Inflation Unemployment and the Phillips Curve How the

- Slides: 11

Inflation, Unemployment, and the Phillips Curve How the Phillips curve demonstrates the inflationunemployment tradeoff that policy makers face.

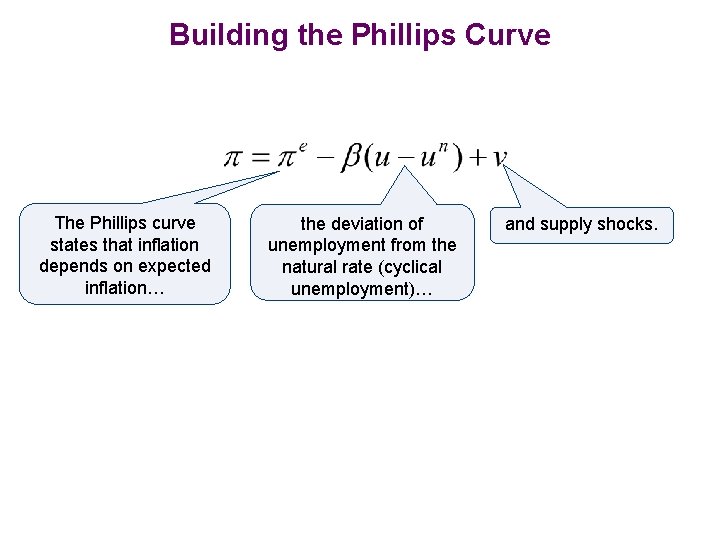

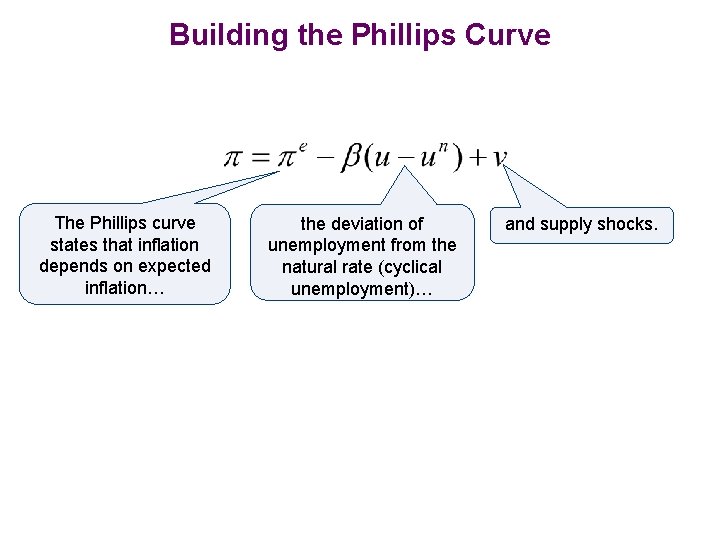

Building the Phillips Curve The Phillips curve states that inflation depends on expected inflation… the deviation of unemployment from the natural rate (cyclical unemployment)… and supply shocks.

