Introduction to Corporate Risk Management Risk Management WHAT

- Slides: 30

Introduction to Corporate Risk Management

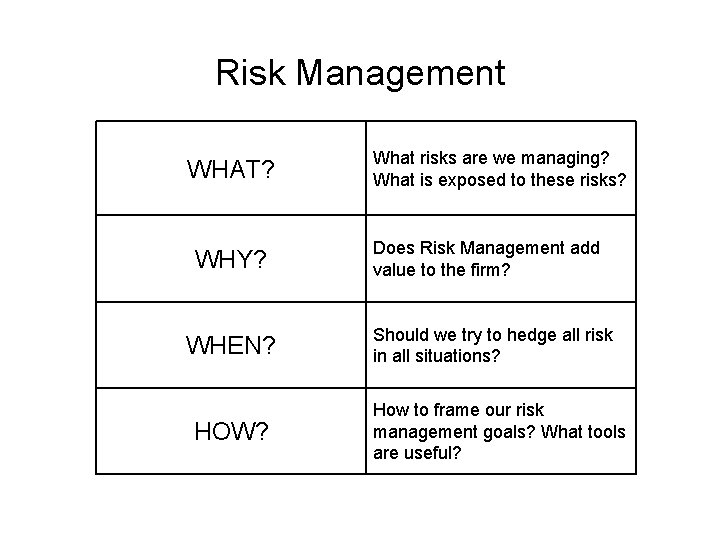

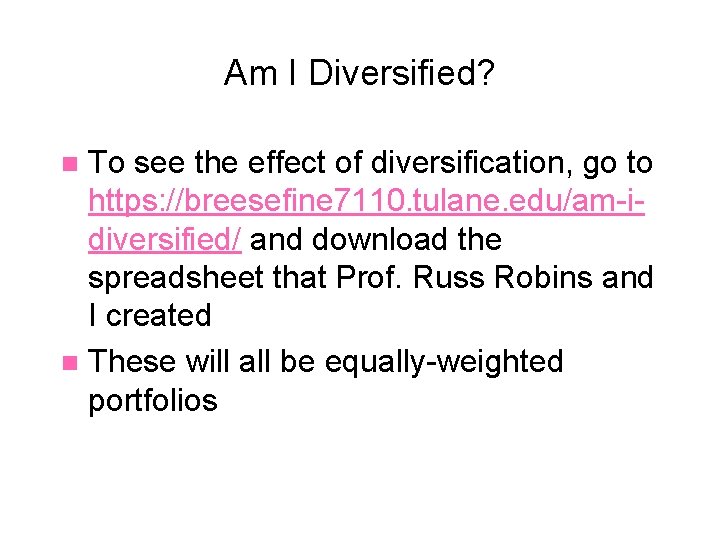

Risk Management WHAT? WHY? WHEN? HOW? What risks are we managing? What is exposed to these risks? Does Risk Management add value to the firm? Should we try to hedge all risk in all situations? How to frame our risk management goals? What tools are useful?

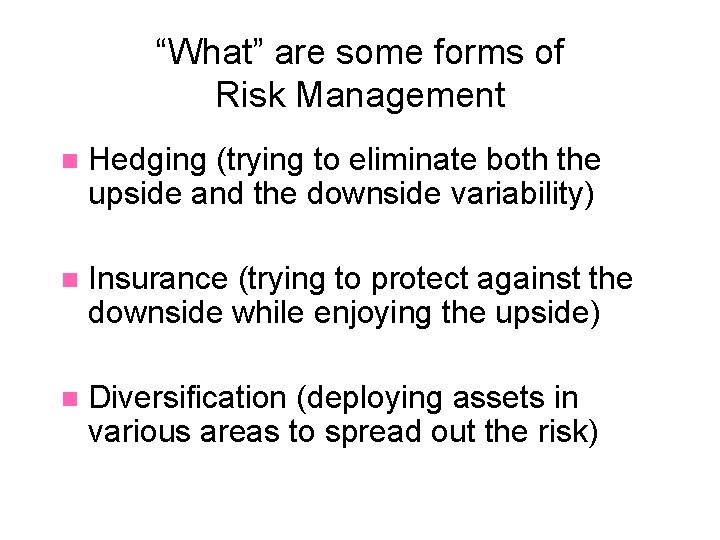

“What” are some forms of Risk Management n Hedging (trying to eliminate both the upside and the downside variability) n Insurance (trying to protect against the downside while enjoying the upside) n Diversification (deploying assets in various areas to spread out the risk)

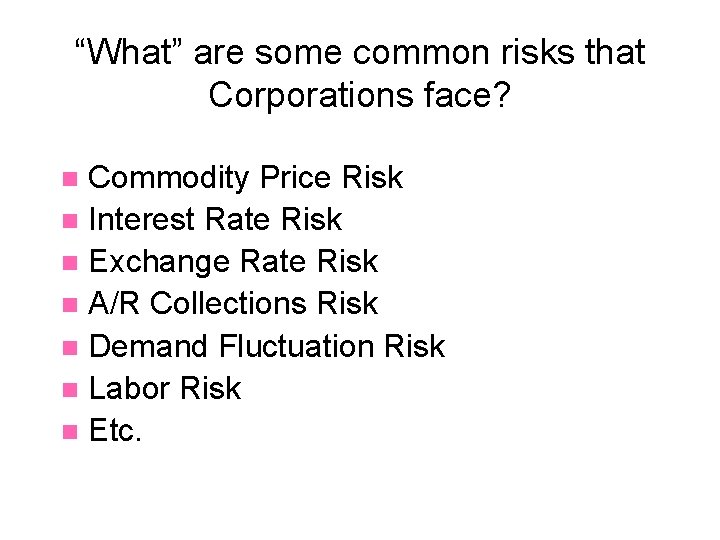

“What” are some common risks that Corporations face? Commodity Price Risk n Interest Rate Risk n Exchange Rate Risk n A/R Collections Risk n Demand Fluctuation Risk n Labor Risk n Etc. n

“What” can Corporate Risk Management protect? Earnings n Return on Equity Price n Portfolio of Assets held n Cash Flows are perhaps most important n

