Grid Connected Rooftop Solar PV Program SBIWORLD BANK

Grid Connected Rooftop Solar PV Program SBI-WORLD BANK Presentation by- SBI

Presentation Overview SBI at a glance Background of the Program SBI Commitment and Contribution Business Models Financing Modes Eligible Projects Benchmarks Parameters World Bank Conditions 2

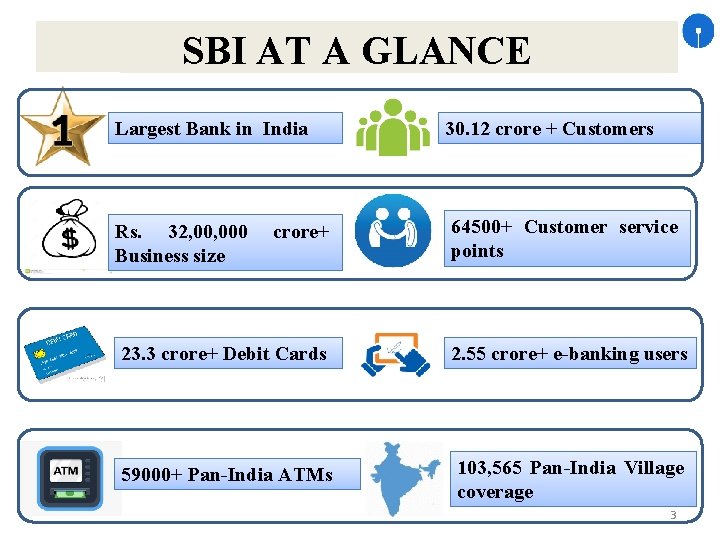

SBI AT A GLANCE Largest Bank in India 30. 12 crore + Customers Rs. 32, 000 Business size 64500+ Customer service points crore+ 23. 3 crore+ Debit Cards 2. 55 crore+ e-banking users 59000+ Pan-India ATMs 103, 565 Pan-India Village coverage 3

Background of the Program GOI has set an ambitious growth target of installation of 175 GW aggregate capacity of renewable energy by 2022. Out of total 175 GW, target of 100 GW is set for Solar Power under which 40 GW is to be achieved from GC RSPV. MNRE had approached SBI to develop a Program for funding grid connected rooftop solar projects through WB funds. As a result, SBI has prepared the Program for financing grid connected rooftop solar projects.

SBI Commitment & Contribution During RE-Invest 2015, 27 Banks gave commitment to finance 78 GW of Renewable Energy projects. SBI gave commitment of Rs 75, 000 crore which would lead to 15 GW of capacity addition. The commitment given by the Bank translates to 19% of the total commitment given by all the Banks. Pursuant to the commitment, the Bank has sanctioned in excess of Rs 7100 crore for 80 Renewable Energy projects with a total capacity addition of 2435 MW as on September 30, 2016.

Business Models Capex Third Party 6

Capex Model The borrower sets up rooftop solar project with the intent to reduce his own power costs. Residual power, if any, can be feed to the grid. The Borrower would approach an EPC contractor for the installation of the project. The O&M contract may be given to the same EPC contractor or some other person. Debt servicing is dependent on the main business activity of the Borrower. Financial appraisal would be like any other asset (e. g. machinery) financing proposal. 7

Third Party Models RESCO Model AD Model 8

RESCO Model RESCO will develop the rooftop solar projects for its clients on the agreed terms and conditions. RESCO would enter into a long term legally binding lease, right to use or similar agreement for the roof on which solar project will be installed. RESCO will also enter into a PPA for the supply of power. In this model, the same RESCO is likely to take up multiple projects consecutively and simultaneously across different locations. RESCO would be borrower in Bank’s books and liable for repayment of loan. 9

Sub Models under RESCO Model BOOT(Build, Own, Operate & Transfer) BOOM(Build, Own, Operate & Maintain) Rooftop Rental 10

BOOT The RESCO constructs, owns, operates and transfers the ownership of the rooftop solar project after expiry of contract period or as per agreed terms. Generally, transfer of ownership is made, once the RESCO has recovered its cost of capital and a suitable rate of return. After the transfer of ownership, the rooftop owner is responsible for O&M and he may choose to retain the services of the original RESCO or he may make his own arrangements for O&M requirements. 11

BOOM RESCO constructs, owns, operates and maintains the project. RESCO typically ensure that he is able to recover the cost of his capital investment and O&M expenditures over time. 12

Rooftop Rental RESCO will enter into lease agreement with the rooftop owner and set up the solar system on his roof. The rooftop owner will get an agreed amount of rent from the RESCO. The power generated can be either transmitted into Grid or may be provided to private procurer on agreed tariff. 13

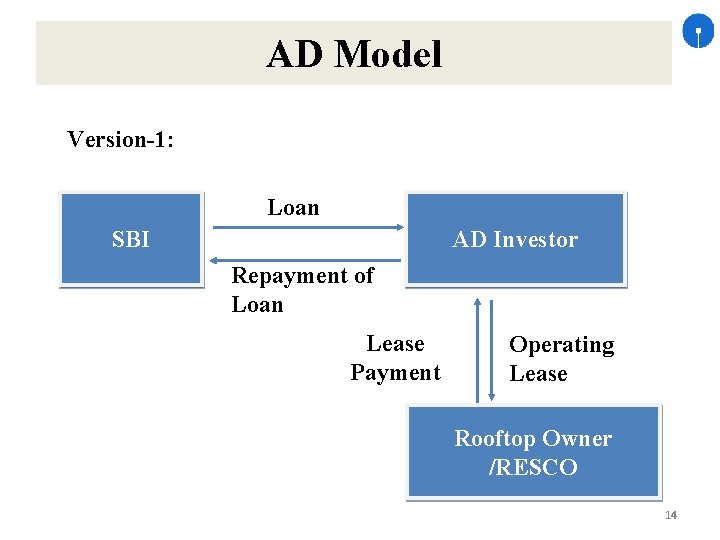

AD Model Version-1: Loan SBI AD Investor Repayment of Loan Lease Payment Operating Lease Rooftop Owner /RESCO 14

