Job Order Costing JOB ORDER COSTING IS USED

Job Order Costing JOB ORDER COSTING IS USED IN A MANUFACTURING ENVIRONMENT. THERE ARE UNIQUE CHALLENGES TO RECORD JOURNAL ENTRIES, MAINTAIN THE JOB ORDER COST SHEET AND ACCUMULATE INFORMATION FOR FINANCIAL STATEMENTS

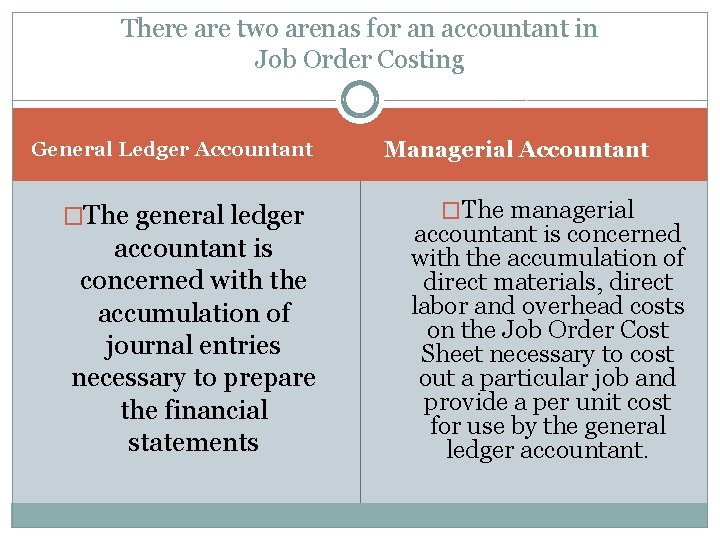

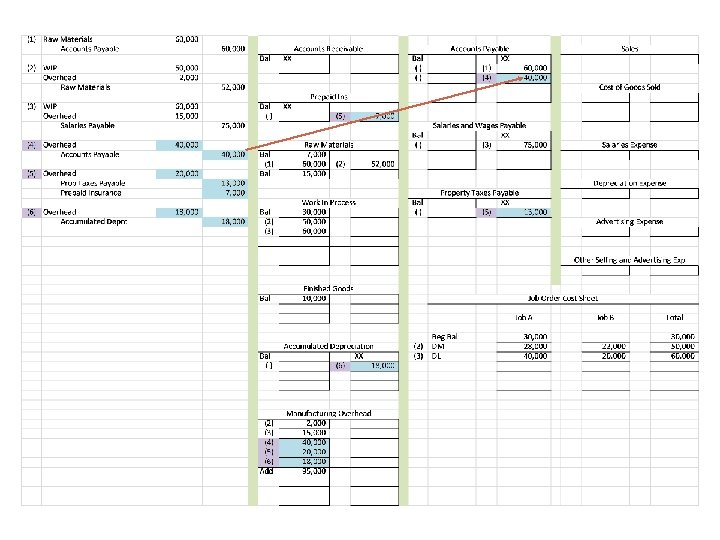

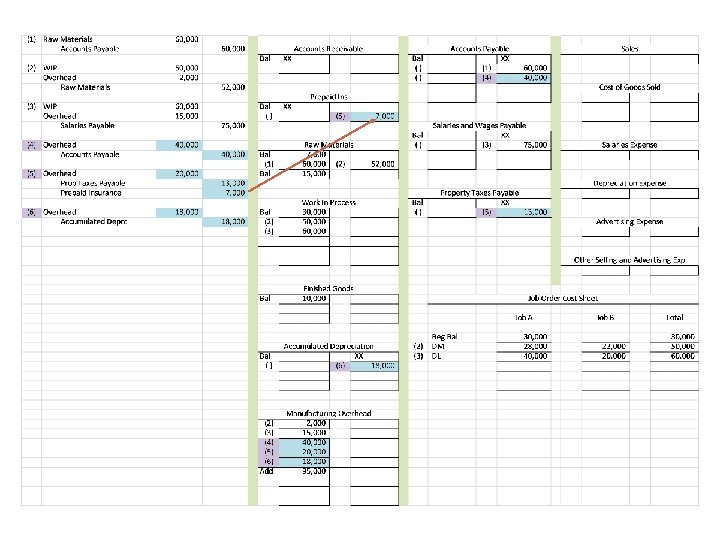

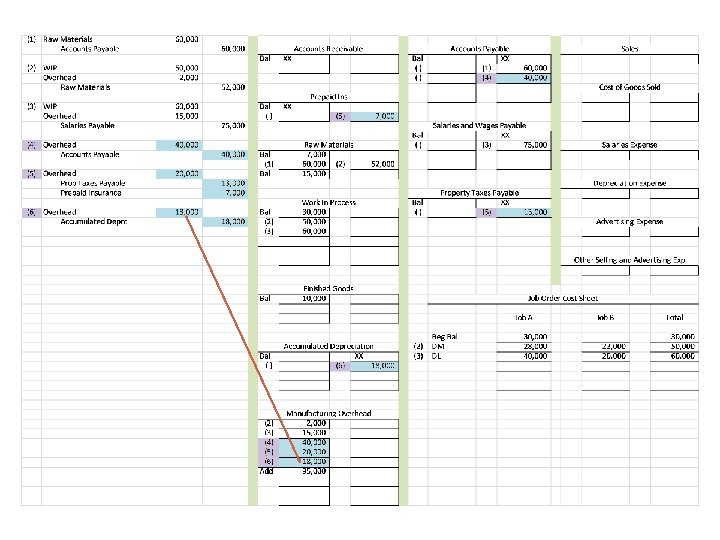

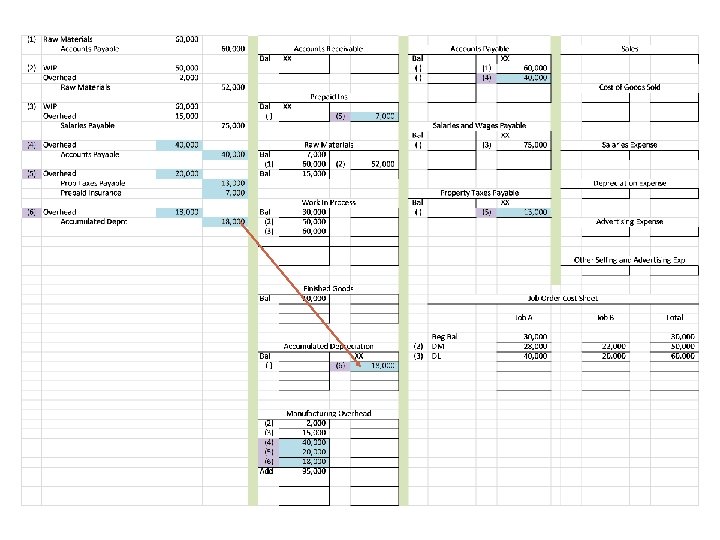

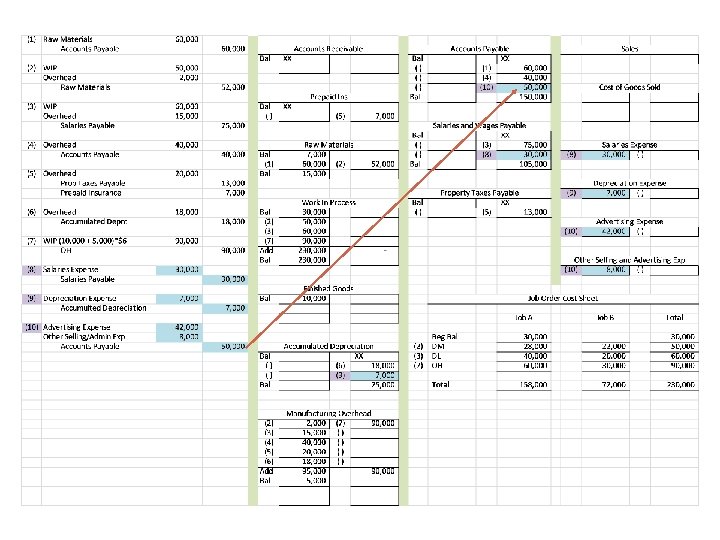

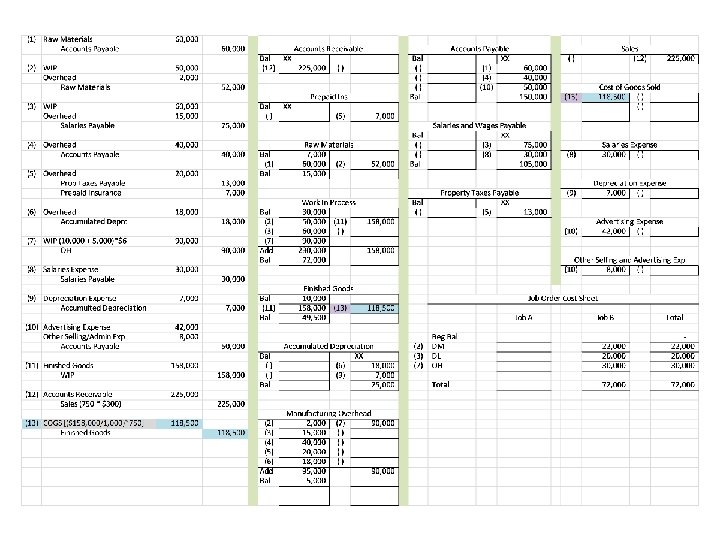

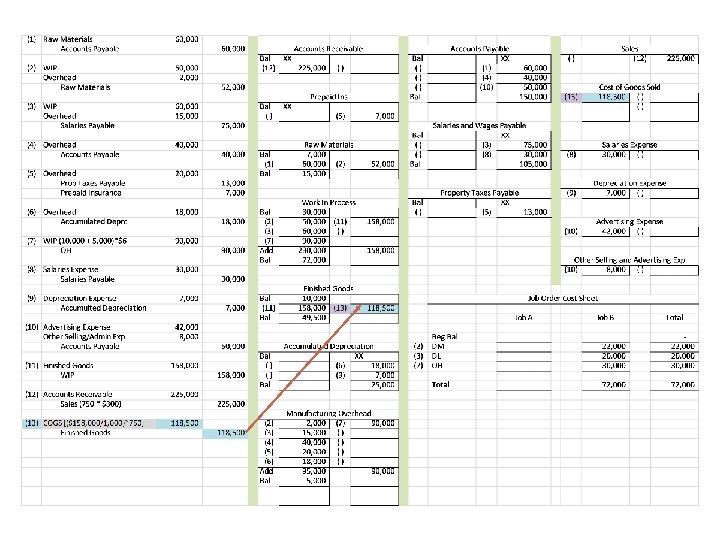

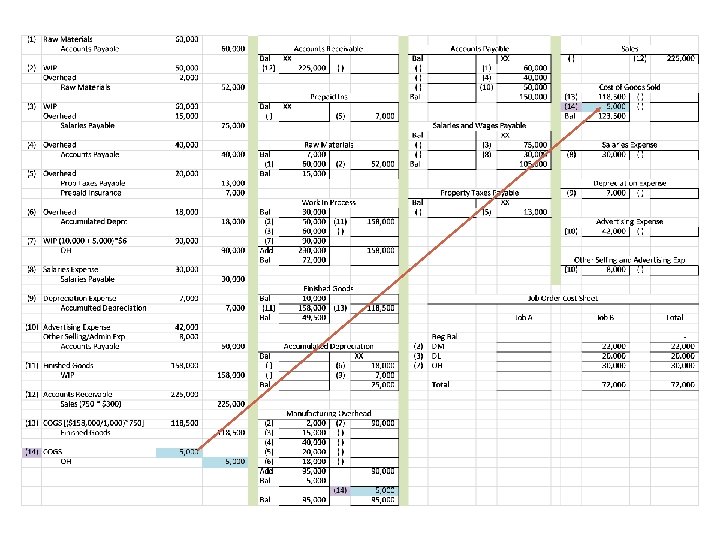

There are two arenas for an accountant in Job Order Costing General Ledger Accountant �The general ledger accountant is concerned with the accumulation of journal entries necessary to prepare the financial statements Managerial Accountant �The managerial accountant is concerned with the accumulation of direct materials, direct labor and overhead costs on the Job Order Cost Sheet necessary to cost out a particular job and provide a per unit cost for use by the general ledger accountant.

Manufacturing Overhead in Job Order Costing • • Manufacturing overhead uses a predetermined rate which is applied to a job based upon which job activity drives the overhead. Typically, the driver is direct labor hours or machine hours. The predetermined rate is determined at the beginning of the accounting year. It is comprised of all projected overhead costs (both fixed and variable) divided by the projected volume of the driver (number of direct labor/machine hours). This process is usually done during the budget phase for the upcoming year. This predetermined rate is then recorded both on the job order cost sheet and the general ledger based upon the actual volumes of the driver for the current period. This process is called “applying overhead. ” The predetermined rates helps to avoid fluctuations of costs by averaging out the effects of the overhead costs and allows for comparison of similar jobs completed in different time periods

