IP Valuation Dr Rahul Verma Assistant Vice President

- Slides: 29

IP Valuation Dr. Rahul Verma, Assistant Vice President, Rahul. Verma@Evalueserve. com Ashutosh Pande Group Manager, Ashutosh. Pande@evalueserve. com October 2010 © 2010 Evalueserve, Ltd. All Rights Reserved - Privileged and Confidential

Presentation Plan IP Valuation Overview IP Valuation Approaches Case Study Slide 2 © 2010 Evalueserve, Ltd. All Rights Reserved - Privileged and Confidential

Presentation Plan IP Valuation Overview IP Valuation Approaches Case Study Slide 3 © 2010 Evalueserve, Ltd. All Rights Reserved - Privileged and Confidential

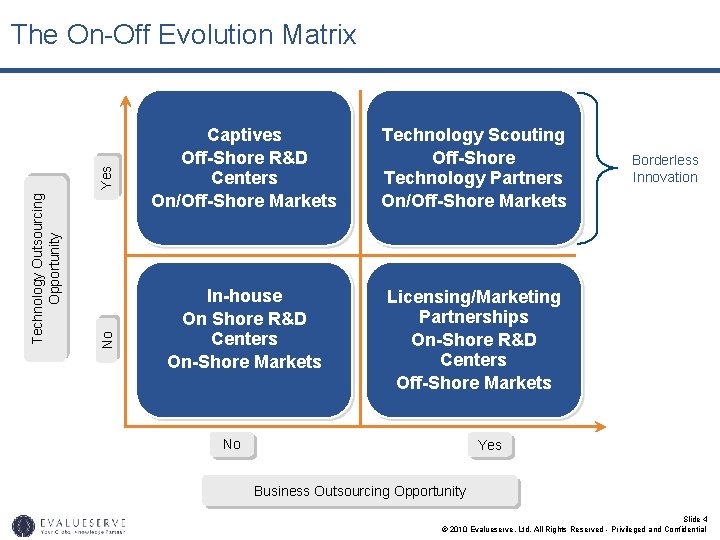

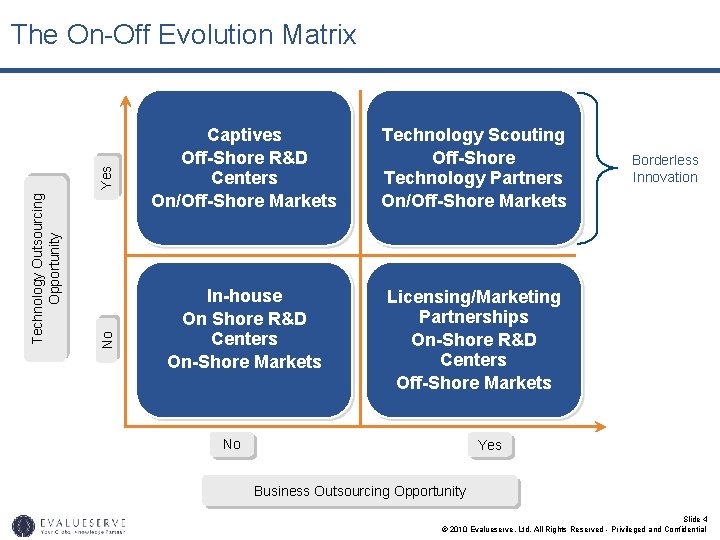

No Technology Outsourcing Opportunity Yes The On-Off Evolution Matrix Captives Off-Shore R&D Centers On/Off-Shore Markets Technology Scouting Off-Shore Technology Partners On/Off-Shore Markets In-house On Shore R&D Centers On-Shore Markets Licensing/Marketing Partnerships On-Shore R&D Centers Off-Shore Markets No Borderless Innovation Yes Business Outsourcing Opportunity Slide 4 © 2010 Evalueserve, Ltd. All Rights Reserved - Privileged and Confidential

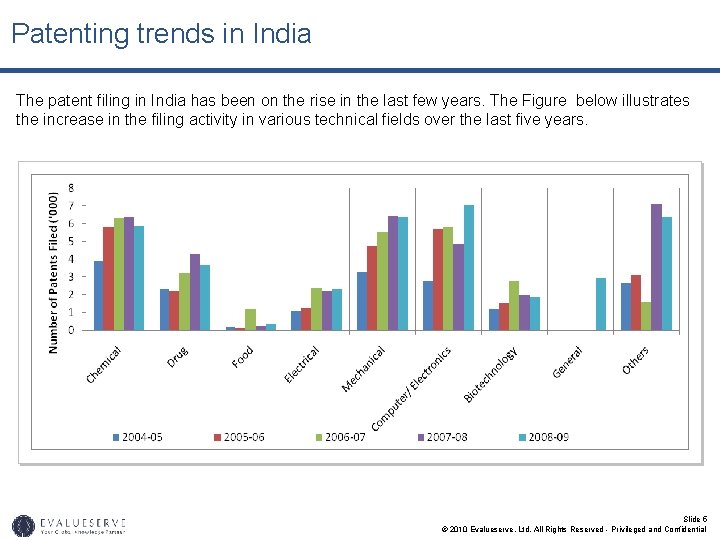

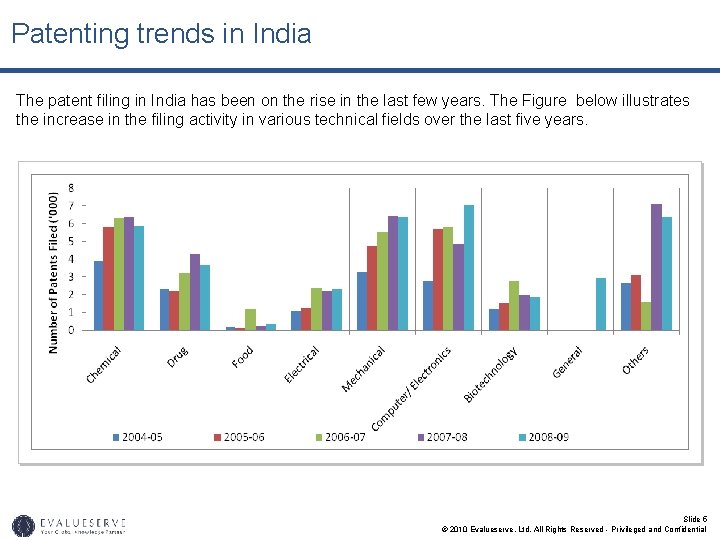

Patenting trends in India The patent filing in India has been on the rise in the last few years. The Figure below illustrates the increase in the filing activity in various technical fields over the last five years. Slide 5 © 2010 Evalueserve, Ltd. All Rights Reserved - Privileged and Confidential

National Innovation Foundation (India) in its website : ". . . the time has come to unleash the creative potential of our scientists and innovators at grassroots level. Only then we can make India truly self-reliant and a leader in sustainable technologies. . propose a national foundation for helping innovators all over the country. This fund. . . will build a national register of innovations, mobilize intellectual property protection, set up incubators for converting into viable business opportunities and help in dissemination across the country. '' Slide 6 © 2010 Evalueserve, Ltd. All Rights Reserved - Privileged and Confidential

National Innovation Foundation Slide 7 © 2010 Evalueserve, Ltd. All Rights Reserved - Privileged and Confidential

Slide 8 © 2010 Evalueserve, Ltd. All Rights Reserved - Privileged and Confidential

