Introduction to Financial Econometrics Mathematics Statistics and Machine

- Slides: 67

Introduction to Financial Econometrics, Mathematics, Statistics, and Machine Learning* Cheng-Few Lee Distinguished Professor of Finance and Economics, Rutgers University Editor of Review of Quantitative Finance and Accounting and Review of Pacific Basin Financial Market and Policy Email: cflee@business. rutgers. edu *Paper to be presented at Fe. AT 2019 Annual Conference on May 31, 2019 1

Outline n n n Chapter Outline Abstract Introduction Financial Econometrics Financial Statistics Financial Technology and Machine Learning Applications of Financial Econometrics, Mathematics, Statistics, and Machine Learning Overall Discussion Summary & Conclusion Appendix A-Chapter titles of Handbook Appendix B-Chapter titles of Textbook Appendix C-Books written and edited by Cheng 2

Chapter Outline (1) 1. 1 Introduction n 1. 2 Financial Econometrics n 1. 2. 1 Single Equation Regression Methods n 1. 2. 2 Simultaneous Equation Models n 1. 2. 3 Panel Data Analysis n 1. 2. 4 Alternative Methods to Deal with Measurement Error n 1. 2. 5 Time-Series Analysis n 1. 2. 6 Spectral Analysis n 1. 3 Financial Mathematics 3 n

Chapter Outline (2) n n n n n 1. 4. 1 1. 4. 2 1. 4. 3 1. 4. 4 1. 4. 5 1. 5. 1 1. 5. 2 1. 5. 3 Financial Statistics Statistical Distributions Principle Components and Factor Analysis Non-parametric and Semi-parametric Analyses Cluster Analysis Fourier Transformation Method Financial Technology and Machine Learning Classification of Financial Technology Classification of Machine Learning Applications 4

Chapter Outline (3) 1. 5. 4 Other Computer Science Tools Used For Financia Technology n 1. 6 Applications of Financial Econometrics, Mathematics, Statistics, and Machine Learning n 1. 6. 1 Asset Pricing n 1. 6. 2 Corporate Finance n 1. 6. 3 Financial Institution n 1. 6. 4 Investment and Portfolio Management n 1. 6. 5 Option Pricing Model n 1. 6. 6 Futures and Hedging 5 n

Chapter Outline (4) n n n n n 1. 6. 7 1. 6. 8. 1 1. 6. 8. 2 1. 6. 9 1. 7. 1 1. 7. 2 1. 8 Mutual Fund Credit Risk Modeling Traditional Approach Machine Learning Approach Other Applications Overall Discussion of This Handbook Chapter title classification Keyword classification Summary and Concluding Remarks 6

Abstract (1) n The main purpose of this introduction chapter is to give an overview of the following 129 papers, which discuss financial econometrics, mathematics, statistics, and machine learning. There are eight sections in this introductory chapter. Section 1 is the introduction, Section 2 discusses financial econometrics, Section 3 explores financial mathematics, and Section 4 discusses financial statistics. Section 5 of this introduction chapter discusses financial technology and machine learning, Section 6 explores applications of financial econometrics, mathematics, 7

Abstract (2) statistics, and machine learning, and Section 7 gives an overview in terms of chapter and keyword classification of the handbook. Finally, Section 8 is a summary and includes some remarks. 8

1. 1 INTRODUCTION (1) n Financial econometrics, mathematics, statistics, and machine learning have been widely used in empirical research in both finance and accounting. Specifically, econometric methods are important tools for asset pricing, corporate finance, options and futures, and conducting financial accounting research. Econometric methods used in finance and accounting related research include single equation multiple regression, simultaneous regression, panel data analysis, time series analysis, spectral analysis, non-parametric analysis, semiparametric analysis, GMM analysis, and other methods. 9

1. 1 INTRODUCTION (2) n In both theory and methodology, we need to rely upon mathematics, which includes linear algebra, geometry, differential equations, Stochastic differential equation (Ito calculus), optimization, constrained optimization, and others. These forms of mathematics have been used to derive capital market line, security market line (capital asset pricing model), option pricing model, portfolio analysis, and others. 10

1. 1 INTRODUCTION (3) n Statistics distributions, such as normal distribution, stable distribution, and log normal distribution, have been used in research related to portfolio theory and risk management. Binomial distribution, log normal distribution, non-central chi square distribution, Poisson distribution, and others have been used in studies related to option and futures. Moreover, risk management research has used Copula distribution and other distributions. Both finance research and applications need machine learning for empirical 11

1. 1 INTRODUCTION (4) analyses. These technologies include: Excel, Excel VBA, n SAS program, MINITAB, MATLAB, machine learning, and others. It is well known that simulation method is also frequently used in financial empirical studies. This handbook is composed of 130 chapters, which are used to show financial econometrics, mathematics, statistics, and machine learning can be used both theoretically and empirically in finance research. 12

1. 1 INTRODUCTION (5) n n Section 1. 1 introduces the topics to be covered in the handbook. Section 1. 2 discusses financial econometrics. In Section 1. 2 there are six subsections. Each subsection briefly discusses a topic. They are: single equation regression methods, simultaneous equation models, panel data analysis, alternative methods to deal with measurement error, time-series analysis, and spectral analysis. 13

1. 1 INTRODUCTION (6) n n n Section 1. 3, financial mathematics is mentioned. Section 1. 4 and its five subsections discusses financial statistics. The subsections in Section 1. 4 are as follows: statistical distributions, principle components and factor analysis, non-parametric and semi-parametric analyses, cluster analysis, and Fourier transformation method. Section 1. 5 briefly discusses financial technology and machine learning. In this section there are four subsections. The first and second subsection go over the classification of financial technology and machine learning. The third subsection mentions machine 14

1. 1 INTRODUCTION (7) subsection talks about computer science tools used in financial technology. n Section 1. 6 discusses applications of financial econometrics, mathematics, statistics, and machine learning and includes nine subsections. The subsections discuss asset pricing, corporate finance, financial institution, investment and portfolio management, option pricing model, futures and hedging, mutual fund, credit risk modeling in terms of both a traditional approach and a machine learning approach, and other applications. n Section 1. 7 is an overall discussion of the handbook. 15 n Section 1. 8 is a summary and provides some concluding

