ITF Transport Outlook Meeting the needs of 9

- Slides: 22

ITF Transport Outlook Meeting the needs of 9 billion people Plenary 2: Towards a Green Economy ITF Transport Outlook Transforming Transportation Plenary 2: DC Towards a Green Economy Washington DC 26 January 2012

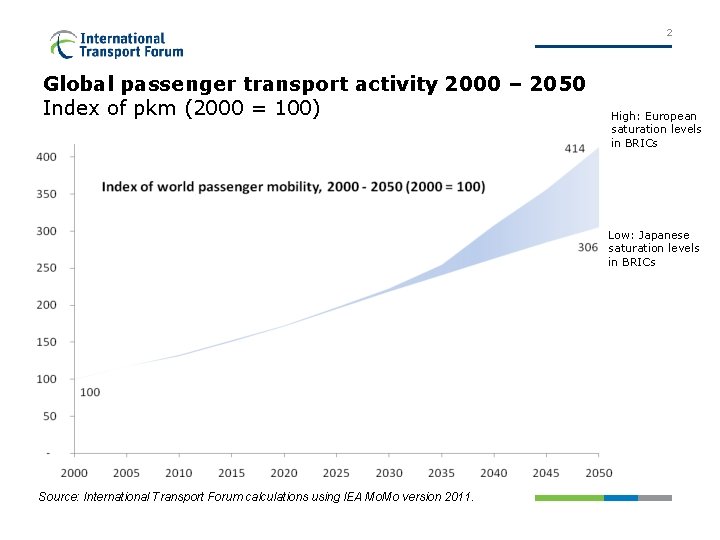

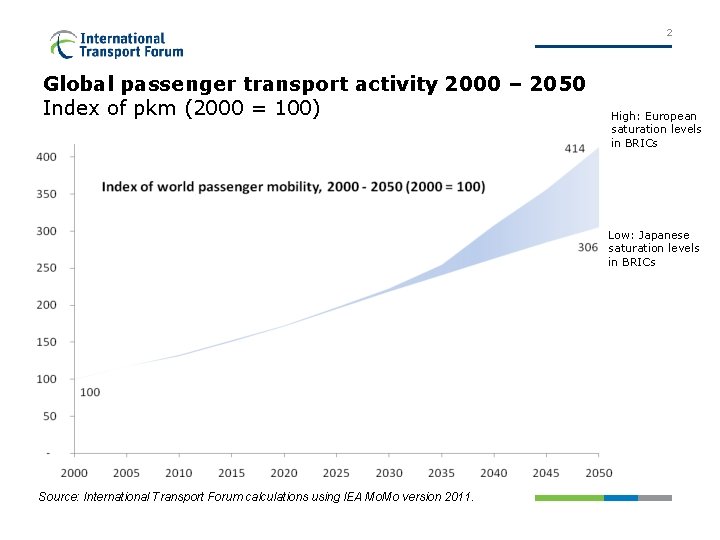

2 Global passenger transport activity 2000 – 2050 Index of pkm (2000 = 100) High: European saturation levels in BRICs Low: Japanese saturation levels in BRICs Source: International Transport Forum calculations using IEA Mo. Mo version 2011.

3 Global passenger transport activity 2000 -2050 • Meeting the needs of 9 billion people • Outlook fraught with uncertainty over such a long period • Global passenger-km increase 3 -4 times by 2050 • Outside OECD pkm could increse 5 or 6 fold • Range is not measure of uncertainty but illustrates potential impact of modest changes in assumptions • Low scenario – IEA base case in WEO 2008, Emerging economies reach Japanese levels of car ownership and use levels • High scenario: European saturation levels • Share of car trips seems set to rise from <10% in China to >50%

4 Aviation • Medium term in line with IEA and IATA • Longer term: • Low scenario lower than IATA especially in OECD countries • High OECD continues to grow non-OECD accelerates with deregulation and open skies • High is still much lower than aircraft makers forecasts

