Introduction Microsoft and Antitrust More aggressive antitrust enforcement

- Slides: 23

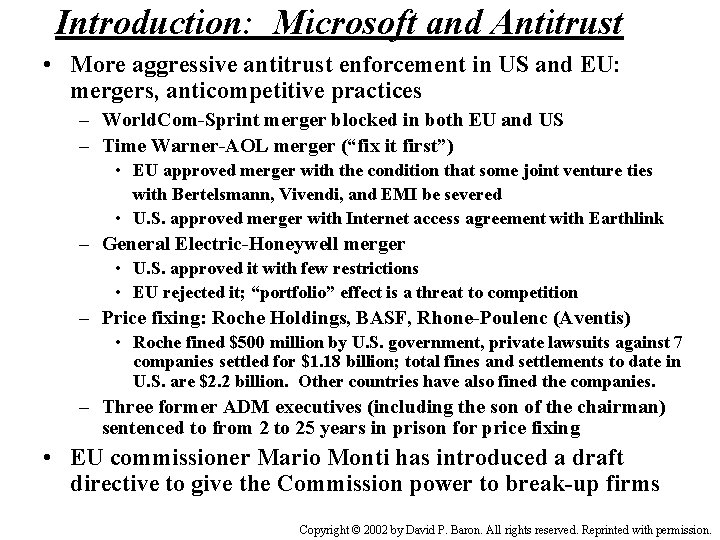

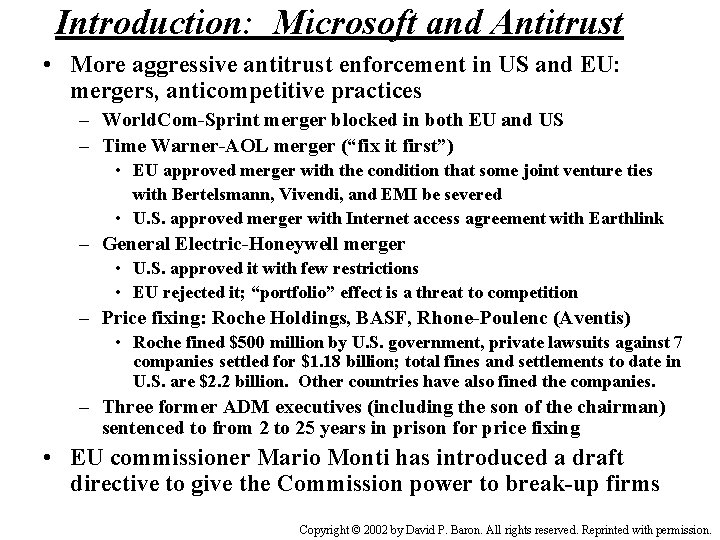

Introduction: Microsoft and Antitrust • More aggressive antitrust enforcement in US and EU: mergers, anticompetitive practices – World. Com-Sprint merger blocked in both EU and US – Time Warner-AOL merger (“fix it first”) • EU approved merger with the condition that some joint venture ties with Bertelsmann, Vivendi, and EMI be severed • U. S. approved merger with Internet access agreement with Earthlink – General Electric-Honeywell merger • U. S. approved it with few restrictions • EU rejected it; “portfolio” effect is a threat to competition – Price fixing: Roche Holdings, BASF, Rhone-Poulenc (Aventis) • Roche fined $500 million by U. S. government, private lawsuits against 7 companies settled for $1. 18 billion; total fines and settlements to date in U. S. are $2. 2 billion. Other countries have also fined the companies. – Three former ADM executives (including the son of the chairman) sentenced to from 2 to 25 years in prison for price fixing • EU commissioner Mario Monti has introduced a draft directive to give the Commission power to break-up firms Copyright © 2002 by David P. Baron. All rights reserved. Reprinted with permission.

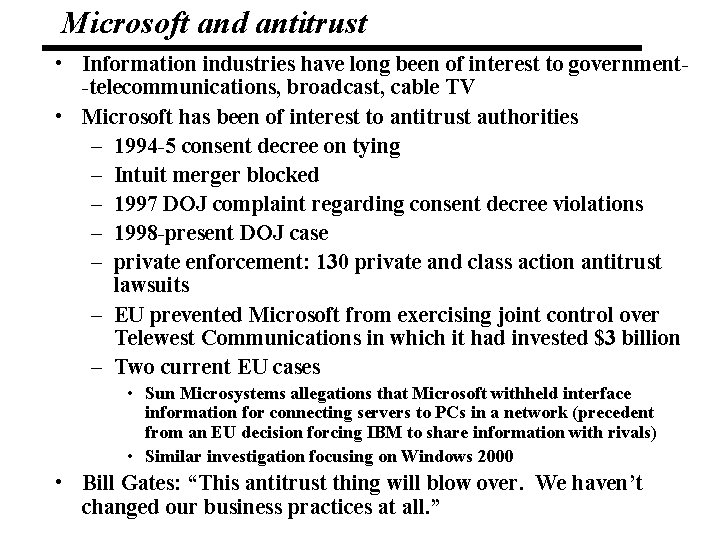

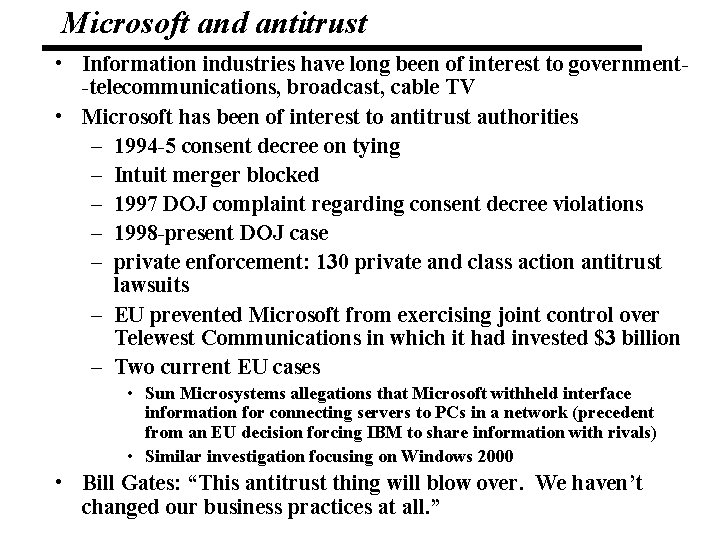

Microsoft and antitrust • Information industries have long been of interest to government-telecommunications, broadcast, cable TV • Microsoft has been of interest to antitrust authorities – 1994 -5 consent decree on tying – Intuit merger blocked – 1997 DOJ complaint regarding consent decree violations – 1998 -present DOJ case – private enforcement: 130 private and class action antitrust lawsuits – EU prevented Microsoft from exercising joint control over Telewest Communications in which it had invested $3 billion – Two current EU cases • Sun Microsystems allegations that Microsoft withheld interface information for connecting servers to PCs in a network (precedent from an EU decision forcing IBM to share information with rivals) • Similar investigation focusing on Windows 2000 • Bill Gates: “This antitrust thing will blow over. We haven’t changed our business practices at all. ”

