Lecture Note 2 Dividend Policy Corporate Finance Lecture

- Slides: 57

Lecture Note 2 Dividend Policy Corporate Finance Lecture Note 2 1

What is in This Note? • • • Overview of Types of Dividends Overview of Forms of Dividends Overview of Dividend Policies Overview of Real World Dividend Decisions Reference: Chapter 18 of RWJJ, Chapter 16 of BMA Corporate Finance Lecture Note 2 2

Roadmap n Understand dividend types and how they are paid n Understand why share repurchases are an alternative to dividends n Understand dividend polices n Understand real world dividend decisions Corporate Finance Lecture Note 2 3

Types of dividends Corporate Finance Lecture Note 2 4

Different Types of Dividends • Many companies pay a regular cash dividend. – Public companies often pay quarterly. – Sometimes firms will pay an extra cash dividend. – The extreme case would be a liquidating dividend. • Companies will often declare stock dividends. – No cash leaves the firm. – The firm increases the number of shares outstanding. Corporate Finance Lecture Note 2 5

Standard Method of Cash Dividend - Payment of cash by the firm to its shareholders. Ex-Dividend Date (除息日) - Date that determines whether a stockholder is entitled to a dividend payment; anyone holding stock immediately before this date is entitled to a dividend. Record Date – Date on which company determines existing shareholders. Corporate Finance Lecture Note 2 6

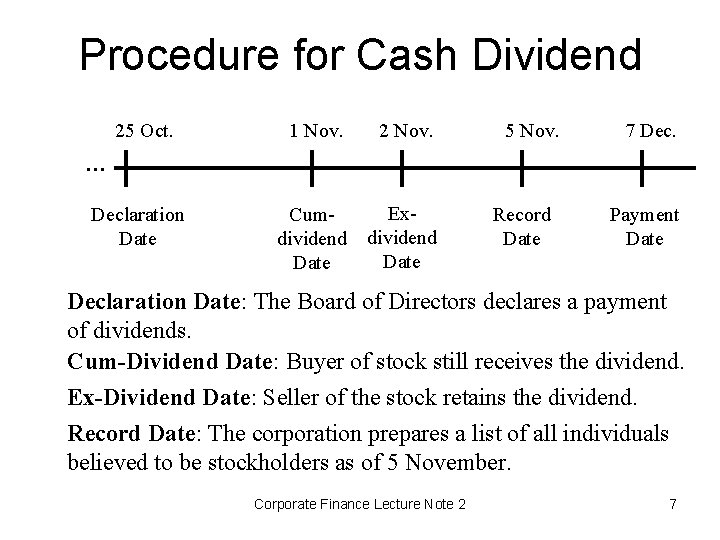

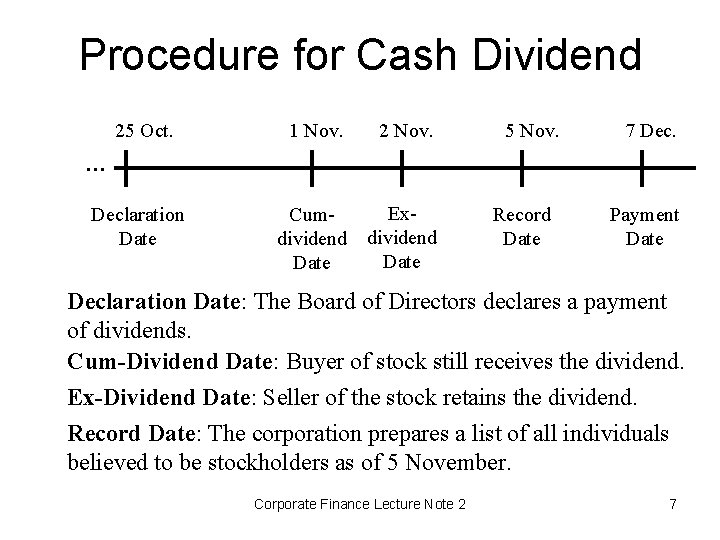

Procedure for Cash Dividend 25 Oct. 1 Nov. 2 Nov. Cumdividend Date Exdividend Date 5 Nov. 7 Dec. … Declaration Date Record Date Payment Date Declaration Date: The Board of Directors declares a payment of dividends. Cum-Dividend Date: Buyer of stock still receives the dividend. Ex-Dividend Date: Seller of the stock retains the dividend. Record Date: The corporation prepares a list of all individuals believed to be stockholders as of 5 November. Corporate Finance Lecture Note 2 7

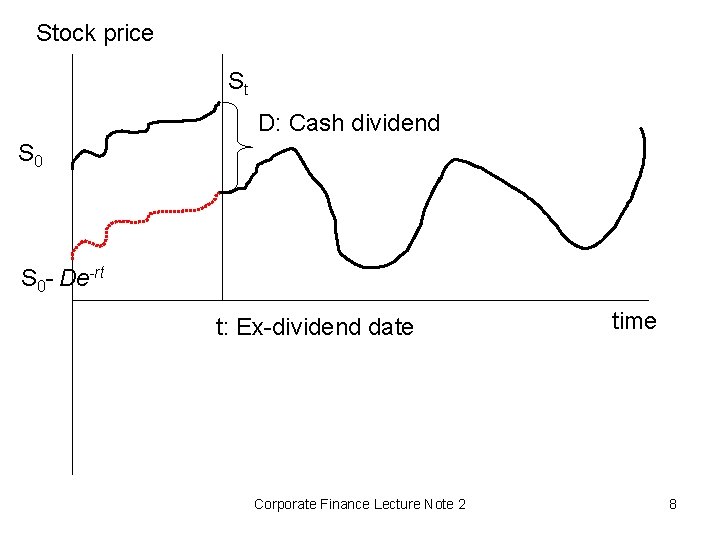

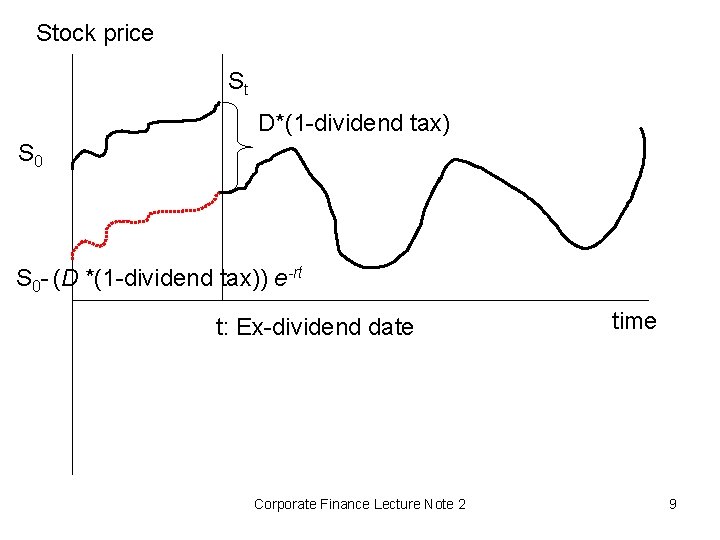

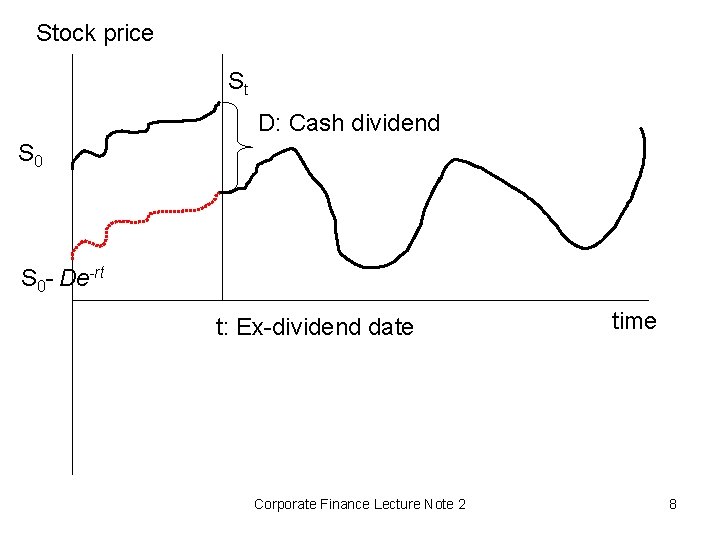

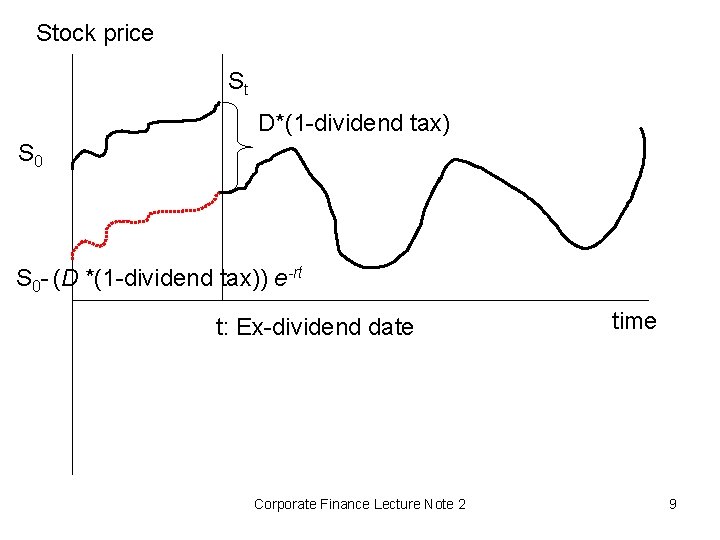

Stock price St D: Cash dividend S 0 - De-rt t: Ex-dividend date Corporate Finance Lecture Note 2 time 8

