Industry Data How to Identify or confirm Your

- Slides: 34

Industry Data: How to Identify (or confirm) Your Target Industry July 29, 2013 Part 2 of 3 -Part EARN Maryland Webinar Series Presented by Lindsey Woolsey

Miss the first EARN Maryland webinar? Webinar 1: July 10, 2013 Industry Partnerships 101: What, Why, How and Impact You can view it at www. earn. maryland. gov Don’t miss the third EARN Maryland webinar: Webinar 3: August 1, 2013 Mobilizing your Partnership: Preparing for the Launch

Ground Rules for the Live Webinar: 1) All participants are in listen-in mode. 2) To ask a question, please type it into the Question box to the right of your screen. 3) We will answer questions at the end of the presentation. 4) You can test the Question box function now by introducing yourself. 5) This a one hour webinar. 6) We will have a 35 -40 minute presentation and leave the remaining time to address the questions that you submit in the Question Box.

Listening Tips: If you cannot hear us, and you logged in via phone, click on the phone icon. If you logged in via audio, click on the "mic" icon, and make sure you turn up the volume on your end. In general, please limit background noise.

Today’s Agenda • Quick Recap on Industry Partnerships – What, Why, How – Training Components • Data – a “run-through” – Why more data? (aka: haven’t we already done this? ) – What kinds of data? – Limitations of data – where it stops, where you take it – Why it matters for Industry Partnerships and accurate training solutions

Designs by

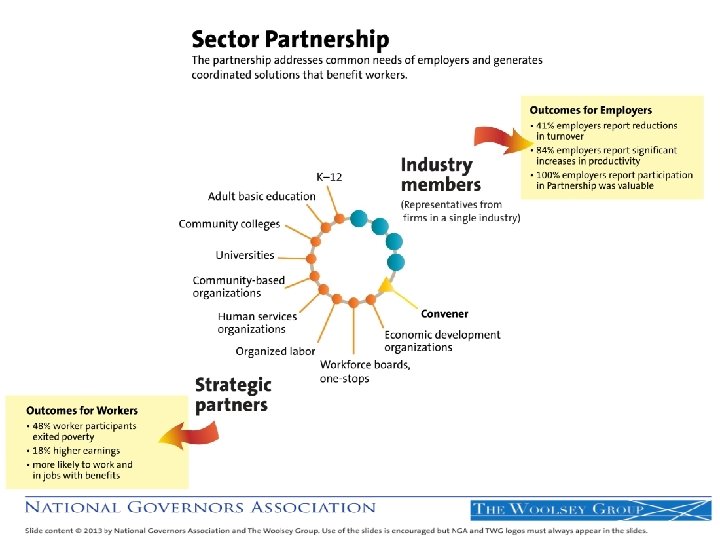

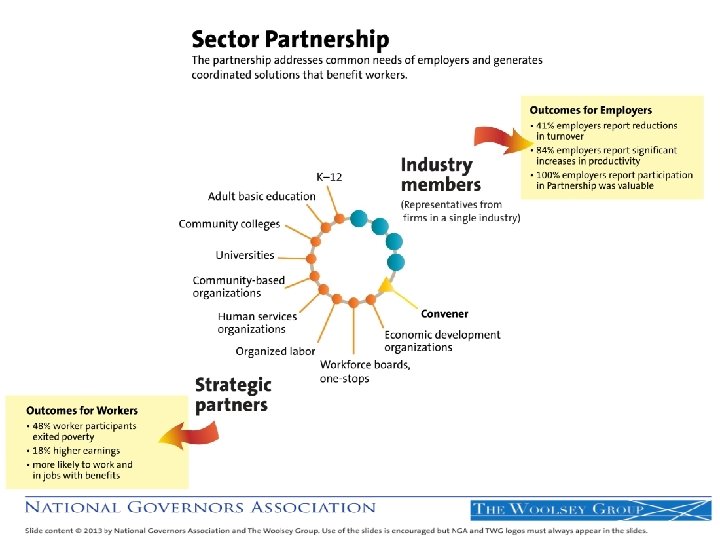

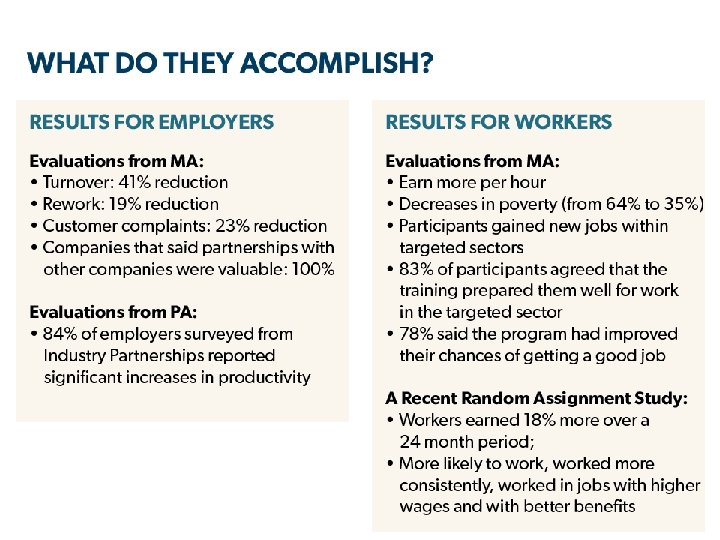

Today’s Industry Partnerships: • • Are employer driven Are regional Are convened by a credible third party Act as a coordinating body across multiple education, workforce development, economic development and other programs Create highly customized responses to a target industry’s needs, and therefore highly accurate responses They are about more than workforce training Treat employers as partners, not just customers Are NOT a grant program, a short term training project, a passing fad; they are a long term partnership

THEY ARE DIFFERENT FROM: • Your local workforce investment board • Your regional or city economic development board • Your Chamber of Commerce • An industry association • Your Community College Advisory Boards

