LIFE INSURANCE COUNCIL PRESS MEET ON OVERVIEW OF

- Slides: 18

LIFE INSURANCE COUNCIL PRESS MEET ON OVERVIEW OF INDIAN LIFE INSURANCE INDUSTRY: TRENDS & OPPORTUNITIES 20 TH FEBRUARY, 2014 HYDERABAD

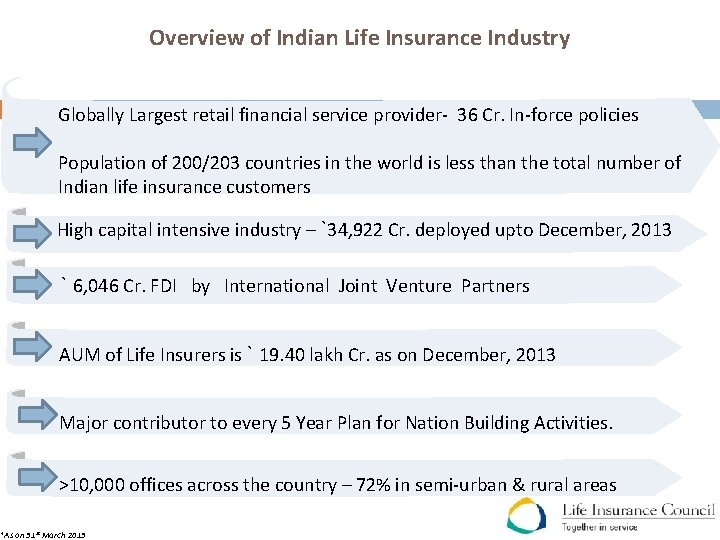

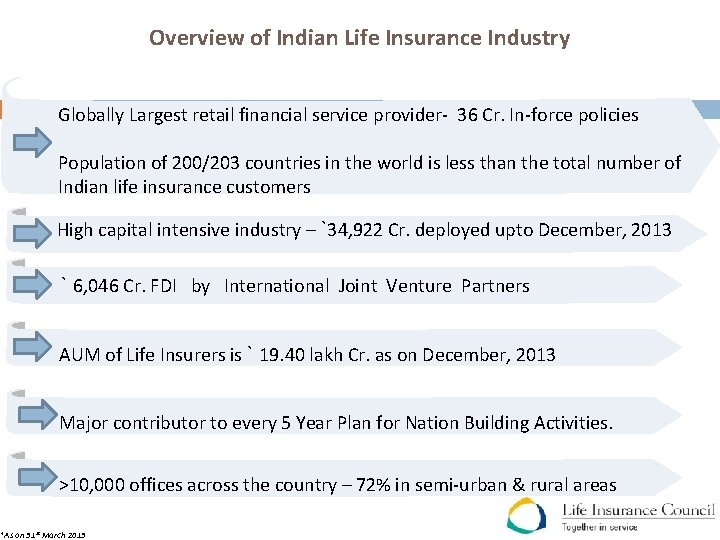

Overview of Indian Life Insurance Industry Globally Largest retail financial service provider- 36 Cr. In-force policies Population of 200/203 countries in the world is less than the total number of Indian life insurance customers High capital intensive industry – `34, 922 Cr. deployed upto December, 2013 ` 6, 046 Cr. FDI by International Joint Venture Partners AUM of Life Insurers is ` 19. 40 lakh Cr. as on December, 2013 Major contributor to every 5 Year Plan for Nation Building Activities. >10, 000 offices across the country – 72% in semi-urban & rural areas *As on 31 st March 2013