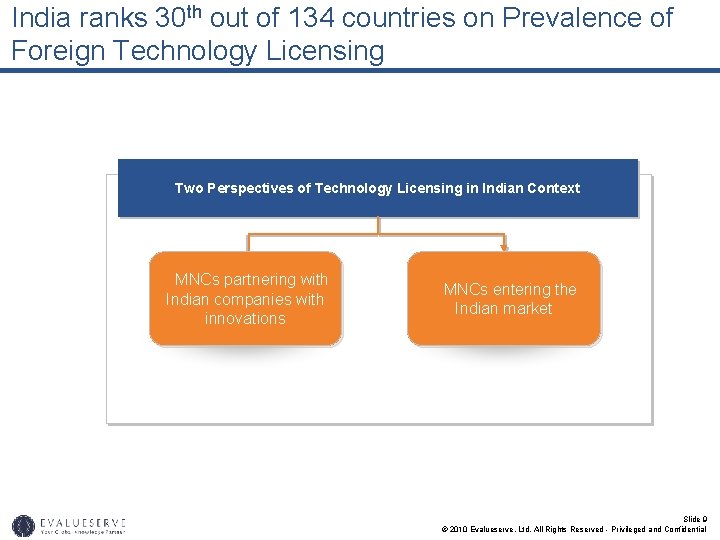

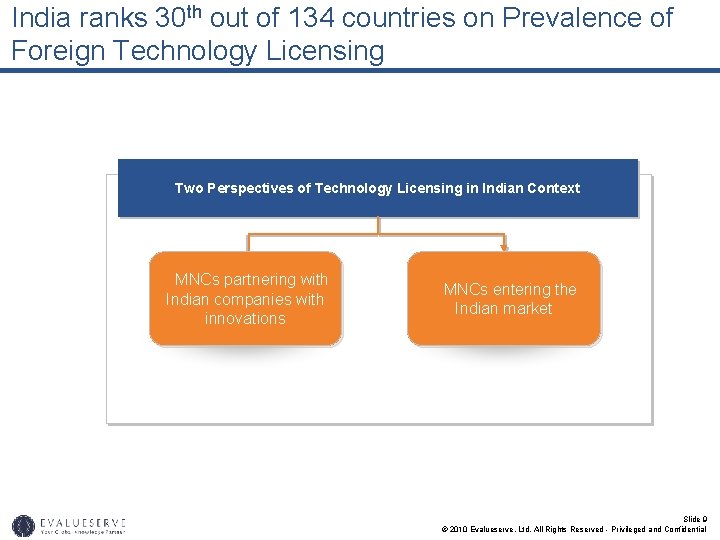

India ranks 30 th out of 134 countries on Prevalence of Foreign Technology Licensing Two Perspectives of Technology Licensing in Indian Context MNCs partnering with Indian companies with innovations MNCs entering the Indian market Slide 9 © 2010 Evalueserve, Ltd. All Rights Reserved - Privileged and Confidential

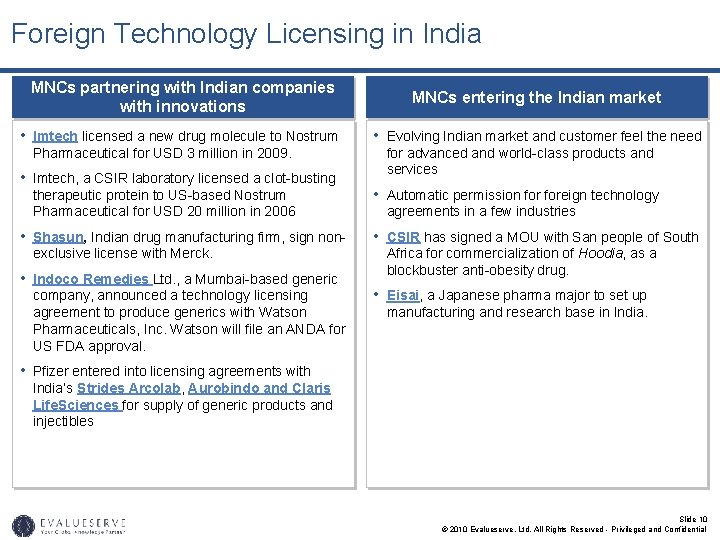

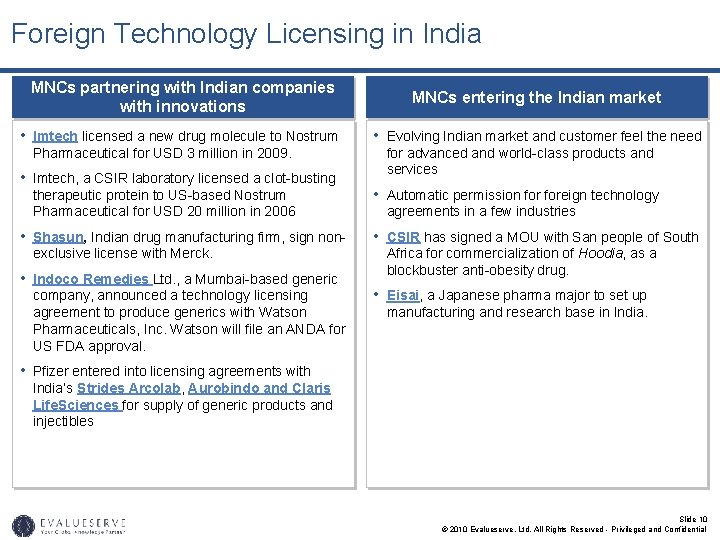

Foreign Technology Licensing in India MNCs partnering with Indian companies with innovations MNCs entering the Indian market • Imtech licensed a new drug molecule to Nostrum • Evolving Indian market and customer feel the need Pharmaceutical for USD 3 million in 2009. • Imtech, a CSIR laboratory licensed a clot-busting therapeutic protein to US-based Nostrum Pharmaceutical for USD 20 million in 2006 • Shasun, Indian drug manufacturing firm, sign nonexclusive license with Merck. • Indoco Remedies Ltd. , a Mumbai-based generic company, announced a technology licensing agreement to produce generics with Watson Pharmaceuticals, Inc. Watson will file an ANDA for US FDA approval. for advanced and world-class products and services • Automatic permission foreign technology agreements in a few industries • CSIR has signed a MOU with San people of South Africa for commercialization of Hoodia, as a blockbuster anti-obesity drug. • Eisai, a Japanese pharma major to set up manufacturing and research base in India. • Pfizer entered into licensing agreements with India’s Strides Arcolab, Aurobindo and Claris Life. Sciences for supply of generic products and injectibles Slide 10 © 2010 Evalueserve, Ltd. All Rights Reserved - Privileged and Confidential

Presentation Plan IP Valuation Overview IP Valuation Approaches Case Study Slide 11 © 2010 Evalueserve, Ltd. All Rights Reserved - Privileged and Confidential