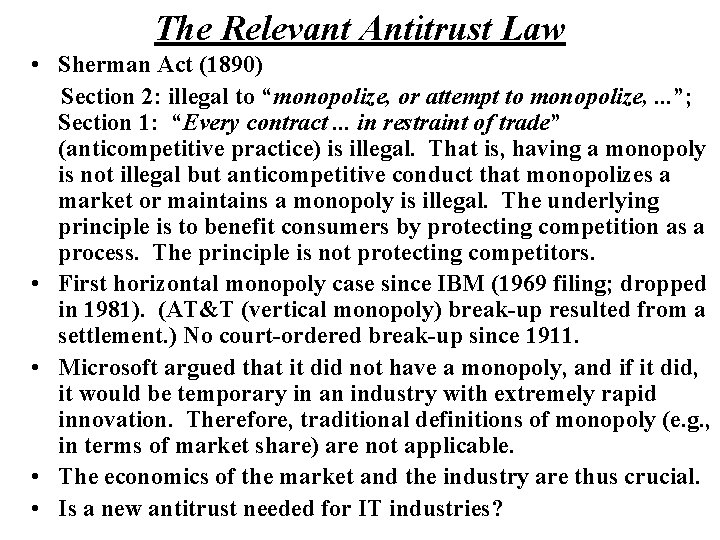

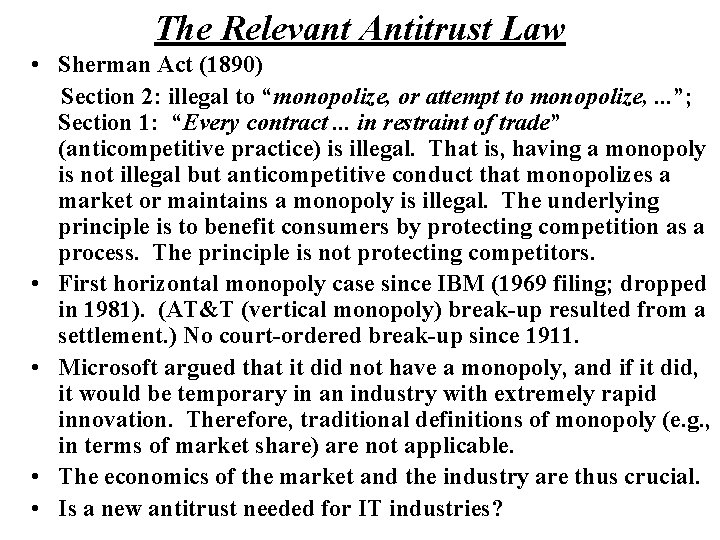

The Relevant Antitrust Law • Sherman Act (1890) Section 2: illegal to “monopolize, or attempt to monopolize, . . . ”; Section 1: “Every contract. . . in restraint of trade” (anticompetitive practice) is illegal. That is, having a monopoly is not illegal but anticompetitive conduct that monopolizes a market or maintains a monopoly is illegal. The underlying principle is to benefit consumers by protecting competition as a process. The principle is not protecting competitors. • First horizontal monopoly case since IBM (1969 filing; dropped in 1981). (AT&T (vertical monopoly) break-up resulted from a settlement. ) No court-ordered break-up since 1911. • Microsoft argued that it did not have a monopoly, and if it did, it would be temporary in an industry with extremely rapid innovation. Therefore, traditional definitions of monopoly (e. g. , in terms of market share) are not applicable. • The economics of the market and the industry are thus crucial. • Is a new antitrust needed for IT industries?

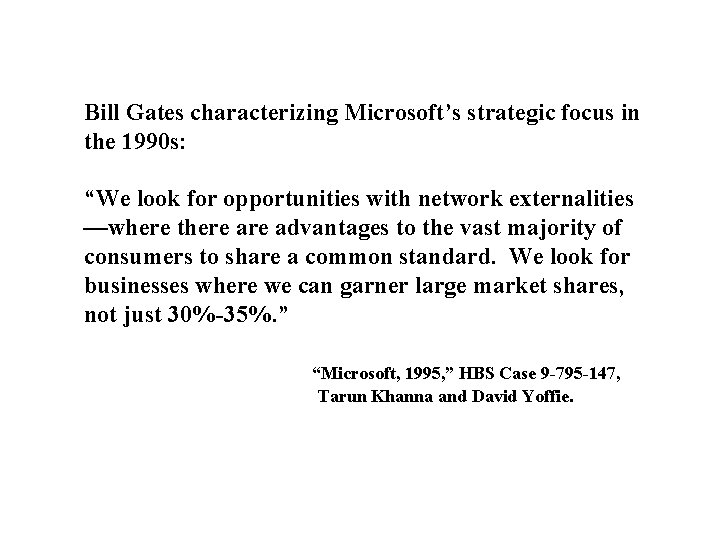

Bill Gates characterizing Microsoft’s strategic focus in the 1990 s: “We look for opportunities with network externalities —where there advantages to the vast majority of consumers to share a common standard. We look for businesses where we can garner large market shares, not just 30%-35%. ” “Microsoft, 1995, ” HBS Case 9 -795 -147, Tarun Khanna and David Yoffie.

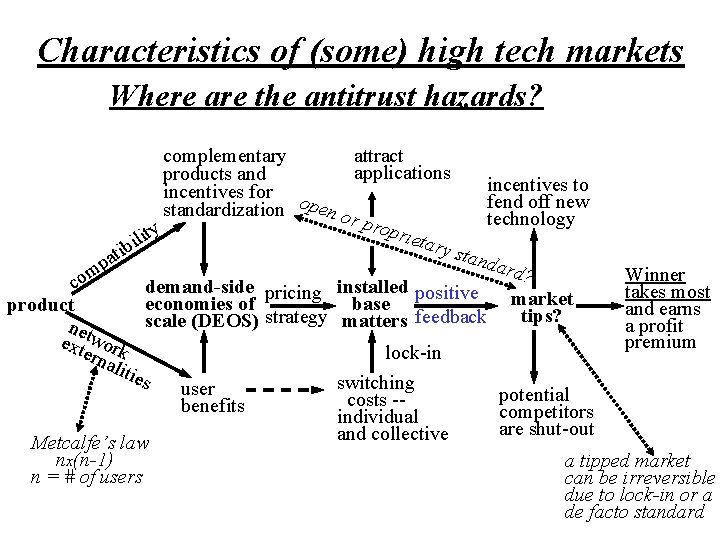

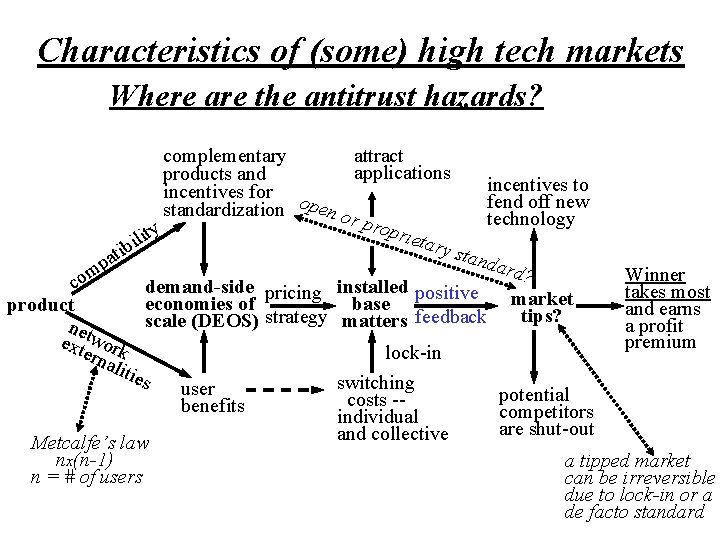

Characteristics of (some) high tech markets Where are the antitrust hazards? attract complementary applications products and incentives to incentives for fend off new standardization open or technology prop y t rieta li i ry st b ti anda a p rd? m Winner o c demand-side pricing installed positive takes most market economies of base product and earns tips? strategy feedback scale (DEOS) matters a profit net w ext ork premium ern lock-in alit ies switching user potential costs -benefits competitors individual are shut-out and collective Metcalfe’s law nx(n-1) a tipped market n = # of users can be irreversible due to lock-in or a de facto standard

