Inventory Costing AverageCost Method computes the average cost

![LIFO vs. FIFO [Rising Prices] Ratio Net Profit Margin NI ÷ Sales ROA NI LIFO vs. FIFO [Rising Prices] Ratio Net Profit Margin NI ÷ Sales ROA NI](https://slidetodoc.com/presentation_image_h/758d658fb25167c7b9efaacd44ab9042/image-13.jpg)

- Slides: 13

Inventory Costing

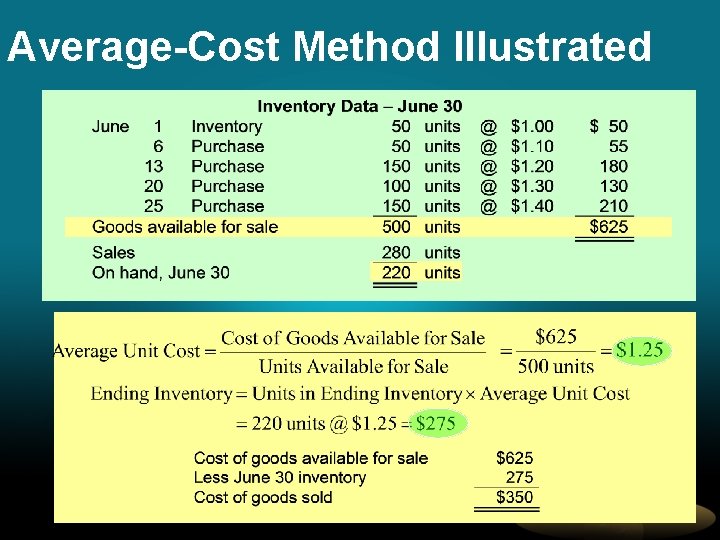

Average-Cost Method … computes the average cost of all goods available for sale during the period in order to determine the value of ending inventory • Tends to level out the effects of cost increases and decreases • Is criticized by some who believe that recent costs are more relevant for income measurement and decision making

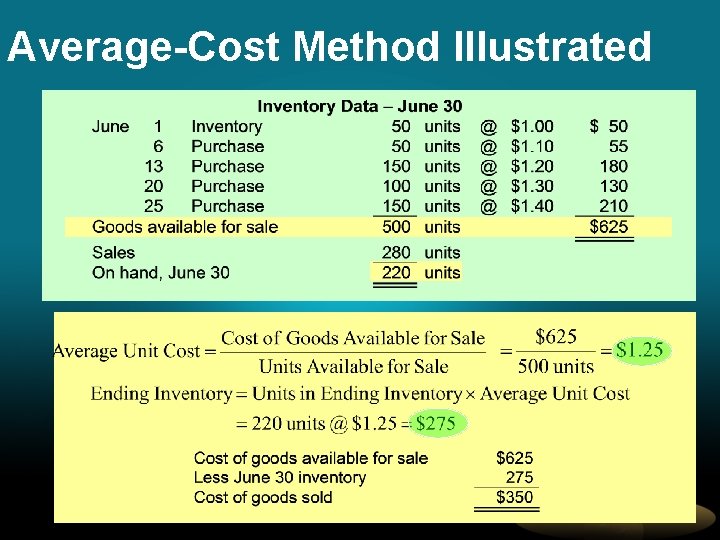

Average-Cost Method Illustrated

First-In, First-Out (FIFO) Method … is based on the assumption that the costs of the first items acquired should be assigned to the first items sold • The cost of ending inventory reflects the cost of merchandise from the most recent purchases • The costs assigned to cost of goods sold are from the earliest purchases

