LESSON 12 2 Determining Payroll Tax Withholding Original

- Slides: 10

LESSON 12 -2 Determining Payroll Tax Withholding Original created by M. C. Mc. Laughlin, Thomson/South-Western Modified by Deborah L. Burns, Johnston County Schools, West Johnston High School CENTURY 21 ACCOUNTING © Thomson/South-Western

2 PAYROLL TAXES page 345 n Taxes based on the payroll of a business are called payroll taxes n A business is required by law to withhold certain payroll taxes from employee salaries n All payroll taxes are based on employee total earnings n Payroll taxes withheld represent a liability for the employer until payment is made to the government n Federal & state governments may charge a business a penalty for failure to pay correct payroll taxes when they are due CENTURY 21 ACCOUNTING © Thomson/South-Western LESSON 12 -2

3 EMPLOYEE INCOME TAX page 345 Ø A business must withhold federal income taxes from employee total earnings. Ø Federal income taxes withheld must be forwarded periodically to the federal government Ø Federal income tax is withheld from employee earnings in all 50 states Ø North Carolina also requires state income tax withholding CENTURY 21 ACCOUNTING © Thomson/South-Western LESSON 12 -2

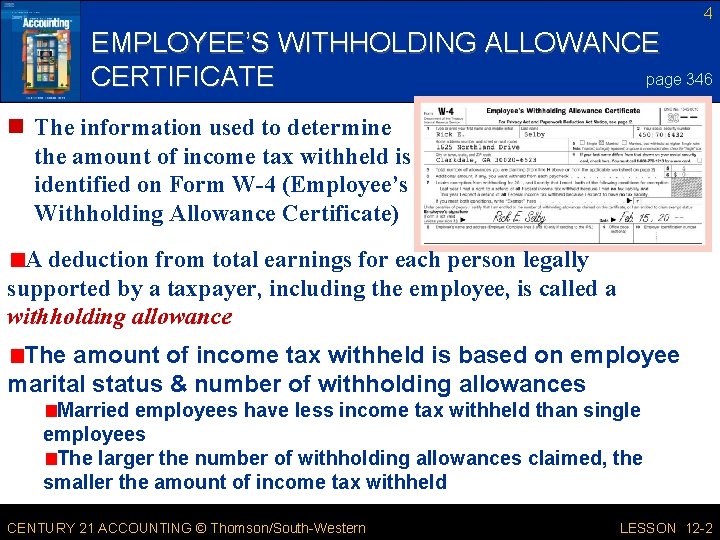

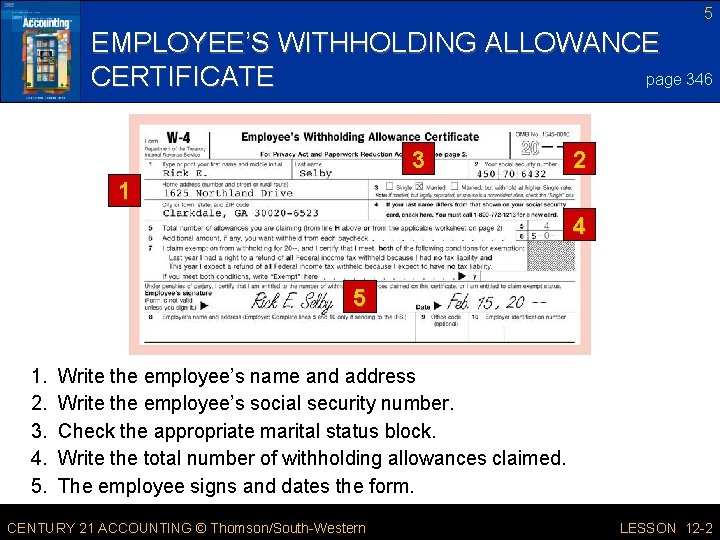

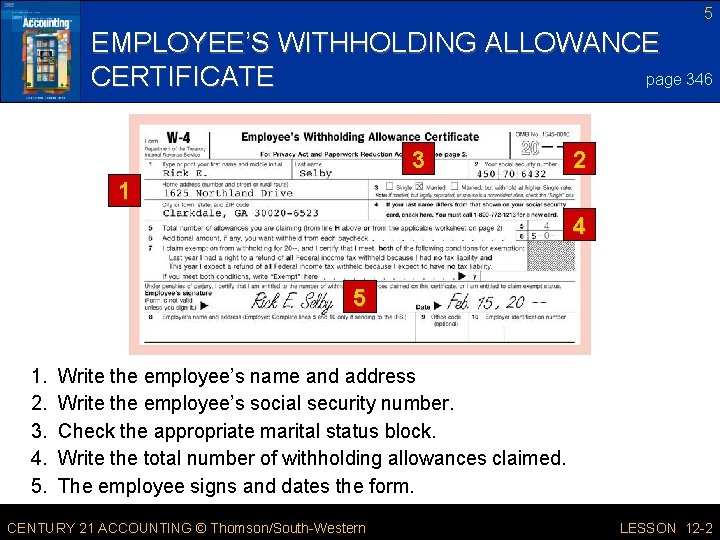

4 EMPLOYEE’S WITHHOLDING ALLOWANCE page 346 CERTIFICATE n The information used to determine the amount of income tax withheld is identified on Form W-4 (Employee’s Withholding Allowance Certificate) A deduction from total earnings for each person legally supported by a taxpayer, including the employee, is called a withholding allowance The amount of income tax withheld is based on employee marital status & number of withholding allowances Married employees have less income tax withheld than single employees The larger the number of withholding allowances claimed, the smaller the amount of income tax withheld CENTURY 21 ACCOUNTING © Thomson/South-Western LESSON 12 -2

5 EMPLOYEE’S WITHHOLDING ALLOWANCE page 346 CERTIFICATE 3 2 1 4 5 1. 2. 3. 4. 5. Write the employee’s name and address Write the employee’s social security number. Check the appropriate marital status block. Write the total number of withholding allowances claimed. The employee signs and dates the form. CENTURY 21 ACCOUNTING © Thomson/South-Western LESSON 12 -2

