Lecture 2 INTERNATIONAL FINANCE 1 1 Lecture 2

- Slides: 29

Lecture 2 INTERNATIONAL FINANCE 1 -1

Lecture 2 International Finance An Overview 1 -2

Chapter Objectives n To identify the main goal of the multinational corporation (MNC) and potential conflicts with that goal n To describe the key theories that justify international business. 1 -3

Multinational Financial Management Multinational corporations are defined as firms that engage in some form of international business. Their managers conduct international financial management. • • International investment and financial decisions Maximise the value of firm Export products or import supplies After maturing in domestic market, the company can distribute in many countries e. g. Coca Cola (deals in different countries with various currencies) 1 -4

Subsidiary Managers • A subsidiary company is one that is a 'sister' or a 'child' company of another usually larger company. • So let's say there is company X. Company Y is another company owned by company X. Therefore company Y is a subsidiary of company X. 1 -5

Goal of the MNC • The commonly accepted goal of an MNC is to maximize shareholder wealth. • We will focus on MNCs that wholly own their foreign subsidiaries. 1 -6

Goal of the MNC • Financial managers throughout the MNC have a single goal of maximizing the value of the entire MNC. ¤ Managers are suppose to make the decisions that can maximise the stock price and therefore serve the stockholders. 1 -7

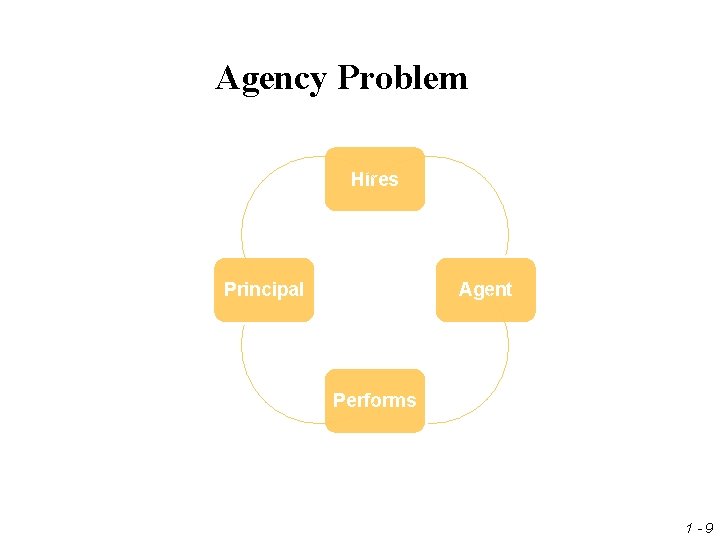

Conflicts with the MNC Goal • When a company’s shareholders differ from its managers, a conflict of goals can exist—the agency problem. 1 -8

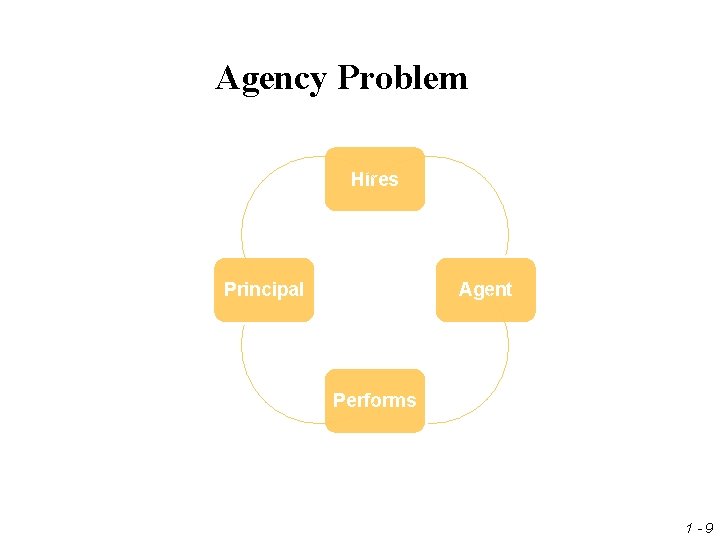

Agency Problem Hires Principal Agent Performs 1 -9

Agency Problem • A decision to establish a subsidiary in one location versus another may be based on the location’s appeal to a particular manager rather than on its potential benefit to shareholders. 1 - 10

Agency Problem • A decision to expand a subsidiary may be motivated by a manager’s desire to receive more compensation rather than to enhance the value of the MNC. 1 - 11

Agency Problems • Agency costs are normally larger for MNCs than for purely domestic firms, due to: ¤ the difficulty in monitoring distant managers, ¤ the different cultures of foreign managers, ¤ the sheer size of the larger MNCs, and 1 - 12

Conflicts with the MNC Goal • Subsidiary managers may be tempted to make decisions that maximize the values of their respective subsidiaries. 1 - 13

Parent Control of Agency Problem The parent corporation of an MNC may be able to prevent agency problems with proper governance. Ø Clearly communicate the goals of the MNC Ø Monitoring by parent Ø Implement compensation plans that reward the subsidiary managers Ø To provide managers with the MNC’s stock (or options to buy the stock at a fixed price) as part of their compensation 1 - 14