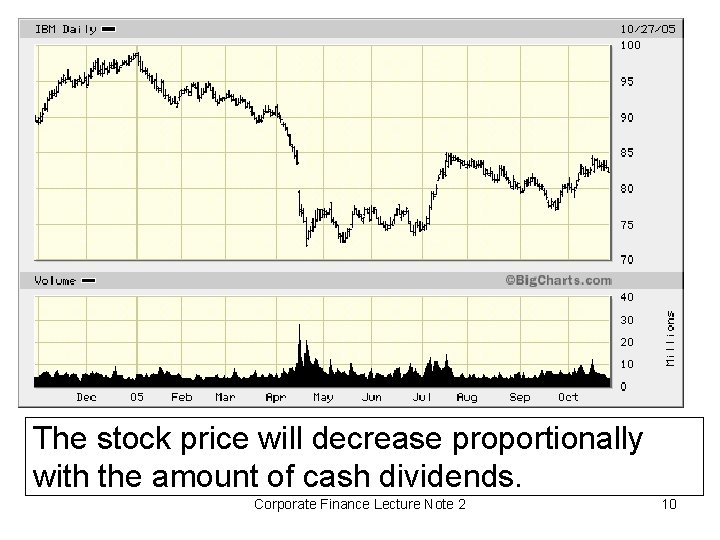

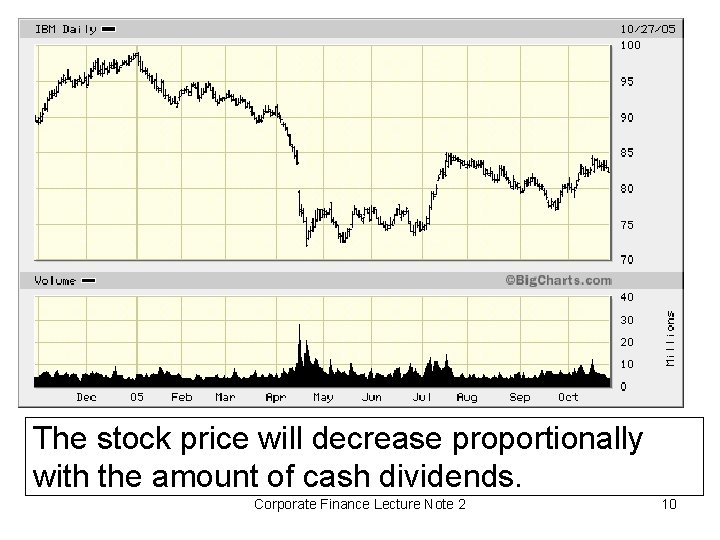

Stock price St D*(1 -dividend tax) S 0 - (D *(1 -dividend tax)) e-rt t: Ex-dividend date Corporate Finance Lecture Note 2 time 9

The stock price will decrease proportionally with the amount of cash dividends. Corporate Finance Lecture Note 2 10

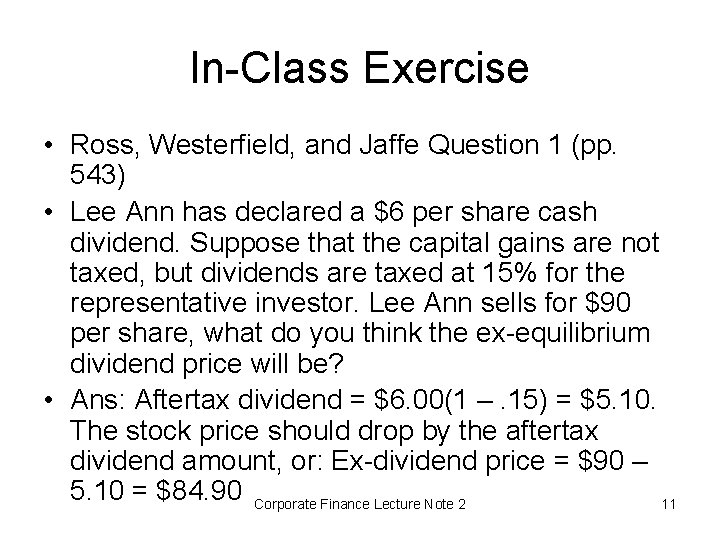

In-Class Exercise • Ross, Westerfield, and Jaffe Question 1 (pp. 543) • Lee Ann has declared a $6 per share cash dividend. Suppose that the capital gains are not taxed, but dividends are taxed at 15% for the representative investor. Lee Ann sells for $90 per share, what do you think the ex-equilibrium dividend price will be? • Ans: Aftertax dividend = $6. 00(1 –. 15) = $5. 10. The stock price should drop by the aftertax dividend amount, or: Ex-dividend price = $90 – 5. 10 = $84. 90 Corporate Finance Lecture Note 2 11

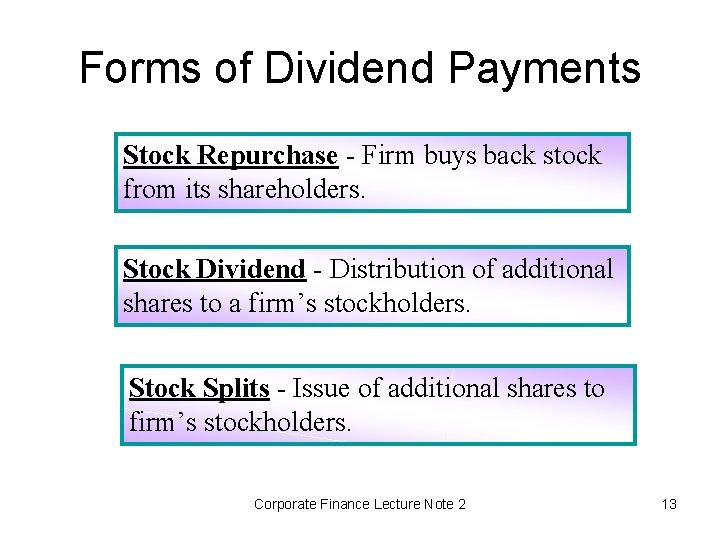

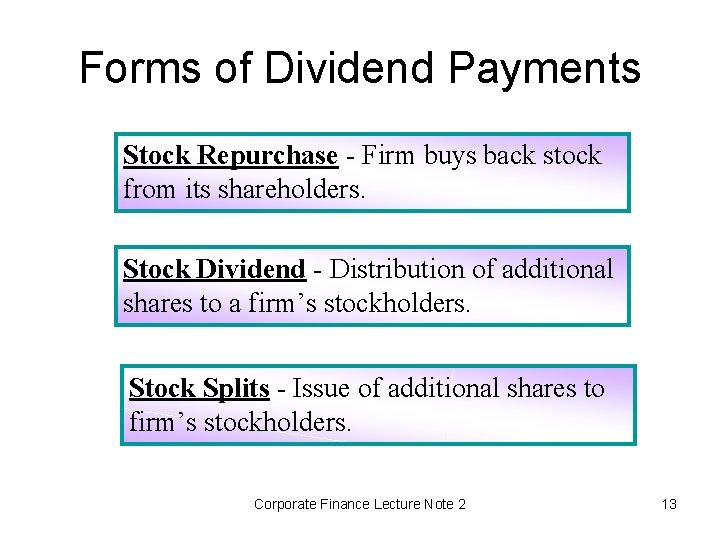

Forms of Dividends Corporate Finance Lecture Note 2 12

Forms of Dividend Payments Stock Repurchase - Firm buys back stock from its shareholders. Stock Dividend - Distribution of additional shares to a firm’s stockholders. Stock Splits - Issue of additional shares to firm’s stockholders. Corporate Finance Lecture Note 2 13

