INPUTOUTPUT STRUCTURE OF THE CANADIAN ECONOMY DLI Ontario

- Slides: 50

INPUT-OUTPUT: STRUCTURE OF THE CANADIAN ECONOMY DLI Ontario Training Guelph University, Guelph, ON April 11, 2006 Ronald Rioux Industry Accounts Division Statistics Canada

2

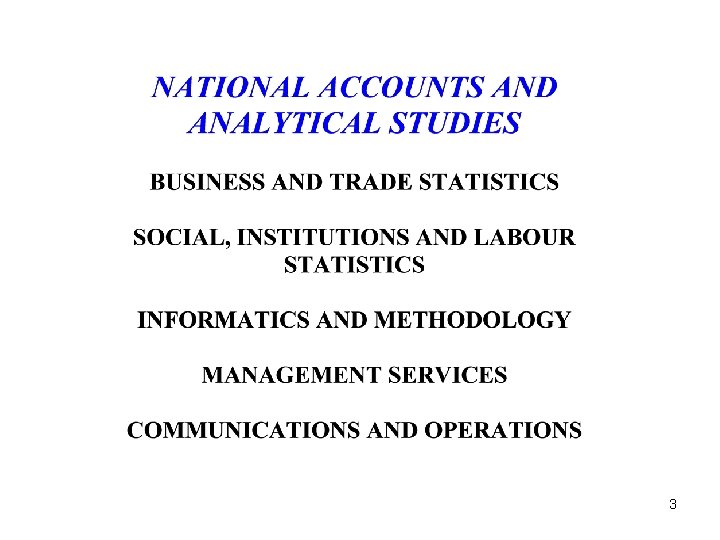

3

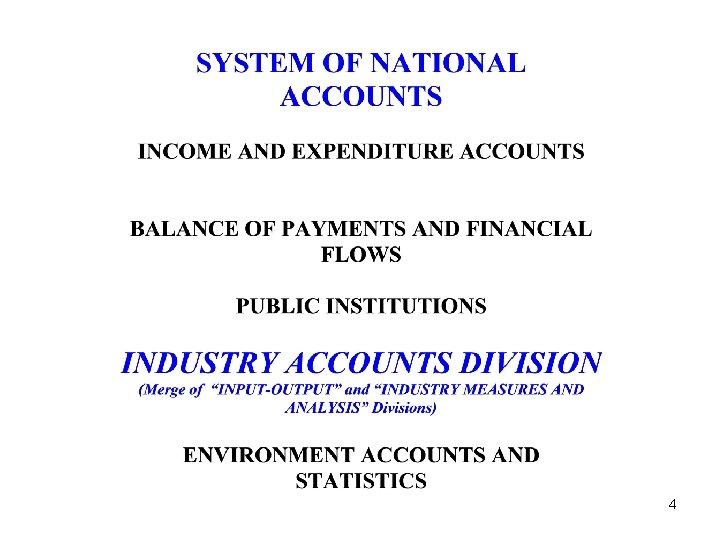

4

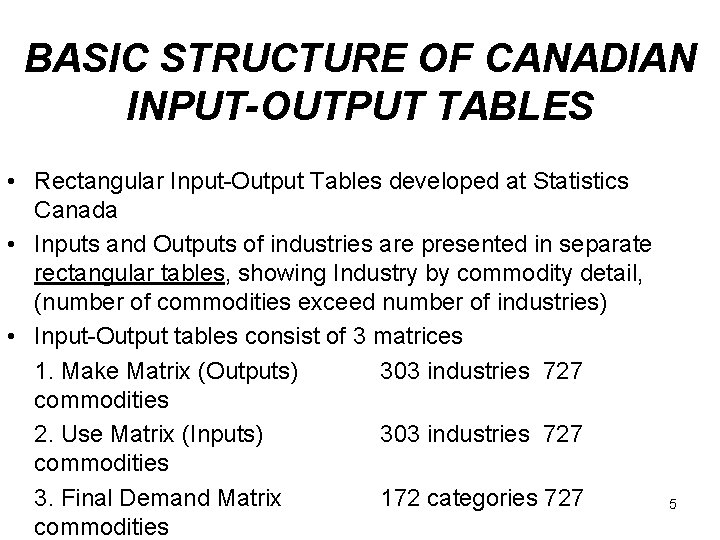

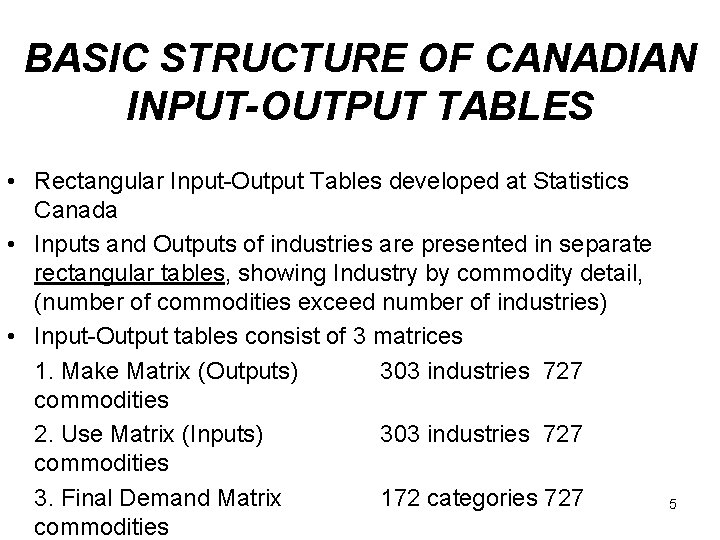

BASIC STRUCTURE OF CANADIAN INPUT-OUTPUT TABLES • Rectangular Input-Output Tables developed at Statistics Canada • Inputs and Outputs of industries are presented in separate rectangular tables, showing Industry by commodity detail, (number of commodities exceed number of industries) • Input-Output tables consist of 3 matrices 1. Make Matrix (Outputs) 303 industries 727 commodities 2. Use Matrix (Inputs) 303 industries 727 commodities 3. Final Demand Matrix 172 categories 727 commodities 5

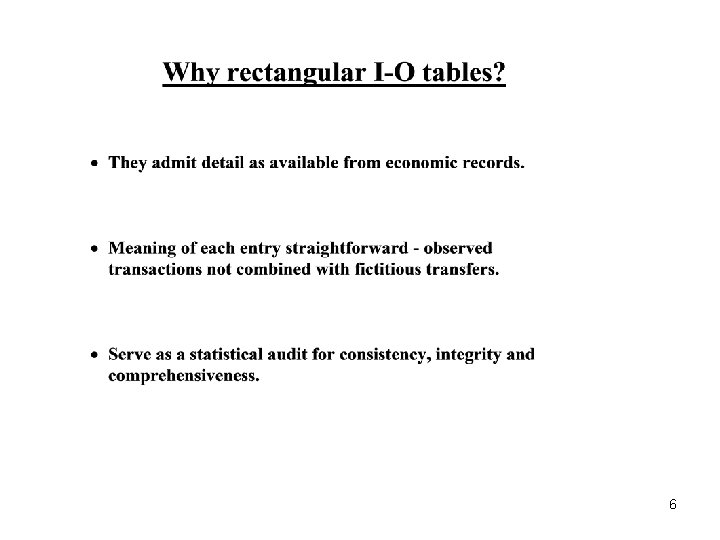

6

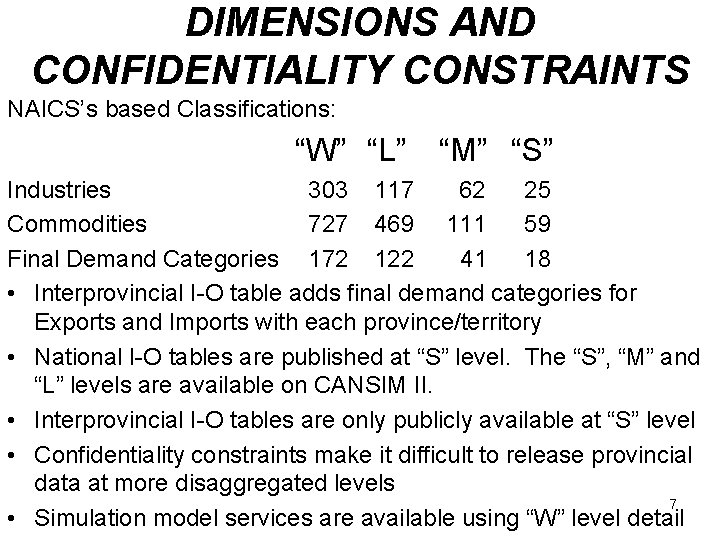

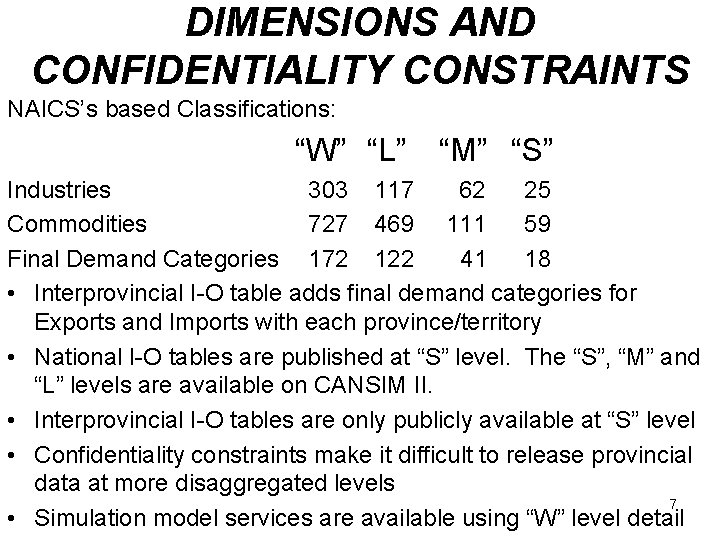

DIMENSIONS AND CONFIDENTIALITY CONSTRAINTS NAICS’s based Classifications: “W” “L” “M” “S” Industries 303 117 62 25 Commodities 727 469 111 59 Final Demand Categories 172 122 41 18 • Interprovincial I-O table adds final demand categories for Exports and Imports with each province/territory • National I-O tables are published at “S” level. The “S”, “M” and “L” levels are available on CANSIM II. • Interprovincial I-O tables are only publicly available at “S” level • Confidentiality constraints make it difficult to release provincial data at more disaggregated levels 7 • Simulation model services are available using “W” level detail

