Indexed Annuity Product Pricing and Risk Management Timothy

![Option basic o “The fighting styles of [a bull and a bear] may have Option basic o “The fighting styles of [a bull and a bear] may have](https://slidetodoc.com/presentation_image_h2/453da6b37cd562f916c7ed590f7b5a30/image-13.jpg)

- Slides: 24

Indexed Annuity Product Pricing and Risk Management Timothy Yi Enterprise Risk Management The Hartford

After this presentation o You will understand n Marketing position of indexed annuity n Basic pricing of indexed annuity n Risk management of indexed annuity including hedging August 4, 2012 2

Disclaimer o Any opinions in this presentation are mine and do not represent those of my employer o Products illustrated in this presentation are from public information and for the illustration purpose only o In order to illustrate the basic key concepts, lots of simplification will be made August 4, 2012 3

Annuity overview o Two phases of annuity contracts n Accumulation (deferred) phase n Distribution (payout/income) phase n Annuity usually refers to “accumulation” phase of the contracts o In US, very few contracts are annuitized from accumulation phase o Similar to certified deposit sold by banks, but usually longer duration guarantee August 4, 2012 4

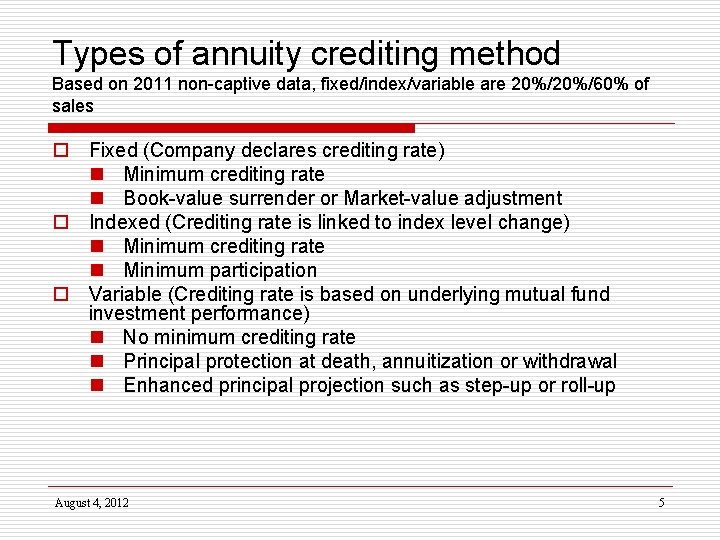

Types of annuity crediting method Based on 2011 non-captive data, fixed/index/variable are 20%/60% of sales o Fixed (Company declares crediting rate) n Minimum crediting rate n Book-value surrender or Market-value adjustment o Indexed (Crediting rate is linked to index level change) n Minimum crediting rate n Minimum participation o Variable (Crediting rate is based on underlying mutual fund investment performance) n No minimum crediting rate n Principal protection at death, annuitization or withdrawal n Enhanced principal projection such as step-up or roll-up August 4, 2012 5

