IAPF TRUSTEE FORUM Stop Press Whats Coming Down

- Slides: 14

IAPF TRUSTEE FORUM “Stop Press” What’s Coming Down The Tracks Mary Hutch Head of Information and Training The Pensions Board 22 March 2005

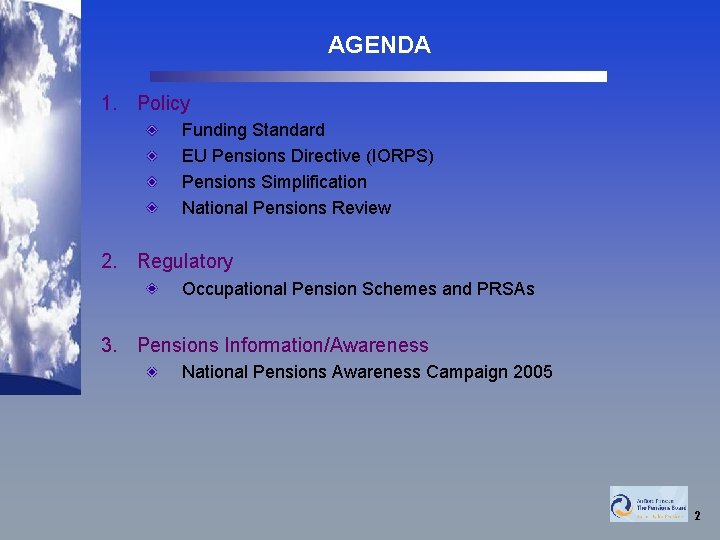

AGENDA 1. Policy Funding Standard EU Pensions Directive (IORPS) Pensions Simplification National Pensions Review 2. Regulatory Occupational Pension Schemes and PRSAs 3. Pensions Information/Awareness National Pensions Awareness Campaign 2005 2

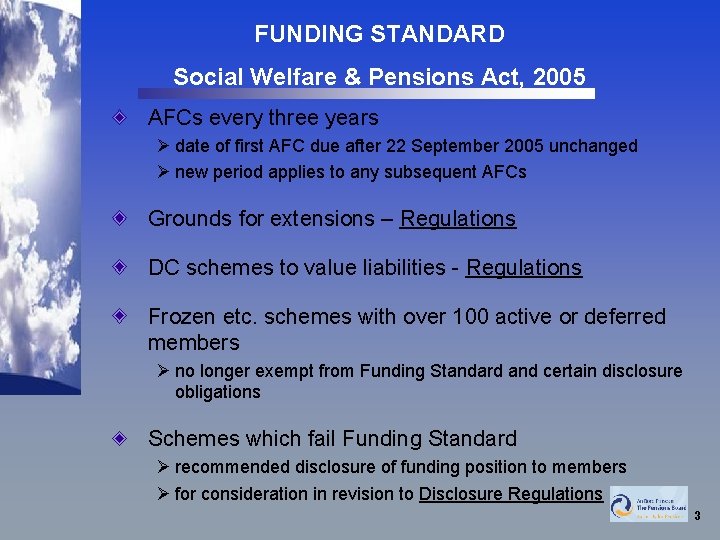

FUNDING STANDARD Social Welfare & Pensions Act, 2005 AFCs every three years Ø date of first AFC due after 22 September 2005 unchanged Ø new period applies to any subsequent AFCs Grounds for extensions – Regulations DC schemes to value liabilities - Regulations Frozen etc. schemes with over 100 active or deferred members Ø no longer exempt from Funding Standard and certain disclosure obligations Schemes which fail Funding Standard Ø recommended disclosure of funding position to members Ø for consideration in revision to Disclosure Regulations 3

EU PENSIONS DIRECTIVE Social Welfare & Pensions Act, 2005 Other Regulations Pending Trusteeship Ø Qualification and training requirements for trustees or their advisers Investment Ø Prudent, diversification, unregulated markets Ø Investment policy principles Ø Borrowing (Working Group to consider prudential and tax issues) Cross Border Schemes Ø Social and Labour Law issues Ø Exemptions from parts of Pensions Act for overseas members Ø Authorisation All to be in place by 23 September 2005 4

POLICY – PENSIONS SIMPLIFICATION Tax treatment of DC type provision Øreport with Department of Finance Draft Disclosure Regulations Øto be in line with IORPS and Funding Standard requirements Ørevised Regulations due mid 2005 5

POLICY – NATIONAL PENSIONS REVIEW Statutory review of pensions coverage due September 2006 Minister bringing forward timing to mid-year 2005 Board to submit proposals to address current situation Ø Progress Report June 2005 Ø Full Report late summer Representative organisations to support and input through organisations by 3 May 2005 Series of workshops to discuss specific aspects 6

