IRISH INSURANCE FEDERATION CLOSING THE IRISH SAVINGS GAP

- Slides: 11

IRISH INSURANCE FEDERATION CLOSING THE IRISH SAVINGS GAP HOW FAR WILL PRSAs TAKE US? ANNE MAHER Chief Executive The Pensions Board 29 April 2004

CONTENTS ªBackground ªProgress ªFuture Direction 2

BACKGROUND National Pensions Policy Initiative (NPPI) ª Recognised need to increase private pension coverage ª Recommended introduction of Personal Retirement Savings Account (PRSA) ª PRSA to be new pensions vehicle which Ø Ø suits flexible labour market facilitates new providers is simple is cost effective ª New pension structure to consist of Ø occupational pension schemes Ø PRSAs 3

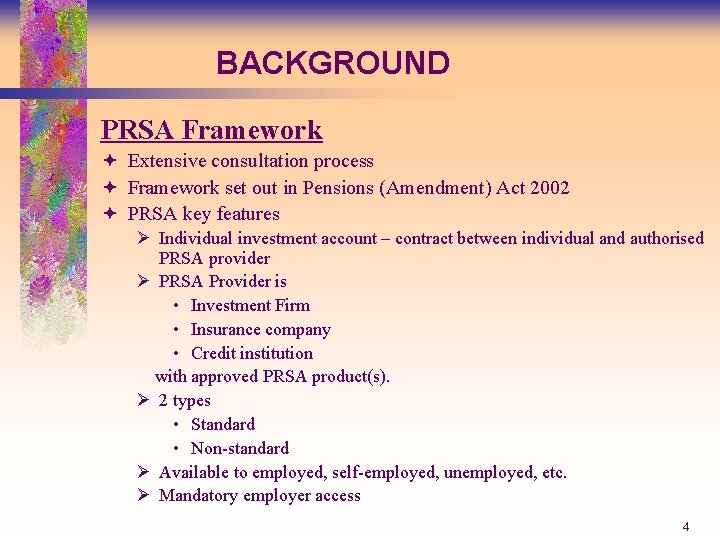

BACKGROUND PRSA Framework ª Extensive consultation process ª Framework set out in Pensions (Amendment) Act 2002 ª PRSA key features Ø Individual investment account – contract between individual and authorised PRSA provider Ø PRSA Provider is • Investment Firm • Insurance company • Credit institution with approved PRSA product(s). Ø 2 types • Standard • Non-standard Ø Available to employed, self-employed, unemployed, etc. Ø Mandatory employer access 4

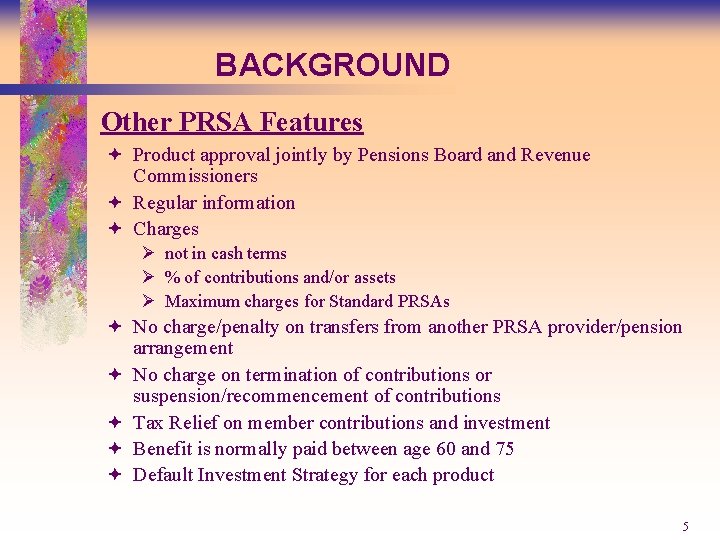

BACKGROUND Other PRSA Features ª Product approval jointly by Pensions Board and Revenue Commissioners ª Regular information ª Charges Ø not in cash terms Ø % of contributions and/or assets Ø Maximum charges for Standard PRSAs ª No charge/penalty on transfers from another PRSA provider/pension arrangement ª No charge on termination of contributions or suspension/recommencement of contributions ª Tax Relief on member contributions and investment ª Benefit is normally paid between age 60 and 75 ª Default Investment Strategy for each product 5

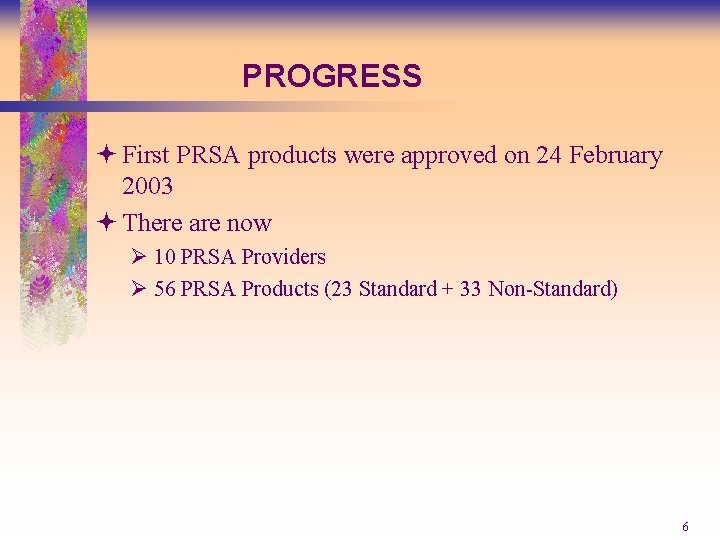

PROGRESS ª First PRSA products were approved on 24 February 2003 ª There are now Ø 10 PRSA Providers Ø 56 PRSA Products (23 Standard + 33 Non-Standard) 6

