Leasing Industry Results in 2012 Polish Leasing Association

- Slides: 18

Leasing Industry Results in 2012 Polish Leasing Association Press Conference 18 th January 2013 Klub Bankowca Ul. Smolna 6 Warszawa

List of Polish Leasing Association Members BAWAG Leasing & Fleet Sp. z o. o. BGŻ Leasing Sp. z o. o. BNP Paribas Leasing Solutions BRE Leasing Sp. z o. o. BZ WBK Finanse & Leasing S. A. Caterpillar Financial Services Poland Sp. z o. o. De Lage Landen Leasing Polska S. A. Deutsche Leasing Polska S. A. Dn. B Nord Leasing Sp. z o. o. Europejski Fundusz Leasingowy S. A. Getin Leasing S. A. Handlowy-Leasing S. A. IKB Leasing Polska Sp. z o. o. Immoconsult Polska Sp. z o. o. ING Lease (Polska) Sp. z o. o. Kredyt Lease S. A. Masterlease Polska S. A. Mercedes-Benz Leasing Polska Sp. z o. o. Millennium Leasing Sp. z o. o. NOMA 2 Sp. z o. o. Nordea Finance Polska S. A. ORIX Polska S. A. PEKAO Leasing Sp. z o. o. PKO Leasing S. A. Raiffeisen Leasing Polska S. A. Scania Finance Polska Sp. z o. o. SG Equipment Leasing Polska Sp. z o. o. SGB-Trans-Leasing PTL Sp. z o. o. Siemens Finance Sp. z o. o. VB Leasing Polska S. A. VFS Usługi Finansowe Polska Sp. z o. o. Volkswagen Leasing Polska Sp. z o. o. Polski Związek Wynajmu i Leasingu Pojazdów

