Is the IPO Pricing Process Efficient Michelle Lowry

- Slides: 26

Is the IPO Pricing Process Efficient? Michelle Lowry G William Schwert (Latest Draft February 2003) M Thomas

Main Objective Examine underwriters’ treatment of public information throughout the entire IPO pricing process, and shed light on the extent to which the IPO price-setting process is efficient. M Thomas

Synopsis This paper claims two key findings regarding the IPO process l Public information is not fully incorporated into the initial price range of IPO’s. l Although public information is similarly not fully incorporated into the offer price, the small economic significance of this relation indicates that the IPO pricing process is almost efficient. M Thomas

Agenda l l l Introductory Overview Dataset Variables Methodology Results Critiques M Thomas

Introductory Overview l l l Information asymmetry between people working on the IPO and investors who buy the stock after IPO released Private information not incorporated into pricing, rewards institutional investors involved during filing period Mixed views in academia on the efficiency of IPO process M Thomas

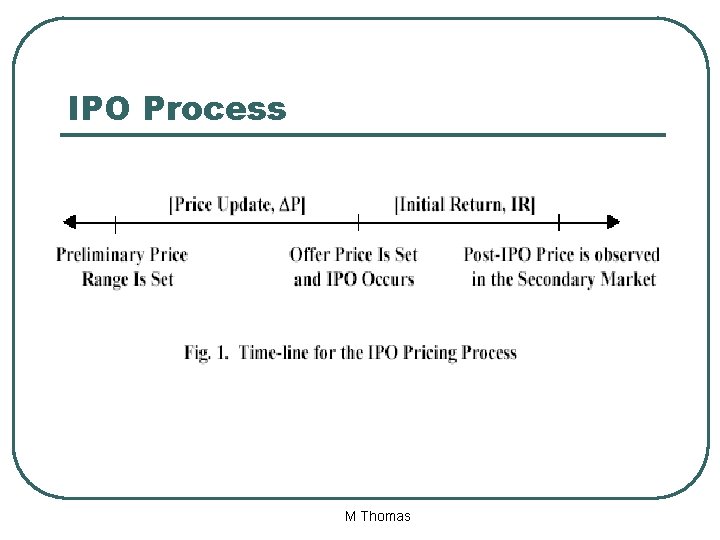

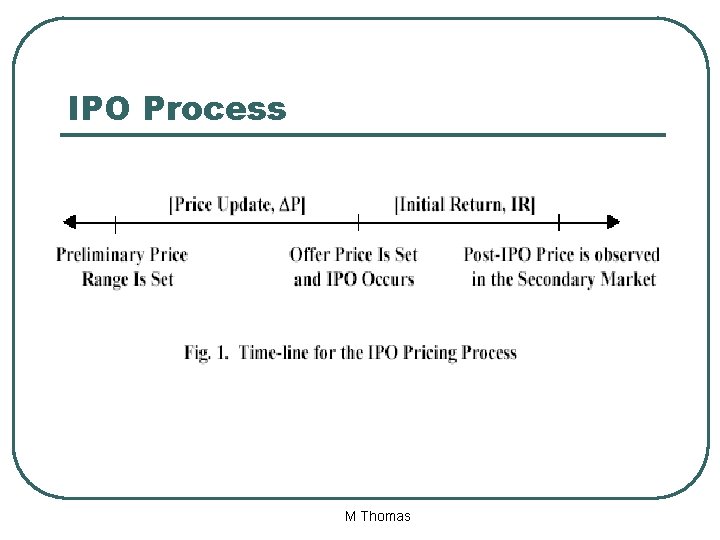

IPO Process M Thomas

Benveniste and Spindt (1989) Partial Updating Hypothesis l Informed investors provide underwriters with private information about the value of the IPO firm during the filing period l Underwriters compensate these investors for the private information they provide by only partially incorporating it into the offer price M Thomas

Ljungqvist and Wilhelm (2002) Institutions that reveal more valuable information during the registration period are rewarded with higher allocations when such information is positive. M Thomas

