HFT 4464 Chapter 1 Introduction to Finance 1

- Slides: 20

HFT 4464 Chapter 1 Introduction to Finance 1

Chapter 1 - Introduction n The purpose of this course is to provide an introduction to financial management. The financial management function is an important part of every hospitality organization. Financial management is used to make key decisions involving expansion, renovation, choice of location, and many others. 1 -2

What Is Financial Management? n Financial management is used to help make three major decisions: 1. Which assets should we invest in? 1. 2. How will we pay for these assets? 1. 3. Purchase, or investment decision Financing decision What should we do with the earnings generated by the assets? 1. Cash flow, distributions (dividend) or reinvest (retained earnings) 1 -3

Differences Between Accounting and Finance n n n Financial accounting involves recording and classifying financial information. u Completion of accounting cycle u Compilation of financial statements u Focuses on earnings (accrual basis) Managerial accounting applies tools to financial information to generate new information (analysis). Finance u Focus on cash flows 1 -4

Differences Between Accounting and Finance n Accounting vs. Finance use accounting information to help owners, managers and investors make value maximizing decisions 1 -5

Differences Between Accounting and Finance n Financial management involves a number of different areas such as: u Stock valuation u Bond valuation u Asset diversification u Property appraisal and valuation u Working capital management 1 -6

Types of Business Organizations n Sole proprietorship Partnership Limited liability partnership Corporation Limited liability company (LLC) Subchapter S corporation n See bottom of page 4 n n n 1 -7

Sole Proprietorship n Advantages u Ease of formation u Greater Control u Single Taxation n Disadvantages u u 1 -8 Unlimited Liability Difficulty in raising capital

Partnership n Advantages u Ease of formation u Greater control u Single Taxation n Disadvantages u u 1 -9 Unlimited Liability Difficulty in raising capital

Corporation n Advantages u Unlimited life u Limited liability u Relative ease in raising capital n Disadvantages u u 1 -10 Relatively difficult to form Double taxation

