Implementation NYU Valuing a Business II Prof Ian

Implementation

NYU Valuing a Business II Prof. Ian Giddy New York University

What’s a Company Worth? q Acquisition Flexics q LBOs q Restructuring Copyright © 2003 Ian H. Giddy Valuation 3

Equity Valuation: Application to M&A Prof. Ian Giddy New York University

What's It Worth? Valuation Methods q Book value approach q Market value approach q Ratios (like P/E ratio) q Break-up value q Cash flow value -- present value of future cash flows Copyright © 2003 Ian H. Giddy Valuation 5

How Much Should We Pay? Applying the discounted cash flow approach, we need to know: 1. The incremental cash flows to be generated from the acquisition, adjusted for debt servicing and taxes 2. The rate at which to discount the cash flows (required rate of return) 3. The deadweight costs of making the acquisition (investment banks' fees, etc) Copyright © 2003 Ian H. Giddy Valuation 6

Equity Valuation in Practice q Estimating synergies q Estimating business restructuring q Estimating financial restructuring q Application to Basix q Valuation in a bidding context Copyright © 2003 Ian H. Giddy Valuation 7

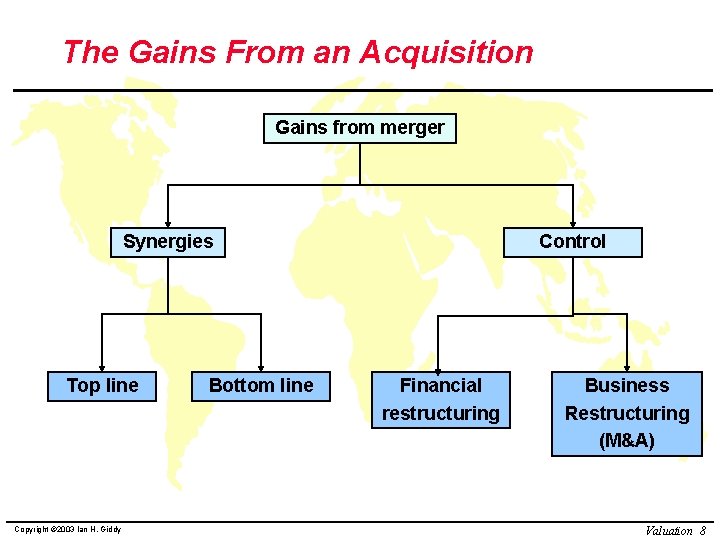

The Gains From an Acquisition Gains from merger Synergies Top line Copyright © 2003 Ian H. Giddy Bottom line Control Financial restructuring Business Restructuring (M&A) Valuation 8

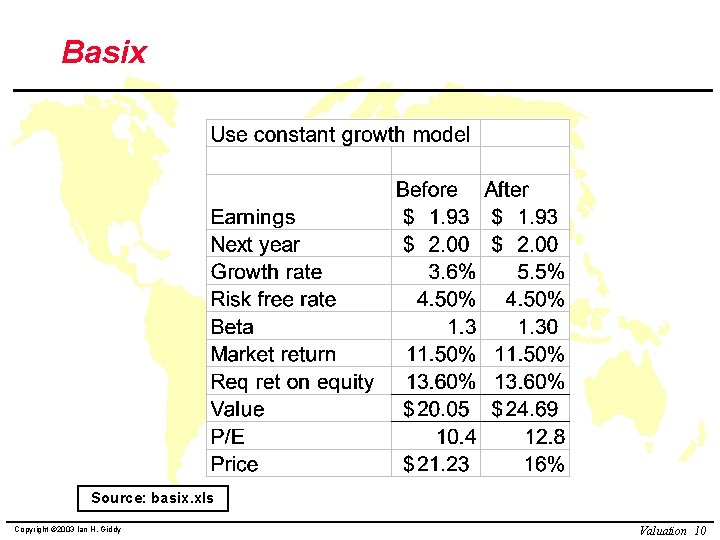

The Basics IBM is considering the acquisition of Basix, Inc. The shares are trading at a P/E of 11, far below IBM’s P/E of 18. Based on past performance the company is expected to earn $2 per share next year, an increase from the current EPS of $1. 93. If IBM acquires Basix, the long-run EPS growth rate could be raised to 5. 5%. The Treasury bond yield is 4. 5%, the company’s beta is 1. 3 and the long run market return is 11. 5%. Is the company worth buying at a P/E of 12? At how much of a premium should we say fugedaboudit? Copyright © 2003 Ian H. Giddy Valuation 9

Basix Source: basix. xls Copyright © 2003 Ian H. Giddy Valuation 10

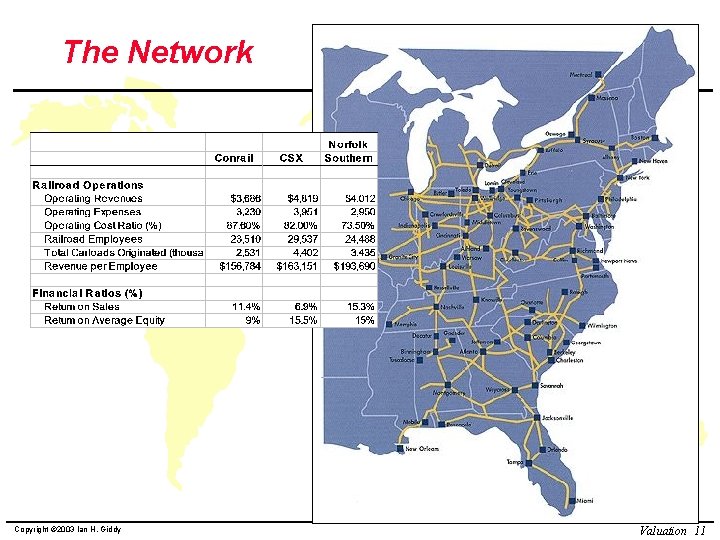

The Network Copyright © 2003 Ian H. Giddy Valuation 11

How Much Premium Can a Buyer Pay? Applying the discounted cash flow approach, we need to know: q The incremental cash flows to be generated from the acquisition, adjusted for debt servicing and taxes q The rate at which to discount the cash flows (required rate of return on equity) q The deadweight costs of making the acquisition (investment banks' fees, etc) q Cost of losing out! Copyright © 2003 Ian H. Giddy Valuation 12