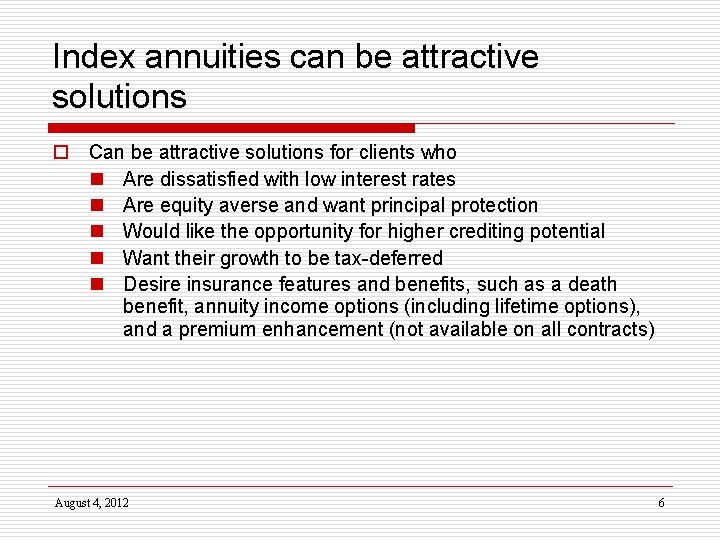

Index annuities can be attractive solutions o Can be attractive solutions for clients who n Are dissatisfied with low interest rates n Are equity averse and want principal protection n Would like the opportunity for higher crediting potential n Want their growth to be tax-deferred n Desire insurance features and benefits, such as a death benefit, annuity income options (including lifetime options), and a premium enhancement (not available on all contracts) August 4, 2012 6

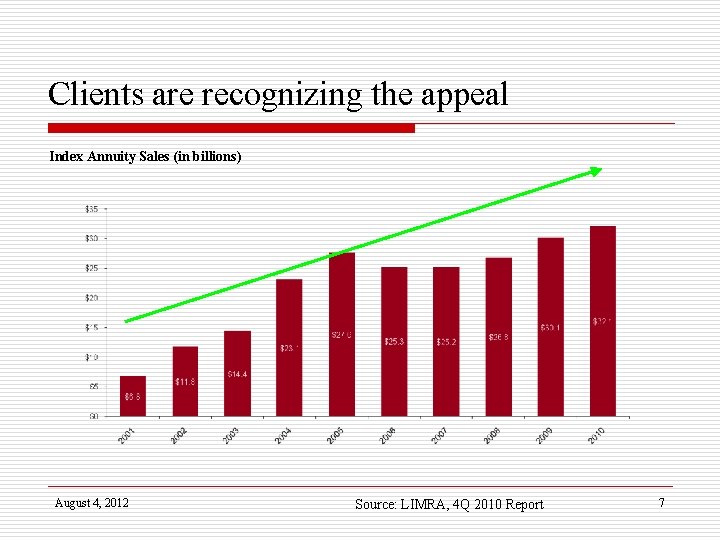

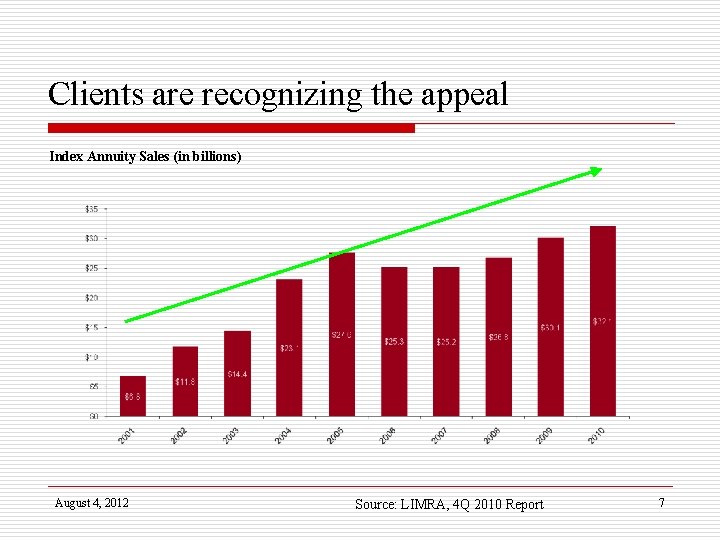

Clients are recognizing the appeal Index Annuity Sales (in billions) August 4, 2012 Source: LIMRA, 4 Q 2010 Report 7

Recent negative press o. Inappropriate sales to seniors o. Lack of suitability review o. Complicated product design o. Long surrender charge schedules o. Illiquidity for emergencies, including Long Term Care o. Two-tier annuities with illusory benefits August 4, 2012 For transcript of Dateline NBC aired on 4/13/2008 http: //www. msnbc. msn. com/id/24095230/ 8

