I HC HOA SEN Khoa Kinh t Thng

- Slides: 78

ĐẠI HỌC HOA SEN Khoa Kinh tế Thương mại 1

KHOA KINH TẾ THƯƠNG MẠI FINANCIAL MANAGEMENT Th. S. Nguyễn Tường Minh Email: minh. nguyentuong@yahoo. com. vn 2

References • Foundation of Financial Management, Block & Hirt, Mc. Graw Hill, 13 th edition, USA, 2009. • Fundamentals of Corporate Finance, Brealey et al. , Mc. Graw Hill, 5 th edition, USA, 2007. • Other relevant materials. 3

Chapter 7: Current Asset Management • Main Contents: 1. 2. 3. 4. 5. Cash Management Collections and Disbursement Marketable Securities Management of Accounts Receivable Inventory Management 4

WHAT IS CURRENT ASSET MANAGEMENT ? • Involves the management of cash, marketable securities, accounts receivable, and inventory • Ensures a competitive advantage and often creates an increase in shareholder value • Primarily concerned with liquidity and safety, and then on maximizing profits 5

I. Cash Management • Financial managers actively attempt to keep cash (non-earning asset) to a minimum – It is critical to have sufficient cash to assuage emergencies. – Steps to improve overall profitability of a firm: • Minimize cash balances • Have accurate knowledge of when cash moves in and out of the firm 6

I. Cash Management (cont’d) 1. Reason for holding Cash Balance • Transactions balances – Payment towards planned expenses • Compensative balances for banks – Compensate a bank for services provided rather than paying directly for them • Precautionary needs – Emergency purposes 7

I. Cash Management (cont’d) 2. Cash flow cycle • Ensure that cash inflows and outflows are synchronized for transaction purposes – Cash budget is a tool used to track cash flows and ensuing balances • Cash flow relies on: – Payment pattern of customers – Speed at which suppliers and creditors process checks – Efficiency of the banking system 8

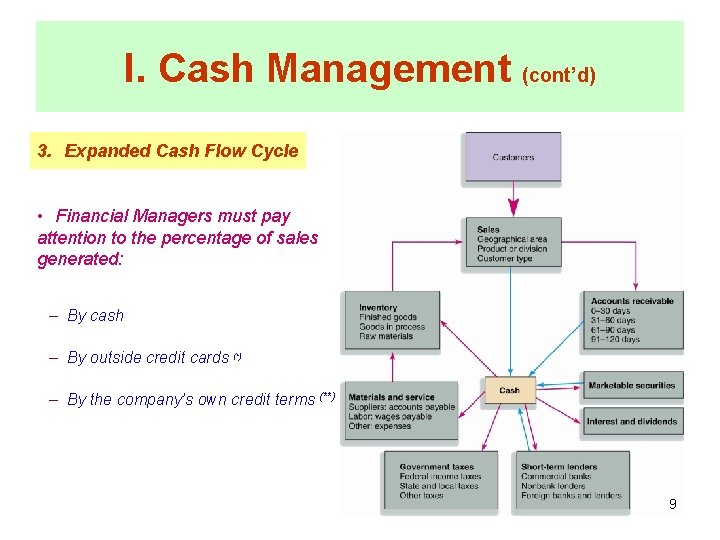

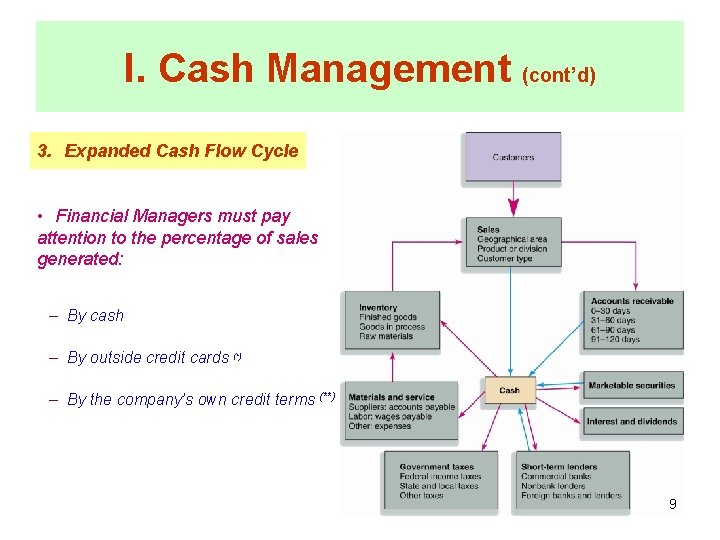

I. Cash Management (cont’d) 3. Expanded Cash Flow Cycle • Financial Managers must pay attention to the percentage of sales generated: – By cash – By outside credit cards (*) – By the company’s own credit terms (**) 9

II. Collections and Disbursements • Primary concern to the Financial managers is the management of: – Cash Inflows – still affected by collection mechanisms – Payment outflow 10

II. Collections and Disbursements (cont’d) 1. Float • Difference between firm’s recorded amount and amount credited to the firm by a bank – Arises due to time delays in mailing, processing and clearing checks through the banking system – Can be managed to some extent by combining disbursements and collection strategies – Main challenge: the physical presentation of the check to the issuing bank 11

II. Collections and Disbursements (cont’d) 1. Float (cont’d) • Factors that help in reducing Float: (*) – Ease of credit and debit cards payments and online banking for customer – Wire transfers for corporation – Rise of Internet commerce 12

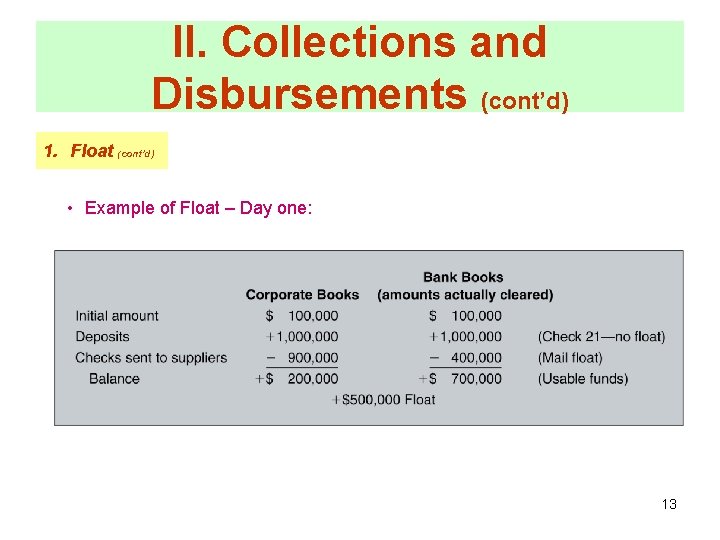

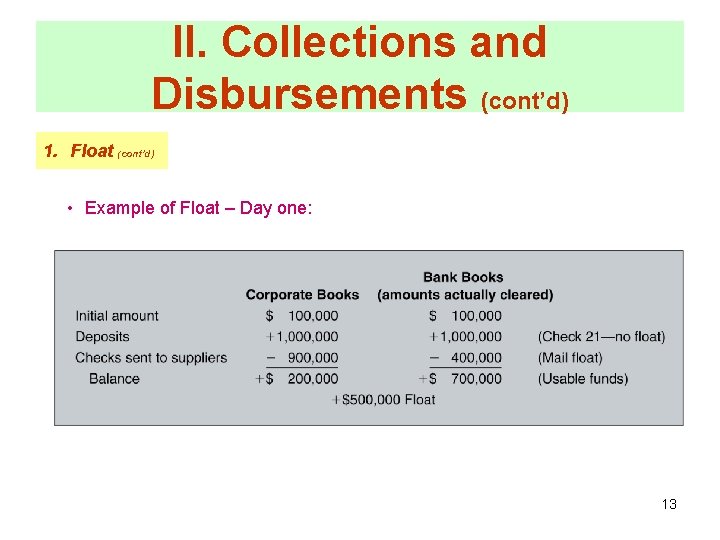

II. Collections and Disbursements (cont’d) 1. Float (cont’d) • Example of Float – Day one: 13

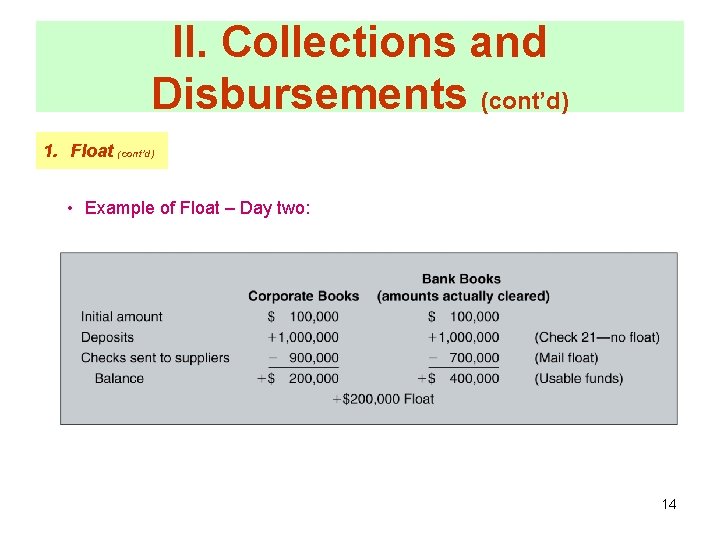

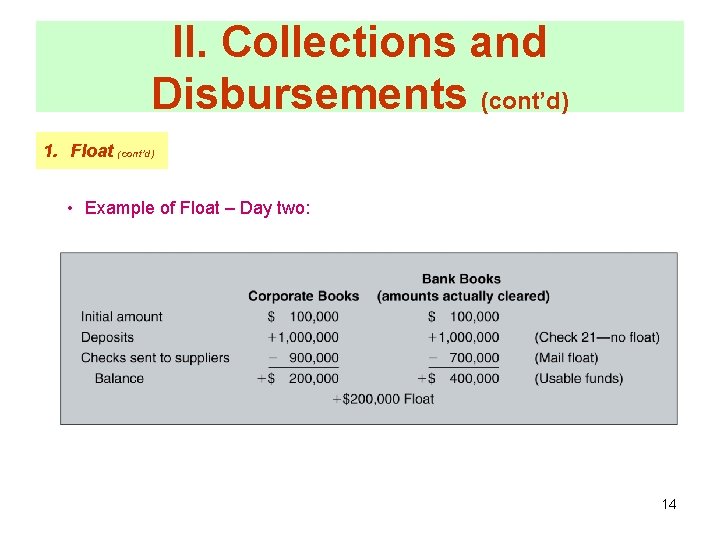

II. Collections and Disbursements (cont’d) 1. Float (cont’d) • Example of Float – Day two: 14

II. Collections and Disbursements (cont’d) 2. Improving Collections • Setting up multiple collections centers at different locations • Adopt Lockbox System (*) for expeditious check clearance at lower costs 15

II. Collections and Disbursements (cont’d) 3. Extending Disbursements (*) • Speed up processing of incoming checks • Slow down payment procedures – Extended disbursement float – allows companies to hold onto their cash balances for as long as possible 16

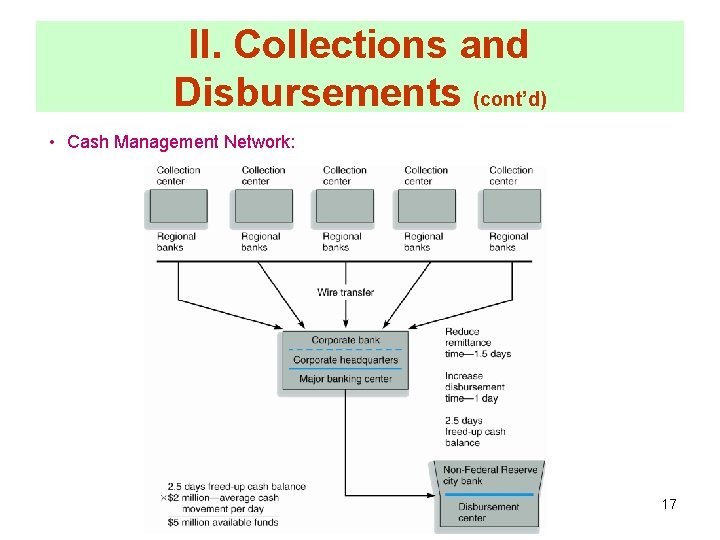

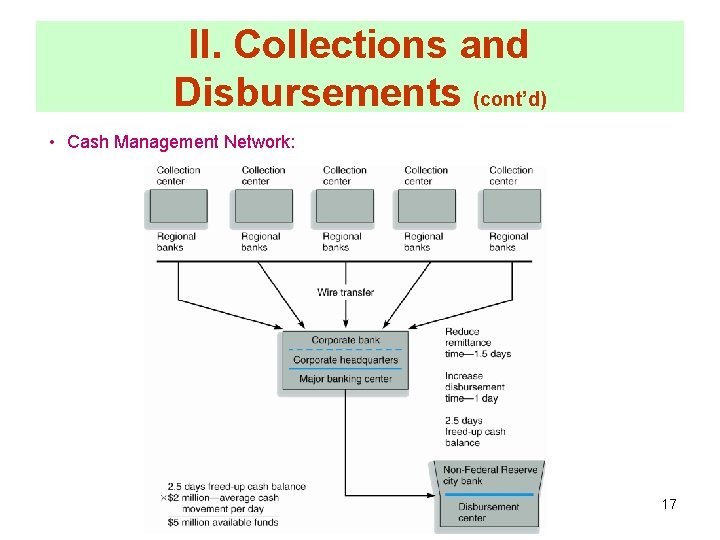

II. Collections and Disbursements (cont’d) • Cash Management Network: 17

II. Collections and Disbursements (cont’d) 4. Electronic Funds Transfer • Funds are moved between computer terminals without the use of a “Check” – Automated Clearinghouses (ACH) • Transfers information between financial institutions and between accounts • Carried out through Society for Worldwide Interbank Financial Telecommunications (SWIFT) 18

