Introduction A mutual fund is a common pool

- Slides: 10

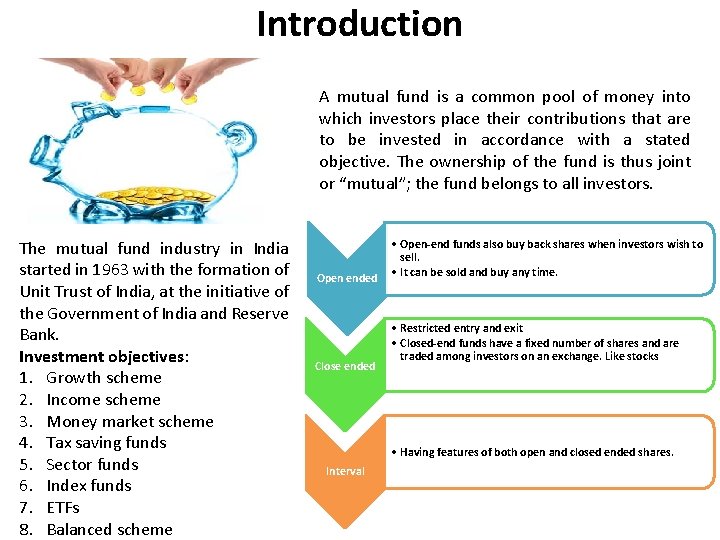

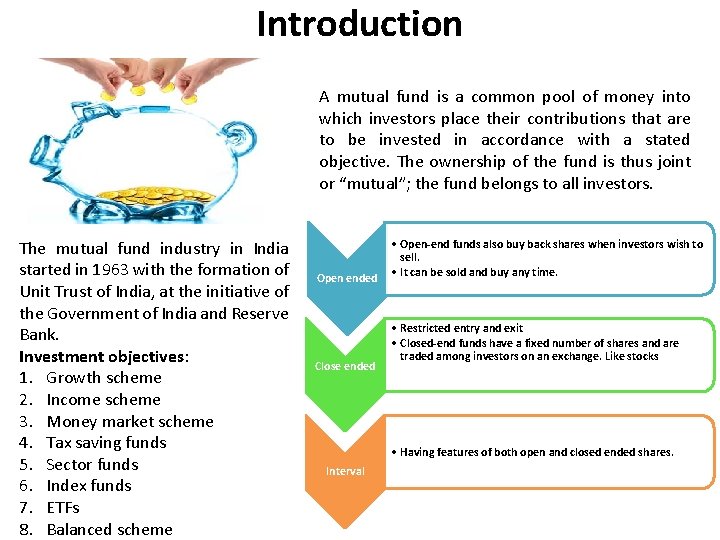

Introduction A mutual fund is a common pool of money into which investors place their contributions that are to be invested in accordance with a stated objective. The ownership of the fund is thus joint or “mutual”; the fund belongs to all investors. The mutual fund industry in India started in 1963 with the formation of Unit Trust of India, at the initiative of the Government of India and Reserve Bank. Investment objectives: 1. Growth scheme 2. Income scheme 3. Money market scheme 4. Tax saving funds 5. Sector funds 6. Index funds 7. ETFs 8. Balanced scheme Open ended Close ended • Open-end funds also buy back shares when investors wish to sell. • It can be sold and buy any time. • Restricted entry and exit • Closed-end funds have a fixed number of shares and are traded among investors on an exchange. Like stocks • Having features of both open and closed ended shares. Interval