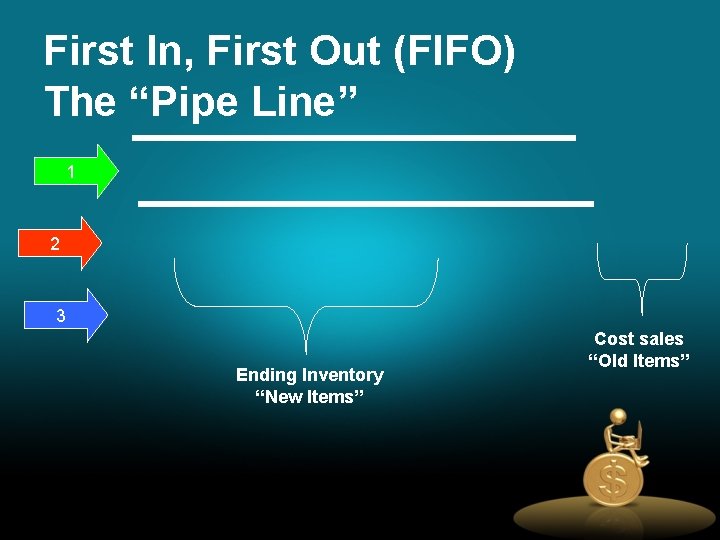

First In, First Out (FIFO) The “Pipe Line” 1 2 3 Ending Inventory “New Items” Cost sales “Old Items”

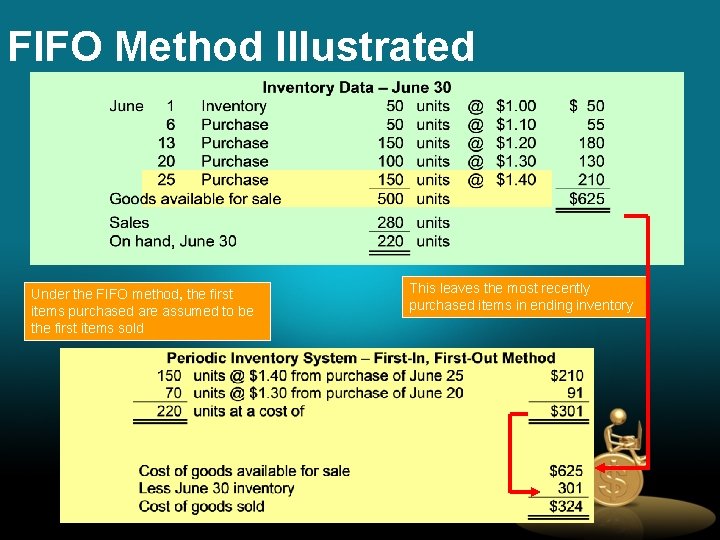

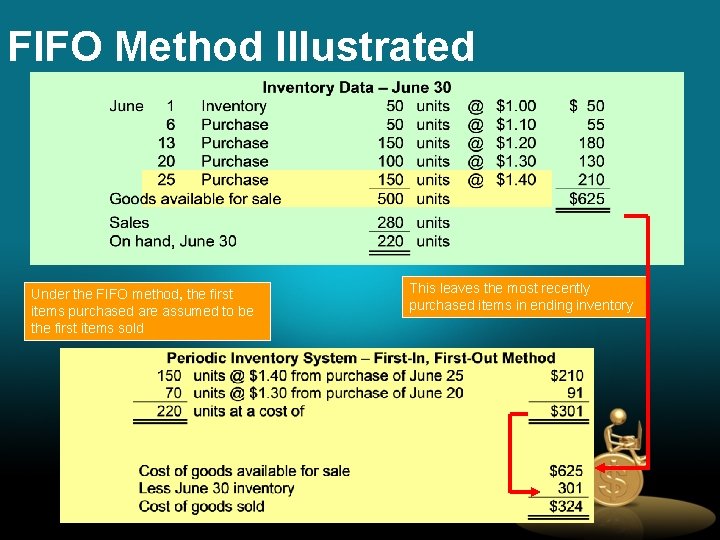

FIFO Method Illustrated Under the FIFO method, the first items purchased are assumed to be the first items sold This leaves the most recently purchased items in ending inventory