Leasing Market

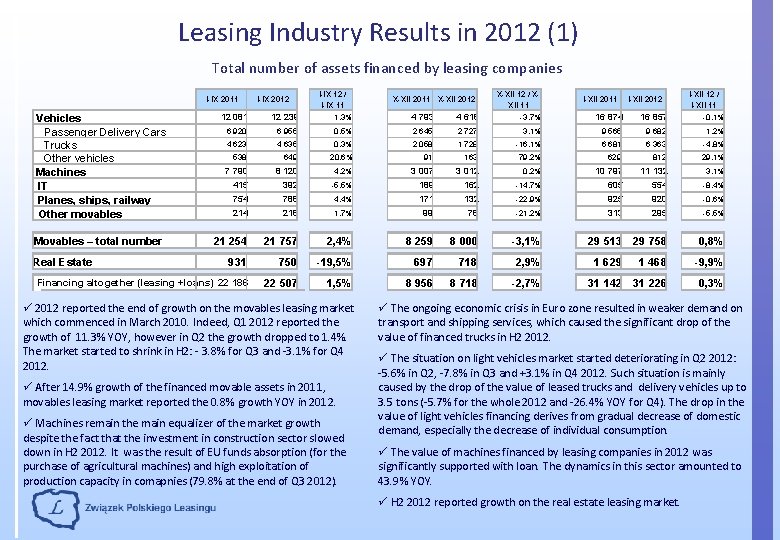

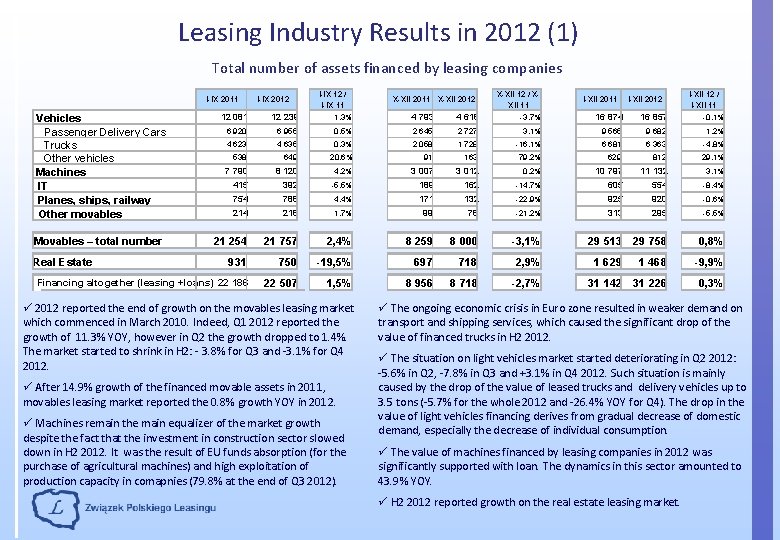

Leasing Industry Results in 2012 (1) Total number of assets financed by leasing companies 12 081 12 239 I-IX 12 / I-IX 11 1, 3% 6 920 6 955 4 623 4 635 I-IX 2011 Vehicles Passenger Delivery Cars Trucks Other vehicles Machines IT Planes, ships, railway Other movables I-IX 2012 X-XII 2011 X-XII 2012 4 793 4 618 0, 5% 2 645 2 727 0, 3% 2 058 1 728 X-XII 12 / XXII 11 -3, 7% I-XII 2011 I-XII 2012 I-XII 12 / I-XII 11 -0, 1% 16 874 16 857 3, 1% 9 565 9 682 1, 2% -16, 1% 6 681 6 363 -4, 8% 29, 1% 538 649 20, 6% 91 163 79, 2% 629 812 7 790 8 120 4, 2% 3 007 3 012 0, 2% 10 797 11 132 3, 1% 415 392 -5, 5% 189 162 -14, 7% 605 554 -8, 4% 754 788 4, 4% 171 132 -22, 9% 925 920 -0, 6% 214 218 1, 7% 99 78 -21, 2% 313 295 -5, 5% 21 254 21 757 2, 4% 8 259 8 000 -3, 1% 29 513 29 758 0, 8% 931 750 -19, 5% 697 718 2, 9% 1 629 1 468 -9, 9% Financing altogether (leasing +loans) 22 186 22 507 1, 5% 8 956 8 718 -2, 7% 31 142 31 226 0, 3% Movables – total number Real Estate ü 2012 reported the end of growth on the movables leasing market which commenced in March 2010. Indeed, Q 1 2012 reported the growth of 11. 3% YOY, however in Q 2 the growth dropped to 1. 4%. The market started to shrink in H 2: - 3. 8% for Q 3 and -3. 1% for Q 4 2012. ü After 14. 9% growth of the financed movable assets in 2011, movables leasing market reported the 0. 8% growth YOY in 2012. ü Machines remain the main equalizer of the market growth despite the fact that the investment in construction sector slowed down in H 2 2012. It was the result of EU funds absorption (for the purchase of agricultural machines) and high exploitation of production capacity in comapnies (79. 8% at the end of Q 3 2012). ü The ongoing economic crisis in Euro zone resulted in weaker demand on transport and shipping services, which caused the significant drop of the value of financed trucks in H 2 2012. ü The situation on light vehicles market started deteriorating in Q 2 2012: -5. 6% in Q 2, -7. 8% in Q 3 and +3. 1% in Q 4 2012. Such situation is mainly caused by the drop of the value of leased trucks and delivery vehicles up to 3. 5 tons (-5. 7% for the whole 2012 and -26. 4% YOY for Q 4). The drop in the value of light vehicles financing derives from gradual decrease of domestic demand, especially the decrease of individual consumption. ü The value of machines financed by leasing companies in 2012 was significantly supported with loan. The dynamics in this sector amounted to 43. 9% YOY. ü H 2 2012 reported growth on the real estate leasing market.

Leasing Industry Results in 2012 (2) Assets financed with leasing ` I-IX 2011 I-IX 2012 I-IX 12 / I-IX 11 X-XII 2012 X-XII 12 / XXII 11 I-XII 2012 I-XII 12 / I-XII 11 Vehicles Passenger Delivery Cars Trucks Other Vehicles Machines IT Planes, ships, railway Other movables 11 780 11 982 1, 7% 4 626 4 429 -4, 3% 16 406 16 411 6 729 6 908 2, 7% 2 586 2 690 4, 0% 9 315 9 599 3, 0% 4 564 4 437 -2, 8% 1 951 1 581 -18, 9% 6 515 6 018 -7, 6% Movables – total number Real Estate Leasing altogether 0, 0% 487 637 30, 6% 89 157 76, 3% 576 794 37, 7% 6 033 5 491 -9, 0% 2 195 1 944 -11, 4% 8 228 7 435 -9, 6% 405 382 -5, 8% 183 149 -18, 7% 588 530 -9, 8% 748 781 4, 4% 169 130 -23, 2% 917 911 -0, 7% 213 216 1, 1% 98 69 -29, 6% 312 285 -8, 6% 19 179 18 851 -1, 7% 7 271 6 721 -7, 6% 26 450 25 572 -3, 3% 693 721 3, 9% 560 587 4, 7% 1 254 1 307 4, 3% 19 872 19 572 -1, 5% 7 832 7 308 -6, 7% 27 704 26 879 -3, 0% Source: Polish Leasing Association