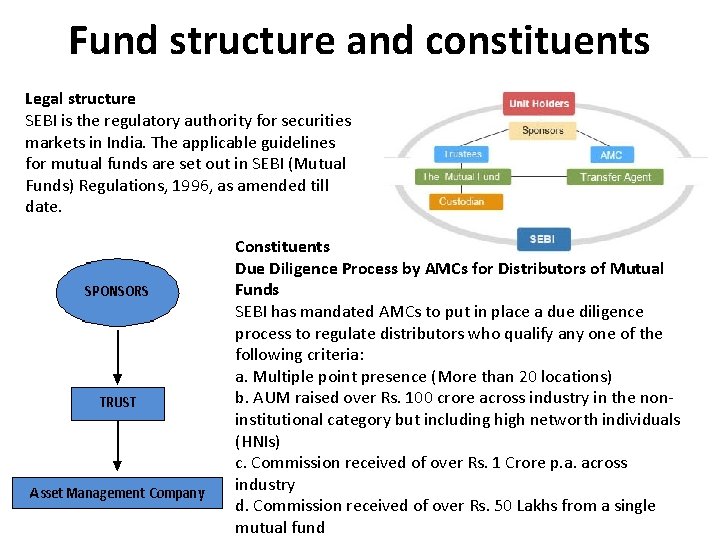

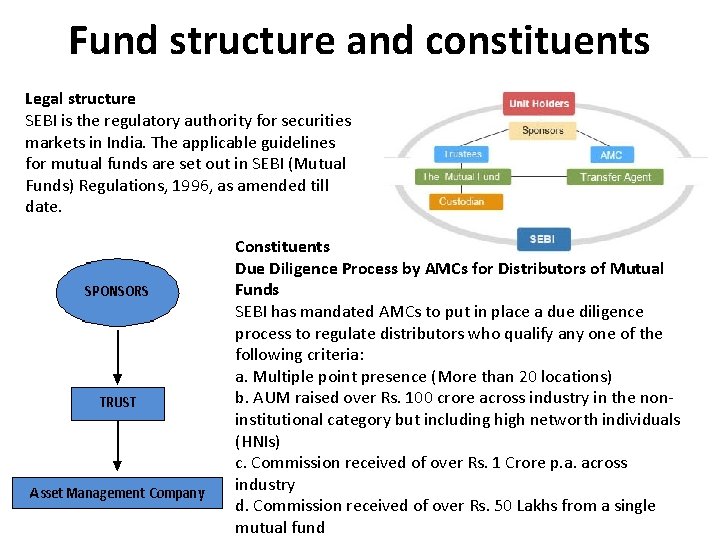

Fund structure and constituents Legal structure SEBI is the regulatory authority for securities markets in India. The applicable guidelines for mutual funds are set out in SEBI (Mutual Funds) Regulations, 1996, as amended till date. Constituents Due Diligence Process by AMCs for Distributors of Mutual Funds SEBI has mandated AMCs to put in place a due diligence process to regulate distributors who qualify any one of the following criteria: a. Multiple point presence (More than 20 locations) b. AUM raised over Rs. 100 crore across industry in the noninstitutional category but including high networth individuals (HNIs) c. Commission received of over Rs. 1 Crore p. a. across industry d. Commission received of over Rs. 50 Lakhs from a single mutual fund

