How Securities Are Traded P V VISWANATH FOR

- Slides: 39

How Securities Are Traded P. V. VISWANATH FOR A FIRST COURSE IN INVESTMENTS

Learning Goals 2 �Understand primary market issue methods �How do investment bankers assist in security issuance? �What are the differences between the various kinds of security markets? �What is margin trading? �What is a short sale? �What is insider trading?

Types of Markets 3 �Target audience Public Offering Private Placement �Degree of Familiarity with Security Initial Public Offering Seasoned Equity Offerings �Novelty of the Security Primary Markets Secondary Markets �Why do we make these kinds of distinctions? Each typology says something about the issues involved.

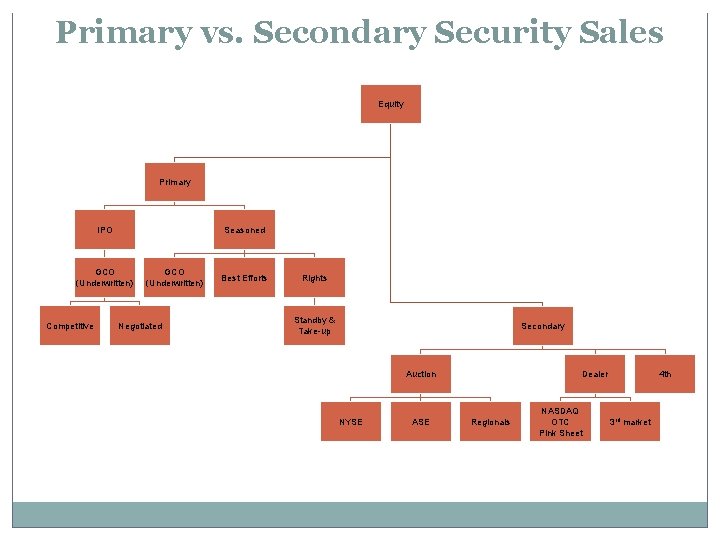

Primary vs. Secondary Market Security Sales 4 • Primary New issue is created and sold Key factor: issuer receives the proceeds from the sale Public offerings: registered with the SEC and sale is made to the investing public Private offerings: not registered, and sold to only a limited number of investors, with restrictions on resale • Secondary Existing owner sells to another party Issuing firm doesn’t receive proceeds and is not directly involved

Third and Fourth Markets 5 � The Third Market refers to trading by non exchange-member brokers/dealers and institutional investors of exchange-listed stocks. In other words, the third market involves exchangelisted securities that are being traded over-the-counter between brokers/dealers and large institutional investors. � The Fourth Market refers to trading of exchange-listed securities between institutions on a private over-the-counter computer network, rather than over a recognized exchange such as the NYSE or Nasdaq. Trades between institutions will often be made in large blocks and without a broker, allowing the institutions to avoid brokerage fees. Source: Investopedia. � There is not a big difference in practice between the third and fourth markets.

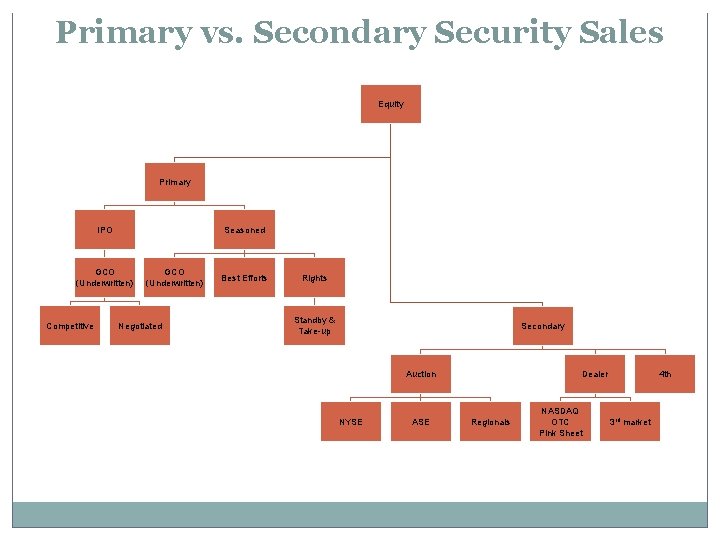

Primary vs. Secondary Security Sales Equity Primary IPO Seasoned GCO (Underwritten) Competitive GCO (Underwritten) Negotiated Best Efforts Rights Standby & Take-up Secondary Auction NYSE ASE Dealer Regionals NASDAQ OTC Pink Sheet 4 th 3 rd market

