Indian Pharma Industry At The Helm Presentation by

Indian Pharma Industry - At The Helm Presentation by Ganesh Nayak, COO and Executive Director, Zydus Cadila

Challenges for healthcare system • Expectation of high quality healthcare – Facilities and infrastructure – High quality affordable medicines • Demographic changes – more people will require prolonged care • Lifestyle changes – Increased prevalence of chronic diseases (substantial part of overall healthcare costs) • Rising healthcare costs

Pharmaceutical spending, as % of total health spending Greece Germany Italy France Spain Denmark UK United States Netherlands Norway Developed countries (7 - 20%) Bulgaria Czech Rep. Hungary Croatia Poland Estonia Slovenia Lithuania Transitional countries (15 - 30%) India Egypt China Indonesia Thailand Tunisia Jordan Argentina South Africa Developing countries (24 - 66 %) 0 10 20 30 40 50 60 In developing countries drugs are largest household and second largest public expenditure for health Source: WHO statistics 70

How to control pharmaceutical spending? “Generics” are the key to reducing pharmaceutical expenditure by offering a low cost alternative to expensive “Brands”

Generics • Generics are pharmaceutical products that contain already marketed and well established drugs, they are – Intended to be interchangeable with originator products – Usually manufactured without a license from original manufacturer or originator – Marketed after patent validity or any other market exclusivity of original product is over – Marketed under a non-proprietary name (INN or other approved name) or under brand names (branded generics) • Generics makes government or household spend less without any compromise on quality or safety – Depending on the market prices of generics could be 30%-90% lower than originator products – US even provides 180 days market exclusivity to a generic product that challenges an existing granted patent

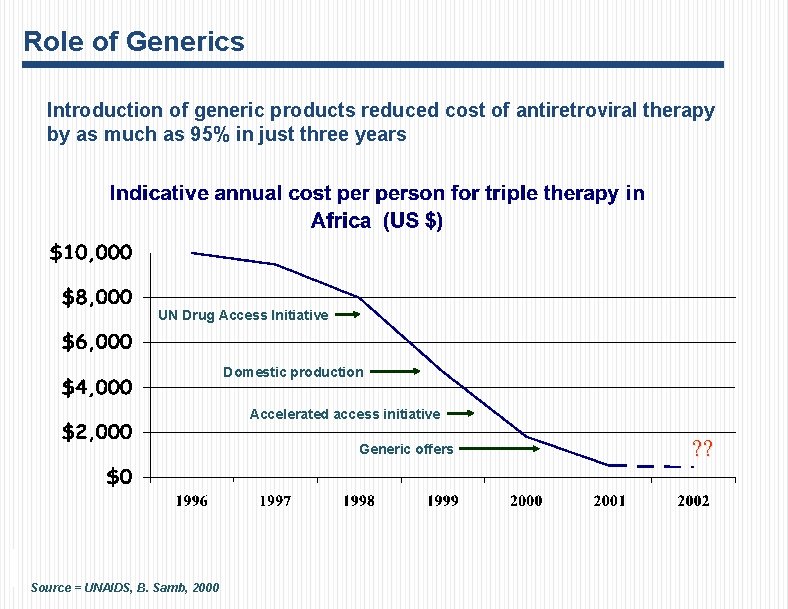

Role of Generics Introduction of generic products reduced cost of antiretroviral therapy by as much as 95% in just three years UN Drug Access Initiative Domestic production Accelerated access initiative Generic offers Source = UNAIDS, B. Samb, 2000 ? ?