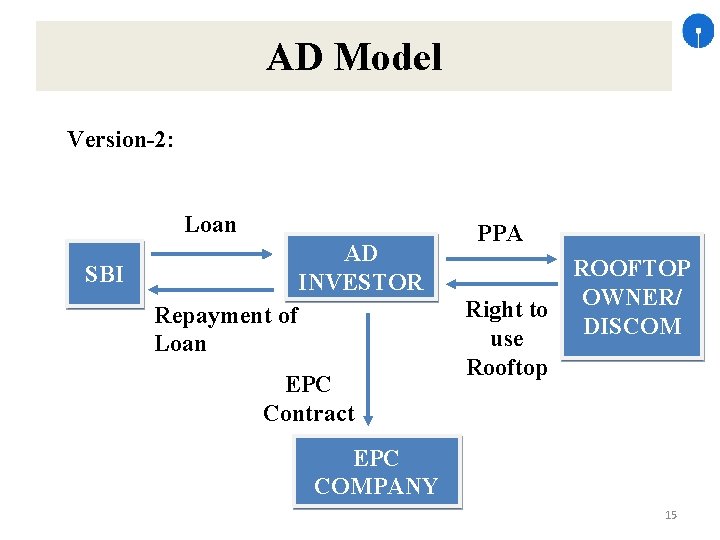

AD Model Version-2: Loan AD INVESTOR SBI Repayment of Loan EPC Contract PPA Right to use Rooftop ROOFTOP OWNER/ DISCOM EPC COMPANY 15

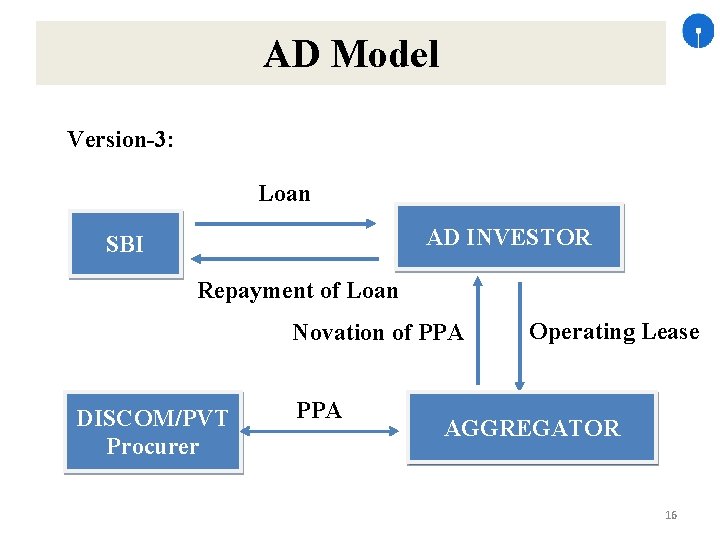

AD Model Version-3: Loan AD INVESTOR SBI Repayment of Loan Novation of PPA DISCOM/PVT Procurer PPA Operating Lease AGGREGATOR 16

Financing Modes Program Mode & Project Mode 17

Program Mode Under this mode, Master Line of Credit/loan facility will be sanctioned to the Borrower to execute multiple rooftop solar projects. Master Line of Credit is proposed since normally rooftop solar projects would be of small size and it would be difficult for the Borrower to approach for approval of all projects at one go. The facility can be sanctioned to the Borrower based on following indicative parameters: ü Past financials of the Borrower ü Experience in rooftop Solar PV projects ü Number of projects executed in the past 18 ü Projected pipeline of the rooftop solar PV projects

• A Master Loan Agreement (MLA) will be signed between the Bank and the Borrower. • MLA will have all legal terms and condition applicable for both Master facility (for Line of Credit) and individual facilities (for individual projects) • Subsequently, individual loan agreements will also be signed for individual loans (containing details about the project, tenor, interest rate and condition precedents e. g. legal opinion on lease agreement & PPA and all regulatory and environment approval). • Individual loan agreements will refer to the Master Loan Agreement and will not repeat all the legal clauses. 19

Off-taker credentials should normally be assessed at the time of sanctioning master loan facility. However, if the details of future off-takers are not known at the time of sanctioning master loan facility, than the off-taker credit risk shall be analyzed at the time of appraisal of individual projects. In case of any deviation from sanctioned terms and conditions of Master loan facility, the same would need to be approved by the Sanctioning Authority that has sanctioned the master loan facility. 20

Project Mode Borrower will develop a single project and avail funds for this project only. The facility would be sanctioned by sanctioning authority and a single loan agreement with all applicable terms and conditions would be executed. Proposal will include projects from single roof owners only. However, if the roof owner owns multiple roofs at the same/multiple locations and want to install rooftop solar project on all the roofs at a single time or in phases, then the proposal shall fall under project mode. 21

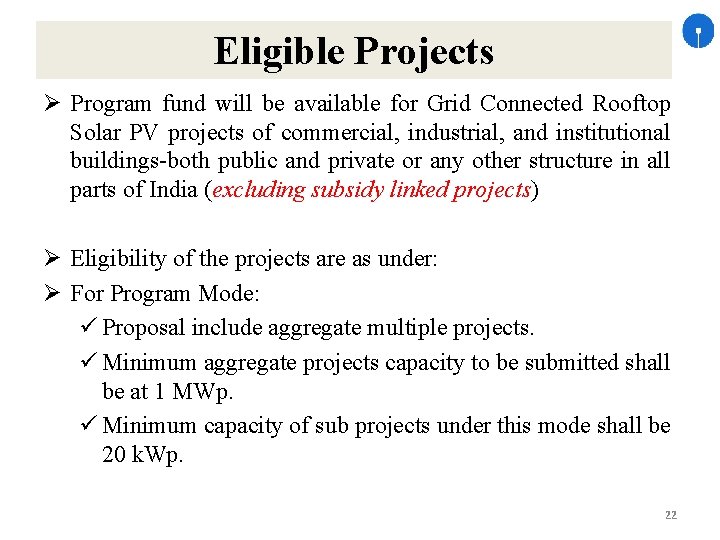

Eligible Projects Program fund will be available for Grid Connected Rooftop Solar PV projects of commercial, industrial, and institutional buildings-both public and private or any other structure in all parts of India (excluding subsidy linked projects) Eligibility of the projects are as under: For Program Mode: ü Proposal include aggregate multiple projects. ü Minimum aggregate projects capacity to be submitted shall be at 1 MWp. ü Minimum capacity of sub projects under this mode shall be 20 k. Wp. 22