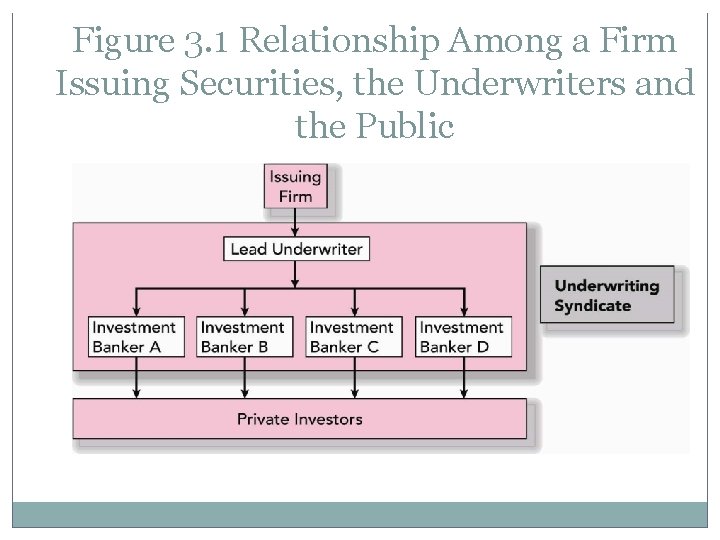

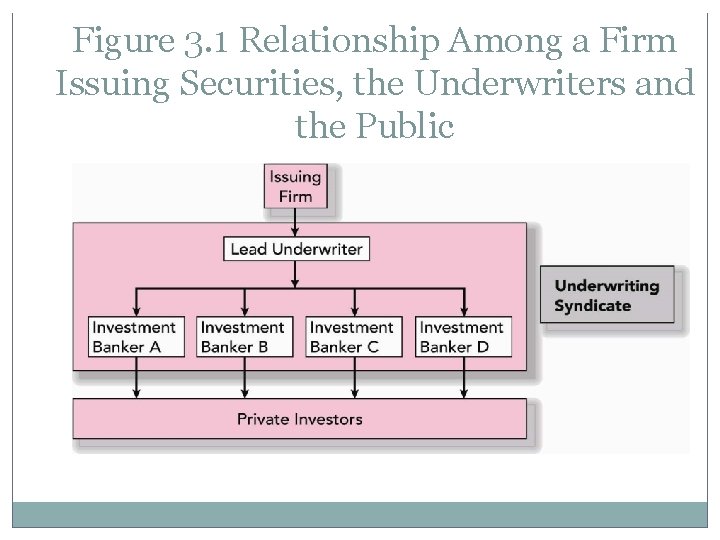

Investment Banking Arrangements 7 � Underwritten vs. “Best Efforts” Underwritten: banker makes a firm commitment on proceeds to the issuing firm Best Efforts: banker(s) helps sell but makes no firm commitment � Negotiated vs. Competitive Bid Negotiated: issuing firm negotiates terms with investment banker Competitive bid: issuer structures the offering and secures bids

Figure 3. 1 Relationship Among a Firm Issuing Securities, the Underwriters and the Public

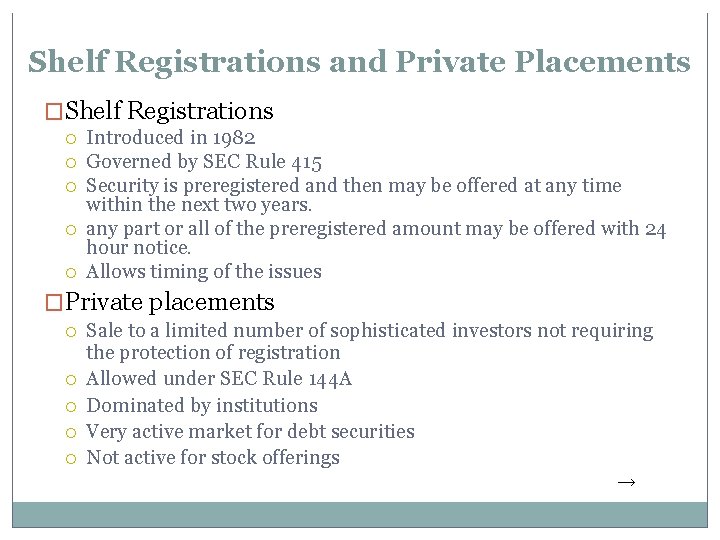

Shelf Registrations and Private Placements �Shelf Registrations Introduced in 1982 Governed by SEC Rule 415 Security is preregistered and then may be offered at any time within the next two years. any part or all of the preregistered amount may be offered with 24 hour notice. Allows timing of the issues �Private placements Sale to a limited number of sophisticated investors not requiring the protection of registration Allowed under SEC Rule 144 A Dominated by institutions Very active market for debt securities Not active for stock offerings →

