Introduction to Macroeconomics Chapter 23 Aggregate Demand Aggregate

- Slides: 23

Introduction to Macroeconomics Chapter 23. Aggregate Demand Aggregate Supply

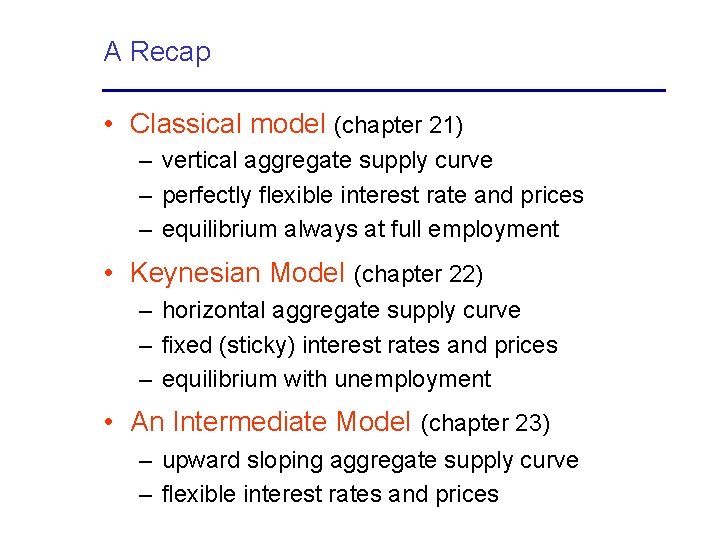

A Recap • Classical model (chapter 21) – vertical aggregate supply curve – perfectly flexible interest rate and prices – equilibrium always at full employment • Keynesian Model (chapter 22) – horizontal aggregate supply curve – fixed (sticky) interest rates and prices – equilibrium with unemployment • An Intermediate Model (chapter 23) – upward sloping aggregate supply curve – flexible interest rates and prices

Aggregate Demand Aggregate Supply 1. Price Changes and Aggregate Demand 2. Aggregate Demand Curve 3. Aggregate Supply Curve 4. Supply-Demand Equilibrium