1. 2 FINANCIAL ECONOMETRICS (1) Ø n n n n 1. 2. 1 SINGLE EQUATION REGRESSION METHODS Heteroskedasticity Specification error Measurement errors and Asset Pricing Tests Skewness and kurtosis effect Nonlinear regression and Box-Cox transformation Structural change Generalize fluctuation Probit and logit regression 16

1. 2 FINANCIAL ECONOMETRICS (2) Ø n n 1. 2. 1 SINGLE EQUATION REGRESSION METHODS Poisson regression Fuzzy regression Path analysis Besides the above-mentioned methodologies, in this handbook we also present other new econometric methodologies such as quantile co-integration (Chapter 92), threshold regression (Chapter 22), Kalman filter (Chapter 53), and filtering methods (Chapter 64). 17

1. 2 FINANCIAL ECONOMETRICS (3) Ø n n n 1. 2. 2 SIMULTANEOUS EQUATION MODELS Two-stage least squares estimation (2 SLS) method Seemly unrelated regression (SUR) method Three-stage least squares estimation (3 SLS) method Disequilibrium estimation method Generalized method of moments 18

1. 2 FINANCIAL ECONOMETRICS (4) Ø n n n 1. 2. 3 PANEL DATA ANALYSIS Fixed effect model Random effect model Clustering effect model 19

1. 2 FINANCIAL ECONOMETRICS (5) Ø n n n 1. 2. 4 ALTERNATIVE METHODS TO DEAL WITH MEASUREMENT ERROR LISREL model Multi-factor and multi-indicator (MIMIC) model Partial least square method Grouping method In addition, there are other errors in variables methods, such as classical method, instrumental variable method, mathematical programming method, maximum likelihood method, GMM method, and Bayesian statistic method. Chen, Lee, and Lee (2015) have discussed above-mentioned methods in detail. 20

1. 2 FINANCIAL ECONOMETRICS (6) Ø n 1. 2. 5 TIME-SERIES ANALYSIS There are various important models in time series analysis, such as autoregressive integrated moving average (ARIMA) model, autoregressive conditional heteroscedasticity (ARCH) model, generalized autoregressive conditional heteroscedasticity (GARCH) model, fractional GARCH, and combined forecasting model. Anderson (1994) and Hamilton (1994) have discussed the issues related to time series analysis. 21

1. 2 FINANCIAL ECONOMETRICS (7) Ø n 1. 2. 5 TIME-SERIES ANALYSIS Myers (1991) discloses ARIMA’s role in time-series analysis: Lien and Shrestha (2007) discuss ARCH and its impact on time-series analysis. Lien (2010) discusses GARCH and its role in time-series analysis. Leon and Vaello-Sebastia (2009) further research into GARCH and its role in time-series in a model called Fractional GARCH. 22

1. 2 FINANCIAL ECONOMETRICS (8) Ø n 1. 2. 5 TIME-SERIES ANALYSIS Granger and Newbold (1973), Granger and Newbold (1974), Granger and Ramanathan (1984) have theoretically developed combined forecasting methods. Lee et al. (1986) have applied combined forecasting methods to forecast market beta and accounting beta. Lee and Cummins (1998) have shown how to use the combined forecasting methods to perform cost of capital estimates. 23

1. 2 FINANCIAL ECONOMETRICS (9) Ø n 1. 2. 6 SPECTRAL ANALYSIS Anderson (1994), Chacko and Viceira (2003), and Heston (1993) have discussed how spectral analysis can be performed. Heston (1993) and Bakshi et al. (1997) have applied spectral analysis in the evaluation of option pricing. 24

1. 3 FINANCIAL MATHEMATICS n n Mathematics used in finance research includes linear algebra, calculus, and Ito calculus. For portfolio analysis we need to use constrained optimization. For CAPM derivation we need to use portfolio optimization chain rule, partial derivative, and some basic geometry. In option pricing model derivation, we need to use Ito calculus as well as related theories and propositions. For example, Black and Scholes (1973), Merton (1973), Hull (2018), Lee et al. (2016), Lee at al. (2013), and others have shown how Ito calculus can be used to derive option pricing model and other research topics. In addition, Lee et al. (2013) have shown how the constrained maximization method and linear algebra method can be used to obtain the optimum portfolio weights. 25

1. 4 FINANCIAL STATISTICS n n n 1. 4. 1 STATISTICAL DISTRIBUTIONS 1. 4. 2 PRINCIPLE COMPONENTS AND FACTOR ANALYSIS 1. 4. 3 NON-PARAMETRIC AND SEMI-PARAMETRIC ANALYSES 1. 4. 4 CLUSTER ANALYSIS 1. 4. 5 FOURIER TRANSFORMATION METHOD 26

1. 5 FINANCIAL TECHNOLOGY AND MACHINE LEARNING n n 1. 5. 1 CLASSIFICATION OF FINANCIAL TECHNOLOGY 1. 5. 2 CLASSIFICATION OF MACHINE LEARNING 1. 5. 3 MACHINE LEARNING APPLICATIONS 1. 5. 4 OTHER COMPUTER SCIENCE TOOLS USED FOR FINANCIAL TECHNOLOGY 27

1. 6 APPLICATIONS OF FINANCIAL ECONOMETRICS, MATHEMATICS, STATISTICS, AND MACHINE LEARNING n n n n 1. 6. 1 ASSET PRICING 1. 6. 2 CORPORATE FINANCE 1. 6. 3 FINANCIAL INSTITUTION 1. 6. 4 INVESTMENT AND PORTFOLIO MANAGEMENT 1. 6. 5 OPTION PRICING MODEL 1. 6. 6 FUTURES AND HEDGING 1. 6. 7 MUTUAL FUND 1. 6. 8 CREDIT RISK MODELING n n 1. 6. 8. 1 Traditional Approach 1. 6. 8. 2 Machine Learning Approach 28