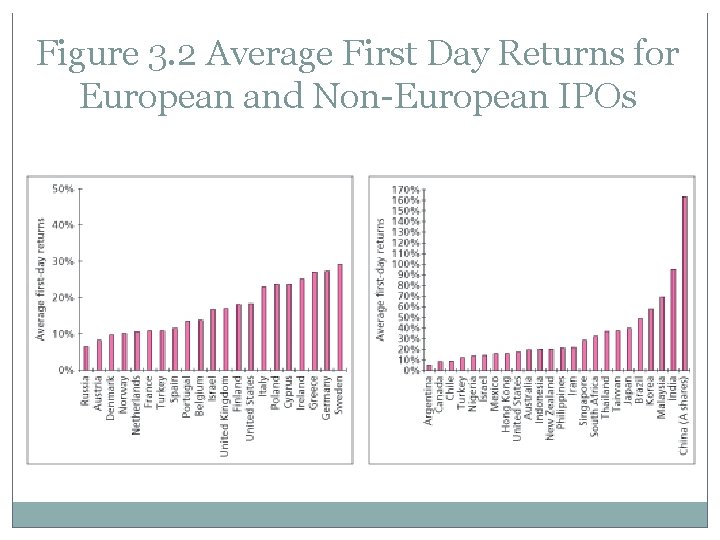

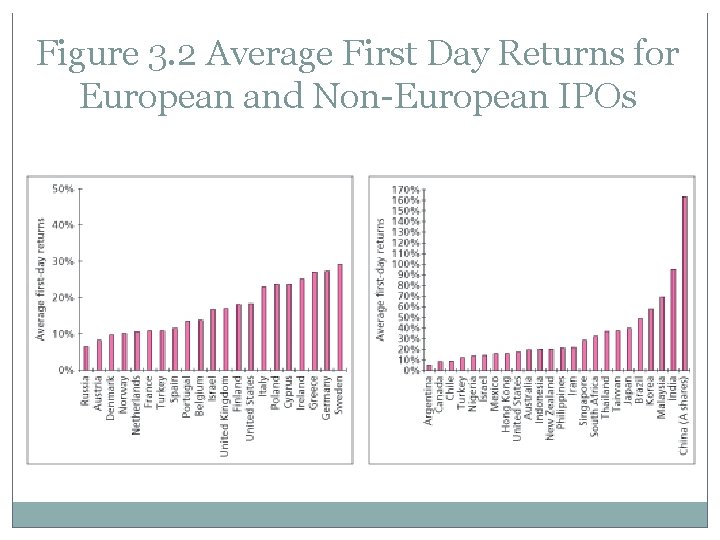

Initial Public Offerings �IPO Process Issuer and Banker put on the “Road Show” Purpose: Book Building and Pricing �Underpricing Post initial sale returns average about 10% or more Easier to market the issue, but costly to the issuing firm

Figure 3. 2 Average First Day Returns for European and Non-European IPOs

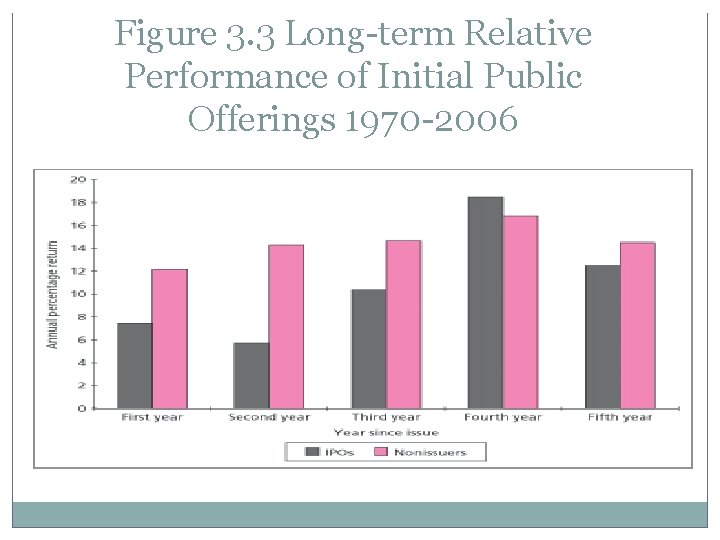

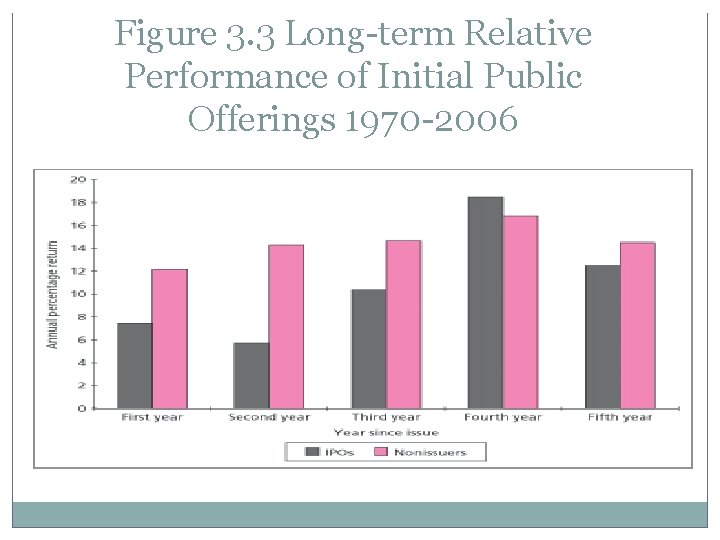

Figure 3. 3 Long-term Relative Performance of Initial Public Offerings 1970 -2006

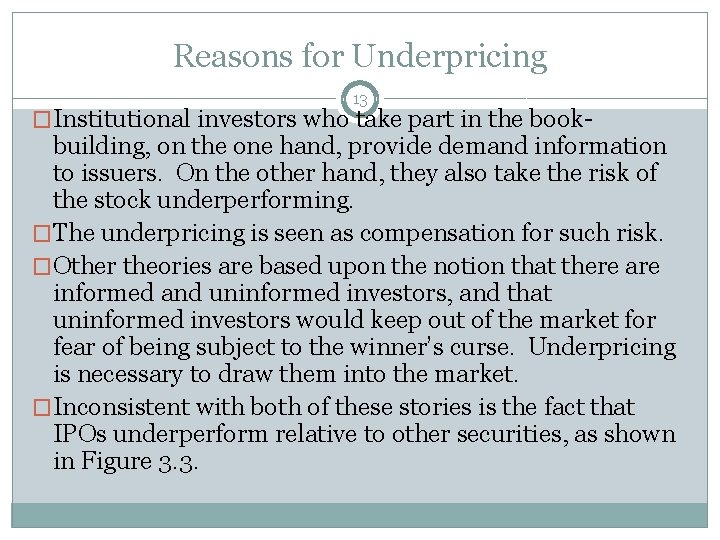

Reasons for Underpricing 13 �Institutional investors who take part in the book- building, on the one hand, provide demand information to issuers. On the other hand, they also take the risk of the stock underperforming. �The underpricing is seen as compensation for such risk. �Other theories are based upon the notion that there are informed and uninformed investors, and that uninformed investors would keep out of the market for fear of being subject to the winner’s curse. Underpricing is necessary to draw them into the market. �Inconsistent with both of these stories is the fact that IPOs underperform relative to other securities, as shown in Figure 3. 3.

