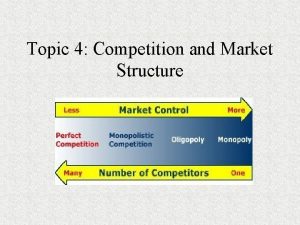

Imperfect Competition Imperfect Competition Monopolistic Competition Monopolistic competition

- Slides: 70

Imperfect Competition

Imperfect Competition Monopolistic Competition

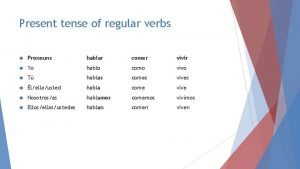

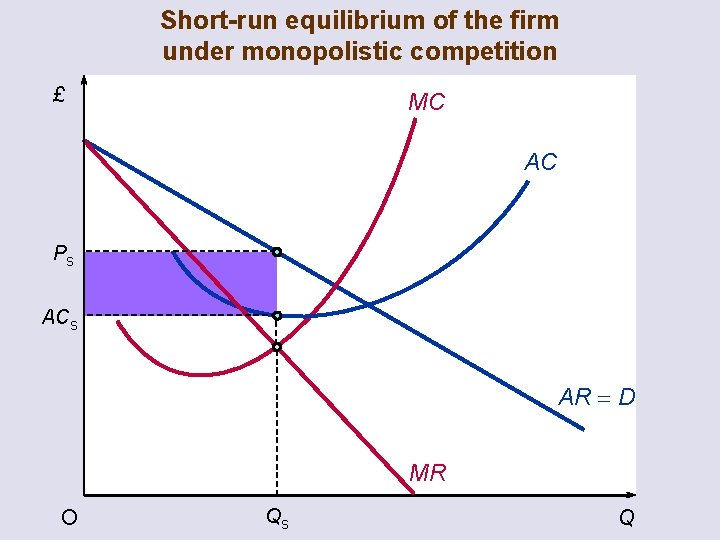

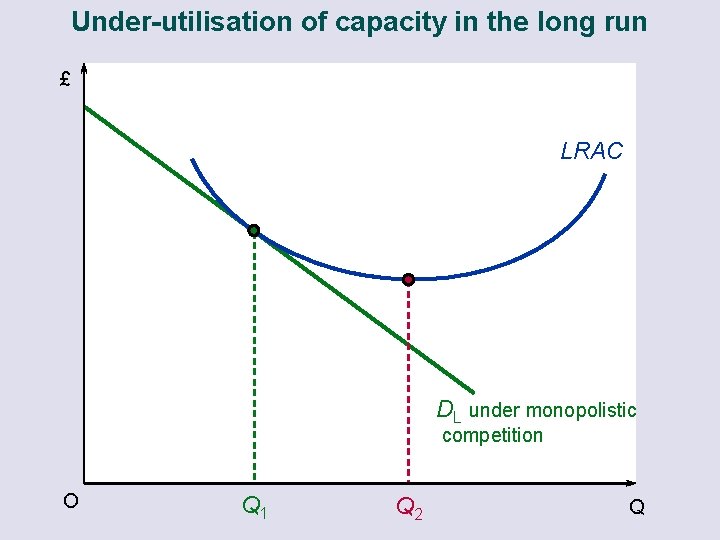

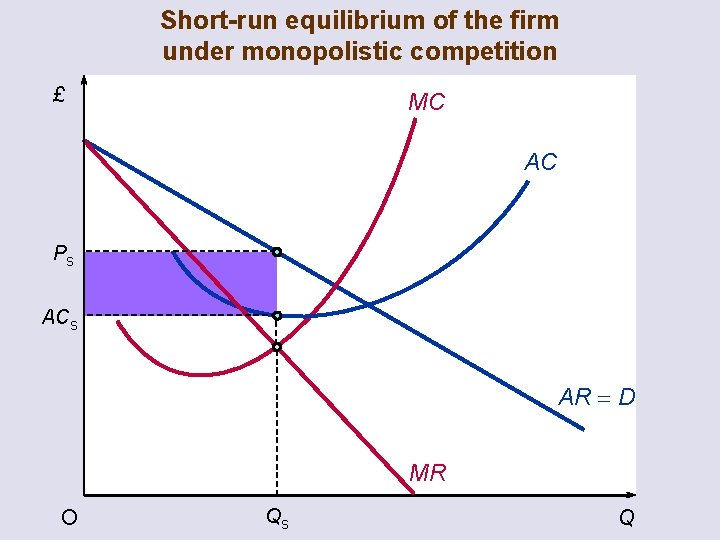

Monopolistic competition Assumptions of monopolistic competition ¡ many or several firms ¡ free entry ¡ differentiated product Equilibrium of the firm ¡ short run ÷ MR = MC

Short-run equilibrium of the firm under monopolistic competition £ MC AC Ps ACs AR = D MR O Qs Q

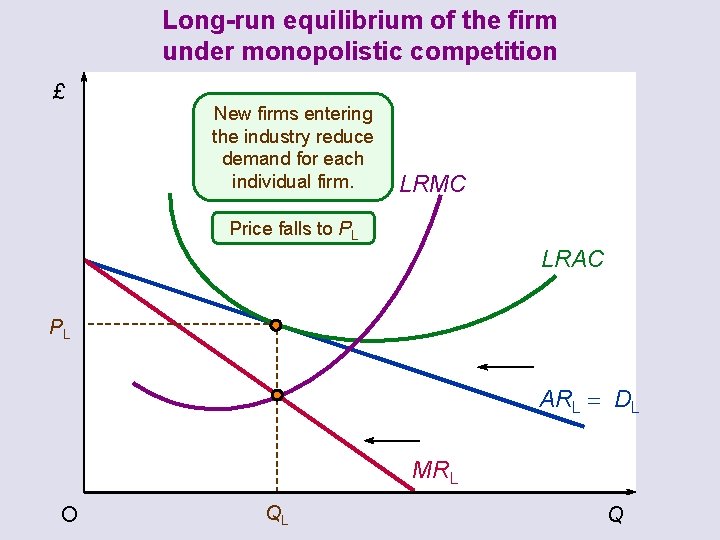

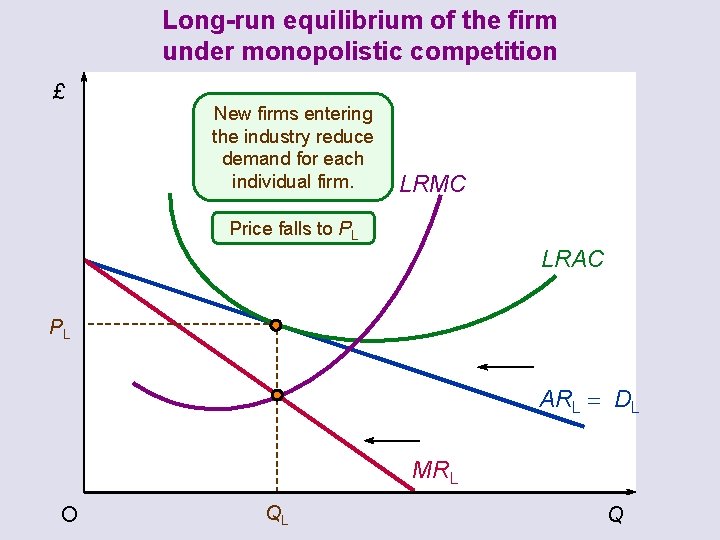

Monopolistic competition Assumptions of monopolistic competition ¡ many or several firms ¡ free entry ¡ differentiated product Equilibrium of the firm ¡ short run ÷ MR ¡ = MC long run ÷ MR = MC; AR = AC

Long-run equilibrium of the firm under monopolistic competition £ New firms entering the industry reduce demand for each individual firm. LRMC Price falls to PL LRAC PL ARL = DL MRL O QL Q

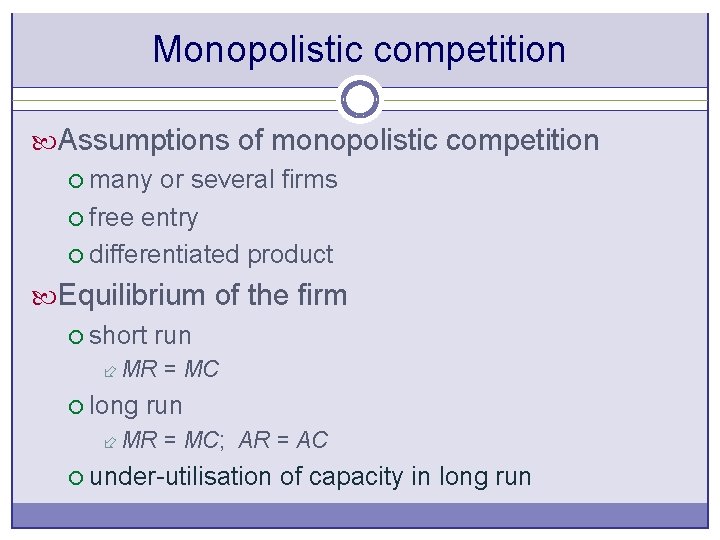

Monopolistic competition Assumptions of monopolistic competition ¡ many or several firms ¡ free entry ¡ differentiated product Equilibrium of the firm ¡ short run ÷ MR ¡ long run ÷ MR ¡ = MC; AR = AC under-utilisation of capacity in long run

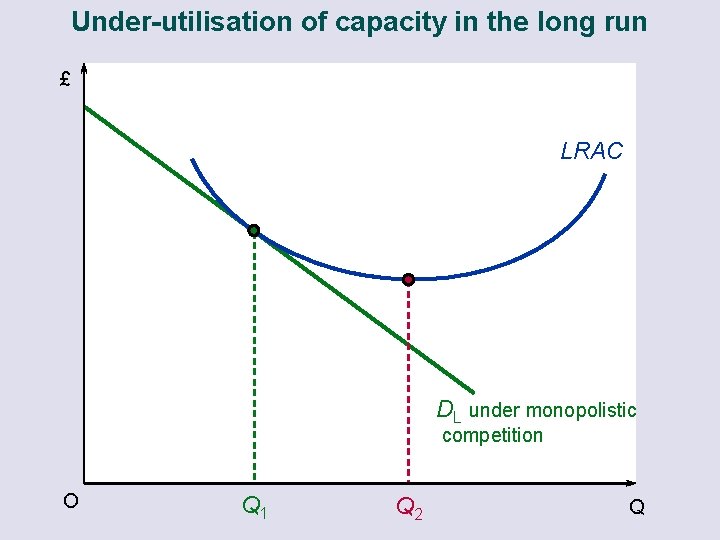

Under-utilisation of capacity in the long run £ LRAC DL under monopolistic competition O Q 1 Q 2 Q

Monopolistic competition Limitations of the model ¡ imperfect information ¡ difficulty in identifying industry demand curve ¡ entry may not be totally free ¡ indivisibilities ¡ importance of non-price competition The public interest ¡ comparison with perfect competition

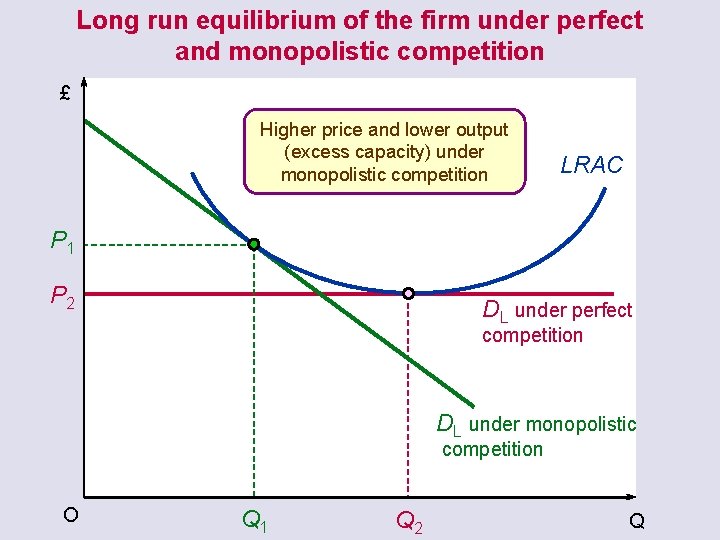

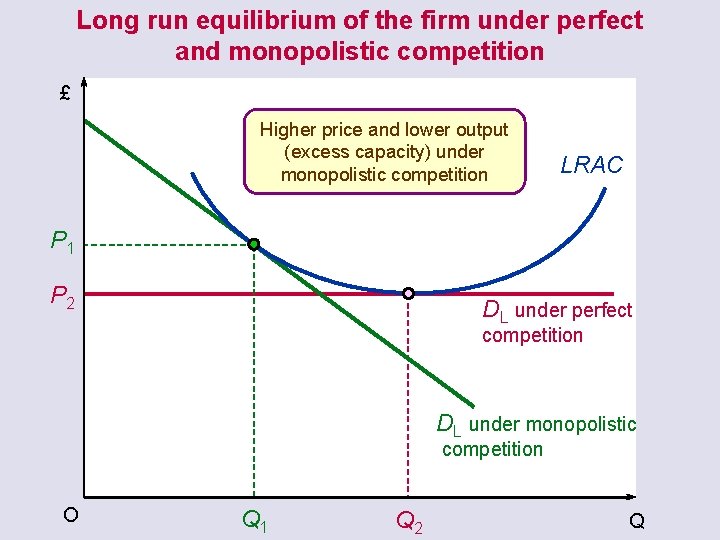

Long run equilibrium of the firm under perfect and monopolistic competition £ Higher price and lower output (excess capacity) under monopolistic competition LRAC P 1 P 2 DL under perfect competition DL under monopolistic competition O Q 1 Q 2 Q

Monopolistic competition Limitations of the model ¡ imperfect information ¡ difficulty in identifying industry demand curve ¡ entry may not be totally free ¡ indivisibilities ¡ importance of non-price competition The public interest ¡ comparison with perfect competition ¡ comparison with monopoly

