Green World Capital LLC Capital for a Greener

- Slides: 17

Green. World Capital, LLC Capital for a Greener World Opportunities for China FDI in U. S. Renewable Energy and Clean Technology Presented by David Elkin University of Pennsylvania April 16, 2013 © 2013 1 Broker dealer services provided through Mufson Howe Hunter & Partners LLC, member of FINRA and SIPC Green. World Capital, LLC Capital for a Greener World

A Big Thank You to Our Sponsors at University of Pennsylvania This presentation was generously sponsored by the University Pennsylvania Chapter of Global China Connection, The Center for East Asian Studies, and the International Relations Program And co-sponsored by Penn Engineers Without Borders, Penn International Sustainability Association, Wharton Energy Club, Penn Oikos, and Wharton China Business Society © 2013 2 Broker dealer services provided through Mufson Howe Hunter & Partners LLC, member of FINRA and SIPC Green. World Capital, LLC Capital for a Greener World

© 2013 3 Broker dealer services provided through Mufson Howe Hunter & Partners LLC, member of FINRA and SIPC Green. World Capital, LLC Capital for a Greener World

The Dragon Turns Green: China's Manufacturers Adapt to a New Era Published : June 03, 2009 in Knowledge@Wharton © 2013 4 Broker dealer services provided through Mufson Howe Hunter & Partners LLC, member of FINRA and SIPC Green. World Capital, LLC Capital for a Greener World

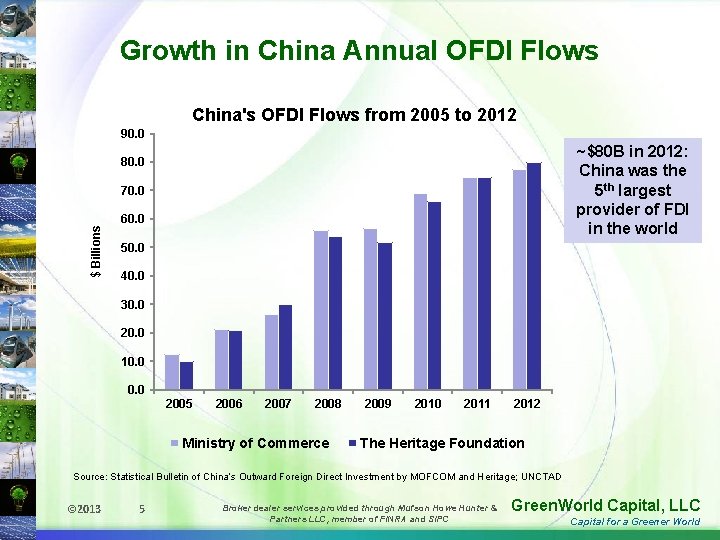

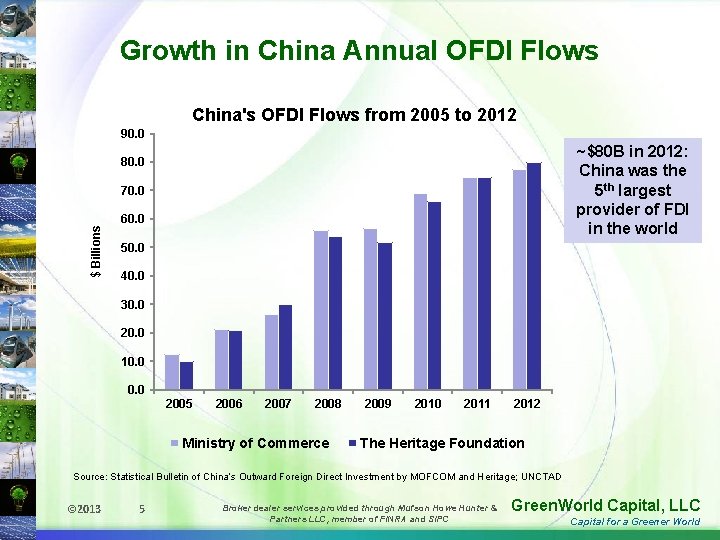

Growth in China Annual OFDI Flows China's OFDI Flows from 2005 to 2012 90. 0 ~$80 B in 2012: China was the 5 th largest provider of FDI in the world 80. 0 $ Billions 70. 0 60. 0 50. 0 40. 0 30. 0 20. 0 10. 0 2005 2006 2007 2008 Ministry of Commerce 2009 2010 2011 2012 The Heritage Foundation Source: Statistical Bulletin of China’s Outward Foreign Direct Investment by MOFCOM and Heritage; UNCTAD © 2013 5 Broker dealer services provided through Mufson Howe Hunter & Partners LLC, member of FINRA and SIPC Green. World Capital, LLC Capital for a Greener World