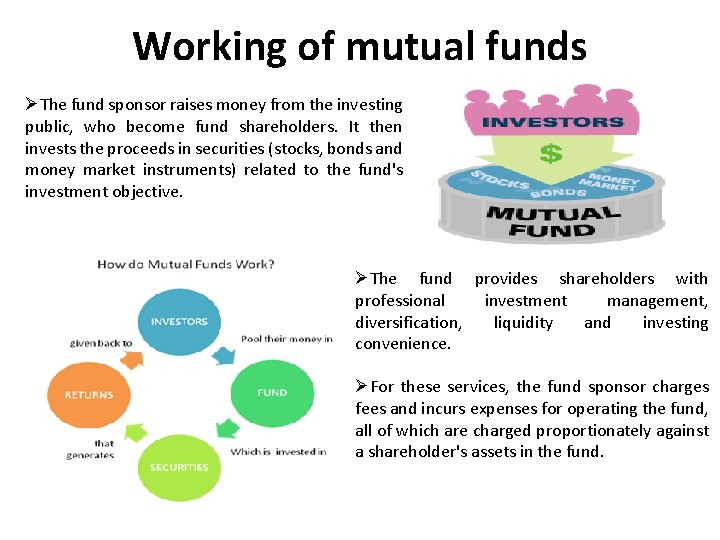

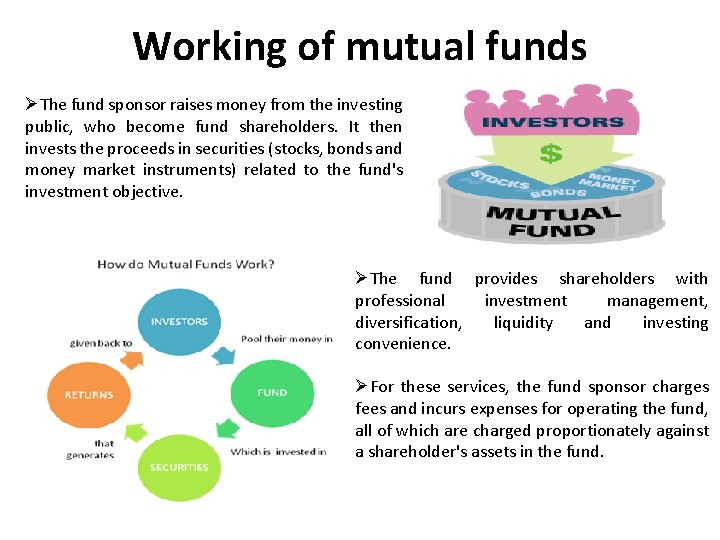

Working of mutual funds ØThe fund sponsor raises money from the investing public, who become fund shareholders. It then invests the proceeds in securities (stocks, bonds and money market instruments) related to the fund's investment objective. ØThe fund provides shareholders with professional investment management, diversification, liquidity and investing convenience. ØFor these services, the fund sponsor charges fees and incurs expenses for operating the fund, all of which are charged proportionately against a shareholder's assets in the fund.

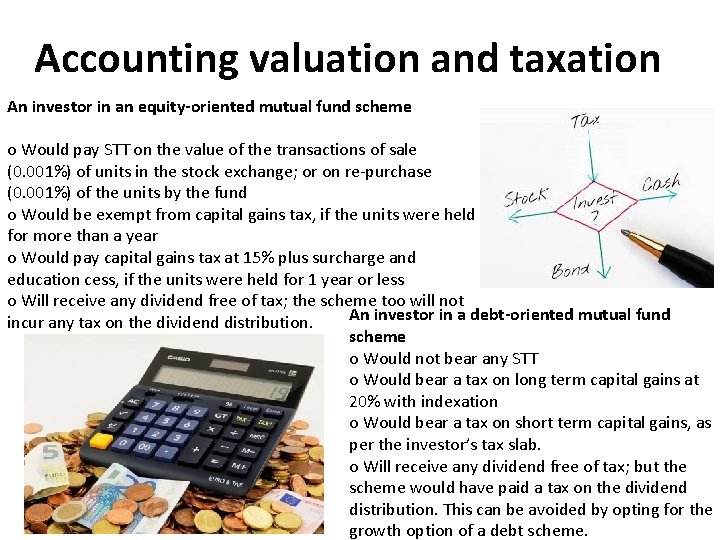

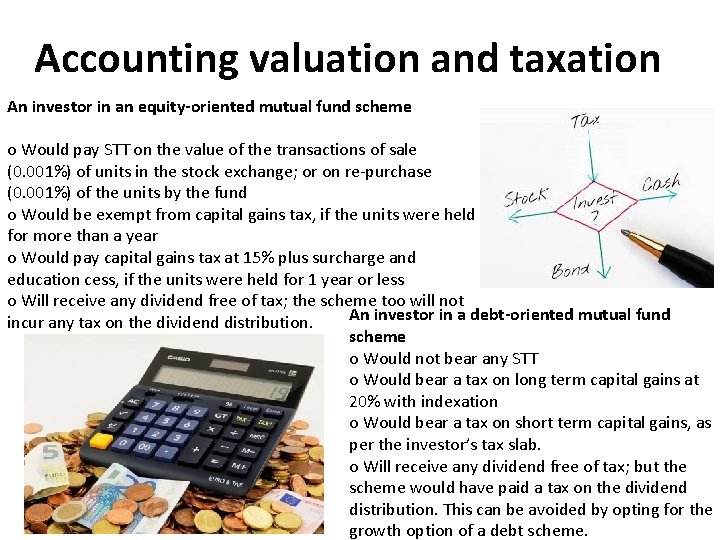

Accounting valuation and taxation An investor in an equity-oriented mutual fund scheme o Would pay STT on the value of the transactions of sale (0. 001%) of units in the stock exchange; or on re-purchase (0. 001%) of the units by the fund o Would be exempt from capital gains tax, if the units were held for more than a year o Would pay capital gains tax at 15% plus surcharge and education cess, if the units were held for 1 year or less o Will receive any dividend free of tax; the scheme too will not An investor in a debt-oriented mutual fund incur any tax on the dividend distribution. scheme o Would not bear any STT o Would bear a tax on long term capital gains at 20% with indexation o Would bear a tax on short term capital gains, as per the investor’s tax slab. o Will receive any dividend free of tax; but the scheme would have paid a tax on the dividend distribution. This can be avoided by opting for the growth option of a debt scheme.