“Why” use Risk Management ? n Does it add Value? n Think back to Miller and Modigliani (they would argue that it doesn’t) n But in a non-perfect world, others say that it does add value! (But it can also reduce value if not used properly)

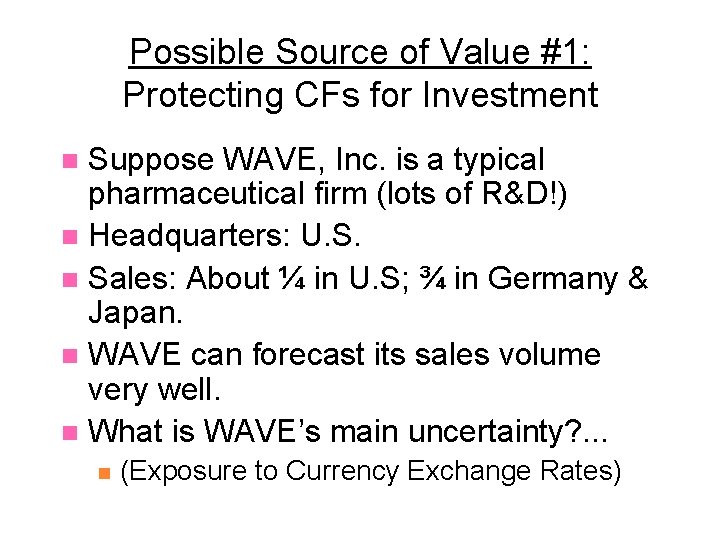

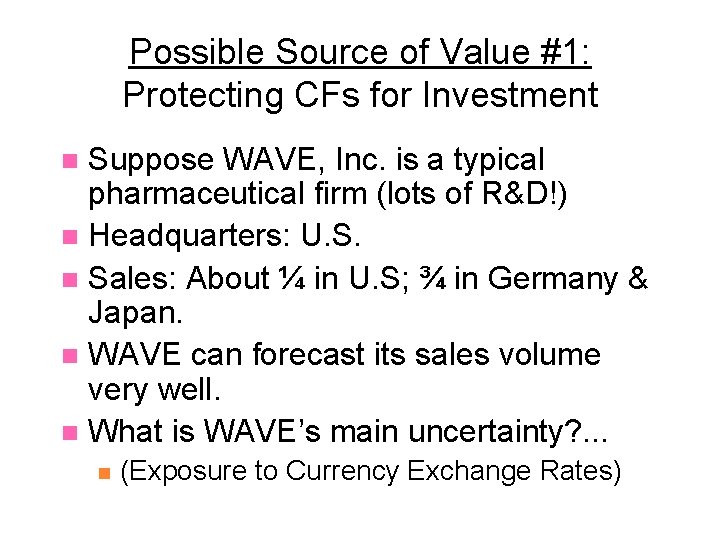

Possible Source of Value #1: Protecting CFs for Investment Suppose WAVE, Inc. is a typical pharmaceutical firm (lots of R&D!) n Headquarters: U. S. n Sales: About ¼ in U. S; ¾ in Germany & Japan. n WAVE can forecast its sales volume very well. n What is WAVE’s main uncertainty? . . . n n (Exposure to Currency Exchange Rates)

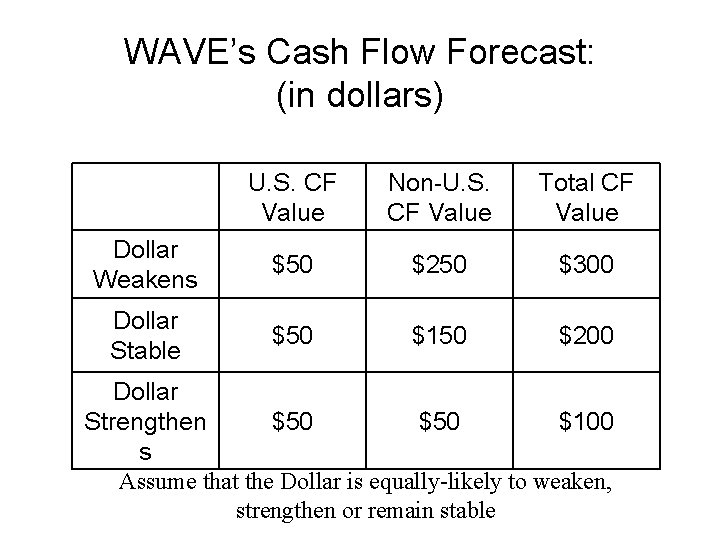

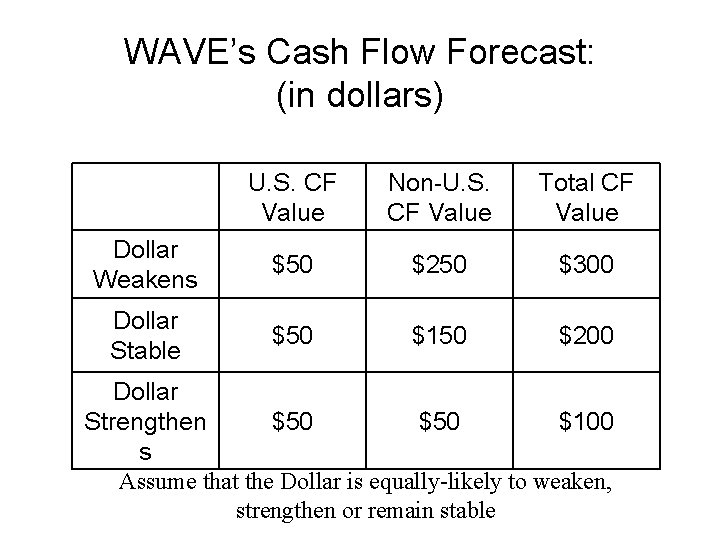

WAVE’s Cash Flow Forecast: (in dollars) U. S. CF Value Non-U. S. CF Value Total CF Value Dollar Weakens $50 $250 $300 Dollar Stable $50 $150 $200 Dollar Strengthen $50 $100 s Assume that the Dollar is equally-likely to weaken, strengthen or remain stable