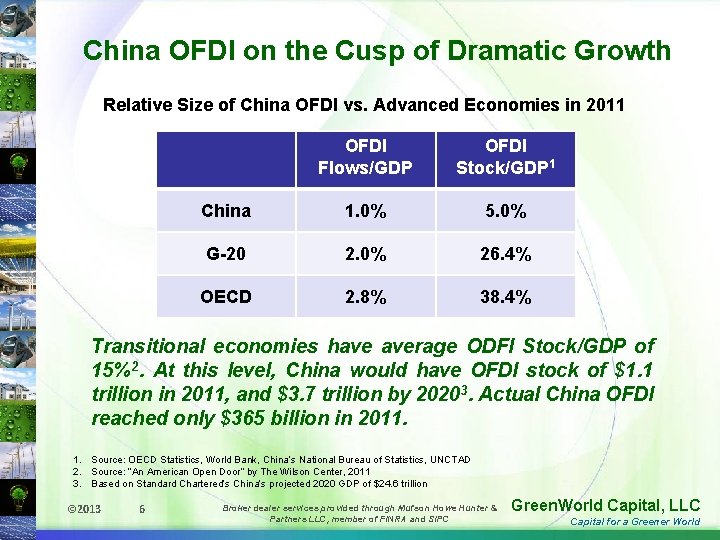

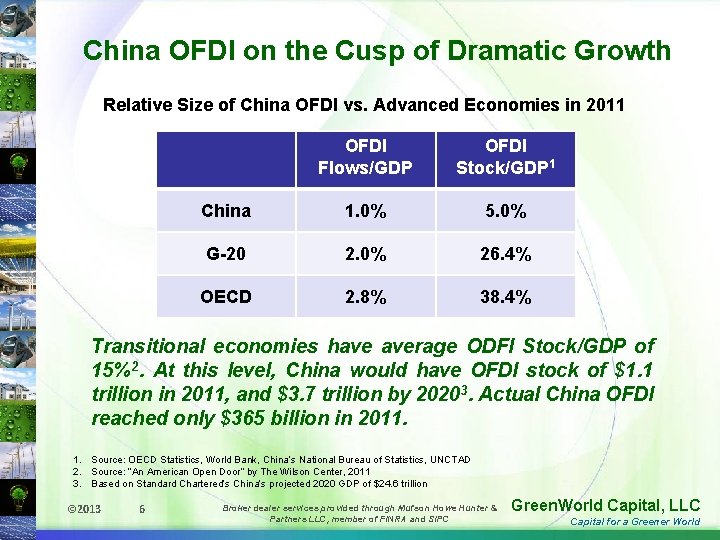

China OFDI on the Cusp of Dramatic Growth Relative Size of China OFDI vs. Advanced Economies in 2011 OFDI Flows/GDP OFDI Stock/GDP 1 China 1. 0% 5. 0% G-20 2. 0% 26. 4% OECD 2. 8% 38. 4% Transitional economies have average ODFI Stock/GDP of 15%2. At this level, China would have OFDI stock of $1. 1 trillion in 2011, and $3. 7 trillion by 20203. Actual China OFDI reached only $365 billion in 2011. 1. Source: OECD Statistics, World Bank, China’s National Bureau of Statistics, UNCTAD 2. Source: “An American Open Door” by The Wilson Center, 2011 3. Based on Standard Chartered’s China’s projected 2020 GDP of $24. 6 trillion © 2013 6 Broker dealer services provided through Mufson Howe Hunter & Partners LLC, member of FINRA and SIPC Green. World Capital, LLC Capital for a Greener World