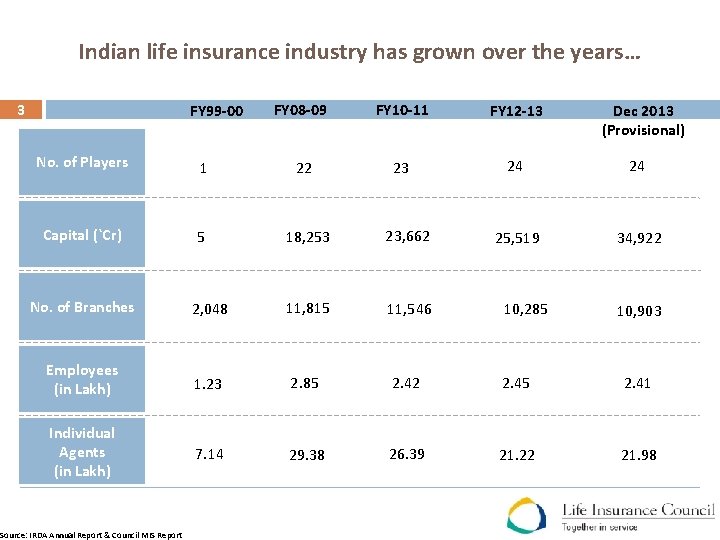

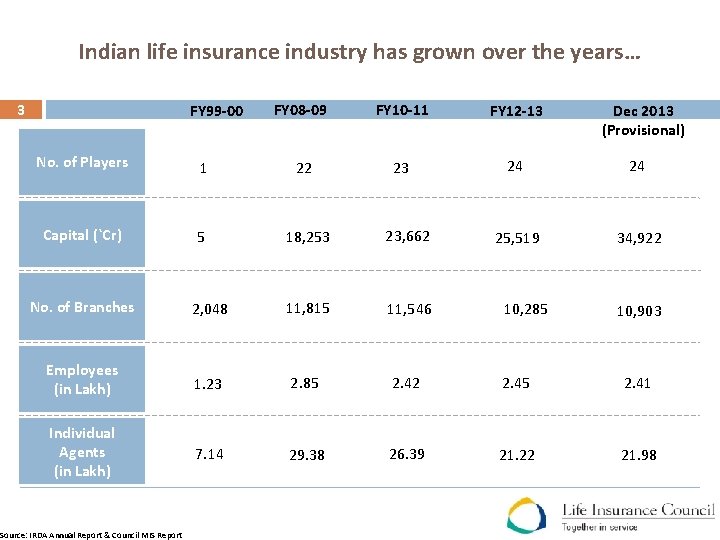

Indian life insurance industry has grown over the years… 3 FY 99 -00 FY 08 -09 FY 10 -11 FY 12 -13 23 24 24 25, 519 34, 922 No. of Players 1 22 Capital (`Cr) 5 18, 253 23, 662 Dec 2013 (Provisional) No. of Branches 2, 048 11, 815 11, 546 Employees (in Lakh) 1. 23 2. 85 2. 42 2. 45 2. 41 Individual Agents (in Lakh) 7. 14 29. 38 26. 39 21. 22 21. 98 Source: IRDA Annual Report & Council MIS Report 10, 285 10, 903