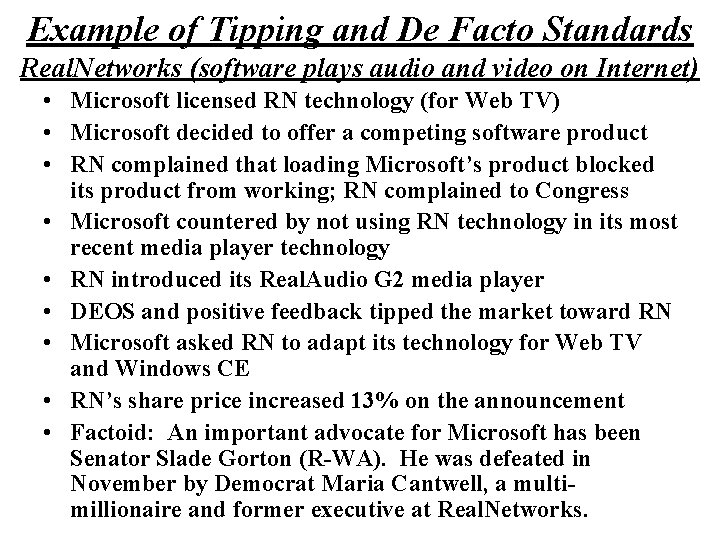

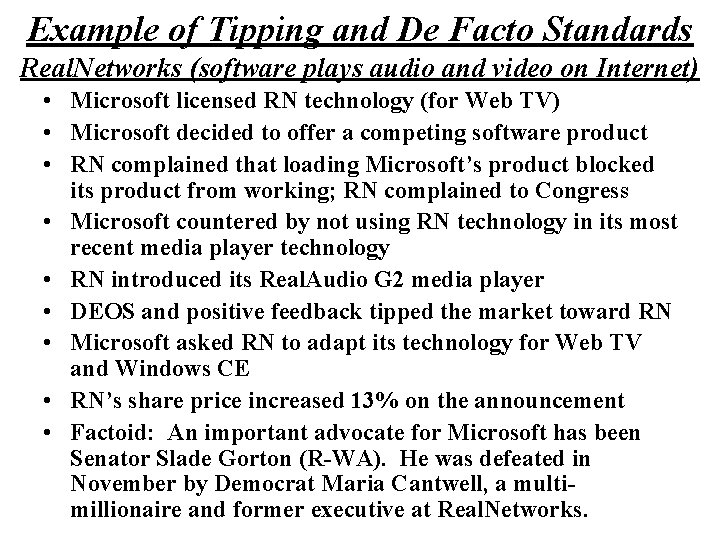

Example of Tipping and De Facto Standards Real. Networks (software plays audio and video on Internet) • Microsoft licensed RN technology (for Web TV) • Microsoft decided to offer a competing software product • RN complained that loading Microsoft’s product blocked its product from working; RN complained to Congress • Microsoft countered by not using RN technology in its most recent media player technology • RN introduced its Real. Audio G 2 media player • DEOS and positive feedback tipped the market toward RN • Microsoft asked RN to adapt its technology for Web TV and Windows CE • RN’s share price increased 13% on the announcement • Factoid: An important advocate for Microsoft has been Senator Slade Gorton (R-WA). He was defeated in November by Democrat Maria Cantwell, a multimillionaire and former executive at Real. Networks.

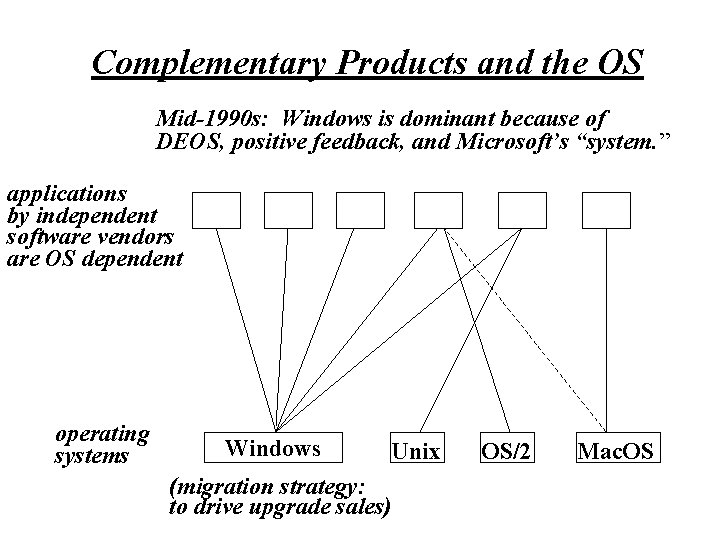

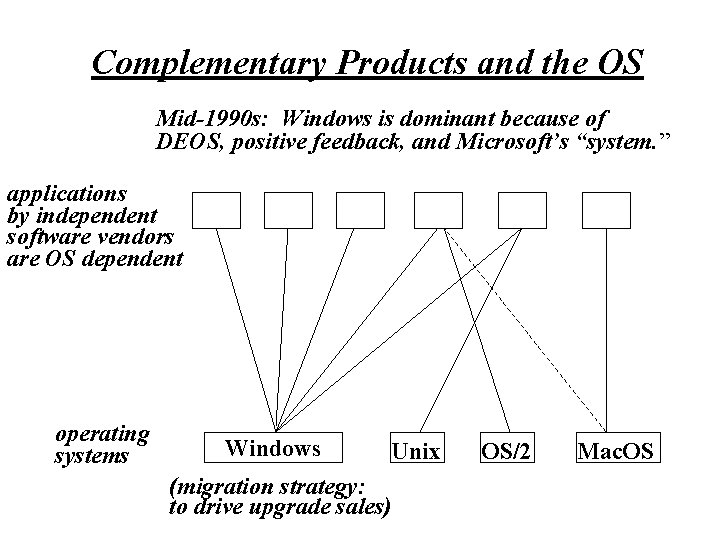

Complementary Products and the OS Mid-1990 s: Windows is dominant because of DEOS, positive feedback, and Microsoft’s “system. ” applications by independent software vendors are OS dependent operating systems Windows Unix (migration strategy: to drive upgrade sales) OS/2 Mac. OS

