Lecture 13 Capital Asset Pricing Model CAPM Topics

![CAPM formula E(Ri) = Rf + βi[E(RM) – Rf] E(Ri) Rf βi E(RM) = CAPM formula E(Ri) = Rf + βi[E(RM) – Rf] E(Ri) Rf βi E(RM) =](https://slidetodoc.com/presentation_image_h2/6f4d55707ed7f36fcebb852471b1bee1/image-3.jpg)

- Slides: 18

Lecture 13 Capital Asset Pricing Model (CAPM)

Topics covered in this lecture 1. 2. 3. 4. 5. The CAPM formula Model interpretation Model applications with numerical examples Estimation of beta with market model Practice question

![CAPM formula ERi Rf βiERM Rf ERi Rf βi ERM CAPM formula E(Ri) = Rf + βi[E(RM) – Rf] E(Ri) Rf βi E(RM) =](https://slidetodoc.com/presentation_image_h2/6f4d55707ed7f36fcebb852471b1bee1/image-3.jpg)

CAPM formula E(Ri) = Rf + βi[E(RM) – Rf] E(Ri) Rf βi E(RM) = expected return on an asset i = risk-free rate = beta of asset I; a measure of systematic risk = expected return on the market portfolio that contains all assets E(RM) – Rf = Market risk premium, a measure of the excess return of the market portfolio over the risk-free rate

Determinants of expected return CAPM => expected return on any asset depends on 3 factors: 1. Rf = Pure time value of money. 2. E(RM) – Rf = Reward for bearing risk. 3. βi = Level of systematic risk on asset i. E(Ri) = Rf + βi[E(RM) – Rf]

CAPM applications • CAPM is used to obtain expected return on any asset or portfolio, as long as we are able to obtain the 3 factors: – Risk-free rate, Rf – Expected return on market portfolio, RM – Beta of the asset or portfolio, βi

Numerical Example 1: CAPM, 1 asset Given the following information, calculate the expected return on the asset. Market data: T-Bill rate = 5% S&P 500 return = 15% Asset-specific data: Beta = 2

Numerical Example 2: CAPM, 1 portfolio, multiple assets Given the following information, calculate the expected return on the portfolio. Market data: T-Bill rate = 5% S&P 500 return = 15% Portfolio-specific data: 5 stocks in portfolio: A, B, C, D, E Beta on assets: βA = 0. 5 βB = 0. 95 βC = 1. 52 βD = 2. 1 βE = 2. 32 Investments in assets: A: $100, 000 B: $200, 000 C: $400, 000 D: $200, 000 E: $100, 000

Numerical Example 2 (cont. ) Step 1: Find portfolio weights based on the market values of the investments. Portfolio weight on Asset i = $ Investment in i / Total portfolio value Note that the portfolio weights must sum up to 1.

Numerical Example 2 (cont. ) Step 2: Calculate portfolio beta. Portfolio beta = Sum of betas of assets in portfolio, weighted by their individuals portfolio weights.

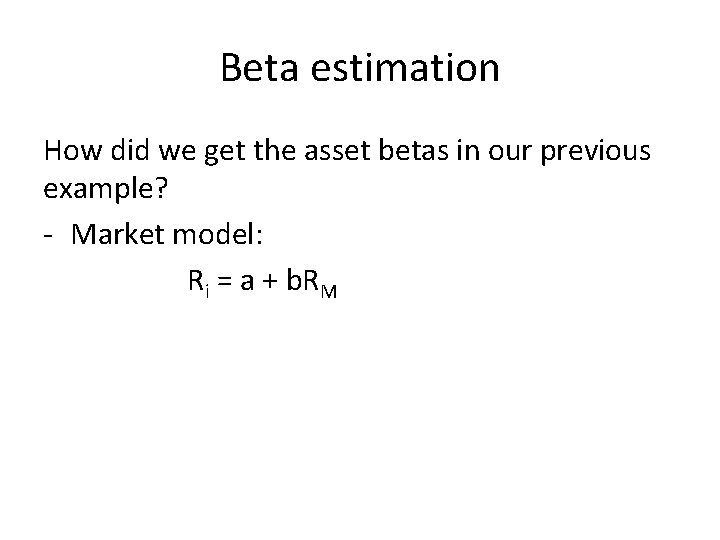

Numerical Example 2 (cont. ) Step 3: Calculate the expected return on the portfolio using CAPM. Rf = 0. 05 RM = 0. 15 Portfolio beta = 1. 5 CAMP Þ E(RP) = Rf + βi[E(RM) – Rf]

