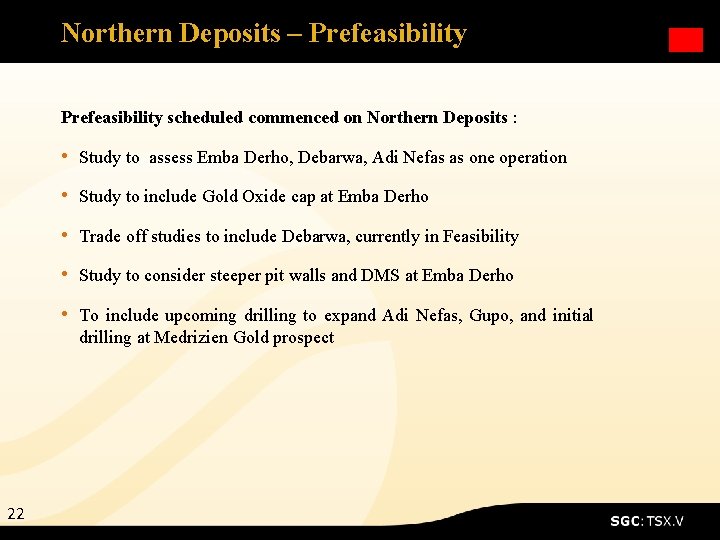

Northern Deposits – Prefeasibility scheduled commenced on Northern Deposits : • Study to assess Emba Derho, Debarwa, Adi Nefas as one operation • Study to include Gold Oxide cap at Emba Derho • Trade off studies to include Debarwa, currently in Feasibility • Study to consider steeper pit walls and DMS at Emba Derho • To include upcoming drilling to expand Adi Nefas, Gupo, and initial drilling at Medrizien Gold prospect 22

Antofagasta – Sunridge Exploration Area/JV • Antofagasta Minerals S. A. signs strategic alliance agreement for US$10 M in exploration expenditures over five years for a 60% interest in the Exploration Area (October 2, 2009) • Sunridge will be operator until a total of US $7 M has been funded by Antofagasta • Antofagasta may earn an additional 15% for a total of 75% interest by completing a feasibility study on any project within the Exploration Areas 23

