Life Insurance presentation Needs and many more Classifying

- Slides: 27

Life Insurance presentation

Needs … and many more

Classifying needs 1 to 5 years Short Term More than 10 years Long Term

Needs Short Term Long Term Buying a bike or car Household assets Going on vacation Gifting your loved ones Upgrading lifestyle Planning for kids education & Marriage Protection for dependent Parent Protection for family (to start in future) Wealth creation for long term Retirement planning Buying a house

Everything has a price tag attached to it…. . Rs . 2 Rs. 8 Family vacation , 0 0, 00 0 , 0 0 00 Car 00 , 0 House 00 00 , 0 00 5, . 3 Rs 0, . 2 Rs Own office

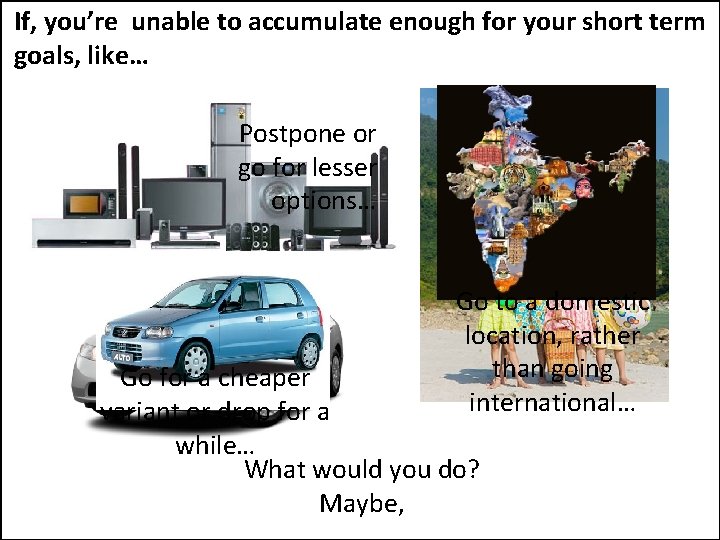

If, you’re unable to accumulate enough for your short term goals, like… Postpone or go for lesser options… Go to a domestic location, rather than going international… Go for a cheaper variant or drop for a while… What would you do? Maybe,

If the same thing happens with your long term goals, like… Send your child to a cheaper College… Settle for a lower standard of living than today… Compromise on your daughter’s wedding … Would you do the same thing?

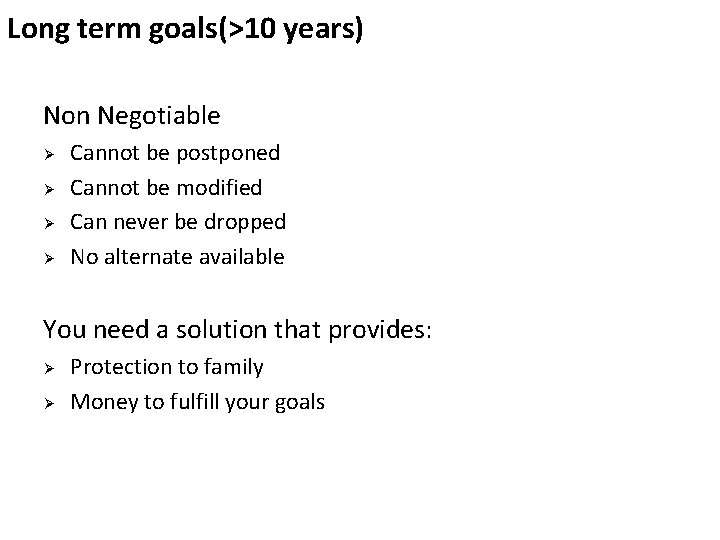

Long term goals(>10 years) Non Negotiable Cannot be postponed Cannot be modified Can never be dropped No alternate available You need a solution that provides: Protection to family Money to fulfill your goals

