Introduction to Futures Options As Derivative Instruments Derivative

- Slides: 17

Introduction to Futures & Options As Derivative Instruments Derivative instruments are financial instruments whose value is derived from the value of an underlying asset An underlying asset can be a commodity, Bond, foreign exchange, equity shares or share indices.

Introduction to Futures & Options As Derivative Instruments The main instruments clubbed under the general term derivatives are Forwards Futures Option on futures Forward rate agreements(FRAs) Swaps

Types of Derivative instruments are of two types 1) Those that are traded in an exchange, such as futures and options 2) Those that are traded over the counter(OTC), such as forwards, FRAs, swaps. An important difference between these two types of instrument is in counter party risk and liquidity.

Forward contracts are the oldest and simplest form of derivative contracts. A forward contract is an agreement between two persons for the purchase and sale of a commodity or financial asset at a specified price to be delivered at a specified future date

Positive aspects of Forward contracts A firm can use the forward market to hedge or lock in the price of purchase or sale of the commodity/financial asset on a future date. Margins are not generally paid on forward contracts and there is also no up-front premium, hence these contracts do not have an initial cost. As forward contracts are tailor-made, the price risk exposure can be hedged upto 100%

Negative aspects of Forward contracts • There is no performance guarantee in a forward contract – always counter party risk • Forward contracts do not allow an investor to gain from favourable price movements or cancel transactions once the contract is made. • It is difficult to get a counterparty that agrees completely to one’s terms • No ready liquidity since forward contract is not traded on exchange

Futures contracts A futures contract is an agreement between a buyer and a seller that requires delivery of a specified quantity of a security, commodity or forex at a fixed time in the future at a price agreed to at the time of entering into the contract.

Features of futures contracts Futures are highly standardised contracts that provide for their performance either through deferred delivery of the asset or cash settlement Future contracts trade on organised exchanges with a clearing association that acts as a middleman between the contracting parties. Both the seller and the buyer of a futures contract pay an initial margin amount to the clearing house, which is used as a performance bond by the contracting parties.

Features of futures contracts Apart from the initial margin, the buyers and sellers of futures contracts also have to pay a daily mark to market margin(MTM margin) to the clearing house through their respective brokers. Individual stocks and stock index derivatives have a maturity date of the last Thursday of the contract month. If the last Thursday happens to be a holiday, the previous day will be the maturity day. Every futures contract represents a specific quantity known as Lot size.