Imperfect Competition Oligopoly

Oligopoly Key features of oligopoly ¡ barriers to entry ¡ interdependence of firms ¡ incentives to compete or to collude? Factors favouring collusion ¡ few firms, open with each other ¡ similar production methods; similar products ¡ significant entry barriers ¡ stable market ¡ collusion is legal

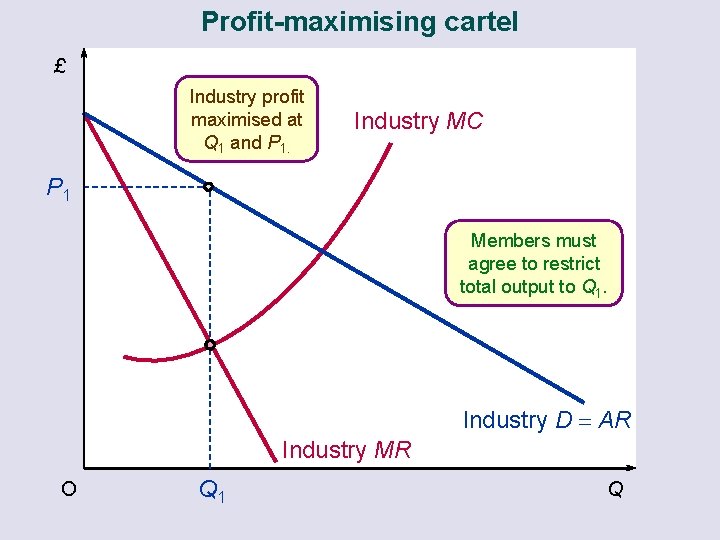

Oligopoly Collusive oligopoly: cartels ¡ equilibrium of the industry

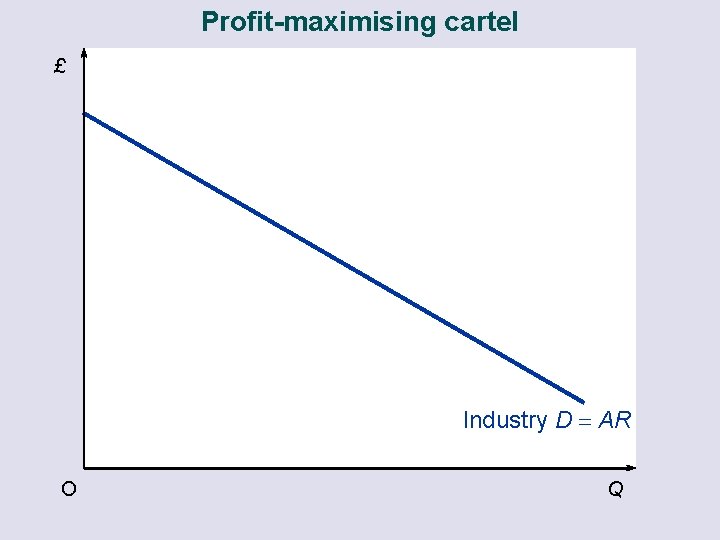

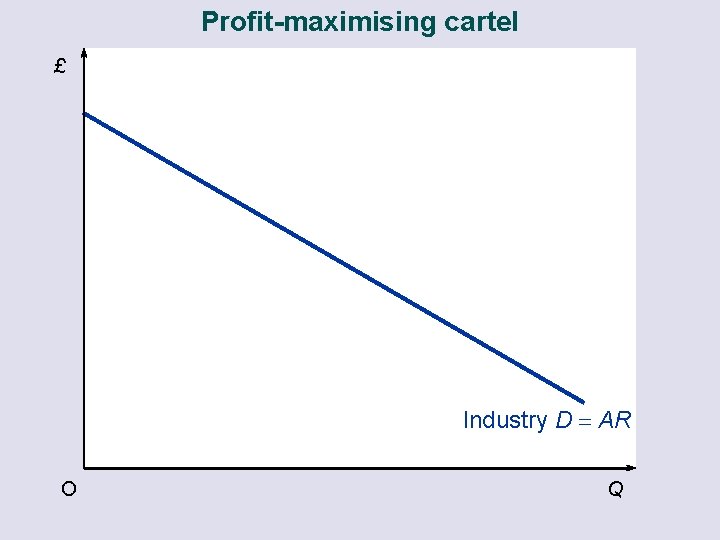

Profit-maximising cartel £ Industry D = AR O Q

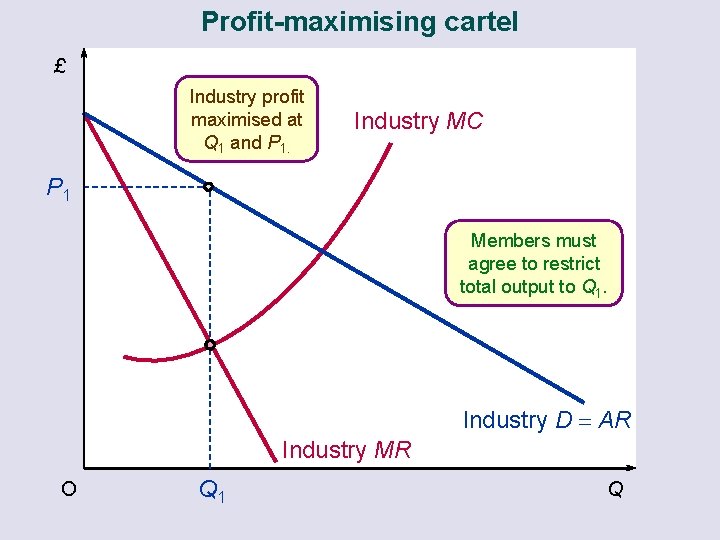

Profit-maximising cartel £ Industry profit maximised at Q 1 and P 1. Industry MC P 1 Members must agree to restrict total output to Q 1. Industry D = AR Industry MR O Q 1 Q

Oligopoly Collusive oligopoly: cartels ¡ equilibrium of the industry ¡ allocating and enforcing quotas

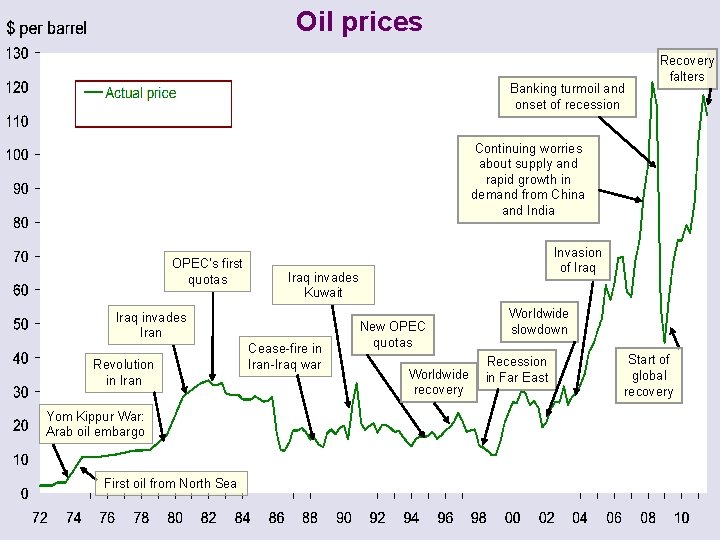

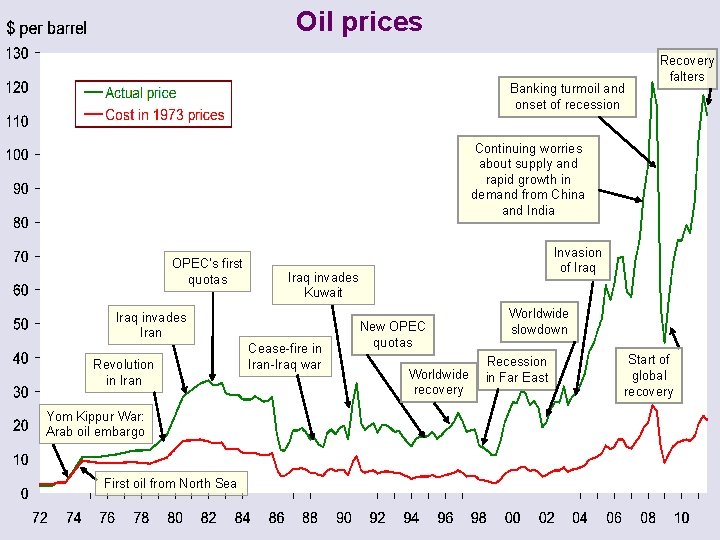

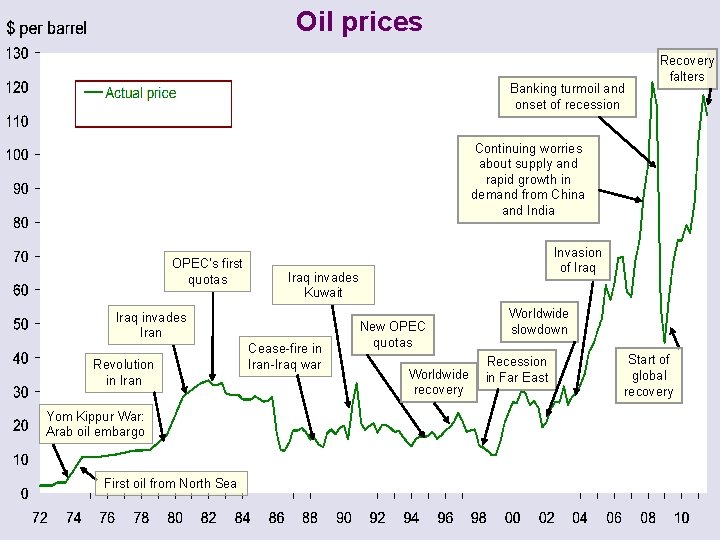

Oil prices Banking turmoil and onset of recession Recovery falters Continuing worries about supply and rapid growth in demand from China and India OPEC’s first quotas Iraq invades Kuwait Iraq invades Iran Revolution in Iran Yom Kippur War: Arab oil embargo First oil from North Sea Invasion of Iraq Cease-fire in Iran-Iraq war New OPEC quotas Worldwide recovery Worldwide slowdown Recession in Far East Start of global recovery

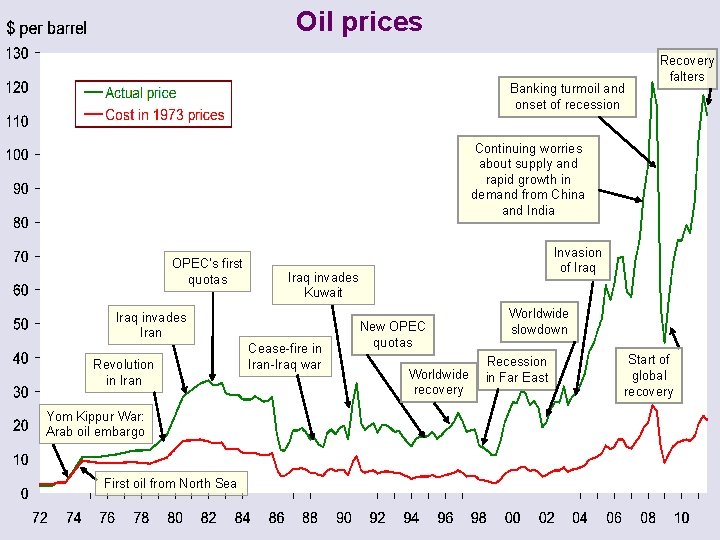

Oil prices Banking turmoil and onset of recession Recovery falters Continuing worries about supply and rapid growth in demand from China and India OPEC’s first quotas Iraq invades Kuwait Iraq invades Iran Revolution in Iran Yom Kippur War: Arab oil embargo First oil from North Sea Invasion of Iraq Cease-fire in Iran-Iraq war New OPEC quotas Worldwide recovery Worldwide slowdown Recession in Far East Start of global recovery