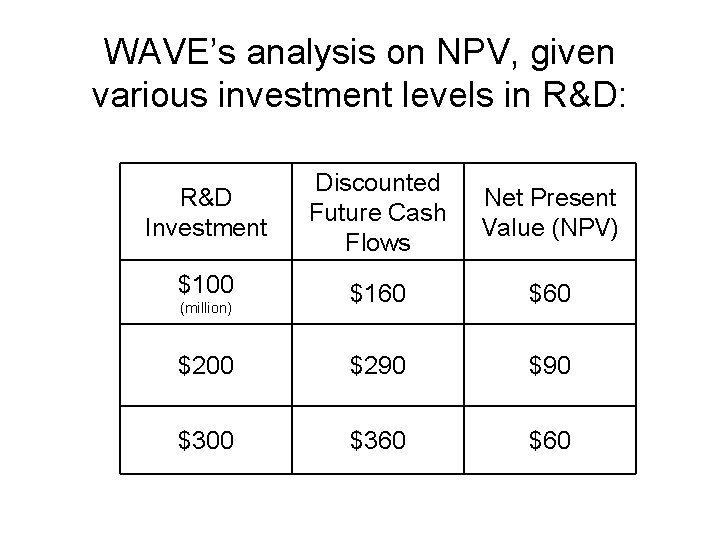

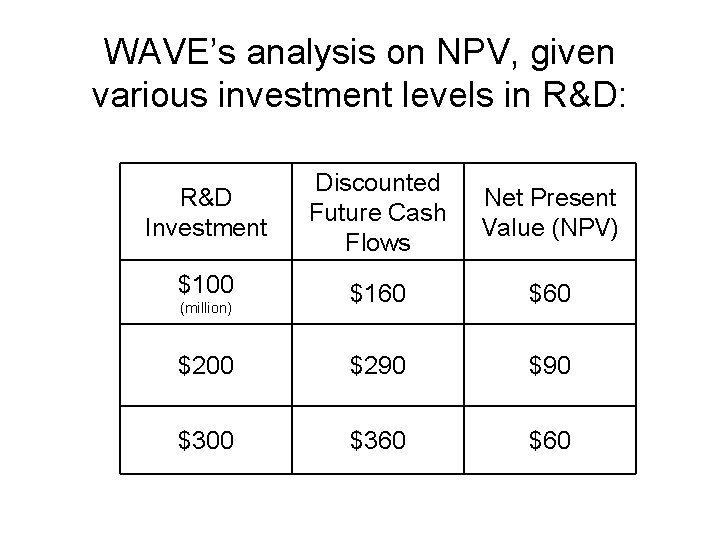

WAVE’s analysis on NPV, given various investment levels in R&D: R&D Investment Discounted Future Cash Flows Net Present Value (NPV) $100 $160 $200 $290 $300 $360 $60 (million)

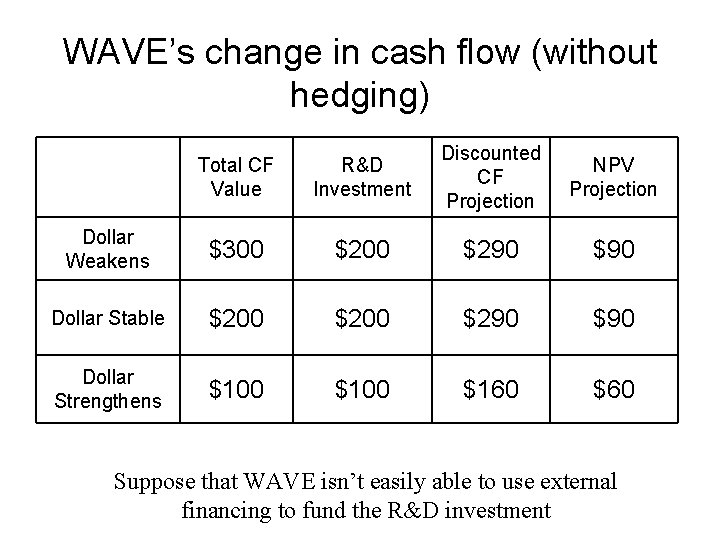

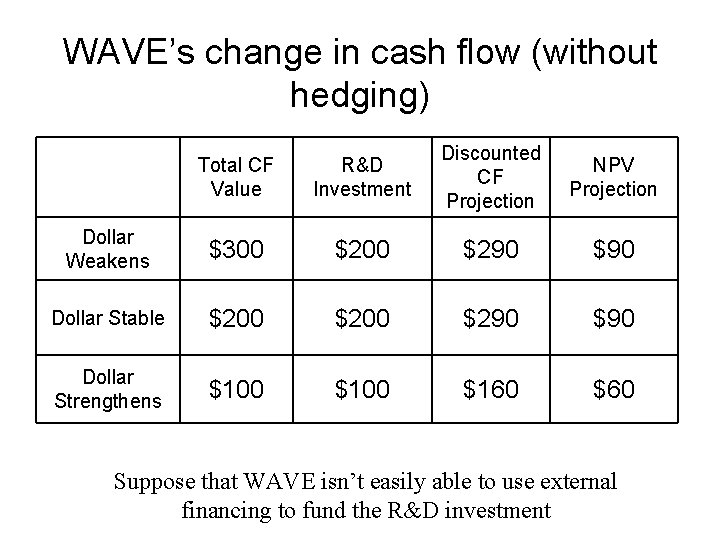

WAVE’s change in cash flow (without hedging) Total CF Value R&D Investment Discounted CF Projection NPV Projection Dollar Weakens $300 $290 $90 Dollar Stable $200 $290 $90 Dollar Strengthens $100 $160 $60 Suppose that WAVE isn’t easily able to use external financing to fund the R&D investment