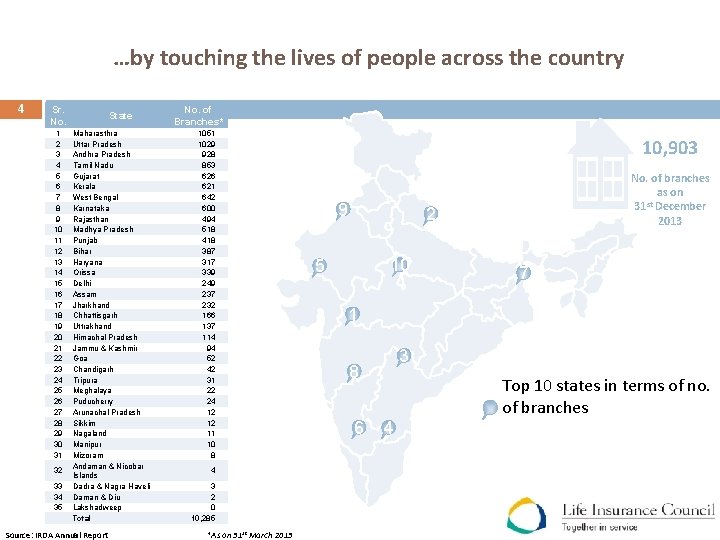

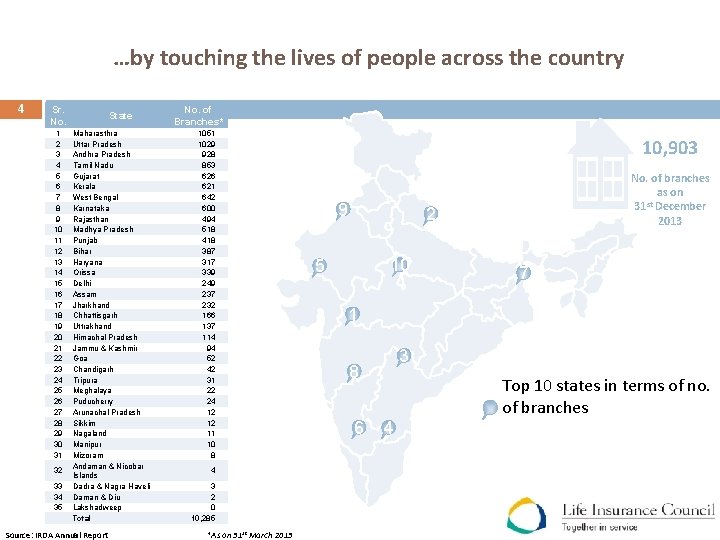

…by touching the lives of people across the country 4 Sr. No. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 State Maharasthra Uttar Pradesh Andhra Pradesh Tamil Nadu Gujarat Kerala West Bengal Karnataka Rajasthan Madhya Pradesh Punjab Bihar Haryana Orissa Delhi Assam Jharkhand Chhattisgarh Uttrakhand Himachal Pradesh Jammu & Kashmir Goa Chandigarh Tripura Meghalaya Puducherry Arunachal Pradesh Sikkim Nagaland Manipur Mizoram Andaman & Nicobar Islands Dadra & Nagra Haveli Daman & Diu Lakshadweep Total Source: IRDA Annual Report No. of Branches* 1051 1029 928 853 626 621 642 600 494 518 418 387 317 339 249 237 232 166 137 114 94 52 42 31 22 24 12 12 11 10 8 4 3 2 0 10, 285 *As on 31 st March 2013 10, 903 9 No. of branches as on st 31 December 2013 2 10 5 7 1 3 8 6 4 Top 10 states in terms of no. of branches

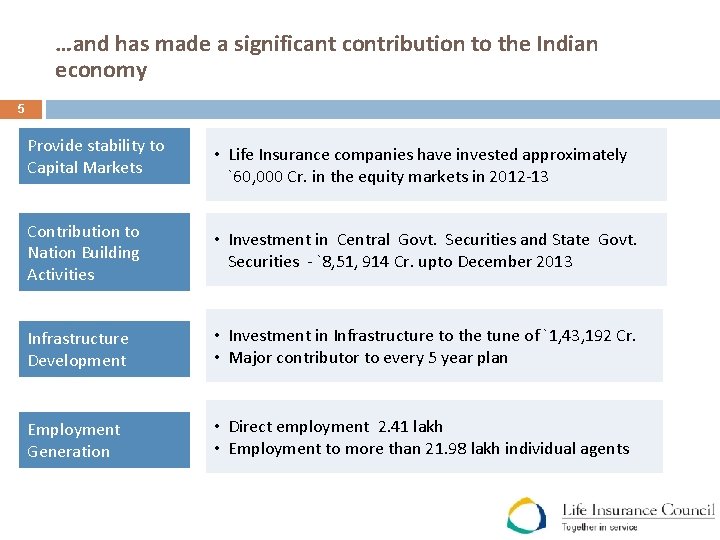

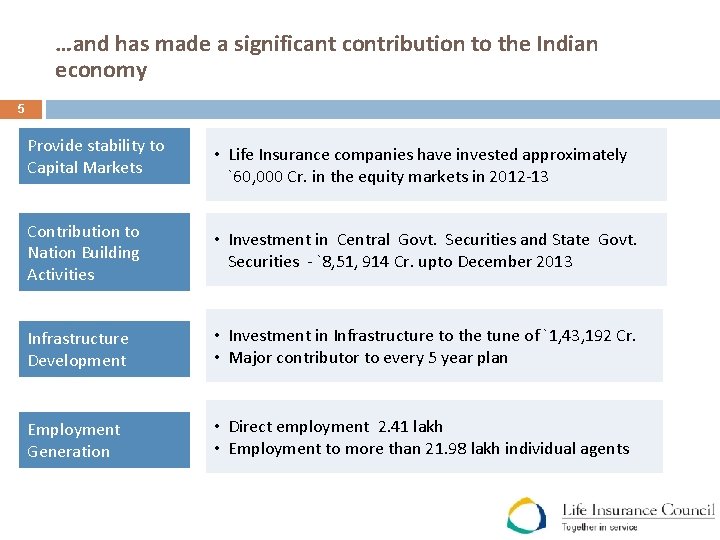

…and has made a significant contribution to the Indian economy 5 Provide stability to Capital Markets • Life Insurance companies have invested approximately `60, 000 Cr. in the equity markets in 2012 -13 Contribution to Nation Building Activities • Investment in Central Govt. Securities and State Govt. Securities - `8, 51, 914 Cr. upto December 2013 Infrastructure Development • Investment in Infrastructure to the tune of `1, 43, 192 Cr. • Major contributor to every 5 year plan Employment Generation • Direct employment 2. 41 lakh • Employment to more than 21. 98 lakh individual agents