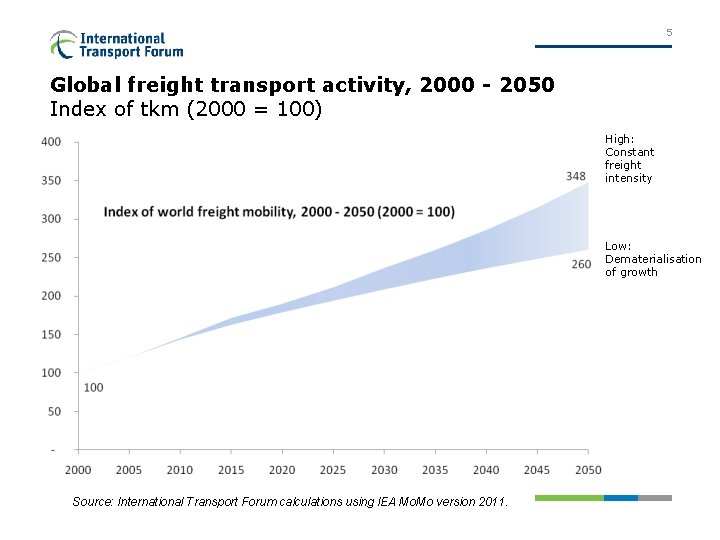

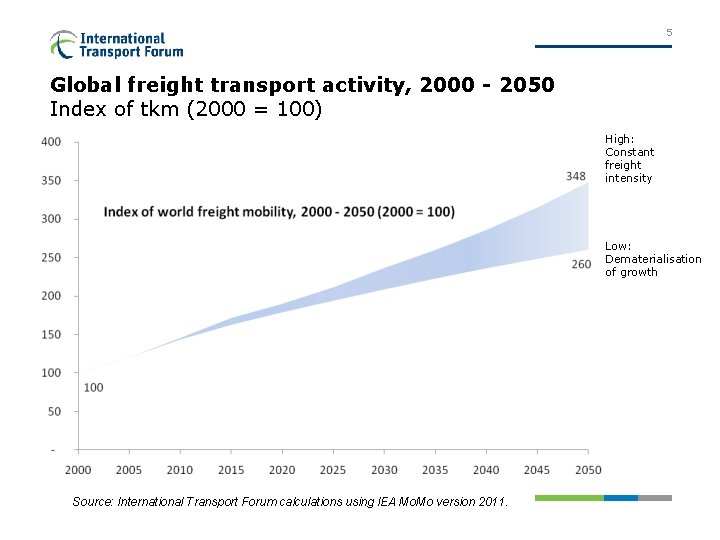

5 Global freight transport activity, 2000 - 2050 Index of tkm (2000 = 100) High: Constant freight intensity Low: Dematerialisation of growth Source: International Transport Forum calculations using IEA Mo. Mo version 2011.

6 Freight Transport Activity 2000 -2050 • Global freight tonne-km to rise 2. 5 – 3. 5 times by 2050 • Low scenario: Dematerialisation of growth, eg shift to services • High scenario: GDP growth continues at 2005 freight intensity levels • Developing countries may be embarking on a relatively freight intensive growth path, so full upside risk not reflected in graph

7 High Scenarios • Best interpreted as where demand would like to go • Realistic? Policy intervention? • Eg fast urbanisation might slow growth of car ownership and use • High energy prices would suppress • But high scenarios far from impossible