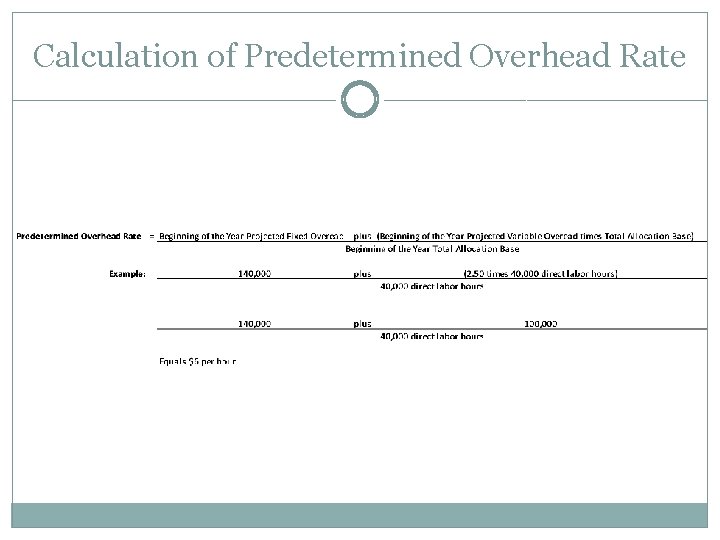

Calculation of Predetermined Overhead Rate

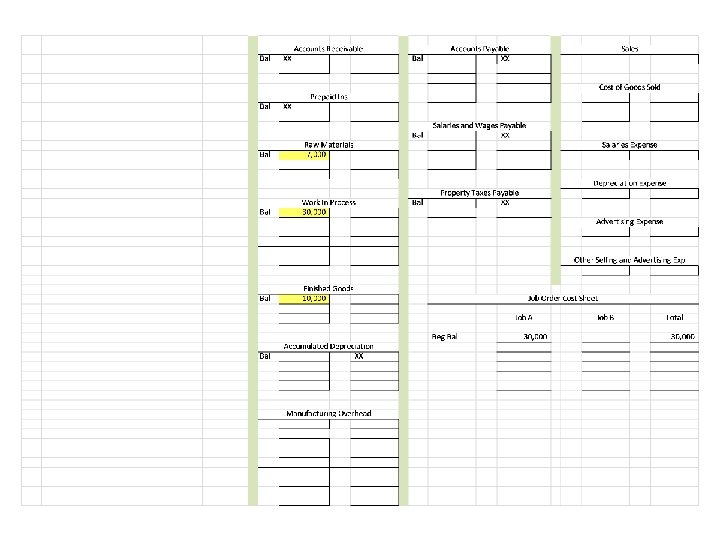

Inventory Accounts Manufacturing accounting requires three inventory accounts. • Raw Materials held in a storeroom and requisitioned for use on the shop or factory floor. • Work in Process – Inventory under production. WIP includes raw materials, direct labor, and applied overhead. WIP is always equal to the Job Order Cost Sheet. • Finished Goods – These are completed WIP units that have been transferred to the store or are available to be shipped.

Manufacturing Transactions THE FOLLOWING IS A SERIES OF SLIDES DEPICTING MANUFACTURING TRANSACTIONS WHICH COMPARE THE DIFFERENT EFFECTS OF THESE TRANSACTIONS BETWEEN THE GENERAL LEDGER ACCOUNTANT AND THE MANAGERIAL ACCOUNTANT.