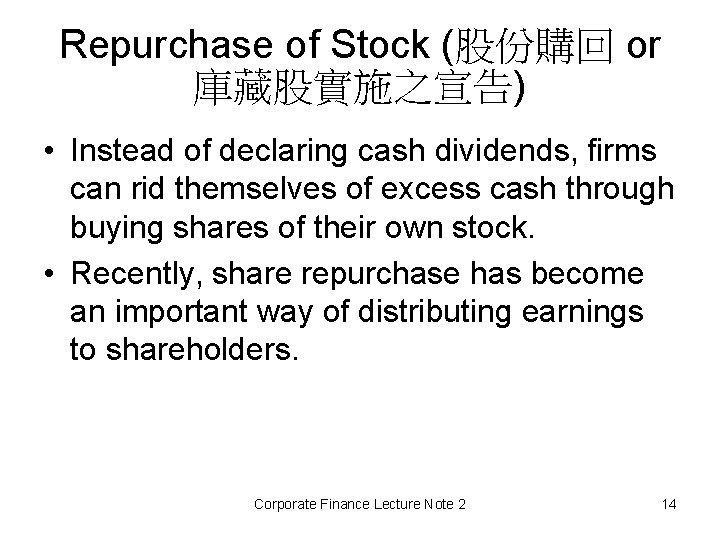

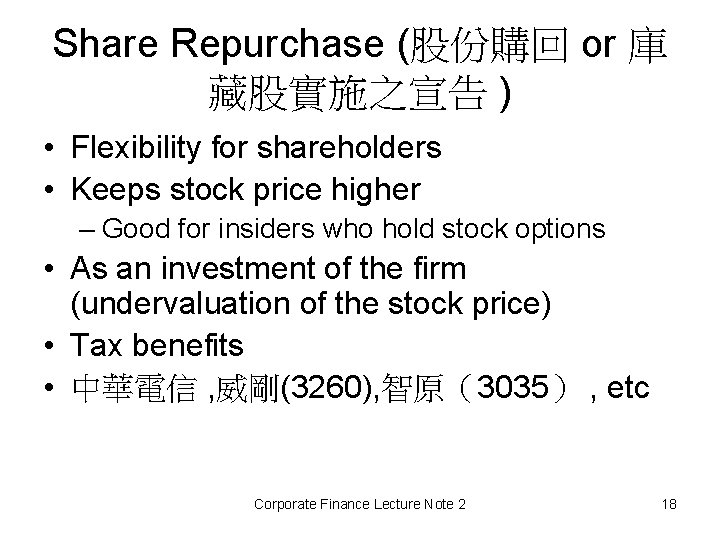

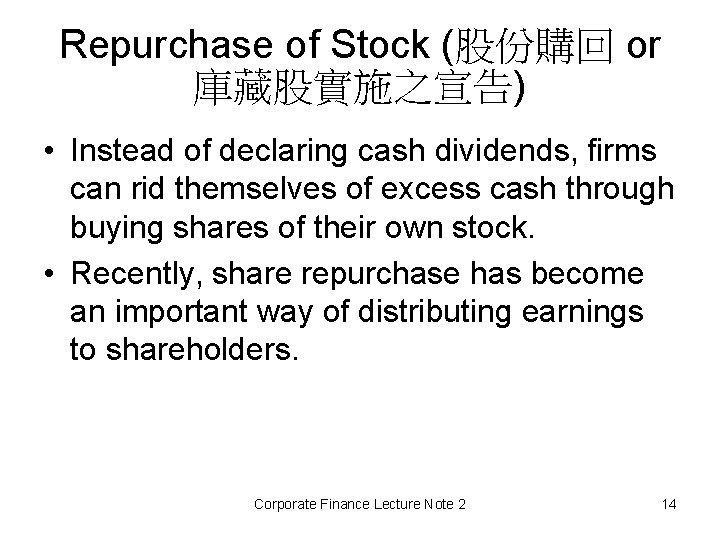

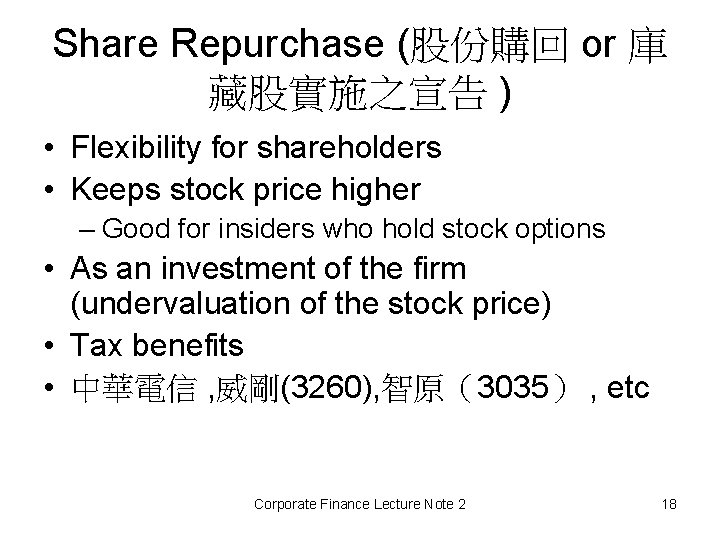

Repurchase of Stock (股份購回 or 庫藏股實施之宣告) • Instead of declaring cash dividends, firms can rid themselves of excess cash through buying shares of their own stock. • Recently, share repurchase has become an important way of distributing earnings to shareholders. Corporate Finance Lecture Note 2 14

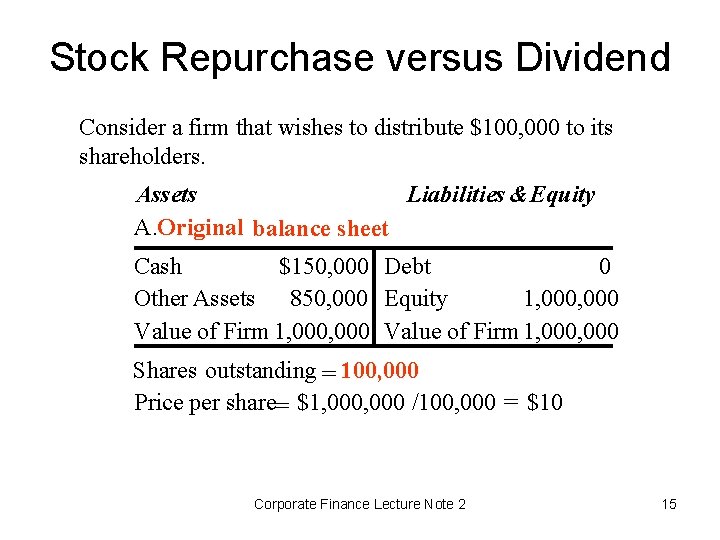

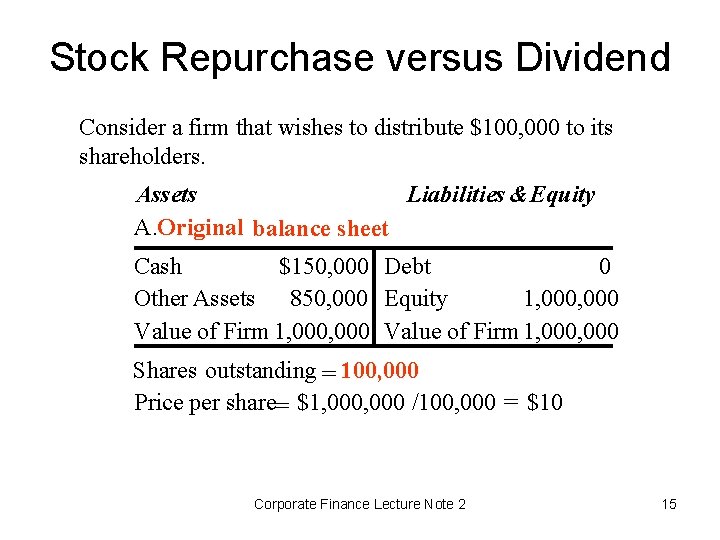

Stock Repurchase versus Dividend Consider a firm that wishes to distribute $100, 000 to its shareholders. Assets Liabilities & Equity A. Original balance sheet Cash $150, 000 Debt 0 Other Assets 850, 000 Equity 1, 000, 000 Value of Firm 1, 000 Shares outstanding = 100, 000 Price per share= $1, 000 /100, 000 = $10 Corporate Finance Lecture Note 2 15

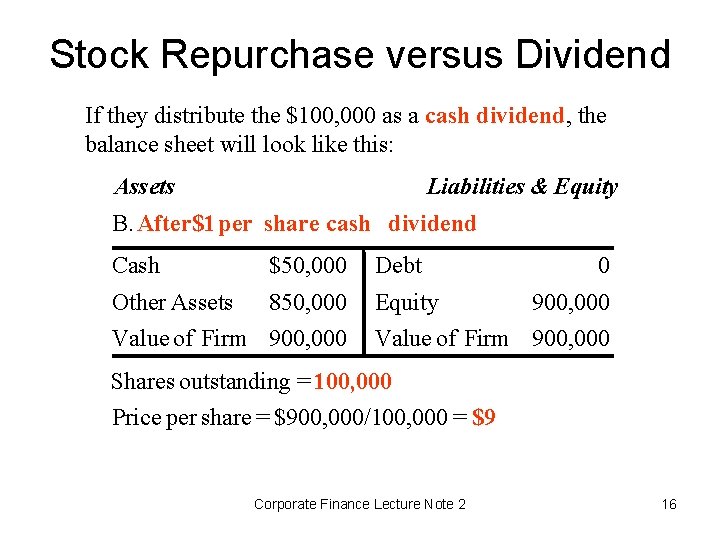

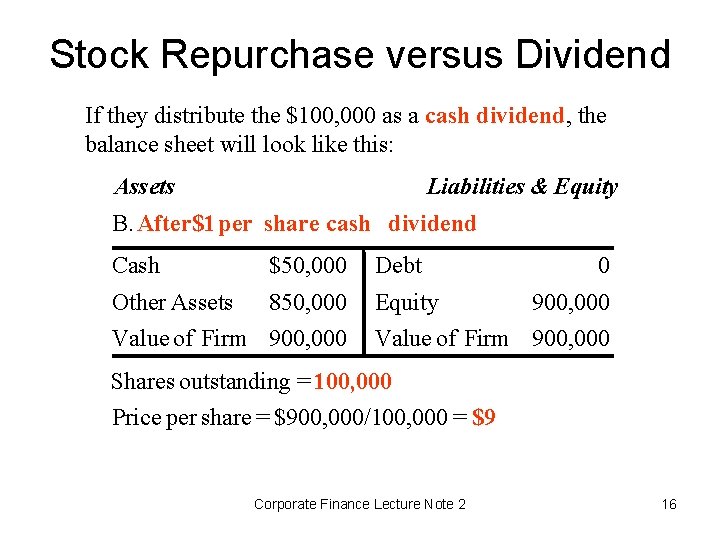

Stock Repurchase versus Dividend If they distribute the $100, 000 as a cash dividend, the balance sheet will look like this: Assets Liabilities & Equity B. After$1 per share cash dividend Cash $50, 000 Debt Other Assets 850, 000 Equity Value of Firm 900, 000 0 900, 000 Value of Firm 900, 000 Shares outstanding = 100, 000 Price per share = $900, 000/100, 000 = $9 Corporate Finance Lecture Note 2 16

