Keuangan dan Akuntansi Proyek Modul 2 BASIC TOOLS

Keuangan dan Akuntansi Proyek Modul 2: BASIC TOOLS CHRISTIONO UTOMO, Ph. D. Bidang Manajemen Proyek ITS 2011

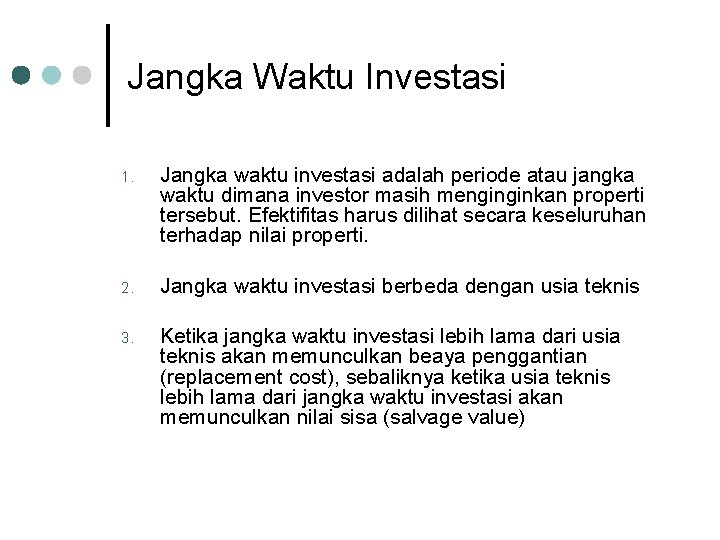

Jangka Waktu Investasi 1. Jangka waktu investasi adalah periode atau jangka waktu dimana investor masih menginginkan properti tersebut. Efektifitas harus dilihat secara keseluruhan terhadap nilai properti. 2. Jangka waktu investasi berbeda dengan usia teknis 3. Ketika jangka waktu investasi lebih lama dari usia teknis akan memunculkan beaya penggantian (replacement cost), sebaliknya ketika usia teknis lebih lama dari jangka waktu investasi akan memunculkan nilai sisa (salvage value)

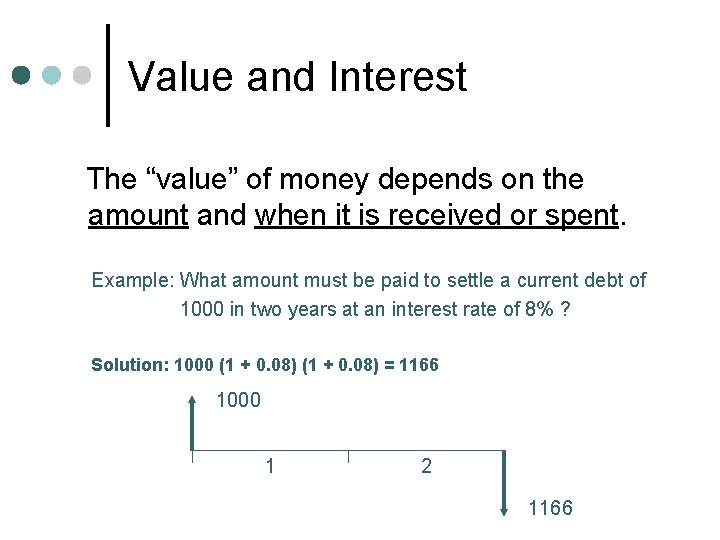

Value and Interest The “value” of money depends on the amount and when it is received or spent. Example: What amount must be paid to settle a current debt of 1000 in two years at an interest rate of 8% ? Solution: 1000 (1 + 0. 08) = 1166 1000 1 2 1166