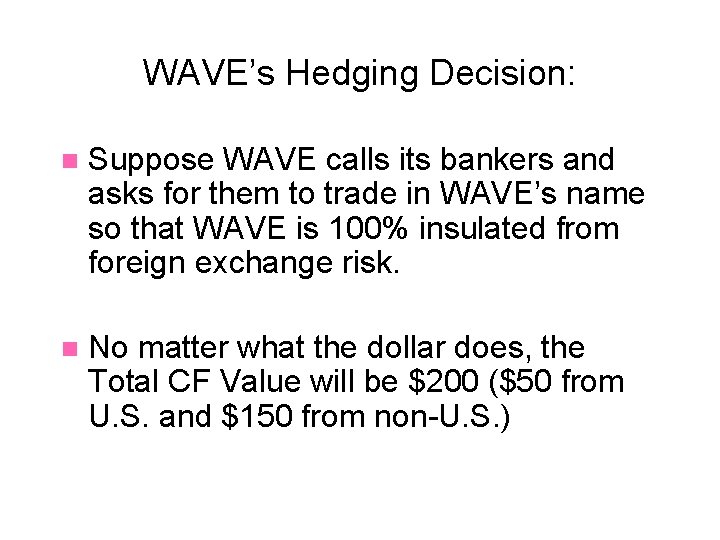

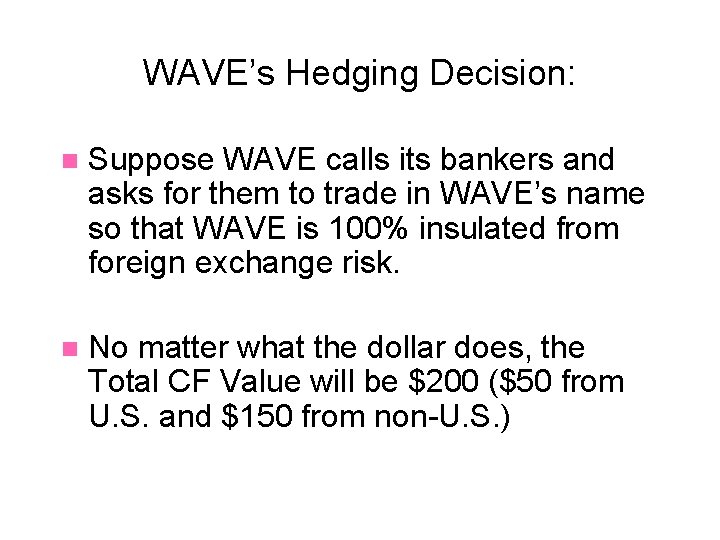

WAVE’s Hedging Decision: n Suppose WAVE calls its bankers and asks for them to trade in WAVE’s name so that WAVE is 100% insulated from foreign exchange risk. n No matter what the dollar does, the Total CF Value will be $200 ($50 from U. S. and $150 from non-U. S. )

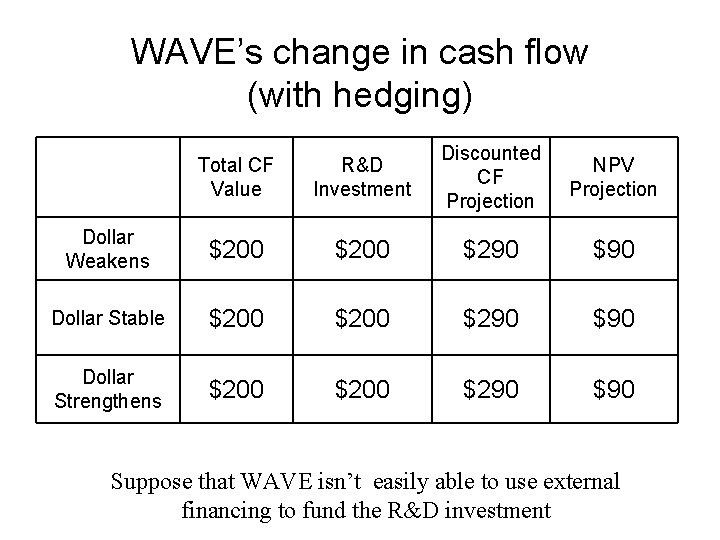

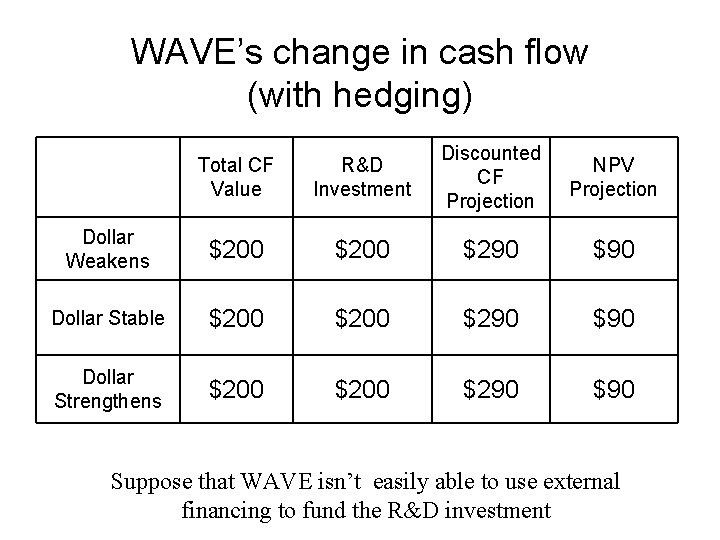

WAVE’s change in cash flow (with hedging) Total CF Value R&D Investment Discounted CF Projection NPV Projection Dollar Weakens $200 $290 $90 Dollar Stable $200 $290 $90 Dollar Strengthens $200 $290 $90 Suppose that WAVE isn’t easily able to use external financing to fund the R&D investment