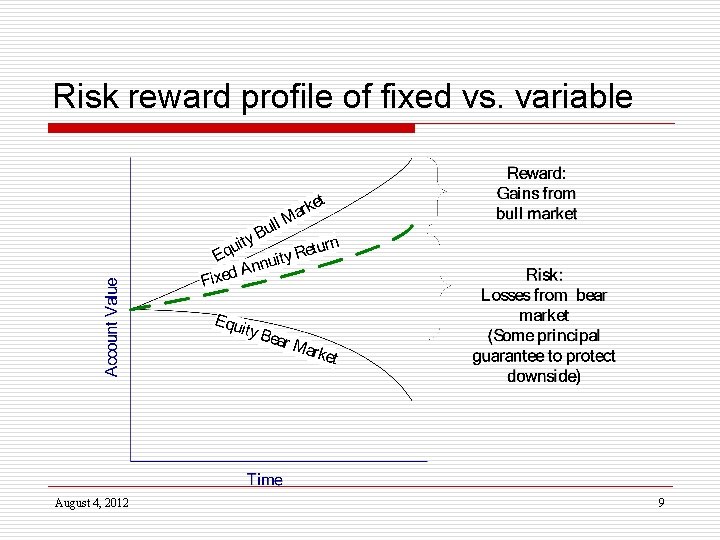

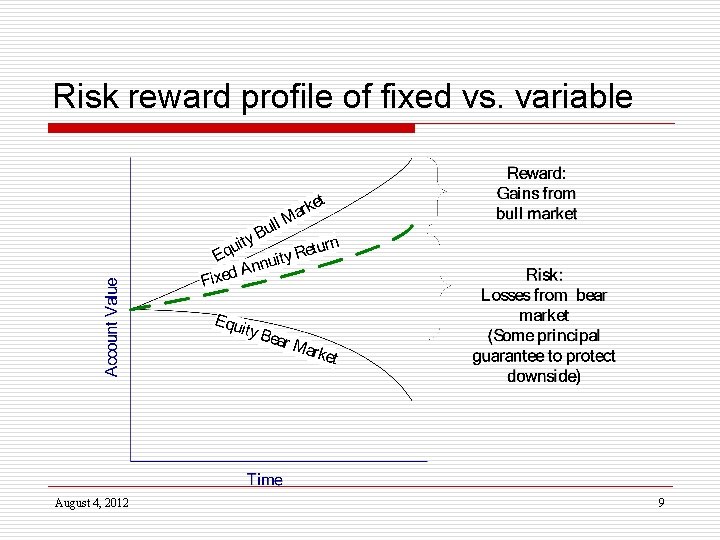

Risk reward profile of fixed vs. variable August 4, 2012 9

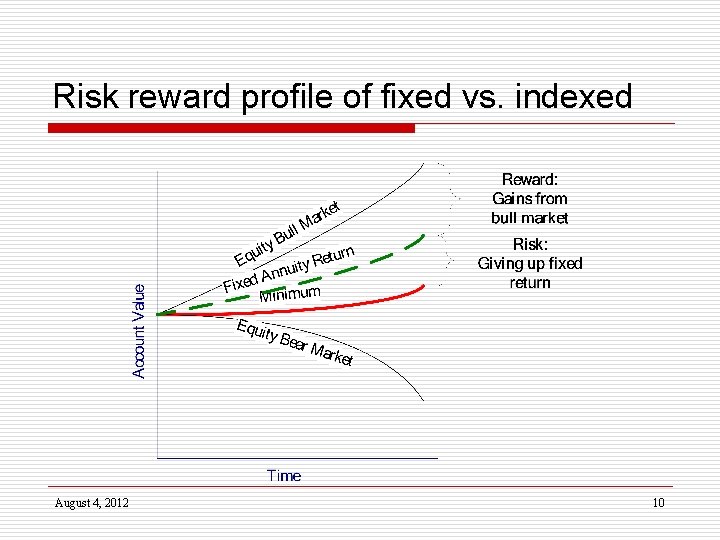

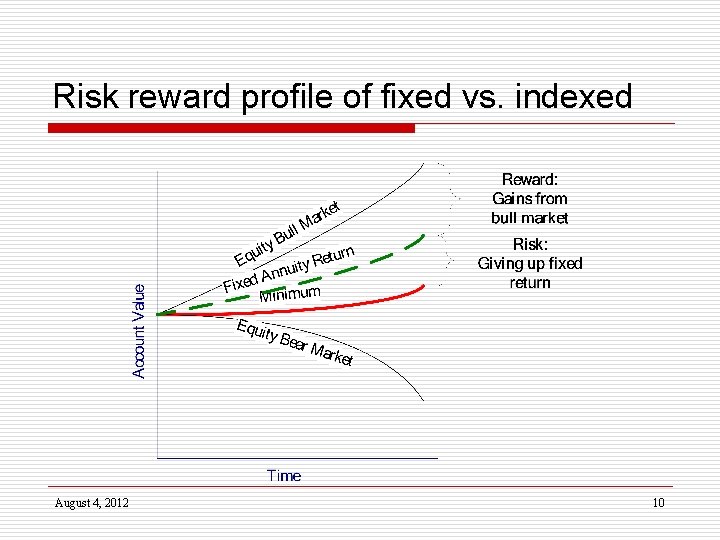

Risk reward profile of fixed vs. indexed August 4, 2012 10

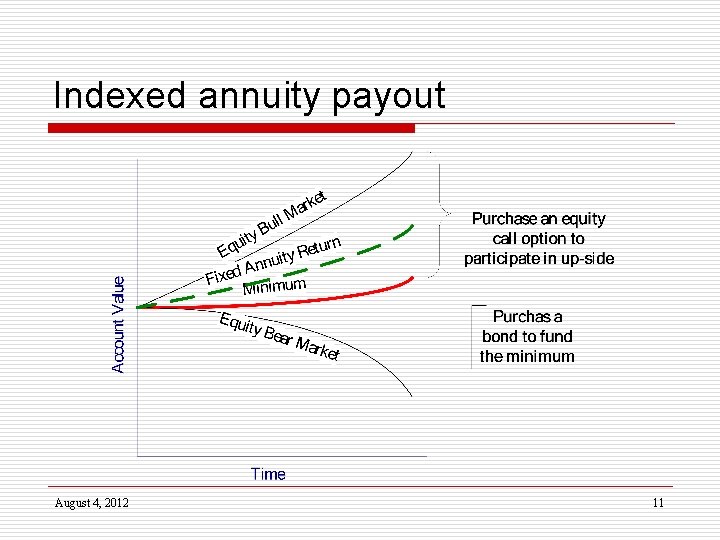

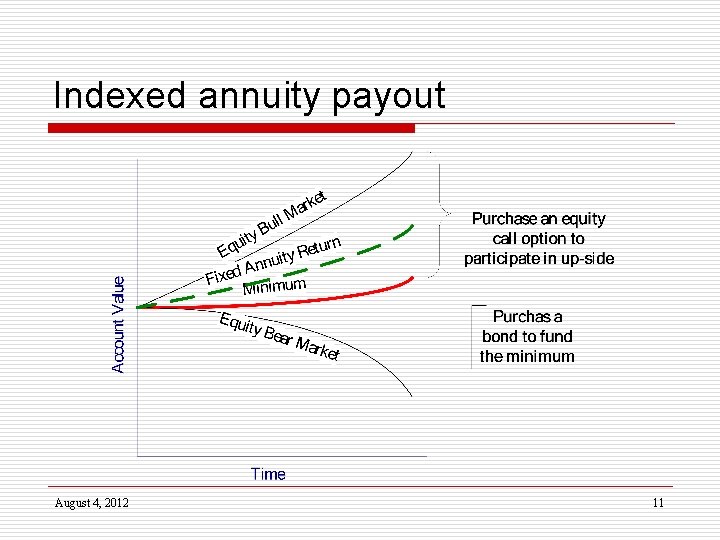

Indexed annuity payout August 4, 2012 11

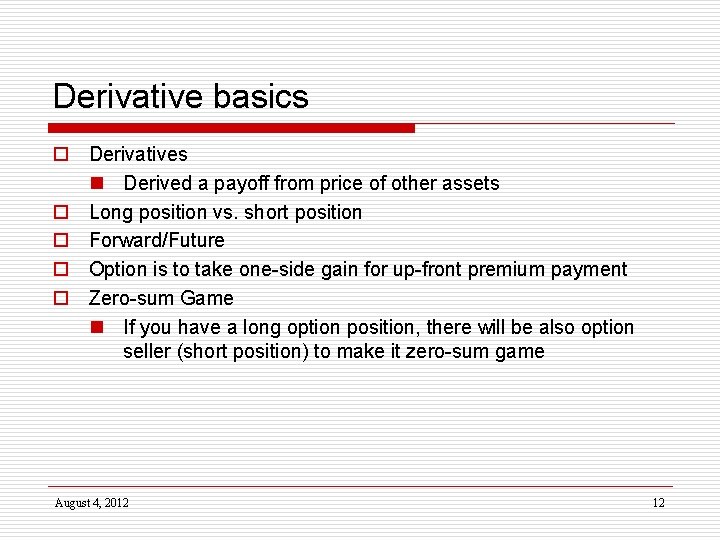

Derivative basics o Derivatives n Derived a payoff from price of other assets o Long position vs. short position o Forward/Future o Option is to take one-side gain for up-front premium payment o Zero-sum Game n If you have a long