Ind AS 115 Revenue from contracts with customers

- Slides: 25

Ind AS 115 – Revenue from contracts with customers January 29, 2019

Ø Speaker’s profile MEGHDOOT JAJOO EXECUTIVE PARTNER ASSURANCE ASA & Associates LLP Handheld: +91 9769928001 Email: meghdoot. jajoo@asa. in Meghdoot Jajoo is an Executive Partner with the Assurance team in Mumbai of ASA & ASSOCIATES LLP. Having worked with the corporate sector as well as in the Big 4 s, he comes with over 20 years of experience in auditing and financial advisory. His areas of specialization are International Financial Reporting Standards (IFRS) and Indian Accounting Standards (Ind AS). Meghdoot has handled clients across the globe viz. Canada, Africa, the Middle East and India. He has advised industry leaders across telecommunications, BPOs, media, technology and logistics.

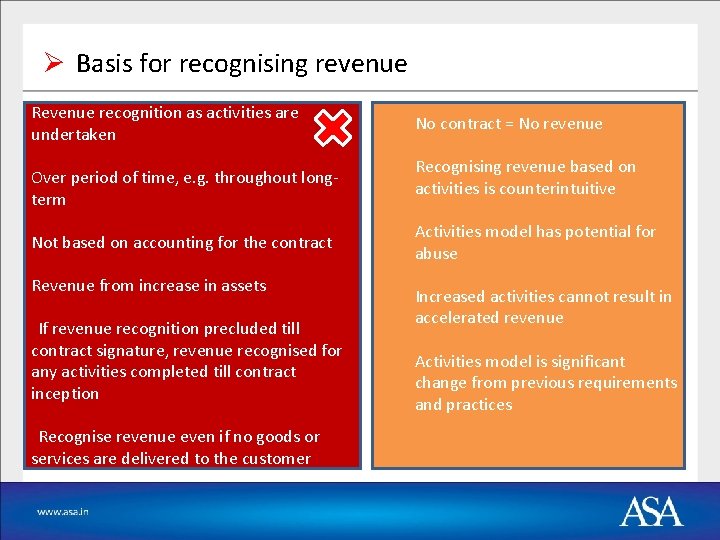

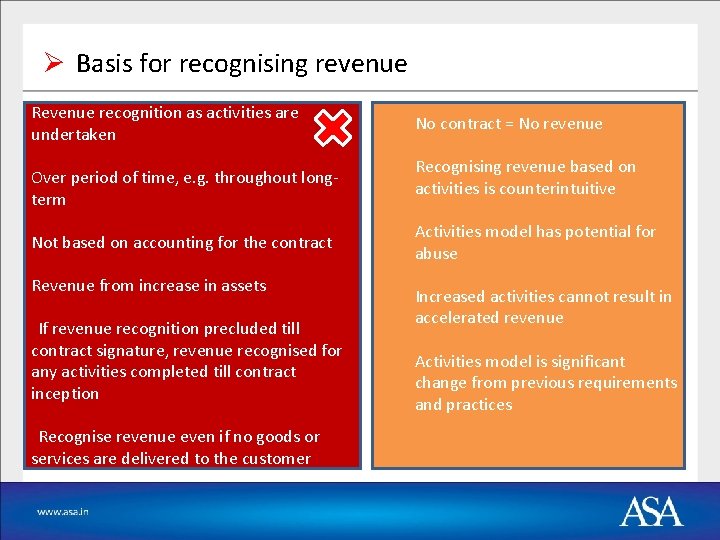

Ø Basis for recognising revenue Revenue recognition as activities are undertaken Over period of time, e. g. throughout longterm Not based on accounting for the contract Revenue from increase in assets If revenue recognition precluded till contract signature, revenue recognised for any activities completed till contract inception Recognise revenue even if no goods or services are delivered to the customer No contract = No revenue Recognising revenue based on activities is counterintuitive Activities model has potential for abuse Increased activities cannot result in accelerated revenue Activities model is significant change from previous requirements and practices

Ø Five step model 1 Identify the contract (s) with a customer 2 Identify the separate performance obligations (PO) in the contract 3 Determine the transaction price 4 Allocate the transaction price to each performance obligation Allocated transaction price to PO #1 5 Recognize revenue when (or as) each performance obligation is satisfied Recognise revenue PO #1 Contract Performance obligation (PO#1) Performance obligation (PO#2) Transaction price Allocated transaction price to PO #2 Recognise revenue PO #2