Market Potential for China OFDI to U. S historically has been world’s largest recipient of global FDI at 17%, 3 x larger than the next largest recipient Market Potential provided that… 1. China’s economy grows to $24. 6 trillion by 2020 as forecast 2. China’s OFDI stock/GDP = 15% transitional economy average 3. U. S. receives 17% of China’s OFDI Market Potential = $620 billion (equivalent to ½ of $1. 2 trillion of U. S. Treasuries that China holds in reserve) © 2013 7 Broker dealer services provided through Mufson Howe Hunter & Partners LLC, member of FINRA and SIPC Green. World Capital, LLC Capital for a Greener World

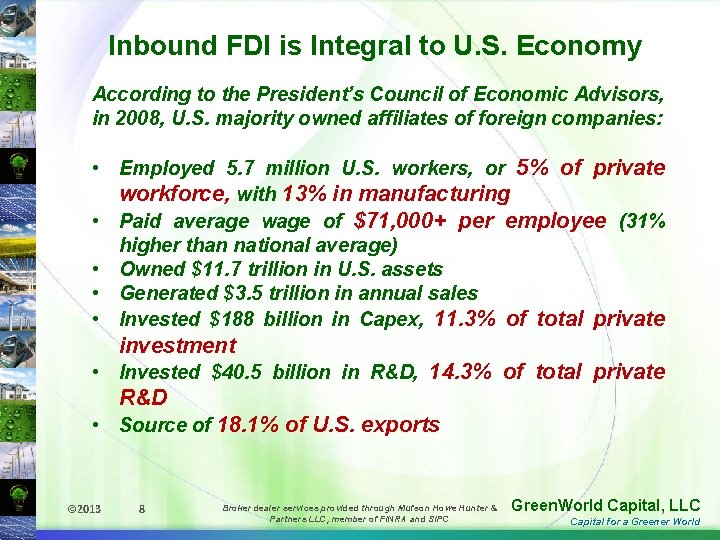

Inbound FDI is Integral to U. S. Economy According to the President’s Council of Economic Advisors, in 2008, U. S. majority owned affiliates of foreign companies: • Employed 5. 7 million U. S. workers, or 5% of private workforce, with 13% in manufacturing • Paid average wage of $71, 000+ per employee (31% higher than national average) • Owned $11. 7 trillion in U. S. assets • Generated $3. 5 trillion in annual sales • Invested $188 billion in Capex, 11. 3% of total private investment • Invested $40. 5 billion in R&D, 14. 3% of total private R&D • Source of 18. 1% of U. S. exports © 2013 8 Broker dealer services provided through Mufson Howe Hunter & Partners LLC, member of FINRA and SIPC Green. World Capital, LLC Capital for a Greener World

Presidential Support President Obama – – “… business investment in the United States by foreign firms is a major engine of economic growth and job creation. My administration is committed to enhancing the efforts of the United States to win the global competition for business investment by leveraging our advantages as the premier business location in the world” Executive Order Creating Select USA. June 2011 © 2013 9 Broker dealer services provided through Mufson Howe Hunter & Partners LLC, member of FINRA and SIPC Green. World Capital, LLC Capital for a Greener World