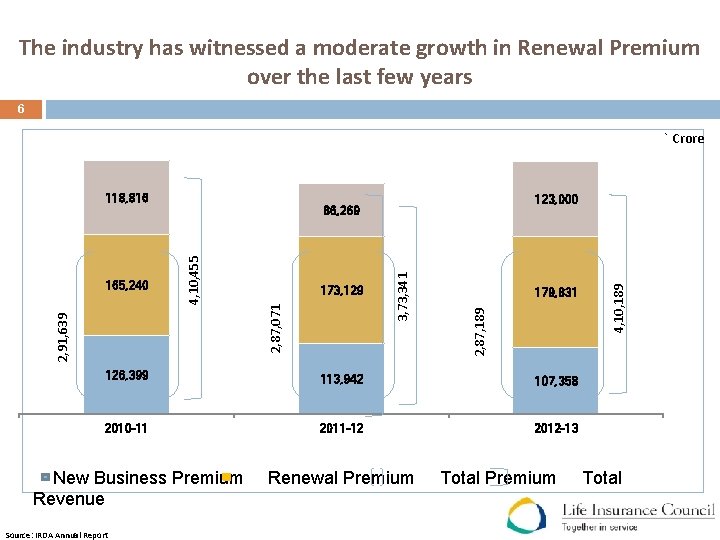

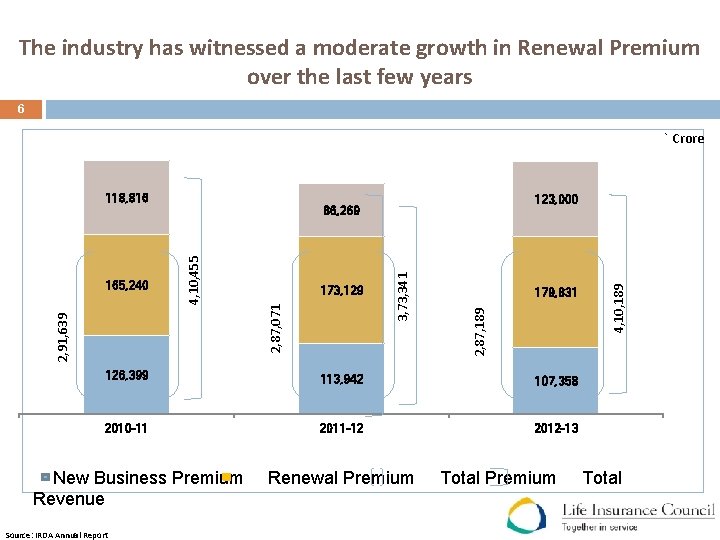

The industry has witnessed a moderate growth in Renewal Premium over the last few years 6 ` Crore 179, 831 2, 87, 189 3, 73, 341 173, 129 2, 87, 071 4, 10, 455 2, 91, 639 165, 240 123, 000 86, 269 126, 399 113, 942 107, 358 2010 -11 2011 -12 2012 -13 New Business Premium Revenue Source: IRDA Annual Report Renewal Premium Total Premium 4, 10, 189 118, 816 Total