Leasing Industry Results in 2012 (3) Assets financed with loan I-IX 2011 Vehicles Passenger Delivery Cars Trucks Other Vehicles Machines IT Planes, ships, railway Other movables Movables – in total Real Estate Loans altogether I-IX 12 / I-IX 11 I-IX 2012 X-XII 12 / XXII 11 I-XII 2012 I-XII 12 / I-XII 11 301 258 -14, 5% 167 189 12, 7% 469 446 -4, 8% 191 47 -75, 6% 59 37 -37, 3% 250 84 -66, 6% 59 198 235, 4% 107 146 36, 8% 166 344 107, 6% 51 13 -75, 4% 2 6 236, 0% 53 18 -65, 6% 1 757 2 629 49, 7% 812 1 067 31, 5% 2 569 3 697 43, 9% 10 11 5, 9% 7 13 93, 6% 17 24 40, 9% 6 1 7 2 10, 1% 2 0 2 8 2, 6% 216, 2% 3333, 2% 8 1 9 10 1179, 0% 2 075 2 906 40, 0% 988 1 279 29, 5% 3 063 4 186 36, 6% 238 29 -87, 7% 137 131 -4, 4% 375 160 -57, 2% 2 313 2 936 26, 9% 1 125 1 410 25, 4% 3 438 4 346 26, 4% Machines financed with loans Other Machines & Devices 7% Medical Equipment 8% Building Equipment Machines for 6% Food Industry 1% Machines for Plastics Production and Metalwork 7% Printing Machines 3% X-XII 2011 X-XII 2012 Agricultural Machines 68% 8, 4% üAll the assets financed with loans constitute 13. 9% of the whole leasing companies production in 2012. In 2011 such index amounted to 11. 0%. üMachines constitute the main pillar of investment financed with loans (85. 1% in comparison to 74. 7% in 2011), which means that the loan constitutes 33. 2% of the total machine production ü The meaning of loan in case of truck financing reported significant growth. The use of loans in the case of finansing light vehicles and real estate reported decrease. ü The use of EU funds by the farmers results in dominant share of agricultural machines in loan financing sector. Source: Polish Leasing Association