Corporate Control of Agency Problems Ø In case of acquisitions due to poor performance of MNC the new management will replace the managers. Ø Institutional investors can complain to board of directors and replace the poor management. 1 - 15

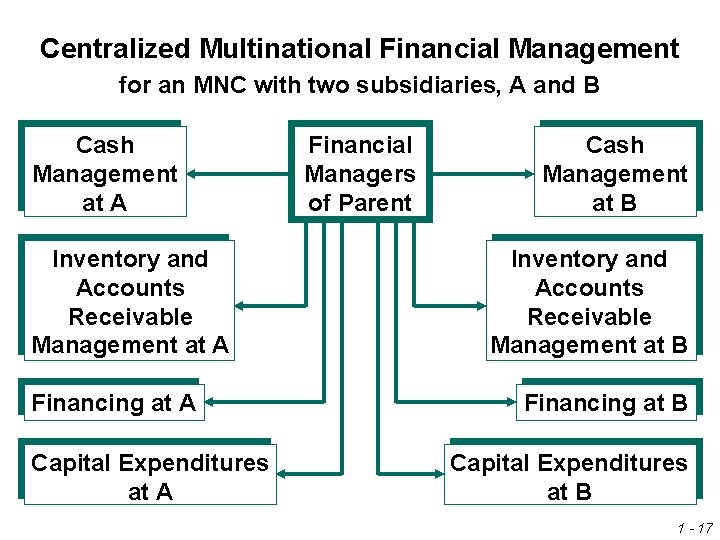

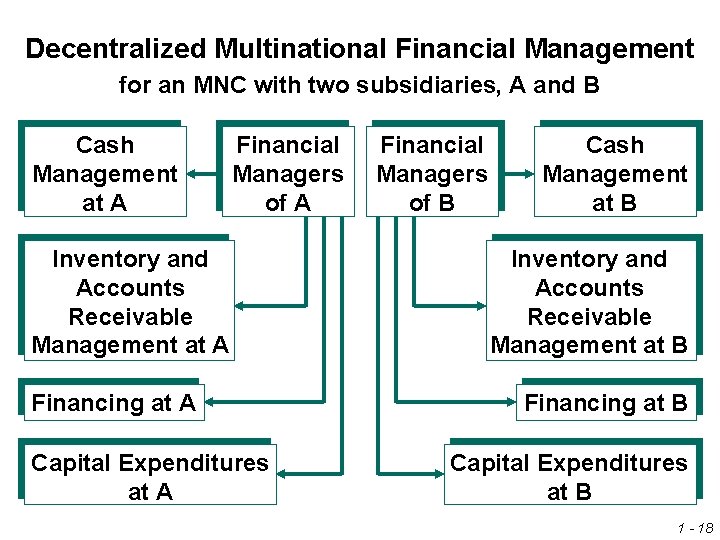

Impact of Management Control • The magnitude of agency costs can vary with the management style of the MNC. • Centralized • Decentralized 1 - 16