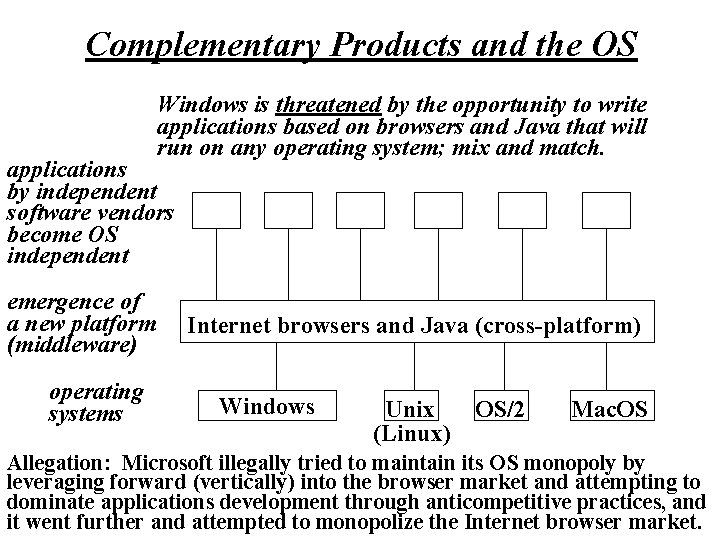

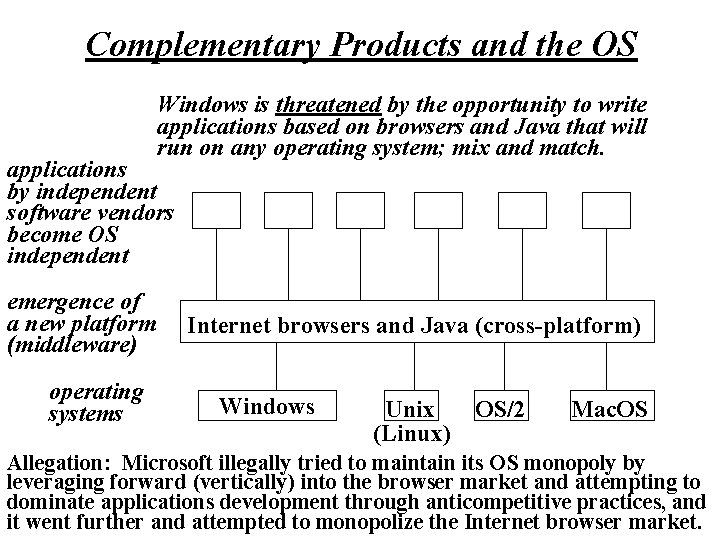

Complementary Products and the OS Windows is threatened by the opportunity to write applications based on browsers and Java that will run on any operating system; mix and match. applications by independent software vendors become OS independent emergence of a new platform (middleware) operating systems Internet browsers and Java (cross-platform) Windows Unix (Linux) OS/2 Mac. OS Allegation: Microsoft illegally tried to maintain its OS monopoly by leveraging forward (vertically) into the browser market and attempting to dominate applications development through anticompetitive practices, and it went further and attempted to monopolize the Internet browser market.

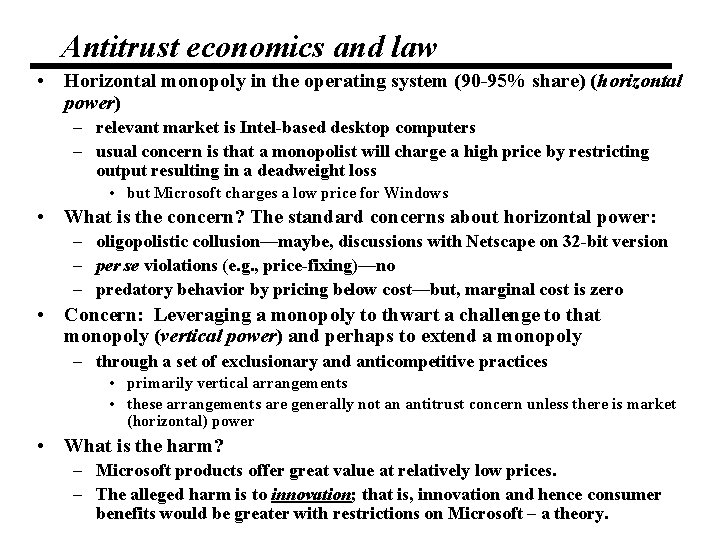

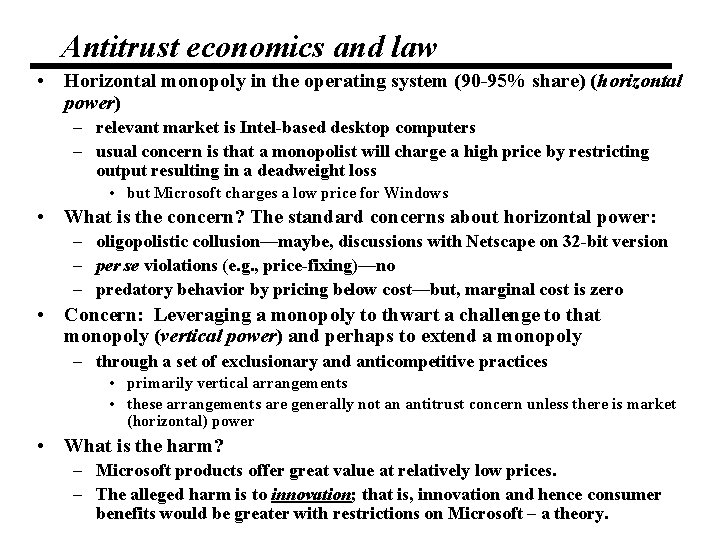

Antitrust economics and law • Horizontal monopoly in the operating system (90 -95% share) (horizontal power) – relevant market is Intel-based desktop computers – usual concern is that a monopolist will charge a high price by restricting output resulting in a deadweight loss • but Microsoft charges a low price for Windows • What is the concern? The standard concerns about horizontal power: – oligopolistic collusion—maybe, discussions with Netscape on 32 -bit version – per se violations (e. g. , price-fixing)—no – predatory behavior by pricing below cost—but, marginal cost is zero • Concern: Leveraging a monopoly to thwart a challenge to that monopoly (vertical power) and perhaps to extend a monopoly – through a set of exclusionary and anticompetitive practices • primarily vertical arrangements • these arrangements are generally not an antitrust concern unless there is market (horizontal) power • What is the harm? – Microsoft products offer great value at relatively low prices. – The alleged harm is to innovation; that is, innovation and hence consumer benefits would be greater with restrictions on Microsoft – a theory.

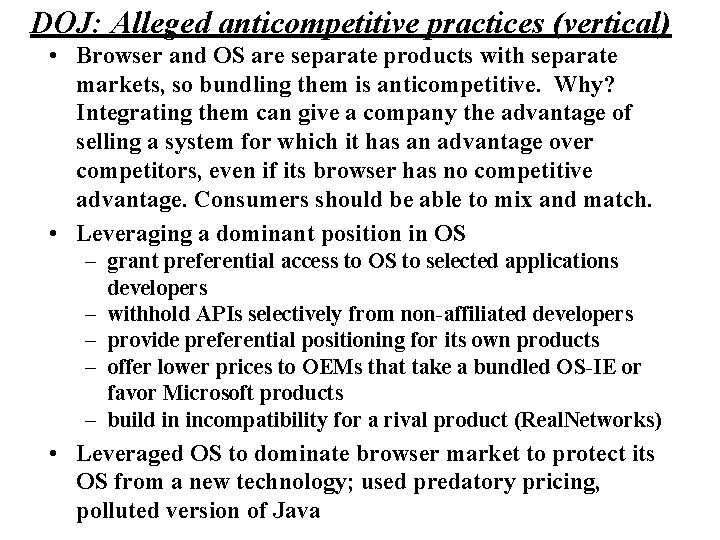

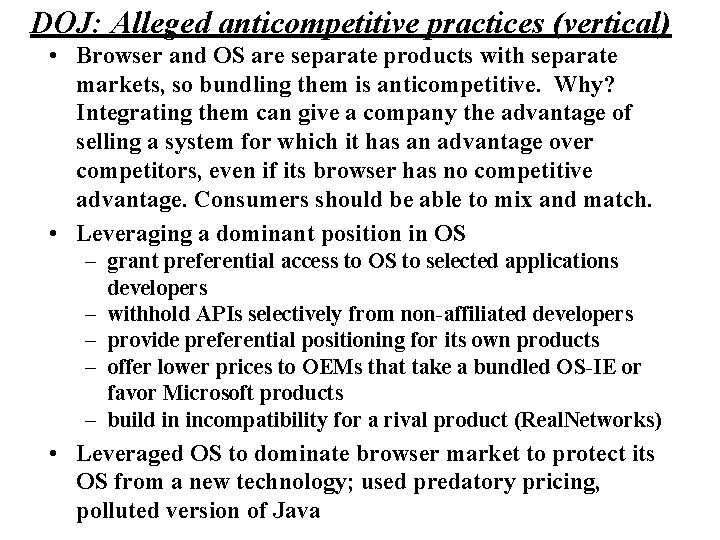

DOJ: Alleged anticompetitive practices (vertical) • Browser and OS are separate products with separate markets, so bundling them is anticompetitive. Why? Integrating them can give a company the advantage of selling a system for which it has an advantage over competitors, even if its browser has no competitive advantage. Consumers should be able to mix and match. • Leveraging a dominant position in OS – grant preferential access to OS to selected applications developers – withhold APIs selectively from non-affiliated developers – provide preferential positioning for its own products – offer lower prices to OEMs that take a bundled OS-IE or favor Microsoft products – build in incompatibility for a rival product (Real. Networks) • Leveraged OS to dominate browser market to protect its OS from a new technology; used predatory pricing, polluted version of Java