Loughran and Ritter (2002 a) “Prospect Theory” Both Public and Private information is only partially incorporated into the offer price M Thomas

Dataset l l Data on all firms that went public between 1985 and 1999 from the Securities Data Co. (SDC) Stock prices from Center for Research in Securities Prices (CRSP) database or SDC Exclusions: Unit IPOs, closed end funds, real estate investment trusts (REITs), American Depositary Receipts (ADRs), and issues with an offer price less than $5 M Thomas

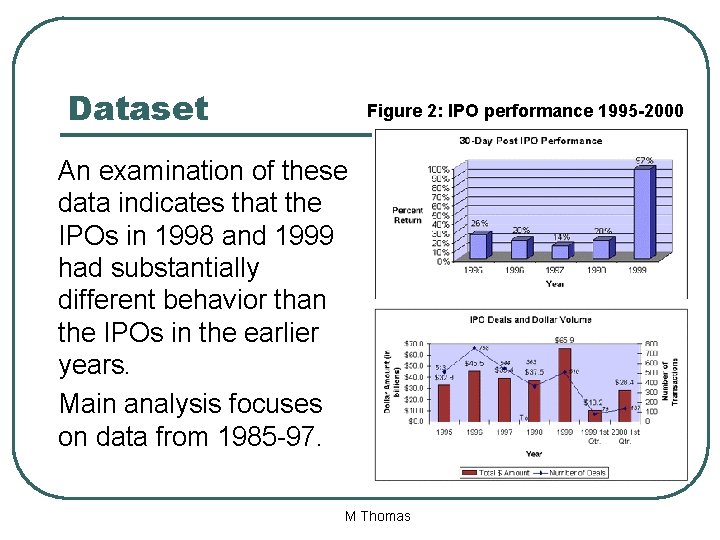

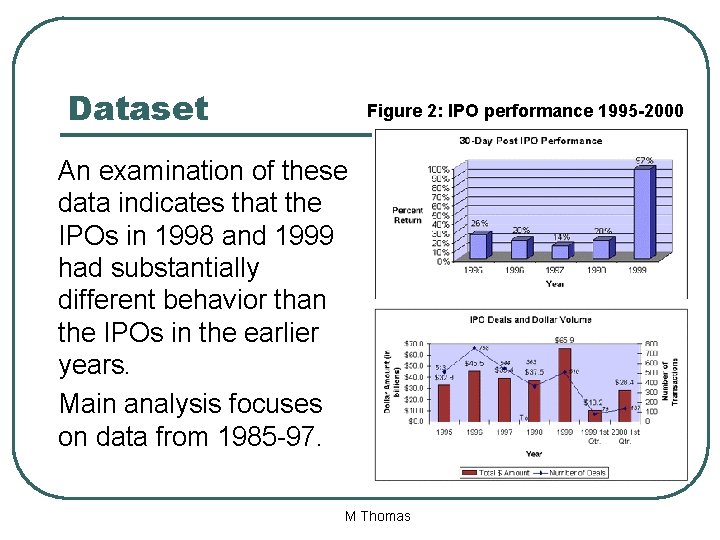

Dataset Figure 2: IPO performance 1995 -2000 An examination of these data indicates that the IPOs in 1998 and 1999 had substantially different behavior than the IPOs in the earlier years. Main analysis focuses on data from 1985 -97. M Thomas