II. Collections and Disbursements (cont’d) 5. International Cash Management • Factors differentiating international cash management from domestic based systems: – Differing payment methods, and higher popularity of electronic funds transfer – Subject to international boundaries, time zone differences, currency fluctuations, and interest rate changes – Differing banking systems, and check clearing processes – Differing account balance management, and information reporting systems – Cultural, tax, and accounting differences 19

II. Collections and Disbursements (cont’d) 5. International Cash Management (cont’d) • Financial managers try to keep as much cash as possible in a country with a strong currency • Sweep account 20

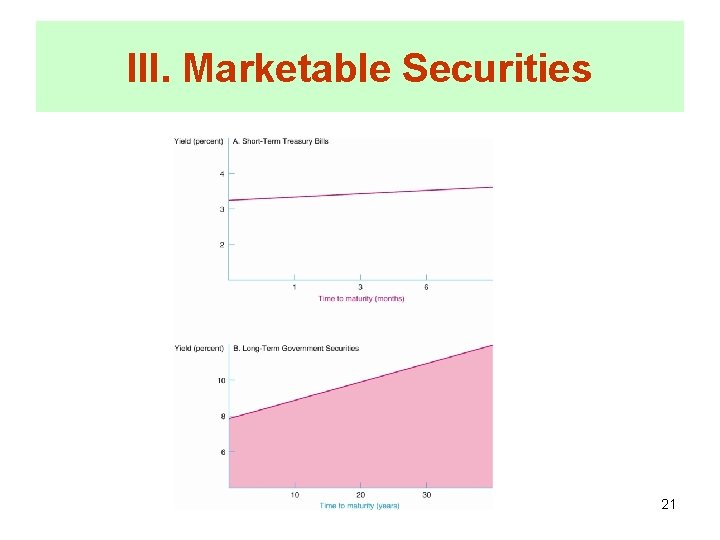

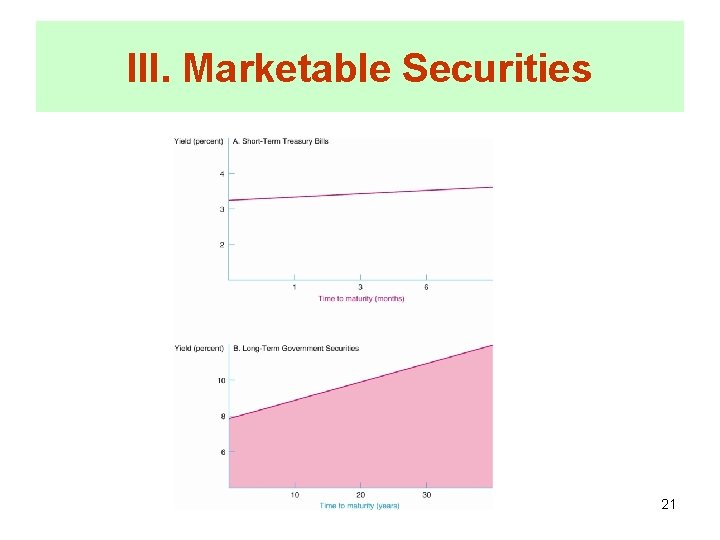

III. Marketable Securities 21

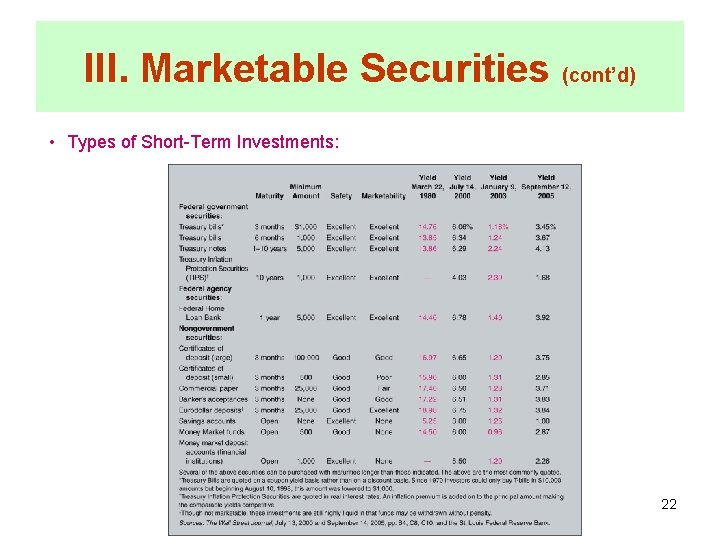

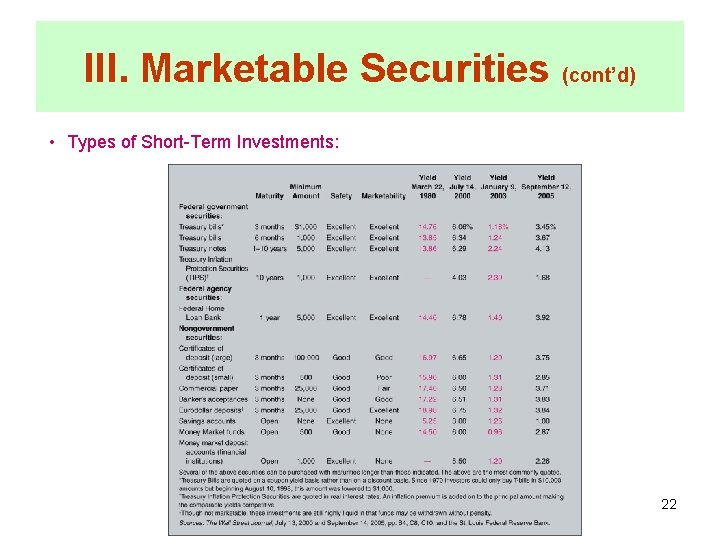

III. Marketable Securities (cont’d) • Types of Short-Term Investments: 22

IV. Management of Account Receivable • Account Receivable as an investment – Should be based on the level of return earned equals or exceeds the potential gain from other investments • Credit policy administration – Credit standards – Terms of trade – Collection policy 23

IV. Management of Account Receivable (cont’d) • Credit policy administration: 1. Credit standard – Determine the nature of credit risk based on: • Prior records of payments and financial stability • Current net worth and other related factors – 5 characters of credit: • Character • Capital • Capacity • Conditions • Collateral 24

IV. Management of Account Receivable (cont’d) 2. Terms of trade – Stated term of credit extension: • Has a strong impact on the eventual size of accounts receivable balance • Creates a need for firms to consider the use of cash discounts 25

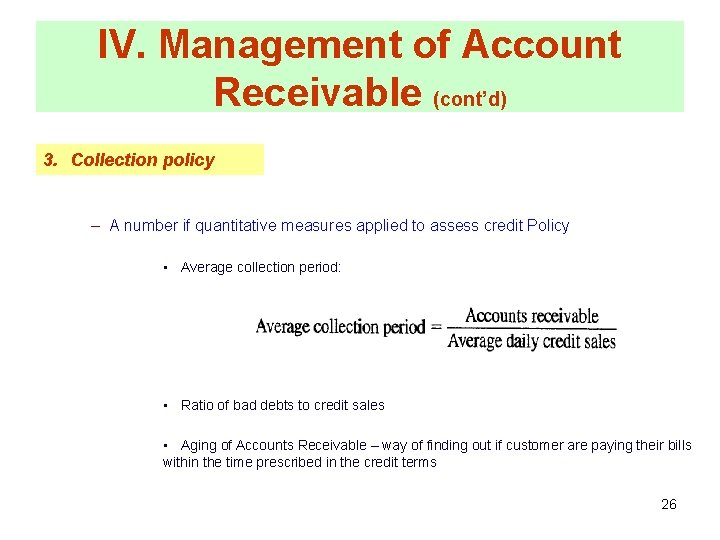

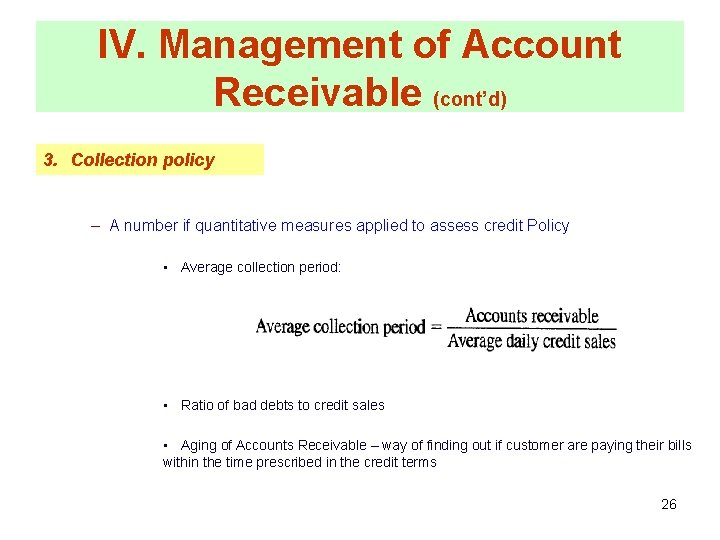

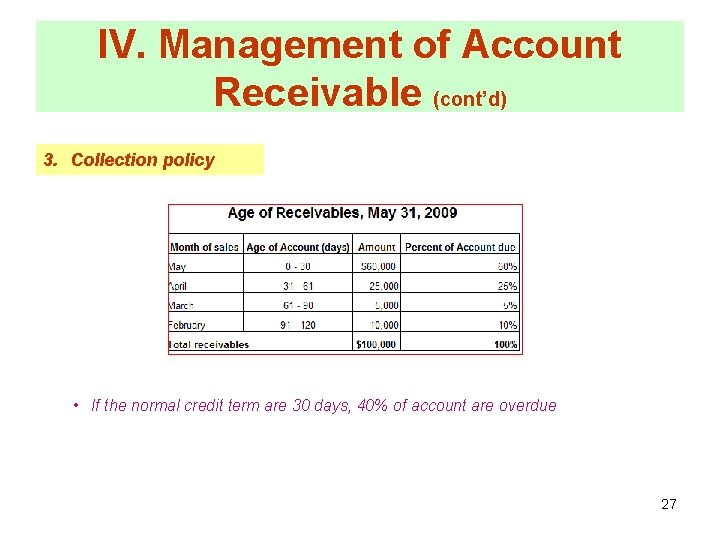

IV. Management of Account Receivable (cont’d) 3. Collection policy – A number if quantitative measures applied to assess credit Policy • Average collection period: • Ratio of bad debts to credit sales • Aging of Accounts Receivable – way of finding out if customer are paying their bills within the time prescribed in the credit terms 26

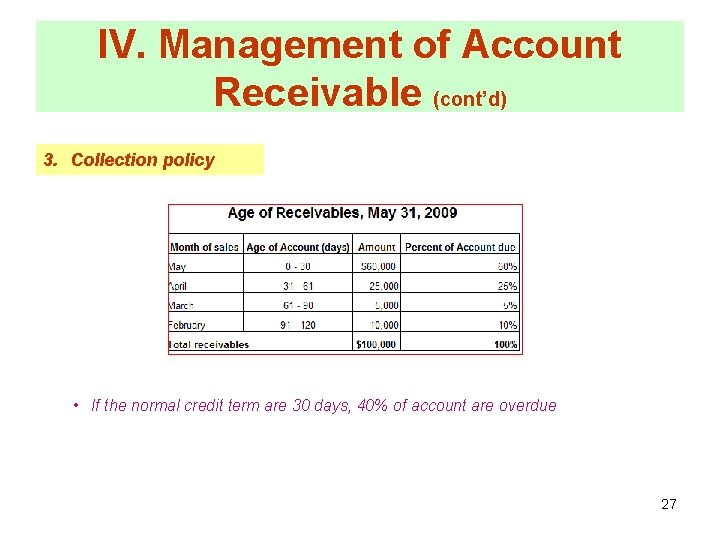

IV. Management of Account Receivable (cont’d) 3. Collection policy • If the normal credit term are 30 days, 40% of account are overdue 27