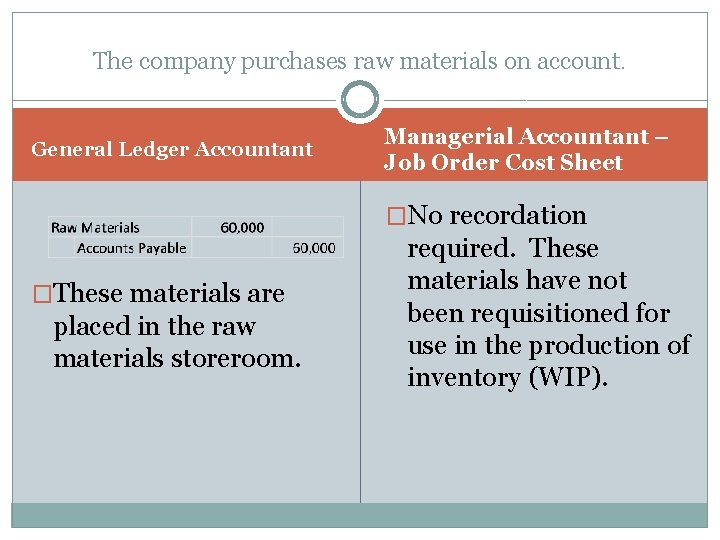

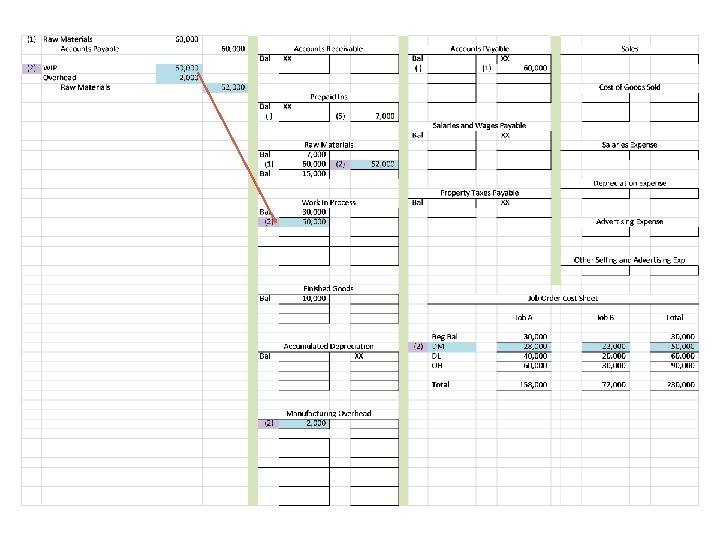

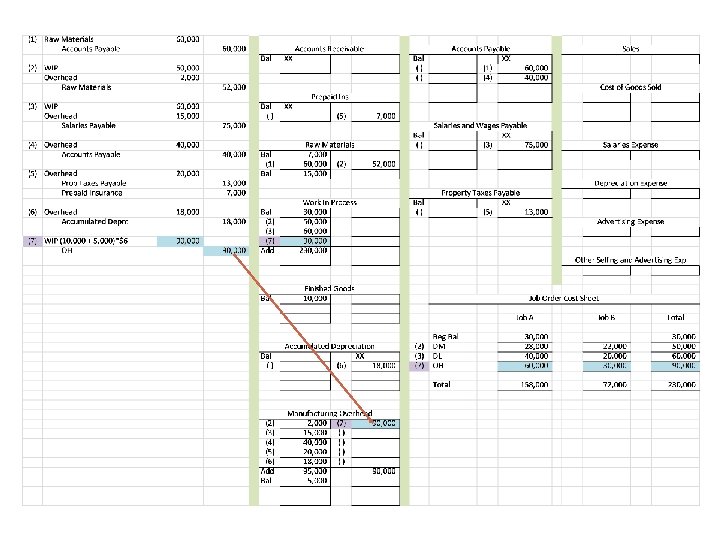

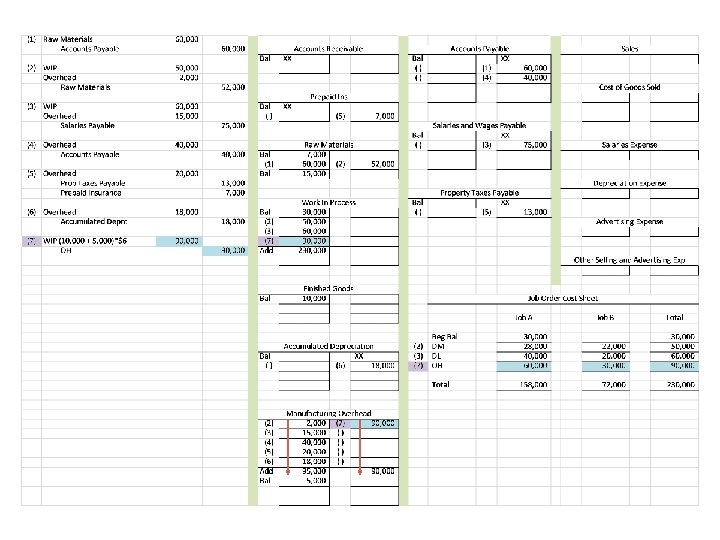

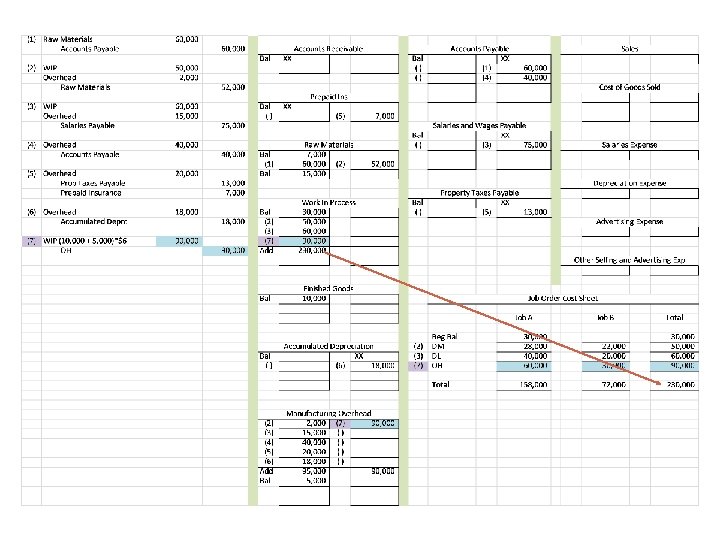

The company purchases raw materials on account. General Ledger Accountant Managerial Accountant – Job Order Cost Sheet �No recordation �These materials are placed in the raw materials storeroom. required. These materials have not been requisitioned for use in the production of inventory (WIP).