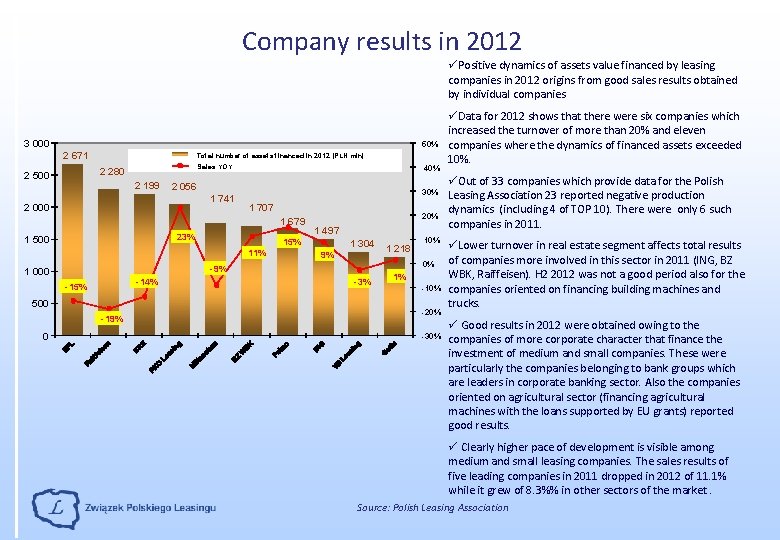

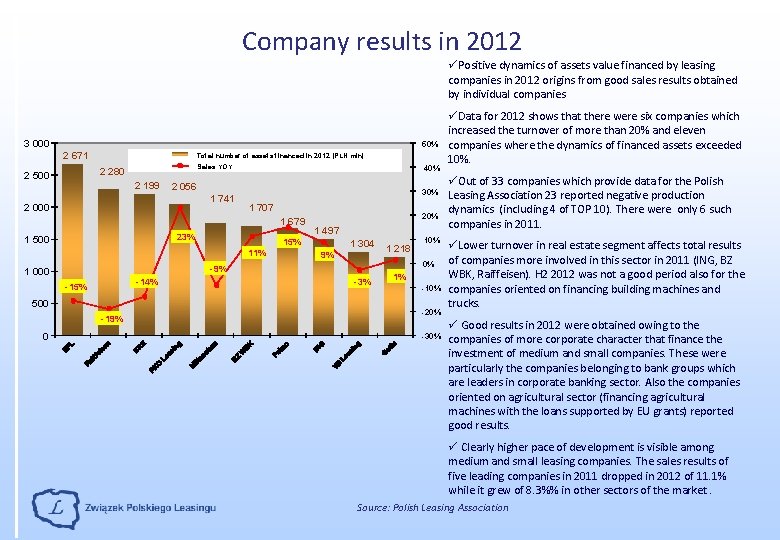

Company results in 2012 üPositive dynamics of assets value financed by leasing companies in 2012 origins from good sales results obtained by individual companies 3 000 50% 2 671 Total number of assets financed in 2012 [PLN mln] Sales YOY 2 280 2 500 2 199 40% 2 056 1 741 2 000 30% 1 707 1 679 23% 1 500 1 497 15% 11% 1 304 9% - 14% -15% 500 - 19% 1 218 10% 0% -9% 1 000 0 20% -3% 1% -10% -20% -30% üData for 2012 shows that there were six companies which increased the turnover of more than 20% and eleven companies where the dynamics of financed assets exceeded 10%. üOut of 33 companies which provide data for the Polish Leasing Association 23 reported negative production dynamics (including 4 of TOP 10). There were only 6 such companies in 2011. üLower turnover in real estate segment affects total results of companies more involved in this sector in 2011 (ING, BZ WBK, Raiffeisen). H 2 2012 was not a good period also for the companies oriented on financing building machines and trucks. ü Good results in 2012 were obtained owing to the companies of more corporate character that finance the investment of medium and small companies. These were particularly the companies belonging to bank groups which are leaders in corporate banking sector. Also the companies oriented on agricultural sector (financing agricultural machines with the loans supported by EU grants) reported good results. ü Clearly higher pace of development is visible among medium and small leasing companies. The sales results of five leading companies in 2011 dropped in 2012 of 11. 1% while it grew of 8. 3%% in other sectors of the market. Source: Polish Leasing Association