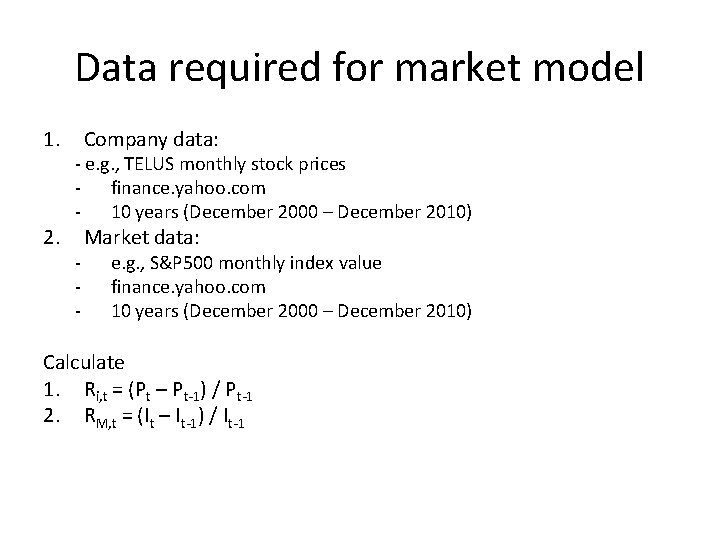

Beta estimation How did we get the asset betas in our previous example? - Market model: Ri = a + b. RM

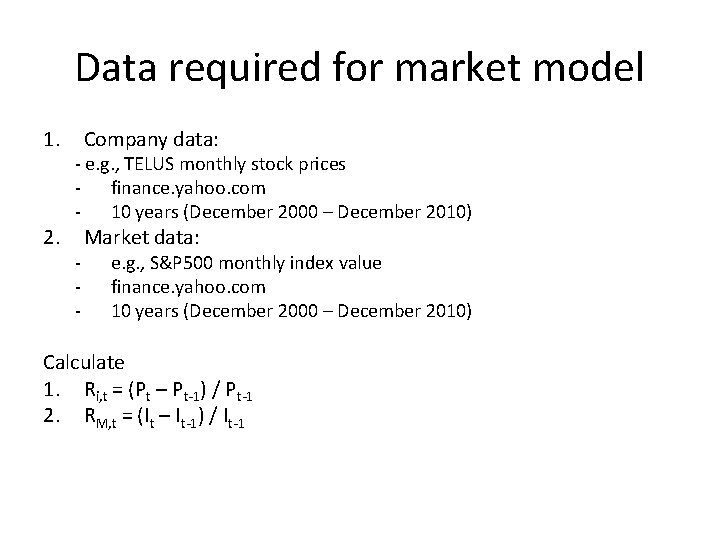

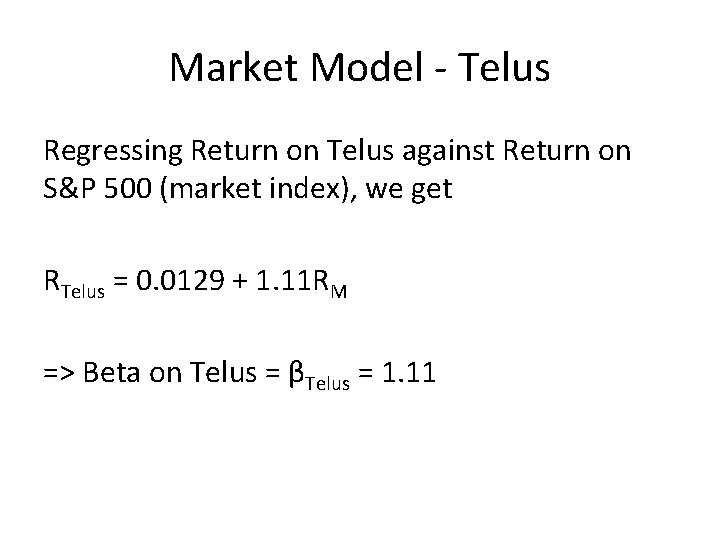

Data required for market model 1. 2. Company data: - e. g. , TELUS monthly stock prices - finance. yahoo. com - 10 years (December 2000 – December 2010) - Market data: e. g. , S&P 500 monthly index value finance. yahoo. com 10 years (December 2000 – December 2010) Calculate 1. Ri, t = (Pt – Pt-1) / Pt-1 2. RM, t = (It – It-1) / It-1

