IUP Faculty Benefits Overview Office of Human Resources

IUP Faculty Benefits Overview Office of Human Resources Lindsey Mc. Nickle Employee Benefits Manager Sutton Hall, Room G-3

Housekeeping Items

Faculty Employment Process �All new faculty members will receive an email from the Office of Human Resources that will include: �Appointment letter & contract �NEOGOV Onboarding Quick Reference Guide �Instructions on the background checking process �Following this initial email, an activation email will be sent to you from NEOGOV and will include: �Information on accessing your computing accounts and ordering a parking pass �Checklist of items to be completed by August 20, 2015

Faculty Employment Process �New Hire Paperwork – Neo. Gov �Background Checks – Justifacts & Cogent �Benefits Enrollment – Employee Self. Service (ESS) “My First Days” & Paper Enrollment Forms

Faculty Employment Process �Items you must present in person to the Office of Human Resources: �Valid Passport or two forms of identification for your I-9 Employment Eligibility Verification �Social Security Card or letter from the Social Security Office that you have applied for a card for Payroll purposes �FBI Fingerprint Records Check Results

Faculty Pay Schedule �All faculty and staff are on an after-the-fact pay schedule �The first pay for the 2015 -2016 Academic Year will be September 18, 2015 �The September 18, 2015 pay is for the pay period August 22, 2015– September 4, 2015 �Benefit deductions will begin on the pay date of the pay period you complete your enrollment

Benefits Eligibility

Faculty Benefits Eligibility �Permanent (tenure-track) faculty �Temporary faculty �Full-time : 12 credits (100%) for two consecutive academic semesters �Part-time: 6 -11. 99 credits (50% to 99. 99%) for two consecutive academic semesters �Eligibility can change if appointments are revised �Faculty members are notified if appointment revisions result in changes to benefits eligibility or cost

Overview of the Faculty Benefits Package

Faculty Benefits Package �Health & Prescription Drug Coverage �Vision & Dental Coverage �Flexible Spending Account Program (FSA) �University Paid Life Insurance (BGLI) �Voluntary Group Life Insurance Program (VGLIP) �Long-Term Disability Insurance Program (LTD) �Retirement Plan Program

Benefits �What is it? �Why do I need it (or not need it)? �How much does is cost? �How do I sign up?

Salary + Benefits Total Compensation

Employee Benefit Rules

Pre-Tax Payroll Deductions for Certain Benefit Plans �Pre-tax payroll deductions are qualified deductions from your paycheck that lower your taxable wages by subtracting these deductions from your gross wages before your tax withholding is calculated �Because these plans have tax benefits, there are IRS rules that must be followed

Health & Prescription Drug Coverage

Health & Prescription Drug Coverage �What is it? �A way to pay for health care expenses for you & your eligible dependents �Protects you from paying the full cost of medical services when injured or sick �Why do you need it? �The cost for medical services is very expensive �Under the ACA, you are fined if you don’t have health insurance �How much does it cost? �Cost is based on the type of plan elected & the number of dependents you add to coverage �How do you sign up? �Initial enrollments are through Employee Self-Service

Health & Prescription Drug Coverage �Two Medical Plan Choices: �Preferred Provider Organization (PPO) – Highmark Blue Shield �Health Maintenance Organization (HMO ) – UPMC for Western PA residents �One Prescription Drug Option: �Highmark Blue Shield/Express Scripts

PPO vs. HMO Health Plan �Each health plan has contracted with medical providers to be in their “network” �PPO plan covers eligible medical services provided by PPO network providers and non-network providers �HMO plan only covers eligible medical services provided by HMO network providers �Coverage for PPO medical services is the same as coverage for HMO medical services �HMOs have additional rules – PCP, referrals �Network of providers is key in choosing a health plan