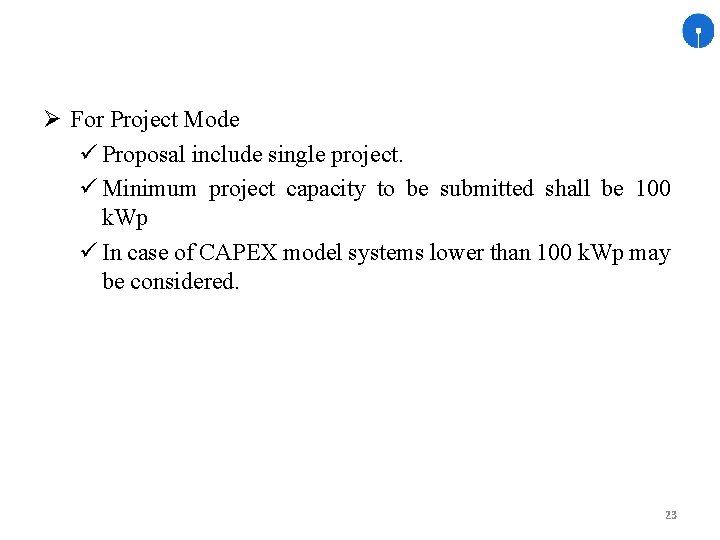

For Project Mode ü Proposal include single project. ü Minimum project capacity to be submitted shall be 100 k. Wp ü In case of CAPEX model systems lower than 100 k. Wp may be considered. 23

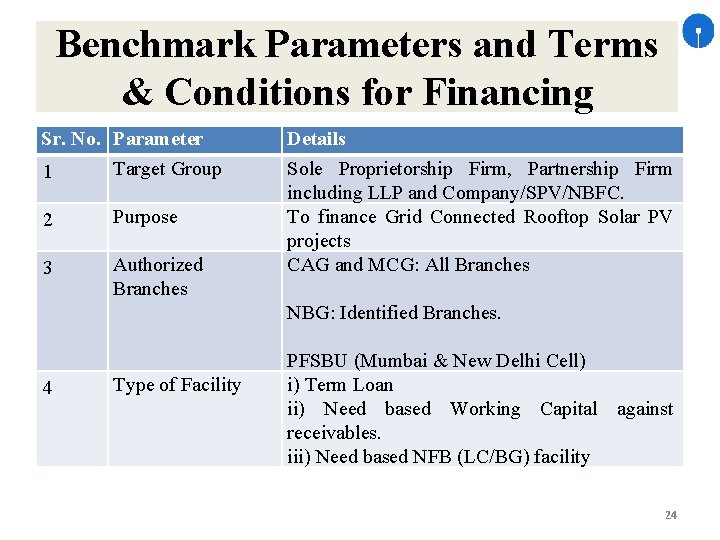

Benchmark Parameters and Terms & Conditions for Financing Sr. No. Parameter Target Group 1 2 Purpose 3 Authorized Branches 4 Type of Facility Details Sole Proprietorship Firm, Partnership Firm including LLP and Company/SPV/NBFC. To finance Grid Connected Rooftop Solar PV projects CAG and MCG: All Branches NBG: Identified Branches. PFSBU (Mumbai & New Delhi Cell) i) Term Loan ii) Need based Working Capital against receivables. iii) Need based NFB (LC/BG) facility 24

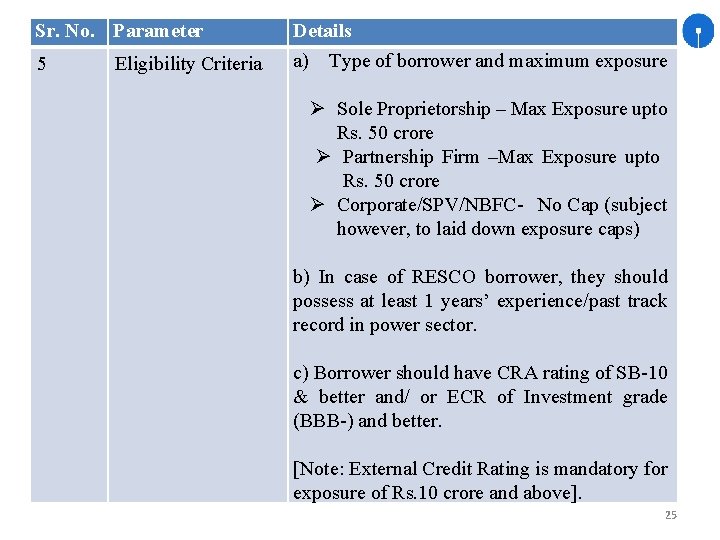

Sr. No. Parameter 5 Eligibility Criteria Details a) Type of borrower and maximum exposure Sole Proprietorship – Max Exposure upto Rs. 50 crore Partnership Firm –Max Exposure upto Rs. 50 crore Corporate/SPV/NBFC- No Cap (subject however, to laid down exposure caps) b) In case of RESCO borrower, they should possess at least 1 years’ experience/past track record in power sector. c) Borrower should have CRA rating of SB-10 & better and/ or ECR of Investment grade (BBB-) and better. [Note: External Credit Rating is mandatory for exposure of Rs. 10 crore and above]. 25