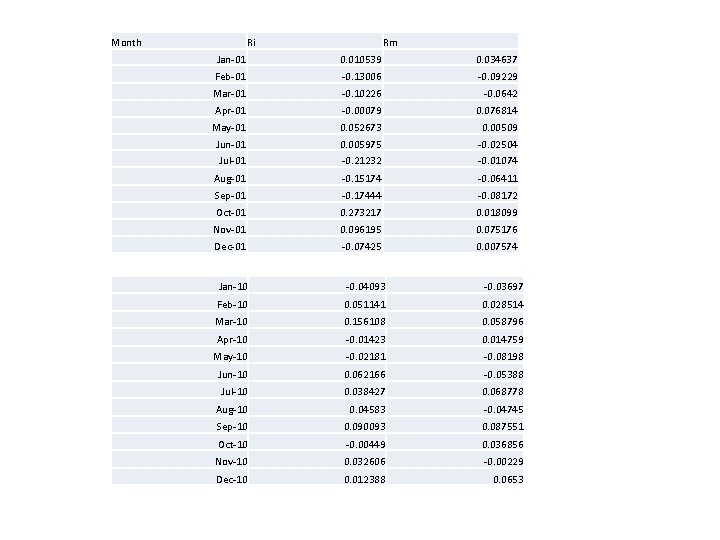

Month Ri Rm Jan-01 0. 010539 0. 034637 Feb-01 -0. 13006 -0. 09229 Mar-01 -0. 10226 -0. 0642 Apr-01 -0. 00079 0. 076814 May-01 0. 052673 0. 00509 Jun-01 0. 005975 -0. 02504 Jul-01 -0. 21232 -0. 01074 Aug-01 -0. 15174 -0. 06411 Sep-01 -0. 17444 -0. 08172 Oct-01 0. 273217 0. 018099 Nov-01 0. 096195 0. 075176 Dec-01 -0. 07425 0. 007574 Jan-10 -0. 04093 -0. 03697 Feb-10 0. 051141 0. 028514 Mar-10 0. 156108 0. 058796 Apr-10 -0. 01423 0. 014759 May-10 -0. 02181 -0. 08198 Jun-10 0. 062166 -0. 05388 Jul-10 0. 038427 0. 068778 Aug-10 0. 04583 -0. 04745 Sep-10 0. 090093 0. 087551 Oct-10 -0. 00449 0. 036856 Nov-10 0. 032606 -0. 00229 Dec-10 0. 012388 0. 0653

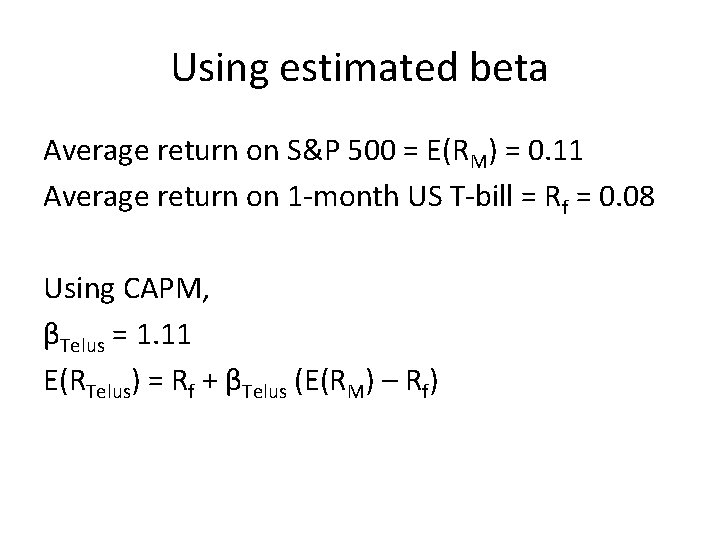

Market Model - Telus Regressing Return on Telus against Return on S&P 500 (market index), we get RTelus = 0. 0129 + 1. 11 RM => Beta on Telus = βTelus = 1. 11

Using estimated beta Average return on S&P 500 = E(RM) = 0. 11 Average return on 1 -month US T-bill = Rf = 0. 08 Using CAPM, βTelus = 1. 11 E(RTelus) = Rf + βTelus (E(RM) – Rf)