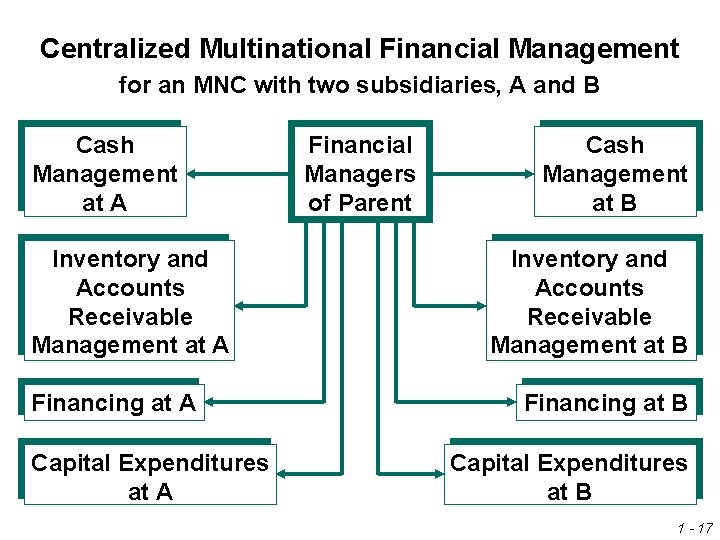

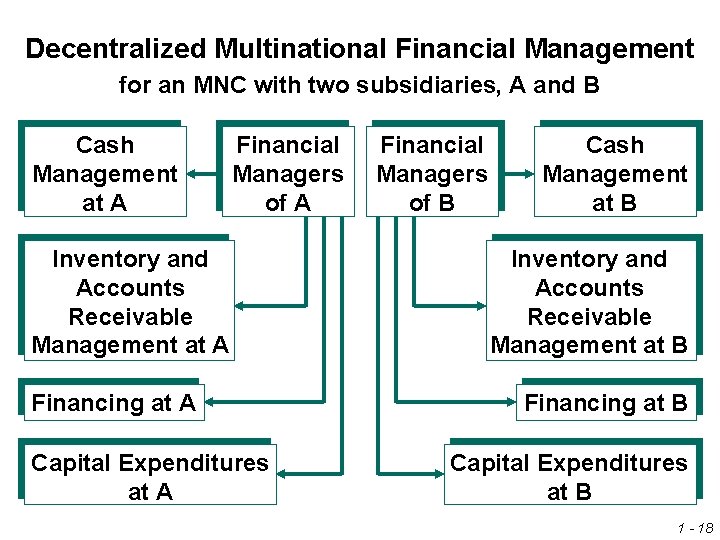

Centralized Multinational Financial Management for an MNC with two subsidiaries, A and B Cash Management at A Inventory and Accounts Receivable Management at A Financing at A Capital Expenditures at A Financial Managers of Parent Cash Management at B Inventory and Accounts Receivable Management at B Financing at B Capital Expenditures at B 1 - 17

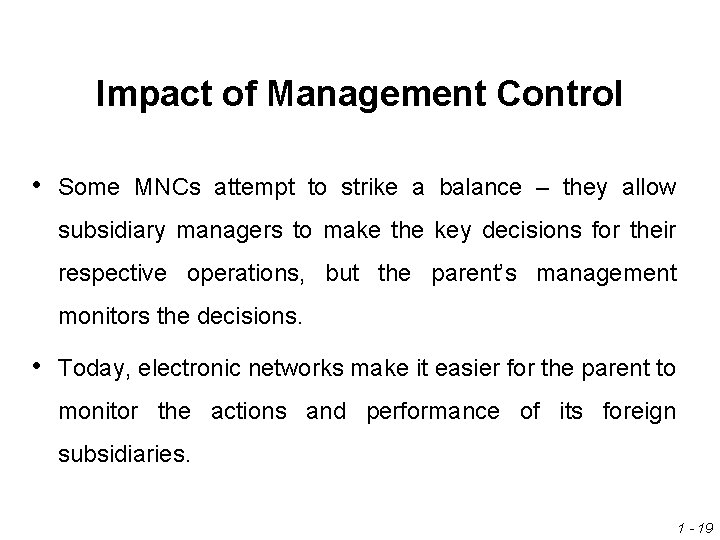

Decentralized Multinational Financial Management for an MNC with two subsidiaries, A and B Cash Management at A Financial Managers of A Inventory and Accounts Receivable Management at A Financing at A Capital Expenditures at A Financial Managers of B Cash Management at B Inventory and Accounts Receivable Management at B Financing at B Capital Expenditures at B 1 - 18

Impact of Management Control • Some MNCs attempt to strike a balance – they allow subsidiary managers to make the key decisions for their respective operations, but the parent’s management monitors the decisions. • Today, electronic networks make it easier for the parent to monitor the actions and performance of its foreign subsidiaries. 1 - 19

MNCs Improvement for Internal Control Process • Establishing a centralized database of information • Ensuring that all data are reported consistently among subsidiaries • Implementing a system that automatically checks data for unusual discrepancies relative to norms 1 - 20

MNCs Improvement for Internal Control Process • Speeding the process by which all departments and all subsidiaries have access to the data that they need • Making executives more accountable for financial statements by personally verifying their accuracy 1 - 21

Impact of Corporate Control • Various forms of corporate control can reduce agency costs: ¤ stock options ¤ hostile takeover threat ¤ investor monitoring 1 - 22

Constraints Interfering with the MNC’s Goal • MNC managers are confronted with various constraints: ¤ Environmental Constraints ¤ Regulatory Constraints ¤ Ethical Constraints 1 - 23

Constraints Interfering with the MNC’s Goal I A recent study found that investors assigned a higher value to firms that exhibit high corporate governance standards and are likely to obey ethical constraints. 1 - 24

Theories of International Business Why are firms motivated to expand their business internationally? 1. Theory of Comparative Advantage 2. Imperfect Markets Theory 3. Product Cycle Theory 1 - 25

1. Theory of Comparative advantage Allows firms to penetrate foreign markets. Specialization by countries ¤ More efficiency ¤ Technological e. g. US, Japan ¤ Agriculture e. g. Jamaica, Mexico ¤ 1 - 26

2. Imperfect Market Theory If perfect market so factors of production are free mobile & equality of costs and returns. Imperfect market provides incentive to seek foreign opportunities, Where factors of production are immobile. ¤ Countries ¤ Costs differs in term of resources and restrictions related to labor ¤ Restriction ¤ MNC’s on transferring funds & other sources Nike and Gap capitalize on foreign resources 1 - 27

3. Product Cycle Theory As a firm matures in home market, it may recognize additional opportunities outside its home country. By Exports Ø Competition will increase in foreign markets Ø Strategies to sustain Ø 1 - 28

Review • Goals of MNCs • Agency Problems • Centralized vs. Decentralized System • Theories of International Business Source: Adopted from South-Western/Thomson Learning. 2006 1 - 29