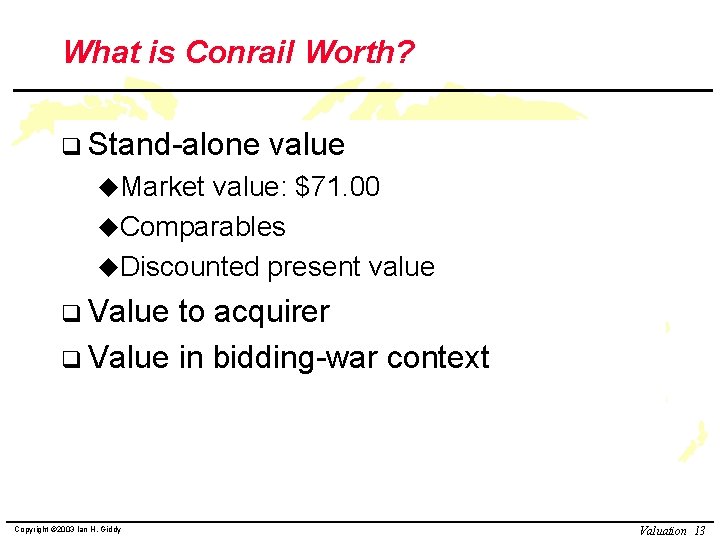

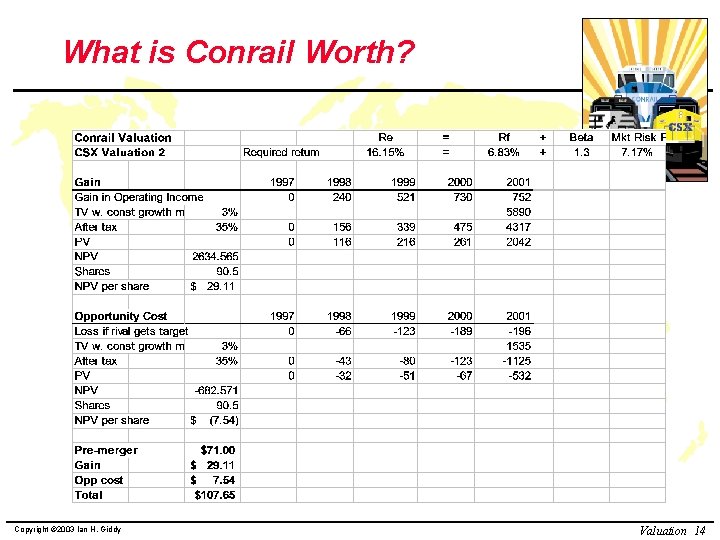

What is Conrail Worth? q Stand-alone value u. Market value: $71. 00 u. Comparables u. Discounted present value q Value to acquirer q Value in bidding-war context Copyright © 2003 Ian H. Giddy Valuation 13

What is Conrail Worth? Copyright © 2003 Ian H. Giddy Valuation 14

But Where Are the Profits? January 2001 http: //www. railwayage. com/jun 01/conrail_split. html Copyright © 2003 Ian H. Giddy Valuation 15

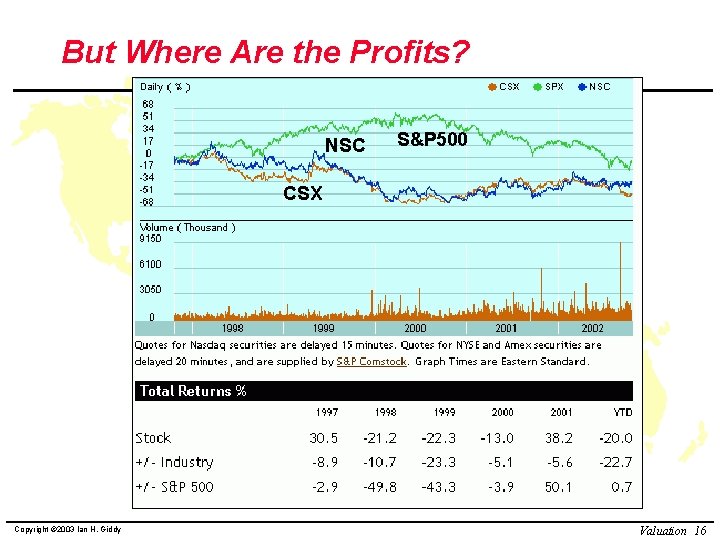

But Where Are the Profits? NSC S&P 500 CSX Copyright © 2003 Ian H. Giddy Valuation 16