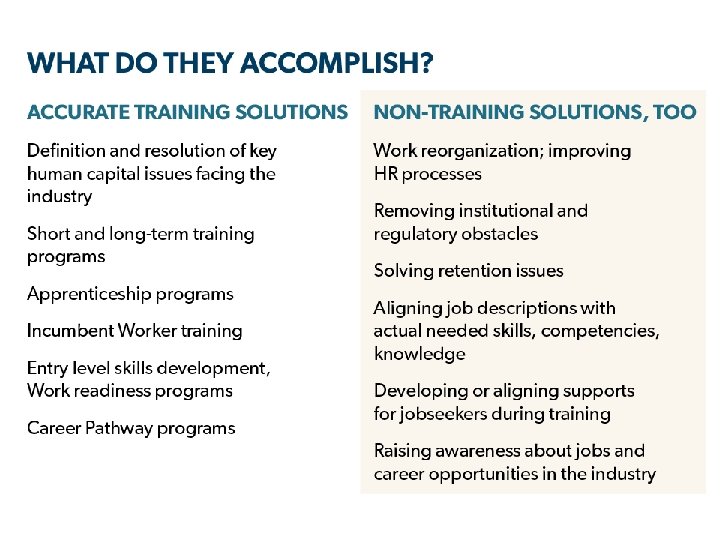

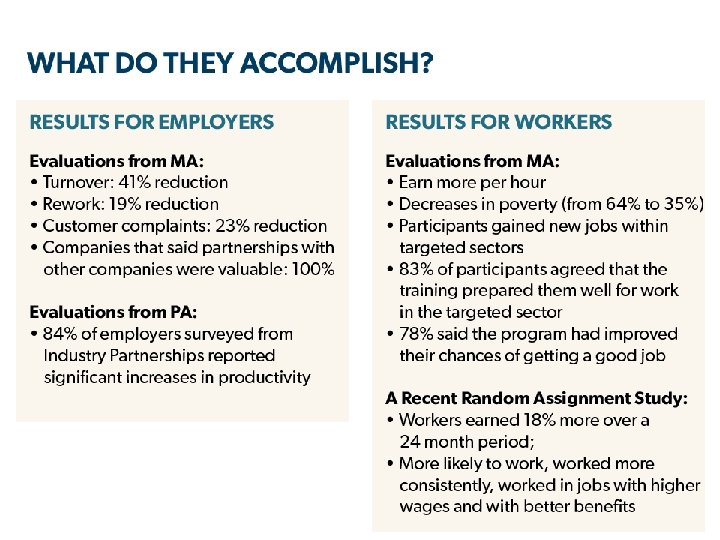

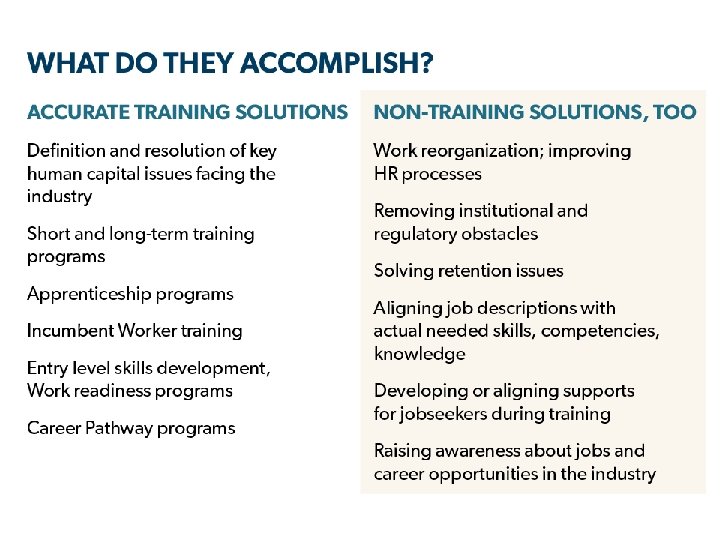

Workforce Training Inevitably is a Central Focus • Why? Because it’s always on the minds of business, in every industry • How is Industry Partnership Training different from “customized job training? ” – Not a one-to-one relationship with an employer; it’s a relationship with the regional industry – There’s a give-and-take; you partner with employers • What level of training are we talking about? – All levels: it depends on the industry’s needs – But IP’s are a highly effective vehicle for low-income/ low-skilled worker advancement

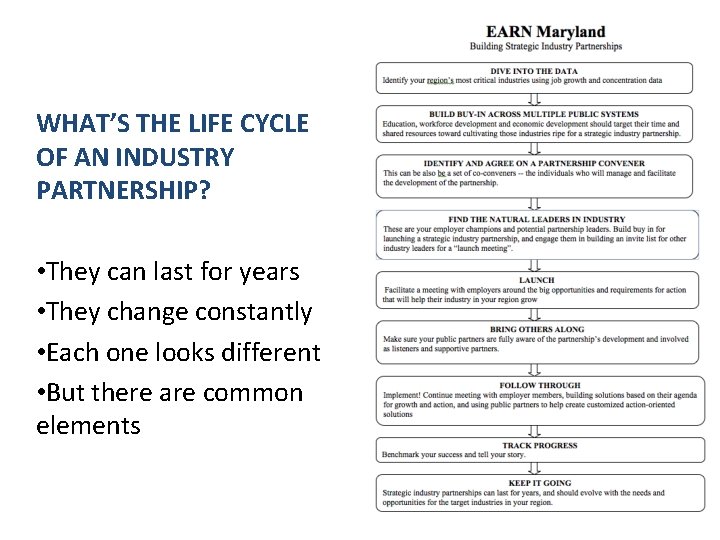

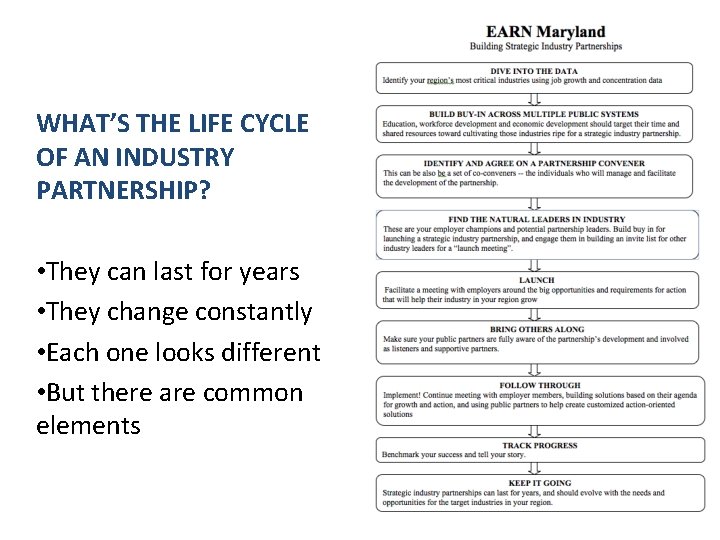

WHAT’S THE LIFE CYCLE OF AN INDUSTRY PARTNERSHIP? • They can last for years • They change constantly • Each one looks different • But there are common elements

