Lecture 4 Indirect Investing Chapter 3 Indirect investing

- Slides: 9

Lecture 4 Indirect Investing Chapter 3

Indirect investing § Investing indirectly refers to the buying and selling of the shares of investment companies. § Instead of buying and selling shares themselves, inventors can give their money to investment companies that manages the money for them by investing in shares and bonds. § An investment company is a financial service organization that sells shares in itself to the public and uses the funds to invest in a portfolio of securities.

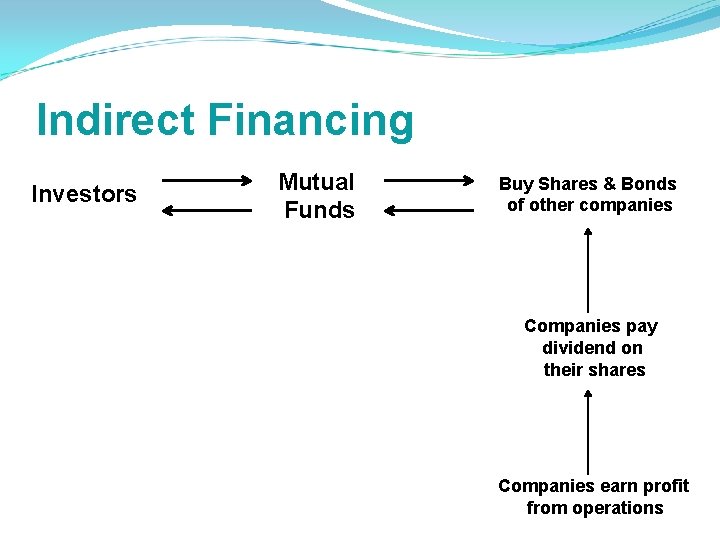

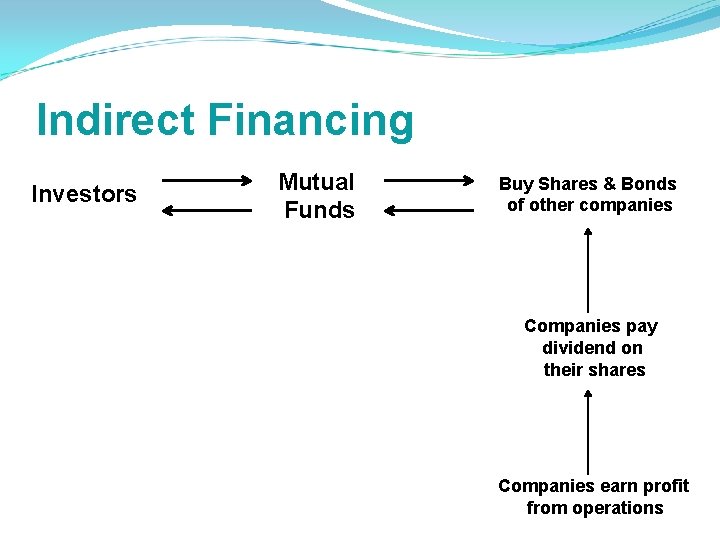

Indirect Financing Investors Mutual Funds Buy Shares & Bonds of other companies Companies pay dividend on their shares Companies earn profit from operations

Types of Investment Companies Types of investment companies: 1. Managed companies A. Closed end investment companies B. Open end investment companies 2. Unmanaged companies A. Index portfolio

Closed End Investment Company § Closed end investment company does not sell additional shares of its own stock after initial public offering. § The shares of a closed-end fund trade in the secondary markets. § Shares prices are determined by demand supply forces in the secondary market.

Advantages of Close End 1. Buying at a Discount Shares of closed end funds sometimes sell at a discount to their underlying NAV, which may give investors who buy shares at a discount the opportunity to enhance their overall investment return. The discount may not narrow over time, however, and short-term trading entails greater risks. 2. Leverage Potential Closed end fund managers can elect to issue senior securities or borrow money to leverage their fund's investments to potentially enhance yields and returns to investors, particularly with fixed income closed end funds. 3. Stable Pool of Capital With a fixed number of shares, closed end funds don't have to keep cash on hand or sell securities in a declining market to meet shareholder redemptions. Managers can remain fully invested and invest in securities with longer time horizons, which may result in higher yields and returns for investors.

Open End Investment Company § Commonly known as mutual funds. § Market capitalization of these companies change constantly as new investors buy additional shares and some existing shareholders sell back their shares to the company. § Mutual funds shares can be purchased either from the company or through a sales agent.

Net Asset value § Investors purchase new shares and redeem existing shares at the net asset value (NAV). § NAV is computed daily by calculating the total market value of the investments, subtracting liabilities and dividing it by the number of shares outstanding.

Advantages of Open End § Record Keeping − Company keeps track of capital gains, dividends, investments § Diversification and Divisibility − By pooling their money, investment companies enable investors to hold fractional shares of many different securities § Professional Management § Lower Transaction Costs