option position, there will be also option seller (short position) to make it zero-sum game August 4, 2012 12

![Option basic o The fighting styles of a bull and a bear may have Option basic o “The fighting styles of [a bull and a bear] may have](https://slidetodoc.com/presentation_image_h2/453da6b37cd562f916c7ed590f7b5a30/image-13.jpg)

Option basic o “The fighting styles of [a bull and a bear] may have a major impact on the names. When a bull fights it swipes its horns up; when a bear fights it swipes down on its opponents with its paws. When the market is going up, it is similar to a bull swiping up with its horns. When the market is going down it is similar to a bear swinging its paws down. ” (Wikipedia) o Call-option, right to buy an asset at a fixed strike price, to gain when the market is up o Put-option, right to sell an asset at a fixed strike price, to gain when the market is down n If you are bullish, purchase a call option and if you are bearish, purchase a put option August 4, 2012 13

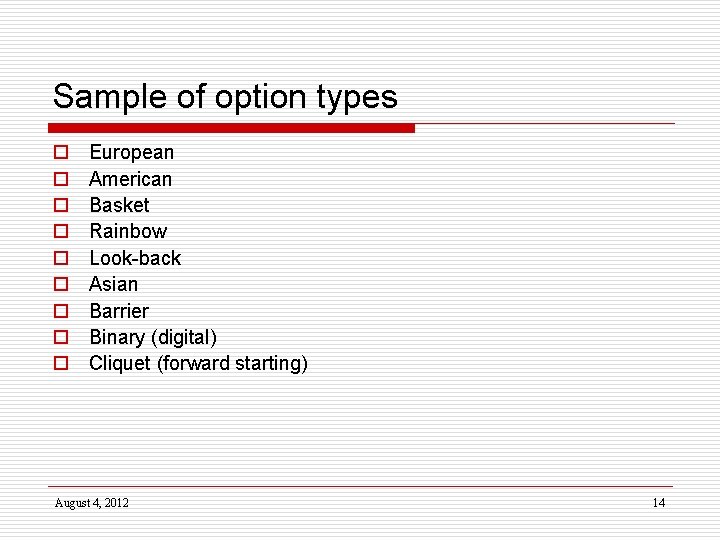

Sample of option types o o o o o European American Basket Rainbow Look-back Asian Barrier Binary (digital) Cliquet (forward starting) August 4, 2012 14

Sample of strategies involving options o Spread n Bull spread n Bear spread o Butterfly o Straddle o Strangle o Collar n Risk reversal o Covered call August 4, 2012 15