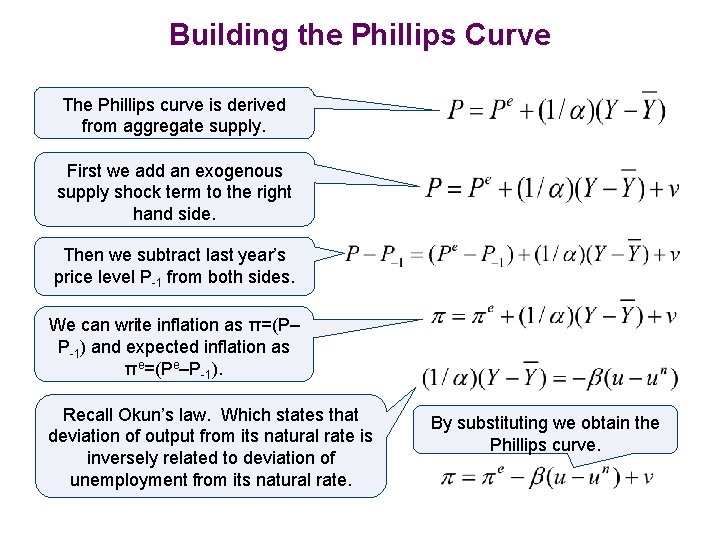

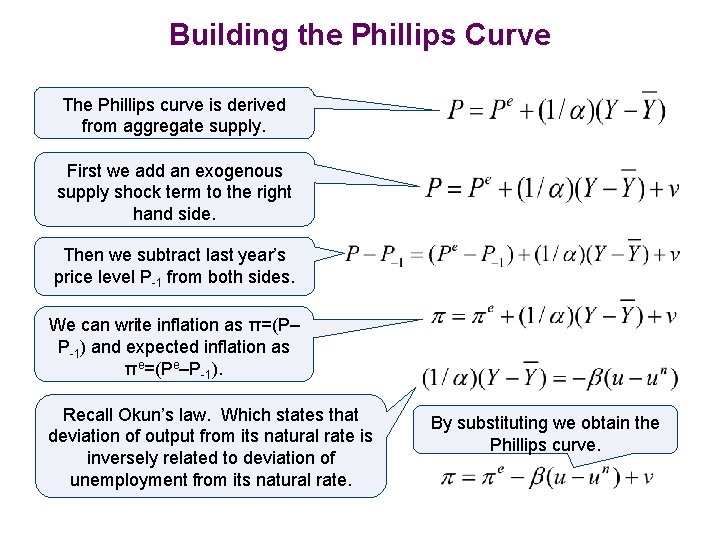

Building the Phillips Curve The Phillips curve is derived from aggregate supply. First we add an exogenous supply shock term to the right hand side. Then we subtract last year’s price level P-1 from both sides. We can write inflation as π=(P– P-1) and expected inflation as πe=(Pe–P-1). Recall Okun’s law. Which states that deviation of output from its natural rate is inversely related to deviation of unemployment from its natural rate. By substituting we obtain the Phillips curve.

Building the Phillips Curve • So the Phillips curve and the short run aggregate supply curve essentially represent the same economic ideas.

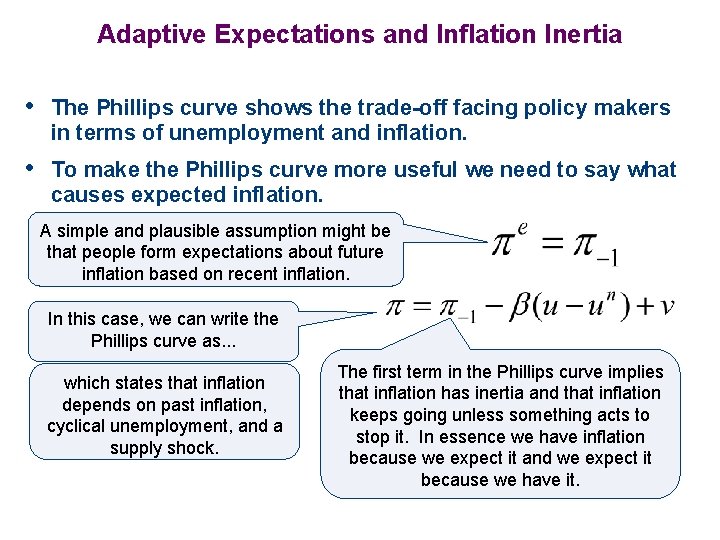

Adaptive Expectations and Inflation Inertia • The Phillips curve shows the trade-off facing policy makers in terms of unemployment and inflation. • To make the Phillips curve more useful we need to say what causes expected inflation. A simple and plausible assumption might be that people form expectations about future inflation based on recent inflation. In this case, we can write the Phillips curve as. . . which states that inflation depends on past inflation, cyclical unemployment, and a supply shock. The first term in the Phillips curve implies that inflation has inertia and that inflation keeps going unless something acts to stop it. In essence we have inflation because we expect it and we expect it because we have it.

