Green Finance Reform and Green Transformation The Five

- Slides: 28

绿色金融改革与促进绿色转型研究 Green Finance Reform and Green Transformation

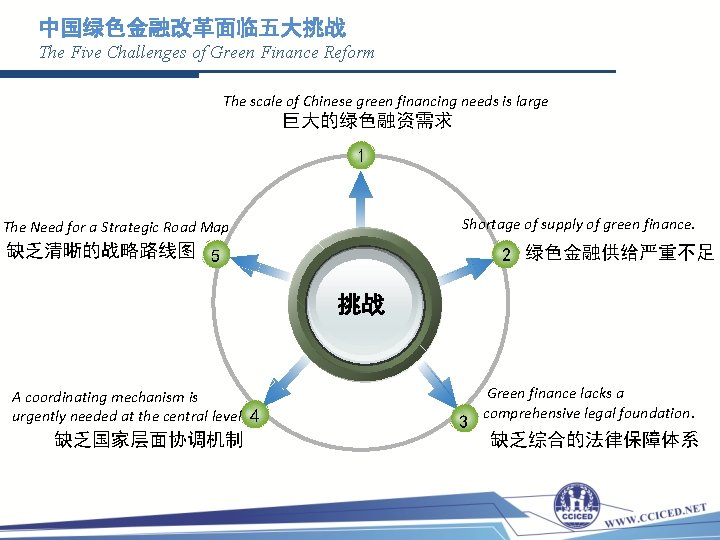

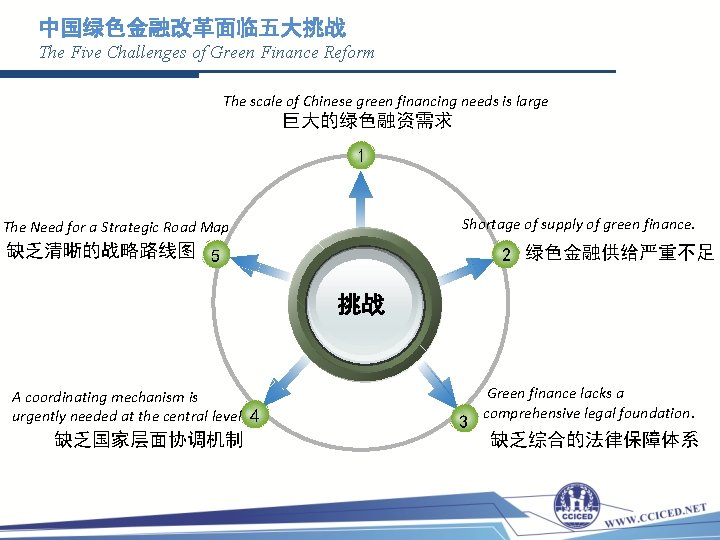

中国绿色金融改革面临五大挑战 The Five Challenges of Green Finance Reform The scale of Chinese green financing needs is large 巨大的绿色融资需求 1 Shortage of supply of green finance. The Need for a Strategic Road Map 缺乏清晰的战略路线图 5 2 绿色金融供给严重不足 挑战 A coordinating mechanism is urgently needed at the central level 4 缺乏国家层面协调机制 3 Green finance lacks a comprehensive legal foundation. 缺乏综合的法律保障体系