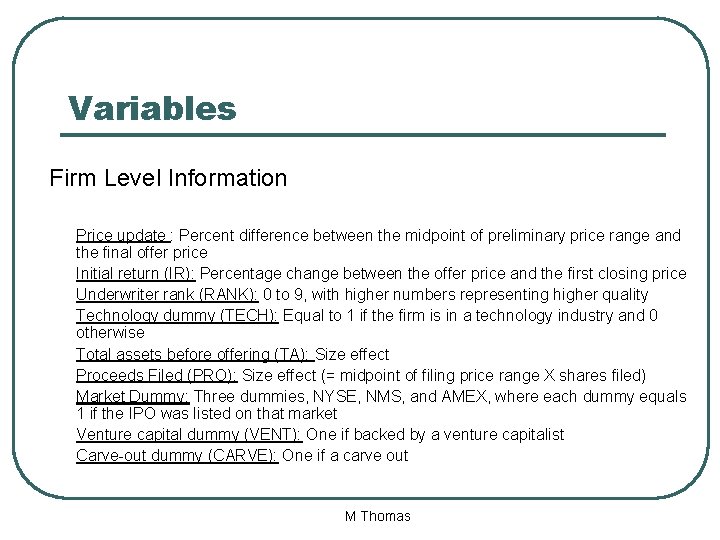

Variables Firm Level Information Price update : Percent difference between the midpoint of preliminary price range and the final offer price Initial return (IR): Percentage change between the offer price and the first closing price Underwriter rank (RANK): 0 to 9, with higher numbers representing higher quality Technology dummy (TECH): Equal to 1 if the firm is in a technology industry and 0 otherwise Total assets before offering (TA): Size effect Proceeds Filed (PRO): Size effect (= midpoint of filing price range X shares filed) Market Dummy: Three dummies, NYSE, NMS, and AMEX, where each dummy equals 1 if the IPO was listed on that market Venture capital dummy (VENT): One if backed by a venture capitalist Carve-out dummy (CARVE): One if a carve out M Thomas

Variables Market returns (MKT): (1) CRSP equally weighted index of NYSE, AMEX, and NASDAQ stocks (2) Returns on a portfolio of all firms that went public during the prior year (3) Returns on a portfolio of technology or nontechnology firms that went public during the prior year, matched with the given IPO depending on whether that firm was in a technology or non-technology industry M Thomas

Variables Asymmetry measures: Investigate the possibility that positive and negative information learned during the registration period affect the offer price differently DP+ equals DP when the price update is positive, and zero otherwise MKT+ equals MKT when the market returns during the registration period are positive, and 0 otherwise M Thomas

Methodology First Step: Examine the relation between the firm-level price update and both firm and deal-specific characteristics and various measures of market returns M Thomas