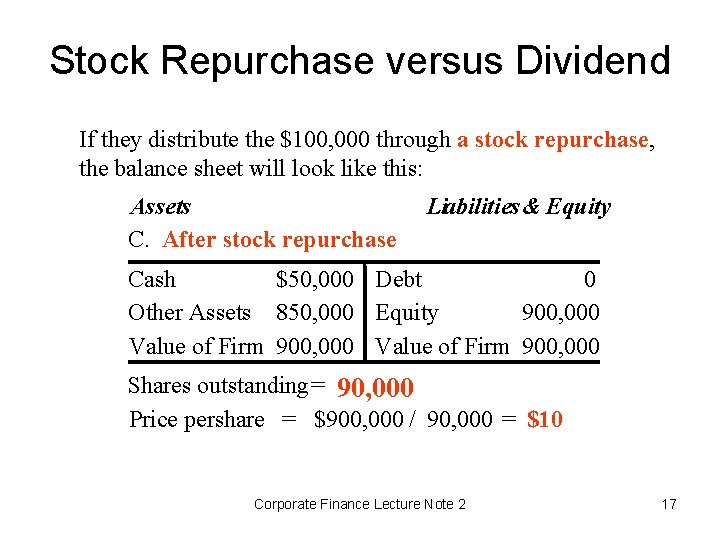

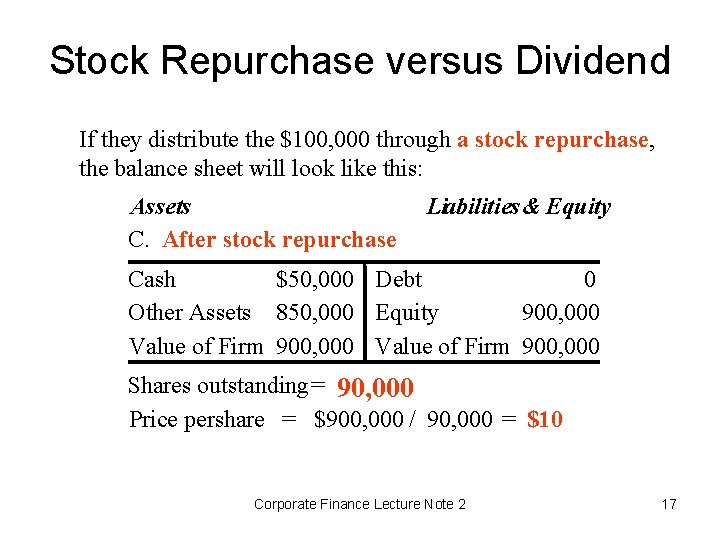

Stock Repurchase versus Dividend If they distribute the $100, 000 through a stock repurchase, the balance sheet will look like this: Assets C. After stock repurchase Liabilities & Equity Cash $50, 000 Debt 0 Other Assets 850, 000 Equity 900, 000 Value of Firm 900, 000 Shares outstanding= 90, 000 Price pershare = $900, 000 / 90, 000 = $10 Corporate Finance Lecture Note 2 17

Share Repurchase (股份購回 or 庫 藏股實施之宣告 ) • Flexibility for shareholders • Keeps stock price higher – Good for insiders who hold stock options • As an investment of the firm (undervaluation of the stock price) • Tax benefits • 中華電信 , 威剛(3260), 智原(3035) , etc Corporate Finance Lecture Note 2 18

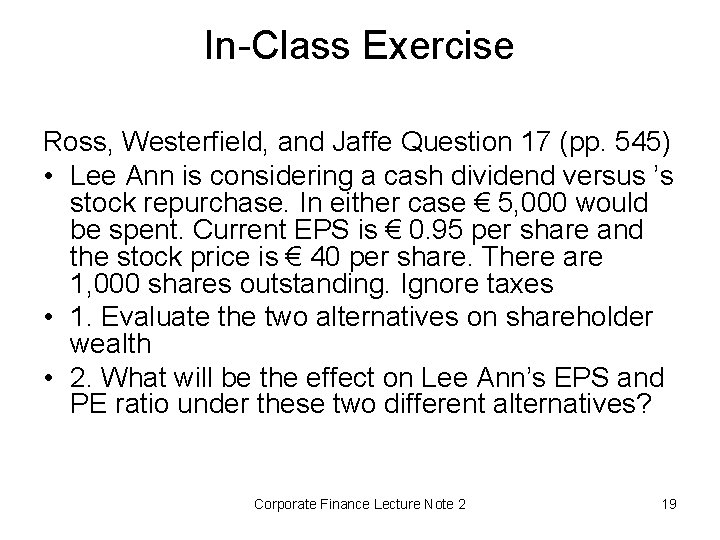

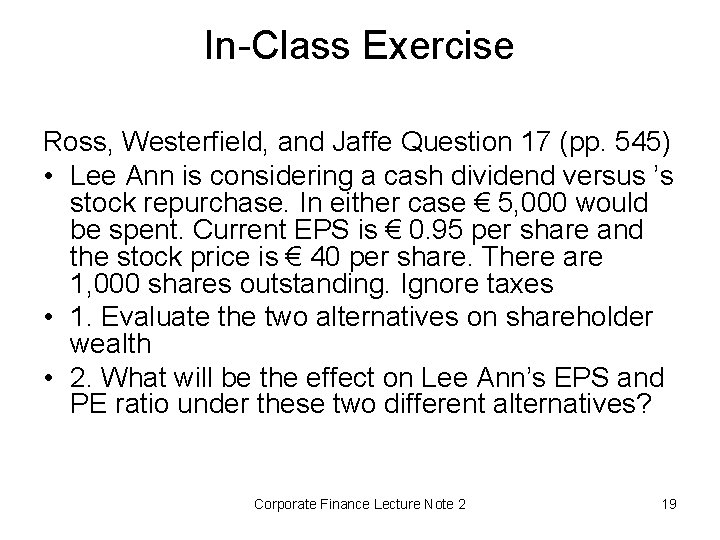

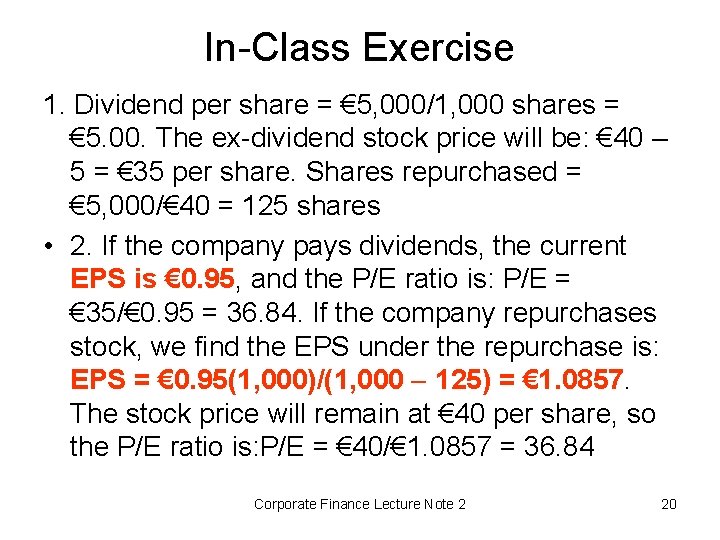

In-Class Exercise Ross, Westerfield, and Jaffe Question 17 (pp. 545) • Lee Ann is considering a cash dividend versus ’s stock repurchase. In either case € 5, 000 would be spent. Current EPS is € 0. 95 per share and the stock price is € 40 per share. There are 1, 000 shares outstanding. Ignore taxes • 1. Evaluate the two alternatives on shareholder wealth • 2. What will be the effect on Lee Ann’s EPS and PE ratio under these two different alternatives? Corporate Finance Lecture Note 2 19

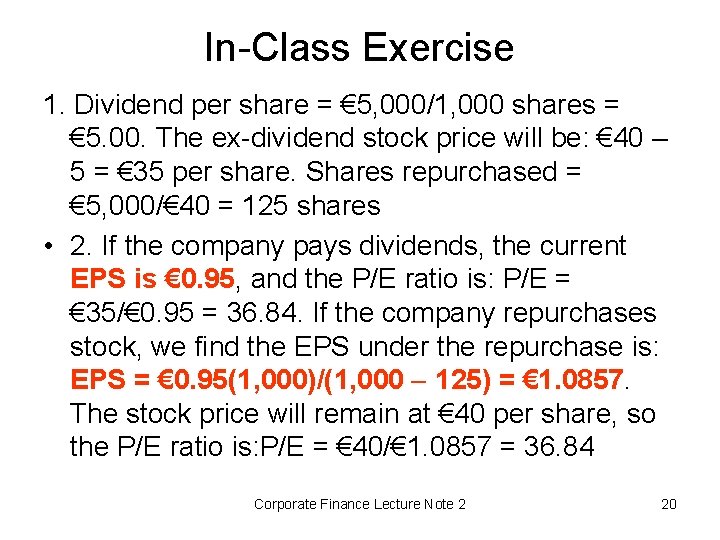

In-Class Exercise 1. Dividend per share = € 5, 000/1, 000 shares = € 5. 00. The ex-dividend stock price will be: € 40 – 5 = € 35 per share. Shares repurchased = € 5, 000/€ 40 = 125 shares • 2. If the company pays dividends, the current EPS is € 0. 95, and the P/E ratio is: P/E = € 35/€ 0. 95 = 36. 84. If the company repurchases stock, we find the EPS under the repurchase is: EPS = € 0. 95(1, 000)/(1, 000 125) = € 1. 0857. The stock price will remain at € 40 per share, so the P/E ratio is: P/E = € 40/€ 1. 0857 = 36. 84 Corporate Finance Lecture Note 2 20