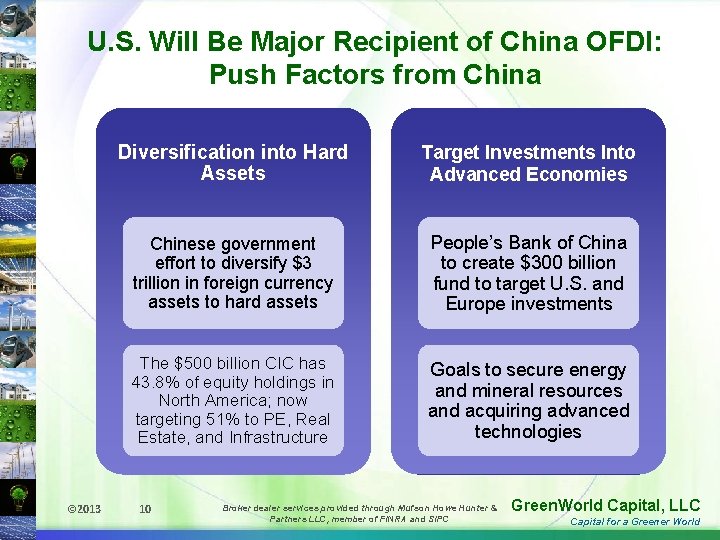

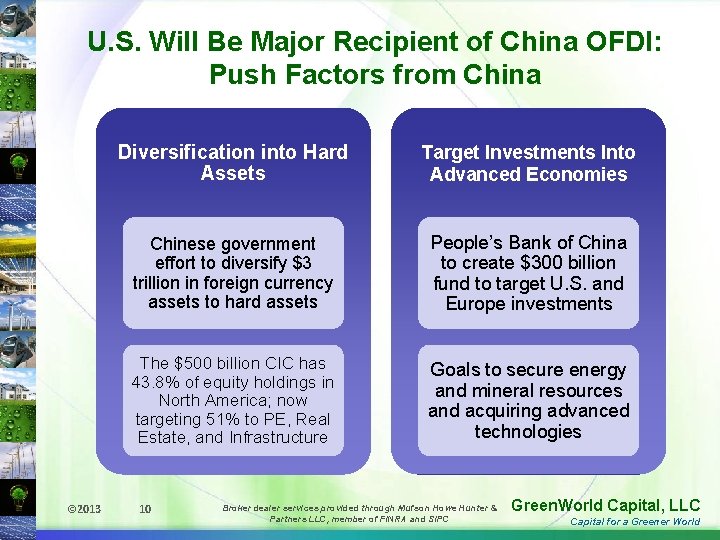

U. S. Will Be Major Recipient of China OFDI: Push Factors from China © 2013 Diversification into Hard Assets Target Investments Into Advanced Economies Chinese government effort to diversify $3 trillion in foreign currency assets to hard assets People’s Bank of China to create $300 billion fund to target U. S. and Europe investments The $500 billion CIC has 43. 8% of equity holdings in North America; now targeting 51% to PE, Real Estate, and Infrastructure Goals to secure energy and mineral resources and acquiring advanced technologies 10 Broker dealer services provided through Mufson Howe Hunter & Partners LLC, member of FINRA and SIPC Green. World Capital, LLC Capital for a Greener World

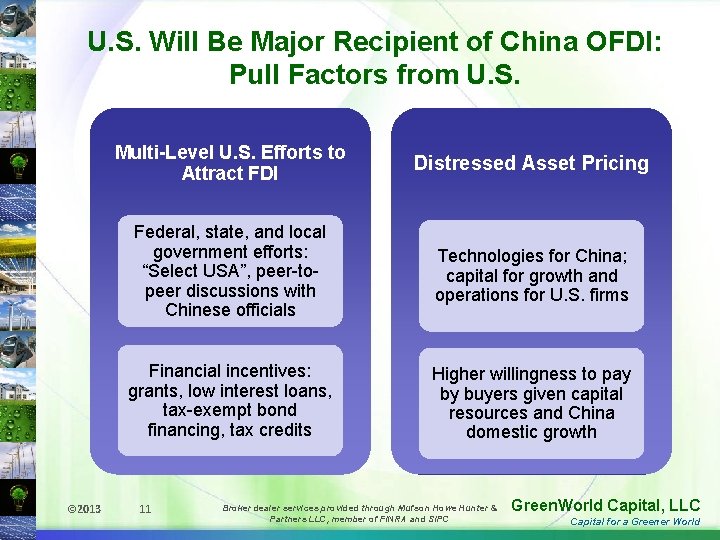

U. S. Will Be Major Recipient of China OFDI: Pull Factors from U. S. © 2013 Multi-Level U. S. Efforts to Attract FDI Distressed Asset Pricing Federal, state, and local government efforts: “Select USA”, peer-topeer discussions with Chinese officials Technologies for China; capital for growth and operations for U. S. firms Financial incentives: grants, low interest loans, tax-exempt bond financing, tax credits Higher willingness to pay by buyers given capital resources and China domestic growth 11 Broker dealer services provided through Mufson Howe Hunter & Partners LLC, member of FINRA and SIPC Green. World Capital, LLC Capital for a Greener World