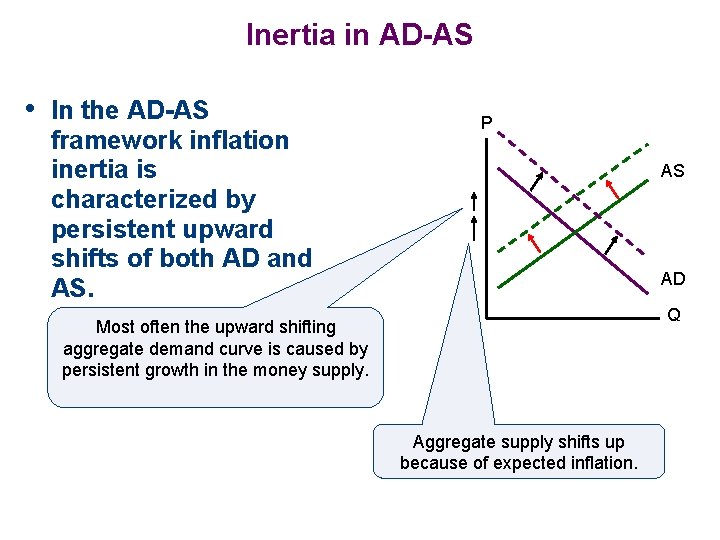

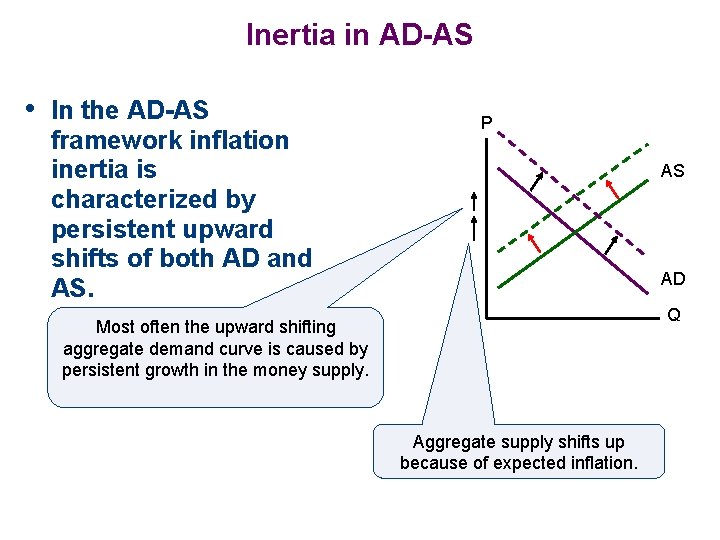

Inertia in AD-AS • In the AD-AS framework inflation inertia is characterized by persistent upward shifts of both AD and AS. P AS AD Q Most often the upward shifting aggregate demand curve is caused by persistent growth in the money supply. Aggregate supply shifts up because of expected inflation.