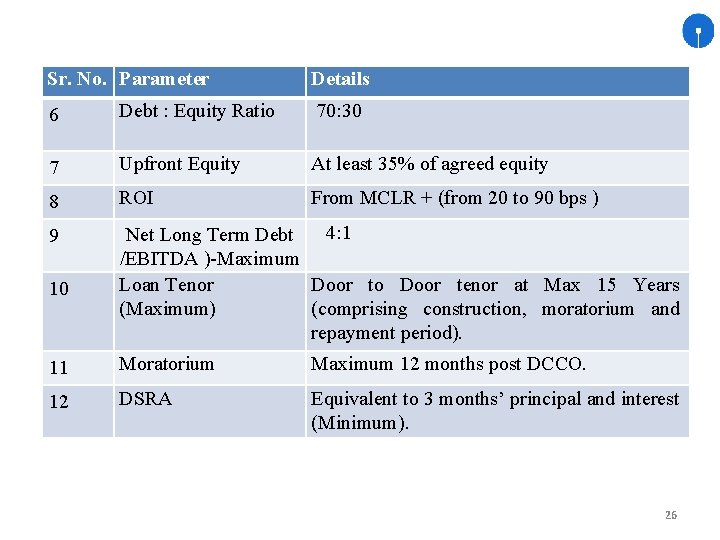

Sr. No. Parameter Details 6 Debt : Equity Ratio 7 Upfront Equity 70: 30 At least 35% of agreed equity 8 ROI From MCLR + (from 20 to 90 bps ) 9 10 Net Long Term Debt 4: 1 /EBITDA )-Maximum Loan Tenor Door to Door tenor at Max 15 Years (Maximum) (comprising construction, moratorium and repayment period). 11 Moratorium Maximum 12 months post DCCO. 12 DSRA Equivalent to 3 months’ principal and interest (Minimum). 26

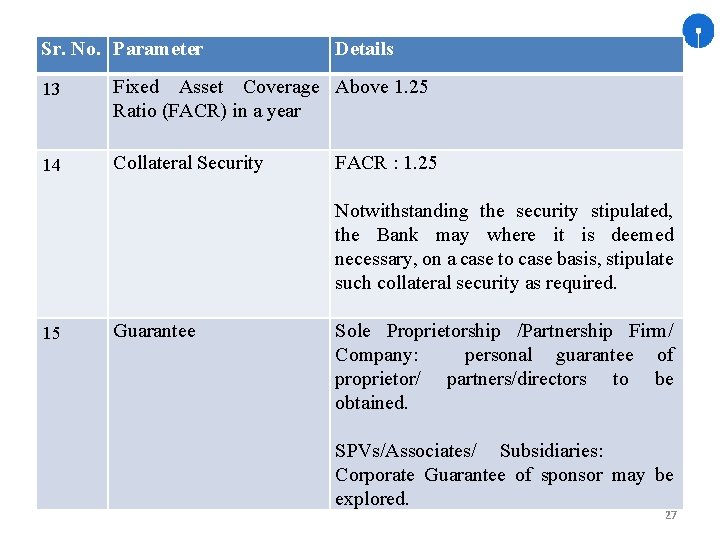

Sr. No. Parameter Details 13 Fixed Asset Coverage Above 1. 25 Ratio (FACR) in a year 14 Collateral Security FACR : 1. 25 Notwithstanding the security stipulated, the Bank may where it is deemed necessary, on a case to case basis, stipulate such collateral security as required. 15 Guarantee Sole Proprietorship /Partnership Firm/ Company: personal guarantee of proprietor/ partners/directors to be obtained. SPVs/Associates/ Subsidiaries: Corporate Guarantee of sponsor may be explored. 27

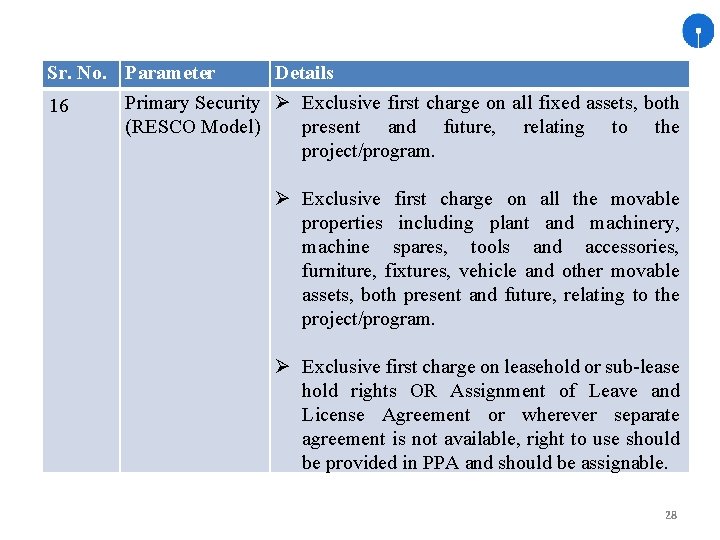

Sr. No. Parameter Details Primary Security Exclusive first charge on all fixed assets, both 16 (RESCO Model) present and future, relating to the project/program. Exclusive first charge on all the movable properties including plant and machinery, machine spares, tools and accessories, furniture, fixtures, vehicle and other movable assets, both present and future, relating to the project/program. Exclusive first charge on leasehold or sub-lease hold rights OR Assignment of Leave and License Agreement or wherever separate agreement is not available, right to use should be provided in PPA and should be assignable. 28