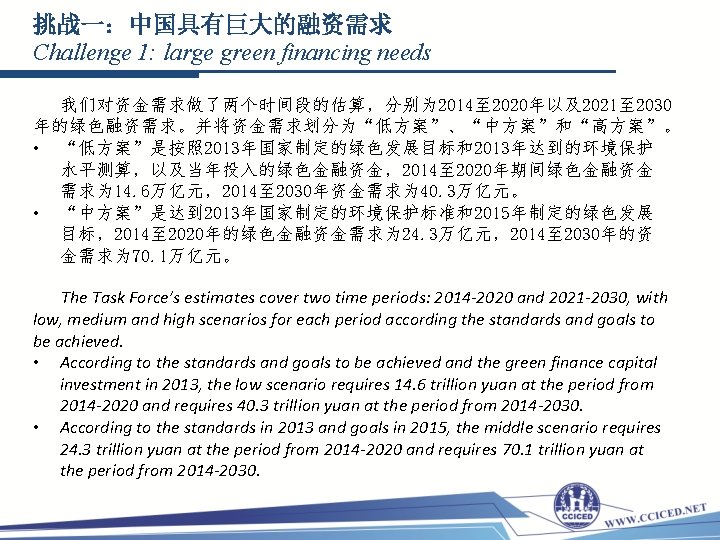

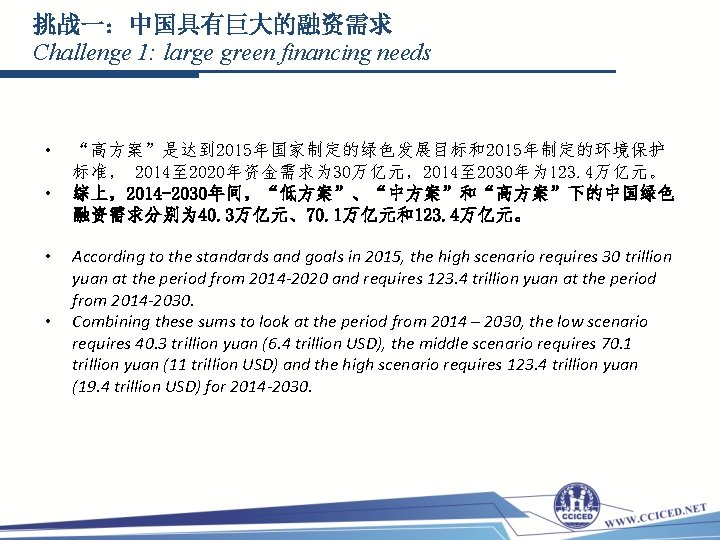

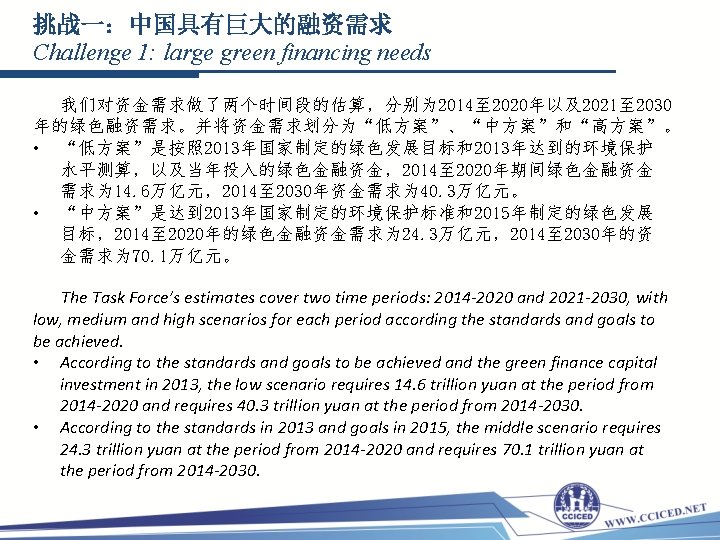

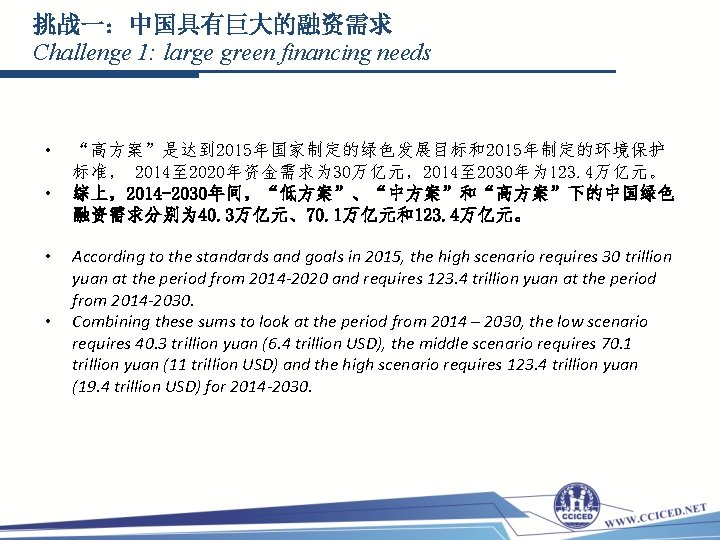

挑战一:中国具有巨大的融资需求 Challenge 1: large green financing needs 我们对资金需求做了两个时间段的估算,分别为 2014至 2020年以及2021至 2030 年的绿色融资需求。并将资金需求划分为“低方案”、“中方案”和“高方案”。 • “低方案”是按照 2013年国家制定的绿色发展目标和2013年达到的环境保护 水平测算,以及当年投入的绿色金融资金,2014至 2020年期间绿色金融资金 需求为 14. 6万亿元,2014至 2030年资金需求为 40. 3万亿元。 • “中方案”是达到 2013年国家制定的环境保护标准和2015年制定的绿色发展 目标,2014至 2020年的绿色金融资金需求为 24. 3万亿元,2014至 2030年的资 金需求为 70. 1万亿元。 The Task Force’s estimates cover two time periods: 2014 -2020 and 2021 -2030, with low, medium and high scenarios for each period according the standards and goals to be achieved. • According to the standards and goals to be achieved and the green finance capital investment in 2013, the low scenario requires 14. 6 trillion yuan at the period from 2014 -2020 and requires 40. 3 trillion yuan at the period from 2014 -2030. • According to the standards in 2013 and goals in 2015, the middle scenario requires 24. 3 trillion yuan at the period from 2014 -2020 and requires 70. 1 trillion yuan at the period from 2014 -2030.

挑战一:中国具有巨大的融资需求 Challenge 1: large green financing needs • • “高方案”是达到 2015年国家制定的绿色发展目标和2015年制定的环境保护 标准, 2014至 2020年资金需求为 30万亿元,2014至 2030年为 123. 4万亿元。 综上,2014 -2030年间,“低方案”、“中方案”和“高方案”下的中国绿色 融资需求分别为 40. 3万亿元、70. 1万亿元和123. 4万亿元。 According to the standards and goals in 2015, the high scenario requires 30 trillion yuan at the period from 2014 -2020 and requires 123. 4 trillion yuan at the period from 2014 -2030. Combining these sums to look at the period from 2014 – 2030, the low scenario requires 40. 3 trillion yuan (6. 4 trillion USD), the middle scenario requires 70. 1 trillion yuan (11 trillion USD) and the high scenario requires 123. 4 trillion yuan (19. 4 trillion USD) for 2014 -2030.

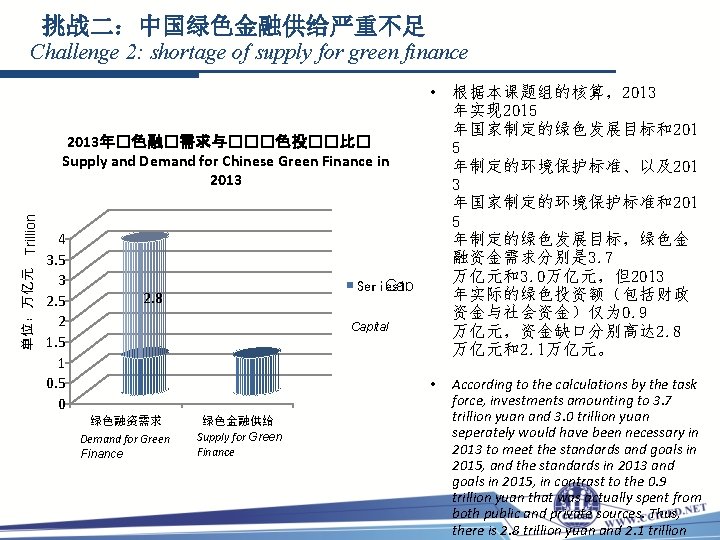

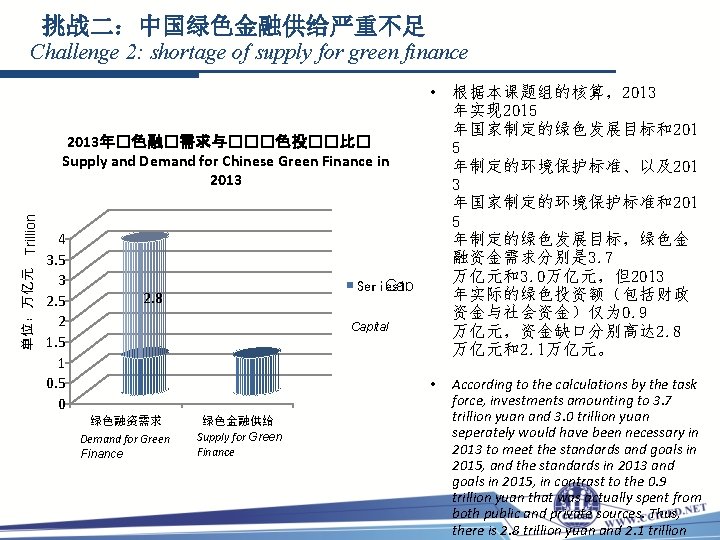

挑战二:中国绿色金融供给严重不足 单位:万亿元 Trillion Challenge 2: shortage of supply for green finance • 根据本课题组的核算,2013 年实现 2015 年国家制定的绿色发展目标和201 2013年�色融�需求与���色投��比� 5 Supply and Demand for Chinese Green Finance in 年制定的环境保护标准、以及201 2013 3 年国家制定的环境保护标准和201 5 4 年制定的绿色发展目标,绿色金 融资金需求分别是 3. 7 3. 5 万亿元和3. 0万亿元,但2013 3 Cap Series 1 年实际的绿色投资额(包括财政 2. 8 2. 5 资金与社会资金)仅为 0. 9 2 Capital 万亿元,资金缺口分别高达 2. 8 1. 5 万亿元和2. 1万亿元。 1 0. 5 0 • 绿色融资需求 Demand for Green Finance 绿色金融供给 Supply for Green Finance According to the calculations by the task force, investments amounting to 3. 7 trillion yuan and 3. 0 trillion yuan seperately would have been necessary in 2013 to meet the standards and goals in 2015, and the standards in 2013 and goals in 2015, in contrast to the 0. 9 trillion yuan that was actually spent from both public and private sources. Thus, there is 2. 8 trillion yuan and 2. 1 trillion

挑战三:中国绿色金融发展缺乏综合的法律保障体系 Challenge 3: Green Finance Development Lacks Comprehensive Legal Foundation • 目前相关的绿色金融法律保障存在立法层次低、可操作性不强、内 容不全面等问题。急需建立和完善绿色金融改革的法律保障。 • A number of problems still exist today, such as incomplete legislation, ineffective operational structures, etc. Therefore, It is urgent to establish and improve the legal foundation for green financial reform.