Eligibility Rules Spouse/Same-Sex Domestic Partners �If your spouse/same-sex domestic partner is employed and their employer offers healthcare coverage, they must be enrolled in the employer plan as primary coverage regardless of the cost �You may enroll a spouse/same-sex domestic partner as a dependent on your health/prescription drug plan as secondary coverage �Primary coverage pays first and secondary coverage may pay what primary doesn’t pay

Health & Prescription Drug Coverage Cost �Depends on the plan you choose & the number of dependents on your plan �You pay for your health care coverage is a percentage of the total premium cost for the plan � 15% of the health care premium is the cost for the HMO plan and new enrollments in the PPO plan �Health care contributions are deducted from your paycheck on a pre-tax basis

Health Plan Changes �Qualifying Events �Add or remove a dependent, cancel coverage and/or enroll in coverage �Changes can be made immediately if you have a qualifying event and enrollment/changes are done within 60 days �Annual Open Enrollment �Add or remove dependents and/or change your health plan option �Held in the spring with changes effective the following July 1

Healthy U Wellness Program

Healthy U Wellness Program �The Healthy U Program is the State System’s Wellness Program �Healthy U is only applicable to the PPO plan option �The State System has contracted with Highmark Blue Shield to provide wellness services �All personal health information you provide as a participant in the program is kept strictly confidential

Why Are We Asked to Participate in a Wellness Program? The cost of the State System’s group health insurance plans are affected by the medical services utilized by the group of individuals the plan covers

Why Have a Wellness Program? Sick People = Higher Utilization of Medical Services = Higher Health Care Premiums = Less Take-Home Pay for You Healthy People = Less Utilization of Medical Services = Lower Health Care Premiums = Higher Take-Home Pay for You

Healthy U Wellness Program �Employee and the covered spouse/same-sex domestic partner must participate �Each must earn 70 points by May 31, 2016 �One required activity: The Wellness Profile (30 points) �Remaining points can be earned by participating in other preventative screenings, activities and programs �Lowest health care contribution will continue for the 2016 -2017 plan year

Healthy U Wellness Program �Must have Highmark Identification Card before you can enroll/participate �Each participant must create their own unique Login ID and Password �Each participant will each receive separate confirmations of completion – print & save these confirmations! �Does not apply to HMO enrollees

Vision & Dental Benefits

Vision & Dental Coverage �Provided by the Pennsylvania Faculty Health & Welfare Fund �Enrollment Cards: IUP APSCUF Office 101 Keith Hall �Program Information: �www. pafac. com

Flexible Spending Account Program

Flexible Spending Account Program (FSA) �What is it? �Opportunity to pay for eligible health care and daycare expenses with tax free dollars �Why do you need it? �To avoid paying taxes & have more take-home pay �How much does it cost? �You decide how much you want to contribute per year up to certain annual maximums �How do you sign up? �Use Employee Self-Service (ESS) to enroll for the remainder of 2015

Flexible Spending Account Program (FSA) �Two Types: �Health Care FSA - used to pay for eligible outof-pocket medical expenses not paid by insurance �Can be used for eligible medical expenses for anyone you claim as a dependent for federal income tax purposes �Dependent Care FSA – used to pay for eligible child or elder care expenses including daycare, before/after-school care and summer day camp

Life, Accident & Disability Insurance

Life, Accident & Disability Insurance �What is it? �A way to protect you and those that depend on you against financial loss �Why do you need it? �To replace your income in the event of death or disability �How much does it cost? �Various factors determine cost �How do you sign up? �Complete a paper enrollment form

University Paid Basic Group Life Insurance �Applies to tenure-track faculty members only �Term life insurance coverage one times your academic year salary up to $50, 000 �Three-month waiting period before life insurance goes into effect �Met. Life �HR Office handles the enrollment

Voluntary Group Life & Personal Accident Insurance Program (VGLIP) �Two plans offered: �Term Life Insurance (VGLI) �Personal Accident Insurance (AD&D) �Fully Employee Paid �Can be used to supplement university paid life insurance (tenure-track faculty members)