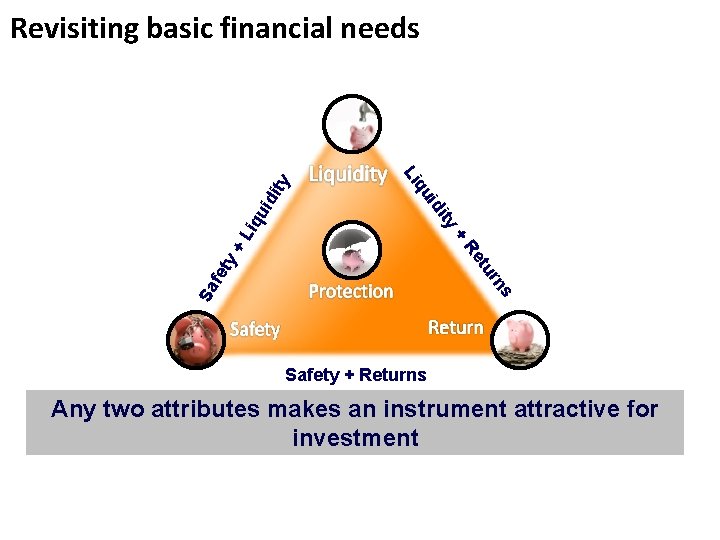

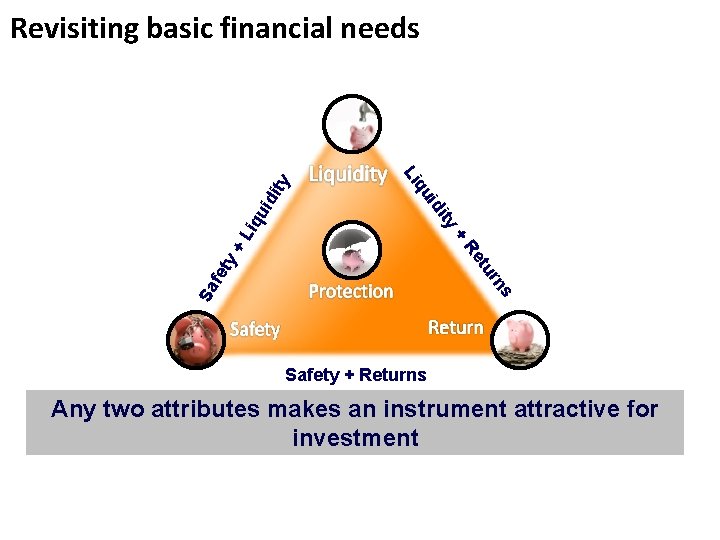

s rn tu Re uid i Sa fet y+ + Liq ty di ui q Li ty Revisiting basic financial needs Safety + Returns Any two attributes makes an instrument attractive for investment

Traditional product basics

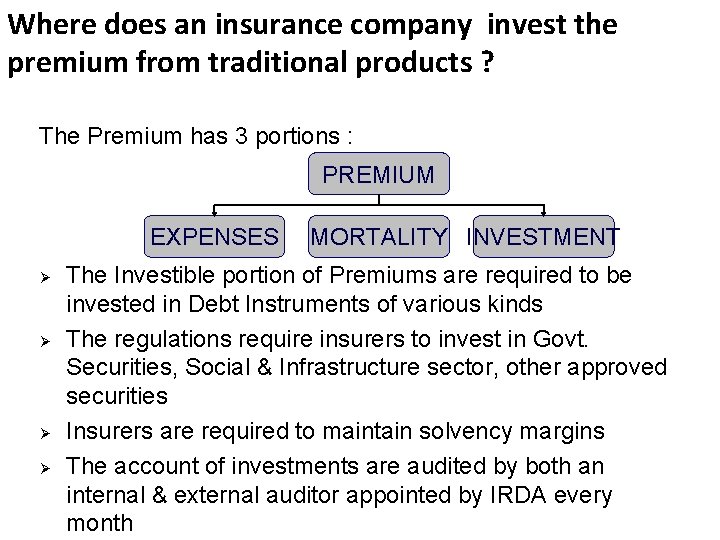

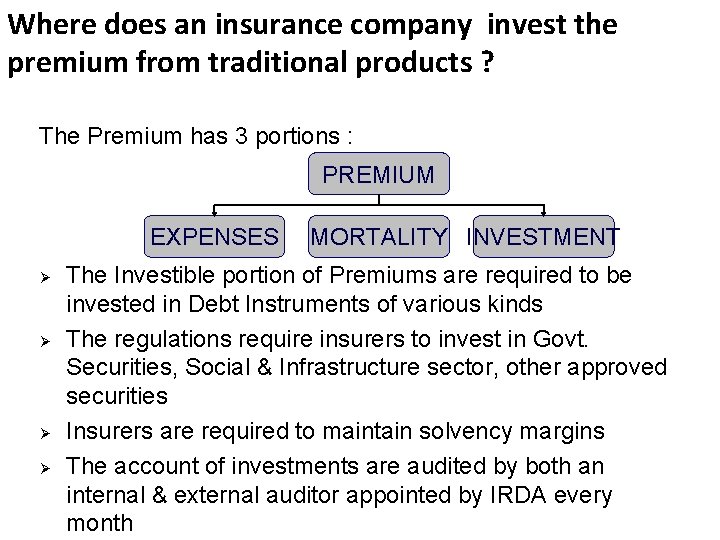

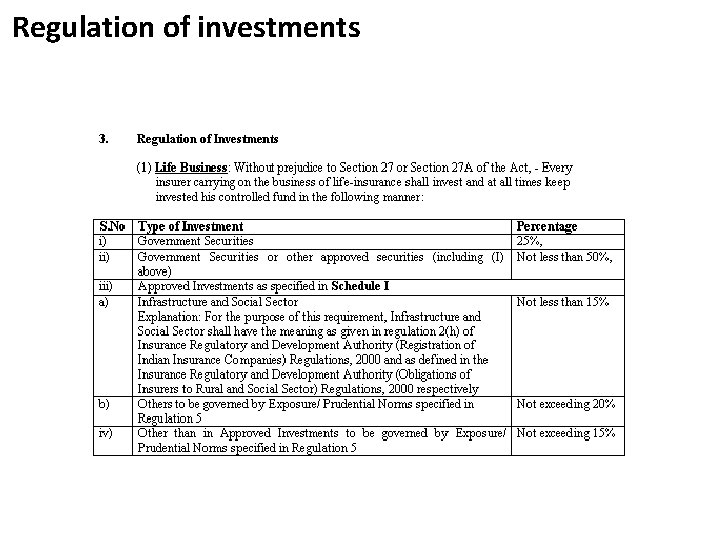

Where does an insurance company invest the premium from traditional products ? The Premium has 3 portions : PREMIUM EXPENSES MORTALITY INVESTMENT The Investible portion of Premiums are required to be invested in Debt Instruments of various kinds The regulations require insurers to invest in Govt. Securities, Social & Infrastructure sector, other approved securities Insurers are required to maintain solvency margins The account of investments are audited by both an internal & external auditor appointed by IRDA every month