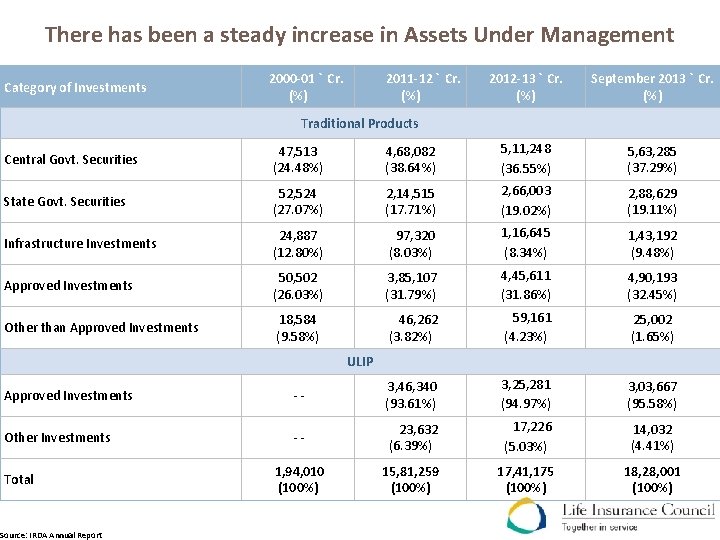

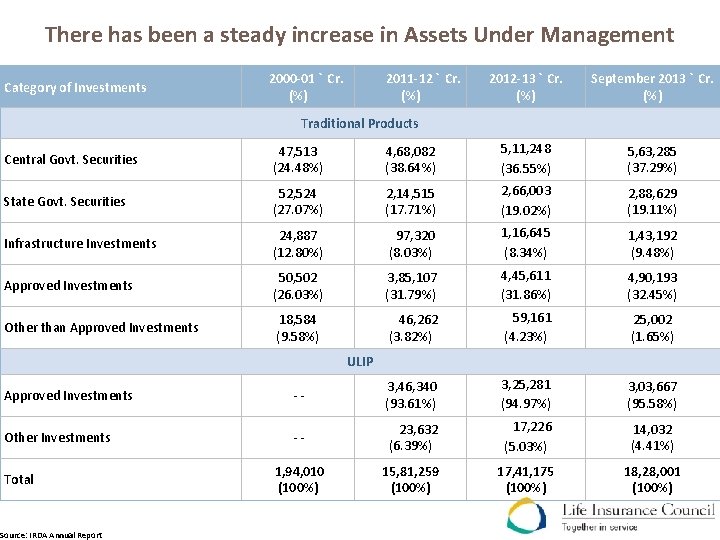

There has been a steady increase in Assets Under Management Category of Investments 2000 -01 ` Cr. (%) 2011 -12 ` Cr. (%) 2012 -13 ` Cr. (%) September 2013 ` Cr. (%) Traditional Products Central Govt. Securities 47, 513 (24. 48%) 4, 68, 082 (38. 64%) 5, 11, 248 (36. 55%) 5, 63, 285 (37. 29%) State Govt. Securities 52, 524 (27. 07%) 2, 14, 515 (17. 71%) 2, 66, 003 (19. 02%) 2, 88, 629 (19. 11%) Infrastructure Investments 24, 887 (12. 80%) 97, 320 (8. 03%) 1, 16, 645 (8. 34%) 1, 43, 192 (9. 48%) Approved Investments 50, 502 (26. 03%) 3, 85, 107 (31. 79%) 4, 45, 611 (31. 86%) 4, 90, 193 (32. 45%) Other than Approved Investments 18, 584 (9. 58%) 46, 262 (3. 82%) 59, 161 (4. 23%) 25, 002 (1. 65%) ULIP Approved Investments -- 3, 46, 340 (93. 61%) 3, 25, 281 (94. 97%) 3, 03, 667 (95. 58%) Other Investments -- 23, 632 (6. 39%) 17, 226 (5. 03%) 14, 032 (4. 41%) 1, 94, 010 (100%) 15, 81, 259 (100%) 17, 41, 175 (100%) 18, 28, 001 (100%) Total Source: IRDA Annual Report

Industry has increased its focus on Customer Centricity

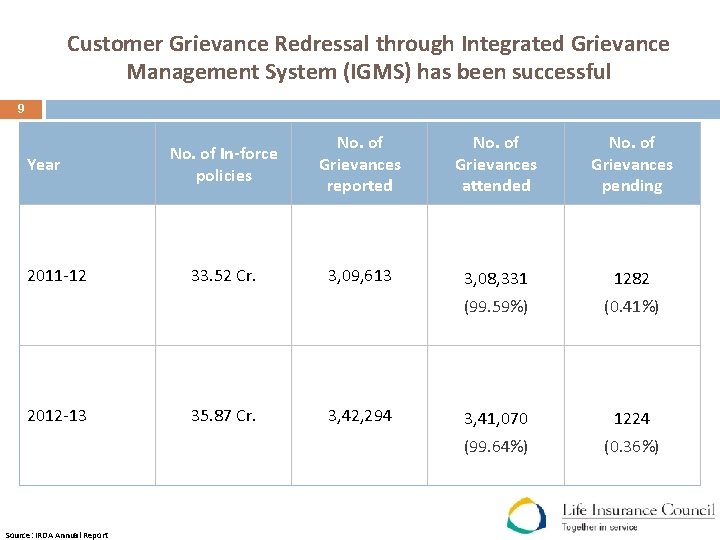

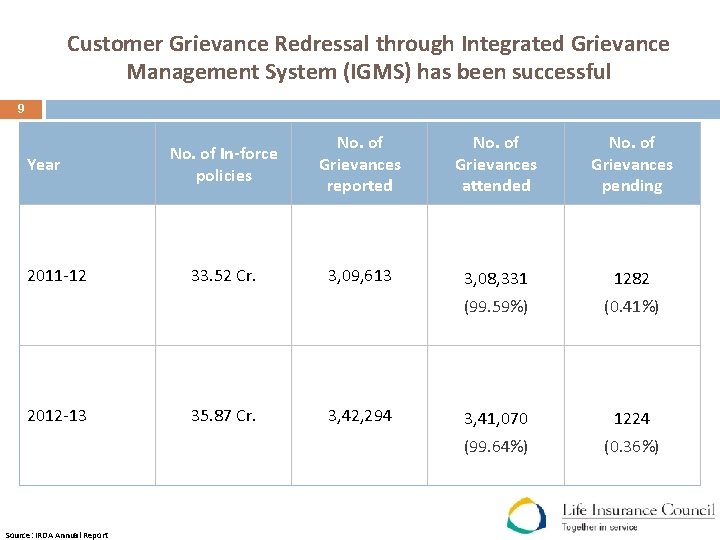

Customer Grievance Redressal through Integrated Grievance Management System (IGMS) has been successful 9 Year 2011 -12 2012 -13 Source: IRDA Annual Report No. of In-force policies No. of Grievances reported No. of Grievances attended No. of Grievances pending 33. 52 Cr. 3, 09, 613 3, 08, 331 1282 (99. 59%) (0. 41%) 3, 41, 070 1224 (99. 64%) (0. 36%) 35. 87 Cr. 3, 42, 294

