LESSON 9 1 Journalizing Purchases Using a Purchases

- Slides: 11

LESSON 9 -1 Journalizing Purchases Using a Purchases Journal Original created by M. C. Mc. Laughlin, Thomson/South-Western Modified by Deborah L. Burns, Johnston County Schools, West Johnston High School CENTURY 21 ACCOUNTING © Thomson/South-Western

2 Merchandising Businesses page 236 ØA business that purchases and sells goods is called a merchandising business ØGoods that a business purchases to sell are called merchandise ØA merchandising business that sells to those who use or consume the goods is called a retail merchandising business ØA business that buys & resells merchandise in retail merchandising businesses is called a wholesale merchandising business CENTURY 21 ACCOUNTING © Thomson/South-Western LESSON 9 -1

3 Merchandising Businesses page 236 ØA journal used to record only one kind of transaction is called a special journal ØMost merchandising businesses use 5 special journals to record daily transactions: ØPurchases journal – for all purchases of merchandise on account ØCash payment journal – for all cash payments ØSales journal – for all sales of merchandise on account ØCash receipts journal – for all cash receipts ØGeneral journal – for all other transactions CENTURY 21 ACCOUNTING © Thomson/South-Western LESSON 9 -1

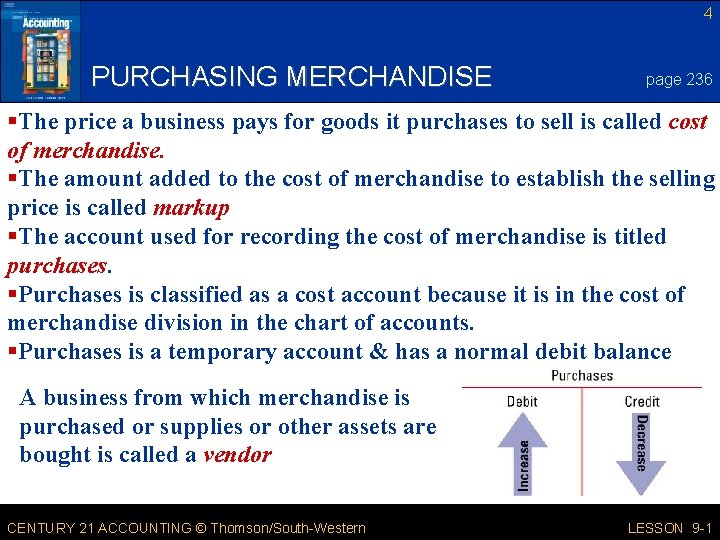

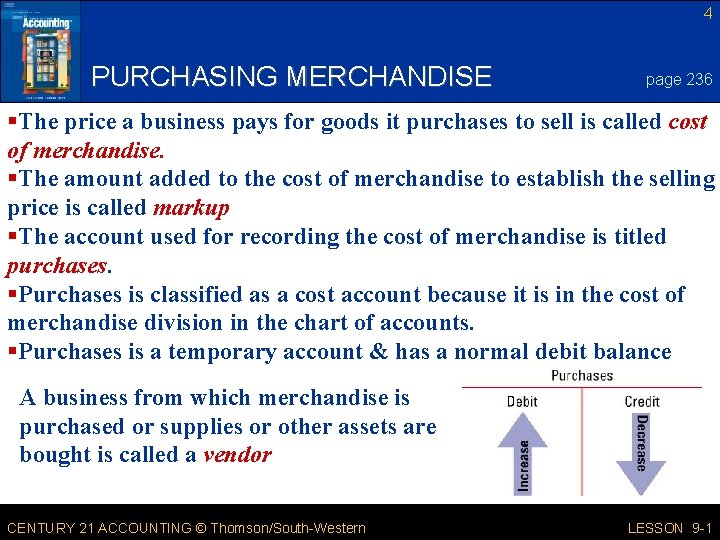

4 PURCHASING MERCHANDISE page 236 §The price a business pays for goods it purchases to sell is called cost of merchandise. §The amount added to the cost of merchandise to establish the selling price is called markup §The account used for recording the cost of merchandise is titled purchases. §Purchases is classified as a cost account because it is in the cost of merchandise division in the chart of accounts. §Purchases is a temporary account & has a normal debit balance A business from which merchandise is purchased or supplies or other assets are bought is called a vendor CENTURY 21 ACCOUNTING © Thomson/South-Western LESSON 9 -1