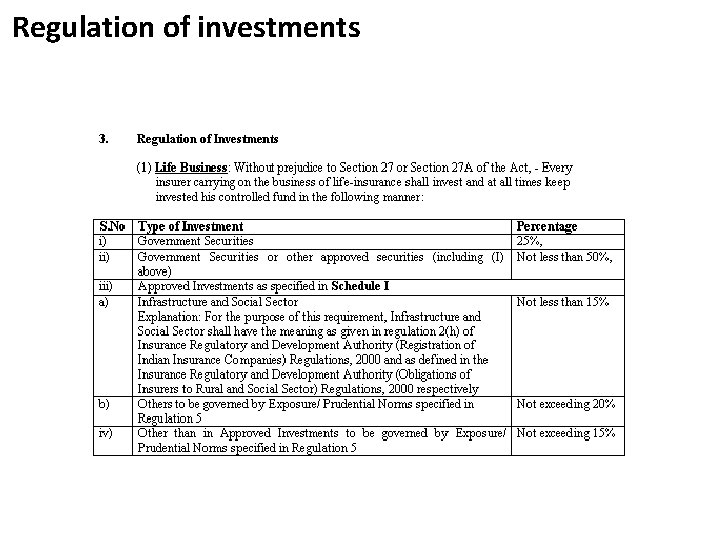

Regulation of investments

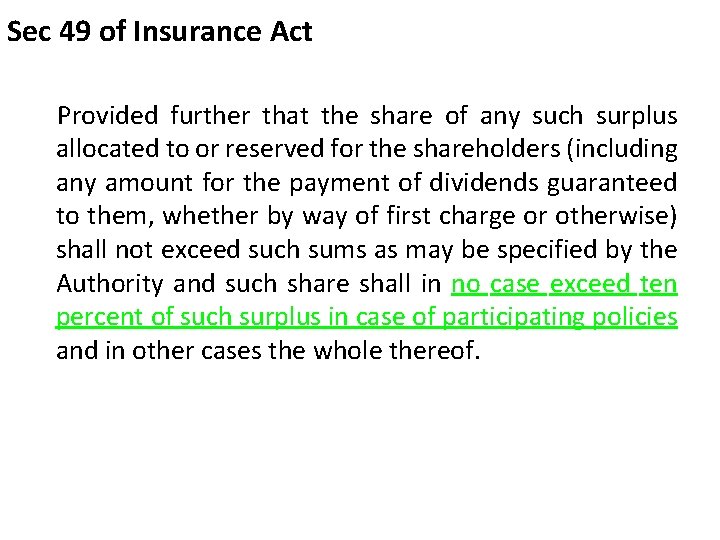

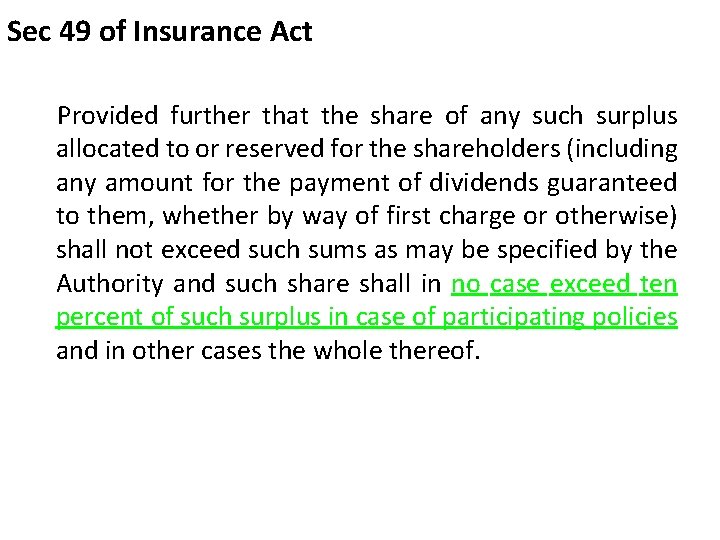

Sec 49 of Insurance Act Provided further that the share of any such surplus allocated to or reserved for the shareholders (including any amount for the payment of dividends guaranteed to them, whether by way of first charge or otherwise) shall not exceed such sums as may be specified by the Authority and such share shall in no case exceed ten percent of such surplus in case of participating policies and in other cases the whole thereof.