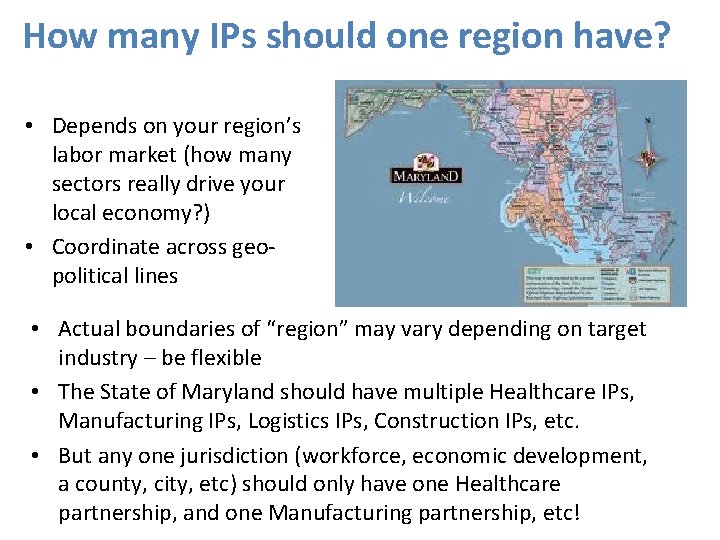

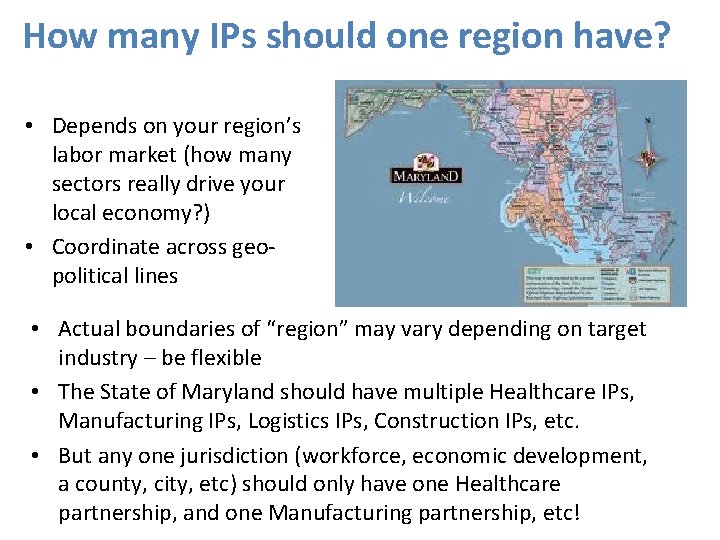

How many IPs should one region have? • Depends on your region’s labor market (how many sectors really drive your local economy? ) • Coordinate across geopolitical lines • Actual boundaries of “region” may vary depending on target industry – be flexible • The State of Maryland should have multiple Healthcare IPs, Manufacturing IPs, Logistics IPs, Construction IPs, etc. • But any one jurisdiction (workforce, economic development, a county, city, etc) should only have one Healthcare partnership, and one Manufacturing partnership, etc!

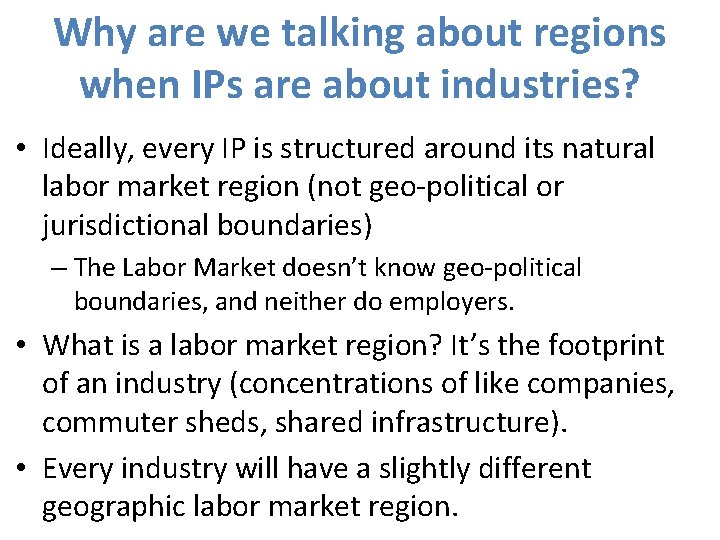

Why are we talking about regions when IPs are about industries? • Ideally, every IP is structured around its natural labor market region (not geo-political or jurisdictional boundaries) – The Labor Market doesn’t know geo-political boundaries, and neither do employers. • What is a labor market region? It’s the footprint of an industry (concentrations of like companies, commuter sheds, shared infrastructure). • Every industry will have a slightly different geographic labor market region.

Any questions at this point?