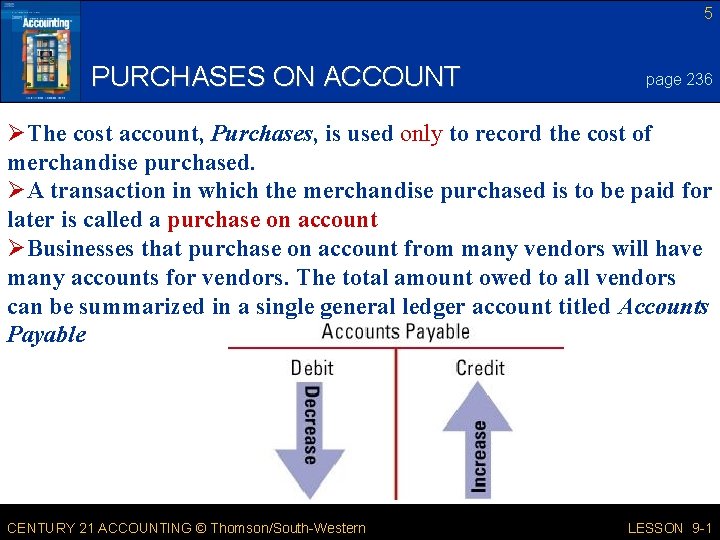

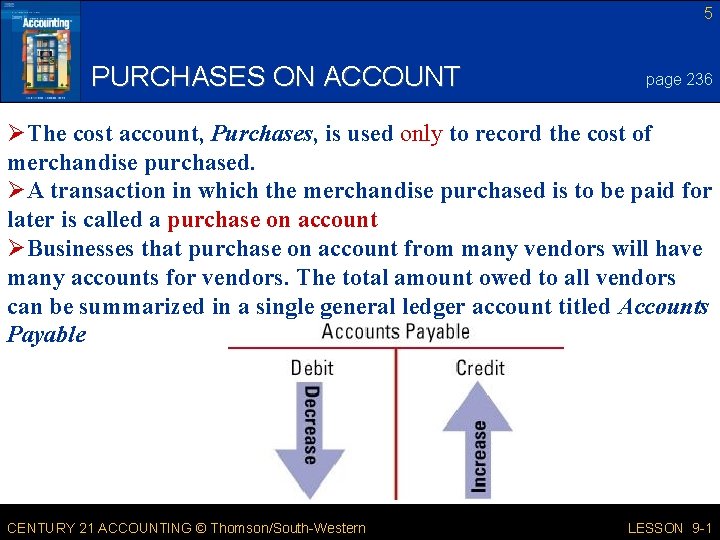

5 PURCHASES ON ACCOUNT page 236 ØThe cost account, Purchases, is used only to record the cost of merchandise purchased. ØA transaction in which the merchandise purchased is to be paid for later is called a purchase on account ØBusinesses that purchase on account from many vendors will have many accounts for vendors. The total amount owed to all vendors can be summarized in a single general ledger account titled Accounts Payable CENTURY 21 ACCOUNTING © Thomson/South-Western LESSON 9 -1