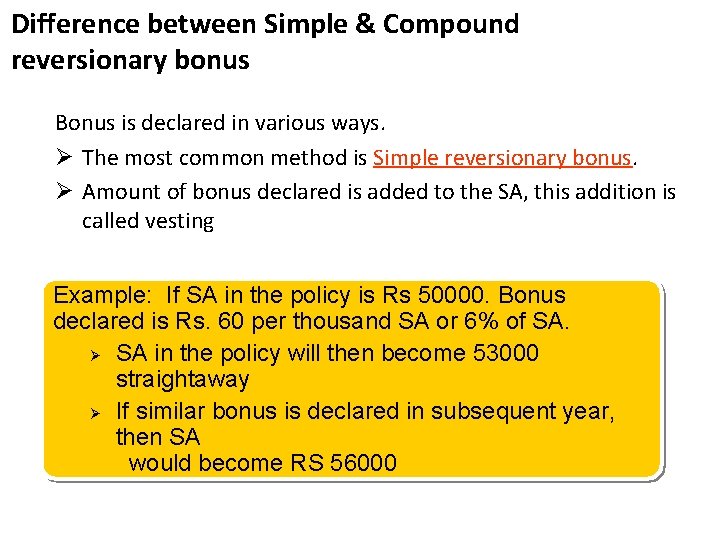

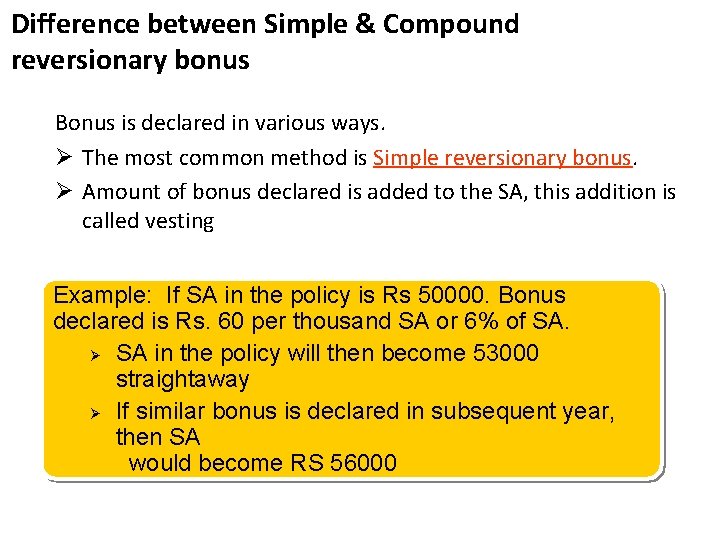

Difference between Simple & Compound reversionary bonus Bonus is declared in various ways. The most common method is Simple reversionary bonus. Amount of bonus declared is added to the SA, this addition is called vesting Example: If SA in the policy is Rs 50000. Bonus declared is Rs. 60 per thousand SA or 6% of SA. SA in the policy will then become 53000 straightaway If similar bonus is declared in subsequent year, then SA would become RS 56000

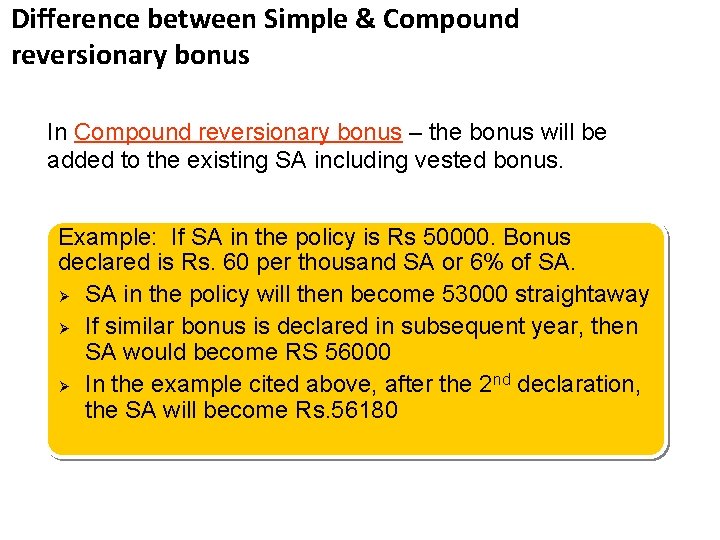

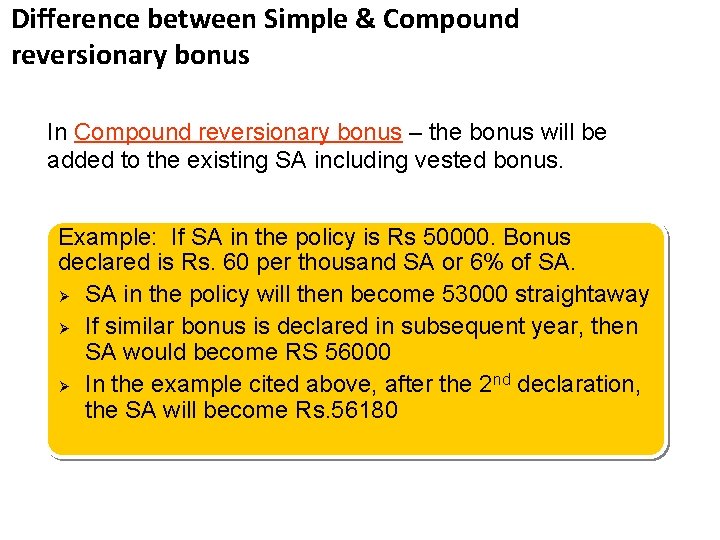

Difference between Simple & Compound reversionary bonus In Compound reversionary bonus – the bonus will be added to the existing SA including vested bonus. Example: If SA in the policy is Rs 50000. Bonus declared is Rs. 60 per thousand SA or 6% of SA. SA in the policy will then become 53000 straightaway If similar bonus is declared in subsequent year, then SA would become RS 56000 In the example cited above, after the 2 nd declaration, the SA will become Rs. 56180