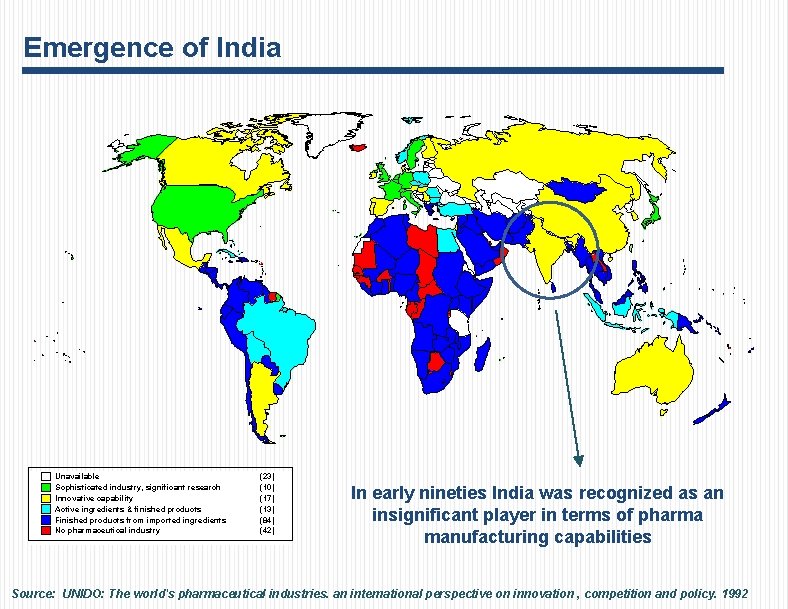

Emergence of India Unavailable Sophisticated industry, significant research Innovative capability Active ingredients & finished products Finished products from imported ingredients No pharmaceutical industry (23) (10) (17) (13) (84) (42) In early nineties India was recognized as an insignificant player in terms of pharma manufacturing capabilities Source: UNIDO: The world's pharmaceutical industries. an international perspective on innovation , competition and policy. 1992

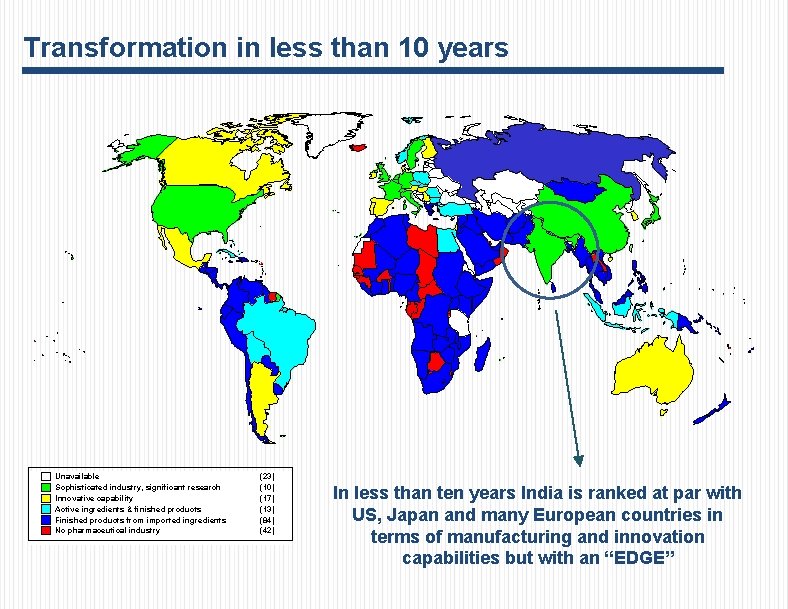

Transformation in less than 10 years Unavailable Sophisticated industry, significant research Innovative capability Active ingredients & finished products Finished products from imported ingredients No pharmaceutical industry (23) (10) (17) (13) (84) (42) In less than ten years India is ranked at par with US, Japan and many European countries in terms of manufacturing and innovation capabilities but with an “EDGE”

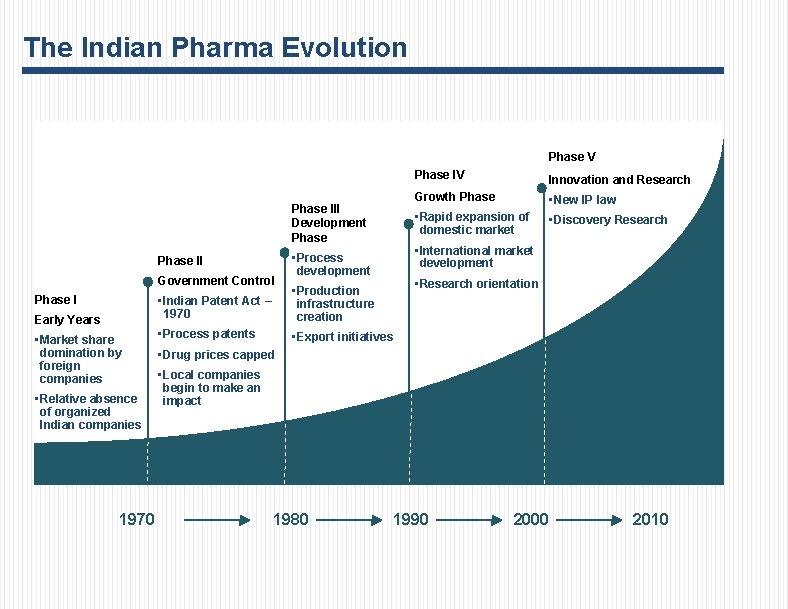

The Indian Pharma Evolution Phase V Phase III Development Phase II Government Control Phase I Early Years • Market share domination by foreign companies • Relative absence of organized Indian companies 1970 Phase IV Innovation and Research Growth Phase • New IP law • Rapid expansion of domestic market • Discovery Research • International market development • Process development • Research orientation • Indian Patent Act – 1970 • Production infrastructure creation • Process patents • Export initiatives • Drug prices capped • Local companies begin to make an impact 1980 1990 2000 2010