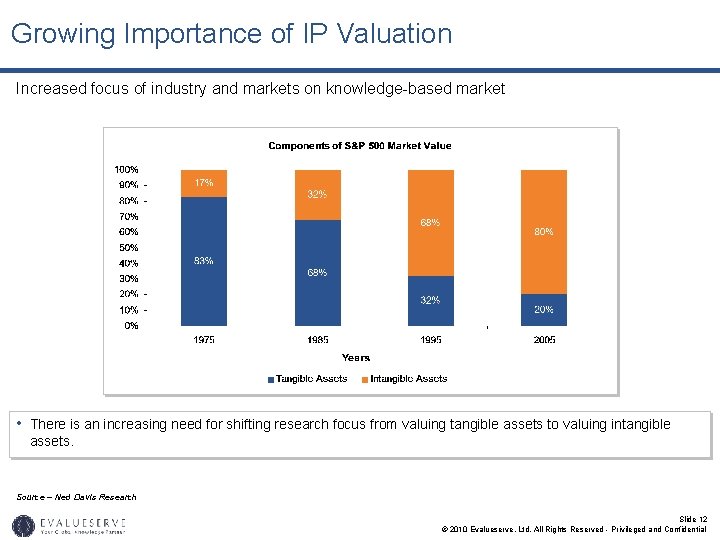

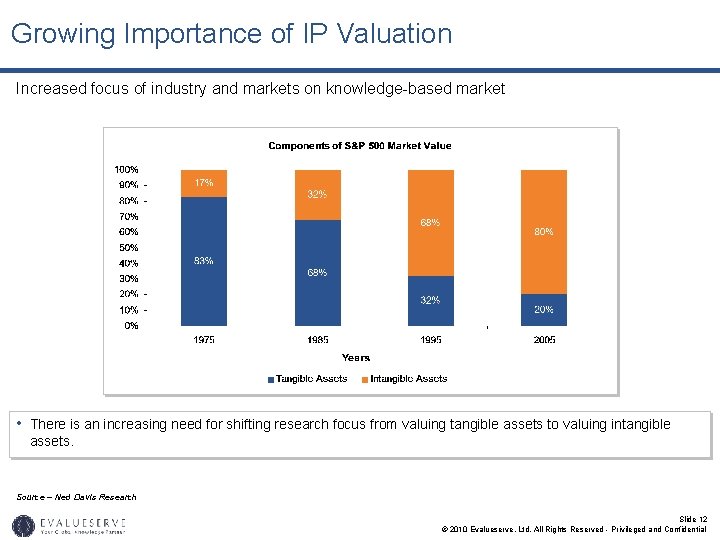

Growing Importance of IP Valuation Increased focus of industry and markets on knowledge-based market • There is an increasing need for shifting research focus from valuing tangible assets to valuing intangible assets. Source – Ned Davis Research Slide 12 © 2010 Evalueserve, Ltd. All Rights Reserved - Privileged and Confidential

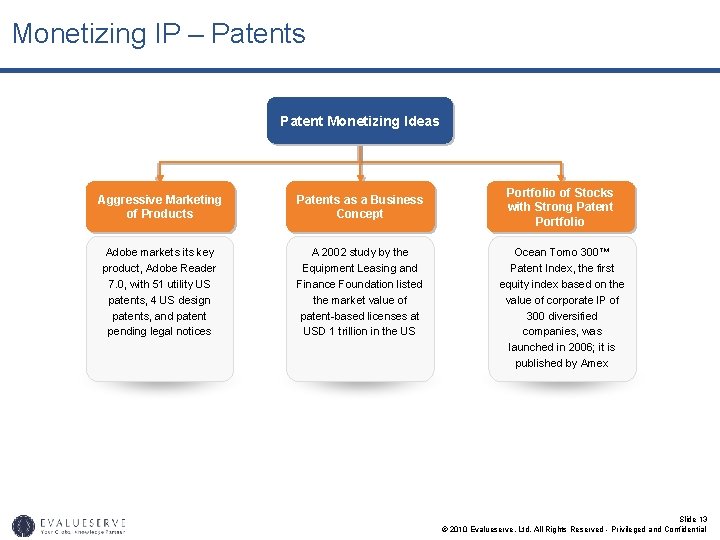

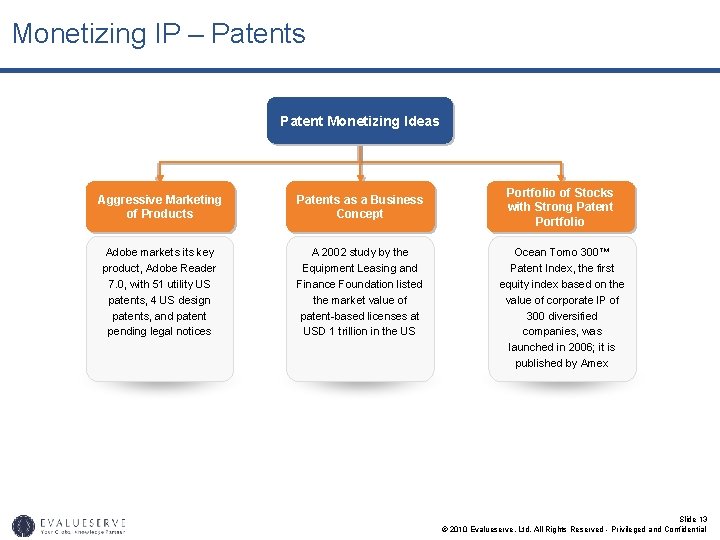

Monetizing IP – Patents Patent Monetizing Ideas Aggressive Marketing of Products Patents as a Business Concept Adobe markets its key product, Adobe Reader 7. 0, with 51 utility US patents, 4 US design patents, and patent pending legal notices A 2002 study by the Equipment Leasing and Finance Foundation listed the market value of patent-based licenses at USD 1 trillion in the US Portfolio of Stocks with Strong Patent Portfolio Ocean Tomo 300™ Patent Index, the first equity index based on the value of corporate IP of 300 diversified companies, was launched in 2006; it is published by Amex Slide 13 © 2010 Evalueserve, Ltd. All Rights Reserved - Privileged and Confidential

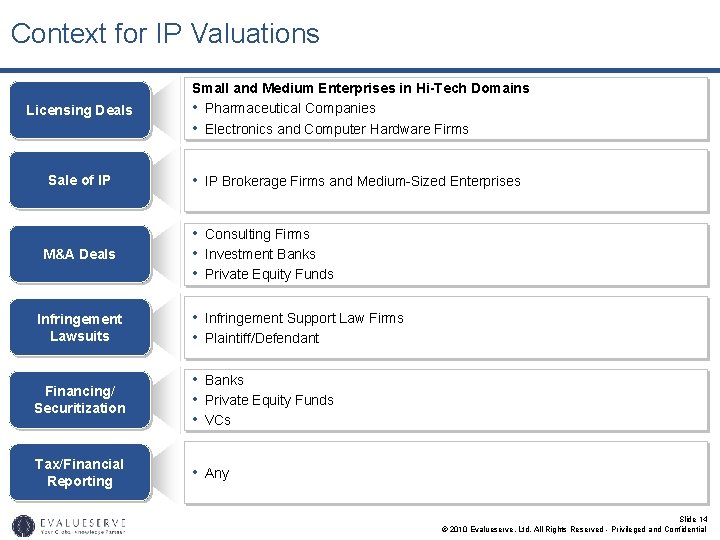

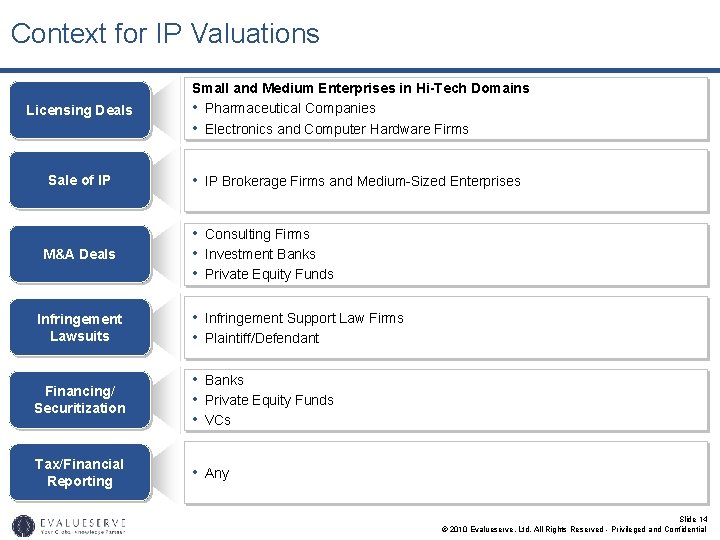

Context for IP Valuations Licensing Deals Sale of IP M&A Deals Small and Medium Enterprises in Hi-Tech Domains • Pharmaceutical Companies • Electronics and Computer Hardware Firms • IP Brokerage Firms and Medium-Sized Enterprises • Consulting Firms • Investment Banks • Private Equity Funds Infringement Lawsuits • Infringement Support Law Firms • Plaintiff/Defendant Financing/ Securitization • Banks • Private Equity Funds • VCs Tax/Financial Reporting • Any Slide 14 © 2010 Evalueserve, Ltd. All Rights Reserved - Privileged and Confidential

