International Accounting 7e Frederick D S Choi Gary

- Slides: 20

International Accounting, 7/e Frederick D. S. Choi Gary K. Meek Chapter 3: Comparative Accounting: Europe Choi/Meek, 7/e 1

Learning Objectives l l Understand how financial reporting is regulated and enforced in five European countries: France, Germany, the Czech Republic, the Netherlands, and the U. K. Describe the key similarities and differences between the accounting systems of these five countries. Identify the use of International Financial Reporting Standards at the levels of the individual company and the consolidated financial statements in these five countries. Describe the audit-oversight mechanisms in these five countries. Choi/Meek, 7/e 2

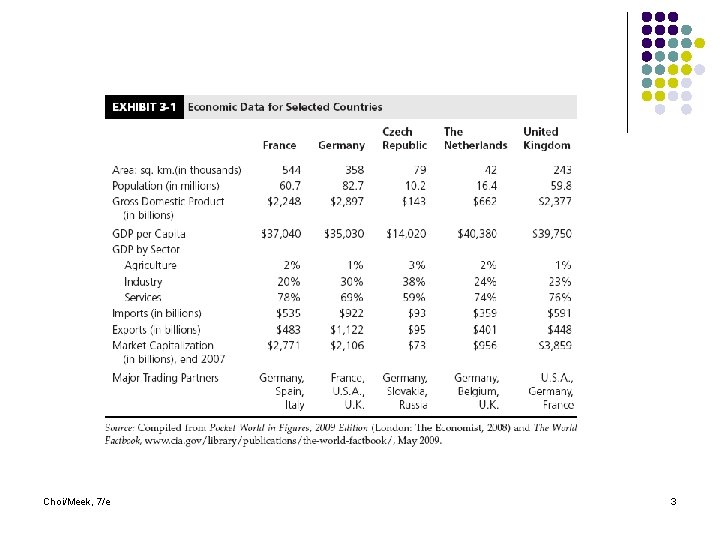

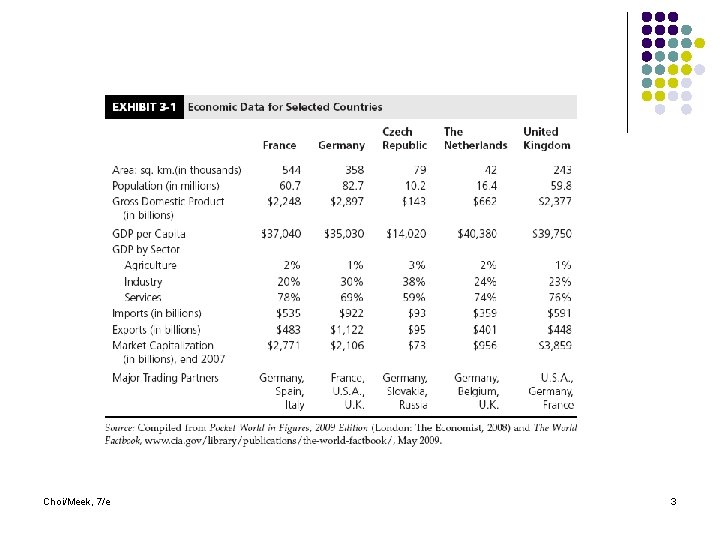

Choi/Meek, 7/e 3

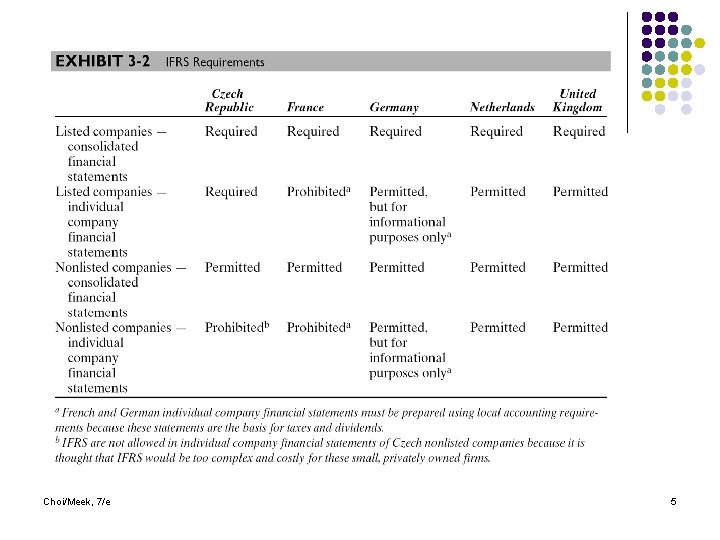

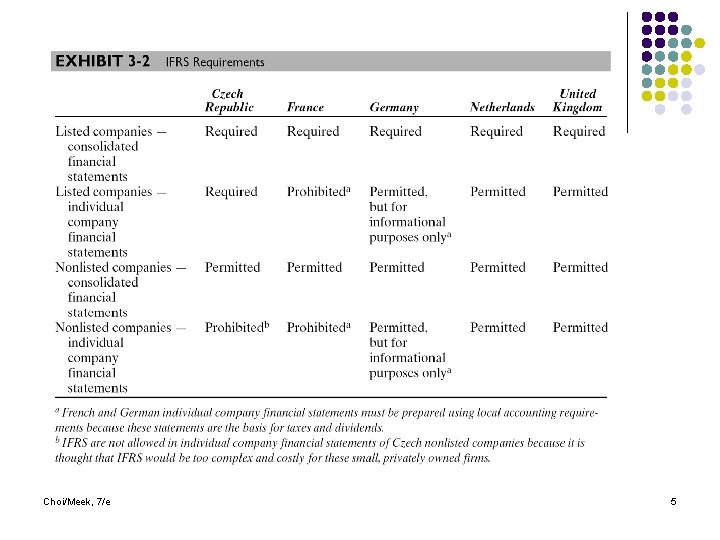

IFRS in the European Union l l l Starting in 2005, all EU-listed companies must follow IFRS in their consolidated financial statements. Generally, IFRS consolidated statements are permitted for non-listed companies. Requirements for individual company financial statements vary – IFRS may be required, allowed, or prohibited. Choi/Meek, 7/e 4