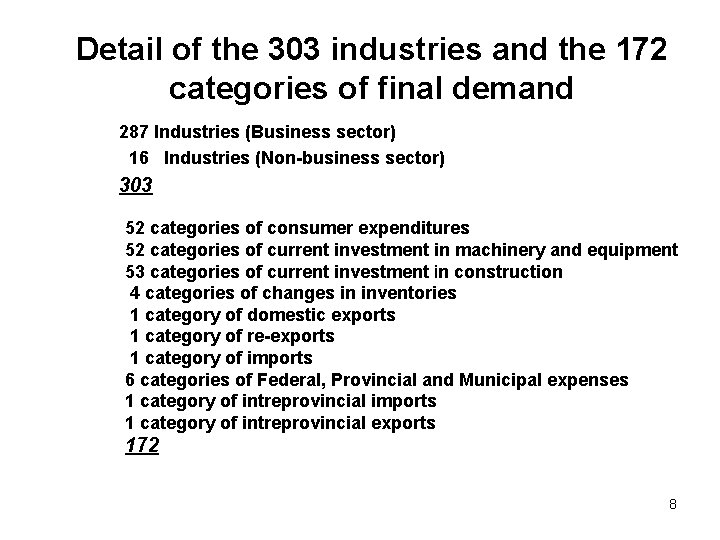

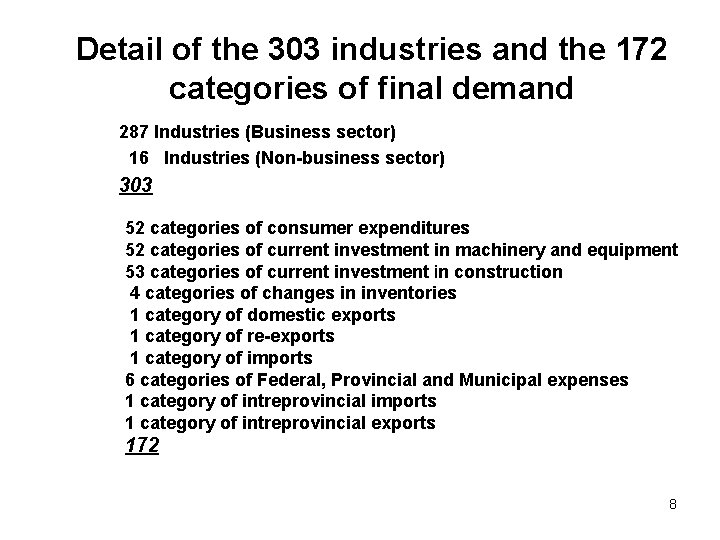

Detail of the 303 industries and the 172 categories of final demand 287 Industries (Business sector) 16 Industries (Non-business sector) 303 52 categories of consumer expenditures 52 categories of current investment in machinery and equipment 53 categories of current investment in construction 4 categories of changes in inventories 1 category of domestic exports 1 category of re-exports 1 category of imports 6 categories of Federal, Provincial and Municipal expenses 1 category of intreprovincial imports 1 category of intreprovincial exports 172 8

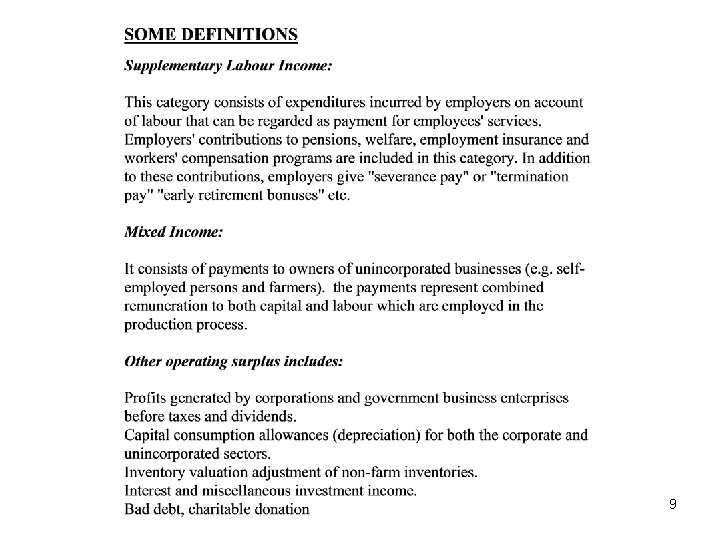

9

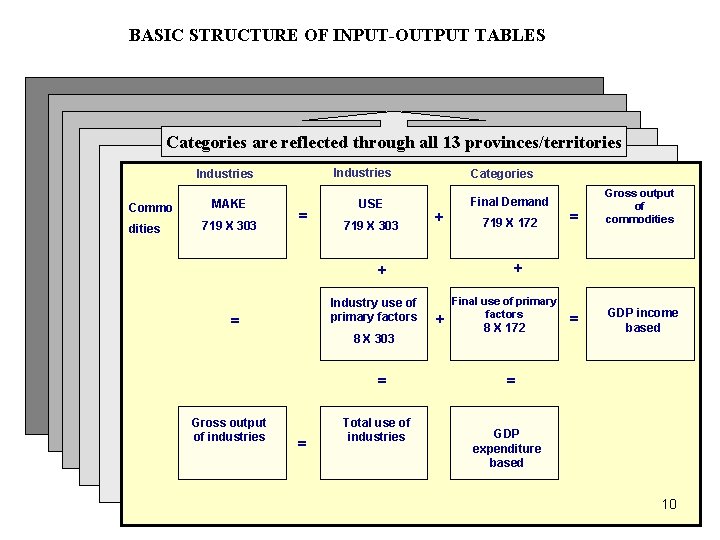

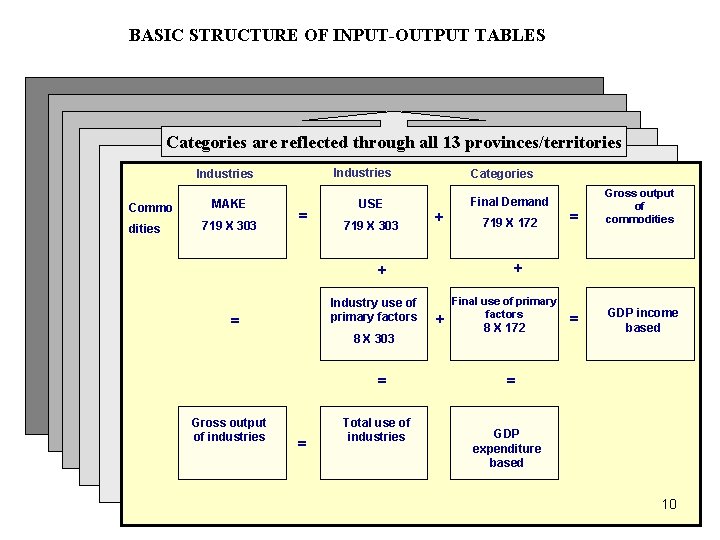

BASIC STRUCTURE OF INPUT-OUTPUT TABLES Categories are reflected through all 13 provinces/territories Industries Commo dities MAKE 719 X 303 = USE 719 X 303 Categories Final Demand + = 8 X 303 = Gross output of industries = Total use of industries = + + Industry use of primary factors 719 X 172 Gross output of commodities + Final use of primary factors 8 X 172 = GDP income based = GDP expenditure based 10

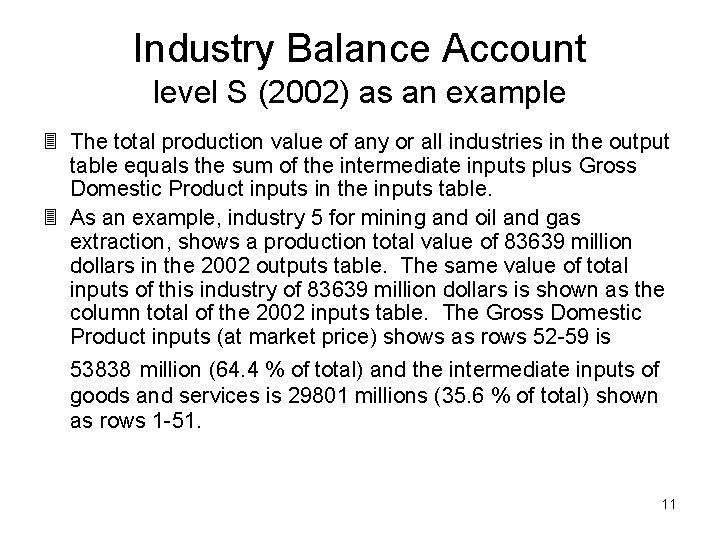

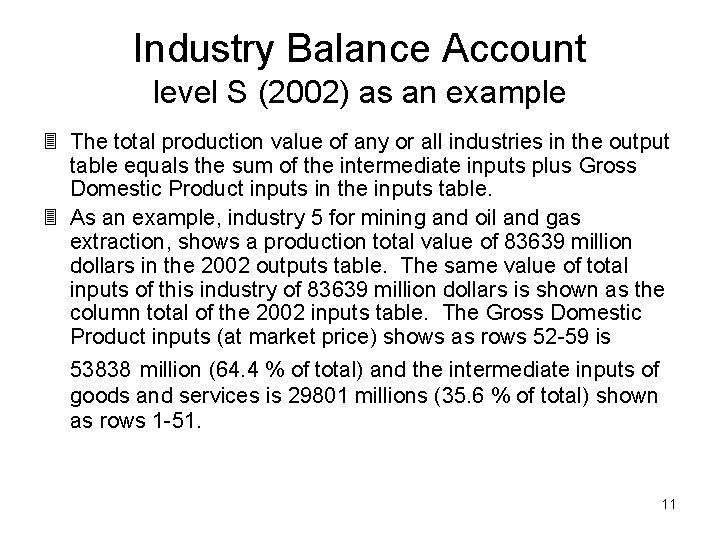

Industry Balance Account level S (2002) as an example 3 The total production value of any or all industries in the output table equals the sum of the intermediate inputs plus Gross Domestic Product inputs in the inputs table. 3 As an example, industry 5 for mining and oil and gas extraction, shows a production total value of 83639 million dollars in the 2002 outputs table. The same value of total inputs of this industry of 83639 million dollars is shown as the column total of the 2002 inputs table. The Gross Domestic Product inputs (at market price) shows as rows 52 -59 is 53838 million (64. 4 % of total) and the intermediate inputs of goods and services is 29801 millions (35. 6 % of total) shown as rows 1 -51. 11