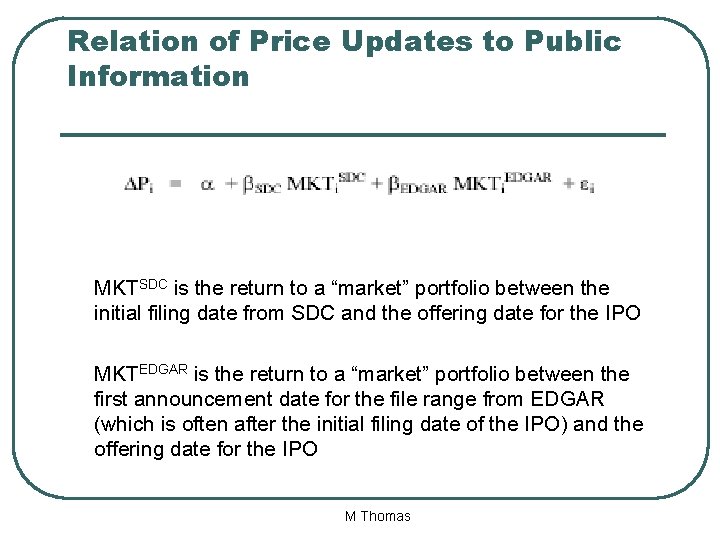

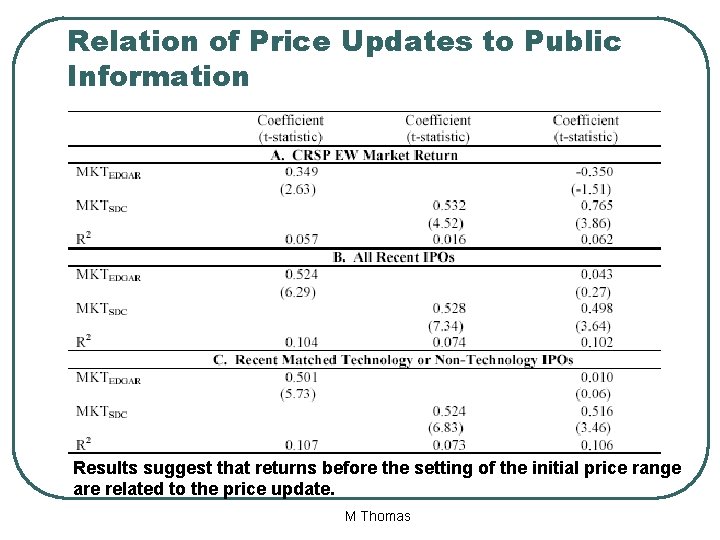

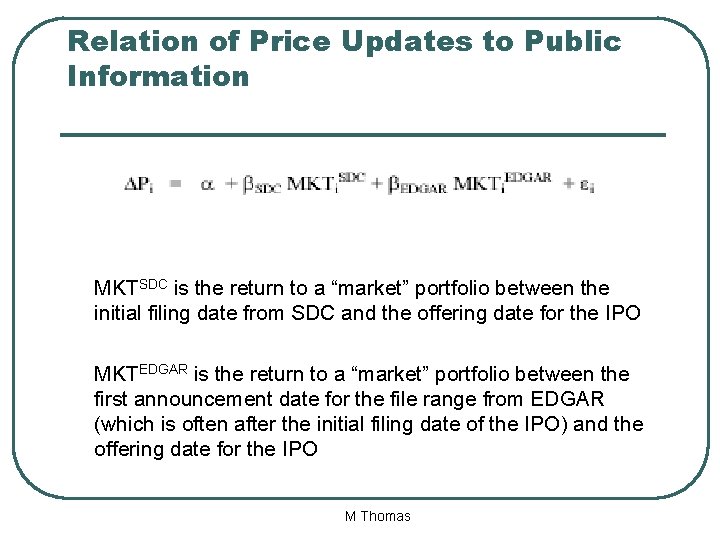

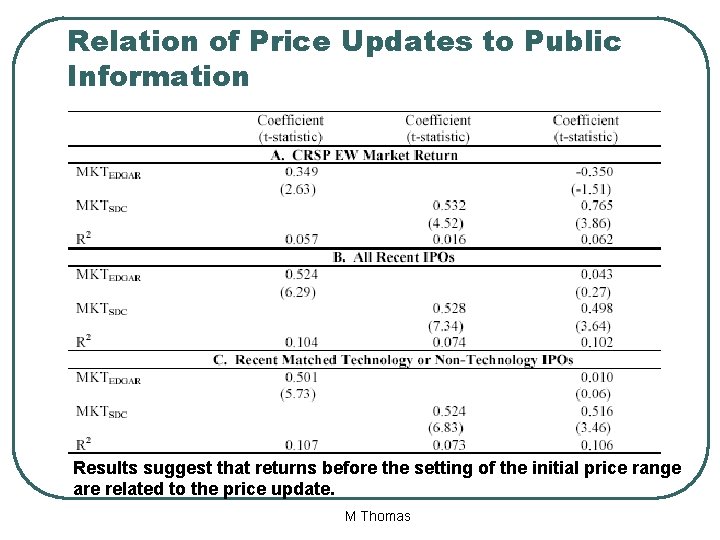

Relation of Price Updates to Public Information MKTSDC is the return to a “market” portfolio between the initial filing date from SDC and the offering date for the IPO MKTEDGAR is the return to a “market” portfolio between the first announcement date for the file range from EDGAR (which is often after the initial filing date of the IPO) and the offering date for the IPO M Thomas

Relation of Price Updates to Public Information Results suggest that returns before the setting of the initial price range are related to the price update. M Thomas