Term Life Insurance (VGLI) �Pays a benefit to the employee’s beneficiary or next of kin in the event of the death of the insured during a specified term. �Coverage is available for Employee, Spouse & Children

Term Life Insurance (VGLI) �Cost is based on your/your spouse’s age, amount of coverage elected, and tobacco usage �Guaranteed benefit if enrolled within first 31 days following the date you become eligible for coverage �Enroll by completing the VGLIP paper enrollment form (on website)

Personal Accident Insurance (AD&D) �Pays a benefit to the employee’s beneficiary or next of kin in the event of the death of the insured by accidental means �Pays a benefit to the insured if permanently disabled as the result of an accident �Coverage is available for Employee, Spouse & Children �Cost is $. 015 per $1, 000 of coverage �Enroll by completing the VGLIP paper enrollment form

Long-Term Disability Insurance Program (LTD) �Pays a benefit in the event of the employee’s disability to help employee cover living expenses �Must be disabled for 90 days or 180 days before a benefit can be paid �Coverage is guaranteed if enrolled within first 31 days following the date you become eligible for coverage �Cost is based on your annual salary and the waiting period option you elect �Enroll by completing the LTD paper enrollment form

Retirement Plan Program

Retirement Plan Program �What is it? �A way to save money to be used as income when you retire �Why do you need it? �Social Security will probably not provide you with the income you need to live comfortably in retirement �The Commonwealth of PA mandates enrollment in a retirement plan �How much does it cost? �Retirement contributions are taken as a percentage of your gross biweekly salary �How do you sign up? �Enroll through Employee Self-Service (ESS) �ARP participants must also contact vendor of choice to set up their account

Retirement Plan Program �Defined Benefit Retirement Plan: �Pennsylvania State Employees’ Retirement System (SERS) �Defined Contribution Retirement Plan: �Pennsylvania State System of Higher Education (PASSHE) Alternative Retirement Plan (ARP)

If you are notified that you are eligible for benefits, you MUST enroll in the State System’s Retirement Program THIS IS THE ONLY MANDATORY BENEFIT PROGRAM

Retirement Plan Enrollment �Enrollment in a retirement plan must be made within 30 days of date of eligibility �If election is not made within 30 days of the date of eligibility – automatic enrollment in SERS �Enrollment is final and binding – there no option to switch plans at a later date

Defined Benefit Retirement Plan: State Employees’ Retirement System (SERS) �Also known as a traditional pension plan �Guarantees participant a specified monthly benefit at retirement �Retirement benefit is based on your salary and number of years you work for the employer �Guaranteed benefit for life if vested (10 years) �State Employees’ Retirement System (SERS)

State Employees’ Retirement System (SERS) �Two options for new members �Class A-3 �Employee contribution of 6. 25% of gross salary �Retirement Benefit Formula: � 2% x Years of Service x Final Average Salary x Early Retirement Factor (if applicable)

State Employees’ Retirement System (SERS) �Class A-4 �Optional Class of Service �A-3 members will have 45 days to A-4 class of service �Employee contribution of 9. 3% of gross salary �Retirement Benefit Formula: � 2. 5% x Years of Service x FAS x Early Retirement Factor (if applicable)

SERS �Tax deferred by reducing gross compensation for federal tax purposes �Vesting is 10 Years �Refunds: �Employee is eligible for contributions & interest (4%) if separated with less than 10 years of service �Normal Retirement Age is age 65 with 3 years of service or “Rule of 92”