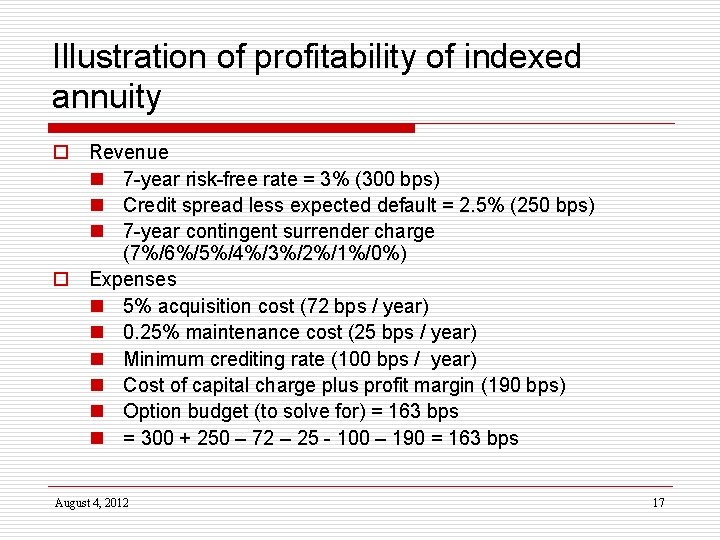

Illustration of profitability of indexed annuity o Example based on a 7 -year surrender-charge period product o Revenue n Risk-free rate n Credit spread less expected default n Contingent surrender charge to recover acquisition expenses o Expenses n Acquisition cost n Maintenance cost n Minimum crediting rate n Cost of capital charge plus profit margin n Option budget August 4, 2012 16

Illustration of profitability of indexed annuity o Revenue n 7 -year risk-free rate = 3% (300 bps) n Credit spread less expected default = 2. 5% (250 bps) n 7 -year contingent surrender charge (7%/6%/5%/4%/3%/2%/1%/0%) o Expenses n 5% acquisition cost (72 bps / year) n 0. 25% maintenance cost (25 bps / year) n Minimum crediting rate (100 bps / year) n Cost of capital charge plus profit margin (190 bps) n Option budget (to solve for) = 163 bps n = 300 + 250 – 72 – 25 - 100 – 190 = 163 bps August 4, 2012 17

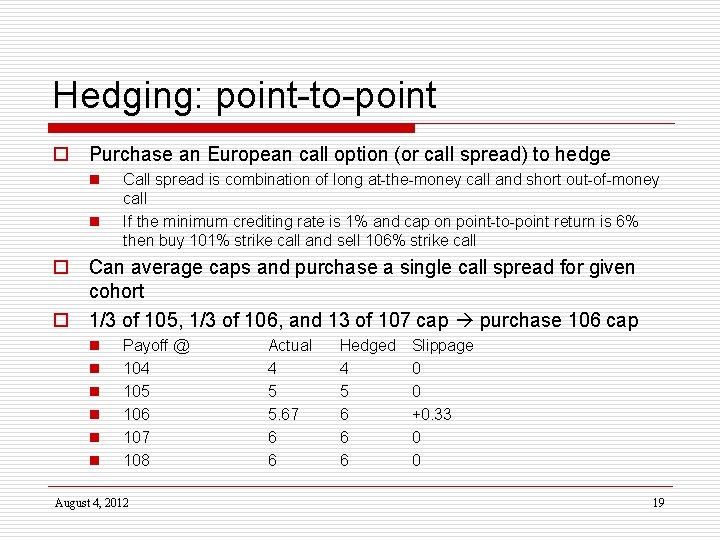

Basic design: point-to-point o Credited rate = Max (minimum, index return) where index return = Index(T+1)/Index(T) o Index returns are usually price returns excluding reinvestment of dividends o European call option to hedge index return o A call option on a price return index will be cheaper than a total return index o Based on the option budget, determine either participation rate or cap on index return August 4, 2012 18