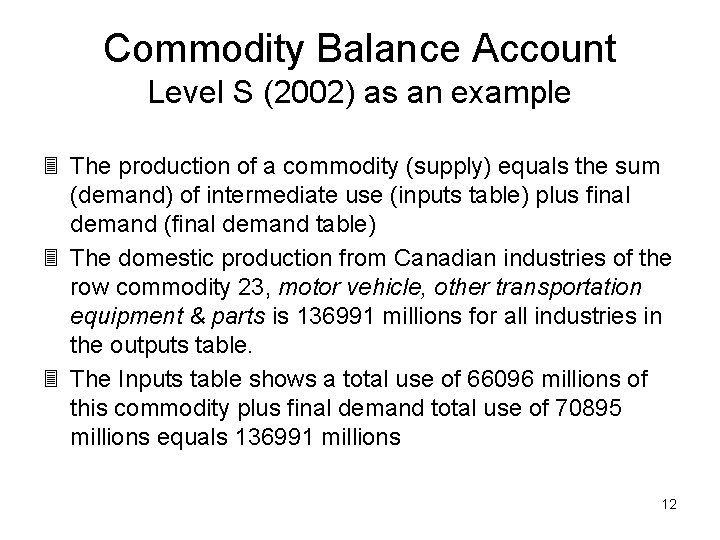

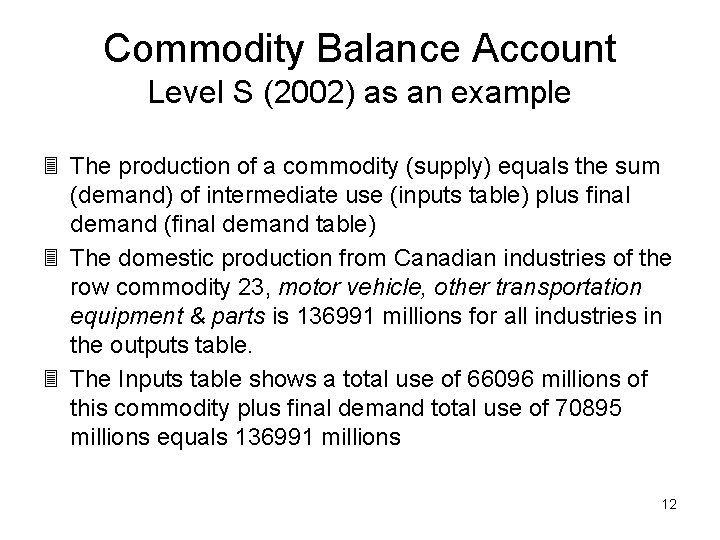

Commodity Balance Account Level S (2002) as an example 3 The production of a commodity (supply) equals the sum (demand) of intermediate use (inputs table) plus final demand (final demand table) 3 The domestic production from Canadian industries of the row commodity 23, motor vehicle, other transportation equipment & parts is 136991 millions for all industries in the outputs table. 3 The Inputs table shows a total use of 66096 millions of this commodity plus final demand total use of 70895 millions equals 136991 millions 12

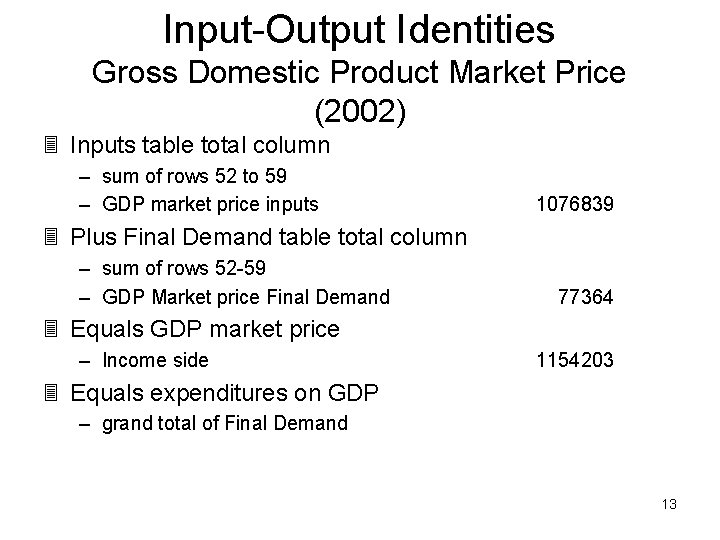

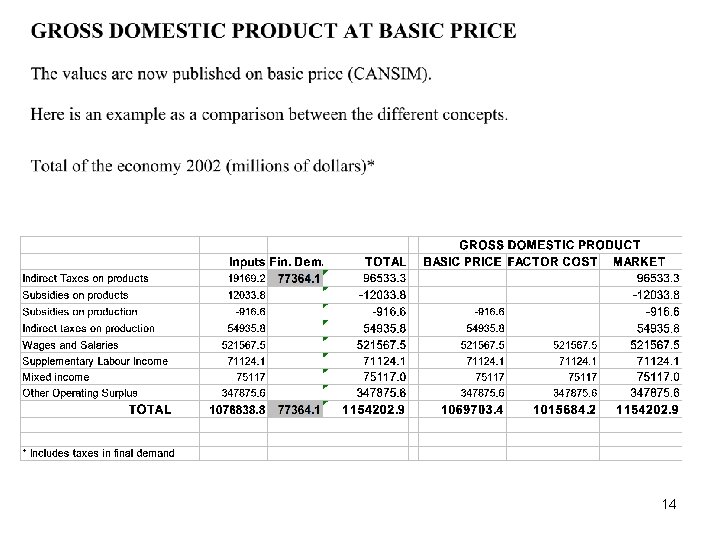

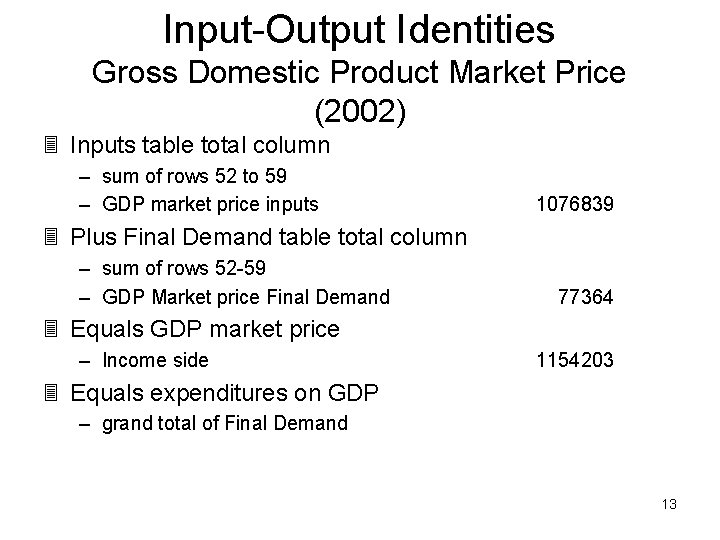

Input-Output Identities Gross Domestic Product Market Price (2002) 3 Inputs table total column – sum of rows 52 to 59 – GDP market price inputs 1076839 3 Plus Final Demand table total column – sum of rows 52 -59 – GDP Market price Final Demand 77364 3 Equals GDP market price – Income side 1154203 3 Equals expenditures on GDP – grand total of Final Demand 13

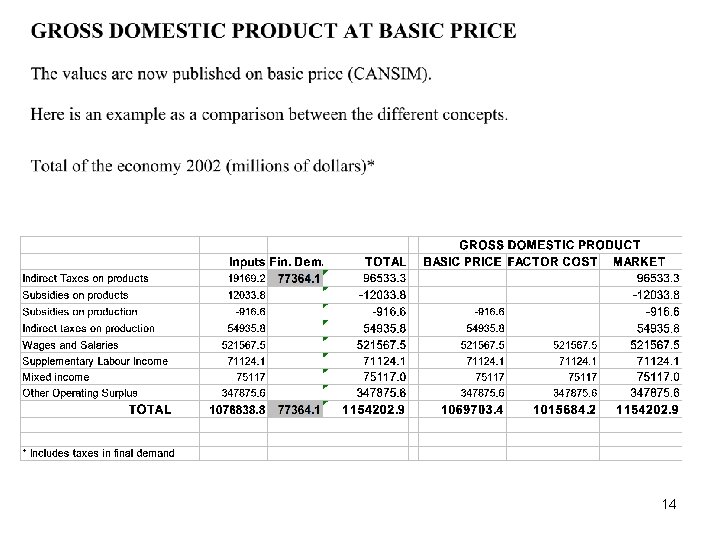

14

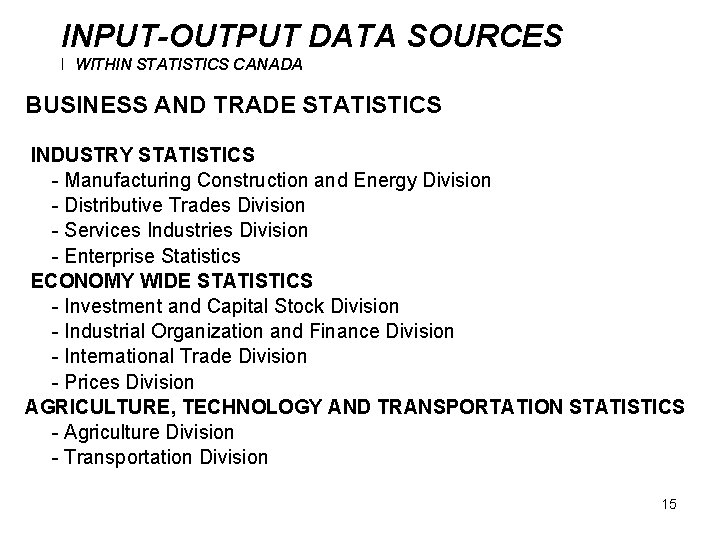

INPUT-OUTPUT DATA SOURCES I WITHIN STATISTICS CANADA BUSINESS AND TRADE STATISTICS INDUSTRY STATISTICS - Manufacturing Construction and Energy Division - Distributive Trades Division - Services Industries Division - Enterprise Statistics ECONOMY WIDE STATISTICS - Investment and Capital Stock Division - Industrial Organization and Finance Division - International Trade Division - Prices Division AGRICULTURE, TECHNOLOGY AND TRANSPORTATION STATISTICS - Agriculture Division - Transportation Division 15

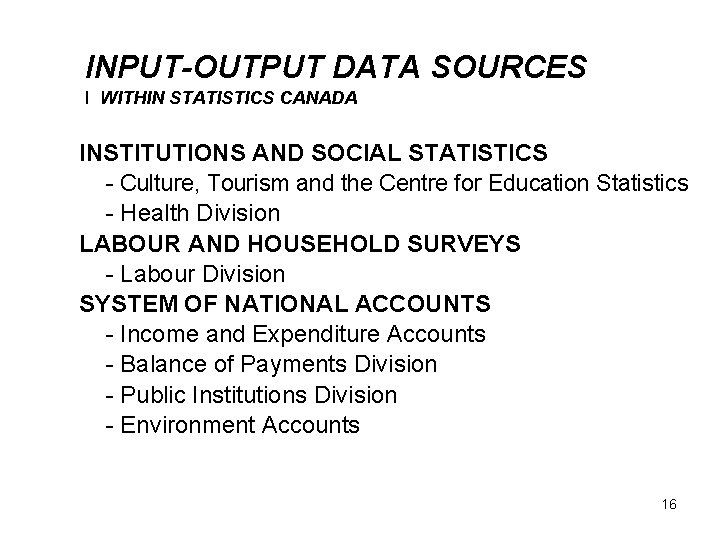

INPUT-OUTPUT DATA SOURCES I WITHIN STATISTICS CANADA INSTITUTIONS AND SOCIAL STATISTICS - Culture, Tourism and the Centre for Education Statistics - Health Division LABOUR AND HOUSEHOLD SURVEYS - Labour Division SYSTEM OF NATIONAL ACCOUNTS - Income and Expenditure Accounts - Balance of Payments Division - Public Institutions Division - Environment Accounts 16