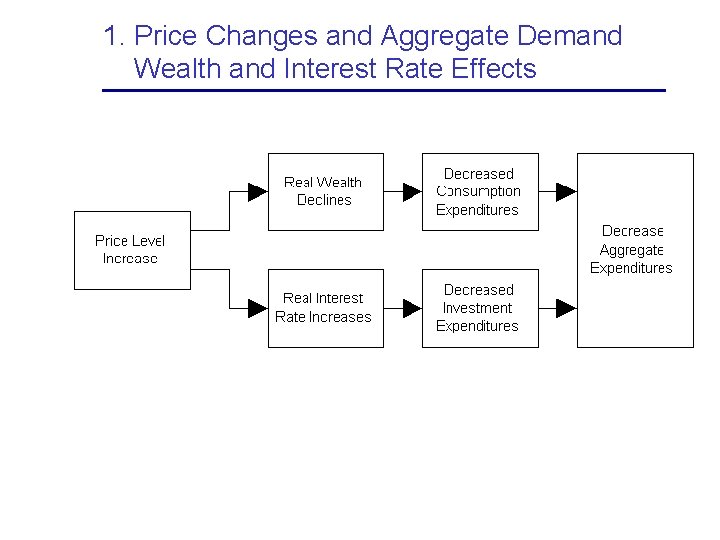

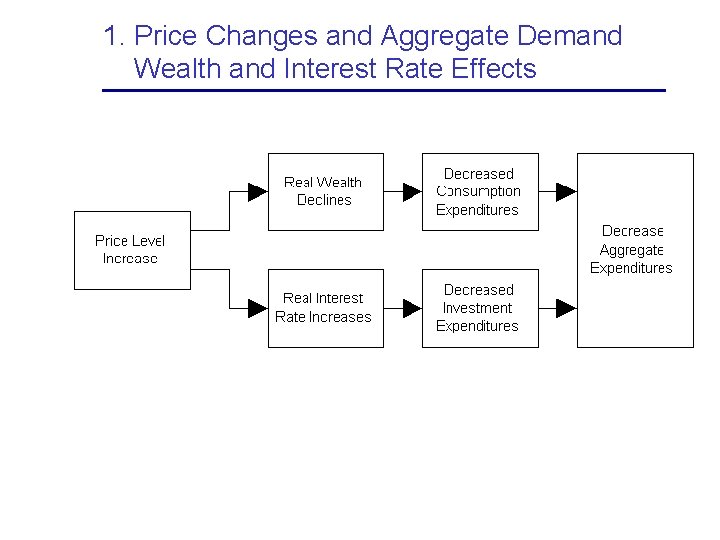

1. Price Changes and Aggregate Demand Wealth and Interest Rate Effects

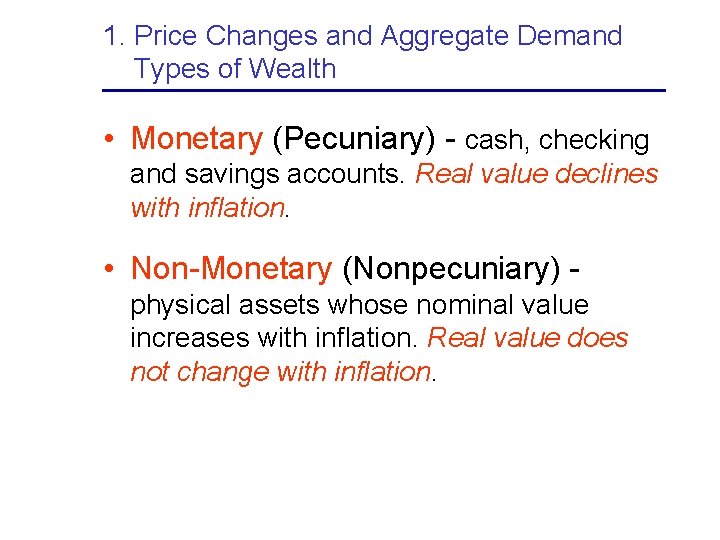

1. Price Changes and Aggregate Demand Types of Wealth • Monetary (Pecuniary) - cash, checking and savings accounts. Real value declines with inflation. • Non-Monetary (Nonpecuniary) physical assets whose nominal value increases with inflation. Real value does not change with inflation.

1. Price Changes and Aggregate Demand Wealth - Purchasing Power • Monetary wealth (cash and savings): As average price level goes up, cash and checking account balances don’t change. Purchasing power (real value) of monetary assets declines. • Nonmonetary wealth unaffected by changes in the average price level. As average price level goes up, price of nonmonetary assets (e. g. , house) also goes up. Real value unchanged.

1. Price Changes and Aggregate Demand Wealth - Real Money Balances = Nominal money balances (cash and savings) corrected for inflation. With inflation: Nominal money balances unchanged Real money balances decline