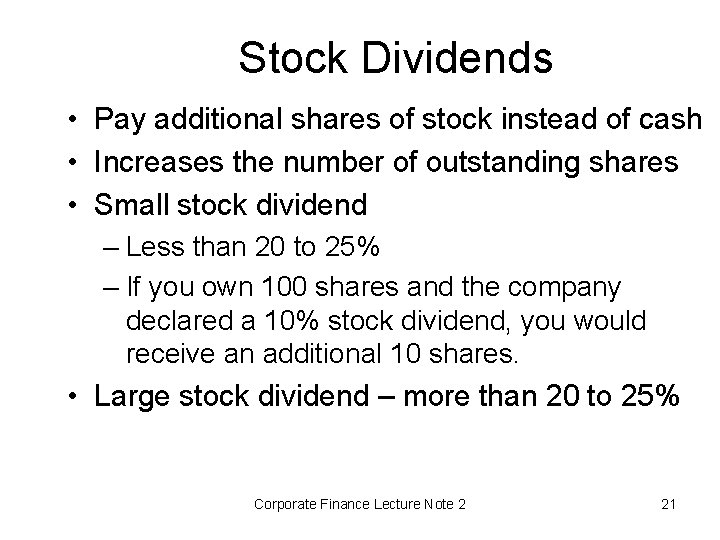

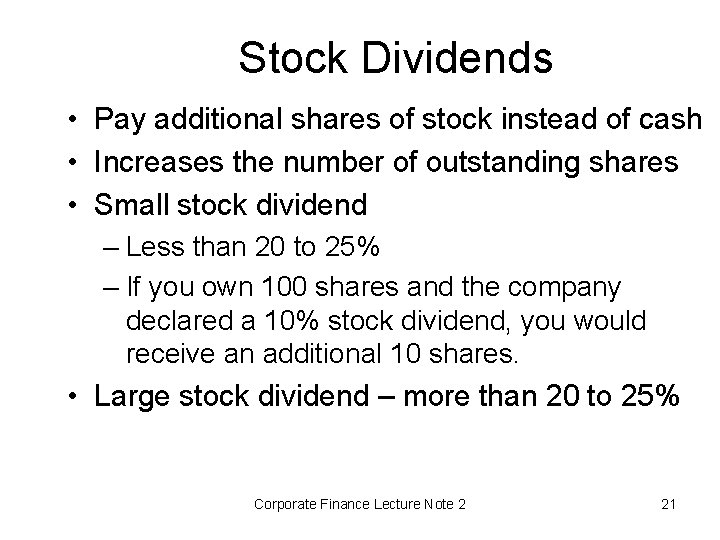

Stock Dividends • Pay additional shares of stock instead of cash • Increases the number of outstanding shares • Small stock dividend – Less than 20 to 25% – If you own 100 shares and the company declared a 10% stock dividend, you would receive an additional 10 shares. • Large stock dividend – more than 20 to 25% Corporate Finance Lecture Note 2 21

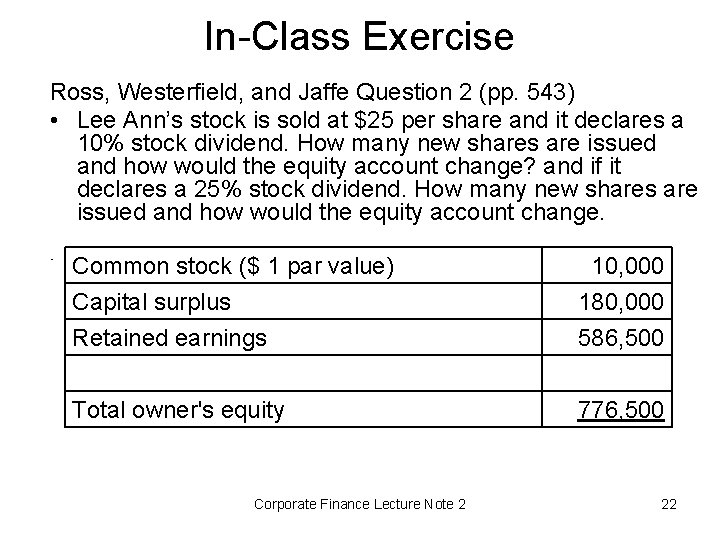

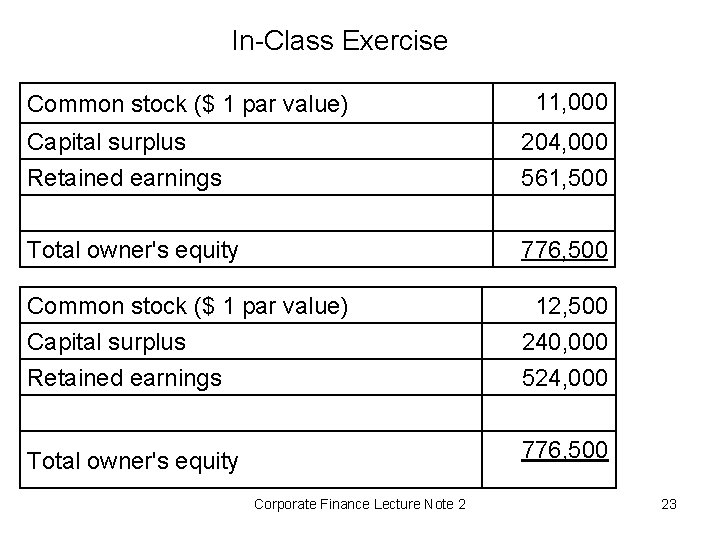

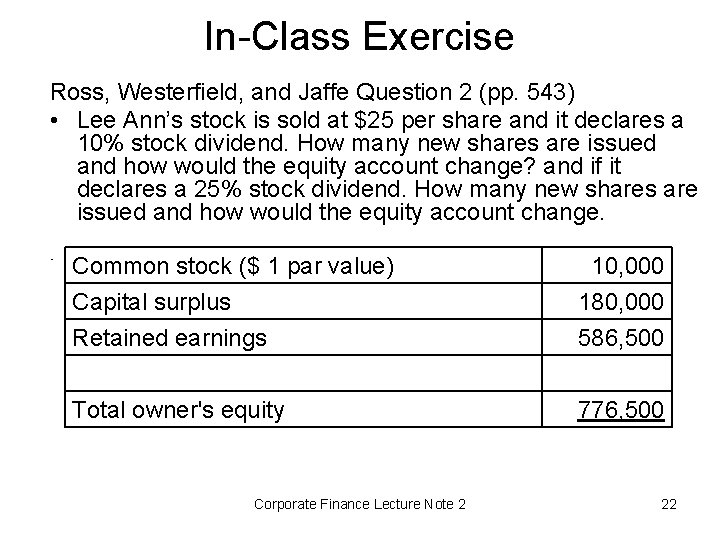

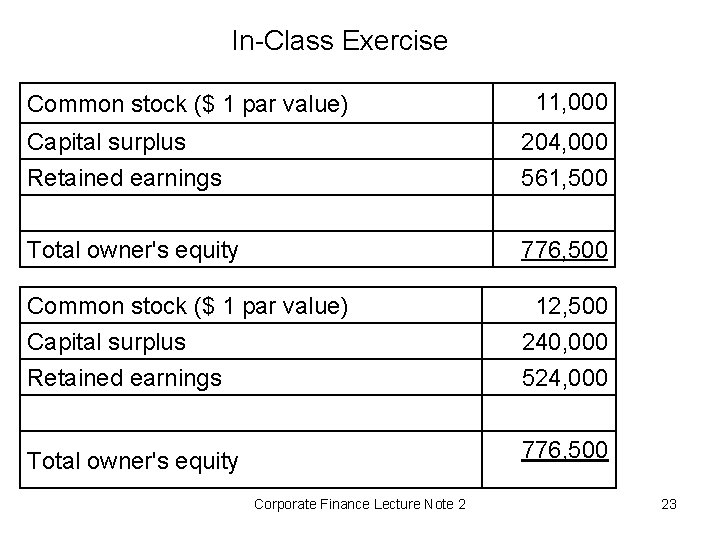

In-Class Exercise Ross, Westerfield, and Jaffe Question 2 (pp. 543) • Lee Ann’s stock is sold at $25 per share and it declares a 10% stock dividend. How many new shares are issued and how would the equity account change? and if it declares a 25% stock dividend. How many new shares are issued and how would the equity account change. • Common stock ($ 1 par value) Capital surplus Retained earnings 10, 000 180, 000 586, 500 Total owner's equity 776, 500 Corporate Finance Lecture Note 2 22

In-Class Exercise Common stock ($ 1 par value) 11, 000 Capital surplus Retained earnings 204, 000 561, 500 Total owner's equity 776, 500 Common stock ($ 1 par value) Capital surplus Retained earnings 12, 500 240, 000 524, 000 Total owner's equity 776, 500 Corporate Finance Lecture Note 2 23

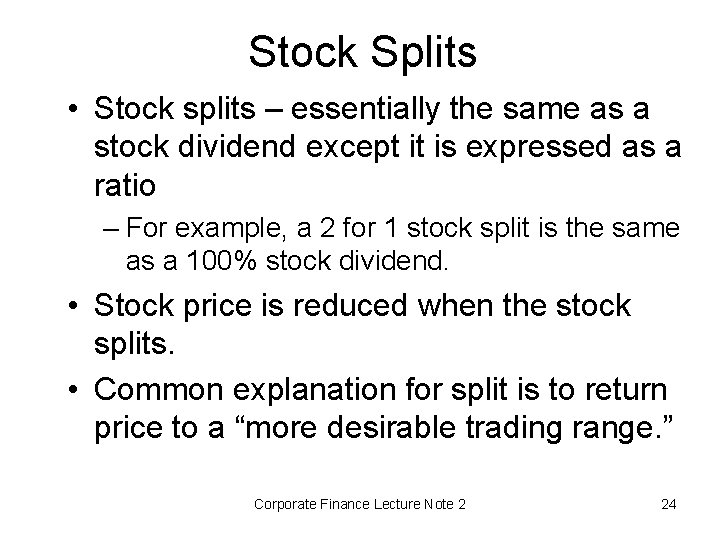

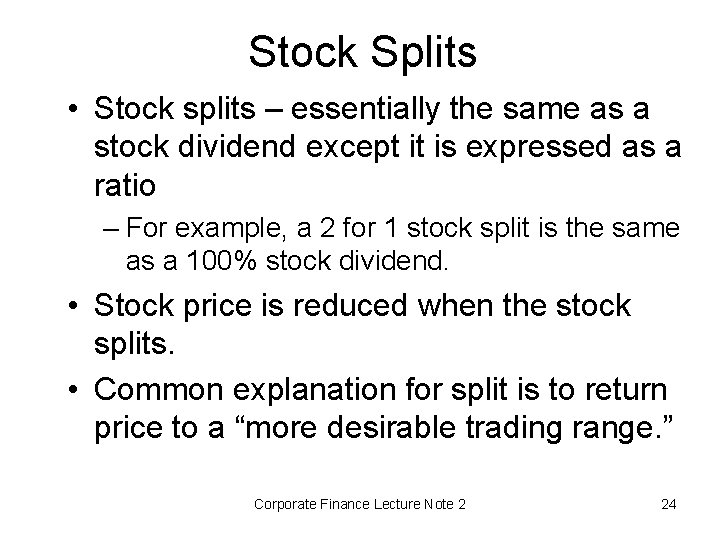

Stock Splits • Stock splits – essentially the same as a stock dividend except it is expressed as a ratio – For example, a 2 for 1 stock split is the same as a 100% stock dividend. • Stock price is reduced when the stock splits. • Common explanation for split is to return price to a “more desirable trading range. ” Corporate Finance Lecture Note 2 24