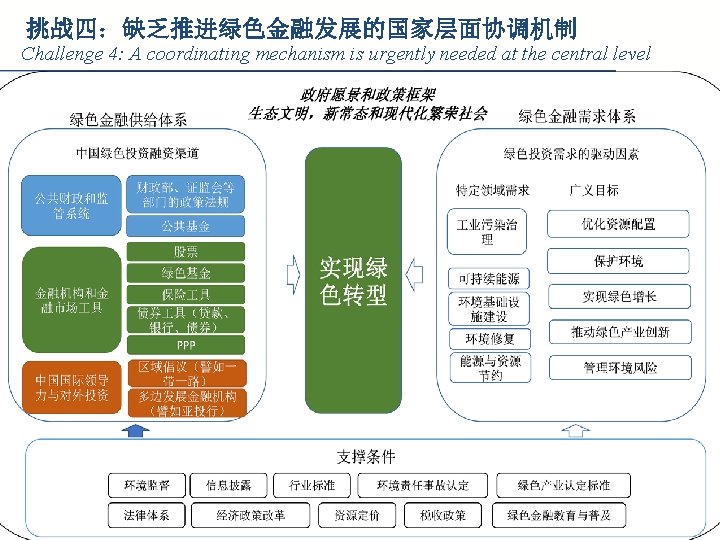

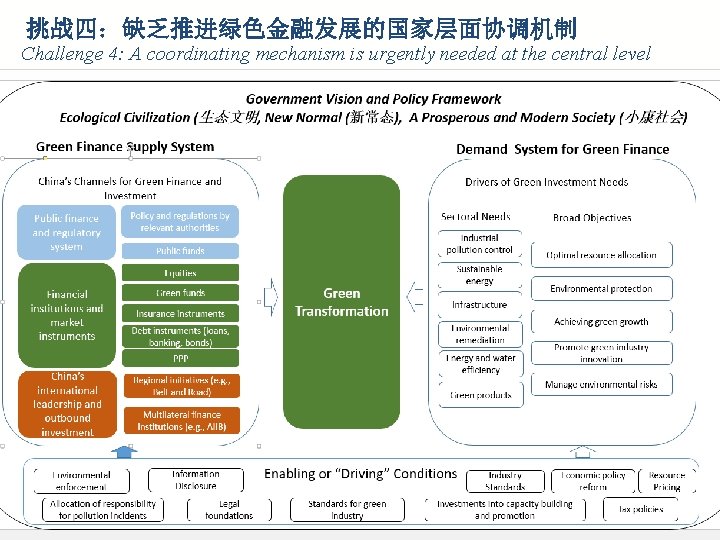

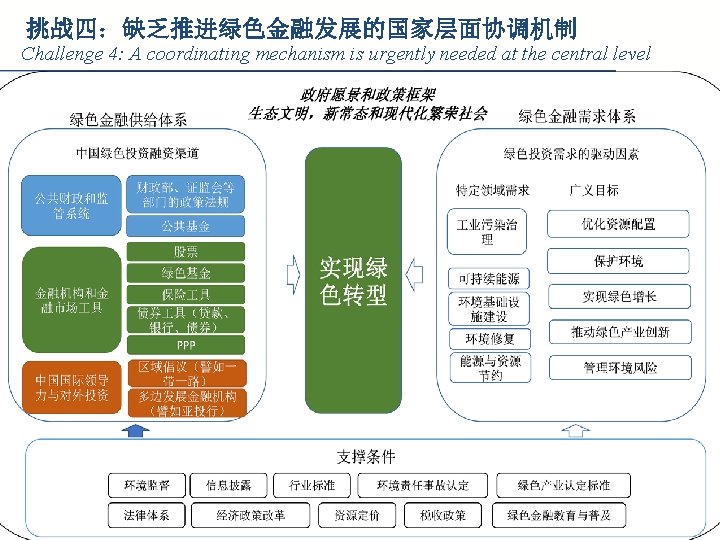

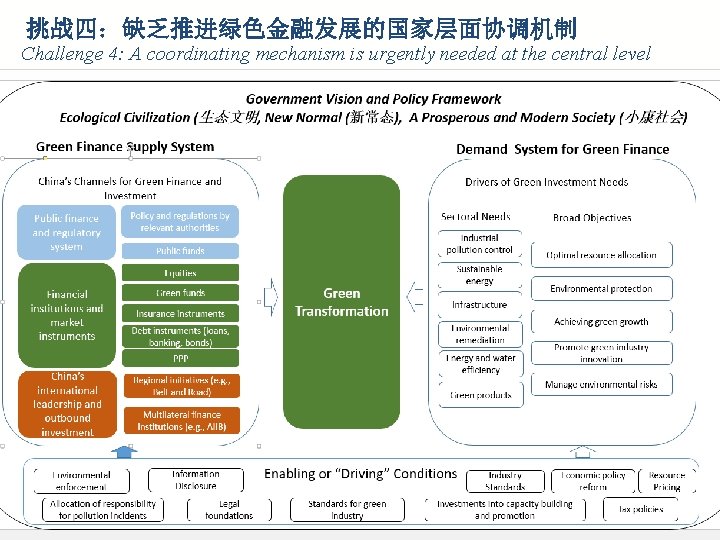

挑战四:缺乏推进绿色金融发展的国家层面协调机制 Challenge 4: A coordinating mechanism is urgently needed at the central level

挑战四:缺乏推进绿色金融发展的国家层面协调机制 Challenge 4: A coordinating mechanism is urgently needed at the central level

挑战四:缺乏推进绿色金融发展的国家层面协调机制 Challenge 4: A coordinating mechanism is urgently needed at the central level • 上图列出了我国绿色金融改革的战略框架,包括四个组成部分,即国家发 展战略目标、绿色金融供给体系、需求体系和支撑保障体系。这也是绿色 金融制度体系的四个组成部分。但这四个部分的各种职能分属于不同部门, 因此应设立中央层面的绿色金融协调机制,加强组织协调。 • Figures above shows the framework of green financial reform in China as containing four parts: the national development strategy and goals, the green finance supply system, the demand system, and enabling (or “driving”) conditions. However, these four parts all pertain to the domain of different government authorities and will best serve the national strategy for green transformation if the parts are developed jointly and in coordination. Hence, a coordinating mechanism is urgently needed at the central level to guide the development of green finance.

挑战五:中国绿色金融改革缺乏清晰的战略路线图 Challenge 5: Green Finance Reform in China Lacks Clear Strategic Route Map • 绿色金融改革需要与中国绿色转型进程紧密衔接,并与中国金融体系自 身改革进展相吻合。绿色金融制度体系的建构和市场体系的完善,是个 长期的、渐进的过程。目前中国绿色金融改革缺乏明确的战略路线图, 导致绿色金融改革的总体协调性、阶段性、操作性较差,难以发挥其对 绿色转型的良好支撑作用。因此,本课题组结合中国绿色转型的阶段性 任务,提出了绿色金融改革战略路线图和优先突破的领域。 • Green finance reform needs a tight connection is a comprehensive project that will build the green financial and market system in stages. At present, green finance reform in China lacks a clear strategic road map. As a result, green finance reform is handicapped with inadequate coordination and operation. For this reason, the Task Force proposes a strategic road map for green finance reform and priority areas that will enable breakthroughs in the near-term.