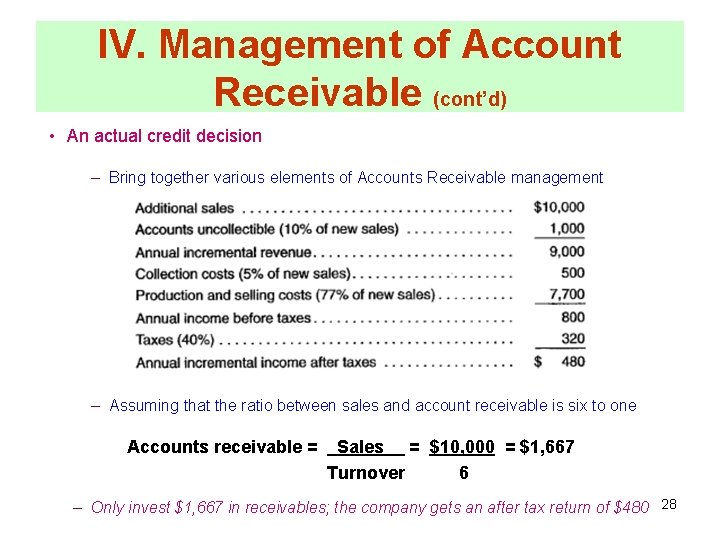

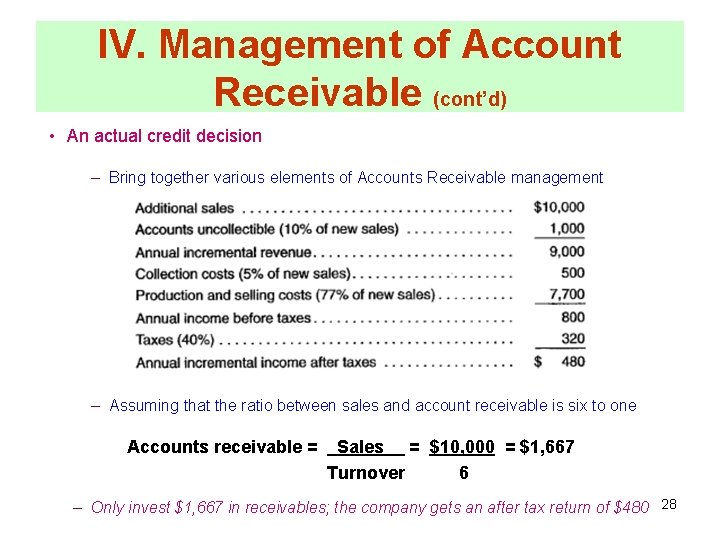

IV. Management of Account Receivable (cont’d) • An actual credit decision – Bring together various elements of Accounts Receivable management – Assuming that the ratio between sales and account receivable is six to one Accounts receivable = Sales = $10, 000 = $1, 667 Turnover 6 – Only invest $1, 667 in receivables; the company gets an after tax return of $480 28

V. Inventory Management • Inventory has three basic categories: – Raw materials – Work in progress – Finished goods • Amount of inventory is affected by sales, production, and economic conditions • Inventory is the least of liquid assets- should provide the highest yield 29

V. Inventory Management (cont’d) 1. Level vs Seasonal Production • Level production – Maximum efficiency in manpower and machinery usage – May result in high inventory buildup • Seasonal production – Eliminate inventory buildup problems – May result in unused capacity during slack periods – May result in overtime labor charges and overused equipment repair charges 30

V. Inventory Management (cont’d) 2. Inventory policy in Inflation and Deflation • Inventory position can be protected in an environment of price instability by: – Taking moderate inventory positions (by not committing at a single price) – Hedging with a futures contract to sell at a stipulated price some months from now • Rapid price movement in inventory may also have a major impact on the reported income of the firm 31

V. Inventory Management (cont’d) 3. The Inventory Decision Model • Carrying Costs: – Interest on funds tied up in inventory – Cost of warehouse space, insurance premiums and material handling expenses – Implicit cost associated with the risk of obsolescence and perish-ability • Ordering Costs: – Cost of ordering – Cost of processing inventory into stock 32

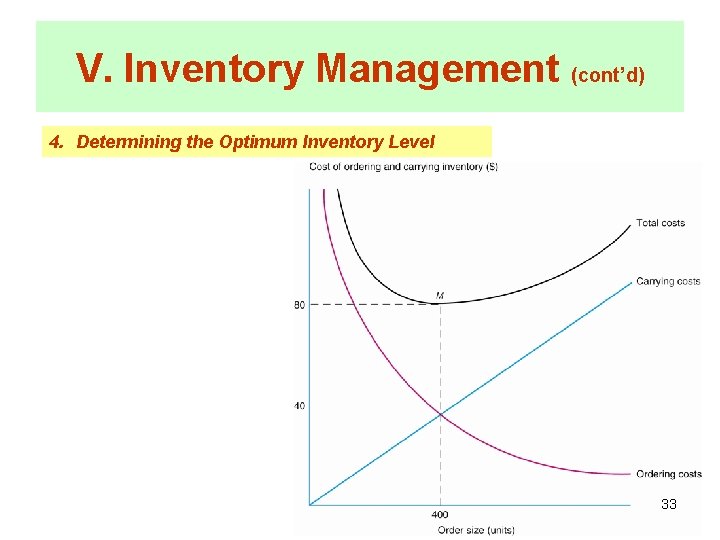

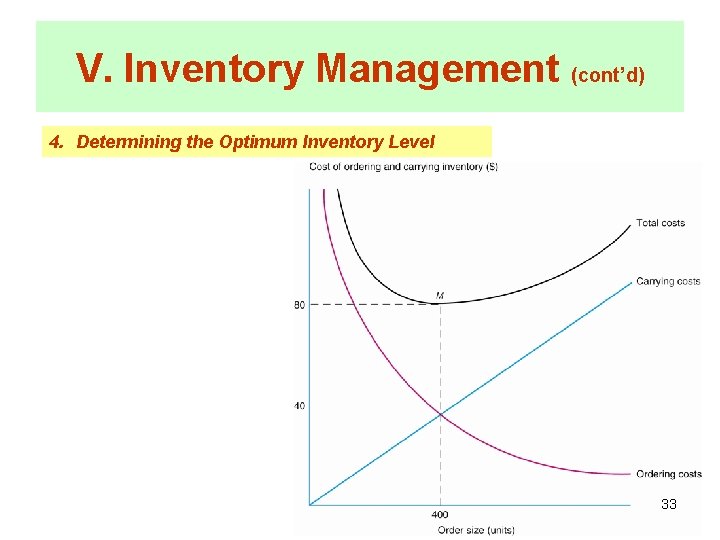

V. Inventory Management (cont’d) 4. Determining the Optimum Inventory Level 33

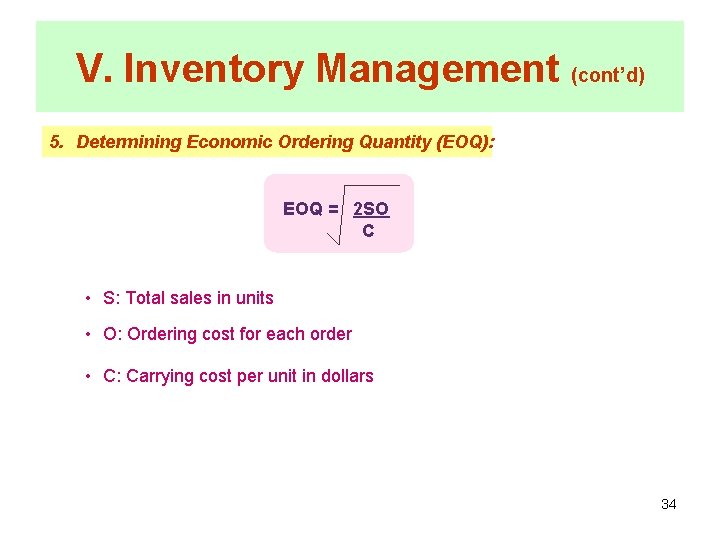

V. Inventory Management (cont’d) 5. Determining Economic Ordering Quantity (EOQ): EOQ = 2 SO C • S: Total sales in units • O: Ordering cost for each order • C: Carrying cost per unit in dollars 34

V. Inventory Management (cont’d) 5. Determining Economic Ordering Quantity (cont’d): Assuming that we anticipate selling 2, 000 units, it will cost us $8 to place each order The price per unit is 1$, the carrying charge per unit is $0. 20. Determine (1) Economic Ordering Quantity, (2) Available Average Inventory, and (3) Total cost of Inventory. EOQ = 2 SO C 35

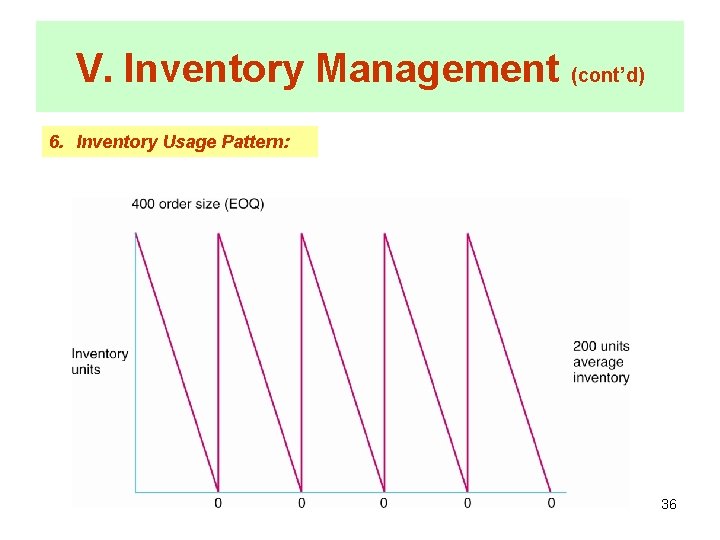

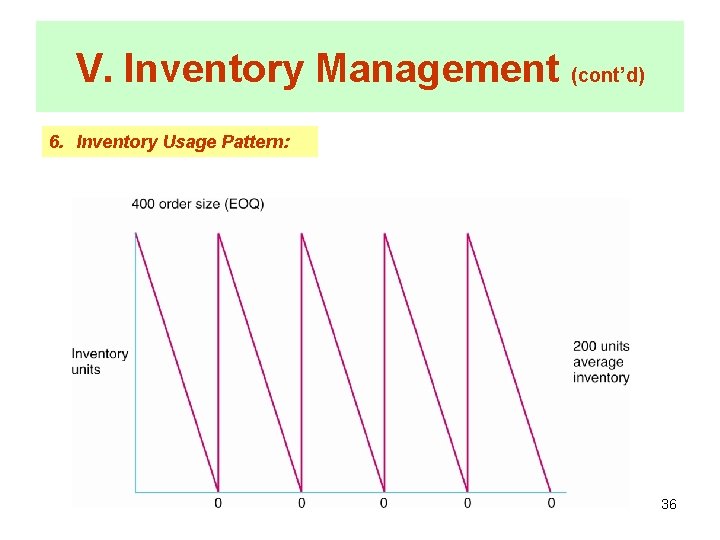

V. Inventory Management (cont’d) 6. Inventory Usage Pattern: 36

V. Inventory Management (cont’d) 7. Safety stocks and Stock outs: • Stock out occurs when a firm is: – Out of a specific inventory item – Unable to sell or deliver the product • Safety Stock (*) reduces such risks: – Increases cost of inventory due to a rise in carrying costs – This cost should be offset by: • Eliminate loss due to stock outs • Increased profits from unexpected orders 37

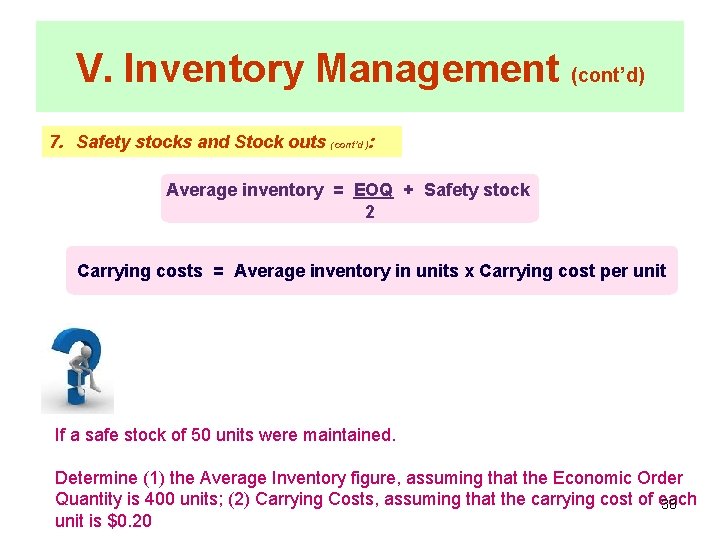

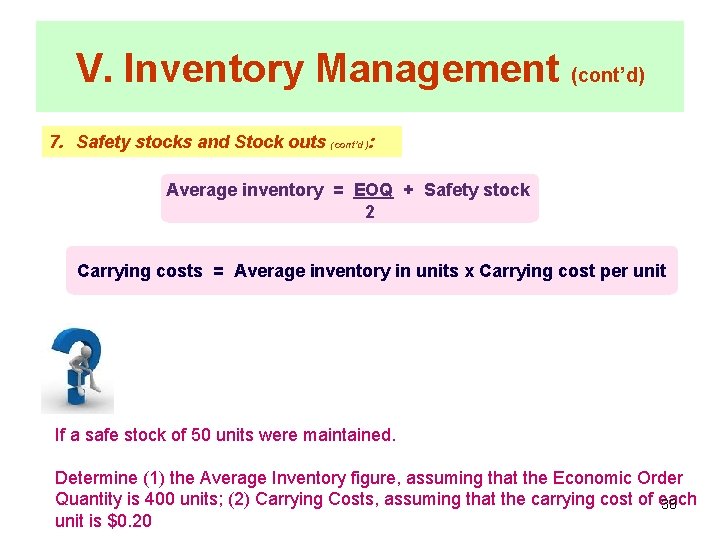

V. Inventory Management (cont’d) 7. Safety stocks and Stock outs (cont’d): Average inventory = EOQ + Safety stock 2 Carrying costs = Average inventory in units x Carrying cost per unit If a safe stock of 50 units were maintained. Determine (1) the Average Inventory figure, assuming that the Economic Order Quantity is 400 units; (2) Carrying Costs, assuming that the carrying cost of each 38 unit is $0. 20