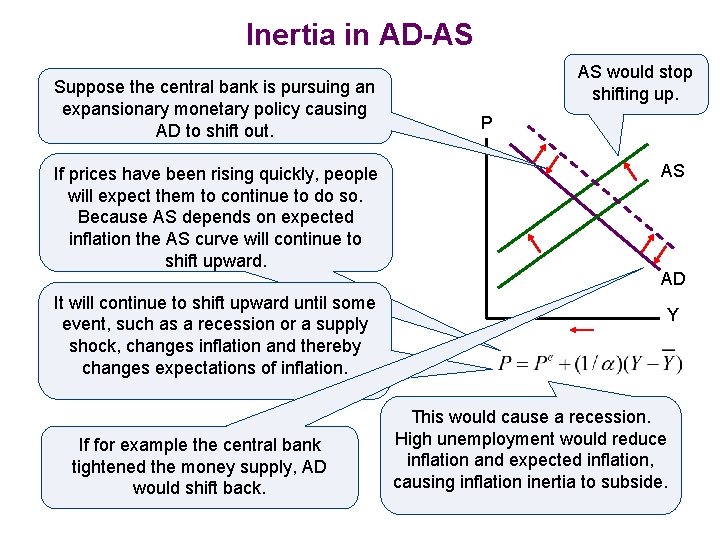

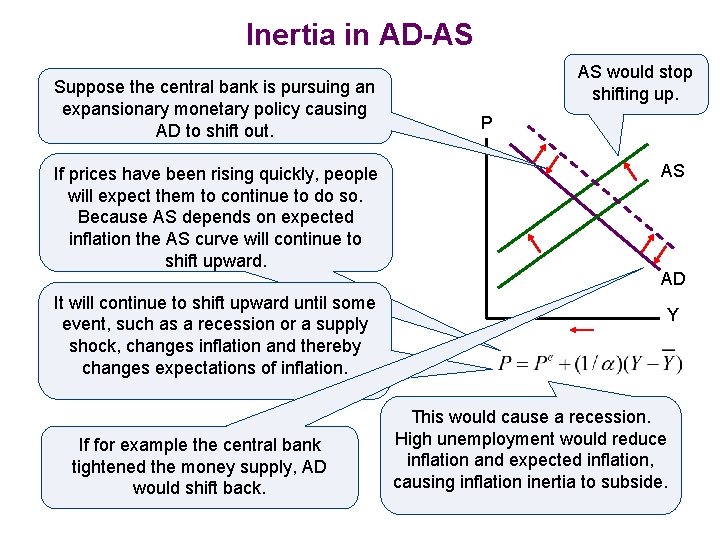

Inertia in AD-AS Suppose the central bank is pursuing an expansionary monetary policy causing AD to shift out. If prices have been rising quickly, people will expect them to continue to do so. Because AS depends on expected inflation the AS curve will continue to shift upward. It will continue to shift upward until some event, such as a recession or a supply shock, changes inflation and thereby changes expectations of inflation. If for example the central bank tightened the money supply, AD would shift back. AS would stop shifting up. P AS AD Y This would cause a recession. High unemployment would reduce inflation and expected inflation, causing inflation inertia to subside.