U. S. Security Markets Overview � Different securities markets in the US Nasdaq OTC Bulletin Board Pink sheets www. pinksheets. com Organized Exchanges � � � New York Stock Exchange American Stock Exchange Regionals Electronic Communication Networks (ECNs) � These are private trading systems maintained separately from exchanges; these allow investors to enter anonymous orders, which can be valuable. � National Market System An initiative to tie all exchanges together so that quotes on one market can be availed of by an investor in another market. It also refers to centralized reporting of trades on all exchanges. However, the NMS only requires that the inside quote be made available, which is often only for a small number of shares. Hence information the depth of the market is still not available to traders in other markets.

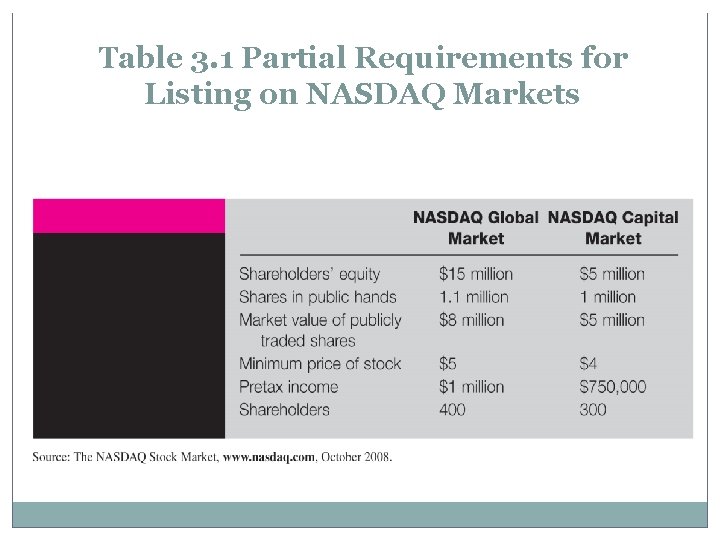

NASDAQ � NASDAQ is the largest organized stock market for OTC trading; it is also an information system for individuals, brokers and dealers � It is a dealer market, i. e. it is a market without centralized order flow. That is, orders are not directed automatically to the best offer in the order book. Securities traded are: stocks, bonds and some derivatives. � There are two Nasdaq markets: � National Market, covering over 3000 companies that have a national or international shareholder base, meet stringent financial requirements and agree to specific corporate governance standards � Nasdaq Small. Cap Market for lower cap firms and looser listing requirements. � There are several levels of subscribers to Nasdaq quotation system Level 1: inside quotes Level 2: receives all quotes but they can’t enter quotes Level 3: dealers can see and post quotes � Super. Montage is a centralized limit order book for Nasdaq securities that allows automatic trade execution.

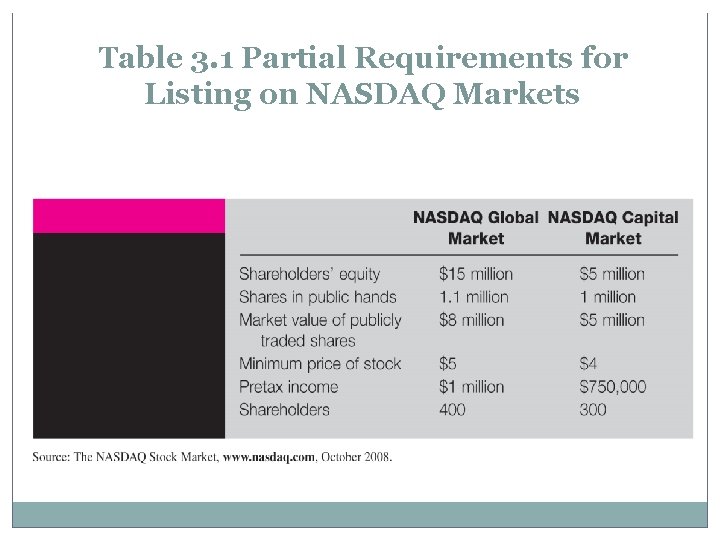

Table 3. 1 Partial Requirements for Listing on NASDAQ Markets

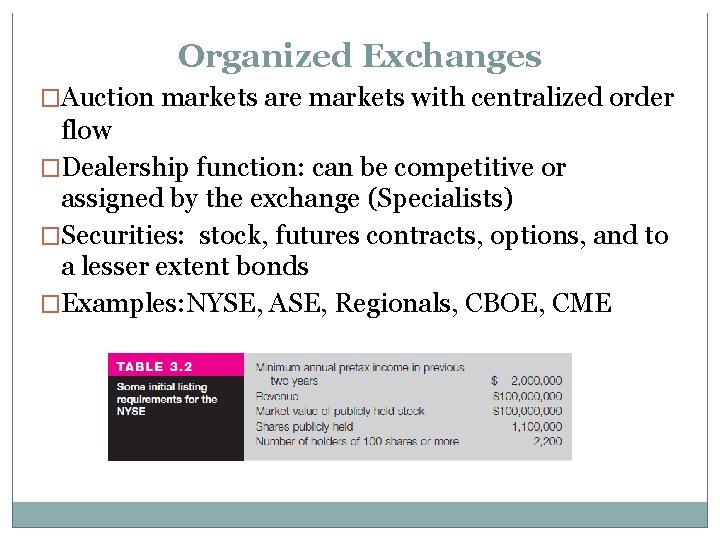

Organized Exchanges �Auction markets are markets with centralized order flow �Dealership function: can be competitive or assigned by the exchange (Specialists) �Securities: stock, futures contracts, options, and to a lesser extent bonds �Examples: NYSE, ASE, Regionals, CBOE, CME