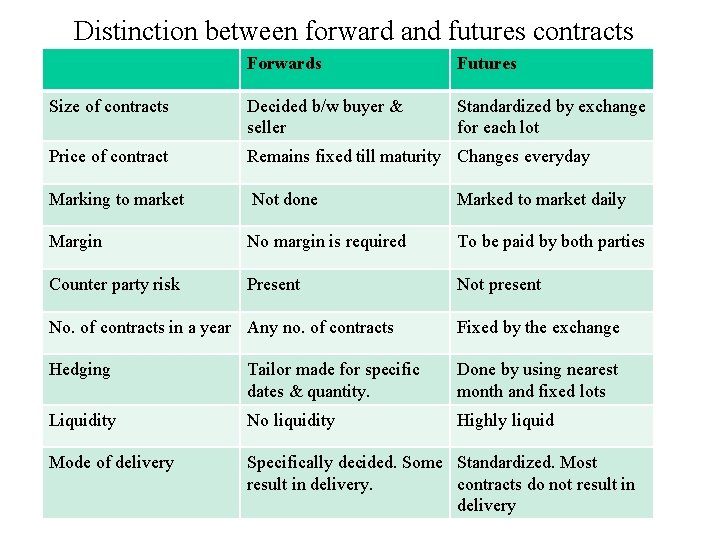

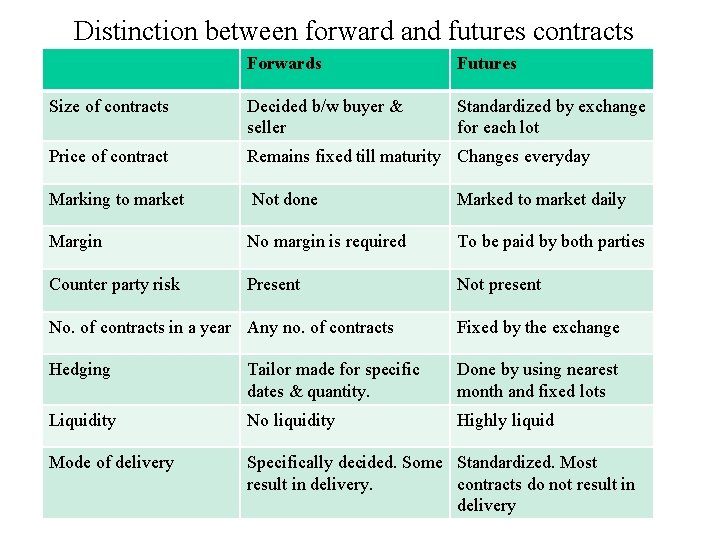

Distinction between forward and futures contracts Forwards Futures Size of contracts Decided b/w buyer & seller Standardized by exchange for each lot Price of contract Remains fixed till maturity Changes everyday Marking to market Not done Marked to market daily Margin No margin is required To be paid by both parties Counter party risk Present Not present No. of contracts in a year Any no. of contracts Fixed by the exchange Hedging Tailor made for specific dates & quantity. Done by using nearest month and fixed lots Liquidity No liquidity Highly liquid Mode of delivery Specifically decided. Some Standardized. Most result in delivery. contracts do not result in delivery

Players/participants in the derivatives market 1) Hedgers are attracted to derivatives market to reduce a risk that they already face. In the commodity market, hedging may be done by a producer or a miller or a stockiest of goods. 2) Speculators have a view on the future price of a commodity, shares, stock index, interest rates or currency. In contrast to hedgers who want to reduce their risk, speculators take a position in the market. Speculators provide hedgers an opportunity to manage their risk by assuming their risk.

Players/participants in the derivatives market 3) Arbitrageur An arbitrageur is risk averse and enters into those contracts where he can earn riskless profits. In imperfect markets, it is possible to make risk less profits by buying at a lower price in one market and selling at a higher price in another market or vice versa. E. g. : Spot price of HDFC Bank is Rs. 1000/- and its 3 -month futures are at Rs. 1040/-. Cost of carry (C) = F – S * 365 * 100 S Days to maturity

Players/participants in the derivatives market Intermediary participants 4) Brokers perform the important function of bringing buyers and sellers together. As a member of a Derivatives exchange, a broker need not be a speculator, arbitrageur or hedger. Membership in the exchange confers on the broker the right to conduct transactions with other members

Players/participants in the derivatives market Institutional framework 5)Exchange An exchange acts a guarantor for the performance of the contract entered by a seller and a buyer, through its member broker. In an online trading system, the exchange provides its members with real time access to information and allows them to execute their orders.

Players/participants in the derivatives market 6) Clearing house The National Securities Clearing Corporation Ltd( NSCCL) is the clearing and settlement agency for all deals executed on NSE’s F&O segment. NSCCL acts as a counter party to all deals on NSE’s F&O segment NSCCL performs clearing, settlement and risk management functions.

Players/participants in the derivatives market 7) Bank for fund management Futures and options contracts are settled daily and this requires transfer of funds from members to clearing house. A bank can make the daily accounting entries in the accounts of the members of the exchange, clearing house and facilitate daily payments. 8) Regulatory framework A regulator creates confidence in the market besides providing a level playing field to all the concerned participants.

Options • Option is one of the variants of derivative contracts • Option contracts give its holder the right, but not the obligation, to buy or sell the specified quantity of the underlying asset for a certain agreed price (exercise/strike price) on or before some specified future date (expiration date). • Call option gives its holder the right to buy. • Put option gives its holder the right to sell.