Lecture 2 on Auctions Revenue Equivalence Auctions serve

- Slides: 18

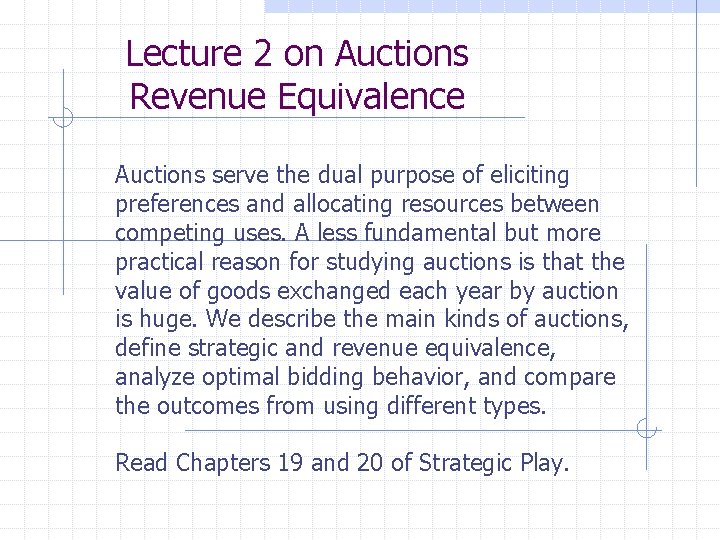

Lecture 2 on Auctions Revenue Equivalence Auctions serve the dual purpose of eliciting preferences and allocating resources between competing uses. A less fundamental but more practical reason for studying auctions is that the value of goods exchanged each year by auction is huge. We describe the main kinds of auctions, define strategic and revenue equivalence, analyze optimal bidding behavior, and compare the outcomes from using different types. Read Chapters 19 and 20 of Strategic Play.

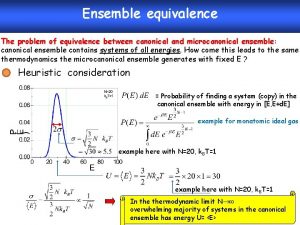

Relaxing strategic equivalence In strategically equivalent auctions, the strategic form solution strategies of the bidders, and the payoffs to all them, are identical. This is a very strong form of equivalence. Can we show that such bidders might be indifferent to certain auctions which lack strategic equivalence?

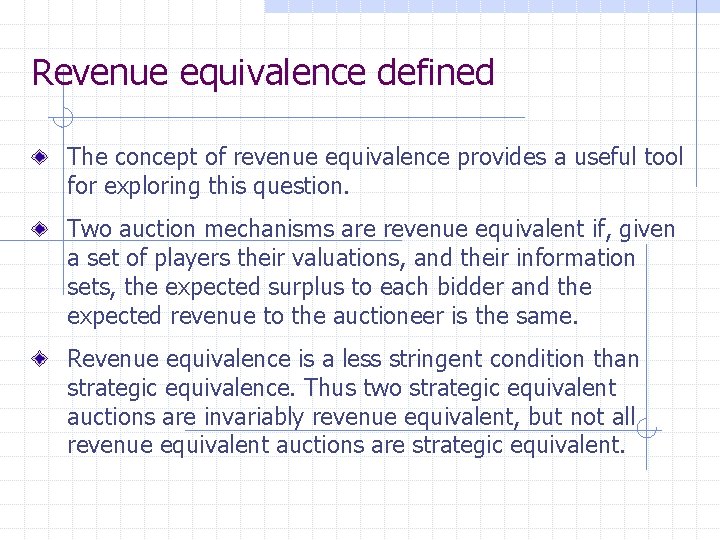

Revenue equivalence defined The concept of revenue equivalence provides a useful tool for exploring this question. Two auction mechanisms are revenue equivalent if, given a set of players their valuations, and their information sets, the expected surplus to each bidder and the expected revenue to the auctioneer is the same. Revenue equivalence is a less stringent condition than strategic equivalence. Thus two strategic equivalent auctions are invariably revenue equivalent, but not all revenue equivalent auctions are strategic equivalent.