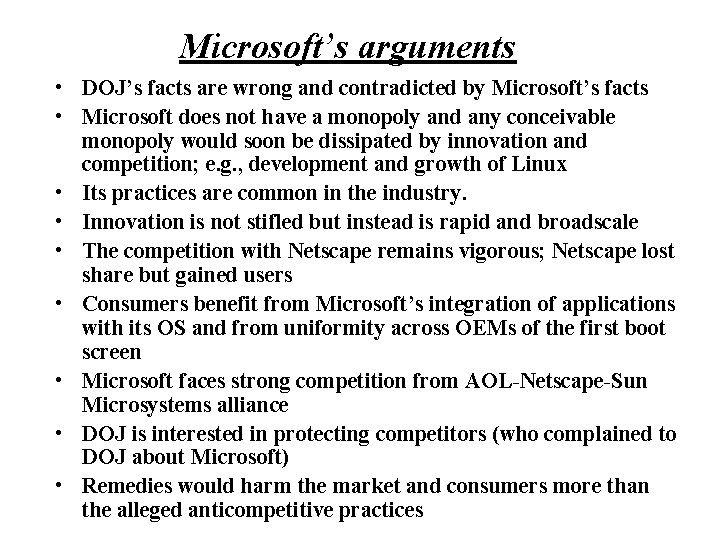

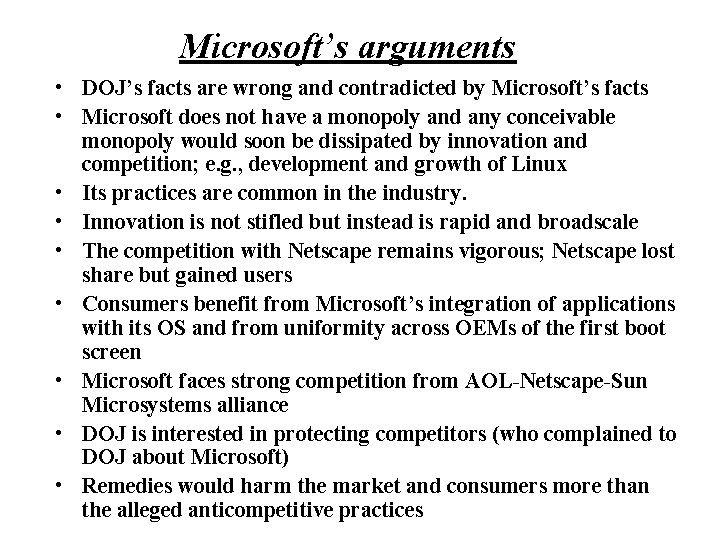

Microsoft’s arguments • DOJ’s facts are wrong and contradicted by Microsoft’s facts • Microsoft does not have a monopoly and any conceivable monopoly would soon be dissipated by innovation and competition; e. g. , development and growth of Linux • Its practices are common in the industry. • Innovation is not stifled but instead is rapid and broadscale • The competition with Netscape remains vigorous; Netscape lost share but gained users • Consumers benefit from Microsoft’s integration of applications with its OS and from uniformity across OEMs of the first boot screen • Microsoft faces strong competition from AOL-Netscape-Sun Microsystems alliance • DOJ is interested in protecting competitors (who complained to DOJ about Microsoft) • Remedies would harm the market and consumers more than the alleged anticompetitive practices

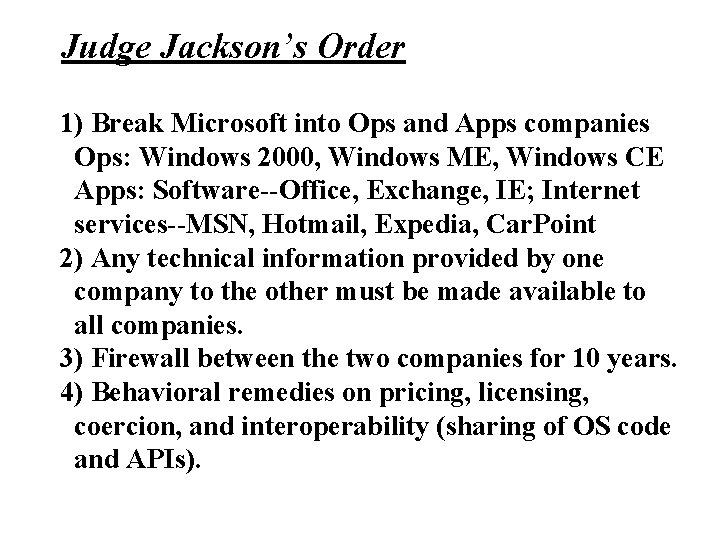

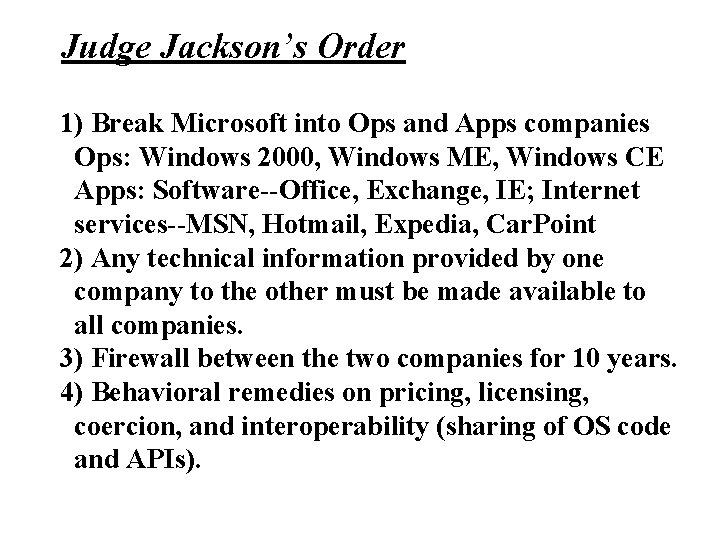

Judge Jackson’s Order 1) Break Microsoft into Ops and Apps companies Ops: Windows 2000, Windows ME, Windows CE Apps: Software--Office, Exchange, IE; Internet services--MSN, Hotmail, Expedia, Car. Point 2) Any technical information provided by one company to the other must be made available to all companies. 3) Firewall between the two companies for 10 years. 4) Behavioral remedies on pricing, licensing, coercion, and interoperability (sharing of OS code and APIs).