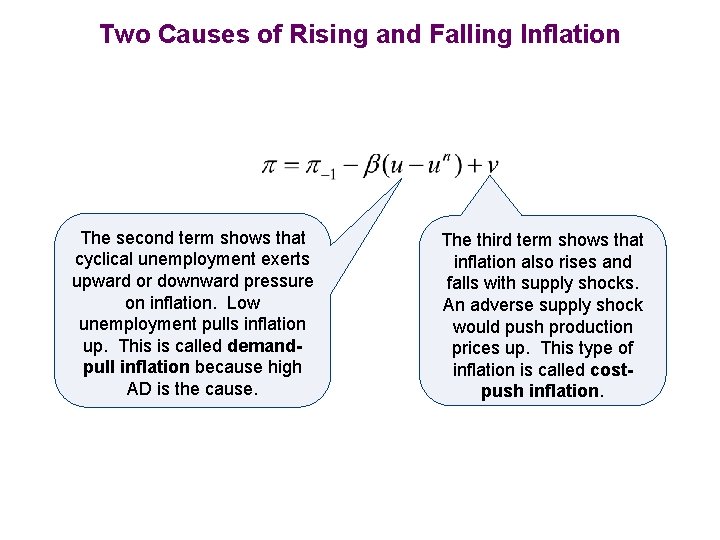

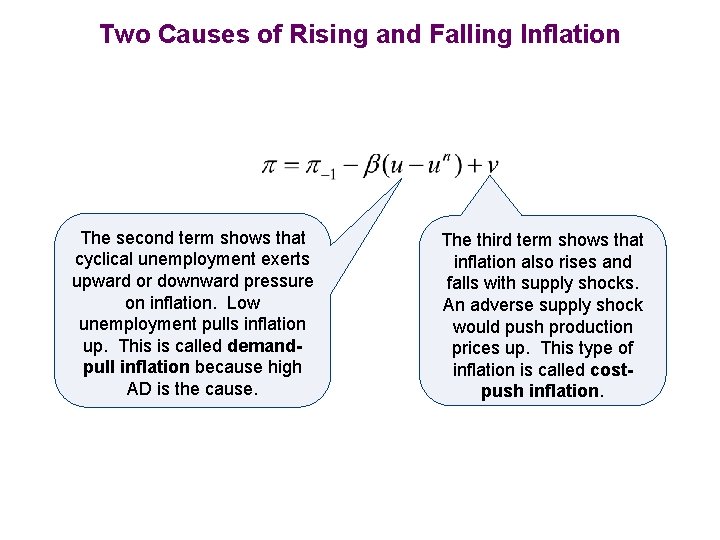

Two Causes of Rising and Falling Inflation The second term shows that cyclical unemployment exerts upward or downward pressure on inflation. Low unemployment pulls inflation up. This is called demandpull inflation because high AD is the cause. The third term shows that inflation also rises and falls with supply shocks. An adverse supply shock would push production prices up. This type of inflation is called costpush inflation.

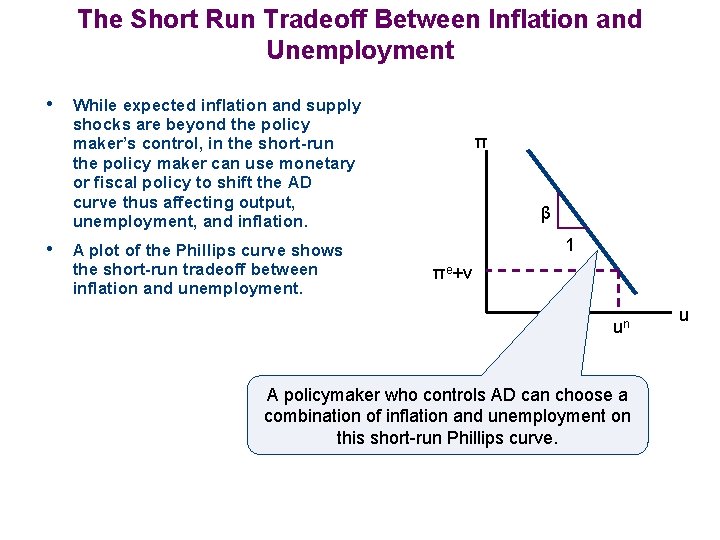

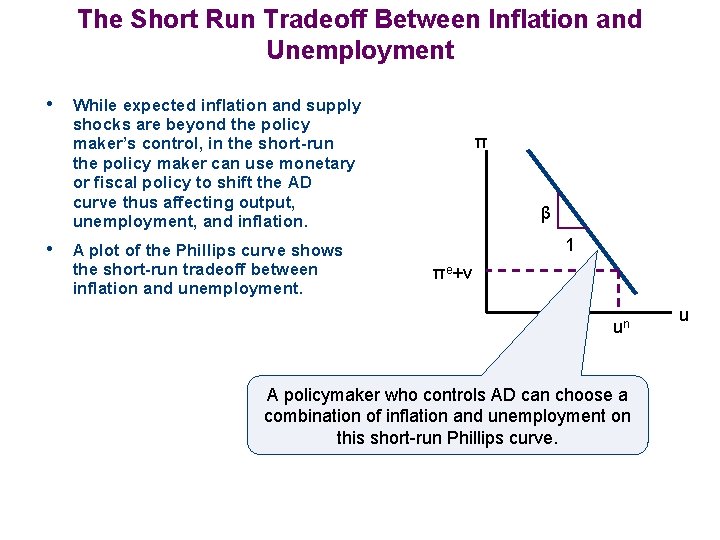

The Short Run Tradeoff Between Inflation and Unemployment • While expected inflation and supply shocks are beyond the policy maker’s control, in the short-run the policy maker can use monetary or fiscal policy to shift the AD curve thus affecting output, unemployment, and inflation. π β 1 • A plot of the Phillips curve shows the short-run tradeoff between inflation and unemployment. πe+v un A policymaker who controls AD can choose a combination of inflation and unemployment on this short-run Phillips curve. u