1. 7 OVERALL DISCUSSION OF THIS BOOK n n 1. 7. 1 CHAPTER TITLE CLASSIFICATION 1. 7. 2 KEYWORD CLASSIFICATION 29

1. 8 SUMMARY AND CONCLUDING REMARKS (1) n This chapter has discussed important financial econometrics and statistics which are used in finance and accounting research. We discussed the regression models and topics related to financial econometrics, including single equation regression models, simultaneous equation models, panel data analysis, alternative methods to deal with measurement error, and time-series analysis. We also introduced topics related to financial statistics, including statistical distributions, principle components and factor analysis, non-parametric and semi-parametric analyses, and cluster analysis. 30

1. 8 SUMMARY AND CONCLUDING REMARKS (2) n In addition, financial econometrics, mathematics, and statistics are important tools to conduct research in finance and accounting areas. We briefly introduced applications of econometrics, mathematics, and statistics models in finance and accounting research. Research topics include asset pricing, corporate finance, financial institution, investment and portfolio management, option pricing model, futures and hedging, mutual fund, credit risk modeling, and others. 31

Appendix A. Chapter Title (1) n n n Chapter 1: Introduction Chapter 2: Do Managers Use Earnings Forecasts to Fill a Demand They Perceive From Analysts? Chapter 3: A potential benefit of increasing book–tax conformity: Evidence from the reduction in audit fees Chapter 4 : Gold in Portfolio: A Long-Term or Short-Term Diversifier? Chapter 5: Application of Simultaneous Equation in Finance Research Chapter 6: Forecast Performance of the Taiwan Weighted Stock Index: Update and Expansion 32

Appendix A. Chapter Title (2) n n n Chapter 7: Statistical Distributions and Option Bound Determination Chapter 8: Measuring the Collective Correlation of a Large Number of Stocks Chapter 9: Key Borrowers Detected by the Intensities of Their Interactions Chapter 10: Application of the Multivariate Average F Test to Examine Relative Performance of Asset Pricing Models with Individual Security Returns Chapter 11 : Hedge Ratio and Time Series Analysis 33

Appendix A. Chapter Title (3) n n n Chapter 12: Application of Intertemporal CAPM on International Corporate Finance Chapter 13: What Drives Variation in the International Diversification Benefits? A Cross-Country Analysis Chapter 14 : A Heteroskedastic Black-Litterman Portfolio Optimization Model with Views Derived From a Predictive Regression Chapter 15: Pricing Fair Deposit Insurance: Structural Model Approach Chapter 16: Application of Structural Equation Modeling in Behavioral Finance: A Study on the Disposition Effect 34

Appendix A. Chapter Title (4) n n n Chapter 17: External Financing Needs and Early Adoption of Accounting Standards: Evidence from the Banking Industry Chapter 18: Improving The Stock Market Prediction with Social Media via Broad Learning Chapter 19: Sourcing Alpha in Global Equity Markets: Market Factor Decomposition and Market Characteristics Chapter 20: Support Vector Machines Based Methodology for Credit Risk Analysis Chapter 21: Data Mining Applications in Accounting and Finance Context 35

Appendix A. Chapter Title (5) n n n Chapter 22 : Tradeoff Between Reputation Concerns and Economic Dependence for Auditors—Threshold Regression Approach Chapter 23: ASEAN Economic Community: Analysis Based on Fractional Integration and Cointegration Chapter 24: Alternative Methods for Determining Option Bounds: A Review and Comparison Chapter 25: Financial Reforms and the Differential Impact of Foreign versus Domestic Banking Relationships on Firm Value Chapter 26: Time-Series Analysis: Components, Models, 36

Appendix A. Chapter Title (6) n n n Chapter 27: Itô’s Calculus and the Derivation of the Black. Scholes Option-Pricing Model Chapter 28: Durbin-Wu-Hausman Specification Tests Chapter 29 : Jump Spillover and Risk Effects on Excess Returns in the United States During The Great Depression Chapter 30: Earnings Forecasts and Revisions, Price Momentum, and Fundamental Data: Further Explorations of Financial Anomalies Chapter 31: Ranking Analysts by Network Structural Hole Chapter 32: The Association Between Book-Tax Differences and CEO Compensation 37

Appendix A. Chapter Title (7) n n n Chapter 33: Stochastic Volatility Models: Faking a Smile Chapter 34: Entropic Two-Asset Option Chapter 35: The Joint Determinants of Capital Structure and Stock Rate of Return: A LISREL Model Approach Chapter 36: Time-Frequency Wavelet Analysis of Stock. Market C 0 -Movement Between and Within Geographic Trading Blocs CHAPTER 37: Alternative Methods to Deal with Measurement Error Chapter 38: Simultaneously Capturing Multiple Dependence Features in Bank Risk Integration: A Mixture 38

Appendix A. Chapter Title (8) n n n Chapter 39: GPU Acceleration for Computational Finance Chapter 40: Does VIX Truly Measure Return Volatility? Chapter 41: An ODE approach for the expected discounted penalty at ruin in a jump-diffusion model Chapter 42: How Does Investor Sentiment Affect Implied Risk-Neutral Distributions of Call and Put Options? Chapter 43: Intelligent Portfolio Theory and Strength Investing in the Confluence of Business & Market Cycles and Sector & Location Rotations Chapter 44: Evolution Strategy Based Adaptive Lq Penalty Support Vector Machines with Gauss Kernel for Credit Risk 39

Appendix A. Chapter Title (9) n n n Chapter 45: Product Market Competition And CEO Pay Benchmarking Chapter 46: Cash Conversion Systems in Corporate Subsidiaries Chapter 47: Is the Market Portfolio Mean-Variance Efficient? Chapter 48: Consumption-Based Asset Pricing with Prospect Theory and Habit Formation Chapter 49: An Integrated Model for the Cost-Minimizing Funding of Corporate Activities over Time 40

Appendix A. Chapter Title (10) n n Chapter 50: Empirical Studies of Structural Credit Risk Models and the Application in Default Prediction: Review and New Evidence Chapter 51: Empirical Performance of the Constant Elasticity Variance Option Pricing Model Chapter 52: The Jump Behavior of a Foreign Exchange Market: Analysis of the Thai Baht Chapter 53: The Revision of Systematic Risk on Earnings Announcement in the Presence of Conditional Heteroscedasticity 41