Step 1 – Identify the contract

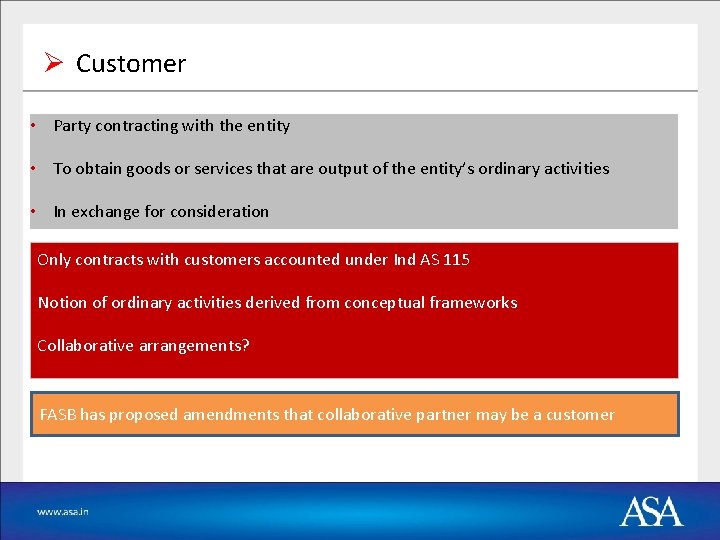

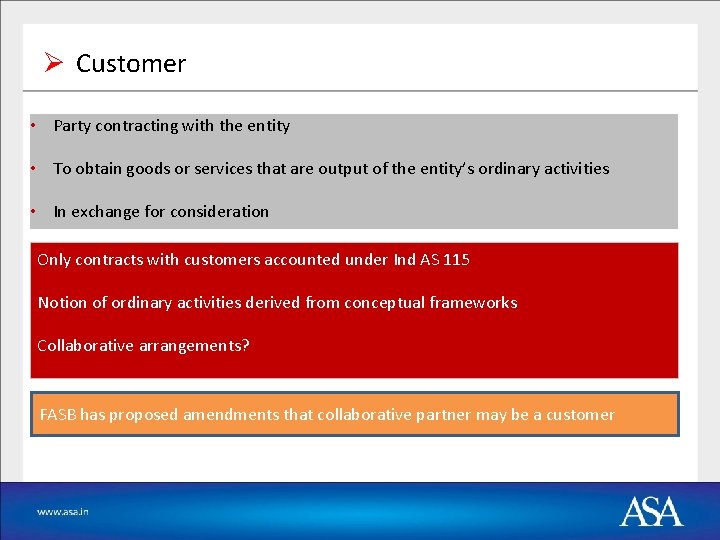

Ø Customer • Party contracting with the entity • To obtain goods or services that are output of the entity’s ordinary activities • In exchange for consideration Only contracts with customers accounted under Ind AS 115 Notion of ordinary activities derived from conceptual frameworks Collaborative arrangements? FASB has proposed amendments that collaborative partner may be a customer

ØExample – Reddington (India) Limited Consolidated revenue for the quarter ended June 30, 2018 was lower by 5% than what it would have been under Ind AS 18. This was due to change in the accounting policy with respect to income from supplier schemes. Income from supplier rebates were hitherto classified as part of revenue from operations. The Group has adjusted supplier rebates against purchase of traded goods on adoption of Ind AS 115.

Step 2 – Identify the separate performance obligations

ØCustomer option for additional goods or services Depending on the contract, promised goods or services may include granting options to purchase additional goods or services – when those options provide a customer with a material right. - Free goods / services Discounted goods / services Sales incentives Customer award credits Contract renewal options Other discounts on future goods / services Revenues are expected to experience a benefit with most of the difference resulting from exercises of customer software purchase options granted in prior years which result in software revenue.

ØNon-refundable upfront fees Mahindra Holidays and Resorts Limited Due to application of Ind AS 115, membership fees and incremental costs to obtain and / or fulfil a contract with a customer, as applicable, is recognised over the effective membership period. The previous standard permitted the upfront recognition of the non-refundable admission fees on sale of the membership. As a result, its revenue for the quarter ended 30 June 2018 was impacted by 18%. Total expenditure for the same quarter was also reduced by 7% due to deferral of contract costs.