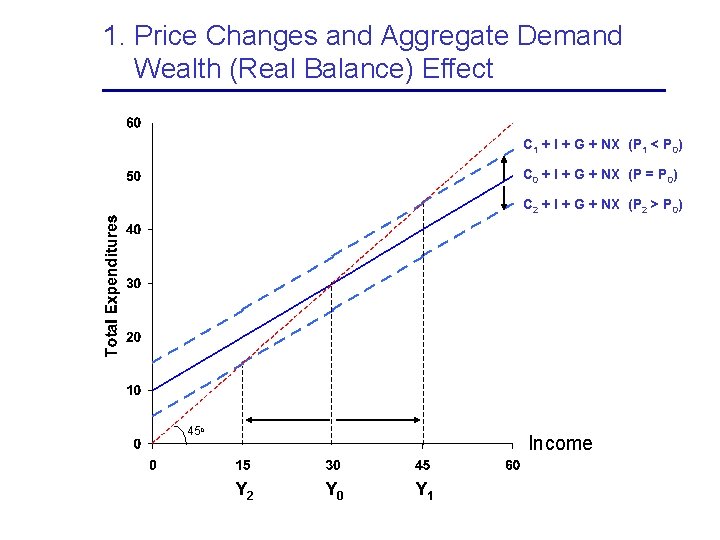

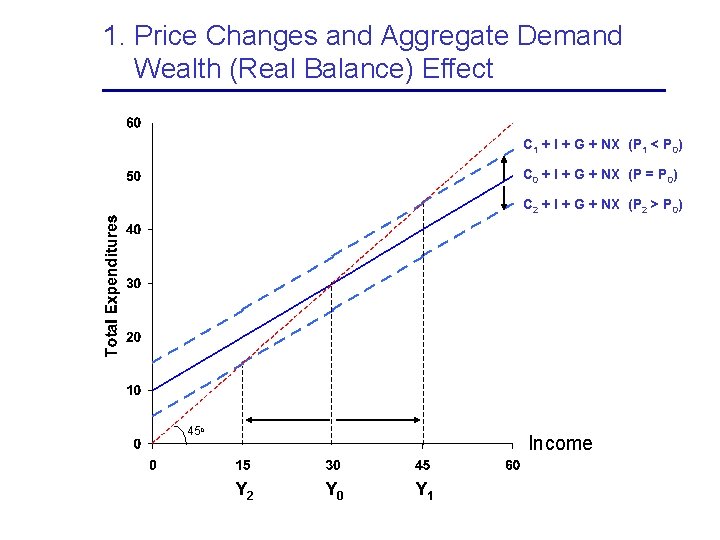

1. Price Changes and Aggregate Demand Wealth (Real Balance) Effect • Consumption is a positive function of income and wealth • Increase in average level of prices • Reduces purchasing power of existing monetary wealth (nonpecuniary wealth unaffected) • Decline in consumption • Keynesian aggregate expenditure curve shifts downward

1. Price Changes and Aggregate Demand Wealth (Real Balance) Effect C 1 + I + G + NX (P 1 < P 0) C 0 + I + G + NX (P = P 0) C 2 + I + G + NX (P 2 > P 0) 45 o Income Y 2 Y 0 Y 1

1. Price Changes and Aggregate Demand Interest Rate Effect - Part 1 Real interest rate is positively related to the average price level: – prices increase (inflation) – decline in real money balances – increase in demand for cash in order to restore real money balances – real interest rates increase to reduce the demand for real money balances and cash (i. e. , return the demand supply for money to equilibrium)

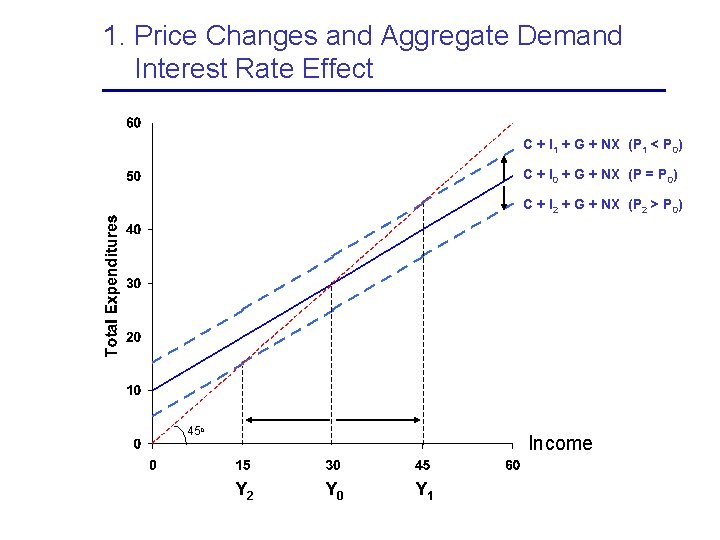

1. Price Changes and Aggregate Demand Interest Rate Effect - Part 2 Investment negatively related to real interest rate and average price level: – – price increase (inflation) real interest rate increases investment declines Keynesian expenditure curve shifts downward

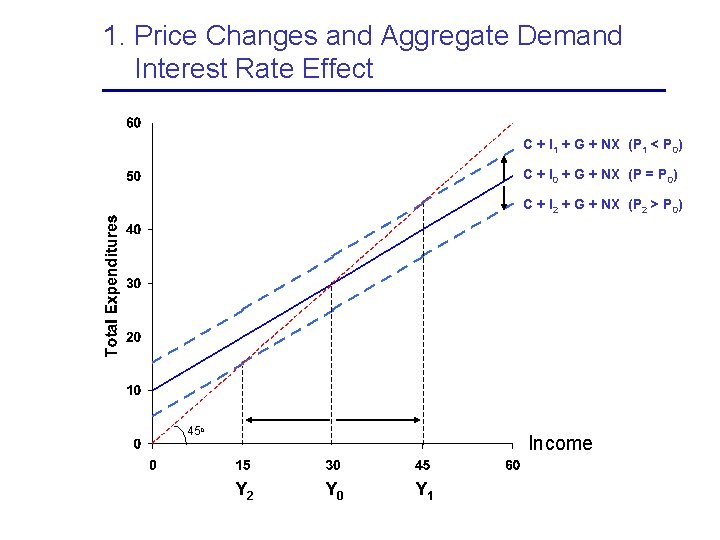

1. Price Changes and Aggregate Demand Interest Rate Effect C + I 1 + G + NX (P 1 < P 0) C + I 0 + G + NX (P = P 0) C + I 2 + G + NX (P 2 > P 0) 45 o Income Y 2 Y 0 Y 1

1. Price Changes and Aggregate Demand Wealth and Interest Rate Effects Increase in average level of prices: • Wealth Effect - decline in consumption and decline in aggregate expenditures • Interest Rate Effect - increase in real interest rate, decline in investment and decline in aggregate expenditures.