Choi/Meek, 7/e 5

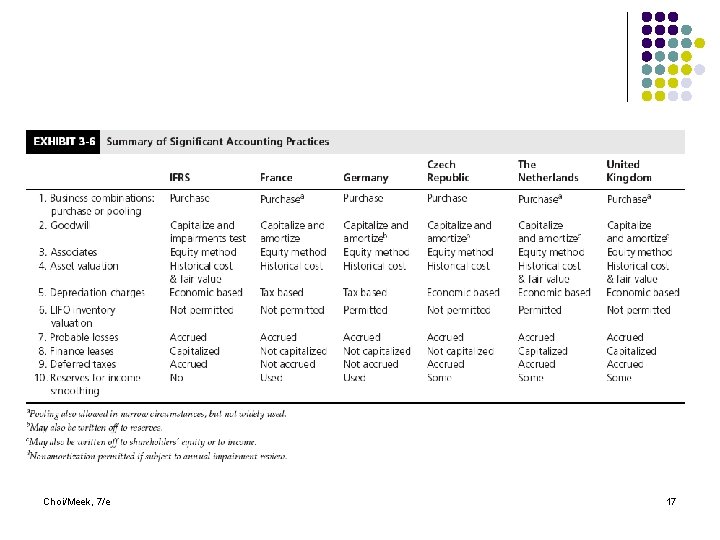

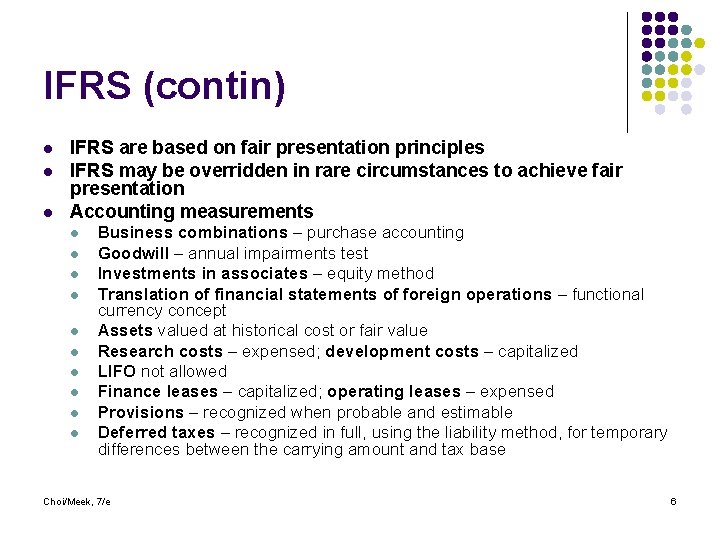

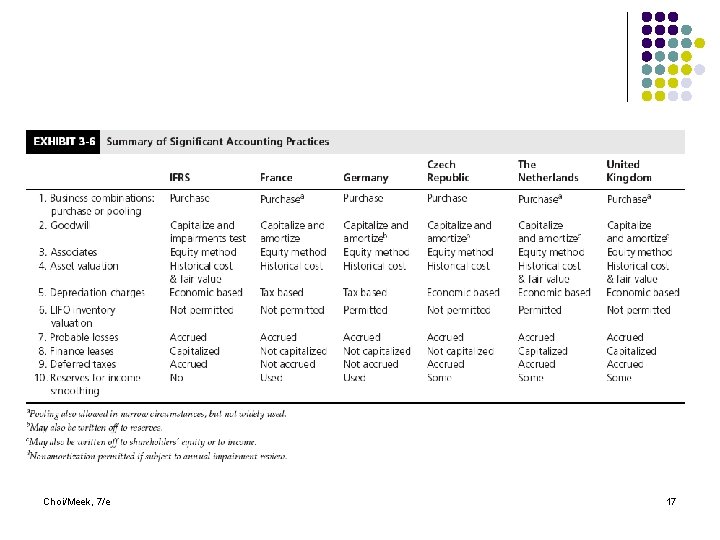

IFRS (contin) l l l IFRS are based on fair presentation principles IFRS may be overridden in rare circumstances to achieve fair presentation Accounting measurements l l l l l Business combinations – purchase accounting Goodwill – annual impairments test Investments in associates – equity method Translation of financial statements of foreign operations – functional currency concept Assets valued at historical cost or fair value Research costs – expensed; development costs – capitalized LIFO not allowed Finance leases – capitalized; operating leases – expensed Provisions – recognized when probable and estimable Deferred taxes – recognized in full, using the liability method, for temporary differences between the carrying amount and tax base Choi/Meek, 7/e 6

France l Overview l “The Plan” – national uniform chart of accounts (national accounting code) l l l Objectives and principles of financial reporting Definitions of elements Recognition and valuation rules Standardized chart of accounts Model financial statements Other influences on French accounting rules l l Choi/Meek, 7/e Commercial legislation (Code de Commerce) Tax laws 7