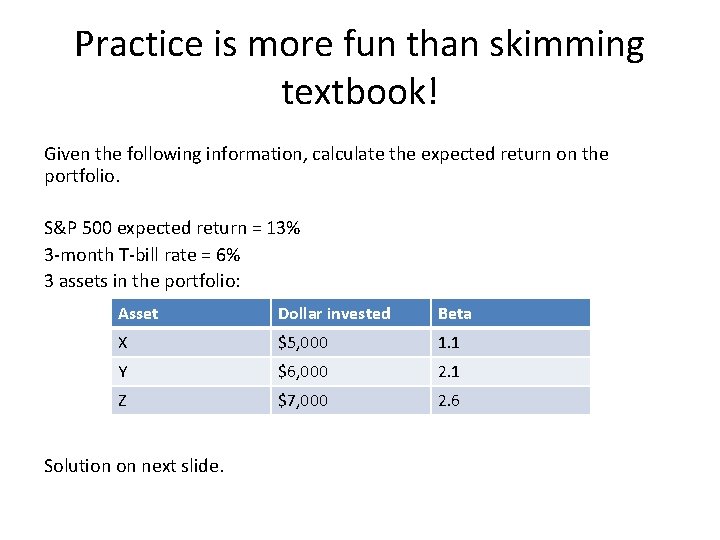

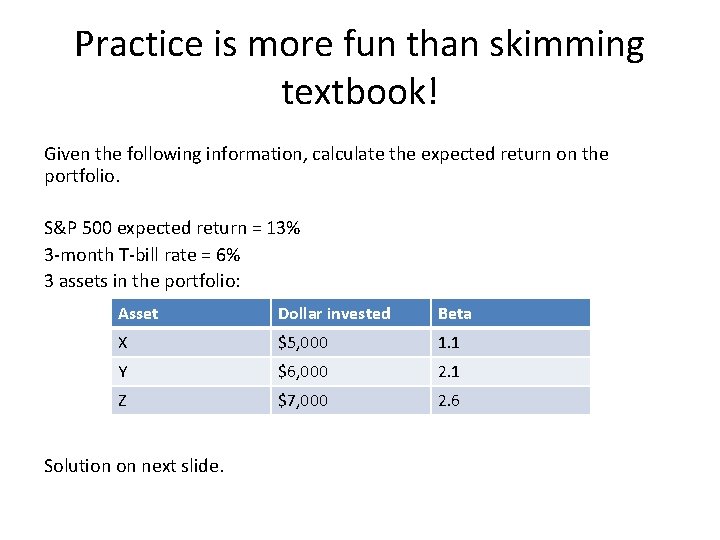

Practice is more fun than skimming textbook! Given the following information, calculate the expected return on the portfolio. S&P 500 expected return = 13% 3 -month T-bill rate = 6% 3 assets in the portfolio: Asset Dollar invested Beta X $5, 000 1. 1 Y $6, 000 2. 1 Z $7, 000 2. 6 Solution on next slide.

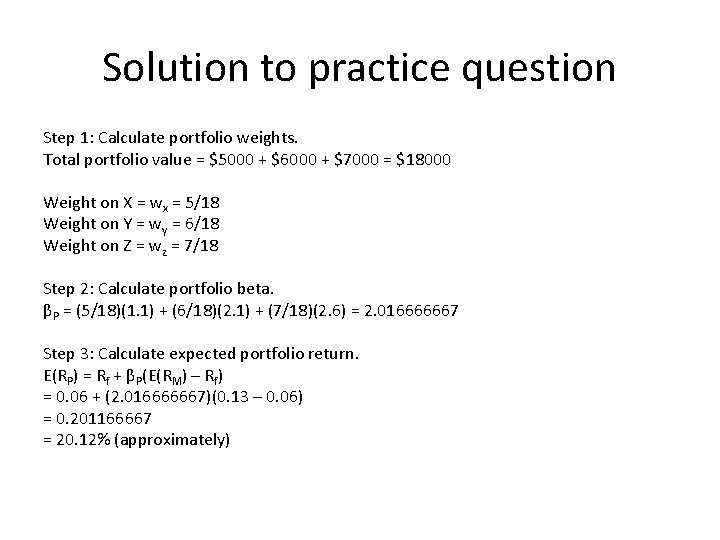

Solution to practice question Step 1: Calculate portfolio weights. Total portfolio value = $5000 + $6000 + $7000 = $18000 Weight on X = wx = 5/18 Weight on Y = wy = 6/18 Weight on Z = wz = 7/18 Step 2: Calculate portfolio beta. βP = (5/18)(1. 1) + (6/18)(2. 1) + (7/18)(2. 6) = 2. 016666667 Step 3: Calculate expected portfolio return. E(RP) = Rf + βP(E(RM) – Rf) = 0. 06 + (2. 016666667)(0. 13 – 0. 06) = 0. 201166667 = 20. 12% (approximately)

End of Lecture 13 On CAPM