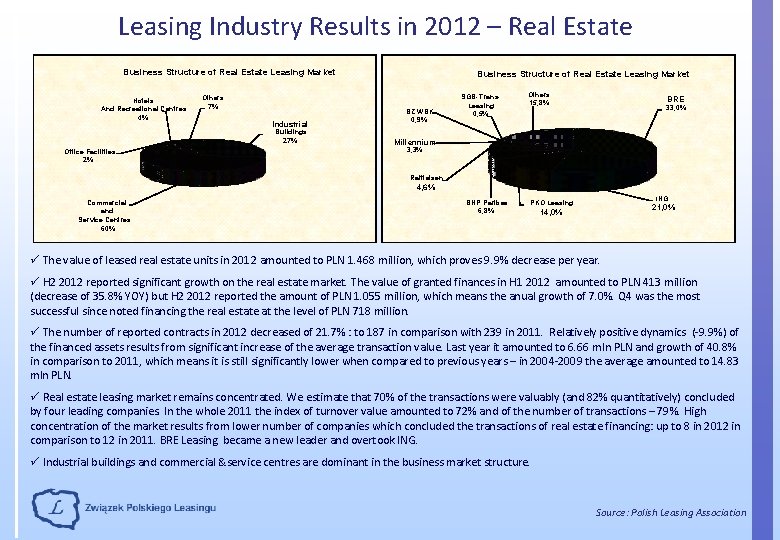

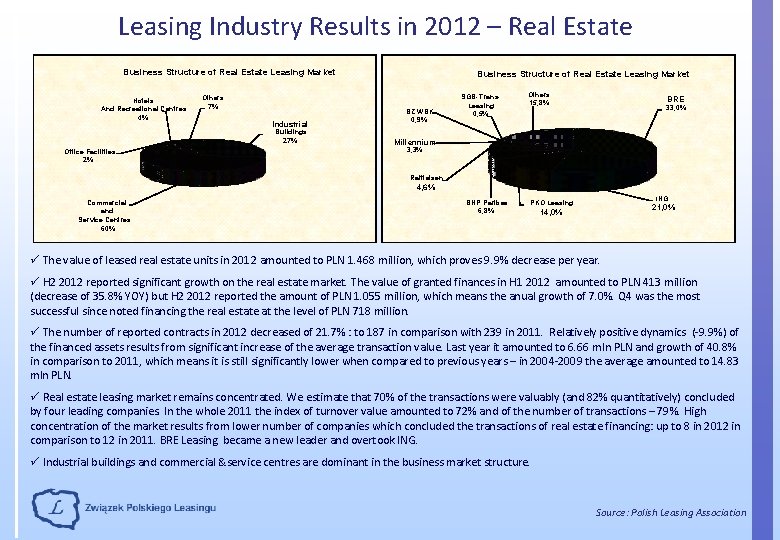

Leasing Industry Results in 2012 – Real Estate Business Structure of Real Estate Leasing Market Hotels And Recreational Centres 4% Others 7% Industrial Buildings 27% Office Facilities 2% Business Structure of Real Estate Leasing Market BZ WBK 0, 9% SGB- Trans. Leasing 0, 5% Others 15, 8% BRE 33, 0% Millennium 3, 3% Raiffeisen 4, 6% Commercial and Service Centres 60% BNP Paribas 6, 8% ING PKO Leasing 21, 0% 14, 0% ü The value of leased real estate units in 2012 amounted to PLN 1. 468 million, which proves 9. 9% decrease per year. ü H 2 2012 reported significant growth on the real estate market. The value of granted finances in H 1 2012 amounted to PLN 413 million (decrease of 35. 8% YOY) but H 2 2012 reported the amount of PLN 1. 055 million, which means the anual growth of 7. 0%. Q 4 was the most successful since noted financing the real estate at the level of PLN 718 million. ü The number of reported contracts in 2012 decreased of 21. 7% : to 187 in comparison with 239 in 2011. Relatively positive dynamics (-9. 9%) of the financed assets results from significant increase of the average transaction value. Last year it amounted to 6. 66 mln PLN and growth of 40. 8% in comparison to 2011, which means it is still significantly lower when compared to previous years – in 2004 -2009 the average amounted to 14. 83 mln PLN. ü Real estate leasing market remains concentrated. We estimate that 70% of the transactions were valuably (and 82% quantitatively) concluded by four leading companies. In the whole 2011 the index of turnover value amounted to 72% and of the number of transactions – 79%. High concentration of the market results from lower number of companies which concluded the transactions of real estate financing: up to 8 in 2012 in comparison to 12 in 2011. BRE Leasing became a new leader and overtook ING. ü Industrial buildings and commercial &service centres are dominant in the business market structure. Source: Polish Leasing Association