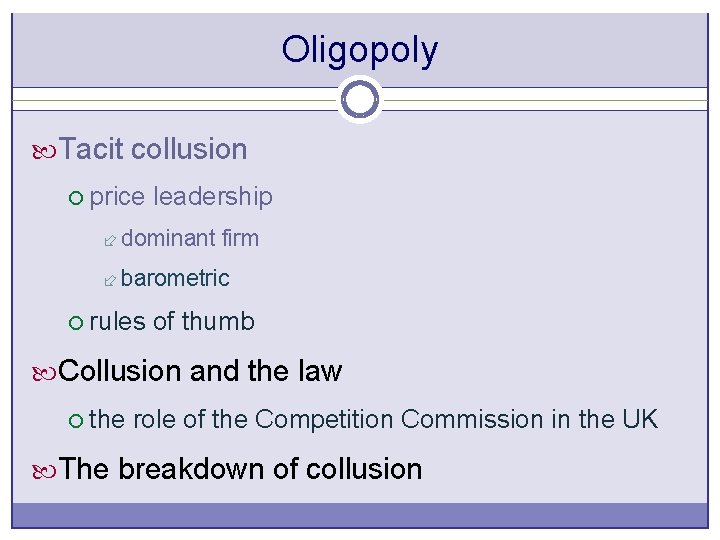

Oligopoly Tacit collusion ¡ price leadership ÷ dominant firm

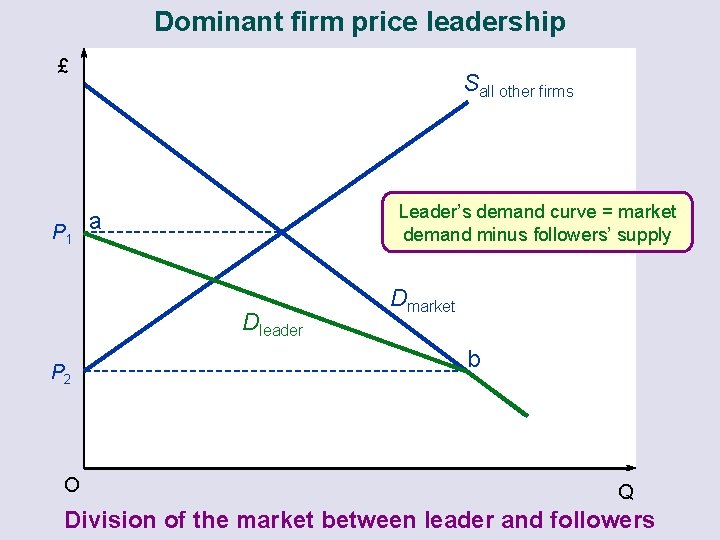

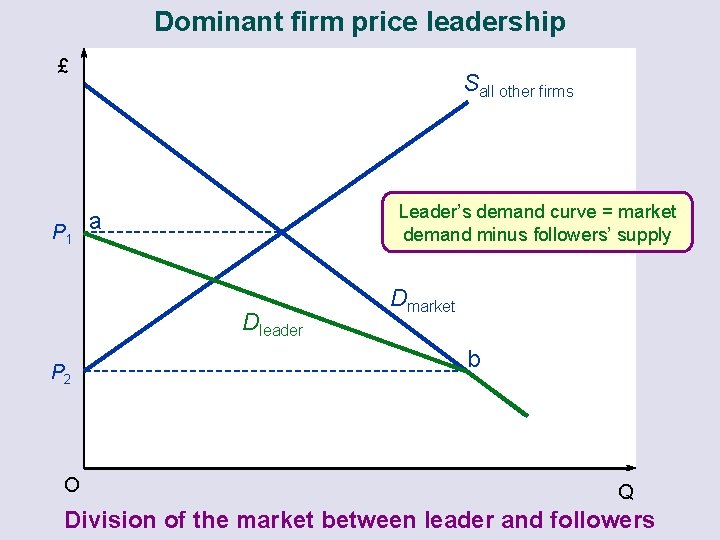

Dominant firm price leadership £ Sall other firms Leader’s demand curve = market demand minus followers’ supply a P 1 Dleader P 2 O Dmarket b Q Division of the market between leader and followers

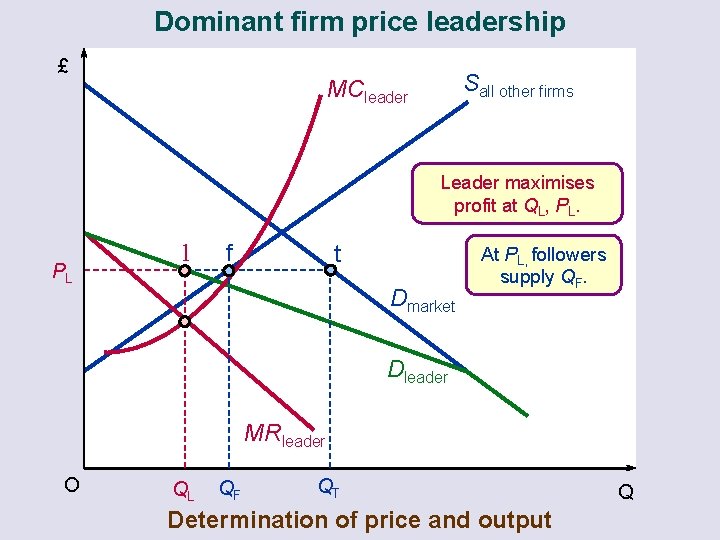

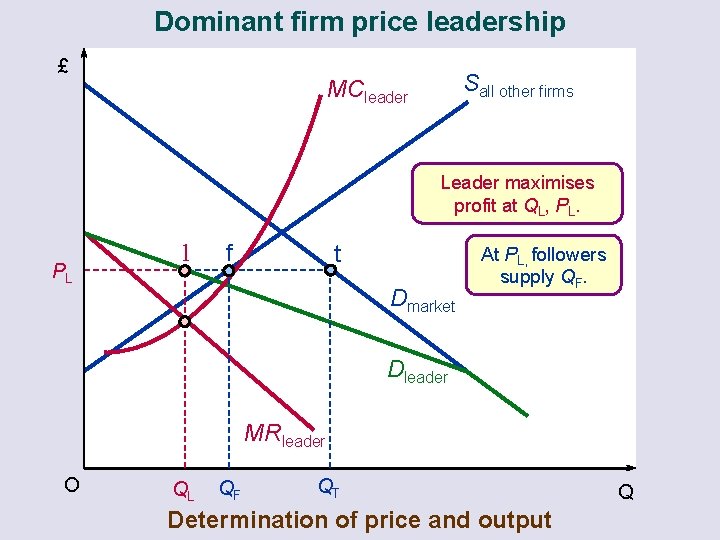

Dominant firm price leadership £ Sall other firms MCleader Leader maximises profit at QL, PL. PL l f t Dmarket At PL, followers supply QF. Dleader MRleader O QL QF QT Determination of price and output Q

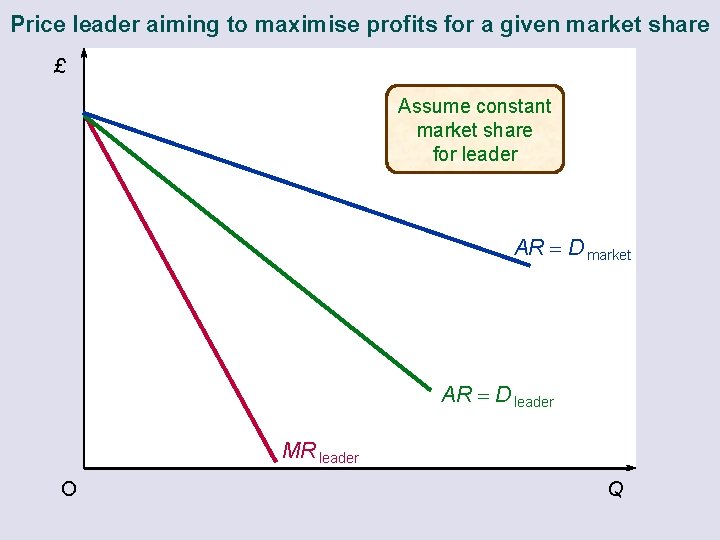

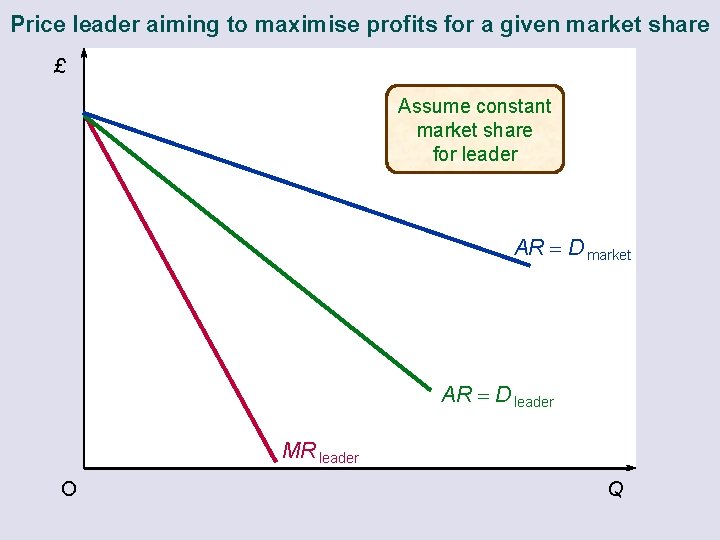

Price leader aiming to maximise profits for a given market share £ Assume constant market share for leader AR = D market AR = D leader MR leader O Q

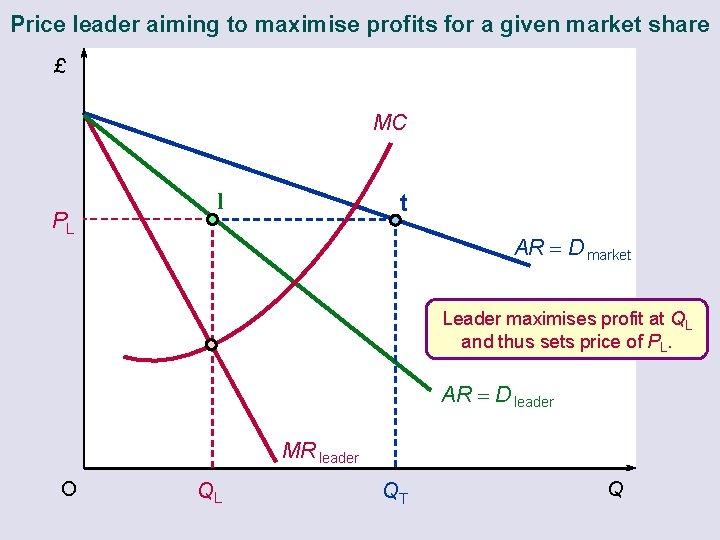

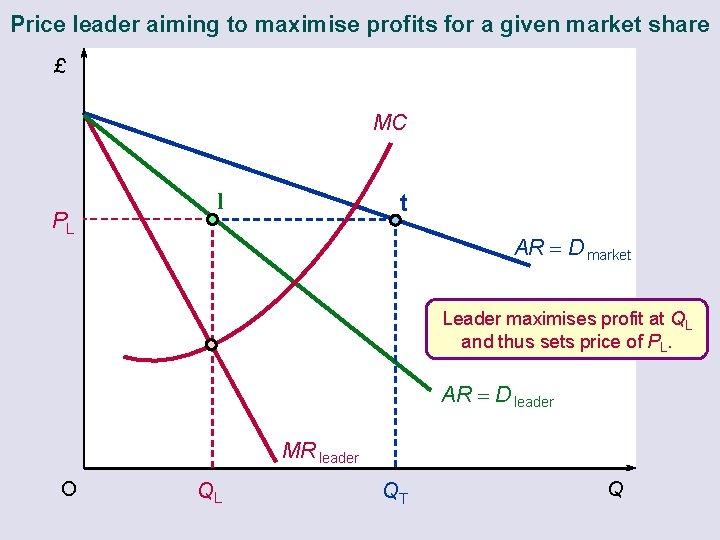

Price leader aiming to maximise profits for a given market share £ MC PL l t AR = D market Leader maximises profit at QL and thus sets price of PL. AR = D leader MR leader O QL QT Q

Oligopoly Tacit collusion ¡ price leadership ÷ dominant firm ÷ barometric ¡ rules of thumb Collusion and the law ¡ the role of the Competition Commission in the UK The breakdown of collusion

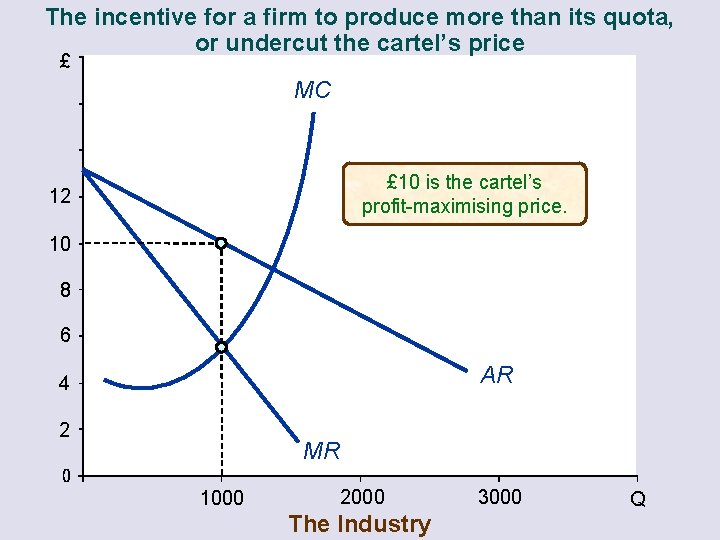

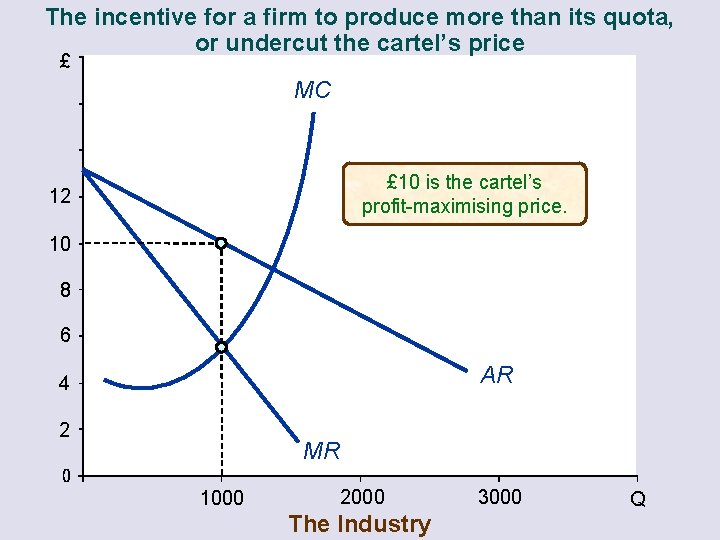

The incentive for a firm to produce more than its quota, or undercut the cartel’s price £ MC £ 10 is the cartel’s profit-maximising price. 12 10 8 6 AR 4 2 MR 1000 2000 The Industry 3000 Q