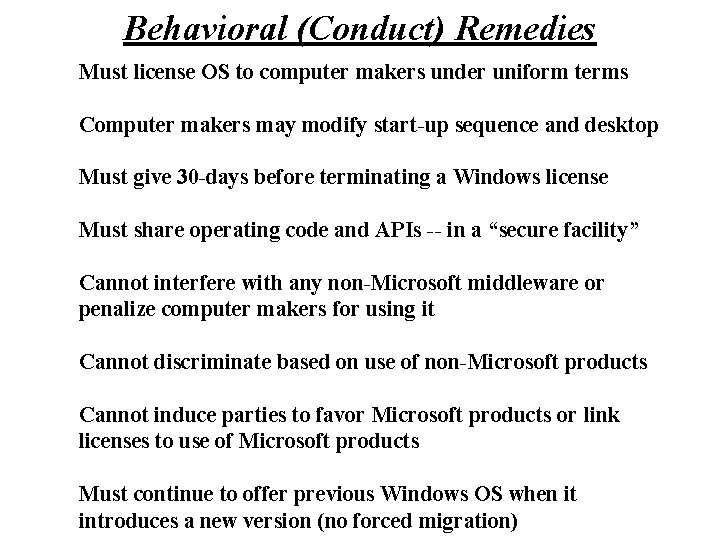

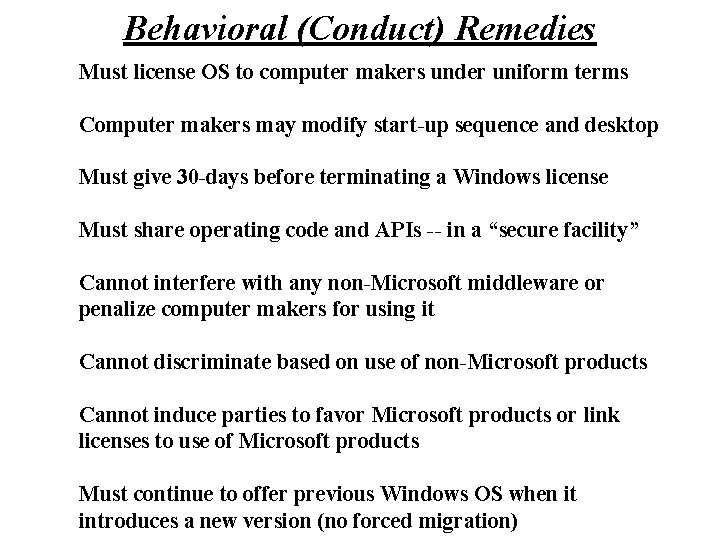

Behavioral (Conduct) Remedies Must license OS to computer makers under uniform terms Computer makers may modify start-up sequence and desktop Must give 30 -days before terminating a Windows license Must share operating code and APIs -- in a “secure facility” Cannot interfere with any non-Microsoft middleware or penalize computer makers for using it Cannot discriminate based on use of non-Microsoft products Cannot induce parties to favor Microsoft products or link licenses to use of Microsoft products Must continue to offer previous Windows OS when it introduces a new version (no forced migration)

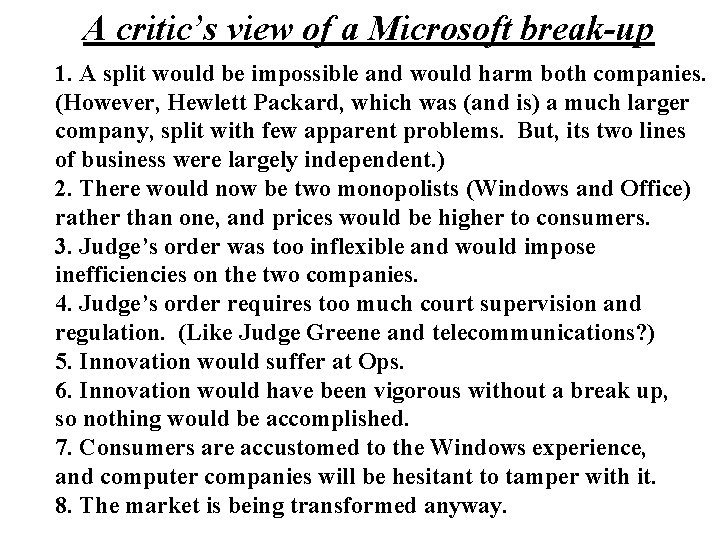

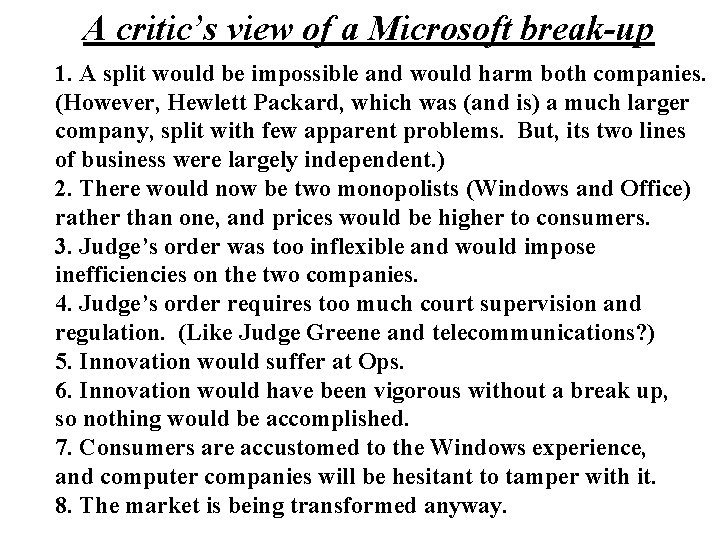

A critic’s view of a Microsoft break-up 1. A split would be impossible and would harm both companies. (However, Hewlett Packard, which was (and is) a much larger company, split with few apparent problems. But, its two lines of business were largely independent. ) 2. There would now be two monopolists (Windows and Office) rather than one, and prices would be higher to consumers. 3. Judge’s order was too inflexible and would impose inefficiencies on the two companies. 4. Judge’s order requires too much court supervision and regulation. (Like Judge Greene and telecommunications? ) 5. Innovation would suffer at Ops. 6. Innovation would have been vigorous without a break up, so nothing would be accomplished. 7. Consumers are accustomed to the Windows experience, and computer companies will be hesitant to tamper with it. 8. The market is being transformed anyway.

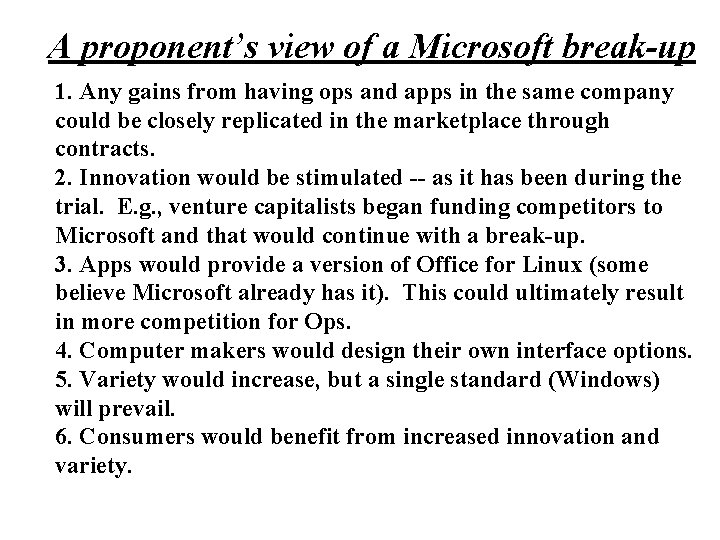

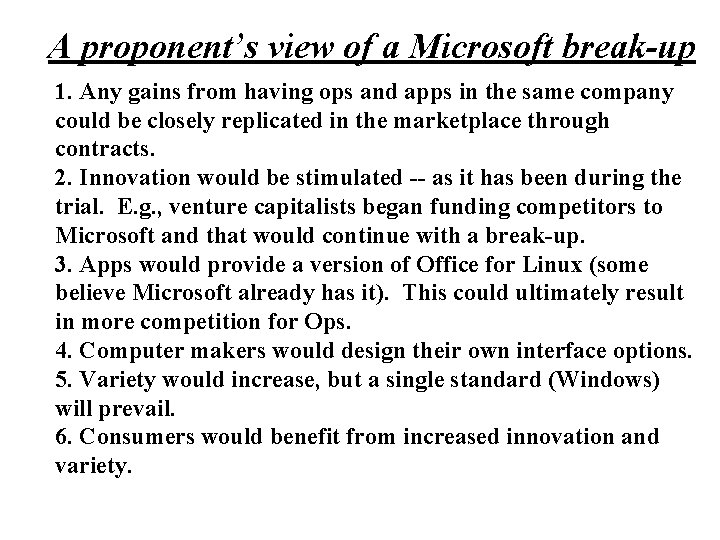

A proponent’s view of a Microsoft break-up 1. Any gains from having ops and apps in the same company could be closely replicated in the marketplace through contracts. 2. Innovation would be stimulated -- as it has been during the trial. E. g. , venture capitalists began funding competitors to Microsoft and that would continue with a break-up. 3. Apps would provide a version of Office for Linux (some believe Microsoft already has it). This could ultimately result in more competition for Ops. 4. Computer makers would design their own interface options. 5. Variety would increase, but a single standard (Windows) will prevail. 6. Consumers would benefit from increased innovation and variety.