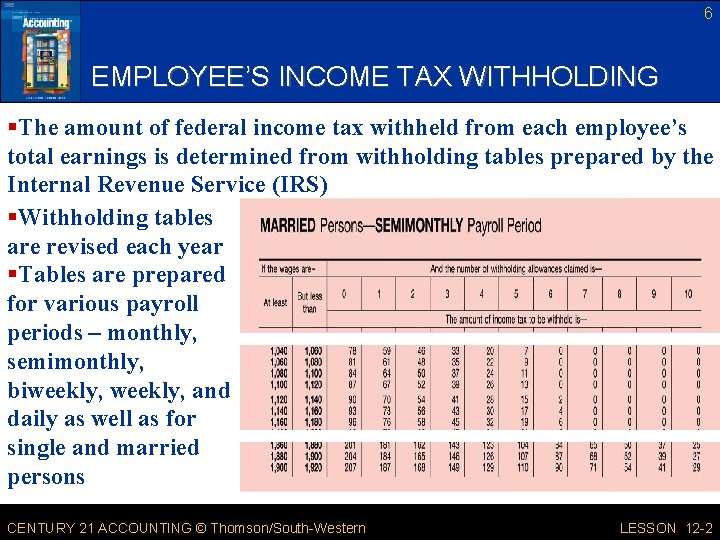

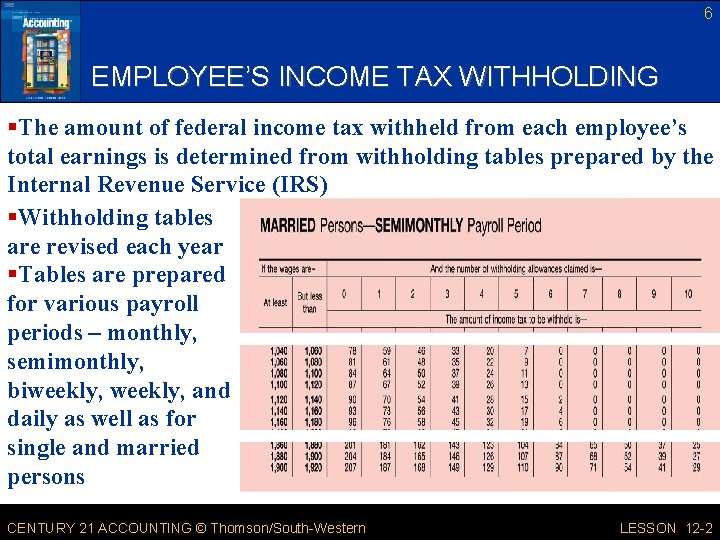

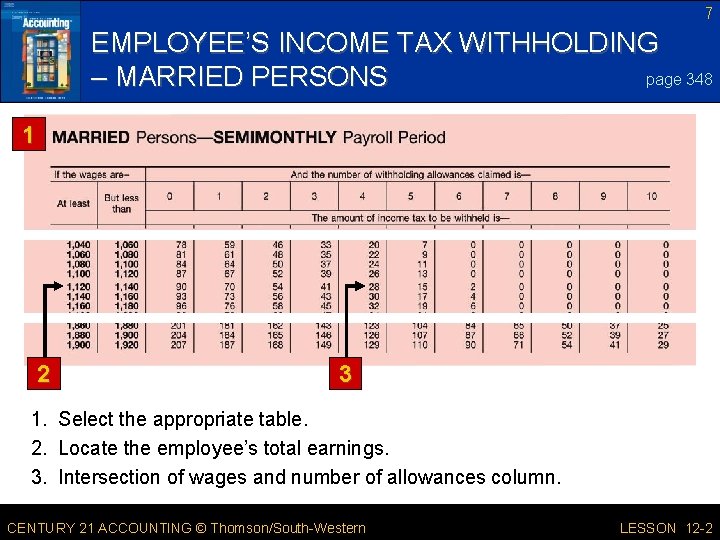

6 EMPLOYEE’S INCOME TAX WITHHOLDING §The amount of federal income tax withheld from each employee’s total earnings is determined from withholding tables prepared by the Internal Revenue Service (IRS) §Withholding tables are revised each year §Tables are prepared for various payroll periods – monthly, semimonthly, biweekly, and daily as well as for single and married persons CENTURY 21 ACCOUNTING © Thomson/South-Western LESSON 12 -2

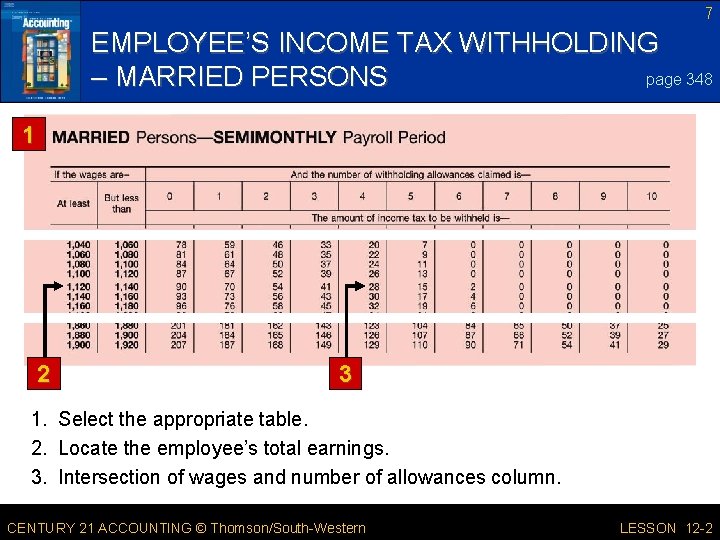

7 EMPLOYEE’S INCOME TAX WITHHOLDING page 348 – MARRIED PERSONS 1 2 3 1. Select the appropriate table. 2. Locate the employee’s total earnings. 3. Intersection of wages and number of allowances column. CENTURY 21 ACCOUNTING © Thomson/South-Western LESSON 12 -2