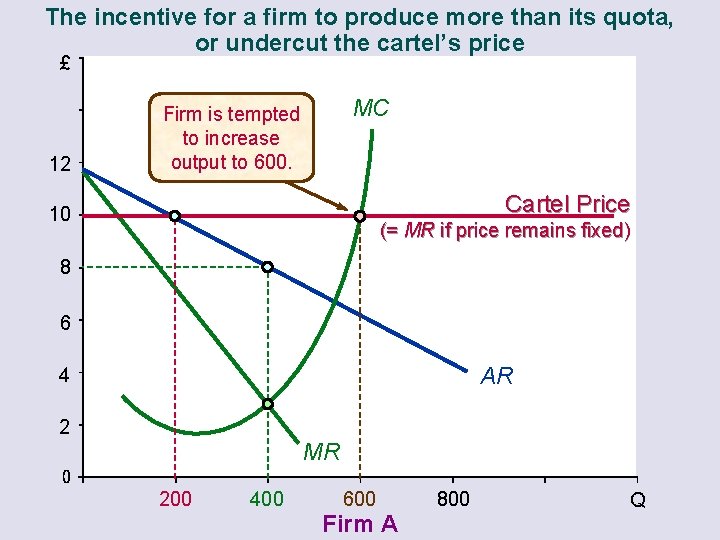

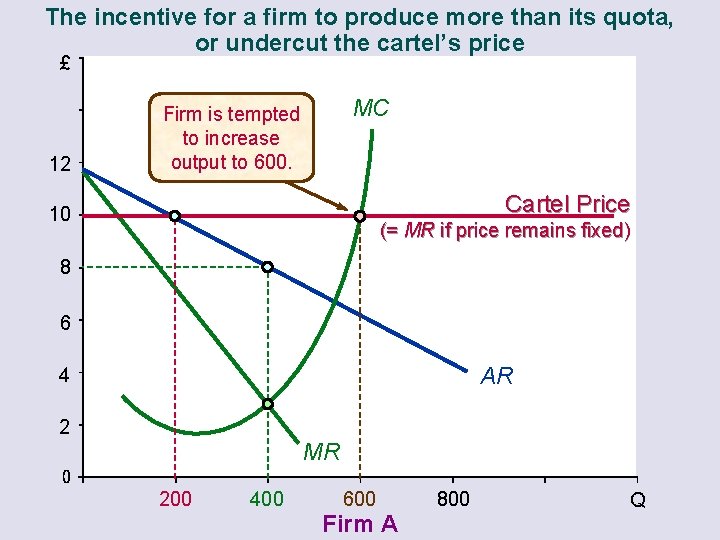

The incentive for a firm to produce more than its quota, or undercut the cartel’s price £ 12 MC Firm is tempted to increase output to 600. Cartel Price 10 (= MR if price remains fixed) 8 6 AR 4 2 MR 200 400 600 Firm A 800 Q

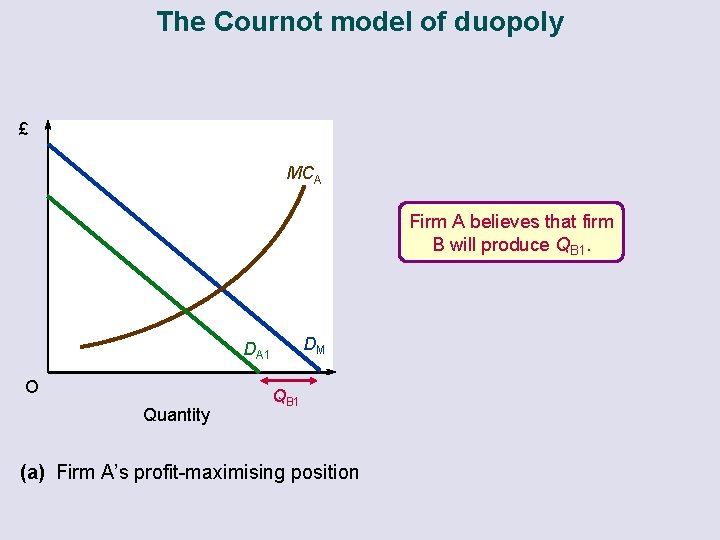

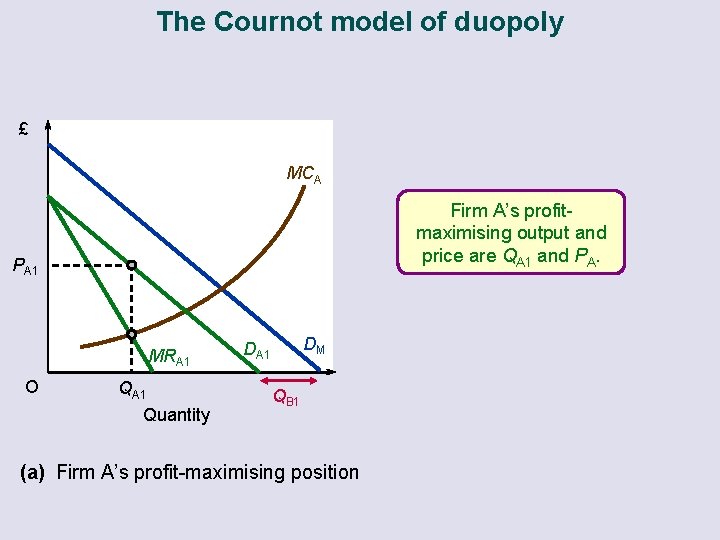

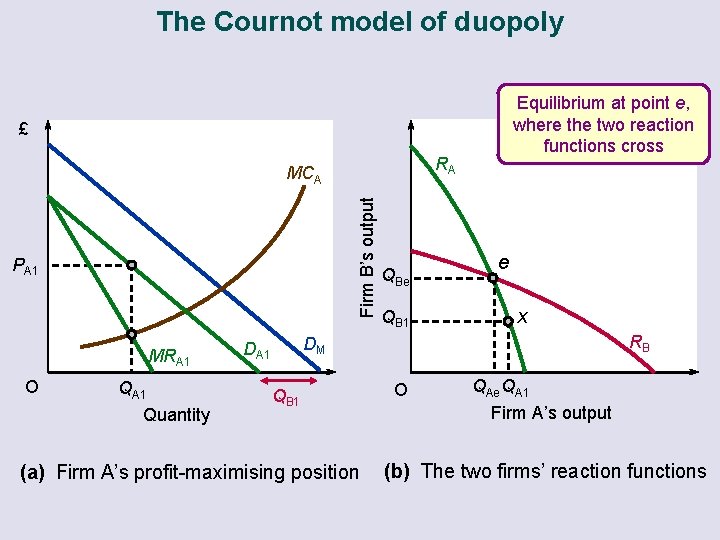

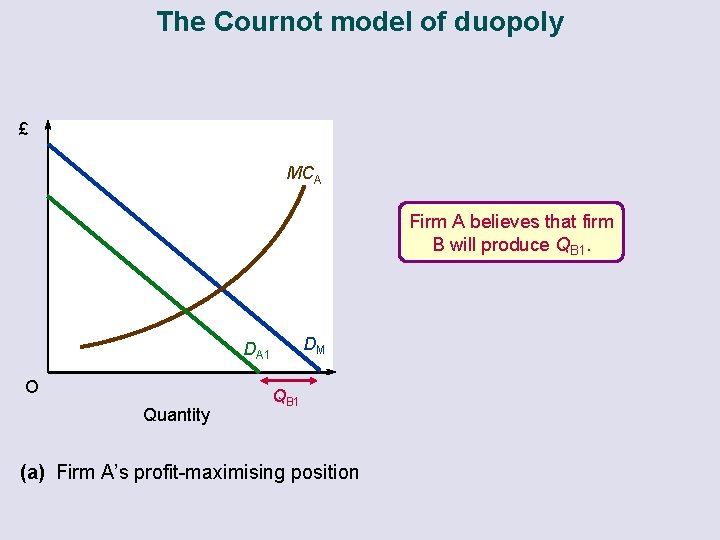

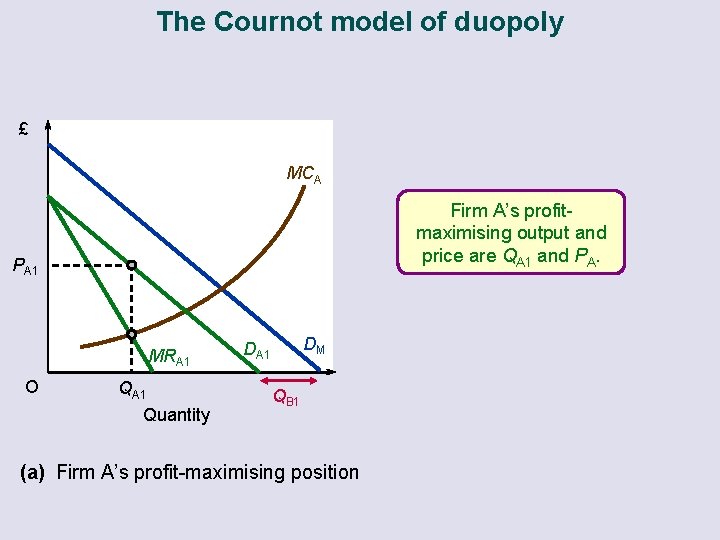

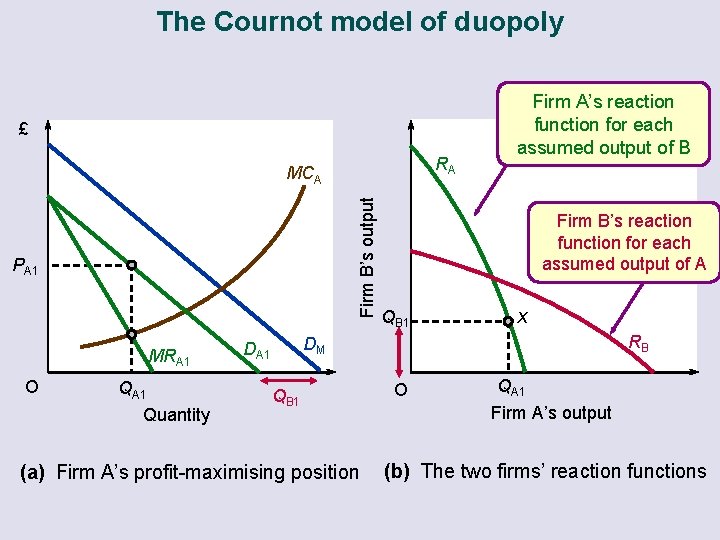

Oligopoly Non-collusive oligopoly: assumptions about rivals’ behaviour The Cournot model of duopoly ¡ assumption that rival will produce a given quantity

The Cournot model of duopoly £ MCA Firm A believes that firm B will produce QB 1. DM DA 1 O Quantity QB 1 (a) Firm A’s profit-maximising position

The Cournot model of duopoly £ MCA Firm A’s profitmaximising output and price are QA 1 and PA. PA 1 MRA 1 O QA 1 Quantity DM DA 1 QB 1 (a) Firm A’s profit-maximising position

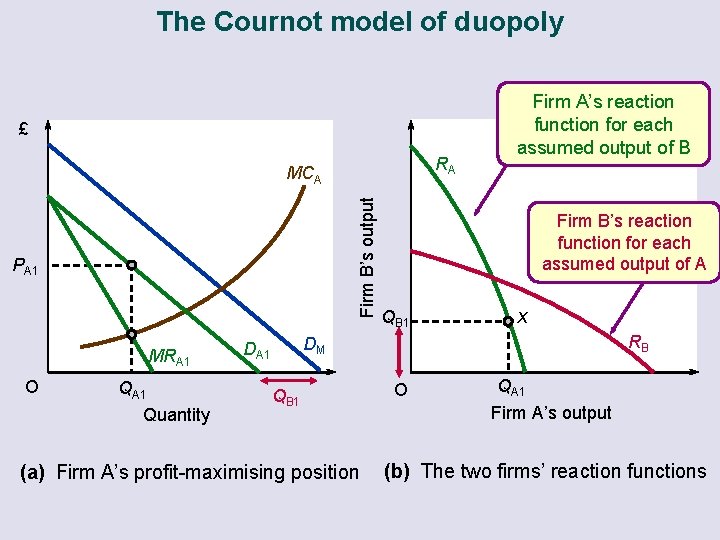

Oligopoly Non-collusive oligopoly: assumptions about rivals’ behaviour The Cournot model of duopoly ¡ assumption that rival will produce a given quantity ¡ profit-maximising price and output for firm A ¡ reaction functions of firms A and B

The Cournot model of duopoly £ RA Firm B’s output MCA PA 1 MRA 1 O QA 1 Quantity Firm A’s reaction function for each assumed output of B Firm B’s reaction function for each assumed output of A QB 1 x RB DM DA 1 QB 1 (a) Firm A’s profit-maximising position O QA 1 Firm A’s output (b) The two firms’ reaction functions

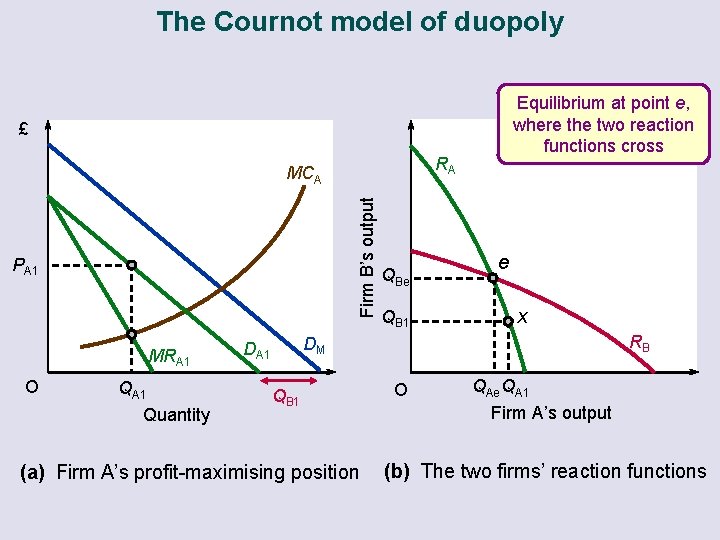

Oligopoly Non-collusive oligopoly: assumptions about rivals’ behaviour The Cournot model of duopoly ¡ assumption that rival will produce a given quantity ¡ profit-maximising price and output for firm A ¡ reaction functions of firms A and B ¡ Cournot equilibrium