2. Aggregate Demand Curve Negative relationship between total expenditures and average price level (downward sloping)

2. Aggregate Demand Curve Deriving the Aggregate Demand Curve • Keynesian Expenditure Curve (Chapter 22) - positive relationship between total spending and income at a given fixed price level. • Aggregate Demand Curve - negative relationship between income (total expenditures) and average level of prices

2. Aggregate Demand Curve Deriving the Aggregate Demand Curve Refer to Figure 23. 4 in textbook

2. Aggregate Demand Curve Slope • Flat demand curve: large response by expenditures to wealth and interest rate effects. A small change in price leads to a large change in demand. • Steep demand curve: small response by expenditures to wealth and interest rate effects.

2. Aggregate Demand Curve Shift AD = C + I + G + NX Aggregate demand curve shifts to the right when: – increase in autonomous spending (C 0, I 0, G 0) – increase in net exports (NX) – reduction in taxes (increase disposable income and consumption) Note: a change in the average price level does not imply a shift in the demand curve, but a movement along (up or down) a stationary demand curve

3. Aggregate Supply Curve Relationship between total output and average price level

3. Aggregate Supply Curve Slope • Classical Range - vertical at full employment output • Keynesian Range - horizontal at a fixed price level • Intermediate Range - upward sloping

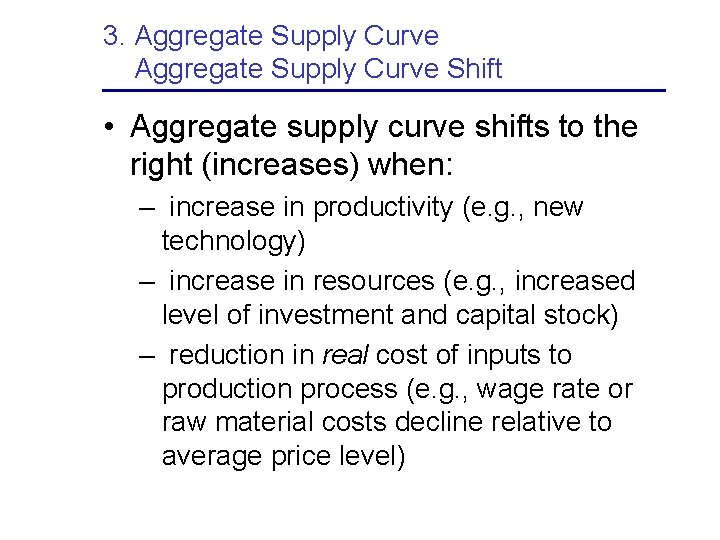

3. Aggregate Supply Curve Shift • Aggregate supply curve shifts to the right (increases) when: – increase in productivity (e. g. , new technology) – increase in resources (e. g. , increased level of investment and capital stock) – reduction in real cost of inputs to production process (e. g. , wage rate or raw material costs decline relative to average price level)