Appendix A. Chapter Title (11) n n n Chapter 54: Applications of Fuzzy Set to International Transfer Pricing and Other Business Decisions Chapter 55: A Time-Series Bootstrapping Simulation Method to Distinguish Sell-Side Analysts’ Skill From Luck Chapter 56: Acceptance of New Technologies by Employees in Financial Industry Chapter 57: Alternative Method for Determining Industrial Bond Ratings: Theory and Empirical Evidence Chapter 58: An Empirical Investigation of The Long Memory Effect on the Relation of Downside Risk and Stock Returns 42

Appendix A. Chapter Title (12) n n n Chapter 59: Analysis of Sequential Conversions of Convertible Bonds: A Recurrent Survival Approach Chapter 60: Determinants of Euro-Area Bank CDS Spreads Chapter 61: Dynamic Term Structure Models Using Principal Components Analysis Near the Zero Lower Bound Chapter 62: Effects of Measurement Errors on Systematic Risk and Performance Measure of a Portfolio Chapter 63: Forecasting Net Charge-Off Rates Of Banks: A PLS Approach Chapter 64: Application of Filtering Methods in Asset Pricing 43

Appendix A. Chapter Title (13) n n Chapter 65: Sampling Distribution of the Relative Risk Aversion Estimator: Theory and Applications Chapter 66: Social Media, Bank Relationships and Firm Value Chapter 67: Splines, Heat, and IPOs: Advances in the Measurement of Aggregate IPO Issuance and Performance Chapter 68: The Effects of the Sample Size, the Investment Horizon and Market Conditions on the Validity of Composite Performance Measures: A Generalization 44

Appendix A. Chapter Title (14) n n n Chapter 69: The Sampling Relationship Between Sharpe’s Performance Measure and its Risk Proxy: Sample Size, Investment Horizon and Market Conditions Chapter 70: VG NGARCH versus GARJI Model for Asset Price Dynamics Chapter 71: Why do Smartphones and Tablets Users Adopt Mobile Banking Chapter 72: Non-Parametric Inference on Risk Measures for Integrated Returns Chapter 73: Copulas and Tail Dependence in Finance Chapter 74: Some Improved Estimators of Maximum 45

Appendix A. Chapter Title (15) n n n Chapter 75: Errors-in-Variables and Reverse Regression Chapter 76: The role of financial advisors in M&As: Do domestic and foreign advisors differ? Chapter 77: Discriminant Analysis, Factor Analysis, and Principal Component Analysis: Theory, Method, and Applications Chapter 78: Credit Analysis, Bond Rating Forecasting, And Default Probability Estimation Chapter 79: Market Model, CAPM, and Beta Forecasting Chapter 80: Utility Theory, Capital Asset Allocation, and Markowitz Portfolio-Selection Model 46

Appendix A. Chapter Title (16) n n n Chapter 81: Single-Index Model, Multiple-Index Model, and Portfolio Selection Chapter 82: Sharpe Performance Measure and Treynor Performance Measure Approach to Portfolio Analysis Chapter 83: Options and Option Strategies: Theory and Empirical Results Chapter 84: Decision Tree and Microsoft Excel Approach for Option Pricing Model Chapter 85: Statistical Distributions, European Option, American Option, and Option Bounds 47

Appendix A. Chapter Title (17) n n n Chapter 86: A Comparative Static Analysis Approach to Derive Greek Letters: Theory and Applications Chapter 87: Fundamental Analysis, Technical Analysis, and Mutual Fund Performance Chapter 88: Bond Portfolio Management, Swap Strategy, Duration, and Convexity Chapter 89: Synthetic Options, Portfolio Insurance, and Contingent Immunization Chapter 90: Alternative Security Valuation Model: Theory and Empirical Results 48

Appendix A. Chapter Title (18) n n n Chapter 91: Opacity, Stale Pricing, Extreme Bounds Analysis, and Hedge Fund Performance: Making Sense of Reported Hedge Fund Returns Chapter 92: Does Quantile Co-integrated Relationships Exist Between Spot and Futures Gold Prices? Chapter 93: Bayesian Portfolio Mean-Variance Efficiency Test with Sharpe Ratio’s Sampling Error Chapter 94: Does Revenue Momentum Drive or Ride Earnings or Price Momentum? Chapter 95: Technical, Fundamental, and Combined Information for Separating Winners from Losers 49

Appendix A. Chapter Title (19) n n n Chapter 96: Optimal Payout Ratio under Uncertainty and the Flexibility Hypothesis: Theory and Empirical Evidence Chapter 97: Sustainable Growth Rate, Optimal Growth Rate, and Optimal Payout Ratio: A Joint Optimization Approach Chapter 98: Cross-sectionally Correlated Measurement Errors in Two-Pass Regression Tests of Asset-Pricing Models Chapter 99: Asset Pricing with Disequilibrium Price Adjustment: Theory and Empirical Evidence Chapter 100: A Dynamic CAPM with Supply Effect: Theory 50

Appendix A. Chapter Title (20) n n Chapter 101: Estimation Procedures of Using Five Alternative Machine Learning Methods for Predicting Credit Card Default Chapter 102: Alternative Methods to Derive Option Pricing Models: Review and Comparison Chapter 103: Option Price and Stock Market Momentum in China Chapter 104: Advancement of Optimal Portfolios with Short-sales and Transaction Costs: Modeling and Effectiveness 51

Appendix A. Chapter Title (21) n n n Chapter 105: The Path Leading Up to the New IFRS 16 Leasing Standard: How was the Restructuring of Lease Accounting Received by Different Advocacy Groups? Chapter 106: Implied Variance Estimates For Black. Scholes And CEV OPM: Review And Comparison Chapter 107: Crisis Impact on Stock Market Predictability Chapter 108: How Many Good and Bad Funds are There, Really? Chapter 109: Constant Elasticity of Variance Option Pricing Model: Integration and Detailed Derivation 52