The Indian advantage Large skill base – Experts in process chemistry – Long history of reverse engineering Vast talent pool – Sheer number of scientists – Motivated & English speaking – Large number of trained Indians returning home from North America and Europe Unmatched cost competitiveness – Lower cost of infrastructure and skilled manpower – Vertical integration

The Indian advantage Strong local industry – Growing expertise with international regulatory compliance – High quality manufacturing with abundant capacities Speed – Very strong entrepreneurial spirit – Hungry for growth and recognition – Quick learners and fast movers Availability of capital – Stock market has seen unprecedented growth in the last decade – Continues to be bullish on the pharma industry

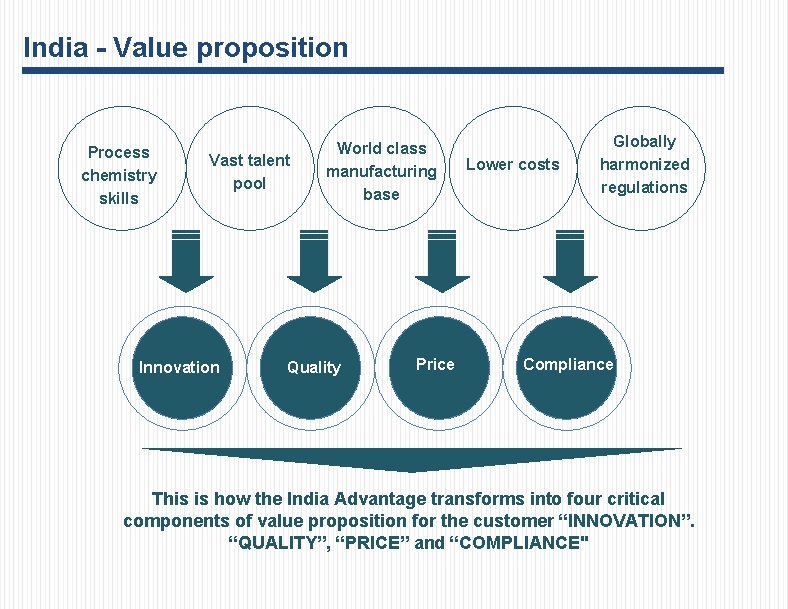

India - Value proposition Process chemistry skills Vast talent pool Innovation World class manufacturing base Quality Price Lower costs Globally harmonized regulations Compliance This is how the India Advantage transforms into four critical components of value proposition for the customer “INNOVATION”. “QUALITY”, “PRICE” and “COMPLIANCE"