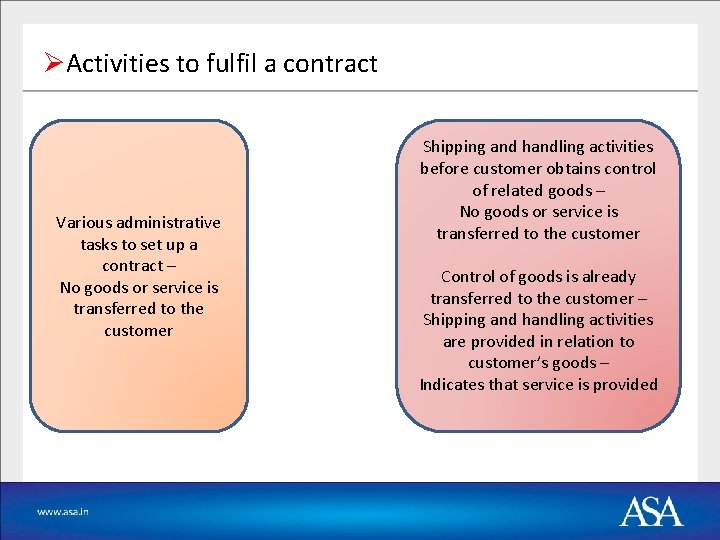

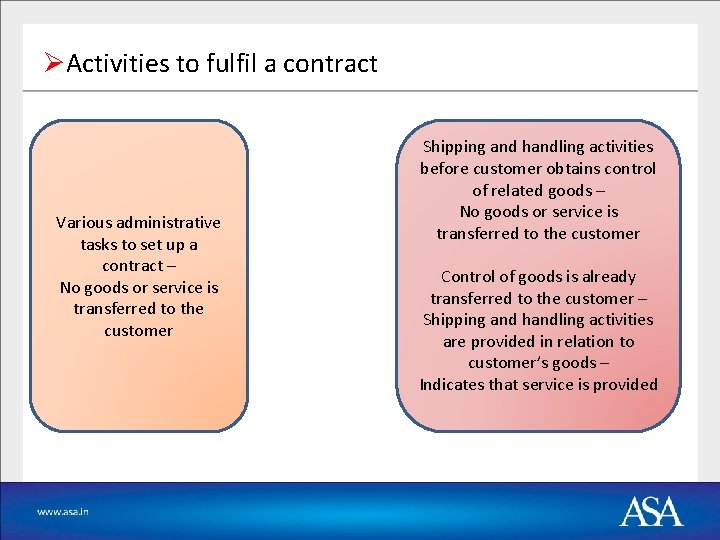

ØActivities to fulfil a contract Various administrative tasks to set up a contract – No goods or service is transferred to the customer Shipping and handling activities before customer obtains control of related goods – No goods or service is transferred to the customer Control of goods is already transferred to the customer – Shipping and handling activities are provided in relation to customer’s goods – Indicates that service is provided