Appendix A. Chapter Title (22) n n n Chapter 110: An Integral-Equation Approach for Defaultable Bond Prices with Application to Credit Spreads Chapter 111: Sample Selection Issues and Applications Chapter 112: Time Series and Neural Network Forecasts of Daily Stock Prices Chapter 113: Covariance Regression Model for Nonnormal Data Chapter 114: Impacts of Time Aggregation on Beta Value and R Squared Estimations Under Additive and Multiplicative Assumptions: Theoretical Results and Empirical Evidence 53

Appendix A. Chapter Title (23) n n n Chapter 115: Large-Sample Theory Chapter 116: Impacts of Measurement Errors on Simultaneous Equation Estimation of Dividend and Investment Decisions Chapter 117: Big Data and Artificial Intelligence in the Banking Industry Chapter 118: A Re-examination of Global Financial Integration: A Non-Parametric Approach Chapter 119: ALAN - Algorithmic Analyst: An application for Artificial Intelligence Content as a Service 54

Appendix A. Chapter Title (24) n n n Chapter 120: Survival Analysis: Theory and Applications in Finance Chapter 121: Pricing Liquidity in the Stock Market Chapter 122: The Evolution of Capital Asset Pricing Models: Update and Extension Chapter 123: The Multivariate GARCH Model and Its Application to East Asian Financial Market Integration Chapter 124: Review of Difference-in-Difference Analyses in Social Sciences: Application in Policy Test Research Chapter 125: Using Smooth Transition Regressions to Model Risk Regimes 55

Appendix A. Chapter Title (25) n n n Chapter 126: Application of Discriminant Analysis, Factor Analysis, Logistic Regression, and KMV-Merton Model in Credit Risk Analysis Chapter 127: Predicting Credit Card Delinquencies: An Application of Deep Neural Networks Chapter 128: Estimating the Tax-Timing Option Value of Corporate Bonds Chapter 129: DCC-GARCH Model For Market and Firm. Level Dynamic Correlation in S&P 500 Chapter 130: Using Path Analysis to Integrate Accounting and Non-Financial Information: The Case for Revenue 56

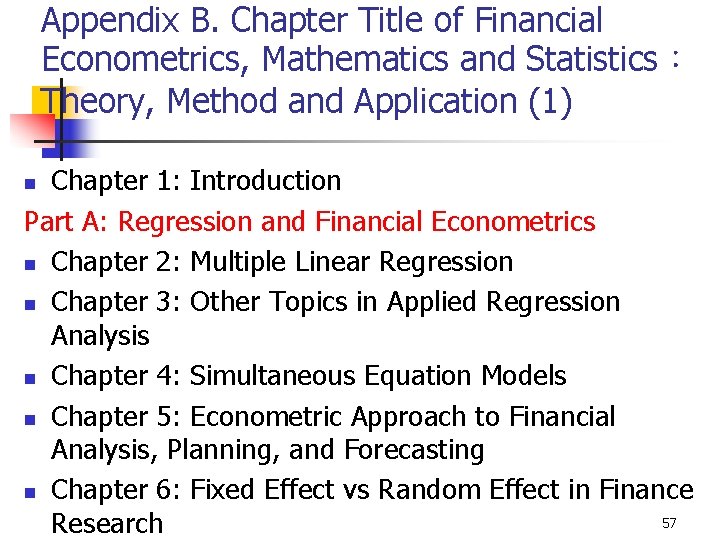

Appendix B. Chapter Title of Financial Econometrics, Mathematics and Statistics: Theory, Method and Application (1) Chapter 1: Introduction Part A: Regression and Financial Econometrics n Chapter 2: Multiple Linear Regression n Chapter 3: Other Topics in Applied Regression Analysis n Chapter 4: Simultaneous Equation Models n Chapter 5: Econometric Approach to Financial Analysis, Planning, and Forecasting n Chapter 6: Fixed Effect vs Random Effect in Finance 57 Research n

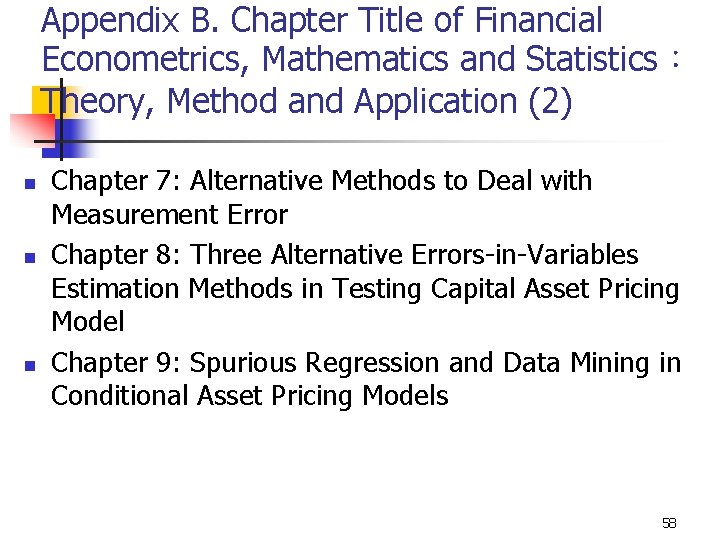

Appendix B. Chapter Title of Financial Econometrics, Mathematics and Statistics: Theory, Method and Application (2) n n n Chapter 7: Alternative Methods to Deal with Measurement Error Chapter 8: Three Alternative Errors-in-Variables Estimation Methods in Testing Capital Asset Pricing Model Chapter 9: Spurious Regression and Data Mining in Conditional Asset Pricing Models 58