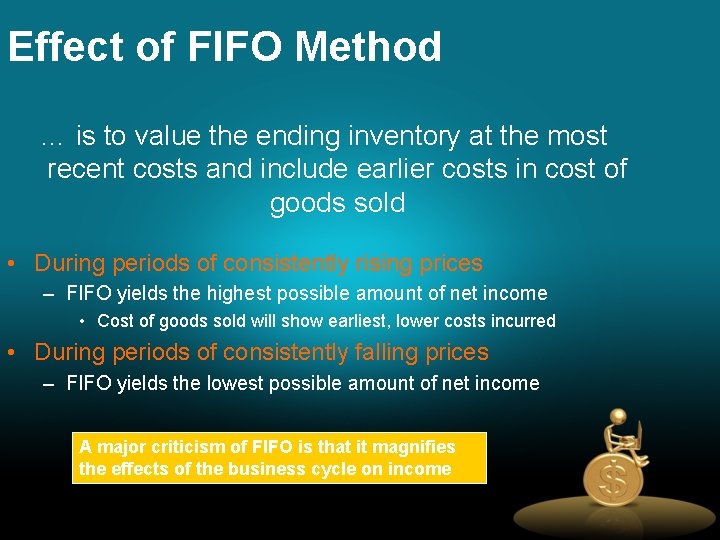

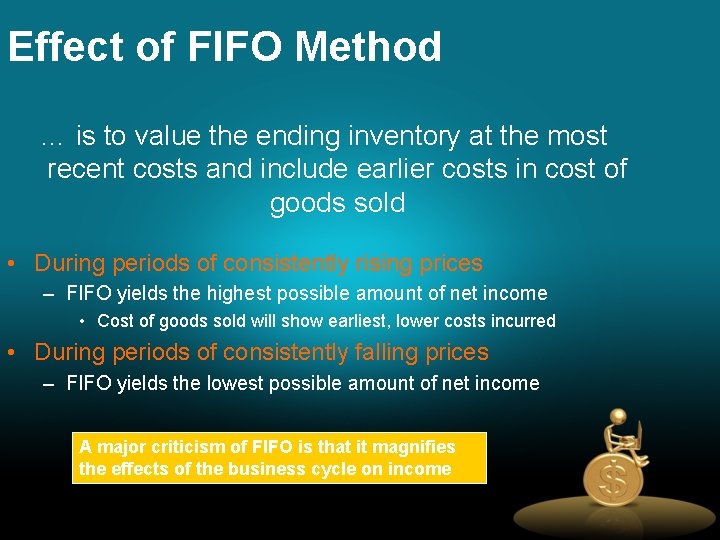

Effect of FIFO Method … is to value the ending inventory at the most recent costs and include earlier costs in cost of goods sold • During periods of consistently rising prices – FIFO yields the highest possible amount of net income • Cost of goods sold will show earliest, lower costs incurred • During periods of consistently falling prices – FIFO yields the lowest possible amount of net income A major criticism of FIFO is that it magnifies the effects of the business cycle on income

