Managing Change Internal Causes of Change You might

- Slides: 17

Managing Change Internal Causes of Change You might merge with another organisation, but two drunks don’t make a sensible person. Gary Hamel In this topic you will learn about: � Change in organisational size ◦ Mergers, takeovers, organic growth and retrenchment � New owners/leaders � Poor business performance Can you think of a real life example of each? BUSS 4. 7 Internal Causes

What does change for a business look like? �Change occurs when a business alters its structure, size or strategy to respond to internal or external influences �Change may be necessary to help a business meet its aims and objectives �Change creates opportunities and threats �Change should not be seen as bad but must be managed carefully to ensure a firm maintains or increases its competitiveness as a result of change BUSS 4. 7 Internal Causes

Reasons for change �To meet objectives ◦ Gain market share ◦ Increase shareholders’ worth �Respond to external forces �Respond to internal forces ◦ Technological advancements ◦ Political and legal changes ◦ Consumer demand ◦ Employee pressures ◦ Owners’ power �Gain competitive advantage ◦ Economies of scale ◦ Market development Look at the history of M&S from 1884 to present How has it changed? What were the key internal and external factors contributing towards the changes? BUSS 4. 7 Internal Causes

Change 1 – Change in organisational size � Businesses can both grow and contract Directors may have an objective of growth. � How can this be achieved? � ◦ Internal growth (Organic) � Opening new branches � New product development inc. diversification ◦ External growth � Mergers and takeovers Directors may have an objective of contracting in order to minimise costs. � How can this be achieved? � ◦ Internal contraction � Delayering � Closing down unprofitable elements ◦ External contraction � Selling off elements of the business BUSS 4. 7 Internal Causes

Internal Growth �Internal or organic growth occurs when a business expands in size by opening new stores, branches, functions or plants �Where can Tescos secure organic growth? ◦ This may be achieved within the UK or on a multinational scale �What are the advantages and disadvantages of organic growth? ◦ Can be time consuming but is a relatively low risk strategy as control is easier to maintain What are the advantages to Tesco of internal growth? What are the risks associated with internal growth? How would Ansoff view the opening of new stores by Tesco in the US? BUSS 4. 7 Internal Causes

External Growth �Integration ◦ The bringing together of two or more firms �Merger – can you define it using the diagram? ◦ When two or more firms agree to become integrated to form one firm under joint ownership ◦ An agreement + + A �Takeover diagram? + + B = + AB – can you define it using the ◦ When one firm gains control over another and becomes the owner, can be + achieved + by buying + = 51% of the shares A A B + + ◦ Can be hostile BUSS 4. 7 Internal Causes

External Growth Remember a process can be within the primary, secondary or tertiary sector – not just a production process �External growth through mergers and takeovers can take a number of forms ◦ 2 firms at the same stage within a process integrate. This is called Horizontal integration. Can you think of an example? ◦ 2 firms at different stages within a process integrate. This is called vertical integration. Can you think of an example? ◦ 2 unrelated firms integrate. This is called a conglomerate. Can you think of an example? BUSS 4. 7 Internal Causes

External Growth TUI merge with First Choice Porsche and VW to merge Corus accepts takeover bid High Court clears P&O’s takeover Little Chef “takeover” talks Watch these 2 video clips In each case identify the objectives of the mergers, the advantages and any potential disadvantages Identify the different reasons for and approaches to these takeovers Why might the Government intervene to disallow a takeover? BUSS 4. 7 Internal Causes

Quick recap � 1 way a business might change size? � 1 reason a business might want to grow? � 1 example of internal (organic) growth? � 1 example of external growth? �What is the difference between vertical and horizontal integration? BUSS 4. 7 Internal Causes