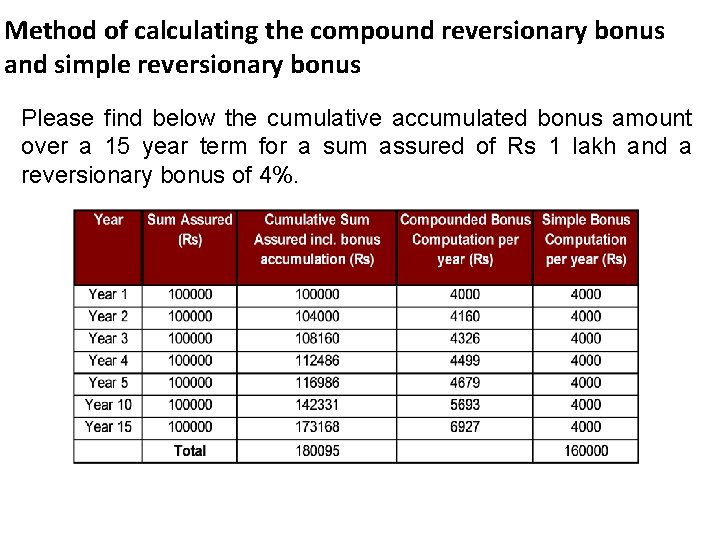

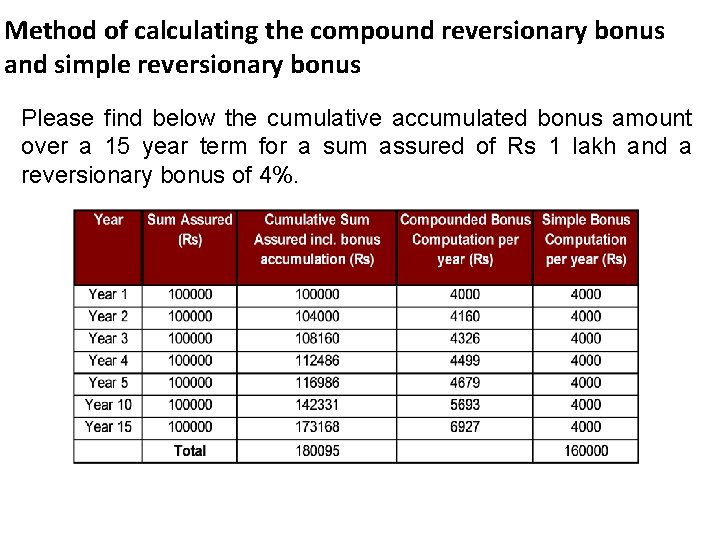

Method of calculating the compound reversionary bonus and simple reversionary bonus Please find below the cumulative accumulated bonus amount over a 15 year term for a sum assured of Rs 1 lakh and a reversionary bonus of 4%.

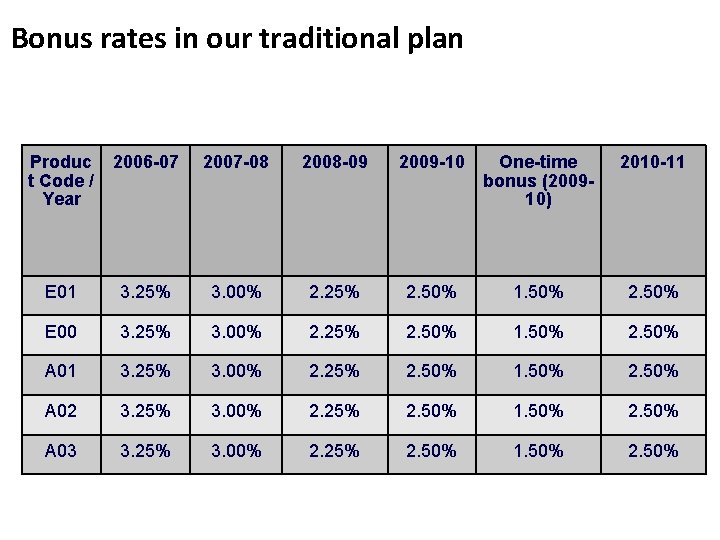

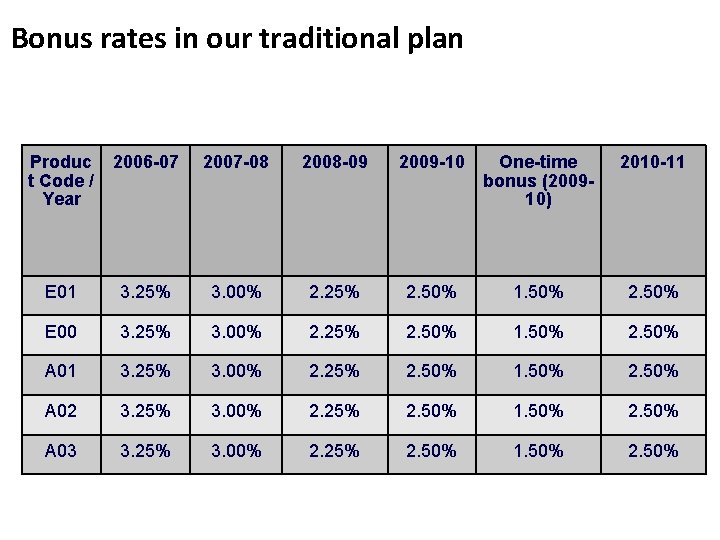

Bonus rates in our traditional plan Produc t Code / Year 2006 -07 2007 -08 2008 -09 2009 -10 One-time bonus (200910) 2010 -11 E 01 3. 25% 3. 00% 2. 25% 2. 50% 1. 50% 2. 50% E 00 3. 25% 3. 00% 2. 25% 2. 50% 1. 50% 2. 50% A 01 3. 25% 3. 00% 2. 25% 2. 50% 1. 50% 2. 50% A 02 3. 25% 3. 00% 2. 25% 2. 50% 1. 50% 2. 50% A 03 3. 25% 3. 00% 2. 25% 2. 50% 1. 50% 2. 50%