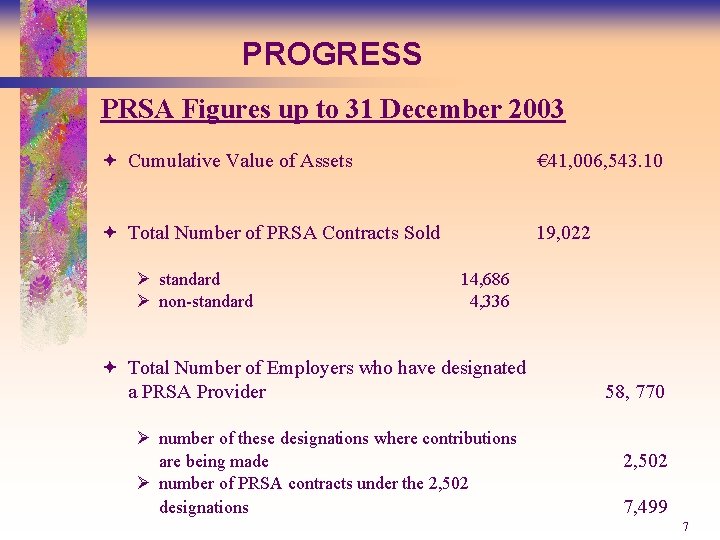

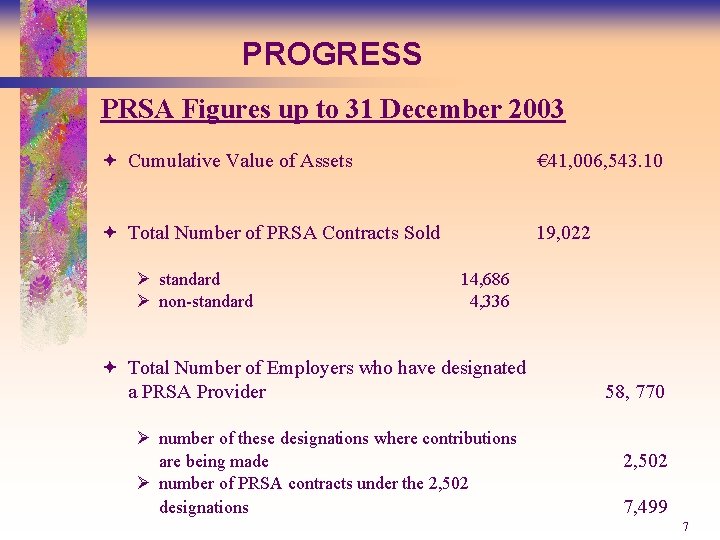

PROGRESS PRSA Figures up to 31 December 2003 ª Cumulative Value of Assets € 41, 006, 543. 10 ª Total Number of PRSA Contracts Sold 19, 022 Ø standard Ø non-standard 14, 686 4, 336 ª Total Number of Employers who have designated a PRSA Provider Ø number of these designations where contributions are being made Ø number of PRSA contracts under the 2, 502 designations 58, 770 2, 502 7, 499 7

PROGRESS Good or Bad? ª Good supply of Providers and Products ª Slow start in difficult environment Ø Falling markets Ø Bad press Ø Post SSIA savings scheme ª Increased pensions awareness ª Reduction in all pension charges ª Steady (if slow) progress now emerging 8

PROGRESS Issues Raised ª Not as simple as planned ª Mixed views over having Standard and Non-Standard ª Limited Broker Support ª Possible Over Regulation ª Danger of ‘shell-PRSAs’ as with UK ‘shell-Stakeholders’ 9

FUTURE DIRECTION Steps in Hand ª Progress being monitored through Pensions Board Reports ª Regular CSO surveys of overall pensions coverage (2004, 2005 and 2006) ª National Pensions Awareness Campaign ª PRSA Incentive Group identifying Ø obstacles to be removed Ø incentives to be considered ª PRSI saving to employers under review ª Statutory requirement to review coverage position in 2006 Ø report to Oireachtas 10

CONCLUSION ª PRSAs Ø will increase pension coverage directly and indirectly Ø but will increase be enough? ª If they achieve coverage targets that is good ª If they fail to achieve adequate coverage targets Ø Pensions Board recommendation in National Pensions Policy Initiative was to consider further mandatory options and Ø Government has indicated that it will ‘grasp the nettle’ if necessary. 11

Gap closing math

Gap closing math Closing the word gap

Closing the word gap Closing the development gap

Closing the development gap Closing the gap pupil premium

Closing the gap pupil premium Nature and use of fire insurance

Nature and use of fire insurance Bog'langan qo'shma gaplar ppt

Bog'langan qo'shma gaplar ppt The designer expresses the ideas in terms related to the

The designer expresses the ideas in terms related to the Demand deposit vs savings deposit

Demand deposit vs savings deposit Savings trial fund

Savings trial fund Montana college savings plan

Montana college savings plan Geothermal cost savings

Geothermal cost savings Alberto musalem

Alberto musalem