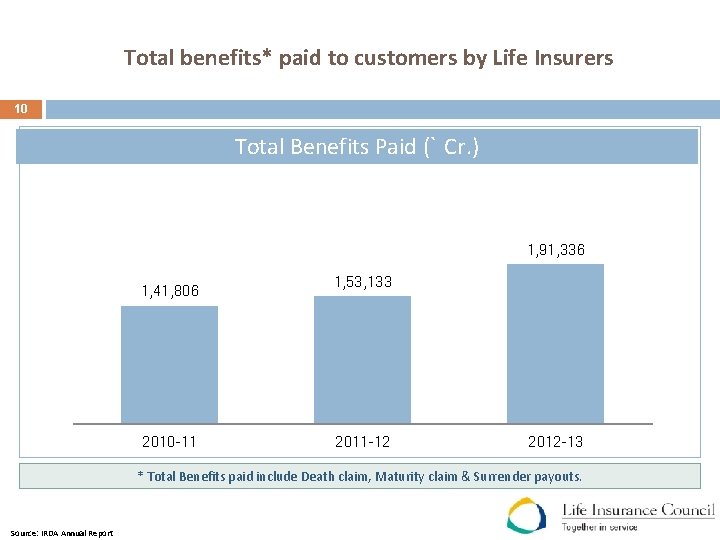

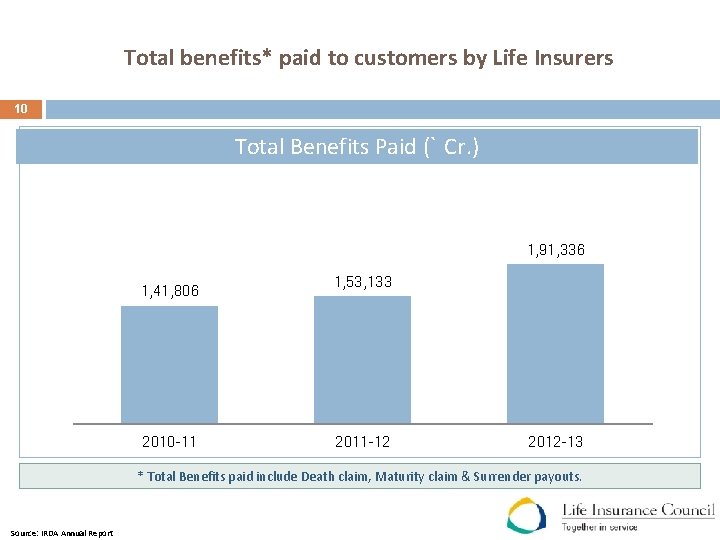

Total benefits* paid to customers by Life Insurers 10 Total Benefits Paid (` Cr. ) 1, 91, 336 1, 41, 806 2010 -11 1, 53, 133 2011 -12 2012 -13 * Total Benefits paid include Death claim, Maturity claim & Surrender payouts. Source: IRDA Annual Report