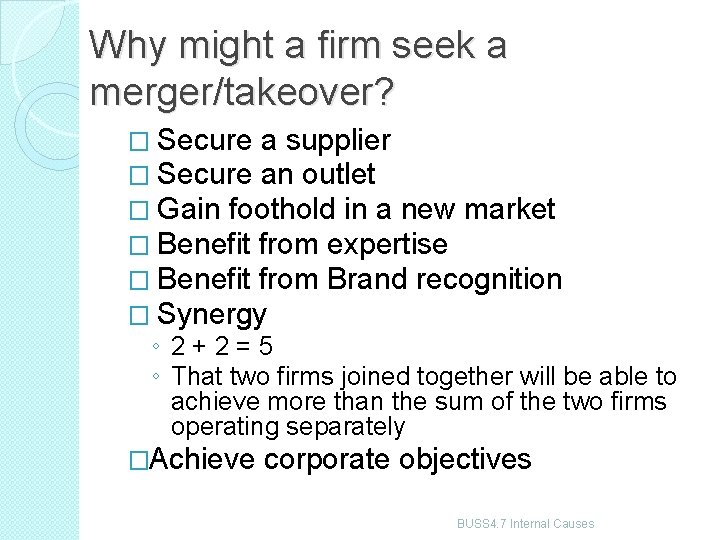

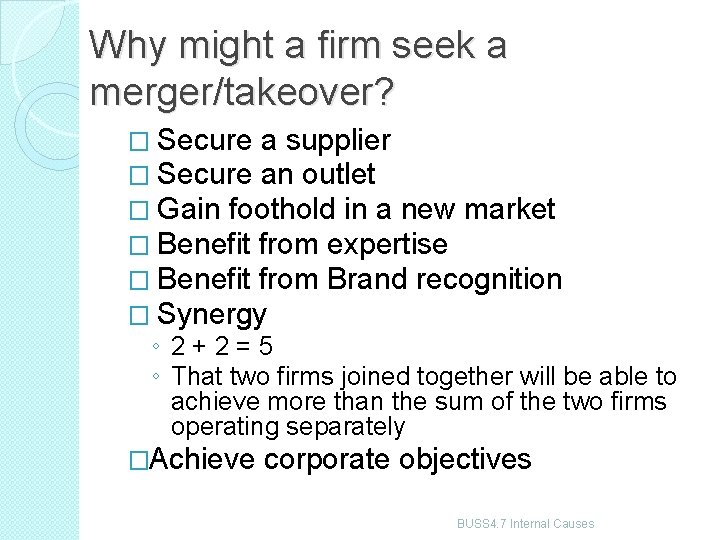

Why might a firm seek a merger/takeover? � Secure a supplier � Secure an outlet � Gain foothold in a new market � Benefit from expertise � Benefit from Brand recognition � Synergy ◦ 2+2=5 ◦ That two firms joined together will be able to achieve more than the sum of the two firms operating separately �Achieve corporate objectives BUSS 4. 7 Internal Causes