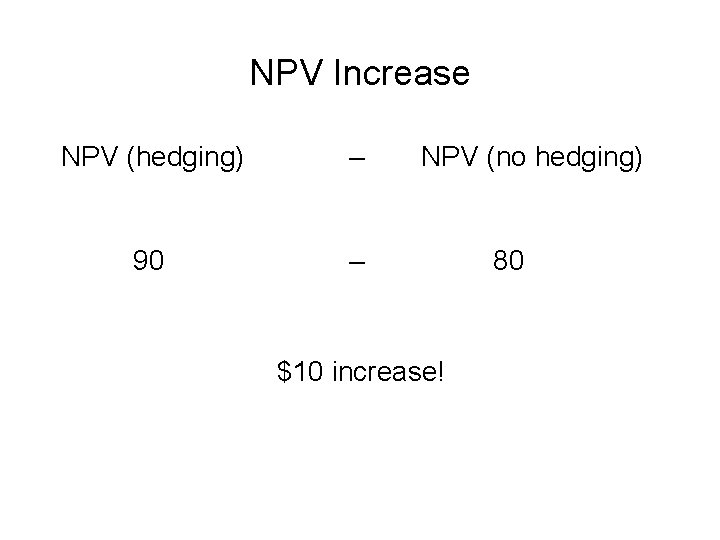

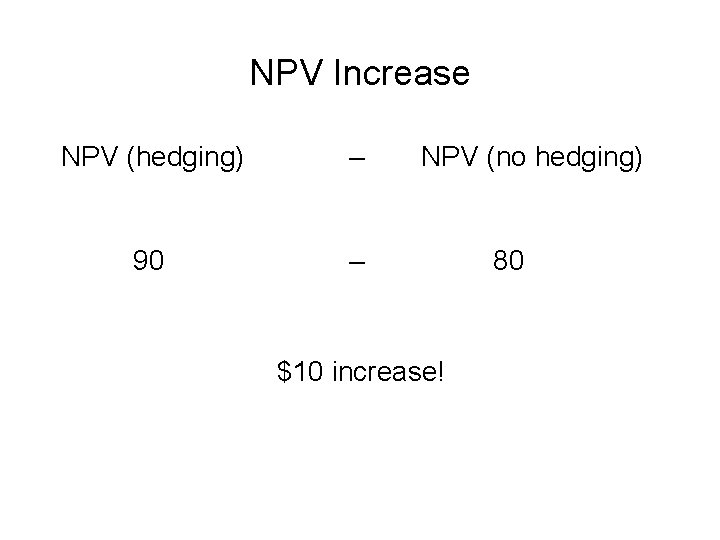

NPV Increase NPV (hedging) – 90 – NPV (no hedging) $10 increase! 80

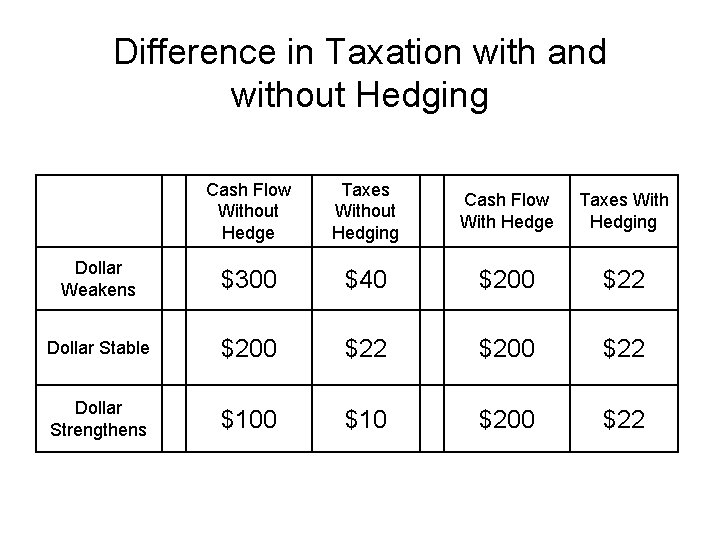

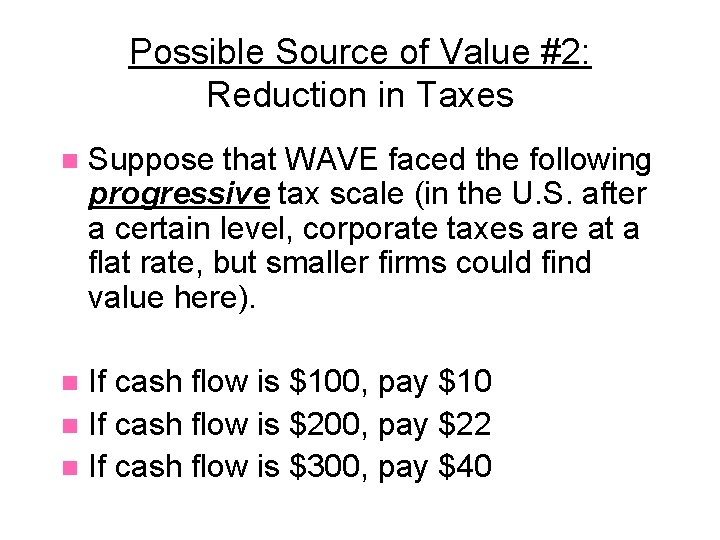

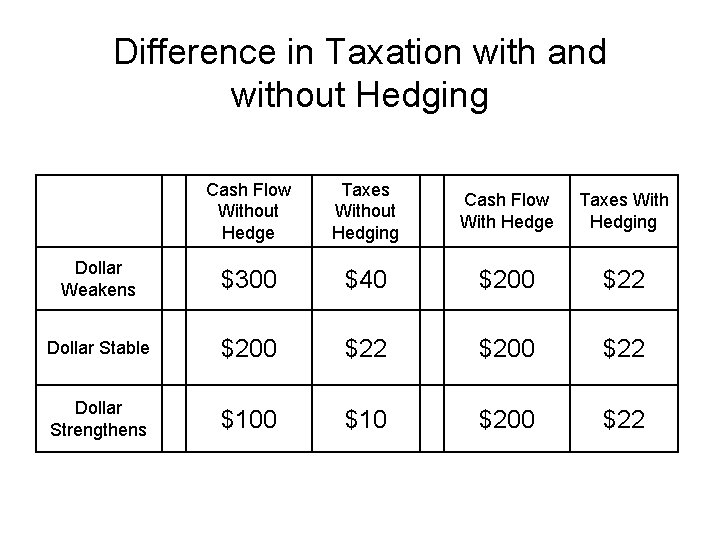

Possible Source of Value #2: Reduction in Taxes n Suppose that WAVE faced the following progressive tax scale (in the U. S. after a certain level, corporate taxes are at a flat rate, but smaller firms could find value here). If cash flow is $100, pay $10 n If cash flow is $200, pay $22 n If cash flow is $300, pay $40 n