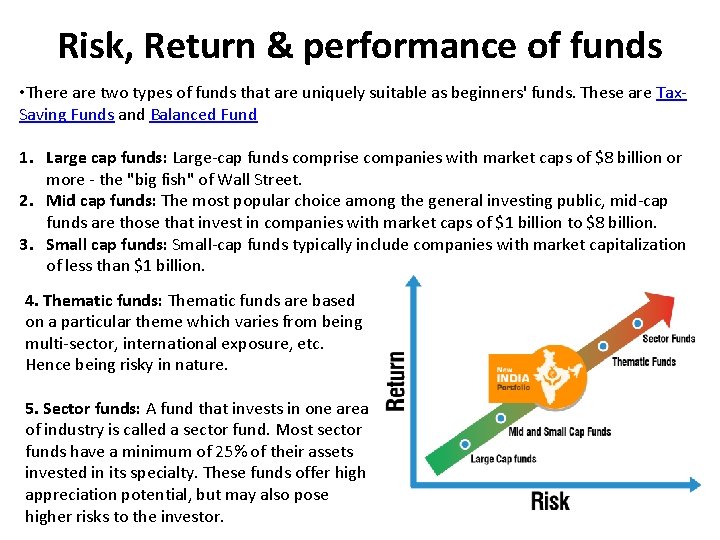

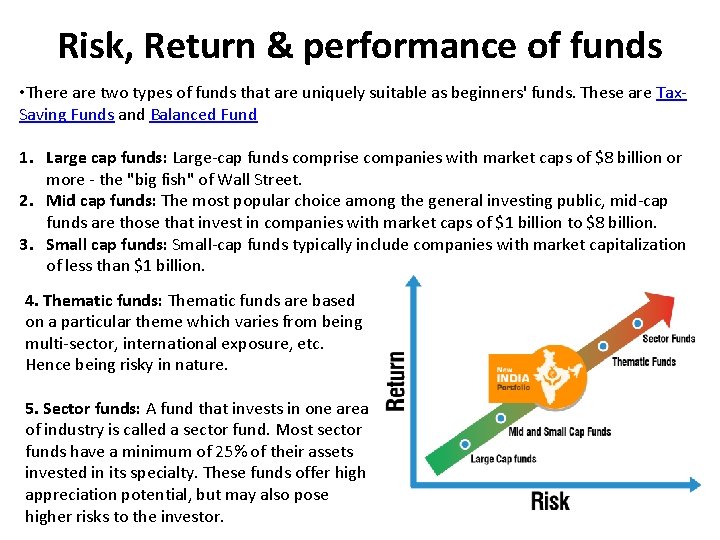

Risk, Return & performance of funds • There are two types of funds that are uniquely suitable as beginners' funds. These are Tax. Saving Funds and Balanced Fund 1. Large cap funds: Large-cap funds comprise companies with market caps of $8 billion or more - the "big fish" of Wall Street. 2. Mid cap funds: The most popular choice among the general investing public, mid-cap funds are those that invest in companies with market caps of $1 billion to $8 billion. 3. Small cap funds: Small-cap funds typically include companies with market capitalization of less than $1 billion. 4. Thematic funds: Thematic funds are based on a particular theme which varies from being multi-sector, international exposure, etc. Hence being risky in nature. 5. Sector funds: A fund that invests in one area of industry is called a sector fund. Most sector funds have a minimum of 25% of their assets invested in its specialty. These funds offer high appreciation potential, but may also pose higher risks to the investor.