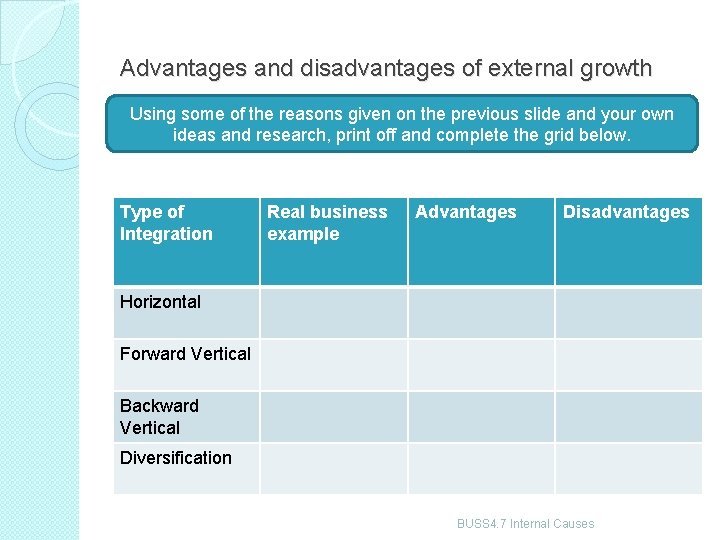

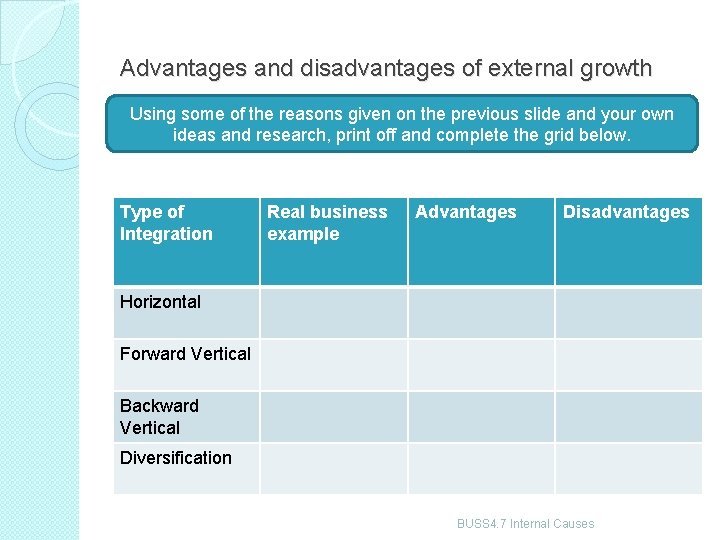

Advantages and disadvantages of external growth Using some of the reasons given on the previous slide and your own ideas and research, print off and complete the grid below. Type of Integration Real business example Advantages Disadvantages Horizontal Forward Vertical Backward Vertical Diversification BUSS 4. 7 Internal Causes