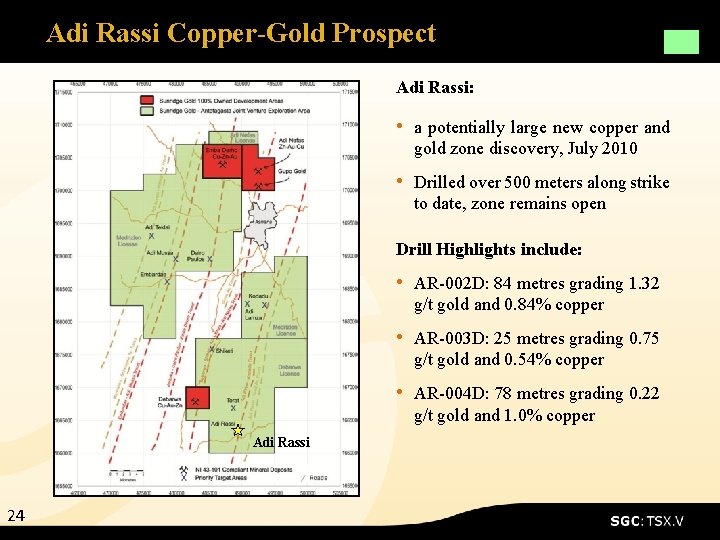

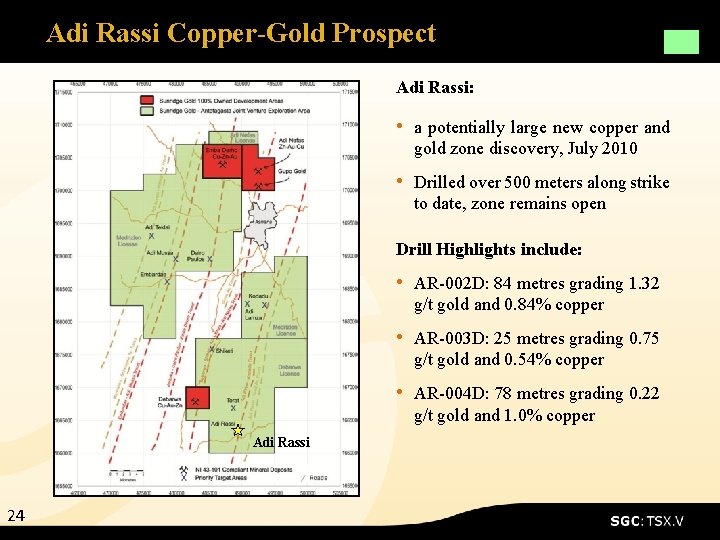

Adi Rassi Copper-Gold Prospect Adi Rassi: • a potentially large new copper and gold zone discovery, July 2010 • Drilled over 500 meters along strike to date, zone remains open Drill Highlights include: • AR-002 D: 84 metres grading 1. 32 g/t gold and 0. 84% copper • AR-003 D: 25 metres grading 0. 75 g/t gold and 0. 54% copper • AR-004 D: 78 metres grading 0. 22 g/t gold and 1. 0% copper Adi Rassi 24