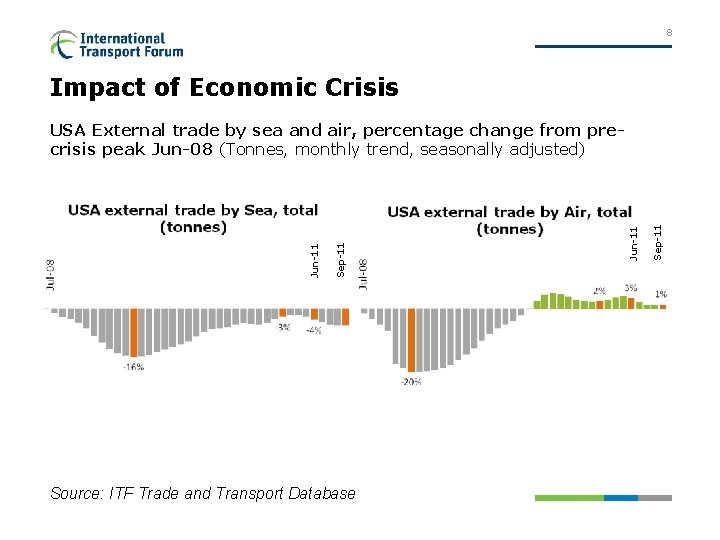

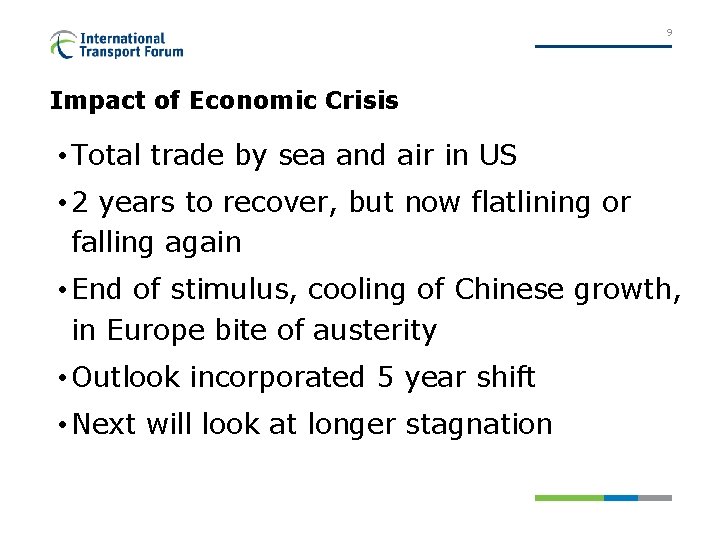

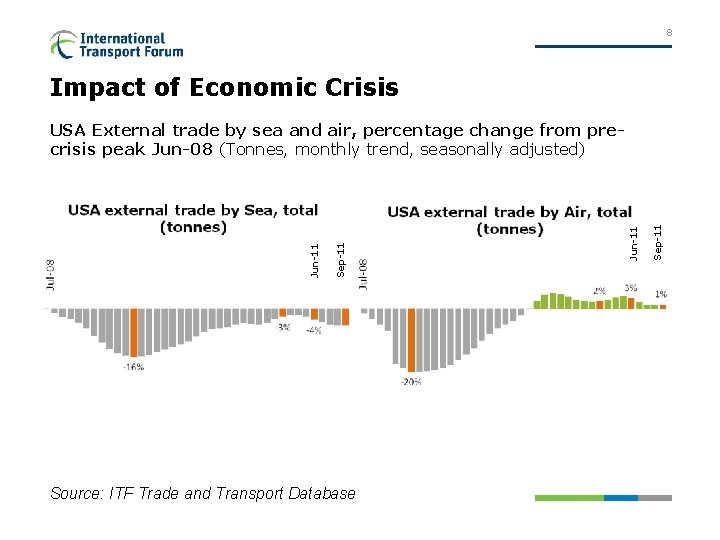

8 Impact of Economic Crisis Source: ITF Trade and Transport Database Sep-11 Jun-11 USA External trade by sea and air, percentage change from precrisis peak Jun-08 (Tonnes, monthly trend, seasonally adjusted)

9 Impact of Economic Crisis • Total trade by sea and air in US • 2 years to recover, but now flatlining or falling again • End of stimulus, cooling of Chinese growth, in Europe bite of austerity • Outlook incorporated 5 year shift • Next will look at longer stagnation

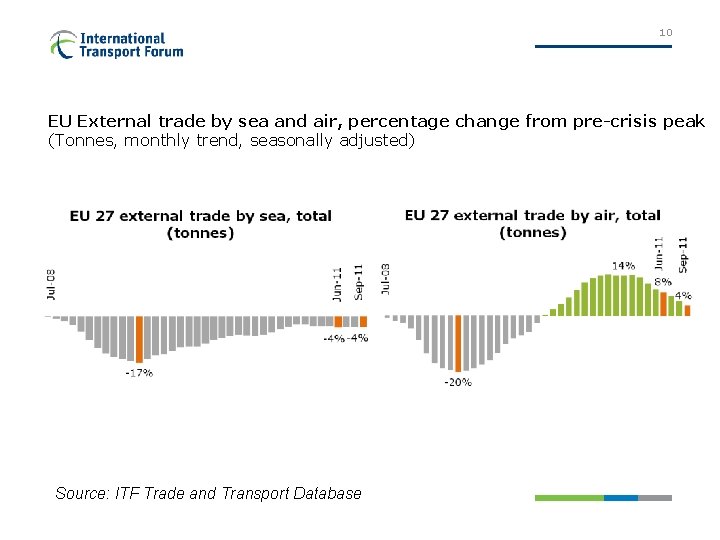

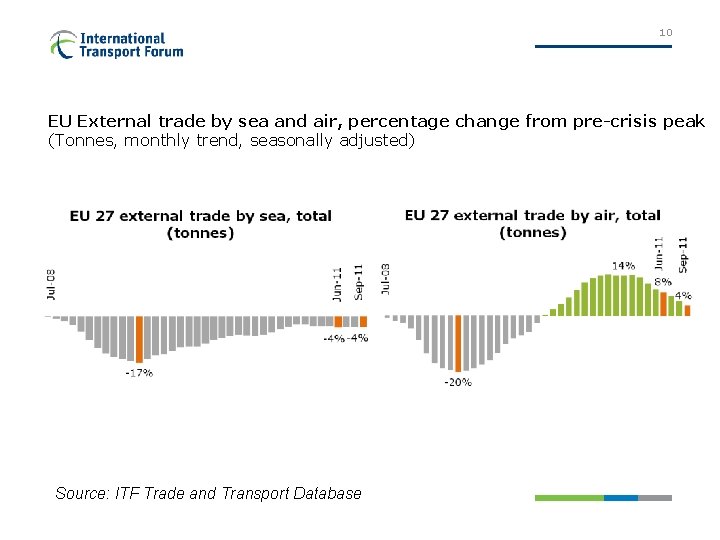

10 EU External trade by sea and air, percentage change from pre-crisis peak (Tonnes, monthly trend, seasonally adjusted) Source: ITF Trade and Transport Database