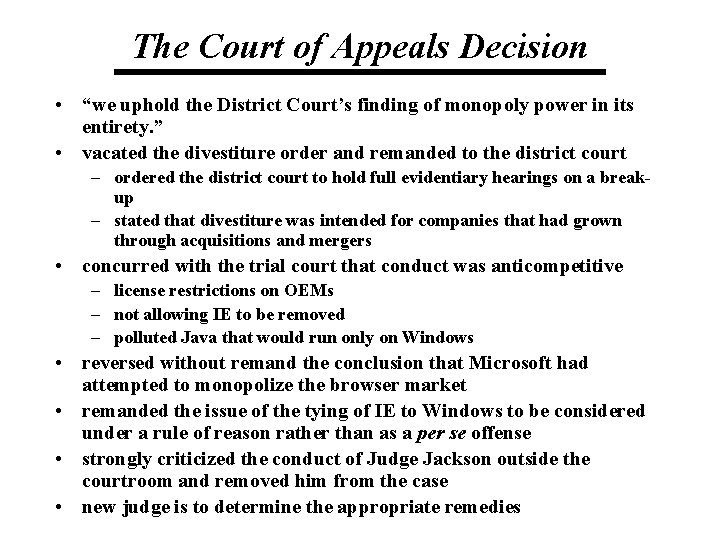

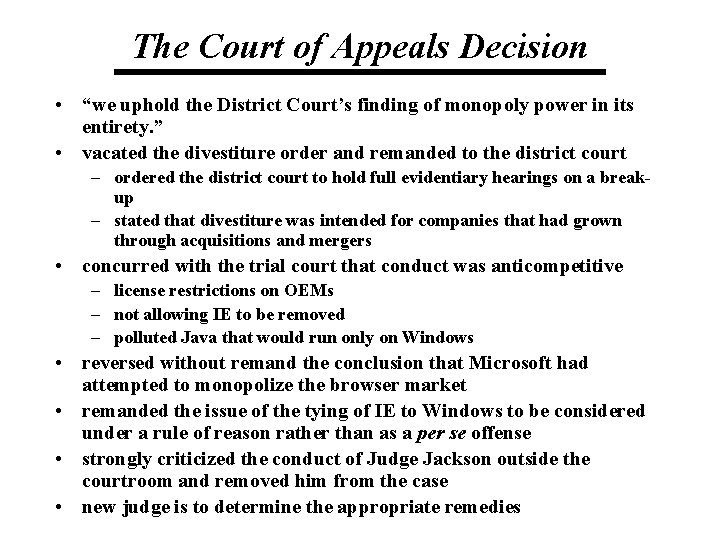

The Court of Appeals Decision • “we uphold the District Court’s finding of monopoly power in its entirety. ” • vacated the divestiture order and remanded to the district court – ordered the district court to hold full evidentiary hearings on a breakup – stated that divestiture was intended for companies that had grown through acquisitions and mergers • concurred with the trial court that conduct was anticompetitive – license restrictions on OEMs – not allowing IE to be removed – polluted Java that would run only on Windows • reversed without remand the conclusion that Microsoft had attempted to monopolize the browser market • remanded the issue of the tying of IE to Windows to be considered under a rule of reason rather than as a per se offense • strongly criticized the conduct of Judge Jackson outside the courtroom and removed him from the case • new judge is to determine the appropriate remedies

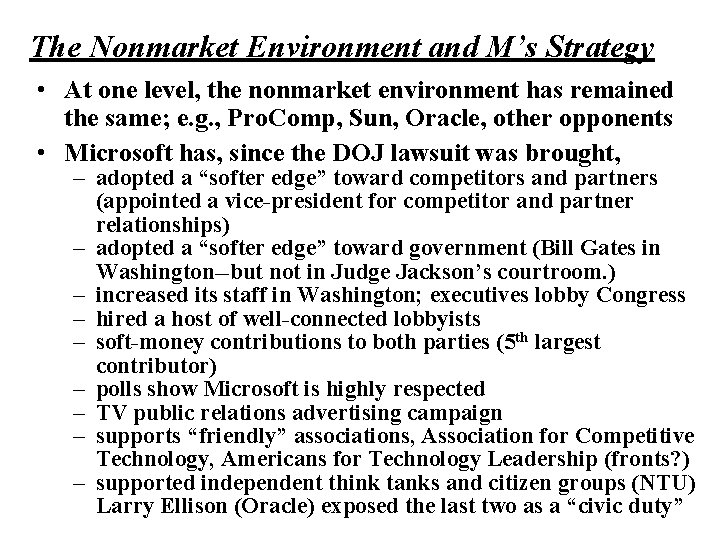

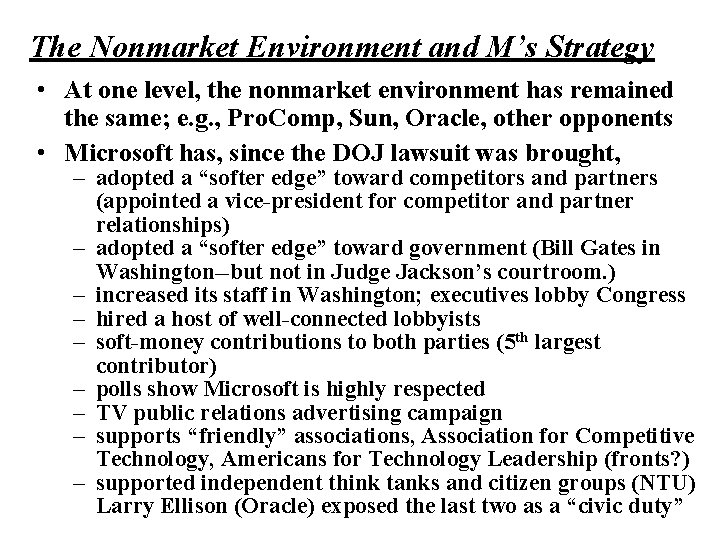

The Nonmarket Environment and M’s Strategy • At one level, the nonmarket environment has remained the same; e. g. , Pro. Comp, Sun, Oracle, other opponents • Microsoft has, since the DOJ lawsuit was brought, – adopted a “softer edge” toward competitors and partners (appointed a vice-president for competitor and partner relationships) – adopted a “softer edge” toward government (Bill Gates in Washington--but not in Judge Jackson’s courtroom. ) – increased its staff in Washington; executives lobby Congress – hired a host of well-connected lobbyists – soft-money contributions to both parties (5 th largest contributor) – polls show Microsoft is highly respected – TV public relations advertising campaign – supports “friendly” associations, Association for Competitive Technology, Americans for Technology Leadership (fronts? ) – supported independent think tanks and citizen groups (NTU) Larry Ellison (Oracle) exposed the last two as a “civic duty”

