Italian National Institute of Statistics National Accounts Department

- Slides: 20

Italian National Institute of Statistics National Accounts Department The disposable income of Households: an international comparison Marianna Ascione Francesca Chiucchiolo Teresa Nardone STATISTICS “Investment in the Future 2” Prague, 14 -15 September 2009 Prague, 14 -15 september 2009 Roofs of Prague

Introduction The paper focuses on the most meaningful patterns of some key macroeconomic indicators for the Households sector in the European countries in the period 2000 -2007. The analysis is performed for: Ø EA – Euro Area (15 Member States) Ø EU – European Union (27 Member States) Ø A number of European countries, namely: Italy, Germany, France, Spain, Portugal, the United Kingdom, the Netherlands, Belgium, Norway, Poland, Czech Republic, Romania and Greece. Data source: annual non-financial sector accounts (ASA) (http: //epp. eurostat. ec. europa. eu/portal/page/portal/sector_accounts/) Data updated to July 2009, for Greece and Romania only 2007 data were missing. In the most of charts we show the average share for the period 2000 -2007 and whereas appropriate we analyse the last year available. Prague, 14 -15 september 2009

Households (S. 14): definition Households sector includes: - individuals or groups of individuals as consumers (including persons living permanently in institutions) - productive units, it is entrepreneurs producing market goods, non-financial and financial services if their distributive and financial transactions are not distinct from those of their owner and which are market producers • sole proprietorship • self-employer • partnerships without independent legal status e. g. partnerships of lawyers, doctors, architects Prague, 14 -15 september 2009

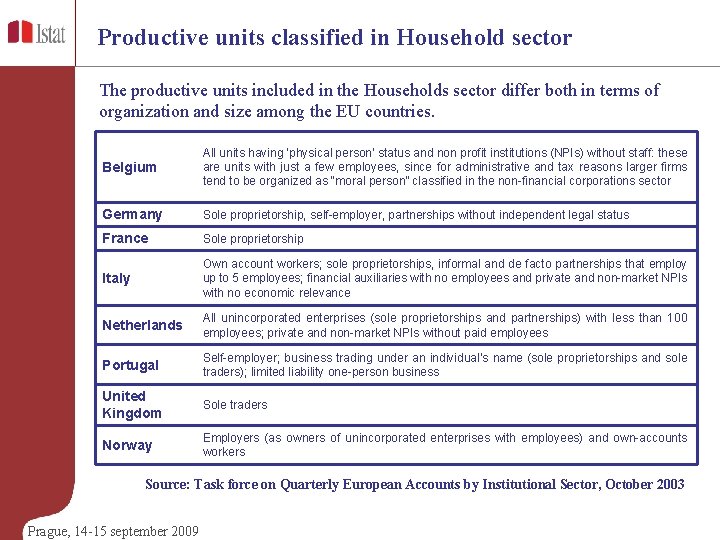

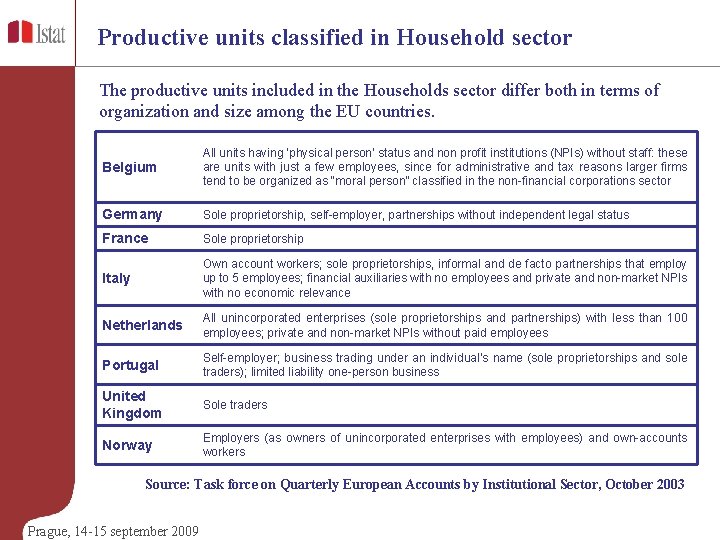

Productive units classified in Household sector The productive units included in the Households sector differ both in terms of organization and size among the EU countries. Belgium All units having ‘physical person’ status and non profit institutions (NPIs) without staff: these are units with just a few employees, since for administrative and tax reasons larger firms tend to be organized as “moral person” classified in the non-financial corporations sector Germany Sole proprietorship, self-employer, partnerships without independent legal status France Sole proprietorship Italy Own account workers; sole proprietorships, informal and de facto partnerships that employ up to 5 employees; financial auxiliaries with no employees and private and non-market NPIs with no economic relevance Netherlands All unincorporated enterprises (sole proprietorships and partnerships) with less than 100 employees; private and non-market NPIs without paid employees Portugal Self-employer; business trading under an individual’s name (sole proprietorships and sole traders); limited liability one-person business United Kingdom Sole traders Norway Employers (as owners of unincorporated enterprises with employees) and own-accounts workers Source: Task force on Quarterly European Accounts by Institutional Sector, October 2003 Prague, 14 -15 september 2009