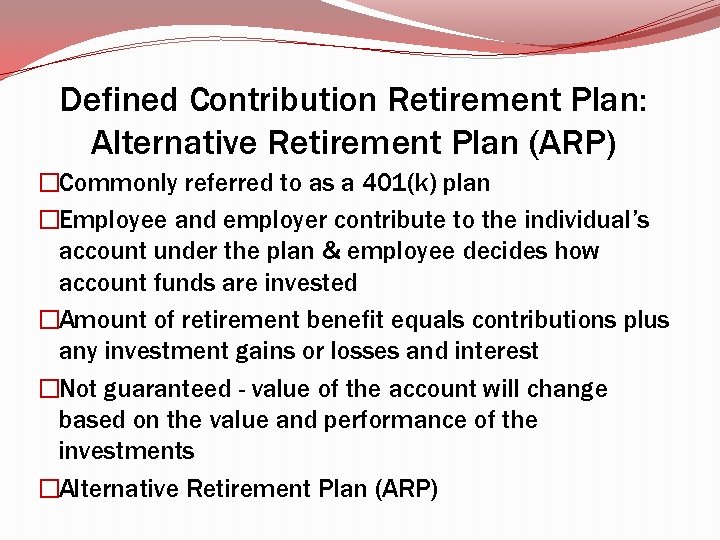

Defined Contribution Retirement Plan: Alternative Retirement Plan (ARP) �Commonly referred to as a 401(k) plan �Employee and employer contribute to the individual’s account under the plan & employee decides how account funds are invested �Amount of retirement benefit equals contributions plus any investment gains or losses and interest �Not guaranteed - value of the account will change based on the value and performance of the investments �Alternative Retirement Plan (ARP)

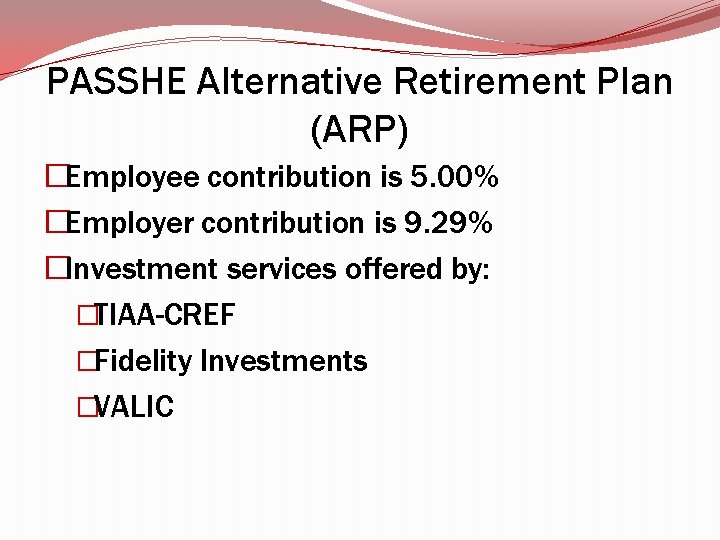

PASSHE Alternative Retirement Plan (ARP) �Employee contribution is 5. 00% �Employer contribution is 9. 29% �Investment services offered by: �TIAA-CREF �Fidelity Investments �VALIC

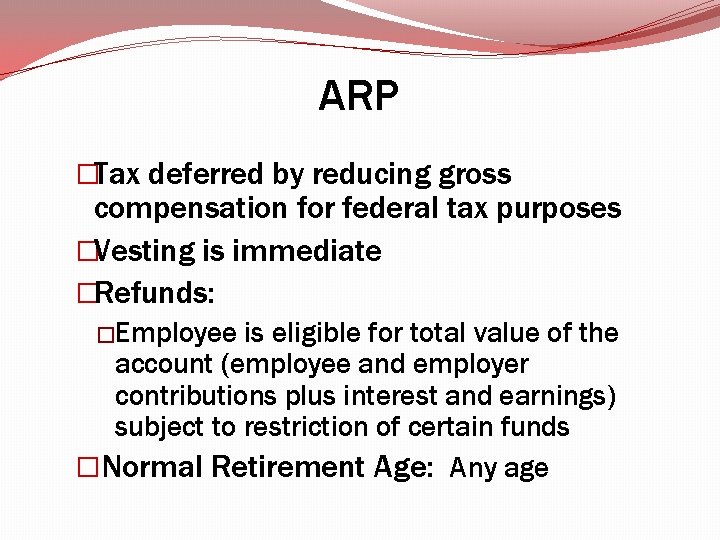

ARP �Tax deferred by reducing gross compensation for federal tax purposes �Vesting is immediate �Refunds: �Employee is eligible for total value of the account (employee and employer contributions plus interest and earnings) subject to restriction of certain funds �Normal Retirement Age: Any age