主要政策建议 Key Recommendations

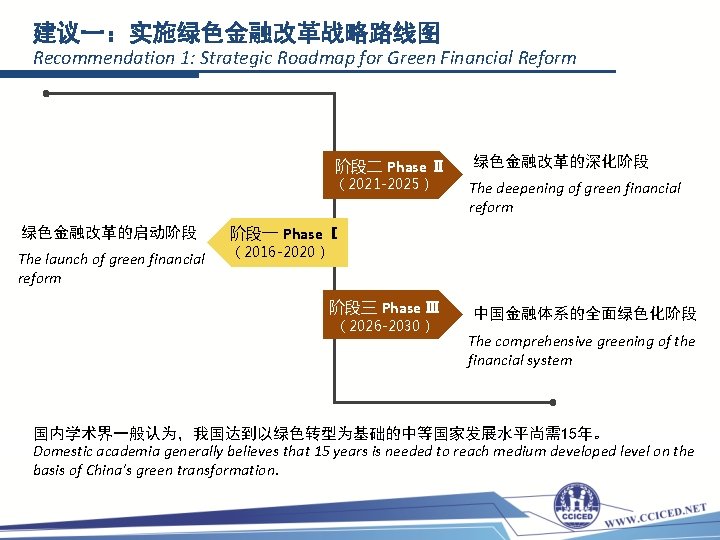

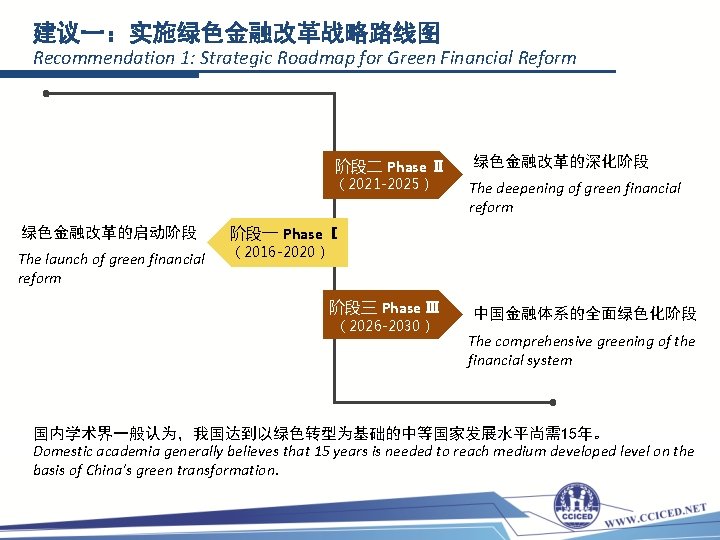

建议一:实施绿色金融改革战略路线图 Recommendation 1: Strategic Roadmap for Green Financial Reform 阶段二 Phase Ⅱ (2021 -2025) 绿色金融改革的启动阶段 The launch of green financial reform 绿色金融改革的深化阶段 The deepening of green financial reform 阶段一 Phase Ⅰ (2016 -2020) 阶段三 Phase Ⅲ (2026 -2030) 中国金融体系的全面绿色化阶段 The comprehensive greening of the financial system 国内学术界一般认为,我国达到以绿色转型为基础的中等国家发展水平尚需15年。 Domestic academia generally believes that 15 years is needed to reach medium developed level on the basis of China's green transformation.

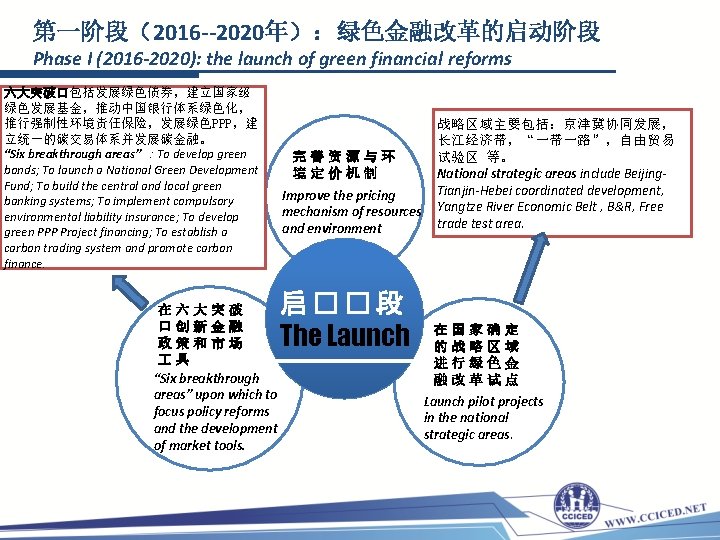

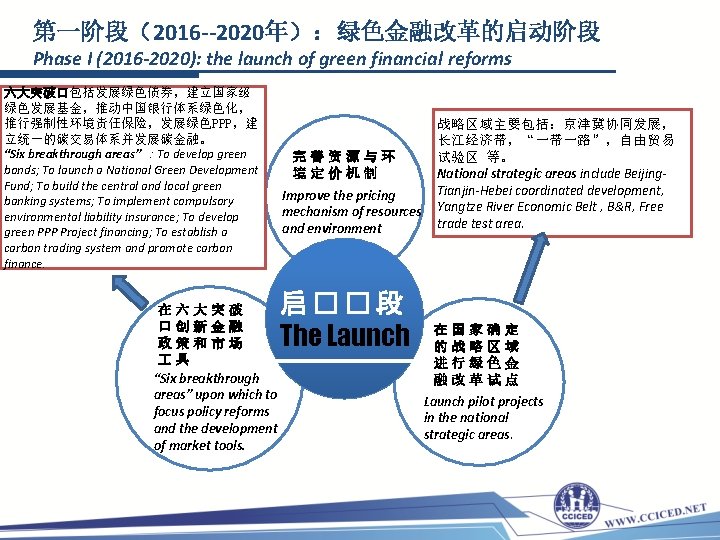

第一阶段(2016 --2020年):绿色金融改革的启动阶段 Phase I (2016 -2020): the launch of green financial reforms 六大突破口包括发展绿色债券,建立国家级 绿色发展基金,推动中国银行体系绿色化, 推行强制性环境责任保险,发展绿色PPP,建 立统一的碳交易体系并发展碳金融。 “Six breakthrough areas” :To develop green bonds; To launch a National Green Development Fund; To build the central and local green banking systems; To implement compulsory environmental liability insurance; To develop green PPP Project financing; To establish a carbon trading system and promote carbon finance. 战略区域主要包括:京津冀协同发展, 长江经济带,“一带一路”,自由贸易 完善资源与环 试验区 等。 National strategic areas include Beijing境定价机制 Tianjin-Hebei coordinated development, Improve the pricing mechanism of resources Yangtze River Economic Belt , B&R, Free trade test area. and environment 启��段 The Launch 在六大突破 口创新金融 政策和市场 具 “Six breakthrough areas” upon which to focus policy reforms and the development of market tools. 在国家确定 的战略区域 进行绿色金 融改革试点 Launch pilot projects in the national strategic areas.

第二阶段(2021 --2025年):绿色金融改革的深化Phase II (2021 -2025): the deepening of green financial reform 自然资源资本化和金融化 Capitalization and financialization of natural resources 将战略区域试点进行全局性拓展 Global expansion of strategic regional pilots 绿色金融发展的重点由支持环境治理逐渐向支持低碳发展转换 The focus of green finance is converted gradually from environmental management support to low carbon development support. 创新开发适合清洁生产等项目需求的金融政策、融资平台和市场 具 Support innovation in policies, financing platforms and market instruments