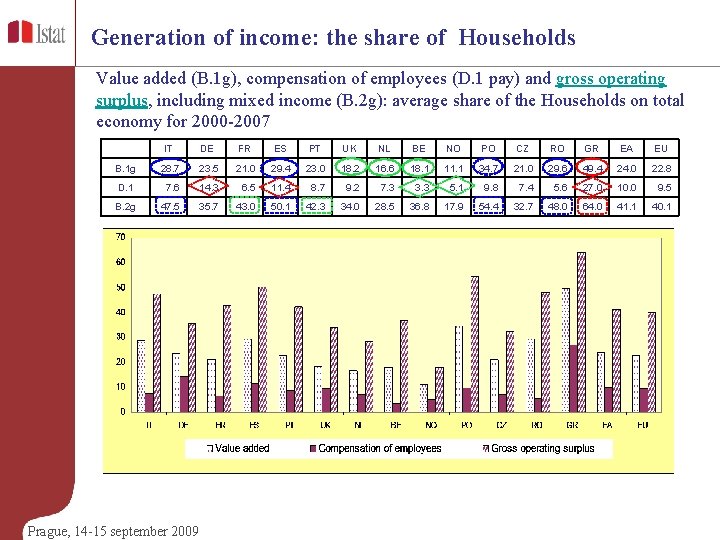

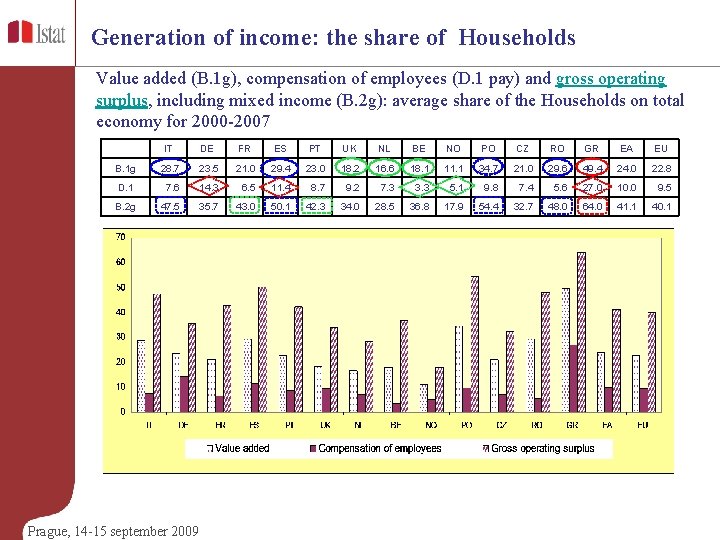

Generation of income: the share of Households Value added (B. 1 g), compensation of employees (D. 1 pay) and gross operating surplus, including mixed income (B. 2 g): average share of the Households on total economy for 2000 -2007 IT DE FR ES PT UK NL BE NO PO CZ RO GR EA EU B. 1 g 28. 7 23. 5 21. 0 29. 4 23. 0 18. 2 16. 6 18. 1 11. 1 34. 7 21. 0 29. 6 49. 4 24. 0 22. 8 D. 1 7. 6 14. 3 6. 5 11. 4 8. 7 9. 2 7. 3 3. 3 5. 1 9. 8 7. 4 5. 6 27. 0 10. 0 9. 5 B. 2 g 47. 5 35. 7 43. 0 50. 1 42. 3 34. 0 28. 5 36. 8 17. 9 54. 4 32. 7 48. 0 64. 0 41. 1 40. 1 Prague, 14 -15 september 2009