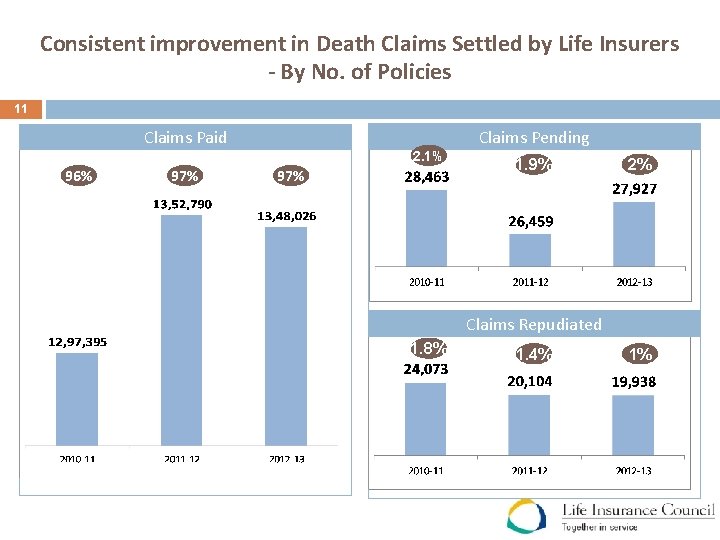

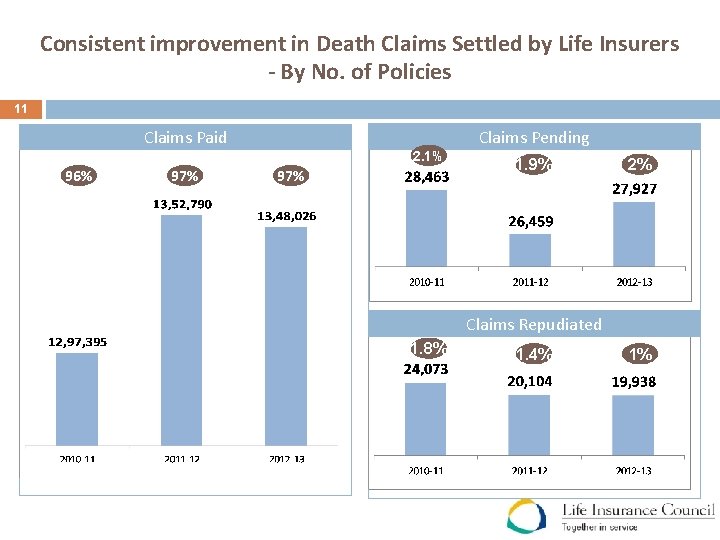

Consistent improvement in Death Claims Settled by Life Insurers - By No. of Policies 11 Claims Pending Claims Paid 2. 1% 96% 97% 1. 9% 2% Claims Repudiated 1. 8% 1. 4% 1%

Driving Growth in Life Insurance Industry in India

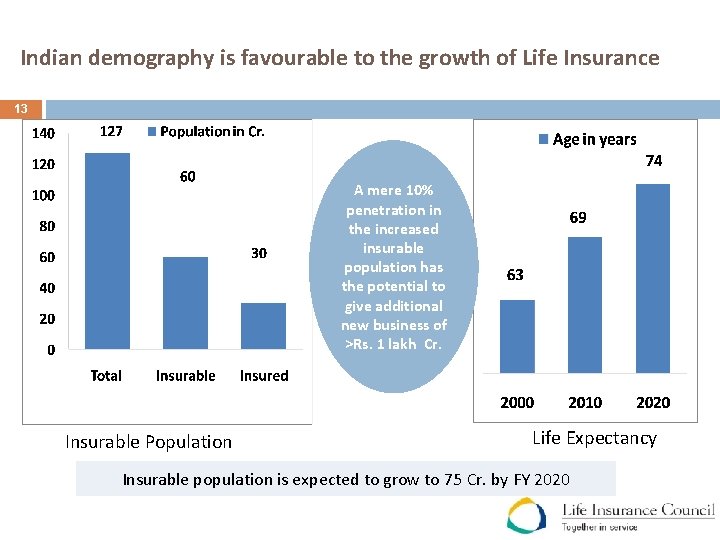

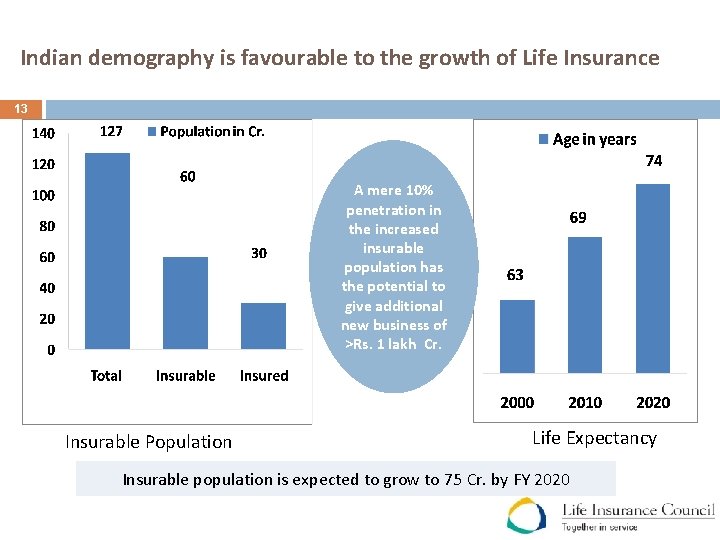

Indian demography is favourable to the growth of Life Insurance 13 A mere 10% penetration in the increased insurable population has the potential to give additional new business of >Rs. 1 lakh Cr. Insurable Population Life Expectancy Insurable population is expected to grow to 75 Cr. by FY 2020