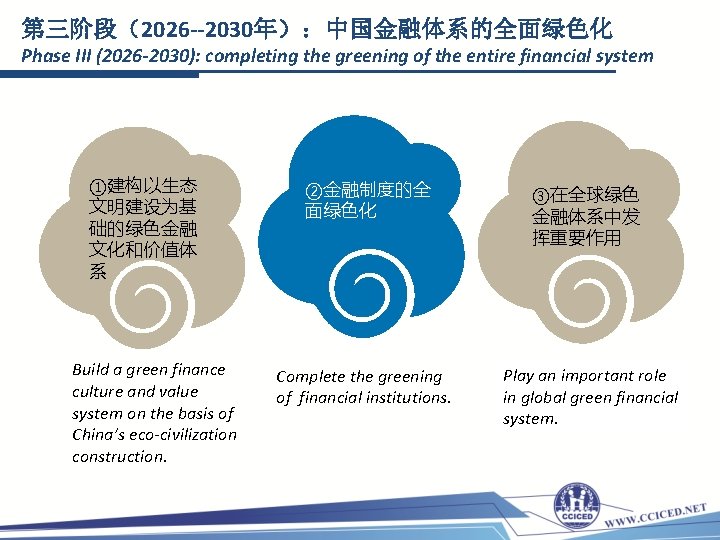

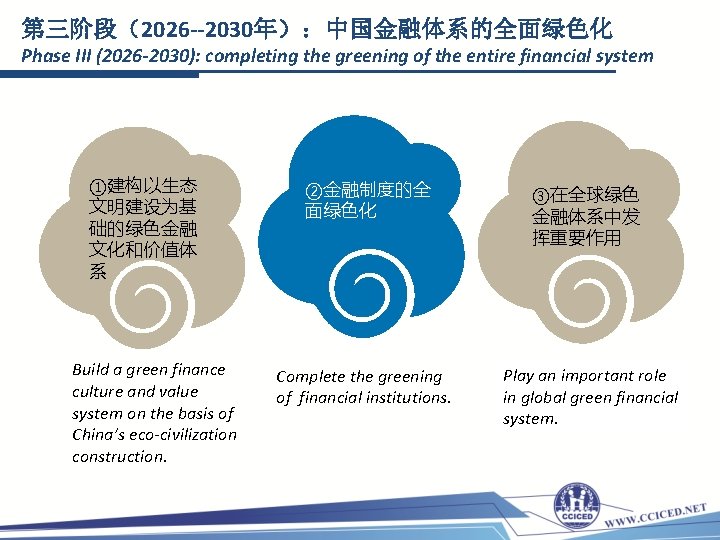

第三阶段(2026 --2030年):中国金融体系的全面绿色化 Phase III (2026 -2030): completing the greening of the entire financial system ①建构以生态 文明建设为基 础的绿色金融 文化和价值体 系 Build a green finance culture and value system on the basis of China’s eco-civilization construction. ②金融制度的全 面绿色化 Complete the greening of financial institutions. ③在全球绿色 金融体系中发 挥重要作用 Play an important role in global green financial system.

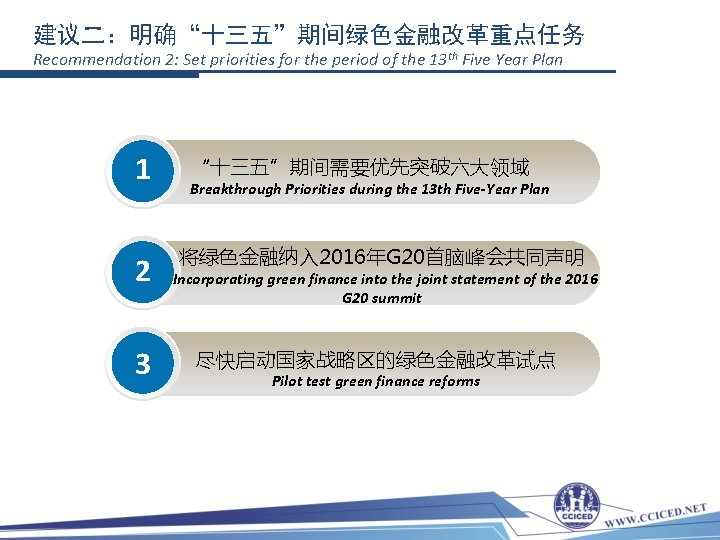

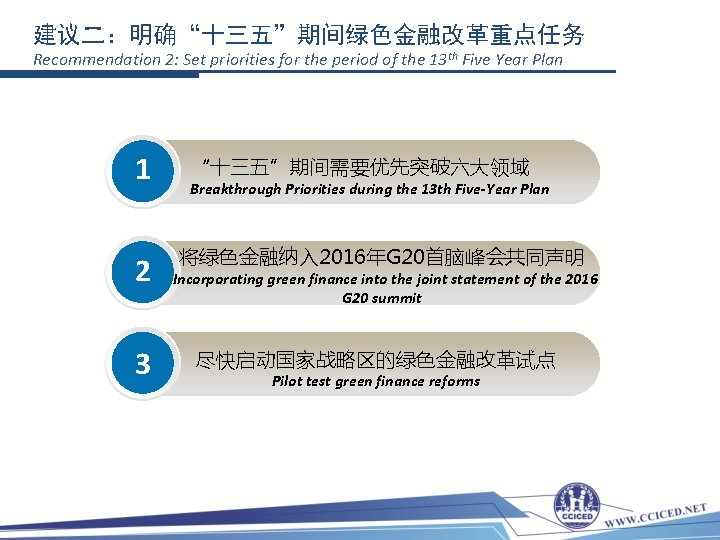

建议二:明确“十三五”期间绿色金融改革重点任务 Recommendation 2: Set priorities for the period of the 13 th Five Year Plan 1 2 3 “十三五”期间需要优先突破六大领域 Breakthrough Priorities during the 13 th Five-Year Plan 将绿色金融纳入 2016年G 20首脑峰会共同声明 Incorporating green finance into the joint statement of the 2016 G 20 summit 尽快启动国家战略区的绿色金融改革试点 Pilot test green finance reforms

①“十三五”期间需要优先突破六大领域 Breakthrough Priorities during the 13 th Five-Year Plan ☆大力发展绿色债券 Promoting green bonds ☆建立国家级绿色发展基金 Launch a National Green Development Fund ☆推动银行体系绿色化 Speed the greening of the banking system 推行强制性环境责任保险 Compulsory environmental liability insurance 发展绿色PPP融资 To develop green PPP Project financing 建立碳交易体系,发展碳金融 To establish a carbon trading system & promote carbon finance

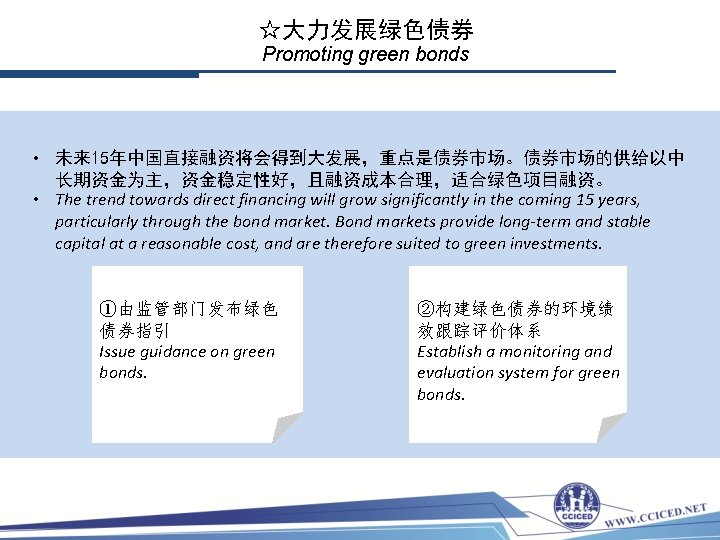

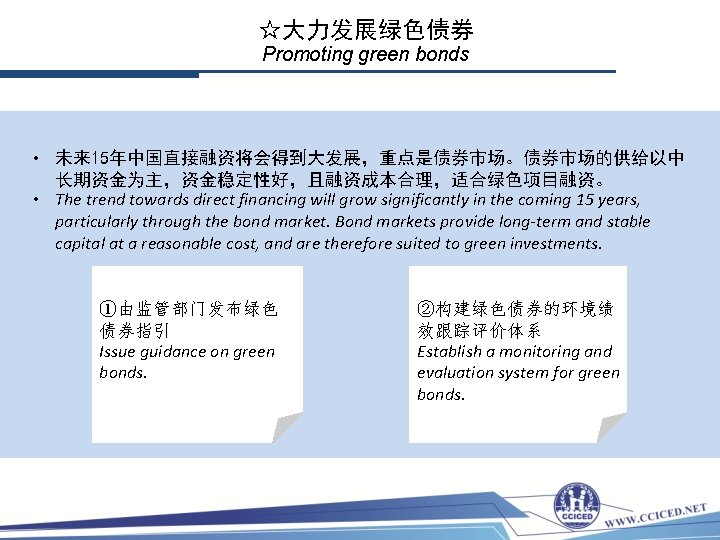

☆大力发展绿色债券 Promoting green bonds • 未来 15年中国直接融资将会得到大发展,重点是债券市场。债券市场的供给以中 长期资金为主,资金稳定性好,且融资成本合理,适合绿色项目融资。 • The trend towards direct financing will grow significantly in the coming 15 years, particularly through the bond market. Bond markets provide long-term and stable capital at a reasonable cost, and are therefore suited to green investments. ①由监管部门发布绿色 债券指引 Issue guidance on green bonds. ②构建绿色债券的环境绩 效跟踪评价体系 Establish a monitoring and evaluation system for green bonds.