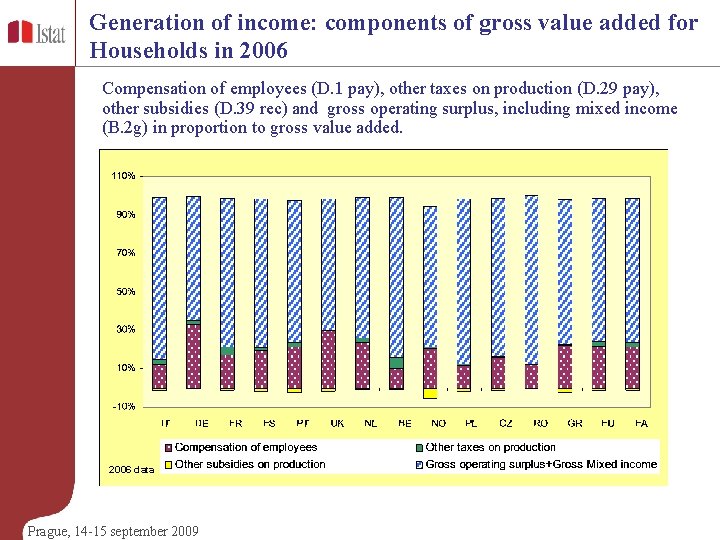

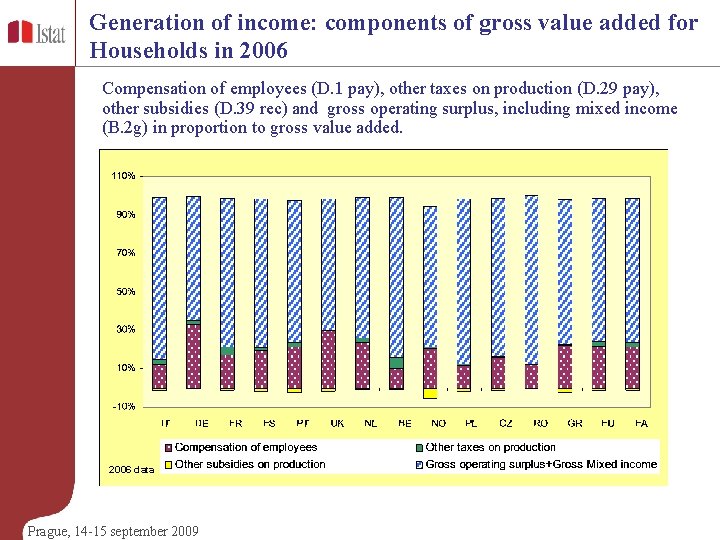

Generation of income: components of gross value added for Households in 2006 Compensation of employees (D. 1 pay), other taxes on production (D. 29 pay), other subsidies (D. 39 rec) and gross operating surplus, including mixed income (B. 2 g) in proportion to gross value added. 2006 data Prague, 14 -15 september 2009

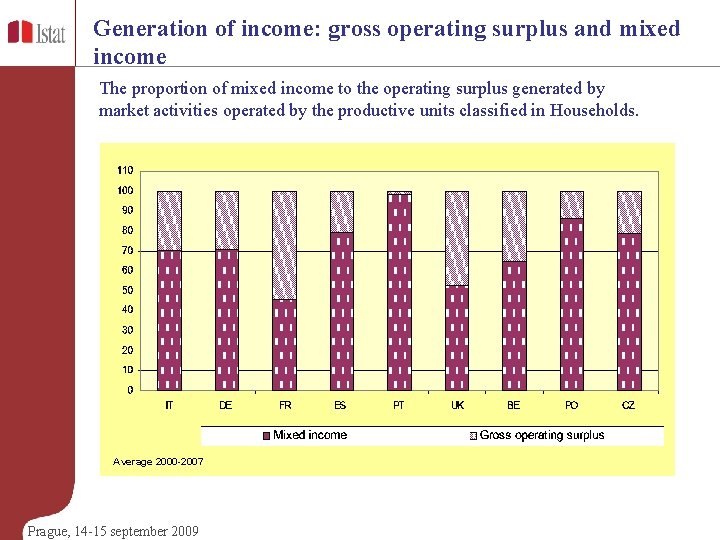

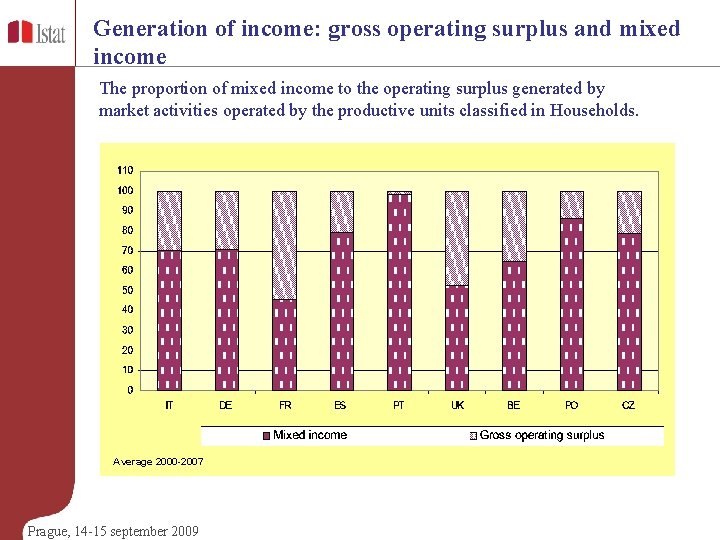

Generation of income: gross operating surplus and mixed income The proportion of mixed income to the operating surplus generated by market activities operated by the productive units classified in Households. Average 2000 -2007 Prague, 14 -15 september 2009

Allocation of primary income of Households Compensation of employees (D. 1 rec), gross operating surplus, including mixed income (B. 2 g) and net property income (D. 4 net): average share on primary income of Households for 2000 -2007. IT DE FR ES PT UK NL BE NO PO CZ RO GR EA EU D. 1 52. 0 65. 3 71. 0 66. 1 69. 9 73. 2 74. 2 69. 3 80. 0 54. 8 68. 7 59. 6 47. 1 64. 8 66. 8 B. 2 g 28. 6 17. 1 20. 1 28. 6 22. 1 15. 3 16. 1 18. 1 15. 1 38. 4 25. 6 36. 5 46. 9 21. 8 20. 9 D. 4 net 19. 5 17. 5 8. 9 5. 3 8. 0 11. 5 9. 7 12. 5 5. 0 6. 8 5. 6 3. 8 6. 1 13. 4 12. 3 Prague, 14 -15 september 2009