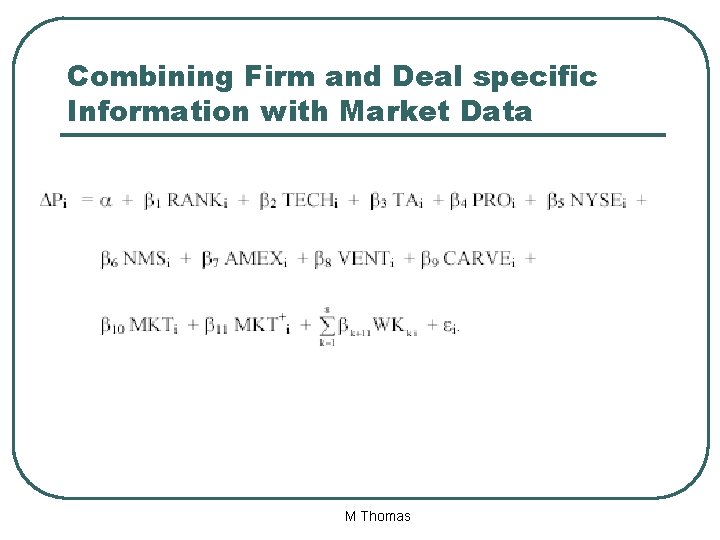

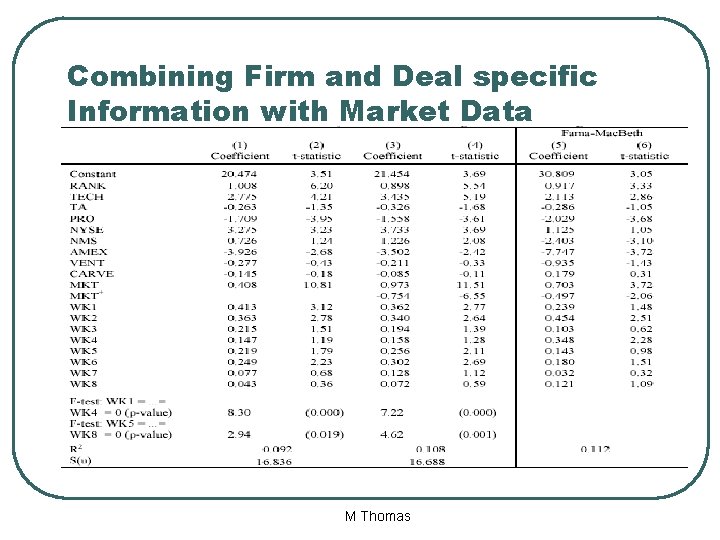

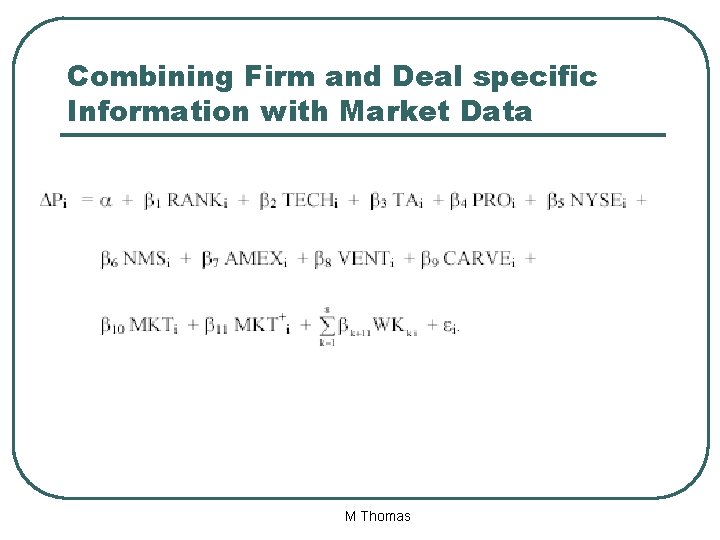

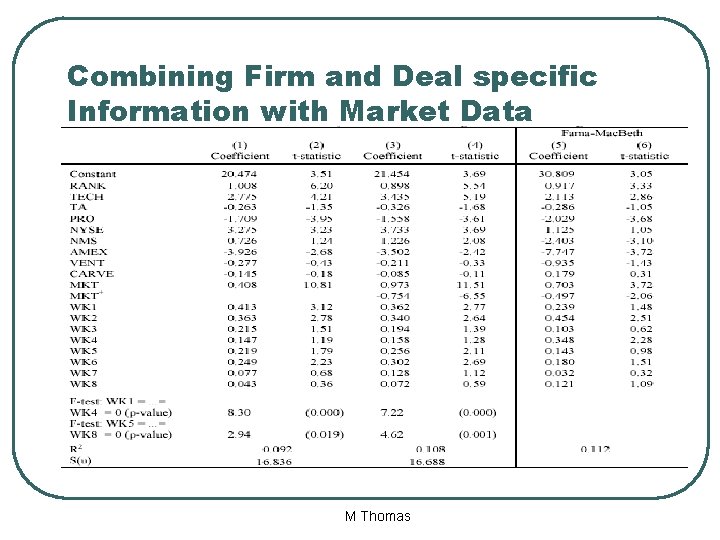

Combining Firm and Deal specific Information with Market Data M Thomas

Combining Firm and Deal specific Information with Market Data M Thomas

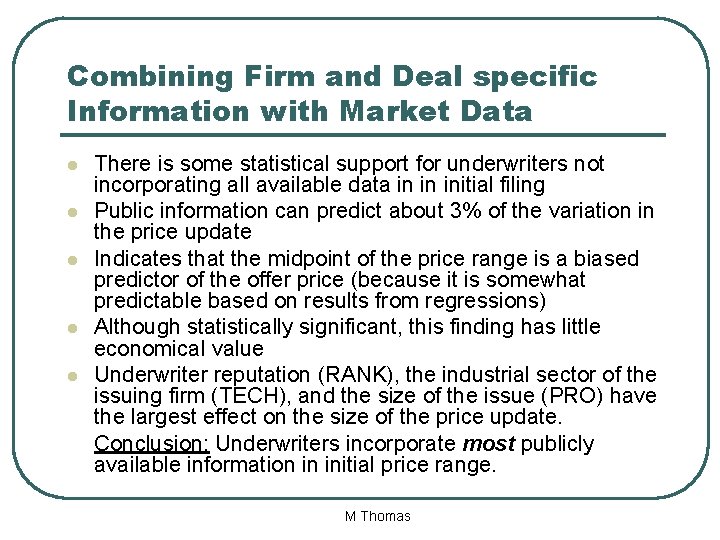

Combining Firm and Deal specific Information with Market Data l l l There is some statistical support for underwriters not incorporating all available data in in initial filing Public information can predict about 3% of the variation in the price update Indicates that the midpoint of the price range is a biased predictor of the offer price (because it is somewhat predictable based on results from regressions) Although statistically significant, this finding has little economical value Underwriter reputation (RANK), the industrial sector of the issuing firm (TECH), and the size of the issue (PRO) have the largest effect on the size of the price update. Conclusion: Underwriters incorporate most publicly available information in initial price range. M Thomas

Methodology Second Step Examine the extent to which two measures of information learned during the registration period, market returns and the price update, are reliably related to the initial return. M Thomas