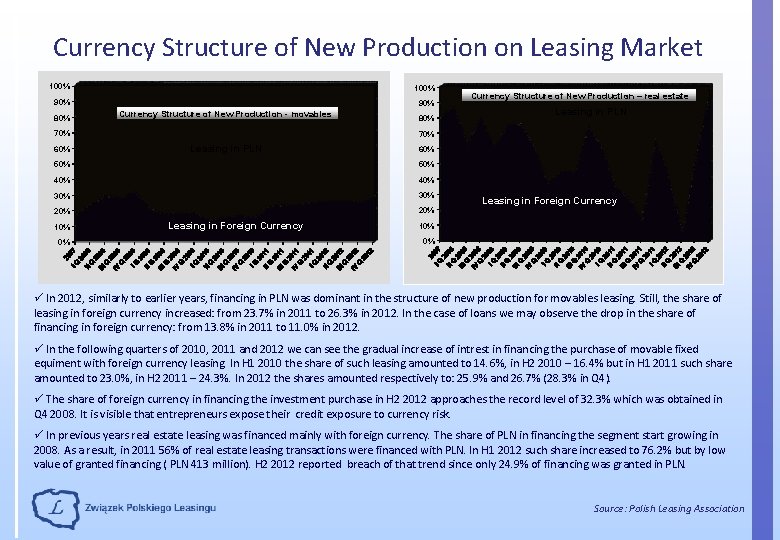

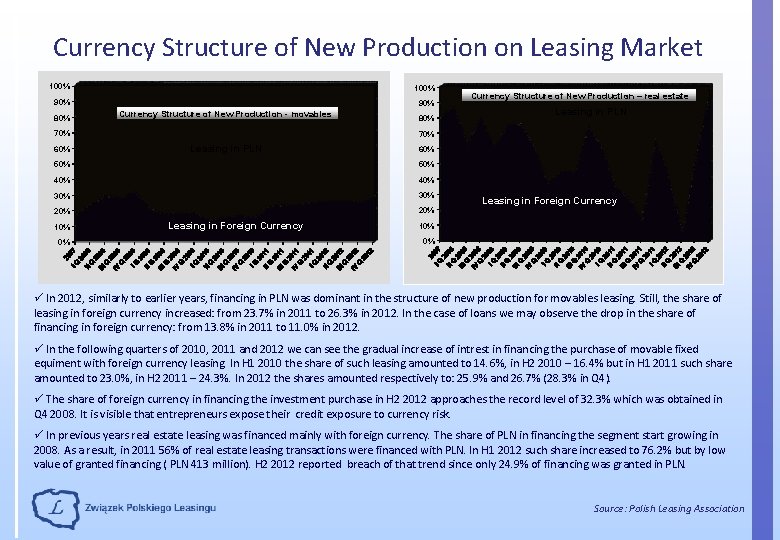

Currency Structure of New Production on Leasing Market 100% 90% 80% Currency Structure of New Production - movables 70% 60% 80% Leasing in PLN 60% 50% 40% 30% 20% 0% Leasing in PLN 70% 50% 10% Currency Structure of New Production - – real estate Leasing in Foreign Currency 10% 0% ü In 2012, similarly to earlier years, financing in PLN was dominant in the structure of new production for movables leasing. Still, the share of leasing in foreign currency increased: from 23. 7% in 2011 to 26. 3% in 2012. In the case of loans we may observe the drop in the share of financing in foreign currency: from 13. 8% in 2011 to 11. 0% in 2012. ü In the following quarters of 2010, 2011 and 2012 we can see the gradual increase of intrest in financing the purchase of movable fixed equiment with foreign currency leasing. In H 1 2010 the share of such leasing amounted to 14. 6%, in H 2 2010 – 16. 4% but in H 1 2011 such share amounted to 23. 0%, in H 2 2011 – 24. 3%. In 2012 the shares amounted respectively to: 25. 9% and 26. 7% (28. 3% in Q 4). ü The share of foreign currency in financing the investment purchase in H 2 2012 approaches the record level of 32. 3% which was obtained in Q 4 2008. It is visible that entrepreneurs expose their credit exposure to currency risk. ü In previous years real estate leasing was financed mainly with foreign currency. The share of PLN in financing the segment start growing in 2008. As a result, in 2011 56% of real estate leasing transactions were financed with PLN. In H 1 2012 such share increased to 76. 2% but by low value of granted financing ( PLN 413 million). H 2 2012 reported breach of that trend since only 24. 9% of financing was granted in PLN. Source: Polish Leasing Association

Investment Financing – Leasing vs Investment Credit 70 value of the real estate leasing active portfolio change in relation to the previous period 60 16, 2% 48, 4 50 43, 9 52, 4 47, 7 47, 3 48, 0 47, 8 45, 4 9, 1% 37, 8 40 80 20% 70 15% 60 50 10% 5, 2% 10, 2% 30 53, 4 52, 4 25% -1, 4% -0, 9% 20 2, 0% -3, 9% 5% 56, 5 49, 8 61, 1 54, 9 53, 4 55, 3 10 -10% 0 60, 8 61, 5 13, 7% 1, 8% 15% 3, 6% 10% 0, 9% 1, 3% -2, 8% -0, 2% 20% 55, 9 9, 4% 20 -5% 0 56, 6 30 -0, 1% 10 change in relation to the previous period 40 0% 0, 5% 25% total value of active portfolio 5% 0% -0, 5% -5% Jan 07 100% 79 bln 90 90% 80 80% 70 70% 60 60% 50 50% 40 Investment loans granted to companies by banks [mln PLN] Deposits/loans for companies index 30 40% 30% 20 20% 10 10% 0 12 12 n ay M 11 Ja Se pt 11 11 n ay M 10 Ja Se pt 10 10 ay M 09 n Ja Se pt 09 09 ay M 08 n Ja Se pt 08 08 n ay M 07 Ja 07 Se pt ay M Ja n 07 0% Source: Polish Leasing Association, National Bank of Poland ü Total value of active portfolio at the end of 2012 amounting to 61. 77 bln PLN (53. 44 bln PLN for movables and 8. 10 bln PLN for real estate) is comparable to the value of balance of the investment credits granted to companies by banks (79. 06 bln PLN as reported on 30 th Nov. 2012). Leasing is the main, apart from credit, external source of financing investments working in economy. ü The value of this portfolio increased within the last 12 months of 0. 7%, which means the growth of 0. 77 bln PLN as reported on 30 th June 2012. ü Data provided by National Bank of Poland concerning money supply (of 30 th Nov. 2012) proves explicit slowdown of the dynamics in the case of banks credit action within investment. The last 12 months showed that the balance of investment credits increased in banks of 2. 4% compared to 27. 6% dynamics YOY reported at the end of 2011 and 19. 1% reported on 30 th June 2012. The present balance is lower of 3. 7%than the level noted six months ago.