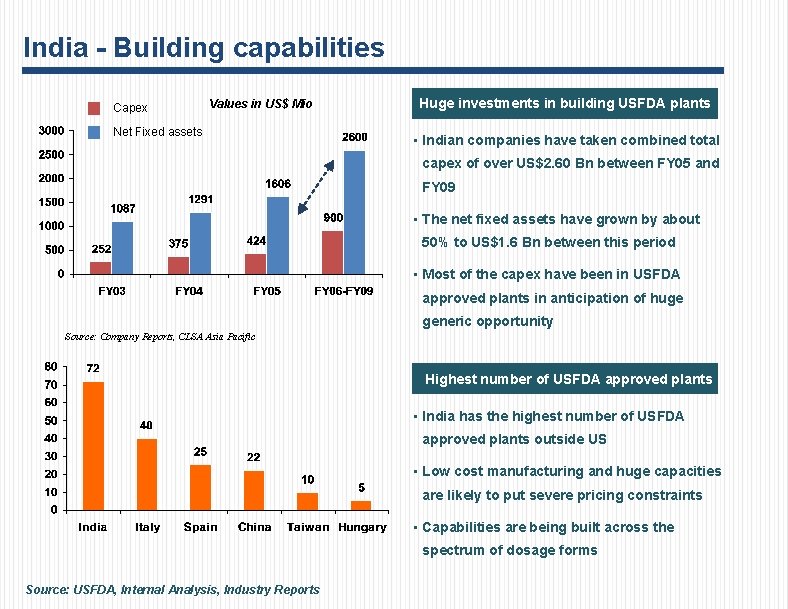

India - Building capabilities Capex Values in US$ Mio Net Fixed assets Huge investments in building USFDA plants • Indian companies have taken combined total capex of over US$2. 60 Bn between FY 05 and FY 09 • The net fixed assets have grown by about 50% to US$1. 6 Bn between this period • Most of the capex have been in USFDA approved plants in anticipation of huge generic opportunity Source: Company Reports, CLSA Asia Pacific Highest number of USFDA approved plants • India has the highest number of USFDA approved plants outside US • Low cost manufacturing and huge capacities are likely to put severe pricing constraints • Capabilities are being built across the spectrum of dosage forms Source: USFDA, Internal Analysis, Industry Reports

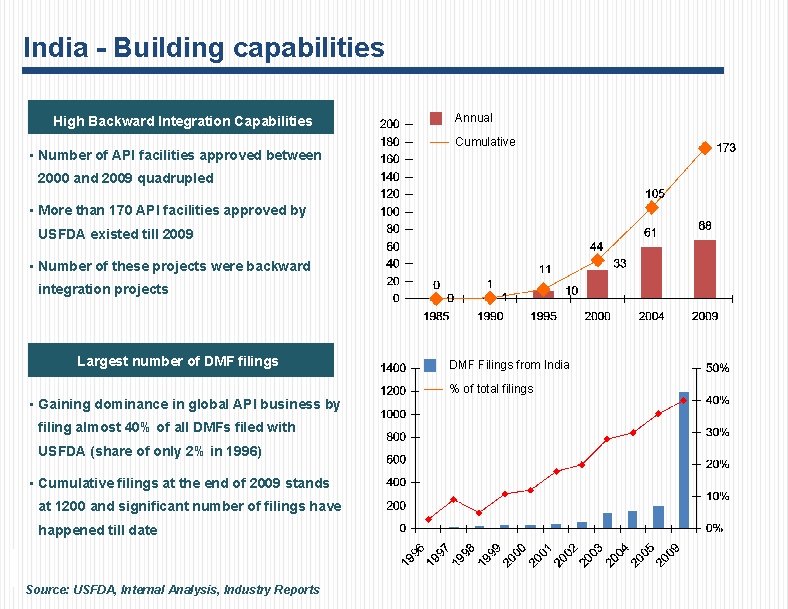

India - Building capabilities High Backward Integration Capabilities • Number of API facilities approved between Annual Cumulative 2000 and 2009 quadrupled • More than 170 API facilities approved by USFDA existed till 2009 • Number of these projects were backward integration projects Largest number of DMF filings DMF Filings from India % of total filings • Gaining dominance in global API business by filing almost 40% of all DMFs filed with USFDA (share of only 2% in 1996) • Cumulative filings at the end of 2009 stands at 1200 and significant number of filings have happened till date Source: USFDA, Internal Analysis, Industry Reports