The Cournot model of duopoly Equilibrium at point e, where the two reaction functions cross £ RA Firm B’s output MCA PA 1 MRA 1 O QA 1 Quantity QBe QB 1 e x RB DM DA 1 QB 1 (a) Firm A’s profit-maximising position O QAe QA 1 Firm A’s output (b) The two firms’ reaction functions

Oligopoly Non-collusive oligopoly: assumptions about rivals’ behaviour (cont. ) The Bertrand model of duopoly ¡ assumption that rival sets a particular price ¡ equilibrium: price cutting until all supernormal profits are competed away Nash Equilibrium in the Cournot and Bertrand models

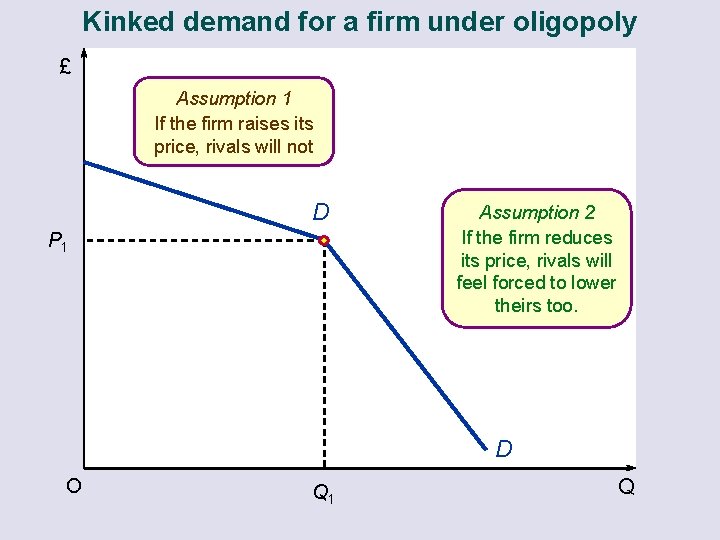

Oligopoly Non-collusive oligopoly: assumptions about rivals’ behaviour (cont. ) The kinked demand curve theory ¡ assumptions of the model ¡ the shape of the demand MR curves

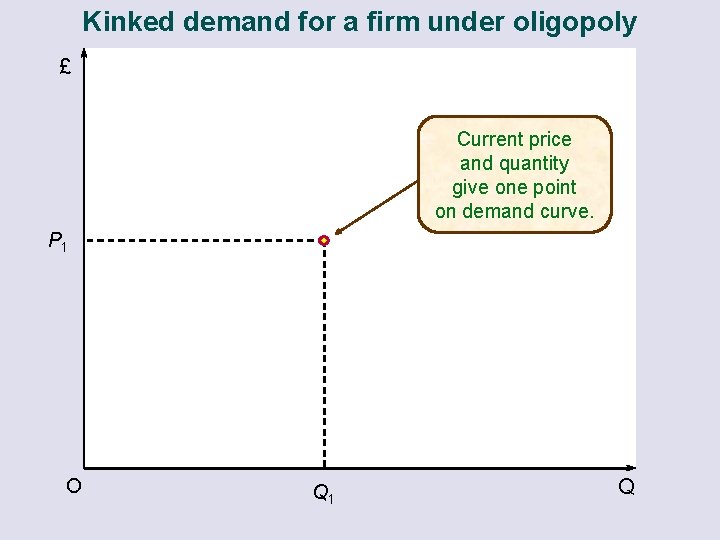

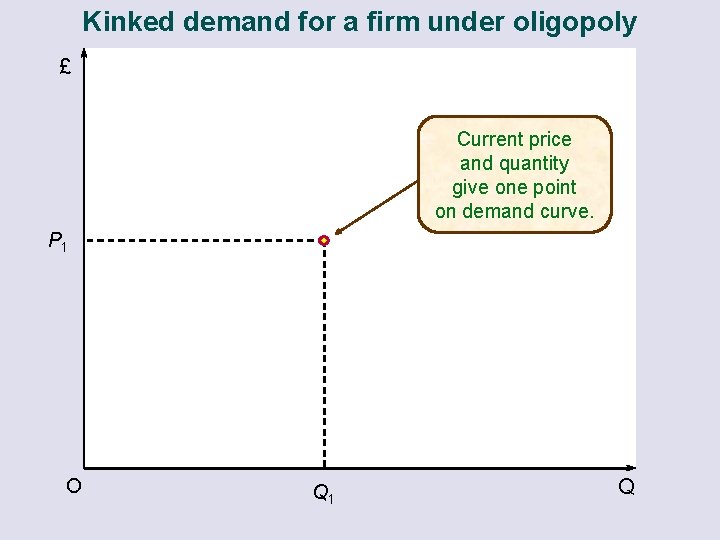

Kinked demand for a firm under oligopoly £ Current price and quantity give one point on demand curve. P 1 O Q 1 Q

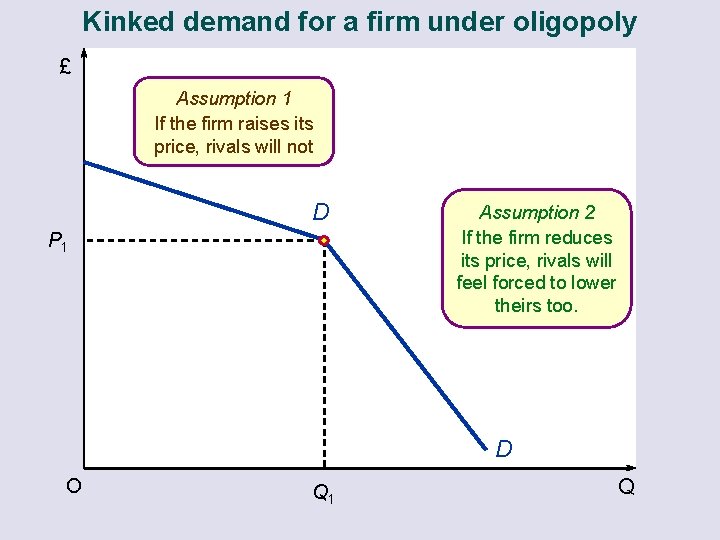

Kinked demand for a firm under oligopoly £ Assumption 1 If the firm raises its price, rivals will not D P 1 Assumption 2 If the firm reduces its price, rivals will feel forced to lower theirs too. D O Q 1 Q

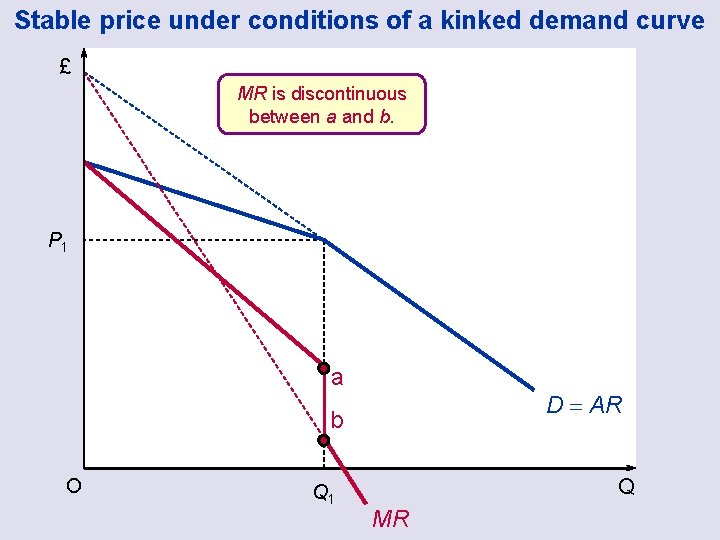

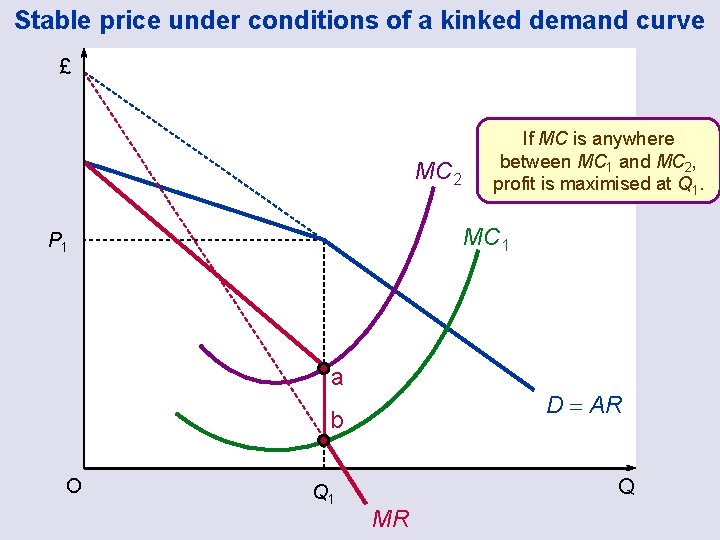

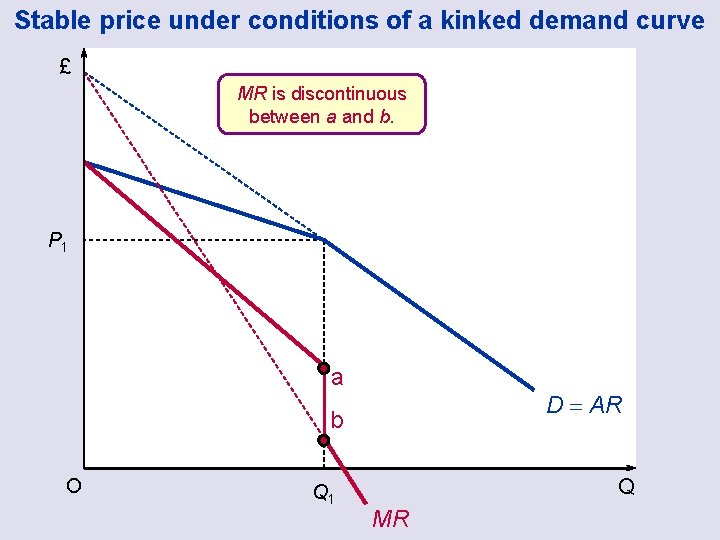

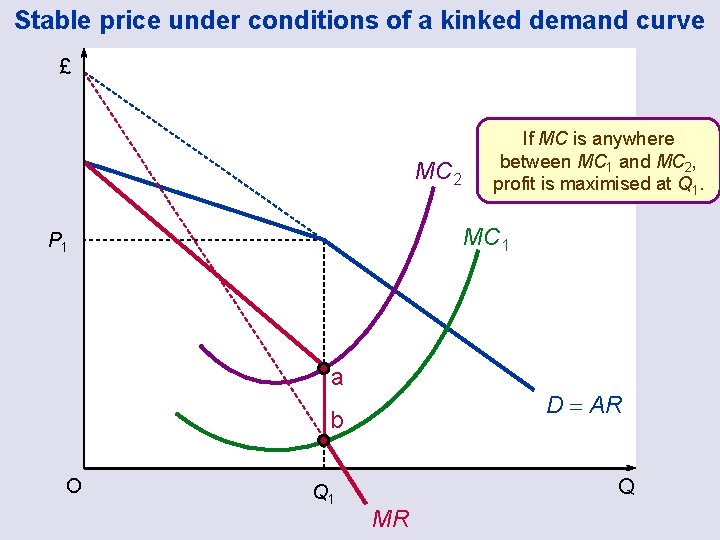

Stable price under conditions of a kinked demand curve £ MR is discontinuous between a and b. P 1 a D = AR b O Q 1 Q MR

Oligopoly Non-collusive oligopoly: assumptions about rivals’ behaviour (cont. ) The kinked demand curve theory ¡ assumptions of the model ¡ the shape of the demand MR curves ¡ effect of a change in costs

Stable price under conditions of a kinked demand curve £ MC 2 MC 1 P 1 a D = AR b O If MC is anywhere between MC 1 and MC 2, profit is maximised at Q 1 Q MR

Oligopoly Non-collusive oligopoly: assumptions about rivals’ behaviour (cont. ) The kinked demand curve theory ¡ assumptions of the model ¡ the shape of the demand MR curves ¡ effect of a change in costs ¡ stable prices ¡ limitations of the model

Oligopoly and the public interest ¡ advantages ¡ disadvantages ¡ difficulties in drawing general conclusions Advertising and the public interest Oligopoly and contestable markets

Imperfect Competition Game Theory

Game Theory Single move or normal-form games ¡ alternative strategies: maximax and maximin ¡ single dominant strategy games