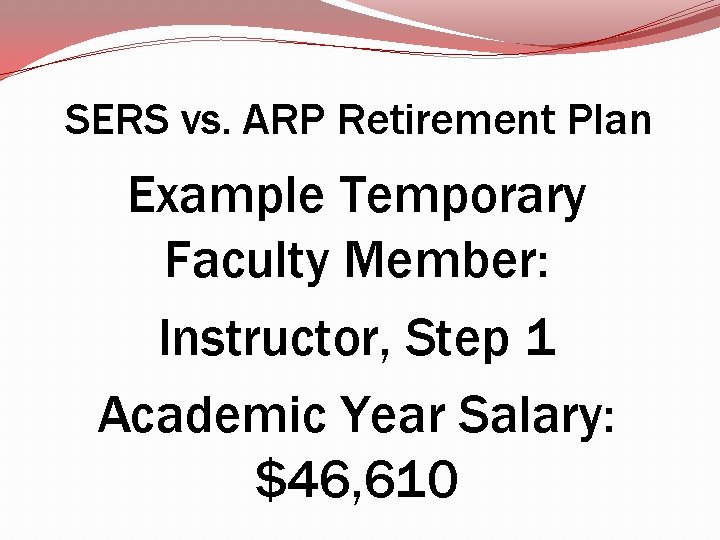

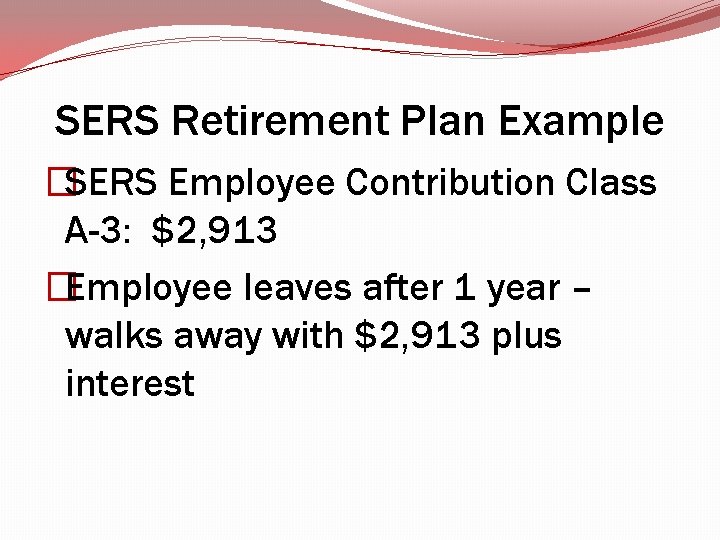

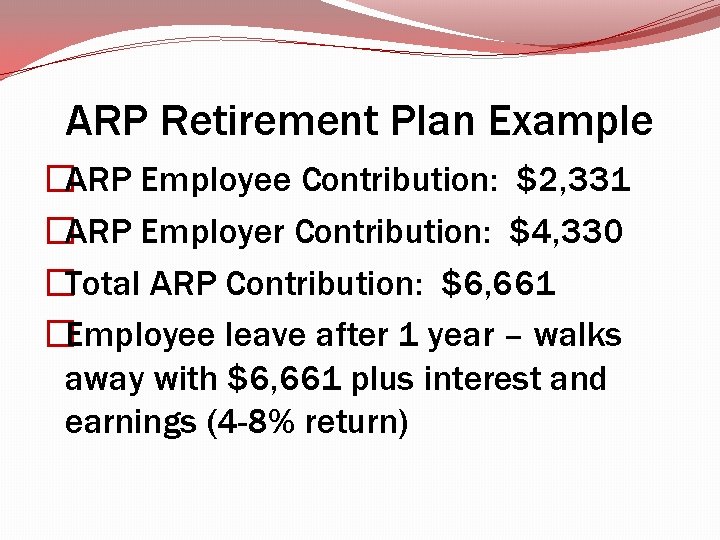

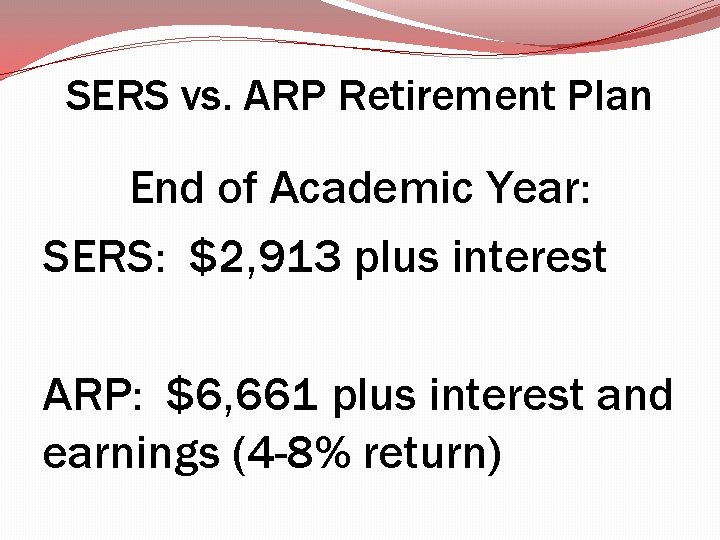

SERS vs. ARP Retirement Plan Example Temporary Faculty Member: Instructor, Step 1 Academic Year Salary: $46, 610

SERS Retirement Plan Example �SERS Employee Contribution Class A-3: $2, 913 �Employee leaves after 1 year – walks away with $2, 913 plus interest

ARP Retirement Plan Example �ARP Employee Contribution: $2, 331 �ARP Employer Contribution: $4, 330 �Total ARP Contribution: $6, 661 �Employee leave after 1 year – walks away with $6, 661 plus interest and earnings (4 -8% return)

SERS vs. ARP Retirement Plan End of Academic Year: SERS: $2, 913 plus interest ARP: $6, 661 plus interest and earnings (4 -8% return)

But Wait, There’s More!

Other Benefits �Tax Sheltered Annuity 403(b) plan �Deferred Compensation 457 plan �Tuition Waiver �Paid & Unpaid Leave Benefits �State Employees’ Assistance Program (SEAP) �PA 529 College Savings Program �U. S. Treasury Savings Bonds �PNC Workplace Banking �Pennsylvania State Employees Credit Union (PSECU)

What Do I Need to Do Next?

New Faculty Benefits Enrollments �All new faculty members will receive an email from the Office of Human Resources that will include �Notification of benefits eligibility �Links to benefit plan information �Instructions on how to enroll in benefits �Initial benefit enrollment period is 30 days from your first day of employment �Benefit elections will be effective retroactive to August 22, 2015

Benefits Enrollment �www. iup. edu/humanresources/ben efits/benefits-enrollment-for-newiup-faculty-members �Detailed Benefits Information: �Worksheets �Cost calculators �Videos and more!

Enrolling in Benefit Programs �Enrollment through Employee Self-Service (ESS): �Health & Prescription Drug Coverage �Retirement Program �Flexible Spending Accounts �Paper enrollment forms: �Voluntary Group Life Insurance Program �Long-Term Disability Program

Required Documentation �Items you must bring in person to the Office of Human Resources: �Original marriage certificate if electing to add spouse to your health care coverage �Notarized same-sex domestic partner certification if electing to add domestic partner to your health care coverage �Original birth certificates if electing to add children to your health care coverage

Questions?

- Slides: 64