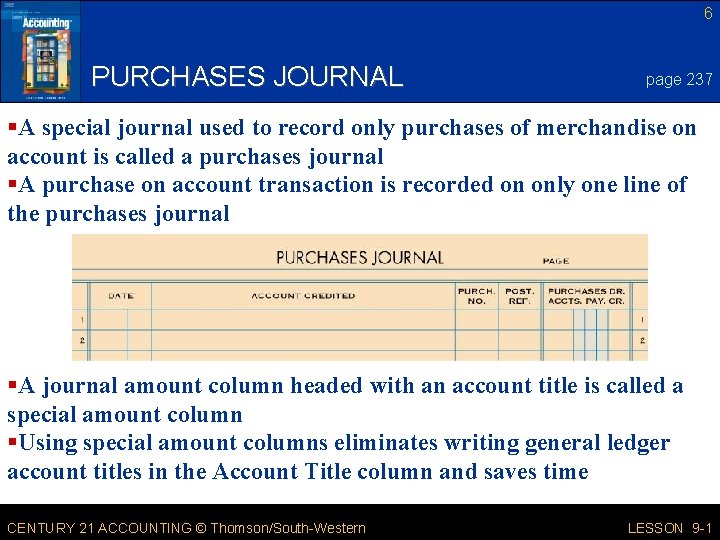

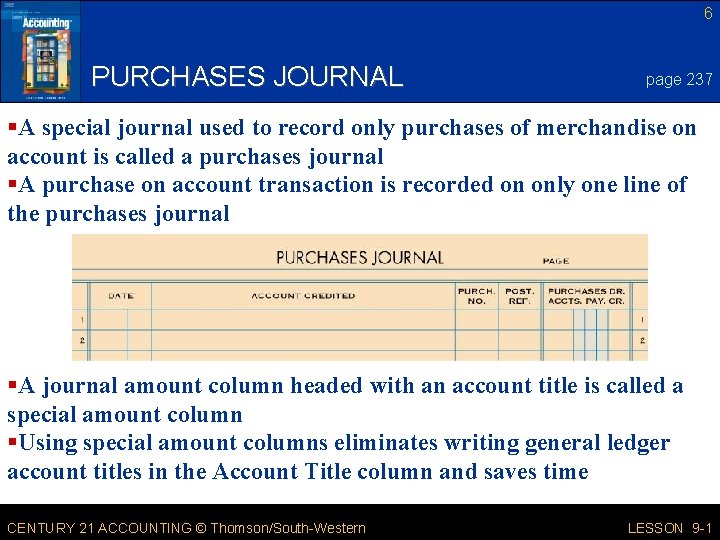

6 PURCHASES JOURNAL page 237 §A special journal used to record only purchases of merchandise on account is called a purchases journal §A purchase on account transaction is recorded on only one line of the purchases journal §A journal amount column headed with an account title is called a special amount column §Using special amount columns eliminates writing general ledger account titles in the Account Title column and saves time CENTURY 21 ACCOUNTING © Thomson/South-Western LESSON 9 -1

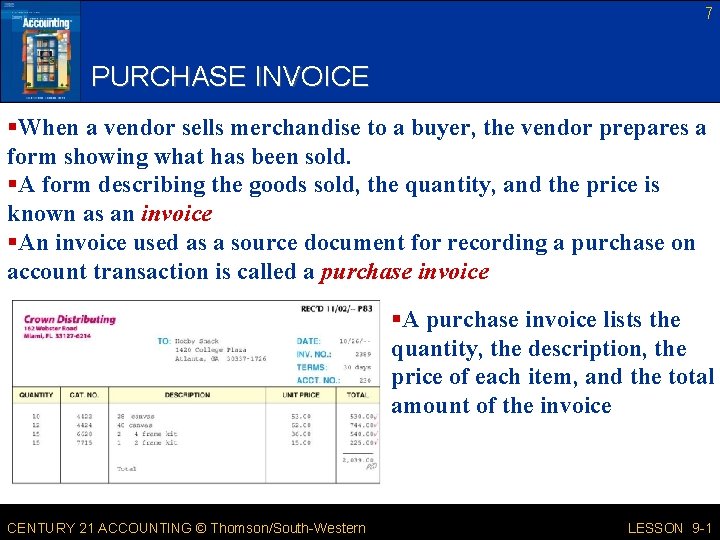

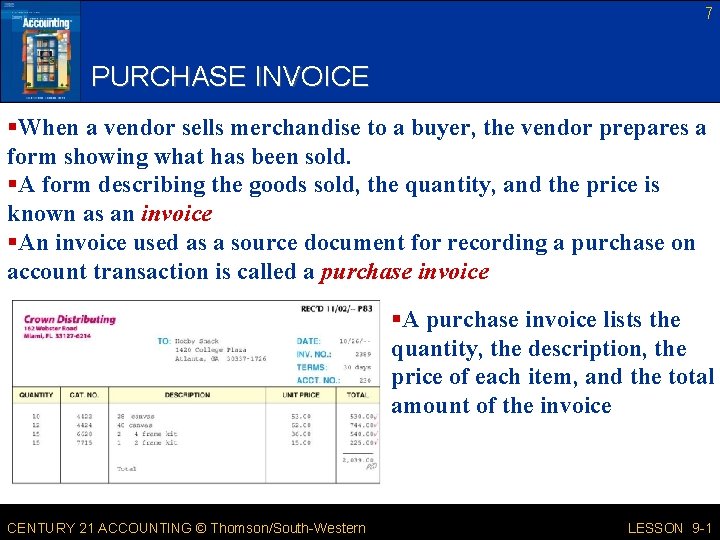

7 PURCHASE INVOICE §When a vendor sells merchandise to a buyer, the vendor prepares a form showing what has been sold. §A form describing the goods sold, the quantity, and the price is known as an invoice §An invoice used as a source document for recording a purchase on account transaction is called a purchase invoice §A purchase invoice lists the quantity, the description, the price of each item, and the total amount of the invoice CENTURY 21 ACCOUNTING © Thomson/South-Western LESSON 9 -1