Preferences and Expected Payoffs Let: U(vn) denote the expected value of the nth bidder with valuation vn bidding according to his equilibrium strategy when everyone else does too. P(vn) denote the probability the nth bidder will win the auction when all players bid according to their equilibrium strategy. C(vn) denote the expected costs (including any fees to enter the auction, and payments in the case of submitting a winning bid).

An Additivity Assumption We suppose preferences are additive, symmetric and private, meaning: U(v) = P(v) v - C(v) So the expected value of participating in the auction is additive in the expected benefits of winning the auction and the expected costs incurred.

A revealed preference argument Suppose the valuation of n is vn and the valuation of j is vj. The surplus from n bidding as if his valuation is vj is U(vj), the value from participating if his valuation is vj, plus the difference in how he values the expected winnings compared to a bidder with valuation vj, or (vn – vj)P(vj). In equilibrium the value of n following his solution strategy is at least as profitable as deviating from it by pretending his valuation is vj. Therefore: U(vn) > U(vj) + (vn – vj)P(vj)

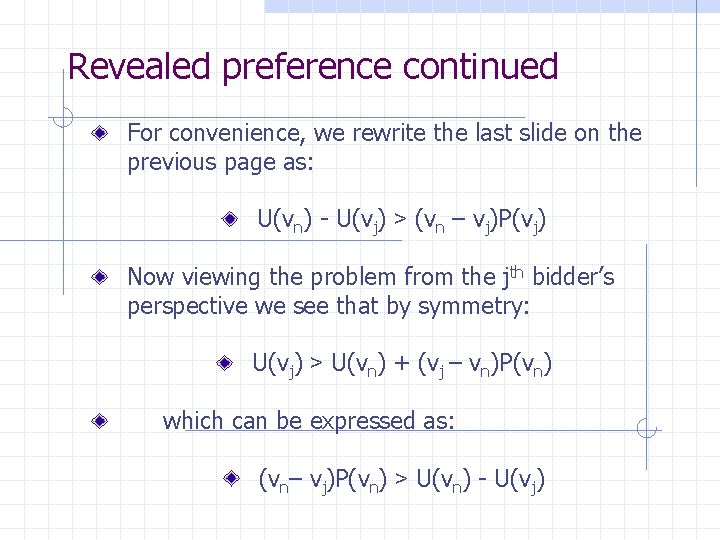

Revealed preference continued For convenience, we rewrite the last slide on the previous page as: U(vn) - U(vj) > (vn – vj)P(vj) Now viewing the problem from the jth bidder’s perspective we see that by symmetry: U(vj) > U(vn) + (vj – vn)P(vn) which can be expressed as: (vn– vj)P(vn) > U(vn) - U(vj)