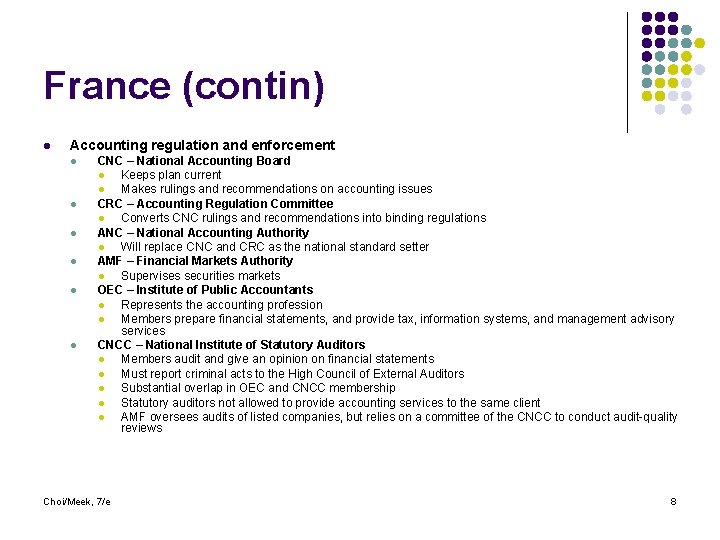

France (contin) l Accounting regulation and enforcement l l l CNC – National Accounting Board l Keeps plan current l Makes rulings and recommendations on accounting issues CRC – Accounting Regulation Committee l Converts CNC rulings and recommendations into binding regulations ANC – National Accounting Authority l Will replace CNC and CRC as the national standard setter AMF – Financial Markets Authority l Supervises securities markets OEC – Institute of Public Accountants l Represents the accounting profession l Members prepare financial statements, and provide tax, information systems, and management advisory services CNCC – National Institute of Statutory Auditors l Members audit and give an opinion on financial statements l Must report criminal acts to the High Council of External Auditors l Substantial overlap in OEC and CNCC membership l Statutory auditors not allowed to provide accounting services to the same client l AMF oversees audits of listed companies, but relies on a committee of the CNCC to conduct audit-quality reviews Choi/Meek, 7/e 8

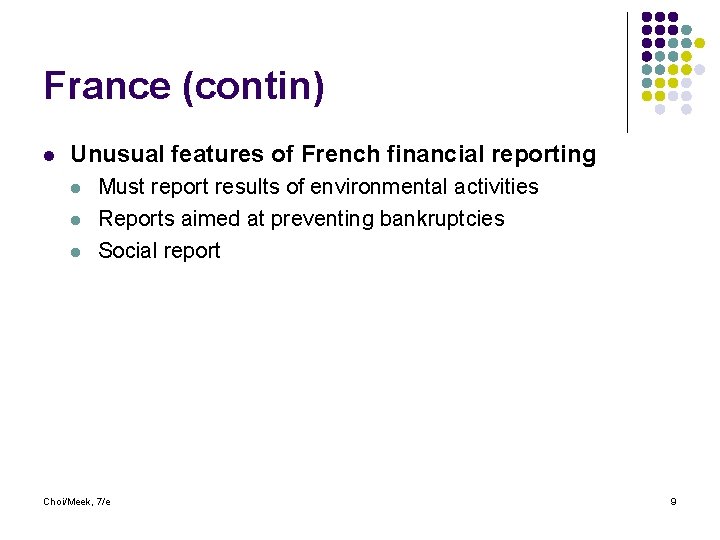

France (contin) l Unusual features of French financial reporting l l l Must report results of environmental activities Reports aimed at preventing bankruptcies Social report Choi/Meek, 7/e 9