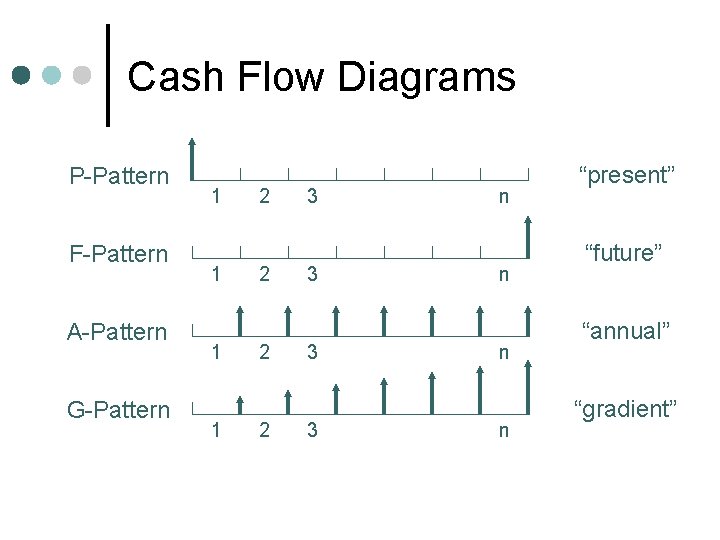

Cash Flow Diagrams P-Pattern F-Pattern A-Pattern G-Pattern 1 1 2 2 3 3 n n “present” “future” “annual” “gradient”

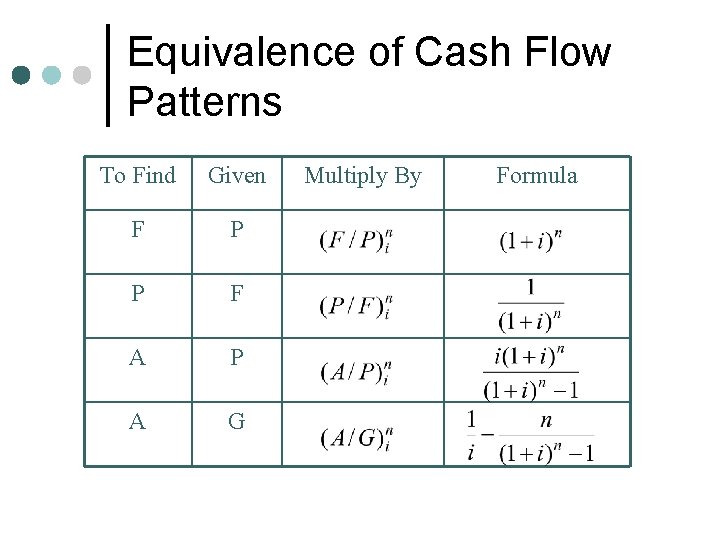

Equivalence of Cash Flow Patterns To Find Given F P P F A P A G Multiply By Formula

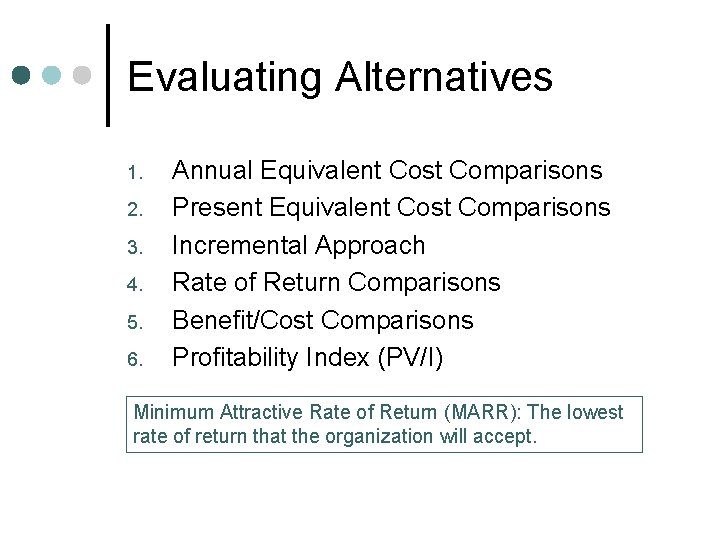

Evaluating Alternatives 1. 2. 3. 4. 5. 6. Annual Equivalent Cost Comparisons Present Equivalent Cost Comparisons Incremental Approach Rate of Return Comparisons Benefit/Cost Comparisons Profitability Index (PV/I) Minimum Attractive Rate of Return (MARR): The lowest rate of return that the organization will accept.