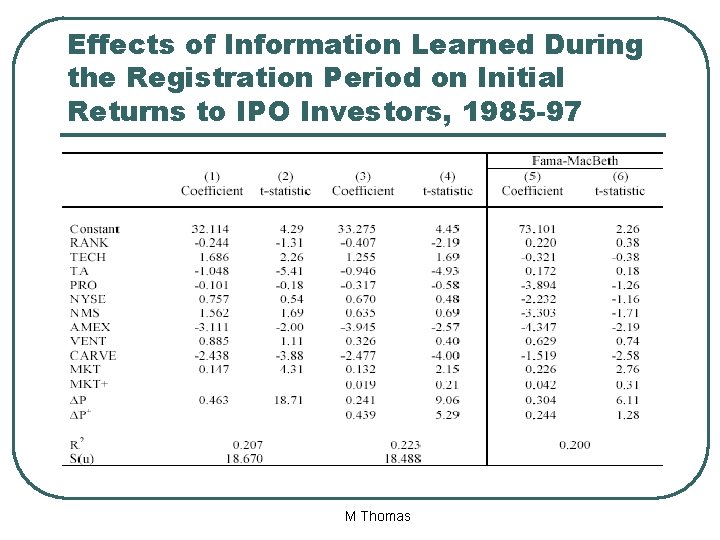

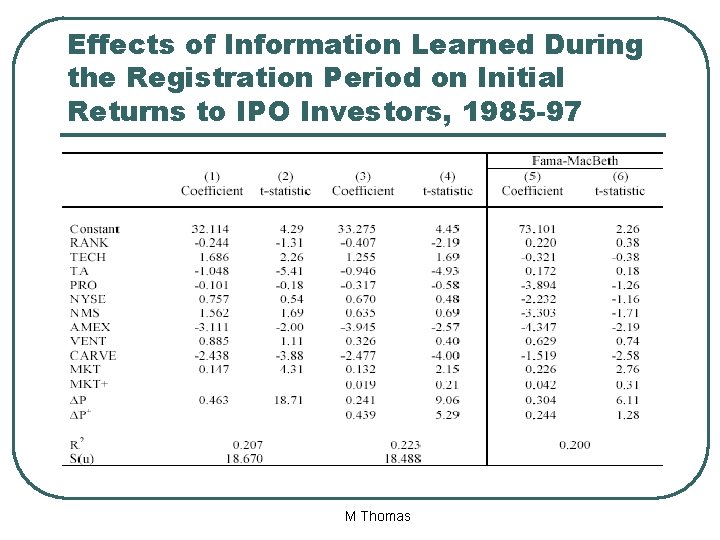

Effects of Information Learned During the Registration Period on Initial Returns to IPO Investors, 1985 -97 M Thomas

Effects of Information Learned During the Registration Period on Initial Returns to IPO Investors, 1985 -97 l l l Both information measures are significantly positive (t statistics of 4. 31 and 18. 71 for MKT and DP, respectively). This indicates statistically significant relation between initial returns and market returns before the offering. Underwriters incorporate negative information more fully into the offer price than positive information. Although statistically important, has little economic impact because private information learned during the filing period has a much greater effect on the initial return than public information. Conclusion: Underwriters do not fully incorporate either private or public information into the offer price. M Thomas