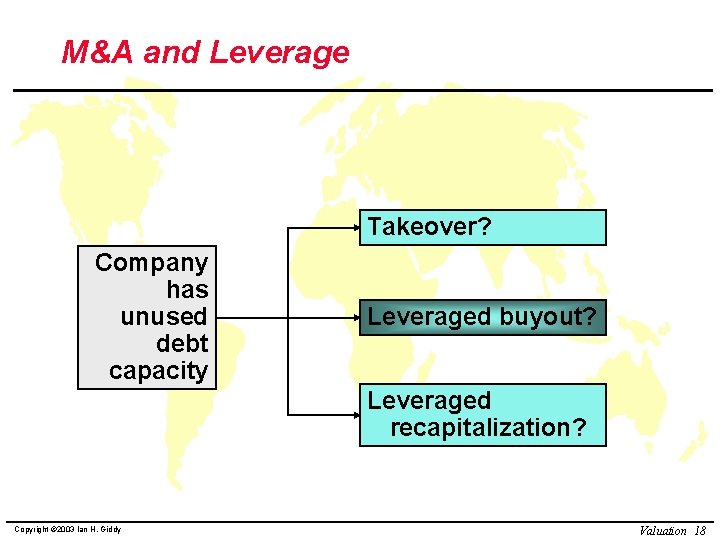

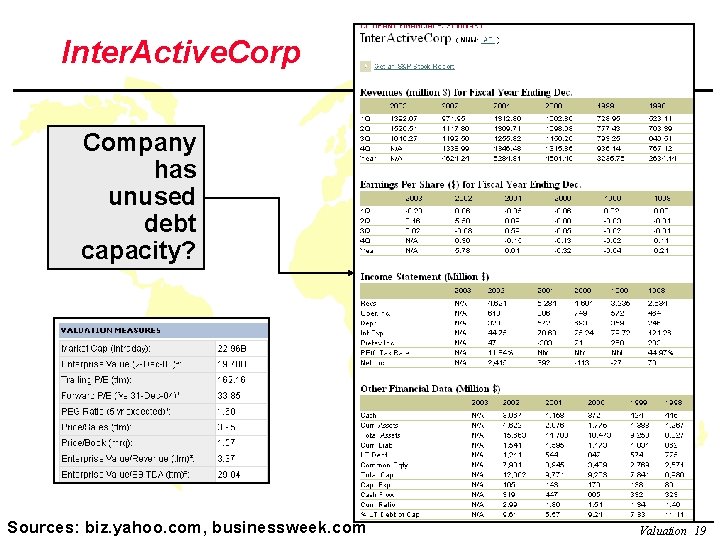

M&A and Leverage Takeover? Company has unused debt capacity Leveraged buyout? Leveraged recapitalization? Copyright © 2003 Ian H. Giddy Valuation 18

Inter. Active. Corp Company has unused debt capacity? Copyright © 2003 Ianbiz. yahoo. com, H. Giddy Sources: businessweek. com Valuation 19

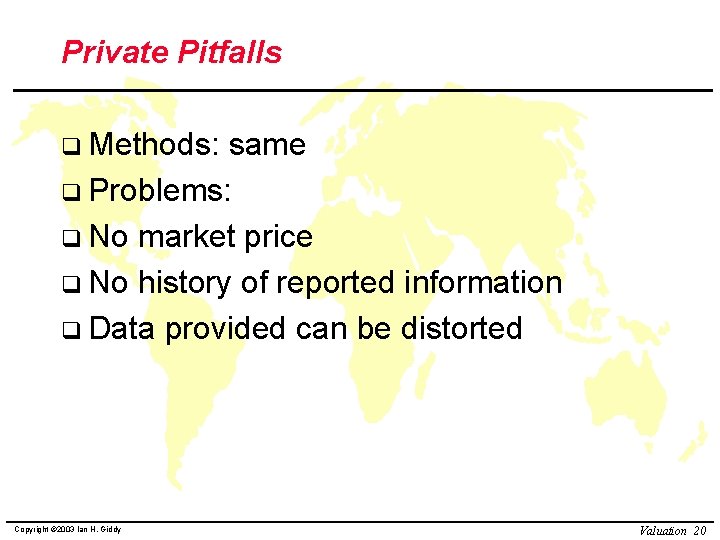

Private Pitfalls q Methods: same q Problems: q No market price q No history of reported information q Data provided can be distorted Copyright © 2003 Ian H. Giddy Valuation 20

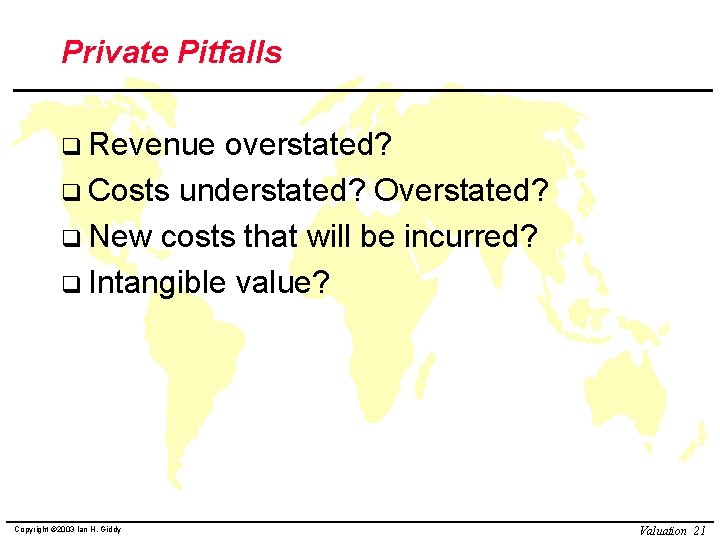

Private Pitfalls q Revenue overstated? q Costs understated? Overstated? q New costs that will be incurred? q Intangible value? Copyright © 2003 Ian H. Giddy Valuation 21