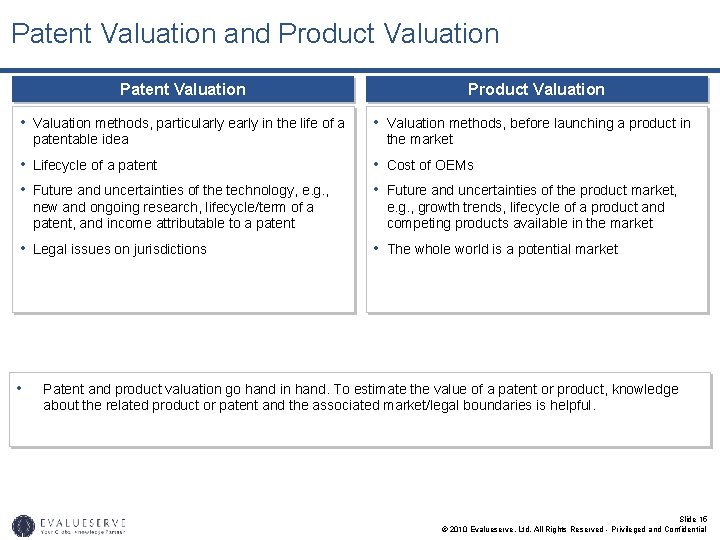

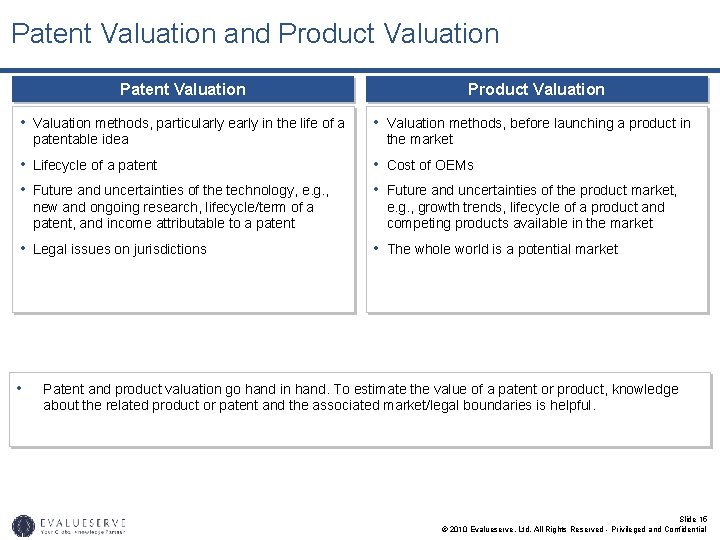

Patent Valuation and Product Valuation Patent Valuation Product Valuation • Valuation methods, particularly early in the life of a • Valuation methods, before launching a product in patentable idea the market • Lifecycle of a patent • Future and uncertainties of the technology, e. g. , • Cost of OEMs • Future and uncertainties of the product market, new and ongoing research, lifecycle/term of a patent, and income attributable to a patent e. g. , growth trends, lifecycle of a product and competing products available in the market • Legal issues on jurisdictions • • The whole world is a potential market Patent and product valuation go hand in hand. To estimate the value of a patent or product, knowledge about the related product or patent and the associated market/legal boundaries is helpful. Slide 15 © 2010 Evalueserve, Ltd. All Rights Reserved - Privileged and Confidential

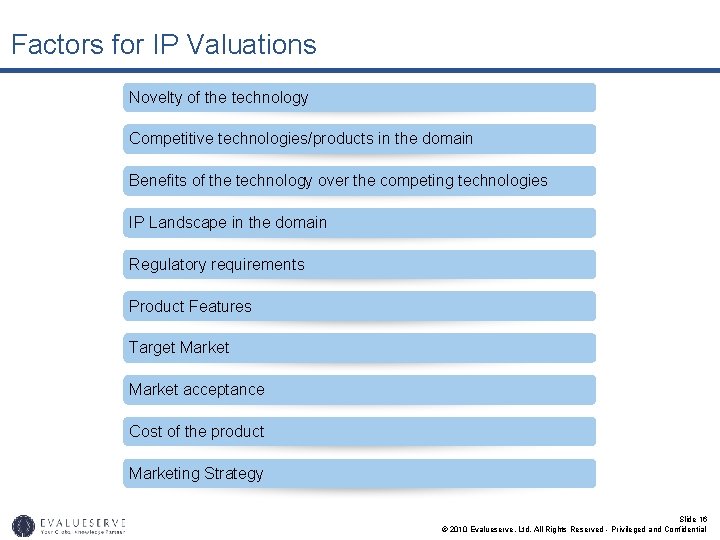

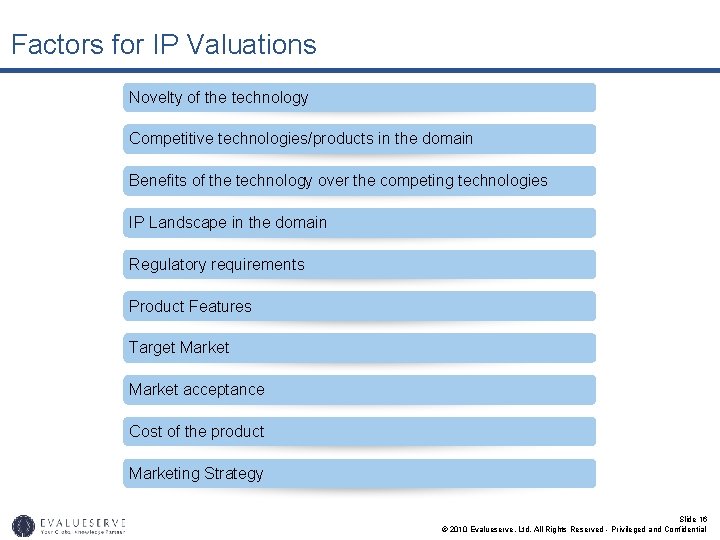

Factors for IP Valuations Novelty of the technology Competitive technologies/products in the domain Benefits of the technology over the competing technologies IP Landscape in the domain Regulatory requirements Product Features Target Market acceptance Cost of the product Marketing Strategy Slide 16 © 2010 Evalueserve, Ltd. All Rights Reserved - Privileged and Confidential