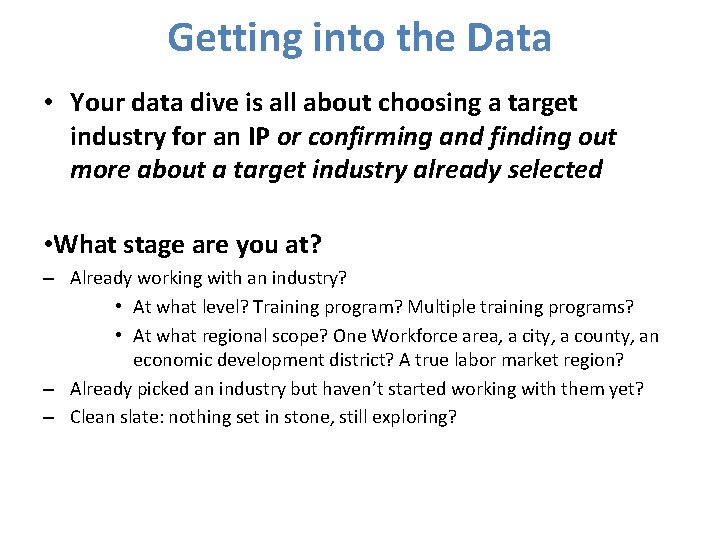

Getting into the Data • Your data dive is all about choosing a target industry for an IP or confirming and finding out more about a target industry already selected • What stage are you at? – Already working with an industry? • At what level? Training program? Multiple training programs? • At what regional scope? One Workforce area, a city, a county, an economic development district? A true labor market region? – Already picked an industry but haven’t started working with them yet? – Clean slate: nothing set in stone, still exploring?

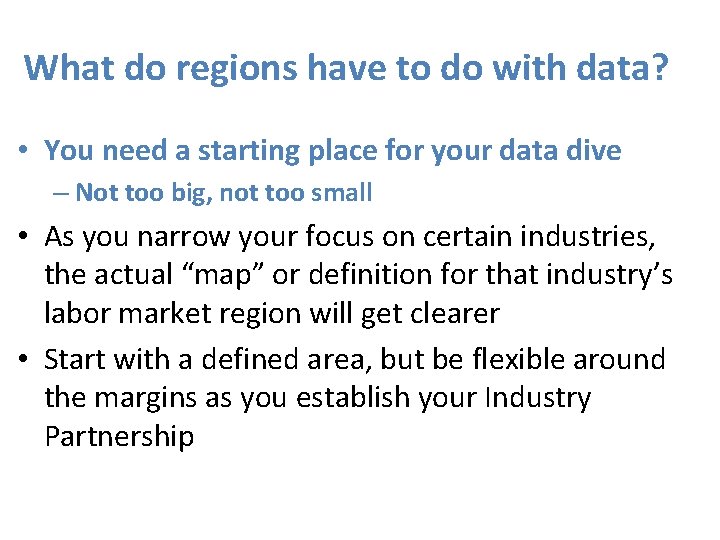

What do regions have to do with data? • You need a starting place for your data dive – Not too big, not too small • As you narrow your focus on certain industries, the actual “map” or definition for that industry’s labor market region will get clearer • Start with a defined area, but be flexible around the margins as you establish your Industry Partnership

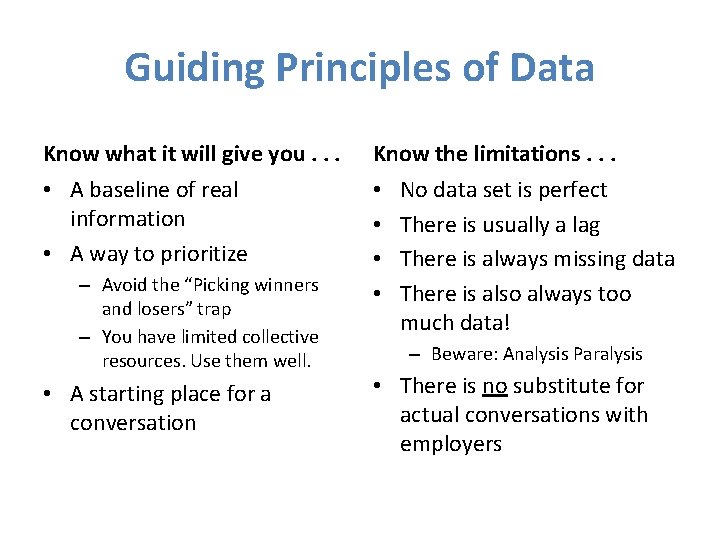

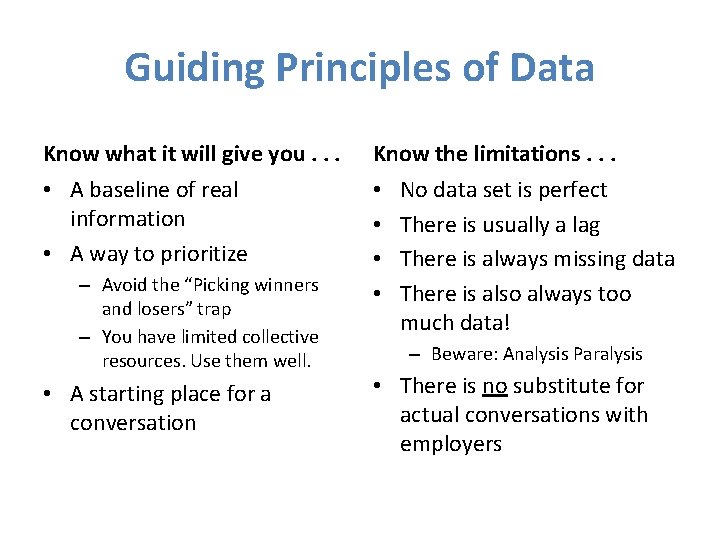

Guiding Principles of Data Know what it will give you. . . Know the limitations. . . • A baseline of real information • A way to prioritize • • – Avoid the “Picking winners and losers” trap – You have limited collective resources. Use them well. • A starting place for a conversation No data set is perfect There is usually a lag There is always missing data There is also always too much data! – Beware: Analysis Paralysis • There is no substitute for actual conversations with employers