Difference in Taxation with and without Hedging Cash Flow Without Hedge Taxes Without Hedging Cash Flow With Hedge Taxes With Hedging Dollar Weakens $300 $40 $200 $22 Dollar Stable $200 $22 Dollar Strengthens $100 $10 $200 $22

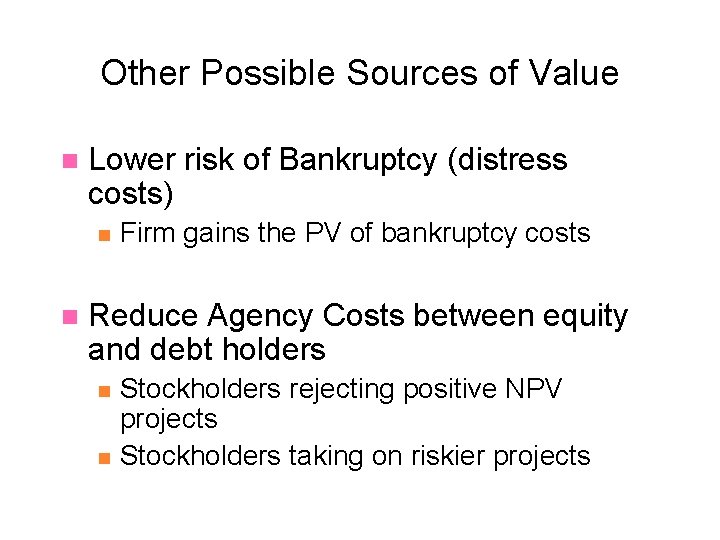

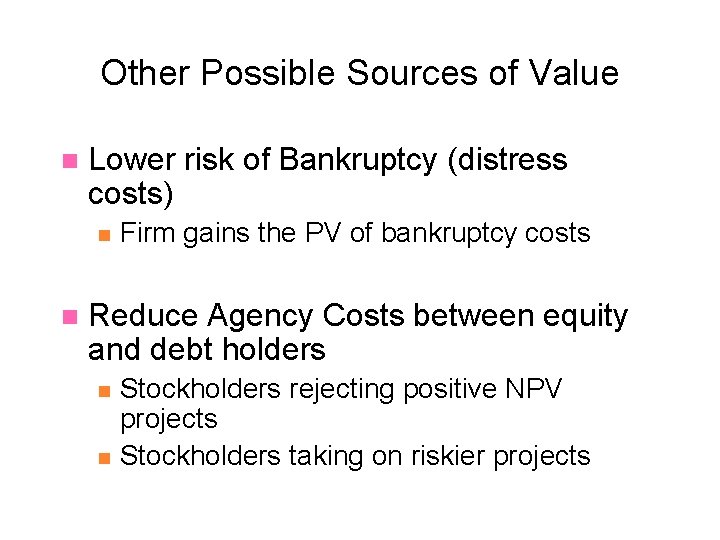

Other Possible Sources of Value n Lower risk of Bankruptcy (distress costs) n n Firm gains the PV of bankruptcy costs Reduce Agency Costs between equity and debt holders n n Stockholders rejecting positive NPV projects Stockholders taking on riskier projects

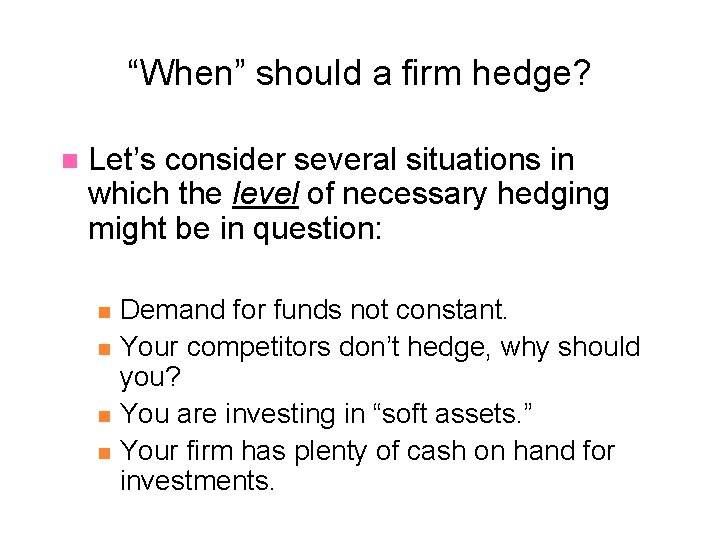

“When” should a firm hedge? n Let’s consider several situations in which the level of necessary hedging might be in question: n n Demand for funds not constant. Your competitors don’t hedge, why should you? You are investing in “soft assets. ” Your firm has plenty of cash on hand for investments.