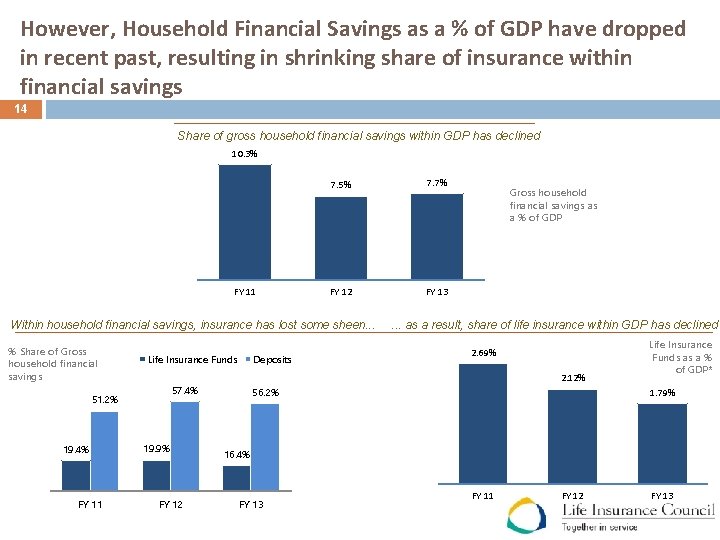

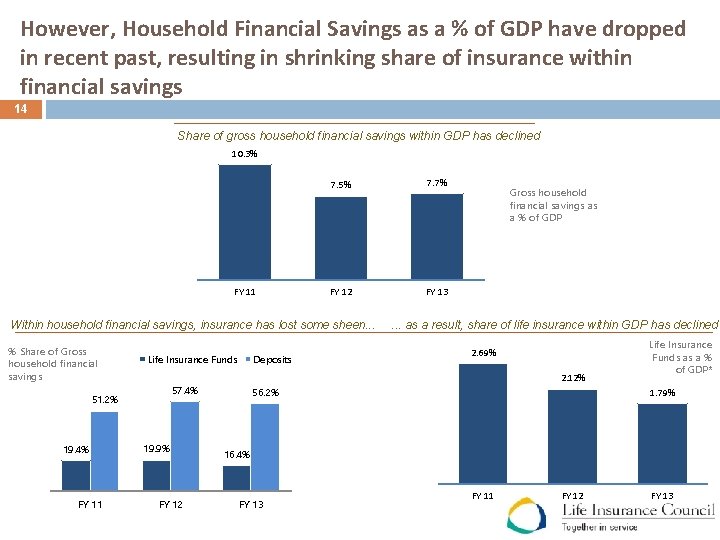

However, Household Financial Savings as a % of GDP have dropped in recent past, resulting in shrinking share of insurance within financial savings 14 Share of gross household financial savings within GDP has declined 10. 3% FY 11 7. 5% 7. 7% FY 12 FY 13 Within household financial savings, insurance has lost some sheen. . . % Share of Gross household financial savings Life Insurance Funds FY 11 19. 9% FY 12 . . . as a result, share of life insurance within GDP has declined 2. 69% 2. 12% 57. 4% 51. 2% 19. 4% Deposits Gross household financial savings as a % of GDP 56. 2% Life Insurance Funds as a % of GDP* 1. 79% 16. 4% FY 13 FY 11 FY 12 FY 13

Multiple actions taken will bring back growth in the life insurance industry 15 New Products with enhanced features launched from January 1, 2014 § 367 new products launched § Benefits for customers with higher insurance covers Pioneers in the globe to grant license to e-repositories § 5 Repositories authorized to open e-Insurance Accounts. Distribution related initiatives § Expand distribution reach – Insurers are poised to increase number of agents to more than 3 million in the next 5 years § Utilize CSCs to expand reach – 1, 000 CSCs each serving a cluster of 6 -7 villages, covering ~6. 5 lakh villages across India § Open Architecture – Banks to become brokers § Proposed Alternate Distribution Channel for Intermediaries

Projections 16 Life insurance segment has the potential to grow 2 -2. 5 times its current size by 2020. The Penetration level of Life insurance industry is expected to grow from 3. 2% to 5% by year 2020 Expected CAGR of Life Insurance industry will be 12 -15% in the next 3 -5 years The net Household Financial savings could reach around 30% in the next 3 years from the present level of 23. 1% (FY 11 -12); Life Insurance being the second most preferred financial instrument will benefit from this.

Life Insurance sector will continue to contribute to nation building 17 Life Insurance employment potential till FY 2020 – 5 Lakh employees Life insurance industry contribution to Infrastructure projects – by FY 2020 Rs. 3. 5 Lakh Cr. Increase in FDI up to 10 billion US $ will increase customer coverage in rural and semi urban areas from 72% to 80% and fuel employment growth in the country and contribute to increase in GDP of the country.

Thank You