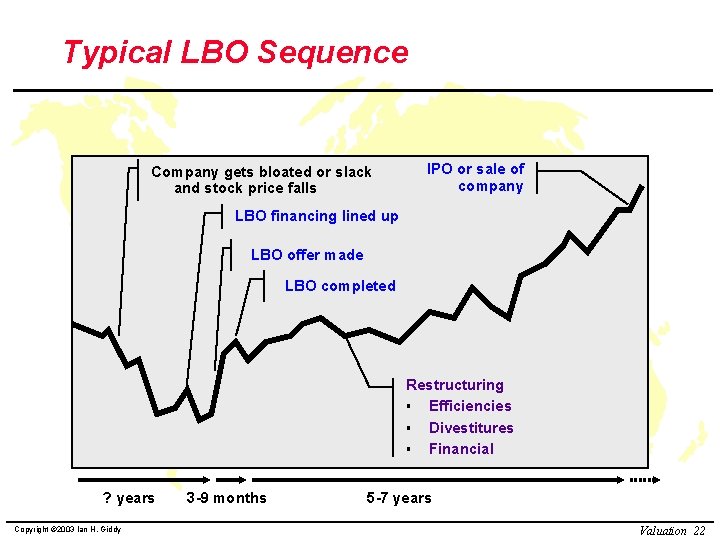

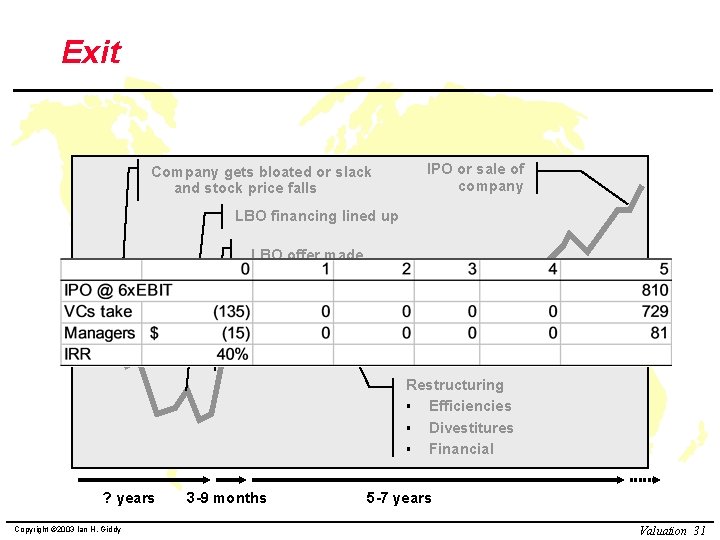

Typical LBO Sequence Company gets bloated or slack and stock price falls IPO or sale of company LBO financing lined up LBO offer made LBO completed Restructuring § Efficiencies § Divestitures § Financial ? years Copyright © 2003 Ian H. Giddy 3 -9 months 5 -7 years Valuation 22

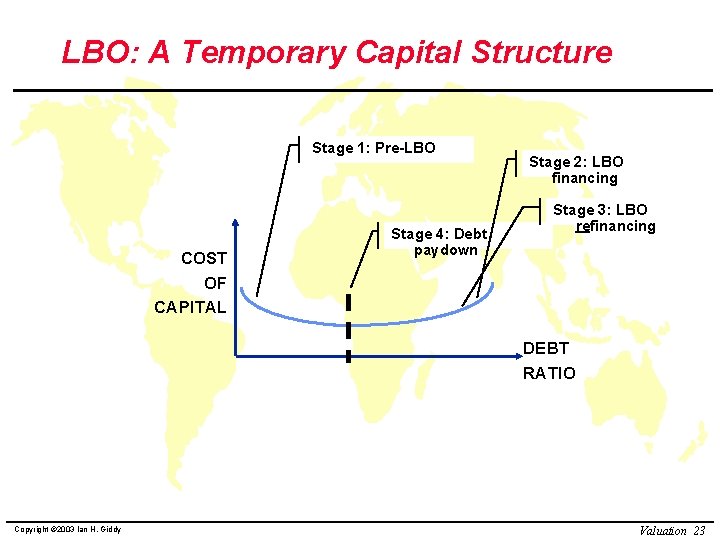

LBO: A Temporary Capital Structure Stage 1: Pre-LBO COST OF CAPITAL Stage 4: Debt paydown Stage 2: LBO financing Stage 3: LBO refinancing DEBT RATIO Copyright © 2003 Ian H. Giddy Valuation 23

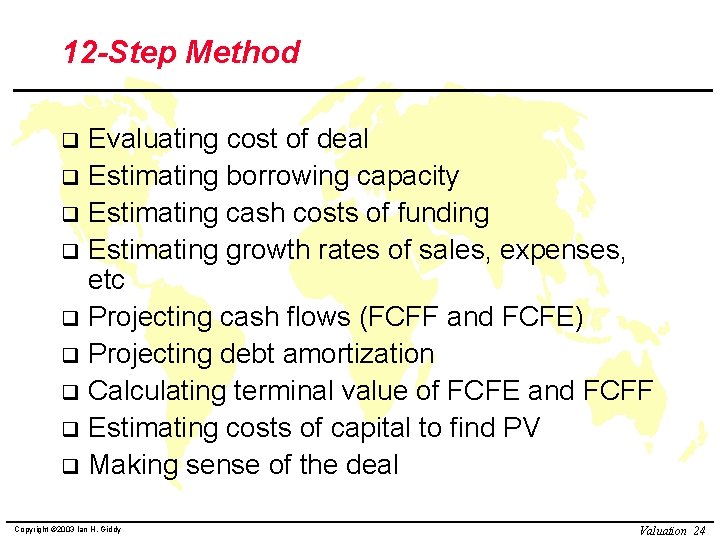

12 -Step Method Evaluating cost of deal q Estimating borrowing capacity q Estimating cash costs of funding q Estimating growth rates of sales, expenses, etc q Projecting cash flows (FCFF and FCFE) q Projecting debt amortization q Calculating terminal value of FCFE and FCFF q Estimating costs of capital to find PV q Making sense of the deal q Copyright © 2003 Ian H. Giddy Valuation 24