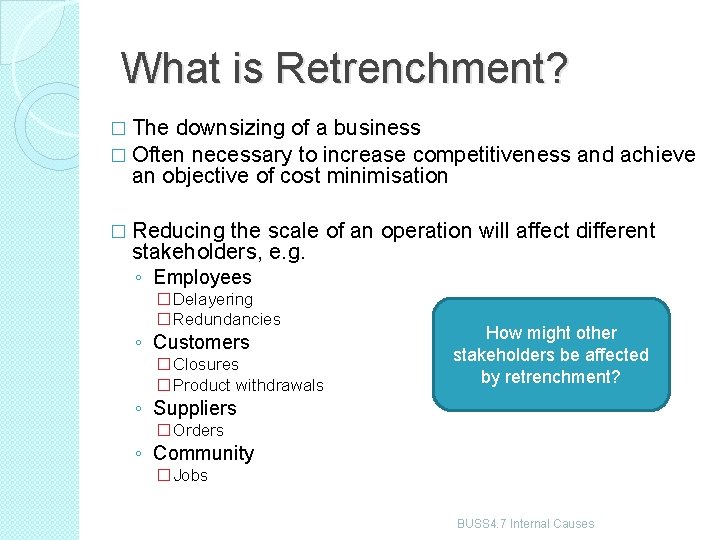

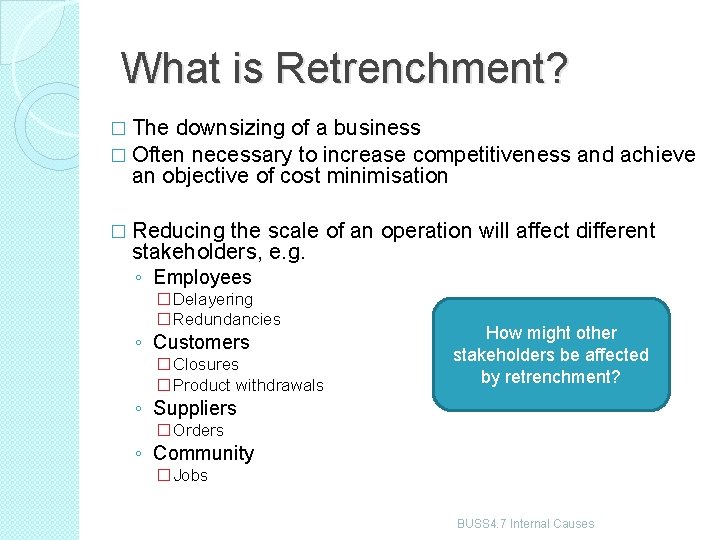

What is Retrenchment? � The downsizing of a business � Often necessary to increase competitiveness and achieve an objective of cost minimisation � Reducing the scale of an operation will affect different stakeholders, e. g. ◦ Employees �Delayering �Redundancies ◦ Customers �Closures �Product withdrawals How might other stakeholders be affected by retrenchment? ◦ Suppliers �Orders ◦ Community �Jobs BUSS 4. 7 Internal Causes

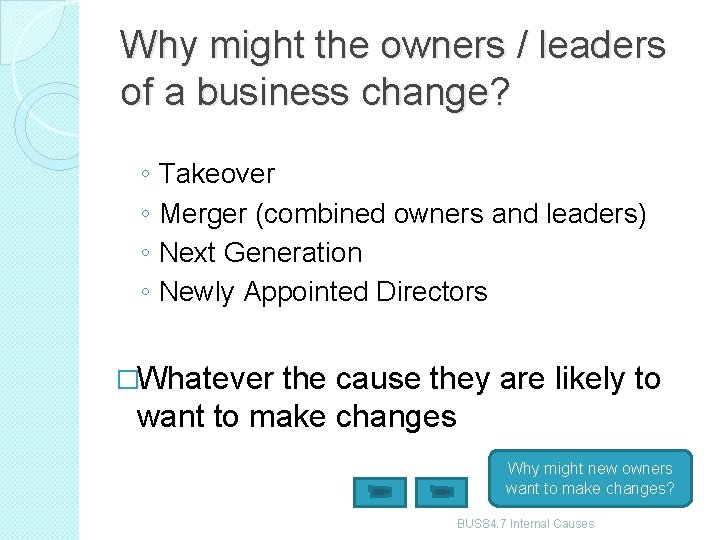

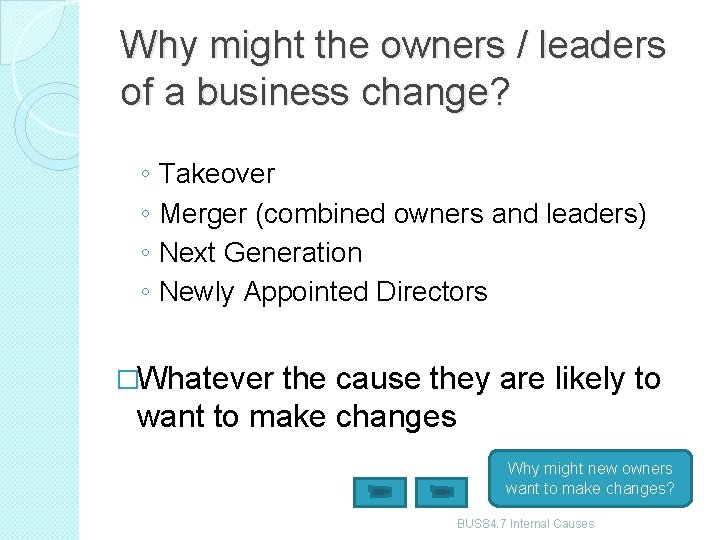

Why might the owners / leaders of a business change? ◦ ◦ Takeover Merger (combined owners and leaders) Next Generation Newly Appointed Directors �Whatever the cause they are likely to want to make changes Why might new owners want to make changes? BUSS 4. 7 Internal Causes

New owners / leaders �Why might new owners or leaders want to make changes? ◦ ◦ ◦ Own vision or mission Change in corporate objectives Cultural differences Personal leadership style Make a difference – fresh ideas Self glorification? You will learn more about the role of culture and leadership in BUSS 4. 9 and BUSS 4. 10 BUSS 4. 7 Internal Causes