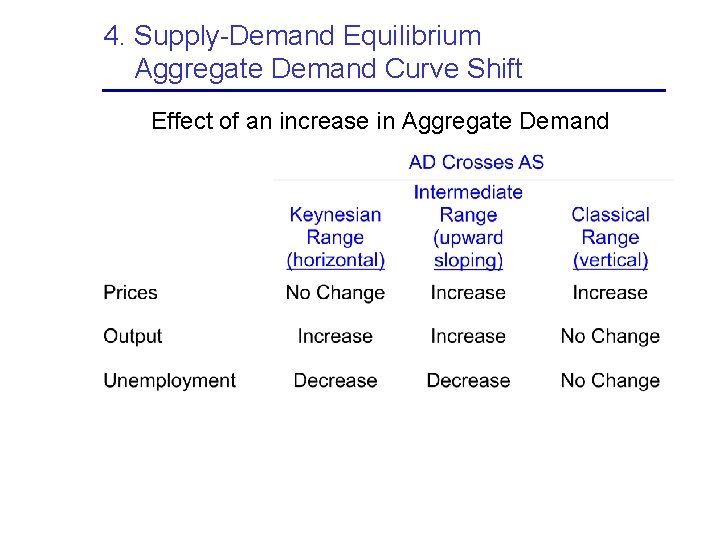

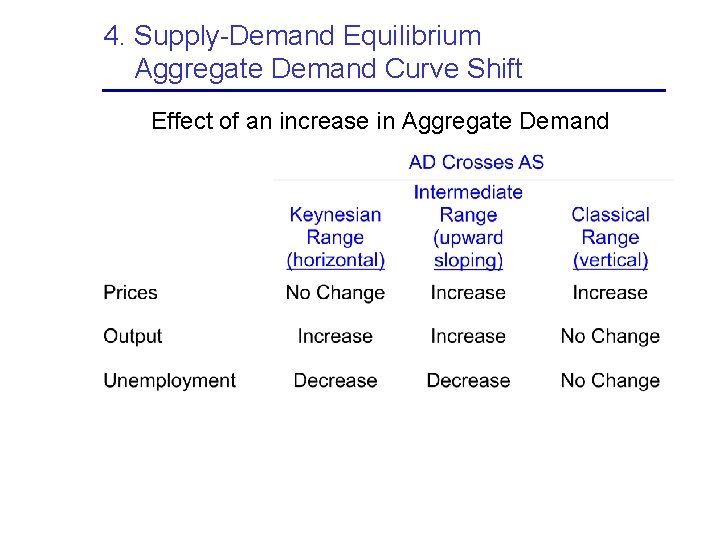

4. Supply-Demand Equilibrium Aggregate Demand Curve Shift Effect of an increase in Aggregate Demand

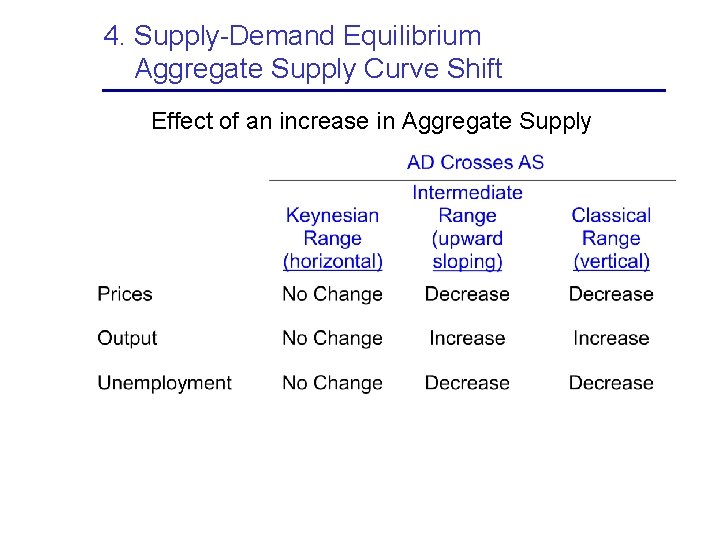

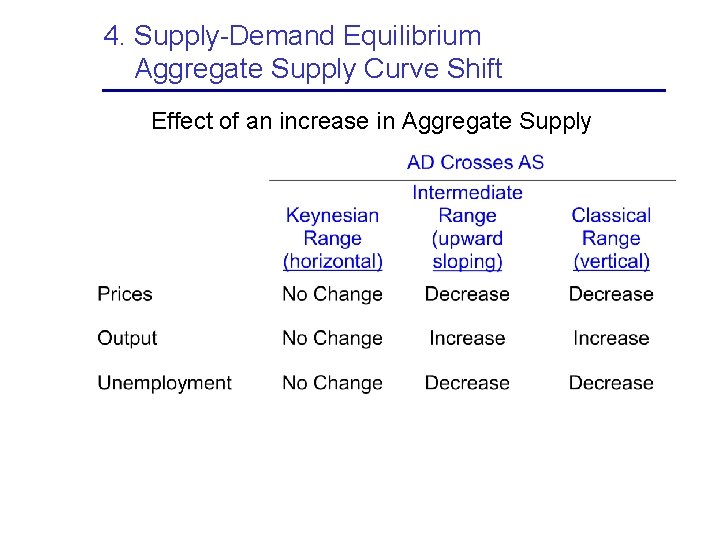

4. Supply-Demand Equilibrium Aggregate Supply Curve Shift Effect of an increase in Aggregate Supply