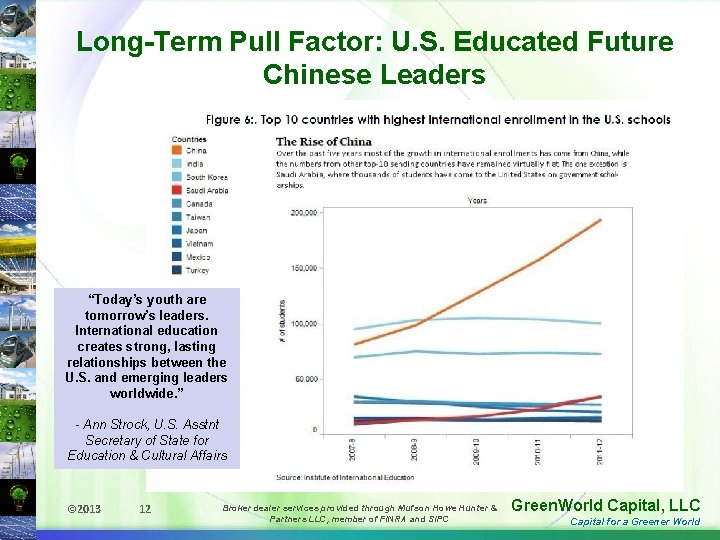

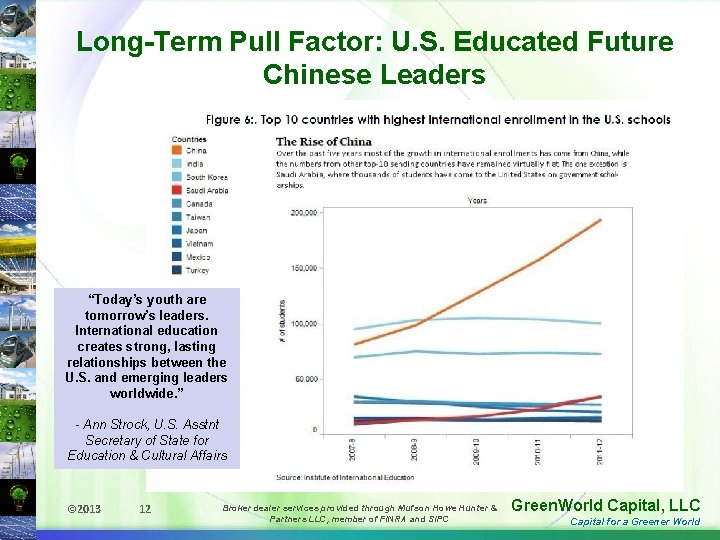

Long-Term Pull Factor: U. S. Educated Future Chinese Leaders “Today’s youth are tomorrow’s leaders. International education creates strong, lasting relationships between the U. S. and emerging leaders worldwide. ” - Ann Strock, U. S. Asstnt Secretary of State for Education & Cultural Affairs © 2013 12 Broker dealer services provided through Mufson Howe Hunter & Partners LLC, member of FINRA and SIPC Green. World Capital, LLC Capital for a Greener World