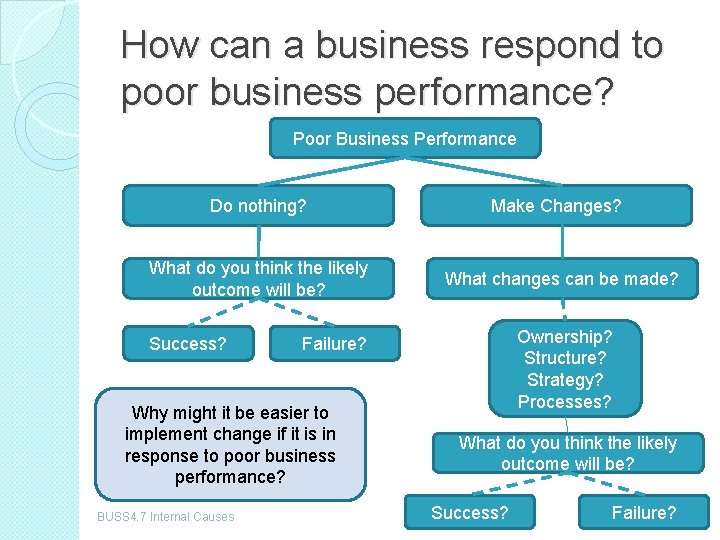

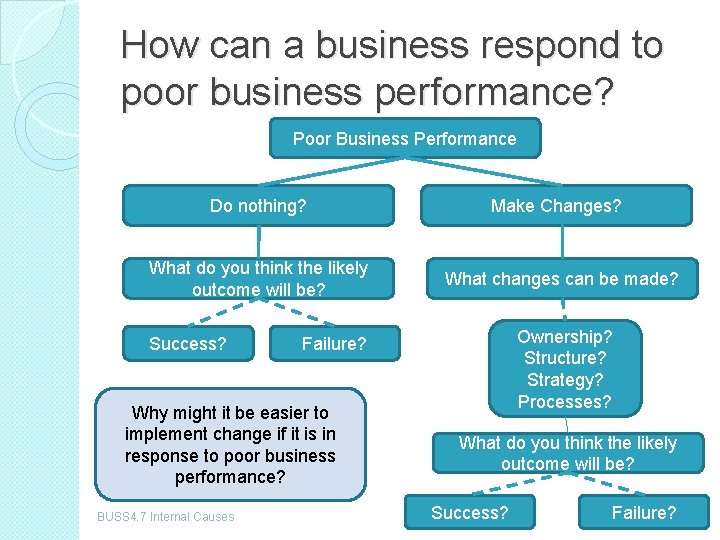

How can a business respond to poor business performance? Poor Business Performance Do nothing? What do you think the likely outcome will be? Success? What changes can be made? Ownership? Structure? Strategy? Processes? Failure? Why might it be easier to implement change if it is in response to poor business performance? BUSS 4. 7 Internal Causes Make Changes? What do you think the likely outcome will be? Success? Failure?

In 2008 India’s biggest car maker Tata bought UK based Jaguar and Land Rover from Ford. By 2013 sales and profitability at the car maker have risen dramatically. To what extent do you think that improved profitability is the only important factor in judging the success of a takeover or merger? Justify your answer with reference to organisations and/or relevant examples of business activities that you know (40 marks) In 2013 Sony’s top management gave up bonuses due to poor business performance whilst Andrew Mason, CEO of Groupon, was fired. Poor business performance is often a trigger for change in an organisation. To what extent is internal change necessary due to the poor performance of a business? Justify your answer with reference to Sony, Groupon and/or any other organisations that you know (40 marks) BUSS 4. 7 Internal Causes

Activity – Know your terminology �Work out what each term should be and then write a clue to help others solve the anagrams ◦ ◦ ◦ ◦ ◦ Liar nth zoo Entrench term Catwalk cabdriver Rang her text low Award cover flirt Whaling torrent Art evoke Tearing into Germ re A neglect room BUSS 4. 7 Internal Causes