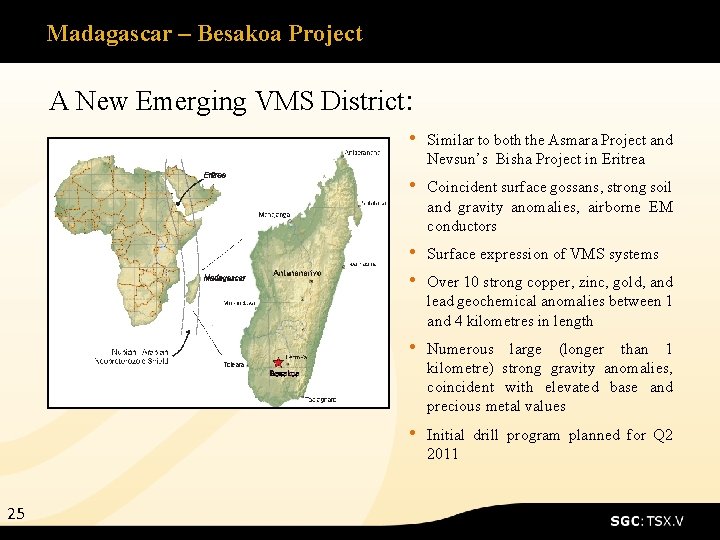

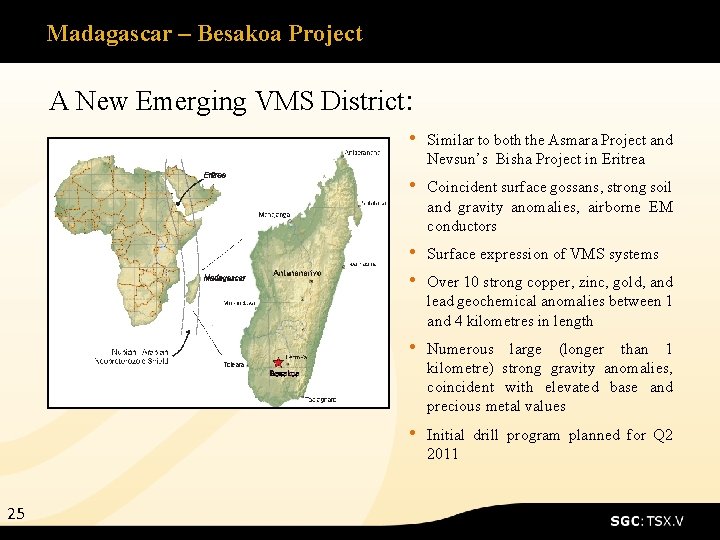

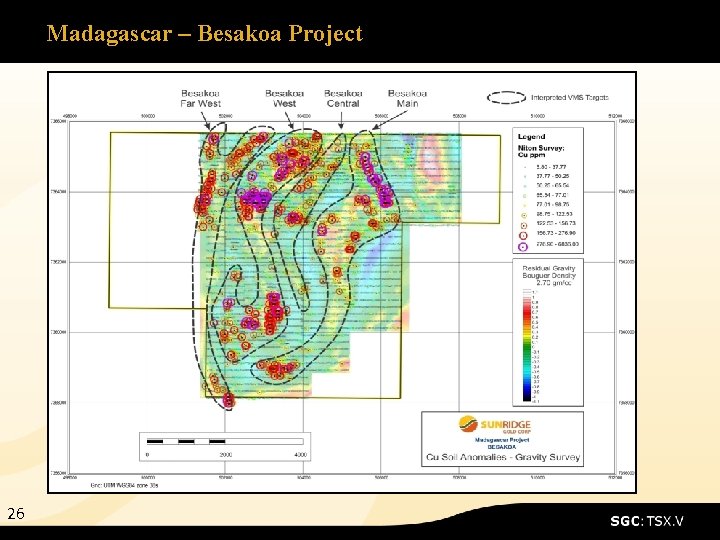

Madagascar – Besakoa Project A New Emerging VMS District: • Similar to both the Asmara Project and Nevsun’s Bisha Project in Eritrea • Coincident surface gossans, strong soil and gravity anomalies, airborne EM conductors • Surface expression of VMS systems • Over 10 strong copper, zinc, gold, and lead geochemical anomalies between 1 and 4 kilometres in length • Numerous large (longer than 1 kilometre) strong gravity anomalies, coincident with elevated base and precious metal values • Initial drill program planned for Q 2 2011 25