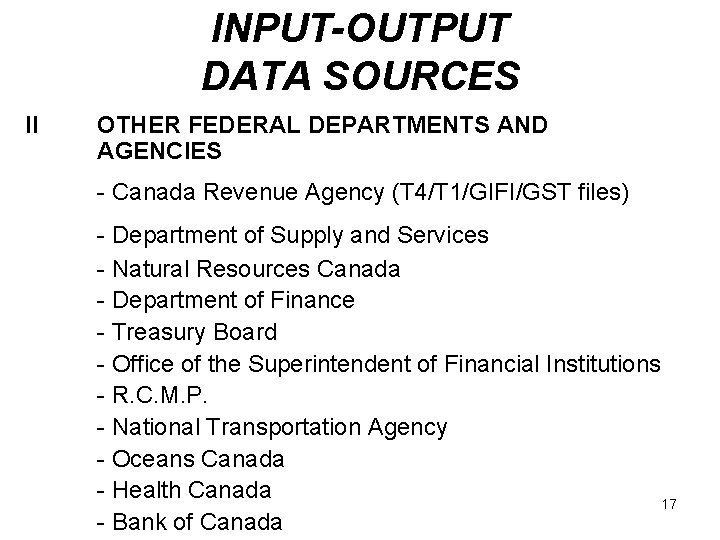

INPUT-OUTPUT DATA SOURCES II OTHER FEDERAL DEPARTMENTS AND AGENCIES - Canada Revenue Agency (T 4/T 1/GIFI/GST files) - Department of Supply and Services - Natural Resources Canada - Department of Finance - Treasury Board - Office of the Superintendent of Financial Institutions - R. C. M. P. - National Transportation Agency - Oceans Canada - Health Canada 17 - Bank of Canada

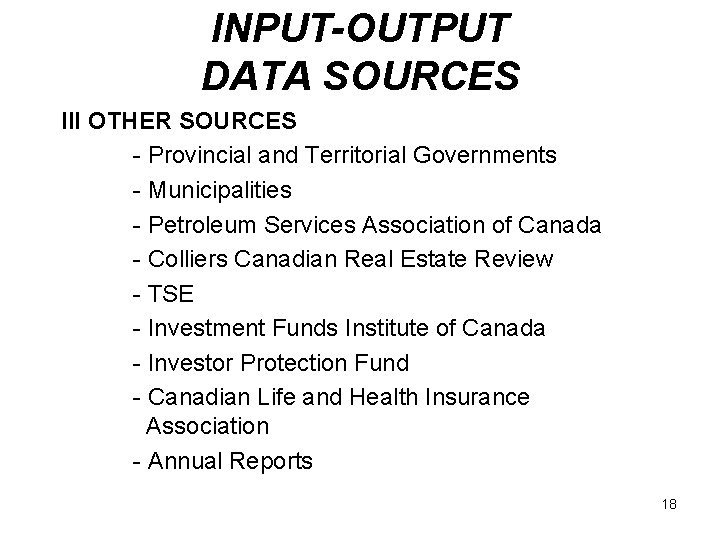

INPUT-OUTPUT DATA SOURCES III OTHER SOURCES - Provincial and Territorial Governments - Municipalities - Petroleum Services Association of Canada - Colliers Canadian Real Estate Review - TSE - Investment Funds Institute of Canada - Investor Protection Fund - Canadian Life and Health Insurance Association - Annual Reports 18

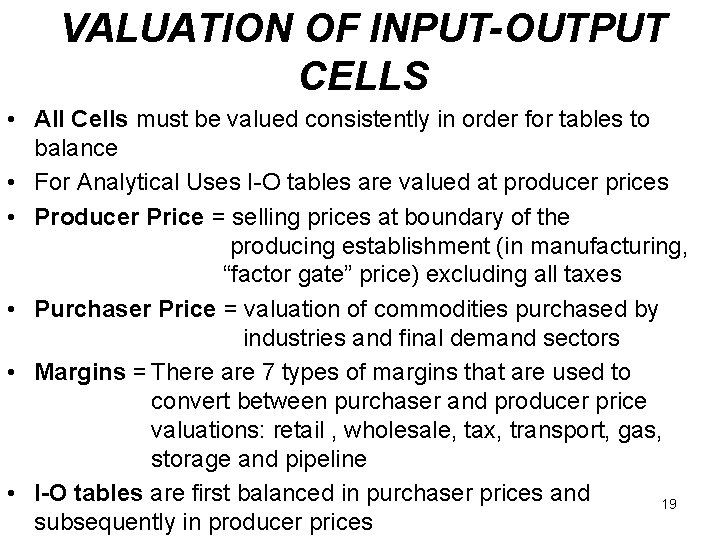

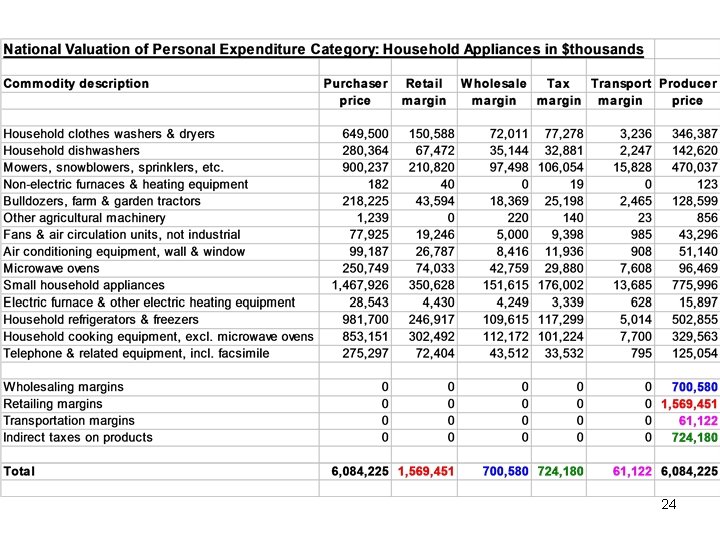

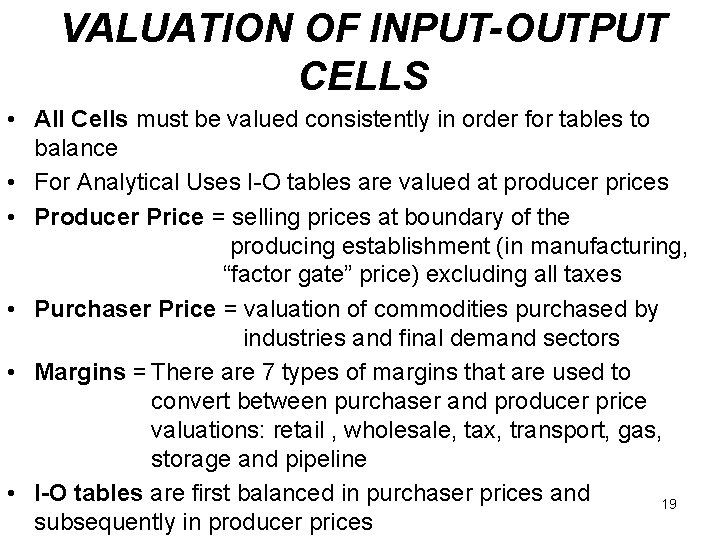

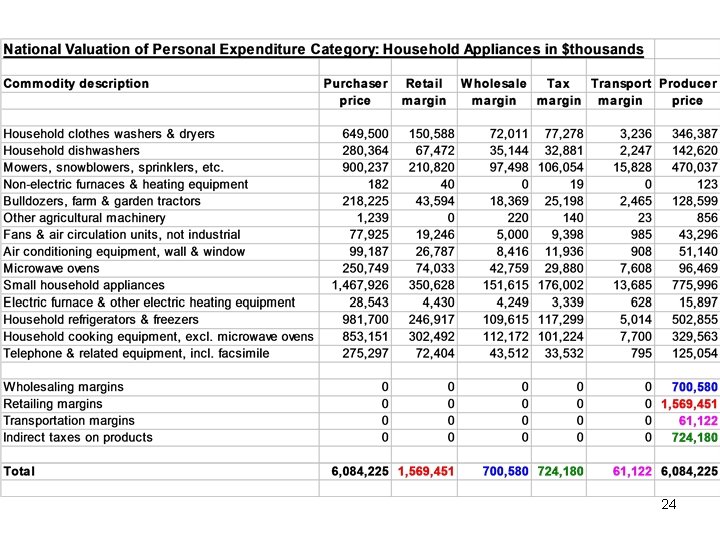

VALUATION OF INPUT-OUTPUT CELLS • All Cells must be valued consistently in order for tables to balance • For Analytical Uses I-O tables are valued at producer prices • Producer Price = selling prices at boundary of the producing establishment (in manufacturing, “factor gate” price) excluding all taxes • Purchaser Price = valuation of commodities purchased by industries and final demand sectors • Margins = There are 7 types of margins that are used to convert between purchaser and producer price valuations: retail , wholesale, tax, transport, gas, storage and pipeline • I-O tables are first balanced in purchaser prices and 19 subsequently in producer prices

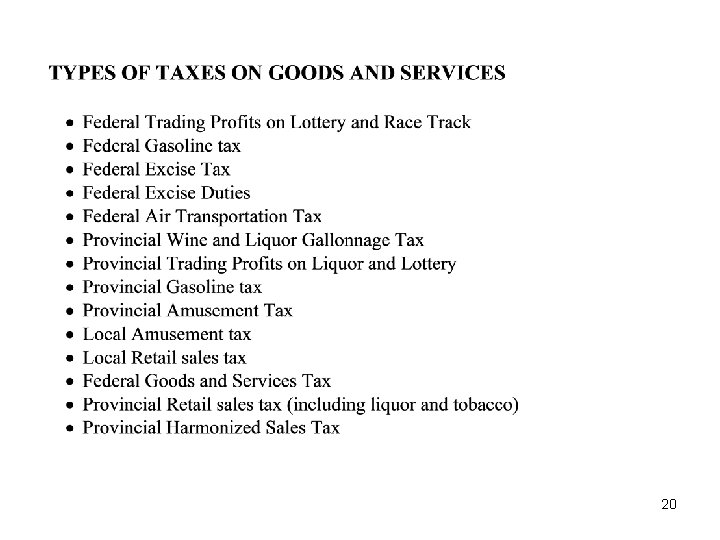

20

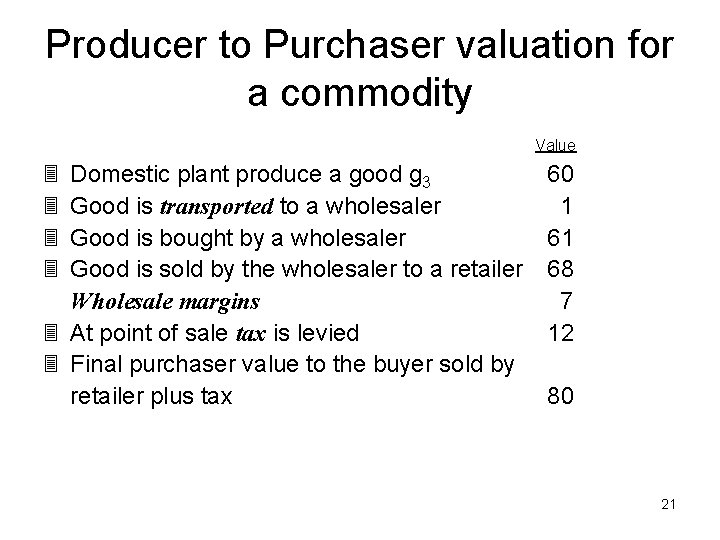

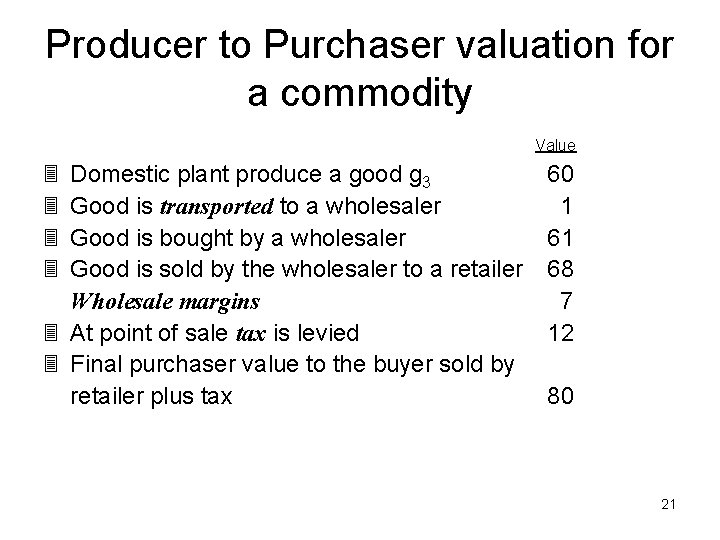

Producer to Purchaser valuation for a commodity Value 3 3 Domestic plant produce a good g 3 Good is transported to a wholesaler Good is bought by a wholesaler Good is sold by the wholesaler to a retailer Wholesale margins 3 At point of sale tax is levied 3 Final purchaser value to the buyer sold by retailer plus tax 60 1 61 68 7 12 80 21