Hedging: point-to-point o Purchase an European call option (or call spread) to hedge n n Call spread is combination of long at-the-money call and short out-of-money call If the minimum crediting rate is 1% and cap on point-to-point return is 6% then buy 101% strike call and sell 106% strike call o Can average caps and purchase a single call spread for given cohort o 1/3 of 105, 1/3 of 106, and 13 of 107 cap purchase 106 cap n n n Payoff @ 104 105 106 107 108 August 4, 2012 Actual 4 5 5. 67 6 6 Hedged 4 5 6 6 6 Slippage 0 0 +0. 33 0 0 19

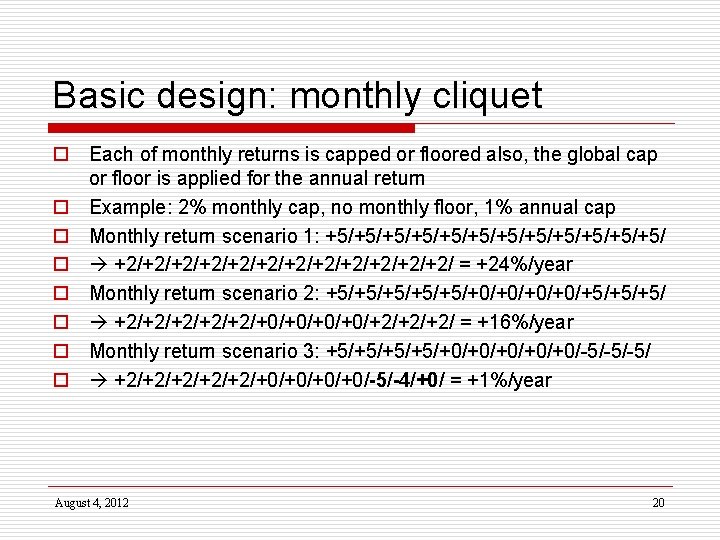

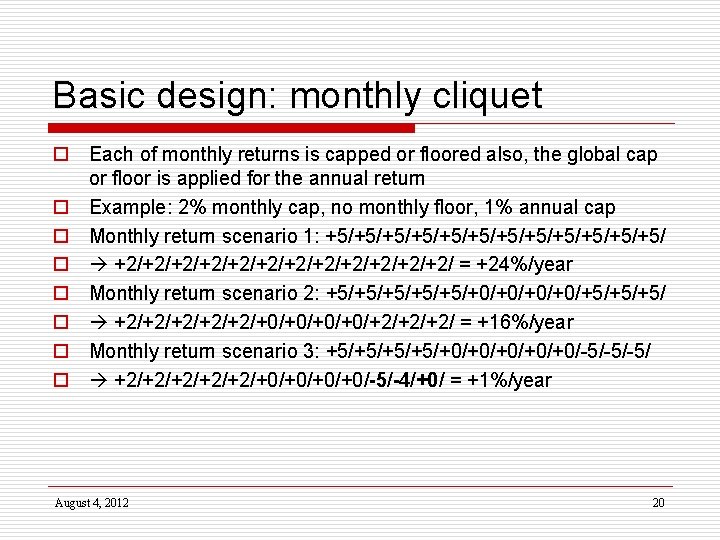

Basic design: monthly cliquet o Each of monthly returns is capped or floored also, the global cap or floor is applied for the annual return o Example: 2% monthly cap, no monthly floor, 1% annual cap o Monthly return scenario 1: +5/+5/+5/+5/+5/+5/ o +2/+2/+2/+2/+2/+2/ = +24%/year o Monthly return scenario 2: +5/+5/+5/+0/+0/+5/+5/+5/ o +2/+2/+2/+0/+0/+2/+2/+2/ = +16%/year o Monthly return scenario 3: +5/+5/+0/+0/+0/-5/-5/-5/ o +2/+2/+2/+0/+0/-5/-4/+0/ = +1%/year August 4, 2012 20

Risk management consideration o Nothing o Hedging n Static hedging n Dynamic hedging August 4, 2012 21