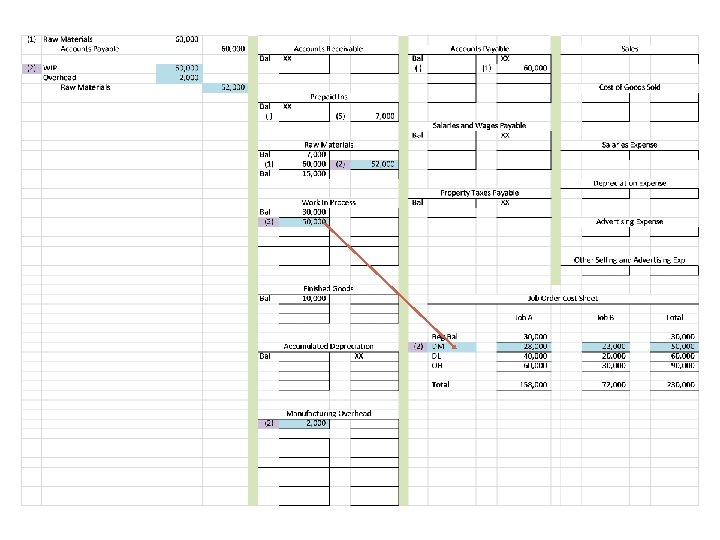

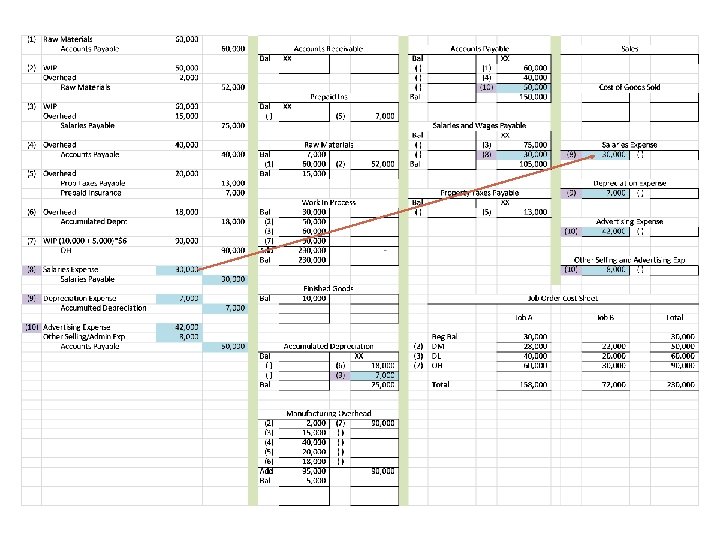

The raw materials inventory clerk is given a requisition for $52, 000 in materials. Direct materials in the amount of $28, 000 are needed for Job A and $22, 000 are needed for Job B. This requisition includes indirect materials in the amount of $2, 000. General Ledger Accountant Managerial Accountant – Job Order Cost Sheet � These direct materials have been � The requisition includes $50, 000 of direct materials and $2, 000 of indirect materials. Indirect materials by definition are overhead. Therefore, the indirect materials are recorded in an account called “overhead. ” The overhead account is debited for actual overhead costs are they are incurred. OH is a clearing acct. requisitioned for use in the production of inventory (WIP). Therefore, they are recorded on the Job Order Cost Sheet. The JOCS is kept by job and in total. Reminder: The JOCS always equals WIP in the accounting records. � Overhead will not be “applied” to the JOCS until the end of the period when the volume of the driver (machine hours) will be known.

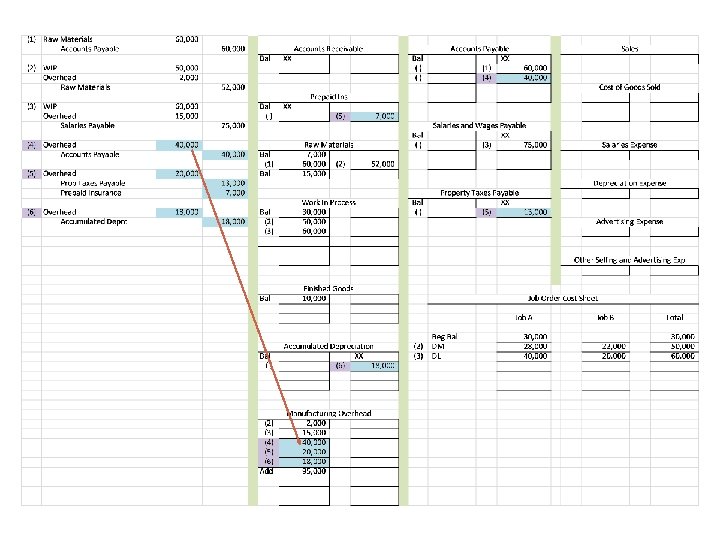

Factory payroll is prepared. Time tickets show wages for Job A are $40, 000 and for Job B are $20, 000. The entire factory payroll is $75, 000; therefore, the remainder is indirect labor—overhead. General Ledger Accountant � WIP is debited for the factory wages of Job A and Job B. The remainder of the factory payroll must therefore be indirect labor. Since this payroll is factory related, indirect labor is by definition overhead. � As was the case for indirect materials, the indirect labor is recorded to overhead. The overhead account is debited for actual overhead costs are they are incurred. Managerial Accountant – Job Order Cost Sheet � The direct labor has been incurred during production of inventory (WIP). Therefore, it is recorded on the Job Order Cost Sheet. Reminder: The JOCS always equals WIP in the accounting records. � Overhead will not be “applied” to the JOCS until the end of the period when the volume of the driver (machine hours) will be known.