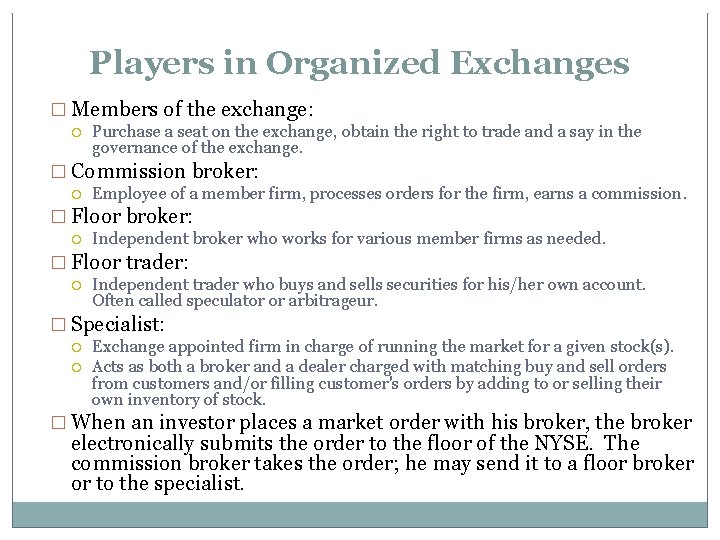

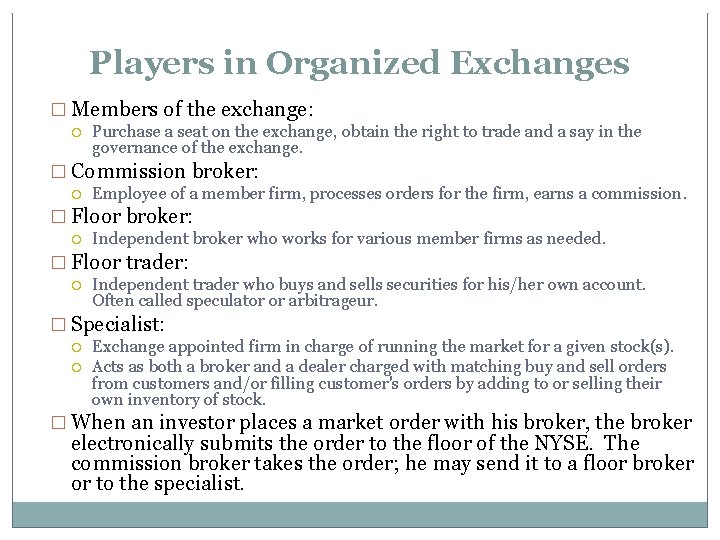

Players in Organized Exchanges � Members of the exchange: Purchase a seat on the exchange, obtain the right to trade and a say in the governance of the exchange. � Commission broker: Employee of a member firm, processes orders for the firm, earns a commission. � Floor broker: Independent broker who works for various member firms as needed. � Floor trader: Independent trader who buys and sells securities for his/her own account. Often called speculator or arbitrageur. � Specialist: Exchange appointed firm in charge of running the market for a given stock(s). Acts as both a broker and a dealer charged with matching buy and sell orders from customers and/or filling customer's orders by adding to or selling their own inventory of stock. � When an investor places a market order with his broker, the broker electronically submits the order to the floor of the NYSE. The commission broker takes the order; he may send it to a floor broker or to the specialist.

Electronic Trading on the NYSE �Super. Dot • Electronic order routing system allows brokers to electronically send orders directly to specialist. • Useful for program trading 0 �Direct. Plus • Fully automated trade execution system • Execution time < ½ second �Electronic order placement is growing, but large orders still require human intervention.