Reverse Stock Splits • Stock price is increased when there is a reverse stock split. • Common explanation for reverse split is to return price to a “more desirable trading range. ” Corporate Finance Lecture Note 2 26

In-Class Exercise Ross, Westerfield, and Jaffe Question 3 (pp. 543) • Lee Ann’s stock is sold at $25 per share and it declares a four-for-one stock split. There are 10, 000 shares outstanding. How many shares are outstanding now? and if it declares a one-for -four reverse stock split. How many shares are outstanding now? • Ans: four-for-one stock split, New shares outstanding = 10, 000(4/1) = 40, 000. one-for-four reverse stock split, New shares outstanding = 10, 000(1/4) = 2, 500. Corporate Finance Lecture Note 2 27

Dividend Policy Corporate Finance Lecture Note 2 28

What is “dividend policy”? • It’s the decision to pay out earnings versus retaining and reinvesting them. Includes these elements: 1. 2. 3. 4. High or low payout? Stable or irregular dividends? How frequent? Do we announce the policy? Corporate Finance Lecture Note 2 29

Roadmap n Dividend Irrelevance Theory n Tax Preference Theory n Dividends Preference Theory n The Clientele Effect Corporate Finance Lecture Note 2 30

Dividend Irrelevance Theory Corporate Finance Lecture Note 2 31

Dividend Irrelevance Theory • dividend policy is irrelevant in the sense that it cannot affect shareholder value • Investors are indifferent between dividends and retention-generated capital gains. If they want cash, they can sell stock. If they don’t want cash, they can use dividends to buy stock. • Modigliani-Miller support irrelevance. • Theory is based on no taxes or brokerage costs, hence may not be true Corporate Finance Lecture Note 2 32

The Irrelevance of Dividend Policy • A compelling case can be made that dividend policy is irrelevant in the sense that it cannot affect shareholder value. • Since investors do not need dividends to convert shares to cash; they will not pay higher prices for firms with higher dividends. • In other words, dividend policy will have no impact on the value of the firm because investors can create whatever income stream they prefer by using homemade dividends. Corporate Finance Lecture Note 2 33

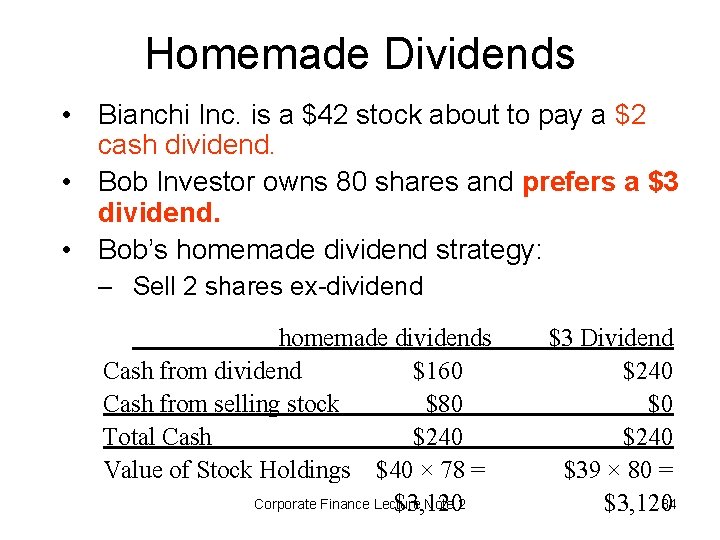

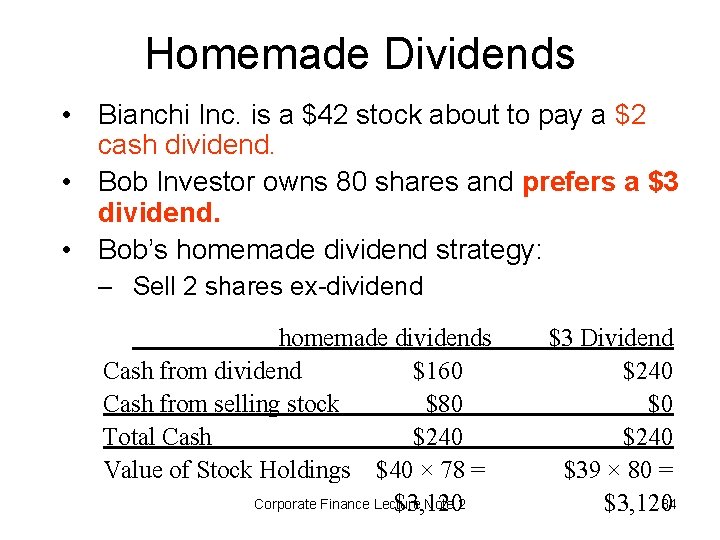

Homemade Dividends • Bianchi Inc. is a $42 stock about to pay a $2 cash dividend. • Bob Investor owns 80 shares and prefers a $3 dividend. • Bob’s homemade dividend strategy: – Sell 2 shares ex-dividend homemade dividends Cash from dividend $160 Cash from selling stock $80 Total Cash $240 Value of Stock Holdings $40 × 78 = Corporate Finance Lecture Note 2 $3, 120 $3 Dividend $240 $0 $240 $39 × 80 = $3, 12034

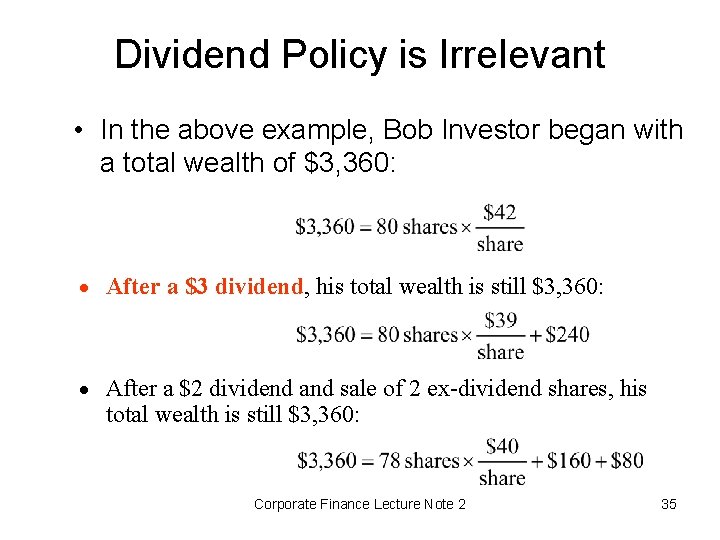

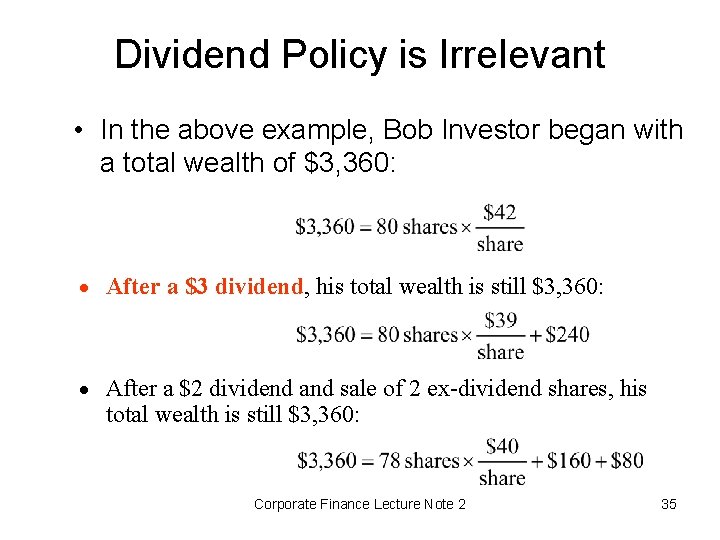

Dividend Policy is Irrelevant • In the above example, Bob Investor began with a total wealth of $3, 360: · After a $3 dividend, his total wealth is still $3, 360: · After a $2 dividend and sale of 2 ex-dividend shares, his total wealth is still $3, 360: Corporate Finance Lecture Note 2 35

Dividends and Investment Policy • Firms should never forgo positive NPV projects to increase a dividend (or to pay a dividend for the first time). • Recall that one of the assumptions underlying the dividend-irrelevance argument is: “The investment policy of the firm is set ahead of time and is not altered by changes in dividend policy. ” Corporate Finance Lecture Note 2 36

Tax Preference Theory Corporate Finance Lecture Note 2 37

Personal Taxes and Dividends • To get the result that dividend policy is irrelevant, we needed three assumptions: – No taxes – No transactions costs – No uncertainty • In the United States, both cash dividends and capital gains are taxed at a maximum rate of 15 percent. • Since capital gains can be deferred, the tax rate on dividends is greater than the effective rate on capital gains. • This could cause investors to prefer firms with low cash dividends. Corporate Finance Lecture Note 2 38