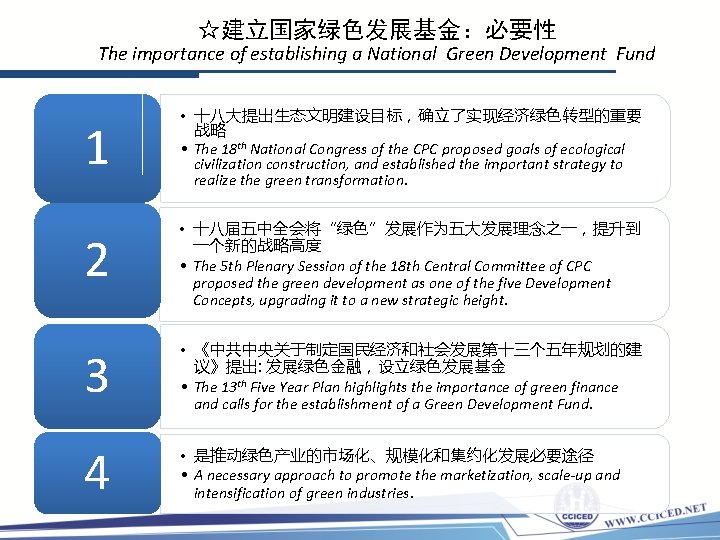

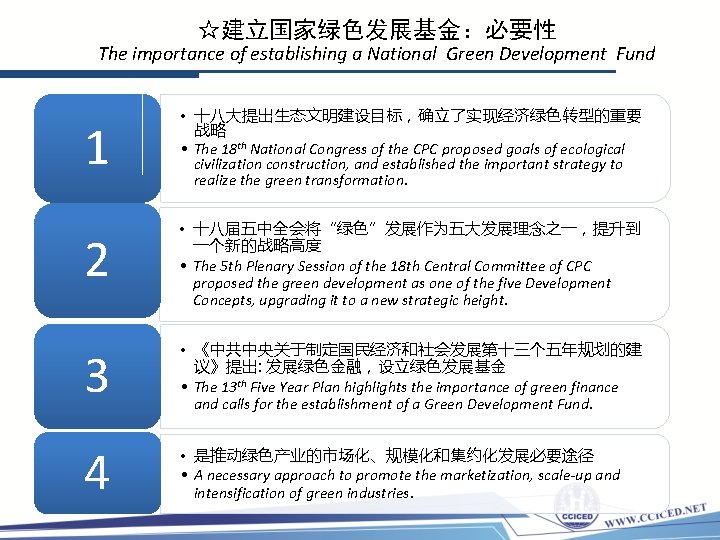

☆建立国家绿色发展基金:必要性 The importance of establishing a National Green Development Fund 1 2 3 4 • 十八大提出生态文明建设目标,确立了实现经济绿色转型的重要 战略 • The 18 th National Congress of the CPC proposed goals of ecological civilization construction, and established the important strategy to 十八届五中全会将“绿 党十八大提出生态文 realize the green transformation. 色”发展作为五大发展 明建设目标,确立了 理念之一,提升到一个 实现经济绿色转型的 新的战略高度。 重要战略 • 十八届五中全会将“绿色”发展作为五大发展理念之一,提升到 一个新的战略高度 • The 5 th Plenary Session of the 18 th Central Committee of CPC proposed the green development as one of the five Development Concepts, upgrading it to a new strategic height. 《中共中央关于制定国 实现外汇储备资金 民经济和社会发展第十 运用的多元化 • 《中共中央关于制定国民经济和社会发展第十三个五年规划的建议》 to diversify China’s 议》提出: 发展绿色金融,设立绿色发展基金 提出: 发展绿色金融,设 foreign currency • The 13 th Five Year Plan highlights the importance of green finance 立绿色发展基金。 reserves and calls for the establishment of a Green Development Fund. • 是推动绿色产业的市场化、规模化和集约化发展必要途径 • A necessary approach to promote the marketization, scale-up and intensification of green industries.

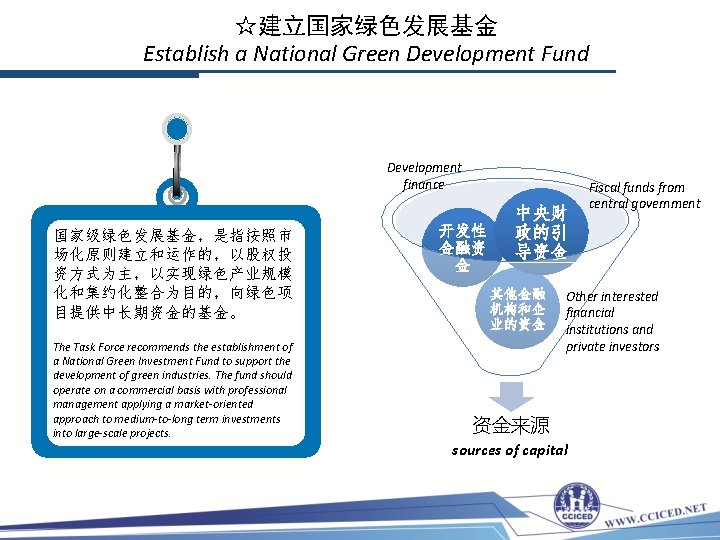

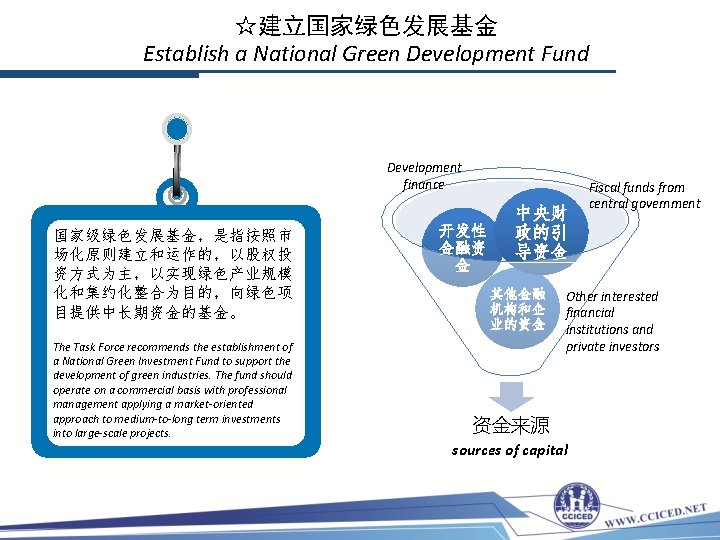

☆建立国家绿色发展基金 Establish a National Green Development Fund Development finance 国家级绿色发展基金,是指按照市 场化原则建立和运作的,以股权投 资方式为主,以实现绿色产业规模 化和集约化整合为目的,向绿色项 目提供中长期资金的基金。 The Task Force recommends the establishment of a National Green Investment Fund to support the development of green industries. The fund should operate on a commercial basis with professional management applying a market-oriented approach to medium-to-long term investments into large-scale projects. Fiscal funds from 开发性 金融资 金 实施中国绿色转型战 central government 中央财 略的需要 政的引 导资金 其他金融 机构和企 业的资金 Other interested financial institutions and private investors 以灵活的融资结构吸引 不同偏好的投资者 资金来源 sources of capital