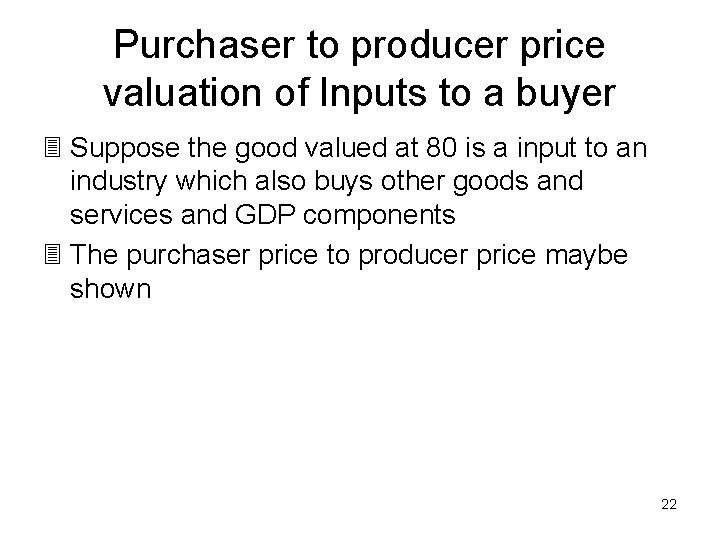

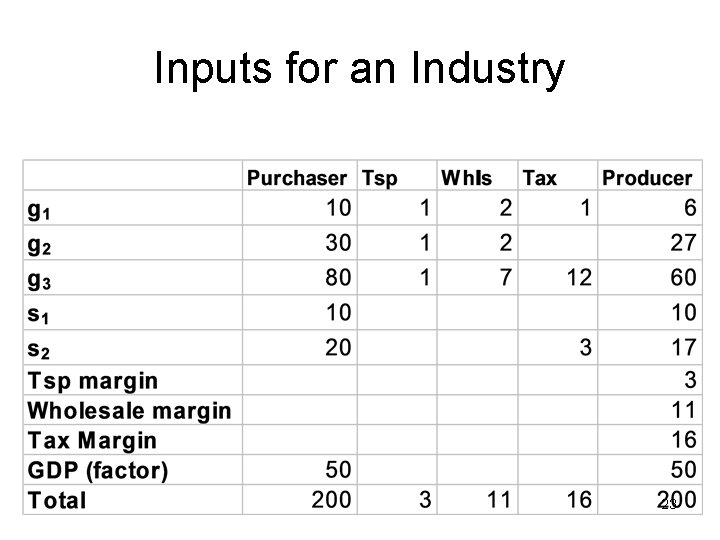

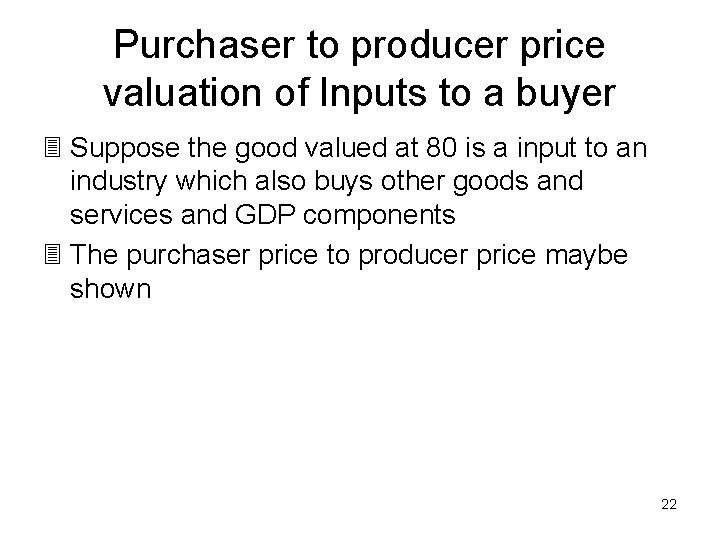

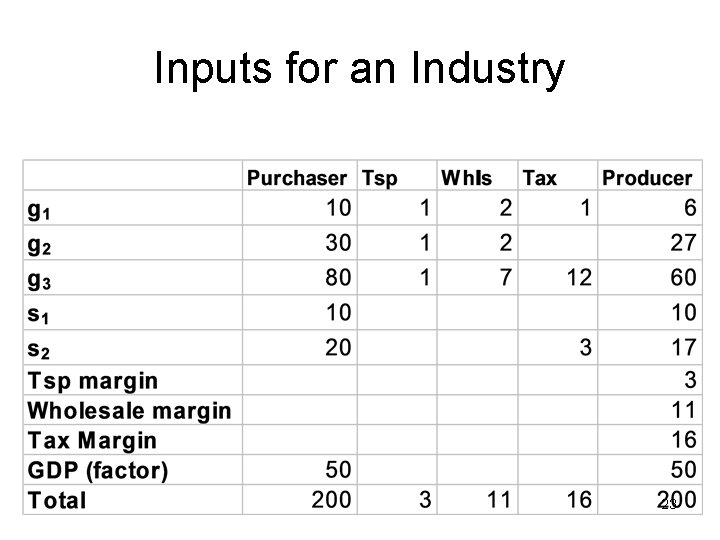

Purchaser to producer price valuation of Inputs to a buyer 3 Suppose the good valued at 80 is a input to an industry which also buys other goods and services and GDP components 3 The purchaser price to producer price maybe shown 22

Inputs for an Industry 23

24

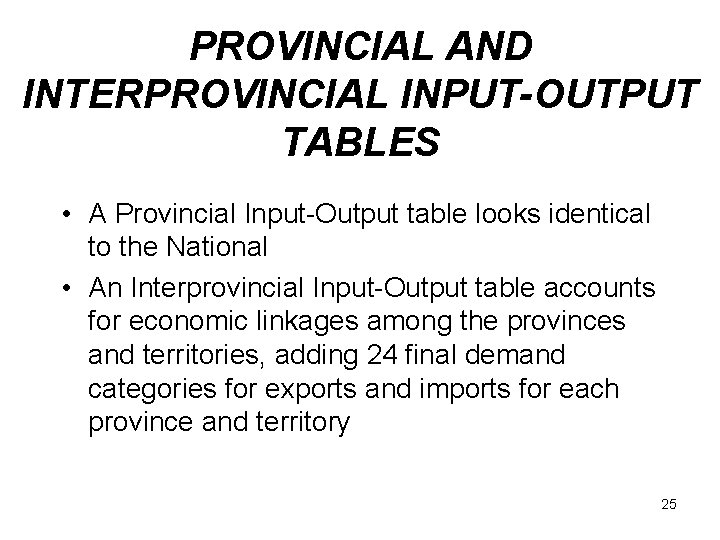

PROVINCIAL AND INTERPROVINCIAL INPUT-OUTPUT TABLES • A Provincial Input-Output table looks identical to the National • An Interprovincial Input-Output table accounts for economic linkages among the provinces and territories, adding 24 final demand categories for exports and imports for each province and territory 25