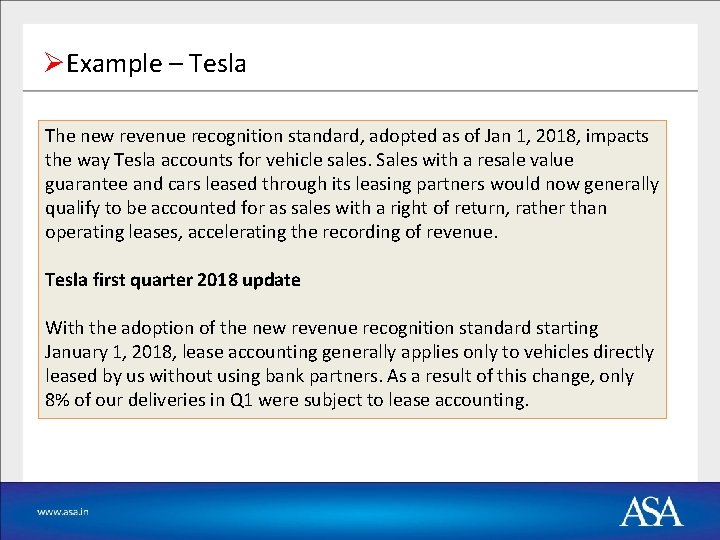

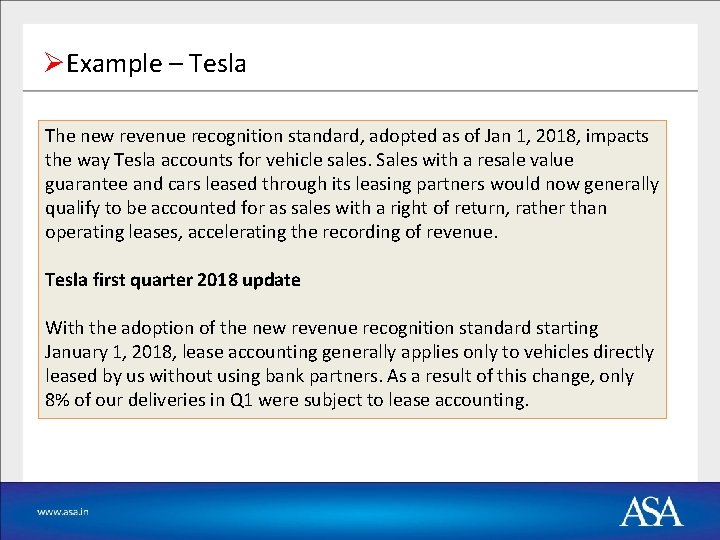

ØExample – Tesla The new revenue recognition standard, adopted as of Jan 1, 2018, impacts the way Tesla accounts for vehicle sales. Sales with a resale value guarantee and cars leased through its leasing partners would now generally qualify to be accounted for as sales with a right of return, rather than operating leases, accelerating the recording of revenue. Tesla first quarter 2018 update With the adoption of the new revenue recognition standard starting January 1, 2018, lease accounting generally applies only to vehicles directly leased by us without using bank partners. As a result of this change, only 8% of our deliveries in Q 1 were subject to lease accounting.

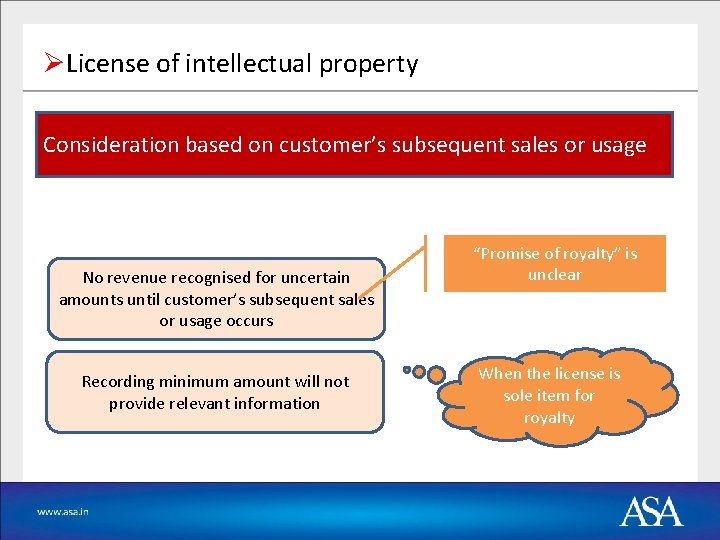

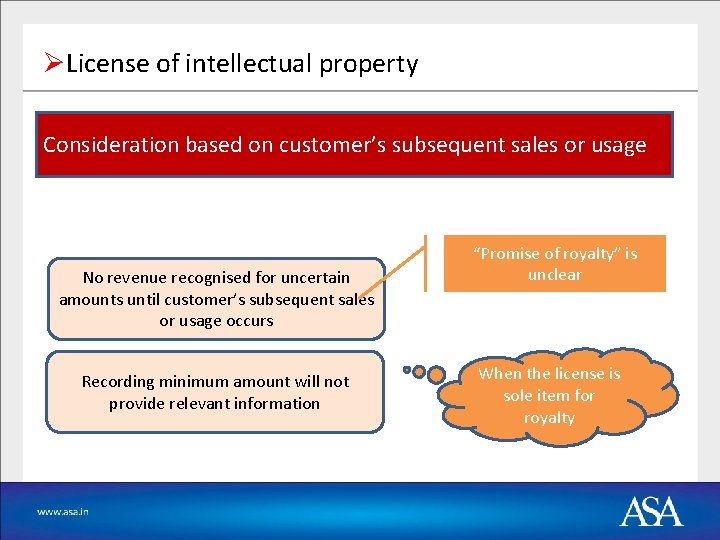

ØLicense of intellectual property Consideration based on customer’s subsequent sales or usage No revenue recognised for uncertain amounts until customer’s subsequent sales or usage occurs Recording minimum amount will not provide relevant information “Promise of royalty” is unclear When the license is sole item for royalty