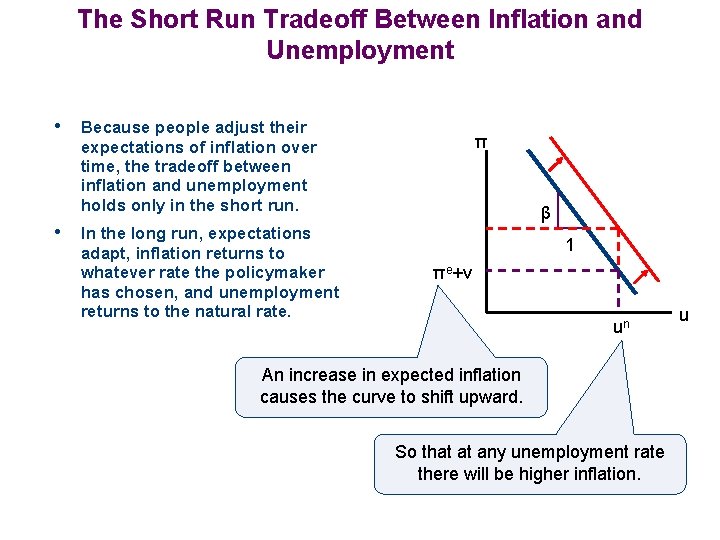

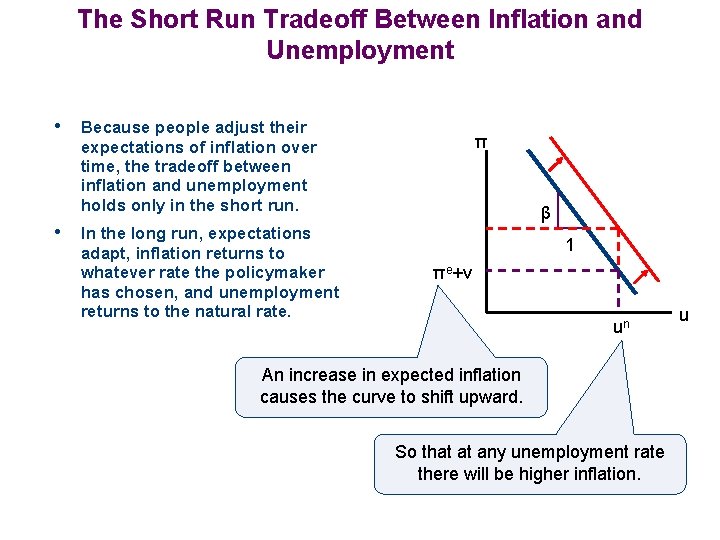

The Short Run Tradeoff Between Inflation and Unemployment • Because people adjust their π expectations of inflation over time, the tradeoff between inflation and unemployment holds only in the short run. β • In the long run, expectations adapt, inflation returns to whatever rate the policymaker has chosen, and unemployment returns to the natural rate. 1 πe+v un An increase in expected inflation causes the curve to shift upward. So that at any unemployment rate there will be higher inflation. u

Conclusions • In this section we discussed the Phillips curve. The Phillips curve demonstrates the inflationunemployment tradeoff that policy makers face.

Philips curve

Philips curve Shifters of srpc

Shifters of srpc Expected vs actual inflation phillips curve

Expected vs actual inflation phillips curve Expected inflation rate phillips curve

Expected inflation rate phillips curve Expected inflation phillips curve

Expected inflation phillips curve Relationship between inflation and unemployment

Relationship between inflation and unemployment Unlike demand pull inflation cost push inflation

Unlike demand pull inflation cost push inflation Short run phillips curve

Short run phillips curve Macroeconomics lesson 3 activity 46

Macroeconomics lesson 3 activity 46 Module 34 featured worksheet the phillips curve

Module 34 featured worksheet the phillips curve Lrpc economics

Lrpc economics S curve and j curve

S curve and j curve