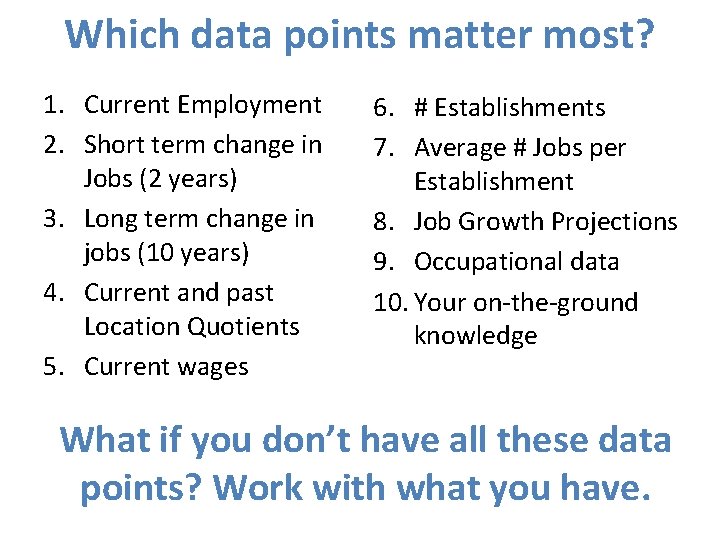

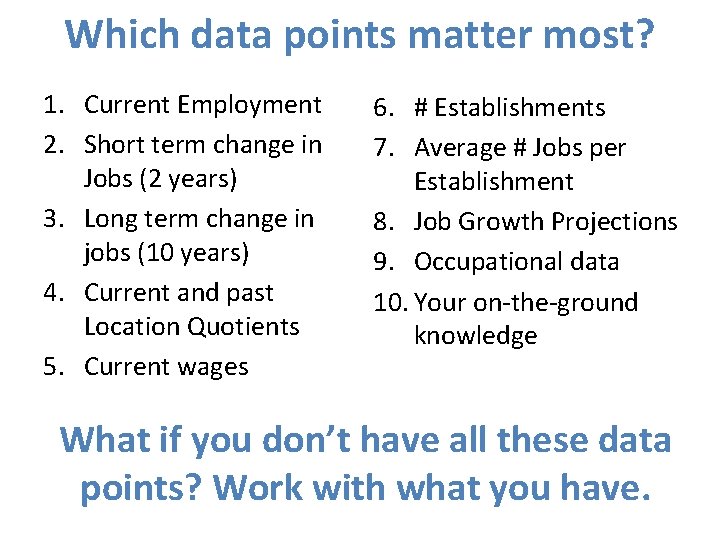

Which data points matter most? 1. Current Employment 2. Short term change in Jobs (2 years) 3. Long term change in jobs (10 years) 4. Current and past Location Quotients 5. Current wages 6. # Establishments 7. Average # Jobs per Establishment 8. Job Growth Projections 9. Occupational data 10. Your on-the-ground knowledge What if you don’t have all these data points? Work with what you have.

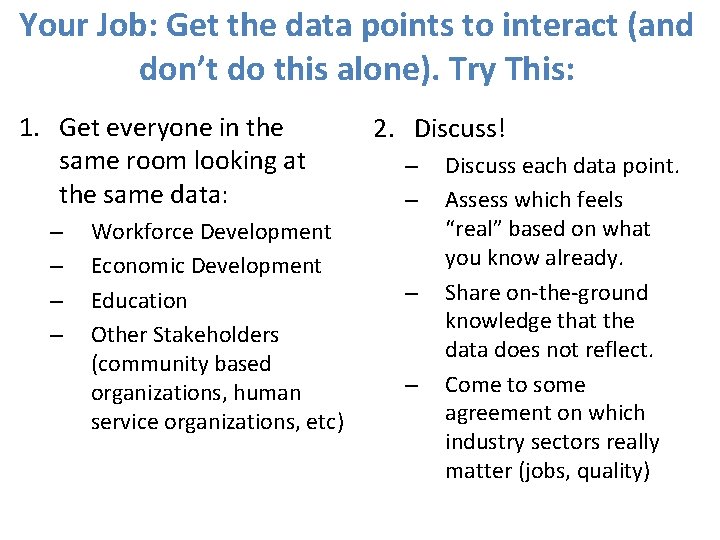

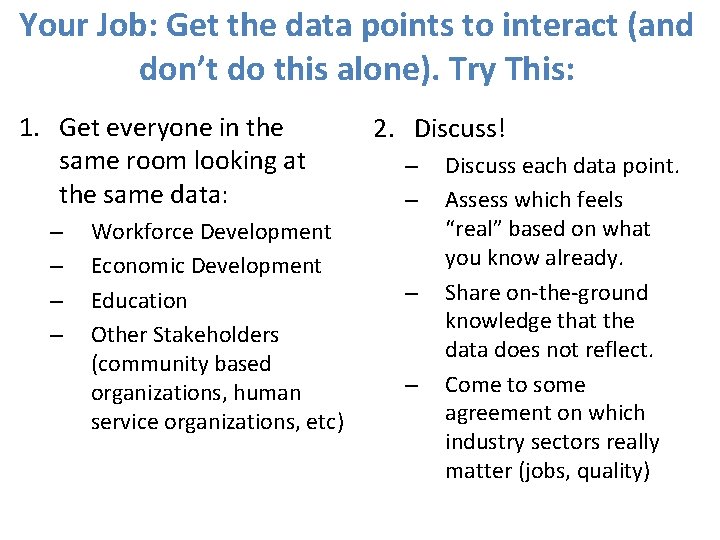

Your Job: Get the data points to interact (and don’t do this alone). Try This: 1. Get everyone in the same room looking at the same data: – – Workforce Development Economic Development Education Other Stakeholders (community based organizations, human service organizations, etc) 2. Discuss! – – Discuss each data point. Assess which feels “real” based on what you know already. Share on-the-ground knowledge that the data does not reflect. Come to some agreement on which industry sectors really matter (jobs, quality)