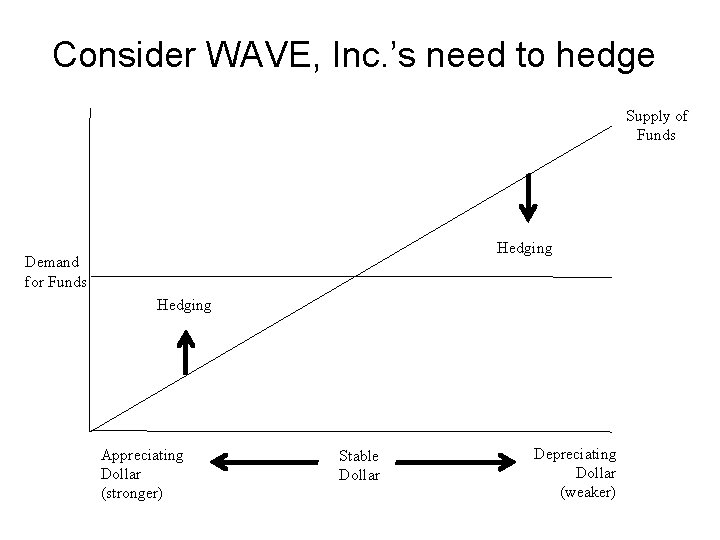

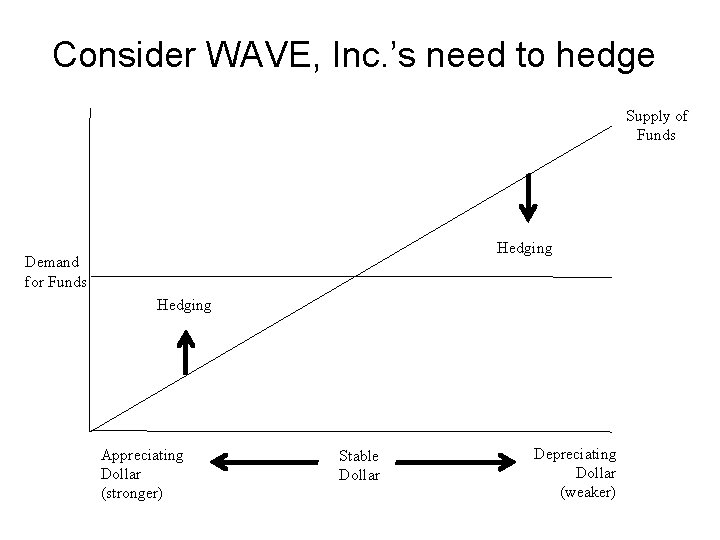

Consider WAVE, Inc. ’s need to hedge Supply of Funds Hedging Demand for Funds Hedging Appreciating Dollar (stronger) Stable Dollar Depreciating Dollar (weaker)

How elastic is the demand for funds? n For WAVE, the demand for investment funds was constant (independent of any risk factors affecting cash flow). n That is, regardless of whether the dollar was weak or strong, R&D funds were needed at a certain level to maximize firm value ($200).

Let’s change WAVE, Inc. ’s industry Suppose WAVE, Inc. is, instead, an oil company that explores for, pumps, and sells oil. n Headquarters: U. S. n Sales: About ¼ in U. S; ¾ in Germany & Japan. n WAVE can forecast its sales volume very well. n What is WAVE’s main uncertainty? . . . n n (Exposure to Currency Exchange Rates)

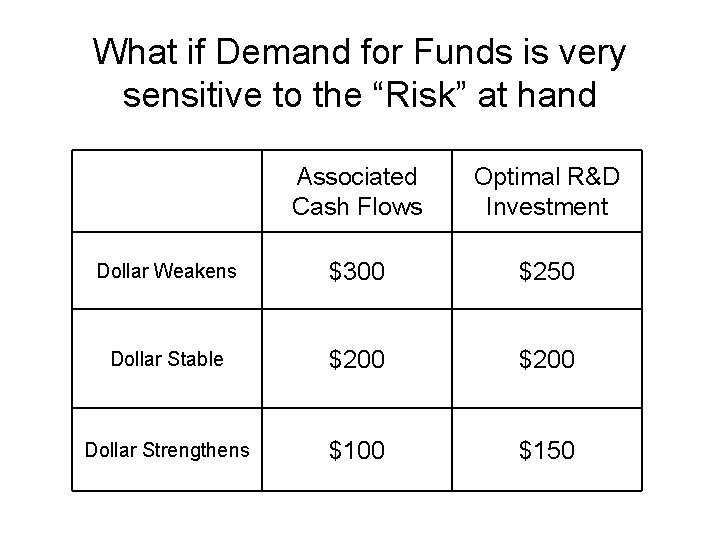

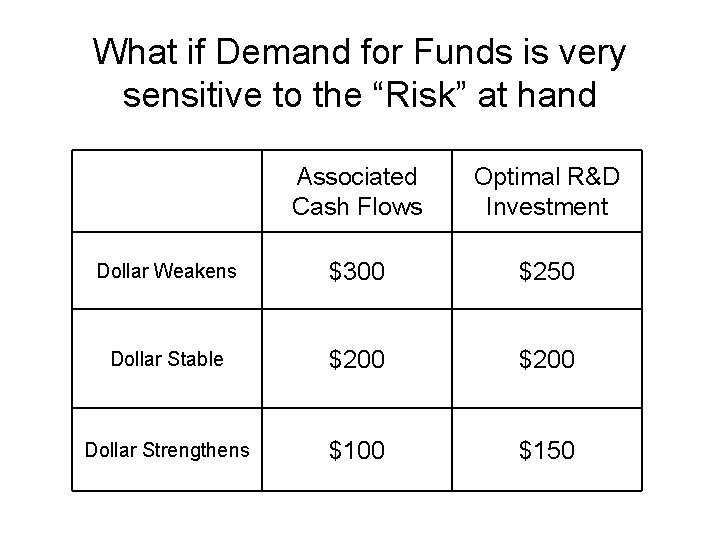

What if Demand for Funds is very sensitive to the “Risk” at hand Associated Cash Flows Optimal R&D Investment Dollar Weakens $300 $250 Dollar Stable $200 Dollar Strengthens $100 $150