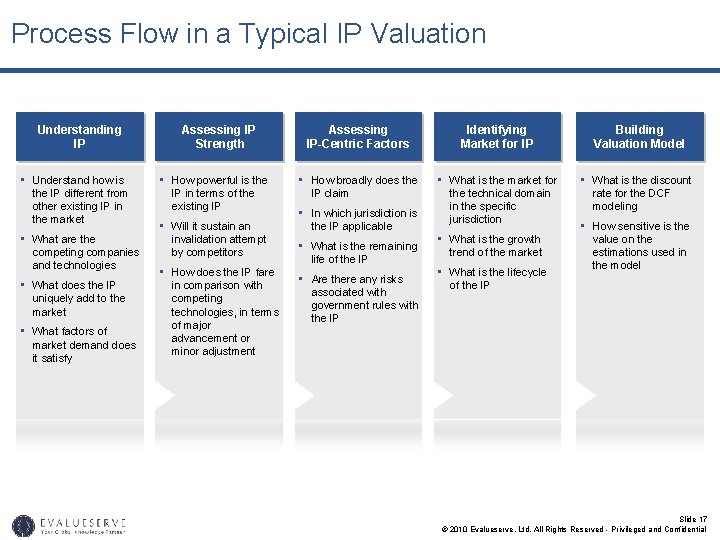

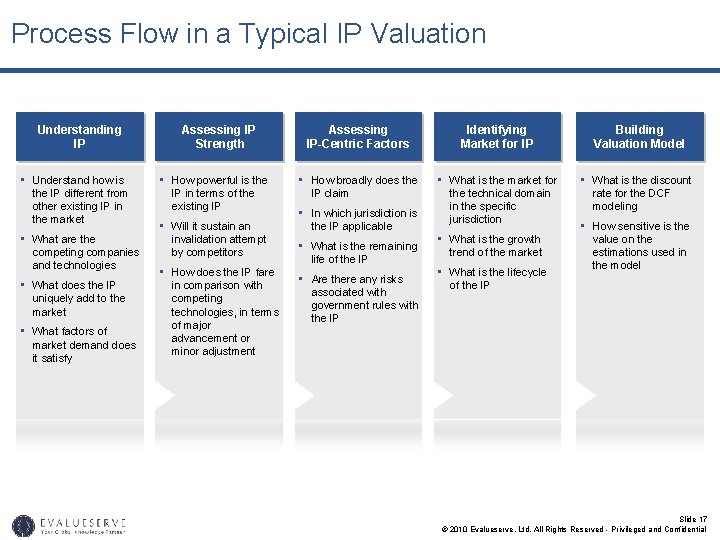

Process Flow in a Typical IP Valuation Understanding IP • Understand how is the IP different from other existing IP in the market • What are the competing companies and technologies • What does the IP uniquely add to the market • What factors of market demand does it satisfy Assessing IP Strength • How powerful is the IP in terms of the existing IP • Will it sustain an invalidation attempt by competitors • How does the IP fare in comparison with competing technologies, in terms of major advancement or minor adjustment Assessing IP-Centric Factors Identifying Market for IP • How broadly does the • What is the market for IP claim • In which jurisdiction is the IP applicable • What is the remaining life of the IP • Are there any risks associated with government rules with the IP the technical domain in the specific jurisdiction • What is the growth trend of the market • What is the lifecycle Building Valuation Model • What is the discount rate for the DCF modeling • How sensitive is the value on the estimations used in the model of the IP Slide 17 © 2010 Evalueserve, Ltd. All Rights Reserved - Privileged and Confidential

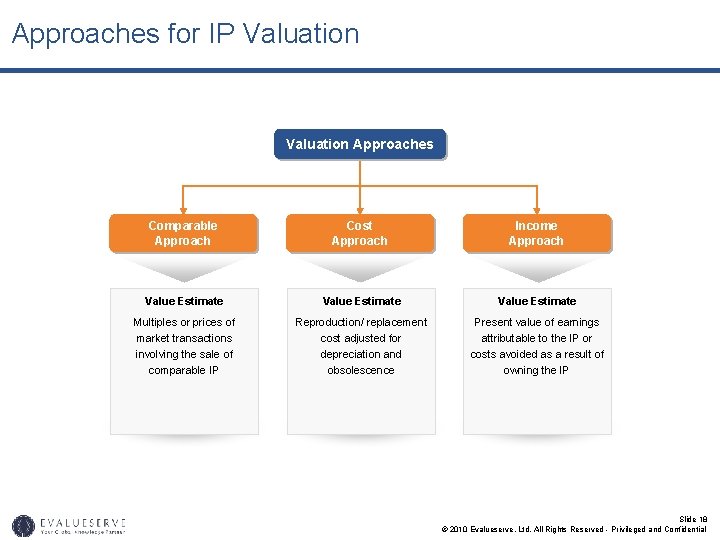

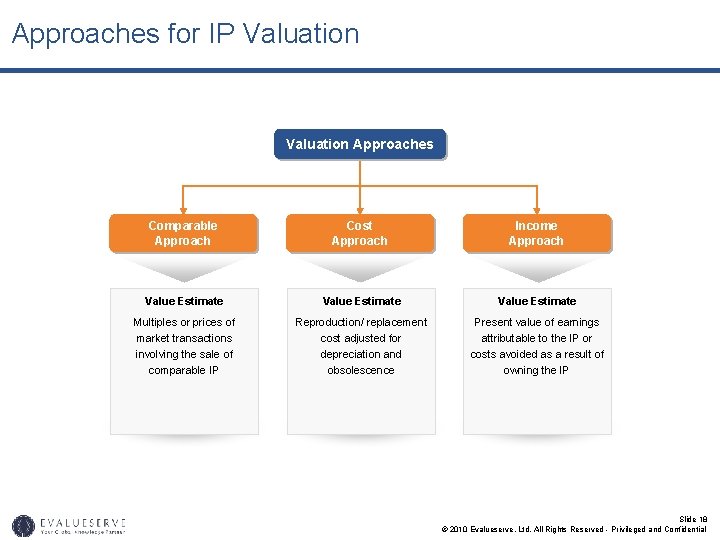

Approaches for IP Valuation Approaches Comparable Approach Cost Approach Income Approach Value Estimate Multiples or prices of market transactions involving the sale of comparable IP Reproduction/ replacement cost adjusted for depreciation and obsolescence Present value of earnings attributable to the IP or costs avoided as a result of owning the IP Slide 18 © 2010 Evalueserve, Ltd. All Rights Reserved - Privileged and Confidential

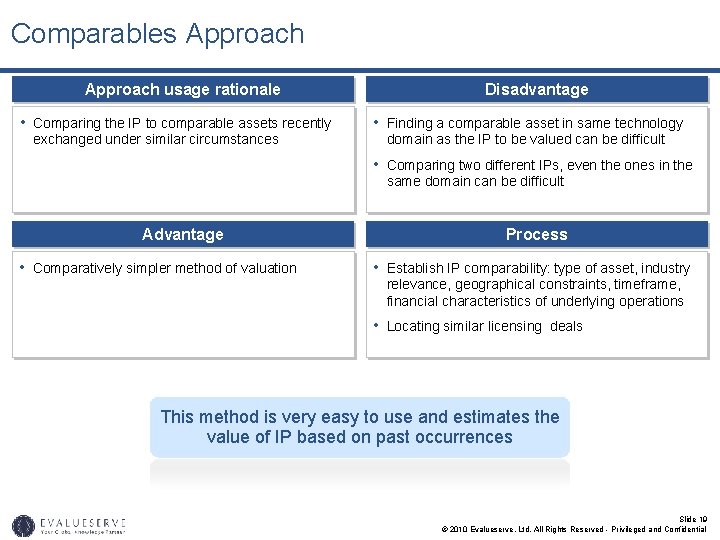

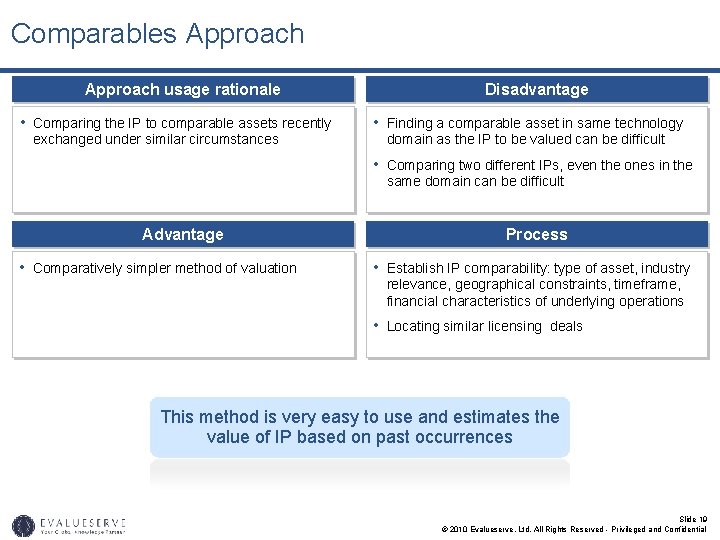

Comparables Approach usage rationale • Comparing the IP to comparable assets recently exchanged under similar circumstances Disadvantage • Finding a comparable asset in same technology domain as the IP to be valued can be difficult • Comparing two different IPs, even the ones in the same domain can be difficult Advantage • Comparatively simpler method of valuation Process • Establish IP comparability: type of asset, industry relevance, geographical constraints, timeframe, financial characteristics of underlying operations • Locating similar licensing deals This method is very easy to use and estimates the value of IP based on past occurrences Slide 19 © 2010 Evalueserve, Ltd. All Rights Reserved - Privileged and Confidential