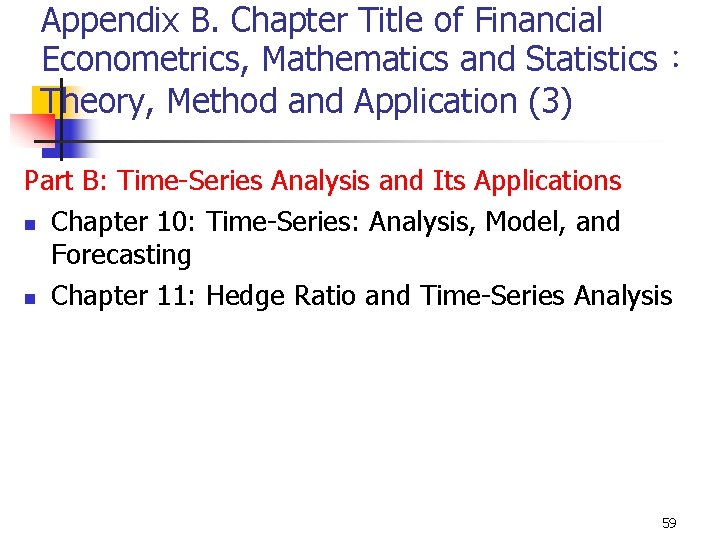

Appendix B. Chapter Title of Financial Econometrics, Mathematics and Statistics: Theory, Method and Application (3) Part B: Time-Series Analysis and Its Applications n Chapter 10: Time-Series: Analysis, Model, and Forecasting n Chapter 11: Hedge Ratio and Time-Series Analysis 59

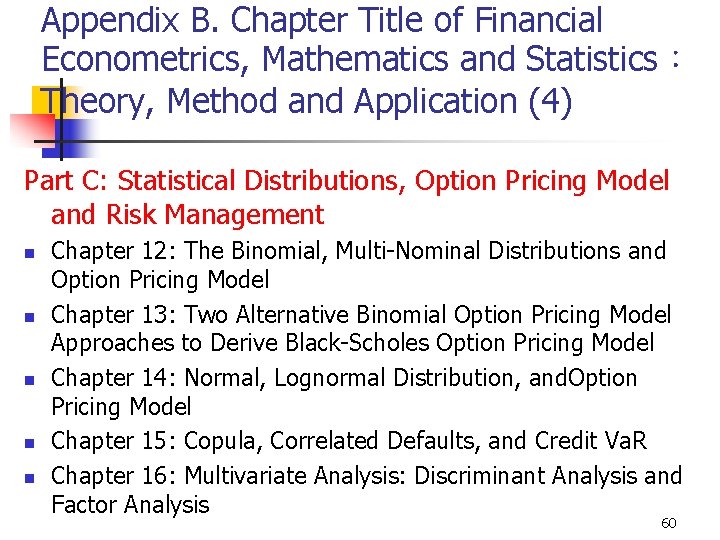

Appendix B. Chapter Title of Financial Econometrics, Mathematics and Statistics: Theory, Method and Application (4) Part C: Statistical Distributions, Option Pricing Model and Risk Management n n n Chapter 12: The Binomial, Multi-Nominal Distributions and Option Pricing Model Chapter 13: Two Alternative Binomial Option Pricing Model Approaches to Derive Black-Scholes Option Pricing Model Chapter 14: Normal, Lognormal Distribution, and. Option Pricing Model Chapter 15: Copula, Correlated Defaults, and Credit Va. R Chapter 16: Multivariate Analysis: Discriminant Analysis and Factor Analysis 60

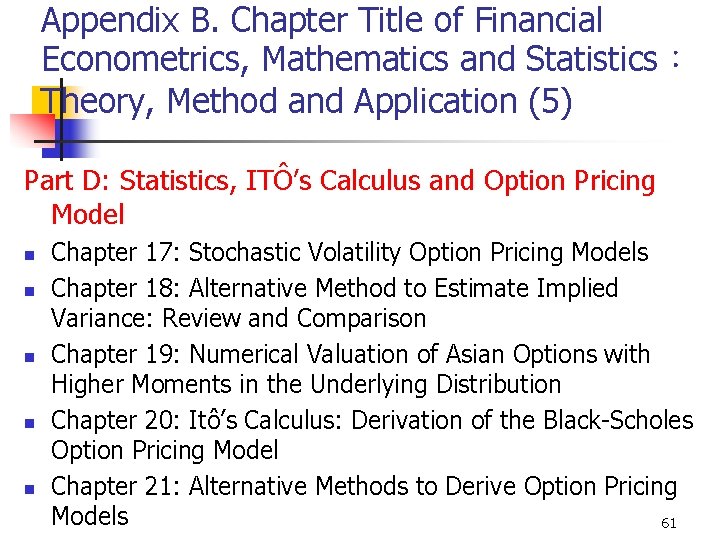

Appendix B. Chapter Title of Financial Econometrics, Mathematics and Statistics: Theory, Method and Application (5) Part D: Statistics, ITÔ’s Calculus and Option Pricing Model n n n Chapter 17: Stochastic Volatility Option Pricing Models Chapter 18: Alternative Method to Estimate Implied Variance: Review and Comparison Chapter 19: Numerical Valuation of Asian Options with Higher Moments in the Underlying Distribution Chapter 20: Itô’s Calculus: Derivation of the Black-Scholes Option Pricing Model Chapter 21: Alternative Methods to Derive Option Pricing Models 61

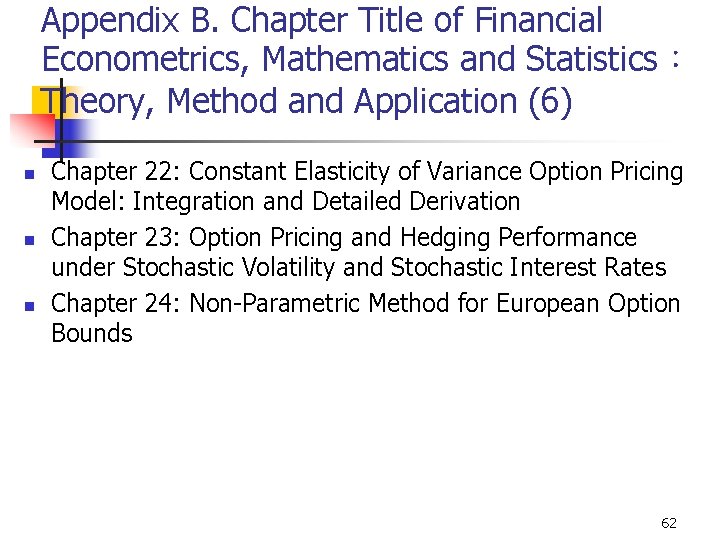

Appendix B. Chapter Title of Financial Econometrics, Mathematics and Statistics: Theory, Method and Application (6) n n n Chapter 22: Constant Elasticity of Variance Option Pricing Model: Integration and Detailed Derivation Chapter 23: Option Pricing and Hedging Performance under Stochastic Volatility and Stochastic Interest Rates Chapter 24: Non-Parametric Method for European Option Bounds 62