Step 3 – Determine the transaction price

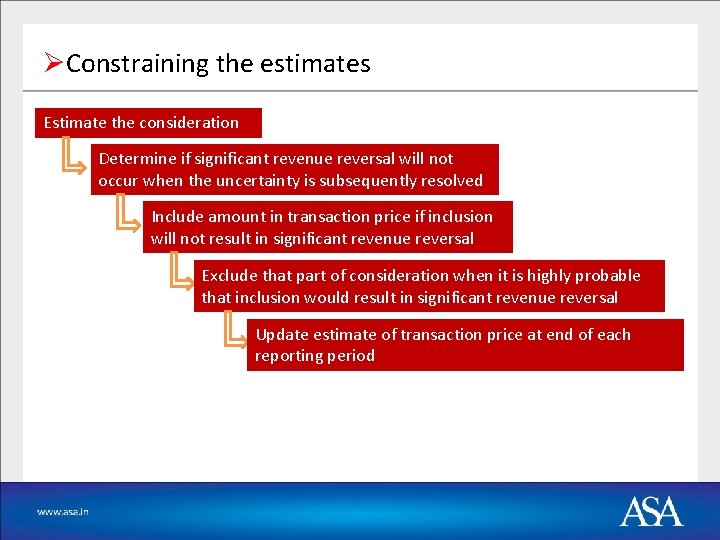

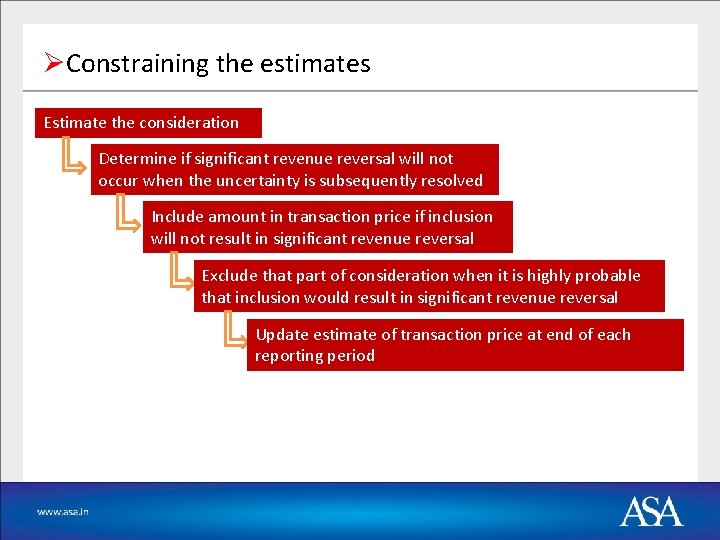

ØConstraining the estimates Estimate the consideration Determine if significant revenue reversal will not occur when the uncertainty is subsequently resolved Include amount in transaction price if inclusion will not result in significant revenue reversal Exclude that part of consideration when it is highly probable that inclusion would result in significant revenue reversal Update estimate of transaction price at end of each reporting period

Step 4 – Allocate the transaction price

ØCombination of methods If two or more of goods or services have highly variable or uncertain SSPs Residual approach Aggregate SSP for goods of highly variable or uncertain SSPs Another method SSP of individual goods relative to aggregated SSP determined using residual approach