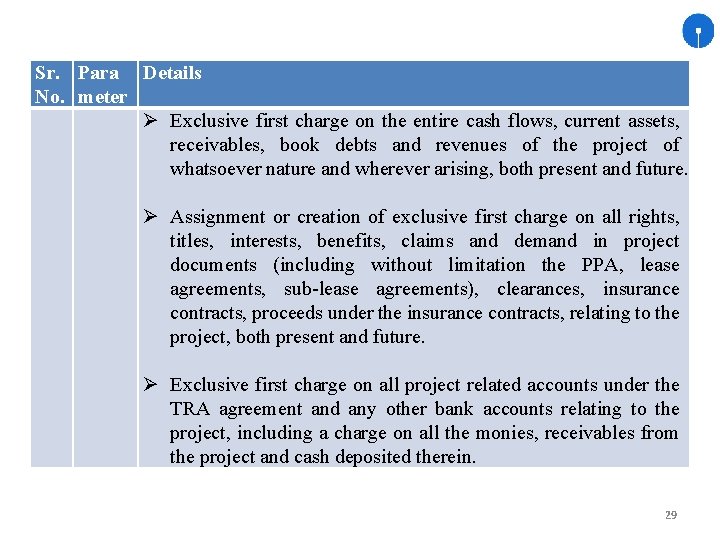

Sr. Para Details No. meter Exclusive first charge on the entire cash flows, current assets, receivables, book debts and revenues of the project of whatsoever nature and wherever arising, both present and future. Assignment or creation of exclusive first charge on all rights, titles, interests, benefits, claims and demand in project documents (including without limitation the PPA, lease agreements, sub-lease agreements), clearances, insurance contracts, proceeds under the insurance contracts, relating to the project, both present and future. Exclusive first charge on all project related accounts under the TRA agreement and any other bank accounts relating to the project, including a charge on all the monies, receivables from the project and cash deposited therein. 29

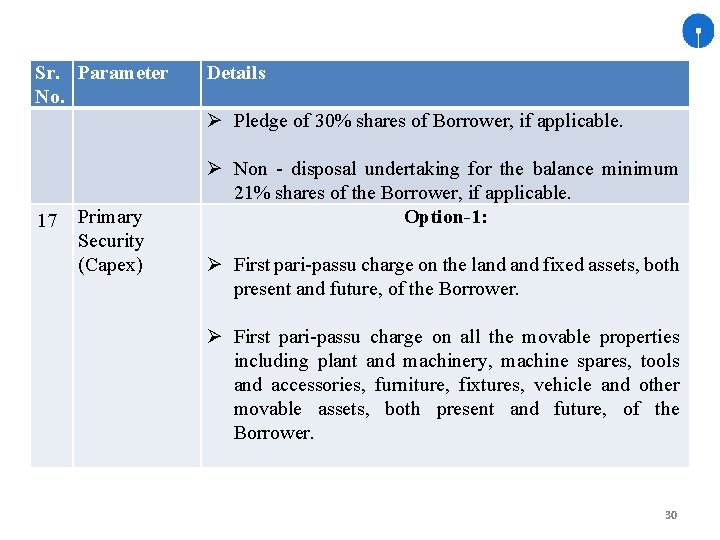

Sr. Parameter No. Details Pledge of 30% shares of Borrower, if applicable. 17 Primary Security (Capex) Non - disposal undertaking for the balance minimum 21% shares of the Borrower, if applicable. Option-1: First pari-passu charge on the land fixed assets, both present and future, of the Borrower. First pari-passu charge on all the movable properties including plant and machinery, machine spares, tools and accessories, furniture, fixtures, vehicle and other movable assets, both present and future, of the Borrower. 30

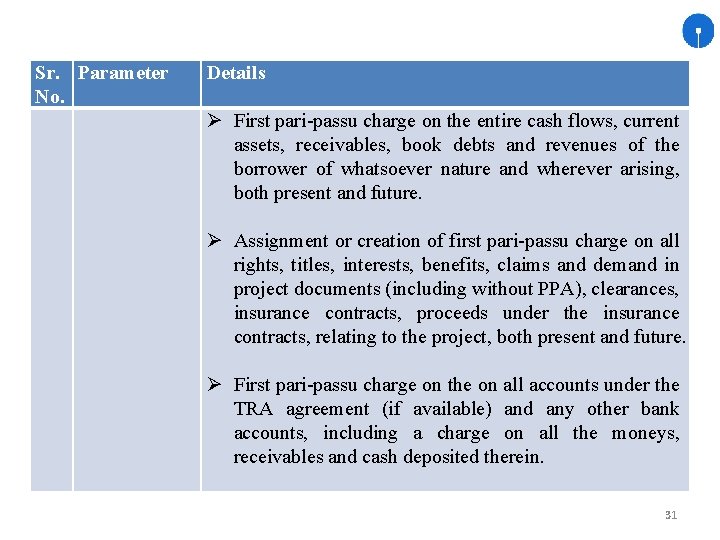

Sr. Parameter No. Details First pari-passu charge on the entire cash flows, current assets, receivables, book debts and revenues of the borrower of whatsoever nature and wherever arising, both present and future. Assignment or creation of first pari-passu charge on all rights, titles, interests, benefits, claims and demand in project documents (including without PPA), clearances, insurance contracts, proceeds under the insurance contracts, relating to the project, both present and future. First pari-passu charge on the on all accounts under the TRA agreement (if available) and any other bank accounts, including a charge on all the moneys, receivables and cash deposited therein. 31

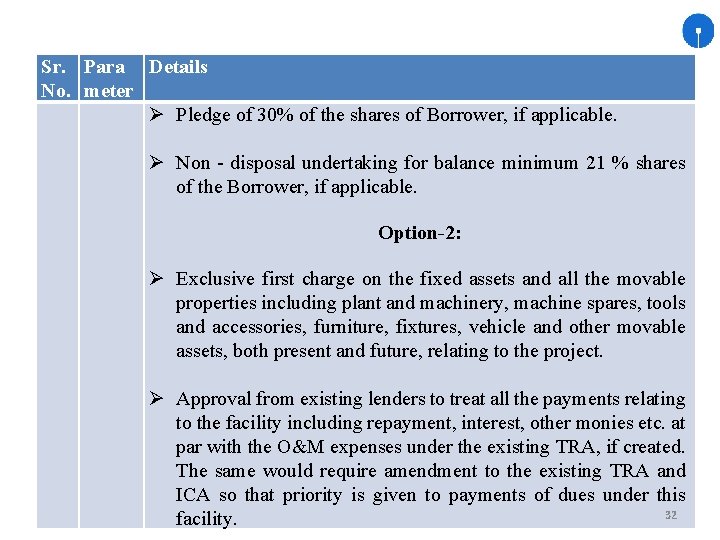

Sr. Para Details No. meter Pledge of 30% of the shares of Borrower, if applicable. Non - disposal undertaking for balance minimum 21 % shares of the Borrower, if applicable. Option-2: Exclusive first charge on the fixed assets and all the movable properties including plant and machinery, machine spares, tools and accessories, furniture, fixtures, vehicle and other movable assets, both present and future, relating to the project. Approval from existing lenders to treat all the payments relating to the facility including repayment, interest, other monies etc. at par with the O&M expenses under the existing TRA, if created. The same would require amendment to the existing TRA and ICA so that priority is given to payments of dues under this 32 facility.