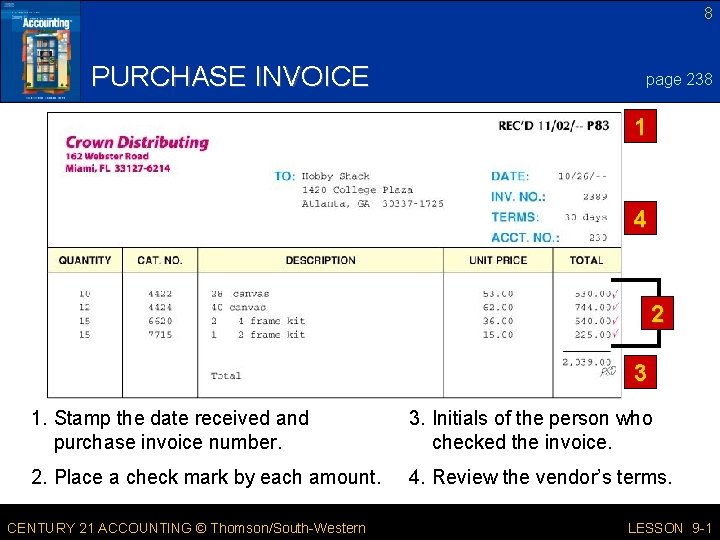

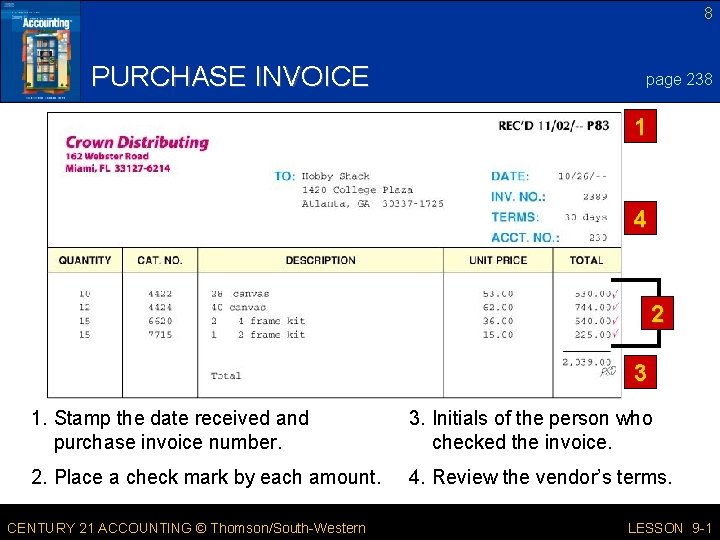

8 PURCHASE INVOICE page 238 1 4 2 3 1. Stamp the date received and purchase invoice number. 3. Initials of the person who checked the invoice. 2. Place a check mark by each amount. 4. Review the vendor’s terms. CENTURY 21 ACCOUNTING © Thomson/South-Western LESSON 9 -1