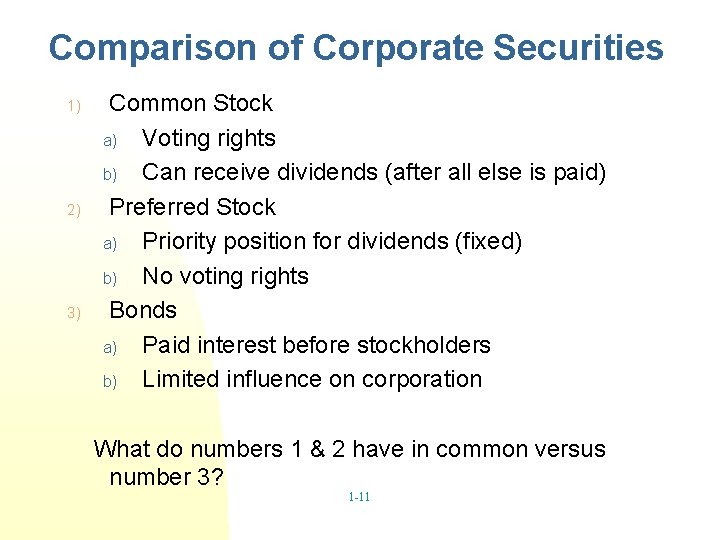

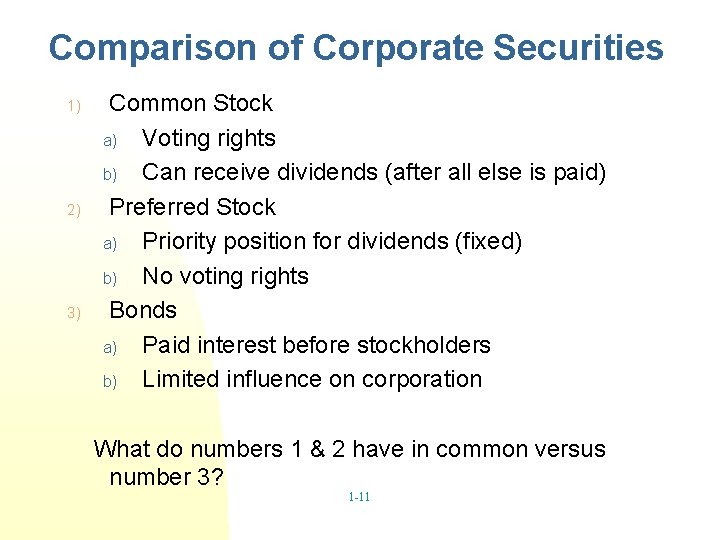

Comparison of Corporate Securities 1) 2) 3) Common Stock a) Voting rights b) Can receive dividends (after all else is paid) Preferred Stock a) Priority position for dividends (fixed) b) No voting rights Bonds a) Paid interest before stockholders b) Limited influence on corporation What do numbers 1 & 2 have in common versus number 3? 1 -11

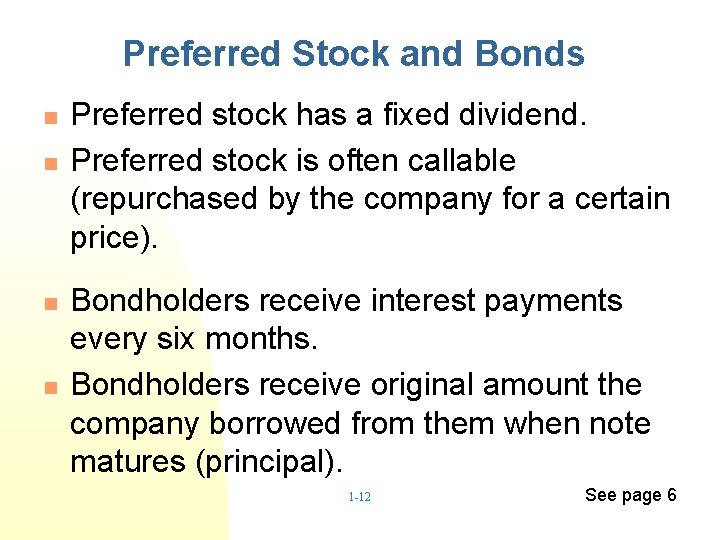

Preferred Stock and Bonds n n Preferred stock has a fixed dividend. Preferred stock is often callable (repurchased by the company for a certain price). Bondholders receive interest payments every six months. Bondholders receive original amount the company borrowed from them when note matures (principal). 1 -12 See page 6

Goal for the Hospitality Financial Manager n n n The goal is to maximize the wealth of the owners. For a corporation, this means increasing the stock price to its highest possible level. Maximizing revenues does not necessarily mean maximizing profits. 1 -13

What Affects the Stock Price? n n The stock price is the sum of present and future dividends. Future dividends are affected by three major factors: u The amount of the dividends (size) u When the dividends are received (timing) u The risk associated with the dividends (risk) 1 -14

Agency Relationships n n n Owners—managers Franchisee—franchisor Owners—lenders Agency relationships involve a principal (example: owner) and an agent (example: manager). Puupose: delegates operating decision to managers (agents) to work in the best interests of the owners 1 -15

What Is an Agency Problem? n n Agency problems arise when an agent does not act in the best interest of the principal. Some typical agency problems: u Shirking u Consumption of perquisites 1 -16

What Do Hospitality Managers Do to Create Value? n n Increase revenues u Careful management of room rates u Mc. Donald’s breakfast market Lower expenses u Control food and beverage costs u Decrease turnover to reduce labor costs u All the time working under an element of uncertainty (risk) u Maximize the potential for outcomes to be greater than expectations 1 -17

We Can Undertake Projects That Create Value n n Kemmons Wilson and the creation of Holiday Inn Marriott International Creation of guest rewards program u In-room video check-out u Marriott’s extensive consumer research regarding courtyard u 1 -18