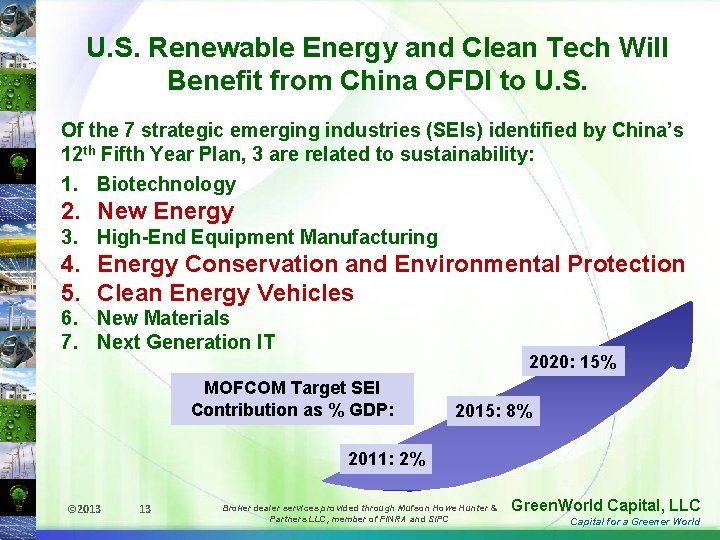

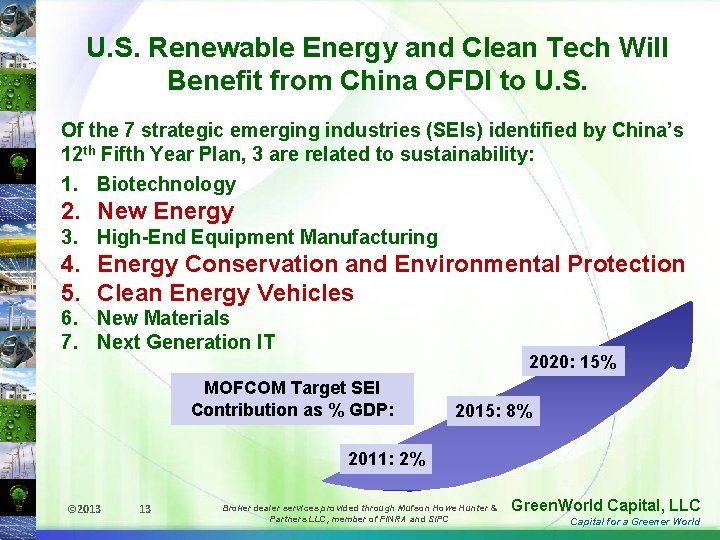

U. S. Renewable Energy and Clean Tech Will Benefit from China OFDI to U. S. Of the 7 strategic emerging industries (SEIs) identified by China’s 12 th Fifth Year Plan, 3 are related to sustainability: 1. Biotechnology 2. New Energy 3. High-End Equipment Manufacturing 4. Energy Conservation and Environmental Protection 5. Clean Energy Vehicles 6. New Materials 7. Next Generation IT 2020: 15% MOFCOM Target SEI Contribution as % GDP: 2015: 8% 2011: 2% © 2013 13 Broker dealer services provided through Mufson Howe Hunter & Partners LLC, member of FINRA and SIPC Green. World Capital, LLC Capital for a Greener World