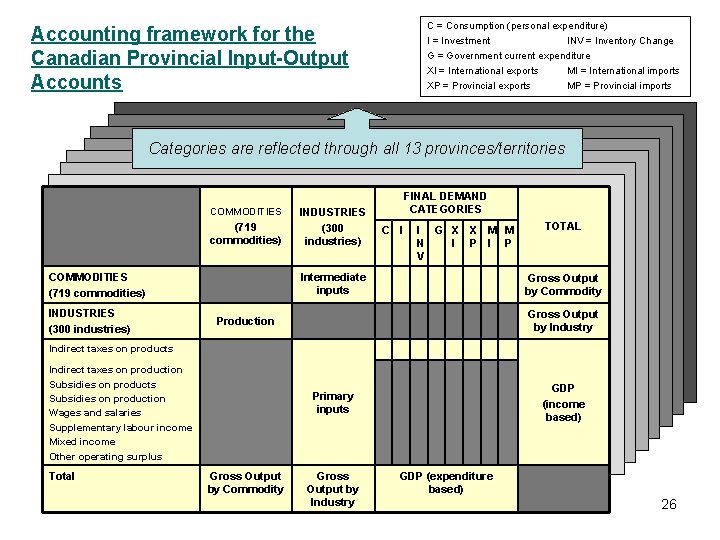

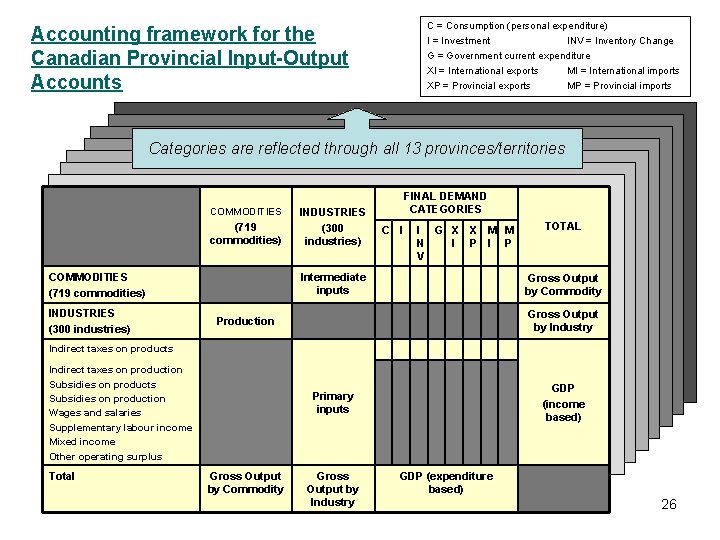

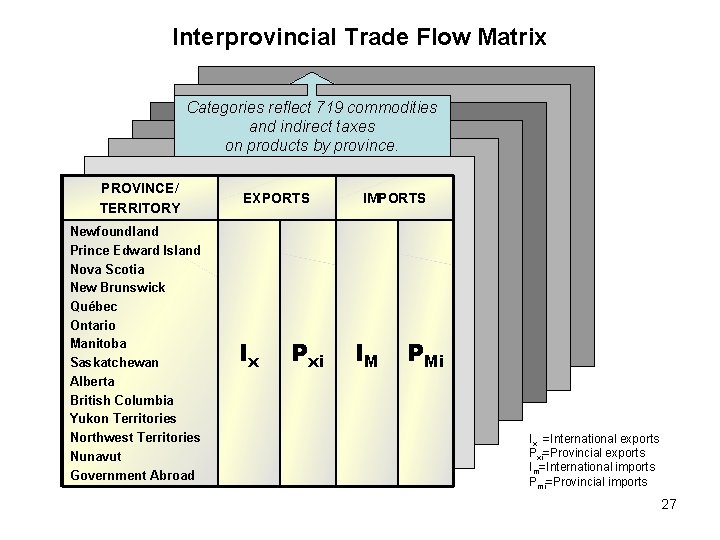

C = Consumption (personal expenditure) Accounting framework for the Canadian Provincial Input-Output Accounts I = Investment INV = Inventory Change G = Government current expenditure XI = International exports MI = International imports XP = Provincial exports MP = Provincial imports Categories are reflected through all 13 provinces/territories COMMODITIES (719 commodities) INDUSTRIES (300 industries) FINAL DEMAND CATEGORIES C I I G X X M M N I P V Intermediate inputs TOTAL Gross Output by Commodity Gross Output by Industry Production Indirect taxes on products Indirect taxes on production Subsidies on products Subsidies on production Wages and salaries Supplementary labour income Mixed income Other operating surplus Total GDP (income based) Primary inputs Gross Output by Commodity Gross Output by Industry GDP (expenditure based) 26

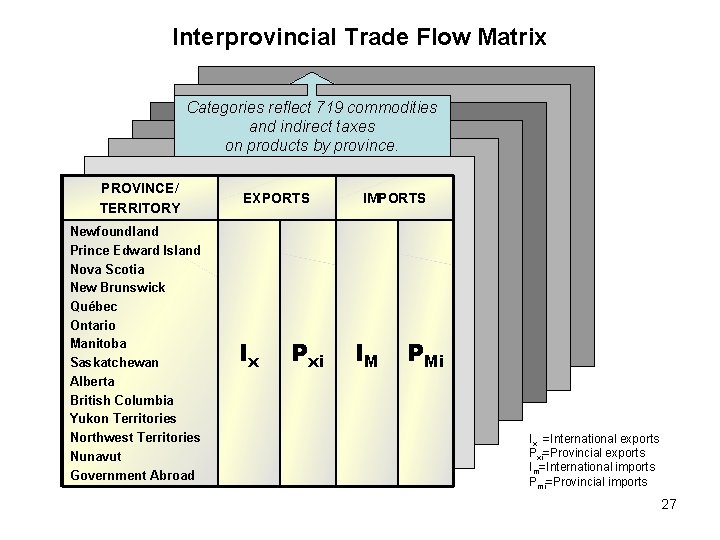

Interprovincial Trade Flow Matrix Categories reflect 719 commodities and indirect taxes on products by province. PROVINCE/ TERRITORY Newfoundland Prince Edward Island Nova Scotia New Brunswick Québec Ontario Manitoba Saskatchewan Alberta British Columbia Yukon Territories Northwest Territories Nunavut Government Abroad EXPORTS Ix Pxi IMPORTS IM PMi Ix =International exports Pxi=Provincial exports Im=International imports Pmi=Provincial imports 27

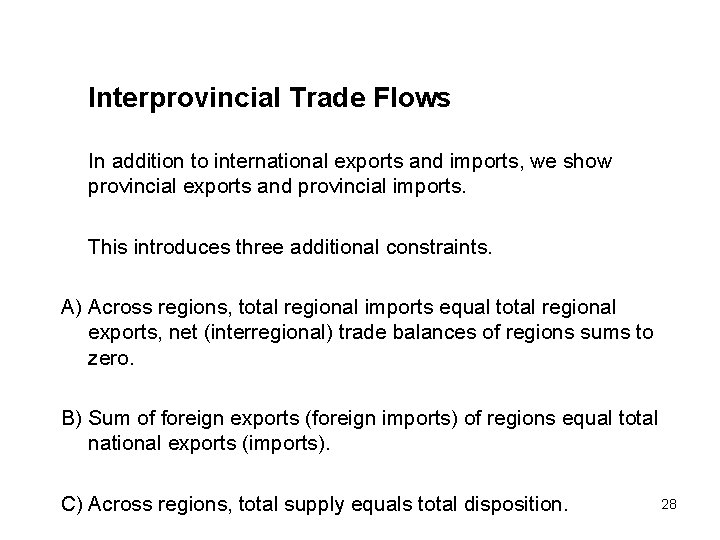

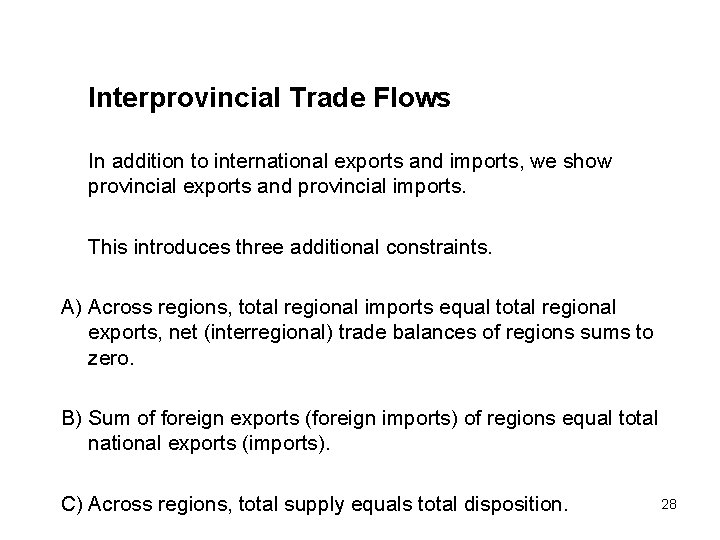

Interprovincial Trade Flows In addition to international exports and imports, we show provincial exports and provincial imports. This introduces three additional constraints. A) Across regions, total regional imports equal total regional exports, net (interregional) trade balances of regions sums to zero. B) Sum of foreign exports (foreign imports) of regions equal total national exports (imports). C) Across regions, total supply equals total disposition. 28

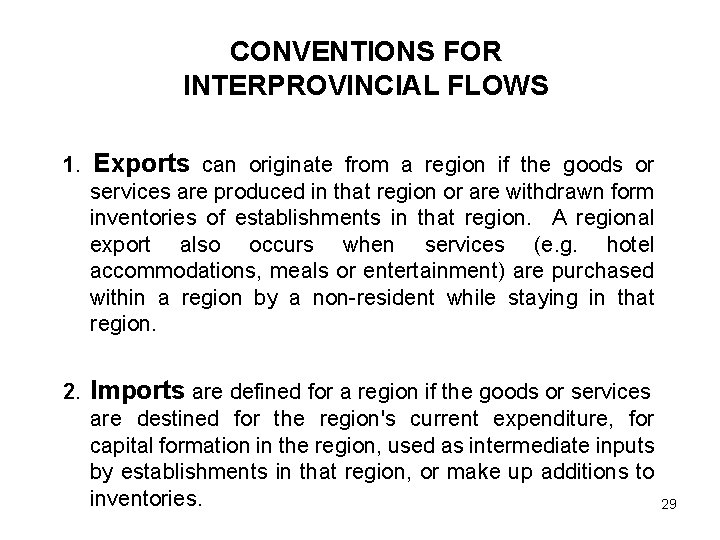

CONVENTIONS FOR INTERPROVINCIAL FLOWS 1. Exports can originate from a region if the goods or services are produced in that region or are withdrawn form inventories of establishments in that region. A regional export also occurs when services (e. g. hotel accommodations, meals or entertainment) are purchased within a region by a non-resident while staying in that region. 2. Imports are defined for a region if the goods or services are destined for the region's current expenditure, for capital formation in the region, used as intermediate inputs by establishments in that region, or make up additions to inventories. 29

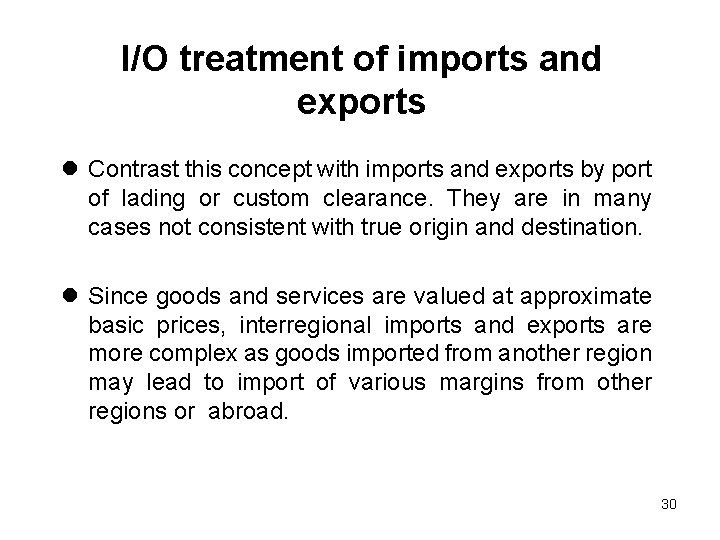

I/O treatment of imports and exports l Contrast this concept with imports and exports by port of lading or custom clearance. They are in many cases not consistent with true origin and destination. l Since goods and services are valued at approximate basic prices, interregional imports and exports are more complex as goods imported from another region may lead to import of various margins from other regions or abroad. 30