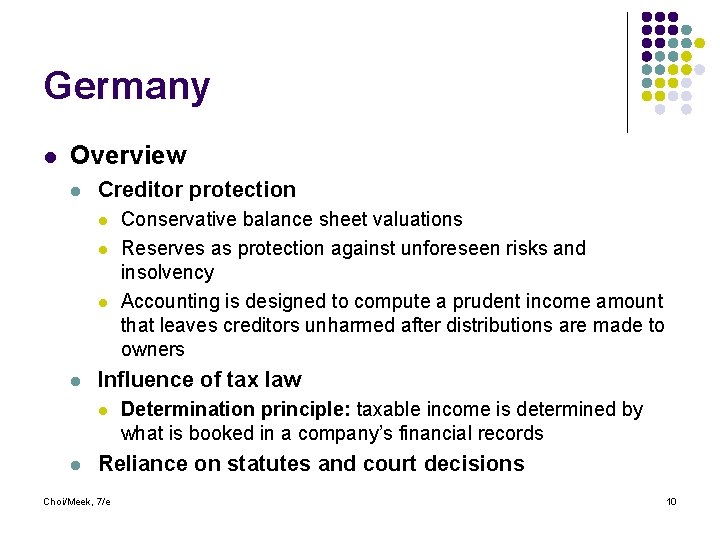

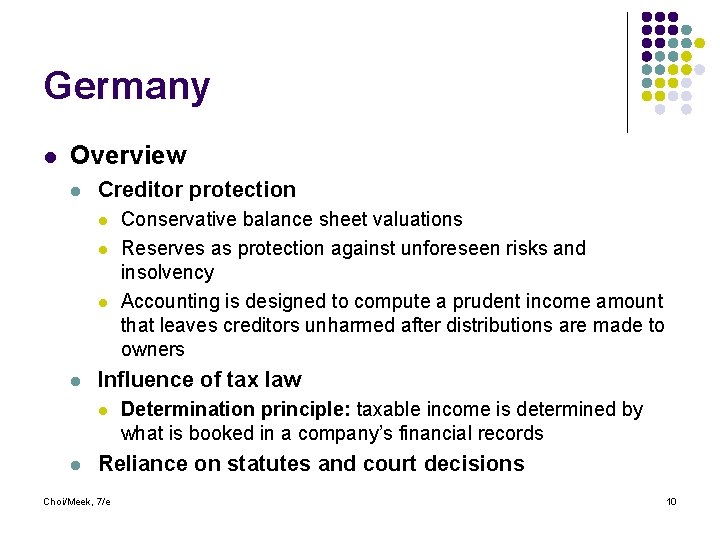

Germany l Overview l Creditor protection l l Influence of tax law l l Conservative balance sheet valuations Reserves as protection against unforeseen risks and insolvency Accounting is designed to compute a prudent income amount that leaves creditors unharmed after distributions are made to owners Determination principle: taxable income is determined by what is booked in a company’s financial records Reliance on statutes and court decisions Choi/Meek, 7/e 10

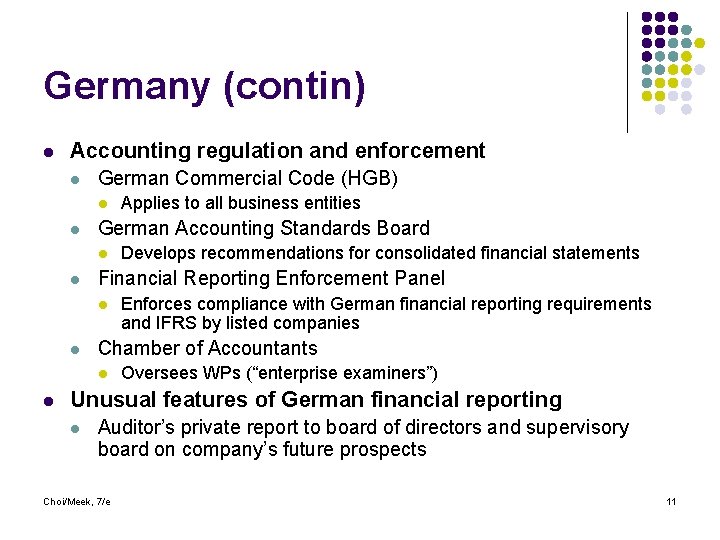

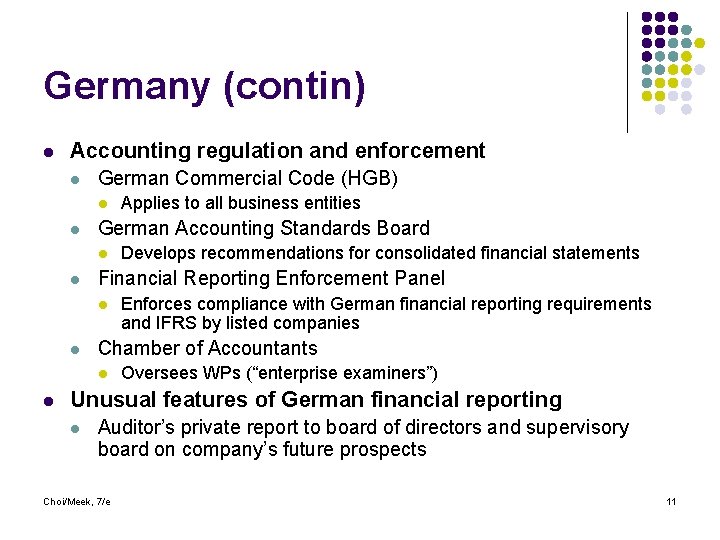

Germany (contin) l Accounting regulation and enforcement l German Commercial Code (HGB) l l German Accounting Standards Board l l Enforces compliance with German financial reporting requirements and IFRS by listed companies Chamber of Accountants l l Develops recommendations for consolidated financial statements Financial Reporting Enforcement Panel l l Applies to all business entities Oversees WPs (“enterprise examiners”) Unusual features of German financial reporting l Auditor’s private report to board of directors and supervisory board on company’s future prospects Choi/Meek, 7/e 11