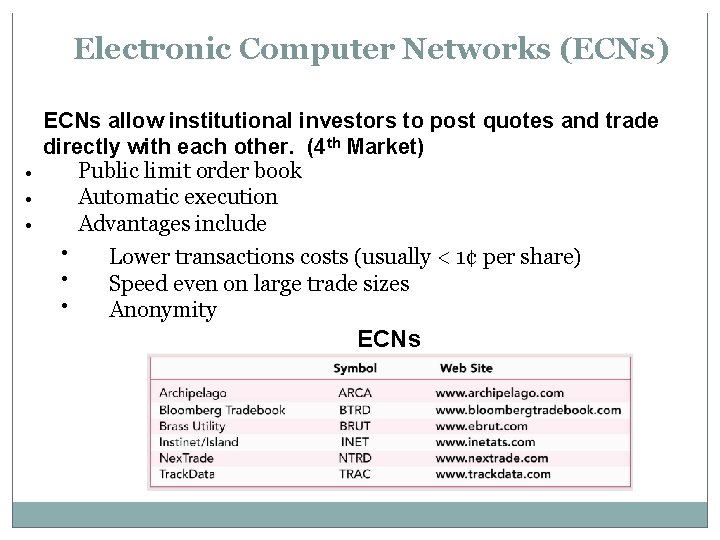

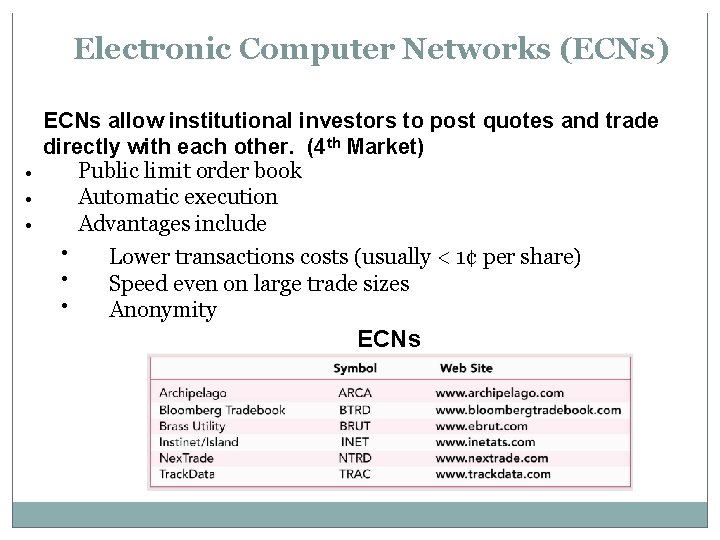

Electronic Computer Networks (ECNs) ECNs allow institutional investors to post quotes and trade directly with each other. (4 th Market) Public limit order book • Automatic execution • Advantages include • • Lower transactions costs (usually < 1¢ per share) • Speed even on large trade sizes • Anonymity ECNs

Market Consolidation Trends � NYSE: • • Merged with Archipelago ECN in 2006 Merged with Euronext in 2007 Acquired the ASE in 2008 Entering Indian and Japanese stock markets � NASDAQ • • • Acquired Instinet/Island in 2005 Acquired Boston Stock Exchange in 2007 Jointly acquired Swedish exchange OMX � Euronext • • • Formed from merger of Paris, Brussels, Lisbon and Amsterdam exchanges Acquired the Liffe in London Merged with NYSE in 2007 � CME acquired CBOT in 2007

Types of Markets: Nature of Trading 22 �Direct Search Markets Example: Craig’s List. �Brokered Markets Example: Real estate market �Dealer Markets Quote-Driven Markets �Auction Markets Order-Driven Markets �Dealer and Auction markets are the most common kind of securities markets.

Auction Markets 23 � An auction market is a market where buyers and sellers directly interact. The NYSE is an example of such a market. � The NYSE specialist is charged with maintaining a “continuous, orderly market. ” � He has four roles: Auctioneer: to ensure that bids and offers are posted accurately and in a timely manner. Agent: to accept limit orders from investors and ensure that the order is appropriately filled. Catalyst: to make sure that price changes are not huge. If there is a demand-supply imbalance, the specialist may bring in other active traders. Principal: s/he may also do this by trading on his/her own behalf. In this role, s/he Must at times trade against the market � Can petition exchange to halt trading � Incur inventory costs/risks of holding stock � Monitor and limit the bid/ask spread � http: //www. investopedia. com/ask/answers/128. asp#axzz 26 I 4 Ifo 00

Dealer Markets 24 � A dealer market is one where dealers stand ready to buy and sell. All transactions are routed through them. The NASDAQ is an example of a dealer market. � The most important player in the NASDAQ is the broker-dealer. � They are large investment companies that buy and sell securities through an electronic network. These market makers maintain inventories and buy and sell stocks from their inventories to individual customers and other dealers. � Each market maker on the Nasdaq is required to give a two-sided quote, meaning they must state a firm bid price and a firm ask price that they are willing to honor. � A market-maker on the NASDAQ does not have the same legal obligation as a NYSE specialist to ensure smooth trading. However, this is effectively his/her function. � The difference between the NASDAQ and the NYSE has reduced quite a bit in recent years, especially after the automation of both exchanges. http: //www. investopedia. com/ask/answers/128. asp#axzz 26 I 4 Ifo 00

Types of Orders 25 �Market Orders �Price-Contingent Orders �http: //webpage. pace. edu/pviswanath/notes/invest ments/securities_trading. html

Trading Costs 26 �Broker Commissions �Bid-Ask Spread (Implicit cost) �Liquidity Cost �Quality of Execution (if there’s a wait, then a worse price may be obtained; ie. the Effective Bid-Ask Spread may be greater than the quoted bid-ask spread) �Margin Cost

The Bid-Ask Spread 27 � The bid price is the price that a trader is willing to pay for a security; the ask price is the price at which he is willing to sell a security. The difference is called the bid-ask spread. � A market order is one that can be executed at the market price, while a limit order either specifies a specific bid price (buy order) or a specific ask price (sell order). Hence as long as there is any limit buy (sell) order, a market sell (buy) order is sure of being executed. Hence a market order takes advantage of liquidity, while a limit order offers liquidity. � The bid-ask spread is the price that impatient traders pay for immediacy. The spread is the compensation that dealers and limit order traders receive for offering immediacy. � Traders consider the spread when deciding whether to submit limit orders or market orders. When the spread is wide, immediacy is expensive, market order executions are costly, and limit order submission strategies are attractive. � The spread is also the most important factor that dealers consider when deciding whether or not to offer liquidity in a market. If the spread is too narrow, dealing may not be profitable.