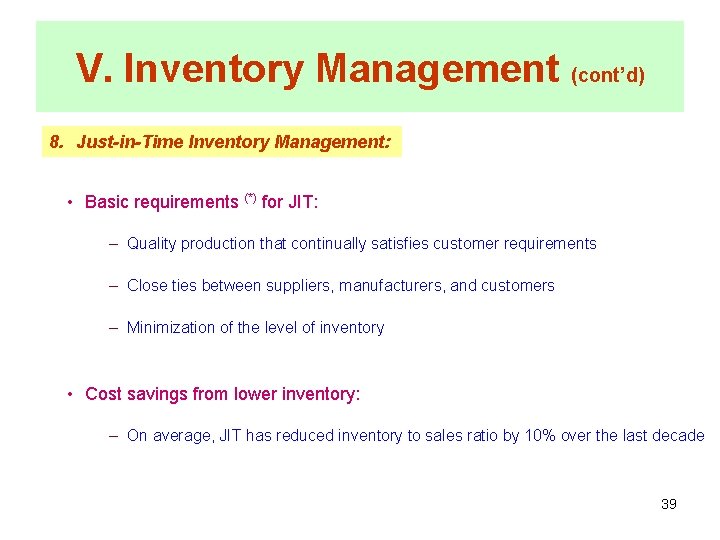

V. Inventory Management (cont’d) 8. Just-in-Time Inventory Management: • Basic requirements (*) for JIT: – Quality production that continually satisfies customer requirements – Close ties between suppliers, manufacturers, and customers – Minimization of the level of inventory • Cost savings from lower inventory: – On average, JIT has reduced inventory to sales ratio by 10% over the last decade 39

V. Inventory Management (cont’d) 8. Just-in-Time Inventory Management (cont’d): • Advantages of JIT – Reduction in space due to reduced warehouse space requirement – Reduced construction and overhead expenses for utilities and manpower – Reduction in costs from quality control – Elimination of waste 40

V. Inventory Management (cont’d) 8. Just-in-Time Inventory Management (cont’d): • Areas of concern for JIT – Integration cost (*) – Parts shortages could lead to lost sales, and slow grwoth • Un-forecasted increase in sales: inability to keep up with demand • Un-forecasted decrease in sales: inventory can pile up – A revaluation may be needed in high-growth industries fostering dynamic technologies 41

Appendix Part 1 - Cash management Part 2 - Float 42

Part 1 CASH MANAGEMENT 43

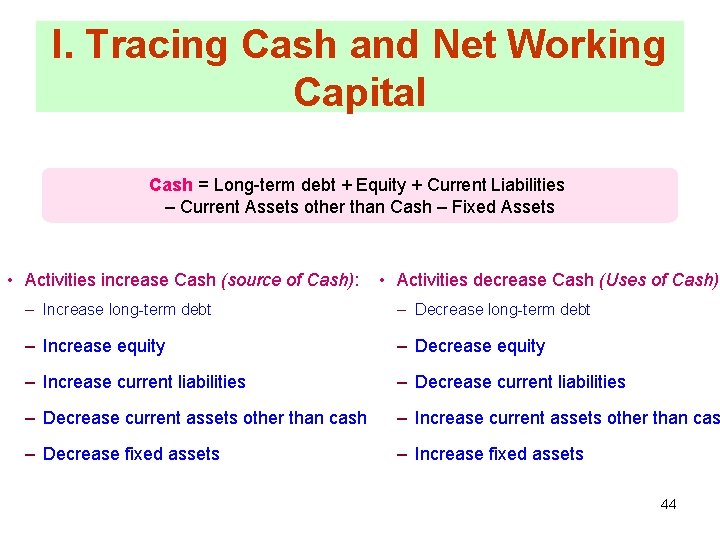

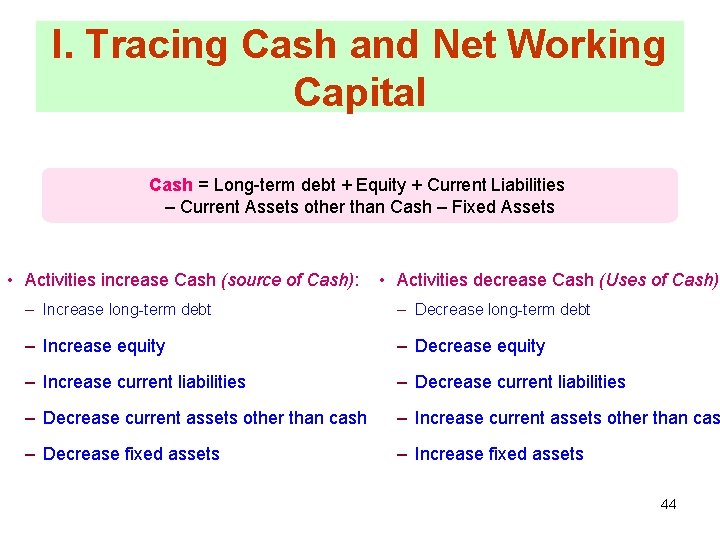

I. Tracing Cash and Net Working Capital Cash = Long-term debt + Equity + Current Liabilities – Current Assets other than Cash – Fixed Assets • Activities increase Cash (source of Cash): • Activities decrease Cash (Uses of Cash): – Increase long-term debt – Decrease long-term debt – Increase equity – Decrease equity – Increase current liabilities – Decrease current assets other than cash – Increase current assets other than cas – Decrease fixed assets – Increase fixed assets 44

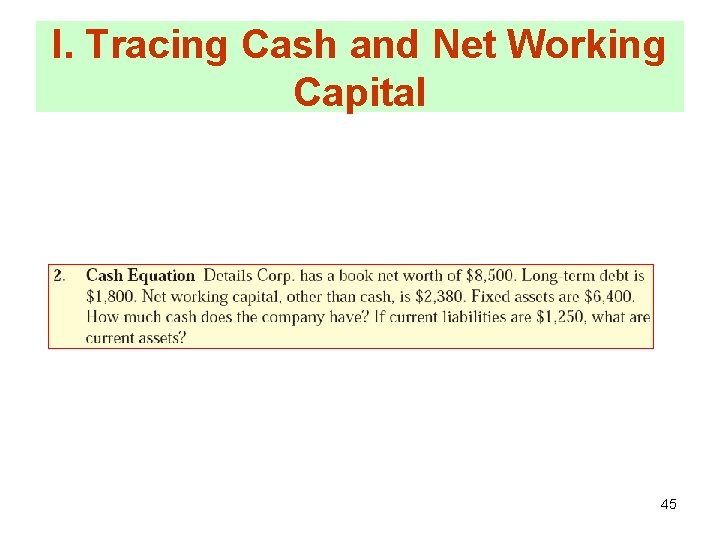

I. Tracing Cash and Net Working Capital 45

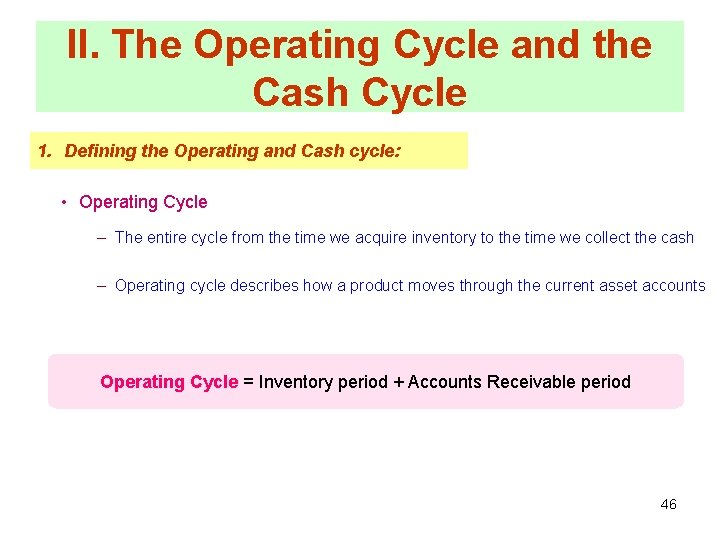

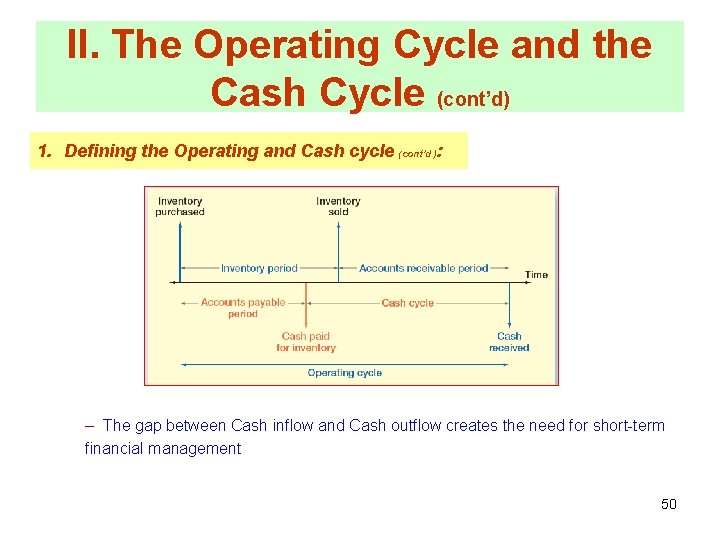

II. The Operating Cycle and the Cash Cycle 1. Defining the Operating and Cash cycle: • Operating Cycle – The entire cycle from the time we acquire inventory to the time we collect the cash – Operating cycle describes how a product moves through the current asset accounts Operating Cycle = Inventory period + Accounts Receivable period 46

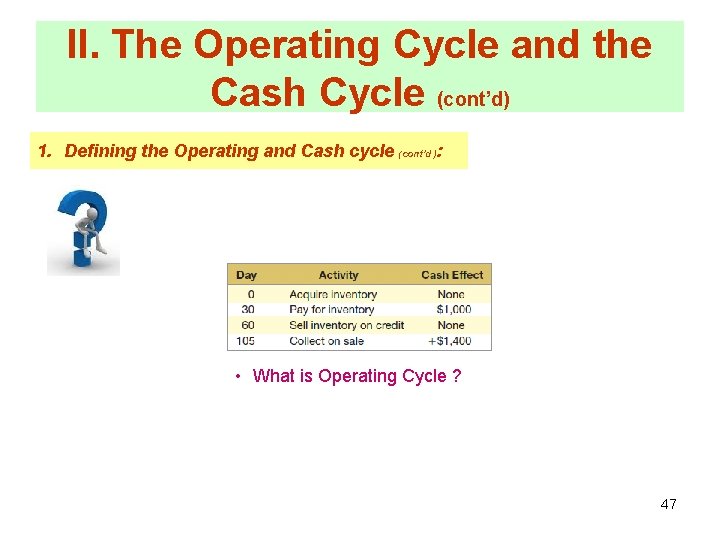

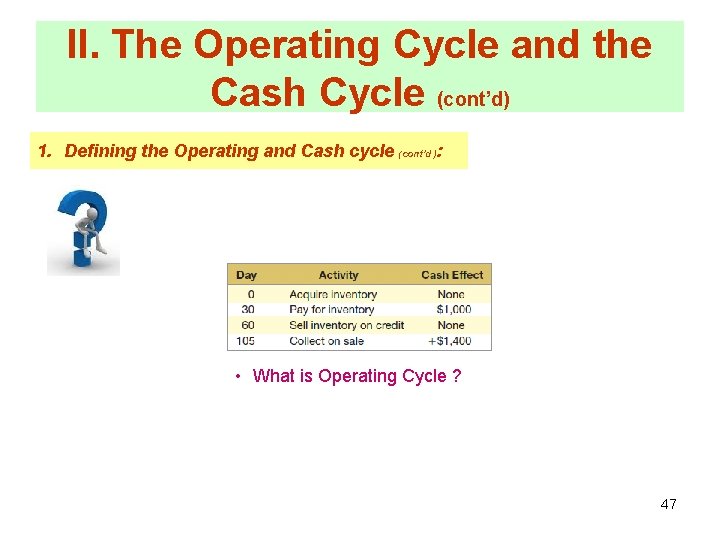

II. The Operating Cycle and the Cash Cycle (cont’d) 1. Defining the Operating and Cash cycle (cont’d): • What is Operating Cycle ? 47