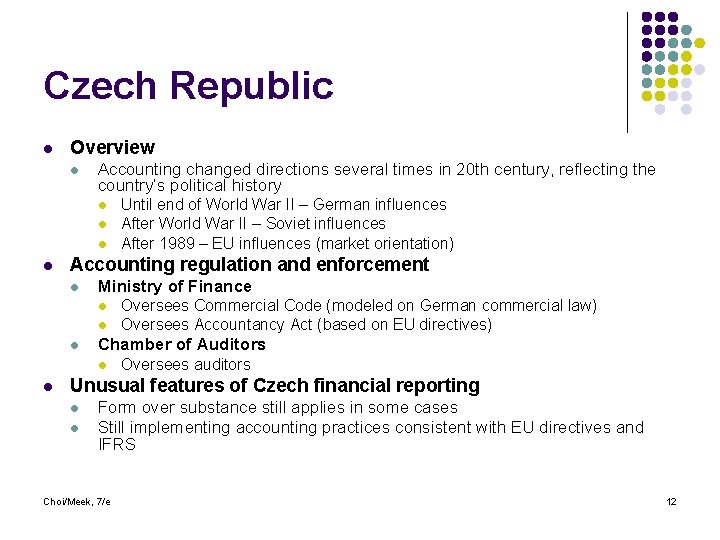

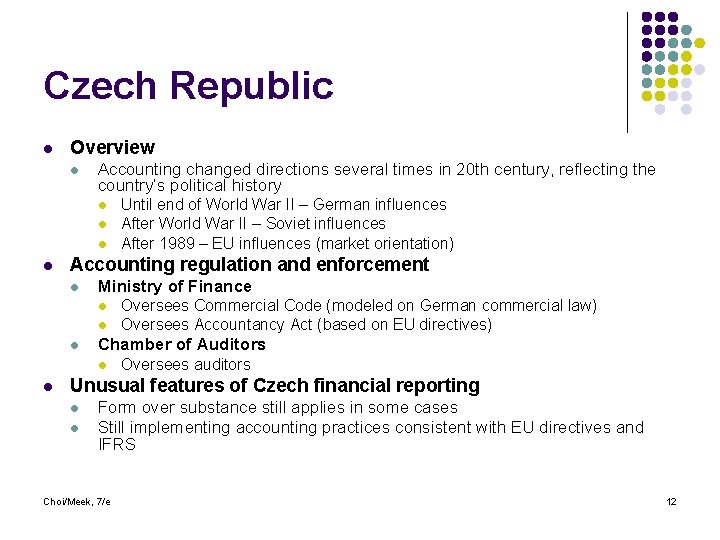

Czech Republic l Overview l Accounting changed directions several times in 20 th century, reflecting the country’s political history l l Accounting regulation and enforcement l Ministry of Finance l l l Oversees Commercial Code (modeled on German commercial law) Oversees Accountancy Act (based on EU directives) Chamber of Auditors l l Until end of World War II – German influences After World War II – Soviet influences After 1989 – EU influences (market orientation) Oversees auditors Unusual features of Czech financial reporting l l Form over substance still applies in some cases Still implementing accounting practices consistent with EU directives and IFRS Choi/Meek, 7/e 12