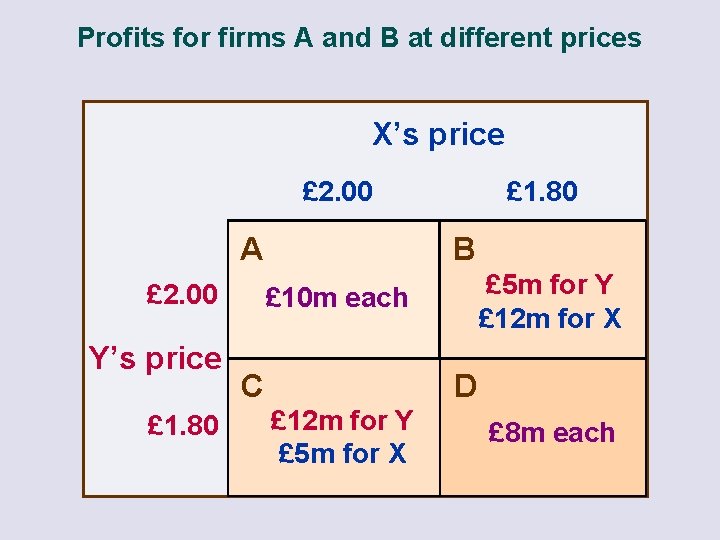

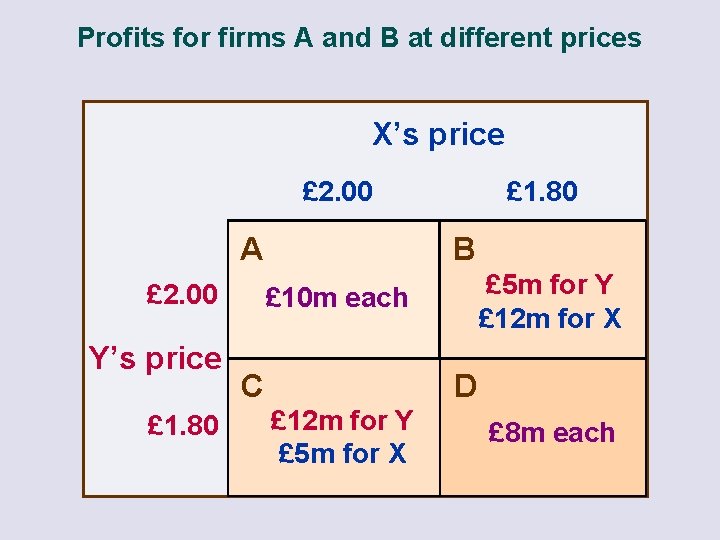

Profits for firms A and B at different prices X’s price £ 2. 00 B A £ 2. 00 Y’s price £ 1. 80 £ 5 m for Y £ 12 m for X £ 10 m each D C £ 12 m for Y £ 5 m for X £ 8 m each

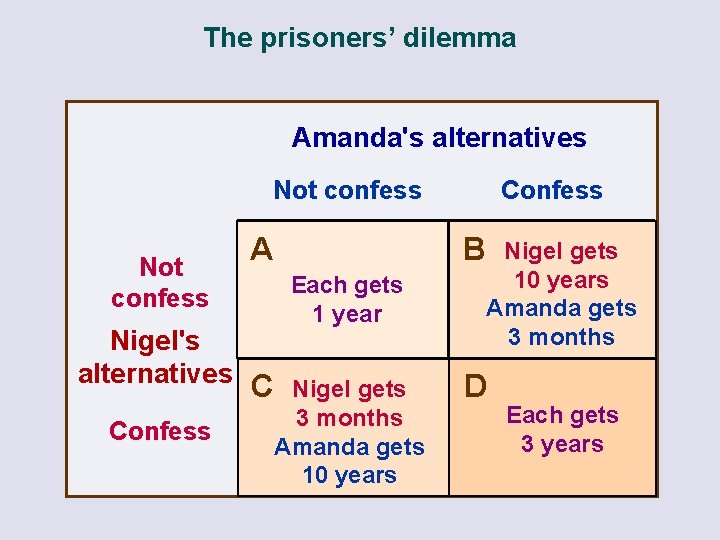

Game theory Single move or normal-form games ¡ alternative strategies: maximax and maximin ¡ single dominant strategy games ÷ the prisoners’ dilemma

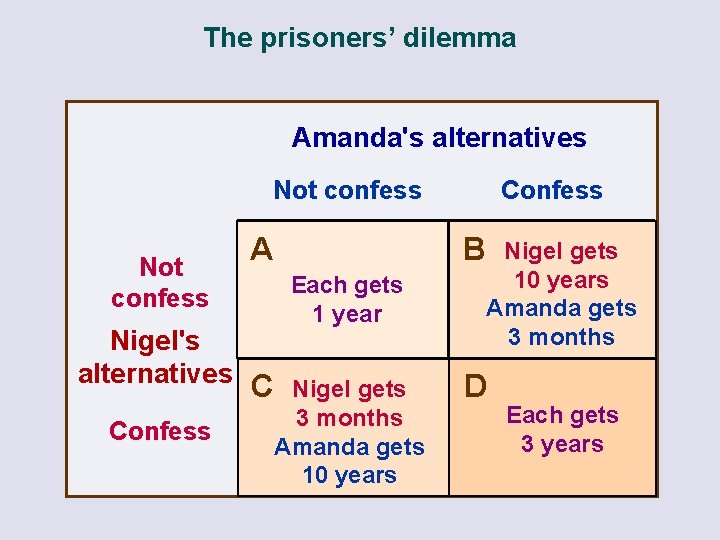

The prisoners’ dilemma Amanda's alternatives Not confess B A Each gets 1 year Nigel's alternatives C Nigel gets Confess 3 months Amanda gets 10 years Nigel gets 10 years Amanda gets 3 months D Each gets 3 years

Game Theory Single move or normal-form games ¡ alternative strategies: maximax and maximin ¡ single dominant strategy games ÷ the prisoners’ dilemma ÷ Nash ¡ equilibrium non-dominant strategy games

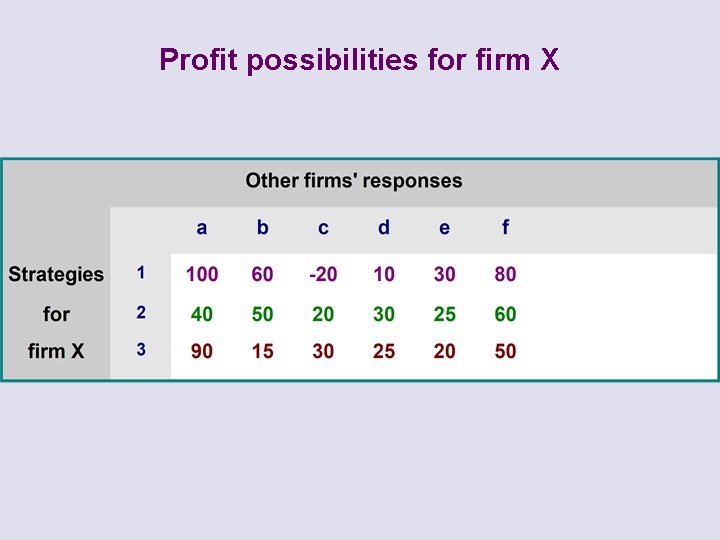

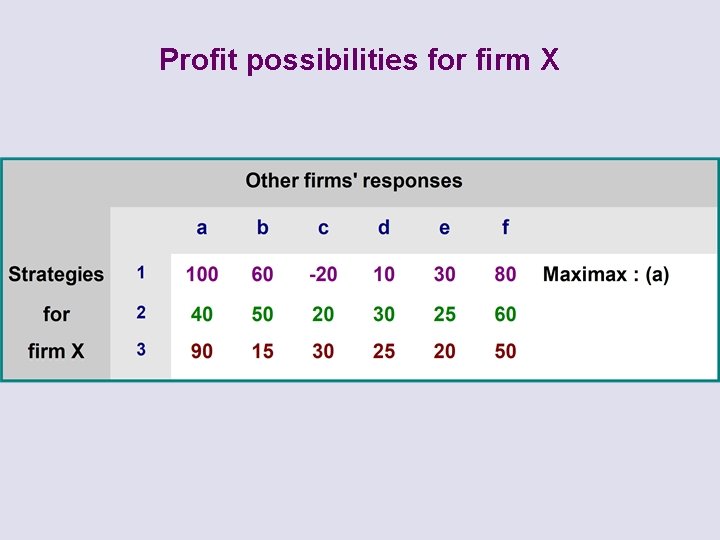

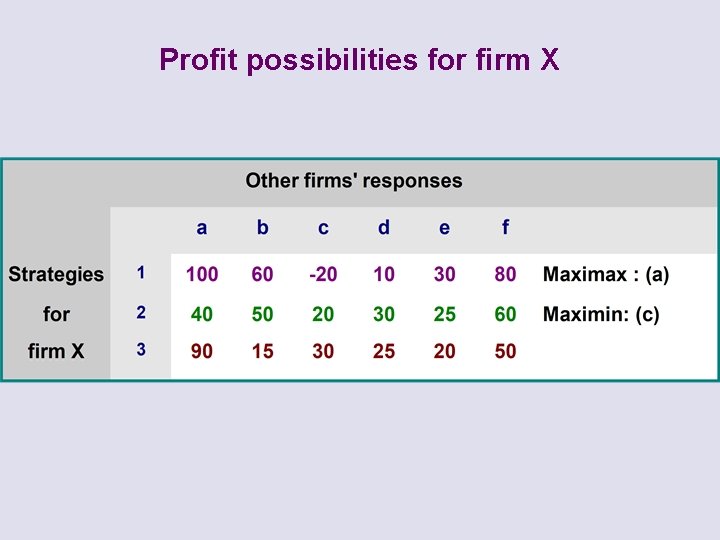

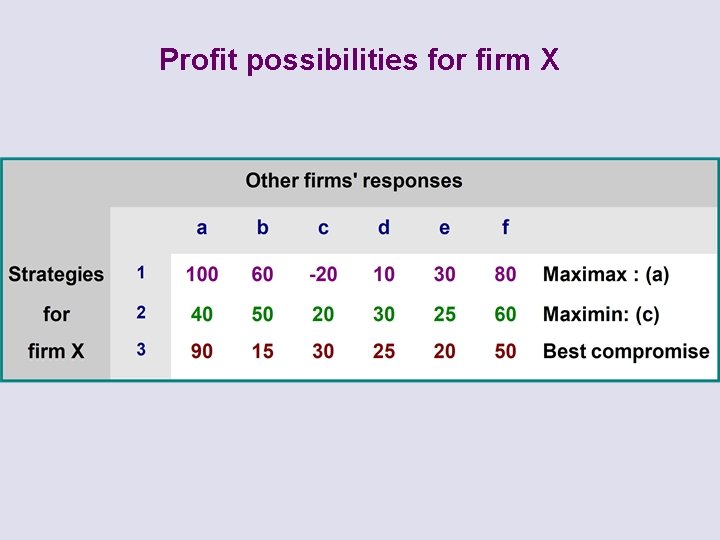

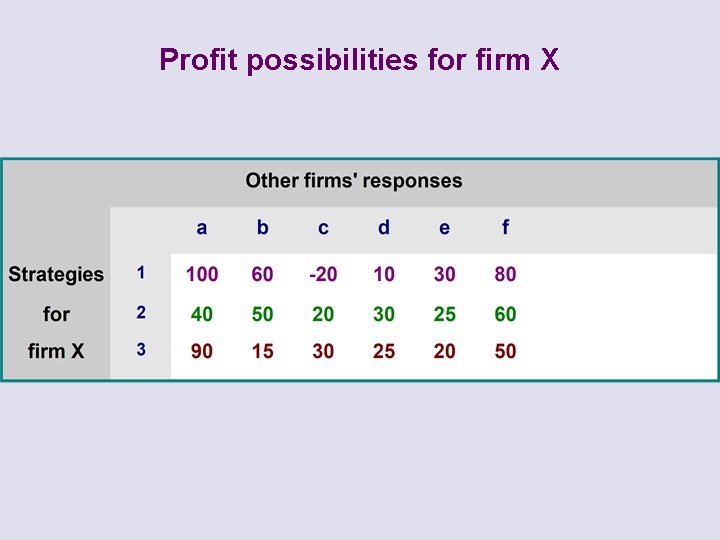

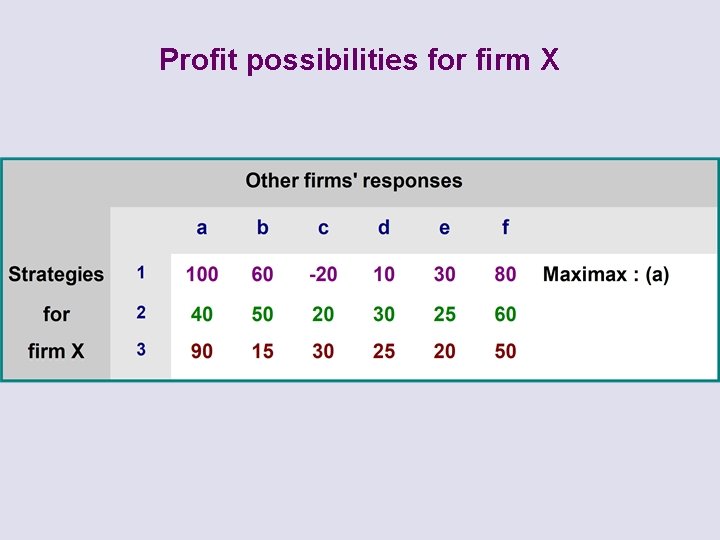

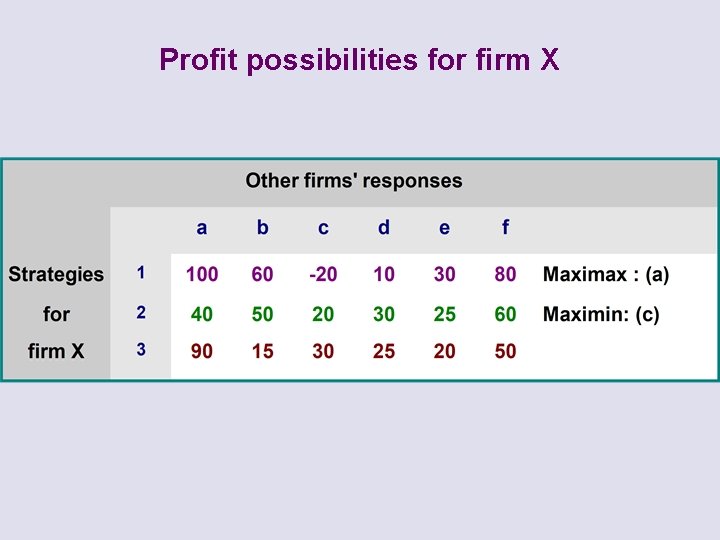

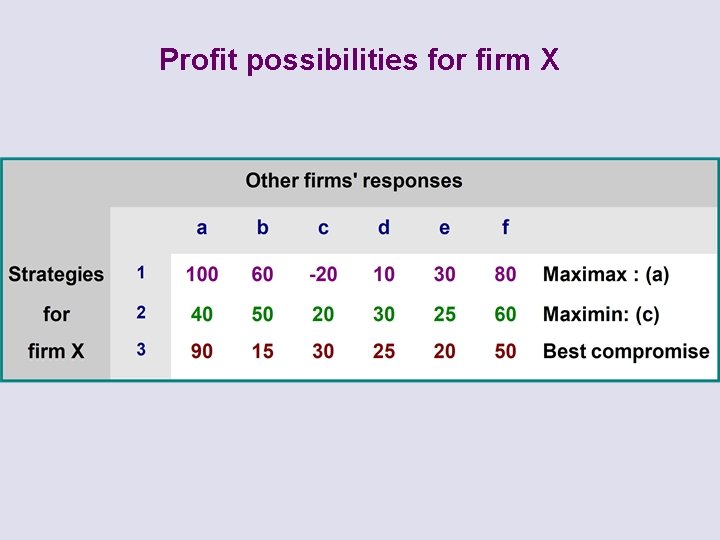

Profit possibilities for firm X

Profit possibilities for firm X

Profit possibilities for firm X

Profit possibilities for firm X

Game theory Multiple move games ¡ the importance of threats and promises ÷ credible ¡ threats the importance of timing ÷ decision trees