Firms without Sufficient Cash Investment Bankers Cash: stock issue Firm The direct costs of stock issuance will add to this effect. Stock Holders Cash: dividends Taxes Gov. In a world of personal taxes, firms should not issue stock to pay a dividend. Corporate Finance Lecture Note 2 39

Firms with Sufficient Cash • The above argument does not necessarily apply to firms with excess cash. • Consider a firm that has $1 million in cash after selecting all available positive NPV projects. – Select additional capital budgeting projects (by assumption, these are negative NPV). – Acquire other companies – Purchase financial assets – Repurchase shares Corporate Finance Lecture Note 2 40

Taxes and Dividends • In the presence of personal taxes: 1. A firm should not issue stock to pay a dividend. 2. Managers have an incentive to seek alternative uses for funds to reduce dividends. 3. Though personal taxes mitigate against the payment of dividends, these taxes are not sufficient to lead firms to eliminate all dividends. Corporate Finance Lecture Note 2 41

Dividends Preference Theory Corporate Finance Lecture Note 2 42

Real-World Factors Favoring High Dividends • Desire for Current Income: Retired investors • Behavioral Finance – It forces investors to be disciplined. • Agency Costs – High dividends reduce free cash flow. Corporate Finance Lecture Note 2 45

Behavioral Finance-Dividends • A natural rule people might create to prevent themselves from over consuming their wealth is “only consume the dividend, but don’t touch the portfolio capital”. • In other words, people may like dividends because dividends help them surmount self-control problems through the creation of simple rules. Corporate Finance Lecture Note 2 46

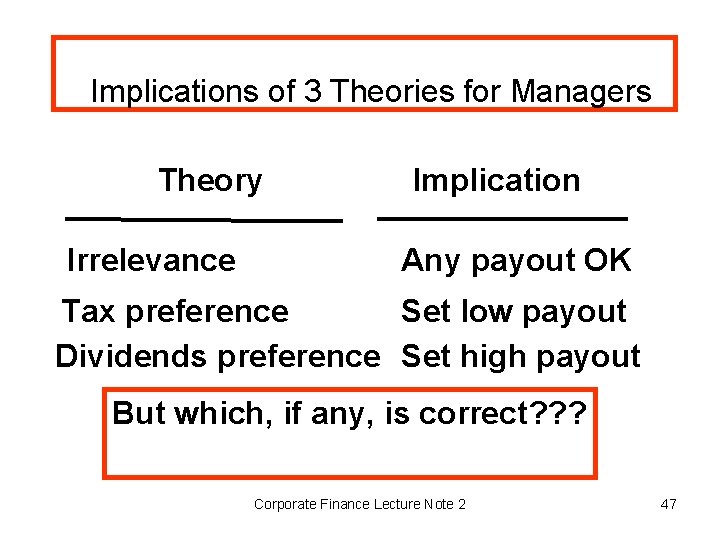

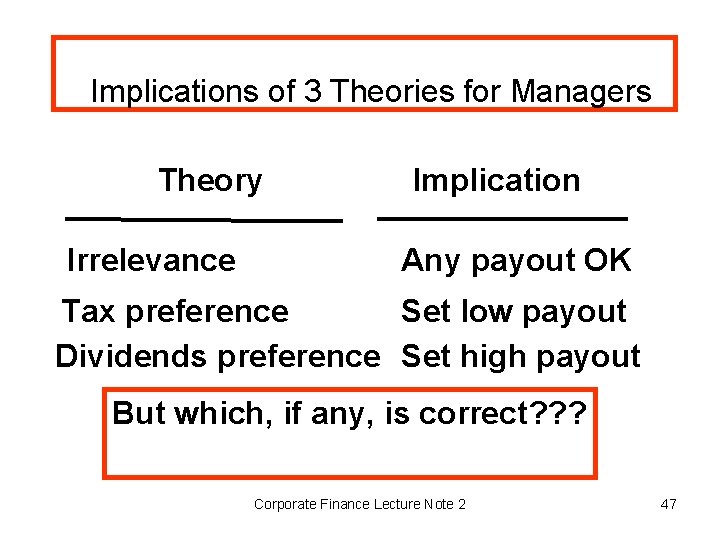

Implications of 3 Theories for Managers Theory Irrelevance Implication Any payout OK Tax preference Set low payout Dividends preference Set high payout But which, if any, is correct? ? ? Corporate Finance Lecture Note 2 47

Which theory is most correct? • Empirical testing has not been able to determine which theory, if any, is correct. • Thus, managers use judgment when setting policy. • Analysis is used, but it must be applied with judgment. Corporate Finance Lecture Note 2 48

The Clientele Effect Corporate Finance Lecture Note 2 49

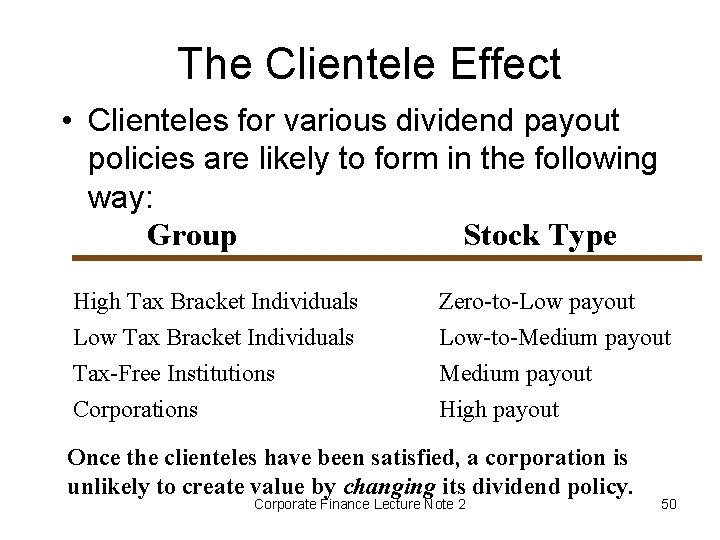

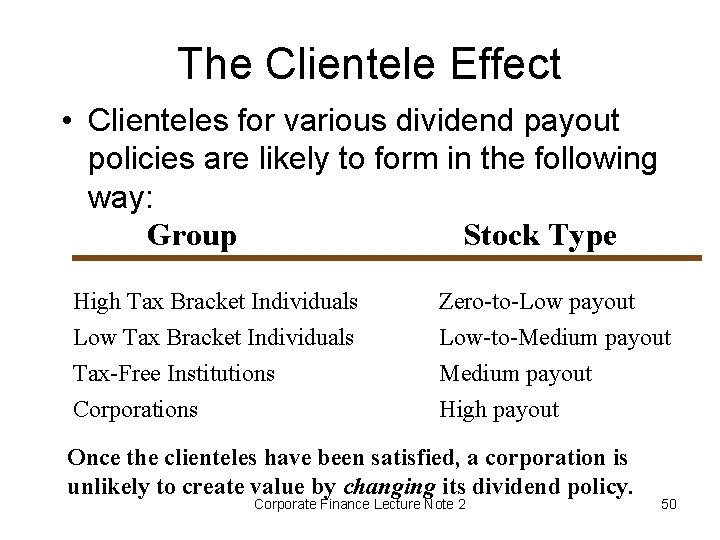

The Clientele Effect • Clienteles for various dividend payout policies are likely to form in the following way: Group Stock Type High Tax Bracket Individuals Low Tax Bracket Individuals Tax-Free Institutions Corporations Zero-to-Low payout Low-to-Medium payout High payout Once the clienteles have been satisfied, a corporation is unlikely to create value by changing its dividend policy. Corporate Finance Lecture Note 2 50

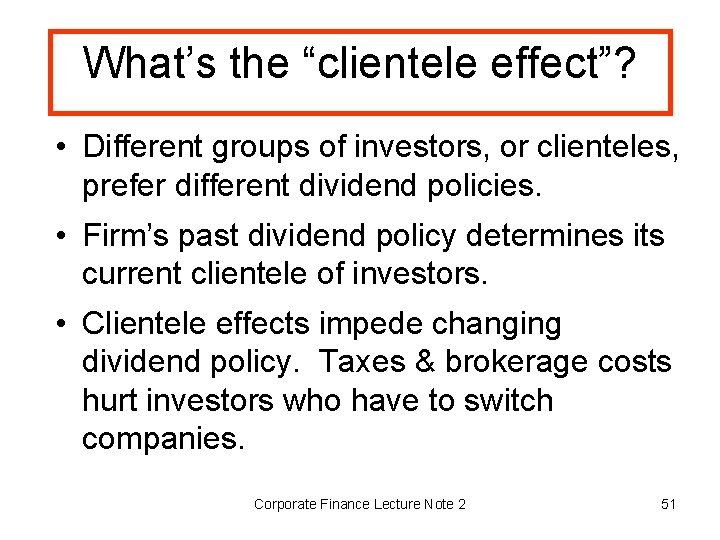

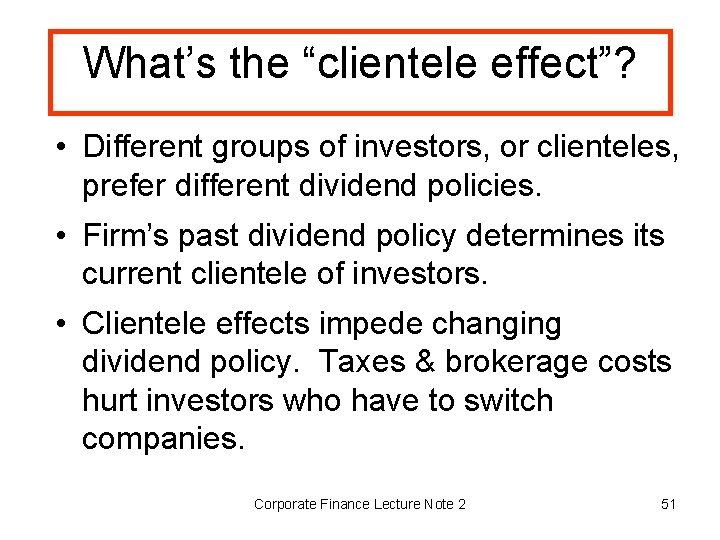

What’s the “clientele effect”? • Different groups of investors, or clienteles, prefer different dividend policies. • Firm’s past dividend policy determines its current clientele of investors. • Clientele effects impede changing dividend policy. Taxes & brokerage costs hurt investors who have to switch companies. Corporate Finance Lecture Note 2 51