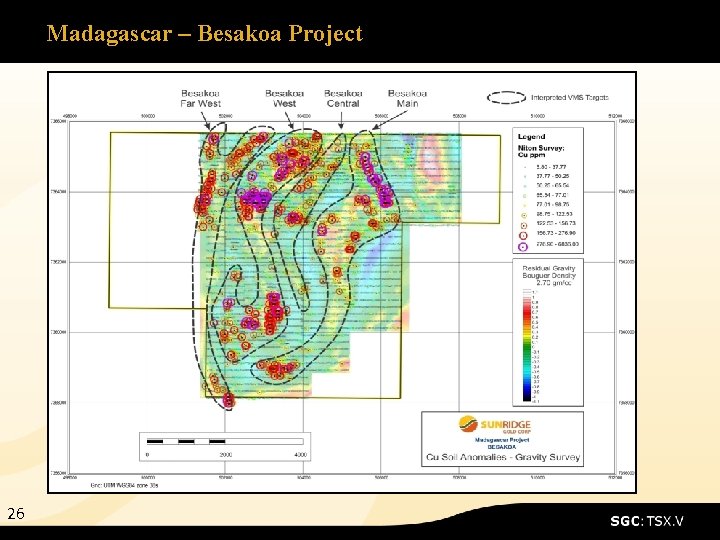

Madagascar – Besakoa Project 26

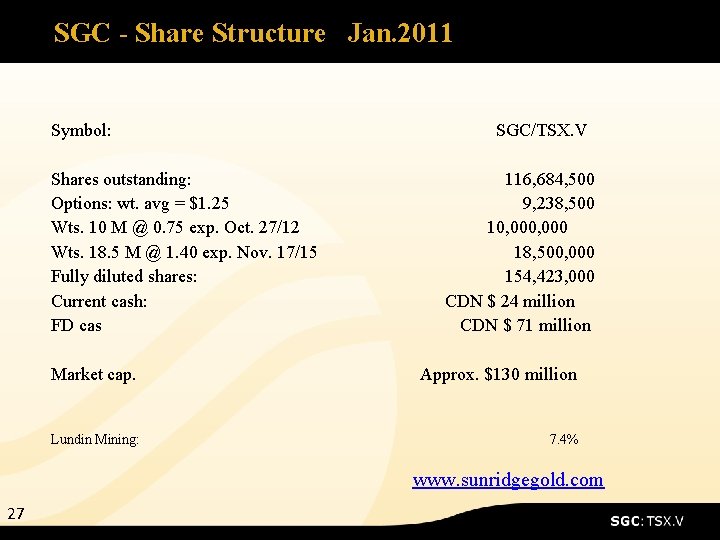

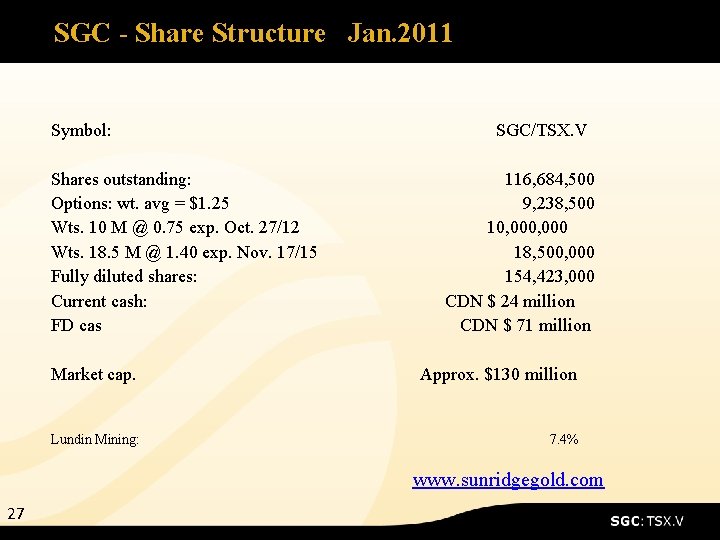

SGC - Share Structure Jan. 2011 Symbol: SGC/TSX. V Shares outstanding: 116, 684, 500 Options: wt. avg = $1. 25 9, 238, 500 Wts. 10 M @ 0. 75 exp. Oct. 27/12 10, 000 Wts. 18. 5 M @ 1. 40 exp. Nov. 17/15 18, 500, 000 Fully diluted shares: 154, 423, 000 Current cash: CDN $ 24 million FD cas CDN $ 71 million Market cap. Approx. $130 million Lundin Mining: 7. 4% www. sunridgegold. com 27