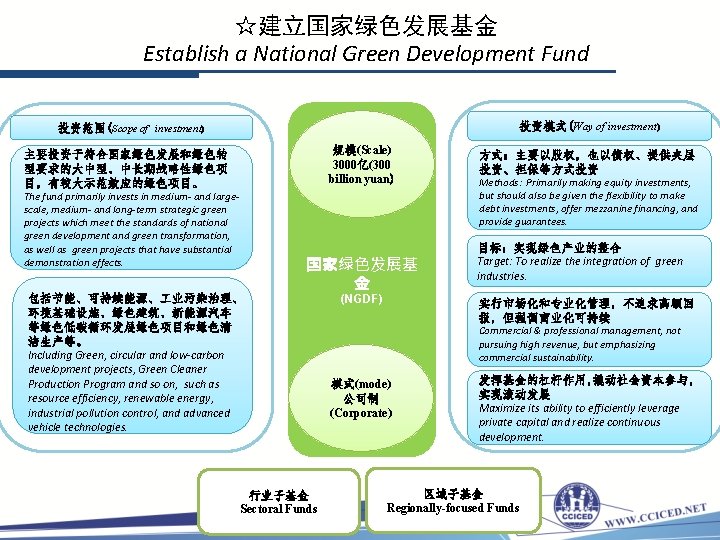

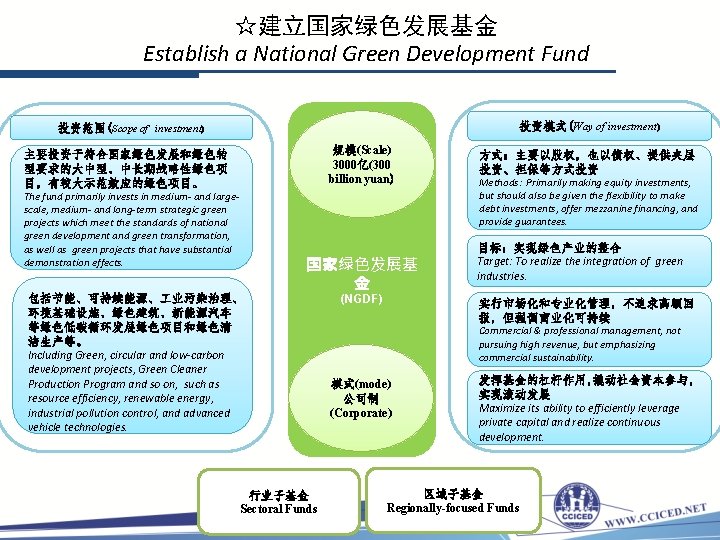

☆建立国家绿色发展基金 Establish a National Green Development Fund 投资模式(Way of investment) 投资范围(Scope of investment) 规模(Scale) 3000亿(300 billion yuan) 主要投资于符合国家绿色发展和绿色转 型要求的大中型、中长期战略性绿色项 目,有较大示范效应的绿色项目。 The fund primarily invests in medium- and largescale, medium- and long-term strategic green projects which meet the standards of national green development and green transformation, as well as green projects that have substantial demonstration effects. 国家绿色发展基 金 包括节能、可持续能源、 业污染治理、 环境基础设施、绿色建筑、新能源汽车 等绿色低碳循环发展绿色项目和绿色清 洁生产等。 Including Green, circular and low-carbon development projects, Green Cleaner Production Program and so on, such as resource efficiency, renewable energy, industrial pollution control, and advanced vehicle technologies. (NGDF) 方式:主要以股权,也以债权、提供夹层 投资、担保等方式投资 Methods: Primarily making equity investments, but should also be given the flexibility to make debt investments, offer mezzanine financing, and provide guarantees. 目标:实现绿色产业的整合 Target: To realize the integration of green industries. 实行市场化和专业化管理,不追求高额回 报,但强调商业化可持续 Commercial & professional management, not pursuing high revenue, but emphasizing commercial sustainability. 模式(mode) 公司制 (Corporate) 发挥基金的杠杆作用, 撬动社会资本参与, 实现滚动发展 Maximize its ability to efficiently leverage private capital and realize continuous development. 行业子基金 Sectoral Funds 区域子基金 Regionally-focused Funds

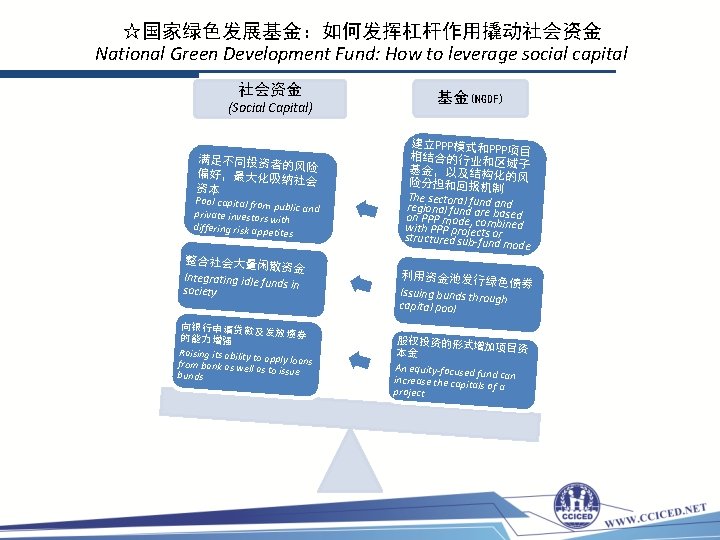

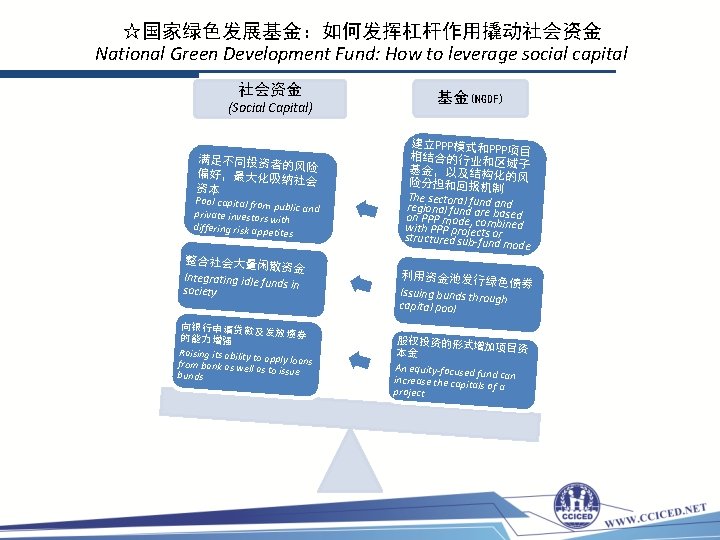

☆国家绿色发展基金:如何发挥杠杆作用撬动社会资金 National Green Development Fund: How to leverage social capital 社会资金 (Social Capital) 党十八大提出生态文 明建设目标,确立了 满足不同投资者的 风险 实现经济绿色转型的 偏好,最大化吸纳 社会 资本 重要战略 Pool capital from p ublic and private investors w ith differing risk appe tites 整合社会大量闲散 资金 Integrating idle fu 《中共中央关于制定国 nds in society 民经济和社会发展第十 三个五年规划的建议》 向银行申请贷款及 发放债券 提出: 发展绿色金融,设 的能力 增强 Ra ising its ability to ap 立绿色发展基金。 ply loans from bank as well as to issue bunds 基金(NGDF) 十八届五中全会将“绿 建立PPP模式和PP P项目 色”发展作为五大发展 相 结合的行业和区域 子 基理念之一,提升到一个 金,以及结构化的 险分担和回报机制 风 新的战略高度。 The sectoral fund a regional fund are b nd ased on PPP mod bined with PPP proe, je cctom s or structured sub-fun d mode 利用资金池发行绿 色债券 Issuing 实现外汇储备资金 bunds through capital pool运用的多元化 to diversify China’s 股权投资的形式增 加项目资 foreign currency 本金 An equity-focused reserves fu increase the capita nd can ls of a project