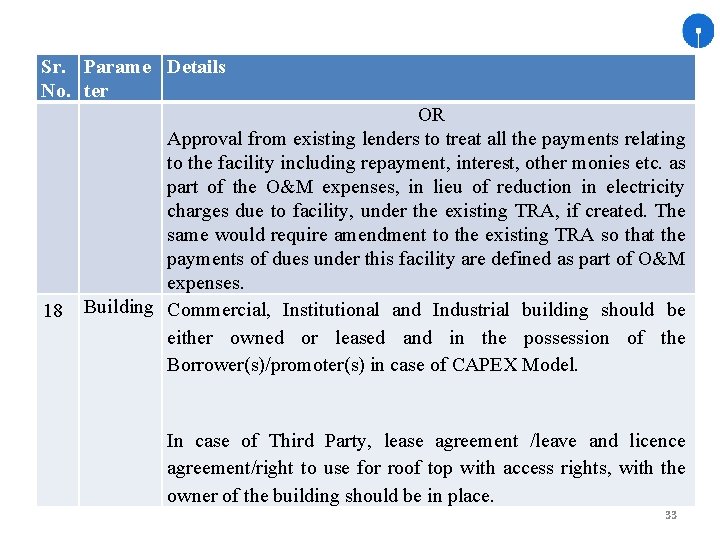

Sr. Parame Details No. ter 18 OR Approval from existing lenders to treat all the payments relating to the facility including repayment, interest, other monies etc. as part of the O&M expenses, in lieu of reduction in electricity charges due to facility, under the existing TRA, if created. The same would require amendment to the existing TRA so that the payments of dues under this facility are defined as part of O&M expenses. Building Commercial, Institutional and Industrial building should be either owned or leased and in the possession of the Borrower(s)/promoter(s) in case of CAPEX Model. In case of Third Party, lease agreement /leave and licence agreement/right to use for roof top with access rights, with the owner of the building should be in place. 33

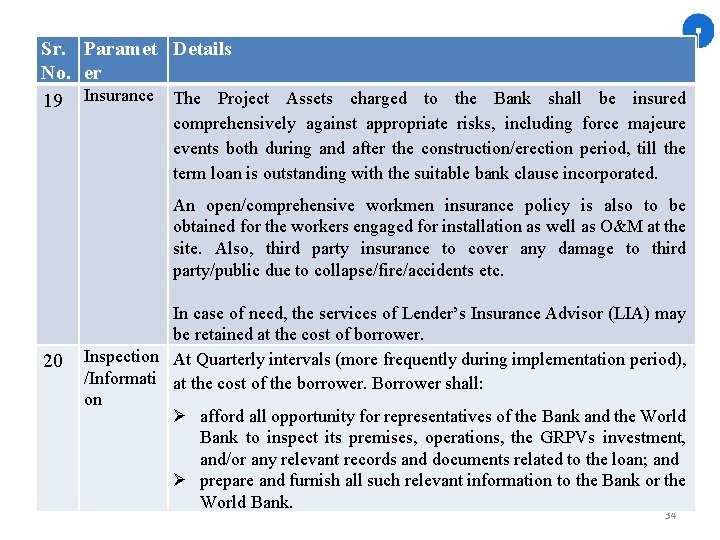

Sr. Paramet Details No. er 19 Insurance The Project Assets charged to the Bank shall be insured comprehensively against appropriate risks, including force majeure events both during and after the construction/erection period, till the term loan is outstanding with the suitable bank clause incorporated. An open/comprehensive workmen insurance policy is also to be obtained for the workers engaged for installation as well as O&M at the site. Also, third party insurance to cover any damage to third party/public due to collapse/fire/accidents etc. 20 In case of need, the services of Lender’s Insurance Advisor (LIA) may be retained at the cost of borrower. Inspection At Quarterly intervals (more frequently during implementation period), /Informati at the cost of the borrower. Borrower shall: on afford all opportunity for representatives of the Bank and the World Bank to inspect its premises, operations, the GRPVs investment, and/or any relevant records and documents related to the loan; and prepare and furnish all such relevant information to the Bank or the World Bank. 34

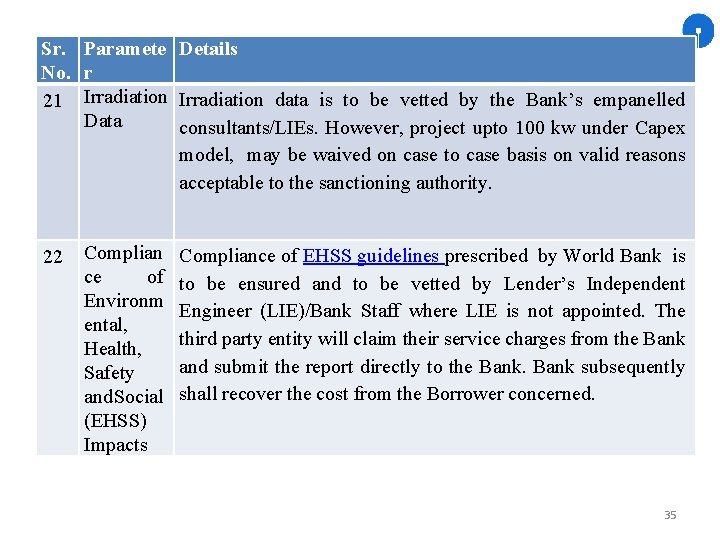

Sr. Paramete Details No. r 21 Irradiation data is to be vetted by the Bank’s empanelled Data consultants/LIEs. However, project upto 100 kw under Capex model, may be waived on case to case basis on valid reasons acceptable to the sanctioning authority. 22 Complian ce of Environm ental, Health, Safety and Social (EHSS) Impacts Compliance of EHSS guidelines prescribed by World Bank is to be ensured and to be vetted by Lender’s Independent Engineer (LIE)/Bank Staff where LIE is not appointed. The third party entity will claim their service charges from the Bank and submit the report directly to the Bank subsequently shall recover the cost from the Borrower concerned. 35