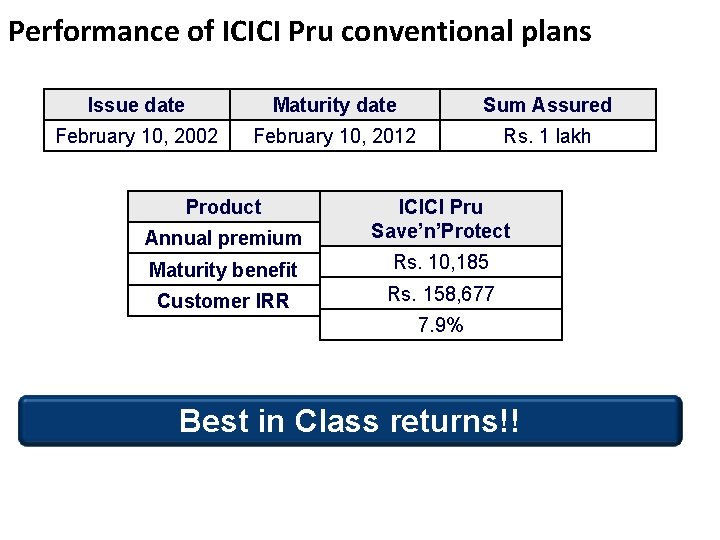

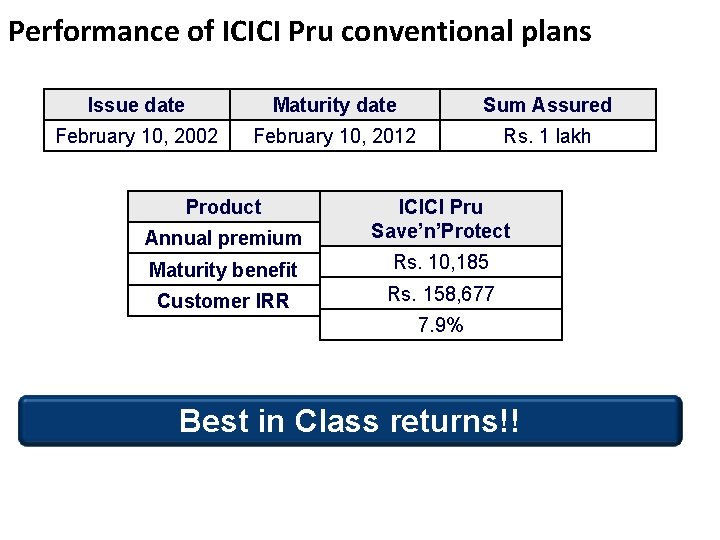

Performance of ICICI Pru conventional plans Issue date Maturity date Sum Assured February 10, 2002 February 10, 2012 Rs. 1 lakh Product Annual premium ICICI Pru Save’n’Protect Maturity benefit Rs. 10, 185 Customer IRR Rs. 158, 677 7. 9% Best in Class returns!!

GSIP: The complete solution Liquidity? Liq ity uid i d ui ty q Li y+ Sa fet • Guaranteed Regular Additions (RAs) ns ur • Guaranteed Maturity Benefit Protection? t Re Guaranteed benefits + So what’s new in GSIP ? Safety + Returns Expected returns?

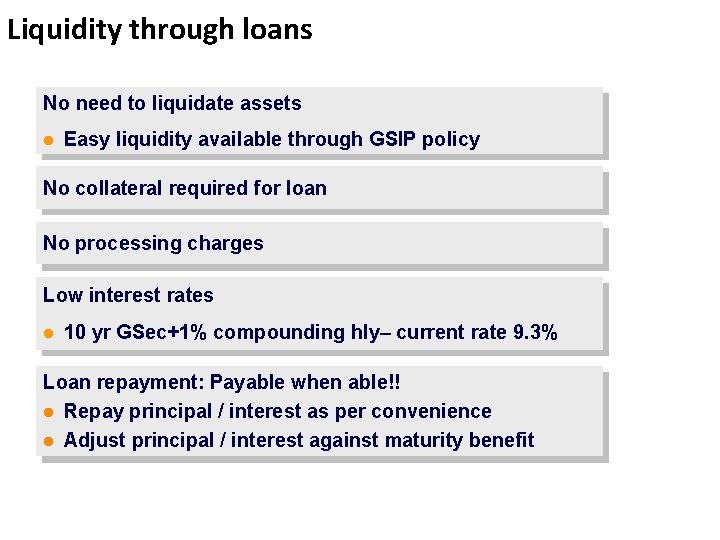

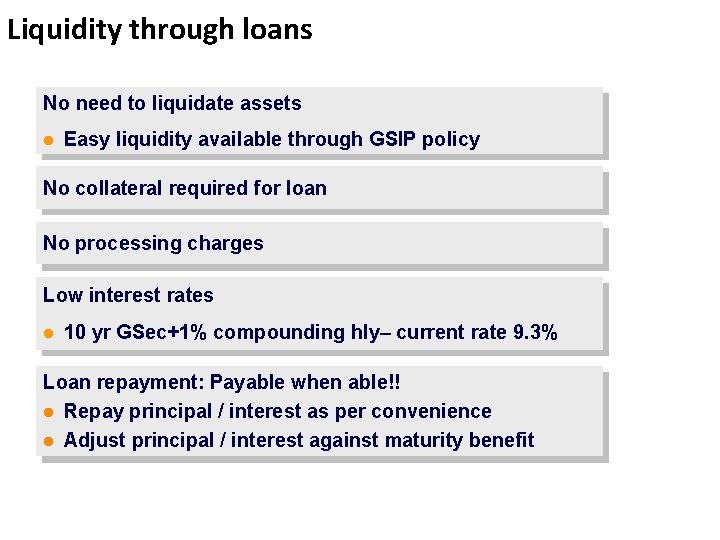

Liquidity through loans No need to liquidate assets Easy liquidity available through GSIP policy No collateral required for loan No processing charges Low interest rates 10 yr GSec+1% compounding hly– current rate 9. 3% Loan repayment: Payable when able!! Repay principal / interest as per convenience Adjust principal / interest against maturity benefit