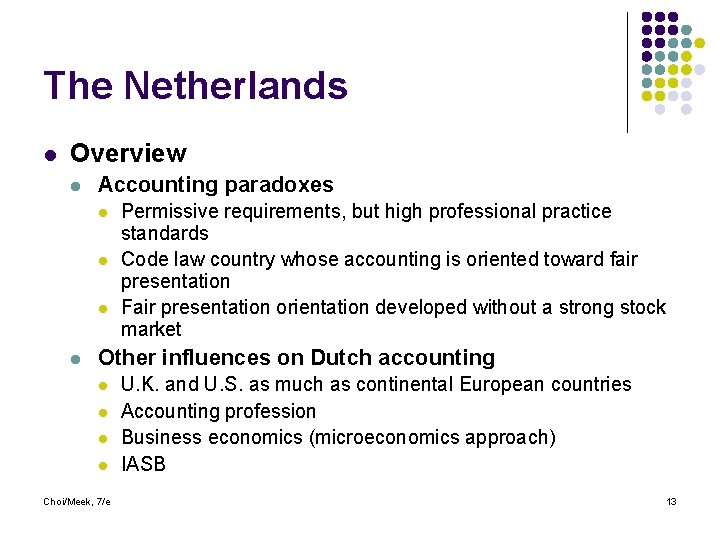

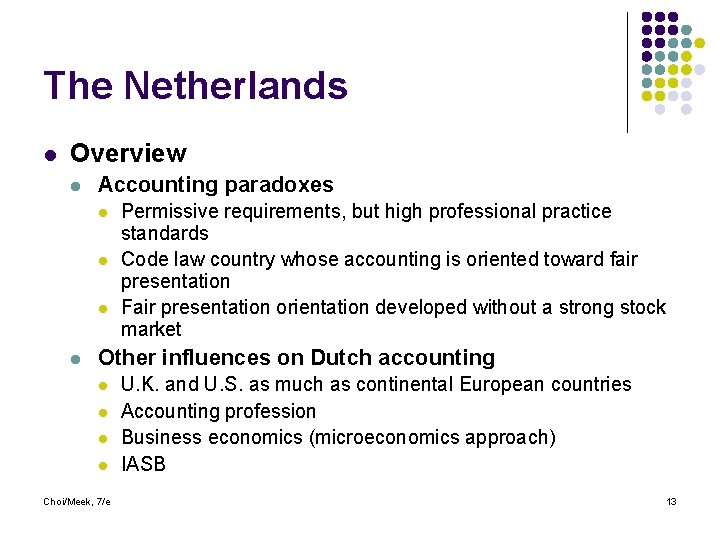

The Netherlands l Overview l Accounting paradoxes l l Permissive requirements, but high professional practice standards Code law country whose accounting is oriented toward fair presentation Fair presentation orientation developed without a strong stock market Other influences on Dutch accounting l l Choi/Meek, 7/e U. K. and U. S. as much as continental European countries Accounting profession Business economics (microeconomics approach) IASB 13

The Netherlands (contin) l Accounting regulation and enforcement l Company law – Act on Annual Financial Statements l Dutch Accounting Standards Board l l Netherlands Authority for the Financial Markets l l l Enforces compliance with accounting requirements NIv. RA l l Supervises operations of securities markets Oversees financial reporting and auditing of listed companies Enterprise Chamber l l Develops guidelines on generally acceptable accounting standards Oversees auditing profession Unusual features of Dutch financial reporting l Financial statements may be in Dutch, French, German, or English l Other than consolidated financial statements of Dutch listed companies, financial statements may be based on Dutch guidelines, IFRS, or a combination l Flexible accounting measurements l l Choi/Meek, 7/e Current values are permitted for tangible assets Opportunities for income smoothing 14

United Kingdom l Overview l Legacy of British accounting l l l Choi/Meek, 7/e First country to develop an accountancy profession Fair presentation (true and fair view) Exported British accounting around the world 15

United Kingdom (contin) l Accounting regulation and enforcement l Companies Act l l Broad financial reporting framework Financial Reporting Council oversees: l Accounting Standards Board § § l Auditing Practices Board § l Enforces compliance with FRSs Professional Oversight Board § § § l Issues auditing standards Financial Reporting Review Panel § l Issues Financial Reporting Standards (FRSs) UITF clarifies FRSs Oversees auditing profession Audit Inspection Unit § Monitors the audit of listed companies Accountancy Investigation and Discipline Board § Investigates and disciplines accountants for professional misconduct Unusual features of British accounting l True and fair override Choi/Meek, 7/e 16