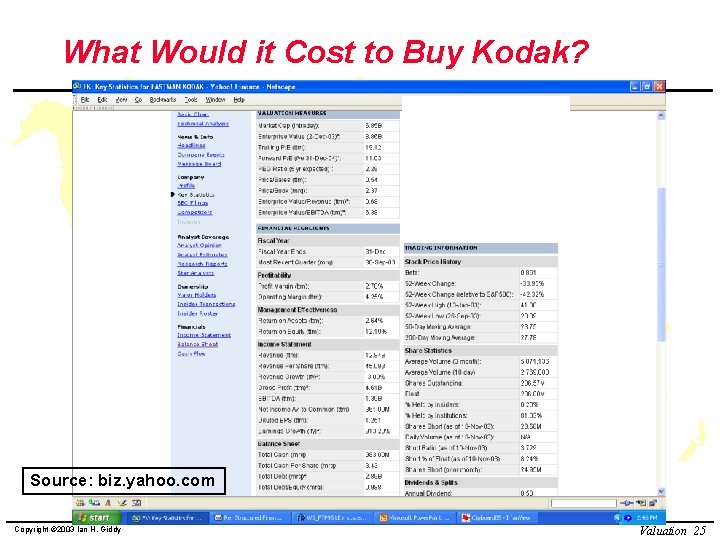

What Would it Cost to Buy Kodak? Source: biz. yahoo. com Copyright © 2003 Ian H. Giddy Valuation 25

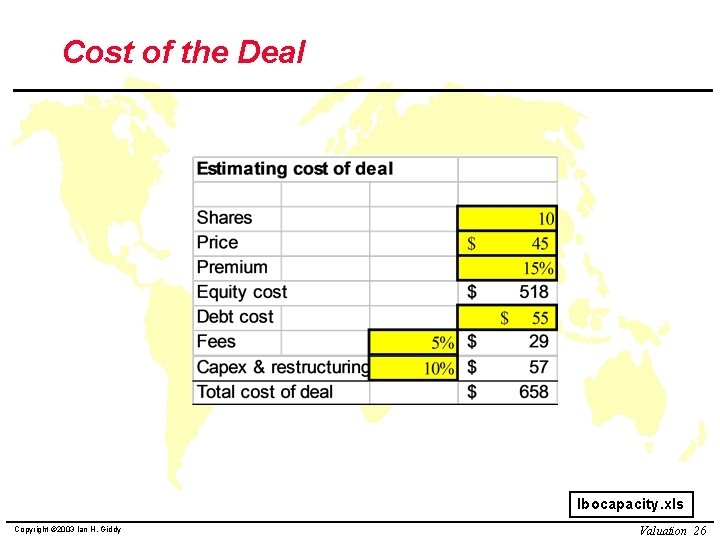

Cost of the Deal lbocapacity. xls Copyright © 2003 Ian H. Giddy Valuation 26

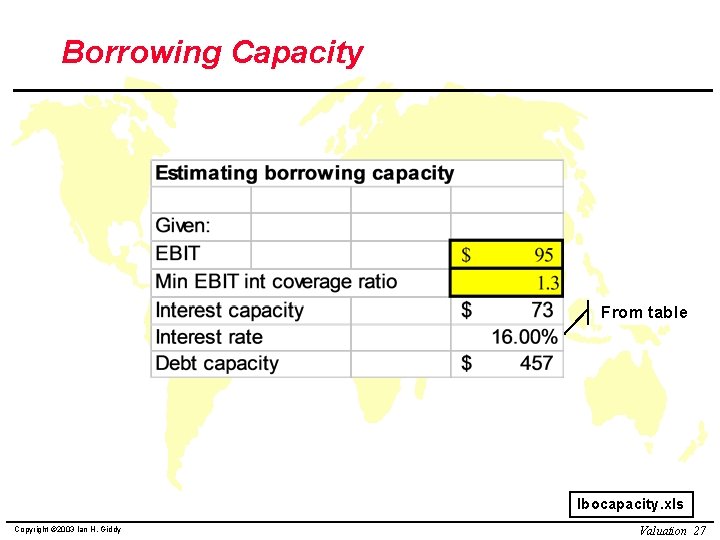

Borrowing Capacity From table lbocapacity. xls Copyright © 2003 Ian H. Giddy Valuation 27