II. The Operating Cycle and the Cash Cycle (cont’d) 1. Defining the Operating and Cash cycle (cont’d): • Cash Cycle – The time between cash disbursement and cash collection Cash Cycle = Operating Cycle - Accounts Payable period (*) 48

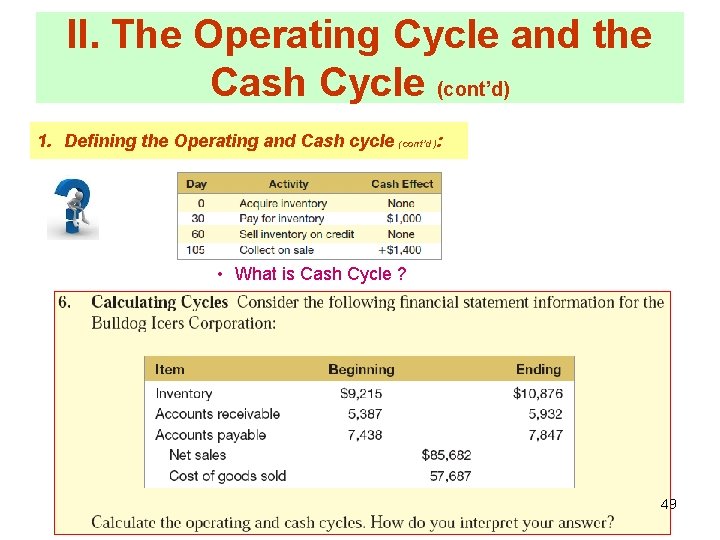

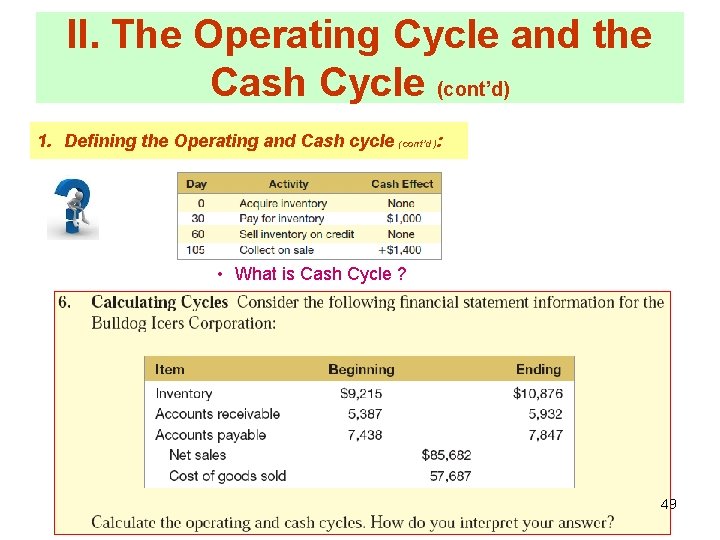

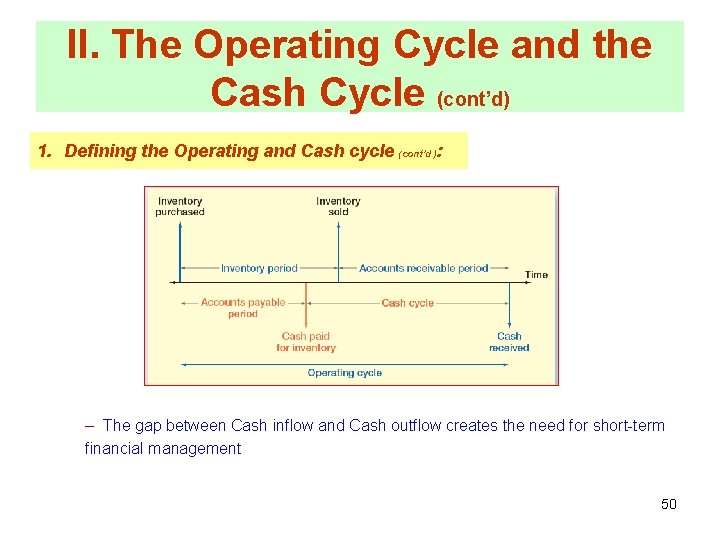

II. The Operating Cycle and the Cash Cycle (cont’d) 1. Defining the Operating and Cash cycle (cont’d): • What is Cash Cycle ? 49

II. The Operating Cycle and the Cash Cycle (cont’d) 1. Defining the Operating and Cash cycle (cont’d): – The gap between Cash inflow and Cash outflow creates the need for short-term financial management 50

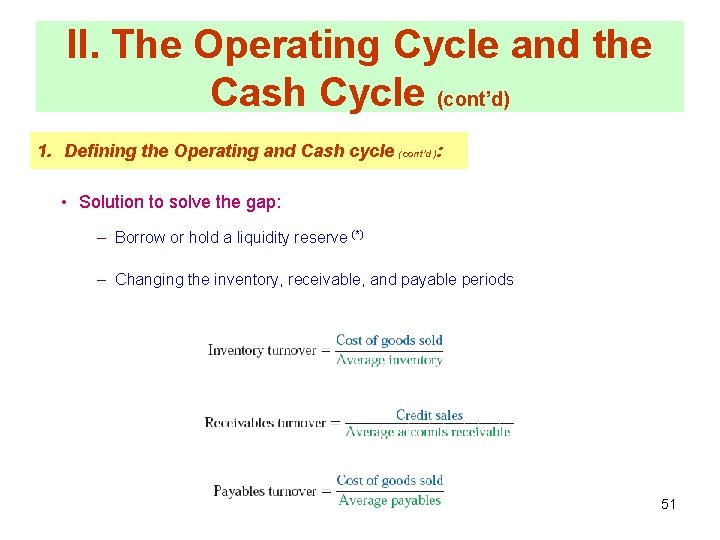

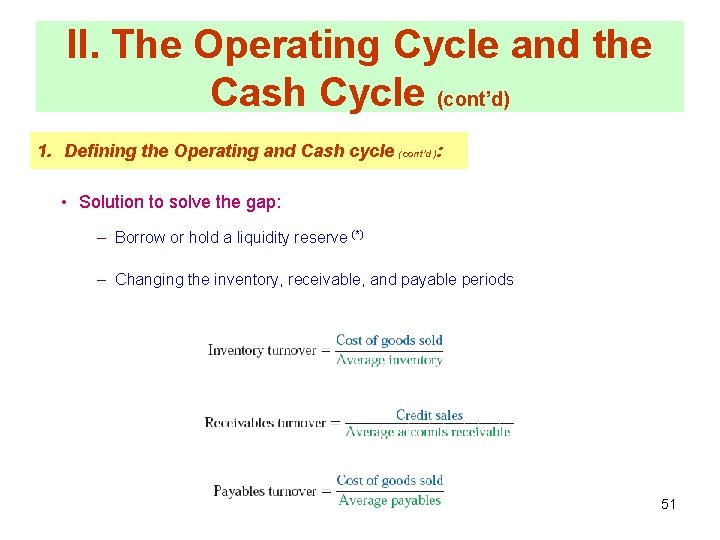

II. The Operating Cycle and the Cash Cycle (cont’d) 1. Defining the Operating and Cash cycle (cont’d): • Solution to solve the gap: – Borrow or hold a liquidity reserve (*) – Changing the inventory, receivable, and payable periods 51

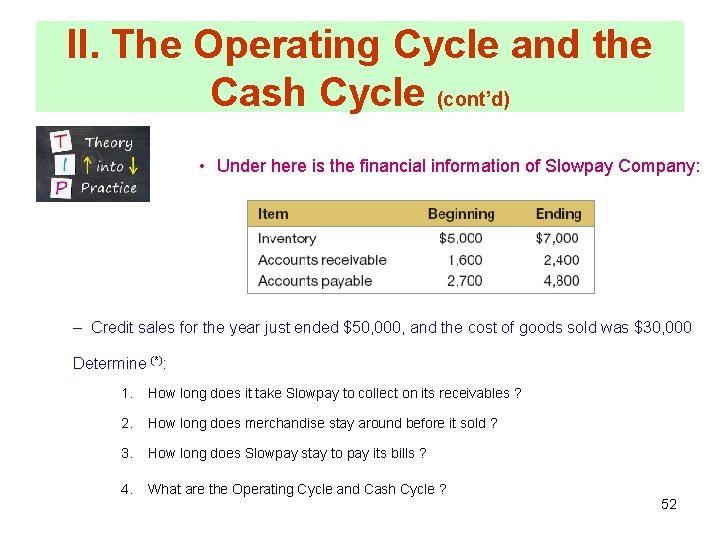

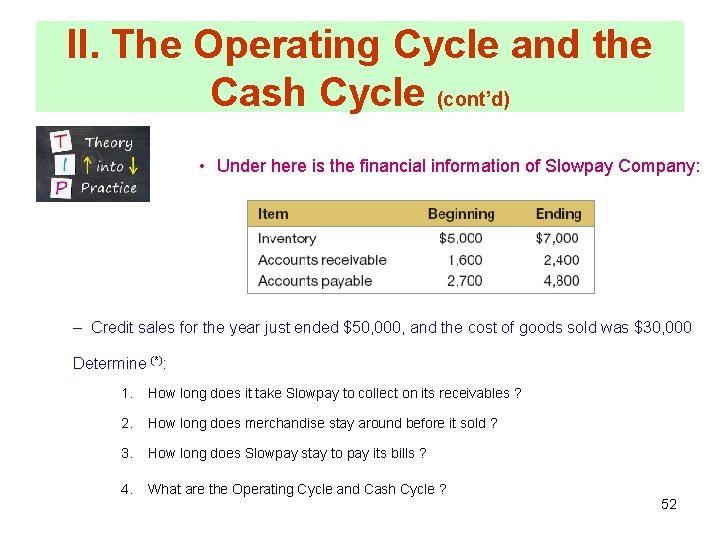

II. The Operating Cycle and the Cash Cycle (cont’d) • Under here is the financial information of Slowpay Company: – Credit sales for the year just ended $50, 000, and the cost of goods sold was $30, 000 Determine (*): 1. How long does it take Slowpay to collect on its receivables ? 2. How long does merchandise stay around before it sold ? 3. How long does Slowpay stay to pay its bills ? 4. What are the Operating Cycle and Cash Cycle ? 52

Part 2 FLOAT 53

I. Understanding Float = Available balance – Ledger balance (book balance) • Available balance – the balance show on the bank account • Ledger balance – the cash balance that a firm shows on its books 54

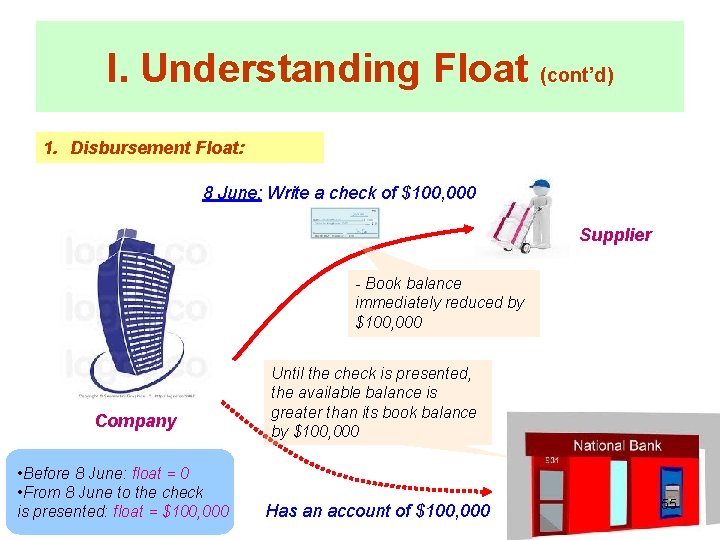

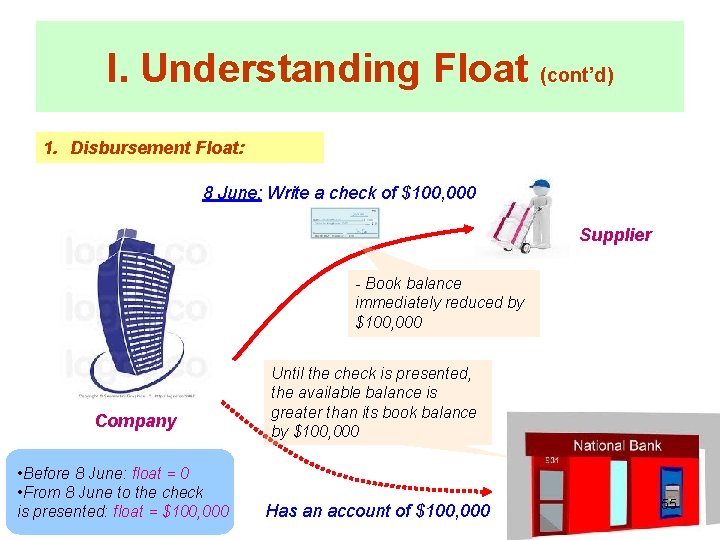

I. Understanding Float (cont’d) 1. Disbursement Float: 8 June: Write a check of $100, 000 Supplier - Book balance immediately reduced by $100, 000 Company • Before 8 June: float = 0 • From 8 June to the check is presented: float = $100, 000 Until the check is presented, the available balance is greater than its book balance by $100, 000 Has an account of $100, 000 55