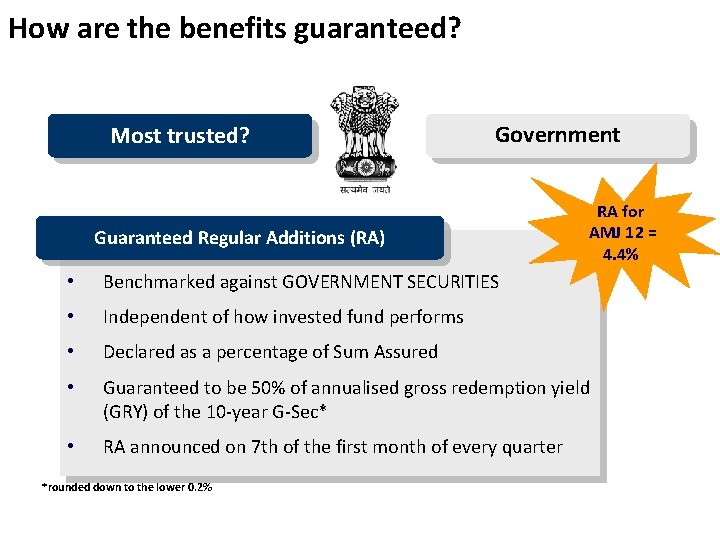

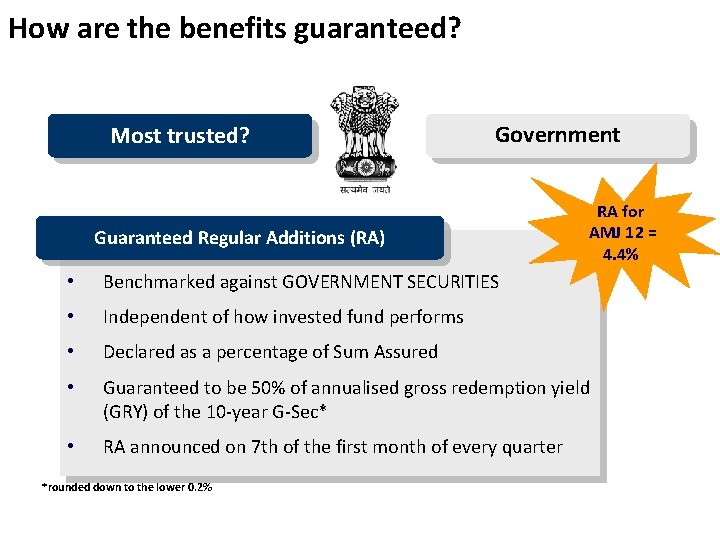

How are the benefits guaranteed? Most trusted? Government Guaranteed Regular Additions (RA) RA for AMJ 12 = 4. 4% • Benchmarked against GOVERNMENT SECURITIES • Independent of how invested fund performs • Declared as a percentage of Sum Assured • Guaranteed to be 50% of annualised gross redemption yield (GRY) of the 10 -year G-Sec* • RA announced on 7 th of the first month of every quarter *rounded down to the lower 0. 2%

ICICI Pru GSIP – Regular Additions Date Regular Addition % October 2010 - December 2010 4. 0% January 2011 – March 2011 4. 1% April 2011 – June 2011 4. 0% July 2011 – September 2011 4. 2% October 2011 – December 2011 4. 4% January 2012 – March 2012 4. 1 % Regular Addition rate for this Quarter 4. 4% Regular Addition for premium of Rs. 1 lakh & PPT-7 Rs. 30, 800

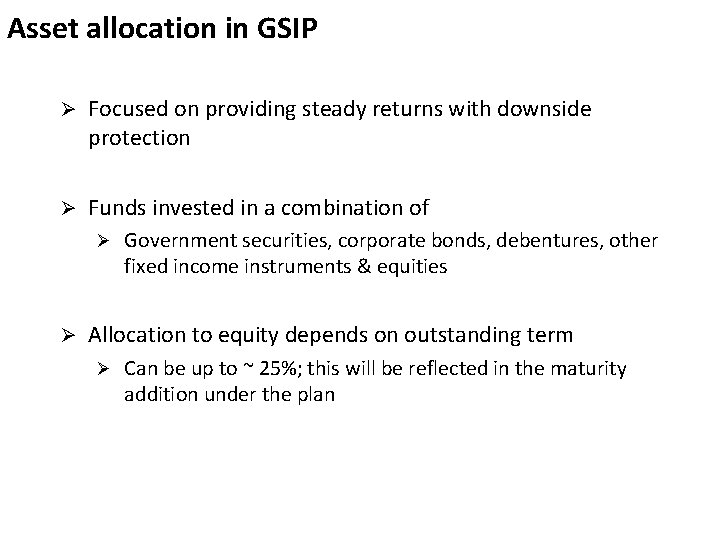

Asset allocation in GSIP Focused on providing steady returns with downside protection Funds invested in a combination of Government securities, corporate bonds, debentures, other fixed income instruments & equities Allocation to equity depends on outstanding term Can be up to ~ 25%; this will be reflected in the maturity addition under the plan