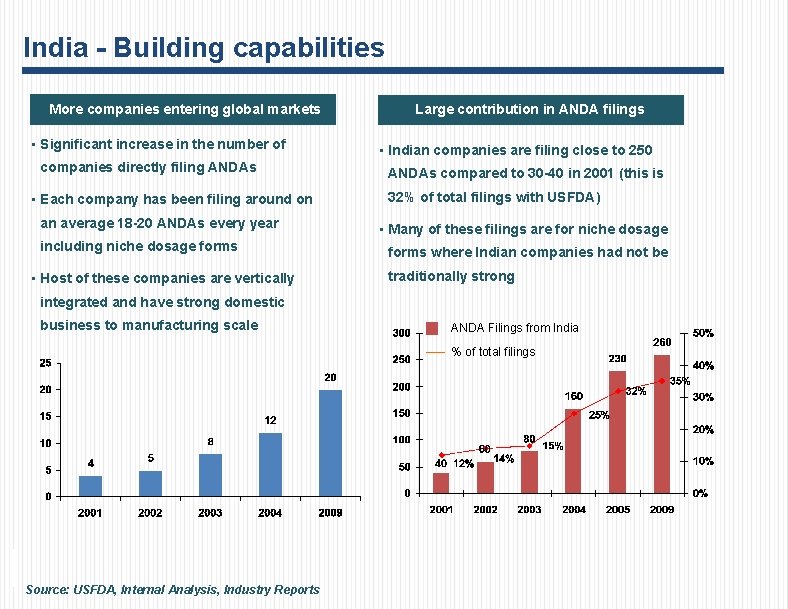

India - Building capabilities More companies entering global markets • Significant increase in the number of companies directly filing ANDAs • Each company has been filing around on an average 18 -20 ANDAs every year including niche dosage forms • Host of these companies are vertically Large contribution in ANDA filings • Indian companies are filing close to 250 ANDAs compared to 30 -40 in 2001 (this is 32% of total filings with USFDA) • Many of these filings are for niche dosage forms where Indian companies had not be traditionally strong integrated and have strong domestic business to manufacturing scale ANDA Filings from India % of total filings Source: USFDA, Internal Analysis, Industry Reports

India - Leading pricing revolution Indian drug prices are lowest in the world Brand Generic Lipitor Atorvastatin Pfizer US Price (US$ per unit) per unit 3. 10 Zocor Simvastatin Merck Norvasc Pfizer Celebrex Company Indian Price (US$ per unit) Indian Price as % to US Price 0. 35 11. 30 3. 80 0. 35 9. 30 Pfizer 1. 30 0. 11 8. 50 Celecoxib Pfizer 2. 40 0. 11 4. 60 Zyprexa Olanzapine Eli Lilly 8. 30 0. 18 2. 10 Paxil Paroxetine Glaxo 2. 44 0. 24 9. 90 Vioxx Rofecoxib Merck 2. 47 0. 11 4. 40 Zoloft Sertraline Pfizer 2. 21 0. 26 11. 90 Pravachol Pravastatin BMS 2. 50 0. 33 13. 20 Fosamax Alendronate Merck 15. 3 0. 70 4. 60 Source: CLSA Asia Pacific-Markets

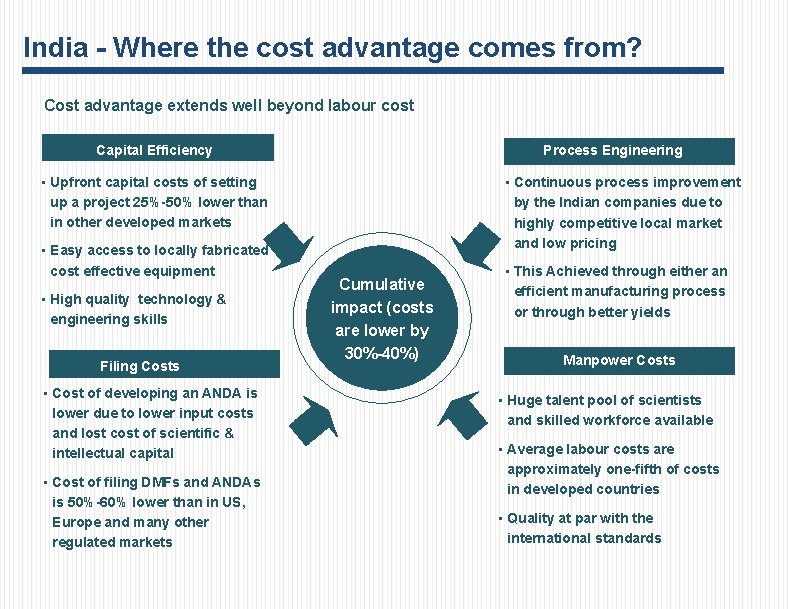

India - Where the cost advantage comes from? Cost advantage extends well beyond labour cost Capital Efficiency Process Engineering • Upfront capital costs of setting up a project 25%-50% lower than in other developed markets • Easy access to locally fabricated cost effective equipment • High quality technology & engineering skills Filing Costs • Cost of developing an ANDA is lower due to lower input costs and lost cost of scientific & intellectual capital • Cost of filing DMFs and ANDAs is 50%-60% lower than in US, Europe and many other regulated markets • Continuous process improvement by the Indian companies due to highly competitive local market and low pricing Cumulative impact (costs are lower by 30%-40%) • This Achieved through either an efficient manufacturing process or through better yields Manpower Costs • Huge talent pool of scientists and skilled workforce available • Average labour costs are approximately one-fifth of costs in developed countries • Quality at par with the international standards