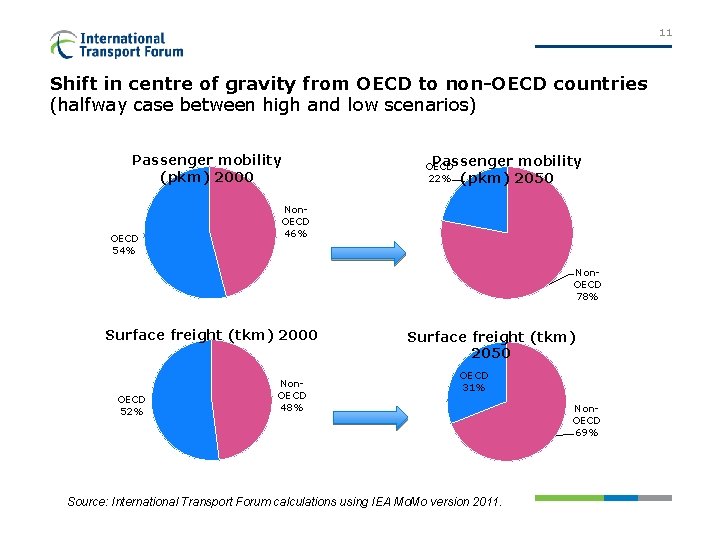

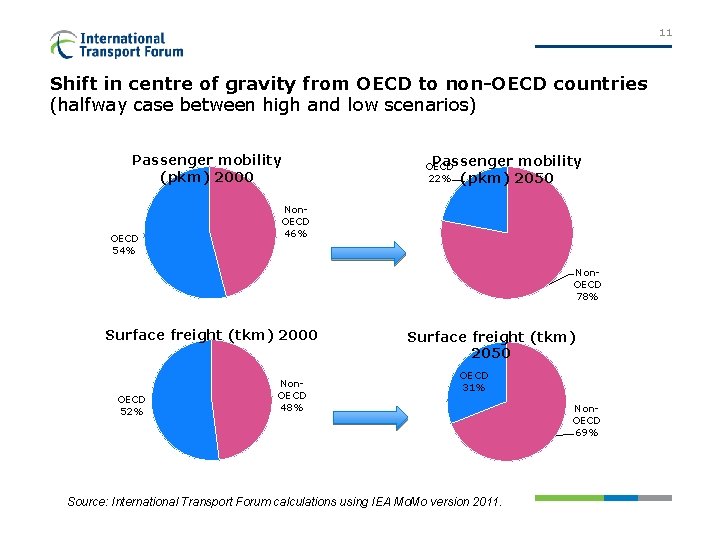

11 Shift in centre of gravity from OECD to non-OECD countries (halfway case between high and low scenarios) Passenger mobility (pkm) 2000 OECD 54% Passenger mobility OECD 22% (pkm) 2050 Non. OECD 46% Non. OECD 78% Surface freight (tkm) 2000 OECD 52% Non. OECD 48% Surface freight (tkm) 2050 OECD 31% Source: International Transport Forum calculations using IEA Mo. Mo version 2011. Non. OECD 69%