Polish Vehicle Rental and Leasing Association (PZWLP) Results in 2012

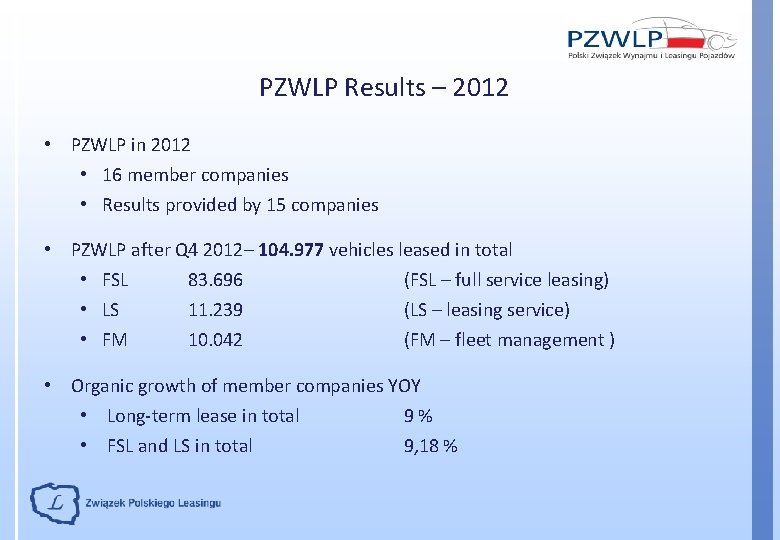

PZWLP Results – 2012 • PZWLP in 2012 • 16 member companies • Results provided by 15 companies • PZWLP after Q 4 2012– 104. 977 vehicles leased in total • FSL 83. 696 (FSL – full service leasing) • LS 11. 239 (LS – leasing service) • FM 10. 042 (FM – fleet management ) • Organic growth of member companies YOY • Long-term lease in total 9% • FSL and LS in total 9, 18 %