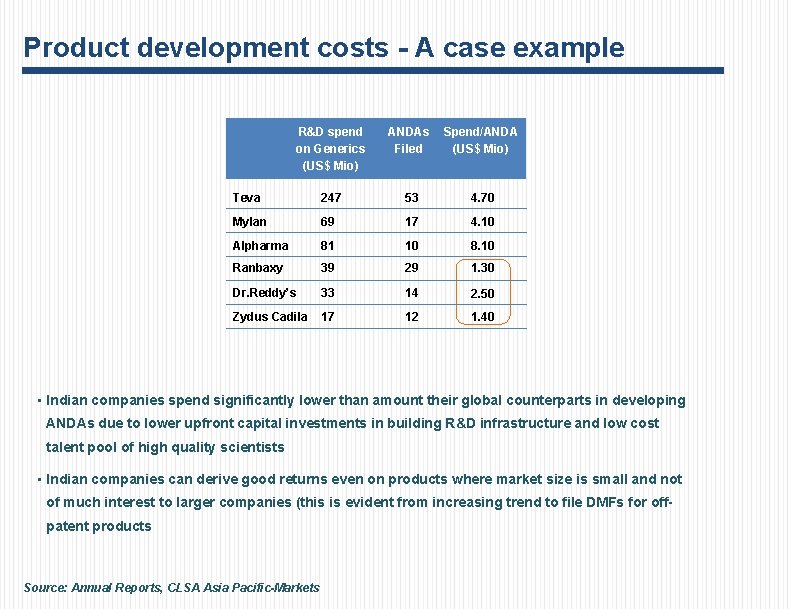

Product development costs - A case example R&D spend on Generics (US$ Mio) ANDAs Filed Spend/ANDA (US$ Mio) Teva 247 53 4. 70 Mylan 69 17 4. 10 Alpharma 81 10 8. 10 Ranbaxy 39 29 1. 30 Dr. Reddy’s 33 14 2. 50 Zydus Cadila 17 12 1. 40 • Indian companies spend significantly lower than amount their global counterparts in developing ANDAs due to lower upfront capital investments in building R&D infrastructure and low cost talent pool of high quality scientists • Indian companies can derive good returns even on products where market size is small and not of much interest to larger companies (this is evident from increasing trend to file DMFs for offpatent products Source: Annual Reports, CLSA Asia Pacific-Markets

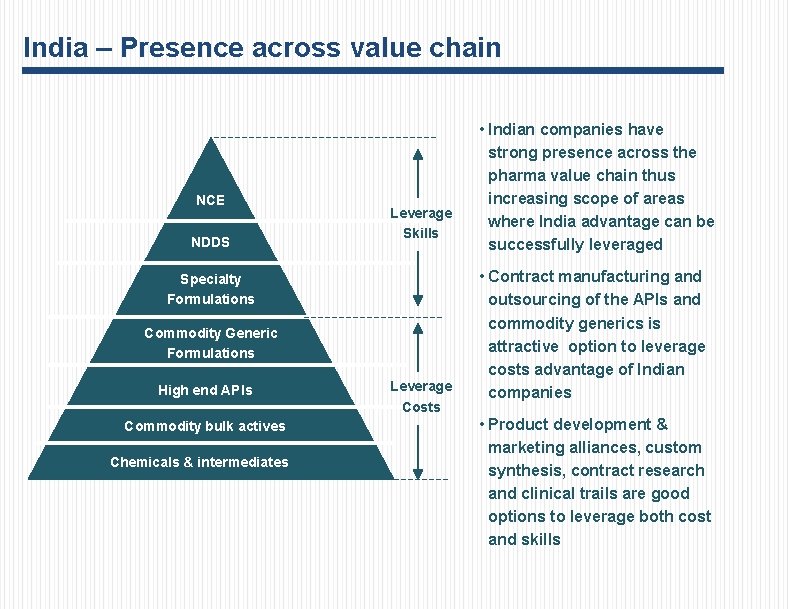

India – Presence across value chain NCE NDDS Leverage Skills Specialty Formulations Commodity Generic Formulations High end APIs Commodity bulk actives Chemicals & intermediates Leverage Costs • Indian companies have strong presence across the pharma value chain thus increasing scope of areas where India advantage can be successfully leveraged • Contract manufacturing and outsourcing of the APIs and commodity generics is attractive option to leverage costs advantage of Indian companies • Product development & marketing alliances, custom synthesis, contract research and clinical trails are good options to leverage both cost and skills

Thank You

- Slides: 20