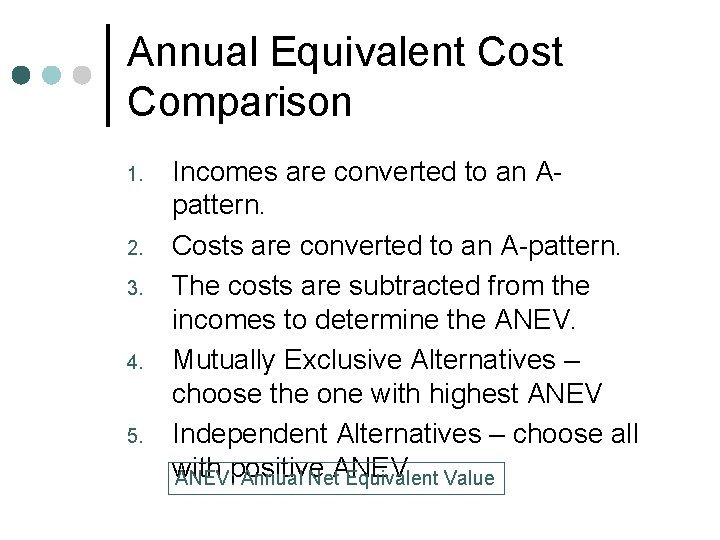

Annual Equivalent Cost Comparison 1. 2. 3. 4. 5. Incomes are converted to an Apattern. Costs are converted to an A-pattern. The costs are subtracted from the incomes to determine the ANEV. Mutually Exclusive Alternatives – choose the one with highest ANEV Independent Alternatives – choose all with ANEV: positive Annual Net. ANEV Equivalent Value

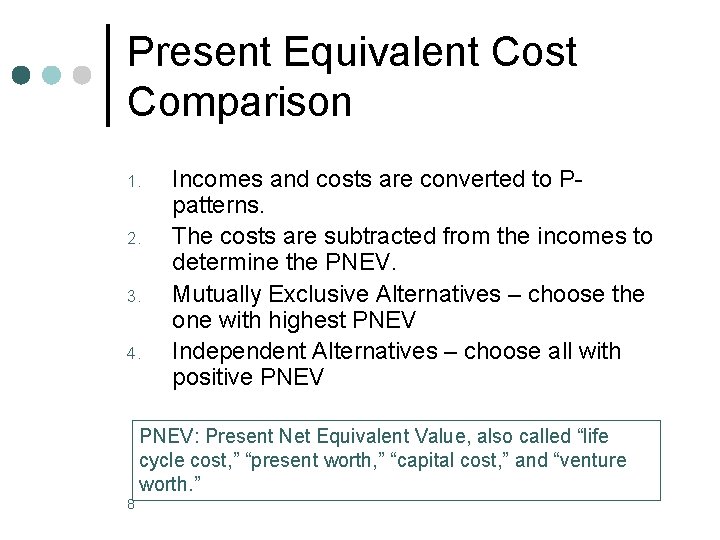

Present Equivalent Cost Comparison 1. 2. 3. 4. Incomes and costs are converted to Ppatterns. The costs are subtracted from the incomes to determine the PNEV. Mutually Exclusive Alternatives – choose the one with highest PNEV Independent Alternatives – choose all with positive PNEV: Present Net Equivalent Value, also called “life cycle cost, ” “present worth, ” “capital cost, ” and “venture worth. ” 8

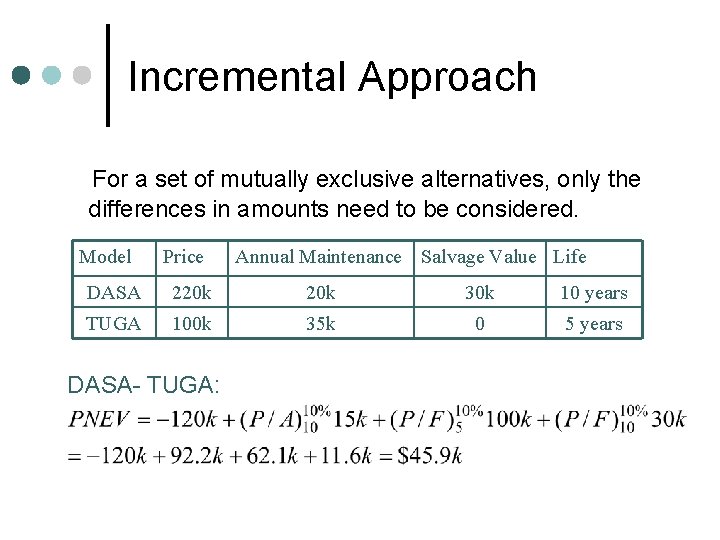

Incremental Approach For a set of mutually exclusive alternatives, only the differences in amounts need to be considered. Model Price Annual Maintenance Salvage Value Life DASA 220 k 30 k 10 years TUGA 100 k 35 k 0 5 years DASA- TUGA:

Rate of Return Method 1. 2. 3. 4. 5. ANEV or PNEV is formulated From this, we solve for the interest rate that will give zero ANEV or PNEV This interest rate is the ROR of the alternative For mutually exclusive alternatives, the one with the highest ROR is chosen For independent alternatives, all with a ROR greater than MARR are accepted ROR: Rate of Return on Investment

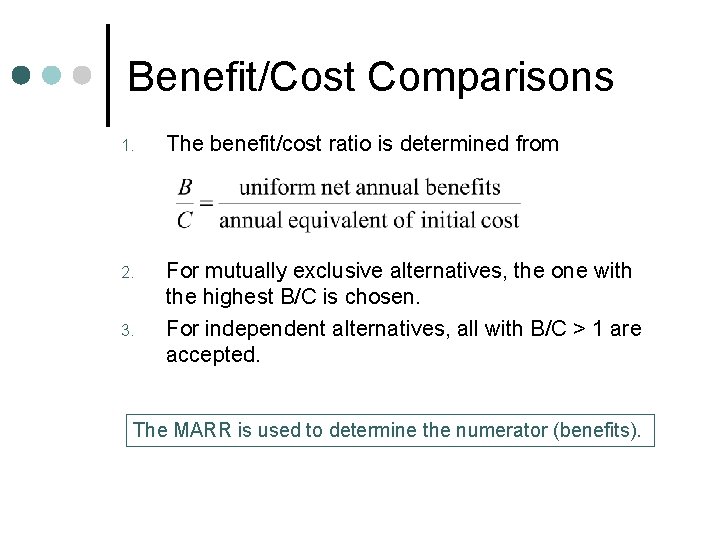

Benefit/Cost Comparisons 1. The benefit/cost ratio is determined from 2. For mutually exclusive alternatives, the one with the highest B/C is chosen. For independent alternatives, all with B/C > 1 are accepted. 3. The MARR is used to determine the numerator (benefits).

Break-Even Analysis 1. 2. 3. 4. Break-even point: the value of an independent variable such that two alternatives are equally attractive. For values above the break-even point, one alternative is preferred. For values below the break-even point, the other is preferred. Break-even analysis is useful when dealing with a changing variable (such as MARR).

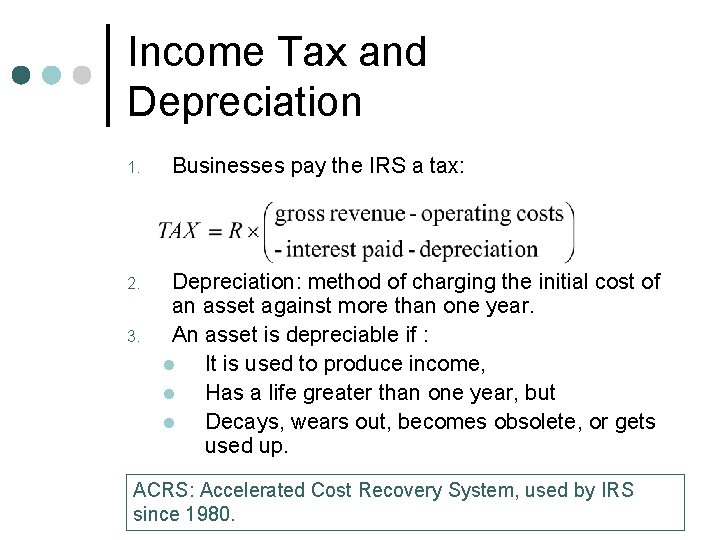

Income Tax and Depreciation 1. 2. 3. Businesses pay the IRS a tax: Depreciation: method of charging the initial cost of an asset against more than one year. An asset is depreciable if : l It is used to produce income, l Has a life greater than one year, but l Decays, wears out, becomes obsolete, or gets used up. ACRS: Accelerated Cost Recovery System, used by IRS since 1980.

- Slides: 13