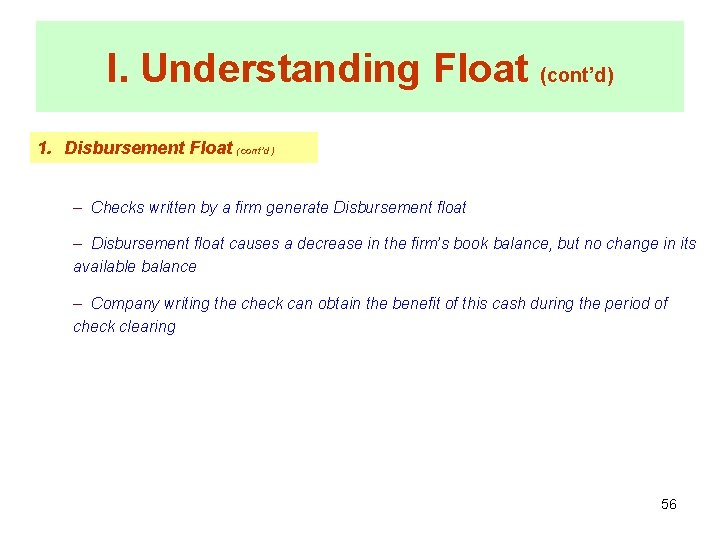

I. Understanding Float (cont’d) 1. Disbursement Float (cont’d) – Checks written by a firm generate Disbursement float – Disbursement float causes a decrease in the firm’s book balance, but no change in its available balance – Company writing the check can obtain the benefit of this cash during the period of check clearing 56

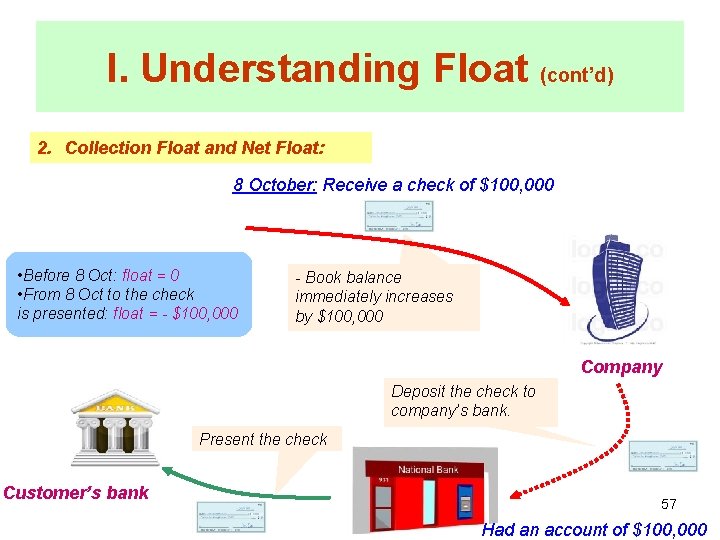

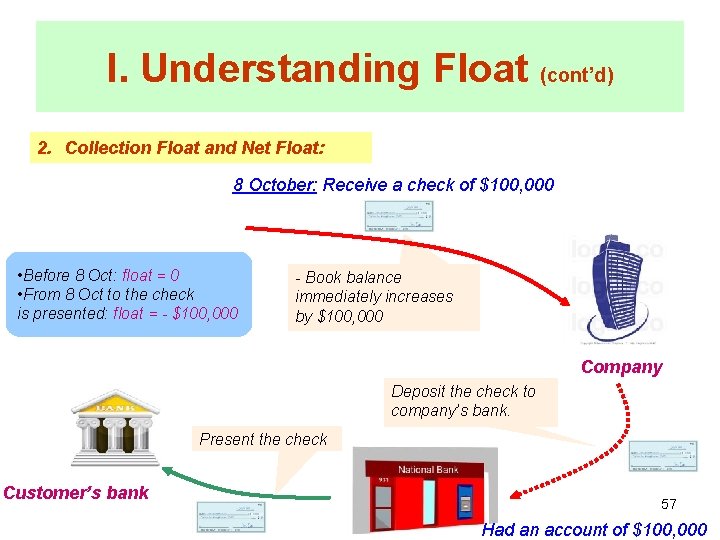

I. Understanding Float (cont’d) 2. Collection Float and Net Float: 8 October: Receive a check of $100, 000 • Before 8 Oct: float = 0 • From 8 Oct to the check is presented: float = - $100, 000 - Book balance immediately increases by $100, 000 Company Deposit the check to company’s bank. Present the check Customer’s bank 57 Had an account of $100, 000

I. Understanding Float (cont’d) 2. Collection Float and Net Float (cont’d) – Checks received by the firm create Collection float Net Float = sum of the total collection + sum of the total disbursement – The net flow at a point in time is the overall difference between the firm’s available balance and its book balance – Net float is positive, the firm’s disbursement float exceeds its collection float or the available balance exceeds its book balance 58

I. Understanding Float (cont’d) 2. Collection Float and Net Float (cont’d) Net Float = sum of the total collection + sum of the total disbursement 59

I. Understanding Float (cont’d) 2. Collection Float and Net Float (cont’d) – The average daily sales of Exxon Mobil are about $1 billion. If the company’s collection could be speed up by a single day… …it could free up $1 billion for investing and with its interest earned 60

I. Understanding Float (cont’d) 3. Float Management – Should speed up collections – reduce the lag between the time customers pay their bills and the time the cash becomes available – control payments and minimize the firm’s costs associated with making payments 61

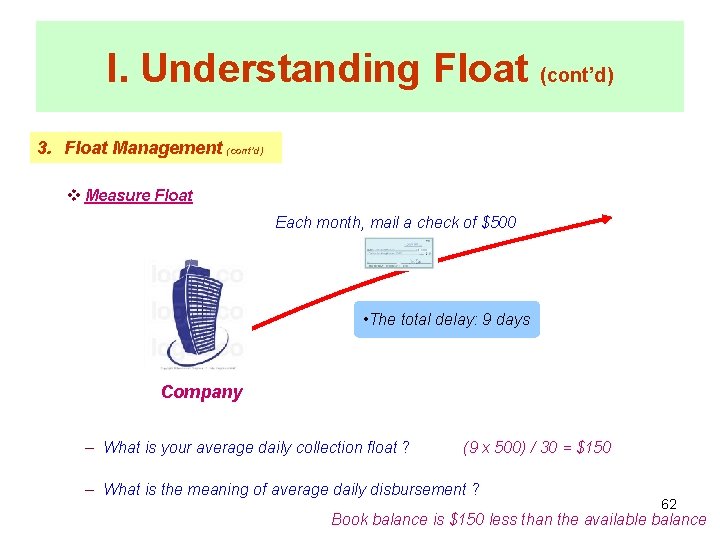

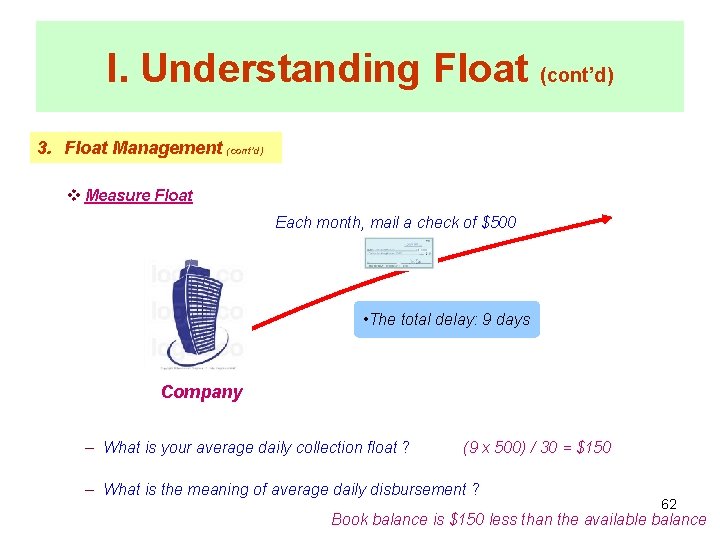

I. Understanding Float (cont’d) 3. Float Management (cont’d) v Measure Float Each month, mail a check of $500 • The total delay: 9 days Company – What is your average daily collection float ? (9 x 500) / 30 = $150 – What is the meaning of average daily disbursement ? 62 Book balance is $150 less than the available balance

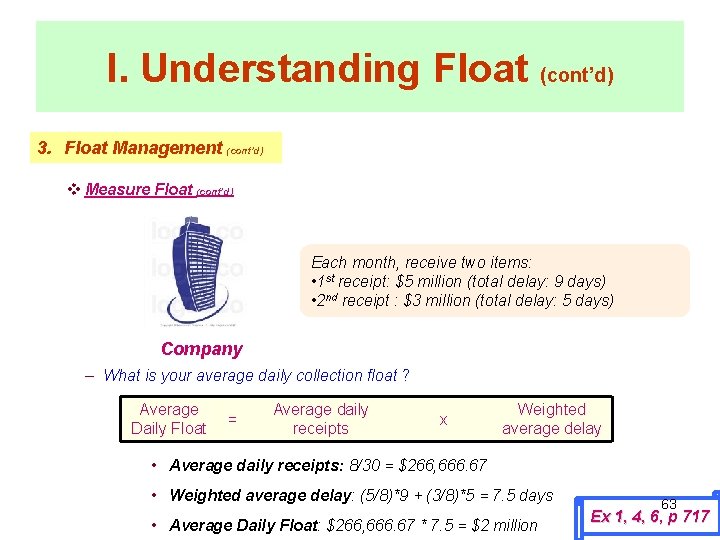

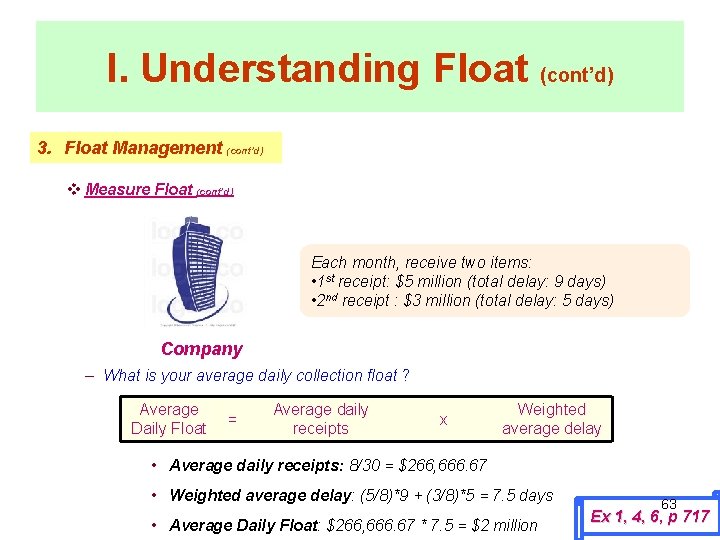

I. Understanding Float (cont’d) 3. Float Management (cont’d) v Measure Float (cont’d) Each month, receive two items: • 1 st receipt: $5 million (total delay: 9 days) • 2 nd receipt : $3 million (total delay: 5 days) Company – What is your average daily collection float ? Average Daily Float = Average daily receipts x Weighted average delay • Average daily receipts: 8/30 = $266, 666. 67 • Weighted average delay: (5/8)*9 + (3/8)*5 = 7. 5 days • Average Daily Float: $266, 666. 67 * 7. 5 = $2 million 63 Ex 1, 4, 6, p 717