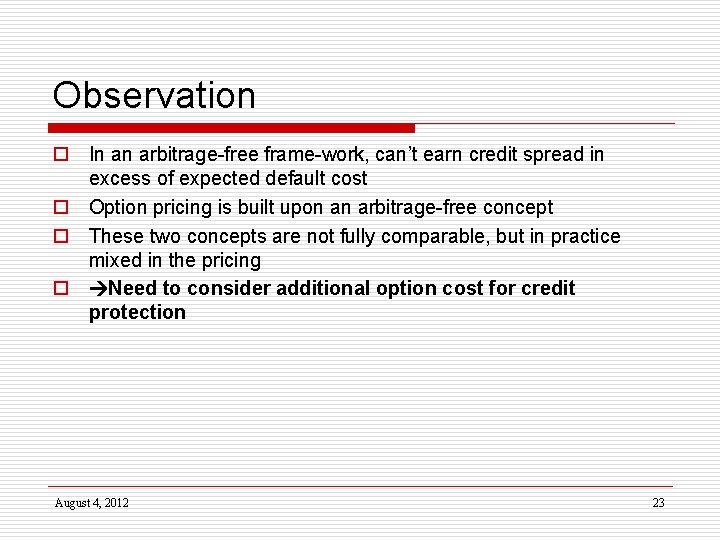

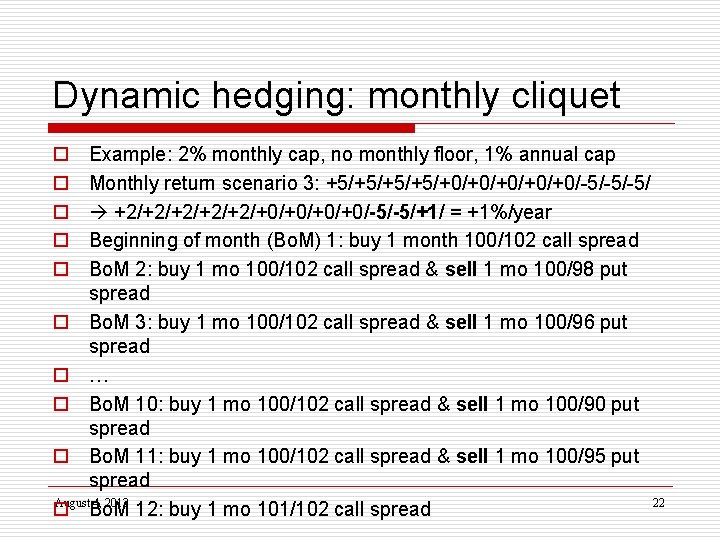

Dynamic hedging: monthly cliquet o o o Example: 2% monthly cap, no monthly floor, 1% annual cap Monthly return scenario 3: +5/+5/+0/+0/+0/-5/-5/-5/ +2/+2/+2/+0/+0/-5/-5/+1/ = +1%/year Beginning of month (Bo. M) 1: buy 1 month 100/102 call spread Bo. M 2: buy 1 mo 100/102 call spread & sell 1 mo 100/98 put spread o Bo. M 3: buy 1 mo 100/102 call spread & sell 1 mo 100/96 put spread o … o Bo. M 10: buy 1 mo 100/102 call spread & sell 1 mo 100/90 put spread o Bo. M 11: buy 1 mo 100/102 call spread & sell 1 mo 100/95 put spread August 4, 2012 22 o Bo. M 12: buy 1 mo 101/102 call spread

Observation o In an arbitrage-free frame-work, can’t earn credit spread in excess of expected default cost o Option pricing is built upon an arbitrage-free concept o These two concepts are not fully comparable, but in practice mixed in the pricing o Need to consider additional option cost for credit protection August 4, 2012 23

Traditional asset liability challenges o Minimum crediting rate guarantee n Need to invest longer duration to minimize reinvestment risk at lower rate (duration L) o Book value surrender n Need to invest shorter duration to minimize market value loss when selling a bond at higher rate (duration S) o Mixed challenges n Invest in a duration between L and S n Purchase options to protect o Need to revise the profitability to additional interest rate option cost August 4, 2012 24