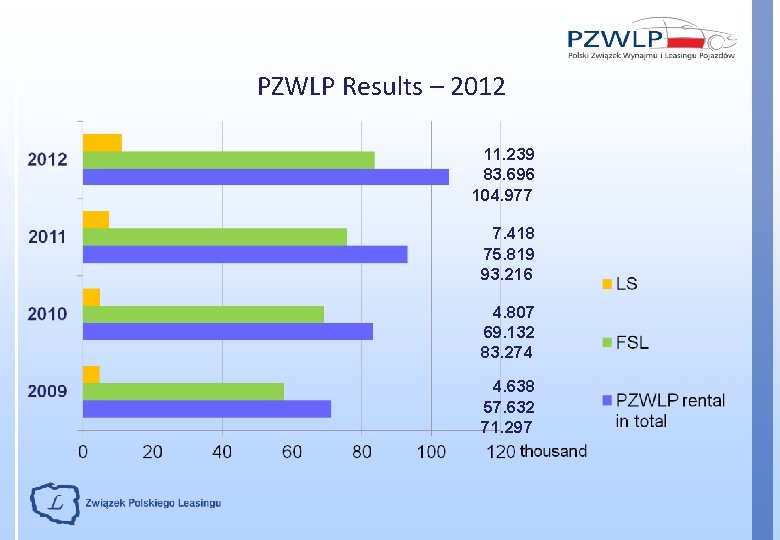

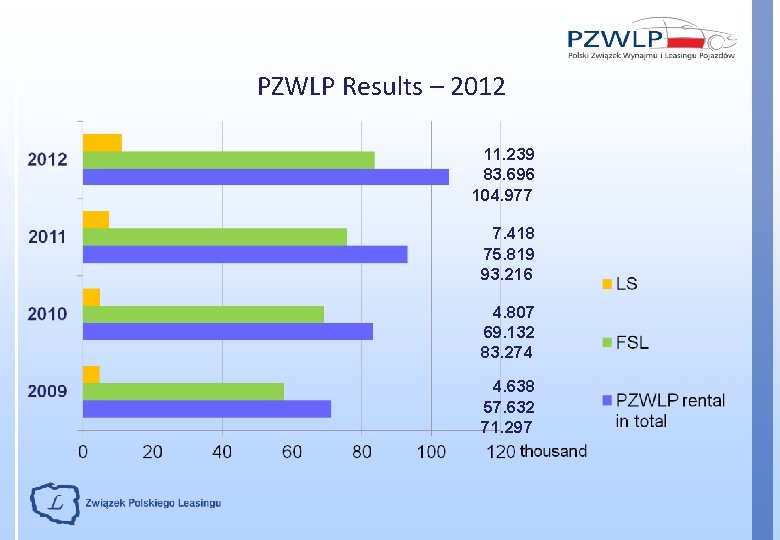

PZWLP Results – 2012 11. 239 83. 696 104. 977 7. 418 75. 819 93. 216 4. 807 69. 132 83. 274 4. 638 57. 632 71. 297

PZWLP and Polish Leasing Association – 2012 Long-term Lease in total 1. Masterlease 2. Lease. Plan Fleet Management 3. Arval Service Lease 4. Alphabet Polska 5. Carefleet 20. 541 19. 999 16. 056 11. 226 8. 711 Full service leasing 1. Lease. Plan Fleet Management 2. Arval Service Lease 3. Masterlease 4. Alphabet Polska 5. Carefleet 15. 901 15. 534 13. 742 10. 638 8. 148 (including 415 in FM) (including 4. 073 in FM) (including 497 in FM) (including 74 in FM) (including 563 in FM)

PZWLP at the turn of 2012 and 2013 • Now 17 members (since middle 2012 – Nivette Fleet Management) • Entering Związek Avis Polska (Avis Polska Association) (January 2013) – beginnings of organised representation of short-term rental industry • Stable development of FSL • Dynamic growth of LS • 2013 forecast for PZWLP– development at the stable level of 5 -7 % per year

Rental Industry 2012/2013 • Main events in Polish rental industry • Contracts continuation and costs optimalisation • Client expectations – changes, trends • Growth of LS significance (incomplete rental) • Market consolidation • Instability of legal environment – changes in VAT deduction of: • • • Insurance Fuel (risk of change) Car service (the changes planned by the Polish Ministry of Finance and their consequences for dealer-repair-service industry)

Rental Industry 2012/2013 • The influence of makroeconomic conditions on rental industry • Regulating-capital requirements in bank sector – potential incentive to the sale of rental companies assets by the big European banks • Low interest rates – possibility of cheap acquisition financing in Poland Europe • Dynamic capital inflow to various industries from Asia– in the following years there is a possibility of investment, eg. Chinese or Korean, in leasing and rental industry • 2013 forecast for the industry – development at the level of 5 % per year

Związek Polskiego Leasingu (Polish Leasing Association) ul. Rejtana 17, Warszawa tel. : (22) 542 41 36 fax: (22) 542 41 37 e-mail: zpl@leasing. org. pl www. leasing. org. pl

Polish leasing association

Polish leasing association Polish leasing association

Polish leasing association Polish leasing association

Polish leasing association Polish notation

Polish notation Reverse polish notation adalah

Reverse polish notation adalah Polish bank association

Polish bank association Polish bank association

Polish bank association Problems of leasing

Problems of leasing Equipment leasing and finance industry snapshot

Equipment leasing and finance industry snapshot Split trac lease

Split trac lease Operating lease

Operating lease Www cxc

Www cxc Www cxc org results 2012

Www cxc org results 2012 Cpea results 2014 grenada

Cpea results 2014 grenada Fiji fishing industry association

Fiji fishing industry association Localization industry standards association

Localization industry standards association Semiconductor industry association

Semiconductor industry association Fusion industry association

Fusion industry association Artemis industry association

Artemis industry association