The company incurs additional overhead items during the course of the month for factory-related items such as utilities/rent, property taxes, prepaid insurance, and depreciation. General Ledger Accountant Managerial Accountant – Job Order Cost Sheet � None of these costs are included on the � These costs are recorded to overhead because they are all necessary for the operations of the factory. The overhead account is debited for actual overhead costs are they are incurred. JOCS. (And none have been recorded to WIP in the general ledger. ) � Overhead will not be “applied” to the JOCS until the end of the period when the volume of the driver (machine hours) will be known.

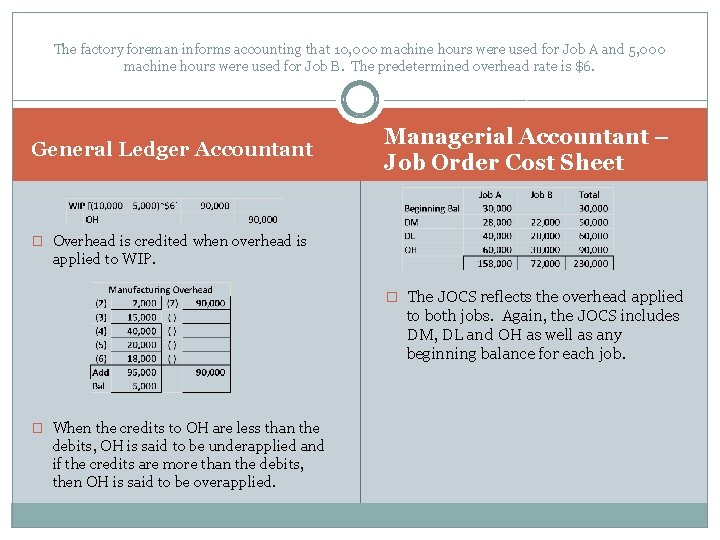

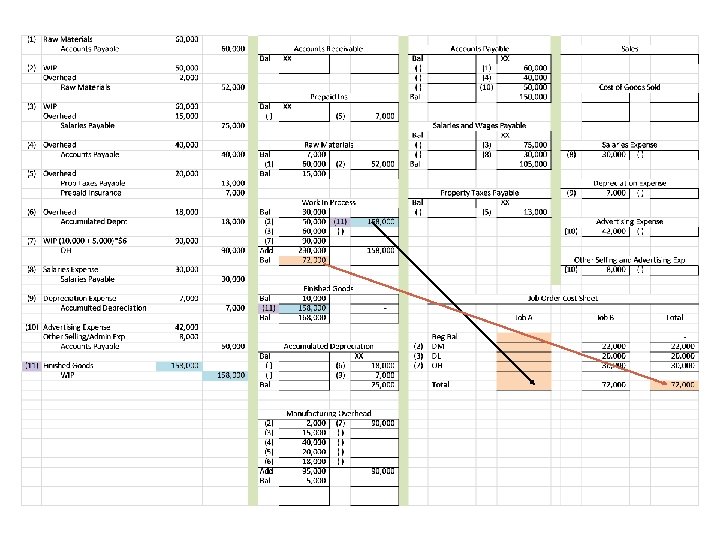

The factory foreman informs accounting that 10, 000 machine hours were used for Job A and 5, 000 machine hours were used for Job B. The predetermined overhead rate is $6. General Ledger Accountant Managerial Accountant – Job Order Cost Sheet � Overhead is credited when overhead is applied to WIP. � The JOCS reflects the overhead applied to both jobs. Again, the JOCS includes DM, DL and OH as well as any beginning balance for each job. � When the credits to OH are less than the debits, OH is said to be underapplied and if the credits are more than the debits, then OH is said to be overapplied.

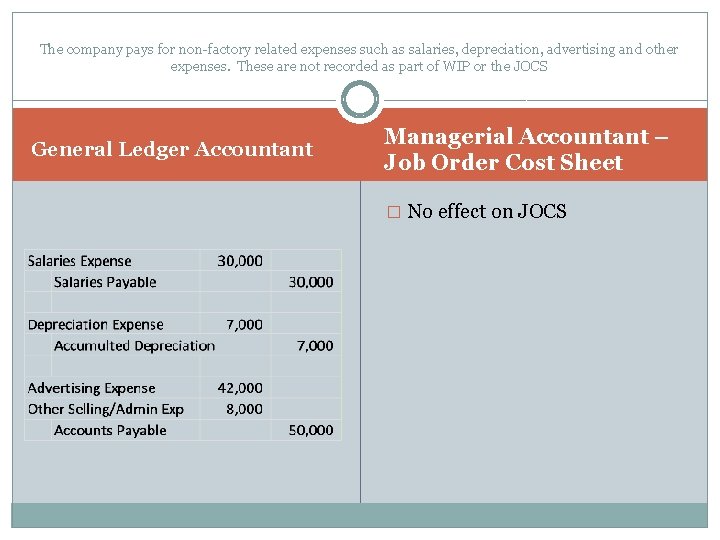

The company pays for non-factory related expenses such as salaries, depreciation, advertising and other expenses. These are not recorded as part of WIP or the JOCS General Ledger Accountant Managerial Accountant – Job Order Cost Sheet � No effect on JOCS