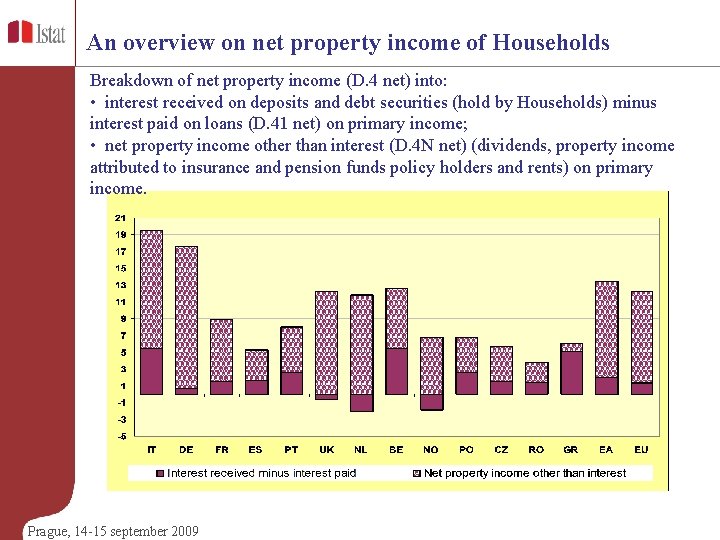

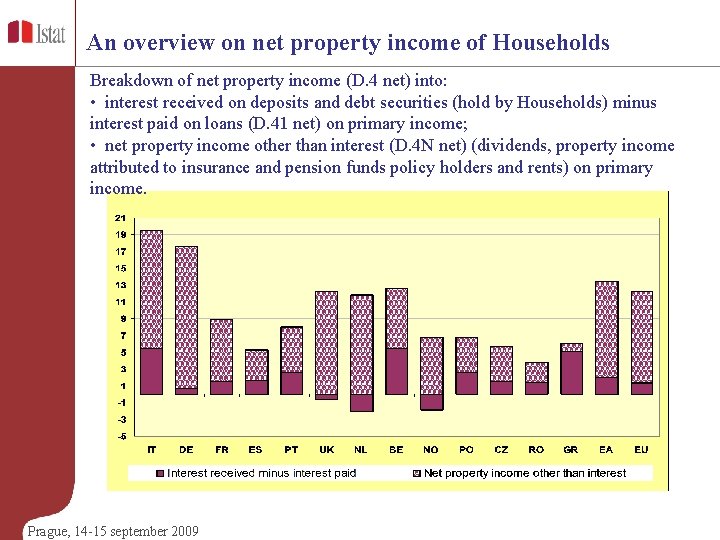

An overview on net property income of Households Breakdown of net property income (D. 4 net) into: • interest received on deposits and debt securities (hold by Households) minus interest paid on loans (D. 41 net) on primary income; • net property income other than interest (D. 4 N net) (dividends, property income attributed to insurance and pension funds policy holders and rents) on primary income. Prague, 14 -15 september 2009

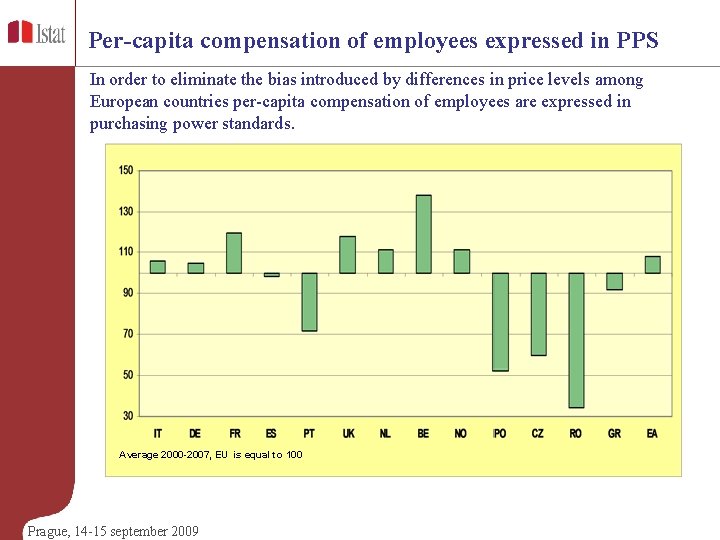

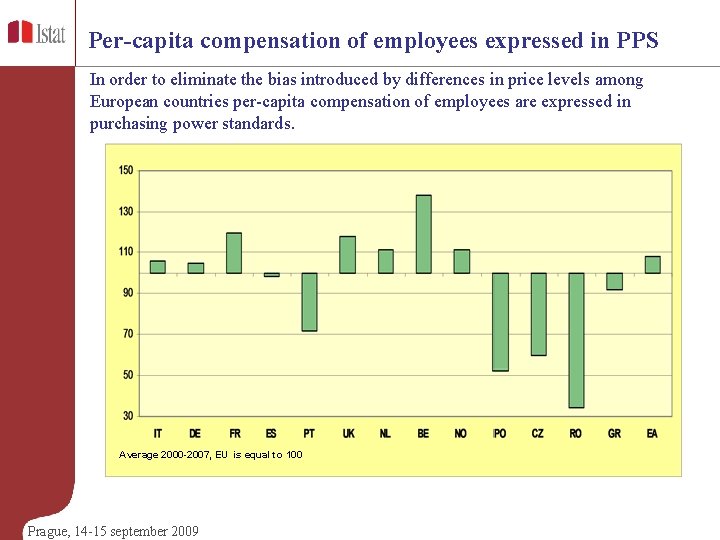

Per-capita compensation of employees expressed in PPS In order to eliminate the bias introduced by differences in price levels among European countries per-capita compensation of employees are expressed in purchasing power standards. Average 2000 -2007, EU is equal to 100 Prague, 14 -15 september 2009