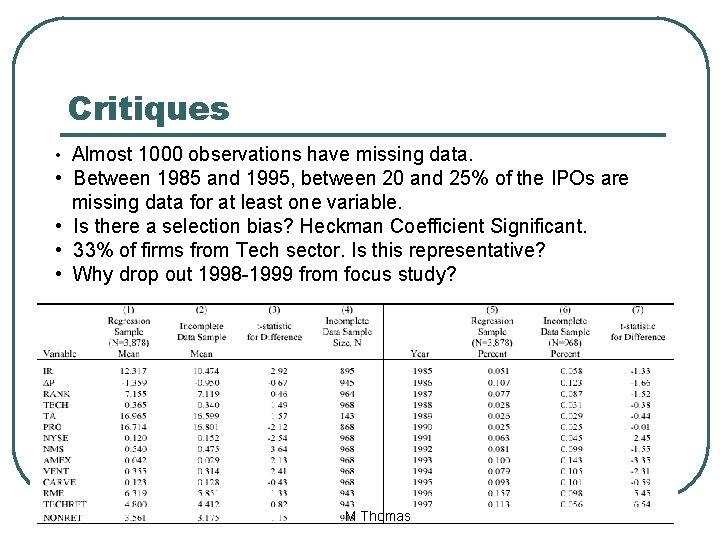

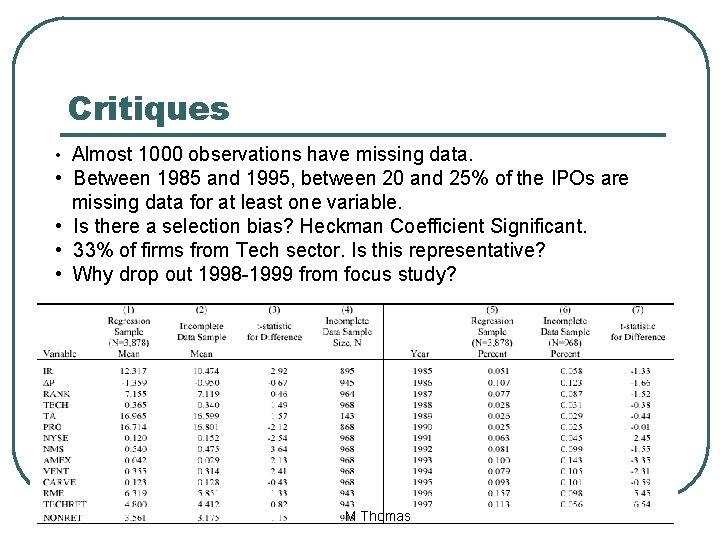

Critiques • Almost 1000 observations have missing data. • Between 1985 and 1995, between 20 and 25% of the IPOs are missing data for at least one variable. • Is there a selection bias? Heckman Coefficient Significant. • 33% of firms from Tech sector. Is this representative? • Why drop out 1998 -1999 from focus study? M Thomas

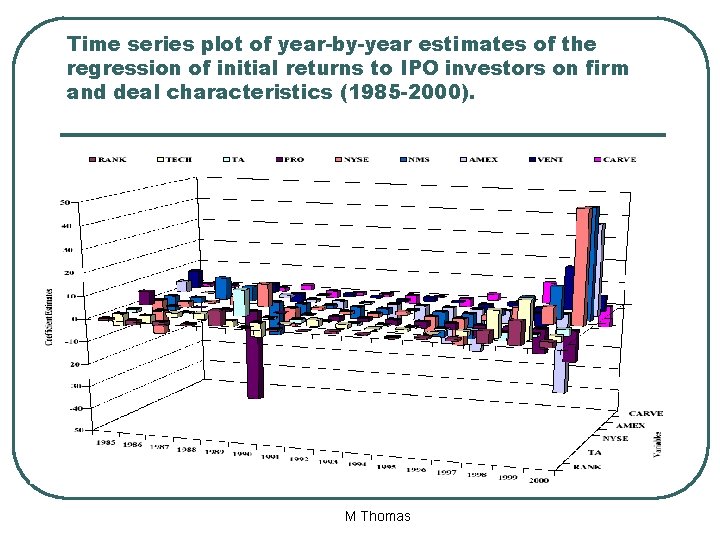

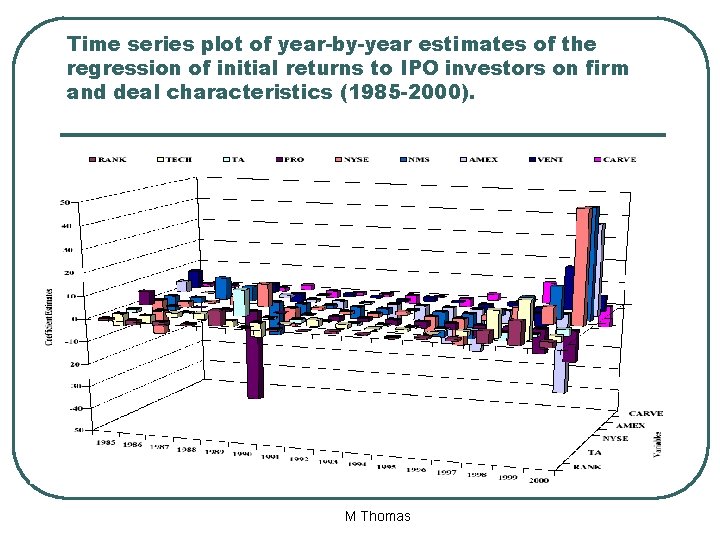

Time series plot of year-by-year estimates of the regression of initial returns to IPO investors on firm and deal characteristics (1985 -2000). M Thomas

Closing Summary l l Findings show that while underwriters omit some public information when they set both the initial price range and the final offer price, the vast majority of public information is in fact fully incorporated. IPO pricing process is almost efficient. M Thomas