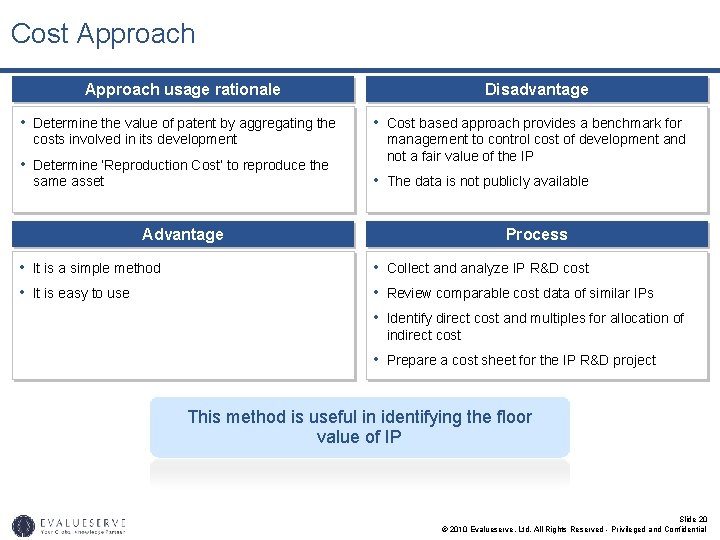

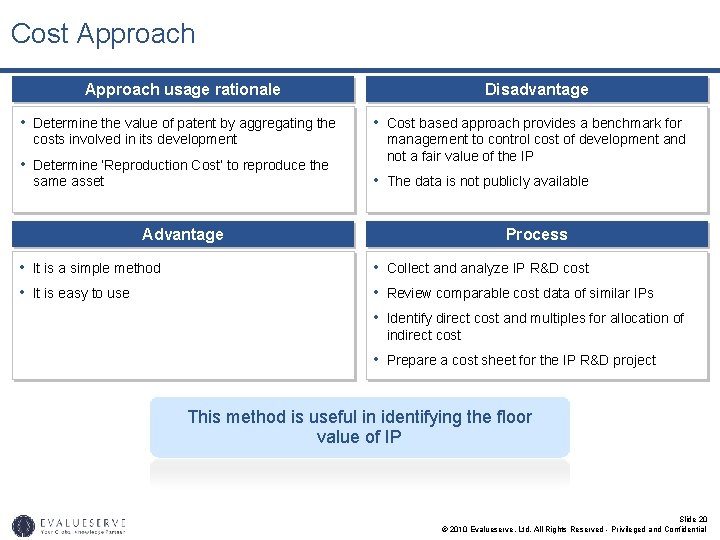

Cost Approach usage rationale • Determine the value of patent by aggregating the costs involved in its development • Determine ‘Reproduction Cost’ to reproduce the same asset Disadvantage • Cost based approach provides a benchmark for management to control cost of development and not a fair value of the IP • The data is not publicly available Advantage • It is a simple method • It is easy to use Process • Collect and analyze IP R&D cost • Review comparable cost data of similar IPs • Identify direct cost and multiples for allocation of indirect cost • Prepare a cost sheet for the IP R&D project This method is useful in identifying the floor value of IP Slide 20 © 2010 Evalueserve, Ltd. All Rights Reserved - Privileged and Confidential

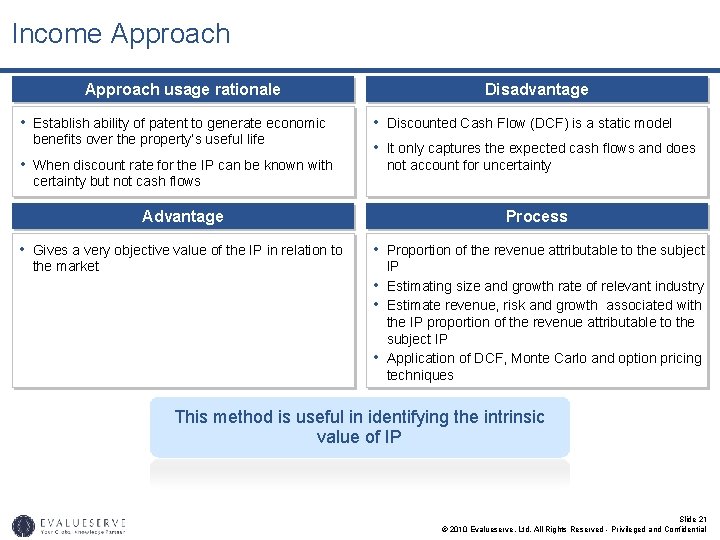

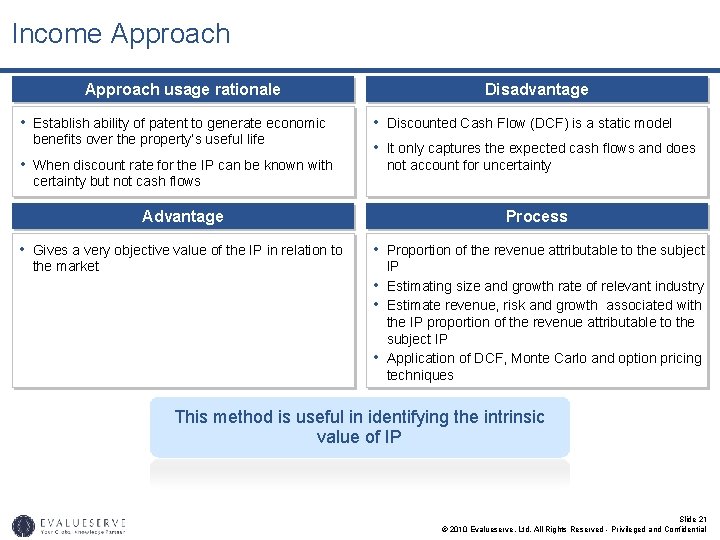

Income Approach usage rationale • Establish ability of patent to generate economic benefits over the property’s useful life • When discount rate for the IP can be known with Disadvantage • Discounted Cash Flow (DCF) is a static model • It only captures the expected cash flows and does not account for uncertainty but not cash flows Advantage Process • Gives a very objective value of the IP in relation to • Proportion of the revenue attributable to the subject the market • • • IP Estimating size and growth rate of relevant industry Estimate revenue, risk and growth associated with the IP proportion of the revenue attributable to the subject IP Application of DCF, Monte Carlo and option pricing techniques This method is useful in identifying the intrinsic value of IP Slide 21 © 2010 Evalueserve, Ltd. All Rights Reserved - Privileged and Confidential

Presentation Plan IP Valuation Overview IP Valuation Approaches Case Study Slide 22 © 2010 Evalueserve, Ltd. All Rights Reserved - Privileged and Confidential