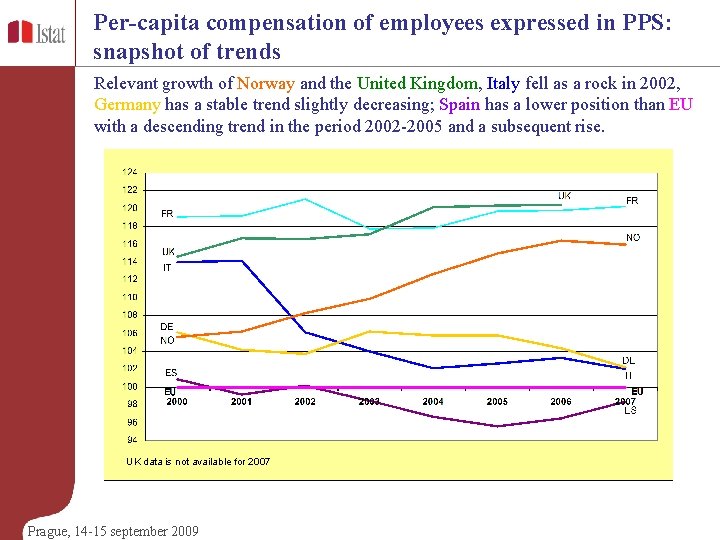

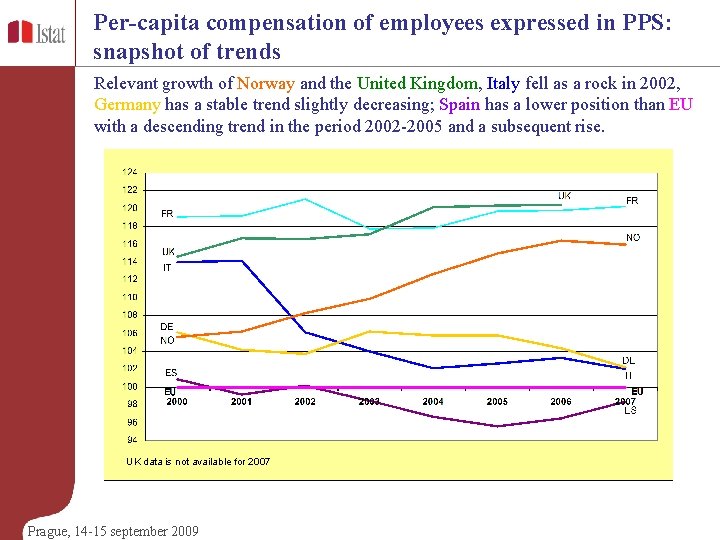

Per-capita compensation of employees expressed in PPS: snapshot of trends Relevant growth of Norway and the United Kingdom, Italy fell as a rock in 2002, Germany has a stable trend slightly decreasing; Spain has a lower position than EU with a descending trend in the period 2002 -2005 and a subsequent rise. UK data is not available for 2007 Prague, 14 -15 september 2009

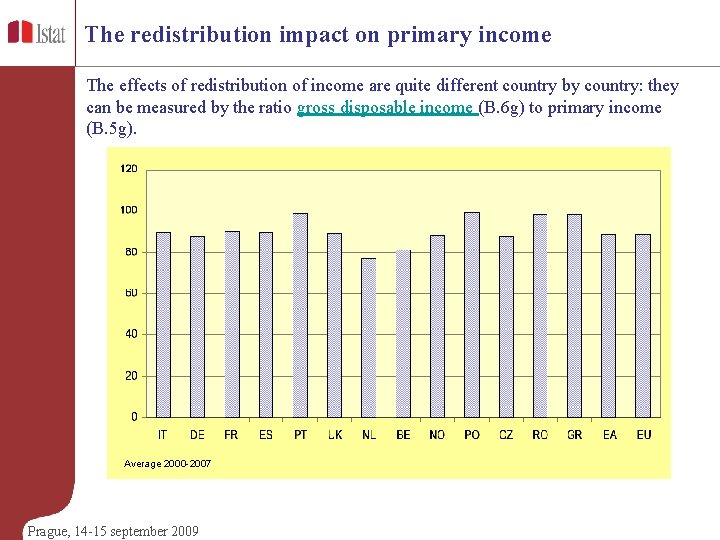

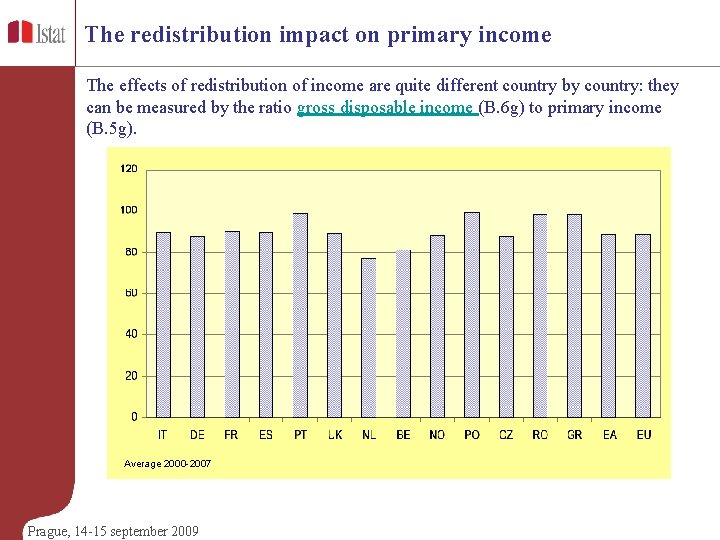

The redistribution impact on primary income The effects of redistribution of income are quite different country by country: they can be measured by the ratio gross disposable income (B. 6 g) to primary income (B. 5 g). Average 2000 -2007 Prague, 14 -15 september 2009