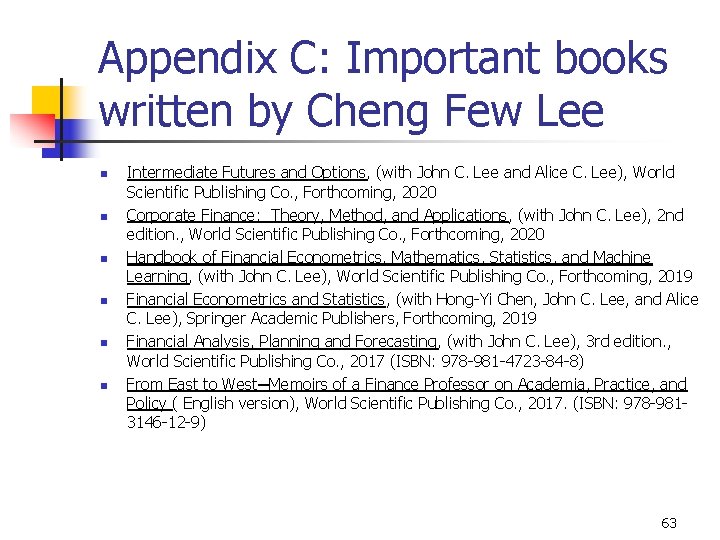

Appendix C: Important books written by Cheng Few Lee n n n Intermediate Futures and Options, (with John C. Lee and Alice C. Lee), World Scientific Publishing Co. , Forthcoming, 2020 Corporate Finance: Theory, Method, and Applications, (with John C. Lee), 2 nd edition. , World Scientific Publishing Co. , Forthcoming, 2020 Handbook of Financial Econometrics, Mathematics, Statistics, and Machine Learning, (with John C. Lee), World Scientific Publishing Co. , Forthcoming, 2019 Financial Econometrics and Statistics, (with Hong-Yi Chen, John C. Lee, and Alice C. Lee), Springer Academic Publishers, Forthcoming, 2019 Financial Analysis, Planning and Forecasting, (with John C. Lee), 3 rd edition. , World Scientific Publishing Co. , 2017 (ISBN: 978 -981 -4723 -84 -8) From East to West─Memoirs of a Finance Professor on Academia, Practice, and Policy ( English version), World Scientific Publishing Co. , 2017. (ISBN: 978 -9813146 -12 -9) 63

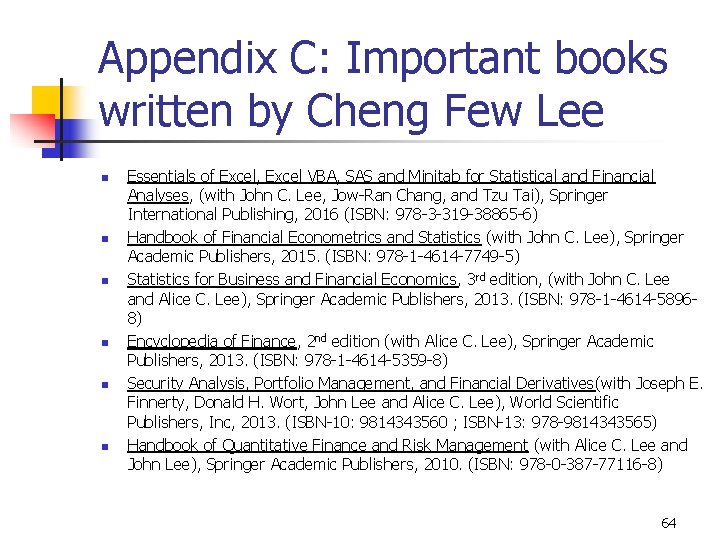

Appendix C: Important books written by Cheng Few Lee n n n Essentials of Excel, Excel VBA, SAS and Minitab for Statistical and Financial Analyses, (with John C. Lee, Jow-Ran Chang, and Tzu Tai), Springer International Publishing, 2016 (ISBN: 978 -3 -319 -38865 -6) Handbook of Financial Econometrics and Statistics (with John C. Lee), Springer Academic Publishers, 2015. (ISBN: 978 -1 -4614 -7749 -5) Statistics for Business and Financial Economics, 3 rd edition, (with John C. Lee and Alice C. Lee), Springer Academic Publishers, 2013. (ISBN: 978 -1 -4614 -58968) Encyclopedia of Finance, 2 nd edition (with Alice C. Lee), Springer Academic Publishers, 2013. (ISBN: 978 -1 -4614 -5359 -8) Security Analysis, Portfolio Management, and Financial Derivatives(with Joseph E. Finnerty, Donald H. Wort, John Lee and Alice C. Lee), World Scientific Publishers, Inc, 2013. (ISBN-10: 9814343560 ; ISBN-13: 978 -9814343565) Handbook of Quantitative Finance and Risk Management (with Alice C. Lee and John Lee), Springer Academic Publishers, 2010. (ISBN: 978 -0 -387 -77116 -8) 64