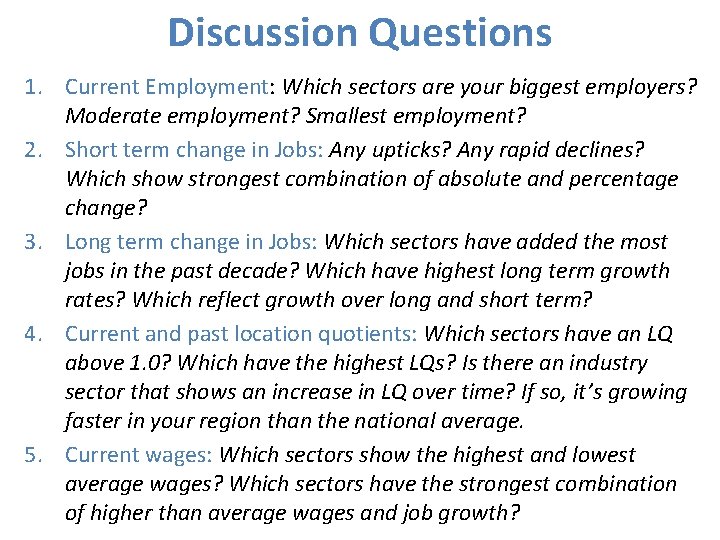

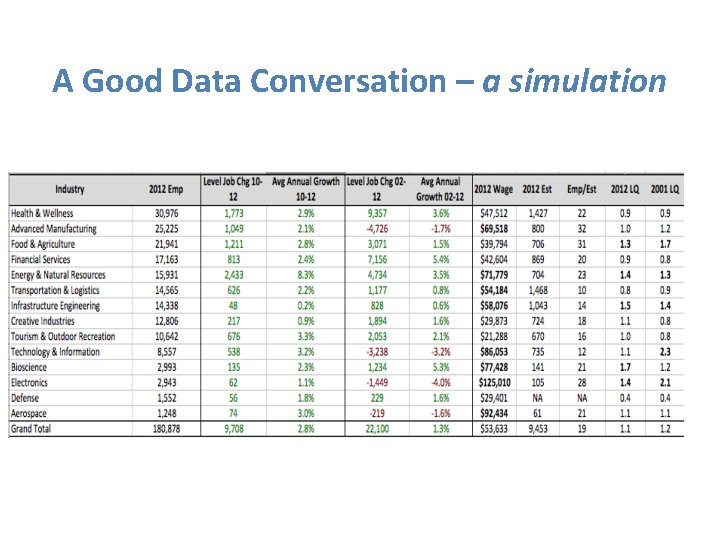

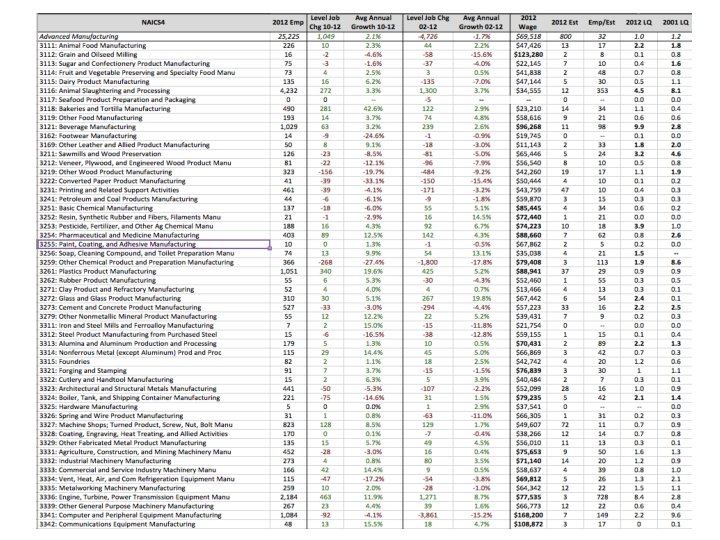

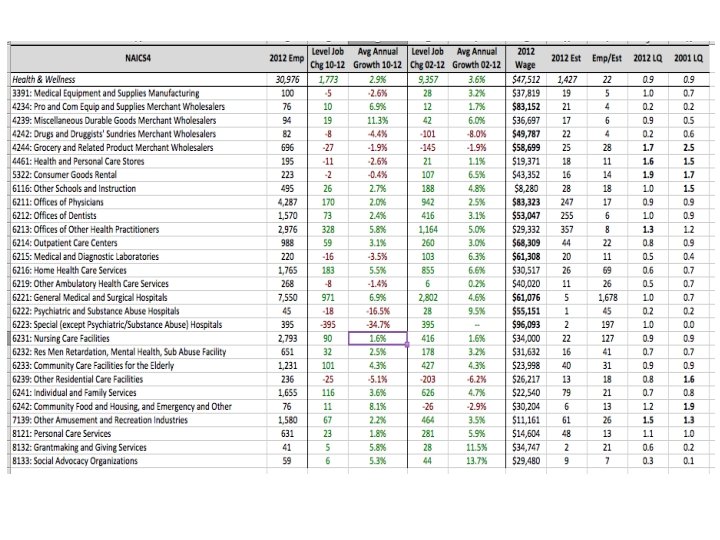

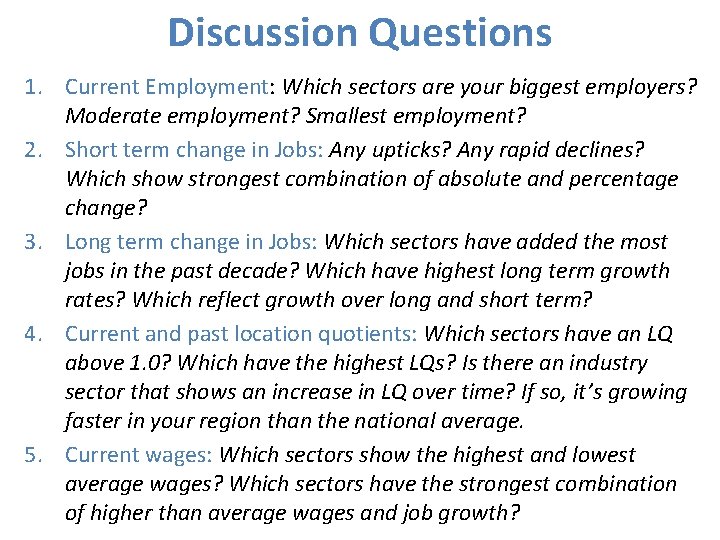

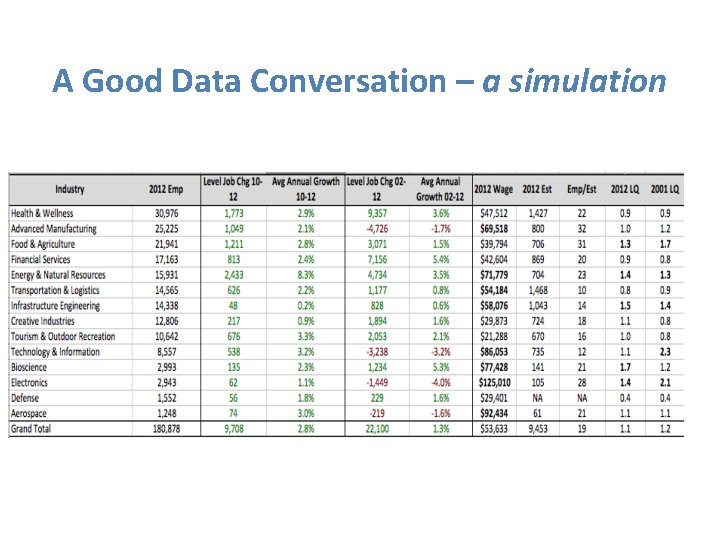

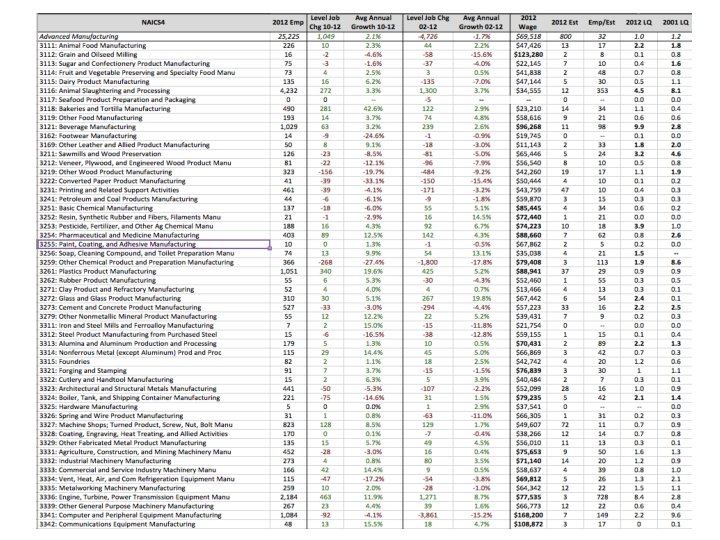

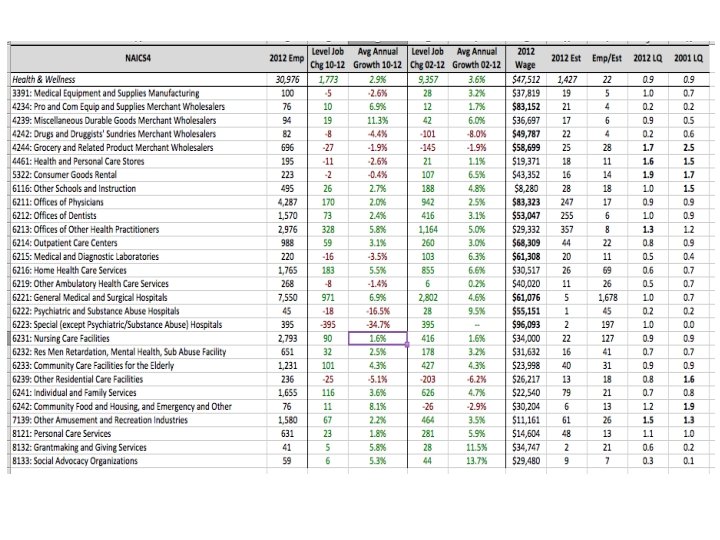

Discussion Questions 1. Current Employment: Which sectors are your biggest employers? Moderate employment? Smallest employment? 2. Short term change in Jobs: Any upticks? Any rapid declines? Which show strongest combination of absolute and percentage change? 3. Long term change in Jobs: Which sectors have added the most jobs in the past decade? Which have highest long term growth rates? Which reflect growth over long and short term? 4. Current and past location quotients: Which sectors have an LQ above 1. 0? Which have the highest LQs? Is there an industry sector that shows an increase in LQ over time? If so, it’s growing faster in your region than the national average. 5. Current wages: Which sectors show the highest and lowest average wages? Which sectors have the strongest combination of higher than average wages and job growth?