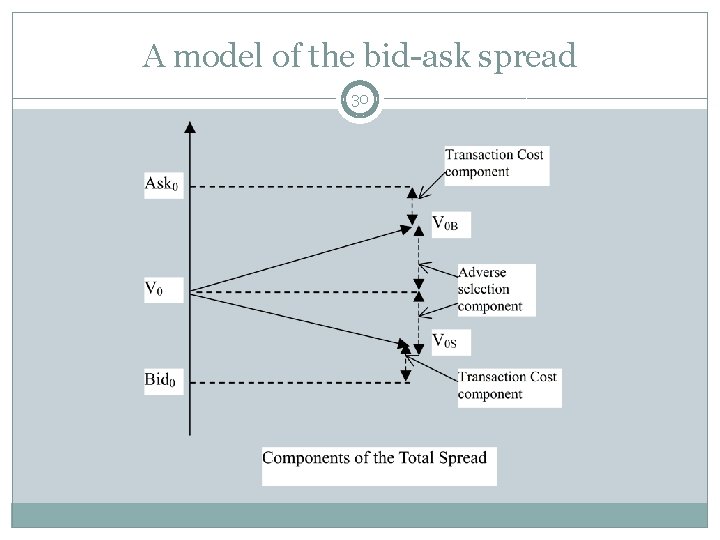

Components of the Bid-Ask Spread 28 �Transaction cost spread component – that part of the bid/ask spread that compensates dealers for their normal costs of doing business. These include financing costs for their inventories, wages for staff, exchange membership dues, expenditures for telecommunications, research, trading system development, clearing and settlement, accounting, office space, utilities, etc. �The adverse selection spread component is the part of the bid/ask spread that compensates dealers for the losses they suffer when trading with well-informed traders. This component allows dealers to earn from uninformed traders what they lose to informed traders.

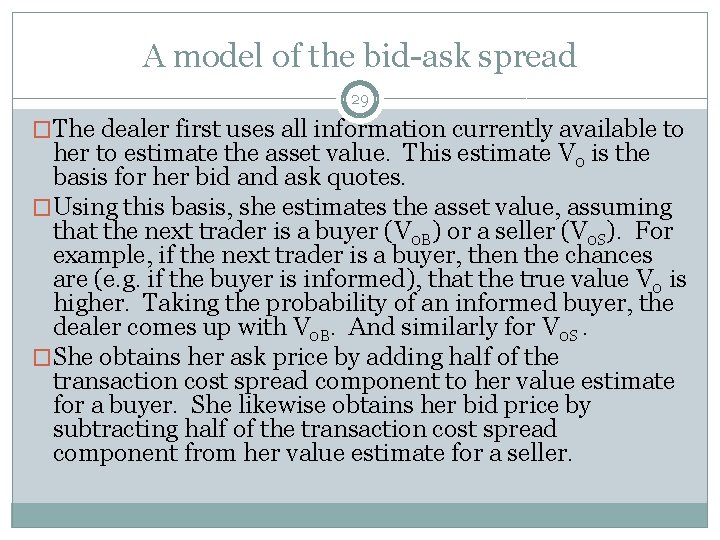

A model of the bid-ask spread 29 �The dealer first uses all information currently available to her to estimate the asset value. This estimate V 0 is the basis for her bid and ask quotes. �Using this basis, she estimates the asset value, assuming that the next trader is a buyer (V 0 B) or a seller (V 0 S). For example, if the next trader is a buyer, then the chances are (e. g. if the buyer is informed), that the true value V 0 is higher. Taking the probability of an informed buyer, the dealer comes up with V 0 B. And similarly for V 0 S. �She obtains her ask price by adding half of the transaction cost spread component to her value estimate for a buyer. She likewise obtains her bid price by subtracting half of the transaction cost spread component from her value estimate for a seller.