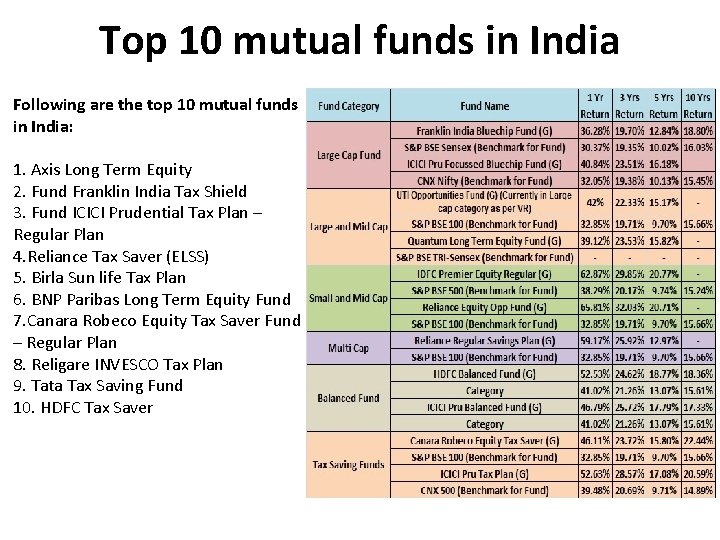

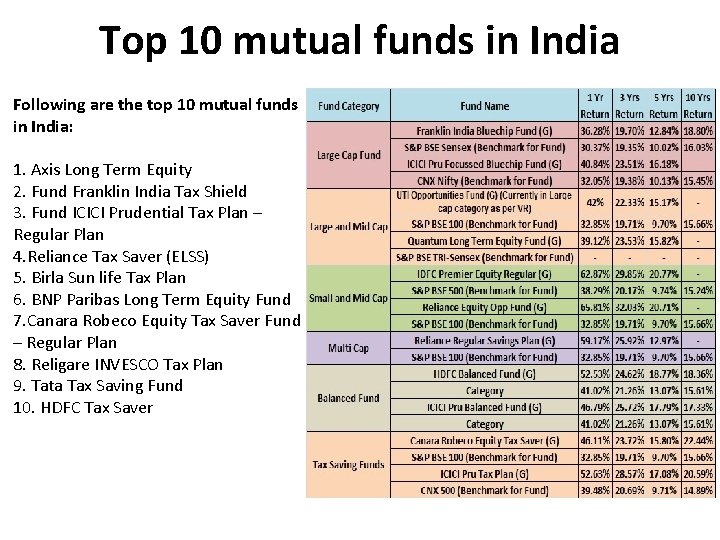

Top 10 mutual funds in India Following are the top 10 mutual funds in India: 1. Axis Long Term Equity 2. Fund Franklin India Tax Shield 3. Fund ICICI Prudential Tax Plan – Regular Plan 4. Reliance Tax Saver (ELSS) 5. Birla Sun life Tax Plan 6. BNP Paribas Long Term Equity Fund 7. Canara Robeco Equity Tax Saver Fund – Regular Plan 8. Religare INVESCO Tax Plan 9. Tata Tax Saving Fund 10. HDFC Tax Saver

Scheme selection Selecting investment product for investors 1. Performance Ranking 2. Ratio analysis 3. Total expense ratio 4. Fund manager tenure and experience 5. Scheme asset size The sequence of decision making in selecting a scheme is: Step 1 – Deciding on the scheme category (based on asset allocation); Step 2 – Selecting a scheme within the category; Step 3 – Selecting the right option within the scheme.

Recommendation for model portfolio & financial plans Risk profiling: Risk profiling is an approach to understand the risk appetite of investors - an essential pre-requisite to advise investors on their investments. The investment advice is dependent on understanding both aspects of risk: • Risk appetite of the investor • Risk level of the investment options being considered 2. Asset allocation: It s the approach of spreading one’s investments 3. Model portfolio: between multiple asset classes to diversify the underlying risk. Young call centre / BPO employee with no dependents 50% diversified equity schemes (preferably through SIP); 20% sector funds; 10% gold ETF, 10% diversified debt fund, 10% liquid schemes. Young married single income family with two school going kids 35% diversified equity schemes; 10% sector funds; 15% gold ETF, 30% diversified debt fund, 10% liquid schemes. Single income family with grown up children who are yet to settle down 35% diversified equity schemes; 15% gold ETF, 15% gilt fund, 15% diversified debt fund, 20% liquid schemes. Couple in their seventies, with no immediate family support 15% diversified equity index scheme; 10% gold , ETF, 30% gilt fund, 30% diversified debt fund, 15% liquid schemes.

THE END