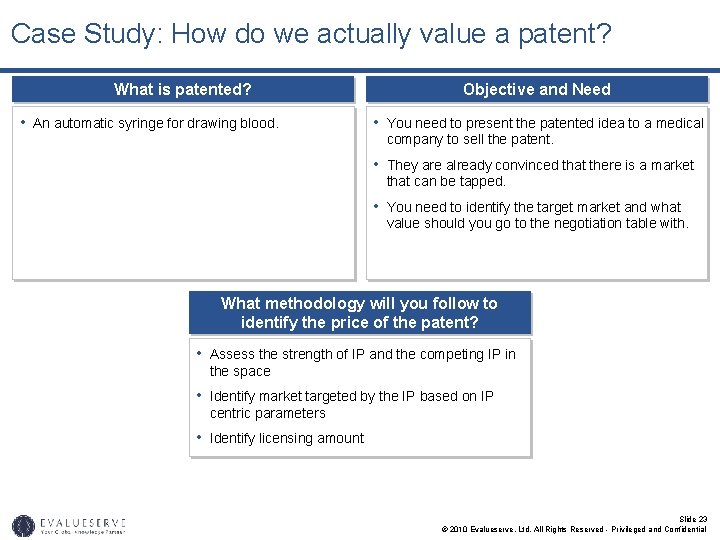

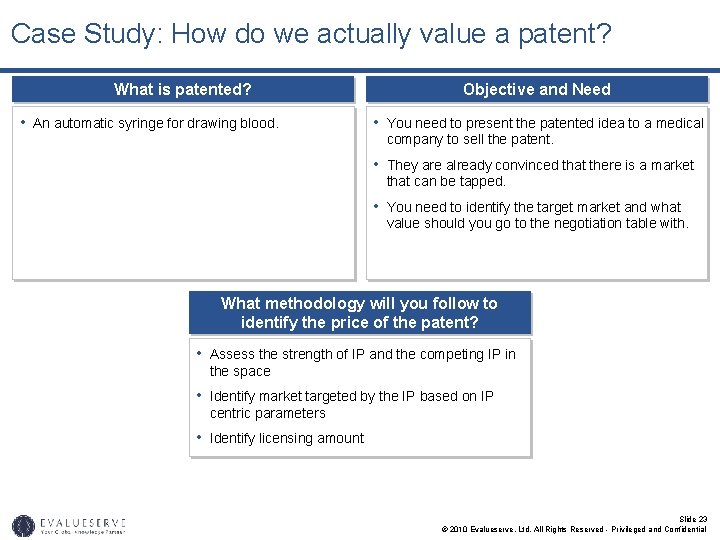

Case Study: How do we actually value a patent? What is patented? • An automatic syringe for drawing blood. Objective and Need • You need to present the patented idea to a medical company to sell the patent. • They are already convinced that there is a market that can be tapped. • You need to identify the target market and what value should you go to the negotiation table with. What methodology will you follow to identify the price of the patent? • Assess the strength of IP and the competing IP in the space • Identify market targeted by the IP based on IP centric parameters • Identify licensing amount Slide 23 © 2010 Evalueserve, Ltd. All Rights Reserved - Privileged and Confidential

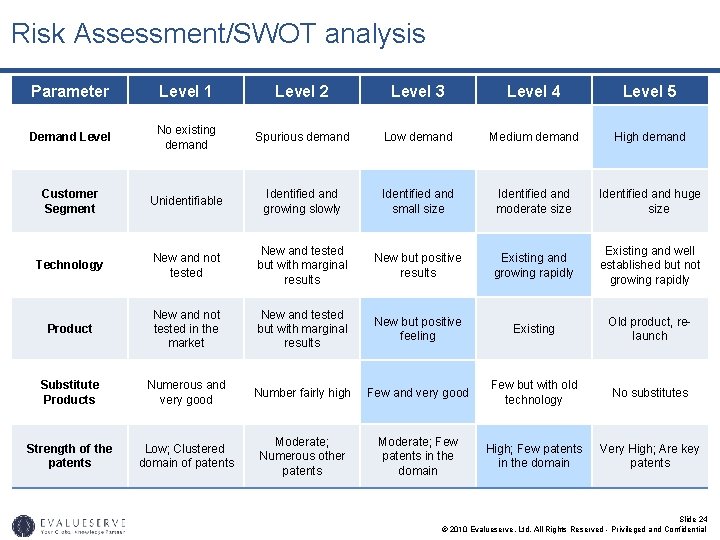

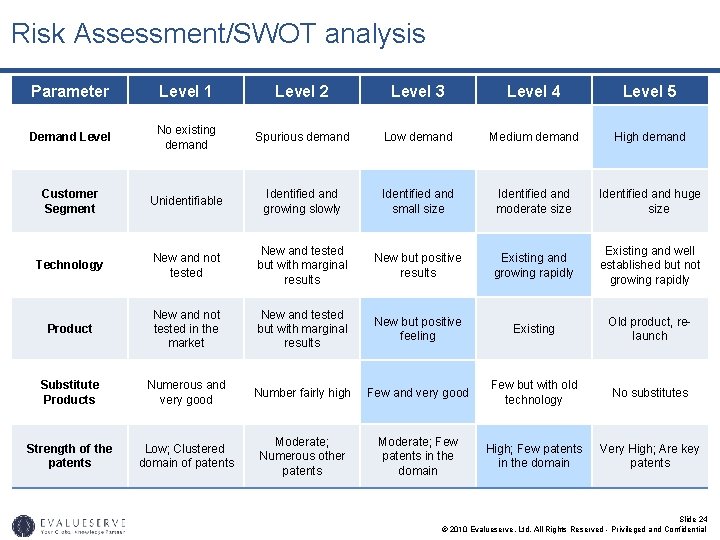

Risk Assessment/SWOT analysis Parameter Level 1 Level 2 Level 3 Level 4 Level 5 Demand Level No existing demand Spurious demand Low demand Medium demand High demand Customer Segment Unidentifiable Identified and growing slowly Identified and small size Identified and moderate size Identified and huge size Technology New and not tested New and tested but with marginal results New but positive results Existing and growing rapidly Existing and well established but not growing rapidly Product New and not tested in the market New and tested but with marginal results New but positive feeling Existing Old product, relaunch Substitute Products Numerous and very good Number fairly high Few and very good Few but with old technology No substitutes Strength of the patents Low; Clustered domain of patents Moderate; Numerous other patents Moderate; Few patents in the domain High; Few patents in the domain Very High; Are key patents Slide 24 © 2010 Evalueserve, Ltd. All Rights Reserved - Privileged and Confidential

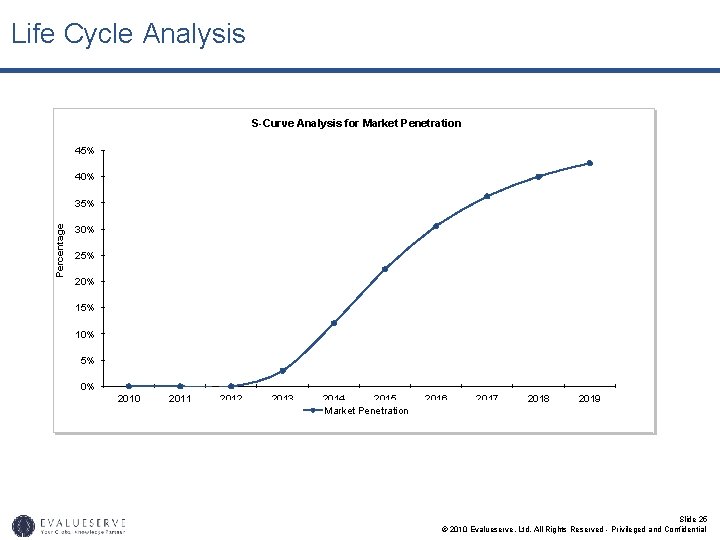

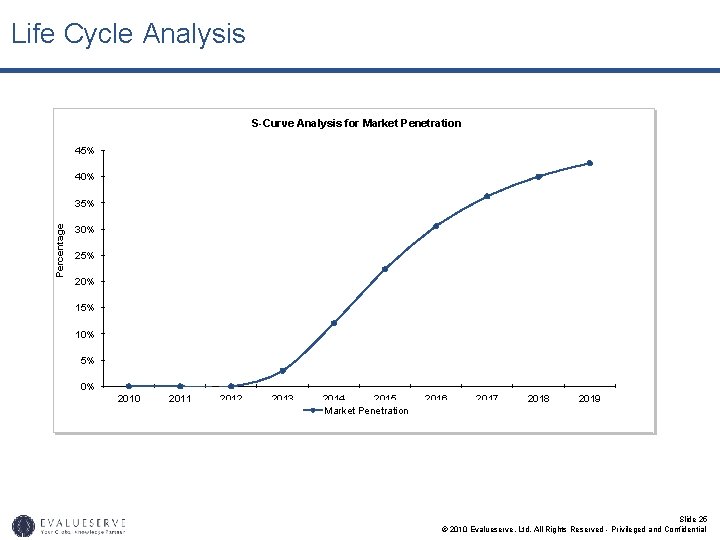

Life Cycle Analysis S-Curve Analysis for Market Penetration 45% 40% Percentage 35% 30% 25% 20% 15% 10% 5% 0% 2010 2011 2012 2013 2014 2015 Market Penetration 2016 2017 2018 2019 Slide 25 © 2010 Evalueserve, Ltd. All Rights Reserved - Privileged and Confidential