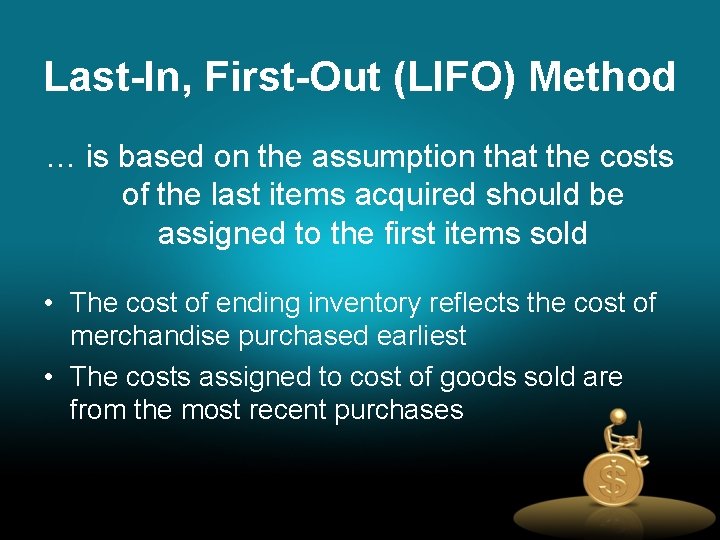

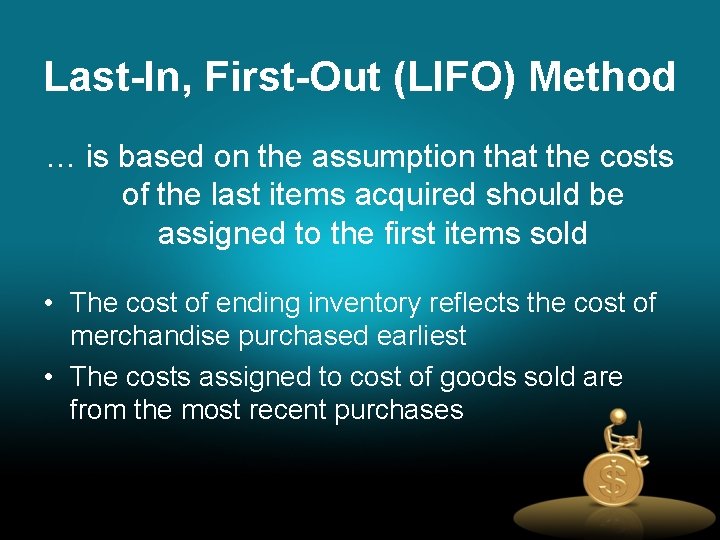

Last-In, First-Out (LIFO) Method … is based on the assumption that the costs of the last items acquired should be assigned to the first items sold • The cost of ending inventory reflects the cost of merchandise purchased earliest • The costs assigned to cost of goods sold are from the most recent purchases

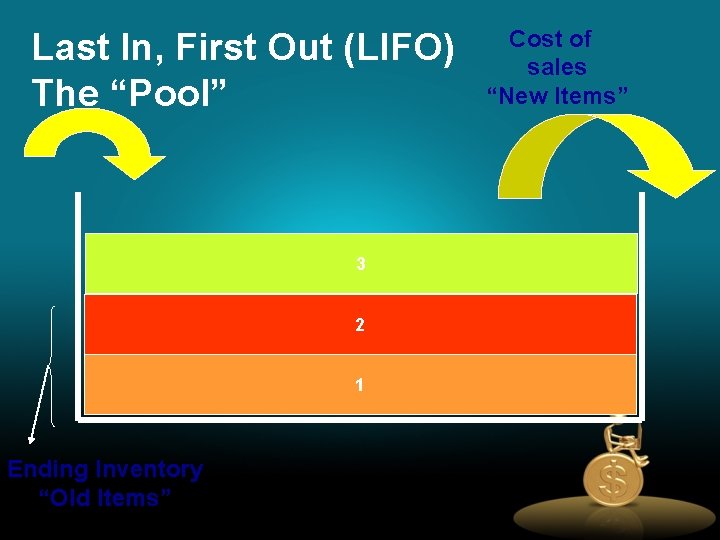

Last In, First Out (LIFO) The “Pool” 3 2 1 Ending Inventory “Old Items” Cost of sales “New Items”