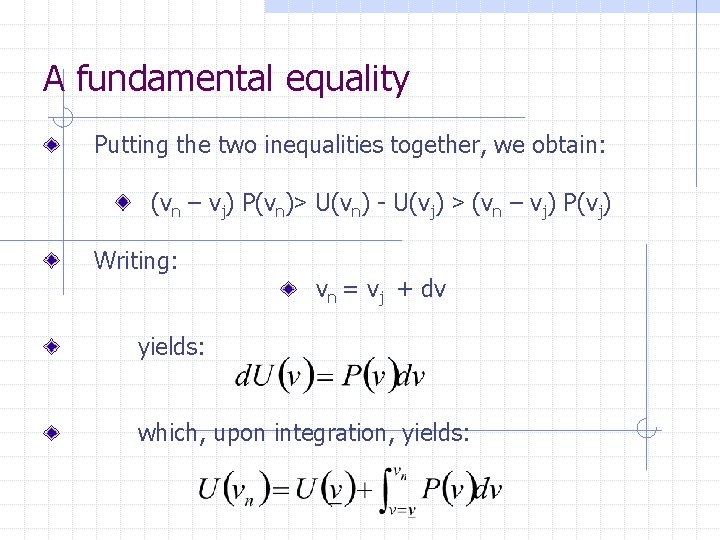

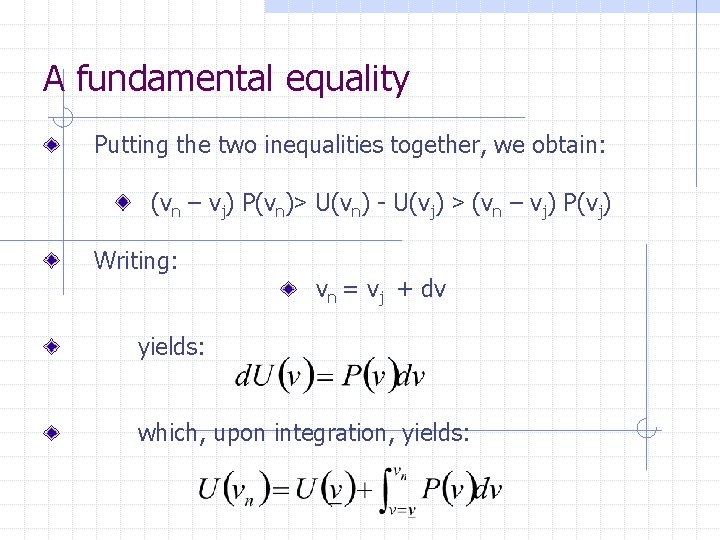

A fundamental equality Putting the two inequalities together, we obtain: (vn – vj) P(vn)> U(vn) - U(vj) > (vn – vj) P(vj) Writing: vn = vj + dv yields: which, upon integration, yields:

Revenue equivalence This equality shows that in private value auctions, the expected surplus to each bidder does not depend on the auction mechanism itself providing two conditions are satisfied: 1. In equilibrium the auction rules award the bid to the bidder with highest valuation. 2. The expected value to the lowest possible valuation is the same (for example zero). Note that if all the bidders obtain the same expected surplus, the auctioneer must obtain the same expected revenue.

A theorem Assume each bidder: - is a risk-neutral demander for the auctioned object; - draws a valuation independently from a common, strictly increasing probability distribution function. Consider auction mechanisms where: - the buyer with the highest valuation always wins - the bidder with the lowest feasible signal expects zero surplus. Then the same expected revenue is generated by the

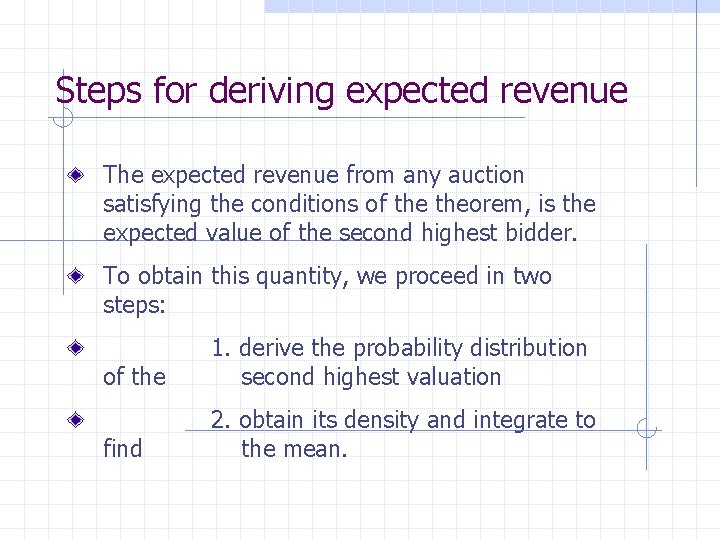

Steps for deriving expected revenue The expected revenue from any auction satisfying the conditions of theorem, is the expected value of the second highest bidder. To obtain this quantity, we proceed in two steps: of the 1. derive the probability distribution second highest valuation find 2. obtain its density and integrate to the mean.