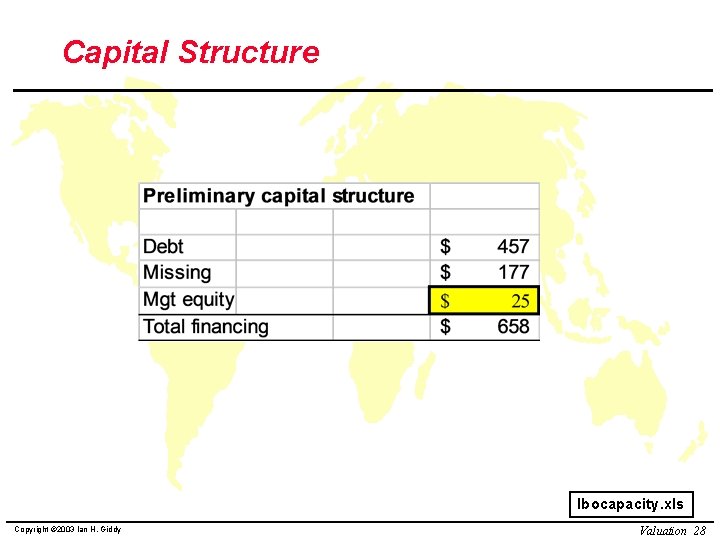

Capital Structure lbocapacity. xls Copyright © 2003 Ian H. Giddy Valuation 28

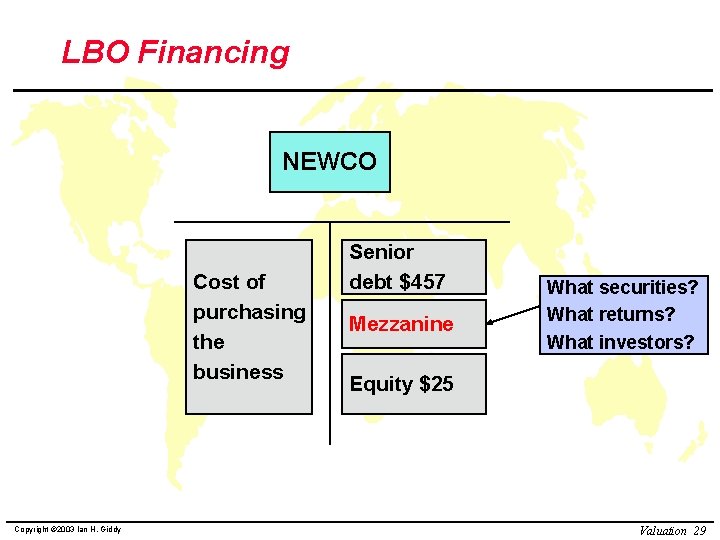

LBO Financing NEWCO Cost of purchasing the business Copyright © 2003 Ian H. Giddy Senior debt $457 Mezzanine What securities? What returns? What investors? Equity $25 Valuation 29

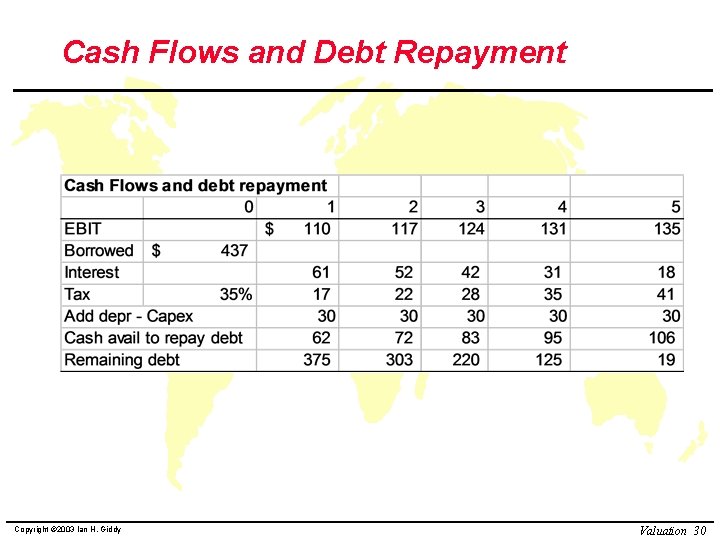

Cash Flows and Debt Repayment Copyright © 2003 Ian H. Giddy Valuation 30

Exit Company gets bloated or slack and stock price falls IPO or sale of company LBO financing lined up LBO offer made LBO completed Restructuring § Efficiencies § Divestitures § Financial ? years Copyright © 2003 Ian H. Giddy 3 -9 months 5 -7 years Valuation 31

Equity Valuation: Application to Restructuring Prof. Ian Giddy New York University

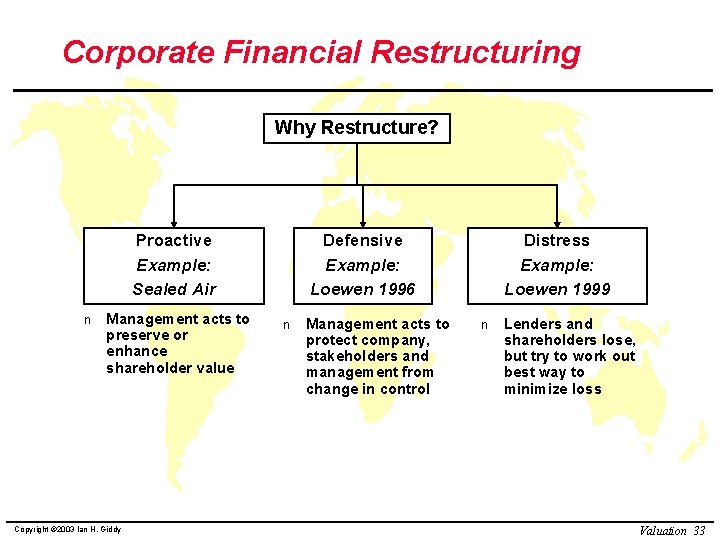

Corporate Financial Restructuring Why Restructure? Proactive Example: Sealed Air n Management acts to preserve or enhance shareholder value Copyright © 2003 Ian H. Giddy Defensive Example: Loewen 1996 n Management acts to protect company, stakeholders and management from change in control Distress Example: Loewen 1999 n Lenders and shareholders lose, but try to work out best way to minimize loss Valuation 33

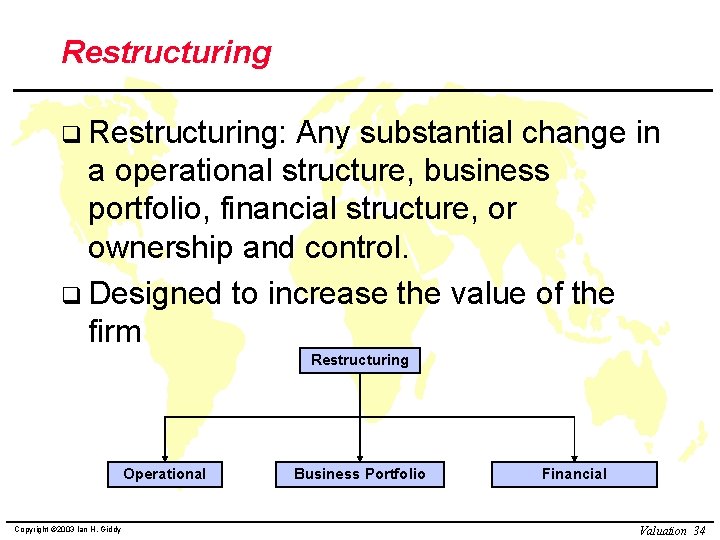

Restructuring q Restructuring: Any substantial change in a operational structure, business portfolio, financial structure, or ownership and control. q Designed to increase the value of the firm Restructuring Operational Copyright © 2003 Ian H. Giddy Business Portfolio Financial Valuation 34