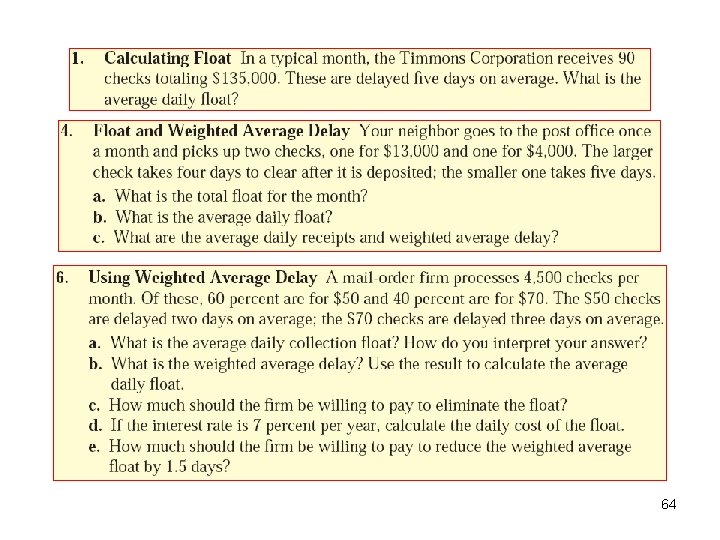

64

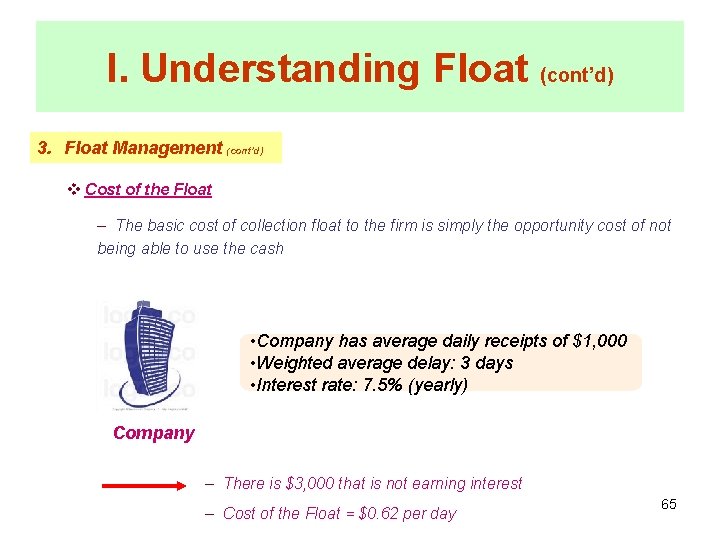

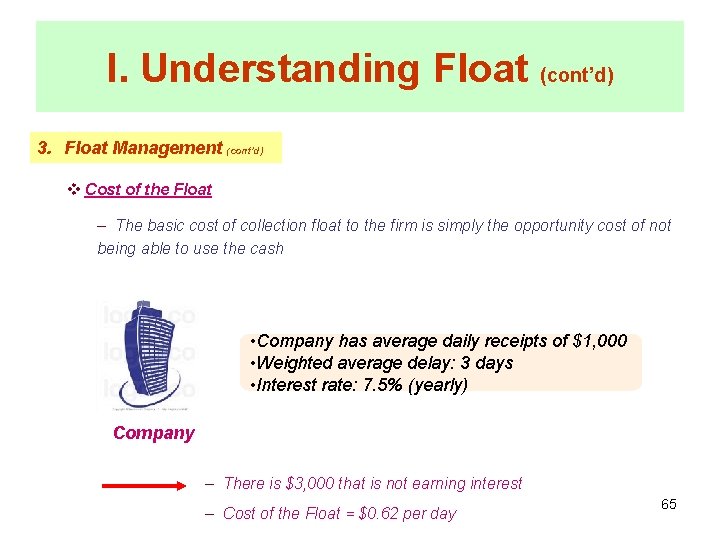

I. Understanding Float (cont’d) 3. Float Management (cont’d) v Cost of the Float – The basic cost of collection float to the firm is simply the opportunity cost of not being able to use the cash • Company has average daily receipts of $1, 000 • Weighted average delay: 3 days • Interest rate: 7. 5% (yearly) Company – There is $3, 000 that is not earning interest – Cost of the Float = $0. 62 per day 65

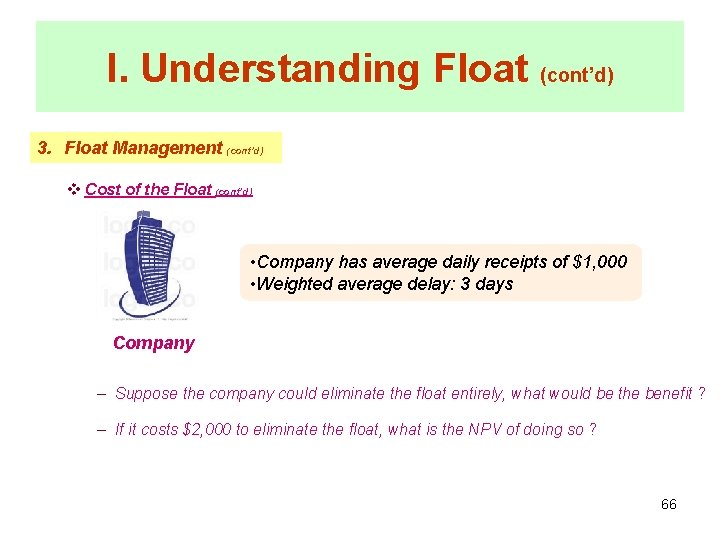

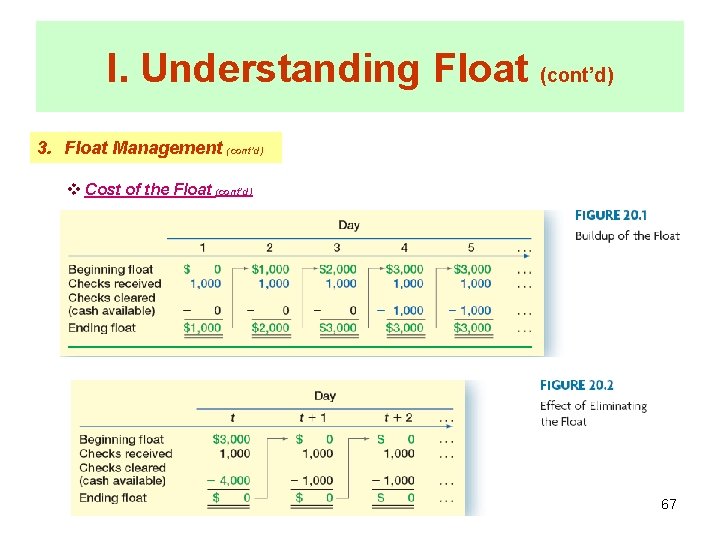

I. Understanding Float (cont’d) 3. Float Management (cont’d) v Cost of the Float (cont’d) • Company has average daily receipts of $1, 000 • Weighted average delay: 3 days Company – Suppose the company could eliminate the float entirely, what would be the benefit ? – If it costs $2, 000 to eliminate the float, what is the NPV of doing so ? 66

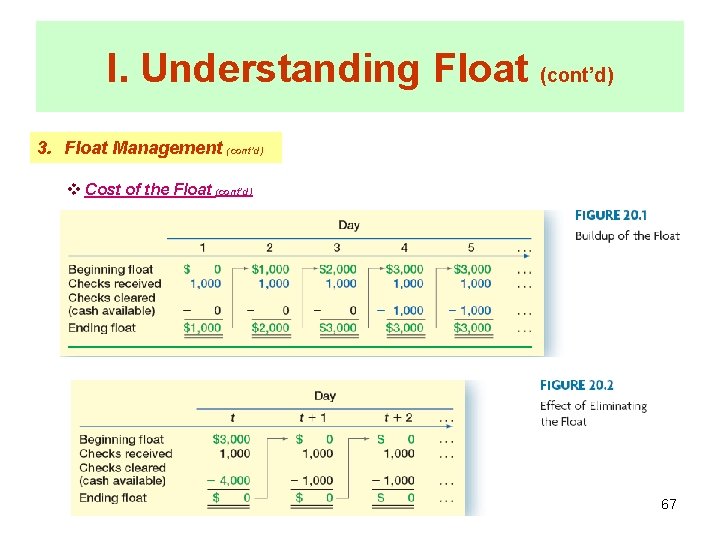

I. Understanding Float (cont’d) 3. Float Management (cont’d) v Cost of the Float (cont’d) 67

I. Understanding Float (cont’d) 3. Float Management (cont’d) v Cost of the Float (cont’d) – Suppose the company could eliminate the float entirely, what would be the benefit ? • It will be richer $3, 000 – If it costs $2, 000 to eliminate the float, what is the NPV of doing so ? • NPV = -$2, 000 + $3, 000 = $1, 000 • The company should do it 68

Part 3 CREDIT AND RECEIVABLES 69

I. Credit and Receivables 1. The investment in Receivables • Firm’s average collection period (ACP): 30 days Company – If credit sales run $1, 000 per day, the firm’s average account receivable will be …… 30 days x $1, 000 per day = $30, 000 – A firm’s investment in account receivable depend on factors that influence credit sales and collections 70 70

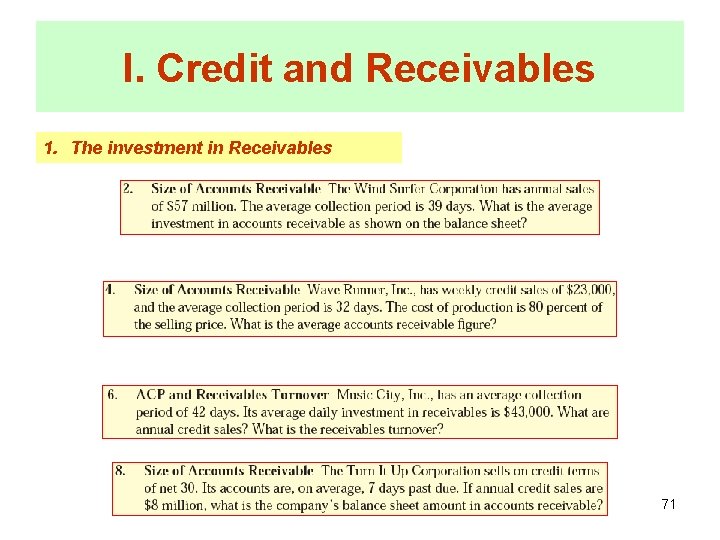

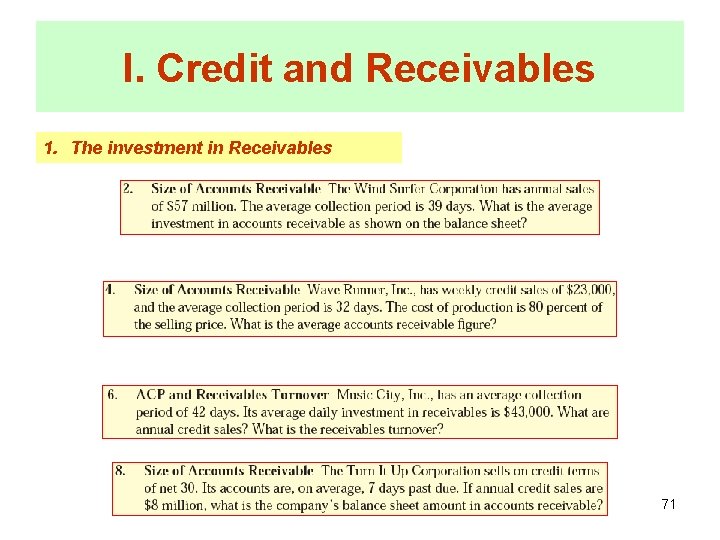

I. Credit and Receivables 1. The investment in Receivables 71

II. Terms of Sale 1. Cash discounts – Cash discounts (sales discounts) – a discount given to induce prompt payment – Cash discounts are given to speed up the collection of receivables – Cash discounts are given to charge higher prices to customers that have had credit extended to them – Buyer pay in 10 days to make the greatest possible use of free credit 2/10, net 30 – …or pay in 30 days to get the longest possible use of money in exchange for giving up the discount (20 days’ credit) 72

II. Terms of Sale (cont’d) 1. Cash discounts (cont’d) v Cost of the Credit ( from buyer’s viewpoint) – Suppose the order if for $1, 000; and applied the term: 2/10, net 30 – Early payment gets the buyers a 2% discount – Does this provide a significant incentive for early payment ? 0 $980 1, 000 10 30 $20 = interest in 20 days of borrowing $980 The buyer pays – The interest rate of $980 = 20/980 = 2. 0408% – Effective Annual Rate (EAR) = (1+ 2. 0408%)365/20 -1 = 44. 6% 73

II. Terms of Sale (cont’d) 1. Cash discounts (cont’d) v Cost of the Credit (cont’d) – From the buyer’s viewpoint, 44. 6% is an expensive source of financing – Ignoring the possibility of default by the buyer, the decision of a customer to forgo the discount works to the seller’s advantage 74