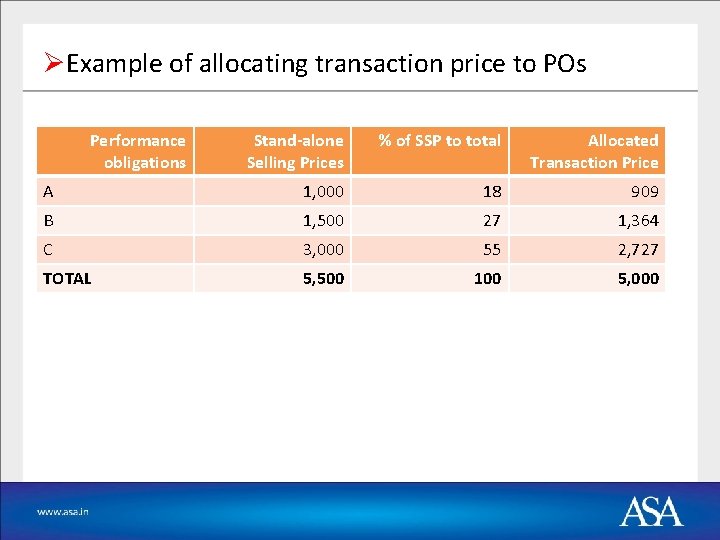

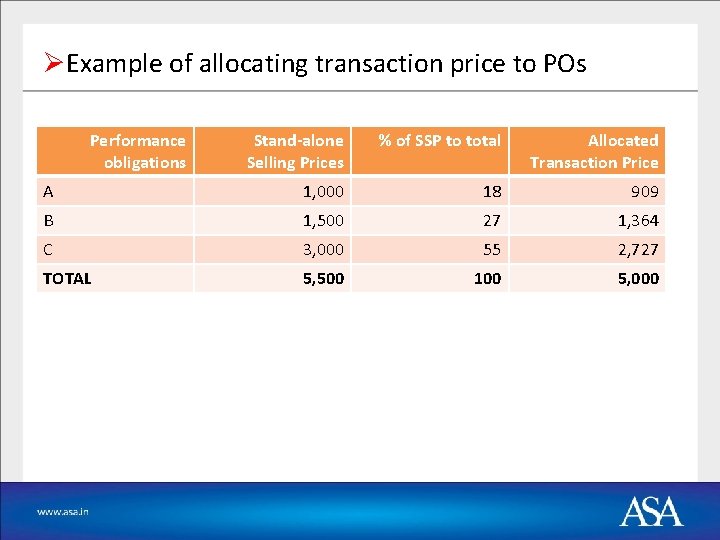

ØExample of allocating transaction price to POs Performance obligations Stand-alone Selling Prices % of SSP to total Allocated Transaction Price A 1, 000 18 909 B 1, 500 27 1, 364 C 3, 000 55 2, 727 TOTAL 5, 500 100 5, 000

Step 5 – Recognise revenue when (or as) each performance obligation is satisfied

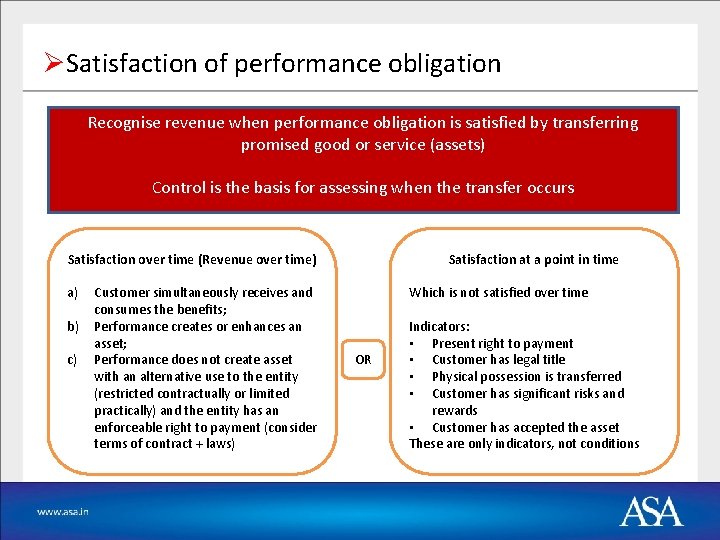

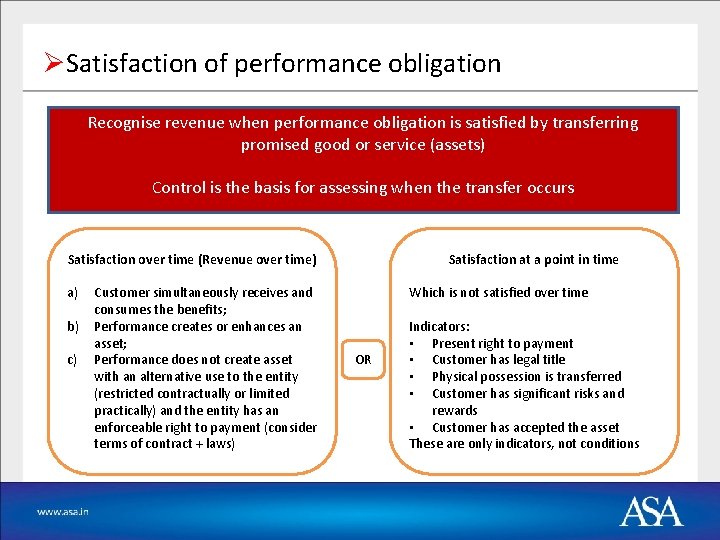

ØSatisfaction of performance obligation Recognise revenue when performance obligation is satisfied by transferring promised good or service (assets) Control is the basis for assessing when the transfer occurs Satisfaction over time (Revenue over time) a) b) c) Customer simultaneously receives and consumes the benefits; Performance creates or enhances an asset; Performance does not create asset with an alternative use to the entity (restricted contractually or limited practically) and the entity has an enforceable right to payment (consider terms of contract + laws) Satisfaction at a point in time Which is not satisfied over time OR Indicators: • Present right to payment • Customer has legal title • Physical possession is transferred • Customer has significant risks and rewards • Customer has accepted the asset These are only indicators, not conditions