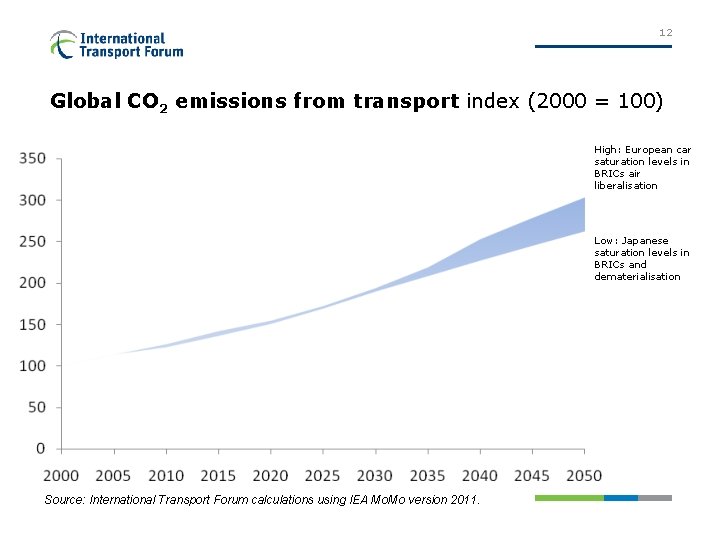

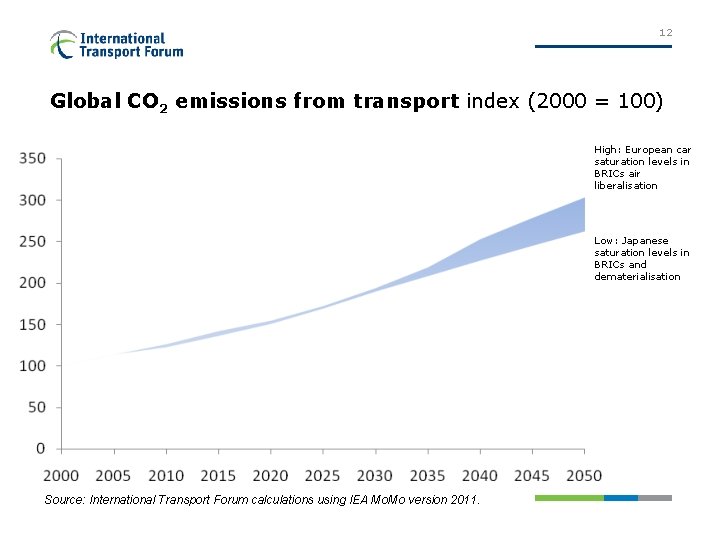

12 Global CO 2 emissions from transport index (2000 = 100) High: European car saturation levels in BRICs air liberalisation Low: Japanese saturation levels in BRICs and dematerialisation Source: International Transport Forum calculations using IEA Mo. Mo version 2011.

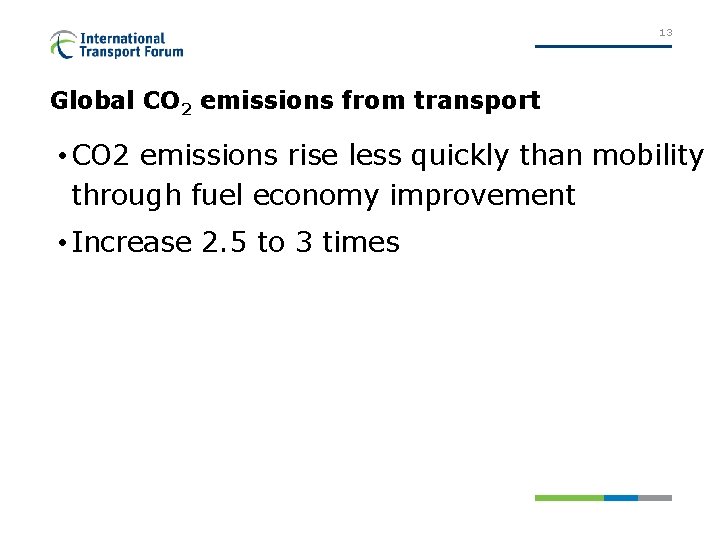

13 Global CO 2 emissions from transport • CO 2 emissions rise less quickly than mobility through fuel economy improvement • Increase 2. 5 to 3 times