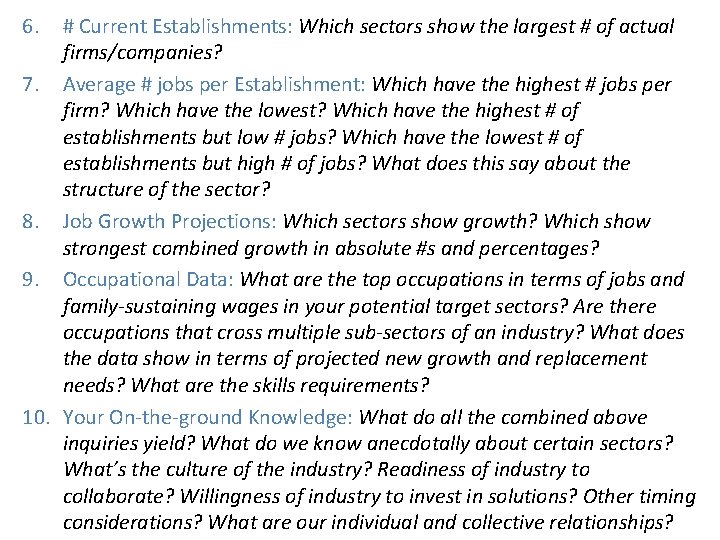

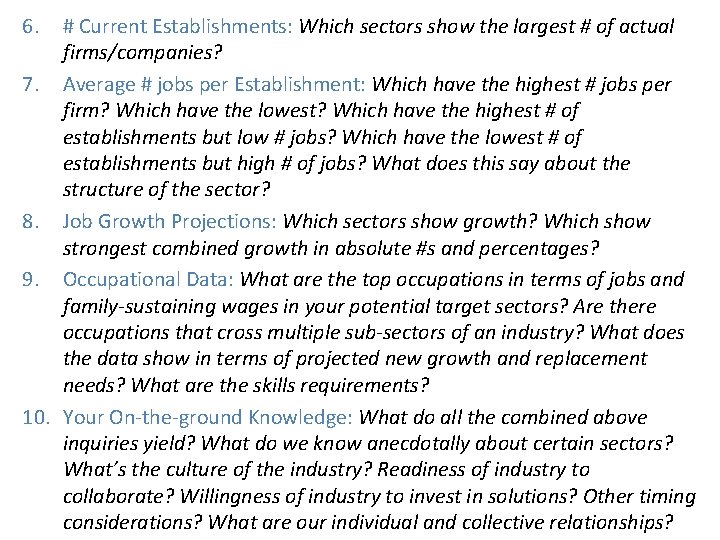

6. # Current Establishments: Which sectors show the largest # of actual firms/companies? 7. Average # jobs per Establishment: Which have the highest # jobs per firm? Which have the lowest? Which have the highest # of establishments but low # jobs? Which have the lowest # of establishments but high # of jobs? What does this say about the structure of the sector? 8. Job Growth Projections: Which sectors show growth? Which show strongest combined growth in absolute #s and percentages? 9. Occupational Data: What are the top occupations in terms of jobs and family-sustaining wages in your potential target sectors? Are there occupations that cross multiple sub-sectors of an industry? What does the data show in terms of projected new growth and replacement needs? What are the skills requirements? 10. Your On-the-ground Knowledge: What do all the combined above inquiries yield? What do we know anecdotally about certain sectors? What’s the culture of the industry? Readiness of industry to collaborate? Willingness of industry to invest in solutions? Other timing considerations? What are our individual and collective relationships?

Any quick questions?

A Good Data Conversation – a simulation

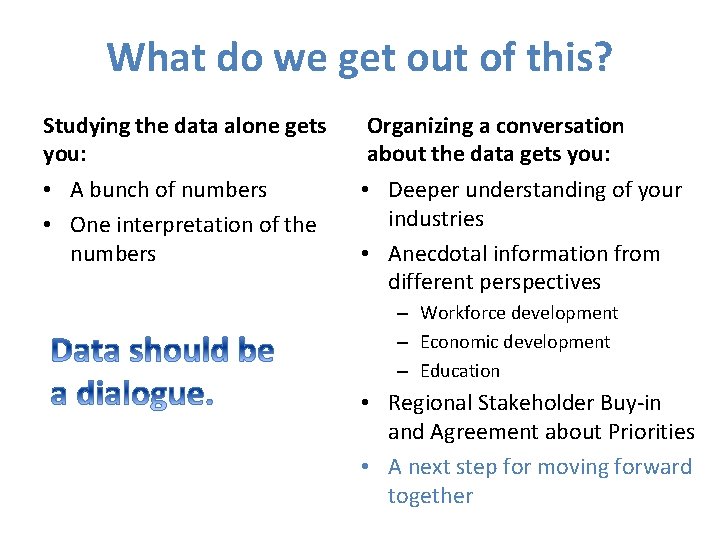

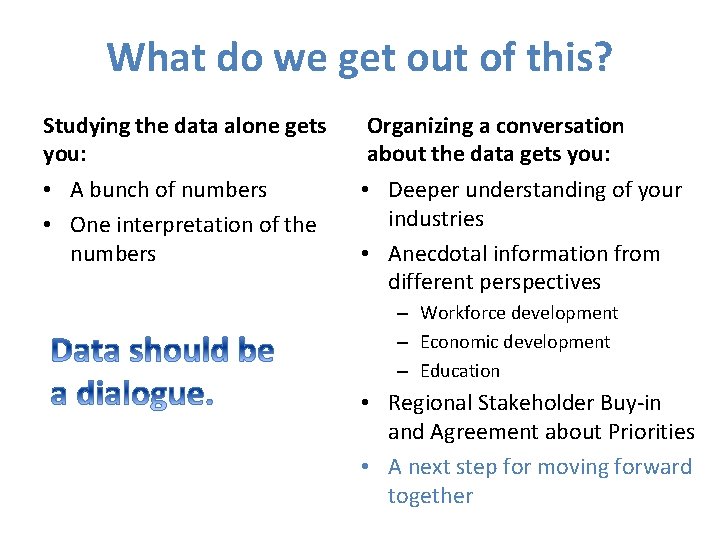

What do we get out of this? Studying the data alone gets you: Organizing a conversation about the data gets you: • A bunch of numbers • One interpretation of the numbers • Deeper understanding of your industries • Anecdotal information from different perspectives – Workforce development – Economic development – Education • Regional Stakeholder Buy-in and Agreement about Priorities • A next step for moving forward together

What are the Next Steps? Creating an Industry Partnership • The data is just the beginning • Real information about industry needs comes from employers • Use your IP to understand training needs • But don’t limit your IP to just workforce issues Get some Training out the Door • Accurate training solutions come from discussing skills needs and opportunities with a group of employers from the same industry in your region (an IP) • Good IPs allow you to get early wins + long term training/ education strategies

What you can expect as part of EARN Maryland: • A data toolkit – Building on the Maryland Workforce Dashboard and inclusive of as many essential data points as possible – A “DIY” Workshop Guide for holding a data conversation with your regional partners • By when? – Mid-September • Why use it? – Supplement what you already know – Find out what you don’t know – Use it as an organizing tool across stakeholders – Use it as a “buy-in” tool to get more support from stakeholders for industry-focused efforts

Next Webinar: • Webinar #3: Thursday, August 1 -2: 00 pm Mobilizing your Partnership – Preparing for the Launch (or Expansion)

More Questions?