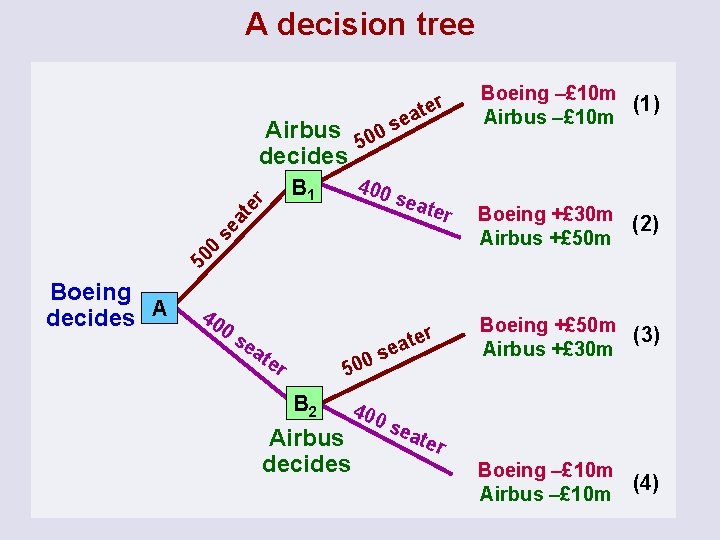

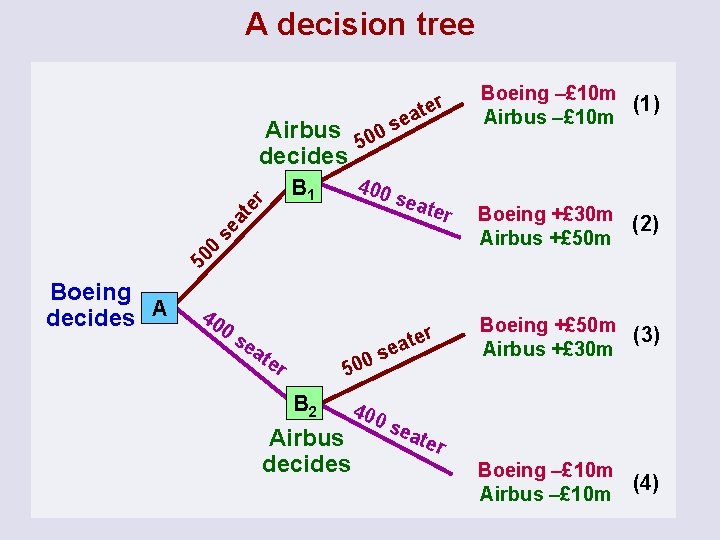

A decision tree ter ea s 0 Airbus 50 decides 400 sea ter 50 0 se at er B 1 Boeing decides A 40 0 s ea te 500 r B 2 Airbus decides er t a se 400 sea Boeing –£ 10 m (1) Airbus –£ 10 m Boeing +£ 30 m (2) Airbus +£ 50 m Boeing +£ 50 m (3) Airbus +£ 30 m ter Boeing –£ 10 m (4) Airbus –£ 10 m

Game Theory Multiple move games ¡ the importance of threats and promises ÷ credible ¡ threats the importance of timing ÷ decision trees ÷ first-mover advantage

Game Theory Limitations of game theory ¡ complex games with multiple players ¡ the role of individuals’ morals and attitudes Potential for cycles of collusion and competition

Imperfect Competition Price Discrimination

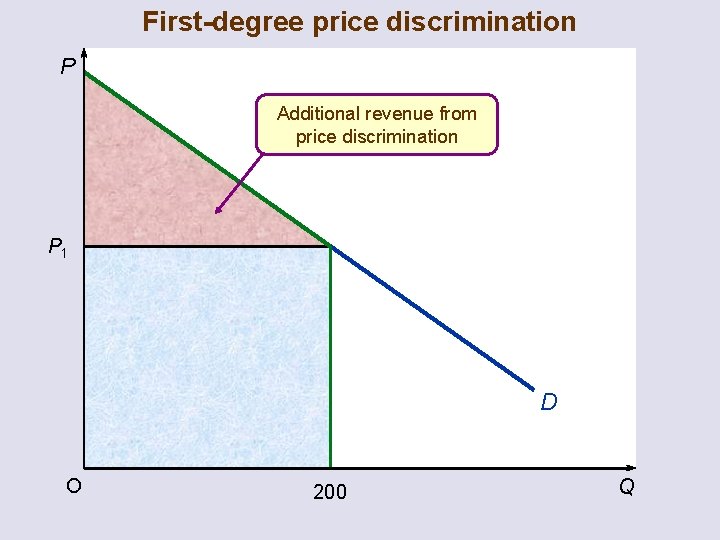

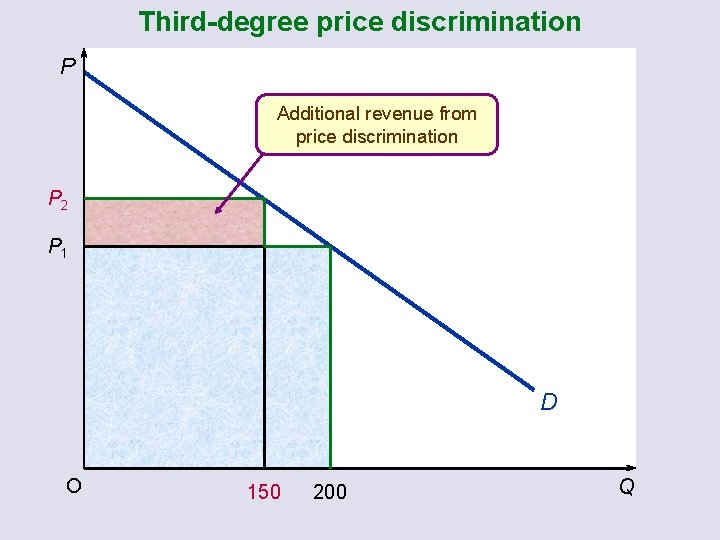

Price discrimination Meaning of price discrimination ¡ different prices for same product produced at same cost Types of price discrimination ¡ first degree

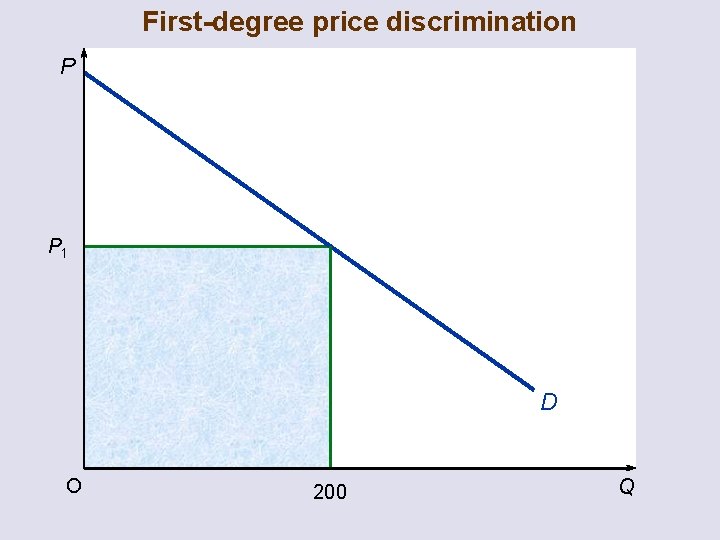

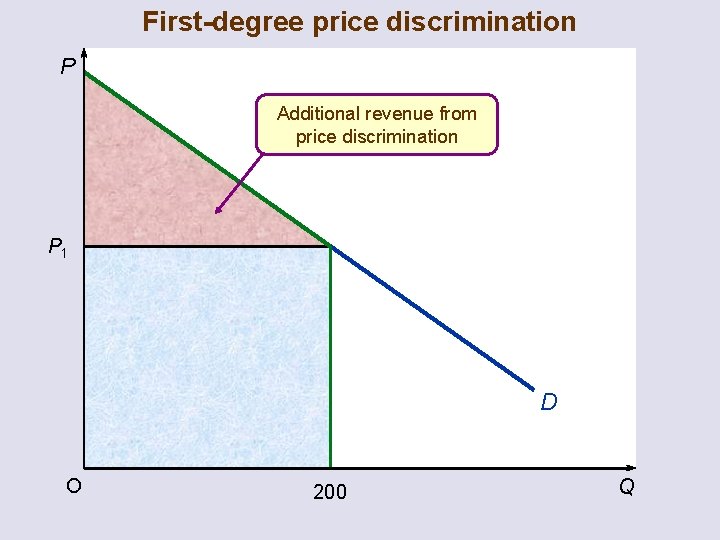

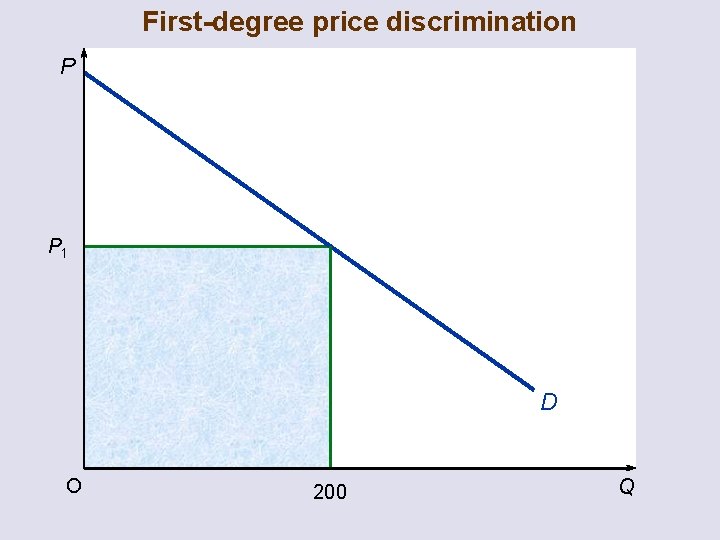

First-degree price discrimination P P 1 D O 200 Q

First-degree price discrimination P Additional revenue from price discrimination P 1 D O 200 Q

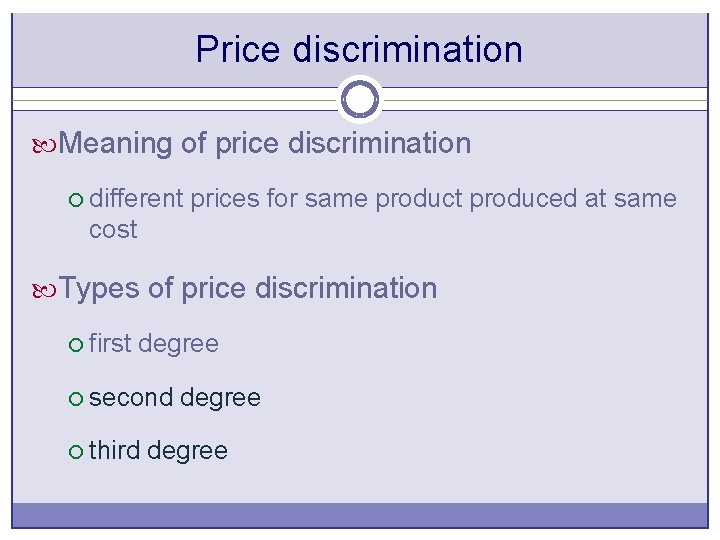

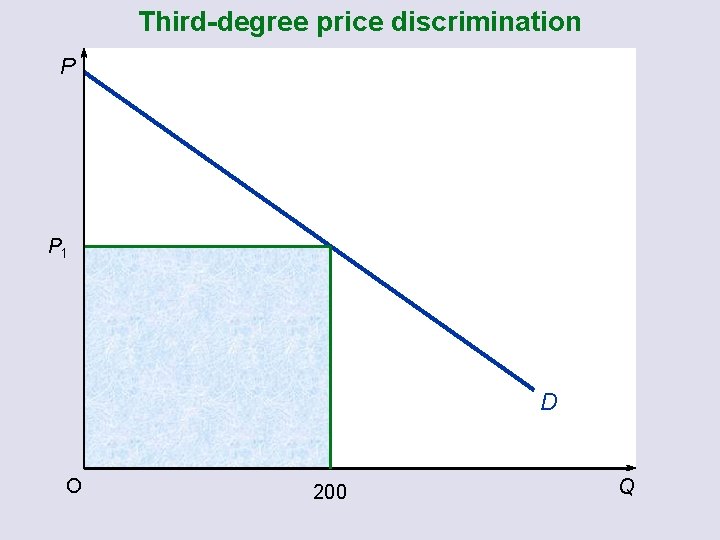

Price discrimination Meaning of price discrimination ¡ different prices for same product produced at same cost Types of price discrimination ¡ first degree ¡ second degree ¡ third degree