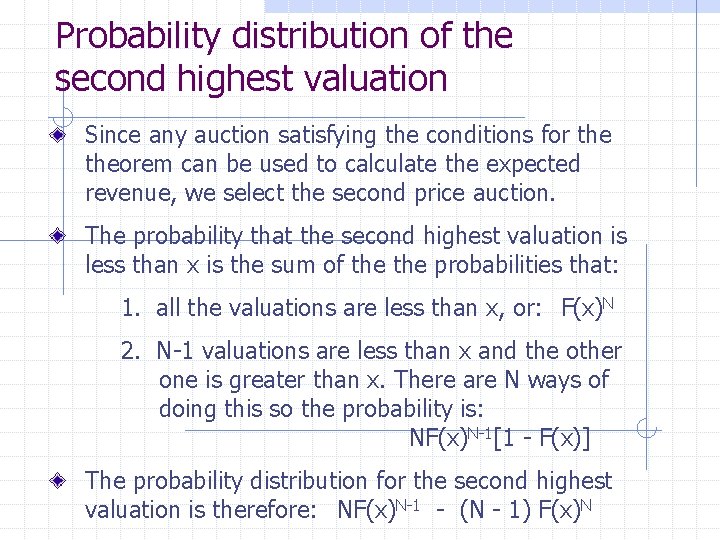

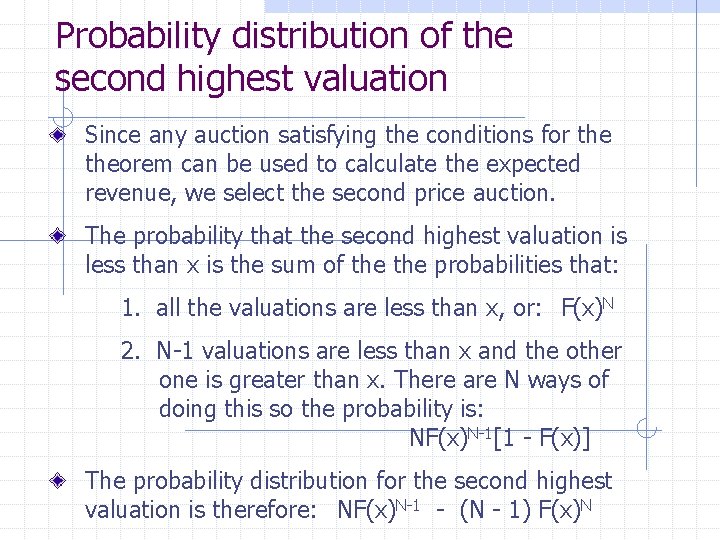

Probability distribution of the second highest valuation Since any auction satisfying the conditions for theorem can be used to calculate the expected revenue, we select the second price auction. The probability that the second highest valuation is less than x is the sum of the probabilities that: 1. all the valuations are less than x, or: F(x)N 2. N-1 valuations are less than x and the other one is greater than x. There are N ways of doing this so the probability is: NF(x)N-1[1 - F(x)] The probability distribution for the second highest valuation is therefore: NF(x)N-1 - (N - 1) F(x)N

Expected revenue from Private Value Auctions The probability density function for the second highest valuation is therefore: N(N – 1)F(x)N-2 [1 - F(x)]F‘(x) Therefore the expected revenue to the auctioneer, or the expected value of the second highest valuation is:

Using the revenue equivalence theorem to derive optimal bidding functions We can also derive the solution bidding strategies for auctions that are revenue equivalent to the second price sealed bid auction. Consider, for example a first price sealed bid auctions with independent and identically distributed valuations. The revenue equivalence theorem implies that each bidder will bid the expected value of the next highest bidder conditional upon his valuation being the highest.