Choi/Meek, 7/e 17

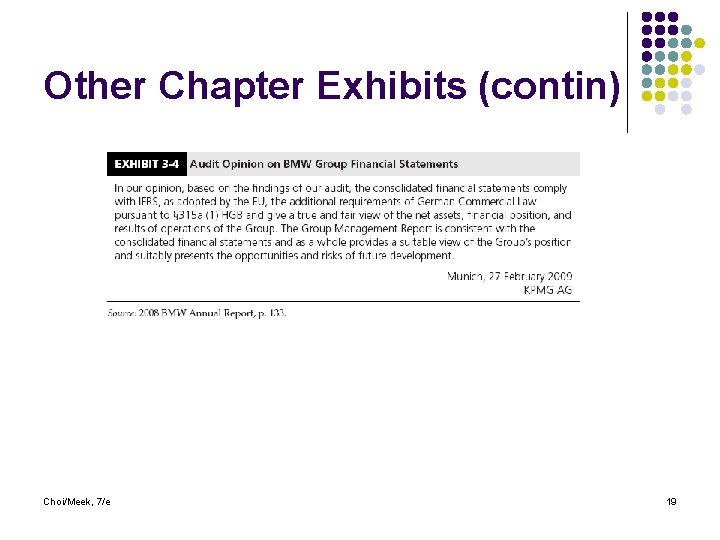

Other Chapter Exhibits Choi/Meek, 7/e 18

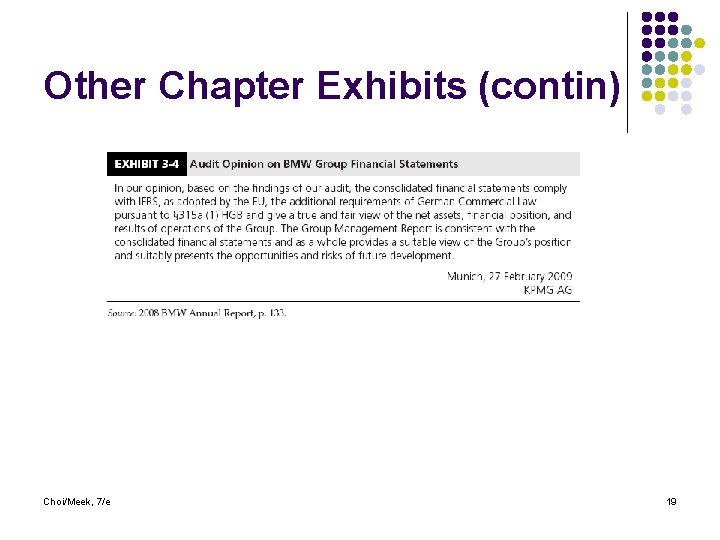

Other Chapter Exhibits (contin) Choi/Meek, 7/e 19

Other Chapter Exhibits (contin) Choi/Meek, 7/e 20

3tun

3tun Những đêm đông khi cơn giông vừa tắt

Những đêm đông khi cơn giông vừa tắt Chơi thử

Chơi thử Kevin choi md

Kevin choi md Mathcounts probability problems

Mathcounts probability problems Choi dae-hee

Choi dae-hee Reagan choi

Reagan choi Lạy chúa chí tôn xin dủ tình xót thương con

Lạy chúa chí tôn xin dủ tình xót thương con Kaitlyn choi

Kaitlyn choi Cùng vui chơi

Cùng vui chơi Choi sookyung

Choi sookyung Wesley choi

Wesley choi Bài tập về chơi chữ

Bài tập về chơi chữ Choi sungjoon

Choi sungjoon đi nhà trẻ các bạn ơi cùng vui chơi

đi nhà trẻ các bạn ơi cùng vui chơi Kyuwon choi

Kyuwon choi Dr yun choi

Dr yun choi Trò chơi khuông nhạc bàn tay

Trò chơi khuông nhạc bàn tay Trò chơi xem kịch câm

Trò chơi xem kịch câm Kyuwon choi

Kyuwon choi Color 02202009

Color 02202009