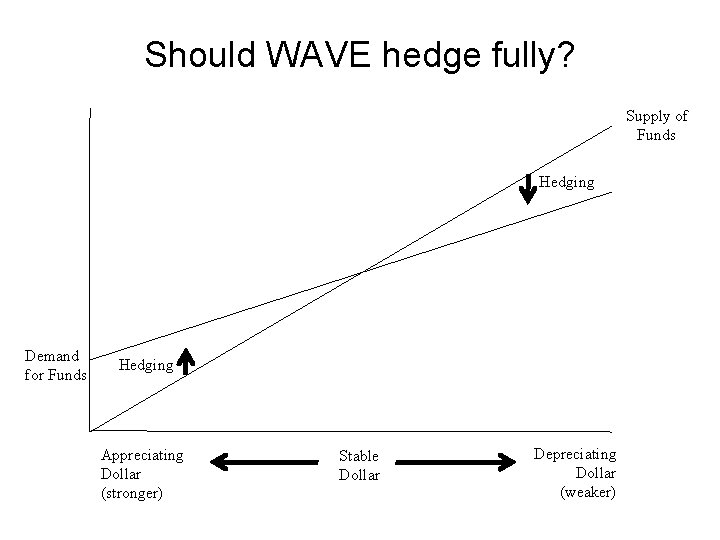

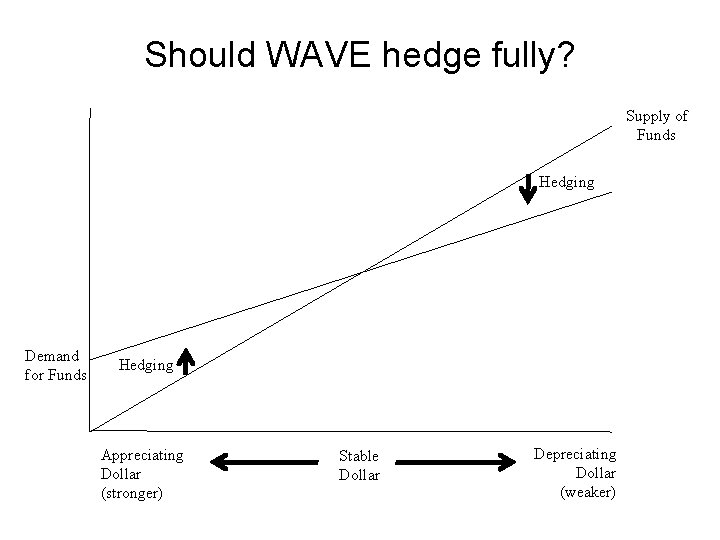

Should WAVE hedge fully? Supply of Funds Hedging Demand for Funds Hedging Appreciating Dollar (stronger) Stable Dollar Depreciating Dollar (weaker)

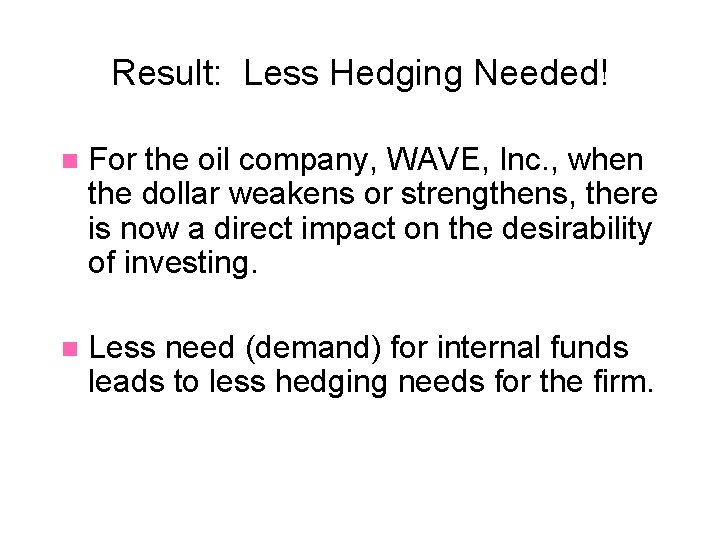

Result: Less Hedging Needed! n For the oil company, WAVE, Inc. , when the dollar weakens or strengthens, there is now a direct impact on the desirability of investing. n Less need (demand) for internal funds leads to less hedging needs for the firm.

Competitive Advantage? n Firms within cyclical industries often suffer and flourish together. n Stable cash flows may allow a hedged firm to take advantage of new capital projects while competitors are suffering from a lack of cash flow.

Fixed vs. “Soft” asset Investment n Suppose you’re trying to borrow money from a bank (or the debt market) for “soft investments, ” what challenges might this bring? n Hedging may allow a firm to have more stable cash flows so that they don’t need to go outside the firm to raise capital.

Options n Calls & Puts n Caps / Floors / Collars n Interest Rate Options n Currency Options

Futures & Forwards n Forward Contracts n Commodity Futures n Index Futures n Interest Rate Futures n Treasury Bond Futures

Swaps n Interest Rate Swaps n Basis Swaps n Currency Swaps n Equity Swaps n Credit Default Swaps

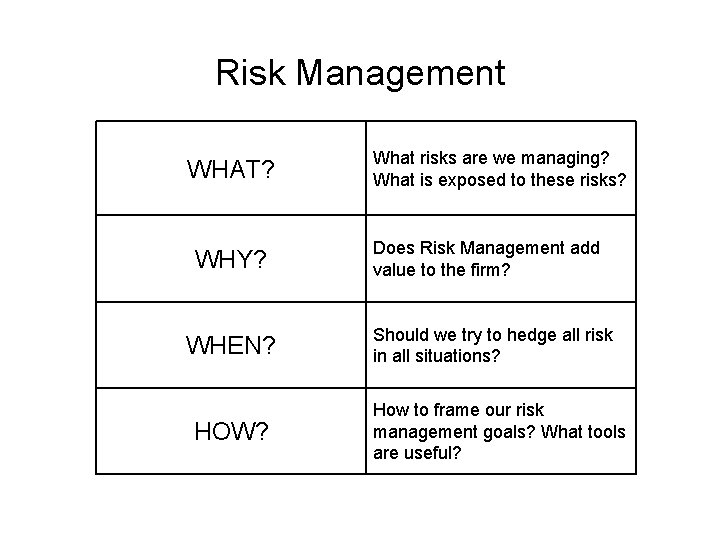

Basic Diversification When assets are not perfectly correlated (Rho < 1. 00), the standard deviation of a portfolio of these assets will always be less than a weighted average of the standard deviations of the individual assets. n Lower correlations result in a lower standard deviation for the portfolio n

Am I Diversified? To see the effect of diversification, go to https: //breesefine 7110. tulane. edu/am-idiversified/ and download the spreadsheet that Prof. Russ Robins and I created n These will all be equally-weighted portfolios n