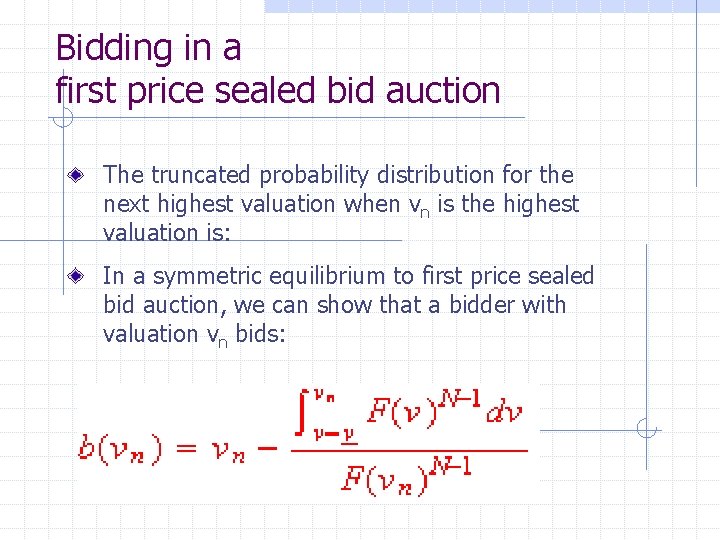

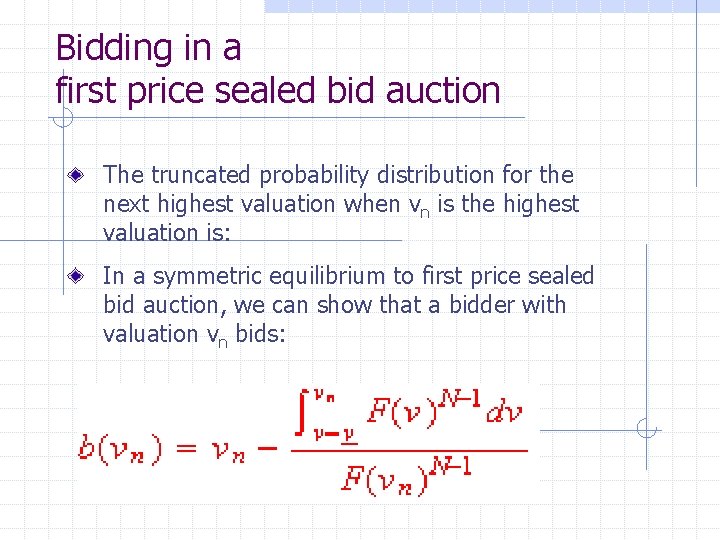

Bidding in a first price sealed bid auction The truncated probability distribution for the next highest valuation when vn is the highest valuation is: In a symmetric equilibrium to first price sealed bid auction, we can show that a bidder with valuation vn bids:

Comparison of bidding strategies The bidding strategies in the first and second price auctions markedly differ. In a second price auction bidders should submit their valuation regardless of the number of players bidding on the object. In the first price auction bidders should shave their valuations, by an amount depending on the number of bidders.

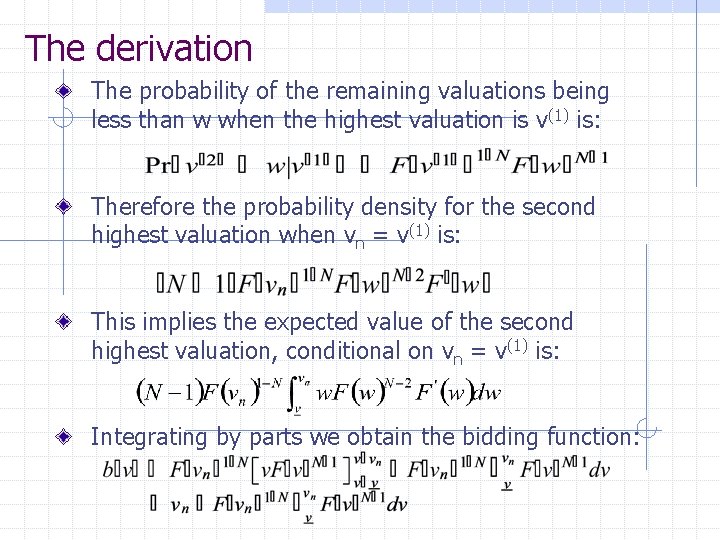

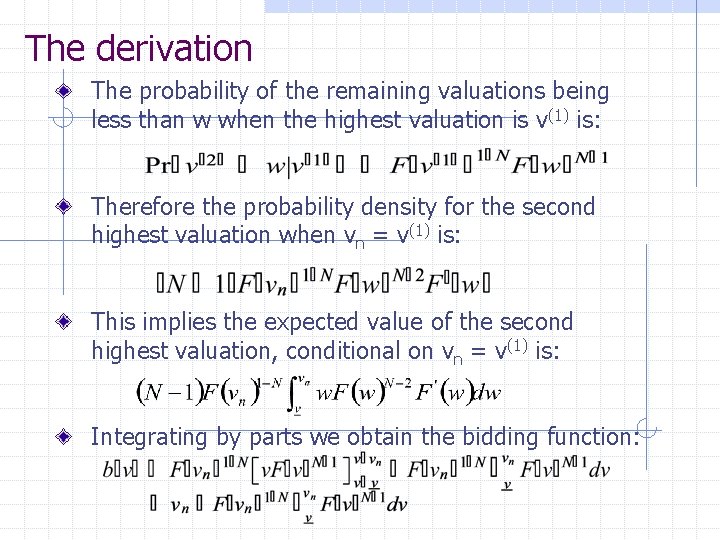

The derivation The probability of the remaining valuations being less than w when the highest valuation is v(1) is: Therefore the probability density for the second highest valuation when vn = v(1) is: This implies the expected value of the second highest valuation, conditional on vn = v(1) is: Integrating by parts we obtain the bidding function:

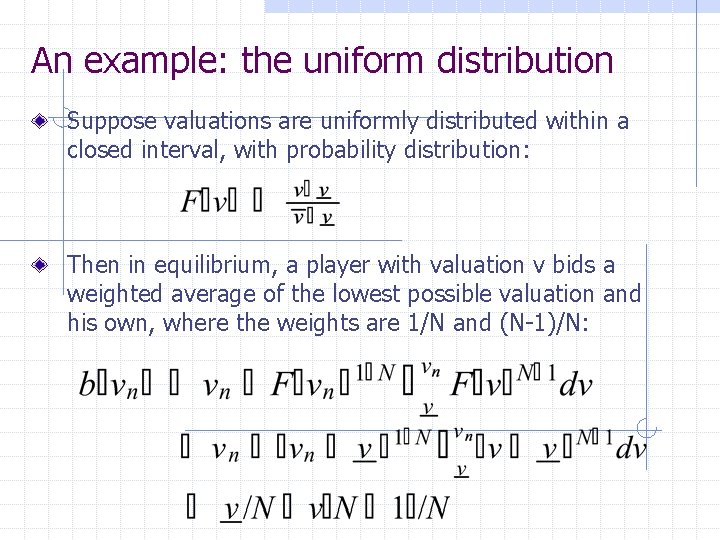

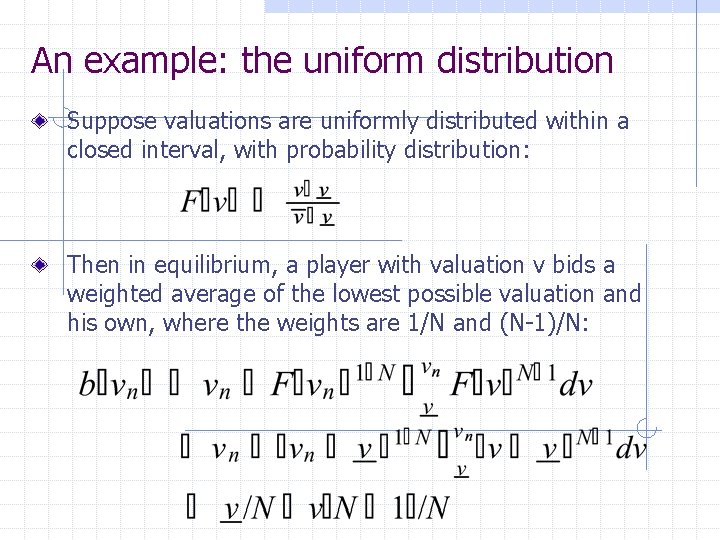

An example: the uniform distribution Suppose valuations are uniformly distributed within a closed interval, with probability distribution: Then in equilibrium, a player with valuation v bids a weighted average of the lowest possible valuation and his own, where the weights are 1/N and (N-1)/N:

Total revenue

Total revenue Dynamic vs formal equivalence

Dynamic vs formal equivalence Revenue equivalence theorem

Revenue equivalence theorem Formal equivalence vs. dynamic equivalence ni eugene nida

Formal equivalence vs. dynamic equivalence ni eugene nida Diastereotopic protons

Diastereotopic protons 01:640:244 lecture notes - lecture 15: plat, idah, farad

01:640:244 lecture notes - lecture 15: plat, idah, farad Ecommerce online auctions

Ecommerce online auctions Baystate auctions

Baystate auctions Ncdfi

Ncdfi Kista bus sales

Kista bus sales Anderson auctions

Anderson auctions Christys angels auctions

Christys angels auctions Regretnet

Regretnet Playauctions

Playauctions Type of auctions

Type of auctions Brightness adaptation and discrimination

Brightness adaptation and discrimination What is a riddle

What is a riddle Forehand serve in badminton

Forehand serve in badminton Serve the lord in the days of your youth

Serve the lord in the days of your youth