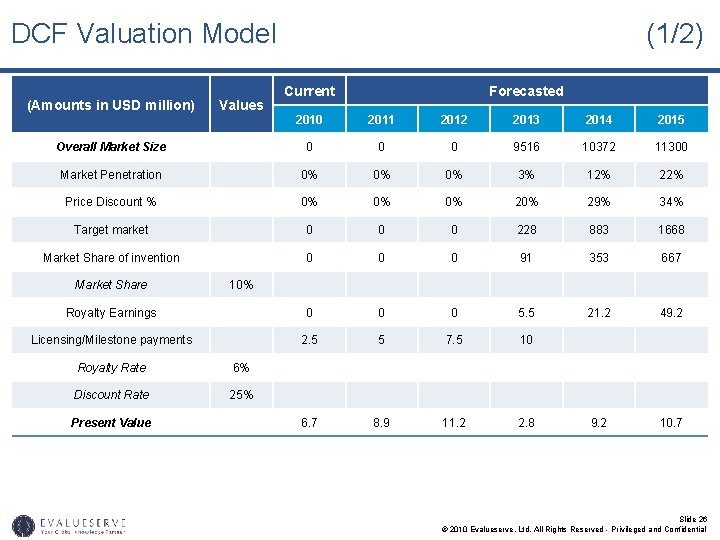

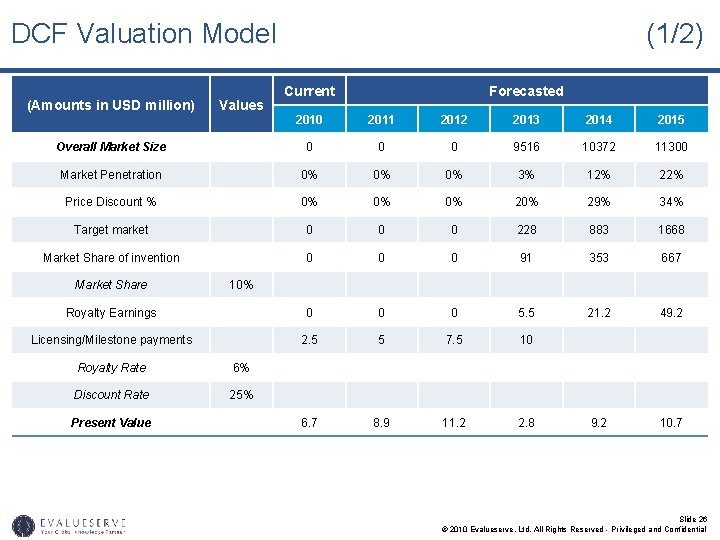

DCF Valuation Model (Amounts in USD million) Values (1/2) Current Forecasted 2010 2011 2012 2013 2014 2015 Overall Market Size 0 0 0 9516 10372 11300 Market Penetration 0% 0% 0% 3% 12% 22% Price Discount % 0% 0% 0% 29% 34% Target market 0 0 0 228 883 1668 Market Share of invention 0 0 0 91 353 667 Royalty Earnings 0 0 0 5. 5 21. 2 49. 2 Licensing/Milestone payments 2. 5 5 7. 5 10 6. 7 8. 9 11. 2 2. 8 9. 2 10. 7 Market Share 10% Royalty Rate 6% Discount Rate 25% Present Value Slide 26 © 2010 Evalueserve, Ltd. All Rights Reserved - Privileged and Confidential

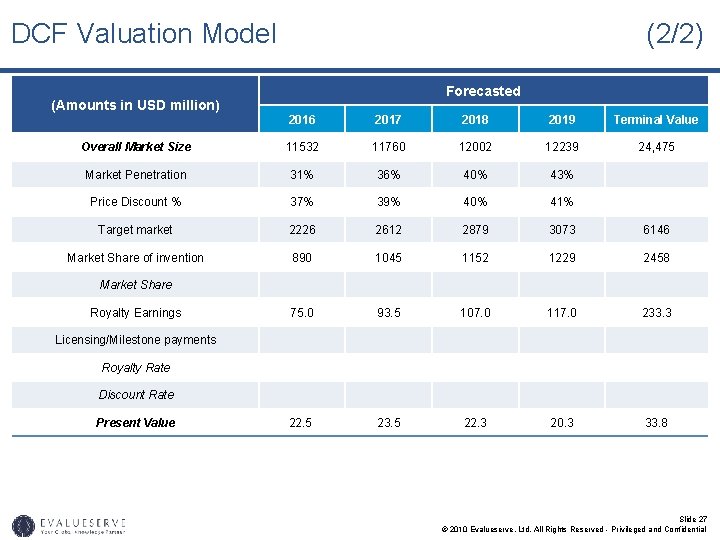

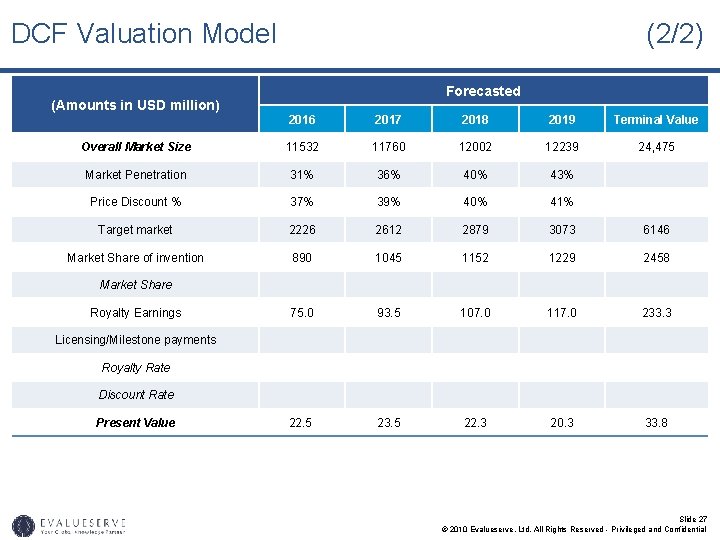

DCF Valuation Model (Amounts in USD million) (2/2) Forecasted 2016 2017 2018 2019 Terminal Value Overall Market Size 11532 11760 12002 12239 24, 475 Market Penetration 31% 36% 40% 43% Price Discount % 37% 39% 40% 41% Target market 2226 2612 2879 3073 6146 Market Share of invention 890 1045 1152 1229 2458 75. 0 93. 5 107. 0 117. 0 233. 3 22. 5 23. 5 22. 3 20. 3 33. 8 Market Share Royalty Earnings Licensing/Milestone payments Royalty Rate Discount Rate Present Value Slide 27 © 2010 Evalueserve, Ltd. All Rights Reserved - Privileged and Confidential

Presentation Plan IP Valuation Overview IP Valuation Approaches Case Study Slide 28 © 2010 Evalueserve, Ltd. All Rights Reserved - Privileged and Confidential

Thank you © 2010 Evalueserve, Ltd. All Rights Reserved - Privileged and Confidential