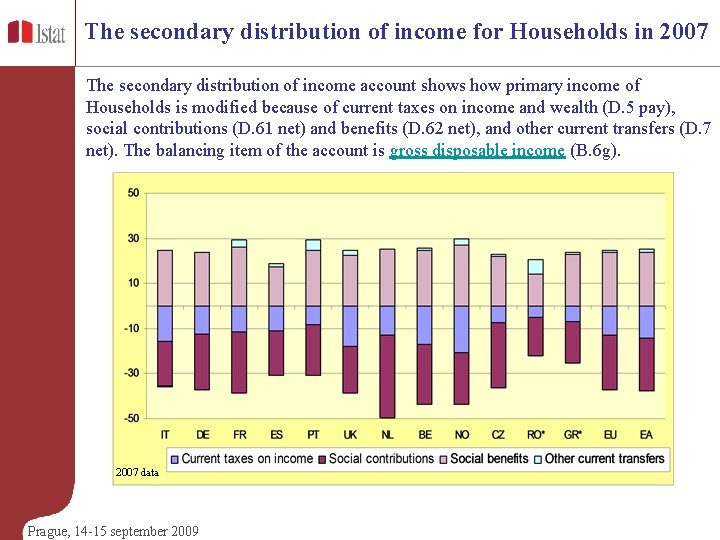

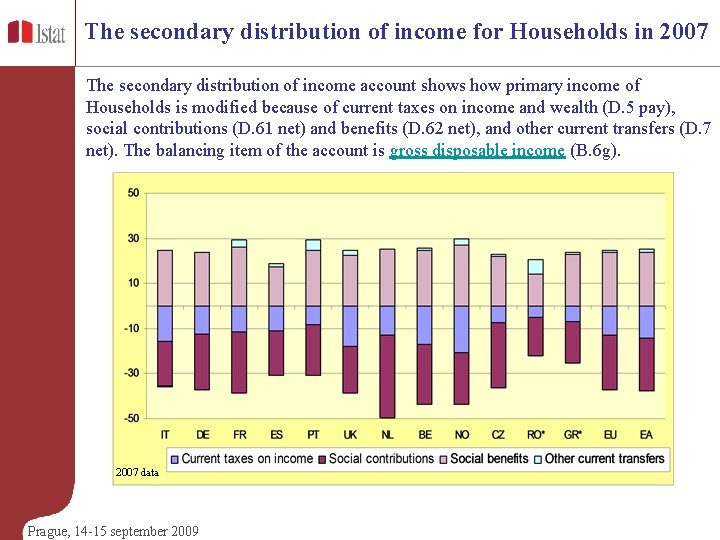

The secondary distribution of income for Households in 2007 The secondary distribution of income account shows how primary income of Households is modified because of current taxes on income and wealth (D. 5 pay), social contributions (D. 61 net) and benefits (D. 62 net), and other current transfers (D. 7 net). The balancing item of the account is gross disposable income (B. 6 g). 2007 data Prague, 14 -15 september 2009

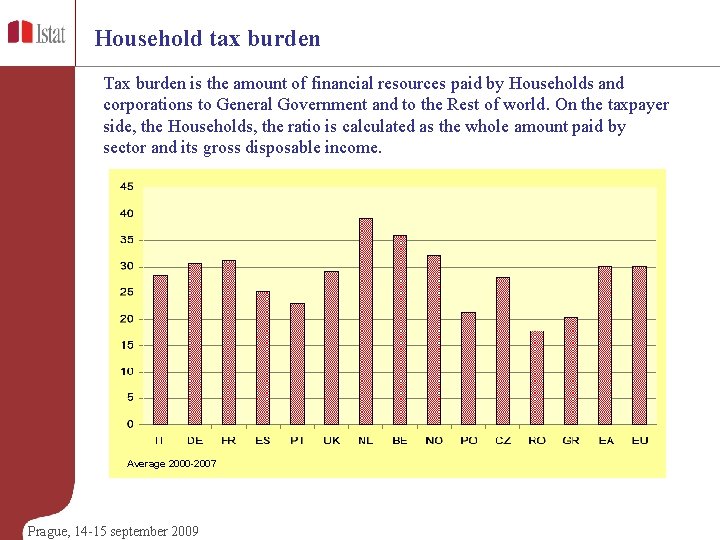

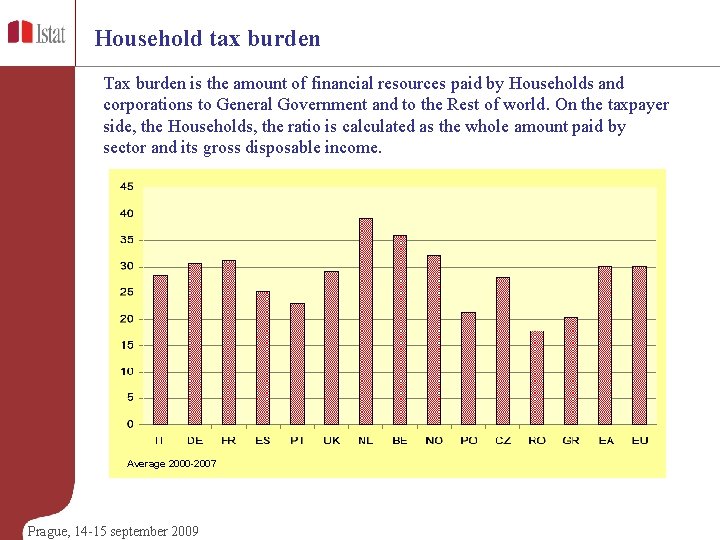

Household tax burden Tax burden is the amount of financial resources paid by Households and corporations to General Government and to the Rest of world. On the taxpayer side, the Households, the ratio is calculated as the whole amount paid by sector and its gross disposable income. Average 2000 -2007 Prague, 14 -15 september 2009