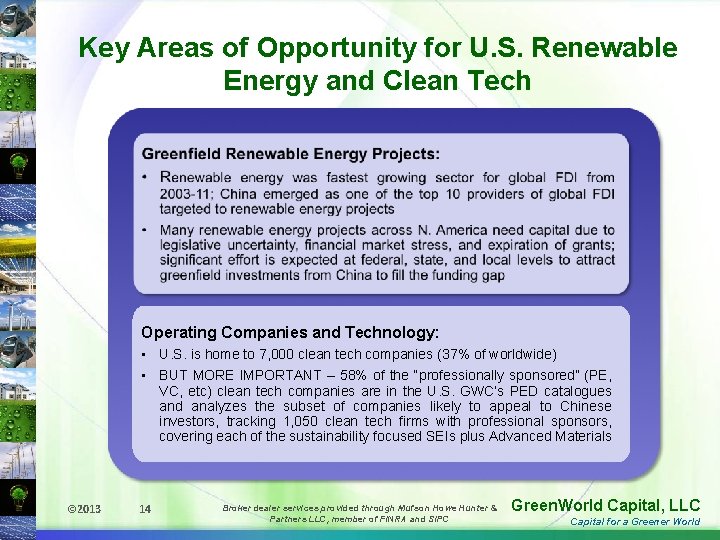

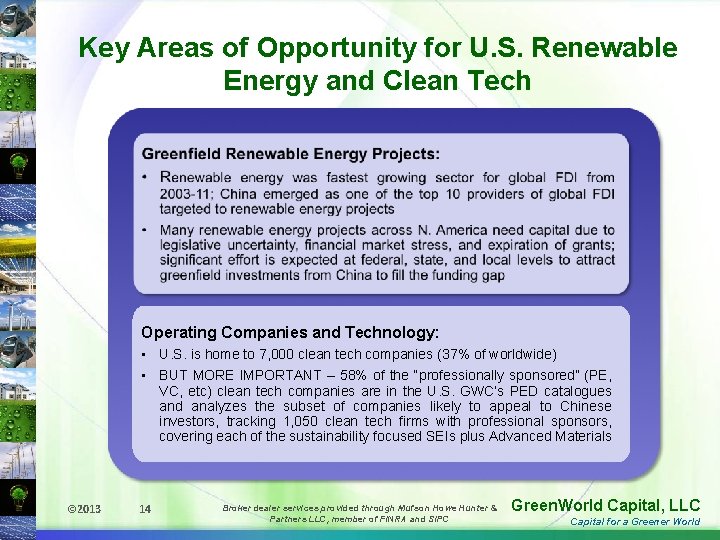

Key Areas of Opportunity for U. S. Renewable Energy and Clean Tech Diversification into Hard Assets Operating Companies and Technology: • U. S. is home to 7, 000 clean tech companies (37% of worldwide) • BUT MORE IMPORTANT – 58% of the “professionally sponsored” (PE, VC, etc) clean tech companies are in the U. S. GWC’s PED catalogues and analyzes the subset of companies likely to appeal to Chinese investors, tracking 1, 050 clean tech firms with professional sponsors, covering each of the sustainability focused SEIs plus Advanced Materials © 2013 14 Broker dealer services provided through Mufson Howe Hunter & Partners LLC, member of FINRA and SIPC Green. World Capital, LLC Capital for a Greener World

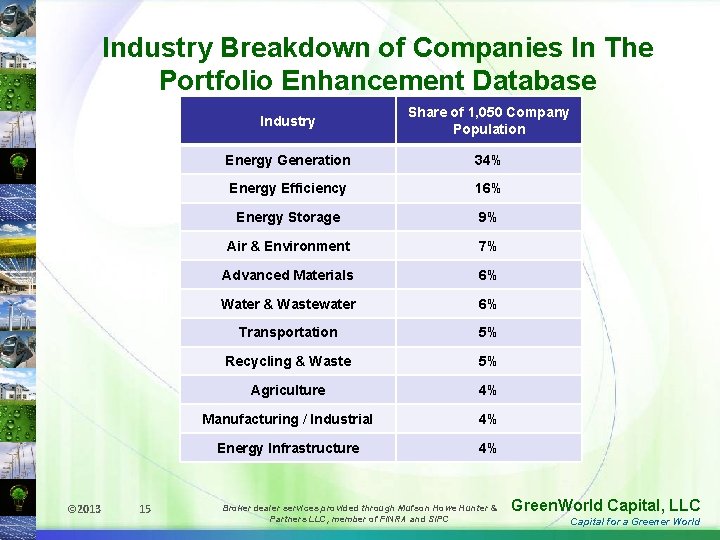

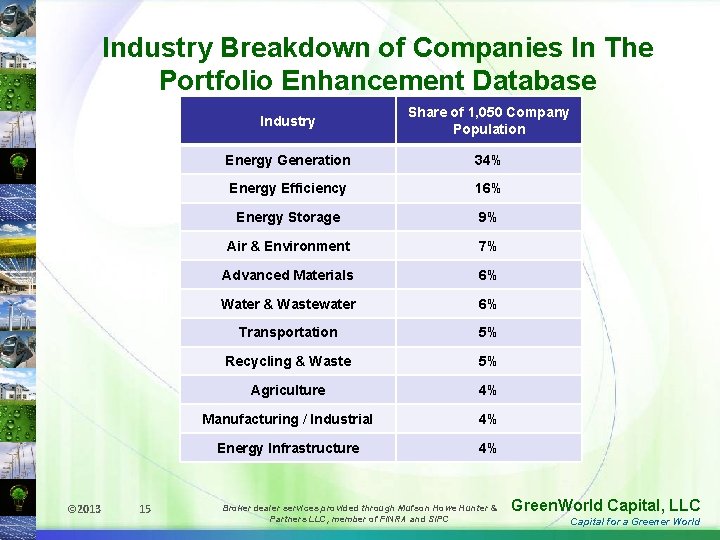

Industry Breakdown of Companies In The Portfolio Enhancement Database © 2013 15 Industry Share of 1, 050 Company Population Energy Generation 34% Energy Efficiency 16% Energy Storage 9% Air & Environment 7% Advanced Materials 6% Water & Wastewater 6% Transportation 5% Recycling & Waste 5% Agriculture 4% Manufacturing / Industrial 4% Energy Infrastructure 4% Broker dealer services provided through Mufson Howe Hunter & Partners LLC, member of FINRA and SIPC Green. World Capital, LLC Capital for a Greener World