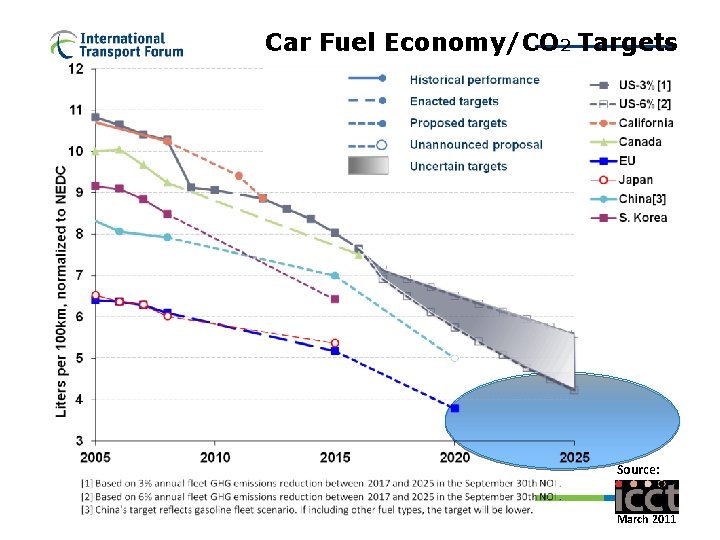

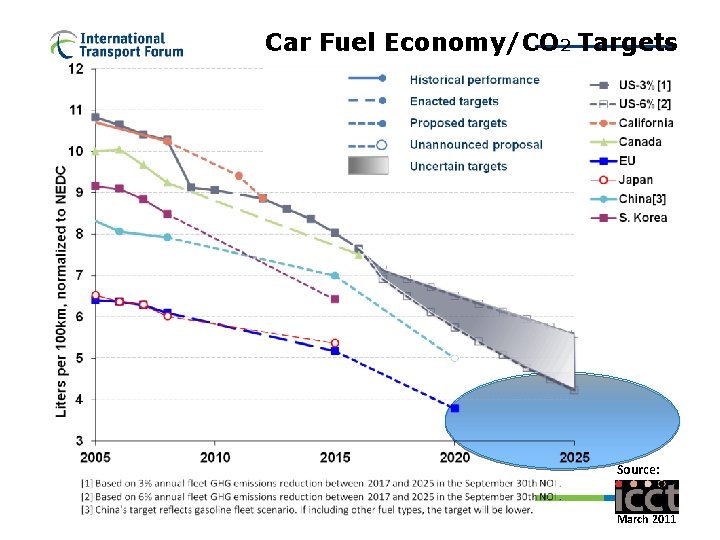

Car Fuel Economy/CO 2 Targets Source: March 2011

15 Global CO 2 emissions from transport • Maximisation of cost effective fuel economy improvement around the world, eg through continues progress with emissions standards would stabilise emissions • GFEI target • 8 l/100 km ave new fleet economy in 2008 rise to 4 l/100 km in 2030; whole fleet 2005 • Impressive but not enough to for IPCC 450 ppm CO 2 limit

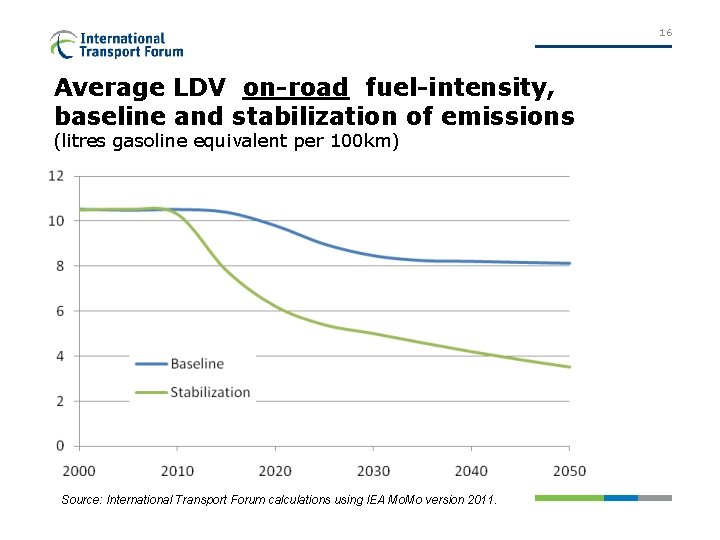

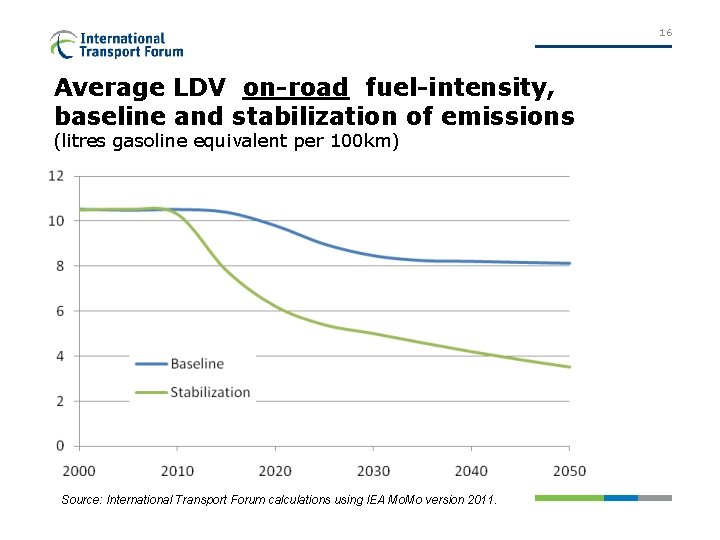

16 Average LDV on-road fuel-intensity, baseline and stabilization of emissions (litres gasoline equivalent per 100 km) Source: International Transport Forum calculations using IEA Mo. Mo version 2011.