The Dividend Decision Corporate Finance Lecture Note 2 52

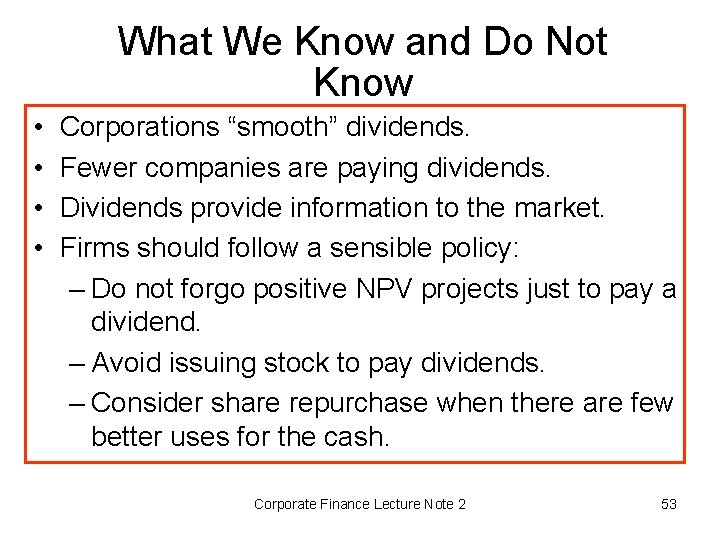

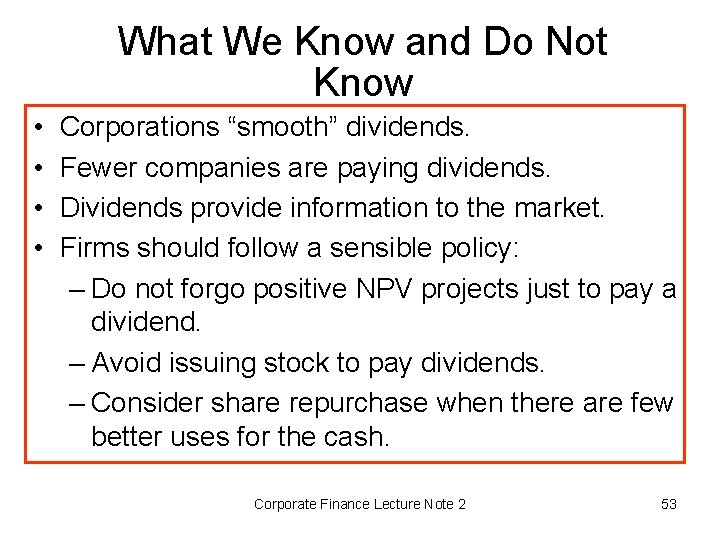

What We Know and Do Not Know • • Corporations “smooth” dividends. Fewer companies are paying dividends. Dividends provide information to the market. Firms should follow a sensible policy: – Do not forgo positive NPV projects just to pay a dividend. – Avoid issuing stock to pay dividends. – Consider share repurchase when there are few better uses for the cash. Corporate Finance Lecture Note 2 53

The Dividend Decision: Lintner’s “Stylized Facts” (How Dividends are Determined) 1. Firms have longer term target dividend payout ratios. 2. Managers focus more on dividend changes than on absolute levels. 3. Dividends changes follow shifts in long-run, sustainable levels of earnings rather than short-run changes in earnings. 4. Managers are reluctant to make dividend changes that might have to be reversed. 5. Firms repurchase stock when they have accumulated a large amount of unwanted cash or wish to change their capital structure by replacing equity with debt. Corporate Finance Lecture Note 2 54

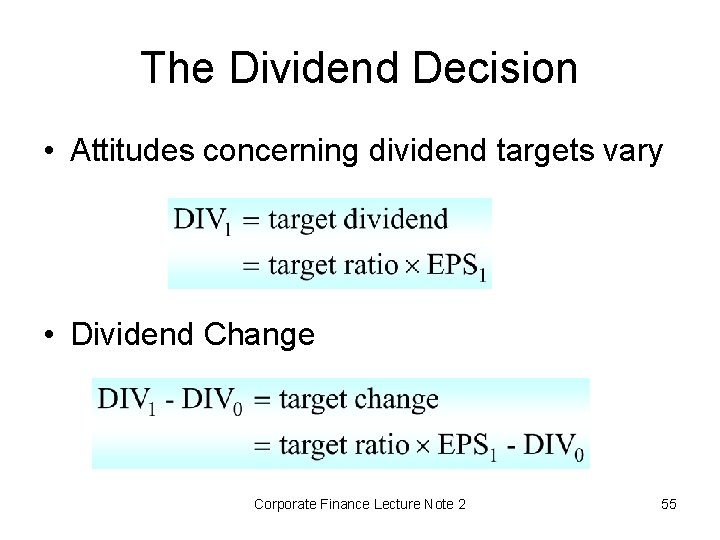

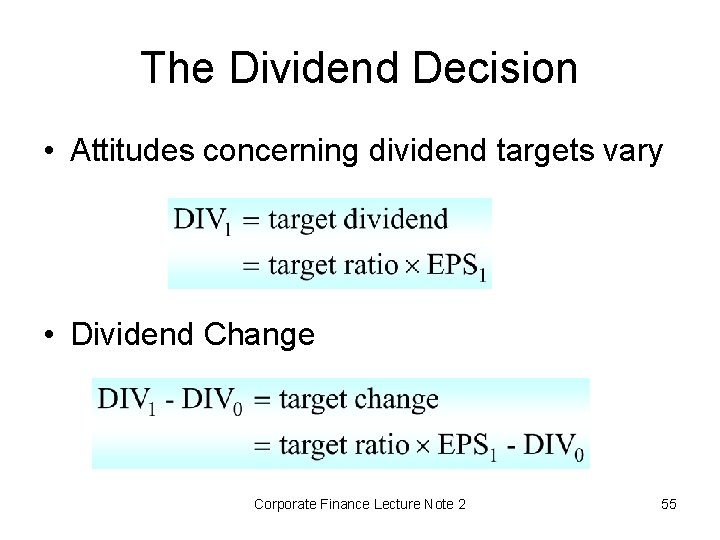

The Dividend Decision • Attitudes concerning dividend targets vary • Dividend Change Corporate Finance Lecture Note 2 55

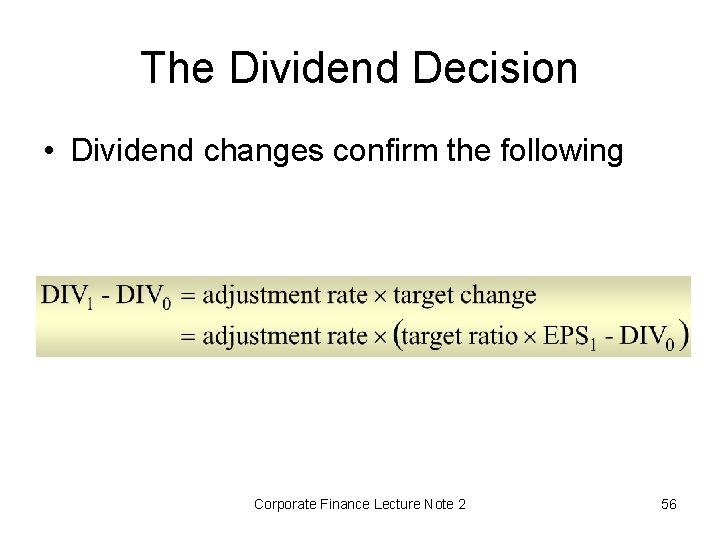

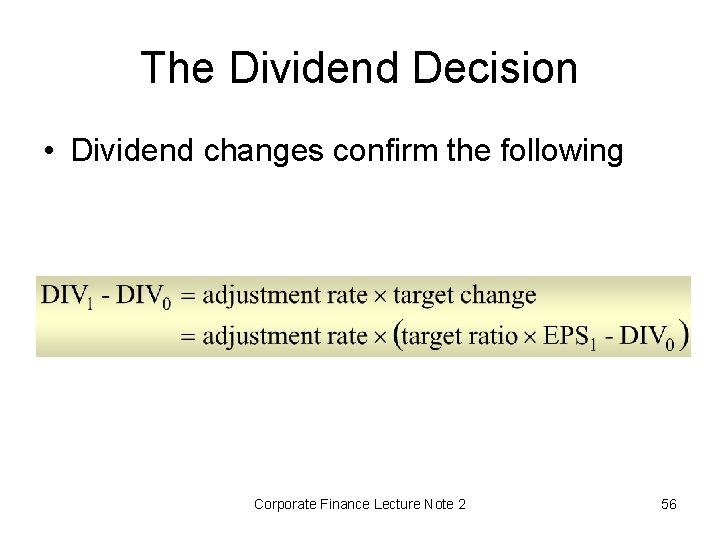

The Dividend Decision • Dividend changes confirm the following Corporate Finance Lecture Note 2 56

Conclusion • What are the dividend polices? • Which dividend policy favors high (low) dividend payouts? • What is the Modigliani-Miller Propositions about dividend polices? • What are the Lintner’s “Stylized Facts” about dividends decisions? Corporate Finance Lecture Note 2 57