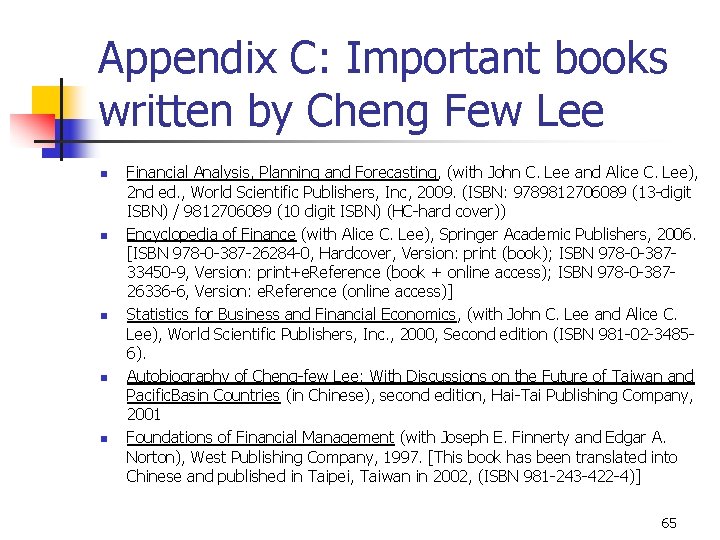

Appendix C: Important books written by Cheng Few Lee n n n Financial Analysis, Planning and Forecasting, (with John C. Lee and Alice C. Lee), 2 nd ed. , World Scientific Publishers, Inc, 2009. (ISBN: 9789812706089 (13 -digit ISBN) / 9812706089 (10 digit ISBN) (HC-hard cover)) Encyclopedia of Finance (with Alice C. Lee), Springer Academic Publishers, 2006. [ISBN 978 -0 -387 -26284 -0, Hardcover, Version: print (book); ISBN 978 -0 -38733450 -9, Version: print+e. Reference (book + online access); ISBN 978 -0 -38726336 -6, Version: e. Reference (online access)] Statistics for Business and Financial Economics, (with John C. Lee and Alice C. Lee), World Scientific Publishers, Inc. , 2000, Second edition (ISBN 981 -02 -34856). Autobiography of Cheng-few Lee: With Discussions on the Future of Taiwan and Pacific. Basin Countries (in Chinese), second edition, Hai-Tai Publishing Company, 2001 Foundations of Financial Management (with Joseph E. Finnerty and Edgar A. Norton), West Publishing Company, 1997. [This book has been translated into Chinese and published in Taipei, Taiwan in 2002, (ISBN 981 -243 -422 -4)] 65

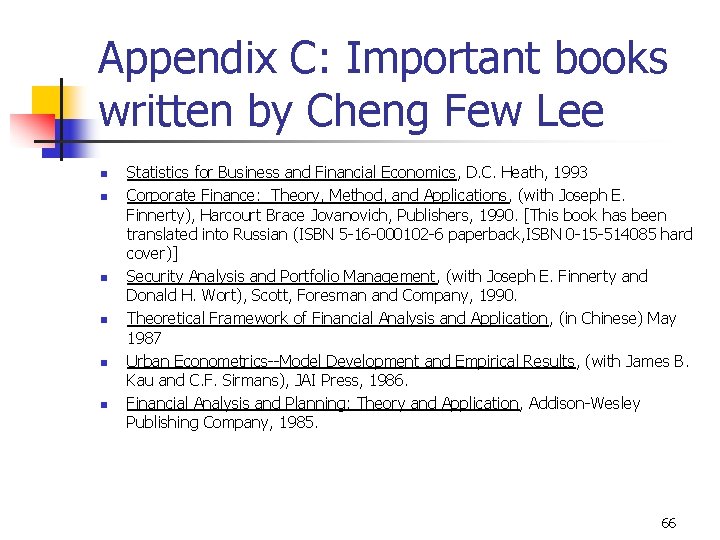

Appendix C: Important books written by Cheng Few Lee n n n Statistics for Business and Financial Economics, D. C. Heath, 1993 Corporate Finance: Theory, Method, and Applications, (with Joseph E. Finnerty), Harcourt Brace Jovanovich, Publishers, 1990. [This book has been translated into Russian (ISBN 5 -16 -000102 -6 paperback, ISBN 0 -15 -514085 hard cover)] Security Analysis and Portfolio Management, (with Joseph E. Finnerty and Donald H. Wort), Scott, Foresman and Company, 1990. Theoretical Framework of Financial Analysis and Application, (in Chinese) May 1987 Urban Econometrics--Model Development and Empirical Results, (with James B. Kau and C. F. Sirmans), JAI Press, 1986. Financial Analysis and Planning: Theory and Application, Addison-Wesley Publishing Company, 1985. 66

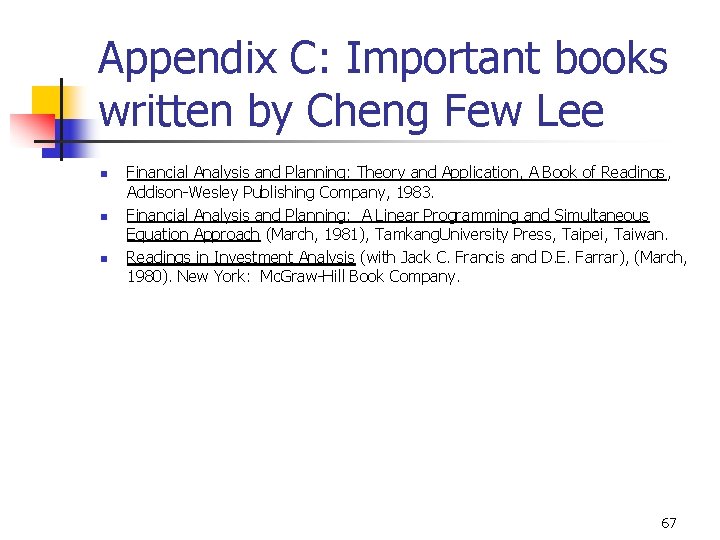

Appendix C: Important books written by Cheng Few Lee n n n Financial Analysis and Planning: Theory and Application, A Book of Readings, Addison-Wesley Publishing Company, 1983. Financial Analysis and Planning: A Linear Programming and Simultaneous Equation Approach (March, 1981), Tamkang. University Press, Taipei, Taiwan. Readings in Investment Analysis (with Jack C. Francis and D. E. Farrar), (March, 1980). New York: Mc. Graw-Hill Book Company. 67