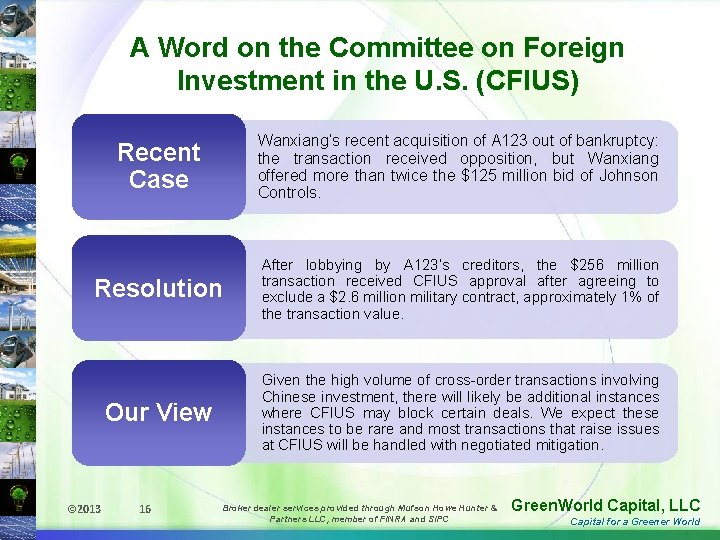

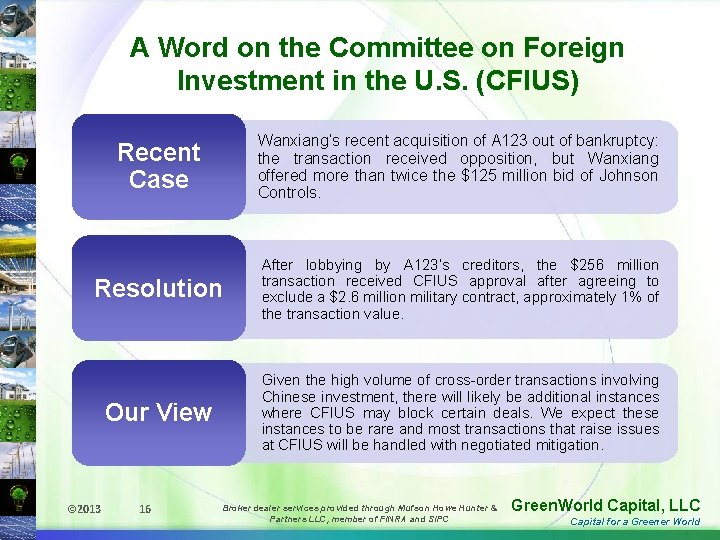

A Word on the Committee on Foreign Investment in the U. S. (CFIUS) Recent Case Wanxiang’s recent acquisition of A 123 out of bankruptcy: the transaction received opposition, but Wanxiang offered more than twice the $125 million bid of Johnson Controls. Resolution After lobbying by A 123’s creditors, the $256 million transaction received CFIUS approval after agreeing to exclude a $2. 6 million military contract, approximately 1% of the transaction value. Our View Given the high volume of cross-order transactions involving Chinese investment, there will likely be additional instances where CFIUS may block certain deals. We expect these instances to be rare and most transactions that raise issues at CFIUS will be handled with negotiated mitigation. © 2013 16 Broker dealer services provided through Mufson Howe Hunter & Partners LLC, member of FINRA and SIPC Green. World Capital, LLC Capital for a Greener World

Conclusion: Chinese OFDI to U. S…. • Provides a much-needed source of capital for U. S. public and private stakeholders in the renewable energy and clean tech industry • Provides attractive investment returns to Chinese investors and useful technologies for Chinese companies • Accelerates deployment of renewable energy and clean tech projects in the U. S. , in turn preserving and creating U. S. jobs • Facilitates U. S. companies’ enormous Chinese market access to the THANK YOU! © 2013 17 Broker dealer services provided through Mufson Howe Hunter & Partners LLC, member of FINRA and SIPC Green. World Capital, LLC Capital for a Greener World