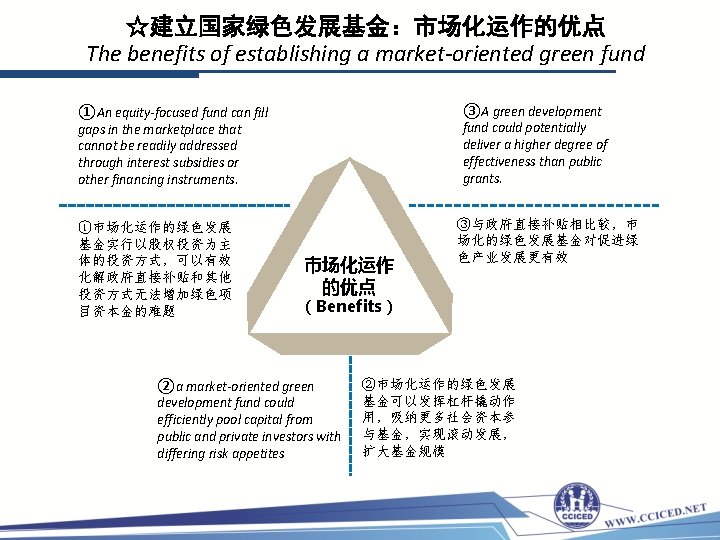

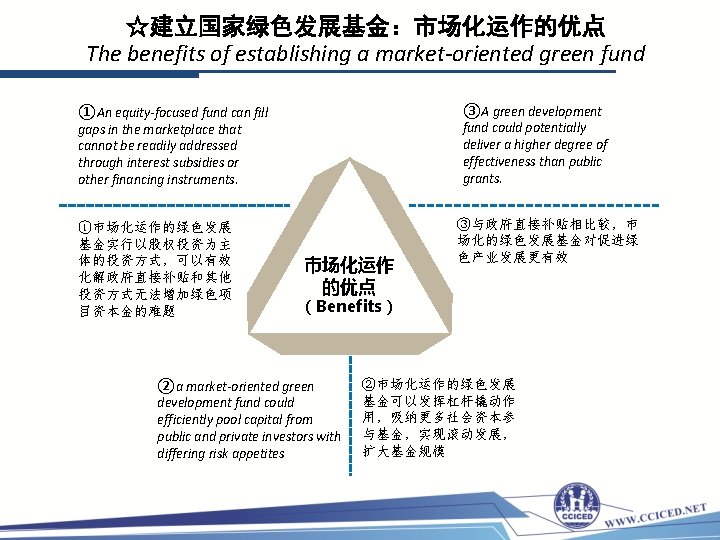

☆建立国家绿色发展基金:市场化运作的优点 The benefits of establishing a market-oriented green fund ③A green development fund could potentially deliver a higher degree of effectiveness than public grants. ①An equity-focused fund can fill gaps in the marketplace that cannot be readily addressed through interest subsidies or other financing instruments. ①市场化运作的绿色发展 基金实行以股权投资为主 体的投资方式,可以有效 化解政府直接补贴和其他 投资方式无法增加绿色项 目资本金的难题 市场化运作 的优点 ③与政府直接补贴相比较,市 场化的绿色发展基金对促进绿 色产业发展更有效 (Benefits) ②a market-oriented green development fund could efficiently pool capital from public and private investors with differing risk appetites ②市场化运作的绿色发展 基金可以发挥杠杆撬动作 用,吸纳更多社会资本参 与基金,实现滚动发展, 扩大基金规模

☆推动银行体系绿色化 Speed the greening of the banking system • 这是“十三五”期间绿色金融改革需要继续突破的领域。中国的金融体系以间接 融资为主,银行业具有举足轻重的地位,在未来相当长的时期内,绿色投资资金 的主要来源仍然是绿色信贷。 • China’s financial system relies primarily on indirect financing and the banking system plays the leading role. Credit will remain the primary source for green financing for the foreseeable future. ①加强银行的环境法律责任。 Increase the environmental legal liabilities of banks. ②在银行内部建立专业化的 绿色信贷机构。 Establish professional green credits departments within banks. ③加大对绿色贷款的贴息力度, 完善贴息机制。 Increase the interest subsidy for green loans, and improve the interest subsidy mechanism.

②将绿色金融纳入 2016年G 20首脑峰会共同声明 Incorporating green finance into the joint statement of the 2016 G 20 summit 将绿色金融纳入 2016年G 20 首脑峰会共同声明,鼓励各 成员国和国际性金融机构发 展绿色金融。 Incorporating green finance into the joint statement of the 2016 G 20 summit and encourage international finance institutions to develop green finance.

③尽快启动国家战略区的绿色金融改革试点 Pilot test green finance reforms in one or more strategic economic zones • 绿色金融改革在国家战略区试点成功,将会引导资金加速流向绿色产业, 并促进绿色金融在全国范围的推广,加速中国经济绿色转型。 • Successful implementation of green finance reform in a strategic economic zone will speed the flow of finance to local green industries. It will also advance the process of extending green finance reforms to a national level as well as speed China’s green economic transformation.

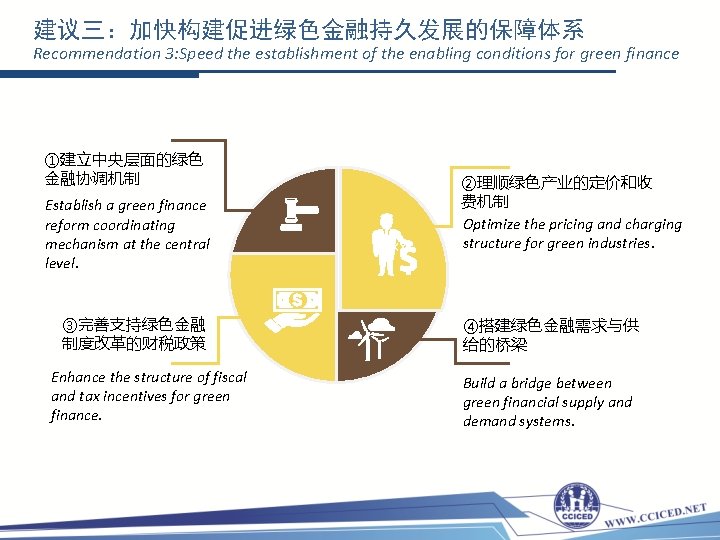

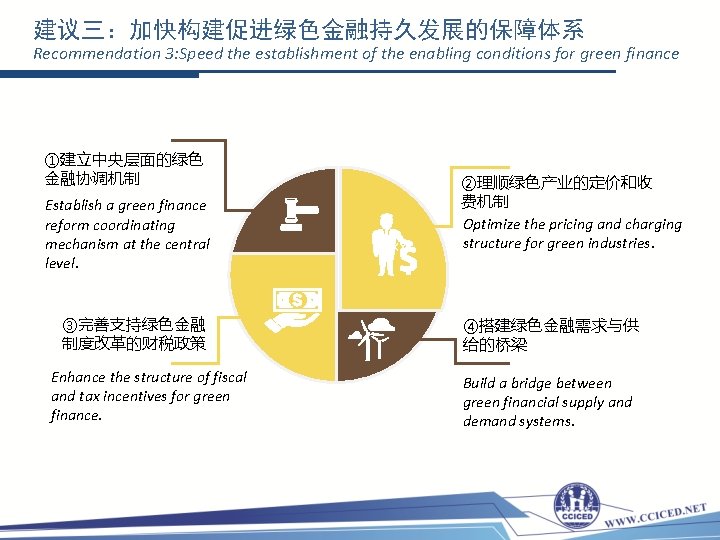

建议三:加快构建促进绿色金融持久发展的保障体系 Recommendation 3: Speed the establishment of the enabling conditions for green finance ①建立中央层面的绿色 金融协调机制 Establish a green finance reform coordinating mechanism at the central level. ③完善支持绿色金融 制度改革的财税政策 Enhance the structure of fiscal and tax incentives for green finance. xxx ②理顺绿色产业的定价和收 费机制 Optimize the pricing and charging structure for green industries. ④搭建绿色金融需求与供 给的桥梁 Build a bridge between green financial supply and demand systems.