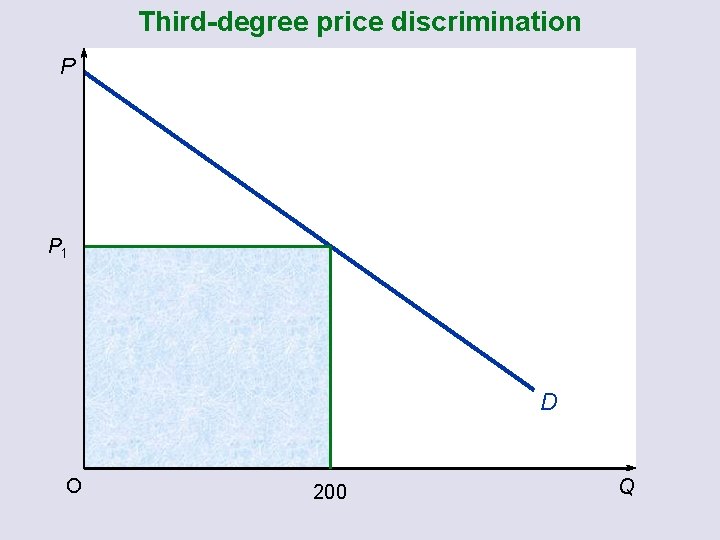

Third-degree price discrimination P P 1 D O 200 Q

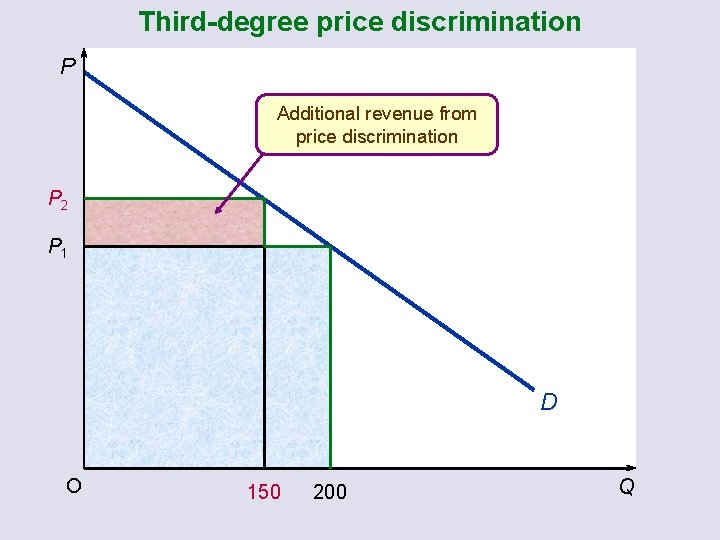

Third-degree price discrimination P Additional revenue from price discrimination P 2 P 1 D O 150 200 Q

Price discrimination Conditions necessary for third degree price discrimination to operate ¡ two or more separable markets, each with different elasticities of demand ¡ monopoly power ¡ no (or limited) opportunity to resell the product

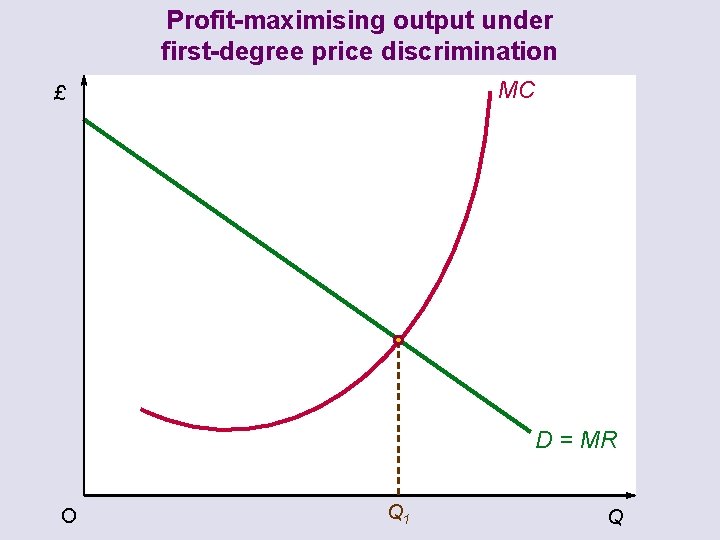

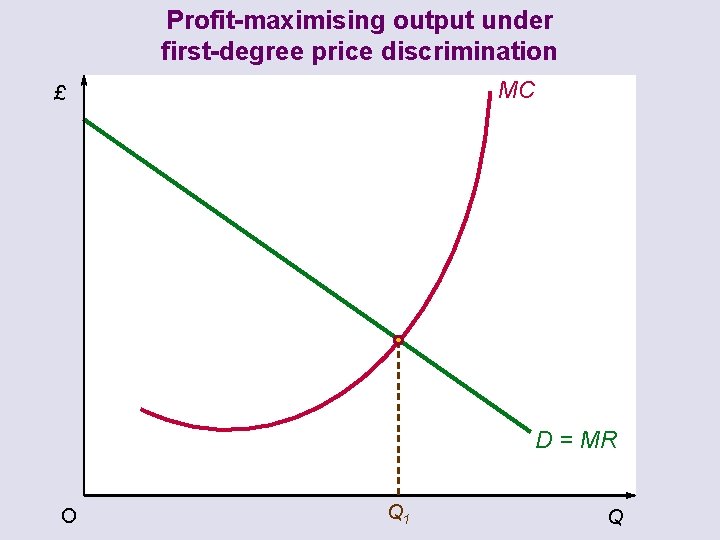

Price discrimination Profit-maximising prices and output under price discrimination ¡ first degree

Profit-maximising output under first-degree price discrimination MC £ D = MR O Q 1 Q

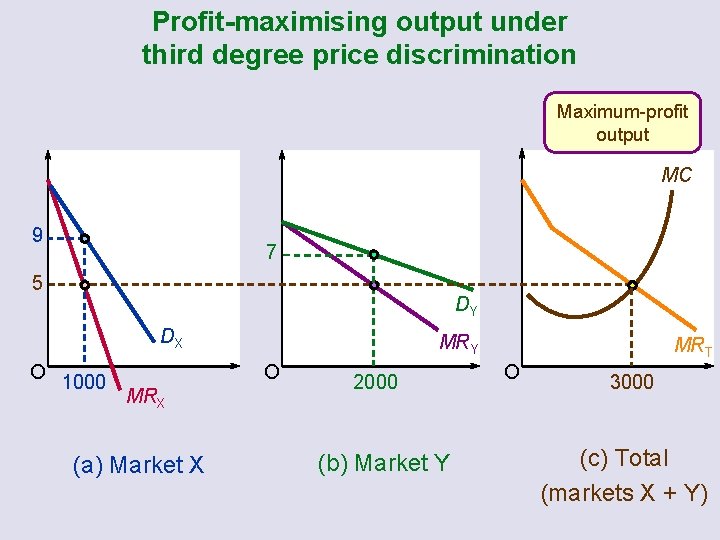

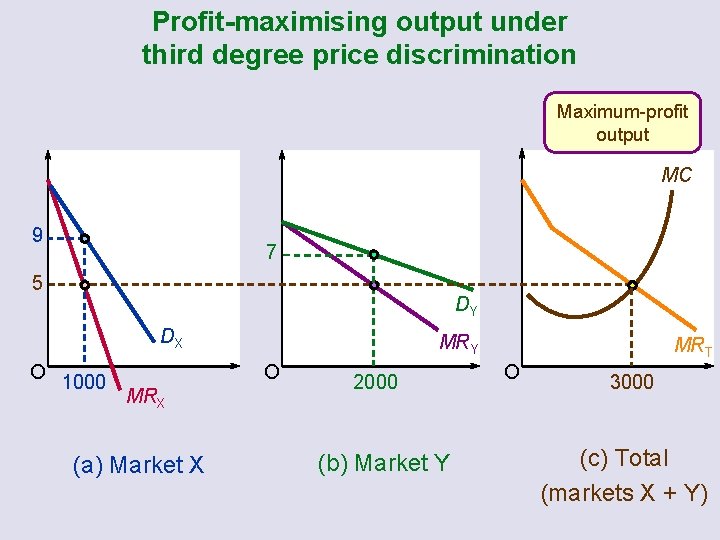

Price discrimination Profit-maximising prices and output under price discrimination ¡ first degree ¡ third degree

Profit-maximising output under third degree price discrimination Maximum-profit output MC 9 7 5 DY DX O 1000 MRY O MRX (a) Market X 2000 (b) Market Y MRT O 3000 (c) Total (markets X + Y)

Price discrimination Profit-maximising prices and output under price discrimination ¡ first degree ¡ third degree Advantages to the firm Price discrimination and the public interest ¡ advantages ¡ disadvantages

Monopoly vs monopolistic competition

Monopoly vs monopolistic competition Monopoly vs oligopoly venn diagram

Monopoly vs oligopoly venn diagram Perfect competition vs monopolistic competition

Perfect competition vs monopolistic competition Lump sum subsidy

Lump sum subsidy Monopoly characteristics

Monopoly characteristics Example of pure competition

Example of pure competition Dynamics of imperfect market

Dynamics of imperfect market Monopolistic competition characteristics

Monopolistic competition characteristics Pros and cons of oligopoly

Pros and cons of oligopoly Consumer surplus in monopolistic competition

Consumer surplus in monopolistic competition Excess capacity in monopolistic competition

Excess capacity in monopolistic competition Monopolistic competition short run

Monopolistic competition short run Example of pure competition

Example of pure competition Oligopoly characteristics

Oligopoly characteristics Monopolistic competition excess capacity

Monopolistic competition excess capacity Characteristics of monopolistic competition

Characteristics of monopolistic competition Monopolistic competition feature

Monopolistic competition feature Monopolistic competition short run

Monopolistic competition short run Difference between monopoly and monopolistic competition

Difference between monopoly and monopolistic competition Conclusion for monopolistic competition

Conclusion for monopolistic competition Chapter 16 monopolistic competition

Chapter 16 monopolistic competition Lesson 1 competition and market structures

Lesson 1 competition and market structures Fast food oligopoly or monopolistic competition

Fast food oligopoly or monopolistic competition What is a monopolistic competition example

What is a monopolistic competition example Chapter 16 monopolistic competition

Chapter 16 monopolistic competition Monopolistic competition def

Monopolistic competition def Consumer surplus in monopolistic competition

Consumer surplus in monopolistic competition Is starbucks an oligopoly

Is starbucks an oligopoly Monopolistic competition example

Monopolistic competition example How is price determined under monopolistic competition

How is price determined under monopolistic competition Monopolistic competition example

Monopolistic competition example Monopolistic competition in long run

Monopolistic competition in long run Price output determination under monopolistic competition

Price output determination under monopolistic competition Chapter 7 section 3 monopolistic competition and oligopoly

Chapter 7 section 3 monopolistic competition and oligopoly Monopolistic competition

Monopolistic competition Examples of oligopoly competition

Examples of oligopoly competition Monopolistic competition short run

Monopolistic competition short run Types of imperfect competition

Types of imperfect competition Imperfect competition

Imperfect competition The most extreme form of imperfect competition is

The most extreme form of imperfect competition is Unit4 competitors

Unit4 competitors Monopolistic market

Monopolistic market (fueron/eran) las doce.

(fueron/eran) las doce. Buscar preterite

Buscar preterite Imperfect voluntariness examples

Imperfect voluntariness examples Siempre imperfect

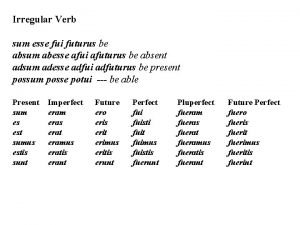

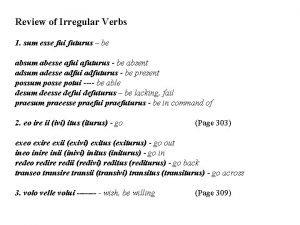

Siempre imperfect Sum esse fui latinski

Sum esse fui latinski Difference between imperfect and preterite spanish

Difference between imperfect and preterite spanish Sons kinsmen thanes

Sons kinsmen thanes Preterite vs imperfect spanish

Preterite vs imperfect spanish Sum, esse, fui

Sum, esse, fui Saliebant

Saliebant Imperfect clue words

Imperfect clue words Is mental and emotional states preterite or imperfect

Is mental and emotional states preterite or imperfect Commencer imperfect

Commencer imperfect Hedge ratio formula

Hedge ratio formula Incomplete information vs imperfect information

Incomplete information vs imperfect information Regular pronouns

Regular pronouns Expected value of imperfect information

Expected value of imperfect information Imperfect imitability

Imperfect imitability Imperfect comprar

Imperfect comprar Imperfect key words

Imperfect key words Juicy verbs spanish

Juicy verbs spanish Imperfect vs preterite examples

Imperfect vs preterite examples Simba cheated examples

Simba cheated examples Destruir irregular preterite

Destruir irregular preterite Oir preterite

Oir preterite Preterite vs imperfect trigger words

Preterite vs imperfect trigger words Past imperfect subjunctive

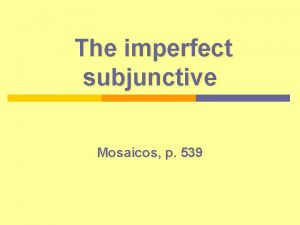

Past imperfect subjunctive Los chicos necesitar (imperfect)

Los chicos necesitar (imperfect) Imperfecto de subjuntivo examples

Imperfecto de subjuntivo examples