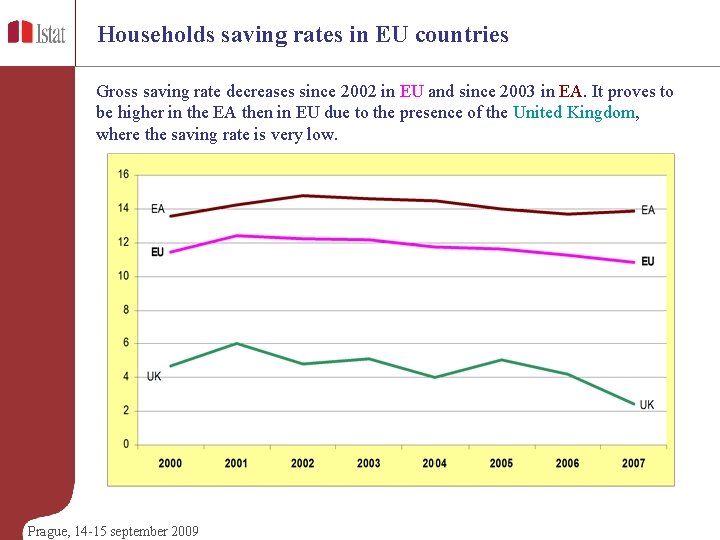

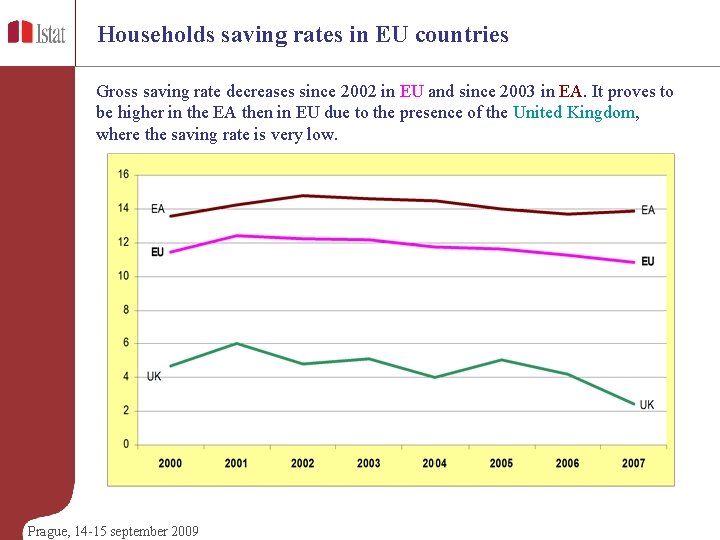

Households saving rates in EU countries Gross saving rate decreases since 2002 in EU and since 2003 in EA. It proves to be higher in the EA then in EU due to the presence of the United Kingdom, where the saving rate is very low. Prague, 14 -15 september 2009

Households saving rates in EU countries For the most of European countries after a short rise in 2001, the saving rates decrease from 2002 until 2006. Then the Households saving rates increase only for Germany, France and the Netherlands. In Italy the saving rate come back to the level registered in 2000. Prague, 14 -15 september 2009