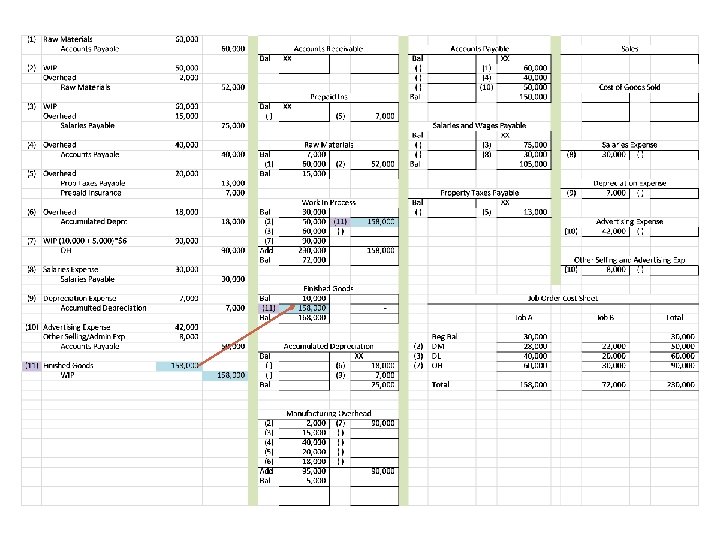

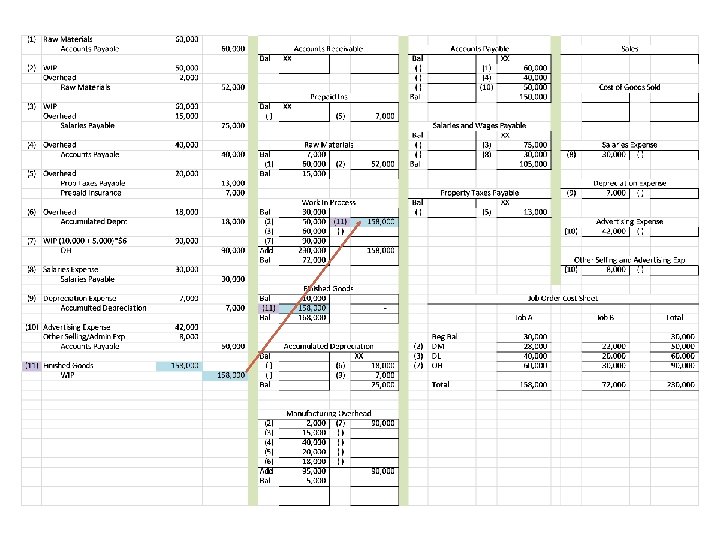

Job A has been completed and all of the costs are moved out of WIP and into Finished Goods. There are 1, 000 units completed for Job A. General Ledger Accountant Managerial Accountant – Job Order Cost Sheet �Was � The total costs of Job A were $158, 000 for 1, 000 units which equates to a cost of $158 per unit. � This JE also reflects cost of goods manufactured. �Now

The company sells 750 units of Job A at a sales price of $300. General Ledger Accountant Managerial Accountant – Job Order Cost Sheet � No effect on JOCS

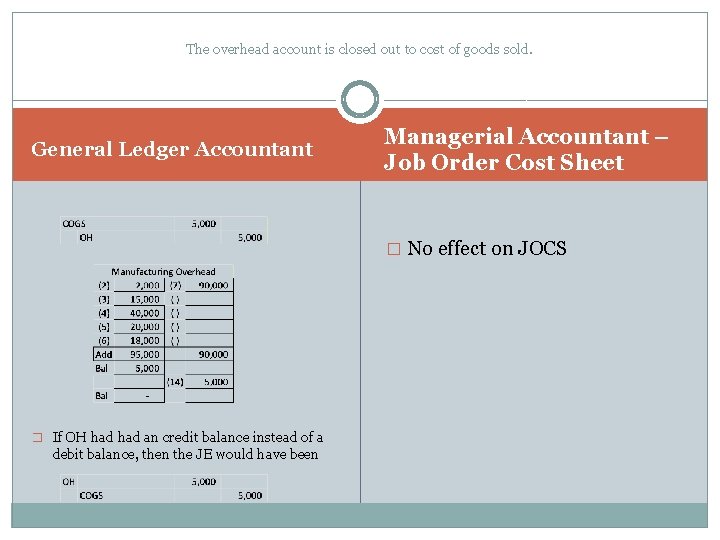

The overhead account is closed out to cost of goods sold. General Ledger Accountant Managerial Accountant – Job Order Cost Sheet � No effect on JOCS � If OH had an credit balance instead of a debit balance, then the JE would have been

Recap THIS IS A RECAP OF THE JOURNAL ENTRIES AND THE RECORDING IN THE GENERAL LEDGER AS WELL AS THE JOCS

- Slides: 58