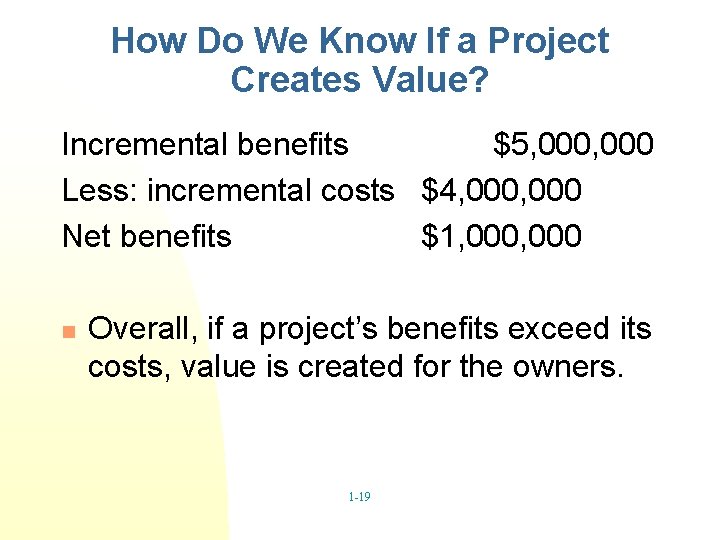

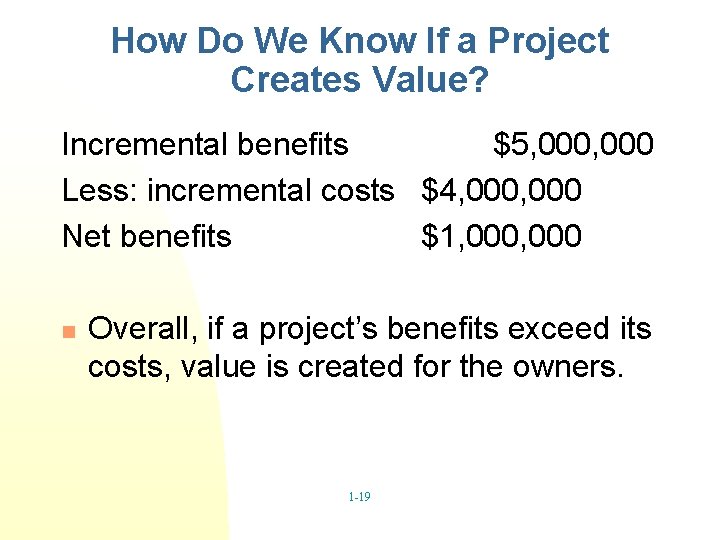

How Do We Know If a Project Creates Value? Incremental benefits $5, 000 Less: incremental costs $4, 000 Net benefits $1, 000 n Overall, if a project’s benefits exceed its costs, value is created for the owners. 1 -19

Homework Assignment Questions: 1, 2, 3, 4, 7, 8, 11, 12 20

Hft 4464

Hft 4464 Hft 3431

Hft 3431 Hft accounting

Hft accounting Fpga high frequency trading

Fpga high frequency trading Hft cable tracker

Hft cable tracker Hft 2220

Hft 2220 Normal balance

Normal balance Hft lsf

Hft lsf Introduction to corporate finance what companies do

Introduction to corporate finance what companies do Chapter 1: introduction to personal finance

Chapter 1: introduction to personal finance Chapter 1 introduction to corporate finance

Chapter 1 introduction to corporate finance Chapter 1 introduction to corporate finance

Chapter 1 introduction to corporate finance Chapter 1 introduction to corporate finance

Chapter 1 introduction to corporate finance Financial problem introduction

Financial problem introduction Introduction to econometrics for finance

Introduction to econometrics for finance Personal finance lab

Personal finance lab Corporate finance quiz

Corporate finance quiz Comii

Comii Local government finance

Local government finance Nnnw corp

Nnnw corp Chapter 2 personal finance

Chapter 2 personal finance