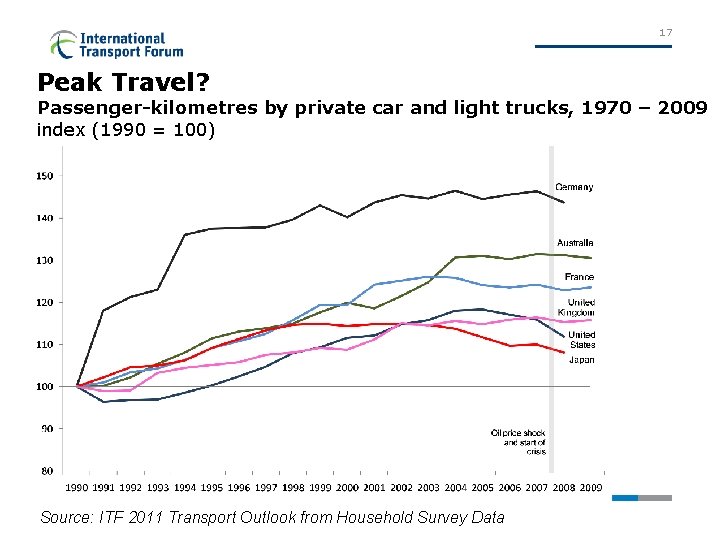

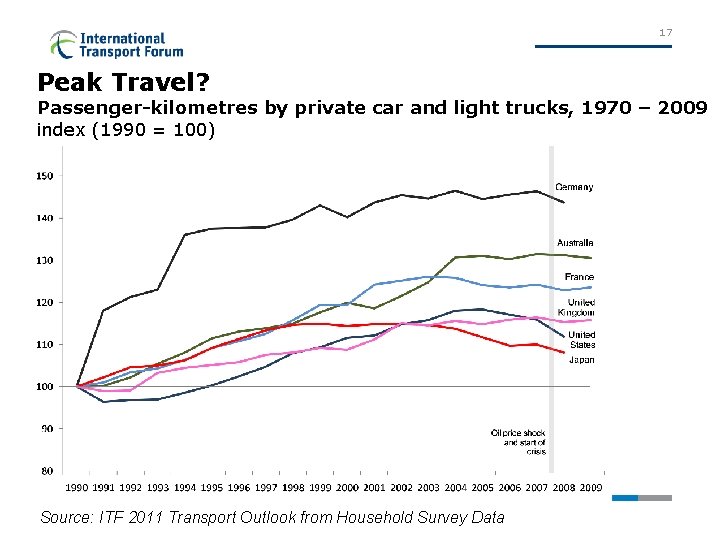

17 Peak Travel? Passenger-kilometres by private car and light trucks, 1970 – 2009 index (1990 = 100) Source: ITF 2011 Transport Outlook from Household Survey Data

18 Peak travel? • Evidence of reduced responsiveness of car and light truck travel to increasing incomes in advanced economies • As the effect of income on travel (vkm) diminishes, it leaves a larger role to other determinants such as fuel prices, urbanisation, ageing and network management • But economic cycle visible in US in particular • And income distribution may have a large role. Income growth in last decade concentrated on wealthiest 10%. Incomes decreased in many of the lower deciles.

19 Peak travel? • High income households are less responsive due to saturation, low income households very responsive • Whether or not growing income translates into more driving (VMT) thus also depends on the distribution of income growth • Uncertainty over future income likely to play a role in medium term • Demographics becoming increasingly important • These factors have strong implications for the projection of long run transport demand