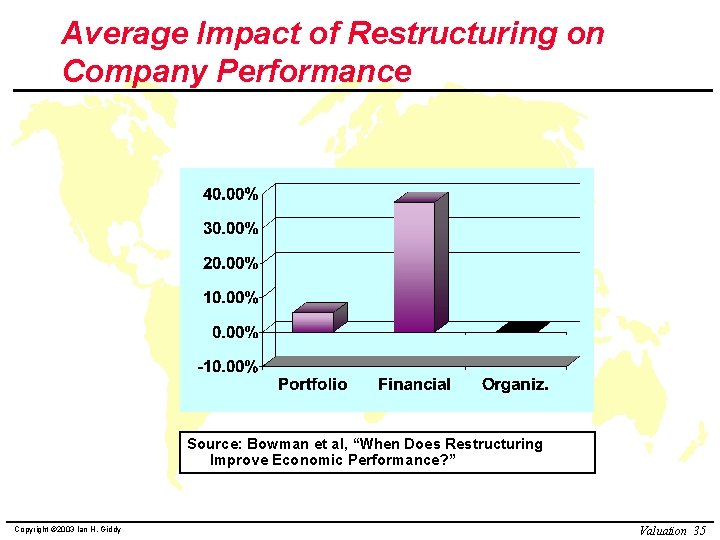

Average Impact of Restructuring on Company Performance Source: Bowman et al, “When Does Restructuring Improve Economic Performance? ” Copyright © 2003 Ian H. Giddy Valuation 35

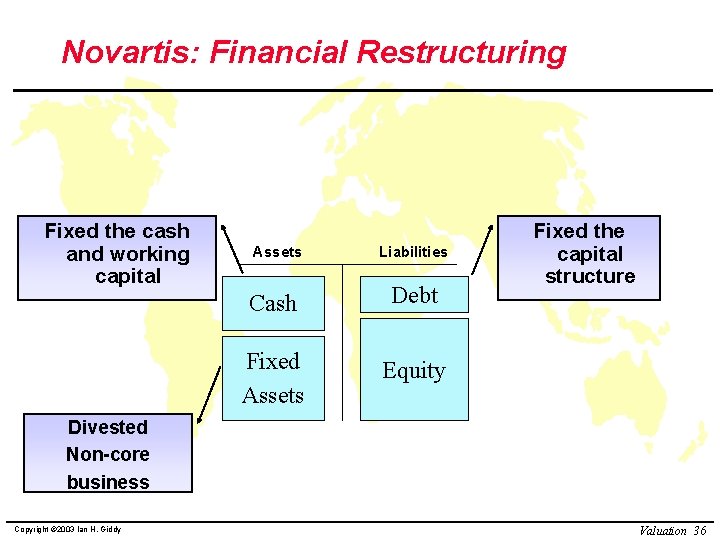

Novartis: Financial Restructuring Fixed the cash and working capital Assets Liabilities Cash Debt Fixed Assets Equity Fixed the capital structure Divested Non-core business Copyright © 2003 Ian H. Giddy Valuation 36

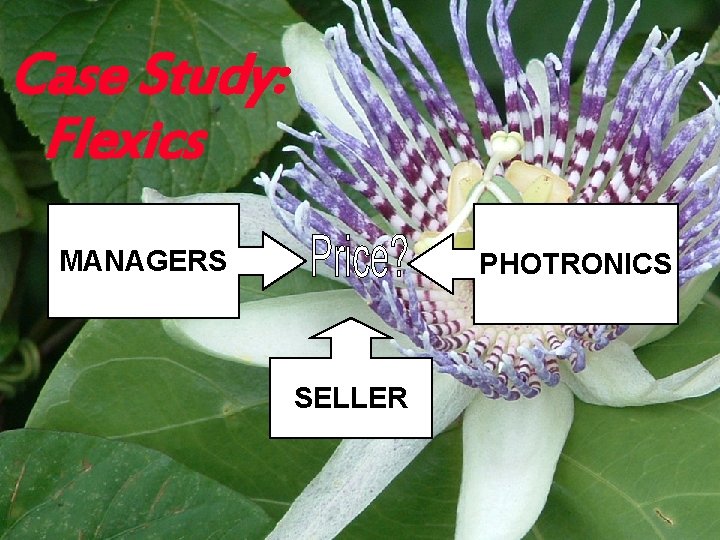

Case Study: Flexics MANAGERS PHOTRONICS SELLER Copyright © 2003 Ian H. Giddy Valuation 37

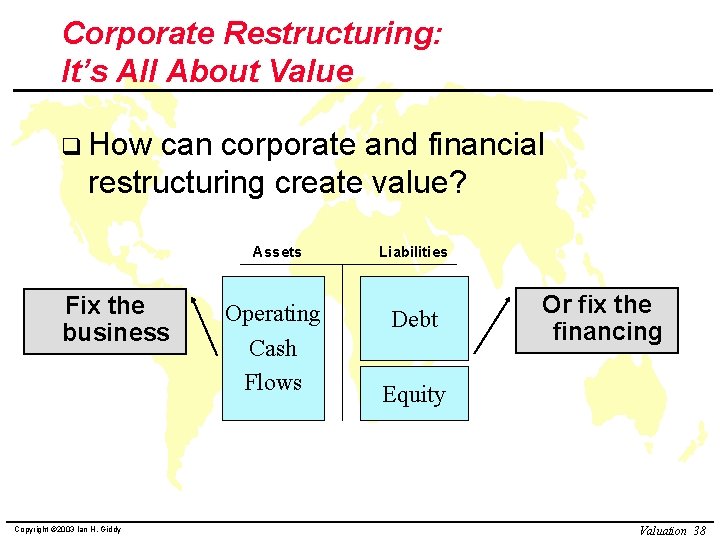

Corporate Restructuring: It’s All About Value q How can corporate and financial restructuring create value? Assets Fix the business Copyright © 2003 Ian H. Giddy Operating Cash Flows Liabilities Debt Or fix the financing Equity Valuation 38