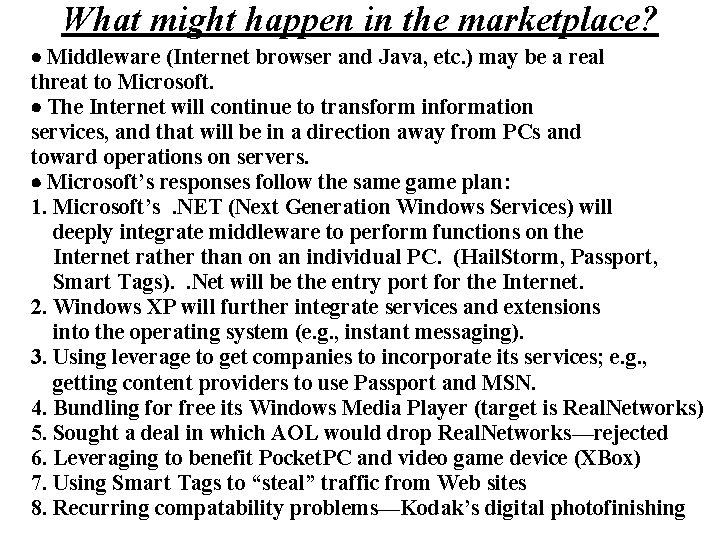

What might happen in the marketplace? Middleware (Internet browser and Java, etc. ) may be a real threat to Microsoft. The Internet will continue to transform information services, and that will be in a direction away from PCs and toward operations on servers. Microsoft’s responses follow the same game plan: 1. Microsoft’s. NET (Next Generation Windows Services) will deeply integrate middleware to perform functions on the Internet rather than on an individual PC. (Hail. Storm, Passport, Smart Tags). . Net will be the entry port for the Internet. 2. Windows XP will further integrate services and extensions into the operating system (e. g. , instant messaging). 3. Using leverage to get companies to incorporate its services; e. g. , getting content providers to use Passport and MSN. 4. Bundling for free its Windows Media Player (target is Real. Networks) 5. Sought a deal in which AOL would drop Real. Networks—rejected 6. Leveraging to benefit Pocket. PC and video game device (XBox) 7. Using Smart Tags to “steal” traffic from Web sites 8. Recurring compatability problems—Kodak’s digital photofinishing

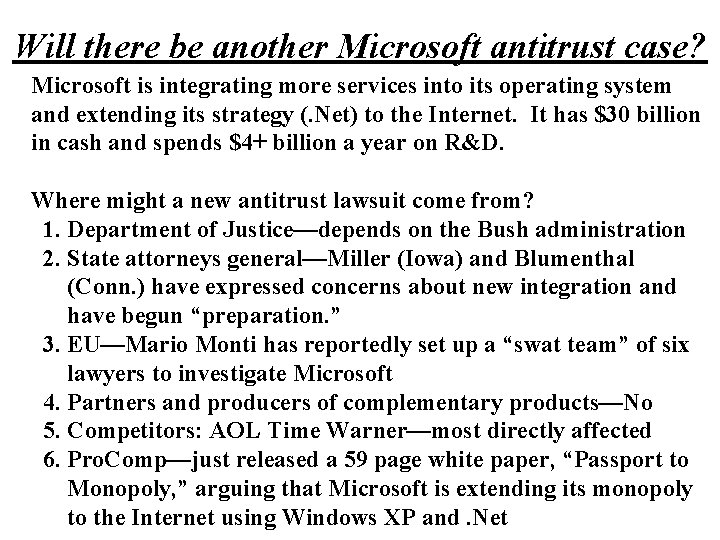

Will there be another Microsoft antitrust case? Microsoft is integrating more services into its operating system and extending its strategy (. Net) to the Internet. It has $30 billion in cash and spends $4+ billion a year on R&D. Where might a new antitrust lawsuit come from? 1. Department of Justice—depends on the Bush administration 2. State attorneys general—Miller (Iowa) and Blumenthal (Conn. ) have expressed concerns about new integration and have begun “preparation. ” 3. EU—Mario Monti has reportedly set up a “swat team” of six lawyers to investigate Microsoft 4. Partners and producers of complementary products—No 5. Competitors: AOL Time Warner—most directly affected 6. Pro. Comp—just released a 59 page white paper, “Passport to Monopoly, ” arguing that Microsoft is extending its monopoly to the Internet using Windows XP and. Net

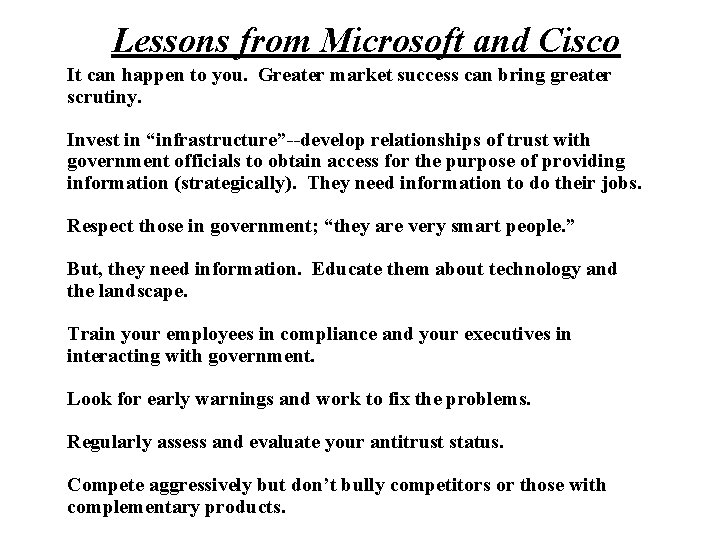

Lessons from Microsoft and Cisco It can happen to you. Greater market success can bring greater scrutiny. Invest in “infrastructure”--develop relationships of trust with government officials to obtain access for the purpose of providing information (strategically). They need information to do their jobs. Respect those in government; “they are very smart people. ” But, they need information. Educate them about technology and the landscape. Train your employees in compliance and your executives in interacting with government. Look for early warnings and work to fix the problems. Regularly assess and evaluate your antitrust status. Compete aggressively but don’t bully competitors or those with complementary products.

Does a new economics require a new antitrust policy? The new economics 1. Network externalities, compatibility, complements, DEOS, and standardization imply winner-take-most markets. 2. High up-front costs, but the marginal costs of production and distribution are close to zero. 3. The prize thus can be enormous, so there should be intense competition to be the winner. Winner then makes very high profits. 4. Shumpeter: a monopoly (the winner) has stronger incentives to innovate than a competitive industry. 5. If not, innovation with new and better technologies will result in the winner being replaced. (But, innovation and new technology (Internet browser and Java) could be blocked by leveraging vertically the Windows monopoly. )

So what is the concern? In addition to leveraging from a monopoly to block technology, modern growth theory predicts that competition is better than monopoly for stimulating innovation. Antitrust concern: Competition-driven innovation can be hampered by leveraging a monopoly using anticompetitive practices. What is required for competition-driven innovation? 1) An opportunity to enter, 2) a level playing field, and 3) interoperability (e. g. , access to APIs). Is a new antitrust policy needed? If the problem is anticompetitive leveraging by a monopoly, are the behavior and the techniques different from the past? Most experts conclude the answer is “no, ” so a new antitrust is not needed. That is, today’s antitrust law and policy will be tomorrow’s antitrust law and policy.

Will Bill Gates again be able to say, “This antitrust thing will blow over. We haven’t changed our business practices at all. ” When will the next Microsoft antitrust case be filed?