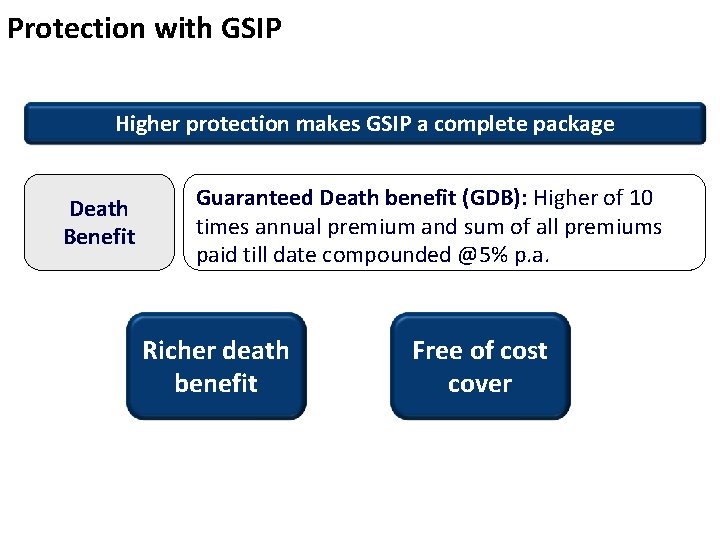

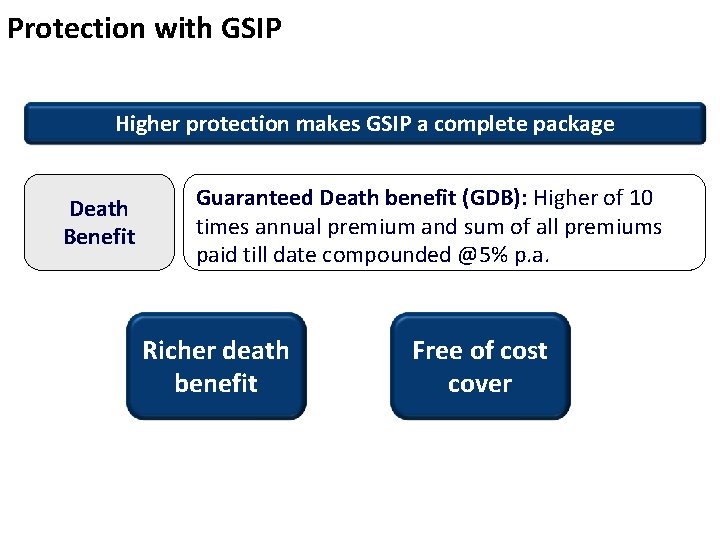

Protection with GSIP Higher protection makes GSIP a complete package Death Benefit Guaranteed Death benefit (GDB): Higher of 10 times annual premium and sum of all premiums paid till date compounded @5% p. a. Richer death benefit Free of cost cover

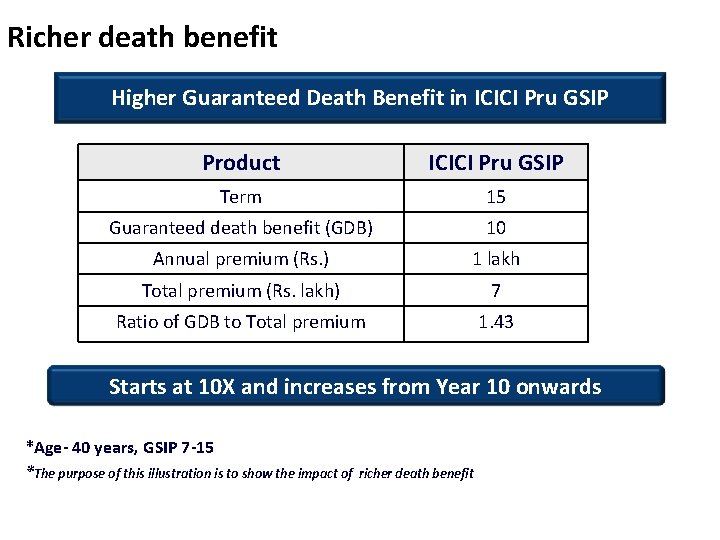

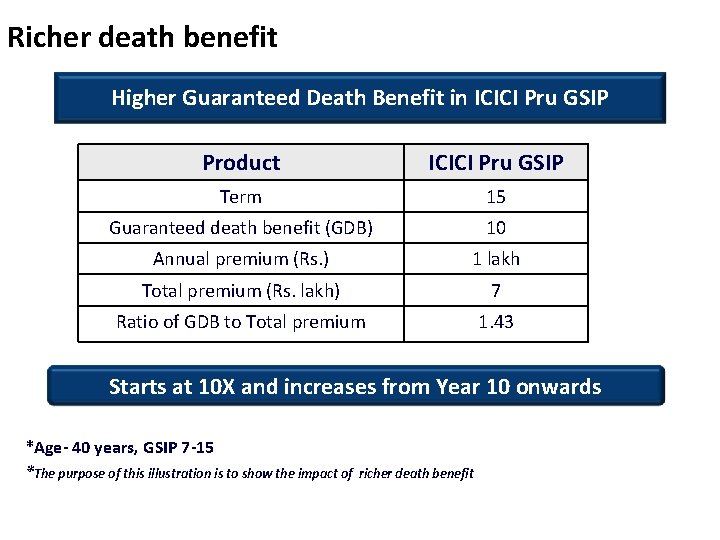

Richer death benefit Higher Guaranteed Death Benefit in ICICI Pru GSIP Product ICICI Pru GSIP Term 15 Guaranteed death benefit (GDB) 10 Annual premium (Rs. ) 1 lakh Total premium (Rs. lakh) 7 Ratio of GDB to Total premium 1. 43 Starts at 10 X and increases from Year 10 onwards *Age- 40 years, GSIP 7 -15 *The purpose of this illustration is to show the impact of richer death benefit

Maturity addition As in normal traditional plan profit is shared in the form of bonuses similarly in GSIP over a term profit earned in plan is shared in form of Maturity Addition

Thank you!!!!