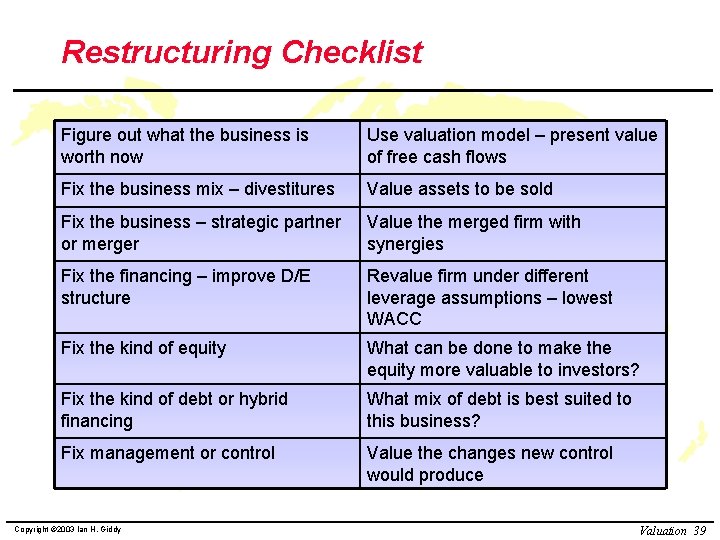

Restructuring Checklist Figure out what the business is worth now Use valuation model – present value of free cash flows Fix the business mix – divestitures Value assets to be sold Fix the business – strategic partner or merger Value the merged firm with synergies Fix the financing – improve D/E structure Revalue firm under different leverage assumptions – lowest WACC Fix the kind of equity What can be done to make the equity more valuable to investors? Fix the kind of debt or hybrid financing What mix of debt is best suited to this business? Fix management or control Value the changes new control would produce Copyright © 2003 Ian H. Giddy Valuation 39

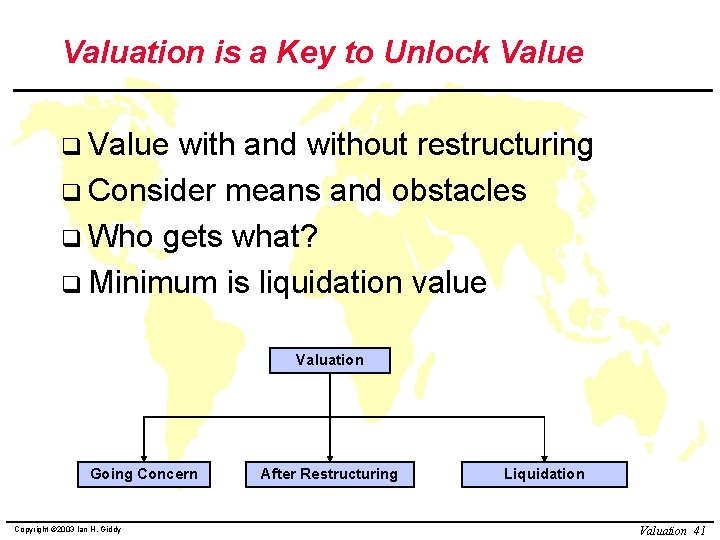

Valuation is a Key to Unlock Value q Value with and without restructuring q Consider means and obstacles q Who gets what? q Minimum is liquidation value Valuation Going Concern Copyright © 2003 Ian H. Giddy After Restructuring Liquidation Valuation 41

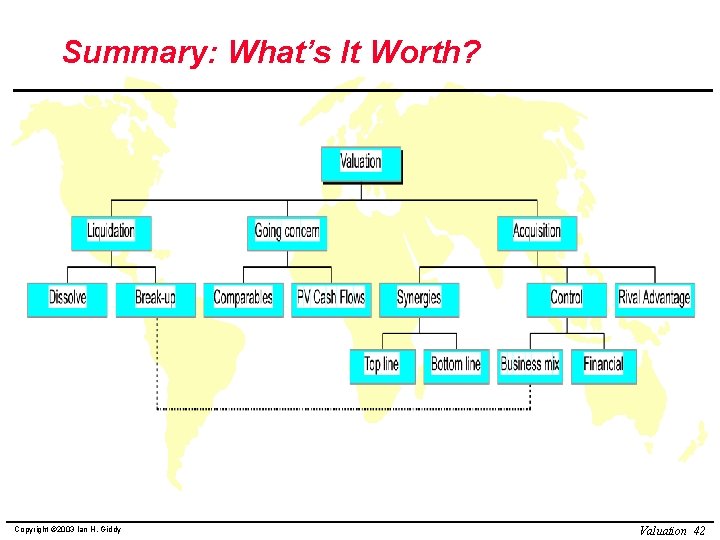

Summary: What’s It Worth? Copyright © 2003 Ian H. Giddy Valuation 42

Conclusion? Valuation techniques force the recognition of assumptions – cost of capital, risk, growth rates, and which numbers matter q Valuation is an essential management tool q Can these approaches be used to change the way your company evaluates its investment decisions? How? q Copyright © 2003 Ian H. Giddy Valuation 43

Further Reading q Books: u Damodaran on Valuation u De. Pamphilis: Mergers, Acquisitions, and Other Restructuring Activities q Web Site: u Damodaran Online: http: //pages. stern. nyu. edu/ ~adamodar q Cheat sheets: www. barcharts. com Copyright © 2003 Ian H. Giddy Valuation 44

- Slides: 42