POLICY – NATIONAL PENSIONS REVIEW Scope and Main Components Review of NPPI’s main strategic recommendations Review of coverage targets in NPPI Report (1998) Review of current position under Second Pillar Options to address coverage and adequacy § Trusteeship review post NPR 7

REGULATORY Occupational Pension Schemes Further prosecutions pending – July Revisions to S 49(3) Guidelines – April PRSAs Follow up on 64, 000 employer audits 7 prosecutions listed – July Commitment to ensure employer compliance with access requirements Guidance Activities Guidance Notes on Equal Pensions Treatment – May Revised Guidance Notes on Ø Determinations by Pensions Board Ø ‘Whistleblowing’ Requirements - June 8

NATIONAL PENSIONS AWARENESS CAMPAIGN 2005 9

NATIONAL PENSIONS AWARENESS CAMPAIGN STRATEGIC PLAN 2005 Awareness Levels The Boards Consumer Awareness Research Audits clearly show a positive increase in pensions and PRSA awareness levels rising from 60% at end of 2003 to over 75% at end of 2004. However, while awareness levels are significant, the coverage rate remains low. Key Priorities for 2005 The Board plans to conduct a strategic pensions awareness campaign in 2005 which will encourage the conversion of awareness into positive action and responsibility; 1. in the form of increased pensions take up. 1. to build an educational foundation about retirement planning for the future 10

ACTION & RESPONSIBILITY In the pursuit of increased pensions uptake NPAC focus for 2005 will include; Key Target Sectors Primary Targets Population aged 25 – 35 years old Women Graduates Farming/Rural Community Self Employed Secondary Targets First time job seekers Students Migrant workers 11

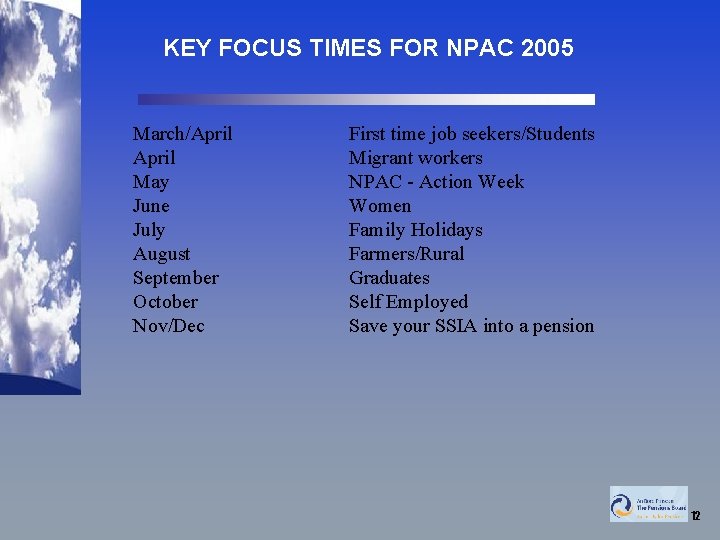

KEY FOCUS TIMES FOR NPAC 2005 March/April May June July August September October Nov/Dec First time job seekers/Students Migrant workers NPAC - Action Week Women Family Holidays Farmers/Rural Graduates Self Employed Save your SSIA into a pension 12

ACTION & RESPONSIBILITY – NPAC 2005 Take Action - Visit the on-line Pensions Calculator at www. pensionsboard. ie The 2005 calculator allows you to estimate the net amount of money you would need to contribute to your pension in relation to your age and current yearly salary to end up with the level of pension you expect in retirement. 13

We all have a responsible role to play…. . …. in actively promoting pension take up ! 14

A tennis player on serve tosses a ball straight up

A tennis player on serve tosses a ball straight up Field stop vs aperture stop

Field stop vs aperture stop One stop teacher stop

One stop teacher stop Coming down the pike

Coming down the pike Coming down of the holy spirit

Coming down of the holy spirit Whats a press conference

Whats a press conference What goes up but never comes down

What goes up but never comes down Trustee mode

Trustee mode Gaa corporate trustee

Gaa corporate trustee Trustee model

Trustee model Fidelity personal trust services

Fidelity personal trust services Njlta

Njlta Trustee vs delegate vs politico

Trustee vs delegate vs politico Compare and contrast trustee period and royal colony

Compare and contrast trustee period and royal colony Compare and contrast trustee and royal georgia

Compare and contrast trustee and royal georgia