A model of the bid-ask spread 30

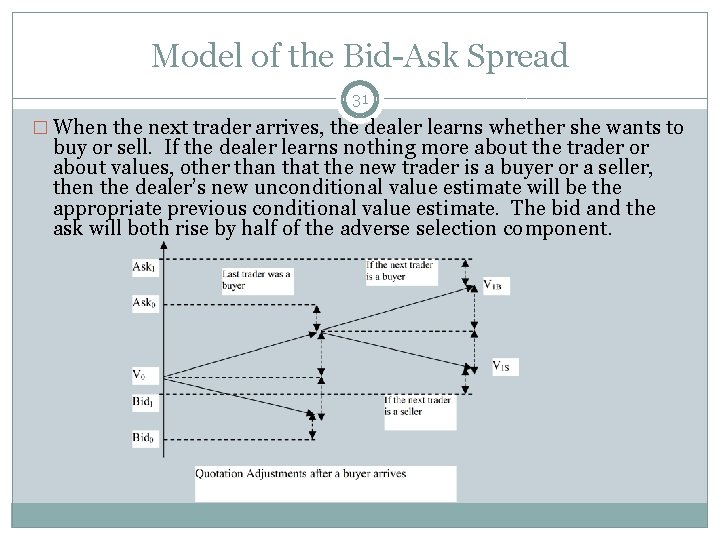

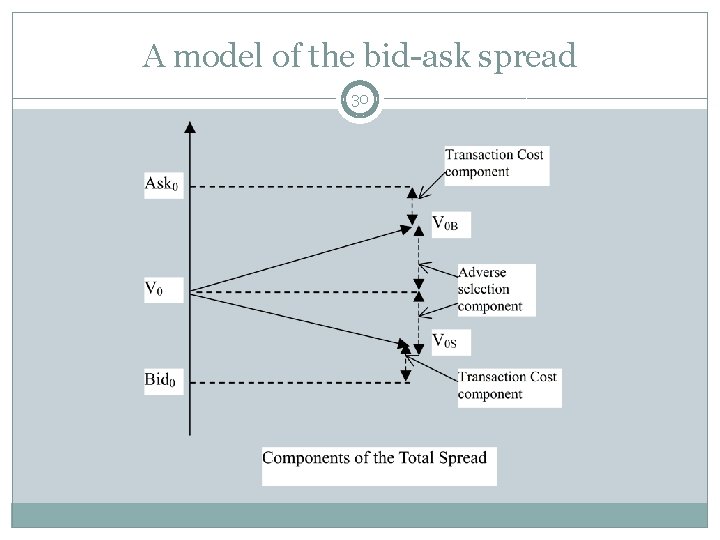

Model of the Bid-Ask Spread 31 � When the next trader arrives, the dealer learns whether she wants to buy or sell. If the dealer learns nothing more about the trader or about values, other than that the new trader is a buyer or a seller, then the dealer’s new unconditional value estimate will be the appropriate previous conditional value estimate. The bid and the ask will both rise by half of the adverse selection component.

Bid-Ask Spread in Order Driven Markets 32 � The bid-ask spread will be non-zero even in pure order driven markets, even if there are no considerations of information asymmetry. � Trading costs/commissions are likely to be higher for limit traders than for market traders because they are more demanding of the exchange’s and the broker’s resources. Suppose commissions for limit orders are l per round trip and m for market orders. � Then since limit traders make the bid-ask spread and market traders pay it, and considering that any trader can either put in a limit or market order and so, in equilibrium, would be indifferent between the two, it must be the case that the net costs for the two types of trades are equal. � Hence l-s = s+m, or s = (l-m)/2 � That is, the bid-ask spread (i. e. the difference between the highest limit buy price and the lowest limit sell price – the price at which limit traders are willing to sell) will be non-zero.

Bid-Ask Spread 33 �As we discussed above, limit orders are not guaranteed to execute. �Also, they provide liquidity and can be picked off by better informed traders, as discussed above. �Hence the bid-ask spread will be greater, the greater the spread between limit order commissions and market order commissions, the greater the cost of canceling and resubmitting limit orders the more volatile underlying true asset values are (the greater the volatility of true values, the greater the value of the timing option granted by limit traders) the greater the information asymmetry.

Fragmentation and Internalization 34 � The setup: A stock you like is offered on your screen for $20. 25. You don't want to pay that, so you give your discount broker an order to buy 500 shares at $20. 125. Your bid pops up on the screen: It's now the highest in the market, and you figure it's only a matter of time before you get your stock. � Free Riding: Then you see 500 shares trade at $20. 125. Then another block at that price. And another. Still you don't get any stock. Other dealers simply use that investor's bid or offer as a reference price at which they will execute their own customers' orders. � Stepping ahead: Then your own broker buys 200 shares from another investor by paying $20. 1875, a smidgen above your bid. � The stock rallies, and your broker unloads the shares he just bought. Frustrated, you cancel your first order and enter another with no preset limit. Five seconds later, your broker confirms you bought 500 shares at $20. 375. You paid $125 more than you expected, but at least you paid just $10 in commission. How Any Market Revamping Might Remove, Add Wrinkles, WSJ, Feb. 29, 2000

Fragmentation and Internalization 35 � Internalization: The practice of executing orders internally using the public best bid or offer as the benchmark is called "internalization" and is how all Nasdaq dealers have traditionally treated their own customers' orders. � Paying for order flow: A huge share of Nasdaq's volume comes from customers of online brokers, who direct orders in particular stocks exclusively to wholesaler dealers such as Knight/Trimark Group Inc. and Charles Schwab Corp. 's capital-markets unit. Wholesalers usually pay for other brokers' order flow because of the opportunity to trade profitably. � The ability for brokers to sell order flow allows them to offer lower commissions. � Some of these problems are because there are several markets. Bids/offers in one market need not be referenced in other markets. A bid to buy on one market can be used as a basis for a dealer to sell that stock at that same price in another market. If those two markets were combined, then the first bid would have to be executed first! � Fragmentation is a discentive to compete. Investors willing to post the best bids or offers aren't necessarily those whose orders get executed. � Potential Solution for some of these problems: Central Order Book � Question: Which of the problems above won’t be solved by centralization?

Buying on Margin 36 �http: //webpage. pace. edu/pviswanath/notes/invest ments/shortsal. html#buyingmargin

Short Sales 37 �http: //webpage. pace. edu/pviswanath/notes/invest ments/shortsal. html#short

Regulation 38 � Securities Act of 1933 �Securities Exchange Act of 1934 – establishes the SEC �Commodity Futures Trading Commission �Securities Investor Protection Act of 1970 �FINRA (Financial Industry Regulatory Authority) – non-governmental self-regulation body �Sarbanes-Oxley Act �Insider Trading regulations – recent investigations of the SEC

Recent Issues in exchange listings 39 �http: //dealbook. nytimes. com/2011/09/08/canada- extends-trading-ban-on-sino-forest/ (A Chinese company that acquired listing on the TSE through a reverse-merger with a defunct listed company) �http: //dealbook. nytimes. com/2012/02/02/losingthe-goose-that-laid-the-golden-egg/ (Trading of unlisted private companies on private exchanges. )