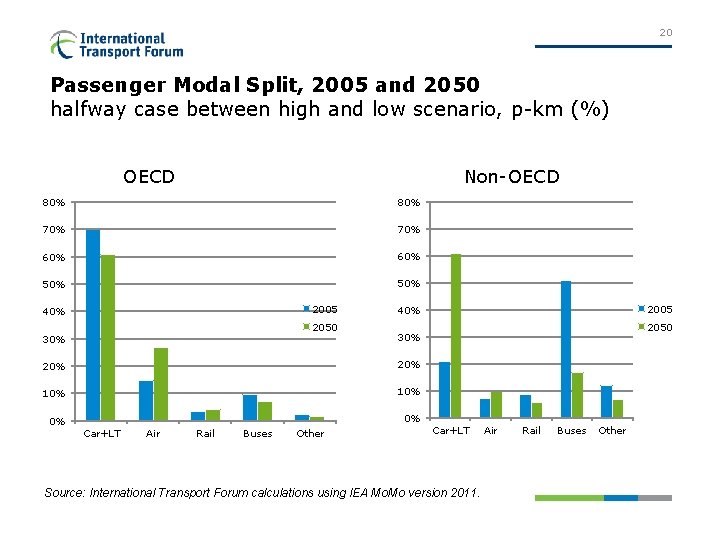

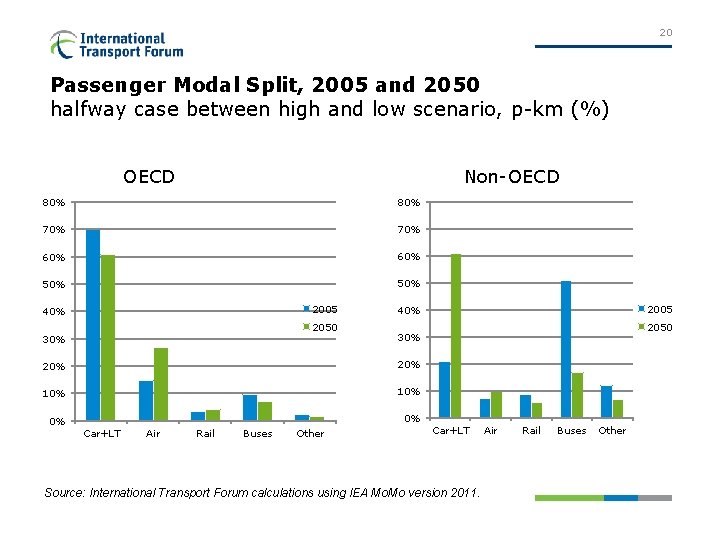

20 Passenger Modal Split, 2005 and 2050 halfway case between high and low scenario, p-km (%) OECD Non-OECD 80% 70% 60% 50% 2005 40% 2050 30% 20% 10% 0% 0% Air Rail Buses Other 2050 30% 20% Car+LT 2005 40% Car+LT Source: International Transport Forum calculations using IEA Mo. Mo version 2011. Air Rail Buses Other

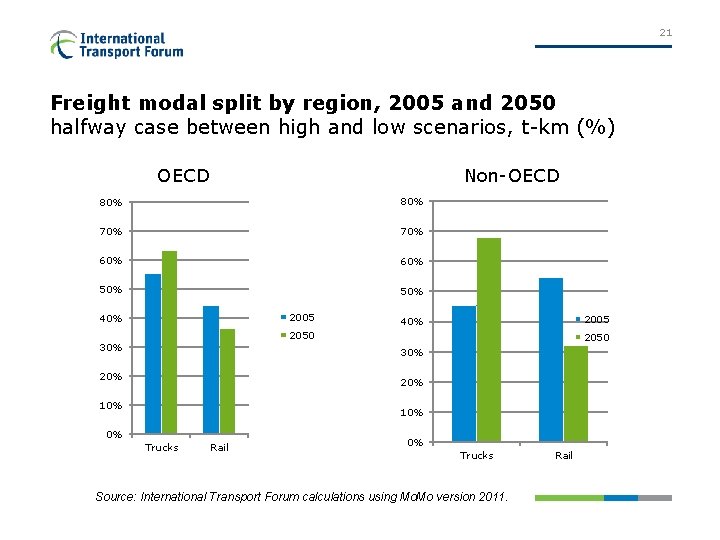

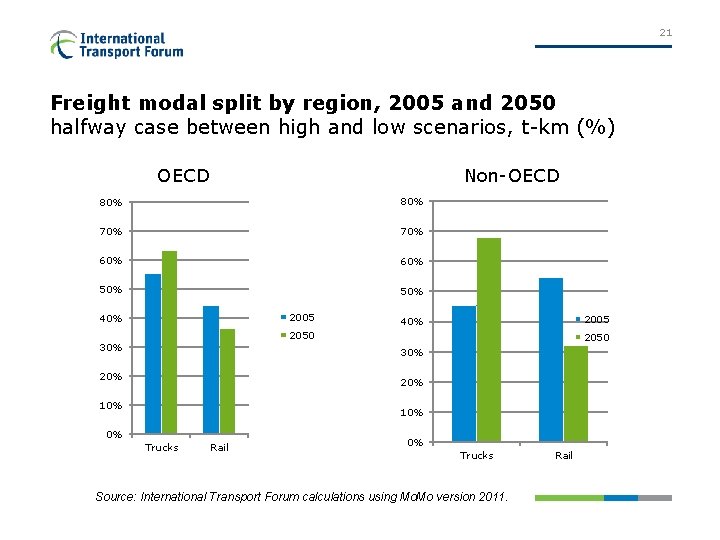

21 Freight modal split by region, 2005 and 2050 halfway case between high and low scenarios, t-km (%) OECD Non-OECD 80% 70% 60% 50% 2005 40% 2050 30% 20% 10% 0% Trucks Rail 0% Trucks Source: International Transport Forum calculations using Mo. Mo version 2011. Rail

Thank you Stephen Perkins T +33 (0)1 45 24 94 96 E stephen. perkins@oecd. org Postal address 2 rue Andre Pascal 75775 Paris Cedex 16