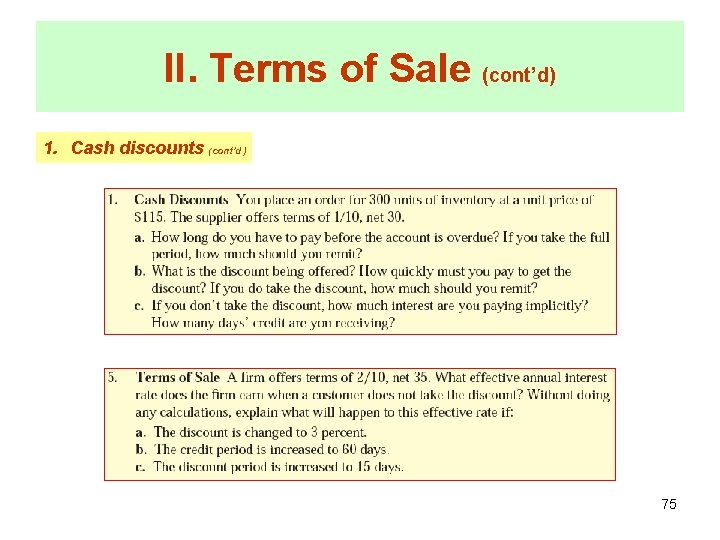

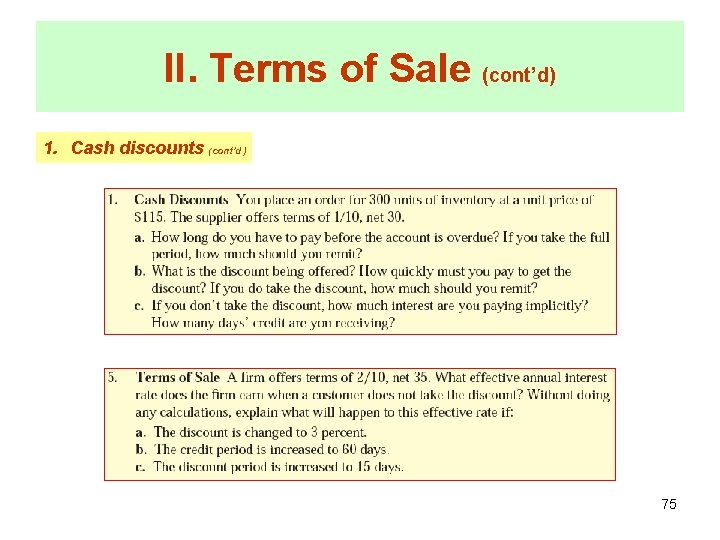

II. Terms of Sale (cont’d) 1. Cash discounts (cont’d) 75

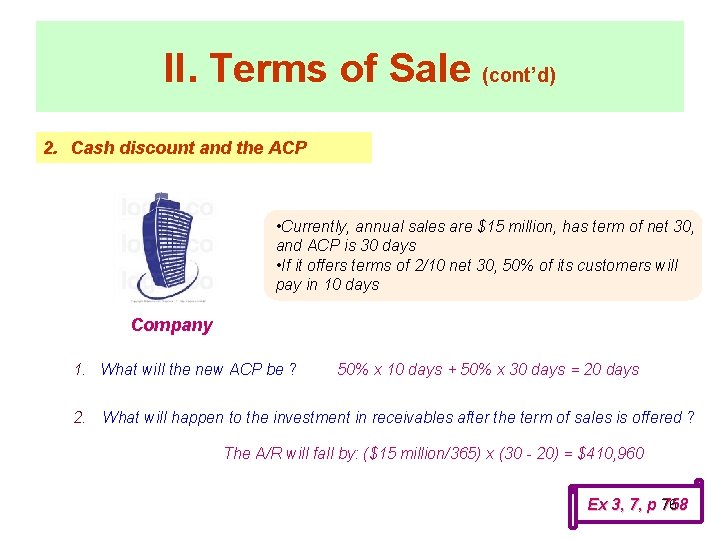

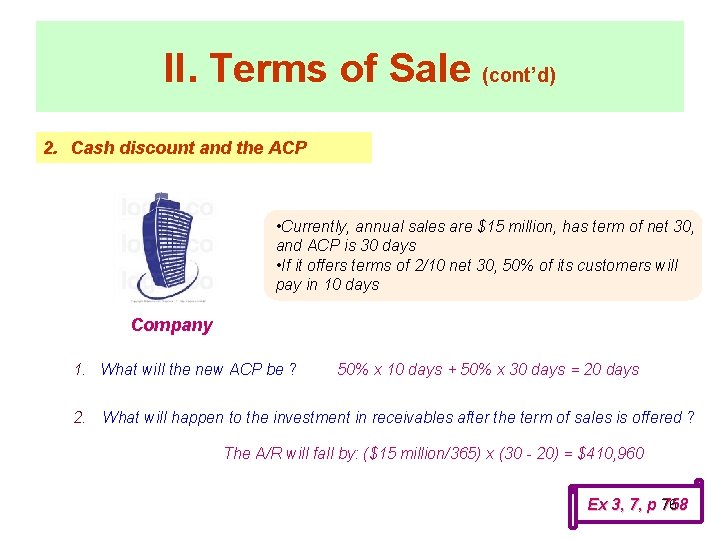

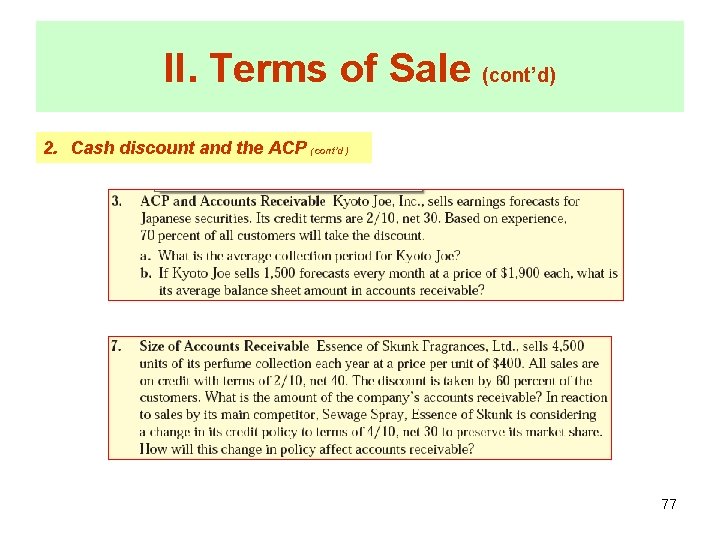

II. Terms of Sale (cont’d) 2. Cash discount and the ACP • Currently, annual sales are $15 million, has term of net 30, and ACP is 30 days • If it offers terms of 2/10 net 30, 50% of its customers will pay in 10 days Company 1. What will the new ACP be ? 50% x 10 days + 50% x 30 days = 20 days 2. What will happen to the investment in receivables after the term of sales is offered ? The A/R will fall by: ($15 million/365) x (30 - 20) = $410, 960 76 Ex 3, 7, p 758

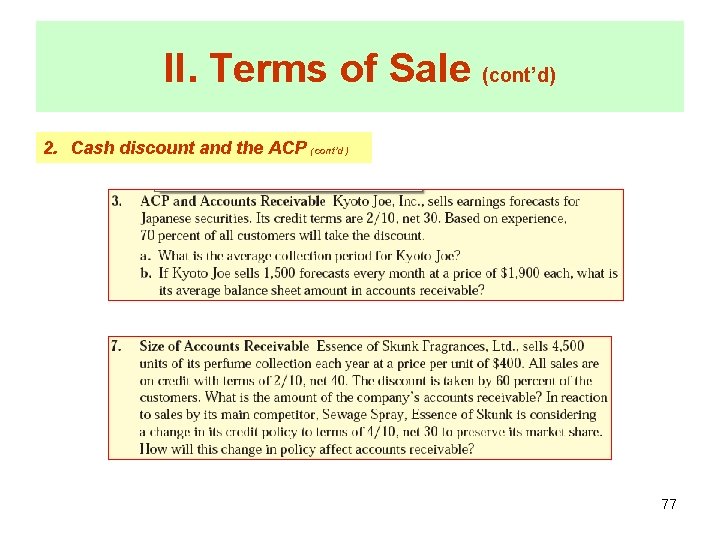

II. Terms of Sale (cont’d) 2. Cash discount and the ACP (cont’d) 77

Thank you for your attention ! 78

Cha v

Cha v Chúc tụng ngài là chúa tể càn khôn

Chúc tụng ngài là chúa tể càn khôn Kinh tin kinh

Kinh tin kinh Kinh vực sâu kinh bởi trời

Kinh vực sâu kinh bởi trời Kinh tin kính

Kinh tin kính Thng

Thng Nhược điểm của túi tiêu hóa

Nhược điểm của túi tiêu hóa Cơ quan sinh sản của cây dong riềng là gì

Cơ quan sinh sản của cây dong riềng là gì Những cây nào sau đây thuộc cây ngắn ngày

Những cây nào sau đây thuộc cây ngắn ngày Sen seni bil sen seni türü

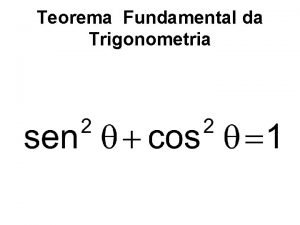

Sen seni bil sen seni türü Sen a + sen b

Sen a + sen b Periodo seno

Periodo seno Sen (a-b)

Sen (a-b) Chu nghia xa hoi khoa hoc

Chu nghia xa hoi khoa hoc Khoa sư phạm đại học đà lạt

Khoa sư phạm đại học đà lạt Tạo thuộc tính lookup cho các trường khóa ngoại

Tạo thuộc tính lookup cho các trường khóa ngoại Hộp khóa nòng

Hộp khóa nòng Tạo thuộc tính lookup cho các trường khóa ngoại

Tạo thuộc tính lookup cho các trường khóa ngoại Tôi tin kính một thiên chúa ba ngôi

Tôi tin kính một thiên chúa ba ngôi Kinh h

Kinh h Kinh thánh xuất ê díp tô ký

Kinh thánh xuất ê díp tô ký Kính tiềm vọng

Kính tiềm vọng Khủng hoảng kinh tế 1929

Khủng hoảng kinh tế 1929 Cấu tạo kính tiềm vọng

Cấu tạo kính tiềm vọng Kinh mến

Kinh mến Kế hoạch kinh doanh rau sạch

Kế hoạch kinh doanh rau sạch Biểu kinh tế của f.quesnay

Biểu kinh tế của f.quesnay Bản đồ kinh thánh

Bản đồ kinh thánh Chiến lược kinh doanh quốc tế của walmart

Chiến lược kinh doanh quốc tế của walmart Cách nhận biết thấu kính hội tụ và tkpk

Cách nhận biết thấu kính hội tụ và tkpk Slide đạo đức kinh doanh

Slide đạo đức kinh doanh 1 tit

1 tit Chúng con xin tạ ơn chúa uy quyền toàn năng

Chúng con xin tạ ơn chúa uy quyền toàn năng Tính tổng chuỗi đan dấu

Tính tổng chuỗi đan dấu Cơ cánh tay

Cơ cánh tay đố kinh thánh sách các quan xét

đố kinh thánh sách các quan xét 5 hình thái kinh tế xã hội

5 hình thái kinh tế xã hội Thần kinh đùi

Thần kinh đùi Kính tiến lên cha nhân từ

Kính tiến lên cha nhân từ Kinh lạy cha

Kinh lạy cha Quá trình desamine hóa có thể tạo ra

Quá trình desamine hóa có thể tạo ra Grand firs hoa

Grand firs hoa Lóa màu trắng hoa

Lóa màu trắng hoa Hoa gió

Hoa gió Lượng giá trị của hàng hóa

Lượng giá trị của hàng hóa Delaware hoa ombudsman

Delaware hoa ombudsman Muối trung hoà

Muối trung hoà Hoa cà có màu gì

Hoa cà có màu gì Ví dụ giọng cùng tên

Ví dụ giọng cùng tên Hoa gì tươi thắm sắc vàng

Hoa gì tươi thắm sắc vàng Nhạc lí cung và nửa cung dấu hóa

Nhạc lí cung và nửa cung dấu hóa Cattlebaron parc hoa

Cattlebaron parc hoa Chữ hoa c

Chữ hoa c Sự tiến hóa của bộ xương người so với thú

Sự tiến hóa của bộ xương người so với thú Cây mọc lên từ hạt

Cây mọc lên từ hạt Willow grove hoa

Willow grove hoa Jenna estates hoa

Jenna estates hoa Monoalphabetic substitution cipher là gì

Monoalphabetic substitution cipher là gì Chẳng may em đánh vỡ một lọ hoa đẹp

Chẳng may em đánh vỡ một lọ hoa đẹp Chu k hoa

Chu k hoa Thpt mỹ hòa hưng an giang

Thpt mỹ hòa hưng an giang Ngục trung vô tửu diệc vô hoa

Ngục trung vô tửu diệc vô hoa Tên một loài hoa chứa tiếng có vần an hoặc ang

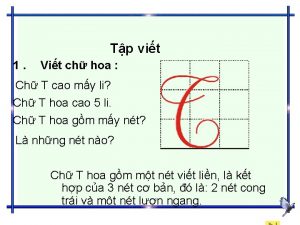

Tên một loài hoa chứa tiếng có vần an hoặc ang Chữ t viết hoa

Chữ t viết hoa Thoái hóa hem

Thoái hóa hem Gley hóa là gì

Gley hóa là gì Cơ quan tiêu hóa và cơ quan tuần hoàn

Cơ quan tiêu hóa và cơ quan tuần hoàn Phương pháp quine mccluskey

Phương pháp quine mccluskey Cách viết chữ s in hoa

Cách viết chữ s in hoa Tắc kè hoa xây lầu trên cây đa

Tắc kè hoa xây lầu trên cây đa Hamlet at dirickson pond

Hamlet at dirickson pond Aaxetilen

Aaxetilen Tượng phật dược sư hoa vô ưu

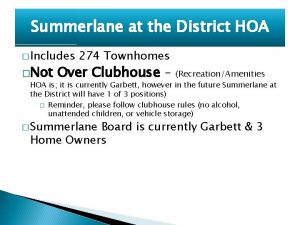

Tượng phật dược sư hoa vô ưu Summerlane at the district

Summerlane at the district The le family was sleeping when mailman

The le family was sleeping when mailman Cấu tạo của hoa

Cấu tạo của hoa Trò chơi âm nhạc

Trò chơi âm nhạc Sue hoa in small claims court

Sue hoa in small claims court B«ng hoa

B«ng hoa