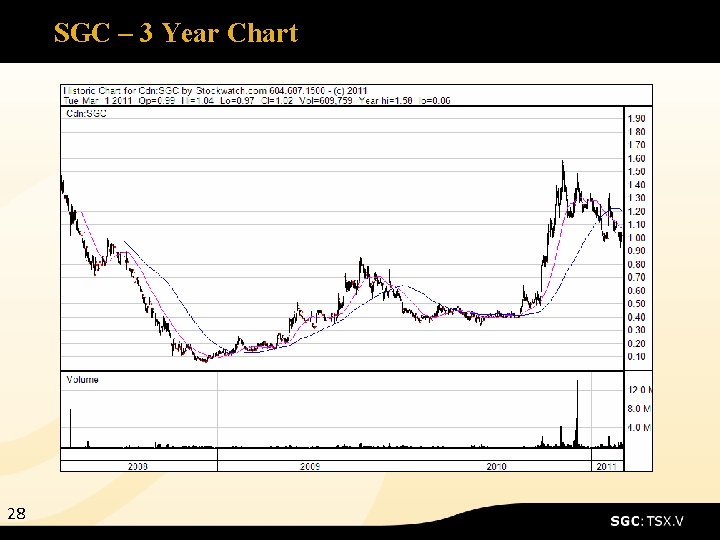

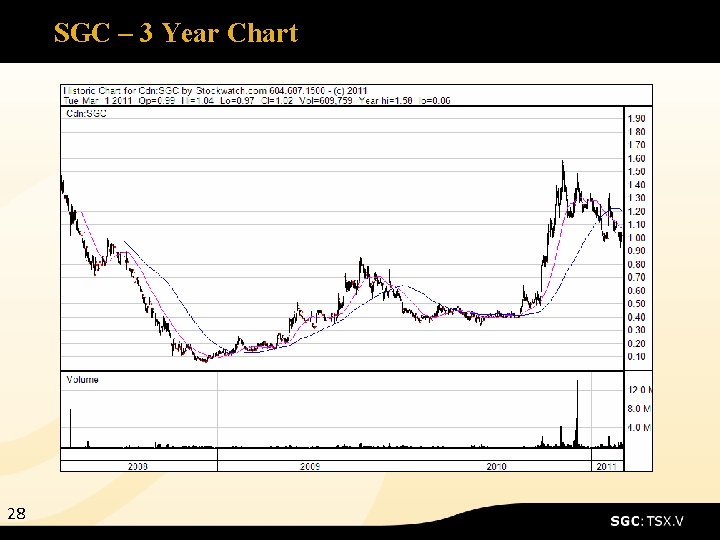

SGC – 3 Year Chart 28

Sunridge Gold Management and Directors 29 Michael Hopley – President/C. E. O. , Director David Daoud – Exploration Manager Scott Ansell – VP Project Development Doris Meyer – CFO & Director Greg Davis – VP Business Development Amanuel Arafine – Eritrean Country Manager, Eritrea Craig angus – Chairman Neil O’Brien – Director (Senior VP Lundin Mining) Stephen Gatley – Director (GM, Lundin Mining) Mark Corra – Director (CFO of B 2 Gold) Eric Edwards – Director

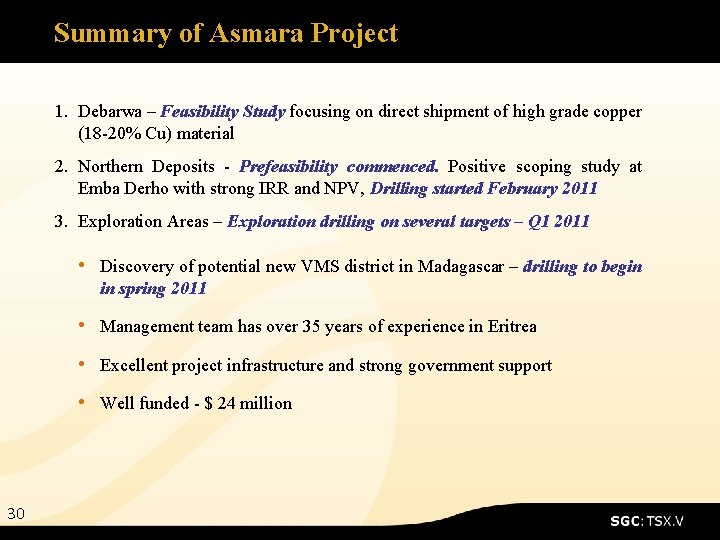

Summary of Asmara Project 1. Debarwa – Feasibility Study focusing on direct shipment of high grade copper (18 -20% Cu) material 2. Northern Deposits - Prefeasibility commenced. Positive scoping study at Emba Derho with strong IRR and NPV, Drilling started February 2011 3. Exploration Areas – Exploration drilling on several targets – Q 1 2011 • Discovery of potential new VMS district in Madagascar – drilling to begin in spring 2011 • Management team has over 35 years of experience in Eritrea • Excellent project infrastructure and strong government support • Well funded - $ 24 million 30

Regulatory Notes All of Sunridge Gold’s exploration programs and pertinent disclosure of a technical or scientific nature are prepared by, or prepared under the direct supervision of Michael J. Hopley, CPG, Sunridge Gold’s President and CEO, who serves as the qualified person (QP) under the definitions of National Instrument 43 -101. Certain disclosures in this presentation, including management’s assessment of Sunridge Gold’s plans and projects constitute forward-looking statements that are subject to numerous risks, uncertainties, and other factors that may cause future results to differ materially from those expressed or implied. Readers are cautioned not to place undue reliance on forward-looking statements. 31