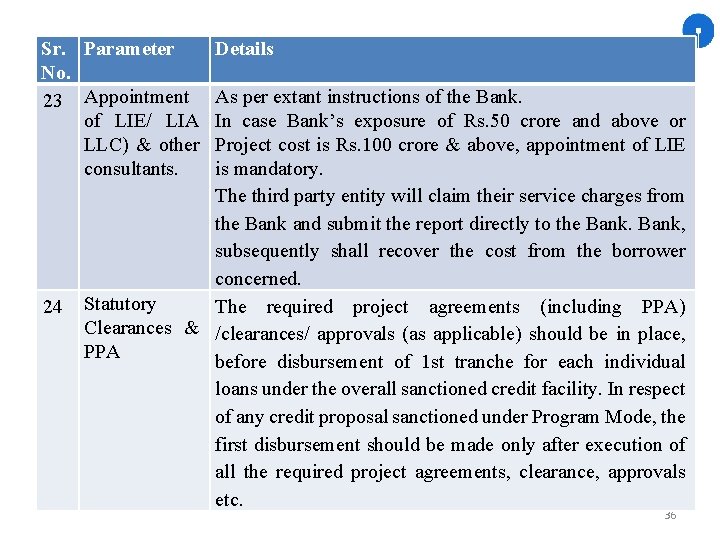

Sr. Parameter No. 23 Appointment of LIE/ LIA LLC) & other consultants. 24 Details As per extant instructions of the Bank. In case Bank’s exposure of Rs. 50 crore and above or Project cost is Rs. 100 crore & above, appointment of LIE is mandatory. The third party entity will claim their service charges from the Bank and submit the report directly to the Bank, subsequently shall recover the cost from the borrower concerned. Statutory The required project agreements (including PPA) Clearances & /clearances/ approvals (as applicable) should be in place, PPA before disbursement of 1 st tranche for each individual loans under the overall sanctioned credit facility. In respect of any credit proposal sanctioned under Program Mode, the first disbursement should be made only after execution of all the required project agreements, clearance, approvals etc. 36

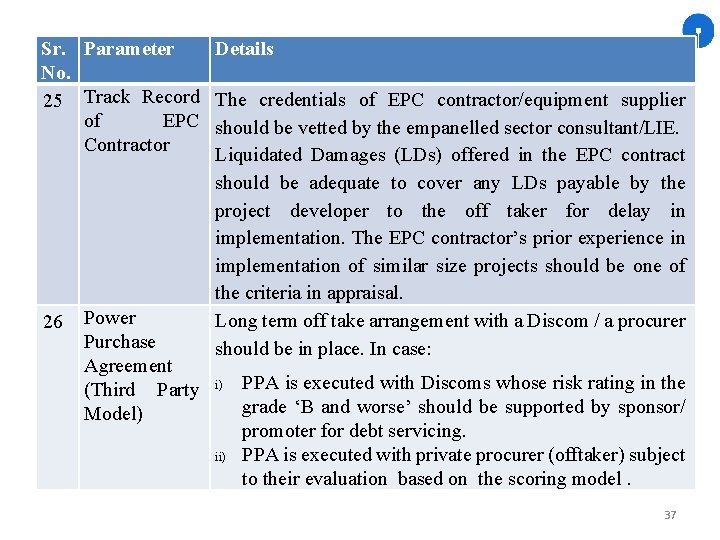

Sr. Parameter Details No. 25 Track Record The credentials of EPC contractor/equipment supplier of EPC should be vetted by the empanelled sector consultant/LIE. Contractor Liquidated Damages (LDs) offered in the EPC contract should be adequate to cover any LDs payable by the project developer to the off taker for delay in implementation. The EPC contractor’s prior experience in implementation of similar size projects should be one of the criteria in appraisal. Long term off take arrangement with a Discom / a procurer 26 Power Purchase should be in place. In case: Agreement (Third Party i) PPA is executed with Discoms whose risk rating in the grade ‘B and worse’ should be supported by sponsor/ Model) promoter for debt servicing. ii) PPA is executed with private procurer (offtaker) subject to their evaluation based on the scoring model. 37

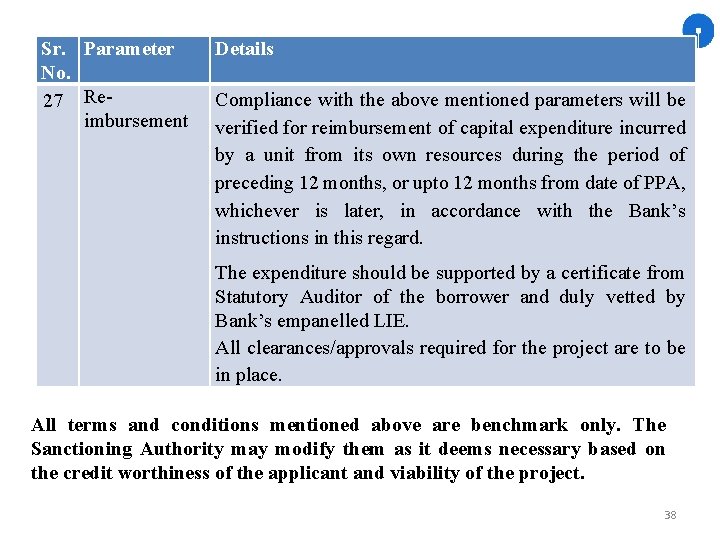

Sr. Parameter No. 27 Reimbursement Details Compliance with the above mentioned parameters will be verified for reimbursement of capital expenditure incurred by a unit from its own resources during the period of preceding 12 months, or upto 12 months from date of PPA, whichever is later, in accordance with the Bank’s instructions in this regard. The expenditure should be supported by a certificate from Statutory Auditor of the borrower and duly vetted by Bank’s empanelled LIE. All clearances/approvals required for the project are to be in place. All terms and conditions mentioned above are benchmark only. The Sanctioning Authority may modify them as it deems necessary based on the credit worthiness of the applicant and viability of the project. 38