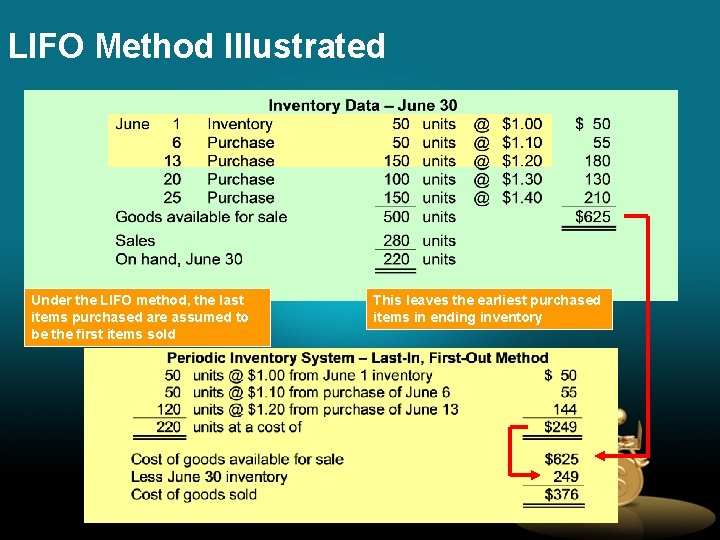

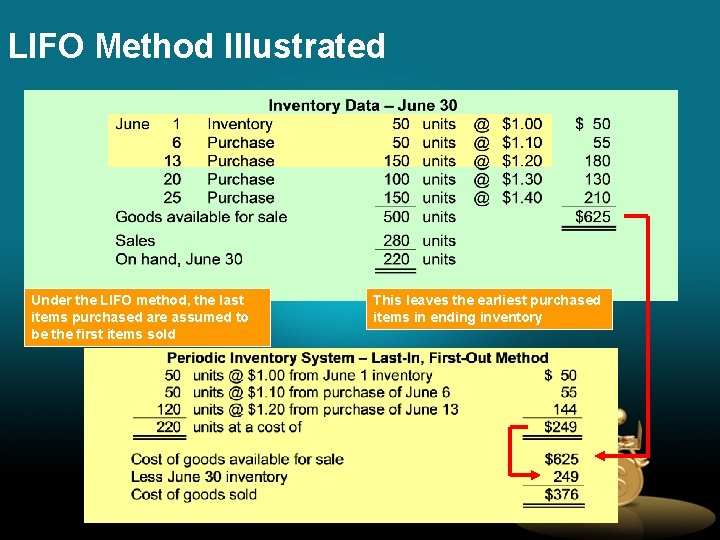

LIFO Method Illustrated Under the LIFO method, the last items purchased are assumed to be the first items sold This leaves the earliest purchased items in ending inventory

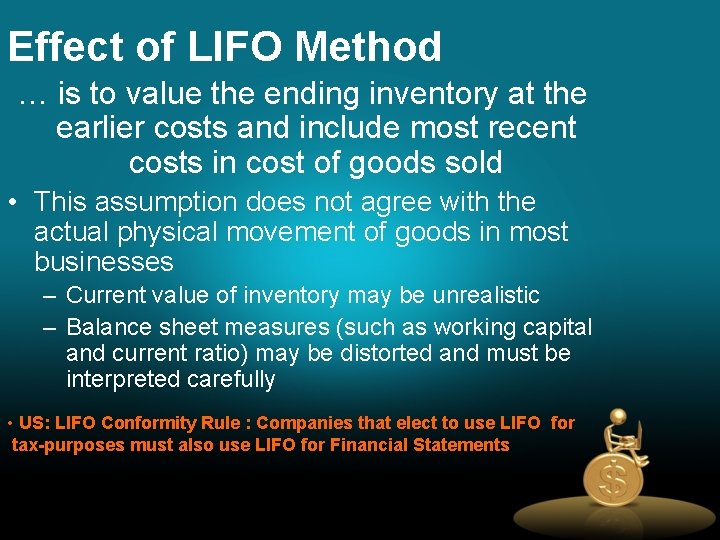

Effect of LIFO Method … is to value the ending inventory at the earlier costs and include most recent costs in cost of goods sold • This assumption does not agree with the actual physical movement of goods in most businesses – Current value of inventory may be unrealistic – Balance sheet measures (such as working capital and current ratio) may be distorted and must be interpreted carefully • US: LIFO Conformity Rule : Companies that elect to use LIFO for tax-purposes must also use LIFO for Financial Statements

Effect of LIFO Method (cont’d) • Strong logical argument for LIFO – Fairest determination of income occurs if the current costs of merchandise are matched against current sales prices • Smoothes out fluctuations in the business cycle – As prices move upward or downward, cost of goods sold will show costs closer to the price level at the time the goods were sold

![LIFO vs FIFO Rising Prices Ratio Net Profit Margin NI Sales ROA NI LIFO vs. FIFO [Rising Prices] Ratio Net Profit Margin NI ÷ Sales ROA NI](https://slidetodoc.com/presentation_image_h/758d658fb25167c7b9efaacd44ab9042/image-13.jpg)

LIFO vs. FIFO [Rising Prices] Ratio Net Profit Margin NI ÷ Sales ROA NI ÷ Assets ROE NI ÷ Equity Debt-to-Equity Debt ÷ Equity ATO Sales ÷ Assets LIFO FIFO Lower (NI Lower) Lower Higher (NI Higher) Higher Lower Higher (Lower Equity) Higher (Lower Assets) Lower (Higher Equity) Lower (Higher Assets)