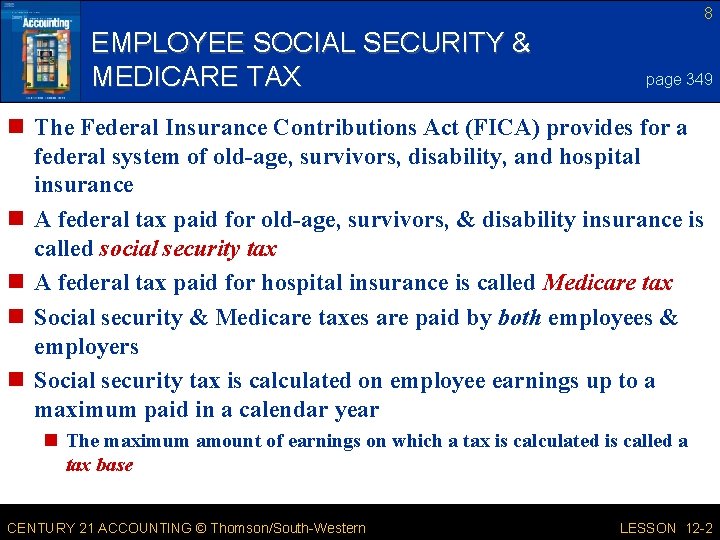

8 EMPLOYEE SOCIAL SECURITY & MEDICARE TAX page 349 n The Federal Insurance Contributions Act (FICA) provides for a federal system of old-age, survivors, disability, and hospital insurance n A federal tax paid for old-age, survivors, & disability insurance is called social security tax n A federal tax paid for hospital insurance is called Medicare tax n Social security & Medicare taxes are paid by both employees & employers n Social security tax is calculated on employee earnings up to a maximum paid in a calendar year n The maximum amount of earnings on which a tax is calculated is called a tax base CENTURY 21 ACCOUNTING © Thomson/South-Western LESSON 12 -2

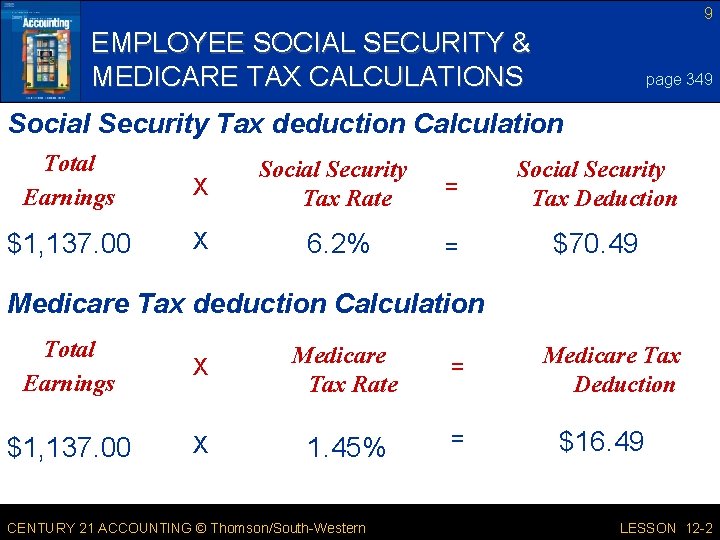

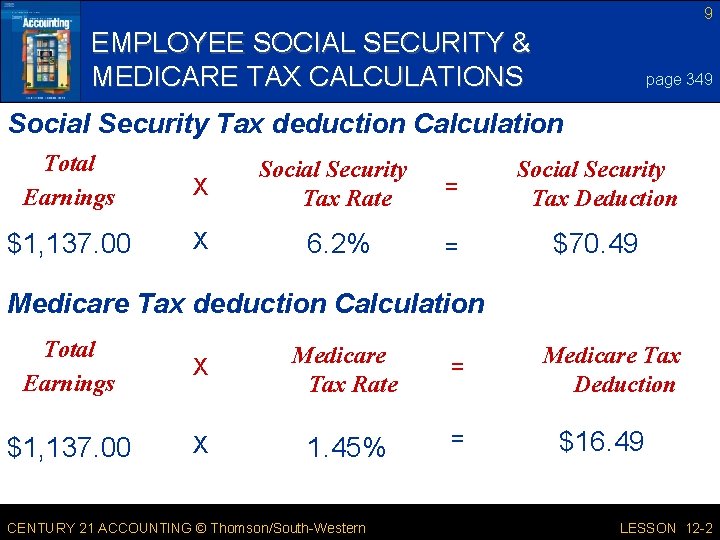

9 EMPLOYEE SOCIAL SECURITY & MEDICARE TAX CALCULATIONS page 349 Social Security Tax deduction Calculation Total Earnings $1, 137. 00 X Social Security Tax Rate = Social Security Tax Deduction X 6. 2% = $70. 49 Medicare Tax deduction Calculation Total Earnings X Medicare Tax Rate = $1, 137. 00 X 1. 45% = CENTURY 21 ACCOUNTING © Thomson/South-Western Medicare Tax Deduction $16. 49 LESSON 12 -2

10 TERMS REVIEW n n n page 350 payroll taxes withholding allowance social security tax Medicare tax base CENTURY 21 ACCOUNTING © Thomson/South-Western LESSON 12 -2