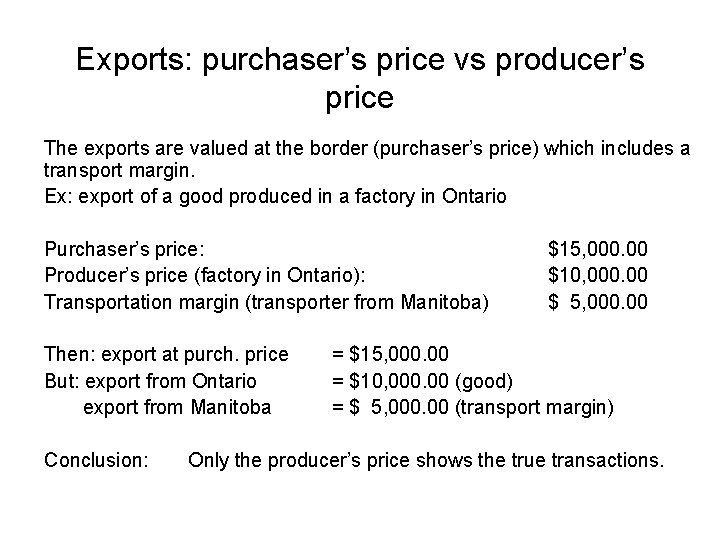

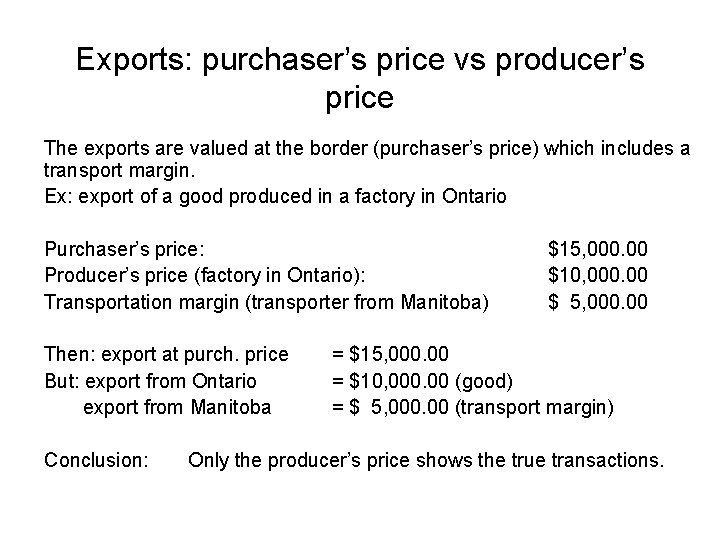

Exports: purchaser’s price vs producer’s price The exports are valued at the border (purchaser’s price) which includes a transport margin. Ex: export of a good produced in a factory in Ontario Purchaser’s price: Producer’s price (factory in Ontario): Transportation margin (transporter from Manitoba) Then: export at purch. price But: export from Ontario export from Manitoba Conclusion: $15, 000. 00 $10, 000. 00 $ 5, 000. 00 = $10, 000. 00 (good) = $ 5, 000. 00 (transport margin) Only the producer’s price shows the true transactions.

APPLICATIONS 32

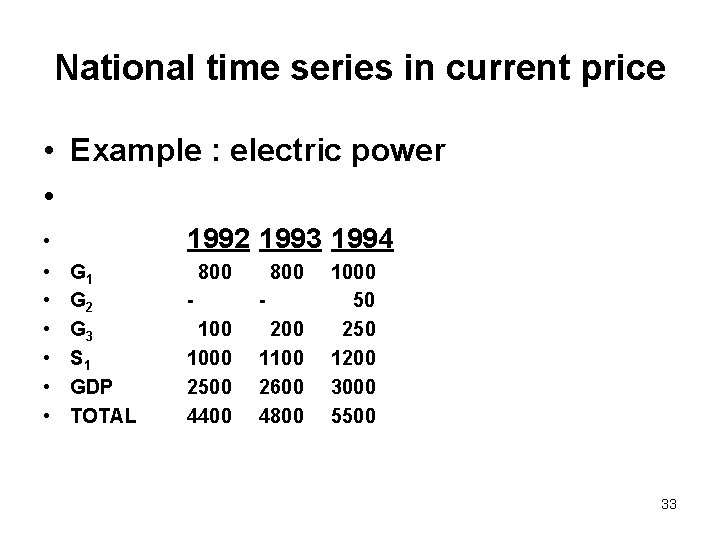

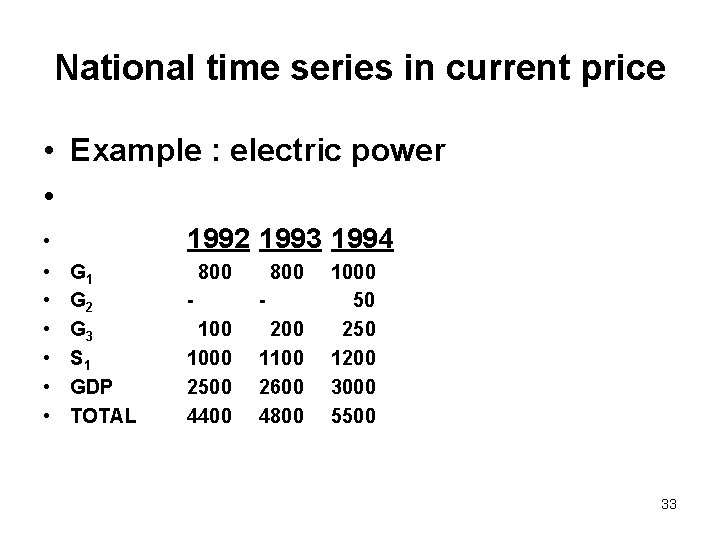

National time series in current price • Example : electric power • • 1992 1993 1994 G 1 G 2 G 3 S 1 GDP TOTAL 800 - - 1000 2500 4400 200 1100 2600 4800 1000 50 250 1200 3000 5500 33

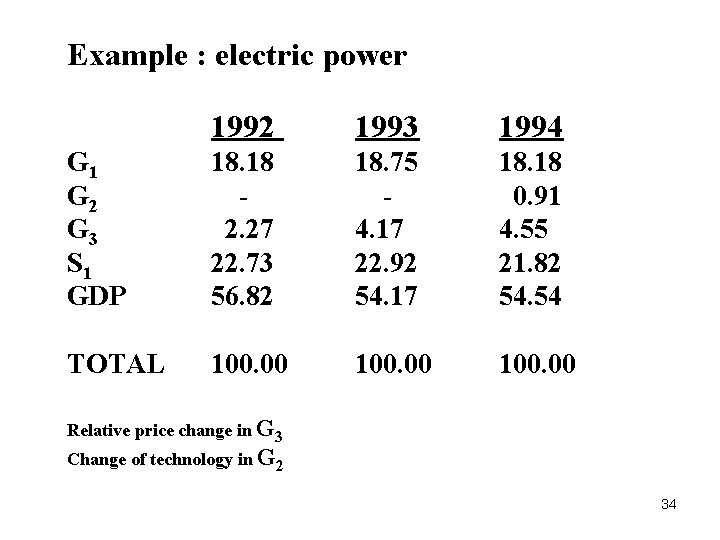

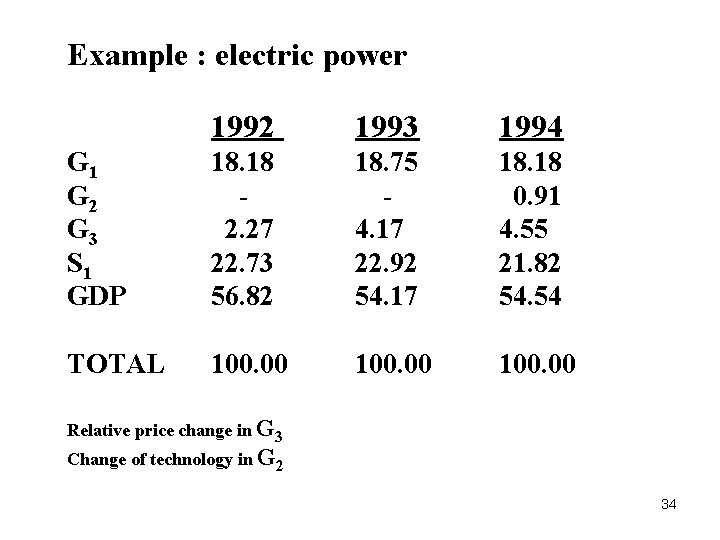

Example : electric power 1992 1993 1994 G 1 G 2 G 3 S 1 GDP 18. 18 2. 27 22. 73 56. 82 18. 75 4. 17 22. 92 54. 17 18. 18 0. 91 4. 55 21. 82 54. 54 TOTAL 100. 00 Relative price change in G 3 Change of technology in G 2 34

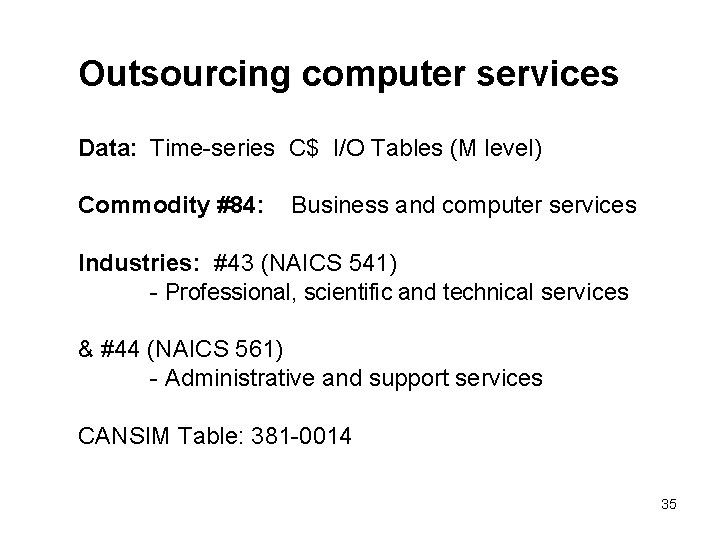

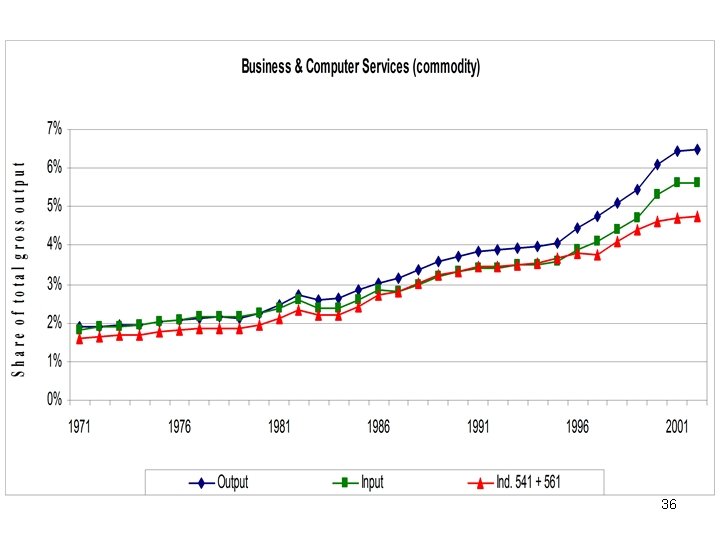

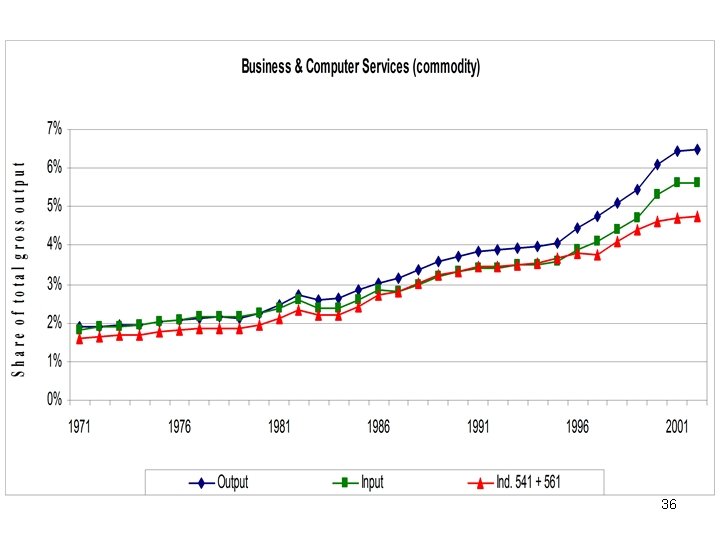

Outsourcing computer services Data: Time-series C$ I/O Tables (M level) Commodity #84: Business and computer services Industries: #43 (NAICS 541) - Professional, scientific and technical services & #44 (NAICS 561) - Administrative and support services CANSIM Table: 381 -0014 35