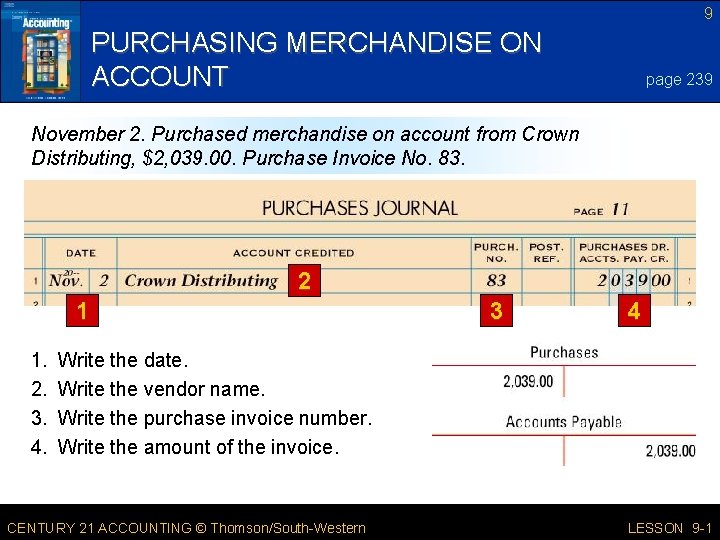

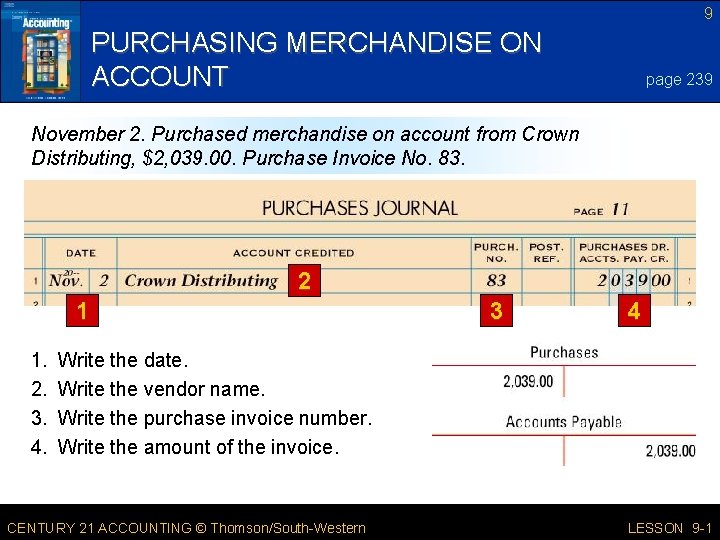

9 PURCHASING MERCHANDISE ON ACCOUNT page 239 November 2. Purchased merchandise on account from Crown Distributing, $2, 039. 00. Purchase Invoice No. 83. 2 1 1. 2. 3. 4. 3 4 Write the date. Write the vendor name. Write the purchase invoice number. Write the amount of the invoice. CENTURY 21 ACCOUNTING © Thomson/South-Western LESSON 9 -1

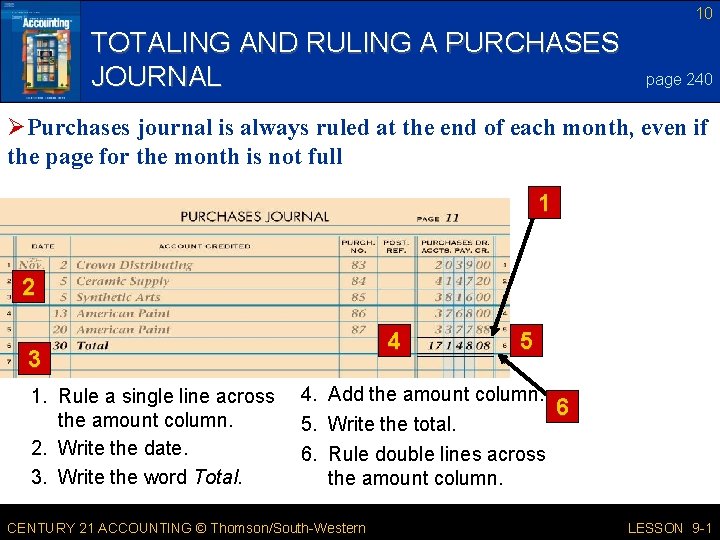

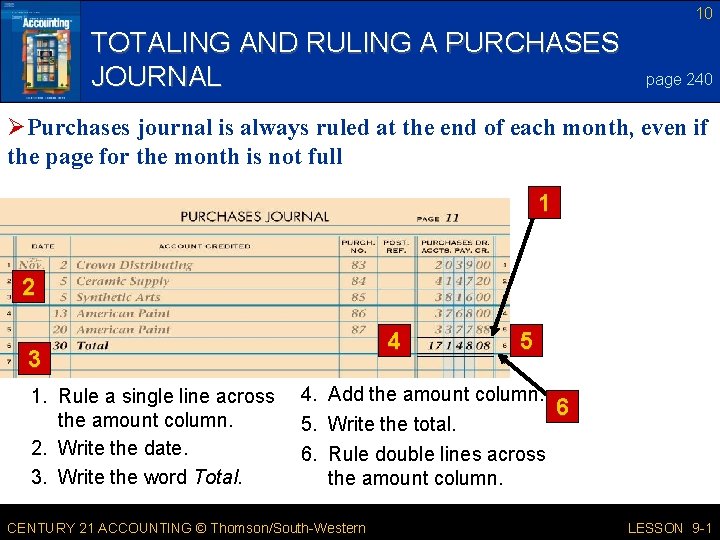

10 TOTALING AND RULING A PURCHASES JOURNAL page 240 ØPurchases journal is always ruled at the end of each month, even if the page for the month is not full 1 2 4 3 1. Rule a single line across the amount column. 2. Write the date. 3. Write the word Total. 5 4. Add the amount column. 5. Write the total. 6. Rule double lines across the amount column. CENTURY 21 ACCOUNTING © Thomson/South-Western 6 LESSON 9 -1

11 TERMS REVIEW n merchandise n merchandising business n retail merchandising business n wholesale merchandising business n corporation n share of stock n capital stock n stockholder CENTURY 21 ACCOUNTING © Thomson/South-Western page 241 n n n n n special journal cost of merchandise markup vendor purchase on account purchases journal special amount column purchase invoice terms of sale LESSON 9 -1