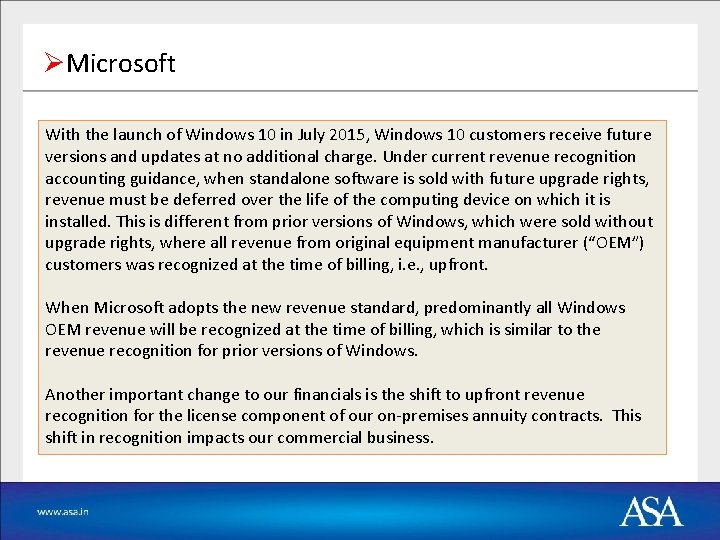

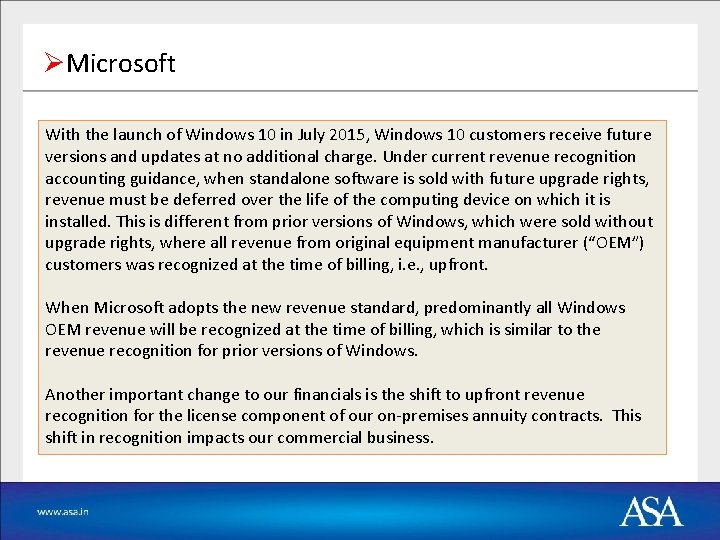

ØMicrosoft With the launch of Windows 10 in July 2015, Windows 10 customers receive future versions and updates at no additional charge. Under current revenue recognition accounting guidance, when standalone software is sold with future upgrade rights, revenue must be deferred over the life of the computing device on which it is installed. This is different from prior versions of Windows, which were sold without upgrade rights, where all revenue from original equipment manufacturer (“OEM”) customers was recognized at the time of billing, i. e. , upfront. When Microsoft adopts the new revenue standard, predominantly all Windows OEM revenue will be recognized at the time of billing, which is similar to the revenue recognition for prior versions of Windows. Another important change to our financials is the shift to upfront revenue recognition for the license component of our on-premises annuity contracts. This shift in recognition impacts our commercial business.