36

AAFC I/O Model (Based on extended agriculture industries) 37

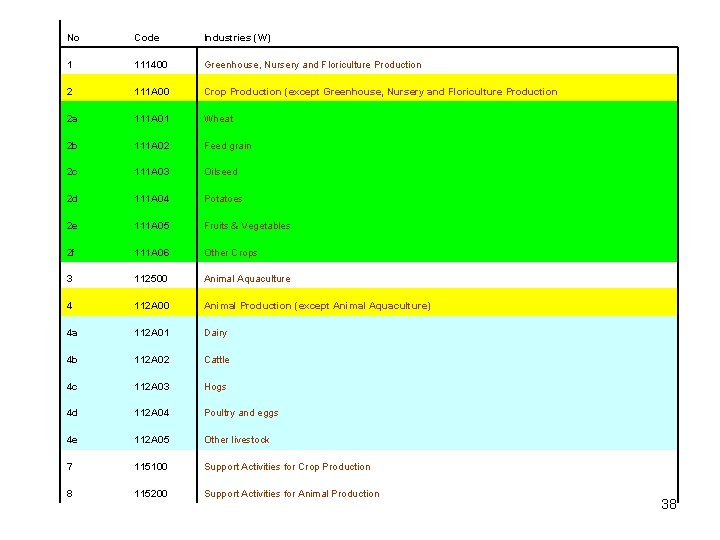

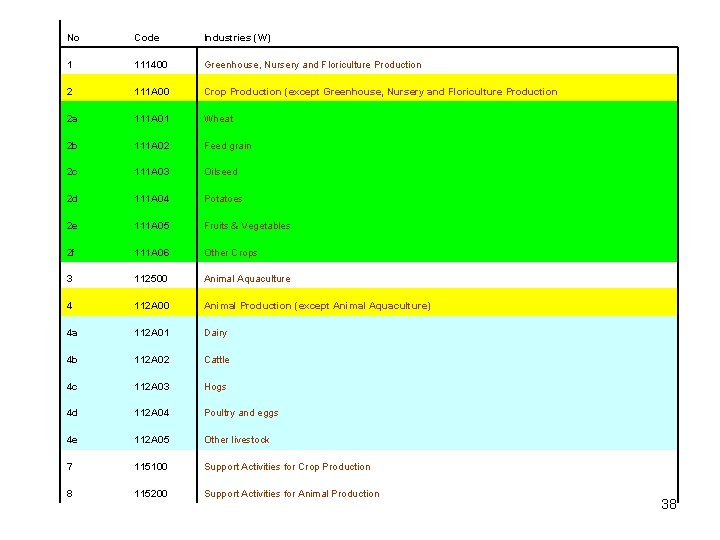

No Code Industries (W) 1 111400 Greenhouse, Nursery and Floriculture Production 2 111 A 00 Crop Production (except Greenhouse, Nursery and Floriculture Production 2 a 111 A 01 Wheat 2 b 111 A 02 Feed grain 2 c 111 A 03 Oilseed 2 d 111 A 04 Potatoes 2 e 111 A 05 Fruits & Vegetables 2 f 111 A 06 Other Crops 3 112500 Animal Aquaculture 4 112 A 00 Animal Production (except Animal Aquaculture) 4 a 112 A 01 Dairy 4 b 112 A 02 Cattle 4 c 112 A 03 Hogs 4 d 112 A 04 Poultry and eggs 4 e 112 A 05 Other livestock 7 115100 Support Activities for Crop Production 8 115200 Support Activities for Animal Production 38

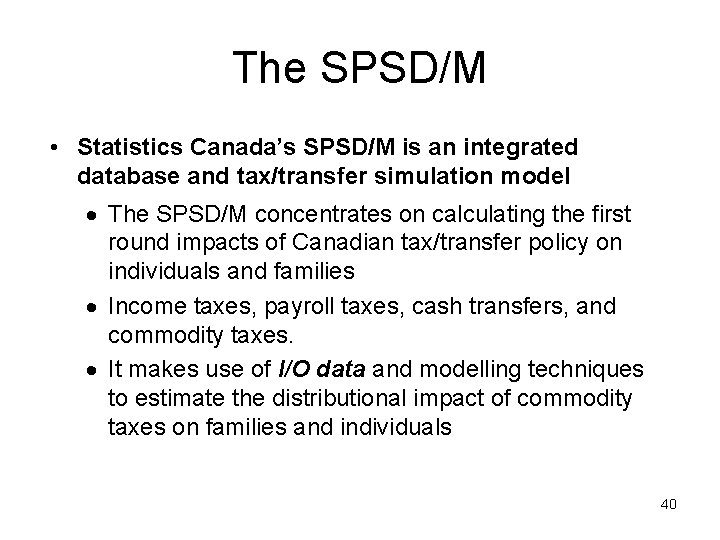

Statistics Canada’s SPSD/M The Social Policy Simulation Database and Model

The SPSD/M • Statistics Canada’s SPSD/M is an integrated database and tax/transfer simulation model · The SPSD/M concentrates on calculating the first round impacts of Canadian tax/transfer policy on individuals and families · Income taxes, payroll taxes, cash transfers, and commodity taxes. · It makes use of I/O data and modelling techniques to estimate the distributional impact of commodity taxes on families and individuals 40

A new SNA module providing you with information at your fingertips! 41

43

44

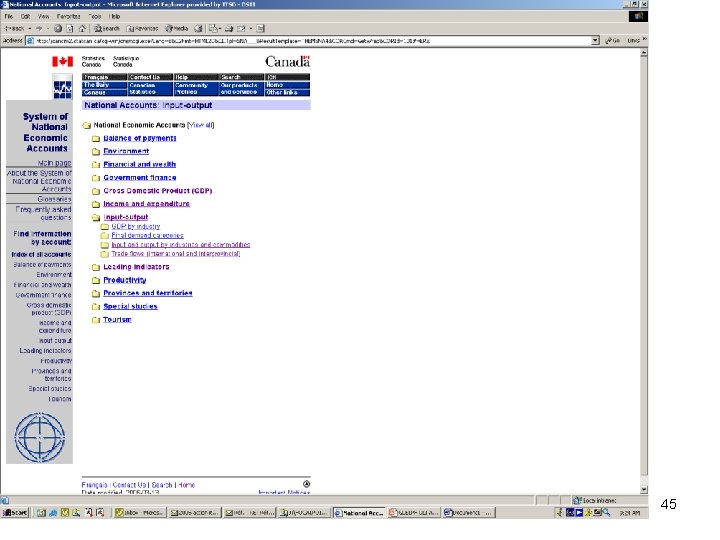

45

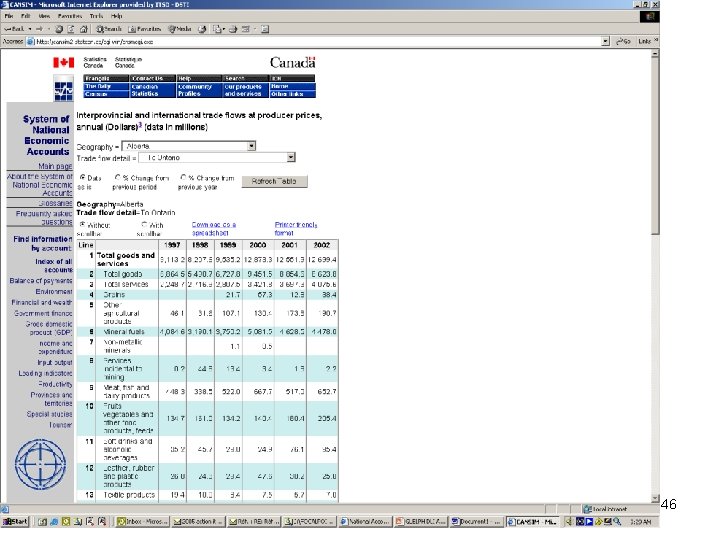

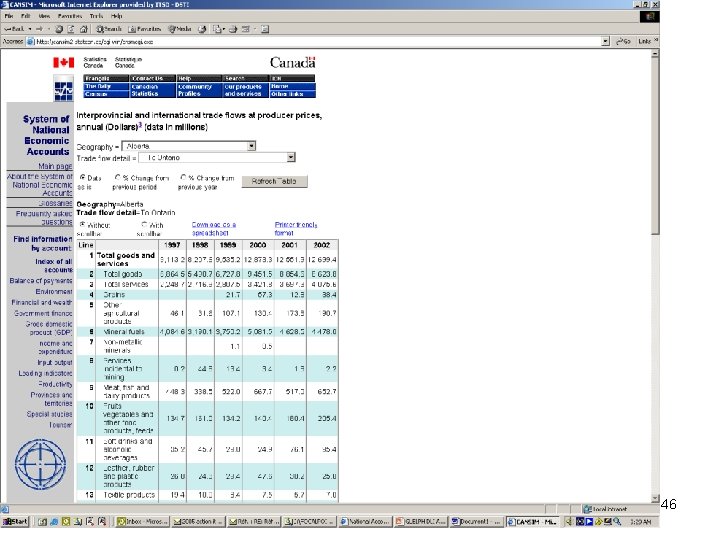

46

References • Hoffman et al. , User’s Guide to Statistics Canada Structural Economic Models, Input-Output Division, Statistics Canada, 1980. • Miller, E. Ronald and Blair, Peter D. , Input-Output Analysis: Foundations and Extensions, Prentice. Hall, New Jersey, 1985. • United Nations, Handbook of Input-Output Table Compilation and Analysis, Series F, No. 74, New York, 1999. 47

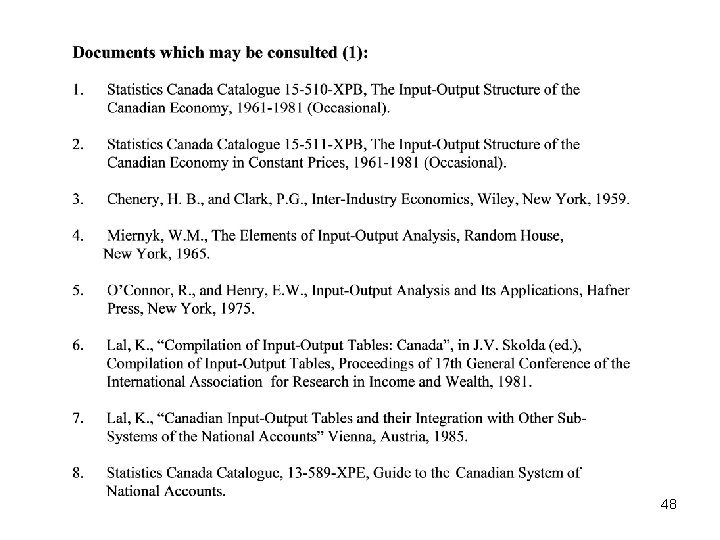

48

49

50