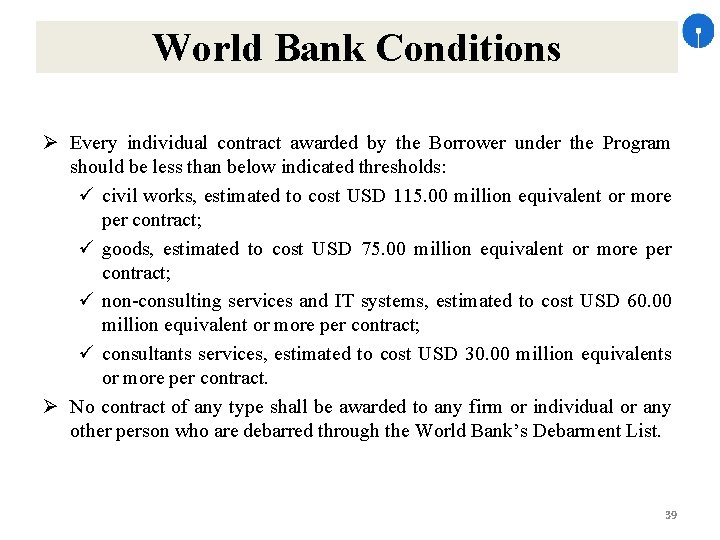

World Bank Conditions Every individual contract awarded by the Borrower under the Program should be less than below indicated thresholds: ü civil works, estimated to cost USD 115. 00 million equivalent or more per contract; ü goods, estimated to cost USD 75. 00 million equivalent or more per contract; ü non-consulting services and IT systems, estimated to cost USD 60. 00 million equivalent or more per contract; ü consultants services, estimated to cost USD 30. 00 million equivalents or more per contract. No contract of any type shall be awarded to any firm or individual or any other person who are debarred through the World Bank’s Debarment List. 39

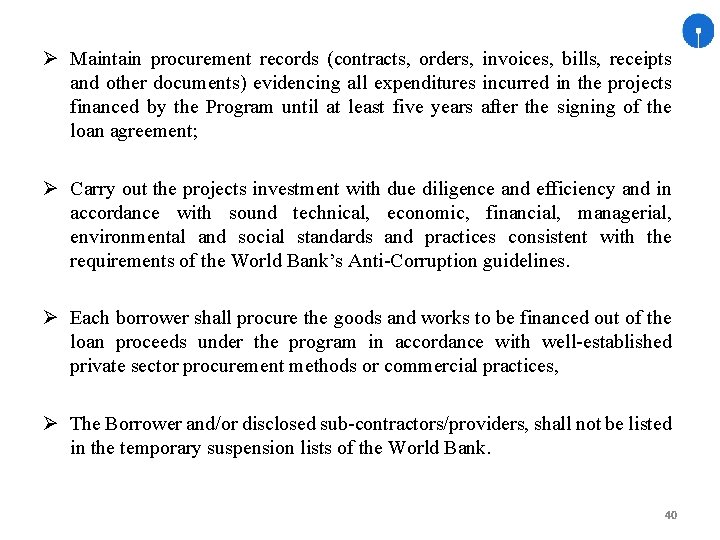

Maintain procurement records (contracts, orders, invoices, bills, receipts and other documents) evidencing all expenditures incurred in the projects financed by the Program until at least five years after the signing of the loan agreement; Carry out the projects investment with due diligence and efficiency and in accordance with sound technical, economic, financial, managerial, environmental and social standards and practices consistent with the requirements of the World Bank’s Anti-Corruption guidelines. Each borrower shall procure the goods and works to be financed out of the loan proceeds under the program in accordance with well-established private sector procurement methods or commercial practices, The Borrower and/or disclosed sub-contractors/providers, shall not be listed in the temporary suspension lists of the World Bank. 40

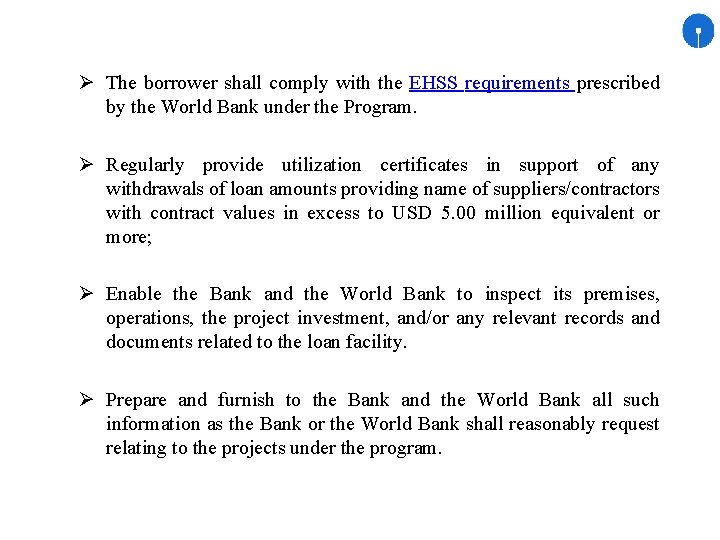

The borrower shall comply with the EHSS requirements prescribed by the World Bank under the Program. Regularly provide utilization certificates in support of any withdrawals of loan amounts providing name of suppliers/contractors with contract values in excess to USD 5. 00 million equivalent or more; Enable the Bank and the World Bank to inspect its premises, operations, the project investment, and/or any relevant records and documents related to the loan facility. Prepare and furnish to the Bank and the World Bank all such information as the Bank or the World Bank shall reasonably request relating to the projects under the program.

The borrower shall comply with all necessary licenses, permits and/or clearances for the installation of the projects as required by the law of the land.

Thank You 43

- Slides: 43