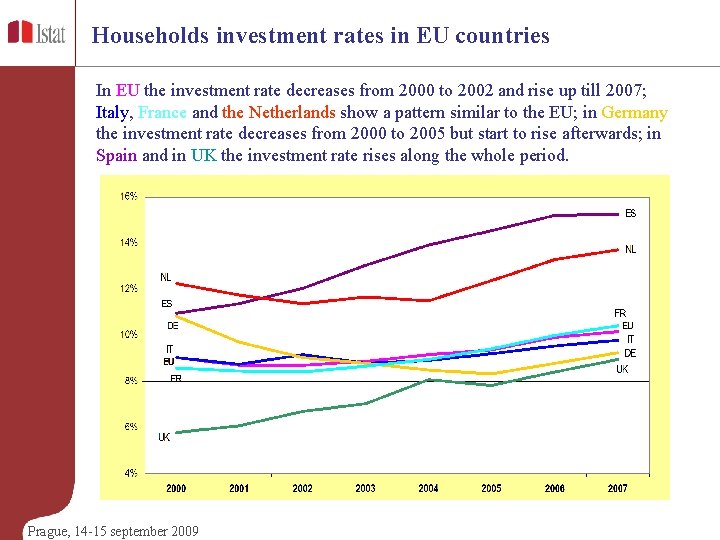

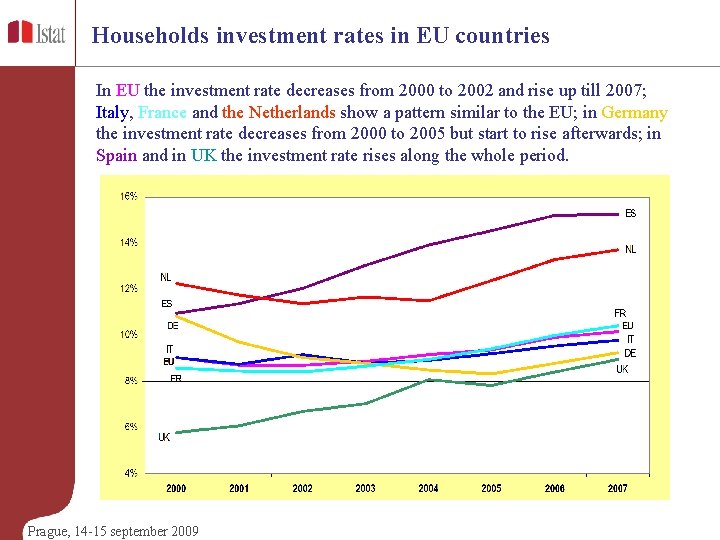

Households investment rates in EU countries In EU the investment rate decreases from 2000 to 2002 and rise up till 2007; Italy, France and the Netherlands show a pattern similar to the EU; in Germany the investment rate decreases from 2000 to 2005 but start to rise afterwards; in Spain and in UK the investment rate rises along the whole period. Prague, 14 -15 september 2009

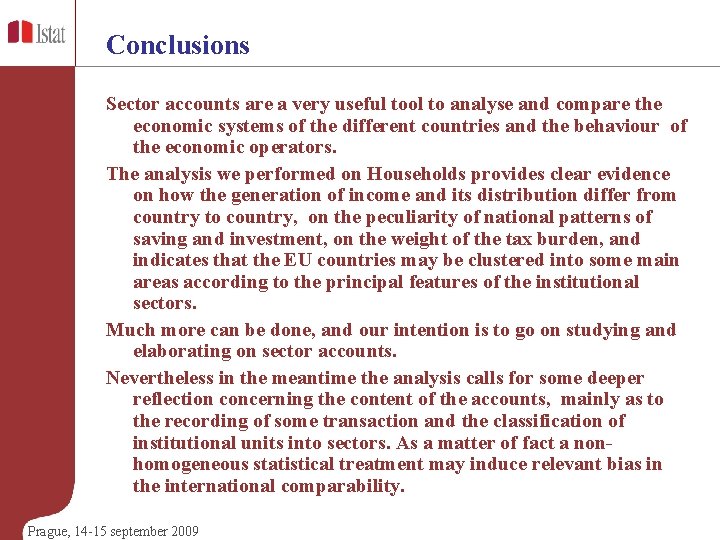

Conclusions Sector accounts are a very useful tool to analyse and compare the economic systems of the different countries and the behaviour of the economic operators. The analysis we performed on Households provides clear evidence on how the generation of income and its distribution differ from country to country, on the peculiarity of national patterns of saving and investment, on the weight of the tax burden, and indicates that the EU countries may be clustered into some main areas according to the principal features of the institutional sectors. Much more can be done, and our intention is to go on studying and elaborating on sector accounts. Nevertheless in the meantime the analysis calls for some deeper reflection concerning the content of the accounts, mainly as to the recording of some transaction and the classification of institutional units into sectors. As a matter of fact a nonhomogeneous statistical treatment may induce relevant bias in the international comparability. Prague, 14 -15 september 2009

ESA 95 definitions Gross operating surplus derives from owner-occupied dwellings for the household sector (ESA 95, para. 8. 20) Mixed income accrues to self-employed households as remuneration for work carried out by the owner or members of the family which cannot be distinguished from the profit as entrepreneur (ESA 95, para. 8. 19) Primary income received by Households consists of compensation of employees, property income (receivable less payable), gross (or net) operating surplus and gross (or net) mixed income” (ESA 95, para. 8. 94). Gross disposable income is the result of all current transactions before consumption, excluding exceptional resources/uses such as capital transfers, holding gains/losses and the consequences of natural disasters. It reflects the net resources, earned during the period, which are available for consumption and/or saving. Prague, 14 -15 september 2009

Thank you! Prague, 14 -15 september 2009 Roofs of Prague

National institute of statistics romania

National institute of statistics romania What is departmental account?

What is departmental account? Ocga 30-10-2

Ocga 30-10-2 Unesco institute for statistics

Unesco institute for statistics Net intake rate formula

Net intake rate formula Introduction to statistics what is statistics

Introduction to statistics what is statistics York national accounts

York national accounts The national income and product accounts

The national income and product accounts Systems of national accounts

Systems of national accounts Sna 2008

Sna 2008 Advisory expert group on national accounts

Advisory expert group on national accounts Ulsan national institute of science and technology

Ulsan national institute of science and technology National institute of meteorology

National institute of meteorology Assistive technology implementation plan

Assistive technology implementation plan Toshiba 1b japanasia

Toshiba 1b japanasia Lviv polytechnic university

Lviv polytechnic university Nawea

Nawea National institute on drug abuse

National institute on drug abuse National institute of standards and technology

National institute of standards and technology National human genome research institute

National human genome research institute National human genome research institute

National human genome research institute