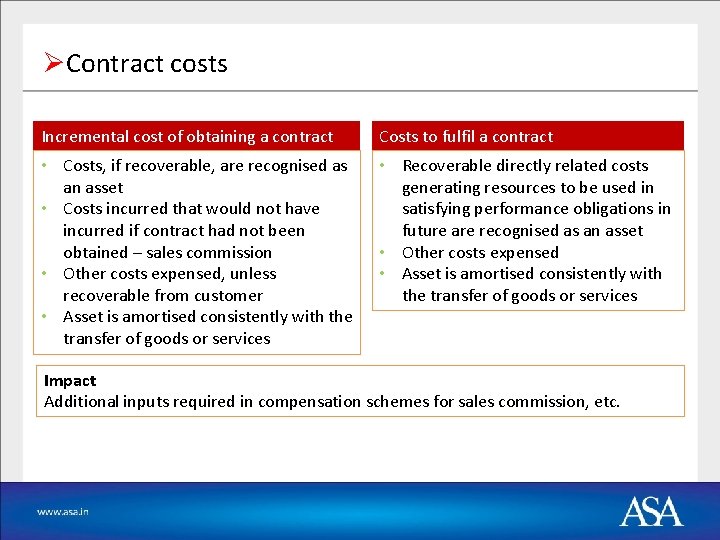

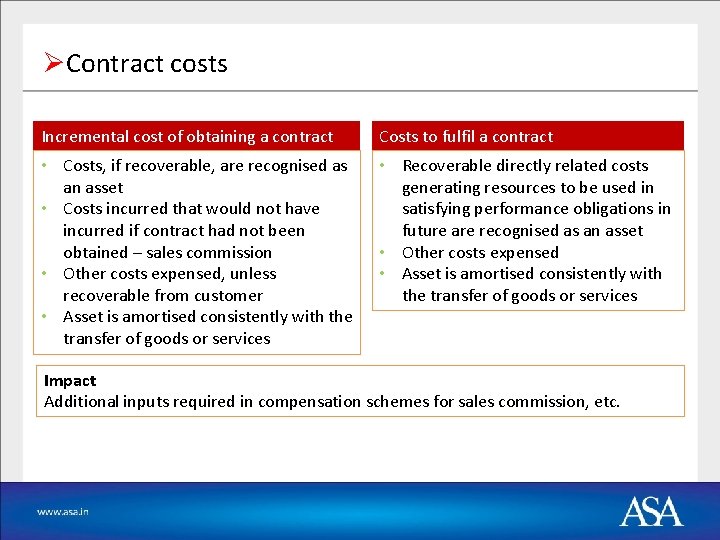

ØContract costs Incremental cost of obtaining a contract Costs to fulfil a contract • Costs, if recoverable, are recognised as an asset • Costs incurred that would not have incurred if contract had not been obtained – sales commission • Other costs expensed, unless recoverable from customer • Asset is amortised consistently with the transfer of goods or services • Recoverable directly related costs generating resources to be used in satisfying performance obligations in future are recognised as an asset • Other costs expensed • Asset is amortised consistently with the transfer of goods or services Impact Additional inputs required in compensation schemes for sales commission, etc.

ØEffective date Ind AS 115 applicability For financial years commencing on or after 1 April 2018. Early application is not permitted. IFRS 15 applicability For financial years commencing on or after 1 January 2018. Early application is permitted.

ØDisclaimer - - - This presentation is intended solely as a draft for discussion/presentation purposes. We express no assurance or other opinion and shall have no responsibility whatsoever to any other party in respect of the contents of this presentation. The comments herein are not binding on any authority / regulators and there can be no assurance that the authority / regulators will not take a position contrary to that advocated by us and that there will be no litigation. The discussions and interpretations in this presentation are based on the existing laws prevailing as of the date of this presentation. If there is a change, including a change having a retrospective effect, in the statutory laws, the implications in this presentation would necessarily have to be re-evaluated in light of the change.

Ind as 115 applicability

Ind as 115 applicability Ind as 11 construction contracts

Ind as 11 construction contracts Total revenue

Total revenue Pre-ind

Pre-ind Deferred tax as per ind as

Deferred tax as per ind as Kampagnetekst genre

Kampagnetekst genre Exploratory ind

Exploratory ind Ind 780

Ind 780 Ind as 116

Ind as 116 Ind as 32

Ind as 32 Pengertian alkalimetri dan asidimetri

Pengertian alkalimetri dan asidimetri Cka eshte indi

Cka eshte indi Dept ind onegov

Dept ind onegov Ind 780

Ind 780 Fair value hierarchy

Fair value hierarchy Ind as 16 property plant and equipment

Ind as 16 property plant and equipment Tgi fiberglass

Tgi fiberglass Ind as 37

Ind as 37 Ttest ind

Ttest ind Antecedent pronoun

Antecedent pronoun Hvordan får man en elefant ind i et køleskab

Hvordan får man en elefant ind i et køleskab 21 cfr part 312

21 cfr part 312 Ind safety report

Ind safety report Ind as 37

Ind as 37 Ind 780

Ind 780 Solicitud de licencia articulo 114 y 115 decreto 688/93

Solicitud de licencia articulo 114 y 115 decreto 688/93